Overview

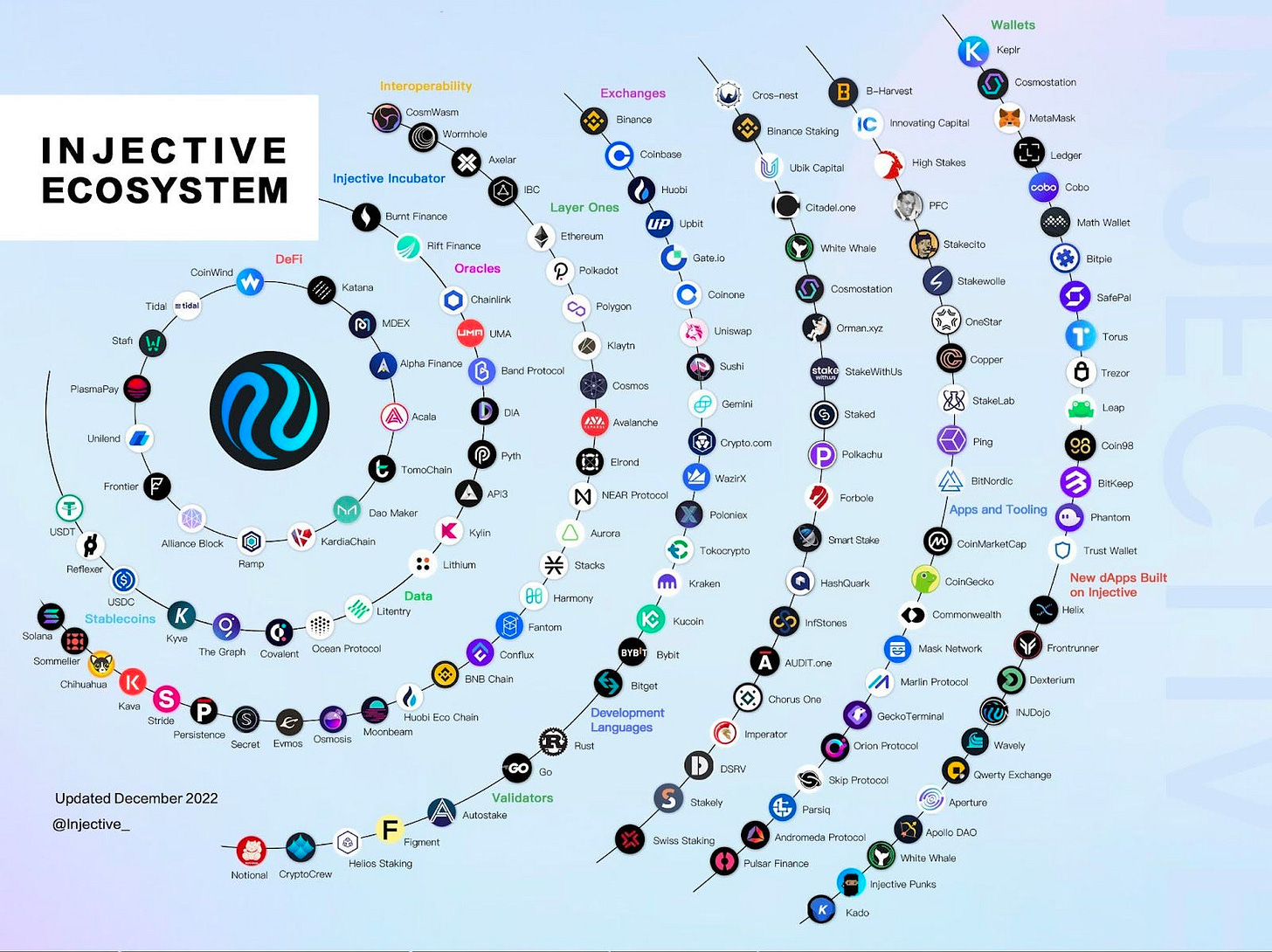

Injective is an interoperable and sector-specific blockchain in the Cosmos ecosystem that supports decentralized applications built on top of a CosmWasm smart contract layer. Among its most dominant DeFi applications, we find spot and derivatives exchanges, prediction markets, lending protocols, and more.

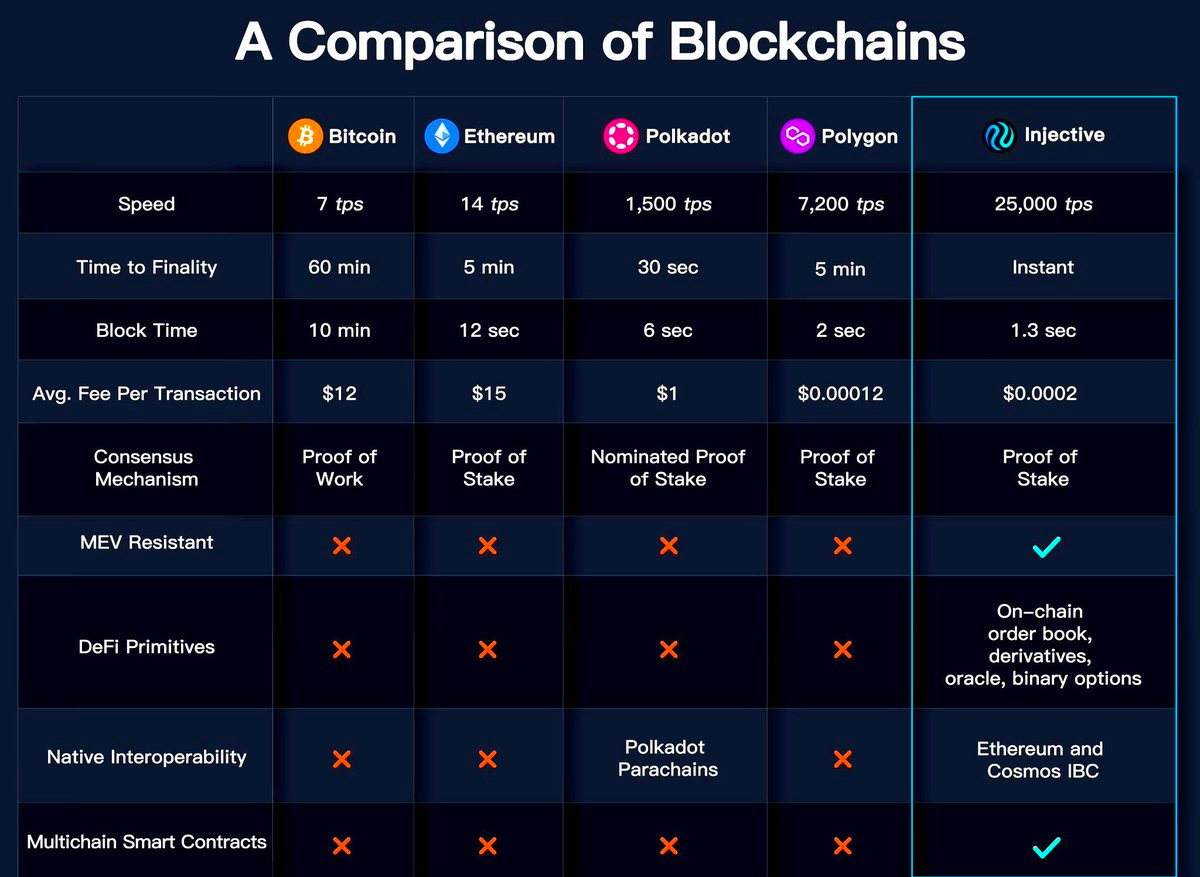

Injective provides core financial infrastructure primitives that applications can leverage in an MEV-resistant way and with zero gas fees for end users. This is achieved with high throughput of up to 25,000 tps (transactions per second) and a block creation time of ~1 second, making it one of the fastest blockchains on Cosmos in terms of block times.

The Injective Hub refers to the platform and gateway that allows users to interact directly with Injective. Some of its core functionalities include: wallets, bridge, staking, governance, auctions, and insurance funds.

Modules

Traders can access functionality provided by different modules.

- Auction – allows token holders to bid on a basket of assets that have been accumulated from exchange trading fees.

- Exchange – helps to build spot and derivatives markets: orderboook management, trade execution, order matching, and order settlement.

- Insurance – supports underwriters who back the derivatives markets hosted on the exchange.

- Oracle – obtains real-world price data (such as traditional stock market data) used to set asset prices on the INJ exchange.

- Peggy – bridges ERC-20 tokens and Cosmos-native assets.

Architecture

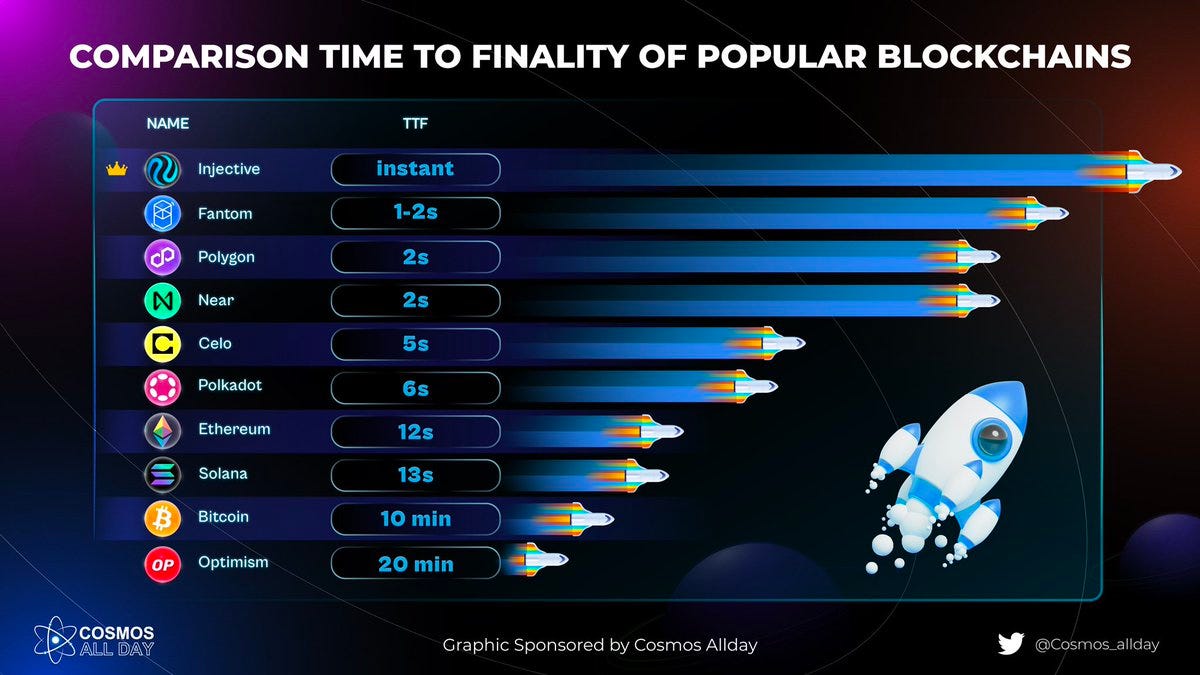

Injective is built using the Cosmos SDK and Tendermint consensus, which allows it to achieve instant transaction finality while sustaining lightning-fast speeds (25,000+ TPS). Thanks to the Cosmos SDK, Injective can develop and implement custom modules, such as their orderbook Dex primitive.

By leveraging Tendermint’s instant finality and the Cosmos SDK’s customizability, Injective is one of the fastest blockchains in Cosmos in terms of block time and can build high-performance primitives such as a fully on-chain central limit order book Dex. As an example of this, Injective’s orderbook engine uses an FBA (Frequent Batch Auction) model that fills orders according to priority over a specific period of time known as the auction interval, which works quite well with its low block times. In addition, Injective can facilitate fast cross-chain transactions across Ethereum and Cosmos Hub. Injective natively uses IBC and is also interoperable with other layer 1-chains with a Wormhole integration. This integration extends the utility for users beyond simple asset transfers. For instance, dApps on Injective could enable seamless cross-chain trading across the Cosmos and Solana ecosystems while also being able to offer yields on Solana (or any other Wormhole-supported asset).

- As a smart contract platform, Injective is optimized for DeFi. It provides out-of-the-box financial primitives such as a fully decentralized order book. For instance, applications can leverage this module to launch derivatives exchanges, prediction markets, sports betting platforms…

- Injective is natively interoperable across a number of sovereign blockchains while also being IBC-enabled. This allows Injective to facilitate seamless transactions across Ethereum, Moonbeam, Cosmos Hub, Avalanche, Solana, and more.

- Injective supports CosmsWasm, a smart contract platform built for the Cosmos ecosystem and that developers can use to easily launch their own smart contract applications.

- Since Injective supports cross-chain transactions with Ethereum and all interoperable chains, it is possible to launch both Ethereum and IBC compatible tokens.

- Intuitive developer experience with flexible and expressive development environments powered by Rust and Golang.

- Injective’s exchange infrastructure is MEV-resistant and its on-chain matching engine employs frequent batch auctions (FBA) with uniform-clearing prices every block to prevent any form of front-running.

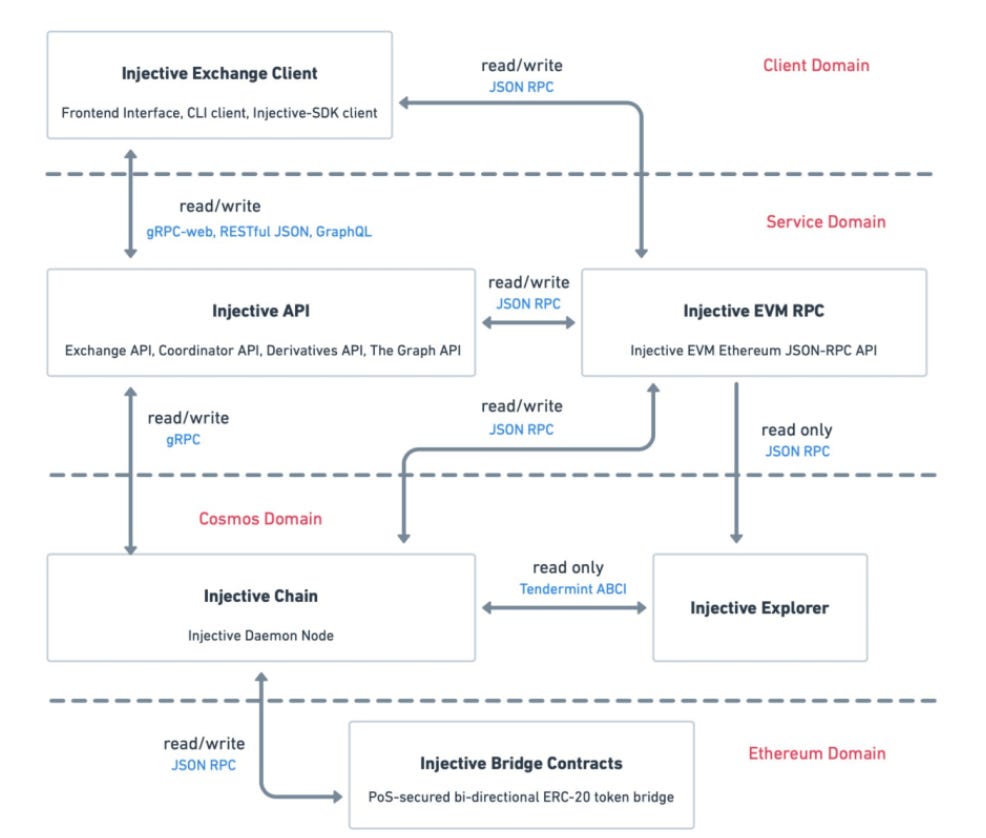

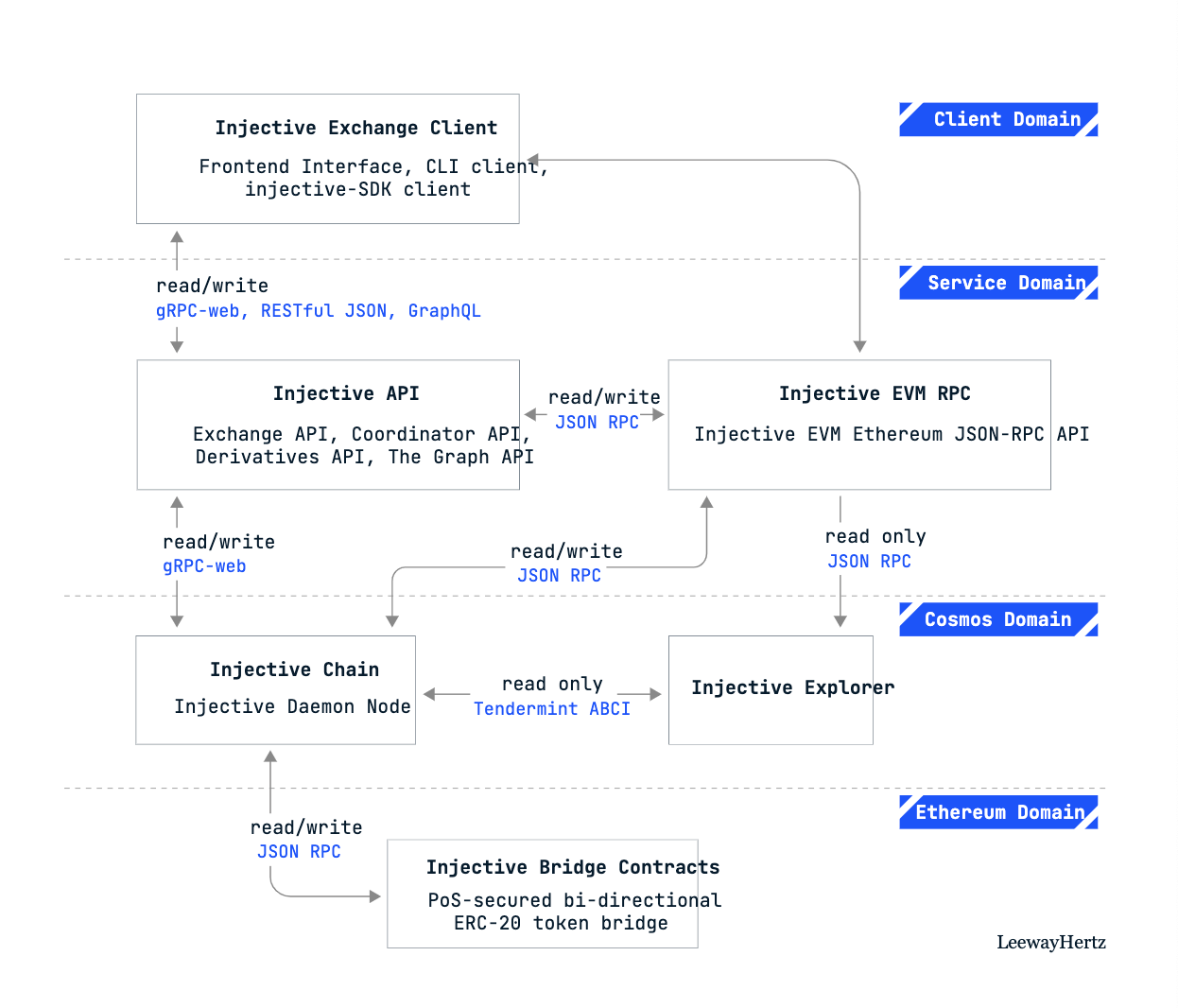

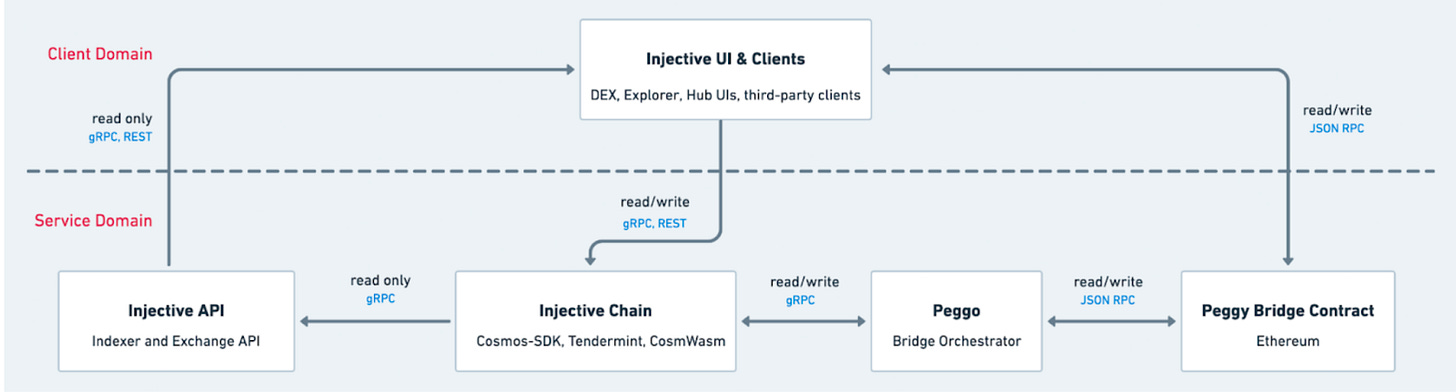

As part of its technical infrastructure, Injective is comprised of 4 main components:

- Injective chain nodes address the scaling and throughput limitations of many layer 1 blockchains.

- Injective dApps and tooling.

- Injectived is a command-line interface and node daemon that connects to Injective.

- Injective TS is a Typescript monorepo that contains packages that can be used by developers to interact with Injective from a Node.js or browser environment.

- Injective Python SDK is a framework used to interact with the Injective chain and Indexer (Exchange API) in Python.

- Injective Go SDK is a framework used to interact with the Injective chain and Indexer (Exchange API) in GoLang.

- Injective local is a testnet and local environment orchestrated with Docker containers with a simple docker-compose file.

- Injective CW is a Rust library designed to help developers build modules as well as interact with Injective’s core modules to call other CosmWasm smart contracts.

- Cosmovisor is a process manager around the Cosmos SDK that monitors the governance module.

- Injective’s exchange client provides a decentralized exchange with an open-source front-end interface that can be deployed on IPFS (InterPlanetary FileSystem).

- Injective’s bridge smart contracts provide cross-chain bridging infrastructure with Ethereum as well as with any IBC-enabled blockchain.

- Secured by validators in the Injective chain.

- Powered by Injective’s custom peggy bridge system.

- Supports standard ERC-20 and IBC-enabled transfers.

- Supports the transmission or arbitrary data, enabling cross-chain execution and smart contract interoperability capabilities with Ethereum.

