Overview

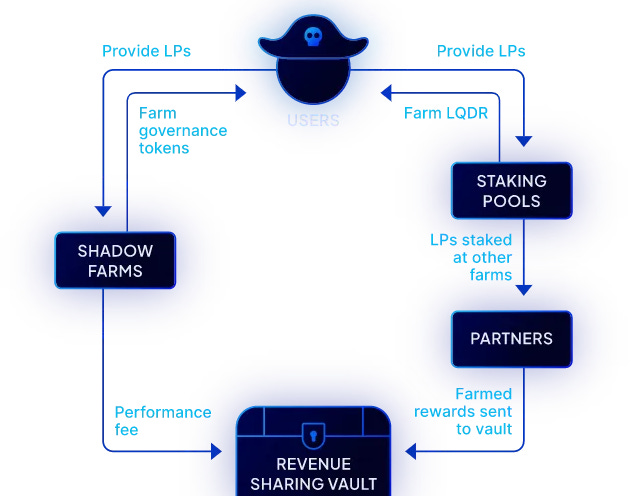

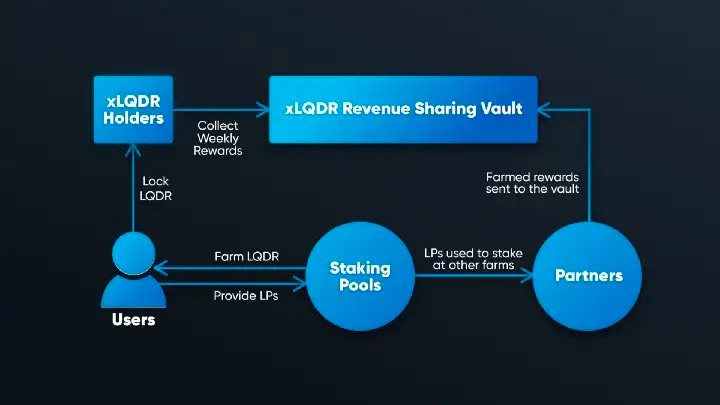

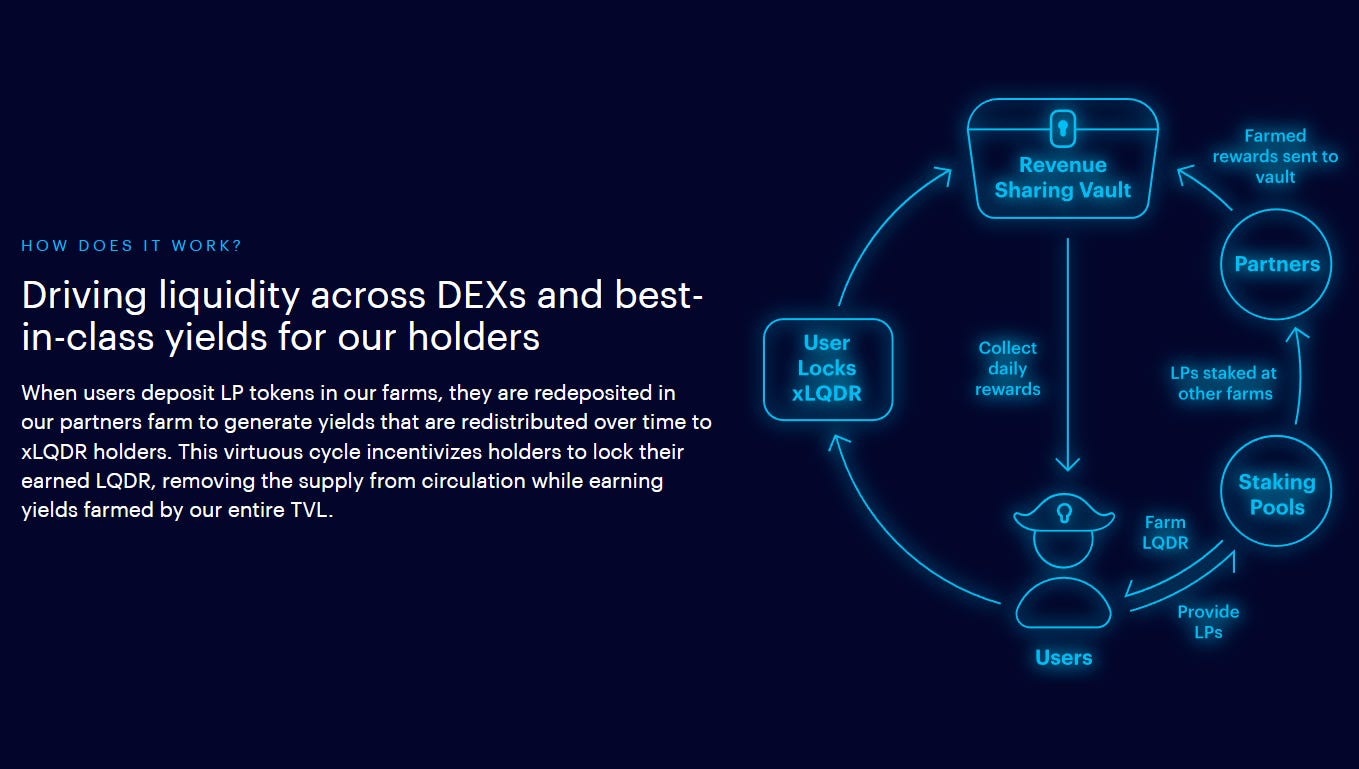

LiquidDriver is a protocol focused on liquidity mining. It has become the first provider of Liquidity-as-a-Service in the Fantom Ecosystem. The idea is to incentivize investors to delegate their LP tokens and yield-bearing assets to LiquidDriver so that LiquidDriver can then redeploy the liquidity across the farms of partner protocols.

The main goal of the project is to bring in more opportunities for users to earn yield on their tokens. This is achieved thanks to the utility attributed to the LQDR token.

