Overview

Osmosis is a fair-launched, customizable Automated Market Maker (AMM) that enables the exchange and management of assets in the Cosmos Interchain ecosystem. Through IBC (Inter Blockchain Communication), the protocol achieves interoperability with other app chains in the Cosmos ecosystem. Besides, its customizable AMM built using the Cosmos SDK allows developers to come up with new use cases by dynamically adjusting the pool’s parameters and settings.

By allowing developers to design and deploy custom AMMs, liquidity pools can quickly adjust to changing market conditions, allowing market participants to make decisions on what the optimal outcome would be, rather than relying entirely on the protocol’s logic. This is possible because Osmosis allows users to launch liquidity pools with unique parameters, like bonding curves, multi-weighted asset pools, and liquidity mining rewards for specific pools.

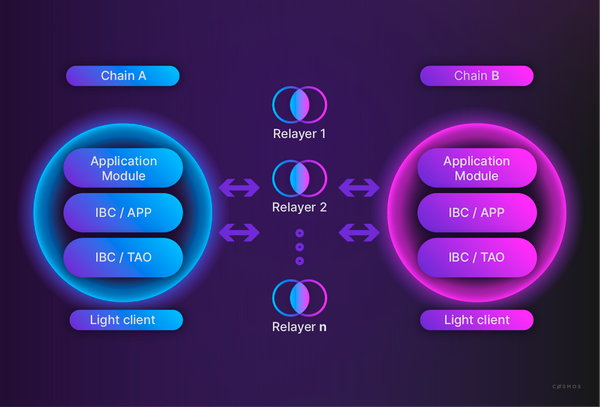

Inter Blockchain Communication is a protocol that allows two blockchains to communicate by transferring assets and data from one to another. IBC solves the problem of bridgeless and trustless communication by providing the necessary infrastructure to establish secure connections and authenticate data packets between Cosmos Zones.

Liquidity mining (also known as yield farming) is the process by which users earn tokens for providing liquidity to a DeFi protocol. This mechanism is used as an incentive to offset the Impermanent Loss experienced by LPs. This is an additional incentive that protocols provide to users to bootstrap the initial liquidity.

Osmosis attempts to solve the shortcomings of traditional AMMs by allowing for innovative use cases in the Cosmos ecosystem. From a design perspective, the protocol optimizes for a more advanced trading experience and better incentives for liquidity providers. This is achieved due to its deep level of customization for parameterizing bonding curves, dynamic swap fees, and multi-asset liquidity pools, all of this achieved using the Cosmos SDK.

Osmosis was designed following the core principles of heterogeneity and sovereignty that the many app chains in the Cosmos ecosystem also represent. Rather than aiming for a rigid and monolithic approach, the protocol seeks to offer AMM designers a variety of tools to customize liquidity pools. By using Cosmos and its cross-chain communication capabilities as a base, Osmosis can offer far broader swapping options to users.

The protocol makes no assumption about the underlying AMM structure. In fact, key parameters such as swap fees and token weights are fully parameterizable for each liquidity pool. The same applies to the bonding curve algorithm and TWAP (Time-Weighted Average Price) calculations of each pool.

It is worth noting that Osmosis is not only a DEX, but an AMM blockchain in the Cosmos ecosystem. Because of that, any IBC-enabled Cosmos Zone can add its token as a tradeable asset on Osmosis. This is a permissionless process that does not require that the token is issued on the Osmosis Zone.

How to ensure that an asset is supported by Osmosis: https://docs.osmosis.zone/overview/integrate/token-listings

Why The Protocol Was Created

Osmosis was heavily inspired by Balancer. The project also takes the concept from Sunny Aggarwal’s paper titled DAOfying Uniswap Automated Market Maker Pools. Rather than aiming for a one-size-fits-all AMM model, Osmosis was designed to offer deep customizability to AMM designers and allow liquidity providers to vote on the governance decisions of their pools.

The goal of Osmosis is to provide the necessary tools to extend the use cases and functionality of AMMs within the Cosmos ecosystem. This vision aims to offer more features than simple asset swaps. Among these features stand out customized pricing curves and pool compositions that allow for dynamic fee adjustments, multi-token liquidity pools, interchain staking, and options markets among others. This challenges the simplicity of other AMMs such as Uniswap and signals a desire to iterate in the design to enable more specialized use cases.

Sunny Aggarwal’s paper titled DAOfying Uniswap Automated Market Maker Pools introduced the first principles of how the AMM should behave. This vision proposed that Uniswap liquidity pools should behave like DAOs where the LP token holders are the DAO members. This would enable the LP token holders to use governance structures to parametrize and customize their “Uniswap instance” to provide the best service for its users.

The scope of governance (what can be voted upon) would affect the following:

- The AMM Curve to explore different trading experiences and use cases beyond the limitations of the constant product formula (x*y=k)

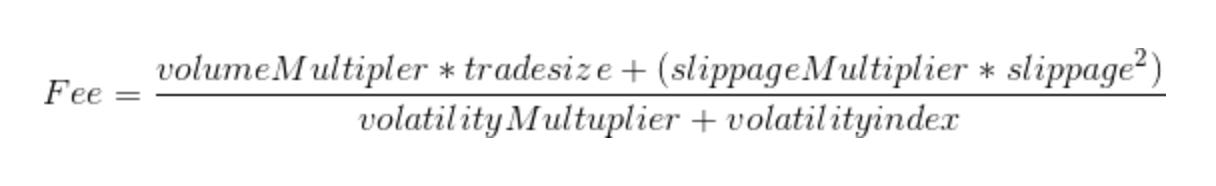

- The fee model, so that market makers could be exposed to volume, spread, and volatility (since the Uniswap model only takes volume into account)

It is mathematically provable that, without fees, market makers would always be less profitable than if they just held the assets in their wallets. This effect is amplified when the asset pair is more volatile. In Uniswap V2, the impermanent loss is offset by charging a trading fee of a fixed 0.3% of the trade size. While Uniswap V3 solves the limitations of having a fixed constant (0.3%), this model can be improved by taking into account more variables, especially volatility, and slippage.

- The spread is proportional to the slippage and is trivial to calculate for any trade size using the curve equation

- The volatility involves taking into account the execution price of a series of trades over a period of time and calculating the magnitude of price changes over a number of blocks.

Slippage is the difference between the expected price of a trade and the price at which the trade is executed

One example of this new dynamic model could provide better incentives for liquidity providers by calculating fees as follows:

When it comes to interoperability, Osmosis leverages the Cosmos SDK to allow it to operate across chains and unlock access to all the TVL available on the Cosmos ecosystem. By integrating IBC (Inter Blockchain Communication) from day one, the protocol can onboard native Cosmos assets in a seamless manner.

Besides, contrary to other Cosmos Zones that have focused their incentive programs on delegators, Osmosis is an attempt to align the incentives of multiple stakeholders beyond delegators, such as LPs, DAO members, stakers… One example of this is that staked liquidity providers have sovereign ownership over their pools. Because of this, the governance of the pools allows liquidity providers to adjust parameters depending on the pool’s competition and market conditions. This is a key differentiator with respect to other application-specific chains in Cosmos since Osmosis derives its sovereignty not only from its architecture but also from the collective sovereignty of the LPs that align their interest to the different tokens that they are providing liquidity for.

Cosmos Zones are application-specific blockchains in the Cosmos ecosystem such that each Zone is connected to a Hub in order to achieve interoperability.

With all of these objectives, core developers Sunny Aggarwal, Josh Lee, and Dev Ojha set out to create Osmosis as the first AMM protocol using the Cosmos SDK. The project was announced in October 2020 and launched on June 19th, 2021.

Osmosis was also the first Cosmos-based chain to popularize IBC transfers. IBC transfers had been available for months before the protocol launch but there was no demand for interoperability

Roadmap

The Osmosis team is currently focused on the development of interfluid staking, and mesh security.

- Given the current success of superfluid staking, the Osmosis team is focusing its efforts on interfluid staking. This will allow liquidity providers in the $ATOM/$OSMO pool to also stake 50% of the underlying $ATOM in their LP position.

- Currently, Osmosis has its own validator set defined by $OSMO staking activity. The chain also receives additional security from $ATOM stakers. The goal with mesh security is to allow the Cosmos Hub to receive additional security from $OSMO stakers as well.

- Since the launch of Osmosis, over $7M have been extracted in MEV. Because of this, Osmosis is targeting a strategic partnership with Skip in order to identify, capture, and redirect the profits from arbitrage opportunities to the community. Although the idea is still being discussed, this would provide benefits such as:

- Increased rewards from staking $OSMO

- Provide transaction fee refunds

- Increase the budget for DAO funding

- Concentrated Liquidity Orderbooks.

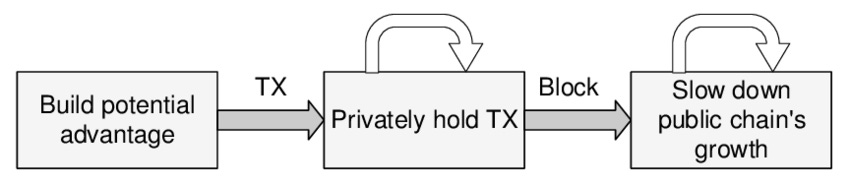

- Threshold Decryptable Mempool. This will prevent transactions from being seen by validators or other parties until their inclusion in a block.

- Cross-chain swaps and Osmosis liquidity outposts.

Team

Osmosis is a product deployed by Osmosis Labs, a company incorporated in Singapore and founded by Sunny Aggarwal and Josh Lee.

Some of the well-known contributors include:

- Jon Ator – Frontend Engineering and Product Planning.

- Alpin Yukseloglu – Protocol Engineer.

- Syed Rahman – Head of Product.

- Aaron Kong – Growth and Strategy Lead.

- Johnny Wyles – Core Contributor.

- valardragon – Core Contributor.

- Kevin.Osmo – Core Contributor.

While Osmosis Labs is responsible for most of the protocol development, the Osmosis project is actually run by a decentralized validator set where every upgrade is voted on and carried on by the community of OSMO token holders. As such, there is no single entity liable for claims or damages to the Osmosis decentralized protocol.

The Osmosis codebase is open source and available on Github.

Contributor’s Guide to Osmosis Chain Repository

DeFi Subsector

As a DEX (Decentralized Exchange), Osmosis allows users to exchange assets using the protocol. However, until now, most Dexes have been very limited by the underlying blockchain they are deployed on. Besides, most Dexes have historically imitated the Uniswap constant product formula. This is not the case with Osmosis, which can be analyzed both as an independent Layer-1 network as well as a separate DeFi Protocol.

