Overview

Oasys is an EVM-compatible, DPoS (delegated proof-of-stake), multi-verse blockchain ecosystem purpose-built for high transaction volumes and minimizing transaction fees. Initially focused on gaming, it is now expanding into real-world asset (RWA) tokenization, such as real estate, with an emphasis on Asian markets.

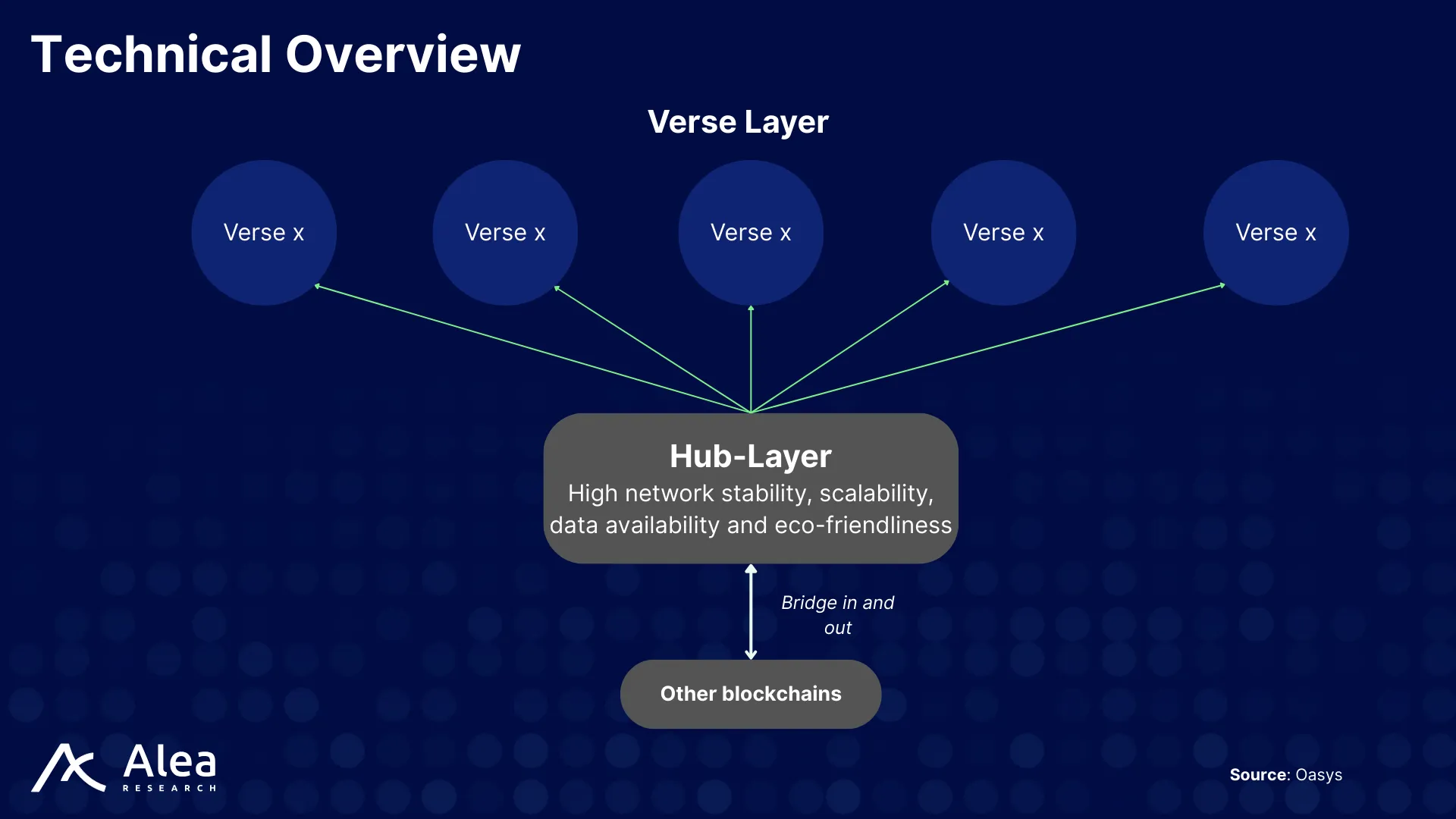

Oasys has a multi-layered architecture consisting of a scalable L1 Hub-Layer and customizable L2 Verses. The Hub is a semi-permissionless DPoS base chain that provides consensus and data availability, batches and finalizes Verse rollups, and hosts only essential contracts. Verses are configurable, mostly permissioned execution layers built and run by Verse Builders, who set policy, govern access, and approve deployments to maintain quality.

Building on its initial vision for gaming, Oasys is expanding its scope to include additional sectors and become the bridge between digital ecosystems and real-world economies, with a growing focus on the tokenization of RWAs across Asia. Its infrastructure supports both permissionless and semi-permissioned activities, and it has established connections in sectors such as gaming, finance, and real estate. Oasys is working to apply blockchain across various standard industries, including culture, commerce, property, and payments.

Problem Statement

Oasys blockchain was developed specifically to address the challenges the gaming industry faces in adopting blockchain technology. The core problem was that existing blockchain infrastructure lacked the features necessary to support the massive transaction volumes and continuous updates required by games. Games often need ongoing development and daily content updates to maintain user engagement, which blockchain systems are not well-suited for. For example, a 15-second or longer transaction confirmation is unacceptably slow in a fast-paced game compared to triple-A games, and even a nominal fee can be a barrier for casual gamers.

Requirements for optimal Web3 gaming:

- Zero or invisible gas fees: Players should not need to manage or pay cryptocurrency to play; the blockchain layer should be financially invisible to end-users.

- Instant or near-instant transactions: Gameplay should finalize actions within a second or less to match Web2 speeds.

- Scam resistance/curation: A safer environment is needed to attract mainstream users and big brands, free from fraudulent projects.

- Developer-friendly environment: Familiar tools (e.g., EVM compatibility) and flexibility in token/NFT design are crucial for traditional studios.

For institutional participants, public blockchains present several distinct challenges. Operational risks include the potential for exposure to security vulnerabilities, as well as a lack of control over transaction processing and consensus mechanisms. Established companies must also consider the risk of reputational damage if associated with exploits, hacks, or other negative events.

Another issue is the unclear regulatory landscape. Many jurisdictions still lack clear guidance on the use and classification of digital assets, making it difficult for institutions to ensure compliance when using public blockchains. Additionally, the transparency and immutability of public ledgers can conflict with privacy requirements and data protection demands in institutional environments.

