Overview

The Maia Ecosystem comprises open-source components and decentralized protocols characterized by a community-centric approach. What started as a yield optimizer and Solidly fork Dex has now become an omnichain DeFi powerhouse. This includes a comprehensive hub of decentralized applications that features:

- Hermes Omnichain AMM (Automated Market Makers) and YLM (Yield and Liquidity Marketplace).

- TALOS Transparent Automated Liquidity Omnichain Strategies.

- Maia Decentralized Strategy Vaults.

- Ulysses Omnichain Liquidity Protocol.

Hermes

Hermes v2 is an omnichain liquidity marketplace that operates as a ve(3, 3) DEX, drawing inspiration from Andre Cronje’s original Solidly model while still introducing notable enhancements.

With v2, Hermes is no longer a Solidly fork. While it retains core features and takes inspiration from Curve’s vote-escrow model and the (3, 3) bonding mechanism pioneered by Olympus DAO, it is a new protocol with mechanisms built from scratch.

- Permanent Locks with Liquid Positions: Unlike the previous veNFT system used by Solidly Forks and Hermes v1, Hermes v2 introduces permanent locks, allowing users to lock their tokens indefinitely while keeping their positions liquid for trading.

- Deposit-Based Tokenized Vault: Instead of claiming rebases, Hermes v2 utilizes a deposit-only ERC4626 tokenized vault. This eliminates the need for users to perform weekly rebases and simplifies the process while increasing the burn rate (permanent lock) of tokens.

Other features of the DEX include:

- Low-Cost, Near Zero-Slippage Trades: The protocol emphasizes low-cost and near zero-slippage trades for both correlated and volatile assets. It encourages trading volume and accrues value from trading fees rather than relying solely on liquidity accumulation.

- Permissionless Pool Creation and Bribes: Users can create liquidity pools in a permissionless manner, and the protocol natively supports bribes, which incentivize users to participate in governance by voting on pool emissions.

- Reward Distribution: Liquidity providers receive token emissions from the native token supply instead of fees. The distribution is based on veHermes votes, with LPs earning between 40% and 100% based on their veHERMES balance. LPs with no veHERMES balance can earn a maximum of 40%.

- Emission Incentives: Hermes v2 incentivizes emissions to promote fees rather than liquidity. It supports third-party tokens and provides native support for veHERMES lockers to accumulate fees and vote on emissions.

- Delegation: The protocol natively supports delegation, allowing users to delegate their voting power to others.

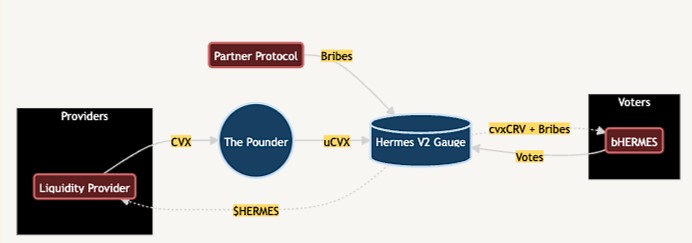

Renting Liquidity

Embedded with Hermes is also a Liquidity Provision Assistant that simplifies the process of supplying liquidity and accruing rewards. This is highly efficient and useful for protocols and DAOs, which often need to rent liquidity for their native tokens.

The design of AMMs makes this process very capital inefficient for LPs, and DAOs often need to incentivize them with emissions from their native token. Hermes solves this by simplifying this process and offering a UX very similar to Uniswap v2 while still getting the benefits offered by concentrated liquidity. This way users will be able to enjoy a more passive experience while still maximizing their yield.

Gauges

Gauges are mechanisms that quantify and help to represent a particular contribution to the protocol. In Hermes, these gauges determine the allocation of token emissions, orchestrating the distribution of inflationary rewards and sharing the accumulated protocol revenue, enriched by both yield from deposited assets and entrusted bribes.

Omnichain Strategy

Hermes v2 builds upon the original ve(3, 3) model of v1, but attempts to improve on the limitations of existing models by expanding its operations across multiple chains as well as offering concentrated liquidity.

The goal of Hermes v2 is to offer multiple more DeFi services that will improve both capital efficiency and user experience, such as:

- Bridge-less omnichain environment, powered with concentrated (Uni V3) and unified liquidity.

- Decentralized Uniswap V3 Liquidity Management.

- Uniswap V3 Liquidity Incentives.

- Refined ve(3,3), becoming a fungible ERC-4626 token.

- Improved UX and UI.

- Omnichain Yield marketplace.

Omnichain and Concentrated Liquidity

Central to Hermes capabilities is the dynamic to swap across multiple chains, employing concentrated and unified liquidity. This makes it possible for participants to seamlessly move their liquidity across different chains, capitalizing on each one’s distinctive attributes and prospects.

Hermes v2 attempts to solve the problem of liquidity fragmentation across multiple chains by utilizing LayerZero as a cross-chain messaging solution. Similar to v1, Hermes will offer swaps for both stable and volatile asset pairs, with the main difference being that v2 will enable swaps to be done across multiple chains leveraging concentrated liquidity.

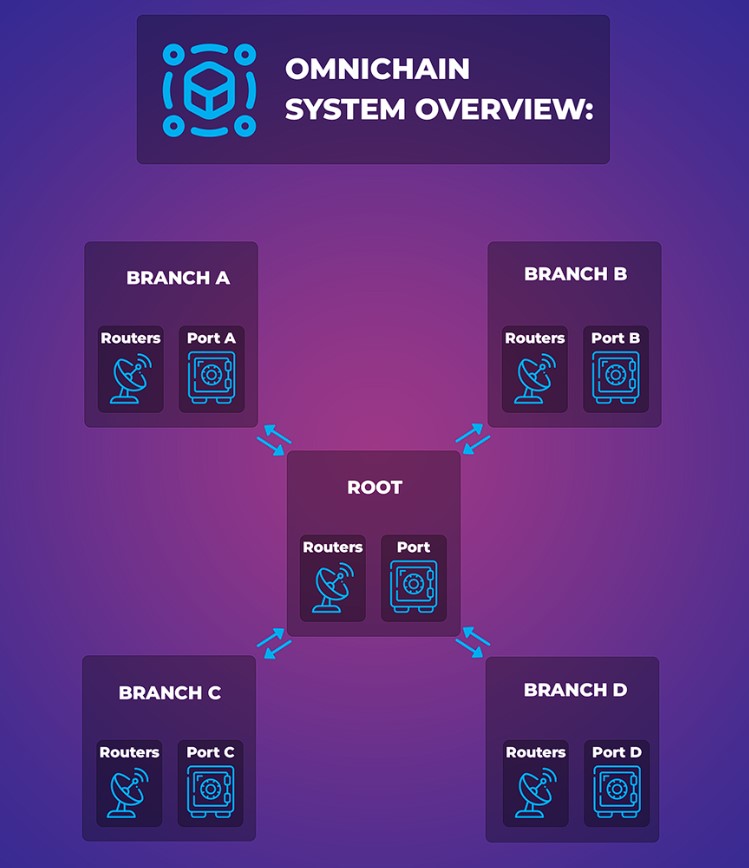

The omnichain DEX operates with a central unified liquidity pool and separate pools called ports for each chain. Users interact with Routers connected to these ports. When a user requests a swap via the Router, input tokens are sent to the corresponding port, and a cross-chain message is initiated. The Root Router then routes transactions through the main liquidity pool, enabling cross-chain swaps without bridges.

Benefits include improved user experience and increased earning potential. Users hold an omnichain balance for earning yield, managing liquidity, swapping assets, and incentivizing liquidity across multiple chains. This way, Hermes V2 consolidates the DeFi world into one accessible platform.

Hermes also allows for the automated management of concentrated liquidity through Talos, enhancing capital efficiency and making it easy for anyone to participate as a liquidity provider. Talos offers multiple vaults to users, each of which will execute a specific liquidity management strategy, allowing users to generate consistent returns according to their preferences and risk tolerance. From a user’s perspective, all that needs to be done is choose a vault and deposit assets into it.

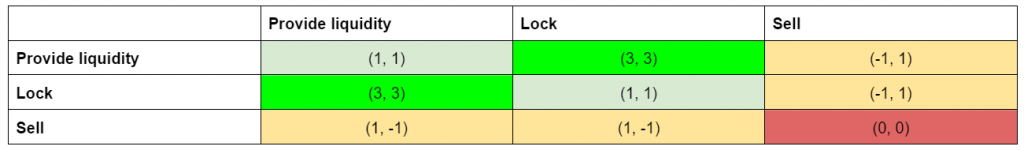

b(3, 3)

Central to the new era of Hermes Tokenomics is the concept of burning – a process where $HERMES tokens are permanently locked, paving the way for the emergence of bHERMES tokens. This showcases the transition from an original ve(3, 3) model to a b(3, 3) model.

The main difference between ve(3, 3) and b(3, 3) is observed from a user experience standpoint. In v1, token locks were represented by veNFTs that are held by token lockers. To maximize their returns and earnings potential, these users periodically claimed their rewards, bribes, locked for the maximum duration of 4 years, and cast their votes on a weekly basis. However, this is a suboptimal user experience for those users who have multiple locks, since they have to manually repeat this process every week.

With v2, the protocol makes the assumption that users who keep increasing their lock every week will continually keep doing so in the future as well. From a protocol perspective, this is the equivalent of burning the underlying tokens, since they will technically be locked in perpetuity and never be unlocked.

b(3,3) makes it possible to permanently lock positions. This is achieved by switching the ERC-721 NFT standard by a ERC-4626 vault contract. This makes it possible for users to maximize their returns without the need to take frequent manual interventions. These actions happen automatically and users keep accruing rewards and voting power.

Burner Vault Contracts

Users can only deposit and not withdraw. Through the Burner ERC-4626 Vault Contract, users deposit $HERMES tokens, receiving bHERMES ERC-4626 shares in return. The conversion ratio, starting at 1:1 during version 2 launch, increases with inflation, safeguarding voters from dilution.

The new protocol version also introduces 3 dynamic utility tokens:

- bHermes Gauges: Holders of bHermes Gauges play a pivotal role in directing weekly emissions to gauges. Voting helps to shape the course of the protocol revenue streams. As revenue, including fees and bribes, flows from each gauge, bHermes Gauges holders reap rewards proportionate to their voting stake, effectively aligning influence with tangible benefits.

- bHermes Boost: Holding bHermes Boost tokens makes it possible to elevate earnings potential on staked liquidity, amplifying APR by up to 2.5x. This represents an increase from a 40% APR with no boost to a potential 100% APR with maximum boost.

- bHermes Votes: Users can augment their influence on the future outlook for the protocol by increasing their governance power. Bestowing governance power, these tokens embolden participation in pivotal decisions – be it adding or removing gauges, partnering strategies, or other governance matters.