- Injective API nodes serve 2 main purposes:

- Serve as the data layer for external clients. Each Injective API node indexes data from the Injective blockchain in real time and provides high-performance and low-latency API endpoints that are implemented for hosting user interfaces, high frequency market making, hosting analytics interfaces or block explorers….

- Provide transaction relay services, which allows applications to make it possible for users to send transactions with zero gas fees paid, thanks to Injective’s fee delegation mechanism.

Decentralized Exchange Primitive

Developers can build Dexes on Injective in order to offer a fully decentralized and on-chain experience that is owned and governed by the community. This primitive also makes it possible to deploy permissionless trading environments where any type of on-chain spot, perpetual, futures, and options market can be launched. The module offers support for an orderbook, matching engine, liquidation engine, oracles, and insurance funds. It also provides developers with capabilities such as advanced order types (stop loss, take profit, reduce-only, post-only), on-chain market maker rebates, liquidity incentives, and subaccounts management capabilities.

As an incentive mechanism to encourage exchanges to act as relayers and source trading activity on Injective, exchanges who originate orders into the shared orderbook on Injective’s exchange protocol are rewarded with 40% of the trading fees from the orders that they source. The protocol itself implements a global minimum trading fee of 0.1% for makers and 0.2% for takers.

Insurance funds

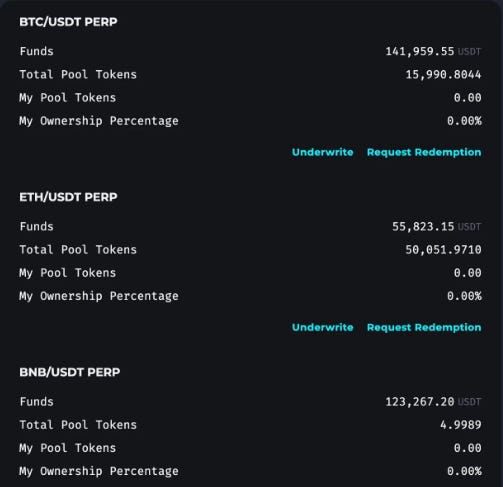

Since Injective allows for the permissionless creation of new markets, there are concerns over protocol solvency. This drove Injective to adopt an isolated risk coverage model. Since Injective doesn’t want risk in one market to spill over to other markets, it requires each new pair to establish an insurance fund before trading is allowed to commence.

In order to isolate risk, Injective features a system of insurance funds. The reason for that is because during periods of high volatility in margin trading, the losing party on a trade might not be able to afford to pay the winning party if they run out of margin, i.e. the position becomes bankrupt. If the trader’s position is liquidated and the new trader takes it over at a worse price than the bankruptcy price, the insurance fund is utilized to cover the resulting deficit.

The insurance fund grows when a position is liquidated at a price that is better than the bankruptcy price. In the scenario where the closing price of a trade is worse than the bankruptcy price, then funds are withdrawn from the insurance fund to pay the winning party.

Unlike most trading platforms, the insurance funds on Injective are specific to each market. This implies that there is not a general pool of capital where insurance funds are accumulated. Instead each new market that is opened on Injective has its own fund. This way, the risk for underwriting insurance is segregated to each market separately.

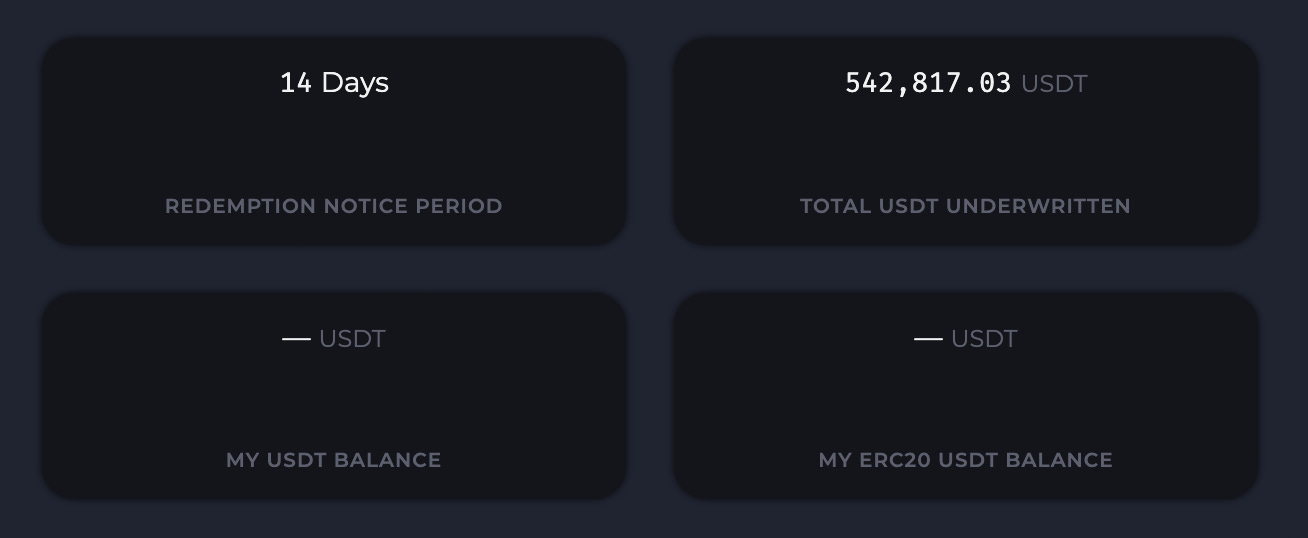

In order for users to underwrite insurance for a derivative market, they stake the collateral asset for that market and, in exchange, receive insurance pool tokens specific to that market. These pool tokens symbolize pro rata (proportional) ownership of the insurance fund. Over time, as the insurance fund grows from liquidation proceeds, the insurance fund backers earn yield from the increase in value of their stake in the insurance fund.

There is a 14-day redemption period to withdraw capital from an insurance funds.

Volan Upgrade

The Volan Upgrade was implemented on January 11, 2024.

With the Volan Upgrade, Injective enables the world’s first native real world asset infrastructure, enhances its blockchain scalability, expands its interoperability, introduces novel burn capabilities, alongside a myriad of groundbreaking enhancements. The Volan Upgrade brings an unmatched L1 infrastructure for developers and institutions alike.

The First Ever RWA Module

Injective has introduced the world’s first Real World Asset (RWA) Module, offering a never before seen approach to creating and managing permissioned assets with extensive customization options. Injective is the only blockchain to support a permissioning layer directly on its native chain which retains capital efficiency for all users while adding compliant access points for financial institutions.

This module enables both institutions to easily launch and access a variety of structured products and RWAs. These include unique offerings such as tokenized fiat pairs, treasury bills, and exclusive credit products, accessible through compliant gateways. Additionally, the platform allows for the creation of tokens with tailored features, including specific allow lists that control asset access.

Interoperability Expansion

The Volan Upgrade introduces an enhanced iteration of the Inter-Blockchain Communication (IBC) Protocol, opening up direct interaction with Injective’s Web3 financial modules, including its on-chain orderbook.

This integration facilitates cross-chain transactions, encompassing advanced order routing and swaps. To illustrate, consider a scenario where a user wants to perform a cross-chain swap using a dApp on another IBC-enabled chain such as Celestia. Through a user-friendly interface, the trader can seamlessly execute the cross-chain swap and route it through Injective’s orderbook module to complete the swap, all without needing detailed knowledge of the underlying processes.

This process eliminates the need for users to navigate through multiple steps, offering a seamless and efficient experience.

Enhanced Enterprise Grade Scalability

Injective’s latest enterprise APIs brings a large update to significantly reduce latency by up to 90% for institutional users. This revamped process is realized through an innovative mechanism that allows users to bypass indexers and directly post transactions onto the blockchain.

The result is a substantial boost in efficiency and speed, further cementing Injective’s position as the fastest L1 for finance ever built.

New Exotic Oracle Feed Design

In its ongoing commitment to foster a network that allows, and is primed for all financial assets such as RWAs, Injective now allows applications to seamlessly integrate off-chain price feeds directly into the blockchain. This empowers dApps to effortlessly introduce a diverse range of exotic assets, markets, and products, spanning foreign exchange (FX) to tokenized bonds and beyond.

Token Economics Optimizations

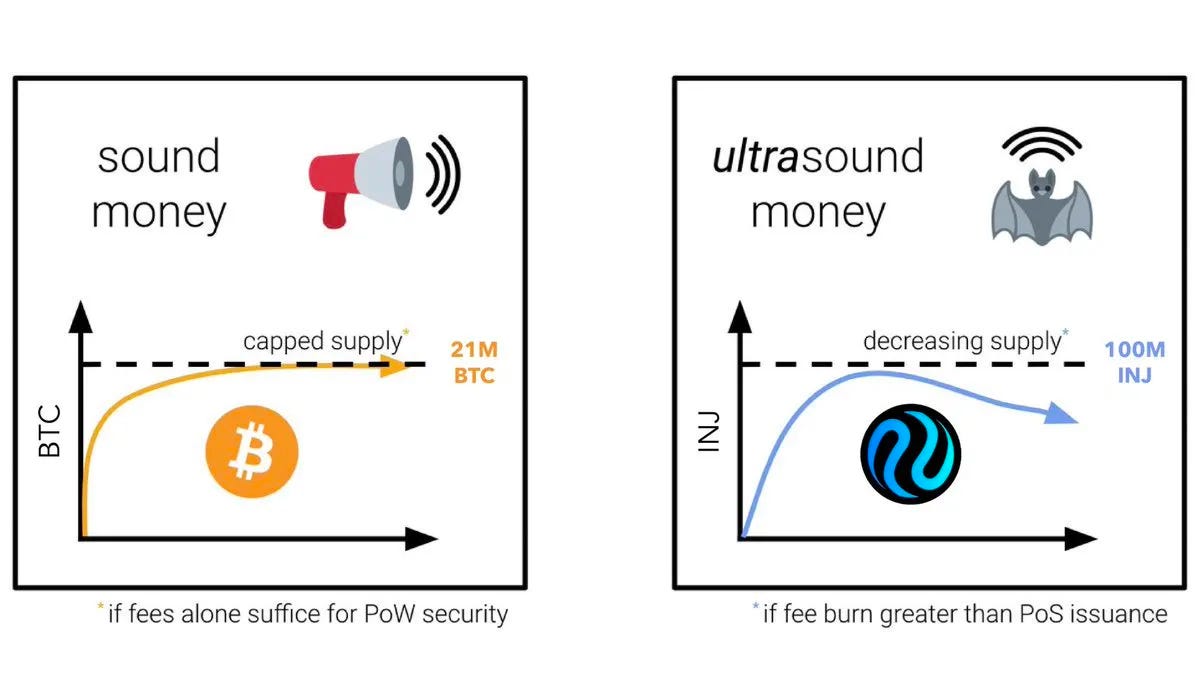

Injective has also modified its on-chain inflation parameters, making the INJ token increasingly deflationary over time. The token’s economics are now designed to improve dynamically as staked assets grow, potentially reducing inflation to near zero in the long term.

Token Burn Enhancements

The Volan Upgrade also provides a much requested feature by the Injective community: the ability to burn any bank token generated on Injective. This allows any project on Injective to have heightened capabilities to carry out token burns.

Roadmap

- 2023 Q1

- Injective Hub V2

- Institutional Zone

- 2023 Q2

- Injective Exchange Module V2

- Casablanca Upgrade

- 2023 Q3

- Injective Orbital Chains

- 2023 Q4

- Mesh chain network

- Carcosa Upgrade

- 2024 Q1

- Multi VM Chains

- Volan Upgrade

Team

Injective Labs is the research and development company focused on the development of the Injective ecosystem. The company was founded by Eric Chen and Albert Chon in 2018 and incubated by Binance Labs in that same year.

- Eric Chen – CEO and Co-founder of Injective Labs.

- Investor at Vessel Capital.

- Venture Partner at Innovating Capital.

- Albert Chon – CTO and Co-founder of Injective Labs.

- Software development engineer at Amazon.

- Consultant at OpenZeppelin.

- Full stack software engineer at Linc Global

- Marketing and copywriter at L3 networks

- Mirza Uddin – Head of Business Development

- General partner at Vessel Capital.

- Two Sigma investor – one of the largest quantitative hedge funds in crypto with $50B in AUM (Assets Under Management).

- Venture Capital at Index Ventures – early backers of Dropbox, Roblox, Notion, Figma, and Robinhood among others.

- Chris Choi – SVP of Product

- VP of product at Crypto.com.

- Founder of Scribe Intelligence.

- Data analyst and project manager at Bloomberg.

- Noah Axler – General Counsel

- Julie Lee – Director or Marketing

- Product marketing at Together Labs.

- Content marketing at Tesla.

- Marketing content specialist at Samsung Electronics.

- Bojan Angjelkoski – Technical Lead

- Senior software engineer at World Trade Organization.

- Full stack engineer at Nullsec.

- Full stack engineer at NG Solutions GmbH.

- Nam Dang – Technical Lead Engineer

- Blockchain engineer at Laclary.

- Blockchain engineer at Ferdon

- Software engineer at Touchstone AI.

- Nikola Marcetic – DevOps Engineer

- Ruth Tsang – Product Design Lead

- Product Designer at Freelance.

- Designer at Dune.

- Joan De Arcayne – Product Manager

- Co-Founder at UnchainedTools

- Product Director Wallet at Paxful

- Markus Waas – Blockchain Engineer

- Blockchain Consultant at Ocelot

- Founder at SolidityDeveloper

- Thomas Lee – Frontend Engineer

- Frontend Developer at Chainstack

- Fullstack developer at Helixtap

- Achilleas Kalantzis – Integrations Engineer

- Vessel IT Engineer at Lomar Shipping Limited

- IT Assistant at The Libra Group

- Bartek Tofel – Blockchain QA Engineer

- Phuc Ta – Software Engineer

- Mikhail Pustovalov – Blockchain Engineer

- Michele Meloni – Golang Software Engineer

- Back-End Software Engineer at CodeNotary

- Golang Senior Developer at Payfolder

- Shane K Moore – Senior Front-End Developer

- Front-end Developer at William Blair

- Advisor at Open Koi

- Xinran Xu – Business Development

- Global Business Development at B-Labs

- FellowFellow at FinTech4Good

- Vivian Ma – Marketing Manager

- Astra Rakhmatilla Kyzy – Crypto Accountant

- Staff Accountant at Robert Half

- Associate at HC Global Fund Services, LLC

- Yangyang Li – PR Manager

- Liangliang Ning – Graphic Design Lead

- Jacqueline Finnegan – VP of Talent Acquisition

- Talent Advisor at Anti Capital

- Senior Recruiter at Kraken Digital Asset Exchange

- Dimitar Dimitrov – Community Manager

- Stefan Pik – Community Manager

- Alex Pao – Community Manager

Sector Outlook

Injective is a layer 1 blockchain on Cosmos optimized for DeFi protocols. Its value proposition is to provide the most advanced and next-generation financial infrastructure for building decentralized, fast, cross-chain, and low-fee applications (zero gas costs for end users). On multiple occasions, Injective has signaled their intent to continue building applications that onboard new users and facilitate the growth of institutional adoption beyond cloning use cases from established applications on EVM chains. As the industry moves away from exorbitant DeFi yields coming from highly inflationary assets, Injective is ready to offer products that are often seen in TradFi, such as spot and derivatives markets based on an orderbook model.

Even though Injective has consolidated its dominance in the Cosmos ecosystem, they still confront the competence of established competitors in other chains such as GMX, Synthetix, or Gains Network. Also, DyDx is expanding its services and deploying their custom appchain in Cosmos. Injective will also face the competition of Kujira, Sei, and other Cosmos competitors who are coming into the scene. More specifically, Injective was built as a sector-specific chain focused on the development of an interoperable ecosystem for spot and derivatives trading.

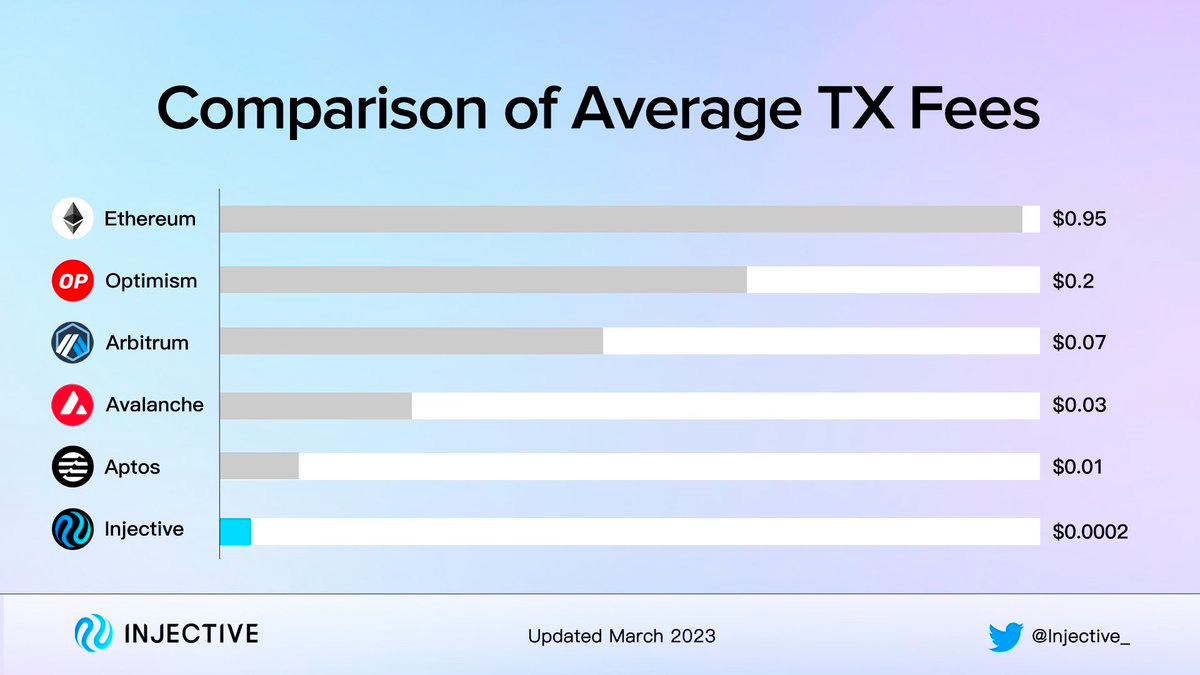

Gasless trading

Built on the Cosmos SDK, the Injective Chain employs customized Ethereum accounts, app-generated wallets, and a distinct implementation for parsing EIP-712-typed data. This makes it possible for users to pay zero gas fees, since their transactions are subsidized by the Exchange’s relayer. Even if that’s the case, Injective still has one of the lowest average transaction fees in the industry.

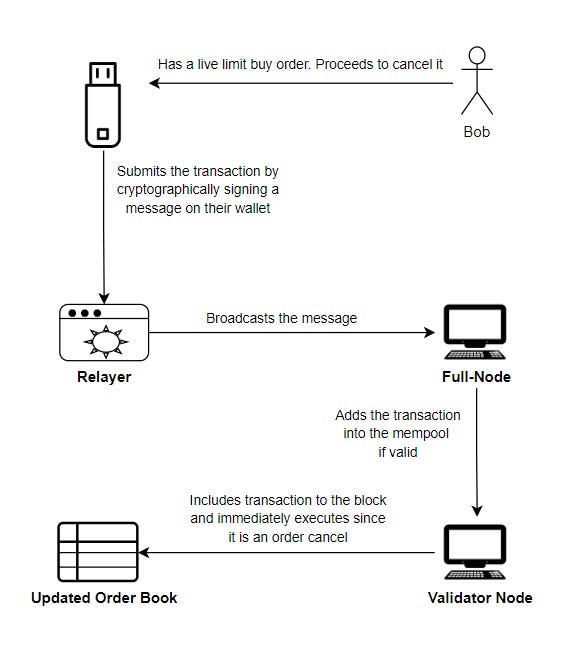

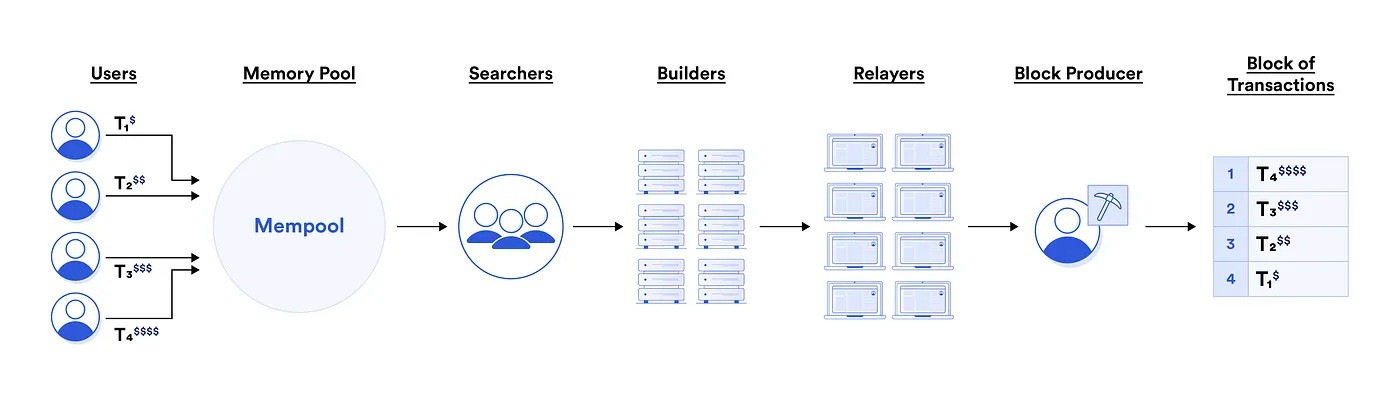

Users convey interaction requests via cryptographically signed messages to Exchange dApps (relayers). These messages, known as meta-transactions, are then transmitted by the exchange DApp to a comprehensive Injective Chain node, where they are unpacked and added to the mempool. Subsequently, the node examines the transaction and incorporates it into a block, arranging transaction execution based on categorical priority. Liquidation and order cancellation requests receive preferential treatment in this process.

Injective’s unique way to process transactions greatly benefits end-users by eliminating gas fees when accessing the chain via an exchange dApp. Instead of traders, Exchanges broadcast signed messages to Injective Chain nodes, and all associated fees for chain interactions are absorbed by the exchange dApp, resulting in no gas fees for traders. This enables users to trade on the exchange without holding INJ tokens in their accounts, significantly improving the user experience.