Developing with existing token standards can also introduce technical barriers. Institutions aiming to issue or manage digital assets must ensure precise control over supply, transfer restrictions, and compliance with relevant legal frameworks. This becomes especially complex when trying to enforce rights management for digital property, such as intellectual property represented by NFTs, or when seeking to integrate with TradFi systems that operate under different rules.

Value Proposition

Oasys’ competitive moat stems from its specialization and targeted design around specific segments. While EVM compatibility is not a unique feature, Oasys combines it with the ability to design isolated, specific L2 environments and advanced token logic, providing a Web2-like UX and gaming experience while keeping assets on blockchain rails. Because of its permissioned nature, teams can iterate quickly, tune block parameters per project, and avoid congestion across projects.

Oasys’ value proposition main points:

- High-performance multi-layer design: Verses (L2) for fast, scalable transactions, tied to the Hub (L1) for security. Each game can have its dedicated Verse.

- Gasless gameplay: Oasys removes direct gas fees for players, as game developers (Verse operators) handle the blockchain costs for users.

- Web2-like speed: Near-instant transaction confirmation by the 7-day challenge period.

- Data availability and recovery: All Verse data is rolled up to the Hub, ensuring data availability and recovery even if a Verse or game server fails.

- Flexible trust model: Verses can be permissioned, semi-permissioned, or permissionless according to the developer, allowing enterprises to maintain quality and IP integrity.

- Token standards and NFT support: Enables multi-token economies – the $OAS token plus custom Verse tokens and in-game tokens, with multiple token standards and an official NFT bridge.

Oasys’ validator council includes established companies. The platform features controls and processes designed to meet institutional operational and audit standards. A validator council that includes Bandai Namco, SEGA, Ubisoft, and Square Enix provides institutional credibility, while controlled environments and transparent onchain records reduce operational and reputational risk. The rising institutional and regulatory interest in digital assets across Asia (Singapore, Hong Kong, Japan) matches Oasys’ approach and GTM (go-to-market). With institutional credibility, user-focused UX, and a controlled ecosystem, Oasys GTM focuses on the growth of blockchain RWA infrastructure in the region.

Technical Overview

Oasys operates on a two-layered architecture composed of the Hub-Layer (L1) and Verse-Layers (L2). The Hub-Layer serves as the foundational EVM-compatible Delegated Proof of Stake (DPoS) blockchain, and the Verse-Layers are implemented using optimistic rollups.

The Hub-Layer acts primarily as a consensus layer and a data availability layer, storing and exchanging data. Even if a Verse-Layer is lost or goes down, its data can be restored entirely as long as the Hub-Layer is running.

Direct deployment of new smart contracts to the Hub-Layer is highly restricted, limited to:

- Contracts related to tokens/NFTs.

- Rollup and bridge functionalities.

- From Oasys-approved EOAs or via governance approval.

Validators on the Hub require a minimum of 10 million $OAS tokens to participate. Blocks are generated every 6 seconds, and the network achieves finality in around 30 seconds.

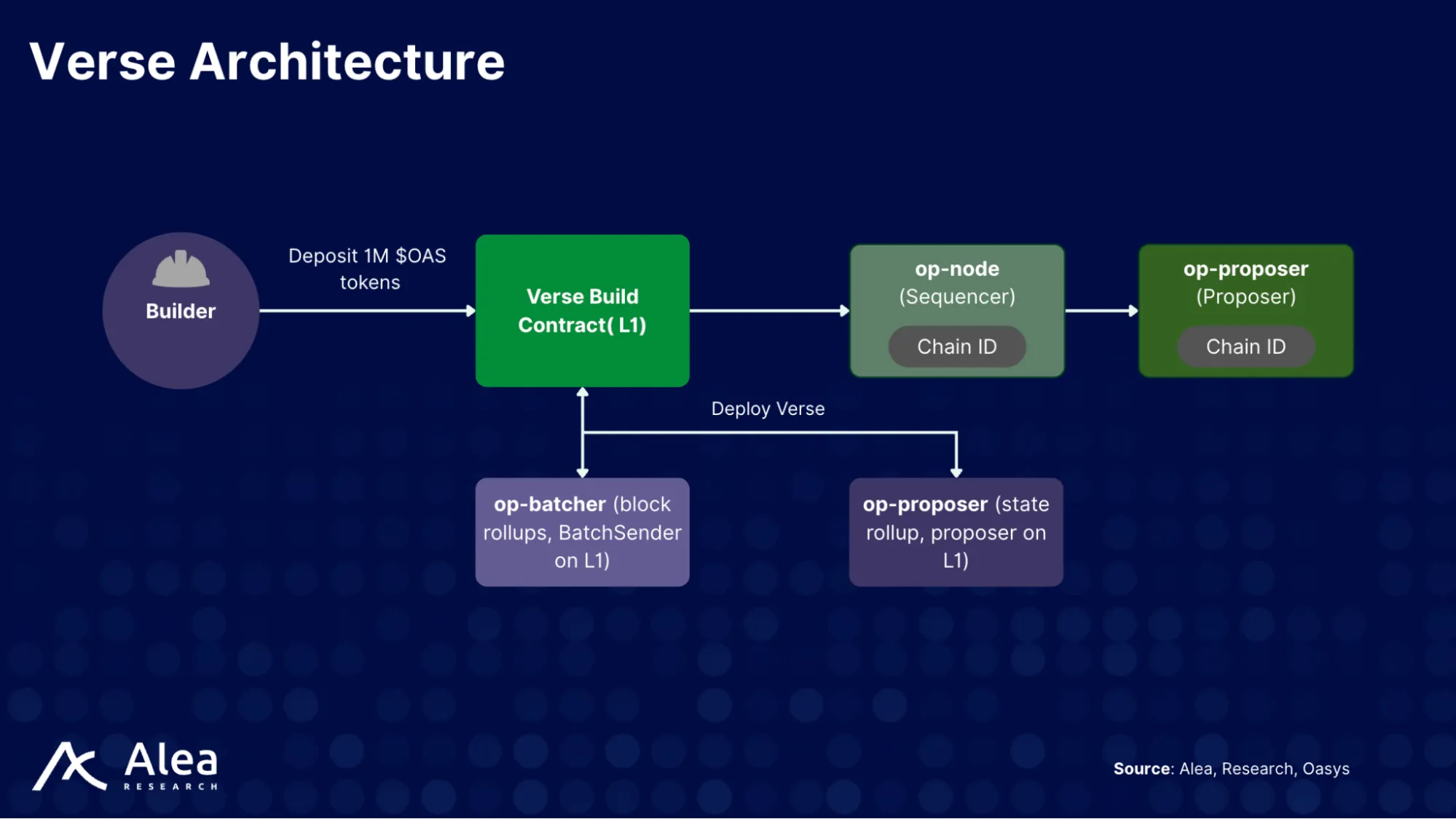

The Verse-Layer functions as the execution layer, where game logic and applications run. They are built as a modified version of OPStack. All Verse-Layers operate as permissioned L2s, where Verse Builders have control over which smart contracts can be deployed. This skin-in-the-game model reduces scam risk and promotes higher-quality apps, as Verse Builders must lock 1 million $OAS for 180 days to launch a Verse-Layer.