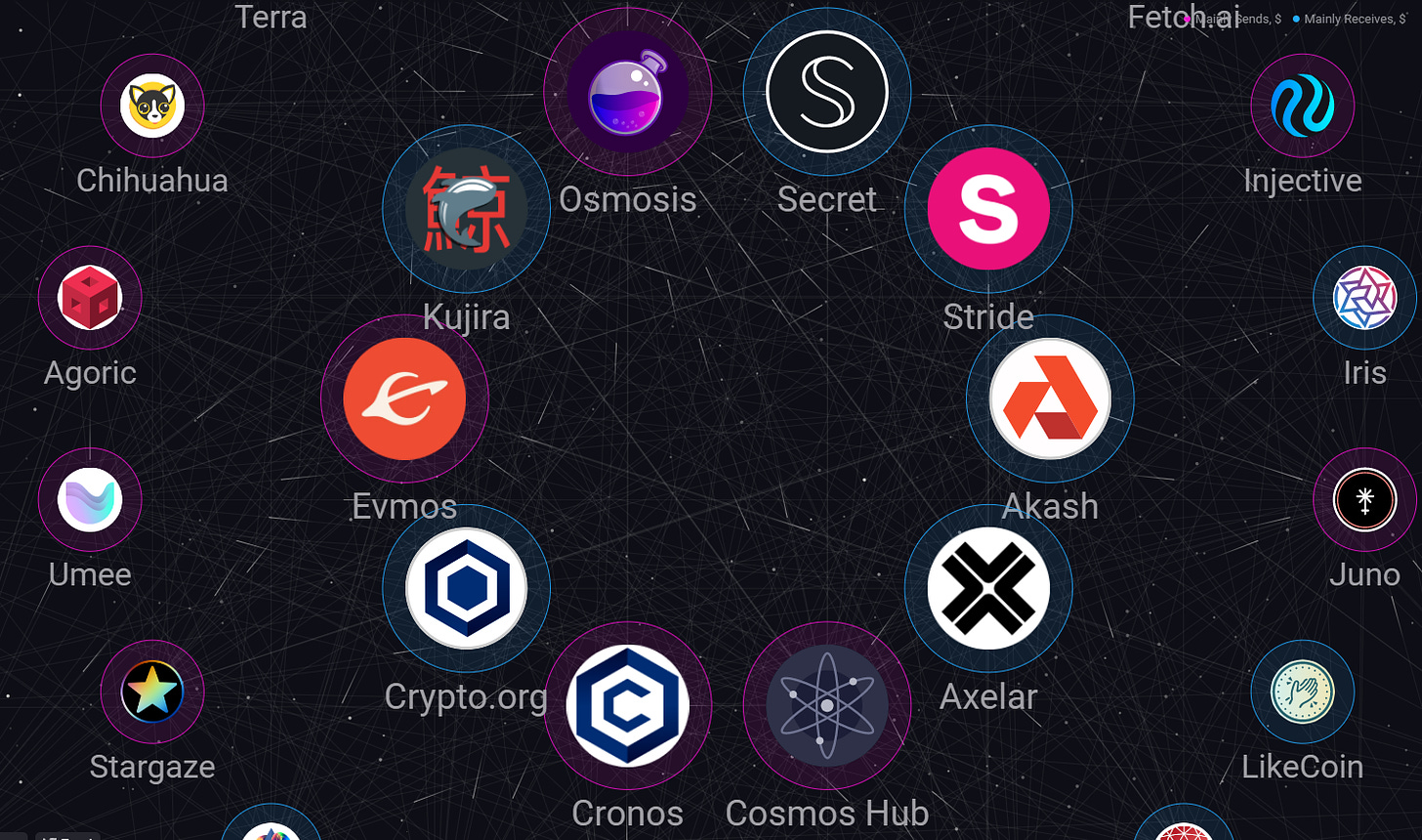

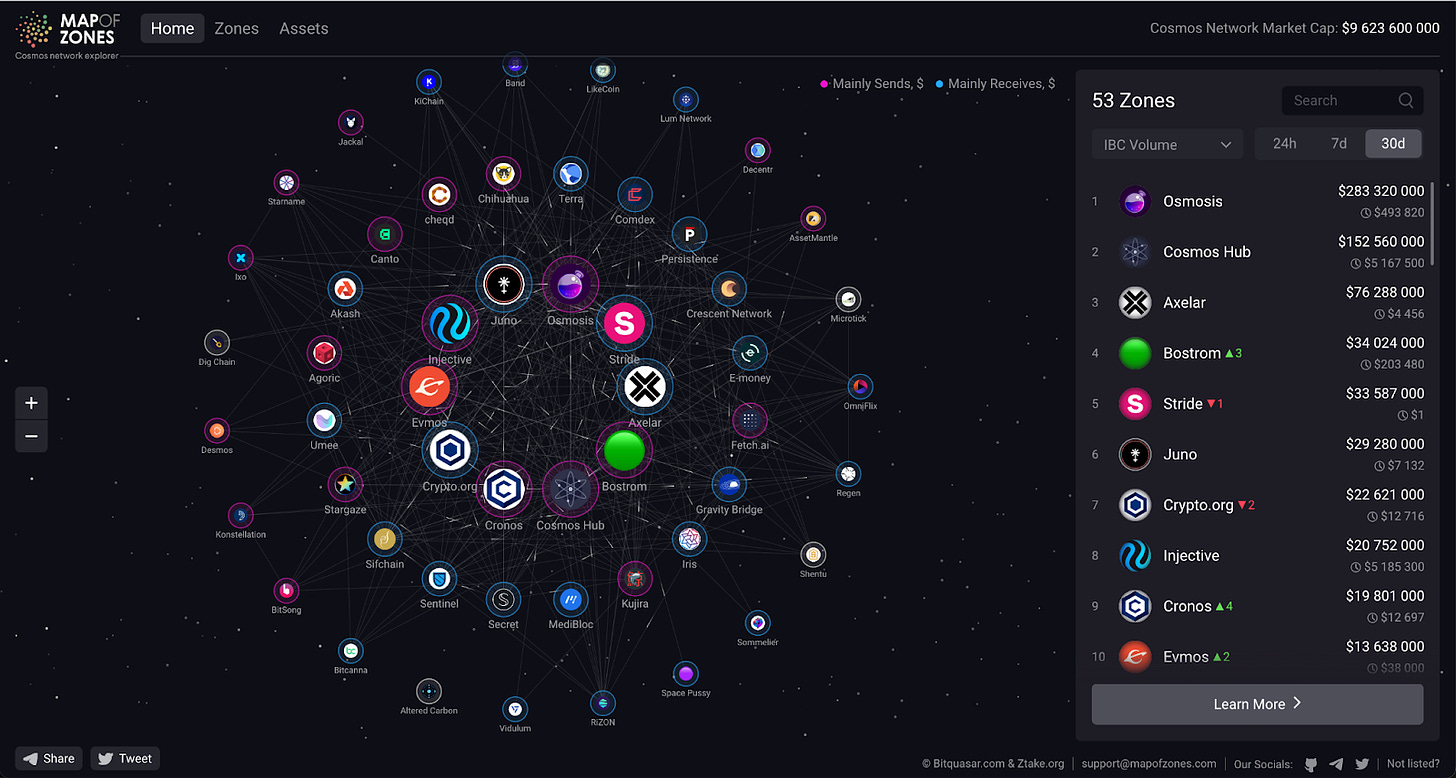

By building on the Cosmos ecosystem, Osmosis can leverage interoperability at the protocol level. This means that Osmosis can execute transactions across different networks in a seamless manner. For users, it means that they can access a bigger market for trading: the market cap of all projects in the Cosmos ecosystem provides a multibillion-dollar marketplace.

Cosmos Map of Zones reveals that Osmosis occupies a bright spot thanks to its connectivity with other Cosmos chains. In fact, it has been the leader chain by volume on a consistent basis. Notably, Osmosis was the first IBC-enabled DEX in the Cosmos ecosystem. Although now there are alternatives such as Injective Protocol or the Gravity DEX, Osmosis continues to rank first in IBC transactions thanks to its first-mover advantage.

Osmosis also has a competitive advantage over other AMMs due to its custom features. By allowing the AMM to quickly adapt to changing market conditions, Osmosis offers a competitive advantage for developers to come up with innovative use cases since they have the freedom to change key protocol parameters like swap fees, token weights, TWAP calculations, price curves, etc., This is often not the case in the majority of competitors, which must hard-code their protocol parameters.

Taking Uniswap V3 as an example, its AMM allows users to create liquidity pools with different sizes ranging from 0.3% to 1%. While this might be flexible enough for most users, most sophisticated traders demand additional parameters such that, for instance, fee structures respond to changes in volatility or account for slippage conditions. Osmosis’s original vision (inspired by Sunny Aggarwal’s paper titled DAOfying Uniswap Automated Market Maker Pools) aimed to adapt the Uniswap AMM model to become a more versatile tool by:

- Adding more customizability to Uniswap price curves by turning liquidity pools into DAOs that can use its governance structure to improve the parameters of the curve and fee models.

- Allowing multiple DAOs to compete for the same trading pair to provide the best value for users.

Currently, there are 53 projects building on Osmosis that will bring in decentralized perpetual futures, CDP-based composable collateral, money markets, yield aggregators, etc.

Osmosis also has the potential to deliver potential returns as a result of its first-mover advantage in deploying safe and low-fee access to cross-chain asset swaps. This allows the protocol to acquire users, volume, and liquidity ahead of its competitors.

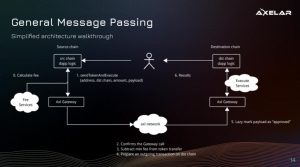

Furthermore, cross-chain swaps are only the first cross-chain offering provided by Osmosis. Apps that adopt Osmosis as their back-end will also benefit from the generic interchain messaging, interchain NFTs, and the full spectrum of DeFi use cases enabled through IBC and Axelar.

Also, Osmosis announced the integration of Kado as a fiat on-ramp, which will improve the user experience by providing a similar experience to a CEX while still maintaining the permissionless and censorship-resistance properties of the blockchain.

Competitive Landscape

As of now, no competing cross-chain liquidity service provider can offer similar levels of security and decentralization as the combination of Osmosis and Axelar.

- Wormhole enables quality bridging and insurance at the expense of decentralization.

- Connext’s optimistic mechanism introduces latency.

- Other secure alternatives such as the Gravity Bridge and Thorchain cannot offer the range of cross-chain services or the integration speed of Osmosis and Axelar.

The Osmosis co-founder Sunny Aggarwal has also publicly mentioned that he does not see Cosmos and Polkadot as competitors. In fact, Osmosis will enable swaps between Cosmos, Polkadot, and Ethereum. Osmosis aspires to become more than just a DEX on Cosmos and, thanks to its integration with Axelar, it hopes to become the core infrastructure layer for cross-chain interoperability.

For Users

Target Users

Osmosis is known as the number one source of liquidity in the Cosmos ecosystem. Its primary function is an AMM, meaning it functions as a DEX for users who wish to trade and swap between assets, and as a place for investors to deposit liquidity for these swaps to earn a yield. In addition, users can also create their own liquidity pools permissionlessly, and customize the parameters as they see fit. This makes for more possibilities for users and investors.

AMM

In Osmosis, AMM pools are permissionless and any user can make a pool for any asset. Pool creators are responsible for setting swap and exit fees paid by traders and liquidity providers. The AMM offers the following features:

- Token weights: In Osmosis, liquidity pools are clusters of tokens with pre-defined weights, where a token’s weight is how much its value accounts for the total value within the pool (e.g. Uniswap pools assign 50-50 weights to each asset of their dual-asset pools). Pool creators are responsible for setting weight parameters during the creation of the pool.

- Deterministic Pricing is a side effect of fixed token weights. Since the assets maintain their weights by divergences in value relative to each other, the price will adjust so that the relative values between tokens remain equal. Deterministic pricing is the reason why liquidity is so important for AMMs. The reason is that the cost of each trade is based on how much it disrupts the ratio of assets within the pool. For instance, traders prefer deep liquid pools because each of their orders involves only a small percentage of the total assets in the pool and prevents single orders from causing dramatic price swings.

- For example, in a 50-50 weighted pool between assets A and B, a large buy of asset A results in fewer tokens in the pool and an increase of the token A price.

- Low-liquidity pools result in slippage, where the cost of a trade is much higher/lower than the trader expects.

- Arbitrage between liquidity pools of the same assets helps to keep prices relatively stable.

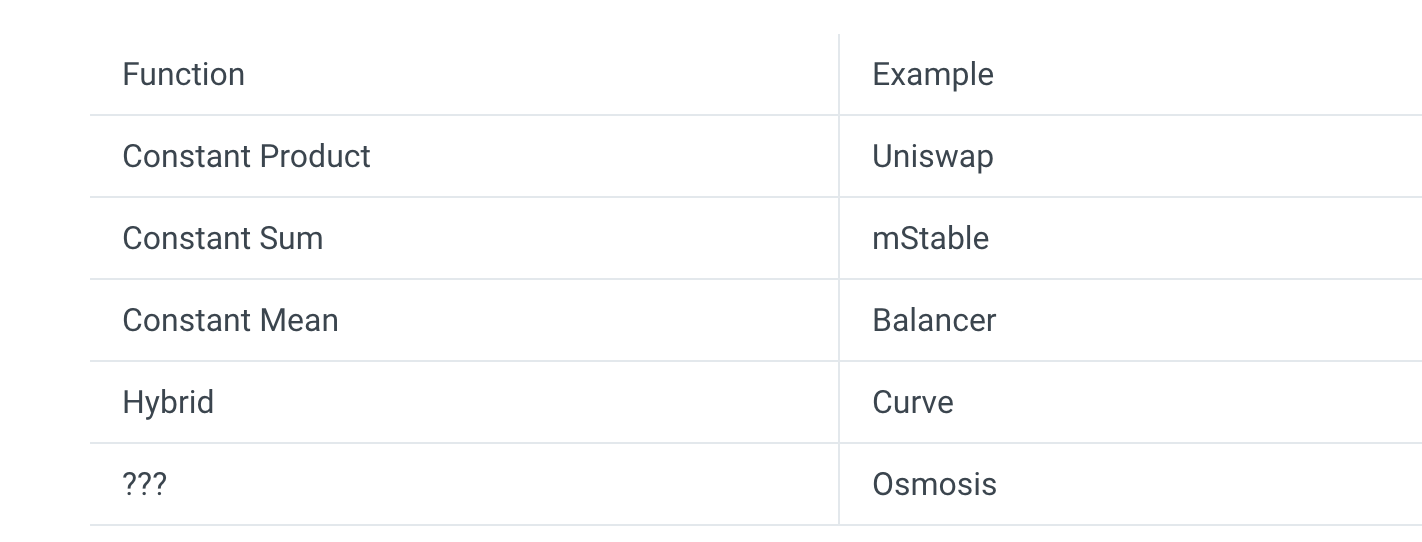

- Market maker functions are customized and specific to each pool. Pool creators can choose the bonding curve of their choice. Because of this, Osmosis does not require every pool to utilize the same function. This allows liquidity pools to be created with any conceivable design. This creative freedom allows for more innovation to come up with new methods of reducing slippage or impermanent loss.

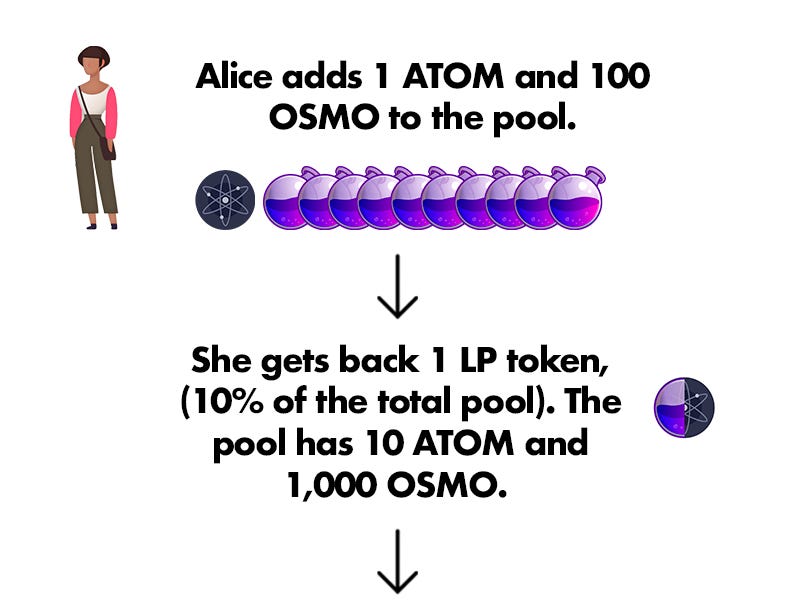

LP Tokens

Similar to other AMMs, when users deposit assets into a liquidity pool, they receive LP tokens that represent their share of the total pool (these tokens do not correspond to an exact quantity of the tokens provided, but rather to the proportional ownership of the pool). When users remove the liquidity, they get back the percentage of the liquidity represented by their LP tokens. Since buying/selling removes/adds tokens to the pool, it is unlikely that users withdraw the same amount of each token they deposited. They will usually receive more of one asset and less of another, based on the trades executed in the pool.

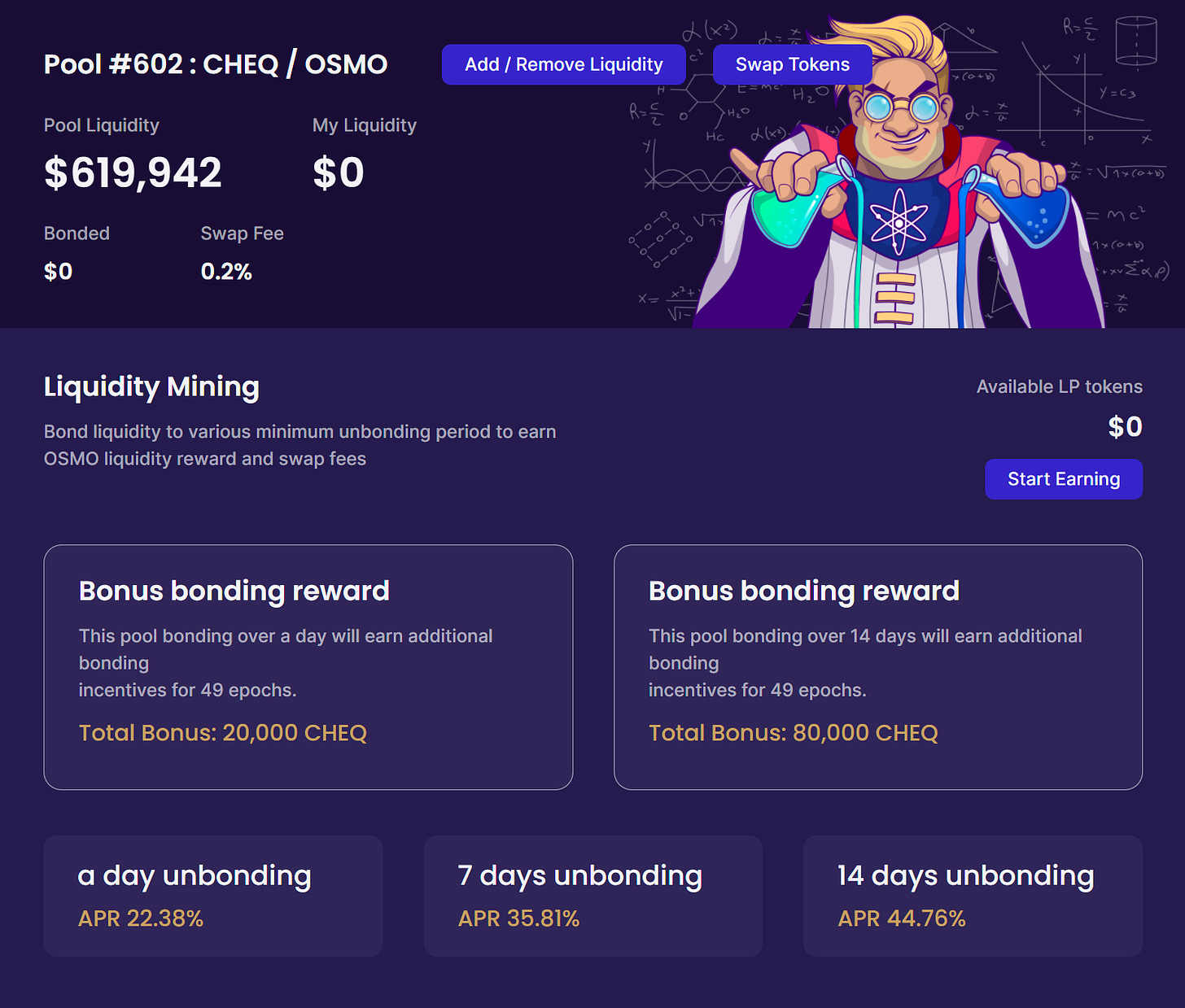

Liquidity Mining

Osmosis resorts to liquidity mining (also known as yield farming) to incentivize liquidity providers to deposit their assets in the protocol during its early stages of development and growth. These rewards come from the $OSMO token inflation and are meant to offset the impermanent loss experienced by LPs. This represents an extra incentive beyond the earnings that result from trading fees.

