Overview

HAI is a decentralized stablecoin protocol that utilizes a variety of collateral assets to maintain its value. Unlike traditional stablecoins pegged to fixed assets like USD, HAI employs a controlled-peg mechanism and a PID (Proportional-Integral-Derivative) controller to dynamically adjust interest rates, influencing its market price based on the underlying collateral.

The HAI protocol is a multi-collateral fork of $RAI (Reflexer stablecoin) designed to offer a stable yet flexible medium of exchange: the $HAI stablecoin. The controlled-peg concept allows $HAI to adjust its peg, not fixed to a specific value like $1, but rather guided by economic mechanisms and algorithms to maintain stability relative to its diverse backing assets. Users participate in the ecosystem by depositing acceptable forms of collateral to mint $HAI, which they can use for trading, lending, or other financial activities on-chain. This system ensures that the value of $HAI is backed by valuable crypto assets, contributing to the stability of the protocol.

How Does it Work?

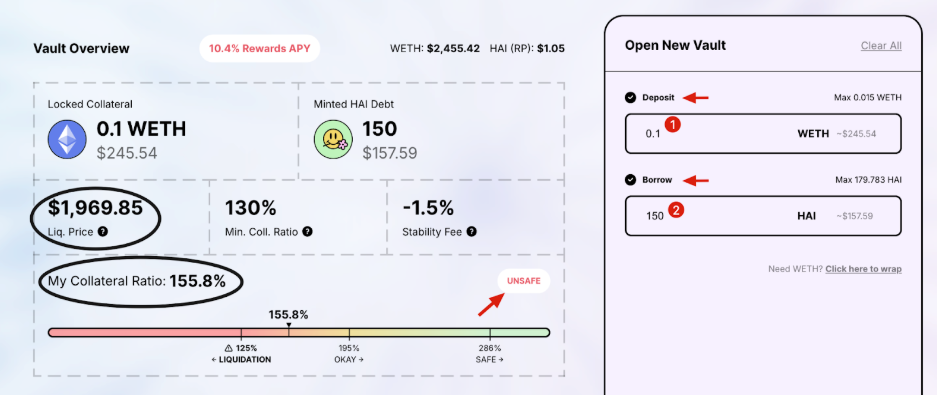

HAI operates on a system where users, or “minters,” can create or “mint” $HAI tokens by engaging in over-collateralized debt positions (CDPs). This means that each $HAI token is backed by a greater amount of collateral than the circulating units of $HAI itself. Minters deposit assets into specially designated accounts called Vaults and can mint $HAI against these assets. As the protocol is currently deployed on Optimism, collateral types accepted include $OP, $WETH, and $wstETH among others, with additional assets to be supported in the future. The assets deposited in the Vaults remain the property of the user and are not mixed with assets from other Vaults, thus keeping risks isolated.