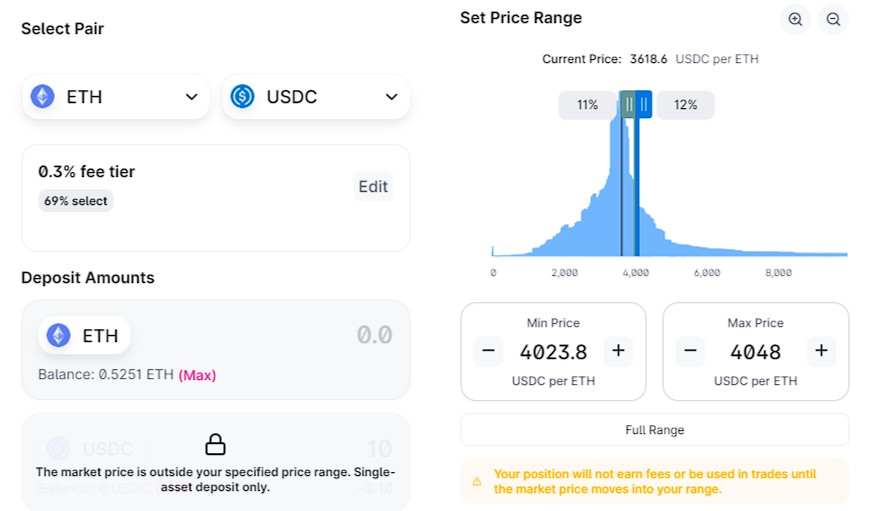

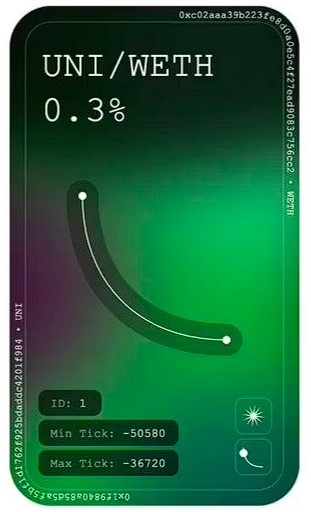

Uniswap v3 Gauges

Uniswap v3 gauges introduce a new dimension to liquidity mining within the Uniswap v3 protocol.

- Enhanced liquidity mining: Central to Uniswap V3 Gauges is the notion of liquidity mining incentives. These incentives are thoughtfully tailored to align with each Uni V3 NFT position’s liquidity per seconds within traded ticks. This intricate relationship between the amount of liquidity provided and the time it has been invested enables more efficient liquidity provisioning and bolsters the overall depth of the liquidity pool.

- Flexibility and minimal disturbance: LPs face a momentary loss of new rewards when a new gauge cycle begins until they restake. Additionally, staked positions forfeit fees until unstaked. For that reason, the Uniswap V3 Staker contract is modeled with a sense of fairness. It recognizes all liquidity within a pool, whether staked or not, and rewards from non-staked pools return to the Hermes Minter, preserving a balanced reward distribution mechanism.

- Equitable distribution and minimum range: Governance steps in with a minimum range requirement that prevents concentration of emissions among a selected few pools. Every gauge has a minimum range for staked Uniswap V3 NFT positions that is determined by governance. This was added to prevent a few users with narrow positions from accumulating the majority of emissions. By setting a minimum range for Uni V3 positions, the pool remains stable, and the liquidity is distributed more fairly among all users.

- Customized incentives: Each pool’s depth is customly incentivized by the interplay of asset correlation. This nuanced approach ensures optimal pool stability, mitigating deviations from the equilibrium point.

- Stable pools, featuring closely correlated assets, enjoy a narrow range.

- Volatile pools, boasting loosely correlated assets, thrive within a wider minimum range.

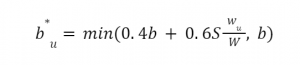

- Boosted rewards: Rewards are mapped through time spent within the designated liquidity range. The equation for calculating boost balances the position rewards with the user’s stake in bHERMES. This means that the total supply used to calculate the boost of each position is the maximum rewards that it could have earned during the incentive duration. Therefore, the maximum is the total week’s rewards if staked during the whole week.

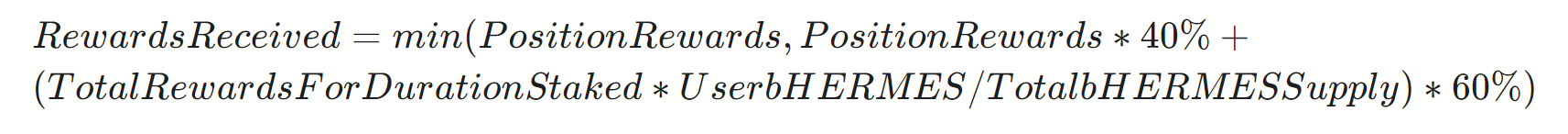

The formula calculates the rewards received by a user, based on their position rewards as well as their stake in the bHERMES token. This way, the rewards are determined by taking the minimum value between the position rewards and a combination of two other factors: the position rewards multiplied by 40%, and the total rewards for the duration staked multiplied by the user’s bHERMES stake divided by the total bHERMES supply, multiplied by 60%.

This formula ensures that users are rewarded for both their position in the liquidity pool and their stake in the bHERMES token, while the rewards remain capped at the position rewards.

An integration with Hermes v2 Gauges enhances rewards through boosted Uni v3 NFTs staked in the Uniswap v3 Staker. The Factory ensures security, immutability, and non-custodial control, making it a powerful solution for simplified and enhanced staking experiences.

Other features include:

- Immutability: The contracts are immutable – without implementing any proxy pattern.

- Non-custodial: Only the user who deposited an NFT can redeem it, and only the owner can withdraw the deposited bHermes Boosted tokens.

However, it is worth noting that fee-on-transfer tokens and rebasing tokens are not supported. To mitigate this problem, the following solutions can be implemented.

- Fee-on-transfer tokens can create a token wrapper for their tokens.

- Even though rebasing tokens are supported during the creation of the pool, the protocol and liquidity providers will ultimately bear the loss of a negative rebase when their position becomes active, with no way to recover the loss.

Yield Marketplace

The protocol features a yield marketplace that makes it possible for users to engage in the trading of yield rights. This empowers market participants with the ability to optimize their returns with a great degree of flexibility, expanding yield prospects across chains.

bHermes Gauges

bHermes Gauges are the governance mechanism that helps to shape the distribution of newly minted $HERMES. Through voting, bHERMES holders allocate their bHERMES balance to their preferred Gauges, consequently unlocking 100% of the gauge’s revenue.

This dynamic interplay crafts a self-optimizing ecosystem, where the bHERMES voters collectively guide emissions towards Gauges generating revenue. This synergy fortifies the platform’s long-term profitability and sustainability, nurturing a thriving DeFi landscape.

Participation in bHERMES Voting mandates the acquisition of bHERMES and the vote-burning (Burn) of HERMES. This crucial process ushers in a world of influence, where you can:

- Direct $HERMES Emissions to Gauges: Channel your voting power to influence the allocation of newly minted $HERMES among diverse Gauges.

- Vote on Gauges for Emission Allocation: Employ your voting power to sway the proportion of $HERMES allocated to specific Gauges.

- Earn Fees: By allocating your voting power to a chosen Gauge, you can partake in the distribution of fees generated by that Gauge.

- Collect Bribes: Certain Gauges accrue extra rewards from bribes, enticing your voting power allocation in exchange for liquidity rental. This process is orchestrated by protocols seeking liquidity for their native tokens.

As a voter, you can enjoy the flexibility of altering your vote as often as desired within each week. Bribes and fees are disbursed at each epoch’s close, every Thursday 00:00 UTC. A 24-hour grace period precedes this, initiating every Wednesday 00:00 UTC, during which votes can be reduced but not increased.

bHermes Gauge Voters can also delegate their voting power. This can help to remove some overhead but it remains important to be careful with who the voting power is being delegated to.

- Delegation to an untrusted address spells irrevocable loss of voting power.

- Conversely, delegation to a random address devoid of voting power usage enables the restoration of your delegation.

With v2, one of the most notable releases are custom gauges, which allow for the creation of gauges that can earn revenue from sources other than AMM trading fees. While these features will not be included at launch, they are possible use cases that can be rolled out in the future.

Some examples include:

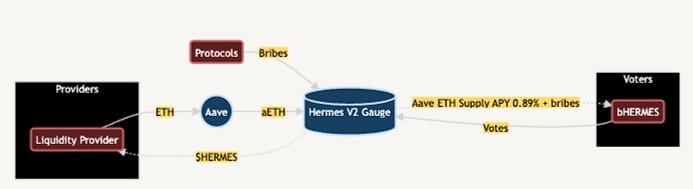

- Money Market gauges – for earning lending yield on deposited assets.

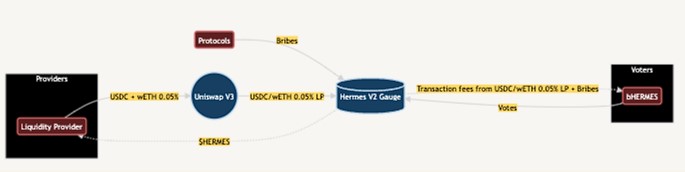

- Dex gauges

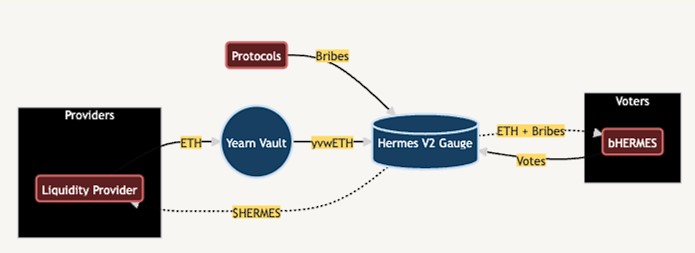

- Yearn vault gauges – for single token deposits, such as yUSDT.

- vlCVX gauges – to earn revenue from bribes.

To become active, custom gauges need to be approved and whitelisted via governance, and to create a governance proposal one has to own bHERMES. Once created, the community will be able to assess the viability through a risk assessment and vote on whether to include the gauge or not.

| Token standard | Category | Example | Revenue | Bribable? |

| ERC-20 | Money markets | aETH (Aave) | Lending yield | Yes |

| ERC-721 | Uniswap v3 LPs | wETH-USDC 0.05% | Trading fees | Yes |

| ERC-4626 | Vote-locked | uCVX | Bribes | Yes |

| ERC-4626 | Yearn Vaults | yvwETH | Yield strategies | Yes |

In order to participate, the process involves the following steps:

- Obtain the target asset: Users need to obtain the underlying token (e.g., aETH). This involves depositing ETH into Aave’s Arbitrum Market to receive aETH.

- Stake the target asset: Users stake (deposit) their acquired aETH into the Hermes V2 Gauge.

- Accumulation of yield: Voters influence the accumulation of yield through voting

- If no one votes, yield keeps accumulating until someone votes.

- If everyone votes, yield decreases, driving some users to seek higher yield elsewhere

- Distribution of yield:

- Liquidity providers receive $HERMES emissions proportional to their stake.