A core feature of the Verse-Layer is the elimination of gas fees for users, which are instead paid by Verse Builders. Transactions on the Verse-Layer are designed to be instantaneous with the help of the instant verifier mechanism.

Hub-Layer (L1)

The Hub-Layer is the semi-permissionless base for Oasys and functions to support the Verse-Layers by handling data availability, processing rollup transactions, maintaining consensus, and managing core assets and bridges. The scalability does not depend on an increase in Verse-Layer transactions, as the Hub-Layer handles them via rollups.

By design, Oasys restricts the Hub’s functionality to essential services: batching rollup transactions from L2, managing fungible/non-fungible tokens (FT/NFT) records, maintaining bridge contracts, and other core operations.

Data Availability and Node Network

All data is stored on the Hub-Layer. The network of nodes handling the ordering of blocks is based on a forked version of Geth with minimal modifications. Geth is the most widely used Ethereum client, written in Go. It handles peer-to-peer networking, consensus, the EVM, and the state database. The forked Geth code replaces Ethereum’s PoS for Oasys’s DPoS:

- Validator selection: Only those with a sufficient amount of staked $OAS tokens (10 million) can produce/validate blocks.

- Block production logic: The proposer/validator is rotated according to a weighted random shuffling mechanism based on the amount of staked $OAS.

- Staking modules: Track staked tokens, rewards, slashing, and validator status.

- Epoch management: Validators and staking rewards are managed in fixed intervals (daily epochs).

Validator selection and reward distribution occur at the end of each epoch, lasting approximately one day, which equals 14400 blocks at 15 seconds per block. Rewards come in the form of gas fees and validation rewards (operation-based), calculated at the end of each epoch. Oasys does not produce uncle blocks, since all block producers are selected through a consensus process. The Hub-Layer targets a minimal cost of 1 cent per transfer for gas fees, keeping transaction expenses low.

The node system distinguishes between a validator owner and a validator operator. Both are wallet addresses, but they have different purposes. The validator owner is the fixed, persistent identity responsible for staking $OAS tokens and claiming rewards, ideally secured with a hardware wallet. The validator operator is a dynamic account dedicated to the day-to-day signing of blocks, which can be easily replaced by the owner if compromised, giving a layer of operational security.

Verse-Layer (L2)

Verse-Layers are execution environments, and they function as optimistic rollups. Anyone can become a Verse Builder by depositing over 1 million $OAS tokens into the verse contract (on Hub-Layer), which is then locked for 180 days. This upfront capital lock-in serves as an initial commitment mechanism and a gatekeeping measure to exclude unsuitable builders. After locking the funds, the Builder registers key addresses, sets the block time, and deploys the required Hub-Layer contracts. These addresses must also be funded with $OAS to handle L1 gas costs.