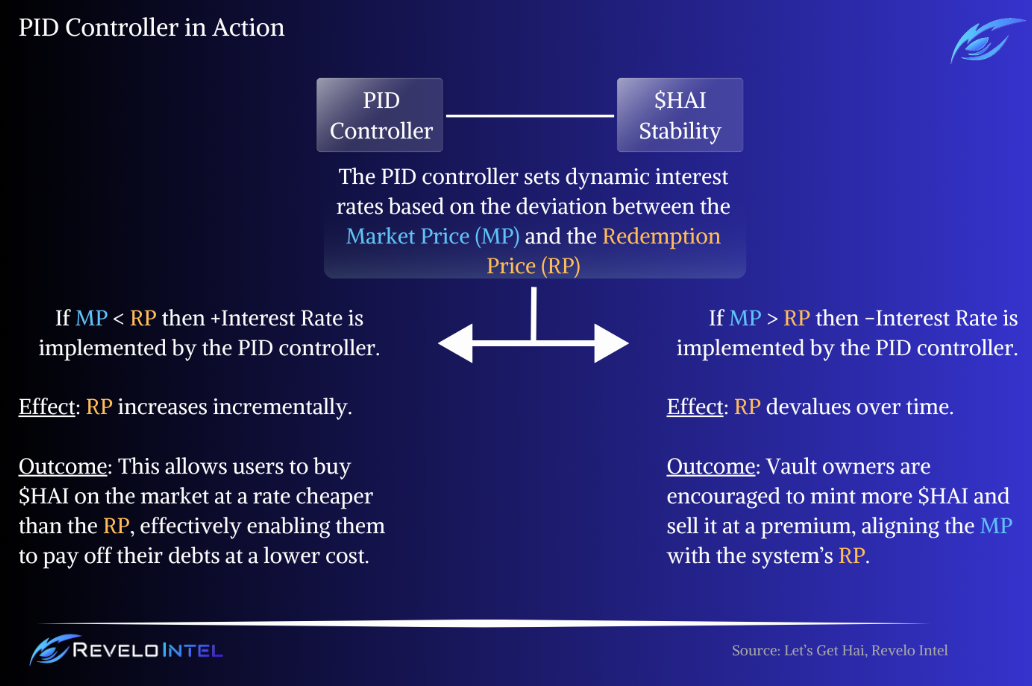

Unlike most fiat-backed and centralized stablecoins, like $USDC or $USDT, but also other crypto-backed CDPs like $DAI or $USDS, which are pegged directly to the U.S. Dollar (USD), HAI utilizes a floating peg mechanism managed by a PID controller. This system accounts for two primary prices:

- Market Price (MP): The price at which $HAI is currently trading on the open market.

- Redemption Price (RP): The internal valuation of $HAI by the system.

Note that, due to the use of volatile assets as collateral backing, users need to carefully manage the amount of $HAI they mint relative to their locked collateral’s value. If the value of the collateral assets decreases beyond certain thresholds, the position would be at risk of being liquidated through collateral auctions. These auctions are part of the protocol’s measures to safeguard the stability of $HAI and maintain user confidence in the protocol’s robustness and reliability. This mechanism ensures that $HAI remains adequately backed by real assets, protecting the integrity and value of the stablecoin.

Key Components of HAI

Here are the key components of the HAI protocol and their roles.

| Vaults | Vaults are isolated smart contracts that hold the collateral assets of a user’s position. They are essential for holding the assets that will back the newly minted units of the $HAI stablecoin. The amount of $HAI that can be minted is based on the value of the collateral stored within their Vaults in order to ensure full backing via overcollateralization. |

| $HAI (System Coin) | $HAI is the primary stablecoin issued by the HAI Protocol. It is entirely user-generated, with its value underpinned by a greater value of collateral that remains locked within the system. The pricing mechanism of $HAI is dual-faceted: the Market Price, which is externally determined, and the Redemption Price, which is programmatically set by the protocol itself. |

| KITE (Protocol Token) | $KITE functions as the governance token of the HAI Protocol, empowering holders with voting rights on crucial system modifications, such as changes in collateral types and other protocol developments. Additionally, $KITE tokens are utilized in certain types of auctions within the protocol. |

| Collateral Auction House | This component consists of a suite of smart contracts tasked with managing the liquidation of undercollateralized Vaults. The process involves auctioning off seized collateral to cover outstanding debts, with $HAI being the medium of exchange. |

| Debt Auction House | The Debt Auction House is activated in scenarios where the protocol incurs bad debt. It facilitates the sale of newly minted $KITE tokens in exchange for $HAI, aiming to offset the accrued bad debt on the protocol’s balance sheet. This mechanism is designed as a last resort when standard debt management strategies prove insufficient. |

| Surplus Auction House | As stability fees accumulate over time, they are allocated for covering operational costs (such as oracles and keepers), and for building a surplus buffer to safeguard against potential bad debt. Excess funds collected beyond the necessary buffer can be auctioned off for $KITE tokens, which are subsequently burned to reduce the circulating supply. |

