Overview

Optimism is an EVM equivalent Layer 2 scaling solution for Ethereum that utilizes optimistic rollup technology to enhance transaction speed and reduce costs. This allows for scalability while benefiting from Ethereum’s security. It’s an efficient approach to achieve blockchain scalability without compromising on trust and security.

As an Optimistic Rollup, Optimism leverages the security of a parent blockchain, in this case, Ethereum. It relies on the consensus mechanism of the parent chain instead of creating its own. Blocks are submitted as transaction calldata on Ethereum, making them tamper-proof once enough attestations are received. This ensures the availability and integrity of OP Mainnet.

After the Bedrock upgrade, blocks are stored on the Ethereum blockchain using a non-contract address to minimize L1 gas expenses. The sequencer primarily manages block production in Optimism, providing transaction confirmations, constructing L2 blocks, and submitting user transactions to L1. Transactions can reach the sequencer through two methods: L1 deposits or direct submission to the sequencer. Currently, The Optimism Foundation runs the only block producer on OP Mainnet, with plans for decentralization in the future.

The execution engine updates itself through a peer-to-peer network with other execution engines. The rollup node derives L2 blocks from L1, providing censorship resistance. Optimism enables the transfer of assets and messages between smart contracts on L2 (e.g., OP Mainnet) and the underlying L1 (e.g., Ethereum mainnet). This communication allows the transfer of assets, including ERC20 tokens, between the two networks, facilitated by mechanisms like the Standard bridge.

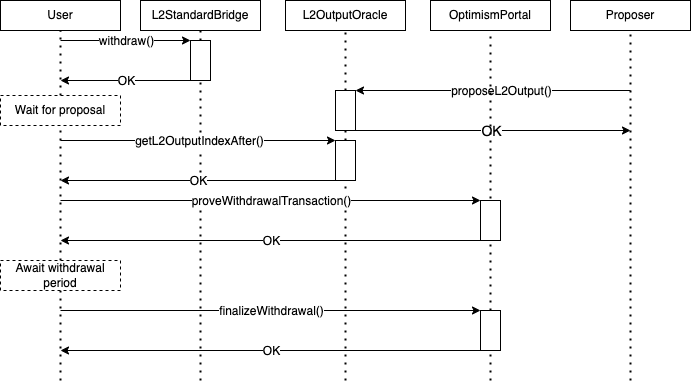

Transactions from Ethereum (L1) to OP Mainnet (L2) are called deposits. They are typically included in the first L2 block of the corresponding epoch, a few minutes after the L1 block where the deposits were initiated. Withdrawals, referring to any OP Mainnet to Ethereum message, have three stages: initialization, submission of withdrawal proof, and finalization. The fault challenge period protects OP Mainnet users against potential bridge vulnerabilities. In Optimistic Rollup, state commitments are published to L1 without immediate proof of validity, pending a challenge window. If a state commitment goes unchallenged during this period, it becomes final and safe for withdrawal proofs. Challenges can invalidate state commitments through a “fault proof” process, ensuring the accuracy of published commitments without rolling back OP Mainnet’s state or transaction order.

OP Stack

The OP Stack stands as the standardized, open-source development framework that drives Optimism’s capabilities, maintained by the Optimism Collective.

The OP Stack comprises a collection of software components managed by the Optimism Collective, serving as the foundation for Optimism. Initially powering Optimism Mainnet and, in the future, the Optimism Superchain, this stack plays a crucial role in creating new Layer 2 (L2) blockchains within the proposed Superchain ecosystem. While it simplifies the creation of L2 blockchains, it can extend to various layers, including tools, block explorers, message passing mechanisms, governance systems, and more.

The OP Stack’s evolution is ongoing, adapting to Optimism’s progress. As the Superchain takes shape, the OP Stack will integrate messaging infrastructure to facilitate seamless interaction among different chains. This ensures that the OP Stack evolves in line with Optimism’s requirements.

Optimism Bedrock is the current iteration of the OP Stack, providing the tools for launching production-quality Optimistic Rollup blockchains. The Bedrock release enables the creation of L2s that are compatible with the Superchain when it launches.

Layers of the OP Stack

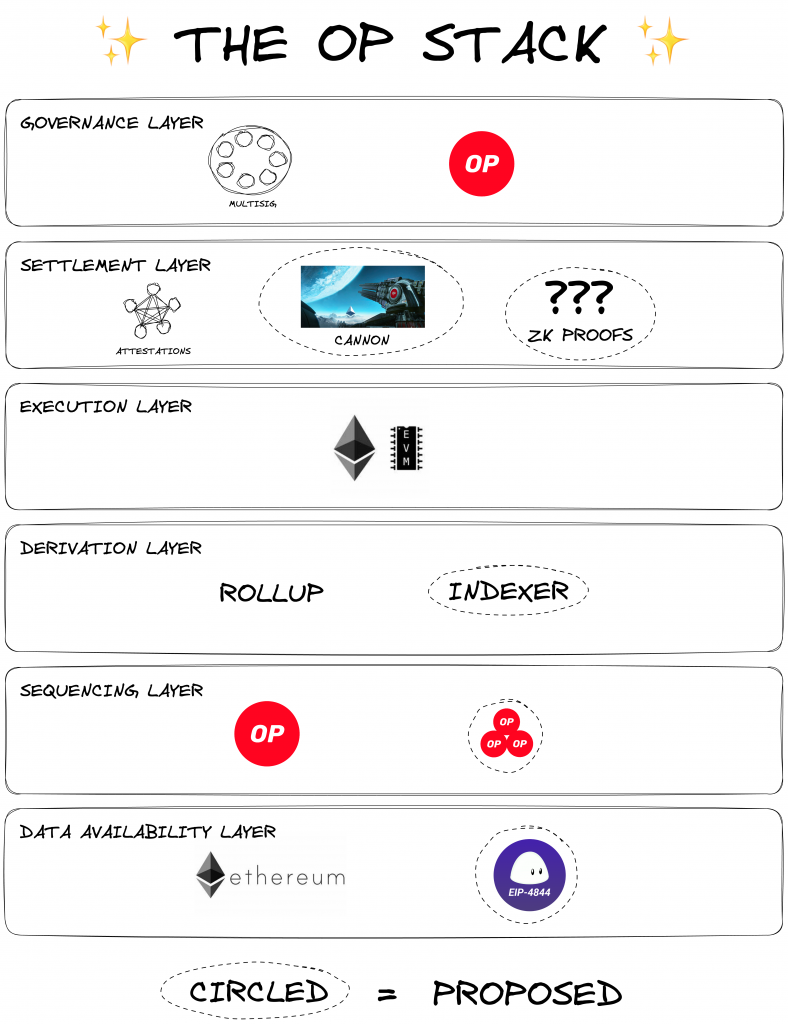

The OP Stack consists of various layers and modules.

Layers

- Data Availability Layer:

- Defines where raw inputs to an OP Stack-based chain are published.

- Different Data Availability modules can be used, impacting the security model of the system.

- Ethereum DA is the most widely used module, allowing data retrieval from Ethereum blockchain.

- Sequencing Layer:

- Determines how user transactions on an OP Stack chain are collected and published to Data Availability modules.

- In the default Rollup configuration, Sequencing is handled by a single Sequencer.

- Future plans include modular Sequencing for more flexibility.

- Derivation Layer:

- Defines how raw data in the Data Availability Layer is processed into inputs for the Execution Layer.

- May use the current system state to process raw input data.

- Supports multiple sources for Engine API inputs.

- Execution Layer:

- Defines the structure of state within an OP Stack system and the state transition function.

- State transitions are triggered by inputs from the Derivation Layer.

- Allows for EVM modifications or different underlying VMs.

- Settlement Layer:

- Establishes a view of the state of an OP Stack chain on external blockchains.

- Used for handling withdrawals of assets from a blockchain.

- Uses mechanisms like Attestation-based Fault Proof, Fault Proof Optimistic Settlement (proposed), and Validity Proof Settlement (proposed).

- Governance Layer:

- Manages system configuration, upgrades, and design decisions.

- Contains mechanisms like MultiSig Contracts and Governance Tokens.

- Governance Tokens decentralize decision-making through voting.

Modules

- Existing Modules:

- Ethereum DA: The most widely used Data Availability module, it sources data from Ethereum blockchain, including calldata, events, and data blobs.

- Single Sequencer: The default Sequencer module where a dedicated actor serves as the Sequencer, with governance determining who can act as the Sequencer.

- Proposed Modules (In Development):

- Multiple Sequencer: A modification to the Single Sequencer, allowing the selection of Sequencers from a predefined set.

- Indexer: A proposed Derivation Layer module that derives Engine API inputs from specific smart contracts on a Data Availability Layer module like Ethereum DA.

- Fault Proof Optimistic Settlement: An alternative to Attestation-based Fault Proof, it uses a permissionless fault proving process to invalidate incorrect proposals.

- Validity Proof Settlement: Uses mathematical proofs to attest to the correctness of a proposed view.

- Governance Tokens: Tokens used to decentralize decision-making, allowing token holders to vote on various project decisions.

OP Stack’s Fault Proof System

L2s on Ethereum, while following the same architectural principles as the L1, introduces a new layer known as the “proving layer.” This layer plays a crucial role in securely bridging L2 outputs back into L1. It ensures that the state claims made in L2 are verifiable and secure on the L1 Ethereum network.

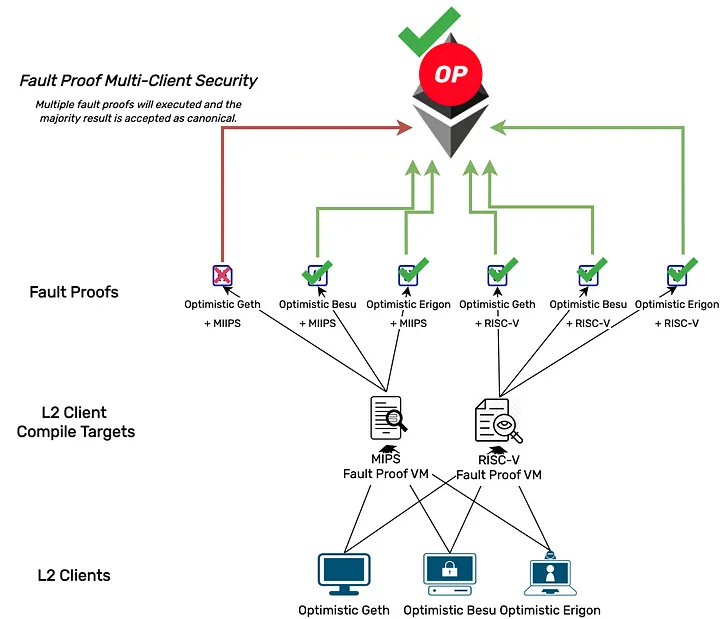

Just as L1 Ethereum benefits from having multiple clients for consensus and execution layers, a multi-proof approach is essential for securing the L2’s proving layer. This approach adds layers of security by diversifying the methods of validation.

In this context, there are three common types of proofs used:

- Attestations: These are proofs that verify the correctness or validity of actions taken within the L2. They serve as confirmations of specific events or transactions.

- Fault Proofs (Fraud Proofs): These proofs are critical for identifying and proving instances of fraudulent behavior or malicious actions within the L2. They are essential for maintaining the integrity of the system.

- ZK Validity Proofs: These proofs use zero-knowledge techniques to verify the correctness of state transitions in a synchronous manner. They prove the execution of state changes when given L1 data and L2 pre-state as input.

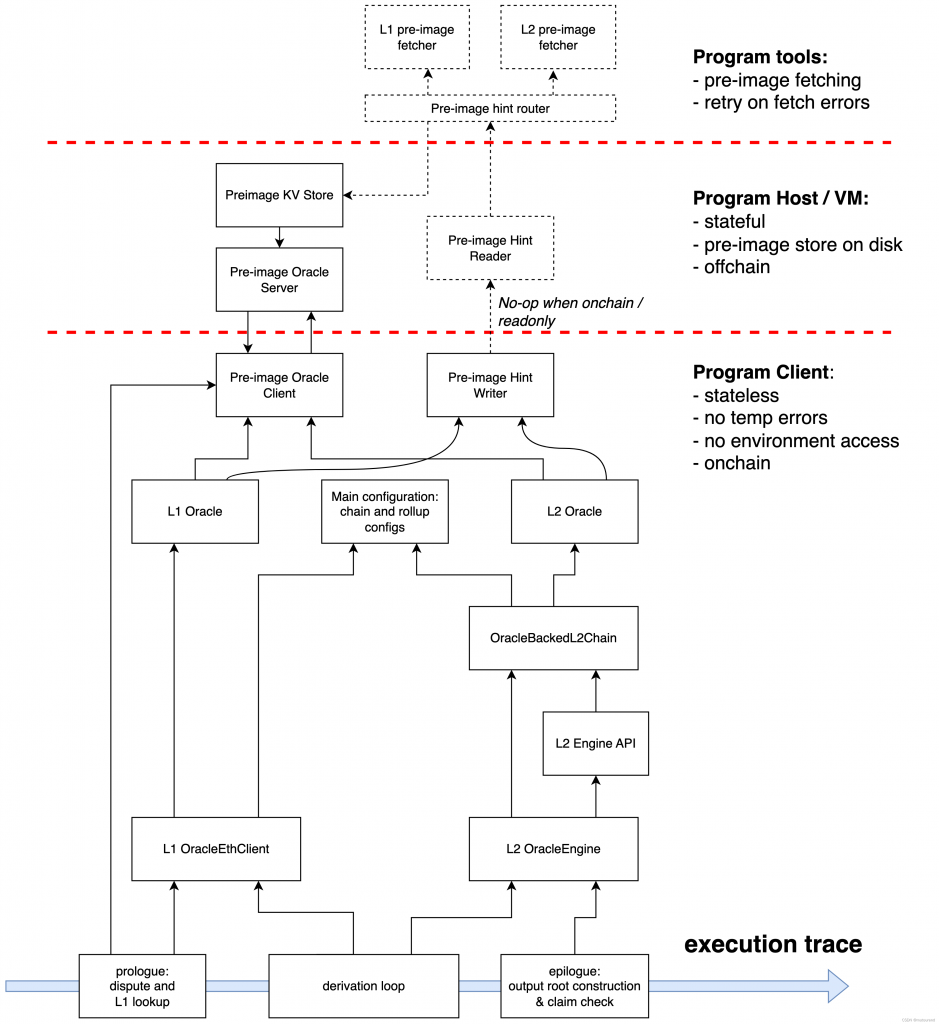

Within the OP Stack’s architecture, the proof system components are thoughtfully decoupled to enhance security and flexibility:

- Program: This defines the synchronous state transition within L2.