High-Speed Optimistic Rollups

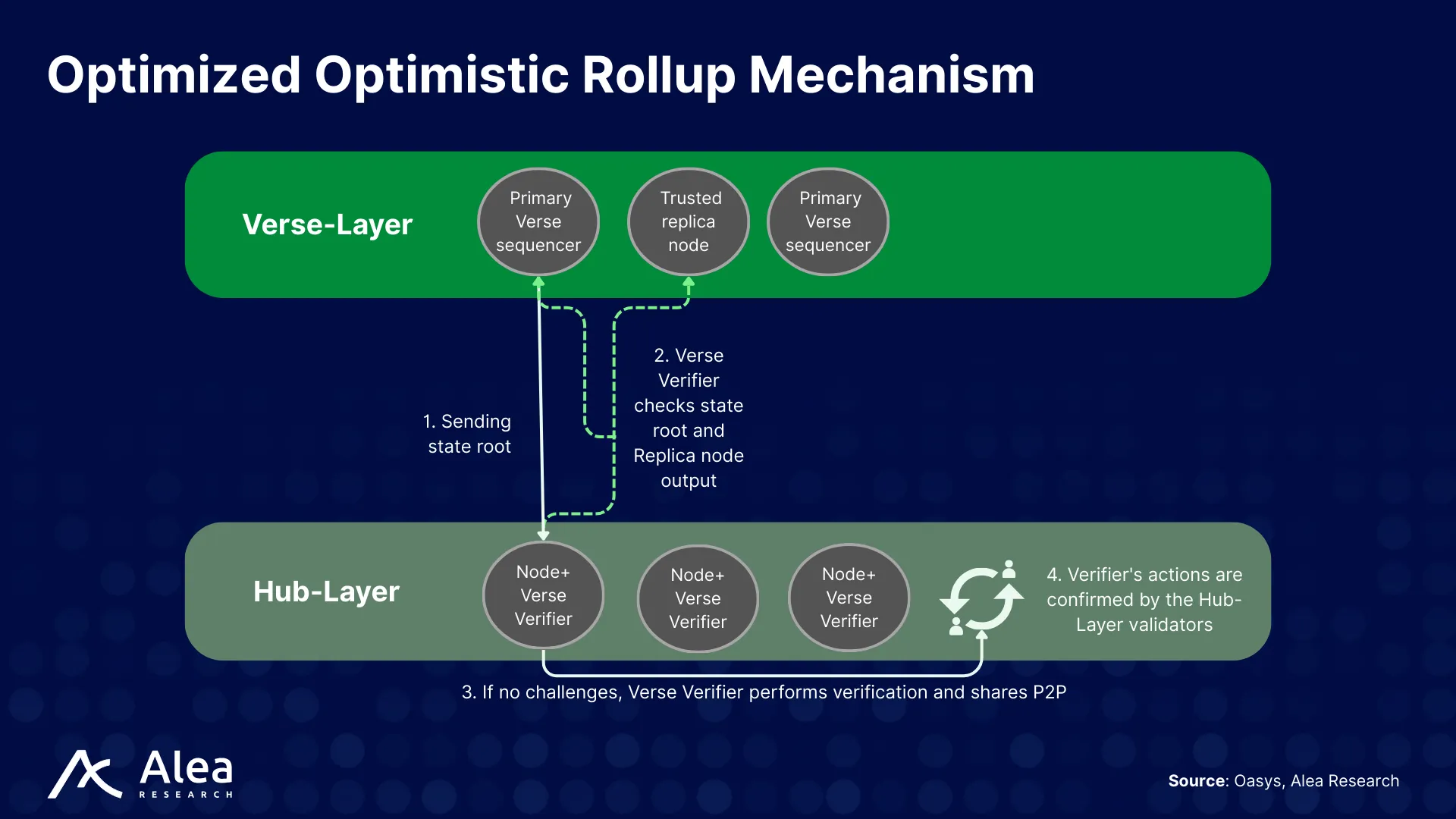

The Verse-Layer utilizes an optimized version of the optimistic rollup framework to facilitate fast and scalable execution. Oasys refers to this optimization as instant verifier, which bypasses the typical 7-day challenge period and enables near-instant transaction finality.

A Verse verifier is the component that implements Oasys’s instant verifier mechanism. All Hub-Layer validators are required to install a verse verifier. It determines whether the rollup can be approved by comparing the state root from the primary Verse sequencer with that of a trusted replica node. Instant verifier requires at least one replica node to be operated by someone other than the Verse Builder to verify the Verse’s integrity.

If no discrepancies are found, the verse verifier validates the rollup state, generates a signature, and shares it via the P2P network with other L1 nodes. When the signature wins support from nodes that together equal more than the required threshold (typically ≥51% or ⅔ majority), it goes to the verification contract, and the rollup is finalized.

Oasys Passport

Oasys Passport is a specialized wallet application designed to simplify the blockchain experience for beginners on the Oasys platform.

Key features include clear transaction displays, a unified view of in-game assets, and an in-app bridging function for easy navigation between different games.

How It Works

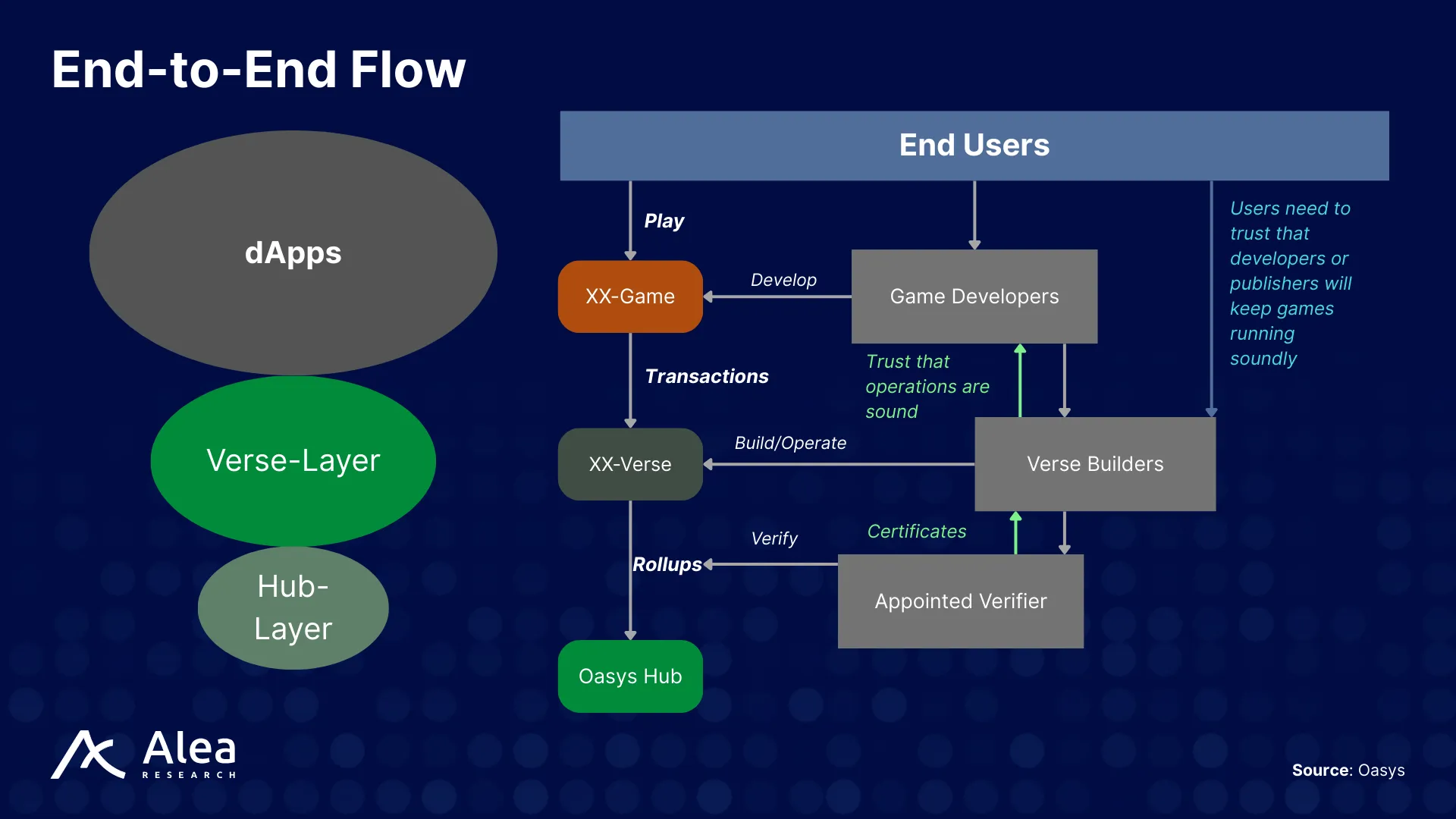

Users can enter the Oasys ecosystem through games in Oasys Navi, without needing extreme in-depth blockchain knowledge. They have instant, gasless transactions, paid for by developers, and can use familiar tools like wallets, explorers, and a built-in bridge UI to manage tokens and NFTs.