In return, Exchanges are rewarded with 40% of trading fees collected through their front-end. All these exchanges are connected to the same markets via a shared orderbook but differ in how they provide access. For instance, one exchange can offer a swap mechanism for spot markets with a UI akin to AMM DEXs, another exchange can give access to a subset of all the perp markets…

Fastest time to finality

Injective has 1-2 seconds block time with instant finality and can support up to 25,000 transactions through Tendermint.

Injective is also the fastest blockchain in the Cosmos ecosystem.

MEV-Resistance

Injective is the first decentralized application of a Frequent Batch Auction (FBA) process for ordering transactions. This allowed Injective to be already an MEV-resistant blockchain prior to Skip’s integration. However, Skip’s integration ensures that any form of MEV value is given back to network users.

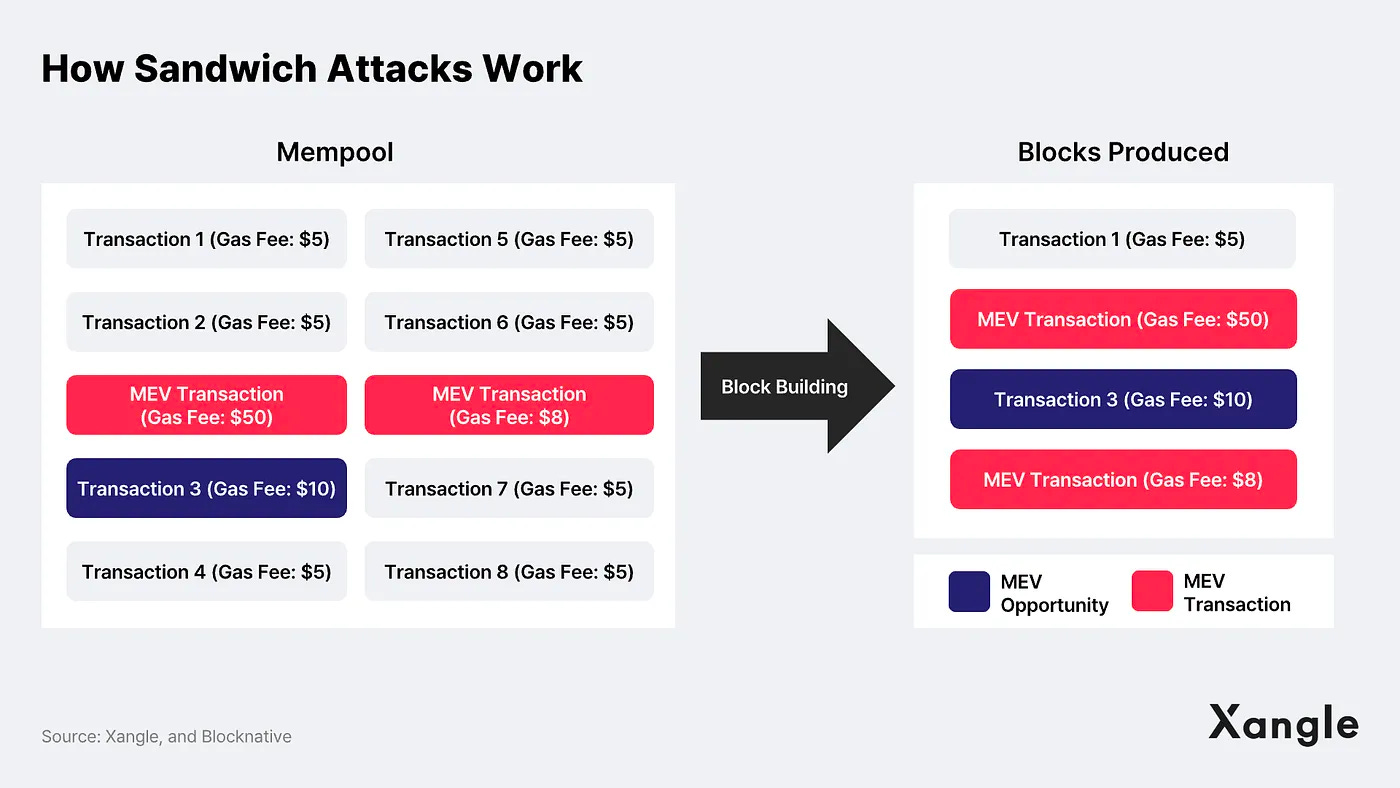

MEV stands for Maximum Extractable Value. It refers to the maximum amount of value that can be extracted from the block production process. This is often achieved by reordering or inserting new transactions (frontrunning, backrunning, sandwich attacks…)

Injective’s orderbook module already helps to eliminate MEV and frontrunning issues on-chain by running an auction process at the end of every single block. Skip will enhance this functionality by also running a segregated auction process at the beginning of every block. The goal behind this is to push users to compete for lucrative arbitrage and liquidation opportunities. The rewards of those auctions will then be sent back to the community such as Injective stakers.

As more dApps continue to launch on Injective, more opportunities for potential MEV may arise. For instance, an example of value capture could take place during the auction mechanism for liquidating assets on derivatives exchanges built on Injective. In this scenario, liquidators can use Skip’s tooling to compete within the same block to submit the maximum price in INJ. The potential rewards would then flow back to INJ stakers which would increase the effective APY for users on-chain.

Highest burn ratio in the industry

The concept of burning is increasingly popular and utilized in the industry, regardless of the underlying chain or protocol utility. This mechanism provides a way to control the supply and demand of a particular token. Usually, burning a certain number of tokens can help to increase the value of the remaining tokens, by making them more scarce.

Injective is the project with the highest burn ratio in the industry. Every week, 60% of the exchange fees are burnt via an auction. The remaining 40% of fees are distributed to the developers who built the dApps. Users can use INJ to bid for the basket of trading fees collected during the week. The winner receives the full basket of assets, and the bid amount is burnt, causing a supply deflation.

The goal behind the burn auction mechanism is to reduce the total supply of INJ tokens over time, leading to a deflationary effect that increases the value of each unit due to the demand remaining constant or increasing. This can create an incentive to hold tokens rather than selling them.

Injective ecosystem

Injective’s mainnet was launched in 2021. Since then, the team focused on creating open-source tools, cross-chain bridges to other blockchains, and building an ecosystem of decentralized financial applications. Currently, the Injective ecosystem includes 100+ projects and over 150,000 community members globally.

Injective assets: https://explorer.injective.network/assets/

Injective smart contracts: https://explorer.injective.network/assets/?tab=smartcontracts

Injective ecosystem dApps: https://explorer.injective.network/featured-dapps/

Helix – Decentralized spot and derivatives orderbook exchange

Helix is a decentralized orderbook exchange that supports spot and derivatives trading with zero gas fees, cross-chain assets, and an intuitive user interface.

Helix operates with the interoperable Injective blockchain, allowing it to natively support a variety of assets in chains including Cosmos, Ethereum, EVMOS, and Moonbeam. Furthermore, Helix also supports a trader’s portfolio feature that assists in organizing and bridging assets on different cryptocurrency wallets, which creates a seamless end-user experience for traders.

- Decentralized Orderbook: Leveraging the Injective infrastructure.

- Cross-Collateral: Multiple tokens are supported as collateral.

- IBC interoperability.

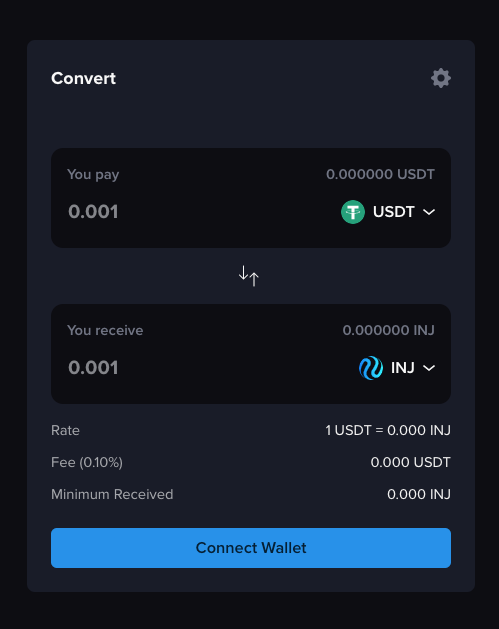

- Helix Convert: Users can quickly exchange assets.

Helix holds the record of becoming one of the fastest growing exchanges upon launch, reaching over $1 billion in cumulative trading volume in just one month. Since then Helix has catapulted to new heights, attaining over $7 billion in cumulative trading volume across spot and perpetual markets.

Helix’s trading environment is also enhanced with institutional gateways by which the protocol can offer custom APIs to top tier financial firms.

CosmWasm modules:

- Exchange module.

- Orderbook primitive.

- Oracle module.

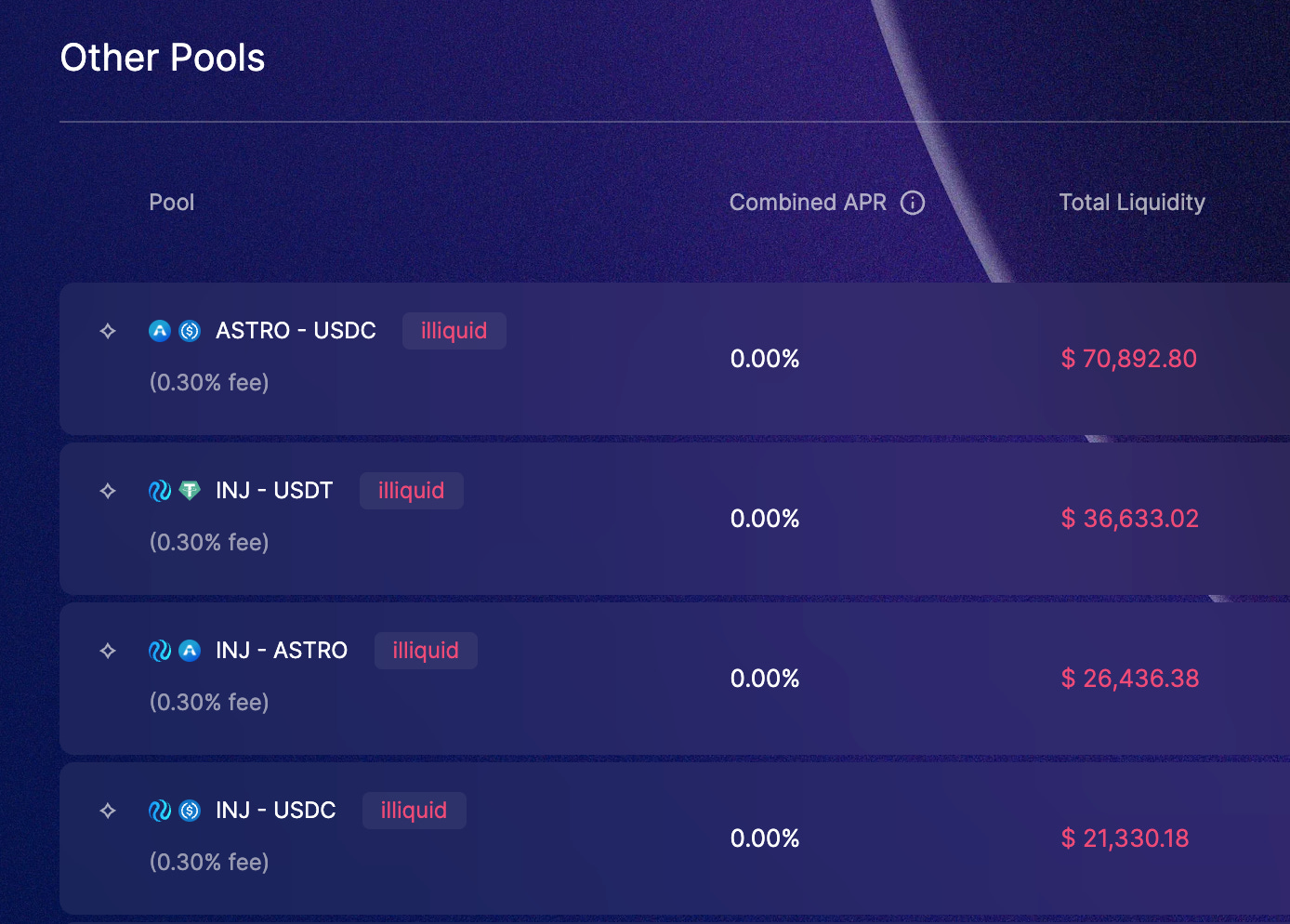

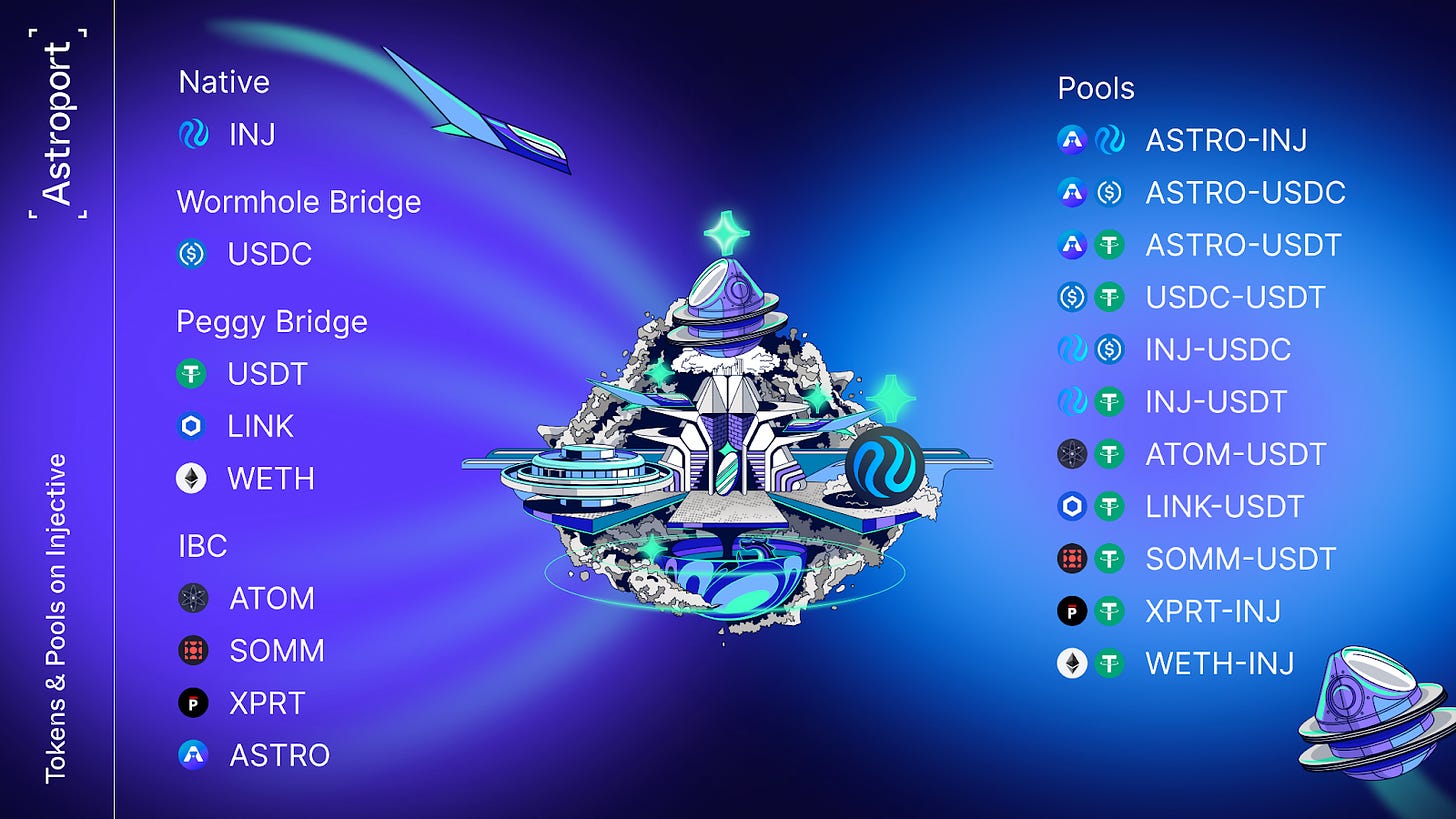

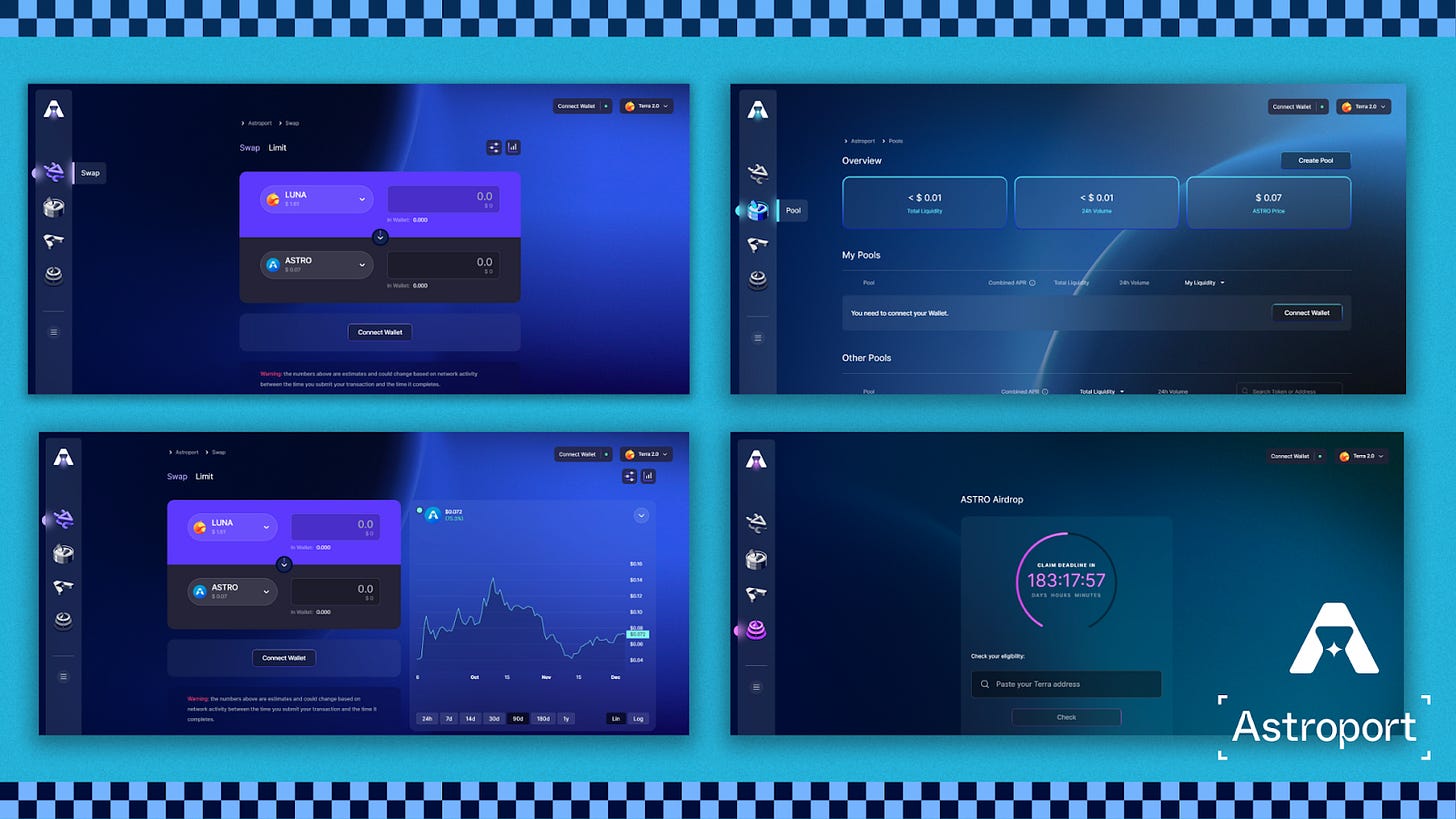

Astroport – AMM Exchange

Astroport is an AMM (Automated Market Maker) exchange where users can instantly swap assets using multiple pool types, including Curve-style stableswap pools and Uniswap v2-style constant product pools.

One of the key differentiators of Astroport is that it can facilitate the swapping of assets bridged from not only Cosmos or Ethereum, but also from Solana, Aptos, and Avalanche through Injective’s recent Wormhole integration.

Astropport supports limits orders powered by Autonomy Network.

CosmWasm modules:

- Exchange module.

- Oracle module.

White whale – Flash loans and arbitrage

White Whale introduces flash loans to Injective, making it easier for users to arbitrage price discrepancies in the market across a wide array of liquidity pools in the Cosmos ecosystem. This way, White Whale AMMs can work in tandem with Injective’s on-chain CLOB primitive to create far more efficient markets.

In the Cosmos ecosystem, liquidity is fragmented across constituent chains (e.g., Cosmos, Osmosis, Secret, etc) and across Dexes on each of the constituent chains (e.g., Astroport, Terraswap, Loop, Phoenix). Fragmented liquidity results in poor swap performance (price discrepancies) and may even seize up in severe crashes when LPs are drained. With the deployment of its smart contracts by Injective Improvement Proposal #192 (IIP-192) White Whale solves key challenges such as:

- Stable Interchain prices from a coordinated pool of LPs that provides deeper liquidity and infrastructure as a service (arbitrage)

- Decentralized and permissionless use of flash loans and arbitrage bots to enable small and medium users to participate in arbitrage, liquidation, and price stabilization.

- Market inefficiencies. The liquidity on Cosmos is fragmented across chains, which results in shallow pools with high spreads and price discrepancies between chains.

- Capital inefficiencies, since every arbitrageur and liquidators would need to have capital available on every Cosmos chain in order to effectively perform their operations. Besides, when there are no arbitrage opportunities, their capital would be sitting idle.

- Centralized market making and the barrier to entry for users as the number of chains increases.

- Benefits for all market participants: stablecoin issuers benefit from deeper liquidity and better conditions for peg maintenance, layer 1s get improved liquidity conditions and more volume, and dApps benefit from stabilized token prices and liquidity aggregation.

White Whale’s Bot First Pools (BFP) can be integrated with Injective’s CLOB (Central Limit Order Book Primitive) to build new synergies and use BFS as the reference price for local applications, which can potentially lead to new arbitrage opportunities. This way, if there is a difference in price between a BFP and local exchange dApps developed on Injective, traders specializing in arbitrage can utilize flash loans from the vaults to come up with new trading strategies.