- VM (Virtual Machine): The VM runs and proves the program’s execution.

- Pre-Image Oracle: This component provides the necessary L1 data and L2 pre-state as inputs.

While many ZK-proofs today tightly couple these components, creating a ZK-EVM that operates on singular L1 transaction data, the OP Stack takes a different approach. It decouples these components to isolate complexity and enable client diversity

The OP Stack’s Fault Proof System (FPS) introduces an intriguing facet through its dispute games—a component that adds a layer of engagement and robustness to the ecosystem. Interactive fault proofs introduce a bisection-game to the VM trace to verify the proof on-chain. In contrast, VM-based ZK proofs arithmetize and folds the execution into a validity proof. Both approaches aim to ensure the correctness and security of L2 state transitions.

At its core, a dispute game is a foundational element within the dispute protocol. It operates as a simple state machine initialized with a 32-byte commitment to any disputable information’s validity. The resolution function, defining whether the commitment is true or false, is left to the implementer. The OP Stack’s first implementation of this, the FaultDisputeGame, is permissionless, as its resolution function hinges on a fault proof program’s execution outcome within an emulated VM.

The program defines the actual state transition as a “client,” while the input-fetching component (providing L1 data and L2 pre-state) acts as the “server.” Operating independently with server/client interactions but without a VM, the program closely resembles a regular blockchain node. This design philosophy allows for the reuse of code and promotes code efficiency.

Dispute games rest on two critical properties:

- Incentive Compatibility: The system rewards truthful claims and penalizes false ones, ensuring fair participation.

- Resolution: Each game possesses a mechanism to definitively validate or invalidate the root claim.

In the Dispute protocol, various dispute games can be crafted, managed, and upgraded through the DisputeGameFactory. This extensibility opens doors to innovative features, such as aggregate proof systems, and the potential to dispute elements beyond L2 state, like a FaultDisputeGame tailored for on-chain binary verification.

The Bisection Game, a specific dispute game within the protocol, is the inaugural game built on the OP Stack’s dispute protocol. This game involves players iteratively dividing an execution trace into individual steps. Once these steps reach commitments to the state at each instruction, the FaultDisputeGame executes a single instruction step on-chain using a generic VM. This VM’s state transition function, denoted as T(s, i) -> s’, can take any form, as long as it adheres to this format.

Key components of the Bisection Game include:

- Claims: Represent commitments to the state of the VM at a specific instruction. These claims can be true or false, with their veracity determined during the resolution phase.

- Positions: Claims are associated with positions in a binary tree, indicating which instruction the claim relates to. Positions are generalized indices.

- Chess Clocks: Players operate under time limits for their moves, with a total game time of 7 days, divided into 3.5 days per side.

- Moves: Players bisect the game until claims commit to the state of a single VM instruction. Moves can be attacks (challenging a parent claim) or defenses (agreements with a parent claim).

- Instruction Step: At the leaf nodes of the position tree, claims commit to the state at a single VM instruction, with the final move being the execution of that instruction on-chain for verification.

Resolution occurs when chess clocks for all claims run out, with a minimum duration of 3.5 days. Each claim spawns its own Sub Game—a DAG with a depth of 1. Sub games rely on the resolution of their child sub games for their own resolution. An honest player’s presence, assuming all moves are exhausted, ensures a favorable resolution for their view of the trace, regardless of the root claim’s honesty. Dishonest claims are susceptible to counters by any party.

Functional Overview of the FPVM

The Fault Proof VM (FPVM) is a critical component within the OP Stack’s fault proof architecture, providing essential functionality to ensure the correctness and security of Layer 2 (L2) Ethereum. It does not implement Ethereum-specific or L2-specific logic directly but provides essential interfaces, most notably the interface to the pre-image oracle. The core responsibility of the FPVM is to execute lower-level instructions within the L2 state transition.

The FPVM distinguishes itself from the Fault Proof Program (FPP), which runs within the FPVM. The FPP represents the client-side logic that defines the L2 state-transition. This separation allows the FPVM to remain minimal and unaffected by Ethereum protocol changes or L2-specific requirements. Instead, updates can be made to the FPP to incorporate changes.

- The FPVM’s requirements are minimal, as it primarily handles synchronous program execution and loads all inputs through the pre-image oracle.

- The FPVM ensures that the program’s execution is in line with the FPP’s definition, and it facilitates the interaction between the program and the oracle.

The FPVM adopts a granular approach to instruction proving. Instead of proving an entire execution trace, it focuses on proving one instruction at a time. This granularity allows for precise validation and verification of each instruction, enhancing security and reducing the complexity of on-chain proofing.

To prove an instruction, the FPVM follows a structured process that generally resembles the Cannon approach:

- Reading from Memory: The FPVM reads the instruction from memory.

- Interpretation: It interprets the instruction, executing it within a thread context.

- Register and Memory Updates: The instruction may lead to changes in the register file and memory.

- Pre-Image Oracle Interaction: To support the pre-image oracle and basic program runtime requirements like memory allocation, the execution supports a subset of Linux syscalls.

- Syscalls for Pre-Image: Read/write syscalls facilitate interaction with the pre-image oracle. The program can request a pre-image by writing a hash and then retrieve the value in small increments.

FPVM to ZKVM

While fault proofs are a crucial aspect of ensuring the integrity of state transitions, there are alternative approaches, such as Zero-Knowledge (ZK) validity-proofs, that offer distinct advantages, including speed and efficiency. The transition from FPVM (Fault Proof VM) to ZKVM can represent a significant evolution in the OP Stack’s capabilities and flexibility.

- ZK validity-proofs offer the potential for rapid bridging between different layers of Ethereum.

- Unlike fault proofs, there is no on-chain challenge game for ZK validity-proofs, meaning there is no specific dispute window. This can lead to faster and more seamless validation

To accommodate a more advanced Ethereum stack and support different client implementations, it’s essential to decouple the VM and the program. This decoupling ensures that the VM can evolve independently of the program, providing flexibility and adaptability.

- The ZK RFP (Zero-Knowledge Request for Proposals) projects are embracing the approach of proving a minimal VM. For example, Risc0 is working on proving a minimal RISC-V VM, while O(1) Labs is focusing on a MIPS VM.

- These VMs are designed to be compatible with the same program used in fault proofs, ensuring consistency and interoperability.

- To enable the support of ZKVM, some modifications are required to make the pre-image oracle load data non-interactively. This adjustment streamlines the process for ZK validity-proofs.

- By taking this approach, the ZKVM can remain future-proof, allowing for smoother transitions and upgrades as the Ethereum ecosystem evolves.

Optimism Bedrock

Optimism Bedrock is the latest official release of the OP Stack, designed to facilitate the creation of production-ready Optimistic Rollup blockchains. It comes with several significant improvements over its predecessor:

- Reduced Transaction Fees:

- Optimism Bedrock implements optimized batch compression, reducing transaction fees.

- Ethereum is utilized as a data availability layer, further optimizing data handling.

- The removal of L1 execution gas reduces L1 data fees to the theoretical minimum, resulting in an additional 10% reduction in fees compared to the previous version.

- Shorter Deposit Times:

- Bedrock introduces support for L1 re-orgs in the node software, significantly reducing deposit confirmation times.

- Deposits are expected to confirm within 3 minutes, a substantial improvement from the earlier 10-minute wait.

- Improved Proof Modularity:

- Bedrock abstracts the proof system from the OP Stack, allowing rollups to use either fault proofs or validity proofs like zk-SNARKs.

- This abstraction enables the use of systems like Cannon to prove faults within the system.

- Enhanced Node Performance:

- The node software’s performance is significantly improved by allowing multiple transactions in a single rollup “block,” replacing the previous “one transaction per block” model.

- This change reduces state growth by approximately 15GB/year at current transaction volumes.

- Technical debt from the previous version is removed, streamlining the node software and eliminating the need for a separate “data transport layer” node for indexing L1.

- Improved Ethereum Equivalence:

- Bedrock aims to closely resemble Ethereum in its design.

- Deviations from Ethereum in the previous version, such as the one-transaction-per-block model, custom opcodes for L1 block information, separate L1/L2 fee fields in the JSON-RPC API, and a custom ERC20 representation of ETH balances, have been removed.

- Bedrock adds support for Ethereum features like EIP-1559, chain re-orgs, and others present on L1.

Design Principles of Optimism Bedrock

- Modularity:

- Bedrock is built with a focus on modularity, allowing for the easy interchange of different components within the OP Stack.

- It employs well-defined interfaces and versioning schemes, enabling a flexible architecture that can adapt to future developments in the Ethereum ecosystem.

- Examples of modularity include the separation of the rollup node and execution client and the modular fault proof design.

- Code Reuse:

- Bedrock maximizes the use of existing Ethereum architecture and infrastructure to inherit security and reliability benefits from battle-tested Ethereum codebases.

- Examples include the use of minimally modified execution clients and EVM contracts instead of precompiled client code.

- Ethereum Equivalence:

- Bedrock is designed to closely resemble Ethereum to provide a familiar developer experience.

- While it maintains Ethereum compatibility, some exceptions exist due to fundamental differences between L1 and a rollup, such as an altered fee model, faster block time (2s vs. 12s), and a special transaction type for including L1 deposit transactions.

- Protocol Components:

- The core components of the protocol include Deposits, Withdrawals, Batches, Block Derivation, and Proof Systems.

- Deposits on L1 are guaranteed to be included in the canonical L2 chain, preventing censorship or control of the L2.

- Withdrawals are cross-domain transactions initiated on L2 and finalized on L1, enabling various interactions between L2 and L1.

- Batches are organized groups of L2 transactions, optimized for data compression and parallelized batch submission.

- Block Derivation ensures the correct timing of deposits, handles timestamps on L1 and L2, and guarantees that the L2 block timestamps stay synchronized with L1.

- Deposits:

- Deposits on L1 are transactions that are to be included in the rollup, guaranteeing their inclusion in the L2.

- Deposited transactions on L2 are derived from the values in the event(s) emitted by a deposit contract on L1.

- Bedrock specifies a gas burn mechanism and a fee market for deposits to prevent denial of service attacks.

- Withdrawals:

- Withdrawals are cross-domain transactions initiated on L2 and finalized on L1.

- Bedrock introduces a two-step withdrawal process to enhance security and reduce the risk of bridge compromises.

- Batches:

- Batches are the wire format for messaging between L1 and L2, designed to minimize costs and software complexity for writing to L1.

- Optimized data compression is used, and messages are parallelized for efficient submission.

- Batch transactions remove all execution gas used by the L1 system, reducing costs.

- Block Derivation:

- The protocol ensures the timing of deposits on L1 is respected with regards to the block derivation of the canonical L2 chain.

- Sequencing epochs and sequencing windows play a crucial role in this process.

- Handling L1 and L2 timestamps, along with a block derivation pipeline, are key aspects of block derivation.

- Fault Proofs:

- Fault proofs are used to ensure trustless execution of L2-to-L1 messaging, such as withdrawals.

- Outputs are hashed in a tree-structured form to minimize the cost of proving any piece of data.

- Proposers periodically submit output roots, which are Merkle roots of the entire canonical L2 chain.

Bedrock Implementation

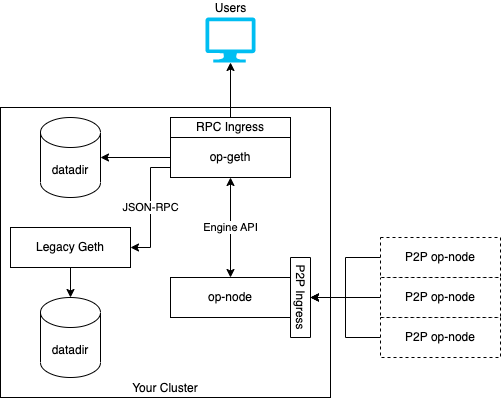

Optimism Bedrock, part of the OP Stack, is implemented with a strong emphasis on technical separation of concerns and compatibility with Ethereum principles.

Execution Client

The Execution Client is responsible for determining the state of the canonical L2 chain, processing inbound transactions, and managing the system’s state. Bedrock relies heavily on Ethereum’s execution client specifications and existing implementations, particularly go-ethereum.

Modifications to go-ethereum are minimal, primarily related to handling deposited transactions and charging transaction fees. Deposited transactions are represented using a new transaction type compliant with the EIP-2718 typed transactions standard.

Transaction fees in Bedrock consist of sequencer fees and data availability fees, both combined into a single gasPrice field in the JSON-RPC.

Rollup Node

Unlike Ethereum, Bedrock doesn’t employ proof-of-stake consensus. Instead, consensus in the canonical L2 chain is established through block derivation.

The Rollup Node is a stateless component responsible for deriving the system’s state by reading data and deposits on L1. Rollup Nodes can be used in multiple ways:

- Verifying the Canonical L2 Chain: In this mode, the node verifies the correctness of output roots shared by other nodes or posted on L1.

- Participating in the L2 Network: Most commonly, Rollup Nodes participate in a network of nodes tracking L2 progression and state. They read data and deposits from L1, interpret blocks, and accept transactions from users and peers.

- Sequencing Transactions: Some Rollup Nodes operate as sequencers, creating new blocks on top of the unsafe L2 head. Currently, there’s typically one sequencer per OP Stack network.

Sequencers are responsible for producing batches, and a separate component called the Batcher reads transaction data from a trusted Rollup Node and converts it into batcher transactions to be written to L1.

Bedrock includes a pair of standard bridge contracts for common types of deposits, simplifying the process of depositing and withdrawing ETH and ERC-20 tokens.

While fault-proof construction and verification are implemented in the Cannon project, the integration of an output root challenger into the Rollup Node is part of later specification milestones.

Bedrock Differences

EVM Changes

- Block Production:

- Blocks are produced every two seconds, which is a departure from the legacy network, where blocks are mined for every incoming transaction.

- The TIMESTAMP opcode returns the timestamp of the block, updating every two seconds.

- The BLOCKNUMBER opcode returns the actual block number, updating every two seconds. This means the one-to-one mapping between blocks and transactions no longer applies.

- The upgrade introduces “system transactions” created by the op-node for executing deposits and updating the L2’s view of L1.

- EIP-1559:

- Optimism Bedrock supports EIP-1559, which changes the gas fee calculation with two components: the base fee and the priority fee.