- Voters get revenue from the underlying yield source and bribes.

bHermes Boost

bHermes Boost is designed to ignite user engagement by amplifying their potential earnings from providing liquidity in Hermes.

- Providing Liquidity: Supplying tokens to a liquidity pool enables trading. As a compensation for this service, liquidity providers are compensated with trading fees and token rewards.

- LP tokens are used to represent and tokenize contributions to a liquidity pool. They serve as proof, entitling you to a share of the pool’s rewards and trading fees.

- Gauge voting: Gauges are smart contracts that measure the allocation of voting power to the different pools and reward users accordingly.

- bHermes tokens encapsulate a user’s stake within the Hermes platforms. The accumulation of bHermes translates into augmented potential rewards.

The boost a user attains, represented as b*u is derived through a formula echoing Curve’s calculations. This formula takes into account factors like the user’s balance, total liquidity supplied by users, user’s bHERMES, and the overall bHERMES across users.

- b*u = User’s boosted balance.

- = User’s balance (measured in LP tokens).

- = Total liquidity supplied by users (measured in LP tokens).

- wu = User’s bHERMES.

- = Total bHERMES of all users.

To preserve the fairness of the system, users are able to have their entire boost applied to all pools, but are only able to have 1 boosted position per pool.

In order to access the boost, a user must hold bHermes Boost tokens as well as provide liquidity to a gauge. The pinnacle of this strategy is to achieve the maximum boost of 2.5x – achieved when a user maintains a similar percentage of bHermes Boost the gauge’s total liquidity. This equilibrium facilitates the boots and encourages the alignment of incentives between liquidity providers and token holders.

Boost = min(1, b)

The optimal boost is rooted in an equation that uses the bHermes balance of users and the amount of liquidity provided. To achieve the maximum boost of 2.5x, a user must hold the same percentage of bHermes Boost as the gauge’s total liquidity. This occurs because if you have the same % Liquidity Pool as you have % veHERMES, then

This boost is restrained by the minimum value between 1.0 and . Hence, potential rewards may increase up to 100%, which is a significant leap from the standard 40%, facilitating a boost of up to 2.5x.

bHermes Votes

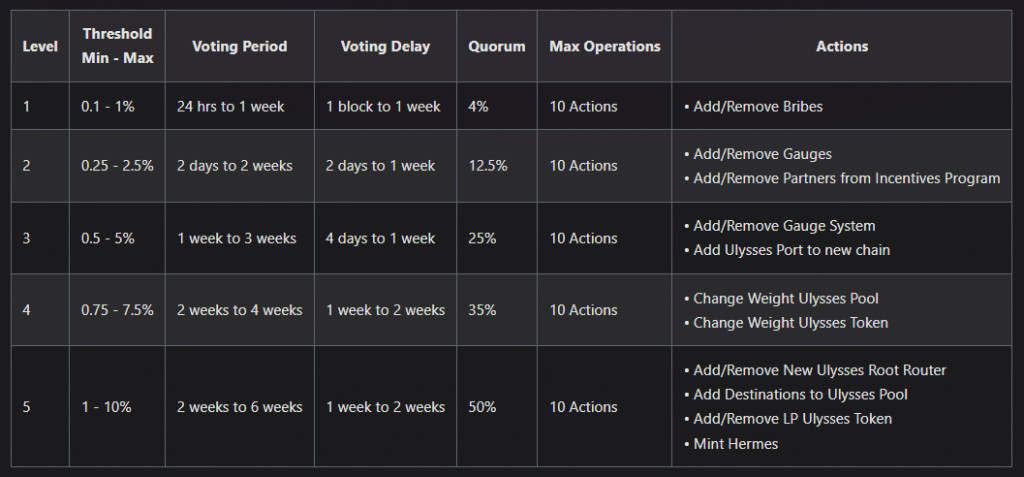

bHermes votes are an instrument designed to democratize the protocol’s decision-making process. Holding bHermes Votes allows users to actively engage in governance proposals (HIPs) and shape the future outlook of the platform.

The realm of governance decisions open to bHermes Votes holders involves topics such as:

- Inclusion or exclusion of gauges

- Adoption or removal of bribes

- Extension of Ulysses Ports to new chains

- Integration or disintegration of partners from the Ecosystem Partnership Program

- Establishment or revocation of Gauge Systems

- Alteration of Ulysses Pools weight

- Modification of Ulysses Tokens weight

- Adjustment of parameters within the Hermes Minter

- Incorporation or elimination of new Ulysses Root Routers

- Integration or cessation of Ulysses Pools from Ulysses Tokens

- Unveiling of Destinations to Ulysses Pools

Recognizing the convenience and utility of delegation, bHermes Votes can be delegated to one or multiple delegates, along with a user’s balance. This allows token holders to entrust their voting power to delegates that they believe in, enabling them to vote on their behalf on governance proposals. It also ensures that users who wish to exercise their own governance power delegate it to themselves prior to a proposal’s submission, establishing a seamless and impactful process.

Crucially, the ability to delegate or undelegate bHermes Votes stands open-ended, affording users the flexibility to adjust their approach as needed.

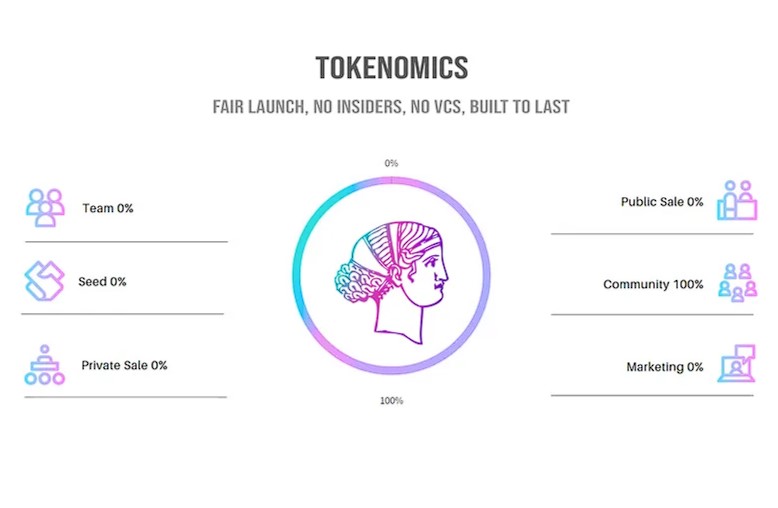

Tokenomics

As an AMM that relies on liquidity providers, the $HERMES token is primarily used to incentivize liquidity providers, who get paid from $HERMES token emissions rather than trading fees.

$HERMES operates with an inflationary supply model, where emissions are crucial for its utility. These emissions compensate for deposited asset yields. The gauge system directs emissions for revenue instead of locking them.

Emissions are determined by the Minter contract based on circulating $HERMES supply. Burning all $HERMES would halt emissions and their distribution to Gauges and Providers.

Weekly $HERMES distribution follows bHermes Gauges holders’ preferences, confirmed at each epoch’s end. Linear distribution minimizes volatility for users and providers.

The DAO secures up to 30% of emissions, using them for protocol development, marketing, partnerships, and growth. This motivates bHermes Votes holders to engage in governance and sustain the platform.

In order to participate in voting, staking or boosting, users are required to vote-lock $HERMES into veHERMES. In doing so, users have to choose how long they are willing to lock their token for. The longer the lock they greater the veHERMES balance they will get.

- Voting: LPs with veHERMES receive trading fees from pools they vote on. By voting, they direct liquidity and earn proportional trading fees.

- Staking & Boosting: LPs get HERMES rewards, but by converting these rewards to veHERMES and vote-locking, they can boost rewards up to 2.5x. This alignment benefits LPs as they can earn 40% to 100% of weekly emissions.

- Voting Power: Holding veHERMES provides voting power in the DAO for decisions and token whitelisting.

$HERMES Token Distribution

$HERMES was distributed to the community through multiple airdrops, all of which came in the form of locked veHERMES NFTs. The reason for this was to achieve a fully decentralized and permissionless voting system to direct emissions to gauges in a way that matches LPs with demand. At the start, there was a weekly distribution of up to 2M tokens distributed based on the current voting weights for the pools.

- Initial veHERMES supply: 20M.

- 85% to the Maia DAO.

- 15% airdropped to Hermes LPs and Maia stakers.

- Initial HERMES supply: 0, releases 2M/day decreasing weekly.

As part of a voting power mining event, other protocols receive 1% of the initial veHERMES supply (0.2 M $HERMES locked for 4 years). The trading pairs for these protocol tokens would get 5% of the initial veHERMES distribution (1M $HERMES) until 50% of the initial $HERMES is distributed (50M $HERMES).

In order to claim rewards, trading fees are deposited as bribes and paid over 7 days to voters of a specific pool. Users can claim rewards by selecting their NFT on the rewards page, checking each pool’s checkbox, and clicking the claim bribes button.

Talos

Talos stands for Transparent Automated Liquidity Omnichain Strategies and it is a peer-to-peer system designed to simplify and enhance the participation in Uniswap v3 concentrated liquidity. Talos introduces ERC-20 wrappers for Uniswap V3 Non-fungible Positions (NFTs), enabling high composability with the underlying NFTs. These LP positions always start 50/50 and if they have a manager, it can call two strategies: rebalancing and reranging.

The protocol also provides decentralized liquidity management strategies, enabling users and DAOs to pool together concentrated liquidity LPs. One of the key differentiators relative to other solutions is that Talos allows for the permissionless creation of strategies.

Strategy Templates allow for rebalancing and rearranging strategies, offering versatility and adaptability for various liquidity management approaches. New Strategy Templates can easily be created by solidity developers as well. They can be used for a wide variety of use cases such as supporting multiple Uni V3 NFTs, hedge options, treasury solutions, multiple rebalancing ratios, fixed expiry dates, and so on.

For instance, the first Strategy Template holds a single Uniswap v3 NFT that anyone can mint for any pool. When the price deviates by a predefined number of ticks from the center of the position, anyone can call the rebalance function to set the ratio to 50/50 again. There is an associated fee to these tasks – if the cost of constantly balancing the position is too large, it either won’t happen or the pool or gas depositors may incur losses.

The protocol supports multiple NFTs, various strategies, and remains transparent in terms of fees and governance arrangements. Talos Strategy Templates are highly flexible and make it possible to explore strategies that:

- Support multiple NFTs.

- Support multiple rebalancing ratios.

- Offer fixed maturity dates.

- Make it possible to hedge options.

- Enable treasury management solutions.

The creation of Strategy Templates is open to everyone and theDAO is constantly exploring mechanisms to incentivize creators.

It is also worth noting that Talos LPs are not ERC-4626. However, wrappers are made available in order to enable seamless integration and composability across DeFI.