Volume Splitting Incentives

Volume splitting present a novel mechanism to divide incentives between pools in proportion to the trades they facilitate, marking a departure from traditional incentive models where incentives are manually allocated. The following are features of this method:

- Pool Groupings: Unlike conventional gauges, Volume Splitting Incentive gauges cover a group of pools rather than a single pool. Incentives are allocated to this grouping, opening up new incentivization strategies such as targeting pairings rather than pools or grouping of like assets. Osmosis has initially passed proposals to create groups for major pairings 4 such as OSMO/ATOM, as well as Stablecoin Agnostic groups that incentivize groups of pools involving well known Stablecoins such as $USDC, $USDT and $DAI.

- Dynamic Recalibration: The proportion of incentives distributed to each pool within the grouping is recalculated every epoch based on the trading volume in the pools over the previous day. This real-time adjustment ensures that pools generating the most volume per unit of liquidity receive a proportionate share of incentives.

- Encouraging Liquidity Migration: Lower fee pools are often associated with higher trading volumes due to lower costs for traders and increased arbitrage opportunities. Volume Splitting Incentives actively encourage liquidity to migrate to these high-traffic, lower-fee pools, creating a self-sustaining cycle where liquidity providers in established markets will be compensated for moving to a lower fee liquidity pairing, while liquidity providers in less popular routes will continue to benefit by remaining in higher fee pools.

- Fees and Attractiveness: As liquidity moves to lower-fee pools, the fee per trade decreases, making Osmosis a more attractive exchange for traders, increasing the volume on the chain. This shift also alters the fee collection ratio between Liquidity Providers and the protocol, compensating the protocol for any liquidity incentive costs by increasing the revenue from the taker fee.

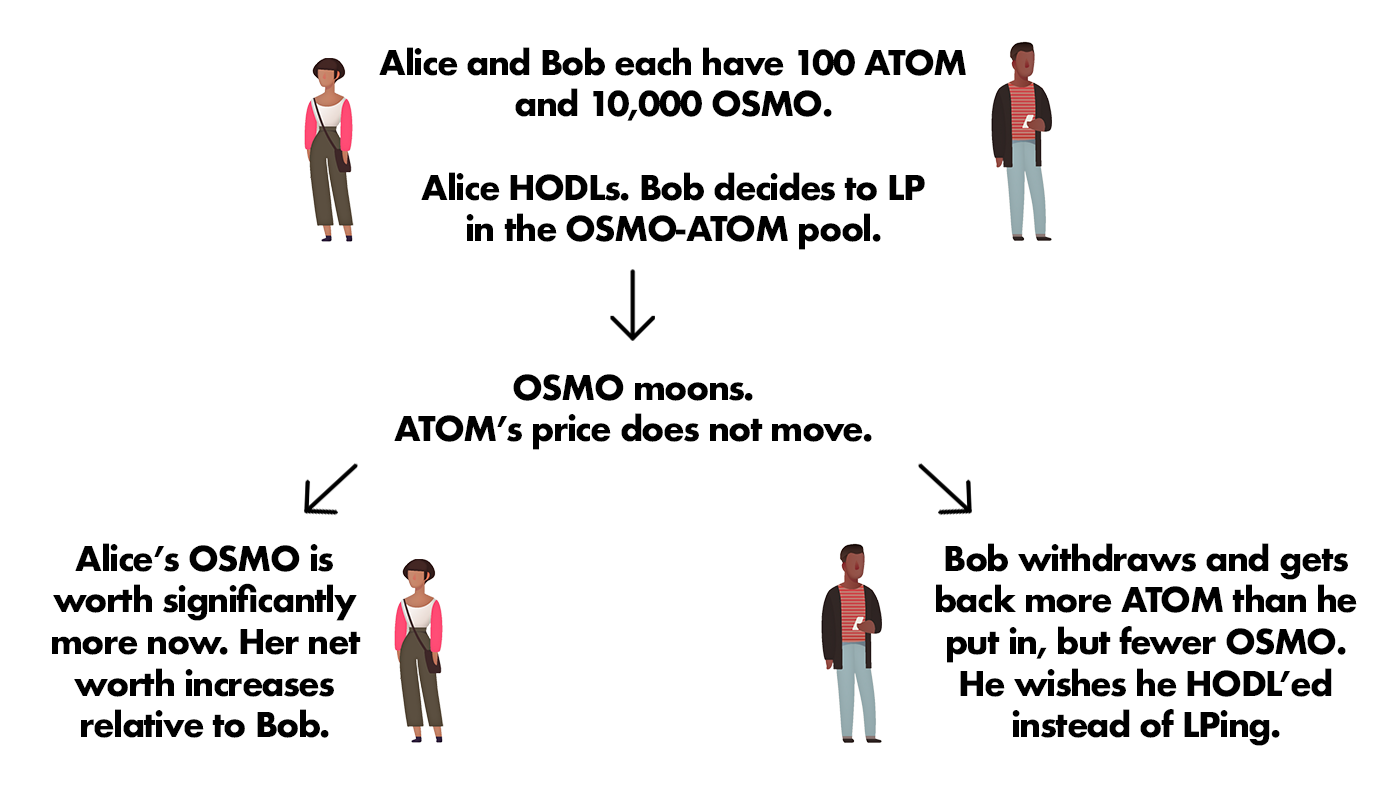

Impermanent Loss

Regardless of the bonding curve of any given pool, liquidity providers are exposed to impermanent loss. Impermanent loss is the difference in net worth between HODLing and LPing. This occurs when LPs would be better off in dollar terms holding their assets instead of depositing them as liquidity.

When the price of the assets in the liquidity pool changes at different rates, LPs end up owning larger amounts of the asset that increase in price less. While this is mitigated in part by distributing swap fees with LPs, liquidity mining rewards also act as an additional incentive

AMM as a Serviced Infrastructure

Osmosis’ design accounts for the rapid increase in the number and complexity of financial instruments in the market, such as options, pegged asset swaps, tokenized leveraged positions… Each of these instruments has its own set of characteristics that produce optimal market efficiency when paired with the correct bonding curve.

By providing an “AMM as a serviced infrastructure”, Osmosis avoids compromising efficiency and can offer a flexible value function whose parameters can be adjusted to work for the majority of decentralized instruments. Since Osmosis provides the creator of the pool with the ability to define its bonding curve value functions while reusing the majority of the key AMM infrastructure, the barrier to creating a tailor-made and efficient automated market maker is significantly reduced.

To ensure abundant liquidity at all times, the DEX implements two mechanisms to support the long-term viability of the project: bonded liquidity gauges, and exit fees.

- Bonded liquidity is usually referred to as liquidity incentives, where LPs who add assets to a liquidity pool for a period of time are rewarded with native $OSMO tokens. LPs can choose the period of time they provide the liquidity for, such that the exact amount of $OSMO they earn depends on the length of bonding time and bonded tokens.

Not all pools receive $OSMO incentives, since this decision is up to governance. Certain pools receive “allocation points” and subsequent $OSMO rewards are issued proportionally based on each pool’s points count. For pools that do not get to earn from $OSMO emissions, external incentive providers may step in to distribute their own rewards and designate the eligibility requirements.

- Exit fees are applied every time bonded capital attempts to withdraw capital from the liquidity pools. This fee is charged in the form of LP tokens and is determined by the pool creator to benefit the remaining contributors in the pool since the exit fee is burned.

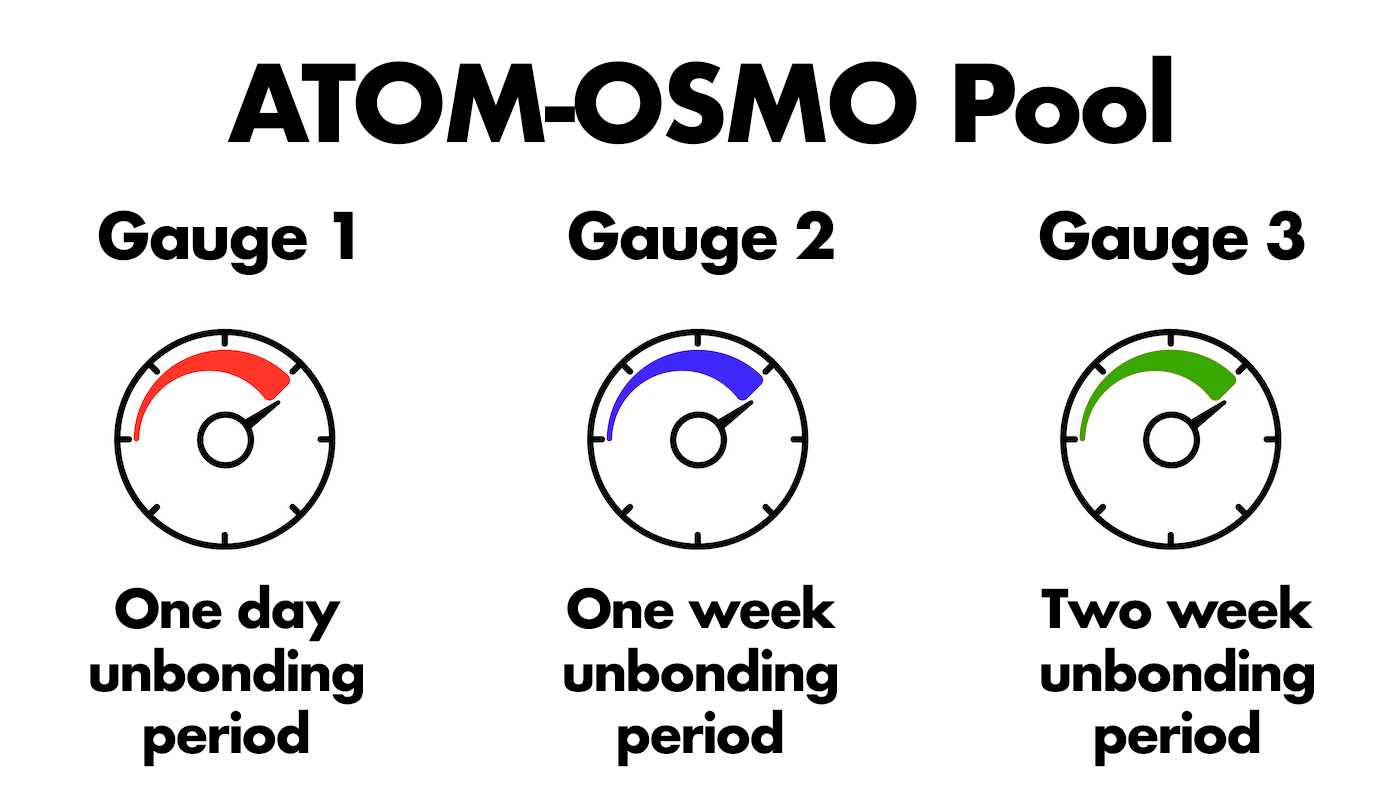

Bonded Liquidity Gauges

Bonded Liquidity Gauges are a mechanism that enables the distribution of liquidity incentives to LP tokens that have been bonded for a minimum period of time.

- Currently, 45% of the daily $OSMO issuance is allocated toward these liquidity incentives.

- The amount received by each user will be proportional to the number of their bonded tokens.

- A bonded LP position can be eligible for multiple gauges.

- The liquidity incentives rewards earned from liquidity mining are not subject to bonding, which means that they are liquid and can be transferred immediately (only the principal bonded shares are subject to the unbonding period).

Osmosis Stableswap

Osmosis stableswaps facilitate deep liquidity and trades with minimal price impacts for stablecoins and correlated assets. This is beneficial for all ecosystem participants:

- DEXs save on incentives since the liquidity for stablecoin swaps is more efficient than in the classic non-concentrated AMM liquidity.

- Liquidity providers will be more attracted to stableswap pools despite their lower incentives because they offer better protection against impermanent loss and allow them to create positions with a single asset.

- DeFi applications such as lending markets, yield vaults, and derivatives protocols… will enjoy access to more capital-efficient stablecoin swaps, which translates into better pricing.

- In addition to swaps between stablecoins, this primitive also improves swaps for quasi-pegged assets, like liquid staking derivatives and their native asset.

Despite the high inspiration from Curve’s concentrated liquidity AMM, Osmosis implements additional features to improve in terms of capital efficiency.

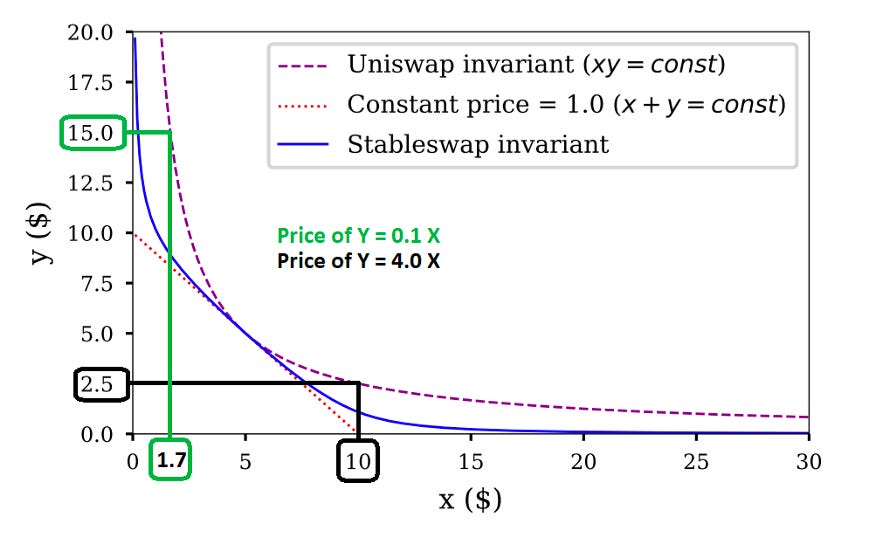

Osmosis stableswap is built using a generalization of Andre Cronje’s Solidly curve: f(x, y) = x*y*(x^2 + y^2) = k

Having a simpler equation than Curve’s design improves the efficiency of on-chain computation of prices, swaps, tokens in/out… This was achieved as a convex optimization algorithm that attempts to equally balance speed, precisions, and computation efficiency.

Beyond the consolidation of one main pool for deep stablecoin liquidity, choosing an initial tripool for incentives would lead to Osmosis’ equivalent of Curve’s 3crv, the LP token that represents a claim on Curve’s 3pool made out of DAI, USDC, and USDT. These “3osmo tokens” could help stabilize other stablecoins in the ecosystem and might perhaps become the meta-stable of the interchain.

You can find a more complex breakdown of the stableswap formula here.

The Interchain is a term used to refer to the way blockchains can communicate and interoperate with each other.

Cross-chain Native Sovereign Chain

The Osmosis chain was designed to be cross-chain native. Because of that, the chain was built to be IBC-compatible from the beginning. This also allows the protocol to, later on, integrate other non-IBC enabled chains such as EVM-based chains (via the Gravity bridge), Bitcoin-like chains, or other alternative smart contract platforms.

As an application-specific chain, Osmosis is unique within the Cosmos ecosystem because it aligns liquidity providers, DAO contributors, and delegator incentives. For instance, staked liquidity providers have sovereign ownership over their pools. On top of that, they can adjust parameters based on the competition across pools and the state of the market. Since nothing in the Osmosis AMM is hard-coded, LP providers can vote to change pool parameters, swap fees, token rates, rewards, incentives, or curve algorithms.