| Global Settlement | Global Settlement acts as a critical safety feature, functioning as an emergency stop for the protocol. This mechanism can be activated to wind down operations smoothly, allowing users to redeem their HAI for the underlying collateral, ensuring user protection under extreme conditions. |

| PID Controller (Proportional-Integral-Derivative) | At the core of the HAI Protocol’s stability mechanism is the PID Controller, a tool that dynamically adjusts $HAI redemption rate. This adjustment is vital for maintaining the stablecoin’s peg to its target value and responding effectively to fluctuations in market conditions. This controller ensures that $HAI remains a reliable and stable medium of exchange across different market scenarios. |

Why the Project was Created

The cryptocurrency market is inundated with stablecoins that are predominantly pegged to the U.S. dollar. HAI introduces a distinctive alternative by providing a free-floating decentralized stablecoin, allowing users to diverge from the traditional fiat system and centralized stablecoins that can impose restrictions. This initiative aligns with the demand for greater optionality in financial tools within the crypto space, allowing users to opt out of conventional economic systems and engage with a more flexible, blockchain-native currency.

While other stablecoins, such as $RAI, are limited to single-collateral options (only $ETH, for instance), HAI broadens the spectrum by accepting multiple types of collateral, including $ETH, $OP, and $wstETH. This diversity reduces the opportunity costs associated with minting stablecoins, as users do not have to relinquish potential gains from other staked assets. The plan to introduce additional collateral types through governance further underscores HAI’s commitment to adaptability and user-centric enhancements.

HAI leverages control-theory technology to manage supply and demand imbalances, a method that provides refined stability mechanisms beyond what first-generation stablecoins have achieved. By deploying on Optimism, HAI offers its users significant reductions in transaction costs (gas fees), enhancing the economic efficiency of activities like opening Vaults and minting $HAI.

The platform is designed to support a range of financial activities, including unique money markets, stacked funding rates, and advanced arbitrage opportunities. It also offers tools for intricate portfolio management strategies and provides mechanisms such as liquidation protection. Additionally, insurance coverage through Nexus Mutual is available, offering an extra layer of security against potential financial risks.

History & Background

HAI DAO introduced the HAI Protocol as an extension of the principles observed in the Reflexer protocol. Developed specifically for the Optimism network, HAI emerged from a nuanced understanding of Reflexer’s foundational approach to DeFi and stablecoins. While $RAI was an advanced concept, the HAI team identified critical areas for enhancement, particularly its limitation to a single-collateral model that only utilized $ETH. This restriction often led to a consistently negative redemption rate, a challenge attributed to the exclusive use of $ETH as collateral.

In pursuit of a more flexible and efficient system, HAI was conceptualized to transcend the limitations observed in RAI. By broadening the collateral base beyond $ETH, the HAI Protocol incorporated a variety of assets including staked $ETH derivatives, and other assets available on the Optimism network. This approach is designed to reduce the opportunity costs linked to the single-collateral approach and to achieve more favorable redemption rates.

Protocol Architecture

HAI leverages the GEB (Godel, Escher, Bach) framework which is a modified fork of MCD (Multi Collateral Dai) with several differences. It’s a specialized infrastructure designed for creating systems capable of issuing stablecoins. Unlike traditional dollar-pegged stablecoins such as $USDC, GEB facilitates the issuance of stablecoins like $HAI, which are backed by a variety of collateral sources. These stablecoins serve dual purposes within the DeFi ecosystem: they act as reliable collateral for other DeFi protocols and serve as a store of value that includes an inherent funding rate.

While HAI is based on the GEB framework, it introduces several enhancements and modifications to better meet the needs of its users and to expand its functionality:

- Advanced System Parameter Controls: HAI incorporates mechanisms that allow for more granular control over system parameters. This capability ensures greater flexibility and responsiveness to market conditions or internal system demands.