With the new arbitrage opportunities, dApps built on Injective can offer a more capital efficient environment that is further bolstered by Injective’s unparalleled institutional support. This means, more applications and market making strategies can be created on Injective to grow the Injective ecosystem further.

Apollo DAO – Asset management

Apollo provides asset storage, yield access, and tools for advanced yield and automation strategies to improve the user experience and yield opportunities of Cosmos. The long-term aim for Apollo is to become the Asset Management Portal and on-chain bank account for Cosmos, improving the user experience through consolidation and automation. Among its product offerings we find:

- Liquidation and position management.

- Fixed leveraged tokens.

- Hedging price exposure of LP tokens or rewards.

Apollo Vaults

Apollo Vaults are designed to help users maximize their yields by automatically compounding their rewards from yield farming on various platforms.

Apollo Safe

Apollo Safe is a multisig frontend for Apollo’s CW3 contract that is IBC compatible and can be deployed across the Cosmos ecosystem to provide support for large ecosystem funds, large DAOs, investment funds, NFT DAOs…

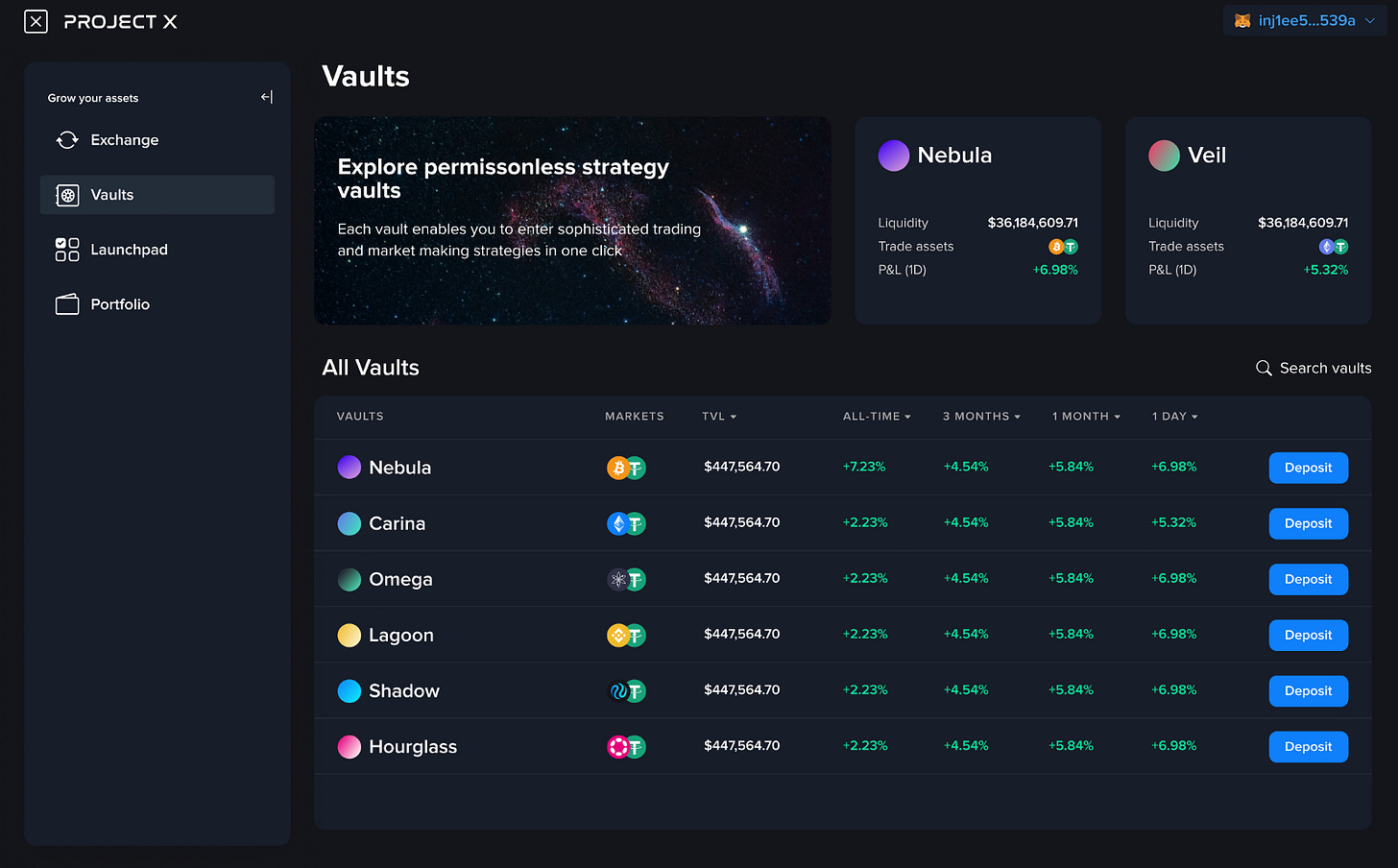

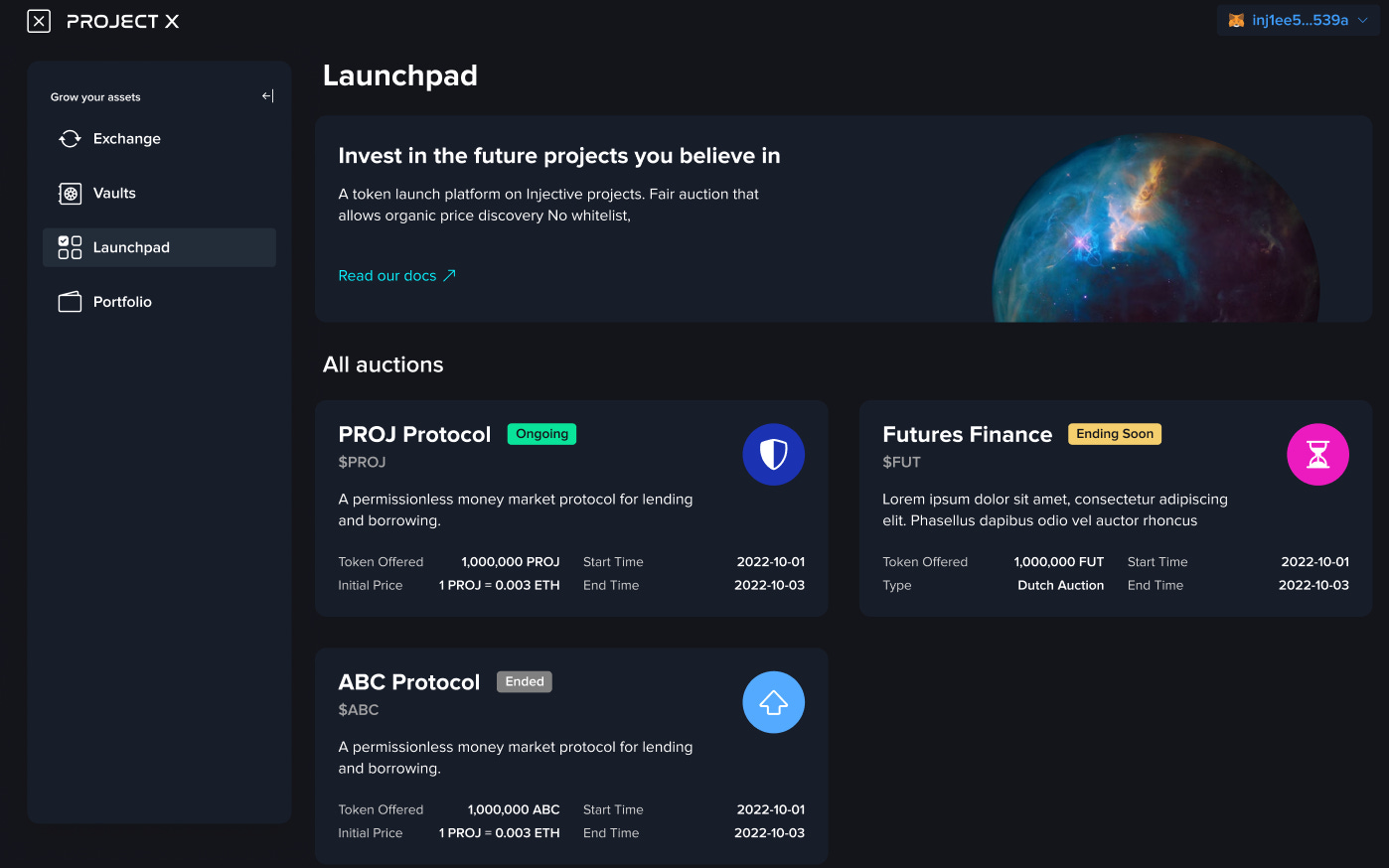

Project X

Project X was unveiled at Cosmoverse 2022. It is a DeFi protocol focusing on automated strategy vaults and a permissionless launchpad for fundraising and token listings. This allows users to deposit funds into automated trading or market making strategies that will earn yield in a passive manner without risk of impermanent loss.

Project X was built to allow developers and users to access trading strategies and passive liquidity provisioning strategies. By building on Injective’s infrastructure, Project X can entirely eliminate frontrunning/MEV with the use of a Frequent Batch Auction (FBA) model.

The launchpad is permissionless and allows anyone to create custom offerings by specifying project name, ticker, and launch format (direct listing, dutch auction…). The launchpad provides a wide range of decentralized auction formats, including dutch auctions and direct listings, making it easy for anyone to create and launch a new token. By combining the launchpad with the automated trading vaults, developers can dramatically reduce the costs associated with new token launches, with no listing fees and no need to hire external market makers.

All components of Project X are interlinked with the broader Injective ecosystem. For example, a new token launchpad token sale can immediately have that asset listed on Injective exchange dApps such as Helix.

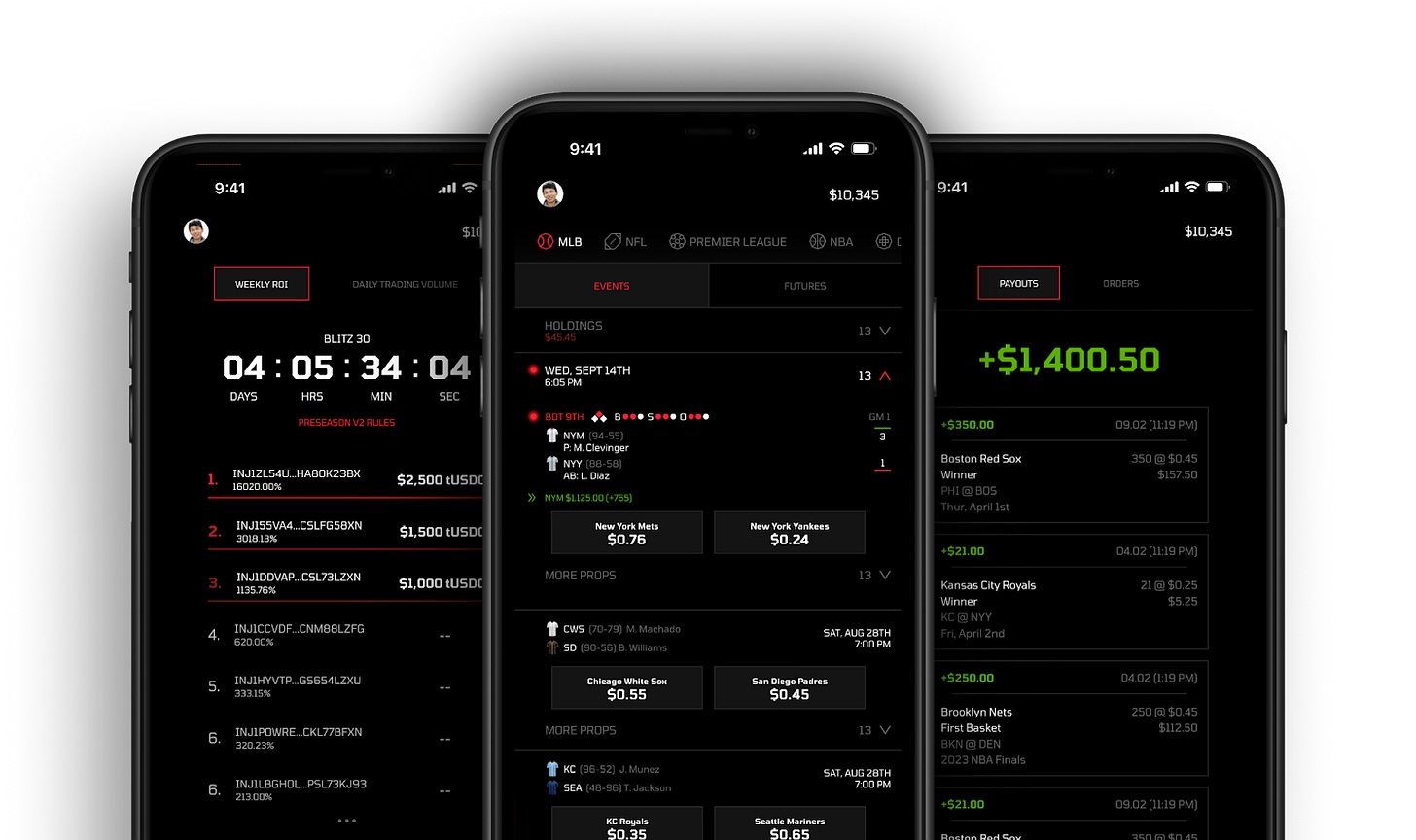

Frontrunner – Sports prediction market

Frontrunner is a decentralized sports prediction market built on Injective where users can buy shares of a sports team or player and trade them like options, contracts, or stocks. A share for the team is created when buy orders on both sides of a match reach $1. This means that prices of opposing sides of an event always equal to $1. Users can create both market and limit orders, and are paid out within 24 hours of the start of an event. This creates constantly actionable and monetizable moments for all users, as they can trade in and out as their opinions change at any time until the result is determined.

Frontrunner’s sports prediction markets are represented as binary options, meaning that there is an end to the market where each share, or asset, is settled at a specific price from $0-$1 (in stablecoin) depending on the outcome. Each of the two sides in a Frontrunner market represents a mutually-exclusive outcome, so besides refund scenarios and some draw scenarios, each share settles at either $0 or $1.

Unlike conventional sportsbooks in which users merely place their bets and wait, Frontrunner empowers users by granting them complete control over their portfolios, enabling them to dynamically purchase or sell positions as the odds fluctuate. This allows users to capitalize on a favorable market by selling high and cashing out their profits or minimizing losses by selling low.

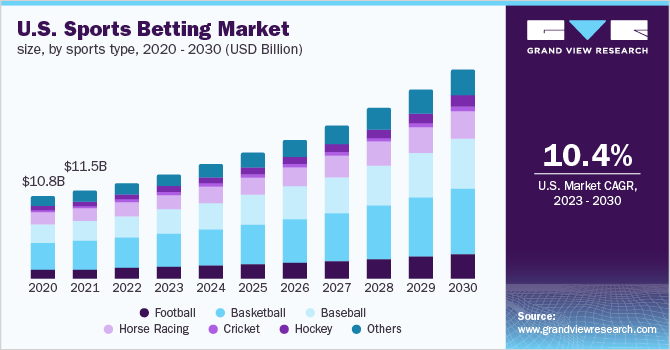

According to Grand View Research, the global sports betting market size was valued at $76.75 billion in 2021, and is anticipated to grow at a rate of 10.2% from 2022 to 2030.

By decentralizing sports betting, Frontrunner reduces the influence of centralized entities, thus creating a fairer and more transparent system for users.

- Centralized sports betting entities often take a significant percentage of the wagered amount as their cut, limiting the amount a user can win in a day, and exerting control over deposited funds.

- Frontrunner eliminates the need for centralized authorities and allows users to place bets quickly and easily with low fees. Moreover, users can retain 100% of their winnings, providing them with greater control over their money.

CosmWasm modules:

- Orderbook primitive.

- Oracle module.

- Binary options module.as

Stride – Liquid Staking

Stride is a specialized app-chain for liquid staking derivatives. Injective’s collaboration with Stride makes it possible to unlock liquidity and yield generating opportunities for stINJ holders

- Liquid staking allows users to stake tokens while still maintaining their liquidity.

- stINJ is a tokenized derivative of staked INJ enabled by Stride, an interchain protocol specializing in liquid staking.

- Injective stakers received an exclusive Stride (STRD) airdrop.

With liquid staking, users can earn staking rewards while also using their staked tokens for other purposes such as trading, yield farming, and lending.

Staking plays a big role in the Injective ecosystem, since it allows users to participate in the Injective DAO governance, secure the network, and earn rewards.

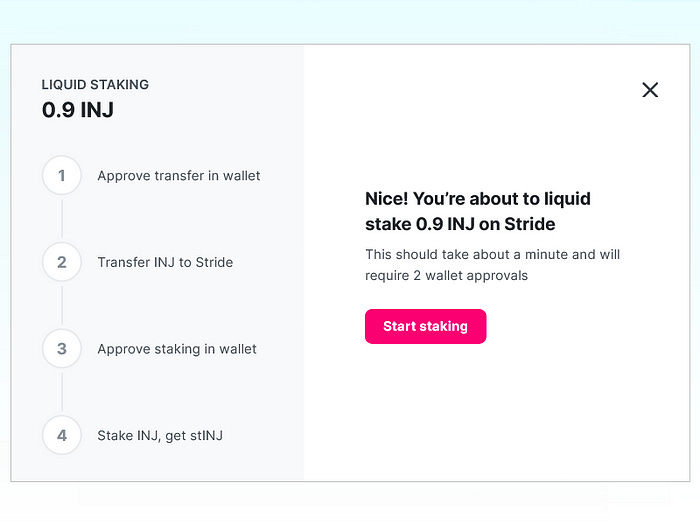

To start liquid staking INJ, users can visit the Stride app, connect their wallet, select INJ from the dropdown menu, enter their desired stINJ amount, and click Liquid Stake.

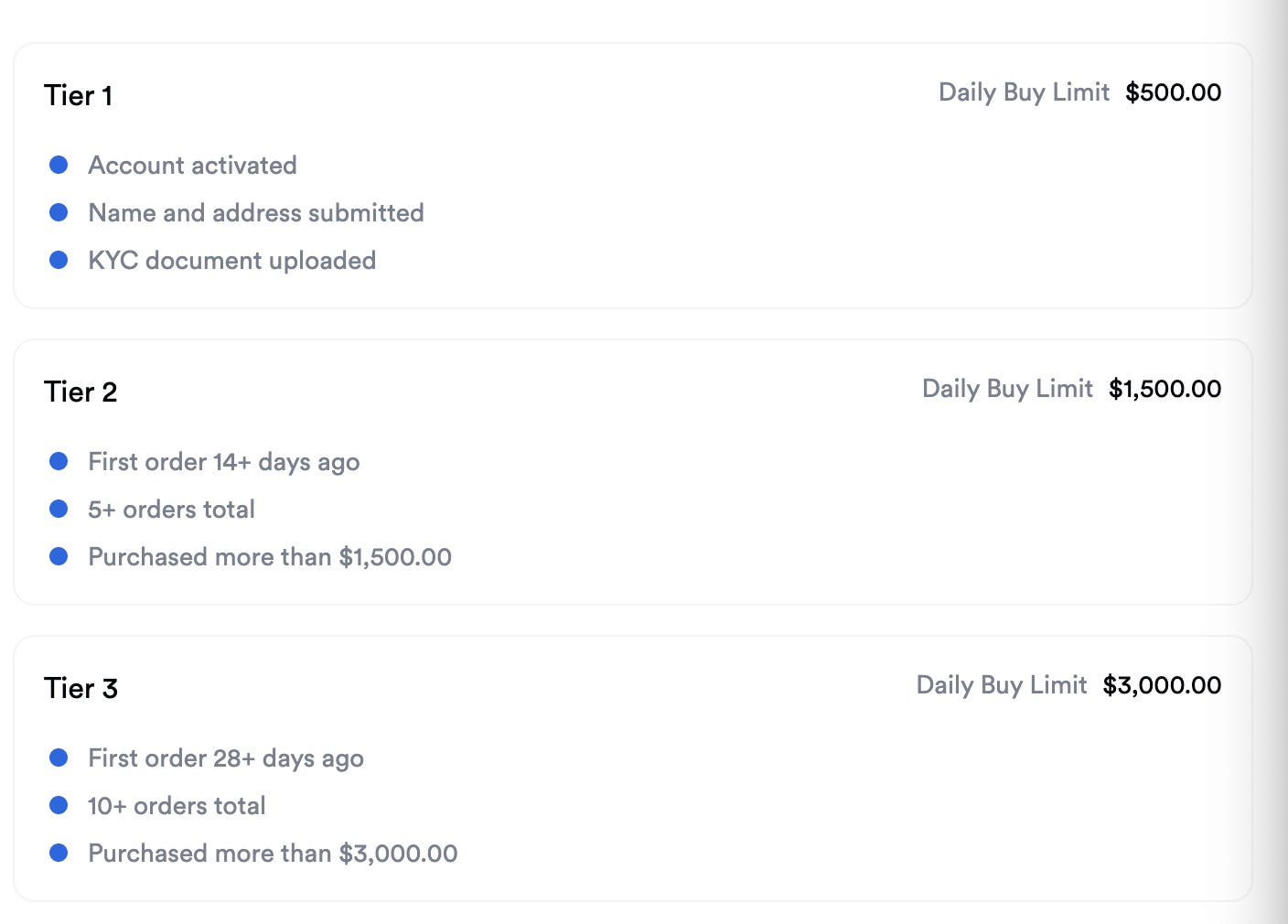

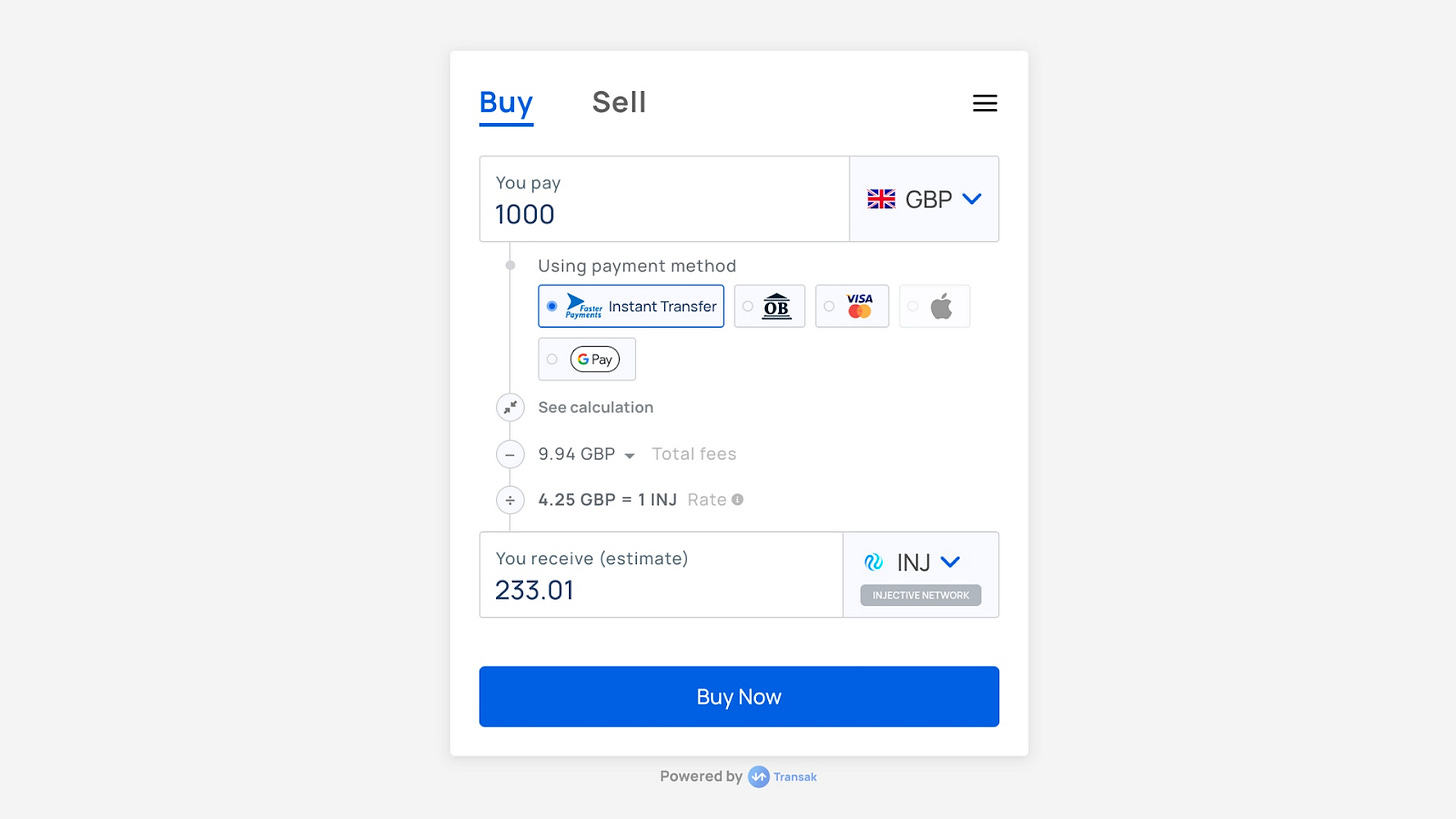

Payment gateways

Injective supports payment gateways that allow users to instantly get onboard with fiat currencies.