- Unlike Ethereum, $ETH is not burned on Bedrock when using EIP-1559. Burning $ETH would lock it in the bridge forever.

- Some EIP-1559 parameters are different from Ethereum, including block gas limit, block gas target, EIP-1559 elasticity multiplier, EIP-1559 denominator, maximum base fee increase, maximum base fee decrease, and block time in seconds.

- The L1 security fee uses the same mechanism as before but is submitted to a non-contract address, reducing the L1 security fee by about 20%.

- Removed Opcodes:

- The Bedrock upgrade aims to be maximally EVM equivalent, and it removes the L1BLOCKNUMBER opcode to reduce differences between Bedrock’s EVM and Ethereum’s EVM.

- ETH Balances:

- Bedrock migrates ETH balances from an ERC20 contract called OVM_ETH into the Bedrock network’s state. The OVM_ETH contract’s methods continue to work, but the totalSupply() method will return zero.

- Chain Reorgs:

- Bedrock nodes always derive blocks from L1, so if L1 experiences a reorg, L2 will reorganize itself to match L1’s state.

- Blocks can be in one of three states: unsafe (not yet submitted to L1), safe (submitted to L1), and finalized (considered final and irreversible).

- Historical Data:

- Bedrock nodes can serve pre-Bedrock block bodies, transactions, and receipts, but historical execution traces require running a Legacy Geth instance.

- Some legacy fields have been removed from pre-Bedrock JSON-RPC transaction responses.

- JSON-RPC:

- Bedrock supports standard JSON-RPC methods exposed by go-ethereum. Some legacy methods have been removed or replaced to reduce differences between Bedrock and Ethereum.

- Mempool:

- Bedrock introduces a private mempool to store pending transactions until they are included in a block, unlike Ethereum’s first-come-first-serve transaction processing.

- Users need to configure op-geth to forward transactions to the sequencer for submission.

- Two-phase withdrawals:

- Bedrock implements a two-phase withdrawal process to enhance security and prevent fraudulent withdrawal proofs.

- Users must post withdrawal proofs upfront, wait for validation, and then finalize the withdrawal after a seven-day waiting period.

- This change is not backward-compatible, and software relying on old withdrawal methods needs to be updated.

- Deposit Replayability:

- Deposits are no longer replayable in Bedrock, unlike the legacy network where they were replayable.

- Deposits on the legacy network that have not been replayed are no longer replayable as part of the migration.

Contracts Changes

Optimism Bedrock includes various contracts that play crucial roles in the operation of the network.

L1 Contracts:

- L2OutputOracle:

- This contract contains the state root of the Optimism blockchain (OP Mainnet, OP Goerli, etc.).

- It receives the result of the fault proof process once fault proofs are activated, replacing the old State Commitment Chain.

- OptimismPortal:

- The OptimismPortal contract provides a low-level API for communication between different layers.

- It’s recommended to use the L1CrossDomainMessenger and L2CrossDomainMessenger for sending messages between L1 and L2 unless bypassing the sequencer is necessary.

- Existing Interface Contracts:

- These contracts maintain the same interface as existed pre-Bedrock to ensure that dApps don’t require significant modifications:

- L1CrossDomainMessenger: Used for sending messages between L1 and L2, which may or may not have assets attached.

- L1StandardBridge: Utilizes L1CrossDomainMessenger to transfer ETH and ERC-20 tokens between L1 and L2.

L2 Contracts

- L1Block:

- The L1Block contract provides information about the latest L1 block known to L2.

- It includes parameters such as block number, timestamp, base fee, hash, and sequence number.

- Note that L1 information is delayed by two block confirmations to mitigate the impact of reorganizations.

- SequencerFeeVault:

- This contract handles funding the sequencer on L1 using the ETH base fee on L2.

- Fees are calculated using EIP 1559, similar to Ethereum, but with different parameter values.

- L2ToL1MessagePasser:

- Used internally by L2CrossDomainMessenger to initiate withdrawals.

- There are two contracts in Bedrock, the legacy contract, and the new contract, each with its specific address.

- Existing Interface Contracts:

- Similar to L1 contracts, these contracts maintain the same interface as pre-Bedrock:

- L1BlockNumber: Provides the number of the latest L1 block, serving as a proxy to L1Block.

- L2CrossDomainMessenger: Used for sending messages from L2 to the underlying L1.

- L2StandardBridge: Used to “attach” assets (ETH and ERC-20 tokens) to messages sent by L2CrossDomainMessenger.

- WETH9: An ERC-20 token that wraps ETH to provide extra functionality like approvals.

Historical Contracts:

- These contracts are no longer relevant but are retained as part of the state for compatibility:

- DeployerWhitelist: Previously used to manage whitelists before OP Mainnet moved out of beta.

- OVM_ETH: Previously used to manage user ETH balances before Bedrock.

Communication Between Layers

In Optimism Bedrock, the terminology around “deposits” and “withdrawals” is specific and essential to understand how messages flow between the underlying L1 blockchain and L2.

Deposits from L1 to L2:

- Recommendations for Creating Deposits: To create a deposit from the underlying L1 blockchain (Ethereum, Goerli, etc.) to L2 (OP Mainnet, OP Goerli, etc.), several options are available, including pre-Bedrock contracts like L1StandardBridge and low-level deposit functionality in L1CrossDomainMessenger.

- OptimismPortal’s depositTransaction: The OptimismPortal contract provides the depositTransaction function, allowing you to perform various actions on L2 from L1. This includes sending transactions, making payments, creating contracts, and more. Importantly, this provides an uncensorable alternative in case the sequencer (which orders transactions on L2) is temporarily down. Verifiers on L2 will still receive these transactions and update the state. When the sequencer is back online, it processes these transactions in the same order to maintain a valid state.

- Buffer for Gas Estimation: It’s recommended to add a 50% buffer to the gas estimate obtained from eth_estimateGas when creating deposits. For example, if the estimated gas consumption is 100,000, you should send the transaction with a gas limit of at least 150,000. This buffer helps ensure that your deposit won’t run out of gas during execution.

- Deposit Fee Adjustment: To prevent potential DOS attacks on Optimism networks via forced L1 to L2 transactions that bypass the Sequencer, a fee adjustment schedule is implemented, closely resembling EIP1559. Deposit fees for L1→L2 transactions are paid by burning a certain amount of L1 gas, which is proportional to the deposit’s L2 gas limit. This means that the actual cost of an L1→L2 deposit may increase by the time the transaction is included in a block and executed. Therefore, adding a 50% buffer to the gas limit is crucial to ensure the deposit won’t run out of gas and revert.

- Address Aliasing for Contract Deposits: Deposits from contracts still use address aliasing, which is a mechanism to handle addresses consistently between L1 and L2.

- Faster Confirmation: Deposits from L1 to L2 are faster, taking about a minute to confirm, as they require only five blocks for confirmation, and L1 blocks are typically produced every 12 seconds.

There is no longer a CTC (canonical transaction chain) contract. Instead, L2 blocks are saved to the Ethereum blockchain using a non-contract address to minimize the L1 gas expenses.

Bedrock: Node Operator Guide

In a Bedrock deployment, there are two main components, and a third component may be required for specific networks:

- Rollup Node (op-node):

- Derives blocks from L1 (Layer 1 Ethereum) and passes them to the Execution Engine.

- Participates in a peer-to-peer network to synchronize unsubmitted blocks created by the sequencer.

- Serves as Optimism’s consensus client.Communicates with the Execution Engine via JSON-RPC using the Engine API.

- Execution Engine (op-geth):

- Executes the blocks received from the Rollup Node.

- Stores the state of the blockchain.

- Exposes standard JSON-RPC methods for querying blockchain data and submitting transactions.

- Acts as Optimism’s execution client.

- Communicates with the Rollup Node via JSON-RPC using the Engine API.Note: It is a minimal fork of go-ethereum.

- Legacy Geth (Optional for OP Mainnet and OP Goerli):

- Serves execution traces for historical transactions that occurred before the Bedrock upgrade.

- Supports historical execution data.

- When an RPC call requires historical execution traces, the Rollup Node forwards the request to Legacy Geth.

- Requests for historical data on Bedrock networks are served directly by the Execution Engine for networks like OP Sepolia.

The communication between the Rollup Node and Execution Engine is facilitated by JSON-RPC via the Engine API, similar to how Ethereum networks operate. These components work together to ensure the proper functioning of the Optimism network. Depending on the specific network you are deploying on, you may or may not need Legacy Geth to handle historical execution traces.

- System Requirements:

- op-node: Minimum 2 CPUs, 4GB RAM, no storage required.

- op-geth: Minimum 4 CPUs, 8GB RAM, at least 40GB storage for OP Goerli or OP Sepolia, 600GB for mainnet (SSD required).

- Download op-geth and op-node as Docker images or compile them from source.

- Node Configuration:

- Configure op-node to point to the correct L1, op-geth, and L2 network.

- Initialize op-geth with the correct network parameters.

- Configure op-geth to communicate with the Rollup Node.

- Optionally, configure Legacy Geth if needed for historical execution data.

- Configuring op-geth:

- Initialize op-geth using either a Genesis File or a Data Directory, depending on the network.

- Ensure sufficient disk space for the network’s data.

- Configure op-geth using CLI flags, including –rollup.historicalrpc, –rollup.sequencerhttp, and others based on your needs.

- Generate a JWT secret for authentication.

- Configure op-geth’s authenticated RPC endpoint.

- Configuring op-node:

- op-node is a standalone binary with no state or initialization.

- Configure it using command line flags or environment variables.

- Specify network-specific genesis parameters using a rollup config file or –network flag.

- Participate in the peer-to-peer network to distribute blocks.

- Configuring Peer-to-Peer Networking:

- Ensure op-node has a static IP address accessible from the public internet.

- Open port 9003 on your firewall for incoming unsubmitted blocks.

- Set up a load balancer with an external IP for Kubernetes deployments.

- Legacy Geth (if needed):

- Run Legacy Geth alongside op-geth for upgraded networks (e.g., OP Mainnet, OP Goerli) to serve historical execution traces.

- Configure Legacy Geth with appropriate flags and specify –rollup.historicalrpc in op-geth.

- Troubleshooting:

- Address and resolve common issues like authentication errors, forbidden hosts, failed P2P config, and wrong chain configurations.

- Ensure all components are running correctly, and your Bedrock node is actively participating in the Optimism network.

- Monitor the node’s performance and maintain it as needed to ensure optimal functionality.

- Resources:

Transaction Flow

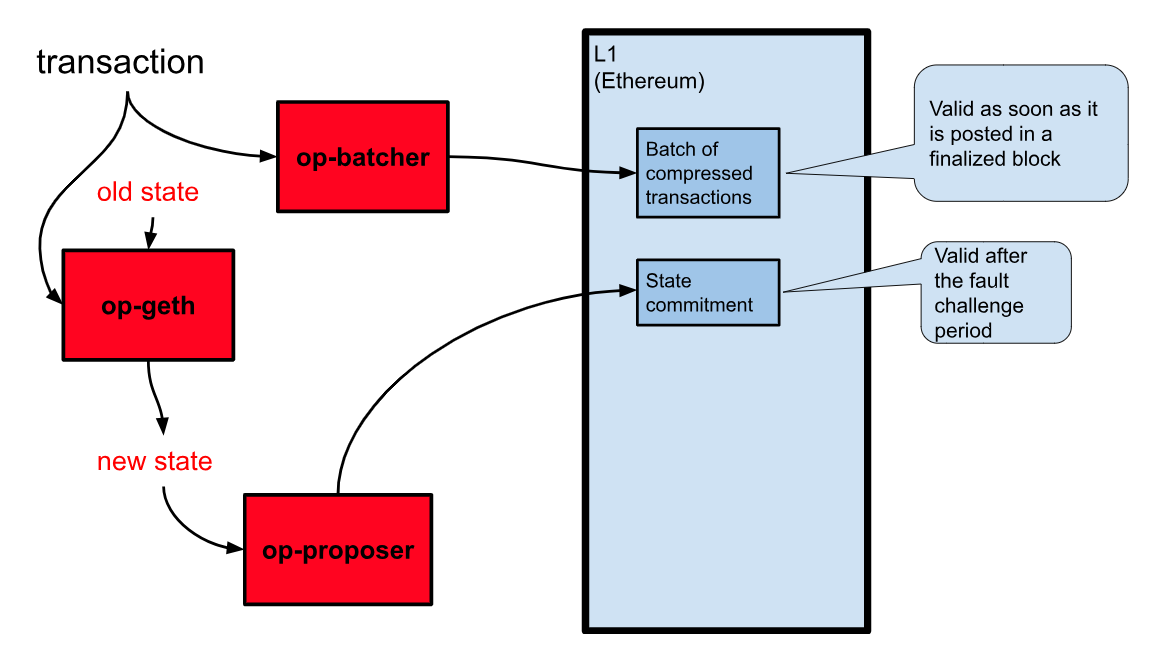

The transaction process for rollups on OP Mainnet involves two essential steps to ensure data integrity and state consistency across Layer-1 (Ethereum) and Layer-2 (OP Mainnet).

Writing the Transaction to L1

The primary mechanism for ensuring that transactions are recorded on L1 is through the use of op-batcher. This component compresses multiple transactions into batches for efficiency and cost-effectiveness. These batches are then posted to L1, securing their availability and integrity. The batcher operates within specific parameters to manage the timing and size of these batches:

- Compression: Transactions are compressed into batches to optimize the data size before being written to Ethereum. This process not only enhances throughput but also aims at achieving a favorable compression ratio to reduce costs.

- Posting to L1: Once a batch is prepared and reaches its designated size or the maximum allowable time limit, it is then posted to L1. The status of these transactions can vary:

- Unsafe: Transactions are processed but not yet confirmed on L1; they risk being dropped if a batcher fault occurs.

- Safe: Transactions are confirmed on L1 but are subject to potential reorganization of blocks on Ethereum.

- Finalized: Transactions are embedded in an Ethereum block that is highly unlikely to be reorganized, making them irreversible.

Once written to L1, the transaction must be executed to modify the state on L2, which is handled by op-geth. After execution, op-proposor is responsible for writing a commitment to the post-transaction state back to L1. This commitment does not need to occur after every single transaction but can be done after a block of transactions, enhancing efficiency.

- State Processing: The actual modification of the state is executed by op-geth, which applies the transaction to the existing state, resulting in a new state. This is followed by:

- Proposing the New Merkle Root: op-proposor then posts the new state’s Merkle root to the blockchain. The use of Merkle roots helps in managing the size of the data that needs to be written back to L1, significantly reducing costs.