- Enhanced Deployment and Upgradeability: The architecture of HAI is designed to facilitate easier and more efficient deployment and upgrades. This approach helps streamline system maintenance and ensures that the platform can evolve seamlessly over time without disrupting existing operations.

- Robust Testing and Simulation Suite: Integral to HAI’s architecture is an advanced testing and simulation environment. This toolset is crucial for preemptively identifying potential system risks and vulnerabilities, thereby allowing for their mitigation before they impact the system.

- Emphasis on Multi-Collateral Operations: Unlike the original GEB framework, HAI places a significant focus on supporting multiple types of collateral. This flexibility broadens the use cases and appeal of HAI, making it more adaptable to diverse market needs and user preferences.

- Inclusion of Factories for Common Contract Types: To simplify the setup and management of collateral types, HAI includes pre-built factories for commonly used contract types. This feature reduces the operational complexity and resources needed to manage and integrate new collateral forms.

- Standardized Methods and Contract Utilities: Standardization across contract interactions and utilities makes the system more accessible for developers and reduces the likelihood of errors during upgrades or when integrating new features.

- Revamped Contract Interactions: HAI features an optimized structure for contract interactions, enhancing the efficiency and reliability of communications between different components of the system.

By building on the GEB framework and integrating these key differentiations, HAI aims to deliver a stablecoin issuance platform that is more advanced, reliable, user-friendly, and versatile.

Control-Theory

Control theory is a branch of engineering and mathematics that deals with the behavior of dynamical systems with inputs, and is used to design systems with predictable behaviors. It is widely used in various technological applications such as cruise control in vehicles, flight navigation systems, chemical reactors, and more. A familiar example in the cryptocurrency industry is the Bitcoin difficulty adjustment algorithm, which maintains a ten-minute average block time regardless of fluctuating network hashrate.

HAI draws inspiration from Reflexer’s usage of control theory to manage the stability of its own stablecoin $RAI. This approach involves an embedded algorithmic controller that adjusts a critical system input; in the case of HAI, the protocol’s pricing of the stablecoin is based on observed deviations from a predetermined target or setpoint.

Traditional stablecoin protocols, such as MakerDAO, strive to maintain their tokens (e.g., $DAI) pegged to stable values like the USD. However, these systems can face challenges such as $DAI price deviations above the USD peg during market volatility or structural protocol issues, as notably occurred in 2020 when $DAI struggled to maintain its peg and protocol vaults got liquidated. MakerDAO responded by incorporating additional types of collateral like $USDC, which, while improving liquidity and peg stability, introduced new risks due to $USDC centralized nature and potential for intervention (e.g., blacklisting capabilities). This is another reason why HAI was created in the first place.

In contrast, HAI uses a PID controller, a tool from control theory, to dynamically adjust its pricing mechanism. This PID controller helps autonomously correct the price of $HAI to bring it closer to its intended peg by modifying protocol responses based on the difference between the current market price and the target price. This system of adjustments works to incentivize user actions that help align the actual stablecoin value with the desired stable value, promoting stability without the need to resort to centralized or potentially risky collateral types.

PID Controller

The PID controller is a component in control systems used across various industries and applications, from automated industrial processes to biological systems. It is estimated that over 95% of industrial applications incorporate some form of PID control due to its effectiveness in managing system outputs.

A PID controller adjusts its output based on three distinct terms, each addressing different aspects of the control process:

- Proportional Term: This term is directly proportional to the current deviation from a set target or setpoint. For example, if a vehicle under cruise control is significantly below the desired speed, the proportional term responds by increasing the output (e.g., accelerating the vehicle) proportionally to the magnitude of the deviation.

- Integral Term: The integral term considers the duration of the deviation, integrating the deviation over time. This aspect of the controller is crucial for eliminating persistent offsets that a purely proportional control could not address alone. It accumulates the total error over time and applies a corrective force that is proportionate to the duration and magnitude of the deviation.