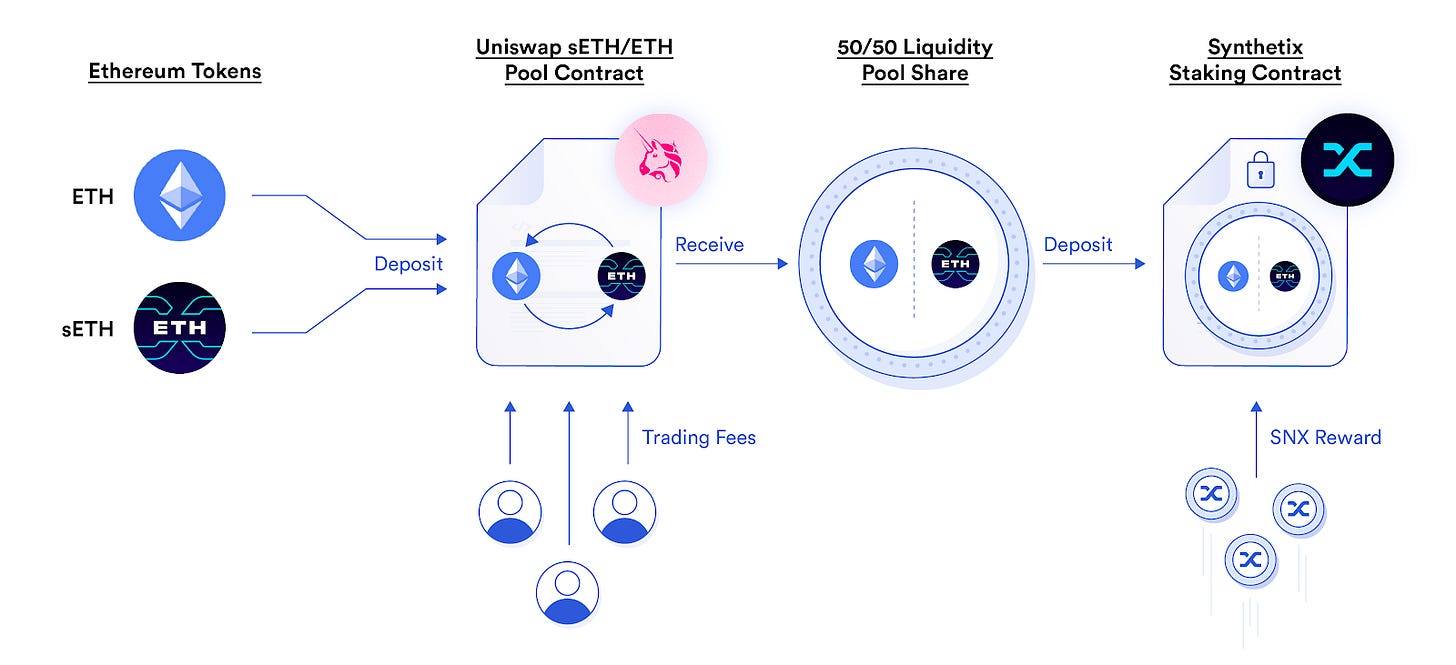

Liquidity mining is the process by which DeFi protocols put their native protocol tokens in a liquidity pool to allow users to earn additional tokens as rewards alongside the yield that comes from that given activity (lend, swap, LP…).

When users put their assets into a decentralized liquidity pool, they are eligible to earn the native token of the protocol. To do so, they can use the LP tokens to access a pro-rata share of the protocol revenue generated from fees. As an example, users could supply liquidity on the LQDR/FTM pair on Spiritswap to then deposit the LP token on the corresponding LiquidDriver farm in order to earn more liquidity mining rewards paid out in LQDR tokens.

Users can stake tokens from partner protocols to earn rewards:

Similarly, LiquidDriver also offers vault products that distribute rewards in LINSPIRIT, BOO, SPELL, BEETS, and LQDR tokens:

- Vault strategy where LP tokens are first staked into the protocol pools to be later deployed to a set of strategy contracts that will deploy the assets in protocol partner pools to generate yield which will be redistributed with qLQDR holders.

- SPELL rewards were phased out in July 2022, as the Fantom MIM3 pool was not providing SPELL incentives anymore, with the Abracadabra team shifting incentives to the Optimism pool instead. As a result, LiquidDriver also stopped providing LQDR incentives for it.

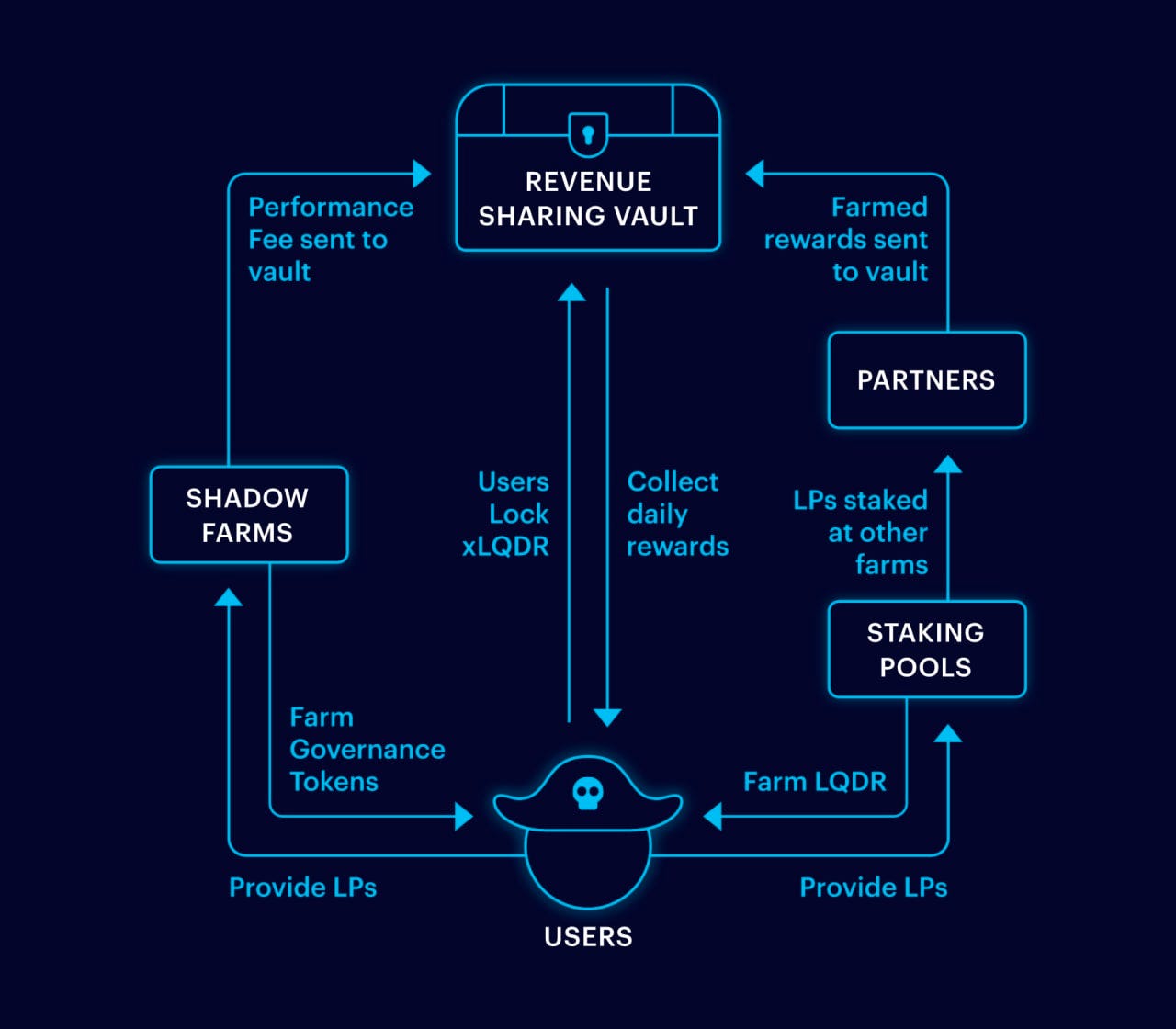

- Revenue-sharing vault is responsible for redistributing the daily rewards earned by the protocol to qLQDR holders. Rewards are collected from:

- Protocol strategies behind the staking pools.