Determining the status of a transaction involves checking whether it is unsafe, safe, or finalized. This can be done using tools like Foundry, where you can query the number of the block containing your transaction and compare it to the latest finalized or safe block number.

The process outlined ensures that all transactions are not only processed efficiently but also maintain a high level of integrity and security. Once a transaction is finalized, it is considered immutable, although the state it leads to can still be subject to fault challenges.

Deposit Flow

The deposit flow in Optimism is a mechanism that enables transactions to seamlessly transition from Layer-1 (Ethereum) to Layer-2 (OP Mainnet). This process ensures that transactions are not only executed efficiently but also maintain their integrity and security across layers.

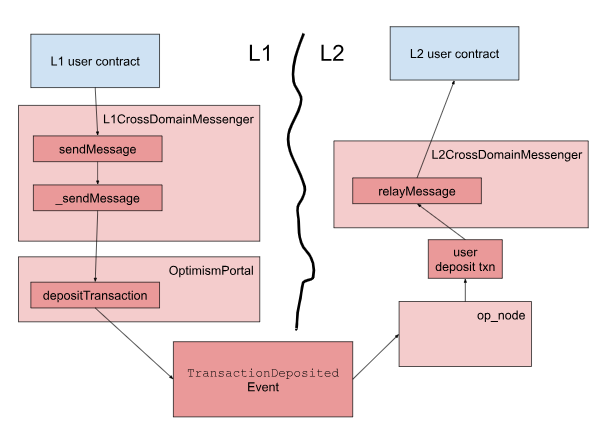

The deposit transaction begins at Layer 1, where a smart contract or an externally owned account (EOA) initiates a deposit to the L1CrossDomainMessenger. This involves specifying the target address on L2, the calldata (formatted as per the ABI of the target L2 account), and a minimum gas limit for the transaction execution on L2:

- Triggering a Transaction: A transaction is initiated using the sendMessage function of the L1CrossDomainMessenger. This function requires the target L2 address, the transaction’s calldata (aligned with the ABI of the target account on L2), and a minimum gas limit necessary for executing the transaction on L2.

- Data Handling and Transmission: The transaction details are then processed through the _send function of the messenger, which ensures that all necessary information is correctly packaged and sent to the corresponding L2 messenger.

Once the data reaches Layer 2, it undergoes the following steps to ensure accurate execution:

- Event Detection: The OP Node on L2 monitors for TransactionDeposited events from L1, extracting the necessary data to process the incoming transaction.

- Executing the Transaction: The extracted data is used to construct and execute the deposit transaction on L2, typically involving the relayMessage function of the L2CrossDomainMessenger. This function conducts the requisite checks before executing the transaction against the designated target contract.

Optimism incorporates several mechanisms to prevent Denial of Service (DoS) attacks during the deposit flow, ensuring both network stability and security:

- Gas Limit Specifications: To prevent abuse and ensure the transaction is processed within resource limits, a specific gas limit is set, which is included in the TransactionDeposited event. This limit reflects the cost of processing the transaction on L2.

- Handling Transaction Failures: If a deposit fails due to issues like insufficient gas, it can be replayed with an adjusted gas limit to accommodate for higher processing costs, ensuring the transaction eventually succeeds.

Withdrawal Flow

The process of withdrawing funds from Layer 2 (such as OP Mainnet) to Layer 1 (Ethereum mainnet) within the Optimism network involves a series of steps designed to ensure the security and verifiability of transactions. This process involves a sequence of transactions to ensure security and verifiability of the withdrawal.

Withdrawal Process

- Initiation on L2:

- Users start the withdrawal process by sending a transaction on L2 using the L2CrossDomainMessenger’s sendMessage function.

- This function takes essential parameters like the target L1 address and the necessary transaction calldata, packaging these into a message set for L1.

- Verification on L1:

- Once the transaction reaches L1, a verification process kicks in to confirm its legitimacy. This involves checking the details against a recorded commitment on the L1 blockchain.

- The transaction must be proven legitimate through a specific proving transaction submitted to L1.

- Finalization on L1:

- After ensuring the transaction’s authenticity and following a fault challenge period to prevent errors or fraud, the withdrawal is ready for finalization.

- The finalization involves executing the transaction on L1, effectively transferring the assets from L2 to the specified L1 address.

Security Measures and Considerations

- Gas Limitations: The system enforces a minimum gas limit to ensure that the L1 transaction can execute properly without running out of gas. Extra gas is accounted for potential computations needed during the withdrawal process.

- DoS Prevention: By requiring specific gas limits and fees, the system prevents denial of service attacks that could occur if malicious entities trigger excessive computations without appropriate fees.

- Fault Challenge Period: This period is critical to safeguard against incorrect or fraudulent withdrawals, ensuring that all transactions are verified and legitimate before being finalized.

Usage and Accessibility

The process is designed to be user-friendly, with most of the technical complexities handled by backend processes. Users interact primarily through simple function calls to initiate and finalize withdrawals.

Superchain

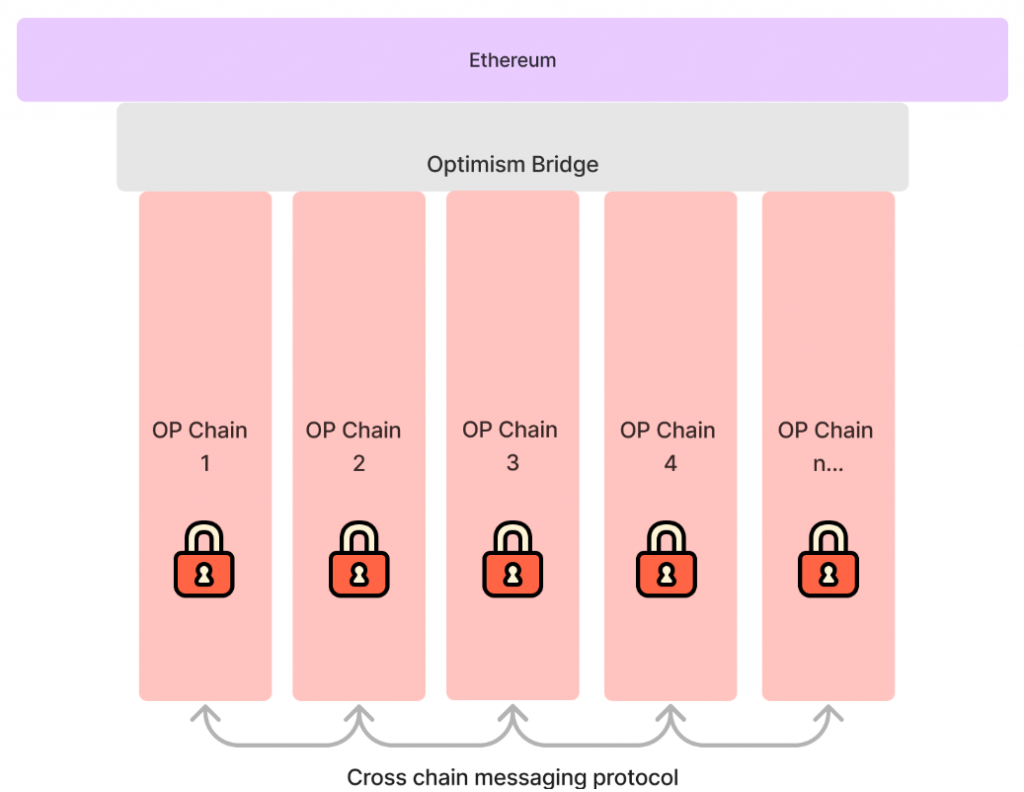

Optimism’s Superchain envisions a multi-chain solution that addresses the limitations of Ethereum’s scalability while maintaining the integrity of the ecosystem. The Superchain builds on the OP Stack and aims to provide horizontal scalability and a unified network of chains, known as OP chains.

The concept of a Superchain represents a major scalability improvement to the OP Stack, aiming to create a network of interconnected chains that share various components and features. To achieve horizontal scalability, multiple chains are necessary, as hardware requirements increase linearly with chain computation. Running chains in parallel is essential to enable scalability without compromising performance.

The current state of blockchain technology faces scalability constraints that hinder the realization of a decentralized web. These scalability issues have prevented many web applications from running on-chain effectively.

In scenarios where blockchain scalability challenges are solved, and on-chain transactions become as cheap as interacting with centralized backends, developers wouldn’t need to worry about backend infrastructure, as the chain guarantees correct execution, uptime, and scalability. Composability, facilitated by shared smart contract execution, would far surpass traditional REST APIs. Additionally, standardized gas markets would reduce infrastructure costs for users, making monetization easier. This would enable highly scalable web applications without the need for a traditional backend, revolutionizing application development.

The Superchain is a conceptual architecture that addresses blockchain scalability. It relies on multiple chains working in parallel to achieve horizontal scalability. By abstracting the notion of chains and making them interchangeable compute resources, the Superchain aims to solve the limitations of traditional multi-chain architectures, including new security models and costly deployments. This allows developers to build cross-chain applications without introducing systemic risk or incurring excessive overhead.

Properties of the Superchain

| Property | Purpose |

| Shared L1 blockchain | Provides a total ordering of transactions across all OP Chains. |

| Shared bridge for all OP Chains | Enables OP Chains to have standardized security properties. |

| Cheap OP Chain deployment | Enables deploying and transacting on OP Chains without the high fees of transacting on L1. |

| Configuration options for OP Chains | Enables OP Chains to configure their data availability provider, sequencer address, etc. |

| Secure transactions and cross-chain messages | Enables users to safely migrate assets between OP Chains. |

Upgrading Optimism to Become a Superchain

The transition of Optimism into a Superchain requires several key changes beyond the Bedrock release. These changes are vital for the deployment and upgradability of multiple chains using the same bridge.

- Upgrade Bedrock Bridge to a Chain Factory:

- The current SystemConfig contract introduced by Bedrock partially defines L2 chains via L1 smart contracts. This concept can be extended by incorporating all L2 chain information on-chain. This includes generating a unique chain ID and configuring values such as block gas limit. By making chain data entirely on-chain, a factory can be developed to deploy configurations and required contracts for each chain. Deterministic contract addresses can also be introduced using CREATE2, simplifying chain interaction and reducing deployment costs.

- Derive OP Chain Data with the Chain Factory:

- Building on Bedrock’s L2 chain derivation, where chain data syncs based on L1 blocks, integrating the L1 chain factory enables Optimism nodes to deterministically sync any OP Chain given an L1 address. This process computes chain state locally, ensuring permissionless and secure determination of OP Chain state. While no proof system is needed for chain derivation, Superchain withdrawals still require a proof system.

- Permissionless Proof System for Withdrawals:

- Bedrock introduced a permissioned entity (proposer) for user withdrawals, leading to linear overhead as Superchain chains increase and limitations due to L1 resources. To overcome this, two features can be introduced:

- Withdrawal Claims: Allow anyone to submit withdrawals, eliminating the need for a designated proposer.

- Remove Proposal Submission Interval: Enable withdrawal claims when users require withdrawals, reducing overhead.

- These features can be supported by a permissionless proof system in Optimism’s bridge contracts, allowing fault-proof-based withdrawal claims. Claims can be submitted with attached bonds, acting as collateral. Challengers can challenge claims, with successful challenges receiving bonds as rewards. Attestations from chain attestors can be used to challenge invalid claims.

- Bedrock introduced a permissioned entity (proposer) for user withdrawals, leading to linear overhead as Superchain chains increase and limitations due to L1 resources. To overcome this, two features can be introduced:

- Configurable Sequencer per OP Chain:

- Bedrock’s sequencer address feature in the SystemConfig contract can be expanded for modular sequencing. OP Chains can configure their sequencer addresses during deployment, fostering sequencer decentralization. This modular approach permits experimentation with sequencing models, facilitating the emergence of user-friendly sequencing standards.

- Shared Upgrade Path for OP Chains:

- To ensure secure and decentralized upgrades, a decentralized security council can be introduced. This council can manage chain attestation sets, initiate contract upgrades, and execute an emergency bridge pause. This pause mechanism can address emergencies, even if private keys are compromised, by freezing L1 funds to prioritize safety over liveness.

- Unfreezing the Bridge via L1 Soft Fork:

- In case of frozen funds due to emergencies, the potential “L1 Soft Fork Upgrade Recovery” mechanism can be considered. This mechanism allows L1 to initiate a bridge upgrade with a soft fork, bypassing Superchain bridge contract permissions. This approach requires further research and community buy-in.

- Achieving the Core Superchain Properties:

- These upgrades collectively establish a system that fulfills core Superchain properties, including a shared bridge for OP Chains, cost-effective chain deployment, configuration flexibility, secure transactions, and cross-chain messaging. The combination of these changes ensures Optimism’s evolution into a Superchain ecosystem that offers enhanced scalability, interoperability, and security.

Extending the Superchain – Enhancements to Realize the Vision

The proposed enhancements to extend the Superchain and realize its vision address several pain points in blockchain scalability and functionality:

- Multi-Proof Security:

- Pain Point: Withdrawal claims rely on a trusted set of chain attestors.

- Proposed Solution: Introduce permissionless proofs, like Cannon, for dispute resolution. Implement a multi-proof system for redundancy to ensure safety.

- Low Latency L2 to L2 Message Passing:

- Pain Point: Cross-Chain transactions are slow because they require waiting a challenge period.

- Proposed Solution: Utilize the OP Stack’s modular proof system to achieve low latency L2 to L2 message passing. This enables different bridge types with varying security and latency.

- Synchronous Cross-Chain Transactions:

- Pain Point: Cross-Chain transactions are asynchronous, preventing atomic cross-chain transactions.

- Proposed Solution: Introduce synchronous cross-chain messaging with shared sequencing protocols on both OP Chains, enabling atomic cross-chain interactions, including complex transactions like cross-chain flash loans.

- Alt-Data Availability Layer — Plasma Protocol:

- Pain Point: Posting transactions to the Superchain is not scalable due to limited L1 capacity.

- Proposed Solution: Implement a Plasma protocol to extend data availability accessible to OP Chains. Plasma data is cheap, and users interested in transaction data download it, reducing scalability constraints on L1.

- Multi-Chain dApp Frameworks:

- Pain Points: Lack of easy frameworks for building scalable dApps across multiple OP Chains, and absence of a user-friendly wallet for managing assets and dApps across multiple OP Chains.