Time Weighted Average Price (TWAP)

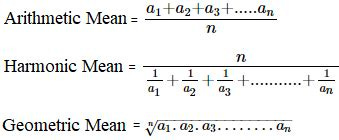

The TWAP package is responsible for serving a TWAP indicator for every AMM pool. This time-weighted average price calculation takes in a sequence of timestamps and prices as inputs and returns a price that represents the average price over that entire period of time. Osmosis currently implements an arithmetic mean (instead of a geometric or harmonic mean).

An asset’s time-weighted average price (TWAP) is the measure of its average price over a predetermined period of time. This indicator is often used by traders as an algorithmic trading indicator that allows them to minimize the impact of large orders on the market (by dispersing the large order into smaller quantities that are executed at regular intervals over time).

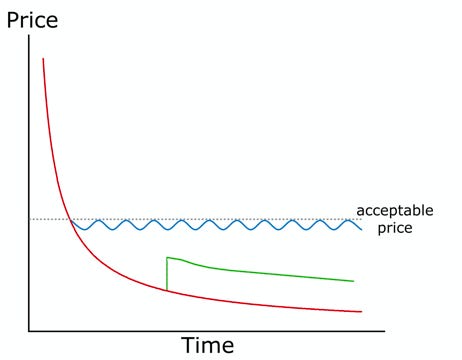

Liquidity Bootstrapping Pools (LBPs)

Liquidity Bootstrapping Pools (LBPs) are a special type of AMM designed specifically for token sales. This is a feature that can be sued by other protocols to distribute their native tokens and achieve initial price discovery.

LBPs are different from other liquidity pools in the ratio of assets within the pool. In an LBP, this ratio changes over time (duration of the token sale). To do that, LBPs set an initial ratio, a target ratio, and an interval of time over which the ratio will adjust. These parameter values are customizable before the token launch. For example, one project could set an initial 90-10 ratio with the goal of reaching a 50-50 ratio over a month. Doing this, the ratio will gradually adjust until reaching the target ratio within the pool.

Similar to other liquidity pools, the prices of the assets are based on the ratio at the time of the trade. Finally, once the LBP period ends, or the final ratio is reached, the pool converts into a traditional liquidity pool.

LBPs find its product-market fit to be an effective use case to facilitate price discovery. This is achieved by demonstrating what the acceptable market price of an asset is over a period of time. Ideally, there will be few buyers at the beginning of the sale. Next, the price will start to slowly decline until traders start stepping in and buying the asset. As the ratios adjust and the price declines, buyers will step in until an acceptable price is reached again.

- When an acceptable price is reached, arbitrageurs will maintain the price at that level (blue line).

- When the target price of the asset is too high, the price might not be attractive enough for traders and there will be lower demand (the green line represents a large buy order but afterward the price continues to decline, since there are no additional traders willing to pay that price for the asset).

Projects must be aware of the parameter values they set to facilitate the price discovery of the pool:

- If the initial price is too low, the asset will get bought up as soon as the pool is created

- If the target price is too high, there will be little demand for the asset

How to create an LBP: https://docs.osmosis.zone/overview/integrate/lbp

Relaying

In IBC, blockchains do not pass messages directly from one chain to another over the network. Therefore, the protocol uses a relayer that monitors and processes message updates on open paths between sets of IBC-enabled chains. The relayer submits these updates in a specific message type that the destination chain can then use to verify the state of the consensus.

In addition to relaying data packets across the chain, the relayer can also open up new paths of communication by creating clients, connections, and communication channels

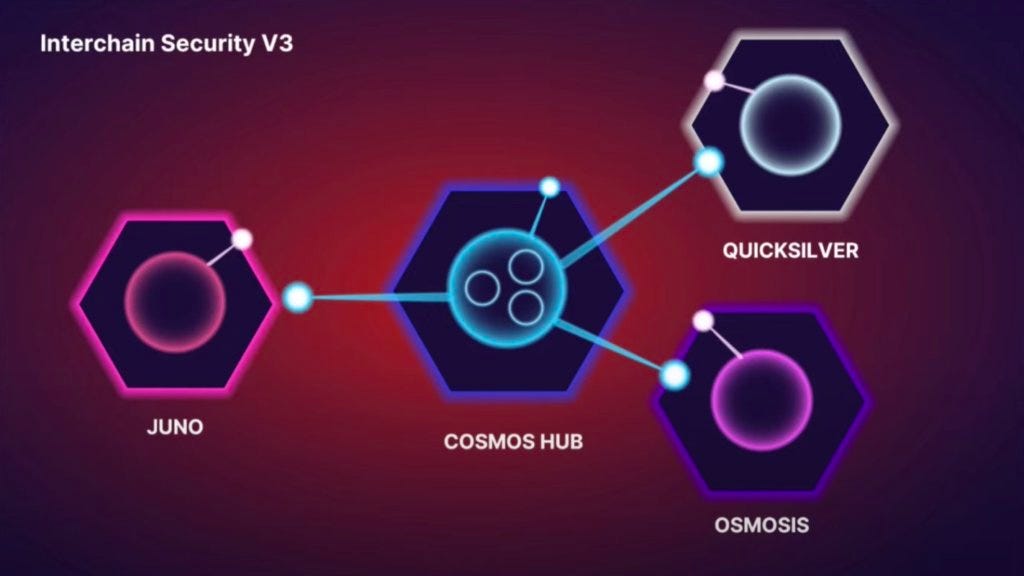

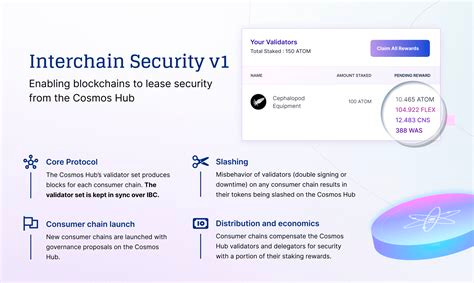

Interchain Security

For a full consolidation and adoption of Mesh Security, Osmosis follows a multi-stage process:

- In version one, one validator set entirely validates another sovereign chain. This method is analogous to an increase in block size and, therefore, does not add any novelty.

- In version two, only a subset of validators would be required to validate a sovereign chain. This is the concept of ‘sharding’. It is a more scalable solution since it does not involve the consensus of additional blockchains. However, this design still lacks the overall sovereignty of a proper mesh network.

- In version three, Cosmos validates its own chain while a subset of its validators validate Osmosis. At the same time, a sovereign validator set on Osmosis also validates its own chain. The problem with this approach is that the Cosmos Hub acts as a centralized point of failure for the entire ecosystem.

The solution to the centralization issue of version 3 is to allow chains like Osmosis to also validate the Cosmos chain via a subset of Osmosis validators. Under this architecture, all Cosmos chains are going to be both provider and consumer chains.

Mesh Security

The Osmosis Grants Program (OGP), in partnership with Axelar, Akash Network, the Osmosis Foundation, and the ATOM Accelerator, will fund an initiative to complete the development of Mesh Security and bring it to mainnet across the Cosmos ecosystem. Mesh Security will be developed as a public good by a team composed of organizations and contributors from across the Cosmos ecosystem. In addition to these initial funding partners, a number of additional chains have verbally committed to support future phases of development including EVMOS, Stargaze, Sei, and Stride.

While the core components of the initial version will be reusable for any CosmWasm-enabled chain, they plan on expanding support for any Cosmos SDK chain in the future. The front-end team will also build 1) an independent web application that is designed to scale to support any mesh-enabled chain; and 2) a UI kit that allows developers to easily embed cross-staking functionality into their application.

Mesh Security vs. Other Security Systems

In models like Interchain Security (ICS), security flows in one direction: down from a parent chain in a hub-and-spoke fashion. In contrast, with Mesh Security, chains combine their market caps for added (bi-directional or multi-lateral) security.

Unlike ICS, Mesh Security partnerships do not require validators to run additional nodes, nor do they require the sharing or cross-chain linking of validators on each chain. Mesh Security simply allows delegators with staked tokens on one chain to restake their bonded tokens to validators of their choice on the partner chain. If the validator they choose to restake on the partner chain misbehaves, the staked tokens will be slashed on both chains. In return for taking on this additional slashing risk, delegators will receive staking rewards from the partner chain in proportion to the amount of CometBFT (Tendermint) power that their home chain is securing for the partner.

Benefits of Mesh Security

- Increased security

- If successful, Mesh Security will increase the economic security of Cosmos chains while allowing them to retain complete sovereignty. There are already high levels of economic interdependence between Cosmos chains (Osmosis, Axelar, Juno, Stargaze, Stride, Mars). Mesh security mitigates the risk of these dependencies by instantiating a security relationship that matches these economic relationships.

- Lightweight Security Provision

- In addition to bilateral security, this infrastructure will also be able to provide uni-directional security. Validators on established chains can “underwrite” the launch of a new chain by running a validator for them. And instead of only relying on their native token for economic security, new chains can be secured by restaked tokens from one or more chains with higher market caps.

- This will allow new chains to rent security from one or more existing chains without requiring governance approval from the security provider chain (uni-directional relationships should only require chain upgrades on the consumer chain).

- Utility Chains with Shared Security

- There are a number of cases where a service is needed but the best version of that service would not be controlled by a single chain. For example, instead of fragmenting name services across many different providers, this service could be in the form of a consumer chain that is secured collectively by all chains in the mesh.

Timeline

The Mesh Security initiative will be completed over three phases, each representing roughly three months of development work.

Phase 1

- Deliver specs and architecture

- Deploy MVP on testnets for feedback

Phase 2

- Deploy a uni-directional version with low-cap chains as consumers

- Test bi-directional version on testnets (both chains are consumers and providers)

- Submit successful governance proposal on Osmosis and Juno (or others) to signal support for implementation

Phase 3

- Deploy bi-directional versions on mainnet

- Deliver open-source repos of core components and UI kit

Cross-chain Swaps as a Service

As a result of the rapid adoption of Axelar as a bridge service provider for application-specific chains in the Cosmos/IBC ecosystem, Osmosis can provide deep liquidity on liquidity pools that allow for swapping assets on any chain supported by IBC.

One of the key differentiators of Osmosis cross-chain swaps is the deep liquidity that the protocol provides for all ecosystem chains in Cosmos. Compared to other applications on Ethereum, like Compound, which had to recalibrate its strategy, dYdX, Synthetix, or Yearn, Osmosis is a sovereign chain instead of an L2 and does not need to pay taxes to the main chain.

Ethereum tokens are available on Osmosis as well, including $WETH and $WBTC. Different wrapped tokens may be listed, but with Axelar playing the role of being the canonical bridge provider. Besides, incentives will be allocated towards AXL-wrapped token pairs. Since Axelar supports many networks, the tokens can be bridged through many different routes. Benefits could be lower transaction fees, increased liquidity across larger or multiple pools for less slippage, or quicker transfer time. However, the downside is that this process adds extra complexity and the user will be subject to swap fees as they trade one wrap-variant for another to jump between certain chains.

Supercharged Liquidity

Supercharged Liquidity (SL) is Osmosis’ customized implementation of the concentrated liquidity mechanism, which was introduced by Uniswap with their UNIV3 implementation. SL will provide liquidity providers and users a 200-300x increase in capital efficiency, significantly improving swap fee collection. Traders on Osmosis will also experience significantly reduced price impacts with large trades.

Custom Trading Ranges

Liquidity providers will be able to supply liquidity at their own custom trading ranges in the pool.

By supplying liquidity within a range where more trading activity takes place, a liquidity provider can significantly enhance the fees they generate. This increase in fees is magnified as long as the trading pair stays within this designated range.

Should the trading price move beyond the range set by the liquidity provider, their ability to earn fees is halted, and the entirety of the provided funds is converted to the lower value between the two assets. To prevent this scenario, liquidity providers can actively modify the price range of their supplied funds to ensure that the trading price remains within the desired range. A narrower range leads to higher earnings but also requires more frequent adjustments.

Only manual pools are available for now, with actively managed pools deployable in the future.

Limit Order Engine

SL can also be used to place “ranged limit orders” that earn swap fees while your limit order is pending execution.

For instance, a user wishes to place a limit order for purchasing $OSMO using $DAI. In this scenario, they can initiate a position with $DAI within the $DAI / $OSMO pool. This involves setting a range below the present trading price.

As the value of $OSMO decreases and starts moving within the predetermined range, the $DAI position will swap into $OSMO and will begin to accumulate swap fees through this liquidity position. If the value of $OSMO keeps dropping to the extent that it exits the defined range on the opposite side, $DAI will be entirely converted into $OSMO. The execution price will be calculated as the geometric mean between the minimum and maximum prices that are established within the specified range.

CosmWasm Pool Module

The CosmWasm pool module enables the creation and management of liquidity pools backed by CosmWasm smart contracts. The feature enables developers to build and deploy custom smart contracts that can be integrated with the rest of the pool types on the Osmosis chain.

The advantage of smart contract pools is that, unlike traditional pools, they can be upgraded and iterated upon without the need for an Osmosis chain upgrade. The module allows for the creation of unique and innovative pool types.

Multi-Asset Fee Whitelisting

Osmosis supports the payment of transaction fees in any whitelisted asset. Currently, assets need to be added to the fee whitelist via governance individually, making it difficult to add or remove additional fee assets quickly.

Following the v16 upgrade, multiple fee assets can be whitelisted using a single governance proposal. Shortly after the upgrade, a governance proposal is expected on chain to whitelist a large number of additional fee denoms, improving the onboarding experience for Osmosis users.

For Investors

Investing Strategies: Liquidity Pools

Customizable Liquidity Pools

Most AMMs have strict parameters that limit the customizability of relevant parameters such as the bonding curve and pool composition. For example, Uniswap only allows two-token pools of equal ratio with a swap fee of 0.3%. This simplicity was very useful for users who had little to no experience in market-making.

However, as the DeFi market size started to increase and market participants became more sophisticated, the need for adaptable liquidity pools became more obvious. This customizability would allow higher-level traders and arbitrageurs to adjust their strategies by interacting with a liquidity pool that would react to market conditions. As an example, the optimal swap fee to charge for an AMM pair may depend on various factors, such as block time, slippage, transaction fees, market volatility…

By making decisions on swap fees, token rates, and reward incentives in a flexible way, liquidity pools can respond to market changes in a way that ensures their success. Nothing in the Osmosis AMM is hard-coded: LP providers can vote to change pool parameters, swap fees, token rates, rewards, incentives, or curve algorithms.

Osmosis provides a protocol that allows market participants to self-identify opportunities in the market and react to market conditions by adjusting various parameters of the pool. For instance, an optimal equilibrium between fee and liquidity can be achieved through an iterative process instead of a centralized one-time decision. This further increases the total addressable market for AMMs and bonding curves that go beyond simple token swaps.

As more liquidity becomes available to users, either through liquidity mining incentives or airdrops, it could be strategic to incentivize market participants to add more liquidity to a pool. This ensures that the pool remains at a healthy and consistent rate for the asset.

Self-Governing Liquidity Pools

The pool governance feature of Osmosis allows for a diverse spectrum of liquidity pools with different risk tolerances and strategies. In Osmosis, liquidity pools are self-governing and completely customizable through governance. This is an innovative and differentiating feature as well since the liquidity pool shares are not only used to calculate the fractional ownership of a liquidity pool but also to provide the right to participate in the strategic decision-making of the liquidity pool.

To incentivize long-term liquidity commitment, shares must be locked up for an extended period of time. Longer-term commitments are awarded by additional voting power or additional revenue from liquidity mining. This long-term commitment helps to prevent the impact of potential vampire attacks, where the ownership of the pool shares is delegated and potentially used to migrate liquidity to an external AMM. Besides, this mechanism provides equity of power amongst liquidity providers, where those with greater skin in the game are given higher voting power to steer the strategic direction of the pool they are taking risks on with their own assets.