- Performance fee applied on top of Shadow Farms.

Also, the utility of LQDR allows for additional use cases such as:

- Locking LQDR to generate qLQDR, which is the yield-bearing version of LQDR

- The longer the locking time, the higher the amount of qLQDR tokens the user receives.

Why The Project Was Created

LiquidDriver was born in Q1 2021 as the first high-yield liquidity mining application for Sushiswap on Fantom. It became the first protocol to allow users to stake their Sushiswap LP tokens and earn LQDR, LiquidDriver’s native token. This was a strategic launch opportunity, since Sushiswap deployed on Fantom without providing incentives.

The objective was to solve the problem of liquidity on Fantom. Despite its high-speed transaction throughput, the LiquidDriver team noticed that it was necessary to bring in more liquidity in order to grow the ecosystem. The thesis behind the project is that liquidity is the backbone for growing decentralized markets. In order to do so, the mission statement focused on:

- Prevent whales from manipulating token incentives by abusing their sizable funds to later dump on smaller stakers.

- Solve the problem of high token inflation, which usually leads to price suppression.

- Liquidity providers for non-LQDR token pairs bear less risk and are less inclined to “farm and dump”

“Farming and dumping” is the practice by which users utilize their capital (also known as mercenary capital) to use a protocol and reap the rewards from token incentives/emissions to later on sell and lock in a profit while abandoning the protocol and leaving retail in a position of disadvantage (the protocol will lose users, the token will drop in value, and the emissions rate might decrease).

The long-term vision was sharing the protocol revenue with LQDR holders. Once the liquidity is brought to an ecosystem, this opens up an abundance of opportunities for both LiquidDriver and partner protocols in the Fantom ecosystem. This statement is based on the premise that for LiquidDriver, collaboration is more valuable than competition.

In V1, the only demand driver for LQDR was the buy-back mechanism. However, the team quickly realized that charging a deposit fee and adding such dynamics on top were not enough to reach a level of organic growth in TVL. That was the origin of V2, which seeked to link the growth of the TVL to the revenue that is directed towards token holders.

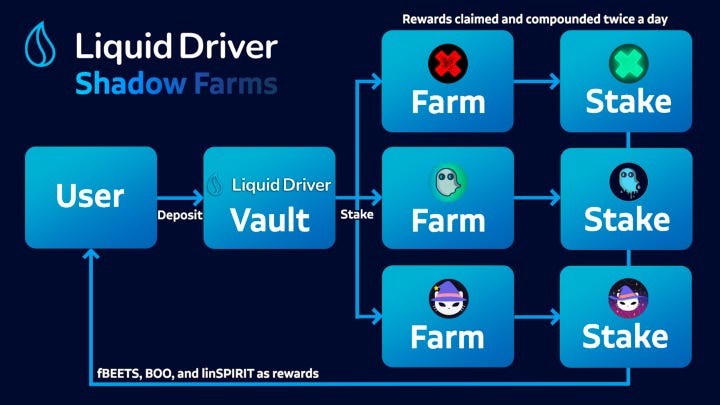

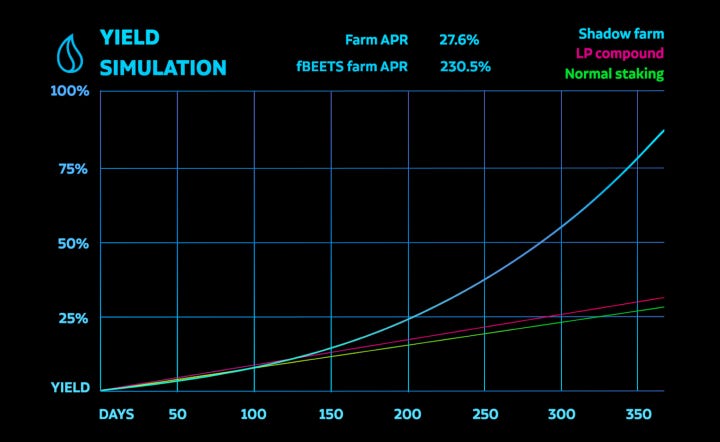

While V2 was a significant improvement for the protocol and helped to increase the total revenue, LiqiudDriver kept innovating by introducing Shadow Farms to allow users to increase the revenue they earn from their LP positions.

Protocol partnerships were a key driver for growth and lead the way to the current roadmap.

Roadmap

Team

Despite being anonymous, the team is accessible on Discord on a regular basis. The team also provides the community with regular updates on its blog, where it also uploads educational content for the protocol users.

- DrLiquid has studied economics and mathematics. He has working experience as a business developer in the FinTech industry, where he has worked for 2 years before launching his own venture in the same industry. Before launching LiquidDriver, he worked for Deus.Finance as a financial engineer.

- bX_Liquid has experience in marketing and consulting businesses. He also has experience working in startups and has been in the Web3 industry for 5 years.He is involved in several upcoming DeFi projects and DAOs as well, where he leads the business development and team-building operations.

- Smartlop is the lead Solidity developer. He has worked as a software developer before moving to the blockchain space in 2019, where he worked for protocols such as Pickle.Finance and Harvest.Finance.

- H.P is a full-stack and blockchain developer with 7 years of experience. He has experience building web applications using modern Javascript frameworks such as React, Angular, and Node.js

- JJBeG00d is the Community Manager for LiquidDriver and also the Spiritswap Crew leader.

- Homme is an advisor for LiquidDriver, and an early DeFi native. He is also a team member of the Berachain network.

- 0xH3pic is a LiquidDriver team member and can often be seen hosting and participating in protocol AMAs, releasing updates to the community, and more.

- GiWeD is a solidity developer for LiquidDriver.

- Pal is a solidity developer for Liquid Driver.

DeFi Subsector

With the goal of growing the Fantom ecosystem and attracting liquidity to it, LiquidDriver can be categorized as a Liquidity-as-a-Service protocol. With V2, the protocol expanded its yield-generating operations to offer on-demand-liquidity-as-a-service for DEXs, synthetic assets, on-chain options, and integrations with more partners.