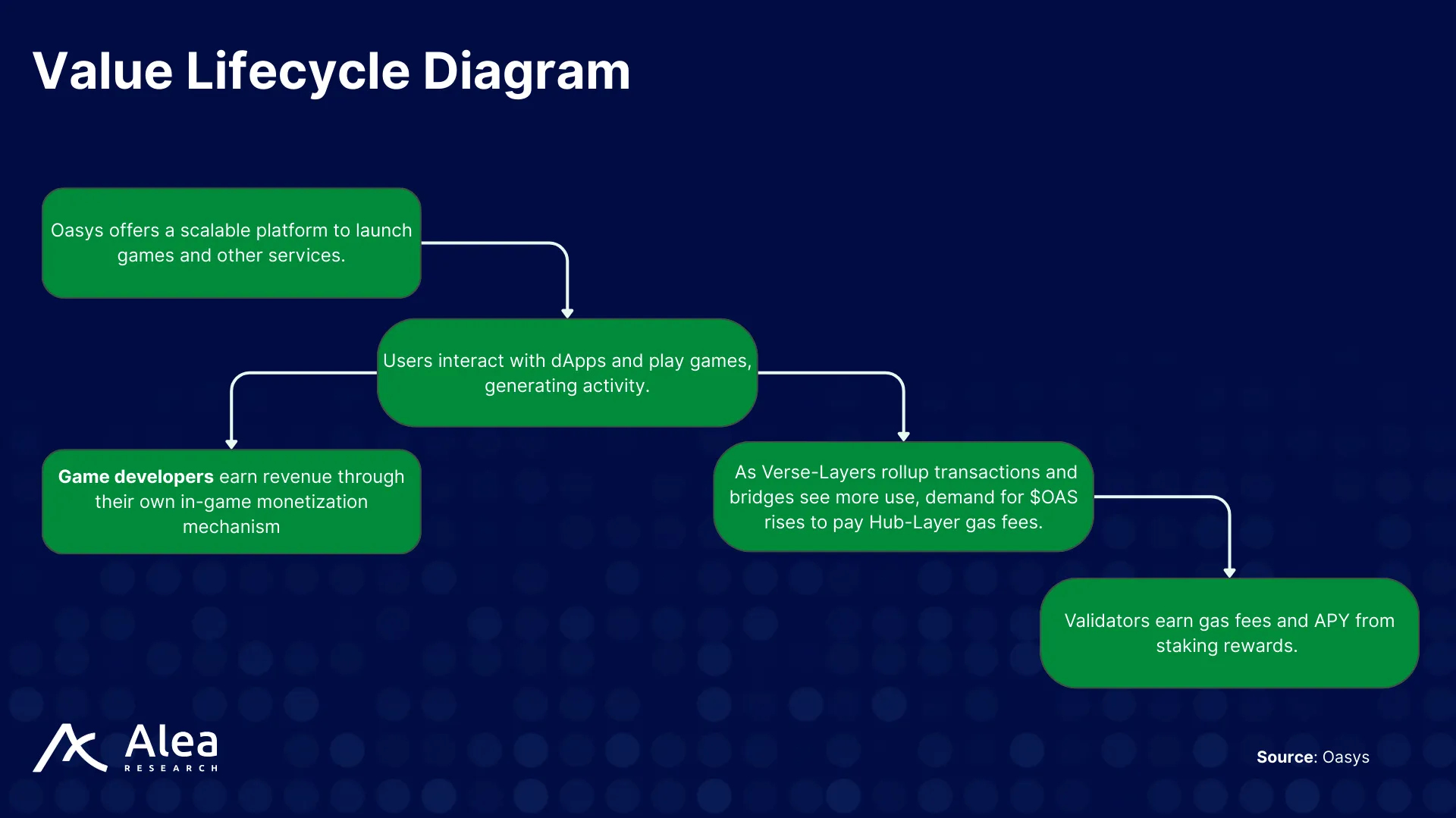

Verse Builders can monetize their Verses and games how they see fit, often with in-game purchases or by allowing others to launch games in their Verse. With increased gaming and dApp usage, more gas fees are distributed to Hub-Layer nodes, making staking and locking up tokens more attractive.

Different assets can move between layers or external chains, while tokens like $OAS and $pOAS are for payments, rewards, and staking. $pOAS is an incentive mechanism that is given to loyal users to encourage payments within Oasys services. 1 pOAS can always be used as 1 OAS for payments.

Target Market

Oasys will continue to support gaming within its ecosystem, but is expanding its coverage to institutional-grade RWA projects. While real estate is the first major use case, Oasys’s Phase 2 goals include expanding tokenization to other sectors, such as entertainment, wellness tourism, healthcare, and intellectual property, as well as exploring broader tokenization use cases across multiple sectors.

Starting from Asia, Oasys is planning international expansion. Oasys Korea has officially launched, with plans for expansion to the U.S. and Europe.

Market Opportunity

Tokenized RWAs represent a fast-growing, institutionalizing sector gaining momentum due to clearer regulation, technological infrastructure, and demand for liquid exposure to real assets. GATES Inc., a Japanese real estate investment firm, has partnered with Oasys to tokenize approximately $75 million worth of Tokyo real estate, marking one of Japan’s largest real estate tokenization projects. The market is slowly expanding through experimental stages, particularly in private credit and government debt sectors. Broader mainstream adoption still faces cross-border legislative differences and the need for operational standardization.

The RWA market opportunity in Asia can be characterized by large-scale economic growth, increasingly explorative regulatory infrastructure, and a push for digital finance modernization. Hong Kong is positioning itself as a digital-asset hub with stable regulations. Mainland China’s RWA Group is launching a compliance-oriented, non-financial RWA trading platform that integrates stablecoins, addressing supply-chain funding and cross-border asset circulation. Other Asian countries follow, such as Singapore and Japan.

Growth Drivers

Governments and regulators across Asia, particularly in Hong Kong, Singapore, Thailand, and Indonesia, are actively creating clear, technology-neutral regulations that encourage innovation while ensuring compliance and investor protection. Initiatives like sandbox environments in Hong Kong help develop interoperable ecosystems linking traditional finance and blockchain-based assets.

Financial institutions and asset managers are increasingly piloting and scaling RWA tokenization projects to enhance yield, liquidity, and operational efficiency. For example, BlackRock’s BUIDL fund demonstrates institutional interest and growing assets under management.

Demand for digital financial products is growing in Asia, particularly among younger demographics. Younger investors and generational wealth transfer accelerate interest in tokenized assets, driving growth in new asset classes including real estate, bonds, commodities, and intellectual property.