- Proposed Solution (Sketch): Develop tools and frameworks on top of the core Superchain protocols to enhance the developer and user experience. Suggested tools include content-addressable smart contracts, cross-chain contract state management standards, and a Superchain RPC endpoint.

Law of Chains

The Law of Chains, introduced by the Optimism Collective on July 26th, 2023, represents a significant stride towards realizing a unified Superchain that leverages the modular and forkable OP Stack. This framework is designed to ensure that each chain within the Superchain upholds shared standards of openness, neutrality, and user protection, mitigating the risks associated with the proliferation and fragmentation of independent blockchains.

The Law of Chains is not just a set of rules but a neutrality framework guiding the collective governance of multiple blockchain networks under the Superchain umbrella. It emphasizes a communal approach to solving problems, where enhancements benefit all members and users experience a consistent and secure environment across different chains.

Key Principles and Stakeholder Protections

- Stakeholders: The framework categorizes stakeholders into Users, Chain Governors, and Chain Servicers, each with specific rights and responsibilities.

- User Protections: Emphasizes uniform protections across chains, mirroring the security and operational standards of Ethereum to ensure a safe and predictable user experience.

- Governor and Servicer Rights: Maintains economic and operational autonomy for Chain Governors and Servicers, allowing them to innovate while adhering to the collective standards.

The governance model transitions from overseeing a single chain to setting standards across multiple chains, promoting a scalable and decentralized ecosystem. The Law of Chains serves as a guiding document to be socially enforced by Optimism Governance, ensuring that all participating chains meet the established criteria.

Section-by-Section Overview of the Law of Chains

- Introduction: Establishes the Law of Chains as an open neutrality framework for promoting core principles such as user protection, decentralization, and economic autonomy.

- Covered Participants: Defines the three groups of ecosystem participants covered by the Law—Users, Chain Governors, and Chain Servicers.

- The Platform: Discusses the application of the Law to the OP Stack platform itself, emphasizing its role as a public good.

- User Protections: Focuses on ensuring uniform protections for all users across the Superchain, comparable to those on Ethereum.

- Chain Governor Protections: Details the rights of Chain Governors to make economic decisions and configure technical settings within set parameters.

- Chain Servicer Protections: Outlines the expectations and rights of Chain Servicers, particularly concerning economic participation and response to governance changes.

- Platform as Commons: Treats the entire OP Stack platform as a communal resource that must be preserved for the benefit of the collective.

- Users First: Prioritizes user protections over other considerations, ensuring their needs are foremost.

- Enforcement: Specifies that the Law of Chains will be enforced through resolutions passed by Optimism Governance.

- Interpretation: Provides guiding principles for interpreting the Law, focusing on minimizing governance overhead and ensuring long-term relevance.

The initial version of the Law of Chains is open for community feedback, with the goal of refining and officially integrating it into the governance process in upcoming seasons. This approach ensures that the framework evolves in response to community insights and technological advancements.

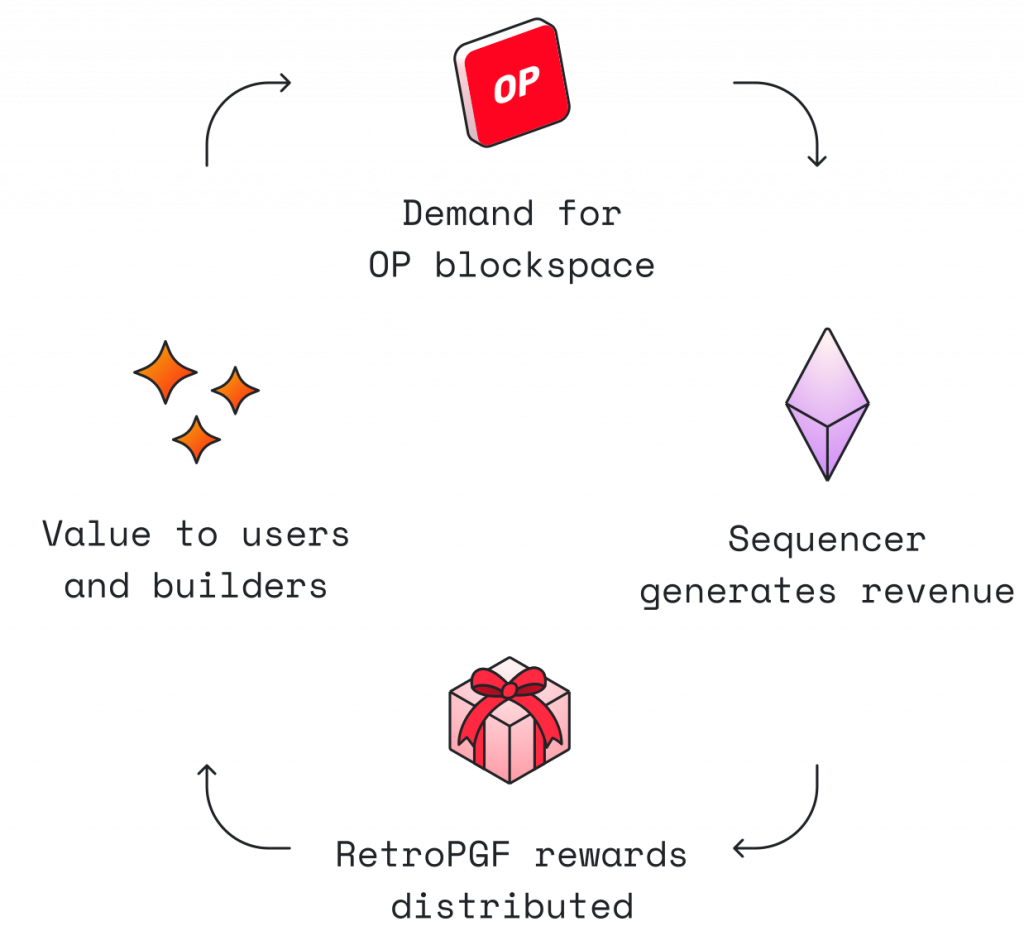

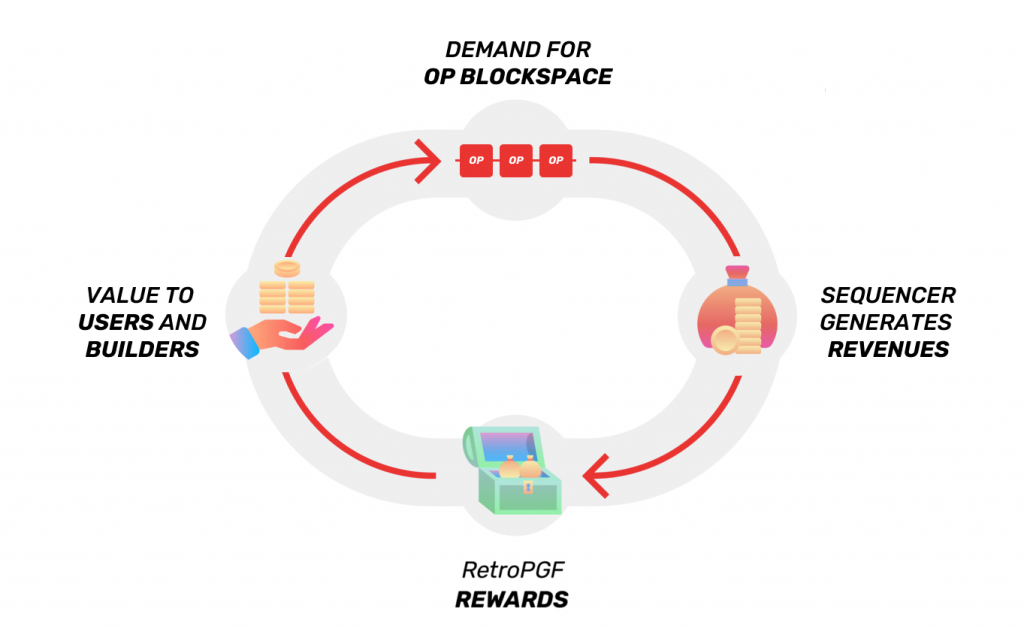

RetroPGF

Public goods refer to resources or initiatives that benefit the entire community and are not driven by direct profit motives. Optimism recognizes the importance of funding public goods to ensure the sustainability and healthy growth of the ecosystem, ensuring the availability of essential tools, infrastructure and resources.

The Retroactive Public Goods Funding (RetroPGF) initiative within the Optimism Collective is an experiment in non-plutocratic governance and the retrospective allocation of funding for public goods.