LiquidDriver differentiates itself from other protocols by creating a positive sum for ecosystem partners. More usage of the protocol drives more liquidity and volume to those partners while enhancing the utility of the LQDR token as a revenue-sharing mechanism.

Yield farming encompasses many activities within DeFi where investors can use their existing assets to generate extra yield. Liquidity mining is one form of yield farming where protocols seek to attract investors by rewarding them with token rewards on top of the additional yield they can generate by organically using the protocol (lending, swapping, providing liquidity…). As a side effect, due to the extra liquidity that enters the protocol, liquidity mining is also a favorable condition for a better trading experience (traders get better prices, LPs collect more revenue from fees due to the increased trading volume…).

Since DeFi Summer, liquidity mining has played an enormous role in bootstrapping the liquidity of layer 1 networks and the decentralized protocols that sit on top. This technique has allowed protocols to distribute their governance tokens amongst investors in a fair and decentralized manner. Over time, liquidity mining programs have evolved significantly, mostly with the goal of achieving a more sustainable emission schedule for the protocol’s native token. While this might have caused a decrease in the realized APY (it used to be triple digits), this ensures a long-term sustainable growth for protocols.

Overall, the team has experience in traditional finance and seeks to improve upon legacy models through decentralized financial opportunities accessible to everyone.

Chains

LiquidDriver is available on the following chains:

- BSC

- Polygon

- Fantom

- KAVA

- Arbitrum

- Avalanche

For Users

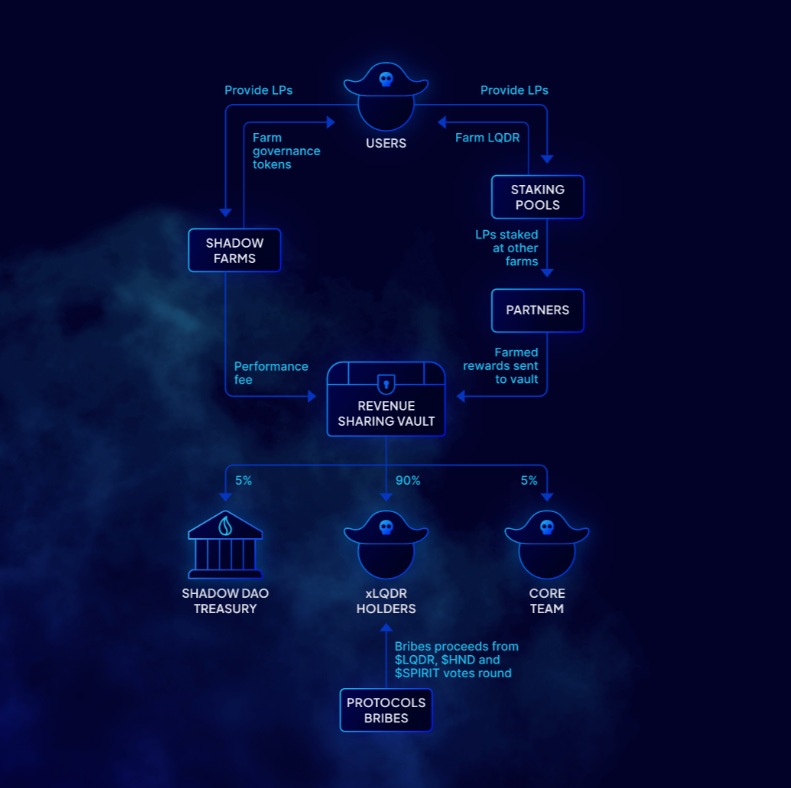

First, users deposit LP tokens in LiquidDriver’s farms. Second, these LP tokens are redeposited in partner farms to generate extra yield.

For (3,3) farms, the yield is compounded into staked governance tokens. A performance fee is charged as revenue for qLQDR holders.

This cycle seeks to align the incentives of both LQDR token holders and protocol partners.

Target Users

LiquidDriver aims to attract 3 types of users.

- Passive income users who may wish to lock up qLQDR for certain periods in order to gain access to protocol revenue constantly.

- Liquidity providers and yield farmers who are seeking higher yields on their existing farms, which translates to more protocol revenue in the form of performance and reward fees.

- Protocols that are looking to rent governance power in voting epochs to improve their LP yields, which results in bribes going to qLQDR holders.

mxLQDR

mxLQDR was changed to qLQDR on December 9, 2023.

mxLQDR was the yield-bearing version of LQDR (a Yield Producing Vested Asset). Its design is heavily inspired by Curve’s veCRV model. The goal of this economic model is to allow the protocol to progressively shift the strategy from a heavy farming token model to a demand and supply mechanism where the value captured by the underlying token is the result of the revenue captured by the protocol from its business operations. This is the reason why the initial buy-back and burn model was abandoned. Furthermore, by creating a vested version of the LQDR token, xLQDR provides further utility to the original token holders.

qLQDR

qLQDR is a new revenue-sharing mechanism, qLQDR, facilitated by Axelar.

Key features of qLQDR include:

- Flexible Locking Options: Lock LQDR on your preferred chain, including Arbitrum, Fantom, Avalanche, BNB, and Optimism.

- Multi-Chain Yield Claims: Retrieve yields from any available chain.

- Mirror batching: We reduced qLQDR cross-chain mirroring by executing the mirroring for every deposit within an epoch. Once you minted qLQDR, you will have to wait for the next execution in order to see your qLQDR on any chains, it will be performed before epoch switch.

- 12-Week Lock Period: Opt for a stable lock-in period without decay.

- Early Withdrawal Option: Withdraw your locked LQDR early with a penalty fee. LQDR taken from the penalty fee will be burned.

- Fees:

- Initial 50% early withdrawal fee for the first 3 months

- Constant 25% fee thereafter

- Expandability: Potential to include additional chains in the future.

(3,3) Farms

Shadow Farms were retired in June 2023, and were replaced by (3,3) farms. These are farms focused on Solidly type DEXs such as Thena Finance on BSC.

Similar to the previous shadow farms, users are able to provide liquidity on the underlying protocol, and then stake the LP tokens on Liquid Driver to enjoy higher yields.