Beyond traditional financial instruments, there is growth in tokenizing non-financial RWAs such as farmland, art, supply chain assets, and even future earnings, expanding the sector’s scope and investment opportunities. Asia’s RWA tokenization sector benefits from the growing international interest in tokenized assets, supported by increasing regulatory clarity, blockchain adoption by banks, and progressive fintech ecosystems.

Adoption Barriers

Several Asian markets, including Singapore and Hong Kong, are notable hubs for RWA tokenization initiatives, particularly in relation to regulatory initiatives. However, barriers persist in areas including legacy integration, security, legal ownership, market liquidity, and education.

Legal frameworks, while also boosting growth, vary widely across Asian jurisdictions, creating fragmentation and compliance uncertainties for cross-border transactions. Navigating AML and KYC rules is resource-intensive, especially for smaller or cross-border platforms.

Many traditional institutions still rely on legacy financial infrastructure, which creates difficulties in integrating tokenized assets and results in costly technological overhauls. Non-standardized protocols and systems hinder communication between tokenization platforms and existing financial networks.

Despite the theoretical promise of liquidity, actual secondary market depth is often insufficient in the beginning, restricting the ability to exchange or redeem tokenized assets easily. A prime example was the introduction of tokenized stocks onchain, where liquidity for most pairs was poor, leading to trade issues. Reliable and mature distribution channels for tokenized products are still underdeveloped, slowing broader access for institutional and retail investors.

Primary Users

Consumers are the primary consumers of content in the Oasys ecosystem, exploring blockchain games and other services on Verse-Layers.

Stakers and delegators, who hold $OAS tokens, help secure the network by staking or delegating their tokens to validators. They receive staking rewards, contribute to security, and influence protocol development. Their risk lies mainly in the opportunity cost of locking up tokens, and their potential returns are closely tied to the network’s overall adoption and health.

Institutional actors such as Verse Builders play a role by operating Verse-Layers, hosting games or other services, and supporting customers’ onboarding efforts. They benefit from mass user reach, customizable smart contracts, token design flexibility, and improved data resilience. The financial risks are relatively high, considering returns are dependent on the success of the services they offer. Institutions’ reputational alignment makes them invested in the protocol’s success.

Economic Design

Demand for $OAS is driven by its use in dApp micropayments, enabling in-game transactions and interactions. Verse Builders have their own game-specific monetization, adding to the flow of $OAS from users into the network economy. Additional revenue comes from the $pOAS conversion mechanism, which rewards loyal users and supplies dApps with convertible token income.

The design creates a value lifecycle: activity on Verse-Layers drives gas fee revenue for Hub-Layer validators; validator rewards incentivize staking and network security; and reinvestment programs like $pOAS fuel further ecosystem growth. As games and dApps succeed, both network usage and token value accrue to stakeholders across the Oasys ecosystem.

Tokenomics Breakdown

Utility

$OAS is the native token of the Oasys ecosystem with a total supply of 10 billion tokens. Here are the key utilities and onchain functions:

| $OAS Token Utility | Description |

| Payment for Gas Fees | Verse Builders pay gas fees in $OAS for rolling up transactions to the Hub-Layer. |

| Verse Building Deposits | To launch a new Verse, builders must deposit at least 1 million $OAS into the Verse contract, locked for 180 days. |

| Decentralized Governance | $OAS token holders can participate in governance by submitting and voting on proposals, including changes to staking parameters, treasury use, or smart contract deployment. |

| Staking Rewards | Validators earn gas fees and operational rewards daily. |

| Payment and Key Currency | $OAS is used for micropayments across the Oasys ecosystem. $pOAS, a non-transferable point token pegged 1:1 to $OAS, is given to loyal users and accepted by dApps, with the Oasys Foundation covering the $OAS conversion, generating revenue for developers. |

Token Value Drivers

The value of the $OAS token is driven by: a) its utility as the native currency for gas fees, payments, and staking; b) its role in securing the network and enabling governance; and c) supply constraints via staking, Verse deposits, and reward mechanisms. The token value grows as the ecosystem grows. With more users, developers, and games, the demand for $OAS increases, while incentive and locking mechanisms reduce its liquid supply.

| Category | Use Case | Description |

| Utility-Driven Demand | Transaction Fees | Required to pay for gas or other onchain actions. |

| Payments & Micropayments | Used as the native currency for in-game purchases, subscriptions, or services. | |

| Access & Participation | Required for accessing certain games, dApps, or governance rights. | |

| Staking for Functionality | Tokens are staked to earn roles (validators, liquidity providers, governance participants). | |

| Supply-Side Constraints | Lock-ups & Vesting | Tokens are released slowly over time to prevent supply shocks. |

| Deposits & Staking | Tokens locked as a requirement to operate or participate (e.g., Verse Building Deposits). | |

| Ecosystem Growth & Network Effects | More Users → More Demand | As more users join, utility and transaction volume grow. |

| More Builders → More Use Cases | Games/dApps increase token sinks and velocity. |

Economic Security

Oasys’s Delegated Proof of Stake (DPoS) consensus mechanism forms the foundation of economic security. All current validators are screened and known entities. This means economic security is further increased by the permissioned nature of the blockchain. Validators have to stake at least 10 million $OAS through the validator contract. $OAS token holders can also be delegators by staking their $OAS to a validator.

Staking rewards are calculated daily at the end of each epoch.

- Validators receive a gas fee for blocks they create.

- They also receive an operation reward for participating in each epoch, which is designed to motivate them to secure the network.

- Delegators receive a share of these staking rewards, while the validator owner gets a commission for operating the nodes. This incentivizes both active operation and passive participation in securing the network.

The staking reward system is designed to stimulate user staking and contribute to the network’s stabilization. Oasys estimates an approximate 10% APY for validating. SOAS can be used for Hub-Layer staking and Verse deposits, allowing early supporters to participate in the ecosystem and earn rewards even before their tokens are fully vested.

Costs of Misbehavior

Low-performance validators are subject to a temporary jail. Suppose a validator is inactive for too long or fails to generate a threshold number of blocks. In that case, they are excluded from block generation and reward eligibility for one epoch (approximately 1 day). Critical malicious behaviors, such as double signing (signing two different blocks at the same height), result in validators being jailed for three epochs (approximately 3 days). Similarly, validators who submit malicious votes are jailed for one epoch (1 day).

Detection happens through a built-in monitoring system, where the node keeps a record of what it has signed in the past (block number + block hash). When it sees a new block proposal for the same block number but with a different hash that’s also signed by the same validator address, it flags that as a double-sign. Evidence of such misbehavior can be submitted to an onchain contract to trigger these penalties. Because validators are all known entities, any misbehavior also brings reputational damage.