The idea behind a vampire attack is to lure users away from a protocol or liquidity pool by forking or incentivizing them to migrate the liquidity to an identical or similar pool that is empowered with a more profitable and attractive incentive mechanism.

One of the most famous vampire attacks was performed by Sushiswap, which offered better liquidity provider rates than its main competitor, Uniswap. This pushed many investors to move their liquidity away from Uniswap and transfer it to Sushiswap instead.

In Osmosis, the liquidity providers who may disagree with the changes made to a pool are able to withdraw their funds with little to no loss. Since Osmosis expects the market to self-discover the optimal value of each adjustable parameter, users will be able to start a competing liquidity pool with their own strategy whenever they disagree with a governance proposal applied to a pool they are in.

Business Model

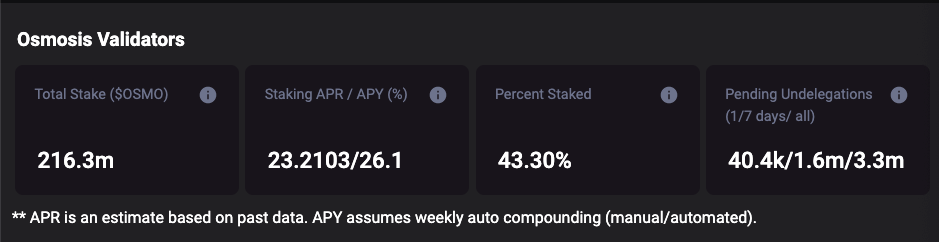

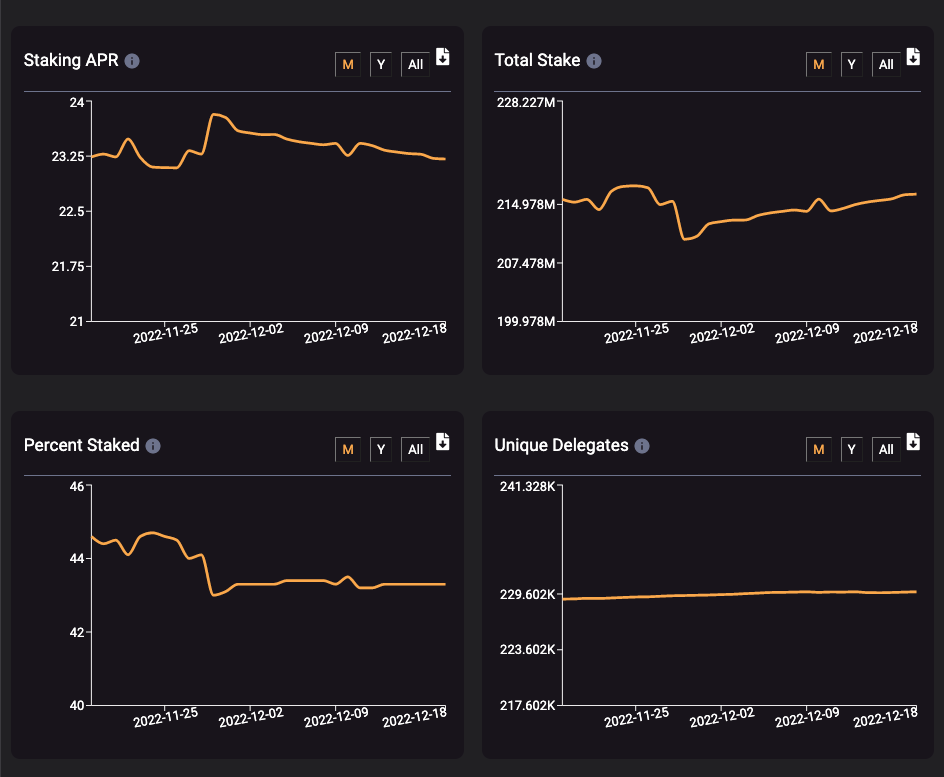

PoS Validation (Staking OSMO)

As a PoS (Proof of Stake) network, token holders are active participants in securing the chain. This is achieved by staking the native token, $OSMO. Validators and delegators secure the chain by participating in network consensus by operating validator nodes (validators) or delegating OSMO tokens to node validators (delegators).

By delegating to a validator, the user is giving permission to that node to use their delegated stake to participate in the consensus of the network. To do that, validators must garner enough stake (self-bonded + delegated) to become active and earn rewards.

While operating a validator requires a level of technical competency, there is no need for delegators to have that knowledge. Any token holder can stake and delegate $OSMO tokens. These tokens will be locked by a validator to start earning rewards. Whenever the delegator wants to recover its liquid tokens, it will start an unbonding process and it will no longer be entitled to staking rewards.

System Requirements

The following requirements are recommended for validators:

- Quad-core or larger AMD/Intel CPU

- 64GB RAM

- 1TB NVMe Storage

- 100 MBPS bidirectional internet connection

How to validate the Osmosis blockchain (mainnet)

How to validate the Osmosis blockchain (testnet)

Staking

- Staking rewards calculator: https://osmosis.smartstake.io/calc

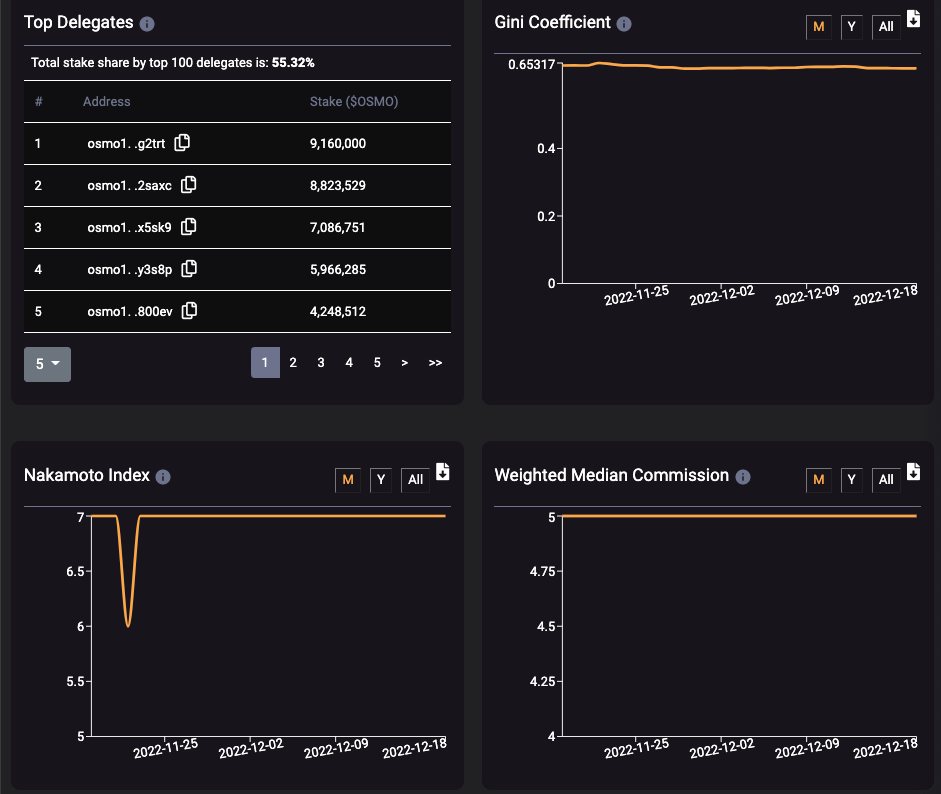

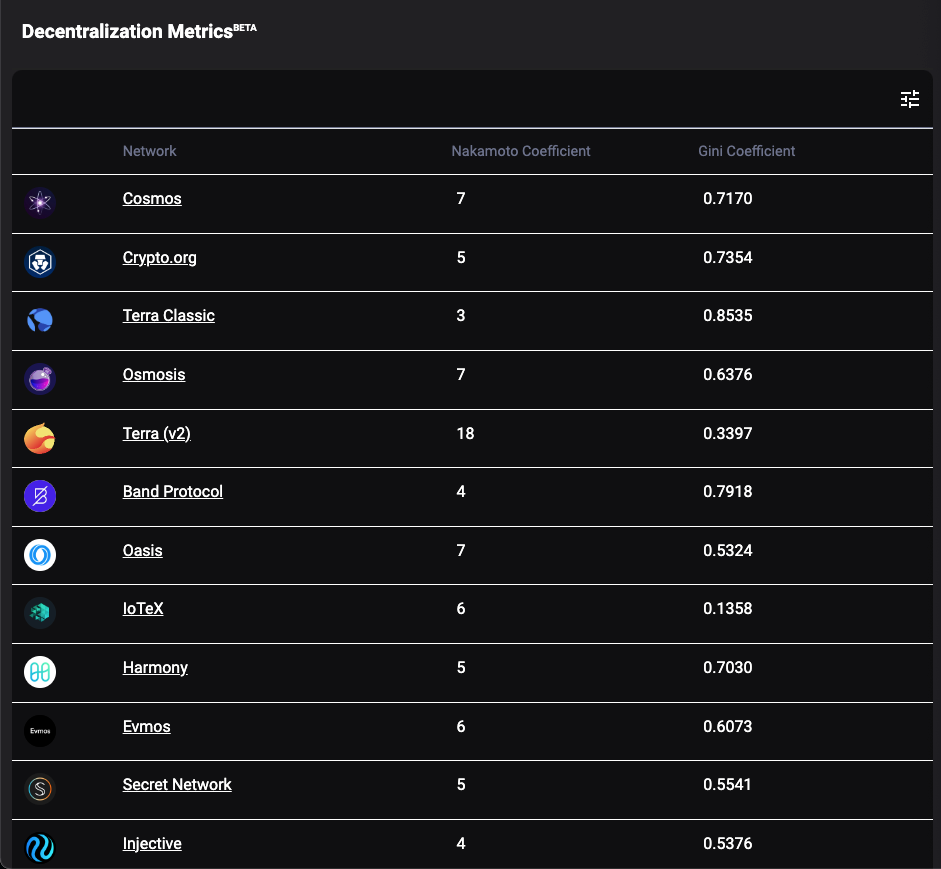

The Gini coefficient is a measure of the reward distribution across the validators in the network (the higher the Gini coefficient, the greater the inequality).

The Nakamoto coefficient measures the degree of decentralization of a blockchain and represents the minimum number of nodes required to attack the network (the higher the Nakamoto coefficient, the more decentralized a blockchain is).

Staking is the process by which users or delegators delegate and bond their $OSMO tokens to an active validator in the Osmosis network in order to receive rewards from inflation (token emissions). The bonded tokens are part of a validator’s stake server as collateral for participating in the network’s consensus process. For this participation, validators earn rewards, but they can also be slashed if they misbehave.

Cross-Staking

Alongside Mesh Security, cross-staking will also be prioritized in the Osmosis roadmap. In Cosmoverse 2022, Sunny Aggarwal, founder of Osmosis, pointed out that roughly 75% of validator sets on Osmosis also run validators on Juno, while 72% of Juno validators also validate Osmosis. The impact of this does not result in an increase in centralization, but rather in the form of a ‘shared security’ model whereby malicious actors on one chain would be slashed on another chain through governance.

In this context, Sunny Aggarwal presented the concept of cross-staking within the Cosmos ecosystem. This would allow validators to boost their rewards across the Cosmos ecosystem using IBC and to submit transactions across more than one chain.

In order to avoid centralization, all delegators choose the validator with the highest rewards due to their participation in cross-staking. Besides, smaller chains would be able to cap the voting power of their chains to protect against 67% attacks.

Revenue Streams

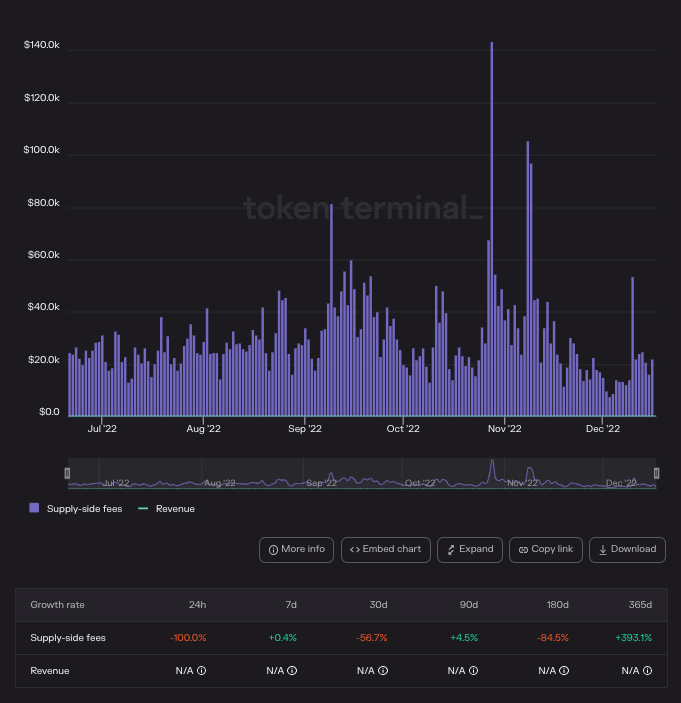

In addition to liquidity mining, Osmosis provides 3 sources of revenue:

- Transaction fees

- Swap fees

- Exit fees

Osmosis Protocol Revenue Module

The Osmosis Protocol Revenue Module came about as a solution to combat MEV (Maximum Extractable Value) searchers capturing millions of dollars through arbitrage on Osmosis (almost $7m), without paying fees to the network in proportion to their profits ($46k in transaction fees).

The module was enabled in the Sodium upgrade on March 16, 2023.

The module was proposed by Skip Protocol (a sovereign MEV infrastructure for sovereign blockchains and protocols), to capture arbitrage opportunities on Osmosis, redirecting proceeds back to the community instead. It is expected to produce an additional $50-150k revenue for the community per month, increasing proportionally with trading volume.

The module works by:

- Checking whether there’s an opportunity to perform riskless arbitrage after every transaction that interacts with a pool on Osmosis.

- When an opportunity is detected, the module will optimally rebalance pools to capture it and distribute the profits to the community.

- Arbitrage profits will be distributed across Osmosis stakeholders based on a future community vote.

- Skip’s payment for developing, maintaining, and upgrading the currently architected solution (and future solutions)

- A share of the new revenue generated from the module is shared with Skip, for as long as Skip actively maintains the module (20% in year 1, halving to 5%).

- The swaps are guaranteed to execute because they run outside of the regular block-building process.

- The module runs after every transaction in the posthandler, a Cosmos SDK feature that allows app chains to run customizable post-transaction processing.

- For this reason, ProtoRev does not pay gas fees, and its swap sequences – as always, barring a full-scale governance/protocol takeover – cannot be frontrun, reordered, or left out.

The Osmosis DAO will be able to use this revenue however it sees fit, with examples such as:

- Lower fees

- Create insurance

- Acquire protocol-owned liquidity

- Pay stakers

- Buy back $OSMO

- Extend emissions

- Fill the community pool for further development.

Economics

Fee Breakdown

The Osmosis txfees modules allow nodes to support multiple assets being used to pay for transaction costs. Because of this, node operators can specify their fee parameters for a single base asset.

- Transaction fees

- Paid by the user any time a transaction is submitted to the chain.

- The fee amount is determined by the computation and storage costs of the transaction.

- The transaction fee is distributed to $OSMO stakers on the network.

- Validators can choose which assets they accept for fees in the block they propose.

- Swap fees

- Charged for making a swap in an LP pool.

- Paid by the trader in the form of the input asset (asset being sold).

- Pool creators specify the swap fee when establishing the pool.

- The total fee for a particular trade is calculated as a percentage of the swap size.