The higher yield comes from the underlying farm APR, along with Single Staking APR from Liquid Driver locked NFT positions in the DEXs.

linSPIRIT

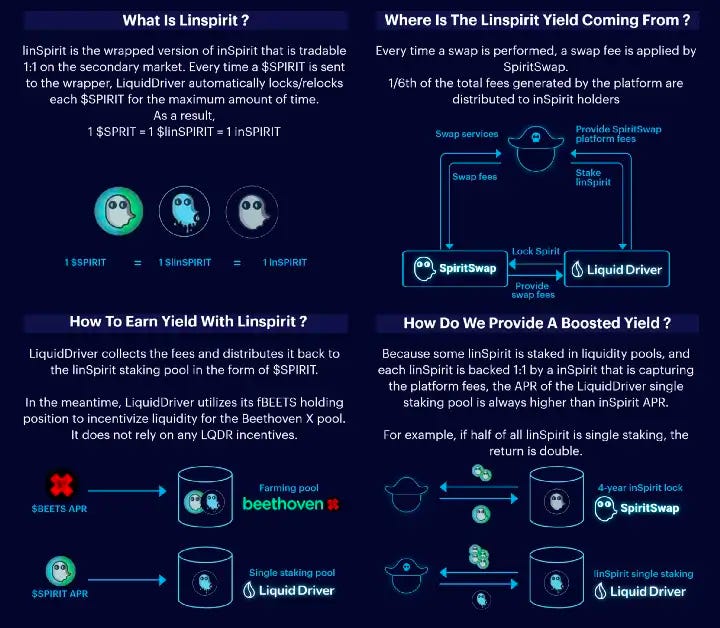

linSPIRIT is the liquid representation of inSPIRIT. This tokenized version makes it possible for users to keep on earning the weekly trading fee accrued by inSPIRIT while holding a liquid representation that can be deployed across DeFi.

- Users can swap SPIRIT for linSPIRIT at a 1:1 ratio

- To trade linSPIRIT back to SPIRIT, users must do so in SpiritSwap.

- When users swap SPIRIT for linSPIRIT, LiquidDriver locks the SPIRIT tokens for the maximum duration period (4 years) on a weekly basis. The protocol then uses the inSPIRIT it has received to boost yields on SPIRIT farms.

- Users can access a liquid position on their locked SPIRIT tokens and they are free to trade this locked position on a DEX at their own convenience

- This opens up investment opportunities such as:

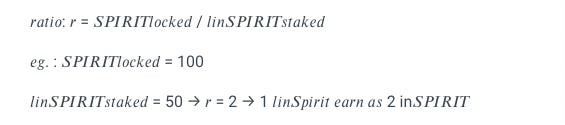

- Stake linSPIRIT to earn weekly rewards from inSPIRT amplified by the boost ratio. Stakers also earn 8% of the SPIRIT revenue from LiquidDriver’s strategies.

- The level of boost depends on the ratio of locked SPIRIT and the staked linSPIRIT.

- Provide liquidity for linSPIRIT/SPIRIT to earn LQDR

liHND

liHND is the liquid representation of veHND, which is a locked representation of the HND governance token.

Similar to how linSPIRIT works, liHND is minted when HND is locked in perpetuity. There is a total of 743K liHND in circulation, with LiquidDriver having a majority of the HND share at 55.9%.

The purpose of wrapping the veHND governance power is to offer users a way to boost the yield they are earning on Hundred Finance’s single-staking pools. This allows users to avoid locking their tokens while being able to automatically boost their yields on LiquidDriver (users do not have to hold either veHND or liHND).

- Users who do not lock HND get access to higher yields by staking on LiquidDriver.

- xLQDR holders earn a 12% performance fee from the protocol’s strategies (redistributed to the Revenue Sharing Vault on a weekly basis).

- liHND stakers earn an 8% performance fee on a weekly basis (gradually paid every block).

Due to the deprecated emissions of HND on Fantom, the plan is to migrate the liquid version of HND, liHND, to the corresponding staking pools in Optimism.

For Investors

Vault strategies

LiquidDriver V2 implements vault strategies to maximize returns for qLQDR holders. Users deposit LP tokens into LiquidDriver’s vaults and these LP tokens are then staked in partner pools by the protocol. The farmed rewards can then be claimed on a daily basis from the revenue-sharing vault.

LiquidDriverV3 changes the operations by introducing a performance fee that will impact the returns of qLQDR holders by applying this fee on top of the rewards farmed by Shadow Farms.

95% of the tokens that LiquidDriver earns on its partners’ pools are used to seed the qLQDR Revenue Sharing Vault. This Vault then redistributes the following rewards on a weekly basis:

- linSPIRIT and BOO from the protocol’s strategies

- LQDR from inflation

- liHND from Hundred.Finance pools

The remaining 5% is allocated to the team’s wallet for future development and maintenance of the protocol.

Business Model

LiquidDriver’s business model is two-fold, as a liquidity-as-a-service provider and governance token hunter and revenue accrual to holders of qLQDR, which represents locked LQDR.

Liquidity as a service:

The initial sole business model of liquidity-as-a-service was to incentivize liquidity for partners, farm with funds staked in their pool, and redistribute the rewards to qLQDR holders. While this was and still is successful, incentivizing with LQDR token emissions resulted in inflation. As a result, V3 is planned with the main goal of drastically cutting LQDR emissions through the implementation of the Shadow Farms while keeping the flexibility to temporarily emit some LQDR in response to specific business opportunities.

Governance power:

Complementing its core business model, accrual of governance power in partner protocols allows LiquidDriver to allocate and direct votes towards farms in ways that benefits its revenue streams, either by directly voting for native farms (eg, LQDR-FTM) without having to emit LQDR tokens as a bribe, or collecting bribes from protocols that may wish to rent governance power.

Revenue Streams

LiquidDriver gets its revenue from performance fees and farmed rewards taken from its farms and bribes under the V3 master gauge. As a liquidity-as-a-service provider, the more TVL that the protocol is able to attract and keep, the bigger the fees from farms and also eventually bribes. In order to provide attractive yields higher than the base protocols, LQDR token is being used as an incentive.

LiquidDriver has also started expanding cross-chain in order to integrate more partners, with LQDR being bridgeable to multiple chains.

Performance fees from the shadow farms and farmed rewards from staking pools and partners are both sent to the revenue sharing vault. From there, 90% of the revenue is distributed to qLQDR holders, while the remaining 10% is split equally into the Treasury and to the Team.

Economics

Fee Breakdown

- Zero deposit and withdrawal fees (there was a 4% deposit fee at genesis which has now been phased out).

- Performance fee applied to Shadow Farms

- 18% on Spiritswap farms

- 4% on Spookyswap and Beethoven farms

- Which are then sent to the revenue-sharing vault for further distribution into the treasury, qLQDR holders and core team wallet.

Operating Expenses

Liquid Driver currently emits 0 $LQDR due to its utilization of locked NFT positions on DEXs.

Tokens

By design, decentralized protocols that rely on liquidity mining to conduct their business have larger token emissions than other categories in DeFi. LiquidDriver seeks to target its users by aiming for a long-term sustainable return that can be provided while increasing the value, utility, and demand for LQDR.

The most important metric to assess for a Liquidity-as-a-Service protocol is its Total Value Locked (TVL), which refers to the economic value of assets that are locked into the protocol to access its functions.