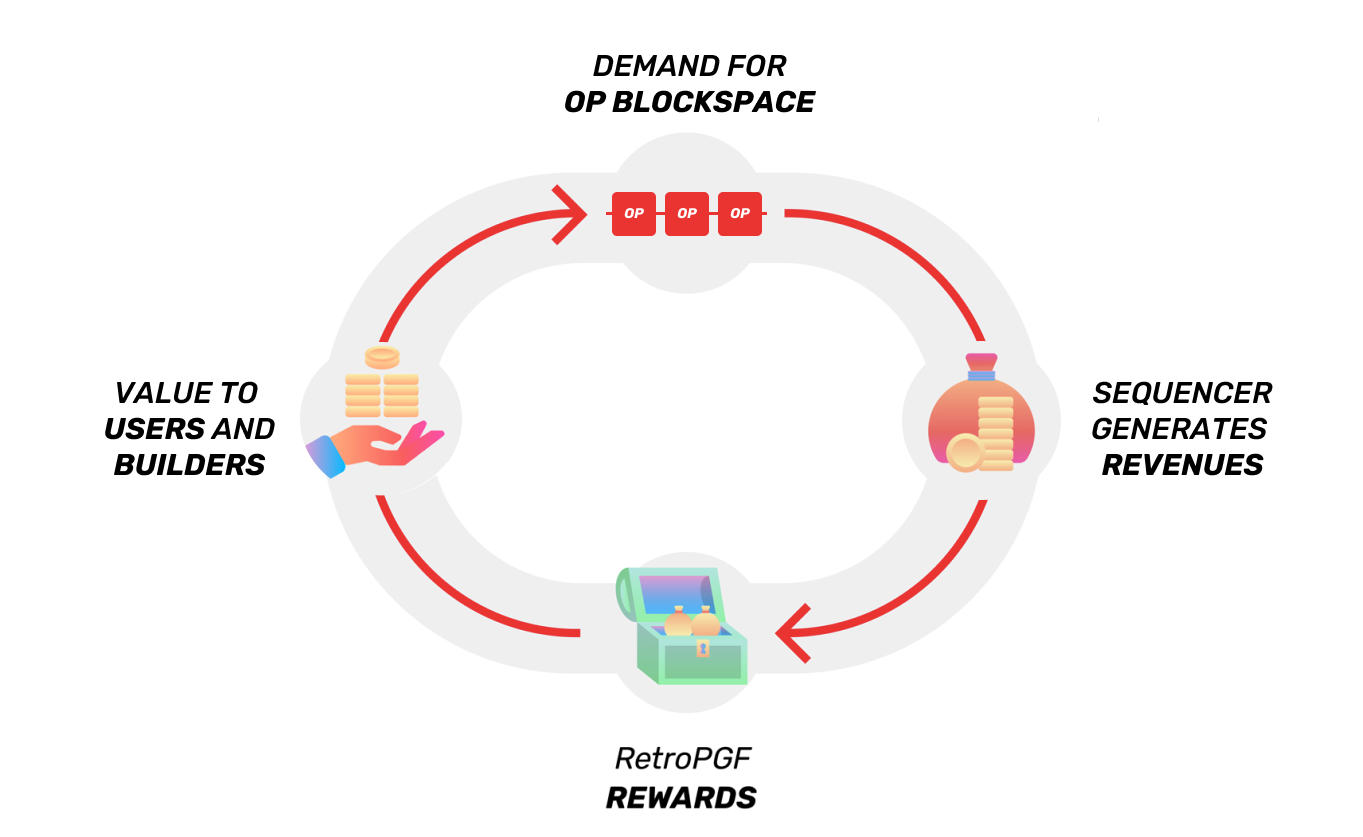

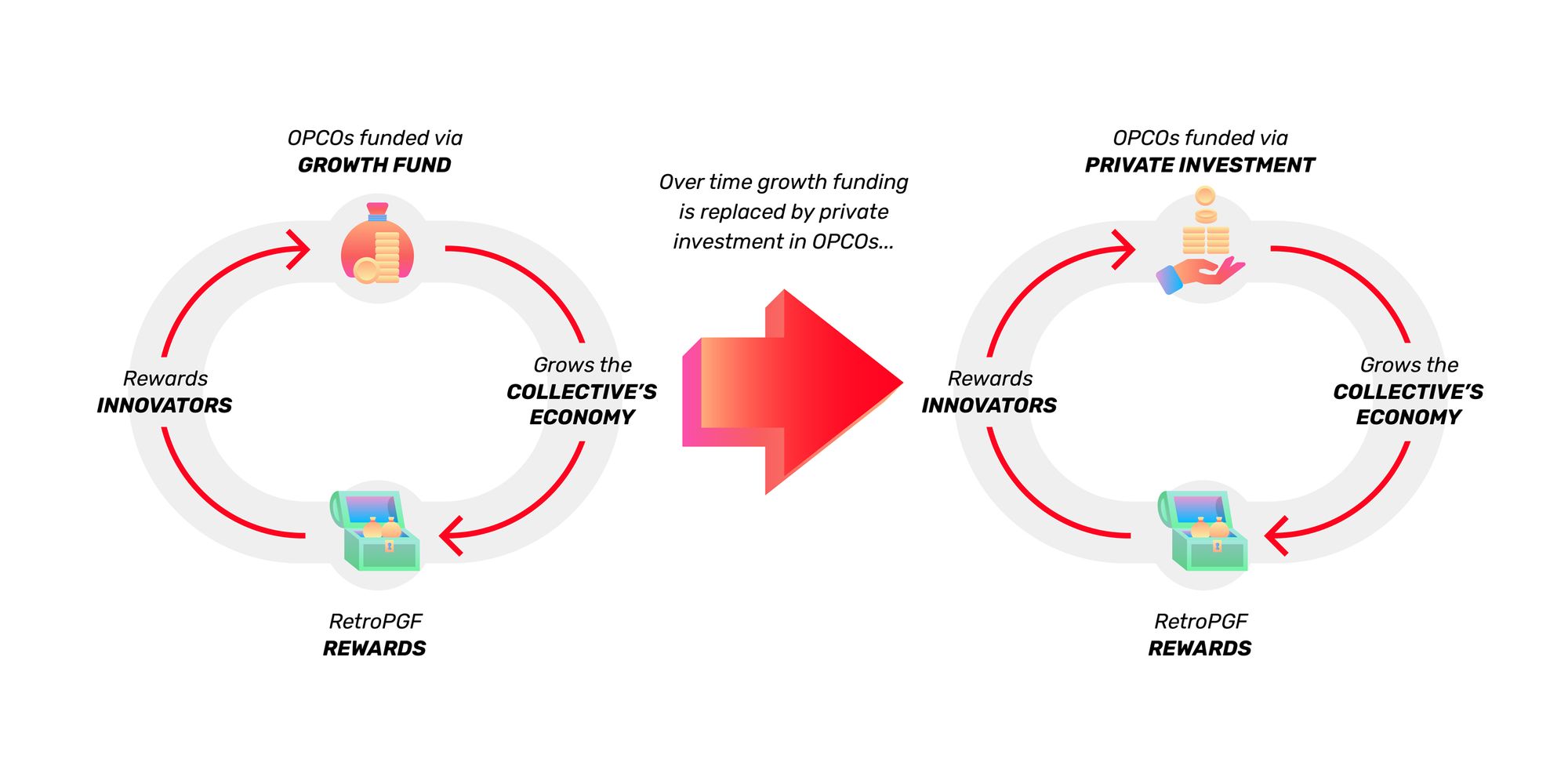

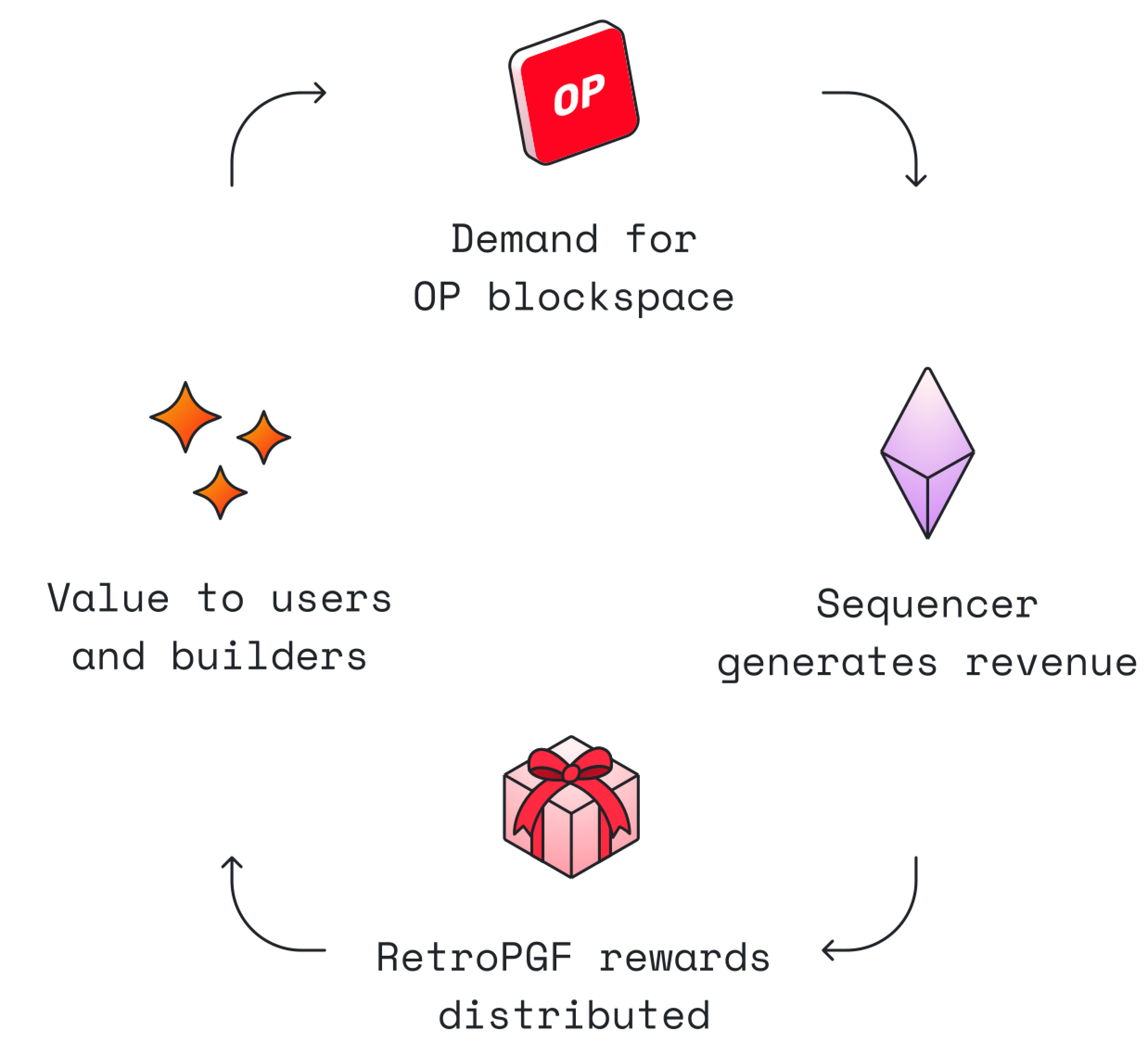

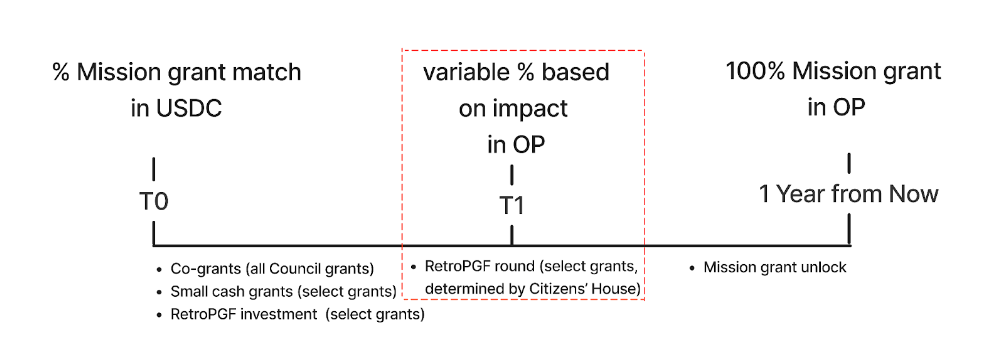

RetroPGF is built on the concept that it is often easier to agree on what was useful in the past than to predict future utility. It involves experiments where members of the Citizens’ House allocate surplus protocol revenue or portions of the RetroPGF token allocation to projects that have demonstrated a positive impact on the Optimism Collective. This aligns with Optimism’s core principle of “impact = profit,” where positive impact should be rewarded with profit.

- RetroPGF provides strong incentives for individuals to create public goods that benefit the Optimism Collective.

- This initiative fosters an ecosystem that is more developer-friendly, informative, and interconnected, thereby driving application usage and increasing demand for blockspace.

- By funding public goods sustainably, the Collective can nurture a robust ecosystem and a more prosperous economy.

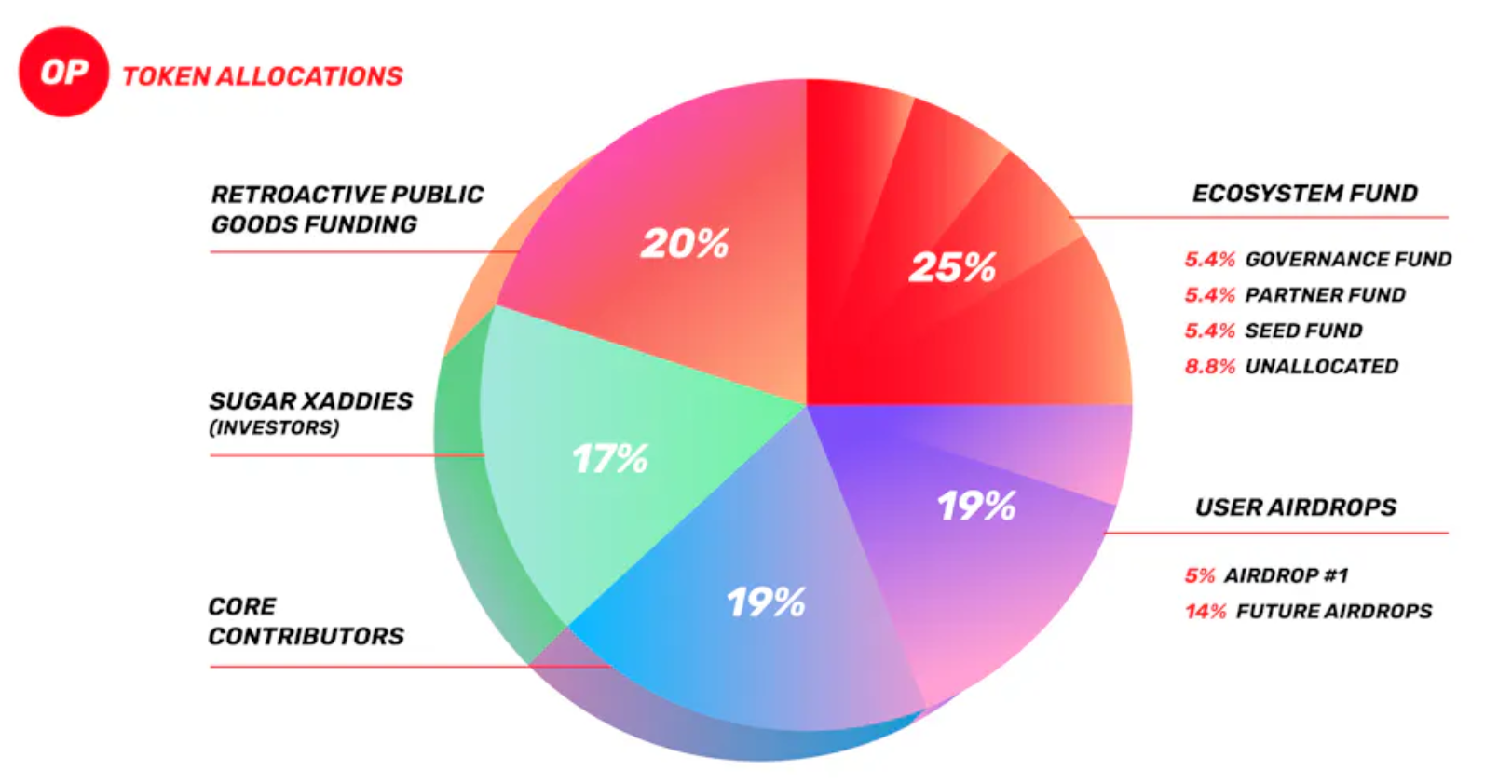

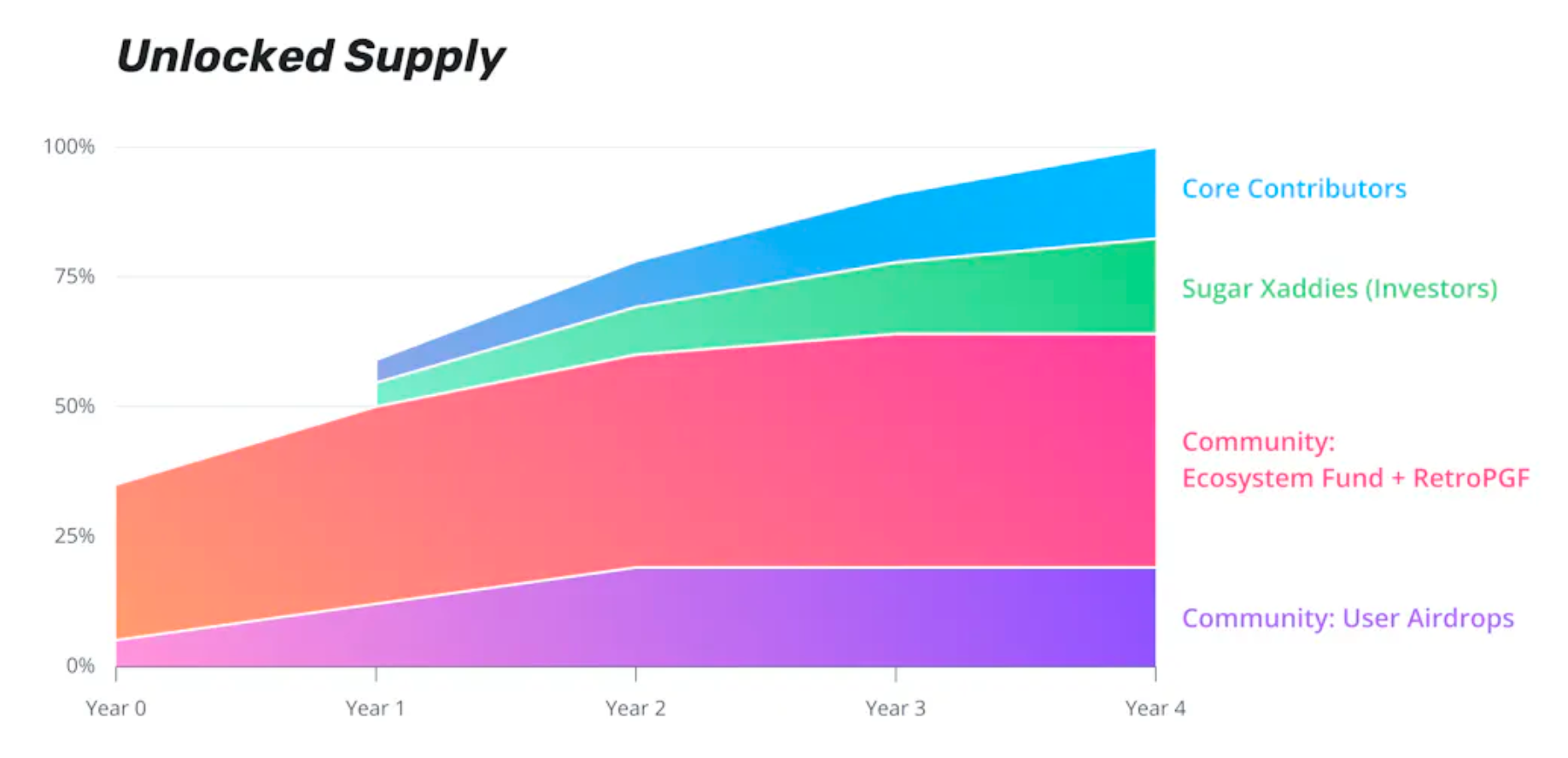

Funding for RetroPGF can originate from two key sources:

- RetroPGF Token Allocation: This consists of 20% of the initial OP (Optimism’s native token) supply designated for RetroPGF.