- Derivative Term: This term concerns the rate of change of the deviation, effectively calculating its derivative. It is used to predict the future behavior of the deviation and provides a corrective action that helps prevent overshoot (going too far beyond the setpoint) and enhances system stability. This term reacts if the deviation begins increasing, suggesting an anticipatory increase in output to counteract this quicker.

In the context of the HAI protocol, the PID controller is utilized to dynamically adjust the pricing of the $HAI stablecoin in response to market conditions. By analyzing the deviations from the desired stablecoin price, the PID controller can fine-tune its responses to ensure that the stablecoin remains as close as possible to its target value. This includes:

- Increasing or decreasing the issuance rate based on the proportional error.

- Adjusting for long-term discrepancies from the target price using the integral term.

- Smoothing out fluctuations and preventing drastic price changes with the derivative term.

The integration of a PID controller in HAI provides a robust mechanism for maintaining stability without the need for centralized control or reliance on rigid collateral systems. Its ability to independently tune each term (Proportional, Integral, Derivative) allows for precise and flexible adjustments ideal for the crypto market.

Core Modules

Behind the core architecture of the protocol discussed above, HAI integrates several additional components responsible for collateral management, stablecoin issuance, governance, and global settlement. These contracts form the foundational building blocks that ensure the protocol’s stability, scalability, and security.

SAFE Engine

The SAFE Engine is the central component of the HAI framework, intricately designed to manage various aspects of the protocol involving user-owned SAFEs (Simplified Agreement for Future Equity) and interest rates for different collaterals. It performs a range of functions critical to the operation of the HAI system:

- Debt Monitoring: It keeps track of debt across different levels (system-wide), specific collateral types, and individual SAFEs.

- Transaction Facilitation: The engine manages the internal transfer of coins, collateral, or debt between accounts, ensuring seamless transaction flows.

- Collateral Seizure: During liquidation events, the SAFE Engine is responsible for seizing collateral from SAFEs to cover outstanding debts.

- Permission Management: It handles account permissions, maintaining secure and authorized access to system functionalities.

- Debt Management: The engine implements debt caps globally, for each type of collateral, and for individual SAFEs to maintain systemic health.

The SAFE Engine distinguishes between two entity types: ACCOUNTs vs SAFEs.

ACCOUNTs can hold coins, collateral, and may include multiple SAFEs, each associated with a specific type of collateral. They may also carry authorized accounts that can modify their balance and, in some cases, hold unbacked debt.

SAFEs are tied to an account’s address and a specific type of collateral. They contain only locked collateral and generated debt and can be modified by the owner account or authorized entities.

Each SAFE is characterized by:

| Account | Address of the owner. |

| Collateral Type | Identifier for the type of collateral. |

| Generated Debt | Total debt produced by the SAFE. |

| Locked Collateral | Amount of collateral locked within the SAFE. |

The SAFE Engine also tracks per collateral type:

| Accumulated Rate | Represents the total accumulated interest rate. |

| Safety Price | The threshold price at which a SAFE begins to be unsafe. |

| Liquidation Price | The price at which a SAFE becomes eligible for liquidation. |

A SAFE remains healthy as long as:

Locked Collateral * Safety Price ≥ Generated Debt * Accumulated Rate

This system includes two parameters necessary for operation and is connected to $HAI. These two are COINs & DEBT. In the system, COINs (other assets) and DEBT operate akin to matter and antimatter, being created and annihilated in pairs. The $HAI token functions as the ERC20 counterpart of a COIN outside the system, maintaining a 1:1 redeemable ratio. This setup allows users to lock COINs to mint $HAI or burn $HAI to unlock COINs, keeping the operations within the system’s framework.

Accounting Engine

The Accounting Engine functions as the core financial management system within the HAI Protocol, primarily responsible for overseeing and managing the economic activities that ensure the protocol’s fiscal health. Its key responsibilities include:

- Tracking Surplus and Deficit: Monitoring the protocol’s financial surplus or deficit, which is critical for maintaining operational balance.