Initially, LiquidDriver explored a buy-back and burn combined with a lottery feature. However, as the protocol progressed, qLQDR was introduced as the mechanism that would link the protocol’s growth in TVL to the amount of rewards that are distributed to the protocol users.

LQDR is an inflationary token deployed on Fantom and that has no maximum supply. Initially, 70,000 LQDR tokens were minted to the deployer address. This liquidity was used for airdrops and to provide the liquidity necessary to start the protocol operations.

- Contract address : 0x10b620b2dbac4faa7d7ffd71da486f5d44cd86f9

- Chain: Fantom Opera

- Max Supply: Unlimited

- Emissions per block: https://analyticsliquiddriver.com/d/n7nmUyigk/emission-data?orgId=1

Out of all the LQDR minted, 8.2% of the initial supply will be reserved for the team’s wallet to further make decisions on how to distribute expenses on marketing, partnerships, product development.

Token emission

Liquid Driver currently has 0 emission rates.

Initial Farming Offering (IFO)

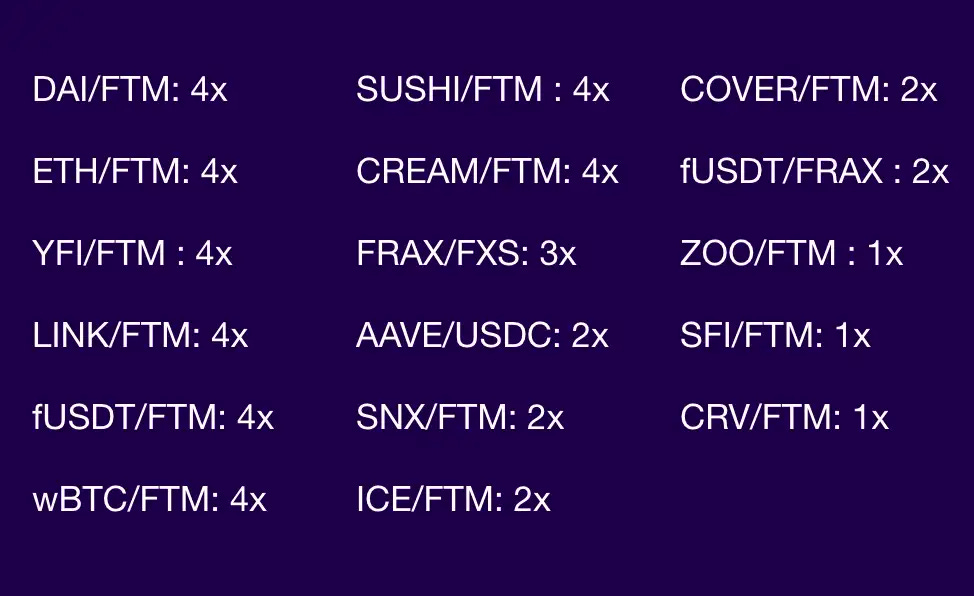

The first batch of LQDR tokens was distributed in a Liquidity Farming Offering that lasted 72 hours. The first 24 hours were reserved for early adopters to avoid whales from taking up big amounts of the rewards. The airdrop rewards amount for the people who staked in the first 24 hours are dependent on the amount of shares of the pool (which disincentivizes sybil attacks where airdrop hunters create multiple wallets to game the amount of tokens they get). At the end of the event, staking was opened. Several staking pools were boosted with LQDR rewards:

After the Initial Farming Offering event, the LQDR pools were launched with extra boosts for each liquidity pair (e.g. 18x LQDR boost on the FTM/LQDR pool).

In investing, ‘whales’ are investors that hold outsized positions when compared to the asset holding of other market participants invested in that asset

LiquidDriver has two tokens: a farming reward token, LQDR, and its vested version, qLQDR, which is used as the governance token:

- LQDR is the reward token issued by the protocol

- No maximum supply

- No official emission schedule (0.108 LQDR emitted per block at the time of writing, which is the equivalent of 10k LQDR tokens/day).

- Emissions will be reduced in the near future.

- The team is exploring different alternatives to increase the utility and value accrual of the token, mainly seeking to grow the TVL by incentivizing participation in the protocol.

- qLQDR is the governance token and vested representation of LQDR

- It is a revenue-sharing token designed to drive protocol revenue to token holders.

- Currently 95% of the native farm tokens earned by LiquidDriver are redistributed to qLQDR holders over time.

- By locking up qLQDR, investors can earn a passive income on a regular basis from a basket of assets that includes BOO, wFTM, LQDR, linSPIRIT, HND, and BEETS.

Till date, the amount of LQDR deposits into farms and qLQDR locks have been steadily increasing. However, it can be seen that the amount of LQDR that is being locked as qLQDR is gradually slowing down, whether due to locked APR being unappealing, low interest in locking duration/narrative, or just a lack of liquidity in the bear market.

qLQDR

qLQDR is a new revenue-sharing mechanism, qLQDR, facilitated by Axelar.

Key features of qLQDR include:

- Flexible Locking Options: Lock LQDR on your preferred chain, including Arbitrum, Fantom, Avalanche, BNB, and Optimism.

- Multi-Chain Yield Claims: Retrieve yields from any available chain.

- Mirror batching: We reduced qLQDR cross-chain mirroring by executing the mirroring for every deposit within an epoch. Once you minted qLQDR, you will have to wait for the next execution in order to see your qLQDR on any chains, it will be performed before epoch switch.

- 12-Week Lock Period: Opt for a stable lock-in period without decay.

- Early Withdrawal Option: Withdraw your locked LQDR early with a penalty fee. LQDR taken from the penalty fee will be burned.

- Fees:

- Initial 50% early withdrawal fee for the first 3 months

- Constant 25% fee thereafter

- Expandability: Potential to include additional chains in the future.

liveTHE

LiquidDriver has developed a liquid wrapper for veTHE yields on Thena (on the Binance Chain). As the protocol expands across chains, live wrappers become a new source of income for qLQDR holders, delivering emission-free yield.

- THE is the native token of Thena.

- veTHE is the ERC-721 tokenized representation of locked THE tokens, ranging from 2 weeks to 2 years.

- liveTHE is the liquid wrapper created by LiquidDriver. It maximizes returns on fees, bribes, and rebases into liveTHE:

- 81.5% for liveTHE single-staking pool.

- 10% automatically used to bribe the liveTHE/THE pool.

- 8.5% max for qLQDR holders.

- Rebases are claimable weekly and added to the veTHE position. Next, the protocol mints an equivalent amount of liveTHE each week after claiming the rebase and distributes it to both liveTHE/THE LPs and the liveTHE staking pool.

- Users can swap THE for liveTHE at any time 1:1 for no additional cost other than the fees associated with a normal swap

- Users can convert their veTHE for liveTHE. The max supply to be minted is capped on a weekly basis and incurs a dynamic conversion fee influenced by the balance of stable LP on Thena.