- Allocation of Surplus Protocol Revenue: Additional funding may come from the surplus revenue generated by the Optimism protocol.

RetroPGF is a long-term endeavor aimed at building the future envisioned by Optimism supporters. Regular rounds of RetroPGF will continue, each with its unique characteristics. This process is dynamic and relies on community participation to evolve and improve.

In the early rounds of RetroPGF, the Optimism Foundation collaborated with the community to decide on scope and voting mechanics. However, as the initiative progresses, the Citizens’ House will have more autonomy in shaping these aspects, with checks and balances from the Token House.

The ultimate goal is to expand RetroPGF’s scope to support the creation of public goods beyond the immediate Optimism ecosystem by continuously refining the tools and processes through regular experimentation.

Identity

Decentralized identity is essential for creating a democratic, secure, and accessible web. It allows individuals to control their personal information, seamlessly manage their identity across different platforms, and enhance privacy without compromising on functionality.

Within the Optimism Collective, decentralized identity is crucial for enabling equitable participation in governance. It underpins a two-house system where both token holders and community members vote in a one-person-one-vote manner, reflecting true community consensus and contributions.

Beyond governance, decentralized identity opens new opportunities for economic empowerment and innovation. It enables secure financial interactions and broader access to global services, allowing users to prove personal attributes securely and privately.

The Collective highlights the use of attestations as key components of decentralized identity. These verifiable claims allow users to demonstrate qualifications or traits without revealing unnecessary personal details, supporting privacy-respecting applications.

Developers are encouraged to explore decentralized identity applications that leverage attestations, enhancing user autonomy and privacy within the Optimism ecosystem.

Attestions

Attestations are crucial building blocks in decentralized identity systems, serving as verified statements made by a recognized entity about an individual, entity, or object. They play a fundamental role in establishing a trust framework within digital platforms.

The Ethereum Attestation Service (EAS) is a suite of smart contracts designed for the creation, verification, and revocation of both on-chain and off-chain attestations. This service acts like a decentralized database, enhancing the reliability of digital attestations across any OP Chain within the Superchain network.

Benefits of Using Ethereum Attestation Service

- Permissionless: EAS operates through a public contract system, making it accessible to anyone without centralized control, thus facilitating an open verification process.

- Robust Tooling: Developers can benefit from advanced tooling for indexing and access management, which are integral to the AttestationStation.

Privacy is a paramount concern when dealing with attestations, as they can generate immutable records on the blockchain. Here are some privacy best practices:

- Consent: Always secure explicit consent from users when collecting personal information, clarifying the purpose, usage, and storage of the data.

- Sensitive Data Handling: Avoid on-chain storage of sensitive data. Instead, use hashes of such data for future verifications.

- Security: Ensure off-chain data is stored securely using encryption and robust access controls.

The Optimist Profile

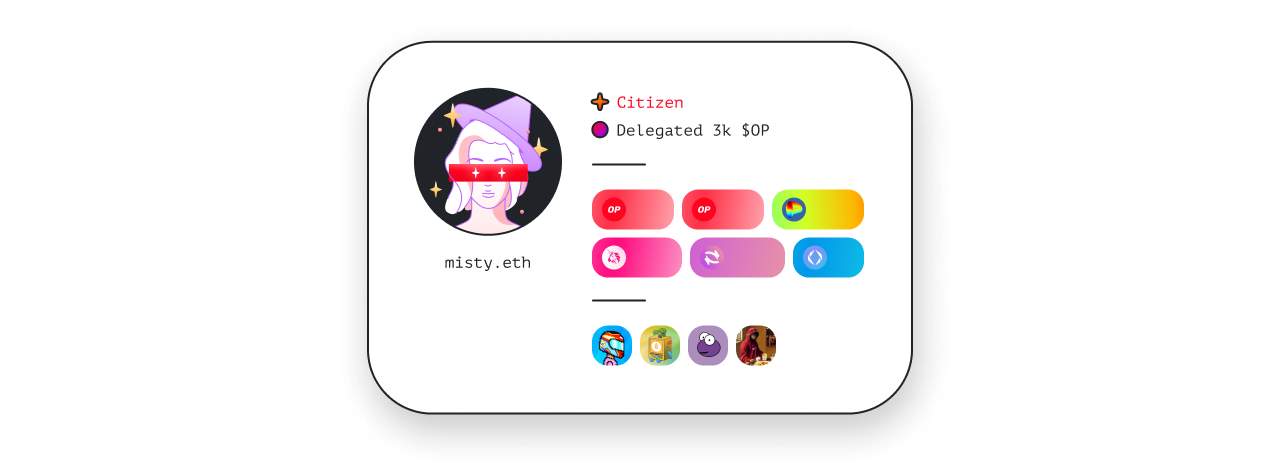

The Optimist Profile is a tool designed to enable contributors to publicly share and verify the impact of their contributions to the Optimism Collective. This profile not only facilitates the creation of a detailed on-chain identity but also enhances the web of trust within the community by allowing peer-to-peer attestations regarding contributions.

Features of the Optimist Profile

- Profile Schema: Each profile is anchored by a unique on-chain self-attestation that outlines the individual’s or organization’s identity.

- Contributions: Contributors can make attestations about their own contributions as well as validate the contributions of others, fostering a robust contribution verification system.

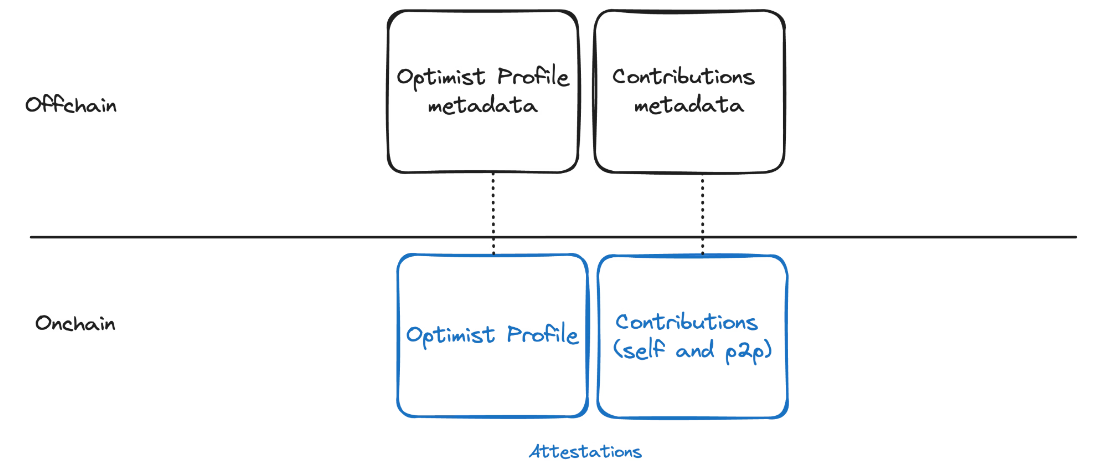

Built on the Ethereum Attestation Service, the Optimist Profile utilizes a structured approach to store and retrieve identity and contribution data:

- Profile Schema UID: 0xac4c92fc5c7babed88f78a917cdbcdc1c496a8f4ab2d5b2ec29402736b2cf929

- Name: Identifies the profile holder.

- Metadata Pointer: Directs to a URI, IPFS hash, or similar blob storage that holds detailed metadata about the profile.

- RetroPGF 3 Application Schema UID: 0x76e98cce95f3ba992c2ee25cef25f756495147608a3da3aa2e5ca43109fe77cc

- Display Name: Name of the application.

- Application Metadata Pointer: Points to blob storage that contains further details about the application.

Why The Project Was Created

Optimism was born out of a mission to scale Ethereum while preserving its core values and making it accessible to people around the world. The creators of Optimism saw the state of Ethereum, burdened by high fees, and recognized that these fees limited its accessibility, particularly for everyday users. Their vision was to bring the promise of Ethereum to a global audience, a vision hindered by transaction fees that could reach up to $100 per swap.

At the technical level, Optimism was developed to address Ethereum’s scalability challenges by introducing a Layer 2 solution that enables faster and more cost-effective transactions while maintaining the security of Ethereum’s architecture. The mission was clear: make Ethereum affordable again by realizing the concept of Layer 2 scaling.

The Ether Phoenix

But not only was Optimism started with the hope of scaling Ethereum, but also the values that characterize the Ethereum community and ecosystem. The creators of Optimism understood that the essence of humanity lies in its capacity to organize and collaborate. As a result, they sought to address this issue through Ether’s Phoenix, a concept that envisions a world where individuals are rewarded in proportion to their positive impact. In this vision, contributing to public goods, like distributing free software, results in proportional financial rewards—a concept known as the “fairness ratio,” where impact equals profit.

Calculating impact can be challenging, as many public goods are intangible, slow to manifest, and difficult to measure using traditional market mechanisms. To tackle this, Optimism proposed a “retroactive” approach to public goods funding. This way, periodical pauses assess past contributions, rewarding individuals for their role in creating a better world.

Ether’s Phoenix represents not only an algorithm but also a mindset—one that believes in the power of cooperation and optimism. It rewards early cooperators who laid the groundwork for funding public goods. It embodies the idea that building systems to support public goods is a public good in itself.

At the start, Optimism’s contribution to this vision was to allocate 100% of centralized sequencer profits to Ethereum protocol development. While it may not solve all the world’s problems, it represents a step in the right direction, a step toward a more harmonious future where cooperation and optimism prevail, and the community is rewarded for its efforts on building a healthy ecosystem.

Retroactive Public Goods Funding – RPGF

Retroactive Public Goods Funding (RPGF) is an initiative that aims to realize the vision of achieving sustainable funding for the Optimism ecosystem. From Vitalik Buterin words:

“It is easier to agree on what was useful than what will be useful. The former is still often a source of disagreement, but it’s a type of disagreement where you could still get reasonably good top-level judgements by using some existing voting mechanism (eg. quadratic voting or even regular voting). The latter is much more challenging. For the profit-making sector, the best that we can do is to build out an ecosystem where people can create startups and invest in them, and get rewarded if they end up correct. So rather than reinventing the wheel entirely, we will create a public-goods-oriented version of the exact same mechanism.”

Building ambitious projects without a clear business model is undeniably challenging. Securing funding, attracting top talent, and overcoming the myriad obstacles that come with creating something exceptional become uphill battles.

Startups, despite their high failure rates, possess a significant advantage—the possibility of an exit. These exits create incentives for investment, hiring, motivation, and equity alignment, as individuals can share in the gains from the project’s success. However, this advantage is largely absent in the realm of nonprofits, open-source software (FOSS), and public goods projects.

In the absence of exit opportunities, even the most talented and well-intentioned builders often veer toward for-profit ventures, potentially compromising their original missions. It’s not solely about amassing wealth; it’s about fairness. Why dedicate oneself to building free software when others reap massive profits from it without any financial upside for the creator?

By drawing inspiration from Vitalik’s ideas, Optimism came up with a mechanism that introduced exits for public goods projects based on the amount of public goods they generate, rather than quarterly profit margins. The goal behind this was to increase the investment capacity and foster more innovation in those technologies that maximize community benefit

The proposal combines protocol-generated revenue, retroactive public goods funding, and a Results Oracle to establish a funding cycle for public good projects akin to the startup model. As a result, the Optimism team has committed to allocating all profits generated from sequencing (before decentralizing the sequencer) to public goods funding experiments, including the potential for the first public goods exit. Moving forward, this commitment underscored the foundational ideas of the inaugural experiment.

The Results Oracle

The Results Oracle is a pivotal component in the concept of retroactive public goods funding (RPGF), and its importance lies in its ability to fund public good projects based on their demonstrated value and impact. Unlike traditional funding mechanisms that rely on projecting the potential future benefits of a project, RPGF recognizes that it’s often easier to evaluate what has already been achieved.

- Agreement on Past Value: Determining the value of past contributions is generally less contentious than predicting future utility. While disagreements may still arise, they can often be addressed using existing voting mechanisms like quadratic voting or conventional voting. This approach provides a more reliable way to assess the historical impact of public good projects.

- Alignment with Profit-Making Mechanisms: The Results Oracle draws inspiration from profit-making sectors where individuals can create startups, invest in them, and receive rewards if they prove to be correct. In essence, it adapts a similar mechanism for public goods projects. Rather than reinventing the wheel, it leverages a familiar and successful model.

- Retroactive Funding: The Results Oracle, unlike other public goods funding DAOs, funds projects retroactively. It recognizes and rewards projects that have already provided tangible value to the community. This retroactive approach encourages builders and contributors by providing concrete incentives for past work.

- Iterative Design: Crafting the perfect design for the Results Oracle is a complex challenge, and naive approaches like coin voting (one person one vote) have known issues. To address this, the design is approached iteratively. Early versions may involve a small group of technically skilled, long-time contributors from the ecosystem, with improvements made over time as the understanding of decentralized governance advances.

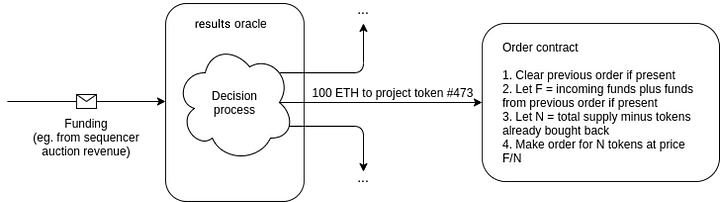

- Reward Distribution: The Results Oracle has the capability to send rewards to various types of addresses, including:

- Individual or organizational addresses primarily responsible for the project.

- Smart contracts representing fixed allocation tables, distributing funds among contributors.

- Project tokens, representing contributions and tradeable on open markets.

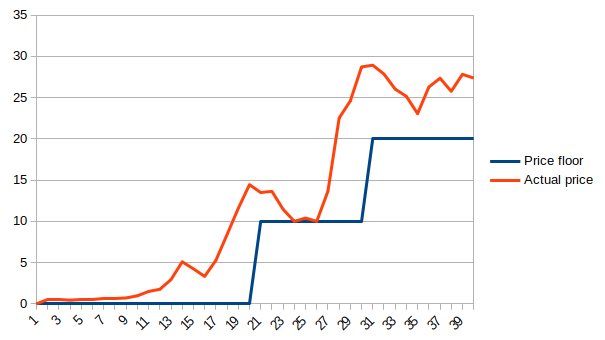

- Project Tokens: The concept of project tokens introduces a novel idea. These tokens serve as a prediction market for what the Results Oracle will fund. The oracle sets a price floor for the tokens, allowing it to allocate rewards to projects multiple times. This approach enables projects to receive rewards from multiple sources, enhancing their sustainability.