Key Early Backers

The Oasys project includes a mix of major gaming companies, venture capital firms, crypto funds, and financial groups. Game studios such as Nexon (South Korean giant behind MapleStory and Dungeon Fighter Online), Bandai Namco Research, SEGA, Ubisoft, and South Korean gaming companies like Netmarble, Wemade, and Com2uS serve as validators and collaborators in the Oasys ecosystem.

Oasys’s key early backers and investors include both high-profile venture firms and major gaming companies, as well as several prominent institutions in crypto and Web3 gaming. Notable names are Galaxy Interactive, Nexon, Republic Capital, Animoca Brands Japan, Fenbushi Capital, Jump Crypto, Mirana Ventures, Amber Group, Infinity Ventures Crypto, and major gaming companies such as Square Enix, Bandai Namco Research, SEGA, Ubisoft, Netmarble, NEOWIZ, Com2uS, and Yield Guild Games.

Oasys formed a strategic partnership with SBI Holdings, one of Japan’s largest financial conglomerates, which also invested funding. SBI’s involvement aims to improve token liquidity and integrate Oasys further into financial markets. Oasys is also collaborating with SBI Holdings in the entertainment and media fields, so-called “Neo Media,” including initiatives such as IP tokenization.

Distribution

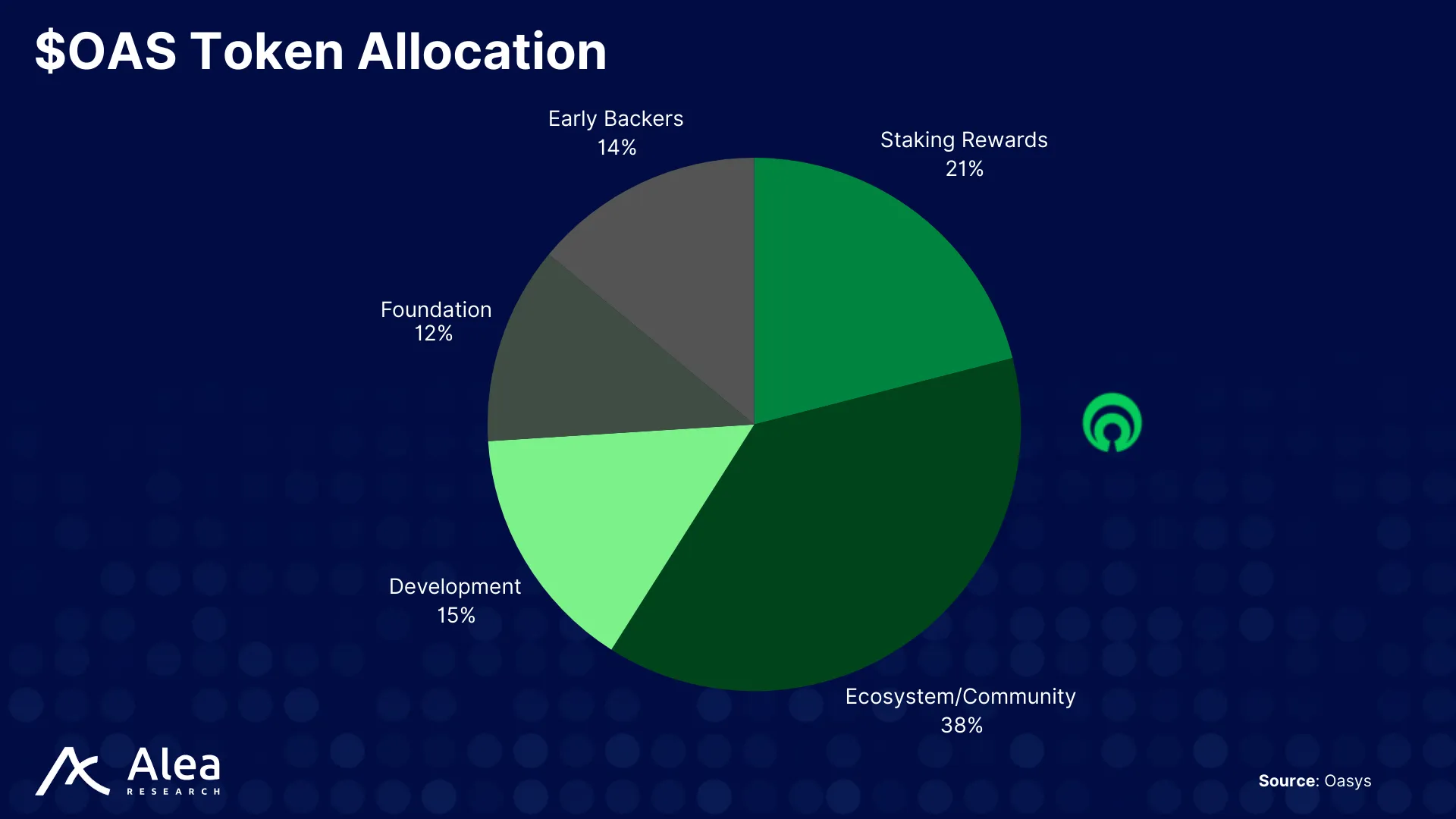

The total initial supply of $OAS tokens is distributed according to the following allocations:

- Foundation, 12%: Allocated to all non-development activities that include product management, design, analysis, research, and support for the growth of Oasys’ ecosystem.

- Early backers, 14%: Allocated to private sale investors, institutional, and individual investors.

- Staking rewards 21%: Allocated as a portion of the staking rewards.

- Ecosystem/Community 38%: Allocated to the partners who build Verse, ecosystem partners, user rewards, liquidity provision, and marketing purposes.

- Development 15%: Allocated to grants and rewards for all developers who participate in the development of Oasys.