- Managing System Debt: This involves initiating and overseeing auctions for debt recovery, a fundamental process for mitigating financial risk within the system.

- Handling System Surplus: Managing surplus either through auctions or direct transfers, ensuring that excess assets are appropriately allocated or reduced.

- Debt Offset with COINs: Accepting COINs, such as those obtained from auctions, and using them to offset accumulated DEBT, thereby balancing the financial ledger.

Within the operational scope of the SAFE Engine, the Accounting Engine holds and manages a consolidated debt balance linked to the contract address. This balance comprises three distinct parts:

- Queued Debt: Represents the amount of debt lined up for auction. This debt is awaiting the auction process but has not yet entered it.

- On Auction Debt: This is the portion of the debt currently engaged in the auction process.

- Unqueued Unauctioned Debt: The debt that is neither queued for auction nor currently being auctioned. It represents the residual debt that is not actively engaged in resolution processes.

The calculation for unqueued-unauctioned debt is given by:

unqueuedUnauctionedDebt=debtBalance−queuedDebt−onAuctionDebt

This component of the debt represents the immediate fiscal responsibilities not currently addressed through auctions. When this unqueued unauctioned debt reaches a predefined threshold known as the debtAuctionBidSize, and once a cooldown period has elapsed, a debt auction is triggered.

During a debt auction, the overall debt of the contract remains constant; however, the classification of the debt changes. As the debt transitions into the auction phase, the onAuctionDebt metric rises, reflecting the amount actively engaged in recovery processes. Concurrently, as debt moves into auction, the unqueuedUnauctionedDebt metric decreases, accounting for the debt now being resolved through the auction.

Liquidation Engine

The Liquidation Engine is designed to manage the liquidation processes of SAFEs. This engine performs several key functions:

- Assessment of Liquidation Status: It continuously evaluates each SAFE to determine if it meets the conditions for liquidation.

- Collateral Seizure: Determines and executes the confiscation of collateral from SAFEs to offset outstanding debts.

- Collateral Auction Activation: Responsible for initiating auctions for the confiscated collateral to recover debts.

The key mechanisms and concepts of the Liquidation Engine are the Liquidation Penalty and the Liquidation Quantity.

A Liquidation Penalty is applied when a SAFE is liquidated. The penalty increases the amount of debt that needs to be covered through the auction process. The formula used is: debtToAuction= DebtToCover * liquidationPenalty.

For example, if Alice’s SAFE holding 1000 TKN is liquidated due to a drop in TKN price, with a debt of 500 COINs and a liquidation penalty of 1.1, the collateral auction will aim to cover 550 COINs of debt.

Liquidation Quantity is the decision on how much collateral and debt to seize from a SAFE during liquidation is based on:

- Full liquidation occurs if the SAFE’s debt is smaller than a predefined volume called liquidationVolume.

- Partial liquidation happens if the SAFE’s debt surpasses liquidationVolume, with residual debt remaining after seizing a proportionate amount of collateral.

- If the SAFE’s debt exceeds the onAuctionSystemCoinLimit, only part of the debt is liquidated, and any surplus remains in the SAFE.

Oracle Relayer

The Oracle Relayer is responsible for the quoting mechanism of the system. Its primary functions include:

- Storing Oracle Addresses: It maintains a record of oracle addresses for each type of collateral used within the system.

- Fetching and Updating Prices: The Oracle Relayer is tasked with retrieving and updating the prices of various collateral types as reported by these oracles.

- Updating Redemption Prices: Based on the prevailing redemption rate, it updates the redemption price which is crucial for maintaining the system’s stability.

This component includes two main mechanisms: Quoting Mechanism & C Ratios.