- Kado Money is an on-ramp solution that makes it seamless for users to get onboarded into the ecosystem with fiat deposits.

- Payfura is a global payment gateway for fiat to crypto conversion.

- Transak enables easy fiat access into Injective with 150+ currencies.

Virtual Machines

Other exchanges on Injective include InjDojo, Dexterium, Wavely, Qwerty Exchange, Becole, or Parallel.

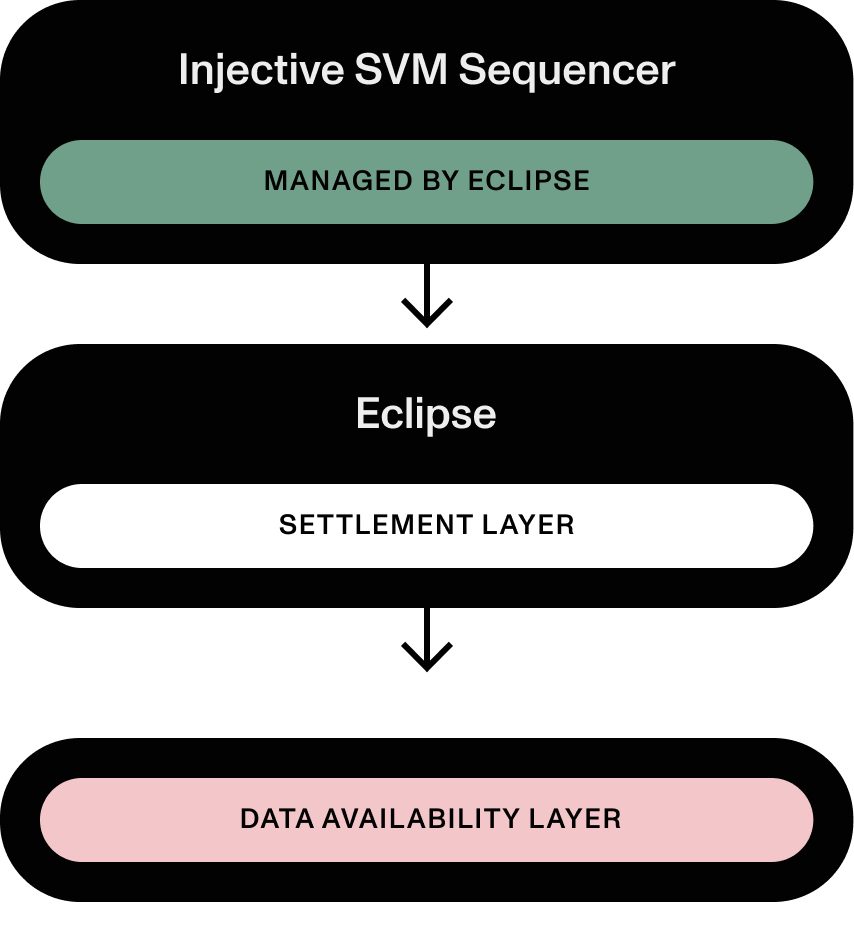

inSVM

inSVM, formerly known as Cascade, is a layer-2 scaling network on Injective built by Injective in collaboration with Eclipse. It has become the first SVM (SeaLevel Virtual Machine) rollup in the Cosmos ecosystem. This unlocks the $9 Billion+ Solana developer ecosystem for Injective. In addition to that, the Solana SVM is capable of parallel processing. This is similar to Injective’s core infrastructure, which also allows for parallel processing. This enables tens of thousands of transactions to be processed in parallel, rather than being restricted to one transaction at a time.

Solana applications are written in the Rust programming language, which is highly used in Web2 but has not been adopted by many blockchains yet. As a result, Solana applications are mostly restricted to their own environment. After the launch of Cascade, those applications can be ported onto Cascade, which is compatible with Rust. With this integration, developers can deploy Rust-based Solana smart contracts to run natively on Injective, despite their differing technical architectures. This way, developers can use the same code and access a much wider crypto audience in the Cosmos ecosystem. Once on Cascade, applications can access the wider Cosmos ecosystem through the IBC (Inter-Blockchain Communication) protocol. This allows anyone to send tokens and messages between Cosmos-based blockchains.

The sequencer will be initially operated by the Eclipse team. Transactions from Solana wallets and smart contract deployments from the Solana command-line interface (CLI) are processed and organized into blocks by the sequence, which then posts the data to a data availability layer.

The contributors to Cascade plan to integrate Celestia as the data availability provider in the future, which will further enhance the scalability of Cascade. Part of the roadmap is also to make it possible for the sequencer to operate in a permissionless manner, meaning that anyone can participate in the network without requiring permission from a central authority. At the core, Injective serves as the core settlement layer, ensuring that the sequencer executes transactions correctly.

Cascade developer docs: https://docs.injective.network/develop/cascade-svm-chain/

inEVM

inEVM, introduced on September 19, 2023, is the first-ever Ethereum Virtual Machine capable of achieving true composability across Cosmos and Solana. The inEVM network was developed in collaboration with Caldera, an L2 rollup infrastructure platform backed by Sequoia.

Injective’s inEVM provides Ethereum developers with exceptional access to Injective’s extensive global network and user base, opening up exciting new possibilities to broaden the scope of their protocols.

inEVM offers several significant advantages for developers, including blazing-fast speeds facilitated by its parallelized structure, immediate transaction finality, a versatile toolkit, shared liquidity, and the ability to interoperate seamlessly within the Cosmos IBC ecosystem and Solana.

dApps launched on the inEVM layer would be able to compose directly with Cosmos and Solana applications. As a result, both inter and intra-VM interoperability would be achieved by builders on the inEVM layer. This in turn results in far more seamless development experience devoid of traditional complexities and barriers.

Injective Nexus

Injective Nexus was introduced on October 24, 2023.

As a result, core chain data from the Injective network will be accessible in BigQuery through the Analytics Hub, Google Cloud’s exclusive data sharing platform.

Nexus enables core chain data from Injective to be shared with the broader mainstream world. In turn, both developers and enterprises can interact with custom data sets across the Injective network such as real-time financial and transaction data. Google Cloud customers and enterprises can utilize bespoke Injective datasets for various use cases, including building DeFi applications, machine learning and institutional trading strategies.

Injective’s value proposition

Injective was launched in June 2021 as a blockchain in the Cosmos ecosystem that was specialized in DeFi applications. It was built on the Cosmos SDK and a Tendermint consensus architecture. Injective became the first EVM-compatible chain on Cosmos that allowed cross-chain transfers between Ethereum and the Cosmos ecosystem. Besides, Injective was also the first Cosmos-based blockchain that managed to offer a completely decentralized orderbook infrastructure.

- Trustless: the settlement logic does not require the intervention of a trusted third party or centralized trade execution coordinator (TEC) to fairly establish the true sequence of incoming transactions.

- Resolvable: conflicting orders submitted in the same block can be fairly and deterministically resolved through Injective’s settlement logic.

- Transparent and publicly verifiable: incoming orders submit time proofs which the public can use to efficiently verify that a fair order sequence was executed.

- Liquidity neutral: the protocol does not enforce any restrictions on the accessibility of different liquidity pools.

- Front-running proof: a predatory front-runner bot cannot intercept incoming orders and manipulate the sequence of order-filling.

Trade collisions occur when multiple takers attempt to take the same maker order at the same time. In an ideal Dex, trades (a taker order that fills a maker order) would clear immediately and the orderbook would be updated accordingly, signaling to other trades that the order has been filled. If an orderbook was to be implemented on a chain like Ethereum, this would be impossible to achieve. The reason for that is that orders are submitted as transactions that are included together in a block that then updates the orderbooks once the block has been mined and added to the chain. Assuming blocks are mined every 12 seconds, Dex protocols would be prone to suffering from collisions for orders submitted within the same block period. Besides, since trades are settled through smart contracts, a relayer would not solve this problem, since traders from other relayers targeting the same make order would still face a collision because they are unaware of the actual status of the order.

Front-runners leverage trade collisions to make profits by intercepting take orders in Dexes. For instance, in a chain that processes transactions via priority gas auctions, race conditions occur when the mempool exceeds the network’s maximum throughput. Because miners would give priority to the transactions paying the higher gas fees, a front-runner could exploit this feature by observing a large pending trade in the mempool and then submitting a colliding trade but with a higher gas fee. Since the miner is likely to include the front-runner’s trade before the other trade, the taker that was front-run would fail to fill their order and would have to resubmit another take order, which will likely be at a worse price and would again be susceptible to front-running.

Over time, the concept of a trade execution coordinator (TEC) was introduced to regulate trades and make the process of order matching more fair. However, while TECs eliminate the threat of front-running and trade collisions by approving trades, trade settlement follows a time priority where the role of the TEC must be played by a centralized provider and trusted entity. In practice, such federated stakeholders are vulnerable to bribery from predatory front-runners.

Potential trustless TEC proposals hash the order information first and then the TEC simply approves the transaction if the hash was not previously approved. However, this model is still susceptible to grinding attacks, where a dishonest TEC reconstructs the trade hash through brute force computation.

Commit and reveal schemes can also be used to prevent front-running while maintaining the desired properties of decentralization and trustlessnes. A taker first submits their intention to fill some make order in the form of a hashed message that contains the trade information and the Dex subsequently verifies the validity of the trade by reconstructing the hash. Although this approach does not resolve accidental collisions, it prevents front-running from other actors because the information is encrypted. Nonetheless, the fact that order confirmation and settlement would require two transactions in separate blocks comes at the cost of a suboptimal user experience.

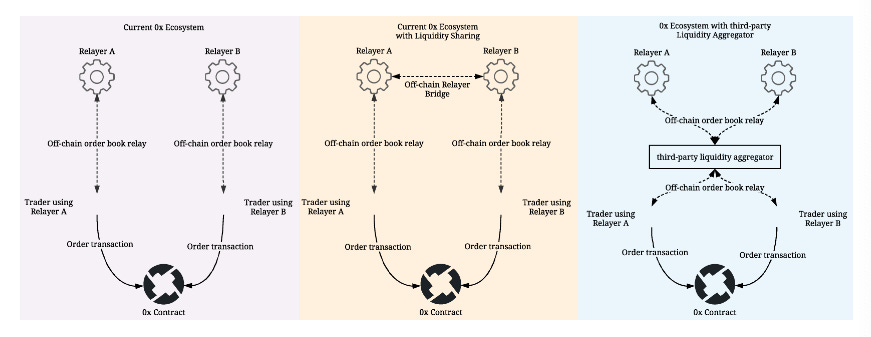

Another problem comes from liquidity fragmentation. To solve this issue, multiple Dex aggregators coexist nowadays. But even if these aggregators were to account for multiple relayers, users would still need to trust that they are honest in displaying the true state of the aggregated orderbook. What’s more, a dishonest aggregator could favor certain relayers’ liquidity pools, censor some orders, or even front-run traders themselves. Since these liquidity aggregators are centralized by nature, it is essential to ensure a good incentives structure for them not to act maliciously. Yet, in the scenario where individual relayers also act as liquidity aggregators by using liquidity bridges, there is a perverse incentive for relayers to act dishonestly when orders collide. Even assuming that relayers act honestly, there can still be order collisions from conflicting take orders submitted by traders in the same block. The underlying problem still remains, since the same race conditions occur, which results in trades with the highest gas fee taking precedence.

Injective’s approach seeks to solve the underlying reason for the problem where one cannot fairly and securely determine who should be the winning taker when a trade collision occurs. This is because the submitted timestamps are unreliable in an asynchronous network.

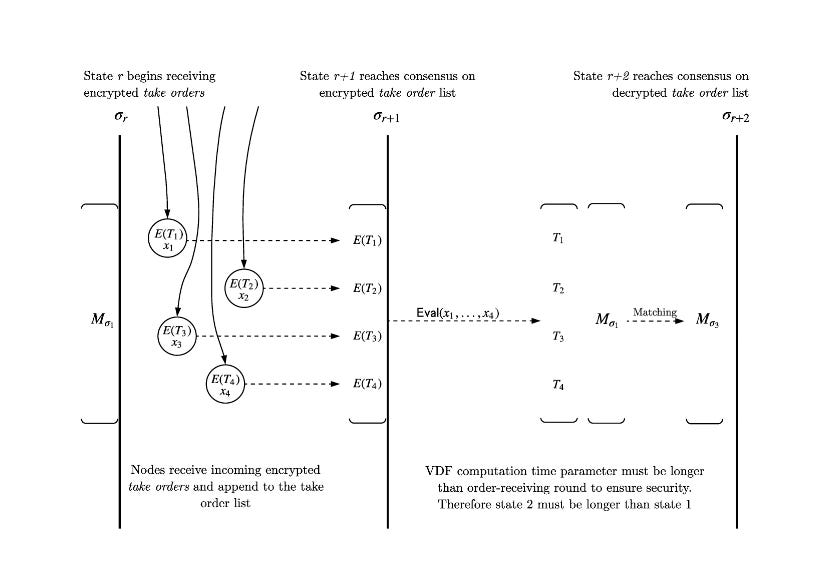

The original whitepaper was published in 2018 and proposed using verifiable delay functions (VDF) and proof-of-elapsed-time to settle trades and share liquidity in a fully decentralized and trustless manner. With verifiable delay functions as a mechanism of elapsed time, in Injective a trader would be able to submit a time proof of settlement logic that verifies whether the taker has indeed observed the order for the duration he claims.

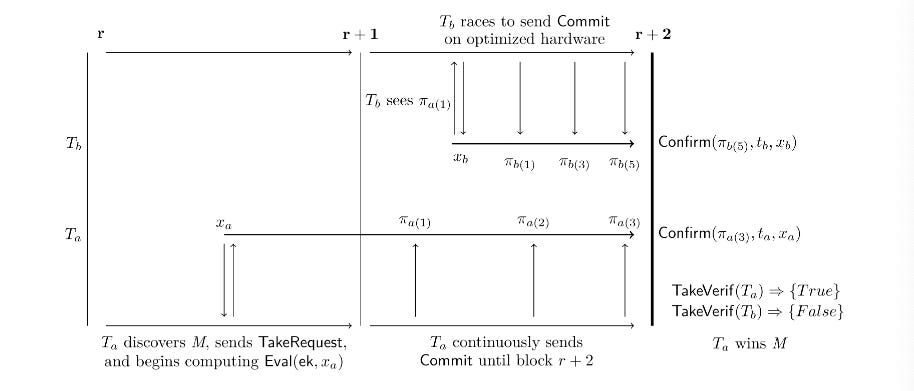

This way, in the scenario where two takers submit the same request at different times but still within the same block, a fair system would allow the taker who submitted the take request first to win the trade. However, since obtaining an accurate timestamp for a given take request is impossible in an asynchronous network and there would be competition between traders who use specialized hardware versus traders using commodity hardware, Injective would use a sidechain implementation where the settlement logic is executed by a trade execution coordinator (TEC). Additionally, a trustless relayer network using Injective’s custom settlement logic would be hosted on the same sidechain and the relayers in this network would match orders using a non-interactive commit-reveal scheme that would prevent trade censorship and frontrunning.

To prevent front-running, a taker first submits the encrypted order information and the information is revealed at a subsequent state.

In the relayer network, commit-reveal schemes are non-interactive, which means that there is no opportunity for malicious relayers to prevent traders from rejecting a taker’s transaction that includes the revealed order information, since no such transaction exists.

Centralized exchanges and Continuous Double Auctions

Since its first days, the value proposition of Injective was to become a custom interoperable layer one protocol for building powerful exchange DeFi derivatives applications. After the release of the initial whitepaper, which conceptualized a protocol based on smart contracts deployed on top of Ethereum, Injective pivoted its strategy to become a standalone layer 1 blockchain on Cosmos. This would allow Injective to achieve instant transaction finality at sustaining lightning-fast speeds.

Centralized exchanges that offer crypto derivatives rely on a Continuous Double Auction (CDA) model where orders are processed as soon as they reach the exchanges. This is achieved either by immediately filling an order on the opposing side of the order book or by resting on the order book until a matching order is found. However, the CDA approach creates incentives for speed, and markets with high volatility that lead to big arbitrage opportunities. In this scenario, the role of market makers is to follow the market price of assets and provide deep liquidity by placing orders on each side of the order book. As the price moves, market makers must cancel and create new orders accordingly. Besides, in the time period between externally signaled price updates, still remains an opportunity for high-frequency traders to fill stale market maker orders before the market maker can cancel them. Consequently, high-frequency traders are able to collect arbitrage opportunities. In order to compete with those high-frequency traders, market makers are forced to invest in advanced technologies such as microwave towers and FPGAs to engage in a nanosecond speed competition. This puts market makers at a disadvantage, since they are unable to keep up with the speed of high-frequency traders. Because of this, market makers often have to increase their investments in competitive tech solutions, which are indirectly paid for by traders through higher trading fees.

Microwave towers and FPGAs are advanced technologies used by HFTs to engage in high-speed trading. Microwave towers are used to transmit data at high speeds, while FPGAs are programmable chips that can be customized for specific tasks.

Knowing that CDA matching engines require high-throughput at unpredictable times, even when they are built by centralized providers, they are rarely able to fulfill market demand with a 100% uptime. These problems are further exacerbated in blockchain networks, which results in decentralized exchanges having a lot less flexibility in solving their design challenges. As a consequence, instead of prioritizing orders by submission-time, most blockchain networks have taken an approach that prioritizes orders with the highest gas fees. This leads to a bad user experience where front-running bots pay a slightly higher gas fee to execute trades before other traders, thereby profiting from the margins of the trader’s slippage tolerance.

This is a common problem in AMM-based exchange protocols, which are designed to eliminate the need for institutional market makers. However, this leads to capital inefficiencies related to the continuous double auction (CDA) mechanism, which are passed directly onto retail traders.

The costs of these capital inefficiencies are significant, and they can have a direct impact on the profitability of retail traders. To address this issue, Injective implements a system of frequent batch auctions (FBAs). By replacing the continuous double auction with frequent batch auctions, Injective is adopting a market design that is both technically robust and competitive against centralized exchanges. This way, Injective is able to eliminate predatory front running while enabling the provisioning of deeper liquidity at tighter spreads by market makers.

Injective’s Frequent Batch Auctions (FBA)

Injective’s FBA model has 3 key features:

- Discrete time. In an FBA, orders are accepted over a discrete time period called the auction interval. At the end of each interval, crossing orders are filled with the following priority:

- Market orders.

- Unfilled limit orders from prior auction intervals.

- Limit orders from the most recent auction interval.

If the quantity of bids and asks differs at the cross, the smaller quantity side is filled in full, while orders from the higher quantity side are filled pro-rata, meaning they are filled partially and evenly. For example, if there are 10 bids and 5 asks, the 5 asks will be filled in full, and each of the 10 bids will be filled with 50% of their quantity.

- Limit orders are filled at a uniform clearing price where the quantity of crossing orders is highest. If the bids and asks cross with the same quantity, the midpoint price is used for the clearing price.

- Sealed bids eliminate the possibility of front running and negative spreads by not publishing orders until the auction interval ends and the batch auction is executed. This passes the costs of capital inefficiencies related to institutional market makers directly onto retail traders.

With this model, the relatively large auction interval gives market makers enough time to cancel stale orders before high-frequency traders are able to execute on them. This eliminates the risk of market makers having to deal with front-running issues, therefore removing their need to invest capital in advanced technologies. This makes it possible for market makers to provide deeper liquidity closer to the market price with tighter spreads. This not only results in a better scenario for retail traders who are trying to fill an order close to a fair price, but it also reduces the volatility associated with potential price crashes.

FBAs aggregate orders for state changes and order book inclusion on a set auction interval. This means that orders are collected and processed at specific intervals rather than being processed immediately. This is analogous to how blockchains queue and write transactions in batches to sequentially-produced blocks. The optimal batching interval for FBAs is up for debate, but it has been academically reported to be between 0.2 and 0.9 seconds, which falls in line with Injective’s auction interval, with batch auctions executing at the end of each block.