- Disagreements and Judgement: In cases where multiple allocation tables or project tokens for the same project emerge due to disagreements over contributions, the Results Oracle must make judgments. It decides not only which project is valuable but also which token or allocation table (or the distribution split among multiple tokens/tables) best represents the contributions. While this judgment is necessary, it is expected to be exceptional rather than routine.

In essence, this mechanism envisions a future where public goods projects receive financial rewards based on their positive impact, creating an ecosystem where builders of public goods can see tangible returns for their contributions. Overall, this approach seeks to align incentives, attract top talent, and enable the sustained growth of projects that benefit society as a whole.

A Pragmatic Approach to Decentralization

Decentralization is a core principle of the blockchain and cryptocurrency space. However, when it comes to layer 2 (L2) solutions, achieving full decentralization is challenging, primarily due to the reliance on upgrade keys.

Understanding the Decentralization Challenges in L2s

Every major L2 project relies on upgrade keys for their L1 contracts, which grant a trusted party the power to execute protocol upgrades. While this enables projects to make improvements and fix bugs, it also centralizes control over the L2 balances. If these keys were compromised, it would put all deposited assets at risk.

Having upgrade keys means that even with fault or validity proofs in place, the security can be overridden by upgrades. This raises questions about the effectiveness of security mechanisms if a central authority can alter them at will.

Nevertheless, the main reason for having upgrade keys is the inherent difficulty of writing bug-free, complex code. In the crypto space, where a single vulnerability can have catastrophic consequences, caution is paramount. This complexity poses a high bar for achieving true decentralization.

Decentralizing Optimism with a Multi-Client Architecture

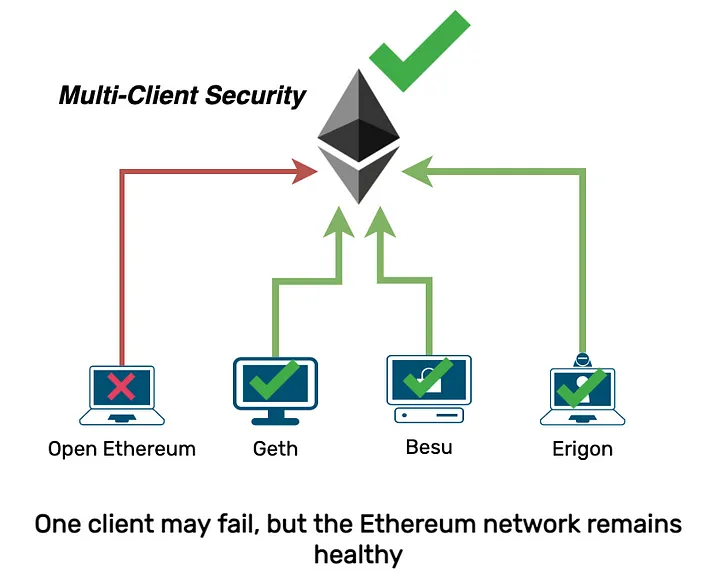

Ethereum provides a valuable case study in achieving decentralized security. Despite experiencing multiple critical bugs and vulnerabilities, Ethereum has remained highly available throughout its existence. This resilience is attributed to Ethereum’s strategic approach to security.

To emulate Ethereum’s success, Optimism is pursuing a pragmatic path to decentralization. This will be implemented following the steps listed below:

- Multi-Client Ecosystem: Ethereum’s strategy revolves around creating a multi-client ecosystem with multiple distinct implementations that can interoperate. The key idea is that bugs are usually uncorrelated between implementations. If one client has a specific bug, another may not suffer from the same issue. This redundancy ensures high availability.

- Decentralizing Optimism: Optimism is designing its architecture to align with Ethereum’s philosophy. It aims to integrate with multiple clients, making it possible to mix and match both the proofs and the clients. This approach maximizes redundancy and reduces reliance on a single central authority.

- Adding ZK Rollups: While Optimism is not immediately adopting zero-knowledge proof technology, it remains open to the possibility in the future. If ZK technology becomes powerful enough to support EVM equivalence, it can be added as another client in the multi-client ecosystem, providing an additional layer of security.

Roadmap

The Path to Technical Decentralization

Optimism, guided by OP Labs, is committed to decentralizing its technical framework known as the OP Stack. This commitment aligns with Optimism’s broader mission to facilitate global coordination through decentralized blockchain technology. The focus is on transforming the OP Stack into an open, modular, and forkable infrastructure that not only scales Ethereum but also maintains its ethos of openness and neutrality.

The journey towards decentralization is central to Optimism’s philosophy of empowering global coordination via blockchain technology. Over the past few years, significant efforts by OP Labs have focused on preparing the OP Stack for this transition. Since the deployment of Bedrock, Optimism has made significant strides toward achieving its goal of technical decentralization.

The path to decentralization is complex, filled with technical challenges that require meticulous, bug-free coding to avoid vulnerabilities. OP Labs has adopted a pragmatic and cautious approach to decentralization, emphasizing the importance of intentional steps towards activating on-chain fault proofs, crucial for securing the Layer 2 infrastructure.

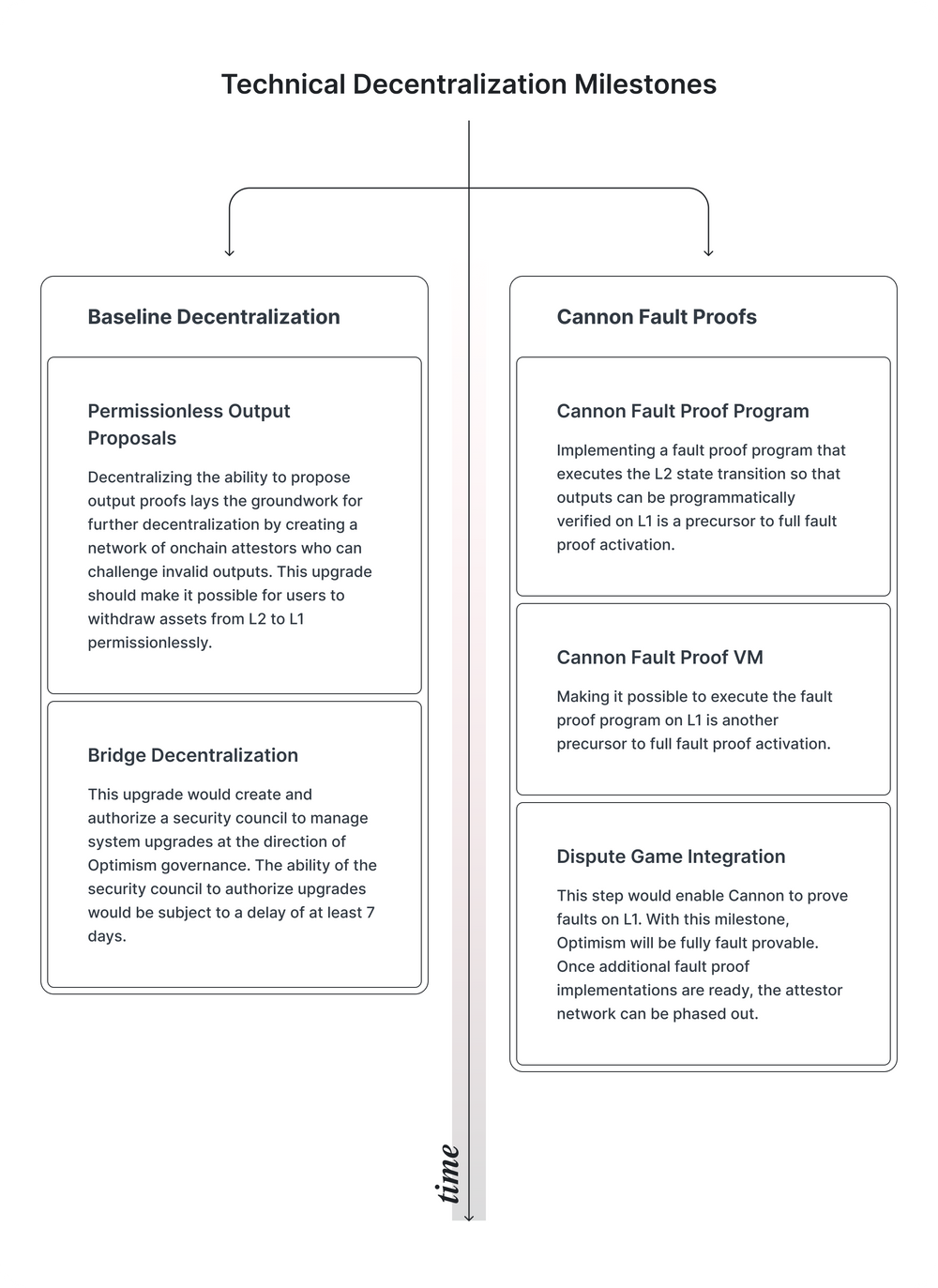

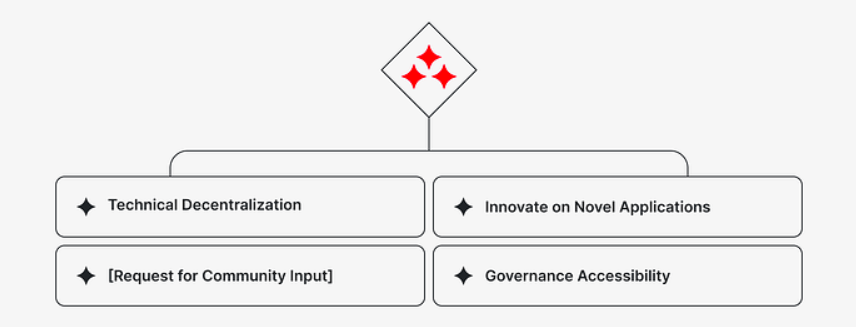

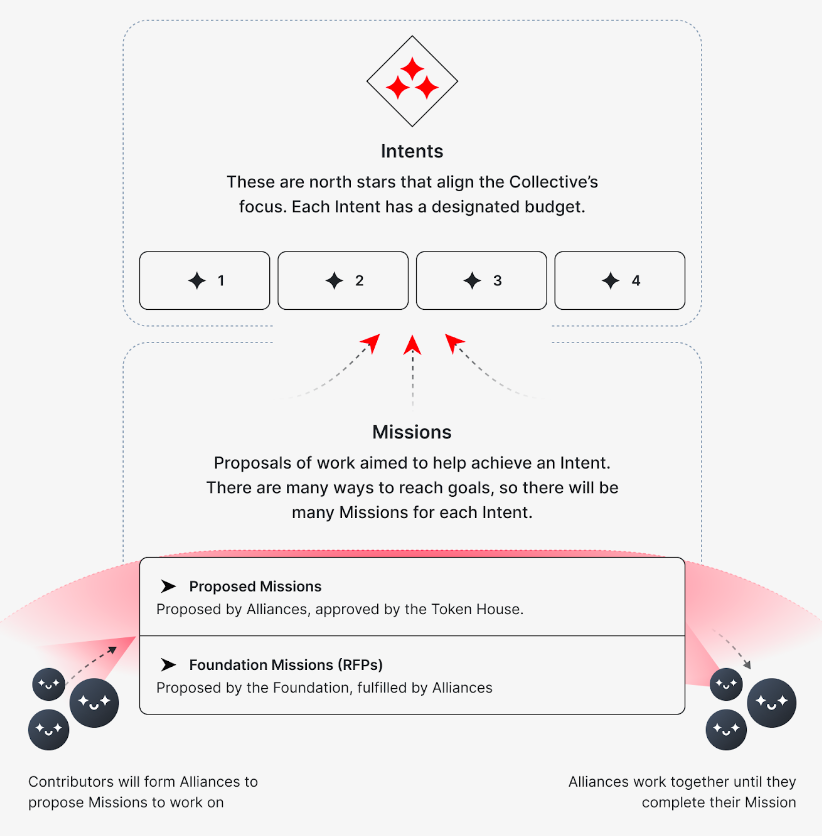

With Bedrock’s infrastructure in place, the focus has shifted towards:

- Activating Fault Proofs: Ensuring that all transitions within the network can be independently verified, increasing security and trust across the platform.

- Decentralizing Network Governance: Progressing beyond central control to a more community-focused governance model. This includes decentralizing the roles of sequencers and proposers to mitigate risks associated with central points of failure.

- Upgrades and Delays: Ensuring that all upgrades have a minimum delay of 30 days to provide ample time for review and community feedback.

Optimism is aiming to reach several key milestones in the near future:

- Full Implementation of Fault Proofs: This critical step will bolster network integrity by allowing for comprehensive verification of state transitions.

- Community Governance Expansion: Efforts are underway to enhance participation in network governance, ensuring that decision-making reflects the diverse perspectives within the Optimism community.

- Sequencer Decentralization: Continuing to distribute the responsibility of transaction sequencing among multiple parties to enhance network resilience and security.

Community collaboration remains a cornerstone of Optimism’s strategy. The ongoing decentralization process benefits significantly from community feedback, which helps refine and optimize the development of the network. OP Labs encourages all stakeholders to participate in discussions and contribute to the governance processes.

Next-Generation Fault Proofs

The introduction of the Fault Proof System by OP Labs marked a significant step in advancing the technical decentralization of the Optimism ecosystem. This system is designed to enhance security and reliability within the Superchain by validating transaction integrity through a series of checks and balances.

The Fault Proof system is comprised of several components each playing a critical role in maintaining the integrity of transactions within the Superchain:

- Fault Proof Program (FPP): The FPP acts as a deterministic program that checks for discrepancies or faults by accessing data from L1. This is essential for ensuring the accuracy of the data across the network.

- Fault Proof Virtual Machine (FPVM): Also known as “Cannon,” this component executes the programs of the FPP. It simulates a MIPS machine running the L2 Ethereum Virtual Machine (EVM), which allows for precise control and verification of the operations.

- Dispute Game: This component is used to resolve disagreements over the outputs produced by the FPVM, ensuring that only valid outputs are finalized. The initial version utilizes a Bisection game to isolate and address disputes effectively.