The Oracle Relayer facilitates the quoting of collateral in terms of $HAI, applying a variable rate to the $HAI price. Each type of collateral within the system is associated with a specific oracle that quotes the collateral in terms of the denomination currency, which for the HAI system is typically represented in US Dollars or an equivalent value. The formula used to calculate the collateral price is: collateralPrice= oraclePrice / redemptionPrice

This formula adjusts the collateral price based on the current redemption price, ensuring that valuations remain consistent with market dynamics.

Safety and liquidation prices are derived by applying specific ratios to the collateral price:

- Safety Price: safetyPrice= collateralPrice * safetyCRation

The safety price defines the threshold above which a SAFE is considered secure. Users may modify the collateralization of their SAFE as long as the resulting state maintains a price above this safety threshold.

- Liquidation Price: liquidationPrice= collateralPrice * liquidationCRatio

The liquidation price determines the point at which a SAFE becomes eligible for liquidation. If the market price of the collateral falls to or below this price, the SAFE may be subject to forced liquidation to recover outstanding debts.

Tax Collector

The Tax Collector is designated to manage the imposition and collection of taxes from various operations within the system. Its responsibilities are multifaceted and include:

- Storing Interest Rates: It maintains records of the interest rates applicable to each type of collateral.

- Managing Tax Revenue Receivers: The module is responsible for keeping track of the addresses designated to receive tax revenues.

- Calculating and Distributing Taxes: It performs calculations necessary to determine the amount of tax due and ensures its distribution according to the defined parameters.

In the contract there are two types of tax receivers:

| Primary Tax Receiver | This is a shared address that is used across all collateral types. It receives the balance of tax revenues after allocations to secondary tax receivers are completed. |

| Secondary Tax Receivers | These are specific addresses set for each collateral type that receives a predetermined percentage of the tax revenue generated from their respective collateral types. |

The tax or stability fee can be modified in two ways:

With a Global Stability Fee: This is a universal fee that applies across all collateral types within the system. It provides a baseline tax rate that contributes to the protocol’s overall stability.

Per Collateral Stability Fee: In addition to the global fee, each collateral type can have its specific stability fee, which reflects the unique risk and economic factors associated with that particular collateral.

Calculating the effective stability fee for any given collateral type can be done by multiplying the global stability fee by the specific per collateral stability fee. This method ensures that each type of collateral contributes appropriately to the protocol’s economic health based on its utilization and risk profile.

The tax collecting routine involves reading the previously stored stability fee before updating it with the new calculation. This approach ensures that tax assessments are based on the most accurate and current information without being retroactively applied, thus maintaining fairness and transparency in tax obligations.

Stability Fee Treasury

The Stability Fee Treasury is structured to manage the collection and utilization of protocol fees. These fees are distinct in that they do not directly impact the calculation of the system’s financial surplus or deficit. The treasury maintains the liquidity of these funds, enabling flexible use as determined necessary by the system owner.

Its key responsibilities include:

| Reward Disbursement | The Treasury is responsible for disbursing rewards, particularly for maintenance tasks that support the ongoing operation and integrity of the protocol. |

| Debt Management | It plays a crucial role in utilizing available funds to address instances of unbacked debt, ensuring the financial health and stability of the system. |

| Payment Management | The Treasury manages various payments initiated by the system owner, which may include operational expenses or strategic outlays. |

| Surplus and Deficit Replenishment | When the funds within the Treasury exceed a predefined threshold, it contributes to replenishing the system’s financial sheets, either by offsetting a deficit or enhancing the surplus. This mechanism ensures that the protocol maintains adequate financial resources to meet its obligations and sustain its operations. |

This component is integral to the financial ecosystem of the HAI Protocol, acting as a buffer and a resource pool that can be tapped into as needed. By keeping these funds liquid and separate from the primary operational accounts of the system, the Treasury provides a critical financial management tool. This setup allows for rapid response to immediate financial needs or opportunities, supporting the overall agility and responsiveness of the protocol’s economic management strategies.