By building on top of Tendermint’s BFT-based PoS consensus, Injective is able to offer instant finality at the end of each interval. Since the FBA has no concept of time priority within auction intervals, it is the perfect market design for blockchains that operate on the same basis.

Prior to the launch of it’s mainnet, Injective went through a period of experimentation with a diverse set of products before making the transition. Apart from the current perpetual and spot markets currently online, the chain had also hosted markets for legacy assets such as synthetic stocks, oil, gas, gold, and forex futures on its Solstice testnet.

Options, synthetics, betting dApps, or any other derivatives instrument that can leverage Injective’s matching mechanism can be built on top of the chain. Since the chain aspires to become a complete toolbox for decentralized financial markets, many other seemingly peripheral financial products like lending services can also be incorporated to enhance protocol services.

Using the Protocol

Injective was created to solve the problem of having to trust a third-party when producing the right sequence of trading orders. Its technology would make it possible to match trade orders within the same block without the intervention of a third-party. The goal was to prevent front-running and ensure that a large number of additional orders can be fulfilled without difficulty.

Users

Different groups of users can participate in the ecosystem:

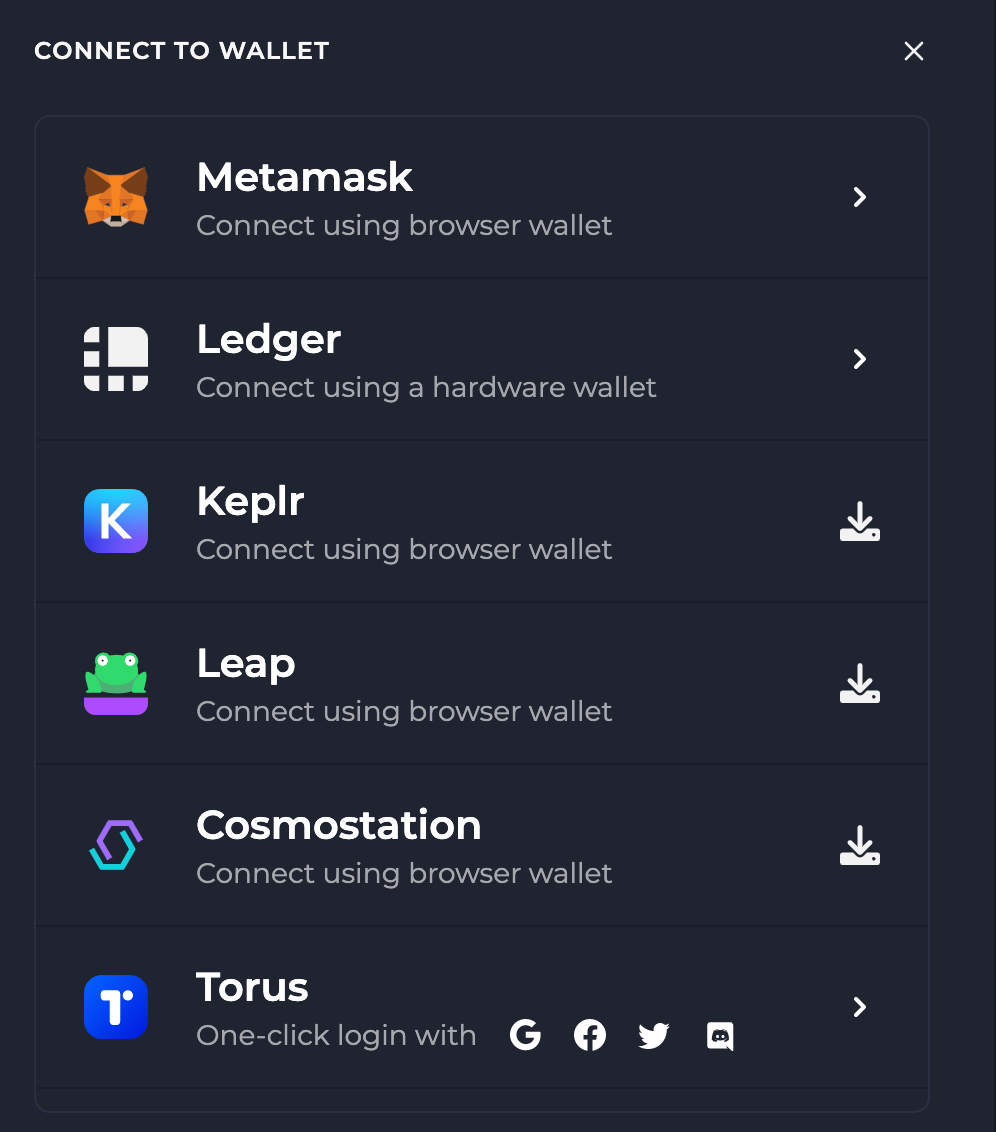

Injective Wallet allows you to monitor your assets on Injective, whether these assets are native tokens on Injective, or bridged assets from Ethereum or various IBC-enabled chains.

Note that Injective supports the memo field. Make sure to check whether your recipient requires this detail to be filled before transferring assets.

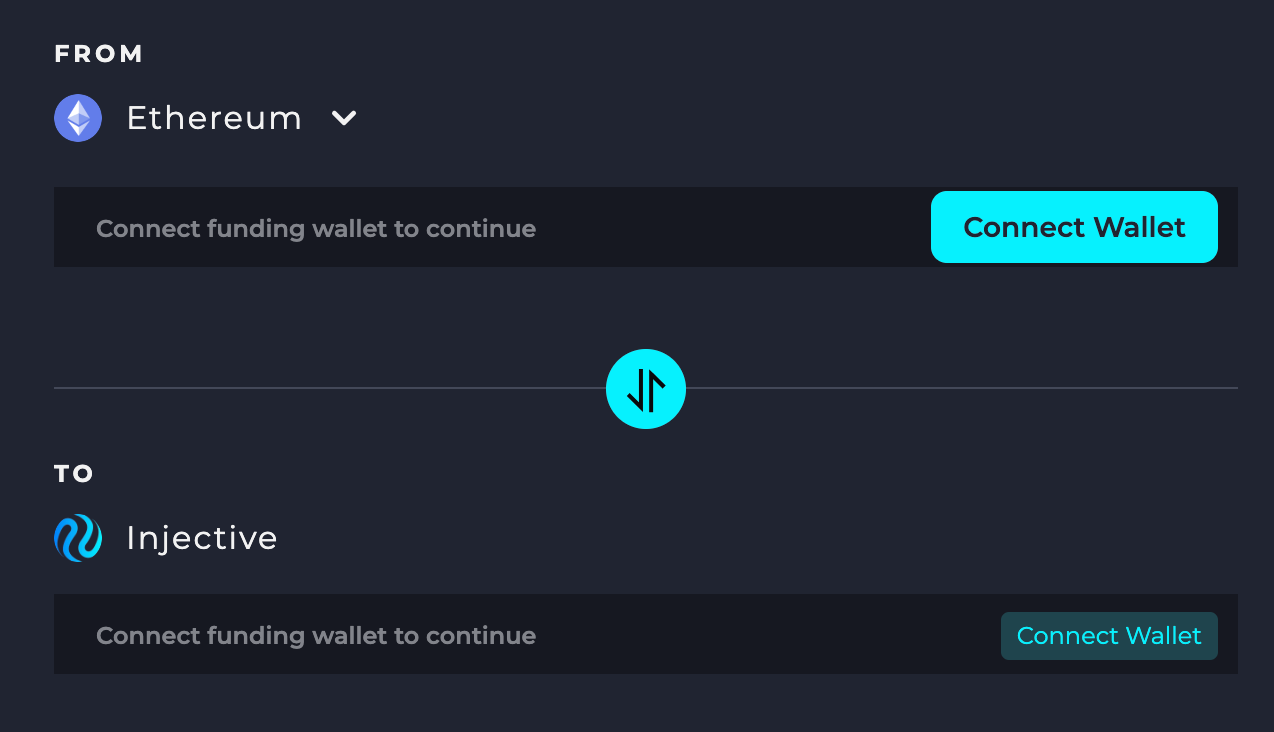

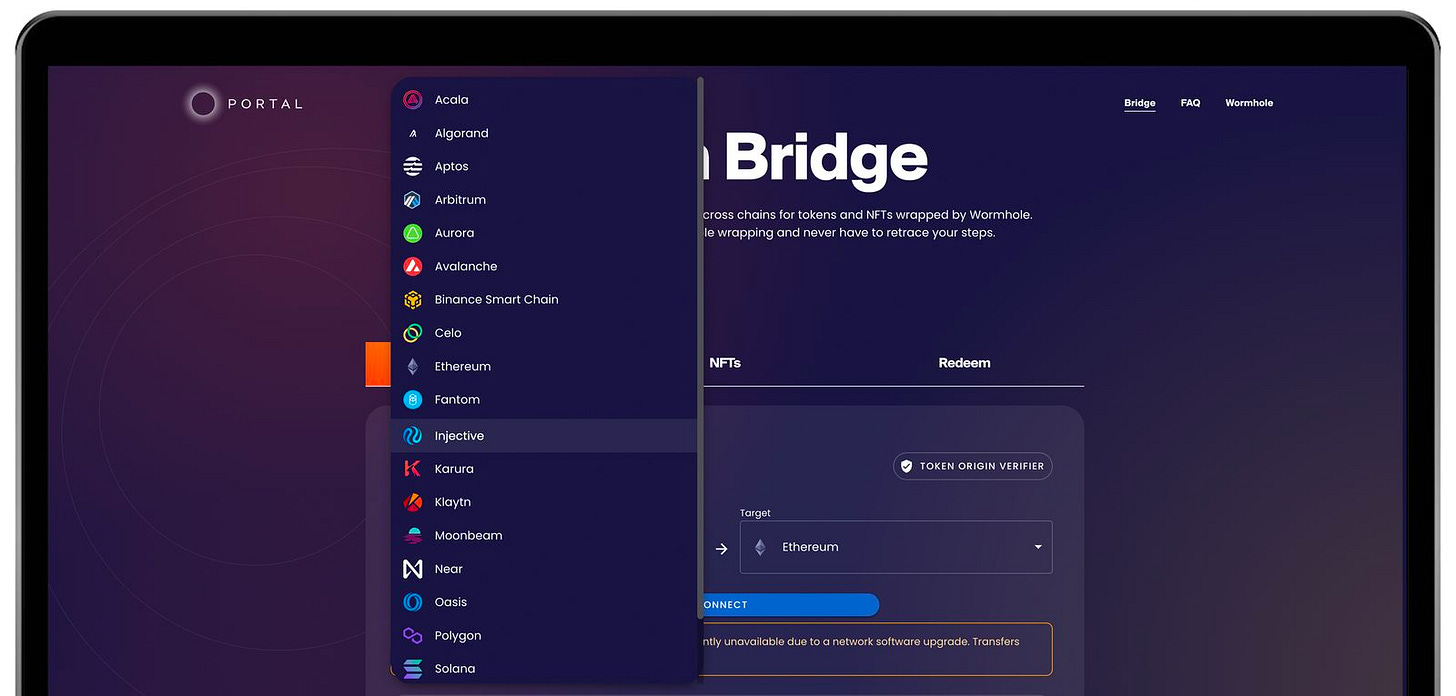

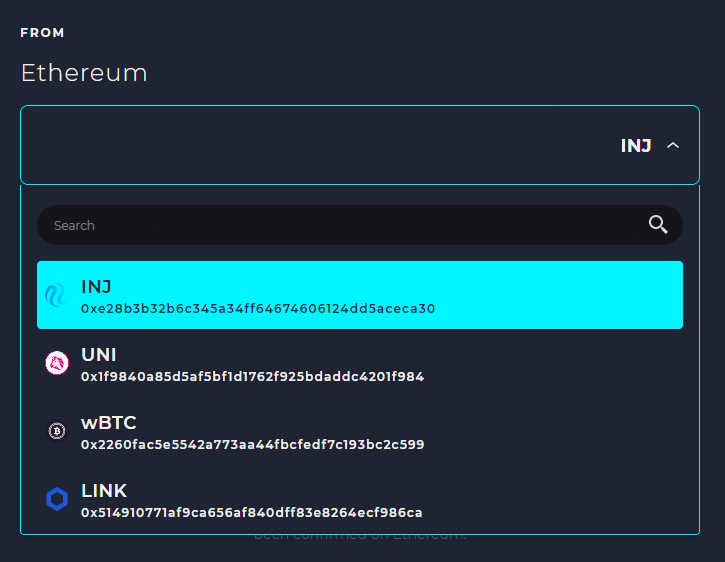

The Injective bridge supports the following integrations:

- Wormhole – Cross-chain connections

- Wormhole currently provides access to some of the most popular blockchains today such as Solana, Aptos, Avalanche, Algorand, BNB Chain, Fantom, Oasis, Polygon, and Ethereum L2 networks.

- Peggy – Any ERC20 token

- IBC – Cosmos IBC-enabled chains

- Axelar – Cross-chain communications

The Injective Bridge can be used to transfer assets in and out of the following chains: Ethereum, Solana, Cosmos Hub, Osmosis, Evmos, Axelar, Moonbeam, Persistence, Secret Network, Stride, Crescent, and Sommelier.

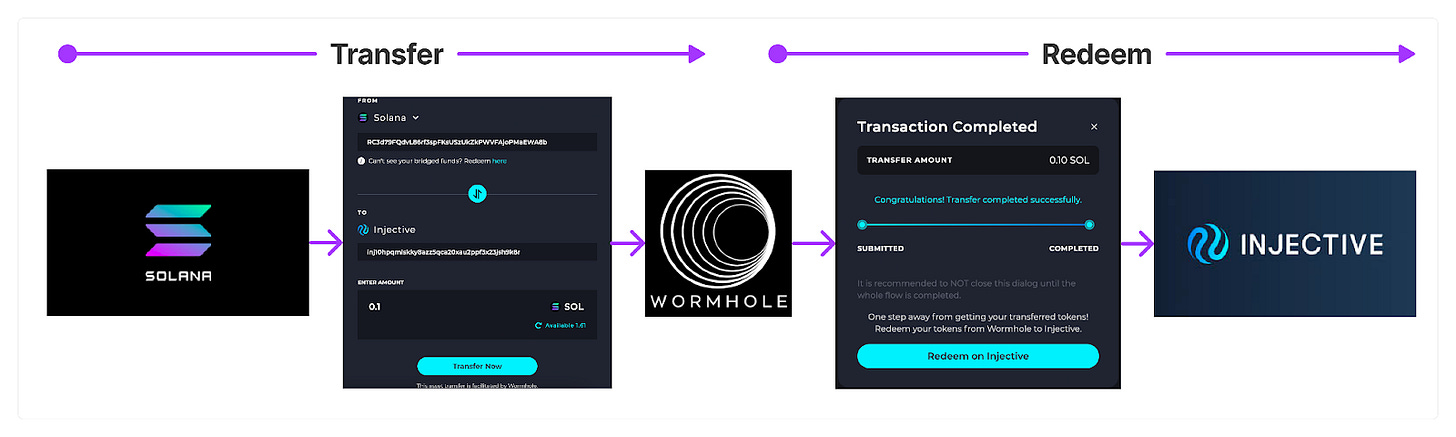

The Injective Wormhole bridge allows users to bridge tokens across different chains. This works by locking the source assets in a smart contract and minting the new Wormhole-wrapped assets on Injective.

All source chains have the same steps to bridge (transfer and redeem), but the experience and the time it takes to confirm transactions can differ based on the source chain.

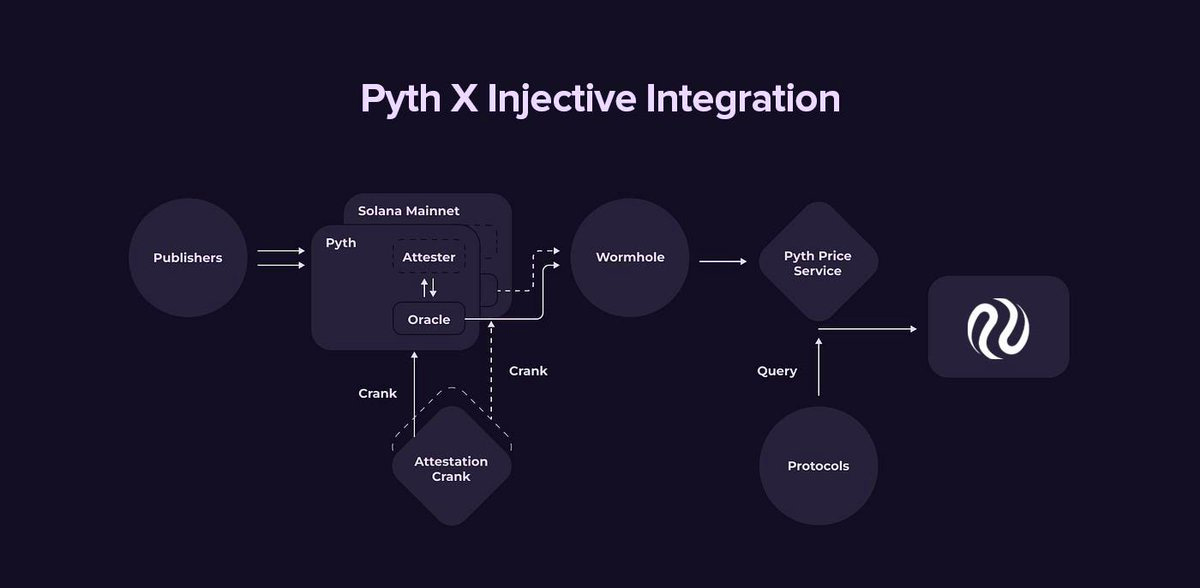

This integration has also made it possible for Injective to fetch off-chain data and make it available on-chain through an integration of Pyth network oracles.

All completed, in progress and failed/canceled transactions can be seen in the history section at the bottom of the Injective Hub bridge page.