- Fees are added to the pool, which results in a pro-rata distribution to LPs proportional to their share of the pool.

- Exit fee

- The exit fee is paid by LPs when they withdraw their liquidity from the pool.

- Paid by liquidity providers in the form of LP tokens (users withdraw the underlying tokens minus a percent corresponding to the exit fee).

- Pool creators specify the exit fee when establishing the pool.

- LP shares from exit fees are burned, resulting in a pro-rata distribution to remaining LPs.

Tokens

$OSMO is the native token of the protocol, which is used for both governance and staking. For instance, token holders can delegate $OSMO to validators in return for staking rewards and voting rights.

Utility

$OSMO is the governance token and allows staked token holders to make decisions on the future of protocol (proposing, vetting, and passing proposals):

- Vote on protocol upgrades

- Allocate liquidity mining rewards for bonded liquidity gauges

- Set the network swap fee

$OSMO token holders determine which pools are eligible for liquidity rewards with the goal of aligning stakeholders and LPs with the longevity of the protocol.

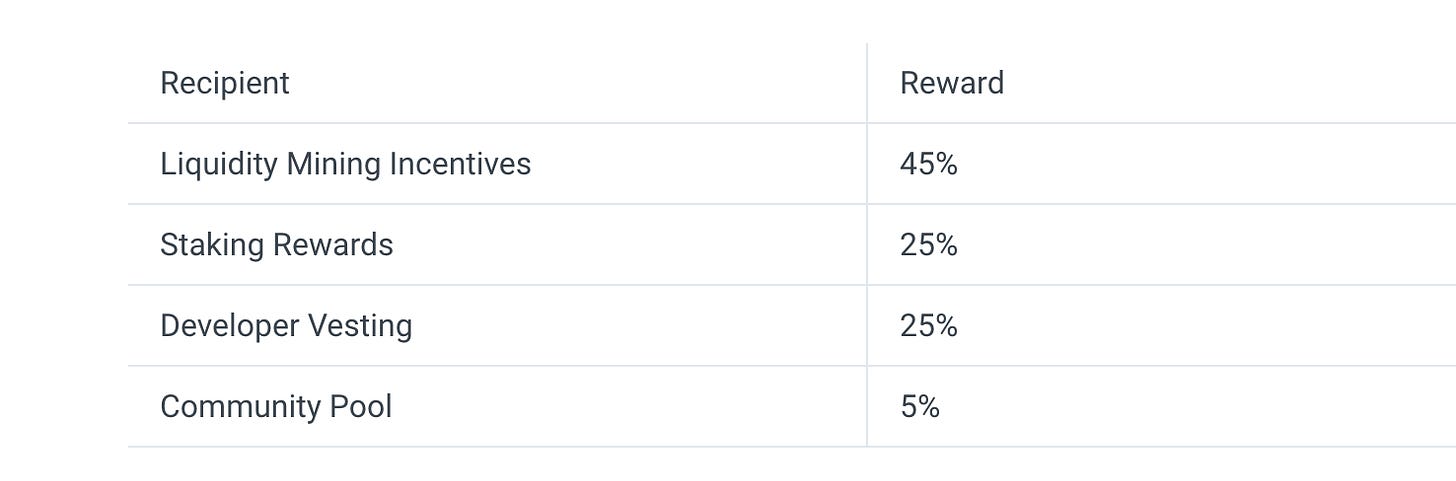

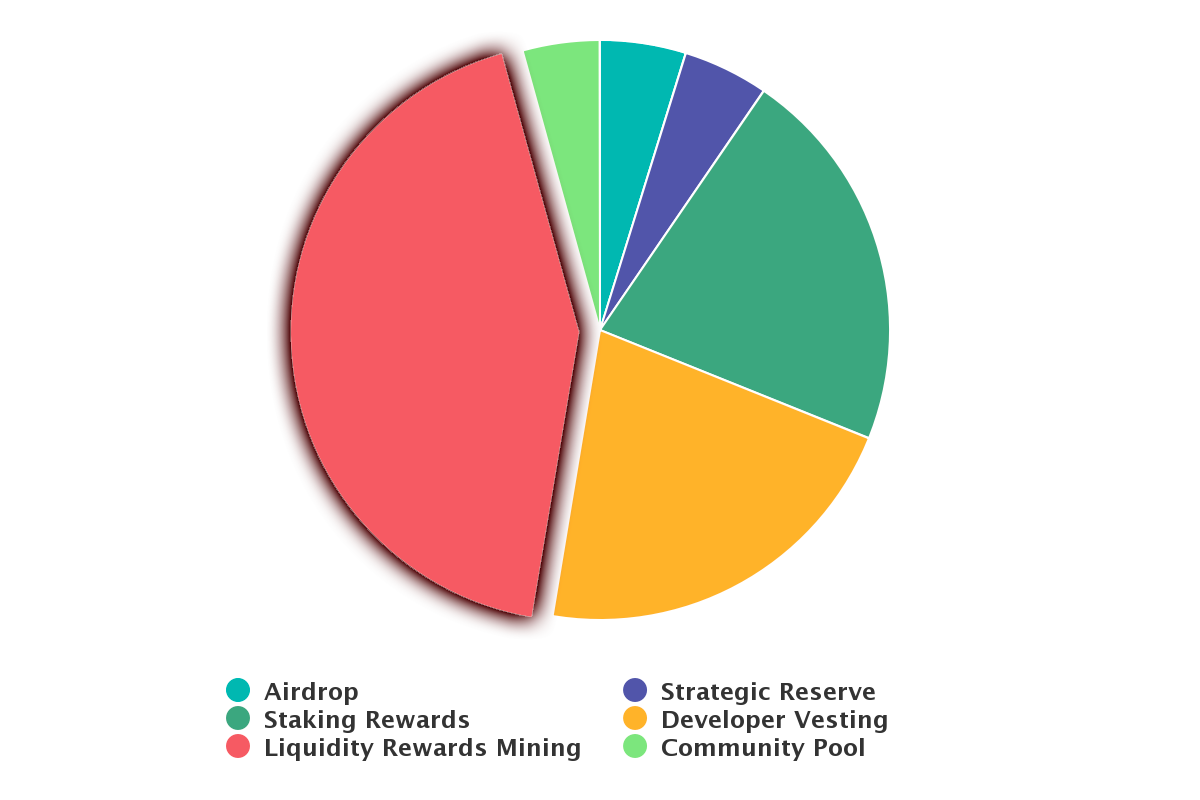

Token Distribution

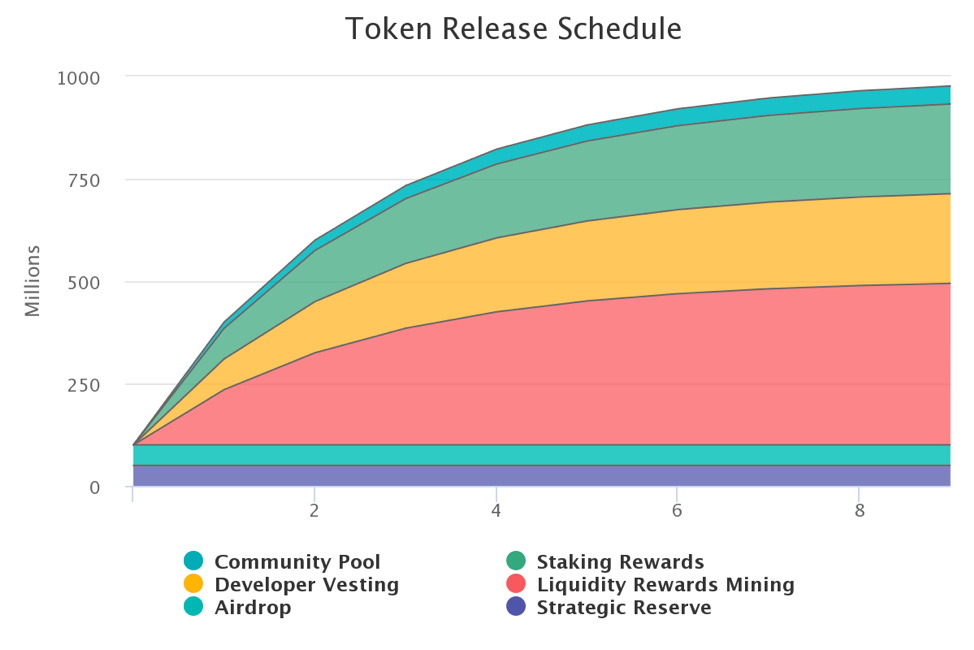

The maximum supply of $OSMO is capped at 1,000,000,000 and follows a 9-year distribution schedule. The distribution emphasizes both staking and liquidity mining rewards, which all together make up 70% of the distribution. This is the result of a strategic decision by the core team to bootstrap the network and gain traction as the go-to Dex in the Cosmos ecosystem.

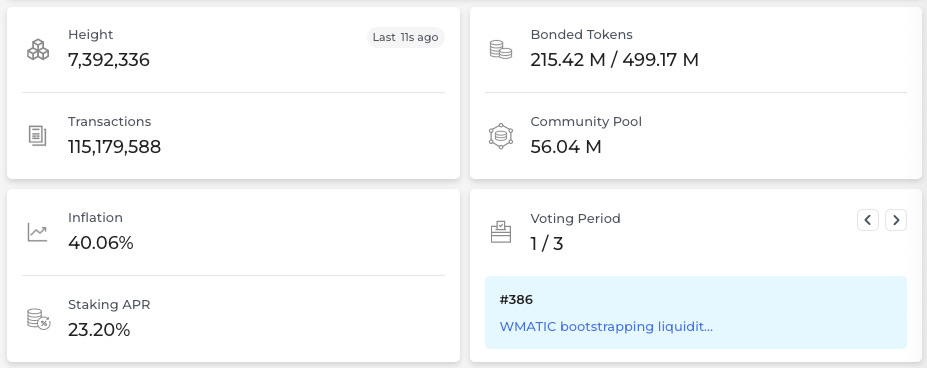

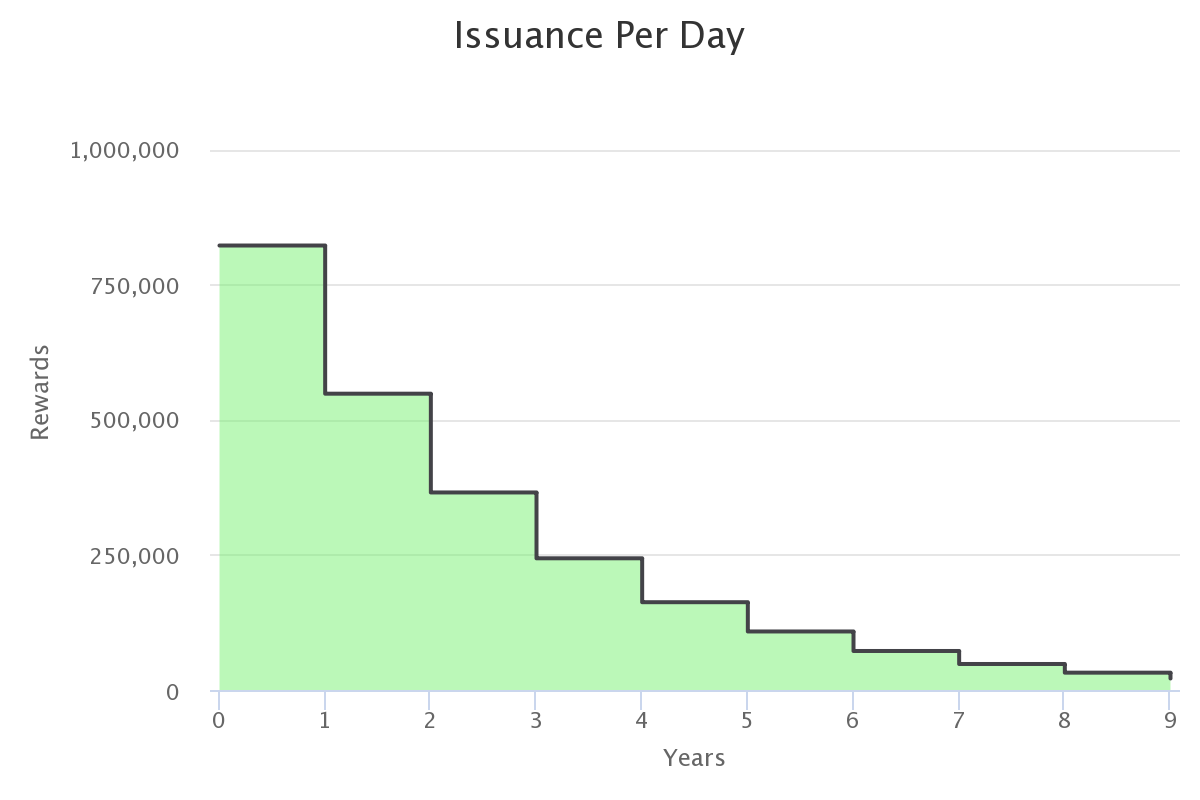

As the protocol gets more product-market fit, the amount of staking rewards and token emissions will flatten over time to reduce the dilution of the token (but also reduce the incentives for token holders). As an example, the inflation of $OSMO during Q1 2022 was 92%. Currently, the inflation rate has decreased to ~40%.

The initially released supply of 100M $OSMO was split evenly between Quadratic Fairdrop recipients and the strategic reserve. After launch, the newly released tokens will decrease the inflation rate following the distribution below.

$OSMO was highly inflationary in the beginning and, over time, the initial released supply will only account for a small percentage of the total supply.

After the genesis supply, additional tokens are issued at the end of each epoch (one day). This is different from the majority of other Cosmos chains, where the issuance is distributed on a per-block basis.

Osmosis’ token issuance follows a thirdening schedule, similar to Bitcoin’s halving (where issuance is reduced by half every 4 years). Due to this issuance cycle, Osmosis token releases are cut by one-third every year.

In the first year, 300M new $OSMO will be issued. In the next year, 200M tokens will be used and in the third year the amount will be 133M tokens. This process continues until Osmosis reaches an asymptotic maximum supply of 1B.

- Liquidity rewards: 45% of released tokens per epoch go towards liquidity mining incentives. Liquidity providers can then bond their tokens to be eligible for $OSMO rewards. Not every LP will receive these rewards, since the percentage allocated to each liquidity gauge depends on Governance.

- Staking rewards are distributed to validators and delegators who help secure the network. They are entitled to 25% of the newly released $OSMO. $OSMO holders can delegate their tokens to validators, who will add the assets to their slashable bond and share the rewards they earn in a proportional manner. Osmosis also allows validators to choose their own commission rate but requires a minimum rate of 5%.

- Developer vesting ensures that 25% of the tokens released per epoch go to developer rewards. These $OSMO tokens are reserved for development and are not transferable or stackable until released. This design ensures decentralization and prevents the development team from exerting too much influence over the governance process.

- Community Pool: 5% of newly released $OSMO goes to the community pool, where governance will make a decision about how to spend the funds: infrastructure, tooling, content, education…

Quadratic Fairdrop

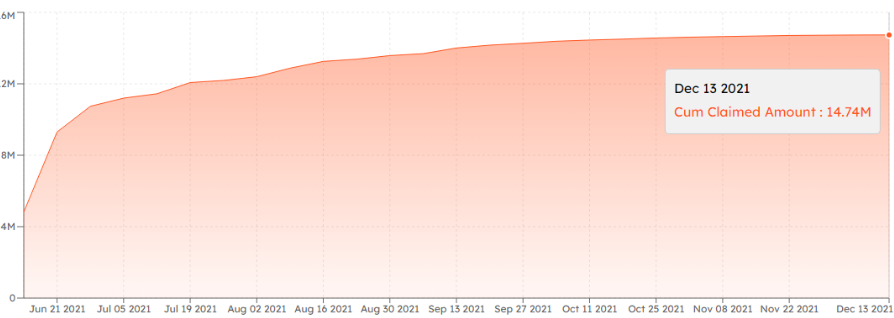

There was no pre-mine and the $OSMO token was daily distributed to network participants, such as stakers, liquidity providers, and developers. The first half of the genesis supply was distributed in a Quadratic Fairdrop.