Position Types

At its core, Talos offers ERC-20 wrappers for Uniswap v3 NFTs. This allows for composability and seamless integrations. The first Talos Liquidity Pools (LPs) are base positions that support one Uniswap V3 NFT at a time. Anyone can create new and/or use existing LPs, and each LP can choose to have multiple strategies associated with it on launch. This makes it possible for actions to be taken with certain parameters, such as setting a rebalancing ratio to have 50% of each asset and dynamically rearranging to a narrower or broader range.

There are two main position types:

- Vanilla: Represent a share of one or more UNI V3 NFT positions.

- Staked: Represent a share of one or more UNI V3 NFT positions that are all staked in Maia’s Uniswap v3 Staker.

The deployer of each position selects the type and it is not possible to change the type in the future.

Vanilla Positions

Vanilla positions allow users to hold Uniswap v3 NFT positions without staking them in the Hermes Uniswap v3 Gauge. This is beneficial for users who want to provide liquidity to the market and earn fees instead of $HERMES emissions. Additionally, because Vanilla Positions are Uniswap v3 NFT wrappers, they are fully composable with existing applications. This allows users to easily create complex positions and strategies by combining their TALOS Vanilla Positions with other liquidity pools and assets.

As with any liquidity position, there is still risk that the value of the underlying assets may decrease or that the position might suffer from impermanent loss. Nonetheless, Vanilla positions earn trading fees and liquidity providers will make a profit as long as the revenue from trading fees exceeds the amount of impermanent loss.

Staked Positions

Talos staked positions introduce the possibility to stake Uniswap v3 NFTs on the platform in order to access benefits such as:

- Staked Liquidity Rewards: Users can stake their Uniswap v3 NFTs in the Hermes gauge, receiving $HERMES rewards in place of traditional liquidity fees (which go to veHERMES voters).

- Composability: Staked positions are represented as ERC-20 wrapper tokens on the Ethereum blockchain, enhancing liquidity and enabling interaction with underlying assets.

- Flexibility: TALOS Staked Positions offer versatile possibilities for constructing diverse positions and strategies, empowering users with liquidity management flexibility.

The downside of the approach is:

- Additional risk of impermanent loss leading to losses on staked positions.

- There might also be specific minimum range prerequisites for staking Uniswap v3 NFTs.

Rebalancing Wrapper

The Uniswap v3 NFT Position Rebalancing Wrapper offers an automated solution for maintaining a balanced portfolio of NFTs within Uniswap v3.

Positions can only be initialized in a 50/50 proportion.

In order to use it, the user will simply wrap a Uniswap v3 NFT position with the wrapper contract. Once wrapped, the position will automatically rebalance based on specified conditions.

The wrapper rebalances when any of these rebalancing conditions are met:

- Deviation from a specified 50/50 NFT ratio by a defined threshold.

- Elapsed time interval (also defined during wrapping).

- A specific on-chain event (can be specified during wrapping).

The ratio, time interval and on-chain event are specified at the time of wrapping the position.

The advantages are:

- Balanced Portfolio: Ensures a balanced portfolio of NFTs, reducing risk from over-exposure to a single NFT

- Automation: Eliminates manual intervention with automated rebalancing.

- Customization: Tailor rebalancing conditions to align with individual strategies.

The potential drawbacks include:

- Gas Costs: Frequent rebalancing might result in higher transaction fees.

- Liquidity Impact: Rebalancing actions could impact position liquidity.

Rearrange Positions

One of the main features of Talos is the ability to bring liquidity positions back to a pre-specified range. This makes it possible to adjust the distribution of liquidity across a given range of assets, which can be done by either expanding or narrowing the range of assets that the liquidity is distributed across.

- When expanding the range, the same amount of liquidity is spread out over a larger number of assets, which can potentially increase the liquidity of assets that were previously less liquid.

- This can be beneficial for market makers and traders as it can increase the trading volume and liquidity of the assets, making it easier to buy and sell them.

- When narrowing the range, the same amount of liquidity is concentrated on a smaller number of assets, which can increase the liquidity of the assets that are included in the narrowed range, but it can also increase the volatility of the assets that are excluded from the range.

- This strategy can be useful for market makers and traders who are looking to focus on a specific set of assets and increase their liquidity.

Talos does not support fee-on-transfer or rebasing tokens.

- Fee-on-transfer tokens will not function with Uniswap V3 router contracts. As a workaround, the token creators may create a token wrapper or a customized router. However, Talos will not be making a router that supports fee-on-transfer tokens.

- Rebasing tokens can succeed in pool creation and swapping, but liquidity providers will bear the loss of a negative rebase when their position becomes active, with no way to recover the loss.

Maia

Maia is a wrapper and aggregator for Hermes and Talos. It is the yield powerhouse of the ecosystem. Central to Maia’s essence is its alignment with yield-bearing tokens and a curated array of strategies.

Maia is the first implementation of the Partner bHermes Vault. This vault allows users to stake their $MAIA converting it to vMAIA and receive two of the three bHermes utilities deposited into the vault: weight and governance. The third utility is boost, which is not claimable by users, but instead used by Maia’s Treasury to host a boost aggregator with Talos Positions to enable further accumulation of hermes.

As a result, Maia directly benefits from Hermes, as the DAO has perpetual collective ownership of 25% of the protocol. This allows the Treasury to generate revenue from Hermes’ trading fees as well as collect bribes from external protocols.

The role of $MAIA

$MAIA, particularly when locked as vMAIA, assumes dual roles as a utility and governance token, orchestrating the coordination mechanisms across the Maia ecosystem. This empowers decentralized decision-making processes and rewards token stakers with a proportionate share of the treasury’s generated profits.

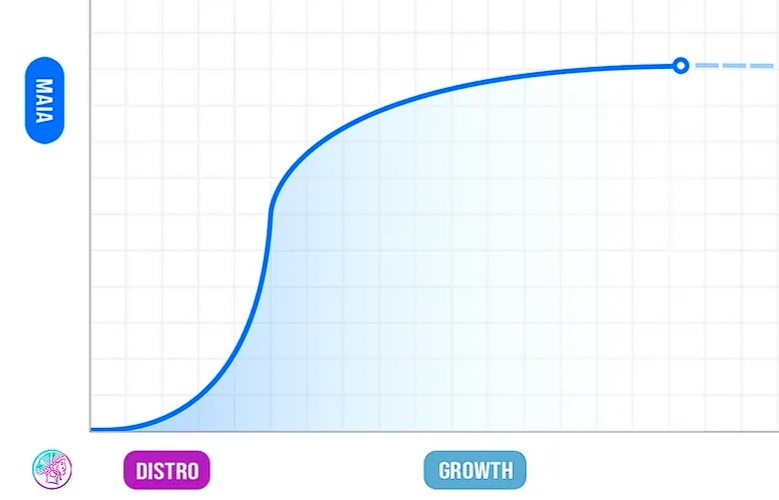

Token emissions started out leveraging OHM’s Staking & Bonding Mechanics for distribution. At first, emissions were governed by a capped supply of 180,000 $MAIA, distributed via rebase. However, as time went by, strategic bonds were proposed through governance as the sole emission mechanism.

In Maia v1, the primary mechanism for value accrual was staking. Users could stake their Maia tokens on the Maia website to earn rebase rewards. These rewards were generated from bond sales proceeds and depended on the staked $MAIA amount and the reward rate defined by the monetary policy. However, the tokenomics have changed in Maia v2.

vMAIA – Maia v2

In Maia v2, vMAIA is a staked variant of $MAIA. By staking $MAIA tokens, users harness bHERMES voting power, strategically channeling it to preferred gauges. This mechanism empowers users to contribute to the ecosystem’s trajectory and actively partake in the DAO’s decision-making.

Users retain the flexibility to stake their $MAIA tokens at their discretion, with the flexibility to stake at any point in time. However, withdrawals of staked tokens are restricted to the first Tuesday of each month, adding a structured element to token access.

vMAIA tokens exhibit fungibility, meaning they can be exchanged for $MAIA tokens. This fungibility allows users to use vMAIA tokens to provide liquidity and enable seamless swaps to $MAIA.

Altogether, the holders of $MAIA are incentivized to:

- Lock $MAIA into vMAIA.

- Participate in Maia DAO’s decision making.

- Accrue Bribes via MAIA Voting Power.

- Earn from the Revenue share of the treasury revenue.

- Maximize earning potential through Maia Vaults.

For instance, by acquiring vMAIA, users can redeem Maia’s portion of $HERMES utility tokens. As a result, users are directly controlling Maia’s share over Hermes.

Overall, staking introduces benefits such as:

- Delegating Maia’s Voting Power: Delegating $MAIA tokens enables a portion of MaiaDAO’s revenue to flow to users, eliminating the need for manual voting for the next week’s emission distribution. For instance, delegations to third-party smart contracts, which in turn make informed choices on pool and strategy preferences, offer a streamlined approach.

- Earning Bribes on Your vMAIA: Users stand to receive bribes as a reward for allocating their voting power to specific gauges, further incentivizing participation.

- Accumulating Boosted Voting Power: A user’s bHERMES voting power grows proportionally alongside their vMAIA balance.

- Active Governance Participation: Engage directly in the governance process by voting on proposals and contributing to new initiatives.

Yield Boosting

Maximizing bHERMES voting power and elevating rewards on deployed capital form the central thrust of vMAIA adoption. At its core, boosting relies on Maia DAO’s allocation of approximately 50% of the bHERMES supply, corresponding to a corresponding basket of bHERMES in the Maian Treasury. This symbiotic relationship between MAIA and bHERMES paves the way for an intricately structured boosting mechanism, intricately linked to gauges.

Boosting rewards are channeled to vMAIA (the staked representation of $MAIA tokens), with an inverse correlation to the volume of staked vMAIA.

- The higher vMAIA stake results in fewer rewards being attributed to vMAIA.

- Conversely, a lower vMAIA stake leads to a higher reward allocation.

As an example, consider this illustrative scenario:

- When 100% of $MAIA is staked as vMAIA, vMAIA’s rewards tally at 0%, as the entirety of $MAIA is staked.

- In contrast, when no $MAIA is staked (0%), vMAIA garners 100% of the rewards, owing to the absence of staked $MAIA. Meanwhile, the DAO retains the remaining rewards.

This dynamic design seamlessly incentivizes vMAIA staking, generating a dual impact of bolstering liquidity and system stability. Simultaneously, the DAO capitalizes on this mechanism to amass rewards, strategically earmarked for protocol development and maintenance endeavors.

Strategic Vault Boosting

Further enhancing the boosting mechanism, Decentralized Strategy Vaults integrate Boost Aggregators at their core. These Vaults can be modularly appended to a spectrum of underlying strategies under $MAIA’s boost purview.

Maia Strategies and vaults

The following strategies and synergies enhance the returns that can be offered by Maia vaults.

- Hermes Synergy and increased rewards through bHermes are integral to the yield optimization that Maia can offer. Maia DAO retains a strategic position in bHermes that empowers users to harness boosting advantages.