- Minimum conversion fee: 12.5%.

- Maximum conversion fee: 70%.

- Minting cap: 15% of the total supply at the beginning of the epoch.

- Dynamic fee = liveTHE / THE_balance * minimum conversion fee.

- Users can swap liveTHE for veTHE at the cost of a 3.5% conversion fee.

liveRETRO

$liveRETRO is the wrapper for Retro Finance’s governance token.

It allows users to enjoy yields gained from veRETRO positions, while still remaining liquid.

- $RETRO to liveRETRO

- Mint $liveRETRO without fees.

- Locks 100% of received $RETRO into veRETRO.

- veRETRO to liveRETRO

- Dynamic fee (30% to 70%), contingent on liveRETRO/$RETRO pool weight.

- Weekly mint capped at 15% of initial epoch supply.

- liveRETRO for veRETRO

- Incurs a 3.5% conversion fee.

Fees, bribes, and rebases earned will be converted to liveRETRO

Fees and bribes:

- 81.5% for liveRETRO single staking pool

- 10%: Automatically used to bribe the pool liveRETRO/$RETRO

- 8.5% for qLQDR holders

Governance

qLQDR is the native governance token of the protocol, which operates as a DAO via token-gated decisions where token holders can submit a vote on governance proposals. Users can create new proposals on the protocol’s Snaphsot page. For a proposal to be considered valid, it must surpass the minimum quorum of 1M qLQDR.

Since the first proposal in October 2021, LiquidDriver has completed and closed a total of 13 proposals. Among these proposals stand out: swapping SPIRIT rewards for linSPIRIT, making investments in other partner DAOs, votes on bribes, distribute treasury assets with qLQDR holders, or create a “Cross-Chain Fund”.

Risks

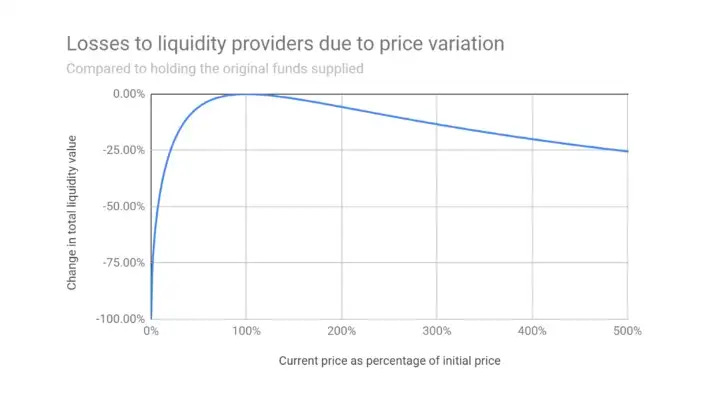

The most common risk in liquidity mining is Impermanent Loss. This is the result of the exposure of an investor to a liquidity pool. Since the user supplies 2 or more assets to a pool and the price of those assets fluctuate, the original liquidity will balance the user’s positions by selling from one token to the other. When this happens, it is possible for users to face scenarios where they could be better off holding the assets in their wallet instead of providing liquidity. If the assets are removed from the LP before the prices return to the original price ratio, the loss becomes permanent.

For example, a user provides $100 of LQDR and$100 of FTM to a liquidity pool. The user then receives a LP token that represents that liquidity position (a receipt of the percentage of a pool that the user is entitled to). As users trade in the pool, they will have to provide the same economic value for each asset so that the LP can maintain the initial 50/50 balance. However, the LP might be unbalanced when the prices are compared with external oracle price fees. If the user withdraws after the price ratio between the two assets changes, he will receive more of the asset in the pool that has a lower price, which results in a lower total balance (measured in USD) when compared to simply holding each asset in their wallet.

Impermanent loss is a common and well-known loss that impacts most liquidity providers that operate on decentralized exchanges. It leads to the potential loss of liquidity providers’ purchasing power as a result of the price slippage in the pools.

When a user provides liquidity into a pool, the two assets are bound together by the AMM to ensure that the value of your LP deposit remains the same. However, if the price of one asset changes drastically with respect to the other, the user might suffer impermanent loss.

This happens because the way most AMMs work is that the users’ initial position sells one of the assets on the way up, and buys on the way down. What ends up happening is that the assets are sold at a price that is an average of the starting and ending prices. If the user compares the original deposited prices with the return after providing liquidity and he/she is at a loss, he/she has experienced impermanent loss.

This is called impermanent loss because the loss is only realized if/when the user withdraws the assets from the pool. For instance, if the assets’ ratio goes from 5x (25.5% IL) but then reverts back to the same ratio as when the user entered the pool, there would be no impermanent loss.

Other than impermanent loss, users must also be aware of:

- Smart contract risks (bugs, security vulnerabilities in the code)

- Project risk (potential backdoors, team abandoning the project, the open source code not matching the deployed contracts…)

Security

The results from the audit by Solidity Finance state that no security vulnerabilities were found in the scope of the contracts that were submitted by LiquidDriver. However, the following issues were pointed out:

- There is an emergency function that can be called if there is an issue or the protocol runs out of rewards. This would allow users to withdraw their funds, but the rewards would be ignored.

- Anyone can call the harvestFromMasterChef() function to bring rewards from the MasterChef V1 contract to the MasterChef V2 contract. The MasterChefV1 contract has not been audited by Solidity Finance.

- The project team can add different types of tokens for staking.

- The project team can update the reward rates for each token at any time.

- A migrator function is present, allowing the core team to migrate all of the users’ staked funds to a new contract without restriction.

Certik noted the following issues:

- The feeHandler contract has a privileged role with respect to how the rewards are controlled by the DAO treasury. They recommended controlling this privileged role with a multisignature wallet to remove a single point of failure.

- The LiquidDriver team acknowledged the finding and has updated the privilege role with a Timelock contract and a Gnosis Safe Contract.

- Centralization risk in the Vault.sol, NonIncentivizedChef.sol and StrategyGeneralBoostLinSpirit contracts. Certik recommends that the owner of che contracts is represented by a multisignature wallet.

- The LiquidDriver team acknowledged the finding and has updated the privilege role with a Timelock Contract and a Gnosis Safe Contract.

- LiquidDriver acknowledged and resolved issues with regards to possible gas optimization in the contracts (none of this would pose any security risk), such as declaring some variables as constant or immutable.