Since the $OSMO token was deployed during a time when the Cosmos Shared-Security model was not yet implemented, Osmosis allocated its genesis supply to the Cosmos Hub through a Quadratic Fairdrop.

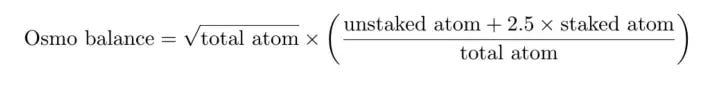

The Quadratic Fairdrop distribution draws its inspiration from quadratic voting, a distribution and incentives alignment scheme that is meant to decrease the inequality in the governance set while still recognizing the most valuable contributors and largest stakeholders. This mechanism rewards Cosmos Hub accounts that actively participate in staking while reducing the amount of $OSMO tokens that are allocated to big players such as exchanges or whales. Through this formula, an address’s potential $OSMO allocation will be proportional to the square root of its $ATOM balance with a 2.5x multiplier applied to staked ATOM tokens:

The snapshot for the Quadratic Fairdrop was taken on February 18, 2021, at 6:00 UTC during the Cosmos Hub Starship Upgrade. Besides, to ensure that users are incentivized, there was a requirement to participate in several on-chain activities in order to earn the airdrop allocation, such as governance, or staking on the Osmosis network. The goal of the quadratic fairdrop ensures that all members of the Cosmos Hub are given an opportunity to participate in Osmosis.

Strategic Reserve

The other half of the genesis supply was set aside for the Strategic Reserve. These funds are reserved (will not be sold on the market) and controlled by a multi-sig DAO initially controlled by the development team. This reserve will be used to align the incentives of long-term stakeholders of the protocol through grants and strategic fundraising. The funds may also be delegated to stakeholders who provide unique value to the ecosystem, such as open-source resources like block explorers, wallets, relayers…

Strategic fundraising rounds are subject to vesting periods that will linearly decrease over two years with a one-year cliff.

Recapturing MEV Revenue

Osmosis has integrated with Skip Protocol, a protocol that brings sovereign MEV infrastructure to blockchains. It currently supports a number of blockchains in the Cosmos ecosystem, including Osmosis, Juno, Injective, and Evmos. Skip Protocol aims to reduce the impact of MEV on blockchain ecosystems. MEV in the context of blockchains has several negative implications. For one, UX can be negatively impacted, as automated bots arbitrage trades happening on the chain. MEV can also have centralizing effects on a blockchain.

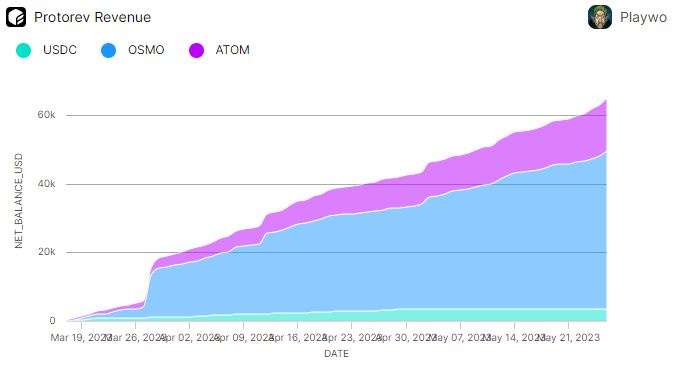

ProtoRev, a recent initiative from Skip Protocol aims to help solve this issue of Osmosis. ProtoRev returns revenue previously lost to MEV back to the chain. This MEV recapture is given in the form of $USDC, $OSMO, and $ATOM.

As you can see, the majority of the real yield being earned from ProtoRev is in $OSMO. This is because most of the trading volume that takes place on Osmosis involves the $OSMO token since it’s used in many LP pairs.

The community is still discussing what productive use cases exist for this real yield that is now being generated for Osmosis. Multiple proposals have been put forward, with some being rejected or receiving criticism.

Liquidity Mining Incentives

There are two ways by which Osmosis pools can earn rewards from liquidity mining incentives:

- $OSMO token inflation (45% of the daily inflation is allocated as incentives for users to bond their liquidity on Osmosis)

- Permissionless creation of external liquidity mining gauges so that other projects can add their own rewards to further incentivize users to deposit assets in one specific pool.

Osmosis Liquidity Mining

Osmosis relies on Bonded Liquidity Gauges to distribute its liquidity mining rewards to LPs that have been bonded for a duration of time. 45% of the daily issuance of $OSMO tokens goes towards these incentives.

Whenever a pool is onboarded to receive Liquidity Mining Incentives, it will be assigned a number of allocation points that will entitle that pool to a specific percentage of the daily $OSMO issuance.

The OsmoIncentives github repo is actively maintained and is responsible for creating a new proposal that adjusts the incentives allocation on a weekly basis. The distribution is exported to a CSV file that is attached to the current voting proposal and the prospective proposal spreadsheets.

- Target Share is allocated to each pool based on its category and the proportion of swap fees the pool has collected within its own category.

- Minimum Share can be assigned to a pool by governance (to incentivize liquidity ahead of the observed trading volume). Minimum shares have currently been set for the $OSMO/$ATOM, $OSMO/$WETH, $OSMO/$WBTC, $OSMO/$CRO, and $OSMO/$USDC pools.

- Maximum Share can be assigned by governance to prevent scenarios where too many incentives are allocated to any one pool and to ensure a diverse range of liquidity is available for traders.

The category of a pool determines the ratio of incentives:

- Osmo/Major – 45%

- Osmo/Stable – 30%

- Osmo/Minor – 14%

- Stable/Major – 0%

- Stable/Stable – 0%

- Others – 2% – Liquidity for Minor tokens paired with non-Osmo

Qualification for Major is determined by governance based on a combination of factors:

- Market cap relative to OSMO

- Whether the majority of the trading volume happens outside of Osmosis or not

- Whether there is a strategic interest to attract more liquidity of a given token

External incentives

External incentives are an effective way for other projects to incentivize users to deposit liquidity in the pool of their native tokens. This is a permissionless process where anyone can deposit any amount of token into a gauge to start bonding rewards to the users of that pool.

In fact, to attract more projects to the ecosystem, Osmosis Governance voted to add the External Incentive Matching program.

The External Incentive Matching program dictates that, if on-chain governance votes in favor of matching external incentives to a pool, then the amount of incentives is measured in dollar value to match the value in $OSMO tokens and release that $OSMO as extra liquidity mining rewards to all bonding gauges of the pool. This has the potential to double the rewards of a project’s external incentives. However, there are certain limitations:

- There is an OSMO bias that can decrease the number of rewards. For example, if the external token is paired with $OSMO, then the value matching is 100%, but if the external token is paired with $ATOM, then the matching value is scaled down to 50%

- See: Osmosis Proposal #264: External Incentive Matching reduction within non-$OSMO categories

- There is a cap on the value that can be paired. This value cannot be more than double the value of the standard $OSMO incentives that the pool will receive from internal liquidity mining rewards (45% daily $OSMO inflation).

- See: Osmosis Proposal #133: Incentive Matching Fee Based and 1:1 Caps

It is also possible to add incentives to any combination of 1-day, 7-day, and 14-day gauges:

- 1-day incentives are split among all 3 gauges

- 7-day incentives are split among the 7-day and 14-day gauges

- 14-day incentives are allocated only to the 14-day gauges

Currently, the only way to create a gauge for external incentives is by running the create-gauge command using the CLI (Command Line Interface)

Current incentives distribution

Superfluid Staking

The $OSMO token is also minted and burned in the context of Superfluid Staking. This is an Osmosis-specific feature that provides the base consensus layer with an extra level of security that it gets from a sort of “Useful Proof of Stake”. By participating in Superfluid Staking, each participant gets an amount of $OSMO representative of the value of their share of liquidity pool tokens staked and delegated to validators. This results in a greater degree of security since this process allows AMM LP shares to be used in the consensus layer of the chain.

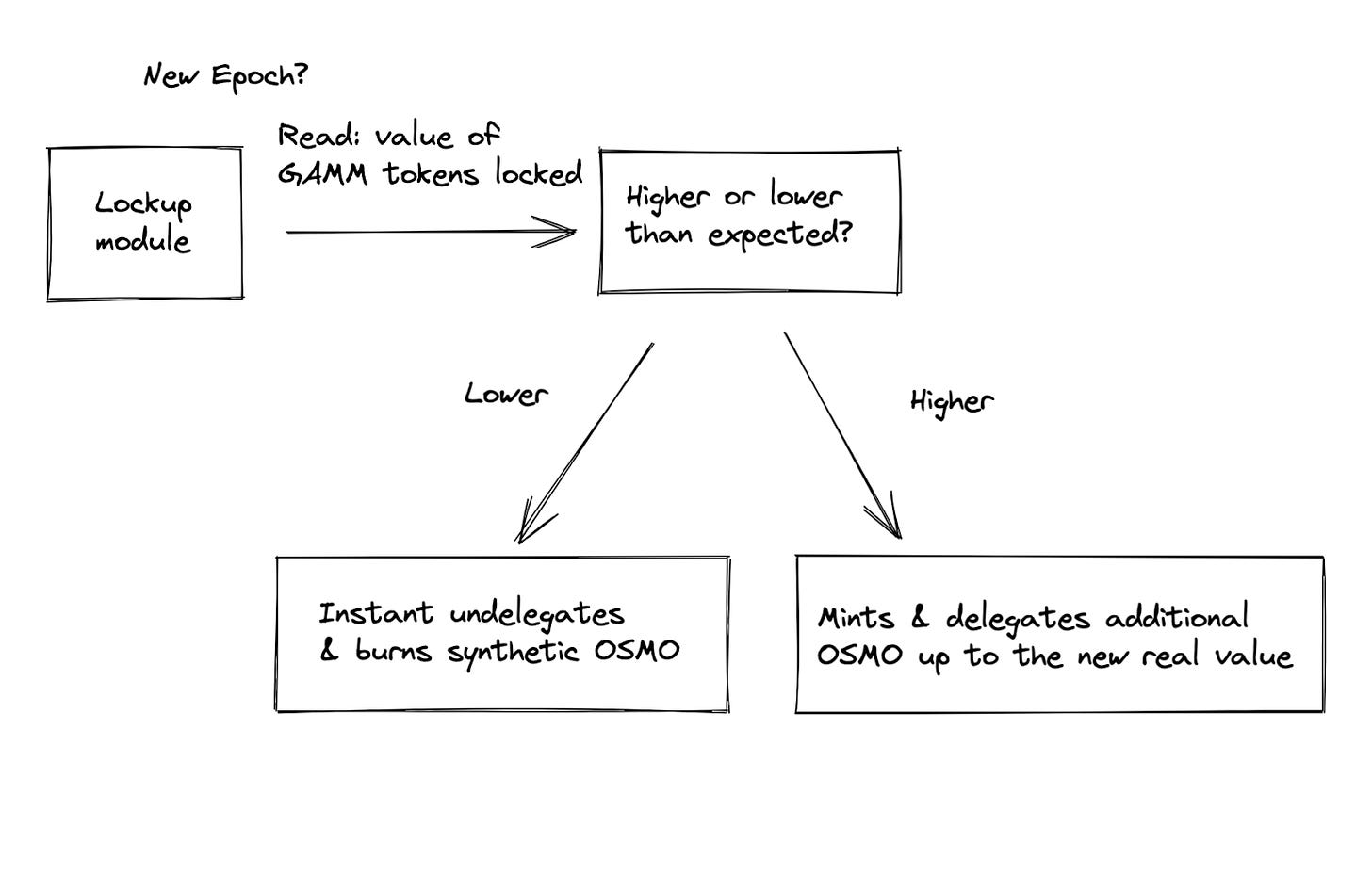

Superfluid Staking requires minting $OSMO. These newly created tokens are then staked on the Osmosis chain and used as collateral. To represent the value of each superfluid stakers’ LP tokens, an equivalent amount of Synthetic $OSMO is minted. Every epoch, the protocol will read the number of locked tokens in the superfluid model to determine the representative price of the LP token shares in order to increase or decrease the $OSMO delegation by minting/burning $OSMO tokens.

- When bonding, the input tokens are locked up and the user receives $GAMM pool tokens in exchange. These $GAMM pool tokens are the representation of a share of the liquidity pool and allows the user to earn from transaction fees as well as participate in the distribution of external gauge tokens. Since your tokens are also bolstering the Osmosis chain’s consensus, you will gain an additional APR reward.

- When unbonding, superfluid tokens are undelegated from the chain’s validators. The owner of the locked funds will then send a message to delete the synthetic asset representation. The undelegated OSMO is then instantly withdrawn from the validator and the OSMO tokens that were originally minted and used for representing your LP shares are burnt.

There are now over 35 million OSMO securing the chain thanks to superfluid staking.

Intermediary accounts establish the connections between the superfluid staked locks and the delegations to the validator. Intermediary accounts group the locked assets for the same validator selection.

The Superfluid Staking module mints an equivalent (of the $OSMO tokens that are locked) amount of $OSMO and sends it to the intermediary account, which will delegate the tokens to the specified validator.

Osmosis Superfluid Staking can further incentivize users to provide liquidity to a pool since they will be able to stake their LP tokens for extra rewards. The extra incentives come from the $OSMO in the pool being staked. Because of this, only pools that use $OSMO as the base asset can participate in superfluid staking.

Currently, there are no strict criteria as to which pools are eligible for participation in Superfluid Staking. Because of that, this is a governance decision.

There are also slashing mechanics in place to punish dishonest validators. When this happens, the amount of tokens that are slashed is calculated and removed from the underlying and synthetic lock. Because of this, it is important for users to do their due diligence before delegating their assets. All slashed tokens go to the community pool (instead of being burned).

Beyond the immediate relocation of incentives and the distribution across multiple pools, Osmosis has managed to gather ~150 validators that provide security to the chain and grant the chain a Nakamoto coefficient of 8. This is a low number in comparison to other Cosmos chains such as Thorchain, which has a coefficient of 28, or even outsider chains such as Solana and Avalanche which, despite being criticized for being too centralized, have coefficients above 30.

Low decentralization remains one of the weaknesses of most chains developed with the Cosmos SDK. Solutions that bring in additional incentives for users, such as superfluid staking, will improve the level of decentralization and network security.

The Nakamoto coefficient is a metric used to gauge the decentralization of a blockchain.

The Nakamoto coefficient represents the number of validators (nodes) that would have to collude together to successfully slow down or block the functionality of a blockchain.

External Airdrops

It is also worth noting that, as more chains enter the Cosmos ecosystem, their projects might want to airdrop some of their tokens to Osmosis accounts. To do that, they will follow the steps indicated in the Osmosis Airdrop Guide:

- Take a snapshot of Osmosis accounts at a given block height (can be found on Mintscan blocks page)

- Select the pool IDs of the pools they would like to reward (can be found in the info.osmosis.zone pools page)

- Export the state of accounts in JSON format by taking a snapshot and distributing the rewards. To do so, it is required to run an Osmosis node (following the step-by-step guide to run a node)

Governance

Protocol users can delegate $OSMO to validators in order to be able to participate in governance by making proposals and voting on different aspects of the protocol, such as upgrades, fee distributions, allocation of mining rewards…

While most AMM protocols have the same global parameters for all liquidity pools, Osmosis governance makes token holders responsible for selecting which liquidity pools should receive liquidity mining rewards. More specifically, the pools eligible for liquidity rewards are selected by $OSMO token holders, allowing liquidity providers to formulate an incentivization strategy that best aligns with the long-term interests of the protocol.