- Strategic partnerships: MaiaDAO’s overarching vision materializes through strategic partnerships with complementary protocols. By uniting forces, the aim is to offer users a cohesive DeFi experience, akin to a multiservice Centralized Exchange (CEX), without custody or counterparty risks.

- Autocompounding Mode: Through ingenious utilization of MEV and game theory, participants are incentivized to sustain vaults, enabling AUTOCOMPOUND MODE for autocompounding with a minor fee derived from rewards. This model redefines autocompounding dynamics, championing decentralization and curbing extractive practices, in contrast to upfront fee charging.

- Leverage: By leveraging the deposited principal amount, Maia vaults (mVaults) can help to maximize or hedge yield farming practices while simultaneously ushering integrations with external protocols.

The Boost Aggregator Factory

The Boost Aggregator Factory allows users to deploy Boost Aggregator contracts for Uniswap V3 NFTs and Hermes V2 gauges. This tool enables aggregation, boost management, and rewards distribution.

- bHermes Boost Utility Tokens: You can decide how much bHermes Boost Utility Tokens to deposit for Uni v3 NFT depositors to use. It is possible to deposit more or withdraw at any time as well.

- Fee percentage: You can set the percentage of Uni v3 NFT rewards that you receive as a fee. This makes it possible to earn a portion of the rewards earned by staked NFTs.

- Whitelisting: It’s possible to whitelist other users in order to allow them to stake their Uni v3 NFTs.

- Only one position per address can be boosted at a time.

- If you whitelist multiple users who intend to stake the same position, the first one to stake will receive the boosted rewards.

- It is recommended to whitelist users with a certain level of trust, especially if the position is not an immutable smart contract like a Talos position. This approach helps to minimize the risk of conflicts between whitelisted users over reward allocation.

Maia v2

Introduced in June 2022, Maia v2 represents the commitment to align incentives and foster sustainable ecosystem growth through enhanced earnings, increased utility, and community-driven governance.

Similar to the Convex and Curve synergy, Maia aims to leverage Hermes Protocol to enhance the MAIA token’s value. This is driven by key changes in the protocol tokenomics. To speed up this evolution, the protocol entered a growth stage where token incentives played a key role. The main objective from these rewards was to facilitate an equitable and fair token distribution as well as support network growth on Metis. This would subsequently be reflected on the token’s price discovery.

With v2, Maia entered a paradigm shift on its emissions model, transitioning from a staking-driven inflationary model to a real-yield and value-driven token distribution coming from the protocol treasury itself. The progression involved recalibrating parameters, judiciously reducing the Reward Rate (RR) with each rebase.

After the v2 launch, bonding would serve as the means to perpetuate the growth of the treasury and fund business development efforts. The issuance of bonds would hinge on the Current Market Price / Backing Ratio, infusing a measured mechanism into the growth trajectory. A proposed maximum monthly bond issuance of 10K $MAIA, contingent on favorable conditions, underscored this prudent strategy.

By moving from emissions-based yields to revenue-based sustainability, this pivotal shift aimed to align the incentives between the protocol users and the DAO treasury itself. $MAIA Locked Staking stands as a cornerstone of this evolution, granting users the potential to lock tokens for up to 16 weeks. In return, participants unlock a share of protocol revenue, governance influence, and Hermes voting power.

Maia v2 also unlocks token utility through Vested Staking, a mechanism mirroring Hermes’ vote-lock approach. Through this, participants can lock tokens for varying periods, enabling a gradual release of vested proceeds. This ingenious mechanism provides users with a proportional share of protocol revenue, governance influence, and Hermes voting power. Additionally, voting enhancements further amplify community involvement, with a revised voting system aligned with the Convex model, allowing retention of previous week’s votes.

In V2, MAIA emission will occur through strategic bonds, replacing staking rewards. These bonds will open under favorable market conditions and will be capped. $MAIA tokens will still be backed by blue-chip assets. The core features of V2 include vote-locking $MAIA for voting power and earning from Maia treasury revenue. Users can also access MAIA vaults, earning rewards with boosting based on their vlMAIA balance.

Tokenomics

The development of the Maia ecosystem has gone through distinct phases, each of them with specific objectives.

- Launch Phase: During the inaugural 24 hours, 2,712 $MAIA tokens were minted and subsequently locked for 10 days until January 24th 2022.

- Initial Distribution and Bootstrap Phase: Spanning from January to August 2022, the next stage prioritized to reach an equitable supply distribution. This culminated in a supply cap of 180,000 $MAIA tokens for v2. The objective was met through diverse farming strategies, preserving and augmenting the platform’s intrinsic backing.

- Dividends / Real Yield Phase: V2 represents a transformative shift in how value flows through the ecosystem: moving from an emissions-focused rewards program to the concept of Real Yield. This is achieved by channeling dividends from a portion of the treasury revenue to $MAIA lockers.

- Bonds and value-driven supply expansion: This phase expands on the idea of bonding. The DAO evaluates the need for a supply expansion through a diligence process, and this ensures that supply expansions take place when they are most beneficial to the ecosystem.

$MAIA Token Distribution

The ethos of Maia is to be a community-driven project and has not received VC funding.

- 45% Adding Liquidity on Nettswap (LP’s Added to Treasury and Bonds Created).

- 45% Treasury Allocation for DAO Investment Strategies.

- Hermes Protocol – Locking and farming $HERMES, receiving veHERMES and fees to grow the treasury.

- Jones DAO and Tethys Finance.

- 10% Development Team.

Ulysses

Ulysses Protocol is a decentralized Omnichain Liquidity Protocol aimed at enhancing capital efficiency. It allows liquidity providers to deploy assets across multiple chains while earning revenue from various chains’ activities. This approach minimizes the challenges of fragmented liquidity in DeFi and offers cost-saving solutions for DeFi protocols.

Key components of the protocol are:

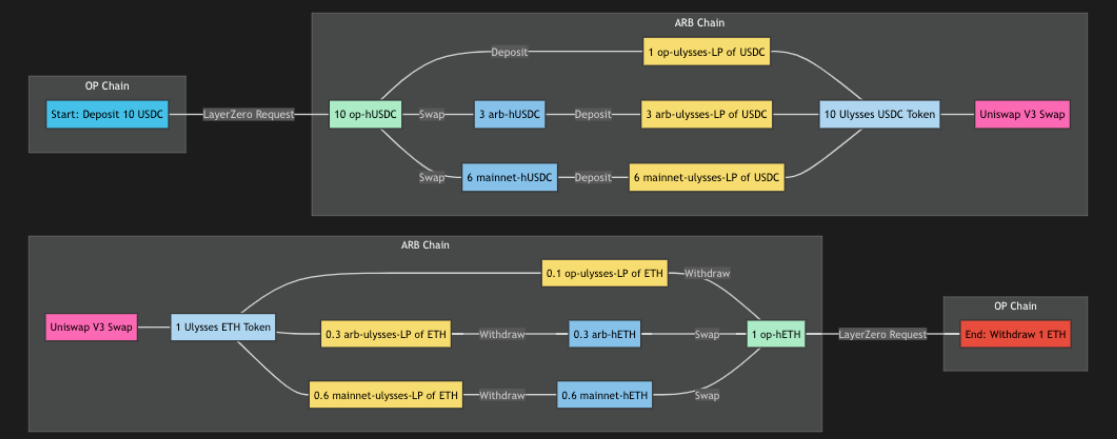

- Virtualized Liquidity: Virtualized Liquidity is empowered by the concept of Ulysses Ports and LayerZero for cross-chain communication. This ensures seamless liquidity utilization across different chains.

- Unified Liquidity Management: This component builds upon the idea of the Delta Algorithm proposed by LayerZero. It introduces a single token representing a collection of Ulysses LPs from the same token but across various chains. This token enables versatility and composability, allowing users to utilize it in different platforms like AMMs (e.g., Uniswap v3) and money markets (e.g., Aave).

To fully understand Ulysses Unified Liquidity Solution, it’s important to distinguish between Ulysses Unified Pools and Ulysses Unified Tokens. These concepts play a crucial role in enabling efficient cross-chain liquidity management.

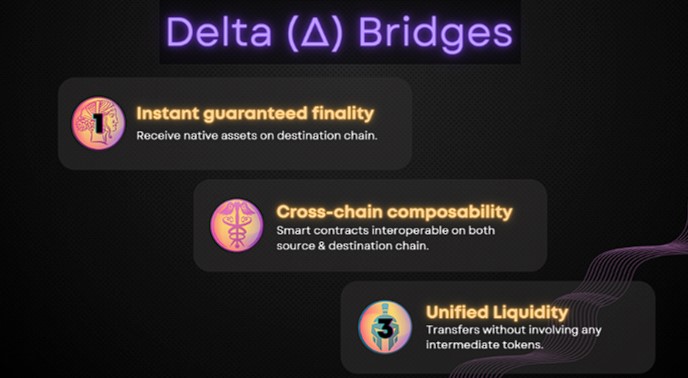

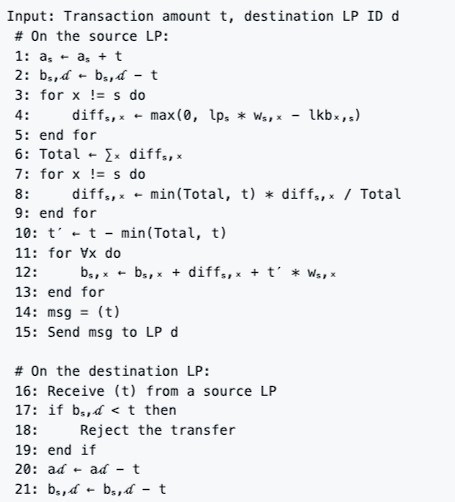

Delta Algorithm

The Delta algorithm works alongside Delta Bridges to allow for cross-chain transfers without the need for intermediary tokens. More info can be found in Revelo’s breakdown covering Stargate.

The fundamental difference between Delta Bridges and standard cross-chain bridges is that Delta Bridges enable direct transfer of native assets between chains. This approach enhances scalability and efficiency in cross-chain transactions, which is made possible by maintaining a pool of liquidity on every chain within the Delta Network.

The delta algorithm, in conjunction with LayerZero’s cross-chain messaging, facilitates the management and distribution of liquidity across multiple chains. This algorithm enables a soft-partitioning of liquidity, assigning a portion of local liquidity to remote chains. For example, if chain X has $100 liquidity, $50 could be assigned to chain Y and $50 to chain Z.

Each chain maintains a single liquidity pool that is soft-partitioned into sections for remote chains. This design allows borrowing and returning liquidity between partitions. The algorithm ensures balance between partitions to manage imbalanced transaction volume, maintaining a proportional relationship between remote balances and asset pools.

The algorithm aims to maintain the proportional relationship between remote balances and asset pools while keeping each balance at or above its initial value. Equilibrium fees and user behavior work together to achieve this balance.

Equilibrium fees incentivize users to balance liquidity. Fees are charged for transfers when the source chain’s balance is high and reimbursed when the balance is low. This encourages users to deposit assets when liquidity is low, maintaining a balanced network.