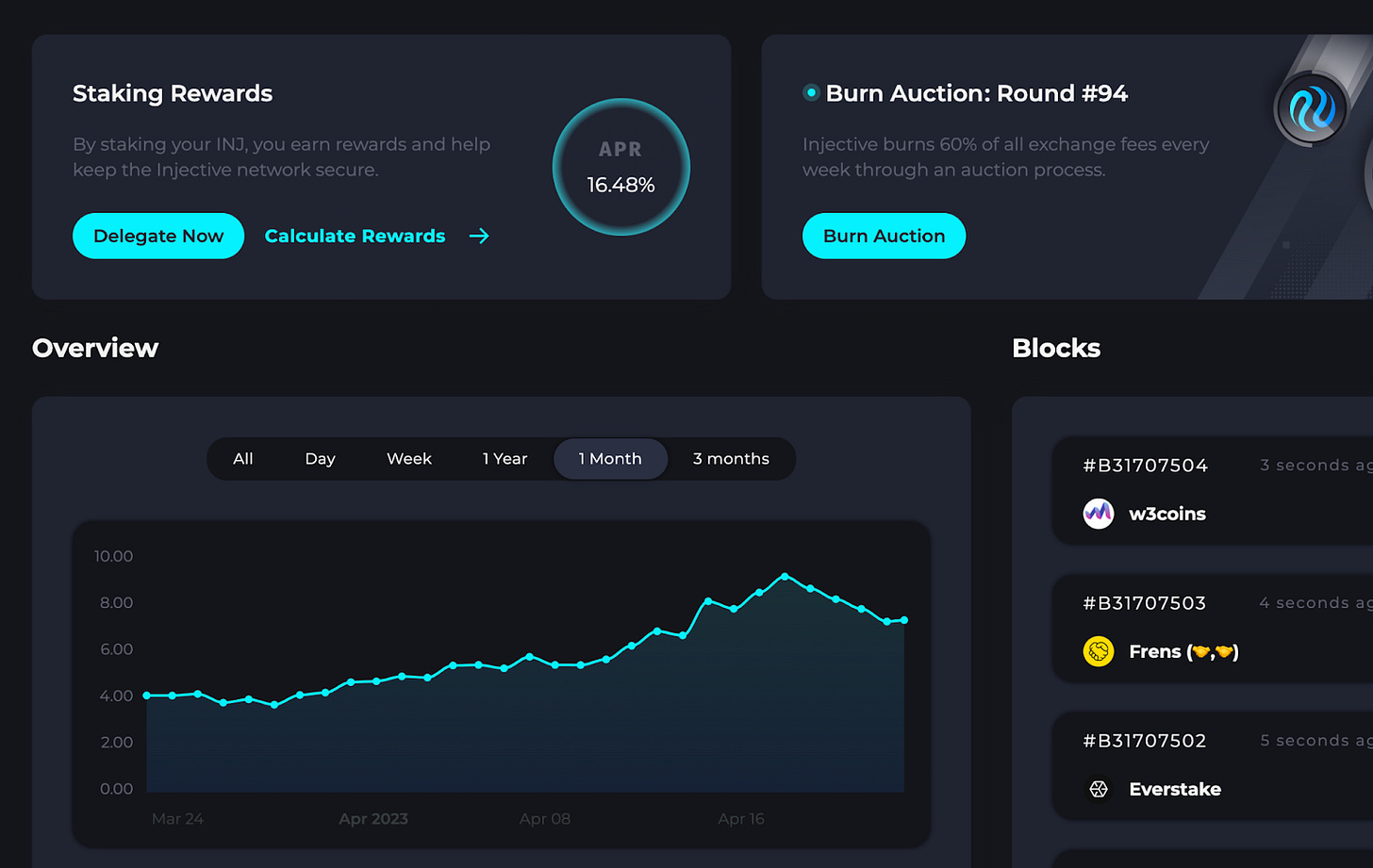

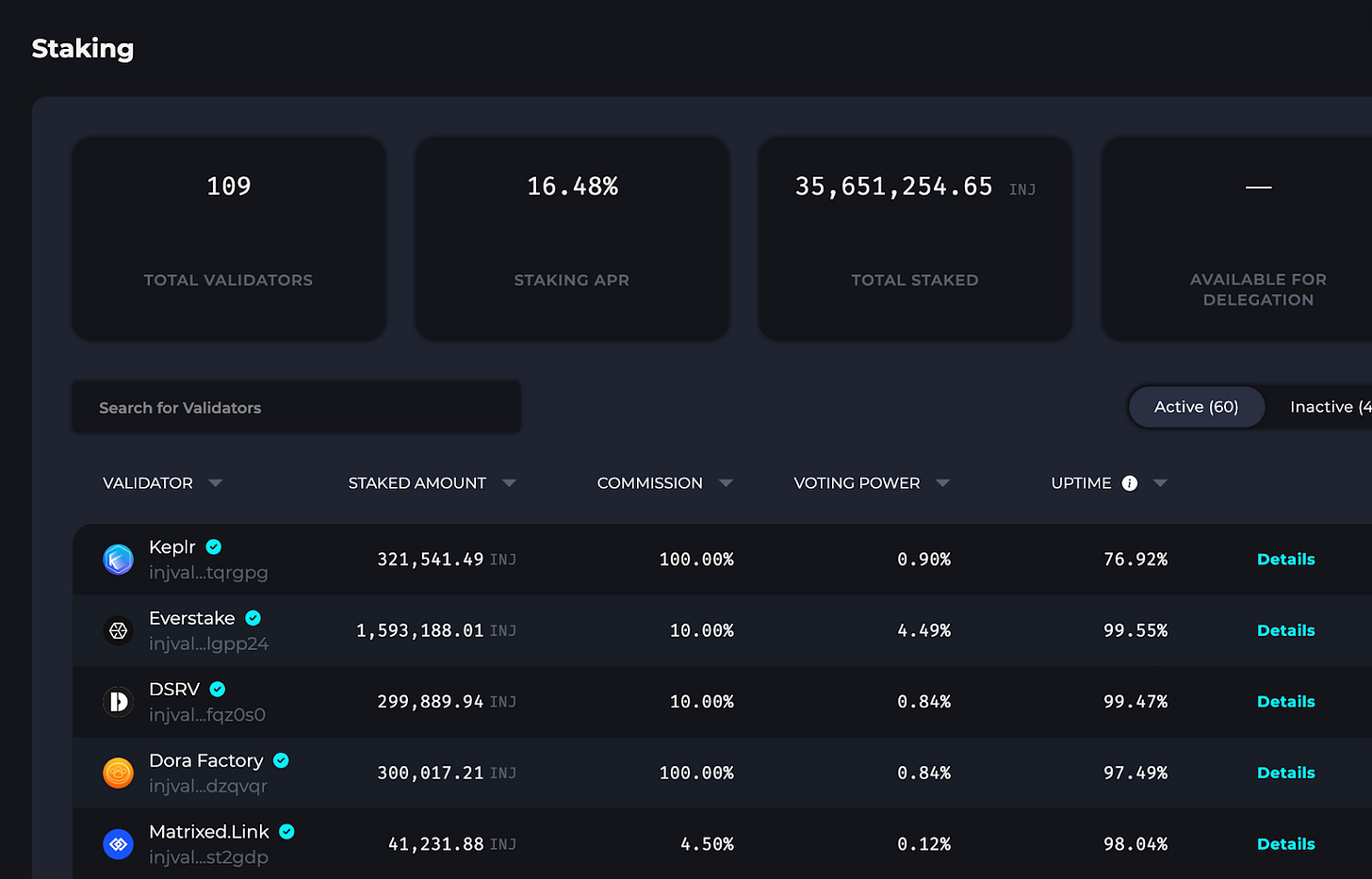

Staking

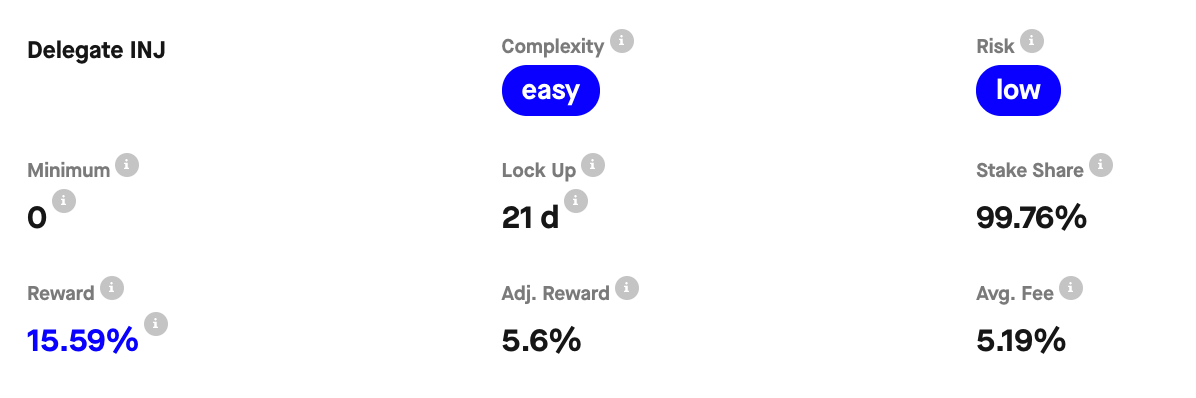

Injective uses the standard DPoS staking mechanism found in the Cosmos-SDK. Users can delegate their INJ tokens to validators to receive a share of rewards generated by the network.

Injective’s staking rewards vary depending on the inflation and total amount of tokens that are staked at a given time.

Injective has 100+ validators, 9,000 delegators, and a ~16% staking APR.

Connect your wallet to: https://hub.injective.network/

In the top right corner you will be able to see your INJ address as well as the equivalent address in Ethereum.

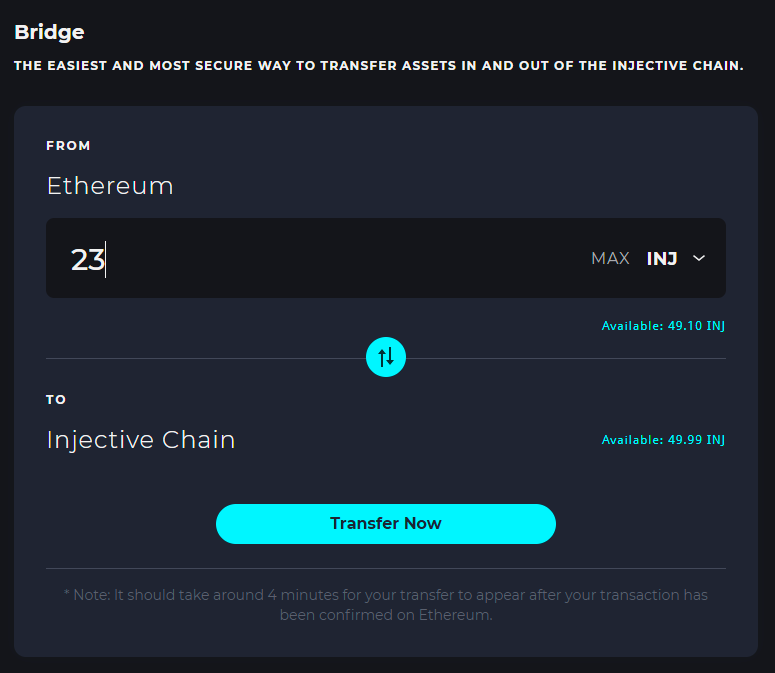

In order to start staking, users can bridge ERC20 INJ to the network and receive native INJ.

In order to bridge tokens from Ethereum, you must pay gas fees in ETH. When the allowance is set and the transaction is confirmed on the Ethereum network, you will be able to provide the amount for the transfer.

It might take up to 4 minutes for your balances to reflect on the Injective Chain after the transaction has been confirmed on Ethereum.

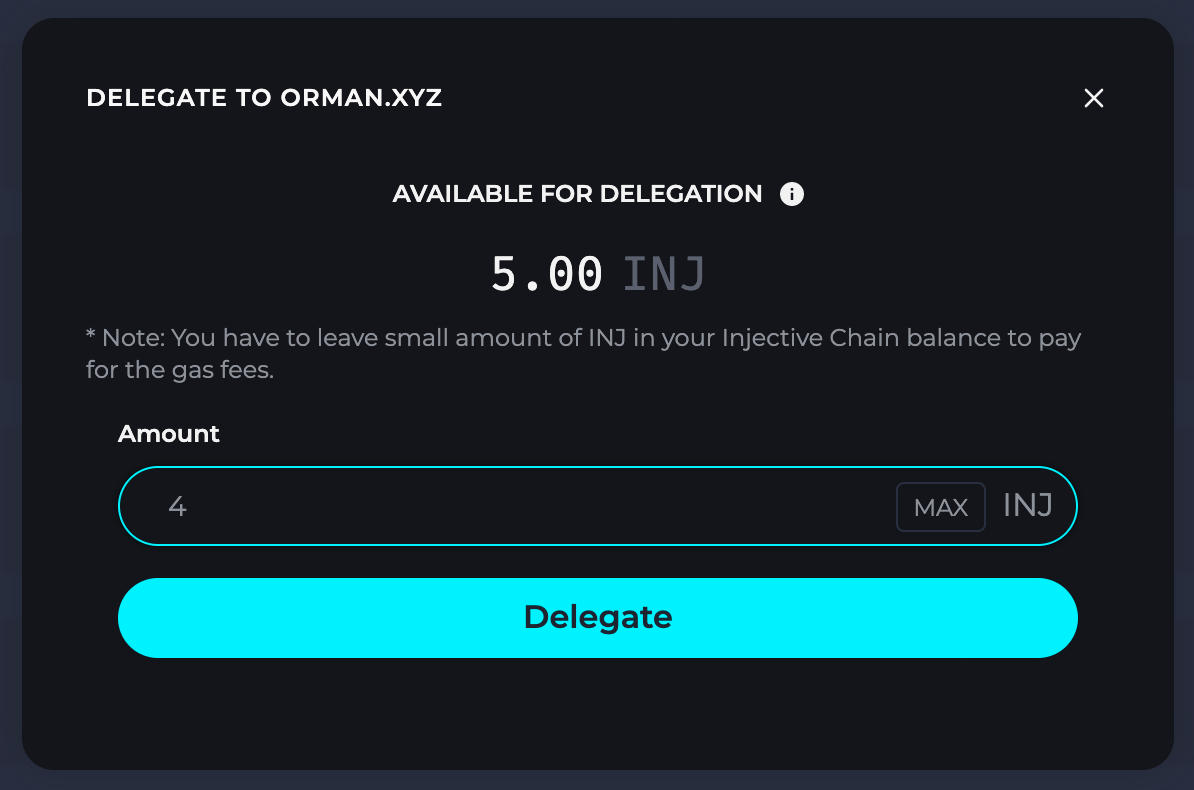

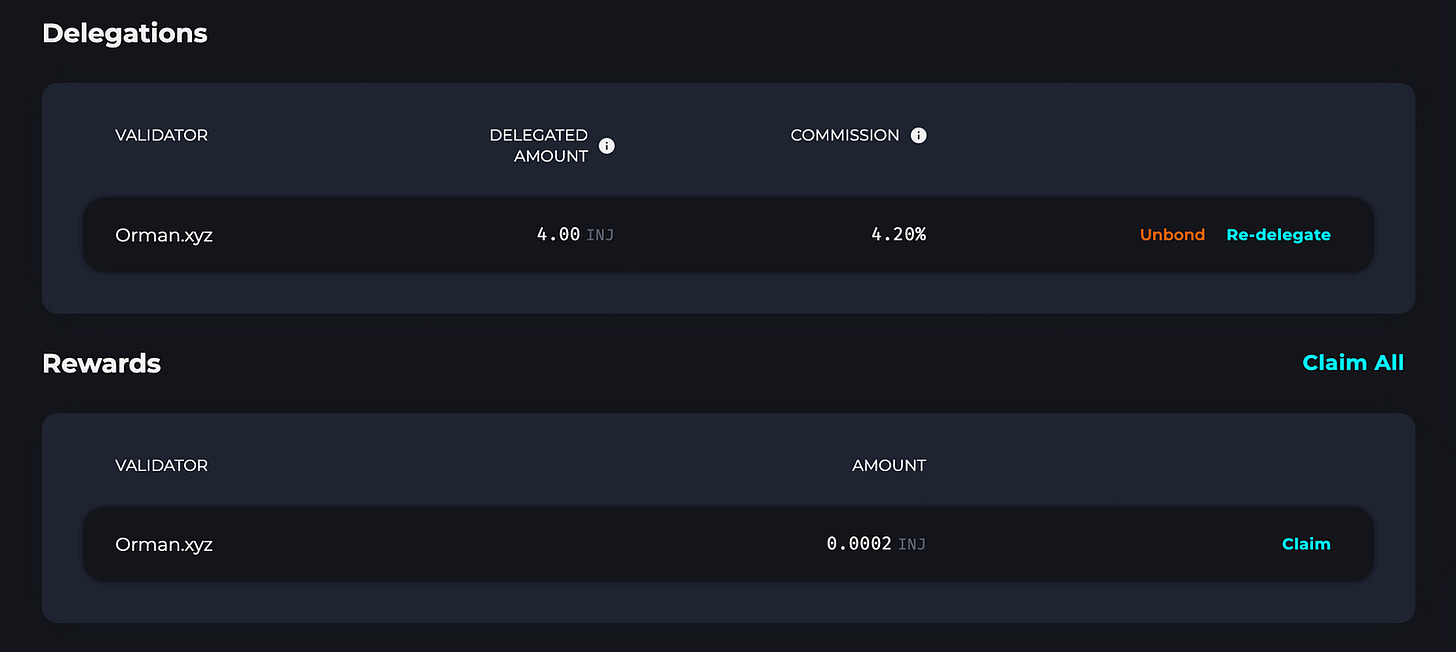

The next step in order to participate in Injective’s PoS chain is to delegate iNJ tokens to a validator.

Injective’s validators are a prominent cohort of established organizations with years of experience in securing Proof-of-Stake blockchains. This includes providers such as Audit One, Chorus One, Citadel One, Figment, HashQuark, and Huobi Pool among others.

Users can also re-delegate their stake to a different validator. In doing so, the user will continue to earn rewards (unlike unbonding, where you stop receiving INJ rewards and your balance is returned to you after a 21-day unbonding period).

Institutions

Institutions can participate in the ecosystem by:

- Building enterprise dApps.

- Accessing institutional products.

- Obtaining incentives.

- Using permissioned gateways.

This also includes day traders, market makers, and algorithmic traders that are seeking to leverage applications in the ecosystem for market making or trading. Injective was built with the needs of these users in mind and provides them with robust access to real-time data via its APIs.

Developers

Developers can build applications atop of Injective to benefit from its instant finality and interoperability between Cosmos and Ethereum (and other blockchains thanks to an integration with Wormhole) in order to build cutting-edge applications.

- Smart contracts are built with CosmWasm, a smart contracting framework built for the Cosmos ecosystem. Simply put, it’s the Cosmos (Cosm) way of using WebAssembly (Wasm), hence the name. CosmWasm is written as a module that can plug into the Cosmos SDK. This means that anyone currently building a blockchain using the Cosmos SDK can quickly and easily add CosmWasm smart contracting support to their chain, without adjusting existing logic.

- Injective offers a completely unique implementation of smart contracts that automatically executes those smart contracts at every block (instead of needing someone to manually force the execution).

- There are on-chain modules that developers can plug and play into their applications, like an on-chain order book, the binary options module, derivatives trading capabilities…

- Developers can earn a percentage of dApp fees on Injective. 40% of fees generated by users on dApps built on Injective go directly towards incentivizing new developers building on Injective, which brings an ever growing funnel of builders to Injective.

- Zero gas fees for end users.

For Investors

Business Model

As a PoS (Proof of Stake) network, token holders are active participants in securing the chain. This is achieved by staking the native token, INJ.

Validators and delegators secure the chain by participating in network consensus by operating validator nodes (validators), or delegating INJ tokens to node validators (delegators). By delegating to a validator, the user is giving permission to that node to use their delegated staked to participate in the consensus of the network. To do that, validators must garner enough stake (self-bonded + delegated) to become active and earn rewards.

While operating a validator requires a level of technical competency, there is no need for delegators to have that knowledge. Any token holder can stake and delegate INJ tokens. These tokens will be locked by a validator to start earning rewards. Whenever the delegator wants to recover its liquid tokens, it will start an unbounding process and it will no longer be entitled to staking rewards.

Validators ranked by state: https://www.mintscan.io/injective/validators

Revenue Streams

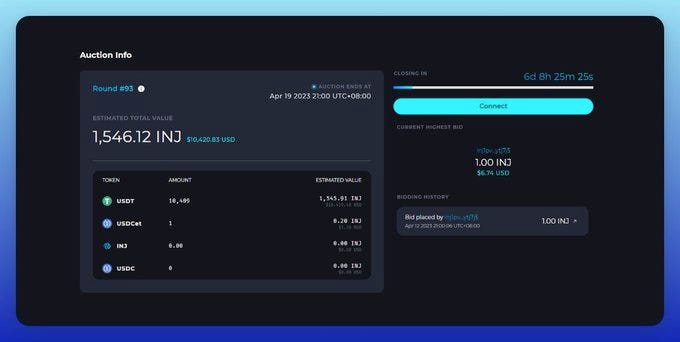

Weekly auction

Every week, 60% of the exchange fees are burnt via an auction. Users can use INJ to bid for the basket of trading fees collected during the week and the winner receives the full basket of assets, and the bid amount is burnt, causing a supply deflation.

Economics

Coingecko: https://www.coingecko.com/en/coins/injective

Exchange analytics:

https://info.injective.exchange/

Fee Breakdown

The protocol itself implements a global minimum trading fee of 0.1% for makers and 0.2% for takers.

- 40% of fees generated by users on dApps built on Injective go towards developer incentives.

- 60% of all fees collected from dApps are auctioned off every week via a buy back and burn mechanism.

Validators charge a commission rate for their service. This commission represents the percentage of the validator’s staking rewards retained by the validator. For example, if this rate is set to 5%, then delegators will receive 95% of the rewards while the validator will receive 5%.

Validators can change their commission rate at any time and that change will be executed in 24 hours. If a validator node sets the maximum rate to 15%, then they may change their commission rate up to 15%.

A validator’s maximum commission rate change defines the maximum daily increase possible. For instance, if the validator has set this parameter to 3% then they can change their commission rate up to 3% within 24 hours. If the maximum commission rate is set to 15% and the maximum commission rate change is set to 3% then the validator can increase it by a maximum of 3% daily up to a maximum of 15%.

Operating Expenses

The cost of operating as a validator ranges from about $50-200 a month, depending on the server infrastructure and hardware requirements being used.

If a validator misbehaves, their delegate stake is partially slashed. Two faults can result in slashing of funds for a validator and their delegators:

- Double signing. If someone reports that a validator signed two blocks with the same block height then this validator is slashed with 5% of its block rewards.

- Downtime does not incur a slashing penalty but the validator is ‘jailed’ and will miss out on staking rewards for 2 hours minimum.

Proof of Stake networks use a reward and penalty mechanism to incentivize good behavior of the nodes that secure the network. Validators receive rewards for both attesting and proposing blocks to the blockchain. However, bad behaviors and dishonest validation are punished with a mechanism called slashing.

Slashing is a mechanism used by PoS networks to discourage harmful behaviors and help to keep the network secure. If there were no slashing penalties in a network, a validator could use its node to validate blocks on multiple chains, sign blocks simultaneously, or be offline and not participate in the block attestation and proposal process.

$150M Injective Ecosystem Group

The $150M Injective Ecosystem Group was announced on January 25, 2023 to further accelerate the development and adoption of Injective. This effort was supported by institutional backers such as Pantera Capital, Kucoin Ventures, Jump Crypto, IDG Capital, Gate Labs, Delphi Labs, Flow Traders and Kraken Ventures. One of the main objectives is to bridge the gap between traditional and decentralized finance.

Having witnessed the growth of ecosystem dApps such as Helix, Frontrunner, Astroport and White Whale, the venture group was assembled to back builders pioneering new ideas across a diverse array of sectors including interoperability, DeFi, trading, PoS infrastructure, rollups and scalability solutions.

To network with the venture collective, builders can apply by submitting a form providing information concerning the project, the team, and the current progress of the undertaking. After presenting the submission, the Venture Group team will examine everything and make contact if additional details are needed.

Tokens

The native token INJ was initially released as an ERC-20 token on Ethereum and then migrated over to its own chain.

INJ

INJ is the native and deflationary asset that powers Injective and its ecosystem. It is used to secure the network, pay for gas fees, and governance.

- INJ, is used as a governance token, allowing holders to vote on changes to the protocol, including updates to its core trading logic, fee structures, and security measures.

- Governance page: https://hub.injective.network/governance

- INJ can be used as collateral for margin trading and derivatives products, as well as an incentives mechanism.

- INJ is the token used to secure the network and earn rewards from staking. It is also used to pay trading fees and by auction bidders.

- INJ has a value capture mechanism where 60% of all fees generated from ecosystem dApps enter a weekly on-chain buy-back-and-burn auction to maintain the deflationary nature of INJ

- Burn auction page: https://hub.injective.network/auction

There is an initial supply of 100M INJ with an initial target inflation of 7% that was lowered to 5% (as per proposal 59) and that gradually decreases to 2%. It is also worth noting that INJ also incorporates a deflationary mechanism from token auction and burning.

Token Burn Auction

Injective features weekly auctions, where 60% of protocol revenue from exchange fees is auctioned off in exchange for $INJ, which is then burned. As a result, if exchange fees increase such that $INJ burned is more than the inflationary rewards, $INJ could be in a deflationary state.

Members of the Injective community can participate in these auctions. Here’s how it happens:

- Members place their bids on the asset basket using $INJ.

- Once the auction concludes, the highest bid wins the assets.

- This winning bid is not re-circulated. Instead, it’s burned, ensuring the value of $INJ is maintained.

On August 16, 2023, the burn mechanic was upgraded to 2.0.

The upgrade to INJ 2.0 aims to enable any dApp on Injective to contribute to burn auctions, therefore extending the benefits of the token burn mechanism to a wider array of protocols.

Under this upgraded system, a diverse range of dApps, spanning lending platforms, NFT marketplaces, prediction applications, and beyond, can opt to contribute to the auction burn. In addition, all protocols have the option to allocate the amount they would like to contribute to the auction, even allocating up to 100% of their collected fees to the auction basket.