Audits

LiquidDriver contracts have been audited by:

- Solidity finance (August 17th, 2021): https://solidity.finance/audits/LiquidDriver/

- MasterChefV2 contract at https://ftmscan.com/address/0xBfe3B559367ac4F0A80000FE7D83959b578C7bA0#code

- StrategySpiritLqdrSpirit contract at https://ftmscan.com/address/0x843e20b809c749858914044649210da7a9701efd#code

- Certik (May 19th, 2022): https://www.certik.com/projects/liquiddriver#audit

LiquidDriver has partnered with Immunify for a bug bounty program:

- The maximum bounty reward for regular contracts is $120,000

- The maximum bounty rewards for Shadow Farms is $200,000

Economic Attack Vectors

- Liquid wrappers (LinSPIRIT, LiHND, etc) are areas of exposure to smart contract risks, which can be exploited to affect the wrapped tokens. While the underlying governance tokens will still be held by the contract, it will present a loss of confidence and price performance.

- The LQDR token itself does not have a limited cap in order to be able to use it as an incentive as and when it is needed. It is a possible area of exploitation that can cause massive dilution to the token if affected.

Dependencies and Access Controls

It is worth noting that, while the access control noted in the audits have been resolved by the team, there is still a trust issue, since the protocol team is responsible for managing the multisig and signing transactions that enable critical protocol operations.

Liquidity risk

While liquidity mining delivers high returns for investors (due to token inflation being allocated to strategic/active users in the protocol), investors must be aware of the two main risks involved in this activity:

- Market volatility will lead to fluctuations in asset prices. As a result, this increases the likelihood of suffering from impermanent loss. It is worth noting that impermanent loss can occur in both directions. The general situation is that the earnings from trading fees should outweigh the impermanent loss. However, it is not uncommon to see scenarios where investors would have been better off withdrawing and holding the assets in their wallet instead of providing liquidity.

- Bad actors or developers dumping their own team tokens or removing liquidity from the rewards pool. Developers can also introduce a backdoor in the smart contract to remove investors’ funds (this is known as “rug pull”).

Project Investors

The team has confirmed that there were no seed or angel investors for LiquidDriver.

Additional Information

The team publicly acknowledges the importance of the community as the first marketer. Besides, many community members have often brought up development ideas that fit perfectly with the protocol’s vision. The majority of contributions revolve around constructive conversations around the protocol that lead to improvements.

Partnerships

LiquidDriver runs a Partner Incentive Program that consists in opening a pool for partner projects and incentivizing liquidity depth in those pools with LQDR rewards.

While the protocol will keep on operating its liquidity mining strategies with its partner protocols, LiquidDriver is also seeking to iterate on their current product offerings and, therefore, is looking to expand their business as follows:

- SpiritSwap:

- Increase TVL on SpiritSwap.

- Give more utility to LQDR on SpiritSwap.

- Reduce the amount of inflation that is needed to incentivize new LPs.

- Boost yields by using the governance power accumulated by LiquidDriver through linSPIRIT.

- Spookyswap:

- Drive the liquidity to the pools that need it most.

- Provide BOO returns to xLQDR holders.

- Beethoven:

- Drive more liquidity to the protocol and strategically allocate assets based on Beethoven’s needs.

- Provide BEETS returns to xLQDR holders.

- Leverage Beethoven’s infrastructure to strengthen linSPIRTIT’s peg.

- Hundred Finance:

- Drive more liquidity to Hundred Finance.

- Provide weekly HND returns to xLQDR holders.

- Boost yields with the governance power acquired through liHND, which locks HND into veHND in return for governance power.

- Satin Finance

- Provide deep liquidity for Satin Finance, allowing users to trade with minimal slippage and price impact.

- Sterling Finance

- Bringing liquidity to Arbitrum.

- Partnership to address issues such as liquidity incentivization and promote long-term sustainability and growth.

- Sterling Finance is providing initial allocation to Liquid Driver as part of the partnership.

- Thenaswap

- Solidly inspired liquidity layer and a DEX on Binance Smart Chain.

- THENA airdrop to a group of xLQDR/FNFT holders.

- Boost yields by using the governance power accumulated by LiquidDriver through veTHE.

- Drive liquidity to Thenaswap via it’s farms.

- Equalizer

- Solidly inspired liquidity layer and a DEX on the Fantom network.

- Boost yields by using the governance power accumulated by LiquidDriver through veEQUAL.

- MorphEx

- Decentralized perpetual exchange powered by Fantom network.

- A swap involving 66,666 xLQDR from LiquidDriver in exchange for 100k esMPX from Morphex.

- Equilibre AMM

- Solidly-inspired liquidity layer on the Kava EVM chain.

- LiquidDriver’s users will benefit from Équilibre’s unique ve(3,3) liquidity mining model, while Équilibre will benefit from LiquidDriver’s best-in-fleet strategies to create an efficient and attractive equilibrium.

- Ramses Exchange

- Ramses is ve(3, 3) dex on Arbitrum that offers veNFTs to top protocols on Arbitrum. The protocol optimizes for community and decentralization.

- Chronos Finance

- A community driven liquidity layer & AMM on Arbitrum that uses a vote escrowed model to drive Liquidity to the highest volume pairs.

- SoliSnek Finance

- A decentralized exchange (DEX) and automatic market maker (AMM) on Avalanche that has been built upon the original Solidly vision.

In addition, LiquidDriver is also working with two DEX aggregators: Rubic, and Yoshi.Exchange.

FAQ

I locked LQDR yesterday, why can’t I claim my rewards?

If you deposit during an epoch N, you need to wait until the next epoch N+1 to be able to claim your rewards from N. At epoch N+2 you can claim your rewards from epoch N+1, and so on.

Why did I get back such a small amount of xLQDR tokens after locking a higher amount of LQDR?

The amount of xLQDR that you receive as a user is based on the duration of your locked period.

If you lock for 2 years (max) you will receive the full amount that you locked.

If you lock for 1 year, you will get half the amount that you locked.

If you lock for 6 months, you will get a quarter of the amount that you locked.

Why is my balance of xLQDR tokens decreasing every day?

This is a design choice. As you approach the end of the lock period, your xLQDR balance will linearly decrease to zero. When the balance reaches zero, it means that you can withdraw the LQDR tokens that you originally locked.

To avoid this decay, users can progressively lock more LQDR tokens.

Why do I get an error that is preventing me from locking more LQDR tokens?

Each user can only extend the lock period once a week.

What can I do with my linSPIRIT holdings? How can I increase the rewards I am earning from it?

linSPIRIT is currently awaiting further progress from SpiritSwap’s situation.

Community Links

- Website: https://www.liquiddriver.finance/

- Shadow Farm: https://www.liquiddriver.finance/shadow

- linSPIRIT: https://www.liquiddriver.finance/linspirit

- Twitter: https://twitter.com/LiquidDriver

- Discord: https://discord.gg/z9GEvBJay6

- DefiLlama: https://defillama.com/protocol/liquid-driver

- Analytics: https://analyticsliquiddriver.com/

Odysee: https://odysee.com/@LiquidDriver