Ports

Ports function as liquidity repositories responsible for managing the deposited capital across different chains where Ulysses is operational.

A Port comes into play whenever assets are deposited into or withdrawn from the Ulysses Omnichain Liquidity System. It operates like a vault with a single-asset pool for each omnichain token active within a particular chain.

Importantly, when users interact with a Port for depositing or withdrawing assets, no protocol fees are charged from their assets.

There are two types of ports:

- Branch Ports: Each chain requires a Branch Port, which caters to the associated Branch Routers within that chain. A Router communicates with the Port to manage actions such as withdrawals, deposits, and interactions with virtualized token contracts.

- Both user requests and system responses trigger these interactions.

- Root Port: The Root Port, located in the Root Chain, communicates with all connected Root Routers. This Port is responsible for maintaining the global state of Virtualized Tokens. It holds a registry containing mappings from underlying to local addresses, as well as from local to global addresses.

- Any action related to adding, removing, or verifying tokens and their balances must go through this contract.

- The Root Port maintains the global state of Virtualized Tokens (hTokens)

Virtual Liquidity

Virtual Liquidity refers to the ability to mirror assets that are locked in different chains within a single liquidity management environment. This helps to avoid liquidity fragmentation and opens up the doors to enhanced composability.

With Virtual Liquidity the underlying assets remain locked in their respective chains while still being able to provide liquidity and earn revenue from activities that take place on different chains.

The Branch hTokens can be used to provide liquidity in different protocols and pools, such as Uniswap, Aave… allowing liquidity providers or depositors to earn revenue and increase their capital efficiency.

Furthermore, Virtualized Liquidity also enables protocols to lower their operational and management costs by incentivizing liquidity for a single unified liquidity token instead of managing incentives for pools scattered across different AMMs and chains.

Virtual Accounts on Arbitrum

The Virtual Account is a smart contract designed to offer encapsulated user balances for decentralized applications (dApps) operating within the Arbitrum root chain environment. Through the utilization of the Ulysses branch chain, users gain access to their balances and can execute various actions, such as token swapping, liquidity addition, farming, and more, across different blockchain networks.

- Cross-Chain Functionality: The Virtual Account empowers users to interact with Arbitrum-based dApps from any Ulysses branch chain. This cross-chain capability eliminates the need for users to manually switch between different blockchain networks to perform actions in the Arbitrum environment.

- Omnichain Wallet: By maintaining distinct accounting for each user, the Virtual Account serves as an efficient solution for managing user balances across multiple blockchain networks. This approach streamlines user interactions without necessitating changes to existing dApp smart contracts.

- Seamless Integration: The Virtual Account seamlessly integrates with the Ulysses branch chain, enabling users to effortlessly access their balances and engage with dApps in the Arbitrum environment.

- Versatility: Users can utilize the Virtual Account to execute a diverse array of actions within Arbitrum-based dApps, including token swaps, liquidity provision, yield farming, and more.

Bridge Agents

Bridge Agents play a pivotal role in facilitating seamless communication between two chains, serving as essential intermediaries. They are responsible for transmitting user requests and managing the system’s responses, ensuring a smooth connection between different components of the protocol.

There are two types of Bridge Agents:

- Branch Bridge Agents: These agents mediate interactions with Branch Routers. They oversee user Deposits, interact with local Branch Ports for asset deposit and withdrawal, and engage with virtualized token contracts.

- Root Bridge Agents: Found in the Root Chain, Root Bridge Agents connect with all associated Branch Chains and their respective Branch Bridge Agents. These agents manage pending user Settlements. Each Root Bridge Agent is connected to a Root Router, enabling seamless integration with other dApps on the Root Chain.

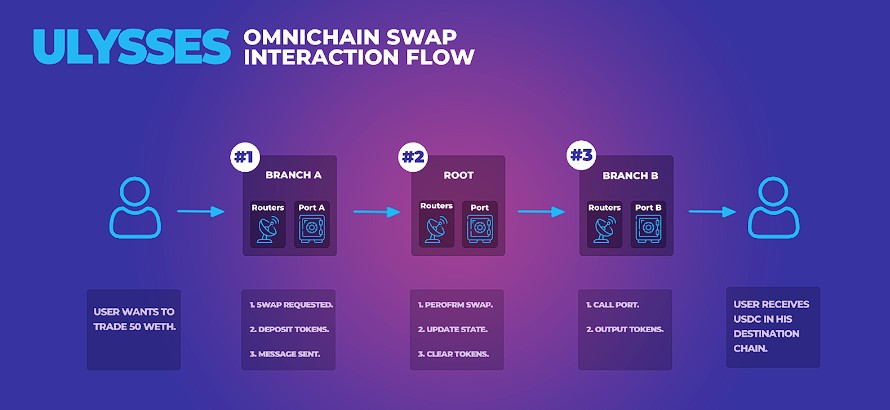

An omnichain swap follows the interaction flow outlined below:

- User Request: The user initiates a swap request with the Branch Bridge Agent, providing the necessary parameters.

- Deposit Assets: The originating Branch Bridge Agent locks the required balance and records the deposit. This deposit data is then communicated to the corresponding Root Bridge Agent via the LayerZero messaging layer.

- Receive Request: The Root Bridge Agent verifies the received request and deposit data from the Branch Bridge Agent. If valid, the request is forwarded to the corresponding Root Router.

- Perform Swap: The Root Router executes the swap and instructs the Root Bridge Agent to transfer the output tokens to the intended destination chain.

- Create Settlement and Send Response: The Root Bridge Agent generates a settlement for the user’s token output and sends a token clearance request to the Branch Bridge Agent on the exit chain.

- Receive Request and Clear Tokens: Upon receiving the communication from the Root Bridge Agent, the destination Branch Bridge Agent requests token clearance for user withdrawal from the local Port.

Routers

Users primarily interact with Routers, which are crucial infrastructure components designed to facilitate customized actions before, during, and after omnichain interactions.

There are two types of routers:

- Branch Routers: Branch Routers function as user-accessible entry and exit points within the omnichain system. When users initiate a request, these routers orchestrate the necessary state changes in the originating Branch Chain’s contract. They also communicate with the connected Branch Bridge Agent to facilitate the transmission and reception of cross-chain messages.

- Root Routers: Root Routers are situated in the Root Chain and are connected to Root Bridge Agents. They ensure seamless reception of requests and transmission of responses. Root Routers interact with various applications on the Root Chain, including Uniswap V3, Maia Vaults, and Hermes Gauges, along with their corresponding voting systems. This enables them to accommodate user requests effectively.

By utilizing Routers, Ulysses ensures:

- Composable Interactions: Users can engage in cross-chain interactions that are customizable to their needs, allowing for flexibility in their actions.

- Smooth User Experience: Routers provide users with a seamless experience as they navigate through different chains and applications.

- Flexibility: The platform’s architecture empowers users to interact with a wide range of third-party applications. The secure and plug-and-play communication channels between chains enhance the versatility of these interactions.

Unified Pools

Ulysses Unified Pools are single-sided staking liquidity pools that enable asset trading among various Ulysses Pools. Unlike the Delta Algorithm LP described in the paper, Ulysses LPs are all located in Arbitrum. This choice offers a trade-off between composability outside and inside Arbitrum. Transactions within Arbitrum have guaranteed finality, unlike transactions from other chains. Moreover, arbitrage within the system is more cost-effective due to seamless execution without cross-chain calls.

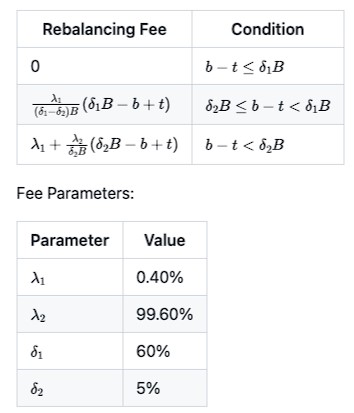

Each Unified Liquidity LP manages a single token from a specific chain and connects to other Unified Liquidity LPs. Liquidity is tradable among these LPs based on set weights. To ensure liquidity availability across chains, there is a rebalancing fee, which may be zero, positive, or negative, depending on the action and pool bandwidth. Additionally, a protocol fee is deposited in each token’s respective gauge.

There are 3 main actions that can be taken:

- Swapping Assets.

- Depositing Assets:

- If both pools’ bandwidths are equal to or greater than their target (50), the transferred amount is evenly distributed between both bandwidths.

- If one pool’s bandwidth is below its target, the transfer is distributed to the deficient bandwidth until it meets the target balance, and then evenly between them.

- If both pools’ bandwidths are below their targets, the transfer is distributed to the lowest bandwidth until they are equal, then evenly between them.

- If one pool’s bandwidth is significantly lower than the other’s, the transferred amount is entirely distributed to the lowest bandwidth.

- Withdrawing Assets:

- If both pools’ bandwidths are less than or equal to their target (50), the transferred amount is evenly removed from both.

- If one pool’s bandwidth is below its target, the transferred amount is removed from the greater bandwidth until it meets the target balance, then evenly between them.

- If both pools’ bandwidths exceed their targets, the transfer is removed from the highest bandwidth until they are equal, then evenly between them.

- If both pools’ bandwidths exceed their targets and one is significantly greater, the entire transferred amount is removed from the highest bandwidth.

Unified Tokens

Ulysses Unified Tokens provide users with the ability to access liquidity pools across multiple chains using a single, unified token. These tokens serve as wrappers for Ulysses Liquidity Pools (ULPs) from different chains, making them functional and accessible within any decentralized application (dApp) on any network.

Ulysses Unified Tokens are designed to be compatible with a variety of ERC-20 tokens and are primarily intended for use with Ulysses LPs. These tokens enable users to manage underlying assets at a fixed ratio, ensuring flexibility and control. The 1:1 ratio between the LP and underlying assets simplifies tracking the value of assets.

There are two major use cases for Ulysses Unified Tokens:

- Trading and Liquidity Provision: Ulysses Unified Tokens are well-suited for both trading and providing liquidity to other pools. For example, users can trade their Ulysses Unified Token for assets on the Binance Smart Chain using Uniswap v3. Similarly, users can add liquidity to an Arbitrum pool from Optimism using their Ulysses Unified Token.

- Foundation for Other Applications: Ulysses Unified Tokens can serve as foundational elements for various applications. Lending platforms, for instance, could use these tokens as collateral, enabling users to borrow against their assets spanning multiple chains. Additionally, stablecoin issuers might leverage Ulysses Unified Tokens to create omnichain stablecoins tied to the value of multiple underlying assets.

It is worth noting that fee-on-transfer tokens will not function and token creators would need to create a token wrapper. Rebasing tokens will succeed in pool creation and swapping but liquidity providers will bear the loss of a negative rebase when their position becomes active, with no way to recover the loss.