Allocation Points

Since not all pools have incentivized gauges, Osmosis relies on staked $OSMO holders to choose which pools to incentivize via on-chain governance.

Allocation points are used by governance modules to allocate rewards to specific gauges and incentivize those pools. Since 45% of the daily $OSMO issuance is assigned to liquidity incentives, the newly released $OSMO is distributed proportionally to the allocation points of each gauge.

The percent of the $OSMO liquidity rewards that each gauge receives is calculated as its number of points divided by the total number of allocation points.

For example, for a distribution of 20 allocation points towards 3 pools with 10 allocation points, 5 allocation points, and 5 allocation points respectively, the pool with 10 allocation points will receive 50% of the incentives that are minted, while the other two pools will receive 25% each.

Governance can also pass a UpdatePoolIncentives proposal to edit the existing allocation points of any gauge. For instance, by setting the allocation points to zero, a pool can be removed from the incentives gauges directly.

Proposals can also set the allocation points of new gauges. For example, when a new gauge is added, the total number of allocation points increases and will dilute the existing incentivized gauges.

Gauge #0 is a special gauge whose functionality is reserved for sending incentives directly to the chain community pool. By assigning allocation points to gauge #0, governance can save the current liquidity mining incentives ($OSMO inflation) to be spent at a later time.

- At Genesis, only Gauge #0 (the community pool gauge) is incentivized.

- At launch, liquidity incentives may only be activated 3 days after Genesis.

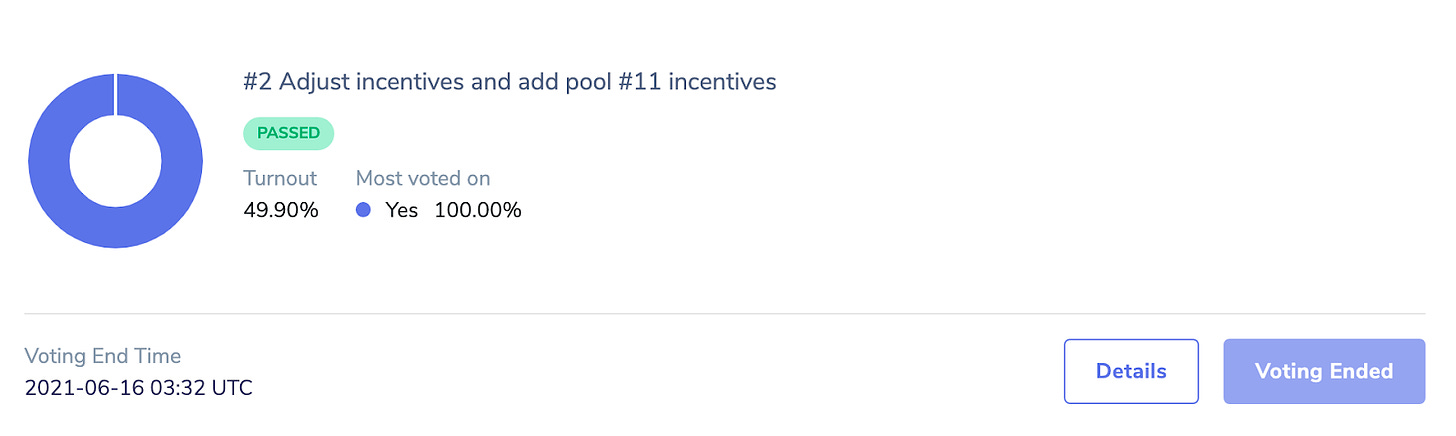

- Governance proposals are allowed to come immediately after launch and choose which gauges/pools to incentivize.

External Incentives

Besides allowing the community to add incentives to gauges, Osmosis also allows anyone to deposit tokens into a gauge for distribution. This feature makes it possible for other projects to augment Osmosis’ own liquidity incentives program.

Projects can add additional incentives to pools paired with their own native token over a period of time that they choose (e.g. a one-month liquidity program).

It is a requirement for pools to be voted in order to be onboarded to receive Osmosis Liquidity Mining incentives. Therefore, to increase the chances of a pool being accepted, it is recommended:

- Propose an OSMO pool

- $OSMO pools have the highest chances of being onboarded since the community usually expresses concerns over incentivizing non-$OSMO pools.

- $ATOM and $USDC are also quite common base assets on Osmosis, but pools with assets other than those (e.g. $JUNO) have lower chances of being onboarded.

- Add external incentives

- Propose well-designed pools

- Avoid setting high swap fees, or high exit fees

- Avoid extremely asymmetrical weighted pools, since this can discourage both liquidity providers and traders

- It is often best to stick to well-tested setups like 50/50 split pools with 0% exit fees and <= 0.3% swap fees

- Create a Commonwealth post about the proposal before its on-chain submission. This will give the community more time to review and provide feedback.

Superfluid Staking

Governance is currently responsible for making decisions about which pools are eligible for participation in Superfluid Staking.

The reason why not all $OSMO pools are allowed to enable Superfluid Staking is that in the case of the asset paired with $OSMO suddenly losing its value, the amount of $OSMO in the pool would shrink significantly. This would be a security concern to the chain since $OSMO is required for validating transactions.

Osmosis Ministry of Marketing

The outcome of Proposal 251 was the formation of the OMM (Osmosis Ministry of Marketing). Through this initiative, the team ensures that the community and official social media platforms are maintained and informed in collaboration with the support of the Osmosis Lab Support Team. The OMM has worked to standardize the public content and reach out to other communities for collaboration and partnerships.

Contact email: marketing@OsmosisDao.zone

Proposals and Participation

Before being recorded on-chain, a governance proposal is first presented in the governance forum. Once on-chain, the proposal will enter a deposit period. If the deposit is not filled before two weeks, the deposit amount will be burned and the proposal will never be voted on.

Requiring a deposit for making a proposal is a mechanism intended to discourage spam proposals. Similar to how voting works in Cosmos, stakers can vote Yes, No, NoWithVeto, or Abstain. Any individual vote can be modified during the voting period.

For a proposal to be valid, there must be enough voting power participating in order to reach the quorum of 20% of the total staked OSMO being active in that proposal. Voting “Abstain” is counted towards the quorum but has no impact on the direction of the vote. The “NoWithVeto” option is typically reserved for spam or malicious proposals. There is a requirement of 33.4% of the voting power to be in the “NoWithVeto” option in order to reject a proposal and burn the deposit.

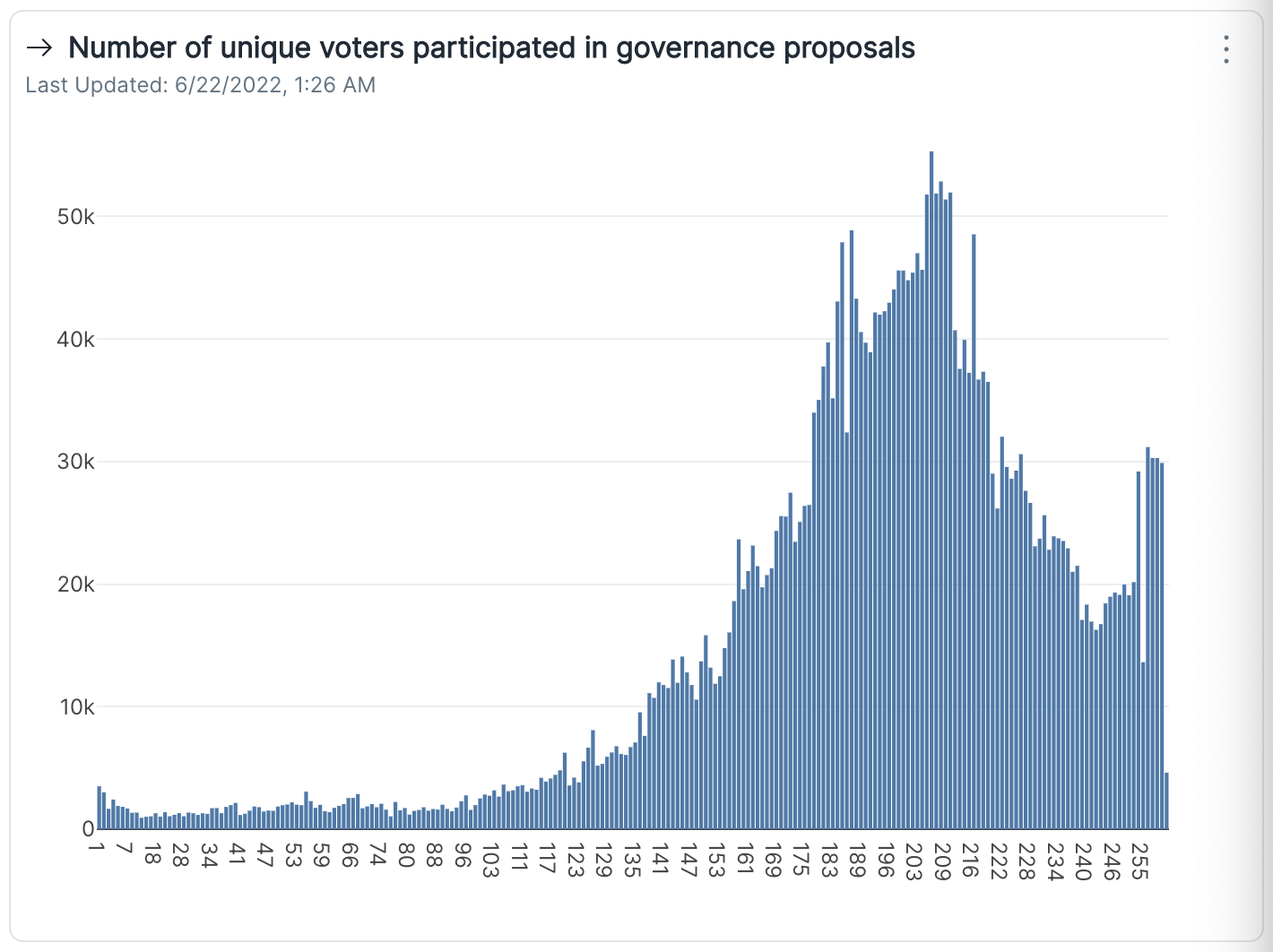

Data from Flipside Crypto reveals that it takes about 23 days on average for a wallet to engage with governance, and only 7% of wallets on Osmosis have never participated in governance voting. By the end of 2022, 228 proposals have been actively voted.

Annual Governance Report 2022

Jay Jeong wrote a 48-page Osmosis Annual Governance Report 2022.

The report included:

- Primer on Osmosis

- 2022’s Major Governance Proposals

- Analysis on Governance Framework

- Analysis on Voting Results

- Conclusion

- Limitations and Further Research

Key Insights of the report were:

- Osmosis’s governance responded swiftly and flexibly to the market situation changes and served an important role in driving the development of the ecosystem.

- Proposals relevant to the $OSMO token incentive are closely related to ensuring participants’ utilities since they directly decide on the direction of its emissions and other various tokenomics policies.

- A wide scope of Osmosis’s governance requires specialized knowledge to understand the topic, making it hard for participants to grasp the main point on a similar level.

- The lack of objective discussion processes among stakeholders for the 320th governance proposal, regarding following the direction of the OFAC regulations, was the direct reason for failing to achieve neutrality in the operation of the Osmosis network.

- The imperatives of Osmosis’s governance are to divide the governance scopes into sub-categories by their purposes and required expertise to improve frameworks in each area and act on fixing the harmed neutrality of the network to allow participants to easily onboard on the protocol and enjoy its fair utilities.

Conclusion of the report:

- Osmosis’s recently integrated features such as ICNS and stable swap.

- Various features such as orderbook, MEV, cross-chain swap, and many others are expected to be released or upgraded in the H1 2023.

- Osmosis emerged as a DeFi hub in the entire blockchain scene thanks to the mutual and complementary development of the core team and the community.

- Osmosis’s governance, mainly focused on incentive-related agendas, is optimized for OSMO’s tokenomics structure and reacts flexibly to market conditions.

- In May 2022, when the liquidity of protocols was disrupted due to the collapse of the Terra ecosystem, the governance framework was given more flexibility, and asset classes were rapidly diversified.

- While TVL decreased since the start of 2022, the staking ratio and voting ratio have steadily increased, proving that the community has strong resilience centered on governance.

- In contrast, since the scope of governance on Osmosis is quite wide, the voting results of the participants are less significant.

- To address this issue and make onboarding easier for more users, it is necessary to further subdivide the scope of governance into objectives and required specialized units and improve each category’s framework.

- Sometimes agendas do not end in consensus due to differences in the interests of various entities or ambiguous contents of the agenda, but this can be addressed through improved governance processes in the future.

- Efforts are needed to address the compromised neutrality of the Osmosis network. In August 2022, Proposal #320 was introduced which went against OFAC’s regulatory direction. There was a discussion about the objectives of the OFAC sanctions and how the proposal if passed, reduces network-wide profits. However, there was little talk about what it means for the Osmosis network to lose neutrality and censorship resistance. This led to the rejection of Proposal #320 which acts to undermine the neutrality of the Osmosis network.

- Besides improving on the governance framework, what is most needed for the current governance of Osmosis is to re-engage in an objective discussion of the results of Proposal #320. This would serve to provide a code of conduct for governance in the future so that it is ensured that results are not biased to any entity when discussing potential proposals.

Risks

Staking Risks

In order to keep validators honest in running the consensus of the chain, there is a slashing mechanism that is used to disincentivize bad behavior. Whenever a slashing incident occurs, a portion of the validator’s stake will be burned (the amount depends on the severity of the misbehavior). Examples of misbehavior include node downtime or double-signing.

- Downtime penalizes nodes that remain offline for a specified period of time. In the case of Osmosis, this penalizes nodes that remain offline for more than 28,500 blocks in a row (approximately 48 hours). When this happens, the validator is removed from the active validator set for 1 minute. Afterward, the validator can submit an “un-jail” transaction to rejoin the active set.

- Double-signing has much more potential for causing network harm. Because of this, double-signing is penalized by burning 5% of the validator’s stake. Not only that but the validator is also removed from the validator set and becomes ineligible to be an active validator ever again. After the slashing event, all delegated tokens become automatically unbonded.

Security

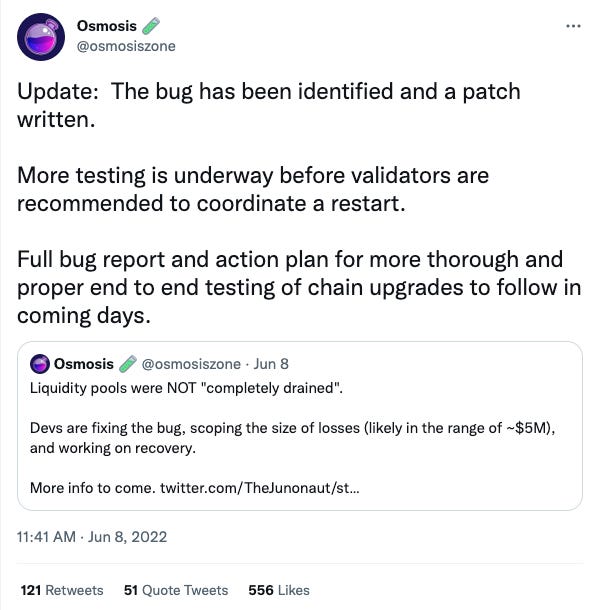

On June 8, 2022, the Osmosis Chain was halted after suffering a $5M exploit that allowed malicious attackers to withdraw 50% more tokens from liquidity pools than they had originally deposited.