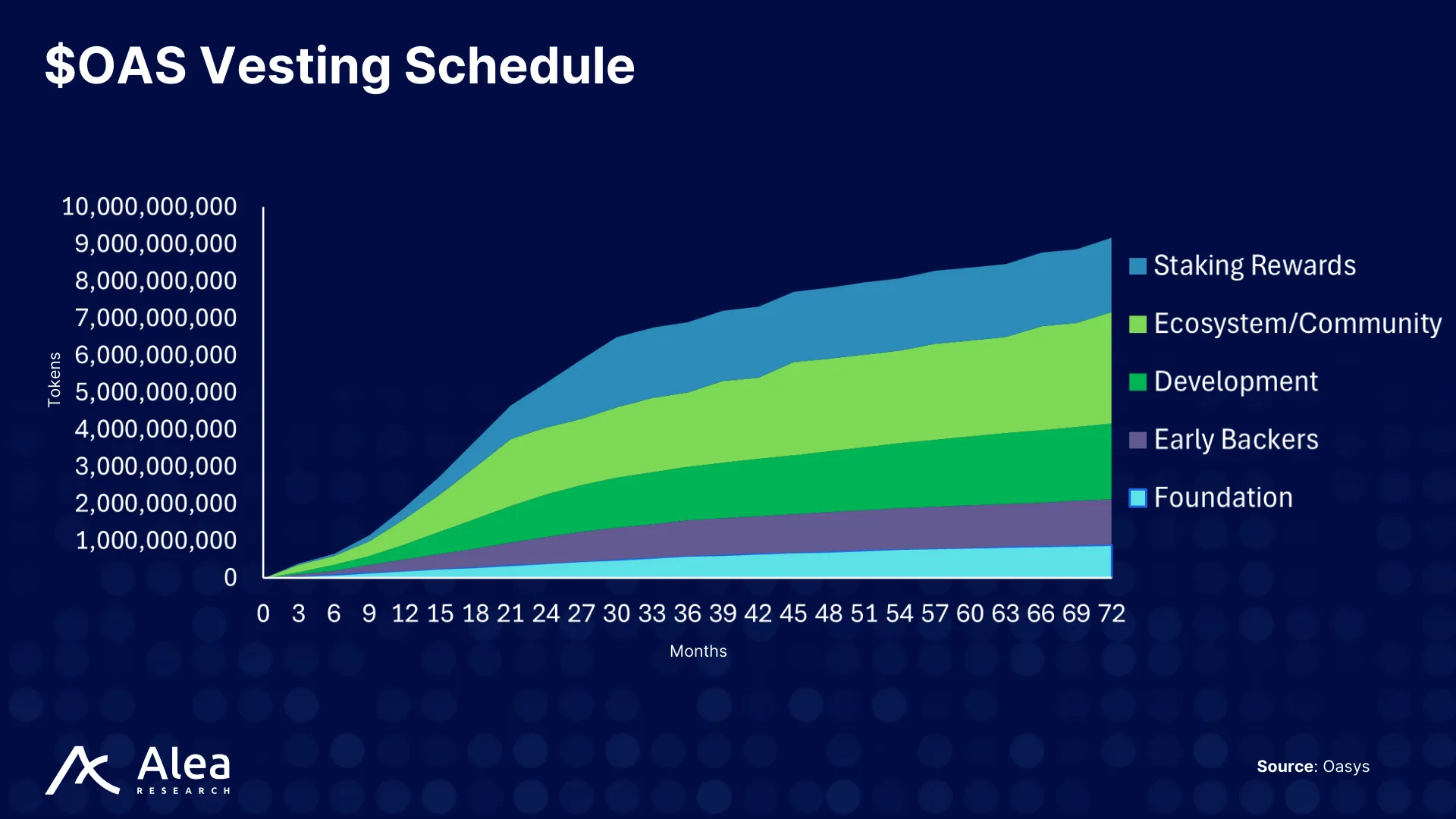

Token Supply Curve

Most tokens are fully vested by the end of 72 months. At the time of writing, it has been approximately 2.5 years since the TGE, or around 31 months.

Details on Funding and Vesting Schedules

The Oasys project has raised approximately $20 million in a private funding round, with additional strategic financing and public sales contributing to a total of about $21 million raised to date.

| Funding

Round |

Amount Raised | Price per Token | Vesting Terms |

| Private Round | $19.9M | $0.0145 | 0% token generation event (TGE) unlock, 12-month cliff, then 4.17% monthly vesting over 24 months after cliff. |

| Public Round | ~$930K | $0.035 | 100% unlocked at TGE (no vesting). |

| Strategic Round | Unknown amount | – | Details not publicly specified. |

Other allocations like development, foundation, and ecosystem tokens have separate vesting schedules (e.g., foundation tokens also have 12-month cliffs with monthly releases), but precise details are less publicly disclosed.

Governance

Oasys employs an indirect democratic approach that combines decision-making through a referendum and a council. This mechanism aims to maintain the legitimacy of decisions while preserving decentralization and autonomy. Current decision-making bodies are:

1) $OAS Token Holders: Any holder of $OAS tokens can participate in decentralized governance through proposal and voting.

2) Council: This is a key decision-making body composed of entities either recommended by the Oasys Foundation or self-nominated, who have obtained approval from validators delegated by the community. The Council is responsible for submitting council proposals and approving public and technical proposals.

3) Technical Committee: Composed of members who developed Oasys and excel at specific technologies, selected by the Council. In emergencies, this committee is responsible for fixing bugs following a technical proposal.

There are two types of proposals: public and council. Public proposals can be submitted to the forum by staking $OAS tokens. To be adopted, they require approval from both the token holders and the Council. Once approved, they are quickly incorporated into the development schedule (council proposals initiated by the Council). Since the Council has already approved them, they only require approval from the token holders to be implemented. Plans are to transition to DAO governance within six years, with proposals undergoing public or council approval and emergency mechanisms allowing rapid intervention by a Technical Committee.

FAQ

What are the key advantages of Oasys for users and game developers?

Oasys offers a gaming-focused blockchain with zero gas fees for users (covered by Verse operators), high speed, and scalability, enabling cost-free, seamless transactions and smooth gameplay. Its dedicated two-layer architecture supports interoperability and flexible game development, used by several established gaming companies.

How does Oasys ensure security and stability, particularly regarding fraud prevention and validator operation?

Oasys aims to provide security through a decentralized validator system requiring significant $OAS staking, layered fraud prevention via optimistic rollups, and secure bridges that avoid centralized liquidity pools. Only vetted smart contracts are deployed, ensuring network stability and reducing fraud risks.

How is Oasys governed, and what role do OAS token holders play?

Governance is decentralized with $OAS token holders submitting and voting on key proposals, staking to become or delegate validators, and participating in decision-making that affects network parameters and treasury management.

What are the roles of the Hub-Layer and Verse-Layer in the Oasys architecture, and how do they interact?

The Hub-Layer provides security, final settlement, and data availability, while the Verse-Layer handles fast, high-volume game transactions and customized game logic. Verse-Layer processes game actions quickly and submits rollups to the Hub-Layer for validation, balancing speed and security.