UniMaia

UniMaia is a Uniswap v3 concentrated liquidity AMM on Metis. Unlike standard constant product AMMs like Uniswap v2, concentrated liquidity AMMs enable liquidity providers to provide liquidity on a specific price range. This results in greater fee earnings from trading fees and more capital efficiency.

- Concentrated Liquidity: LPs can target specific price bands, concentrating their liquidity to create personalized price curves. This fine-tuning allows LPs to allocate capital more effectively. Trading fees are distributed pro-rata based on each LP’s contribution to a given price range. These individual curves are combined into a single curve for trading against total liquidity.

- Capital Efficiency: LPs can maintain the same liquidity depth as v2 but within chosen price ranges, requiring less capital. Savings can be used to expand exposure, invest in other assets, or deposit in DeFi protocols.

- Range Orders: Traders can specify price ranges for trades rather than fixed prices, reducing transaction costs and increasing flexibility. This is useful for various scenarios like profit-taking and buying the dip.

- Non-Fungible Liquidity: LPs can create custom liquidity positions with unique specifications. Trading costs are no longer automatically reinvested, allowing LPs to engage in various strategies while maintaining a passive experience.

- Flexible Fees: Uniswap v3 offers three fee tiers (0.05%, 0.30%, 1.00%) per pair, letting LPs adjust margins based on expected pair volatility. Different fee tiers compensate LPs for varying risk levels.

Introducing a concentrated liquidity AMM on the Metis L2 Network offers several advantages:

- Deliver a more efficient trading experience for users, attracting additional traders and liquidity providers to the network.

- Increase and improve the overall liquidity of the network, leading to higher trading volume and revenue for the ecosystem.

- Create new revenue sources for the ecosystem.

Fees

Maia

There are no fees for staking or unstaking $MAIA.

A customizable 20% performance fee can be charged for the future mVault product under Maia V2.

Hermes

Under the current v1, swap fees are fixed at 0.01%. There are no fees for deposits and withdrawals.

Talos

There is no information regarding Talos’s fees for now.

Ulysses

Transaction fees will be 0.03% with roughly half going to $sMaia as Maia holds over 50% of all $veHERMES.

UniMaia

By using Uniswap’s built-in fee switch, the deployment allocated 10% of the generated fees as follows:

- 3% to veHermes Lockers

- 3% to Maia Stakers

- 4% to Maia DAO Treasury

Why the Project was Created

The Maia ecosystem was conceived to address critical challenges and inefficiencies within the DeFi landscape. Its creation aims to introduce innovative solutions that enhance capital efficiency, incentivize participation, and foster a more sustainable and productive decentralized finance environment. Key motivations behind the creation of the Maia ecosystem include:

- Capital Efficiency: DeFi users often face challenges in managing their capital efficiently, especially in liquidity provision. Maia seeks to optimize capital allocation through strategies like the “Vanilla” strategy, offered by Talos, which leverages pooled assets and auto-compounds fees, leading to enhanced yield generation.

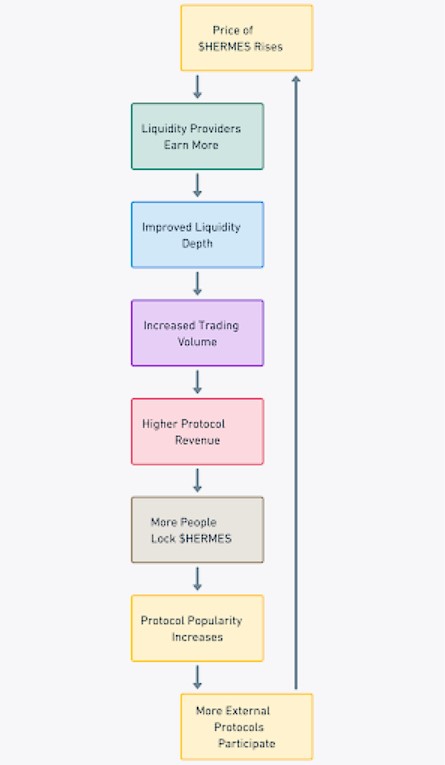

- Incentive Mechanisms: The Maia ecosystem incorporates sophisticated incentive mechanisms, such as the Pendulum Effect enabled by Hermes Protocol, to align the interests of liquidity providers and voters. This results in more effective yield distribution and liquidity provisioning across various assets and tokens.

- Decentralized Governance: The Maia ecosystem emphasizes decentralized governance, enabling users to actively participate in decision-making processes. The combination of voter-driven yield distribution and automated emissions ensures a dynamic and responsive governance framework.

- Optimized Liquidity Provision: The ecosystem leverages the concentrated liquidity model of platforms like Uniswap V3 to create efficient liquidity provisioning. This enables protocols to attract liquidity with reduced costs through the built-in bribe system, increasing the overall efficiency of the DeFi space. Additionally, the integration of LayerZero makes it possible to enable swaps across chains and solve the problem of liquidity fragmentations.

- Sustainability: Maia aims to establish a sustainable DeFi ecosystem by addressing issues like impermanent loss and enhancing the viability of liquidity provision strategies. By incentivizing liquidity providers and voters effectively, the ecosystem promotes long-term engagement and stability.

- Omnichain: Hermes V2 uses an omnichain architecture, allowing for seamless trading of native assets across multiple blockchains without the need for manual bridging. This innovation provides users with a simplified, secure, and efficient platform where all chains are accessible directly, enhancing the overall DeFi interaction.

Roadmap

There is no official roadmap for MaiaDAO so far.

However, the team is working on developing the following:

- Maia V2

- Hermes V2

- Talos

- Ulysses

Sector Outlook

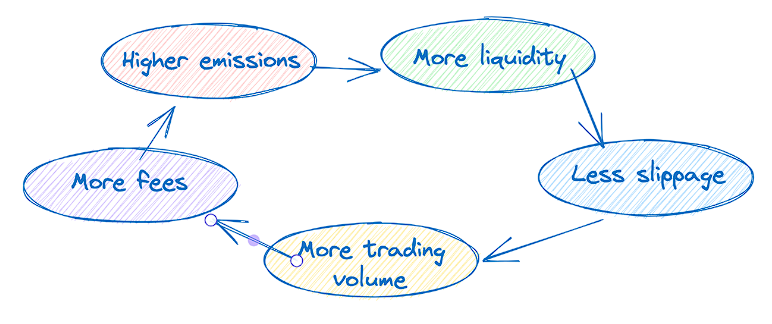

DEXs and AMMs play a crucial role in enabling trading opportunities and improving the overall liquidity conditions of any given ecosystem. As the sector continues to mature, new models and innovations are emerging to address the challenges and limitations associated with traditional DEX and AMM frameworks.

Traditional DEX models, such as the x*y=k (constant function) model employed by Uniswap and Sushiswap, have faced challenges like impermanent loss and inefficient capital allocation. Liquidity mining rewards, while effective in attracting liquidity, have sometimes led to “vampire liquidity”as well – liquidity providers who quickly dump reward tokens, impacting the project’s token price.

DEXes fight to attract liquidity in DeFi, and this competition continues to increase as more competition enters the market. Their goal is to increase their TVL and attract more capital so that they are able to offer deeper liquidity, which leads to a better trading experience and enables swaps with lower slippage. This in turn leads to more fees for liquidity providers, which incentivizes more liquidity to be deployed onto the DEX, which again improves the trading experience.

The Solidly Model and ve(3, 3) AMMs

Introduced by Andre Cronje on January 6, 2022, the Solidly AMM model brings forth improved tokenomics and addresses the misalignment of incentives between liquidity providers and token holders. More specifically, the Solidly model emerged to solve the problem that the emission of rewards needs to be aligned with the actual incentives of the protocol to ensure sustainability. This idea introduces an innovative model incentivizing both fee generation and liquidity provision.

- Adjustment of Weekly Emissions Based on Circulating Supply: In the ve(3, 3) model, the emission of new tokens is adjusted as a percentage of the circulating supply of tokens. This mechanism is designed to incentivize users to lock their tokens, thereby influencing the supply dynamics. This means that the weekly emission amount changes dynamically depending on how many tokens are locked in the voting escrow (ve).

- If a lower percentage of tokens are locked in ve, a higher weekly emission occurs.

- If a higher percentage of tokens are locked in ve, the weekly emission decreases.

- Impact of Emission Decreases with Increased Vesting: As more tokens are vested in the voting escrow, the impact of emissions on the overall supply is reduced. This is achieved by proportionally increasing the holdings of ve lockers as the weekly emission occurs. For example, if the weekly emission results in a 5% supply increase, the holdings of ve lockers are also increased by 5%. This prevents dilution of ve locker holdings, incentivizing participants to vest their tokens.

- Non-Fungible Tokenization of ve Locks: An innovative aspect of the ve(3, 3) model is the tokenization of ve lock positions into non-fungible tokens (NFTs). This enables a single address to own multiple lock positions, with each lock contributing to the overall ve balance. The NFTs representing locks can be traded on secondary markets, allowing for potential liquidity benefits.

One of the central features of the Solidly model is the concept of locking native DEX tokens for a specified period in exchange for a veNFT. The duration of the lock determines the amount of rewards received, with longer locks benefitting the most. Holding veNFTs brings several benefits, including:

- Revenue from fees of the pools they have voted for, paid in base assets.

- Earn a portion of weekly emissions.

- Voting power on AMM pools.

- Boosted rewards based on the balance and LP positions.

In the context of the ve(3, 3) model, fee distribution plays a crucial role in aligning token emission with protocol incentives. This model is designed to optimize the distribution of fees generated by a protocol, ensuring that those who contribute value receive corresponding rewards. Here’s how fee distribution works within the ve(3, 3) framework:

- The ve(3, 3) model proposes a solution by ensuring that participants who lock their tokens in the voting escrow (ve) receive a fair share of the fees generated by the protocol.

- The key principle of ve(3, 3) Ouroboros is that ve lockers not only vote on emission but also earn fees based on their voting preferences.

- Unlike some existing models, where fees are distributed to token holders regardless of their voting choices, the ve(3, 3) model ensures that ve lockers only receive fees from pools they have actively voted for.

This brings in benefits such as:

- Incentivizing Fees Over Liquidity: The ve(3, 3) model prioritizes incentivizing fees rather than liquidity provision. This aligns with the goal of maximizing protocol revenue.

- Higher Payouts for Active Participants: ve lockers earn 100% of fees generated by pools they vote for. This encourages participants to vote strategically for pools with high fee-generating activities, leading to higher payouts.

- Emissions Promote High-Fee Pools: The emission mechanism directs newly minted tokens to pools with the highest fees. This encourages increased liquidity in those pools, improving trading quotes, trade volume, and overall fee generation.

- Self-Optimization and Alignment: The model aligns emissions with protocol incentives, allowing participants to collectively optimize the system. Participants naturally gravitate toward pools that generate higher fees, promoting a self-sustaining cycle of value creation.