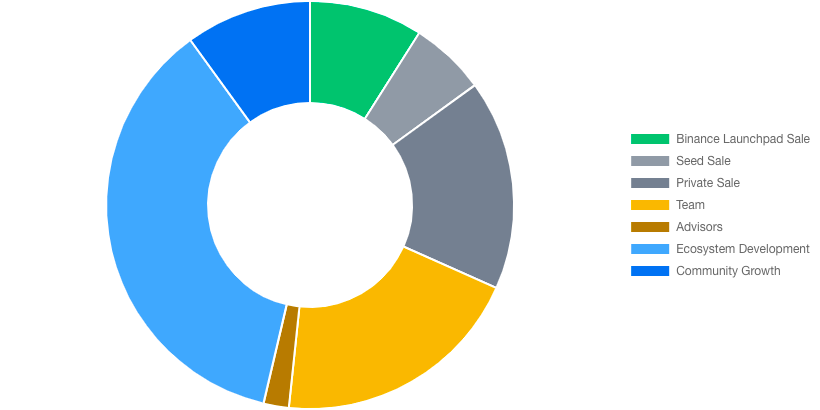

Token allocation

- Ecosystem development: 36.33%

- Team: 20%

- Private sale (16,666,667 INJ at 0.1800 USD / INJ): 16.67%

- Community growth: 10%

- Binance Launchpad sale (Oct 19th 2020, 9,000,000 INJ at 0.4000 USD / INJ): 9%

- Seed sale (6,000,000 INJ at 0.0833 USD / INJ): 6%

- Advisors: 2%

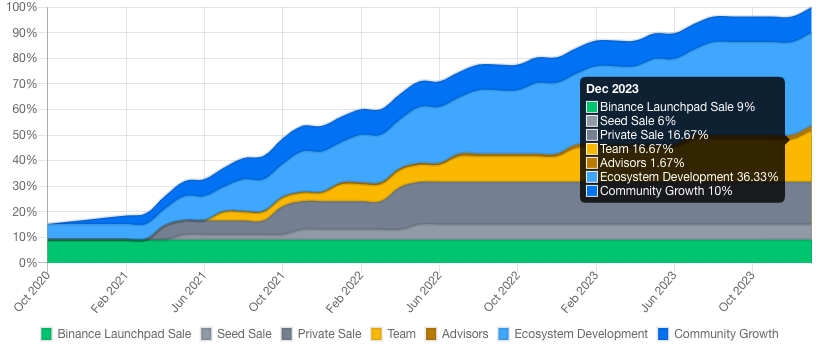

Token release schedule

Governance

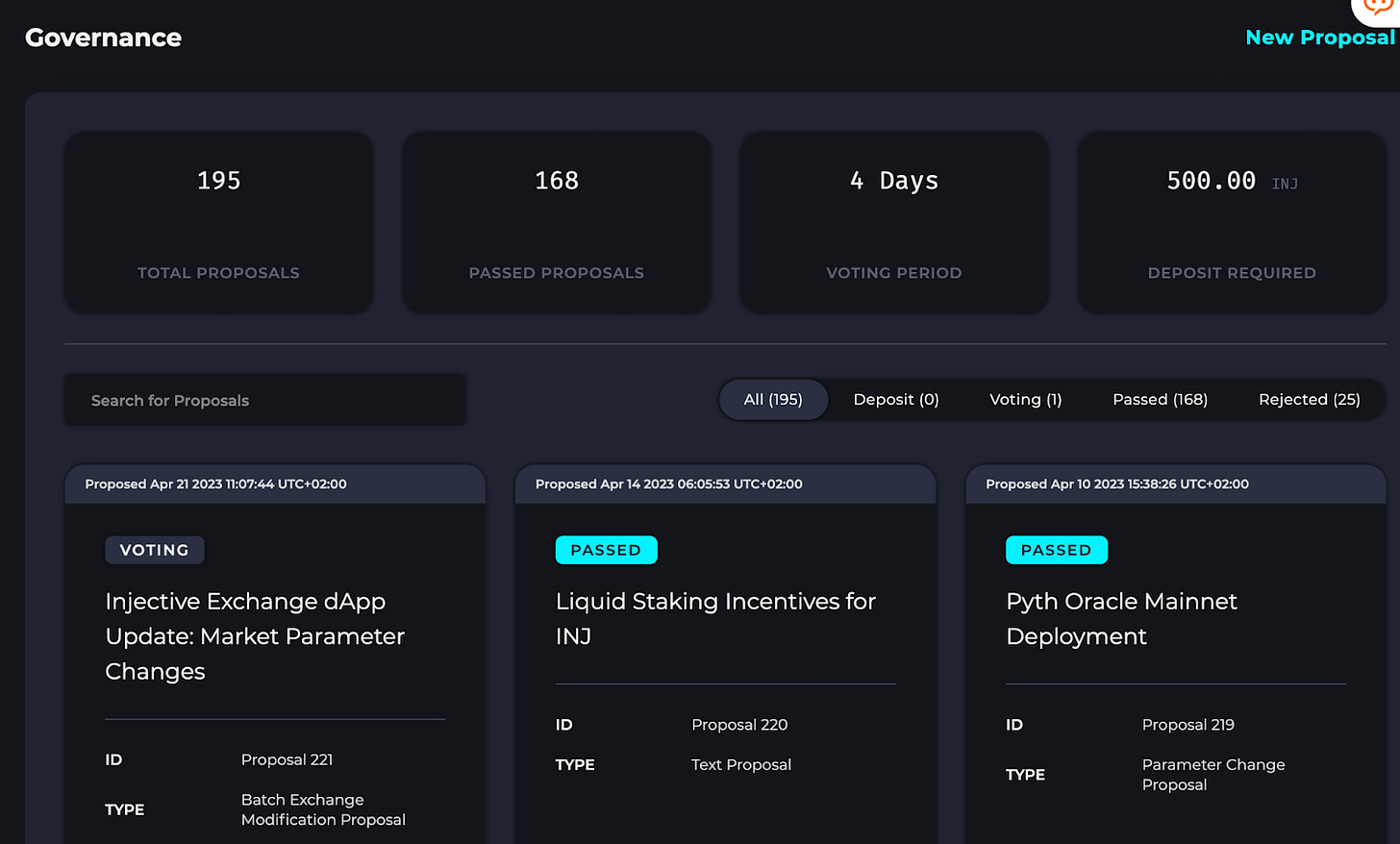

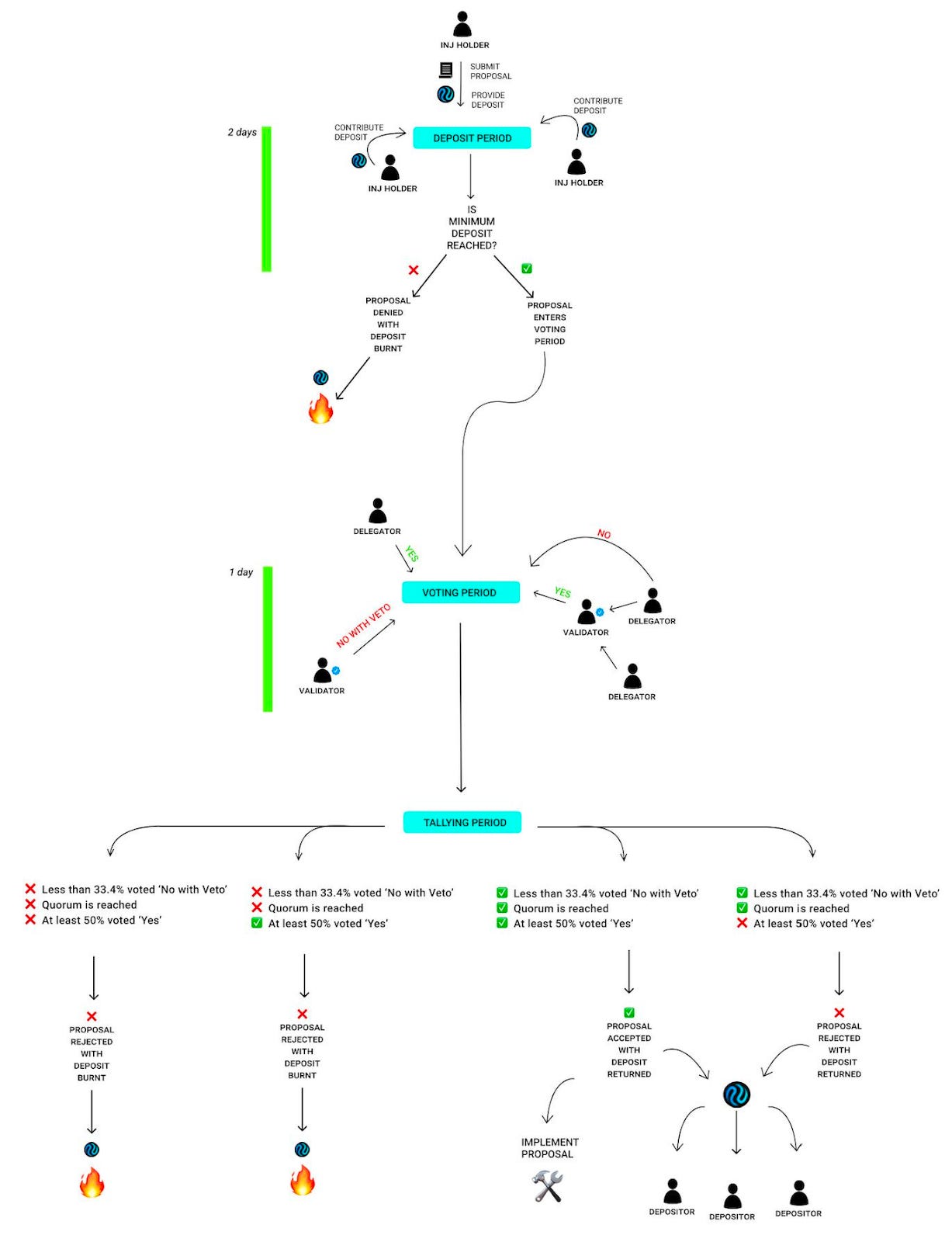

Injective is governed by a global DAO through its native assets, INJ, which allows members of the community participate in protocol upgrade proposals, validate the network’s staking rewards and burn auctions… In order to prevent spam, there is a minimum deposit required of 500 INJ and each voting period lasts over 4 days.

Community members coordinate informally off-chain and engage in forum discussions to debate improvements or trade-offs, and then proceed with the execution of formal on-chain proposals.

Only INJ holders who have staked INJ tokens have the right to vote on proposals, whereas INJ holders that haven’t staked INJ tokens can submit and deposit in proposals. For every proposal, there is a 2-day deposit period defined as the interval of time between the moment the vote opens and the moment the vote closes.

Proposals include but are not limited to parameter changes, launching new markets, updating markets, and software upgrades. Governance proposals can have one of 4 different states at a given time: Deposit, Voting, Passed, or Rejected. Similarly, a vote can be Yes, No, Abstain or No with Veto.

The Abstain vote allows voters to signal that they don’t intend to vote in favor or against the proposal but accept the result of the vote.

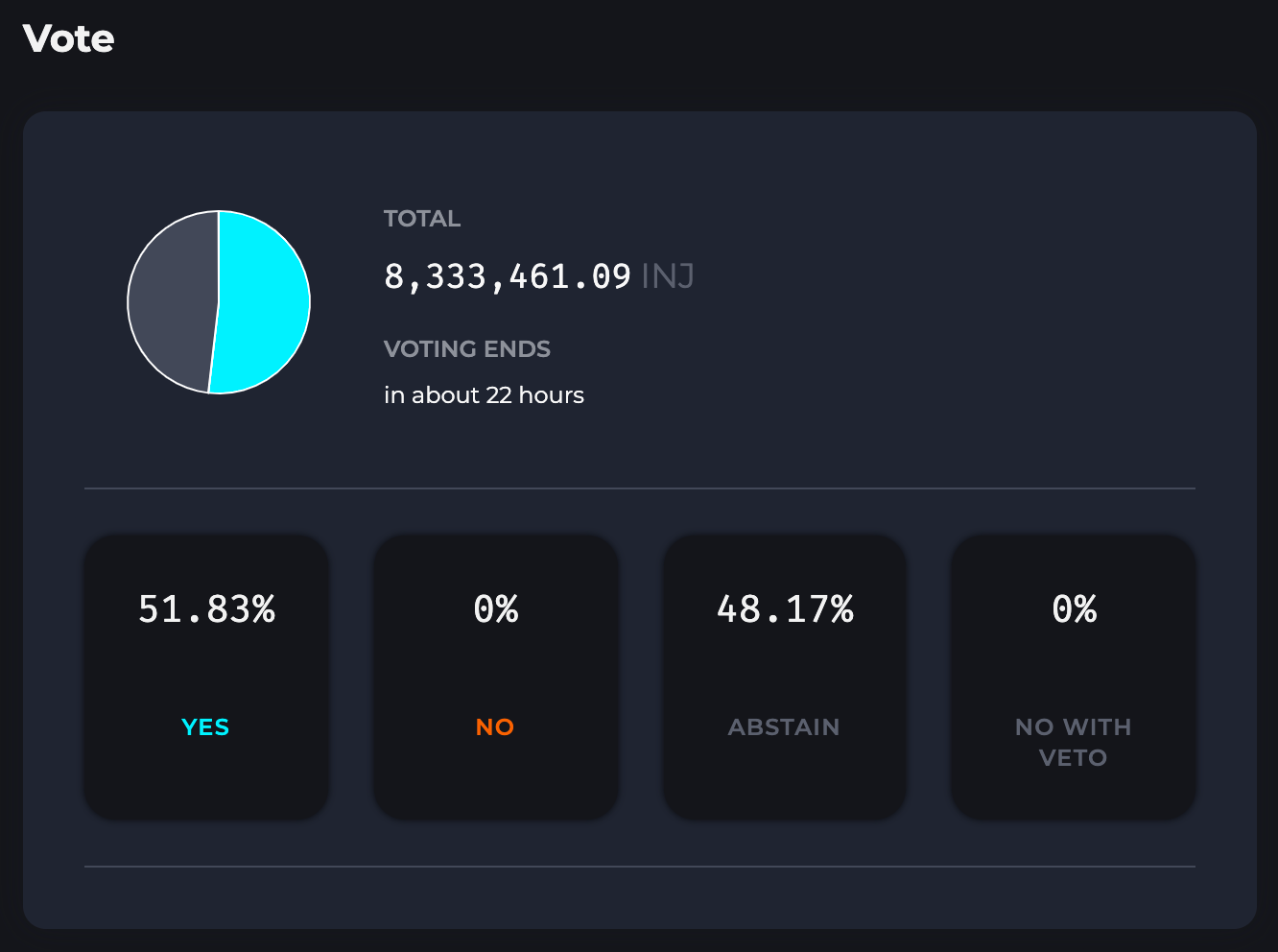

The quorum for a proposal is defined as the minimum percentage of voting power that needs to be casted in a proposal for the result to be valid, and represents 33.4% of the total bonded tokens

The threshold for a proposal is defined as the minimum proportion of Yes votes (excluding Abstain votes) for the proposal to be accepted. The threshold is set at 50% with a possibility to veto if more than 1/3 of votes (excluding Abstain votes) are No with Veto. If the proportion of Yes votes (excluding Abstain votes) at the end of the voting period is superior to 50% and at the same time the proportion of No with Veto is inferior to 1/3 (excluding Abstain votes), then the proposal will pass.

When a proposal is finalized (passed or rejected), the INJ deposits are either refunded or burned based on the final tally of the proposal.

- If the proposal passes or gets rejected with quorum, the deposits will be automatically refunded to the respective depositors.

- If the proposal is vetoed or does not reach quorum, the deposits will be burned.

A participant’s vote on a proposal under a certain validator can be rejected if:

- The participant bonded or unbonded INJ to said validator after the proposal entered its voting period.

- The participant became a validator after a proposal entered its voting period.

Note that this does not prevent a participant to vote with INJ bonded to other validators

Governance Upgrade

A governance upgrade was completed on August 22, 2023.

This upgrade mainly affected the user interface and included the following:

- A more seamless view on the Injective Hub, making it easier for users to launch new proposals, view ongoing votes and analyze the ecosystem itself.

- Find specific tags that allows users to quickly navigate across proposals.

Risks

The network has been running in production since 2021 and has continued to evolve since then. As the chain implements new upgrades and continues to improve, there are still opportunities for the unfortunate introduction of bugs, code vulnerabilities…

Smart contract risk will be present across all applications that build on top of the Cosmos SDK, Tendermint, IBC… On the positive side,the failure of any specific chain, as evidenced by the LUNA and Terra collapse, would have no impact on the rest of the chains.

When it comes to staking, the rewards that are accrued for securing the network are not risk-free. When users delegate INJ to a validator, or run their own validator nodes, they must be aware that validators can be partially slashed if the node misbehaves.

On Injective, there are two possible reasons for slashing:

- Slashing by 5% can occur if the validator signs two different blocks at the same block height (double signing).

- Slashing by ‘jailing’ can occur if the validator is offline for too long. If a validator does not sign a minimum of 500 blocks out of the last 10,000 blocks, the validator will be slashed for downtime and will miss out on staking rewards for at least 2 hours.

Security

The Injective network leverages the Cosmos SDK as an alternative approach to security based on the notion of object capabilities.

While no framework can completely protect developers from introducing bugs and security breaches in their codebase, developers do not have to worry about potential bugs and security vulnerabilities that affect the virtual machine upon which all the applications of the ecosystem are built.

Audits

Injective’s spot and derivatives codebases were audited by Informal Systems in 2021.

- Security Audit Report – June 28 2021 – Informal Systems

- Informal: 5 (5 Resolved)

Bounties

While Injective does not have any bounties on Immunefi, it accepts submissions directly from the public.

Project Investors

In 2018, Injective was selected as one of eight winners for incubation with Binance Labs, Binance’s venture arm. Since then, Binance has supported Injective’s vision of building a product that solves major issues such as poor UX, slow speeds, centralization, and high fees.

Injective was not only incubated by Binance Labs, but also became the first project to launch on Binance Launchpad in October 2020. 9% of INJ’s total supply was sold on Binance’s Launchpad for $0.4 per token at a valuation of $40 million and no lock-up period.

Injective has raised sizable amounts of capital in 2021 and 2022 from notable investors.

- Pre-Seed

- Raised $500k on October 5 2018.

- Binance was the sole investor.

- Seed Round

- Raised $2.6M on July 29 2020.

- Led by Pantera Capital, with participation from QCP Capital, Soteria, Axia8 Ventures, Boxone Ventures, Bitlink Capital, and others.

- Initial Coin Offering

- Raised $3.6M on October 21 2020.

- Public sale on Binance Launchpad.

- Private Placement Token Sale

- Raised $10M at a $1B valuation on April 20 2021.

- Investors include Mark Cuban, Pantera Capital, BlockTower, Hash Ventures, CMS Holdings, and QCP Capital.

- Funding Round

- Raised $40M on August 15, 2022.

- Investors include Jump and BH Digital, the digital asset division of Brevan Howard’s hedge fund.

In November 2021 Injective launched a $120M incentives program, which was the largest liquidity incentive in the Cosmos ecosystem up to that date.

There is also a $150M ecosystem fund initiative with partners such as Pantera capital, Kucoin Ventures, Jump, and Delphi Labs.

Additional Information

Partnerships

Injective has reached strategic partnerships and collaborations with a variety of platforms in order to expand its dApp use cases, conduct technical research, and introduce new decentralized derivatives products.

- Jump Crypto is building infrastructure for decentralized finance, supporting builders on Injective and fostering ecosystem growth.

- Wormhole is a messaging protocol that connects high-value blockchains and enables interoperability between ecosystems. Through this integration, Injective can support additional blockchains in its ecosystem, making Injective one of the most interoperable blockchains today.

- Polkadot facilitates cross-chain communication and interoperability by connecting multiple blockchains into one network. This partnership will enable Injective to expand its dApp use cases to Polkadot and its wider ecosystem of parachains.

- Polygon is a platform for Ethereum scaling and infrastructure development, featuring the Polygon SDK for building various types of applications. Injective has partnered with Polygon to delve into technical research and expand markets for Polygon assets.

- Elrond is a blockchain platform for distributed apps, enterprise use cases, and the new internet economy. Injective’s collaboration will open new markets for Elrond and introduce new decentralized derivatives products to their ecosystem.

- Chainlink provides secure price feeds via its oracle services and allows developers to use off-chain data in their on-chain applications.

- Avalanche is an open-source platform for launching decentralized applications and enterprise blockchain deployments. The integration will allow Injective users to utilize Avalanche assets within the broader Cosmos ecosystem.

- Notify is a web3 notifications platform that provides instant notifications and user alerts to inform users about the state of their trading activities through various channels such as email, Telegram, SMS, Discord… dApps can enable personalized alerts using on-chain and off-chain events, as well as Notifi’s community management tools.

- Chiliz is the leading EVM chain for sports and has been integrated into Injective in order to find synergies between both ecosystems.

- Elixir Protocol – Bringing liquidity to the long tail of cryptoassets via the industry’s decentralized, algorithmic market making protocol.

- Hummingbot – Open source software for building crypto trading bots.

- Tencent Cloud – A global leader in cloud services and a technology company known for owning products such as QQ & WeChat.

- Binance Custody – A leading institutional-grade digital asset custody solution that features sophisticated cold and hot storage security alongside advanced liquidity solutions for institutions to manage digital assets seamlessly.

- Google Cloud – A leading provider of cloud computing services.

- BitGo – A leading institutional custody and digital asset finance provider.

- Kava – A decentralized blockchain that seeks to combine the speed and interoperability of Cosmos, with the developer power of Ethereum.

- Ondo Finance – Ondo is the issuer of USD Yield (USDY), the world’s first tokenized note secured by US Treasuries.

Global hackathon

Injective’s global hackathon has up to $1,000,000 in prizes and offers seed funding opportunities for new ecosystem builders. Participation is open to the public and the Injective technical team will also host workshops and developer sessions.

- Week 1: Launch week – opening ceremony alongside panels where industry leaders from Injective’s ecosystem will share their experiences.

- Week 2: Learn week – multiple technical panels and developer workshops will guide developers step by step on how to optimally build applications on top of Injective’s infrastructure.

- Week 3: Build week – teams work on product development and will have the opportunity to connect directly with mentors.

- Week 4: Demo week – teams present their projects to peers and the Injective Hackathon panel judges.

Injective venture group

The Injective Ecosystem Venture Group is a group of prominent institutions and venture funds that will provide funding to support projects building within a diverse array of sectors in Injective, including interoperability, DeFi, trading, PoS infrastructure, rollups and scalability solutions.

Ninja Masters Ambassador Program

The goal of the Ninja Masters Ambassador Program is to further help accelerate Injective community growth and adoption. Every task that is completed helps the user to earn points and level up in their ranking, which will entitle them to a series of rewards. As an ambassador, anyone in the community can use their skills to spread the Injective message through a diverse set of growth initiatives: content creation, social media, technical development, meme creation, blog writing, community management…

The Ninja Masters consist of 5 ranks. Every task you complete will earn you points and gaining more points is how you can level up your ranking (explained below). Everyone in the Injective Discord server will start off with the Ninja role.