The fundamental idea is to distribute fees to ve lockers based on their voting choices. This encourages participants to vote for actions that directly contribute to the protocol’s success, creating a strong alignment between incentives and actions. Hermes V2 introduces a significant evolution in the mechanics of ve(3,3) with its transition to b(3,3), a model that simplifies user interactions by shifting from a locking to a burning mechanism. This new approach eliminates the need for users to engage in weekly tasks such as claiming distributions or rebases, and managing or renewing locks. By permanently burning the tokens to convert them into b(3,3), the system not only simplifies the management process but also enhances capital commitment, as burned tokens contribute directly to long-term protocol stability and governance influence without the possibility of withdrawal.

In this system, there are 3 primary components:

- Emissions: Solidly’s emission of tokens is tied to the percentage of locked tokens. A fully locked circulating supply would result in no emissions. This design safeguards lockers from dilution.

- Trading fees: All trading fees are channeled to locker, but only from the pools they have voted for. Fees are paid in the base assets of the respective pools.

- Bribes: Anyone can offer bribes to a gauge, and those who vote for the gauge can claim the bribes. Additionally, Solidly introduced negative voting, allowing users to block emissions to a particular pool.

Since the original deployment of Solidly by Andre Cronject, multiple forks have entered the market, each of them innovating on new concepts. Some of them include:

- Velodrome (Optimism L2): Velodrome emerged as Optimism’s leading DEX, leveraging $OP grants for heavy incentivization. It addressed flaws in Solidly, centralized pool whitelisting to prevent exploits, and introduced higher swap fees for productive pools. Weekly emissions were reduced, fostering sustainability.

- Hermes (Metis L2): Created by Maia, Hermes became a major DEX on Metis. It centralized pool whitelisting and implemented a one-week vote lock to counter bribe farming. Hermes introduced concentrated liquidity and a burning mechanism for improved tokenomics.

- 3xcalibur (Arbitrum L2): Native to Arbitrum, 3xcalibur introduced algorithmic minting for emissions, enhancing token sustainability. It aims to become a Tri-AMM, offering volatile and stable-swap pools, lending/credit features, and more.

- Solidly+ (ETH Mainnet Migration): Solidly’s native developers fixed bugs and migrated to ETH mainnet due to liquidity issues on Fantom. The team rectified flaws and introduced governance improvements, planning to launch as Solidly Labs with liquidity partners like Frax, Yearn, and more.

- Equalizer (Fantom L1): Equalizer filled the gap left by Solidly’s migration. It adopted key elements of the model while tweaking max veLOCK period, initial distribution, fee structure, and voting mechanisms.

- Thena (BNB Chain): Deployed on BNB Chain, Thena used the NFT fundraiser approach. It aimed to address liquidity inefficiencies on BNB and introduced changes to fees, bribing, and token whitelisting.

- Retro Finance: Introduces rewards on a yield-bearing stablecoin called $CASH, as well as emitting emissions in the form of call options represented by oTokens (oRETRO).

The Hermes Pendulum

The Hermes Pendulum is the theory that states that any source of liquidity that generates revenue can participate in a gauge system. This thesis is the basis for coming up with Hermes v2 and Custom Gauges. More specifically, Hermes V2 enables the transfer of yield between different revenue-generating assets, such as money markets, Uniswap V3 liquidity pools, vote-locked tokens, and Yearn Vaults. These assets can utilize the Hermes V2 gauge system to facilitate the transfer of yield between Liquidity Providers and Voters, with Voters receiving revenue and Liquidity Providers earning emissions.

The underlying principle states that, by pricing the yield produced by any given source of liquidity, the protocol can create a positive feedback loop or “flywheel effect” that mimics the oscillating motion of a pendulum as it sequentially transfers yield from one place to another.

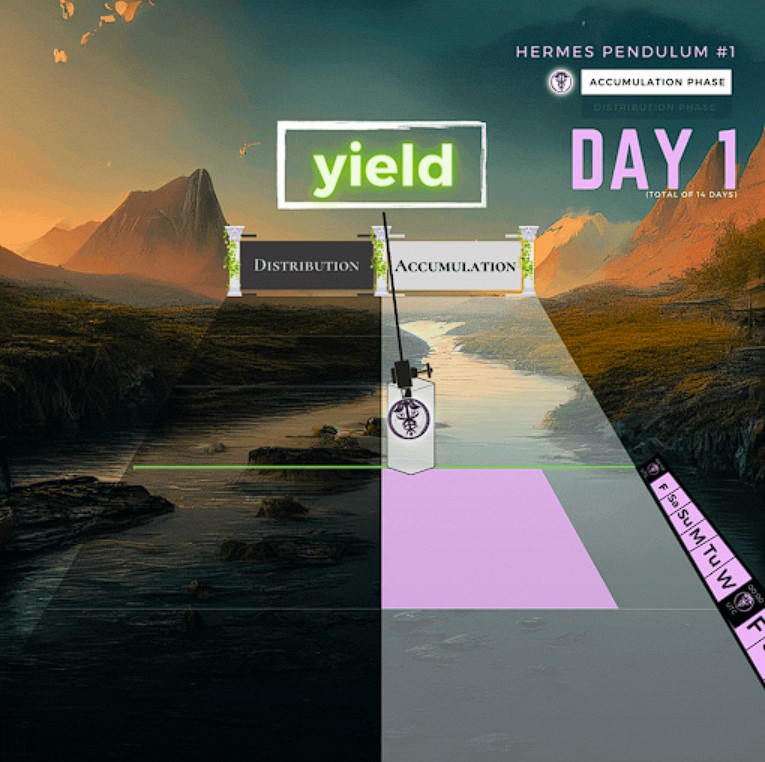

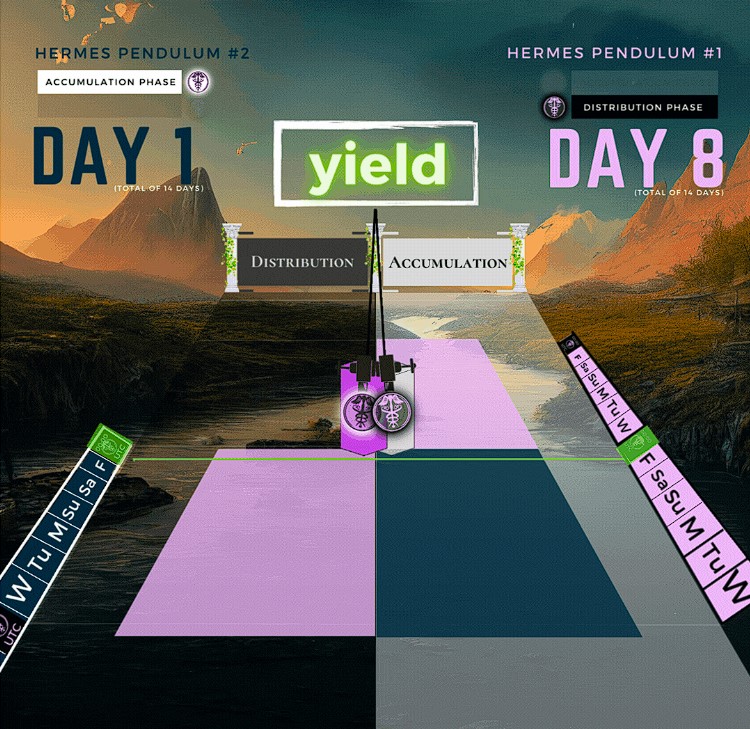

Hermes operates on a time-driven mechanism with distinct phases:

- Each epoch lasts 7 days, starting every Thursday at 00:00 UTC.

- A full cycle consists of 2 epochs, divided into an Accumulation Phase and a Distribution Phase.

- During the Accumulation Phase, yield accumulates over 7 days.

-

- This is followed by a 7-day Distribution Phase where the accumulated yield is distributed.

- One full cycle takes 14 days to complete, with yields transferred sequentially but simultaneously, bridging past and future.

This way, two independent pendulums operate simultaneously, never colliding. This synchronous progression ensures a seamless flow of yield between Liquidity Providers and Voters.

The Talos Effect

When it comes to DEXs, challenges such as unpredictable yields and capital inefficiency are common, compounded by the risk of impermanent loss and the need for complex strategies to optimize trading ranges for various asset pairs.

Hermes V2 addresses these challenges by leveraging a cyclical approach in its operations. It features a structured system where trading volumes cycle through accumulation and distribution phases. During the accumulation phase, revenues accrue over a 7-day epoch as voters allocate their votes, speculating on potential earnings. This leads into the distribution phase, where the accrued yield is distributed, and the cycle restarts, thus making Uniswap V3 fees more predictable and allowing for optimization of emissions for high-yield gauges.

Separately, TALOS specifically enhances liquidity management on Uniswap V3 through strategies like the “Vanilla” strategy, which pools assets and auto-compounds fees. This automation and optimization focus on improving the efficiency and ease of managing liquidity positions, without directly involving the voting or emissions strategies that are part of the Hermes V2 mechanics. This distinction clarifies that while both systems improve user experience and efficiency, they operate in fundamentally different aspects of the DeFi ecosystem.

Potential Adoption

The Solidly model has spurred a positive feedback loop: locked tokens lead to more liquidity, reduced slippage, increased fees, and subsequently, more locked tokens. While Solidly had its initial shortcomings, subsequent forks have improved upon its foundation, introducing additional features and addressing issues.

The journey of Solidly and its forks exemplifies the iterative nature of DeFi development, where projects learn from one another’s successes and failures to create increasingly refined and innovative solutions. The Maia ecosystem, however, features more than a Solidly fork. Unlike other forks, the DAO has managed to incorporate notable features that enhance capital efficiency and improve the overall user experience, such as omnichain swaps and concentrated liquidity.

Chains

All the protocols of the Maia ecosystem were initially launched on Metis. Over time, they will be deployed to other chains such as Arbitrum, Optimism, Polygon and Ethereum.

Using the Protocol

Maia Protocol Participants

The ecosystem converges on 3 primary participants:

- Vaults Liquidity Providers: These participants deposit assets into vaults, earning yield on their contributed assets.

- vMAIA Lockers: $MAIA tokens are locked, with dividends distributed from platform revenue.

- Hermes Bribers: Protocols seeking to lease liquidity within the Hermes Protocol.

Hermes Protocol participants

- Liquidity Providers: These participants deposit liquidity into the protocol pools to earn revenue from trading fees and token emissions.

- Voters: Voters are responsible for holding the reins of governance. With $bHERMES, voters decide the distribution of emissions among Gauges. In return, they claim a portion of the Gauge’s revenue, which comes from accumulated fees and bribes.

- Users can vote once and the vote will last in perpetuity.

- The ratio increases over time and there is no need to claim rebases.

- Hermes Bribers: Protocol partners seeking to lease liquidity within the Hermes Protocol are eager to secure TVL and channel protocol fees from the underlying asset’s Ulysses Unified Liquidity Pools into Gauges as bribes. These bribes, together with yield accrued from deposited yield-bearing tokens like ulCVX, orchestrate the distribution of revenue within Hermes’ Gauges.