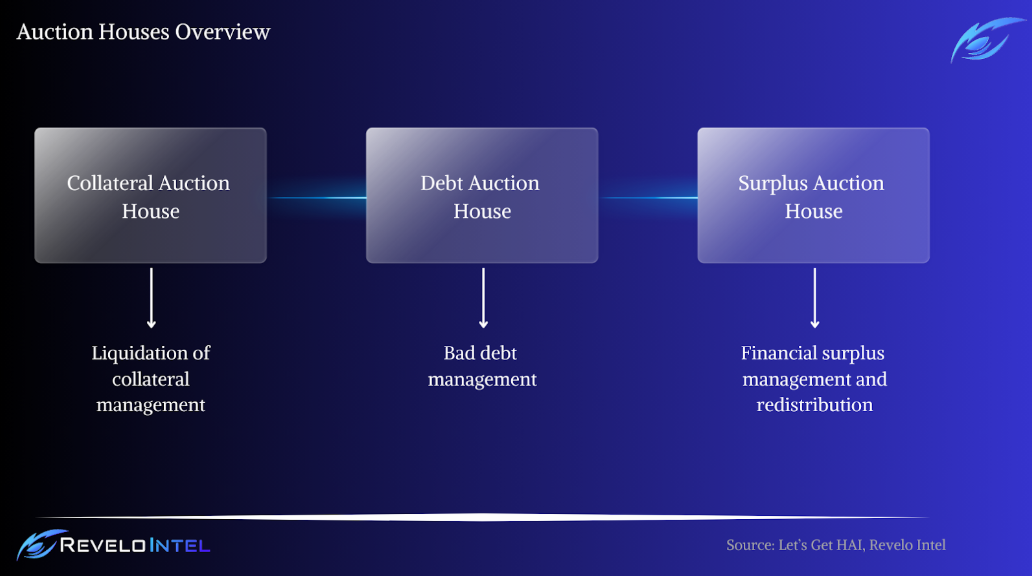

Auction Houses

Auction Houses are core smart contracts that manage and automate the handling of debt, surplus, and collateral. These mechanisms are essential for maintaining the financial stability of the protocol and ensuring effective risk management through the orderly liquidation of assets and redistribution of funds.

There are three types of Auction Houses:

Collateral Auction House

The Collateral Auction House is specifically designed to manage the liquidation of collateral from undercollateralized SAFEs. Its main function is to convert seized collateral into system coins, which are subsequently sent to the Accounting Engine to eliminate corresponding debts. This process is crucial for maintaining the financial stability and integrity of the HAI Protocol.

To facilitate rapid and efficient liquidations, the Collateral Auction House employs an increasing discount model. This model is designed to expedite the auction process by encouraging early participation from bidders, thus ensuring that debts are settled promptly. The mechanism works by applying an incremental discount to the collateral over time, which serves both to attract early bids and to adjust the auction dynamics in response to market conditions.

The collateral auction house relies on a real-time collateral price feed to establish the current market value of the collateral in terms of system coins. Once this baseline is established, the contract uses a dynamic discount model to determine the collateral’s auction price. This is the operation of the discount model:

- Initial Discount: The auction begins with a minimum discount, set by the minDiscount parameter, to kickstart bidding by making initial bids more attractive.

- Per-Second Discount Rate: A critical feature of the discount model is the perSecondDiscountUpdateRate parameter, which dictates how quickly the discount increases with each passing second of the auction duration.

- Maximum Discount Cap: To prevent the discount from escalating indefinitely, a maxDiscount parameter caps the maximum discount that can be applied during any auction. Once this cap is reached, the discount remains constant, providing a final opportunity for bidders before the auction concludes.

The increasing discount model is integral to ensuring that the auction not only starts off appealing to bidders but also adapts over time to facilitate efficient price discovery and collateral liquidation. This approach balances the need to cover debts quickly while also striving for fair market value realization of the collateral.

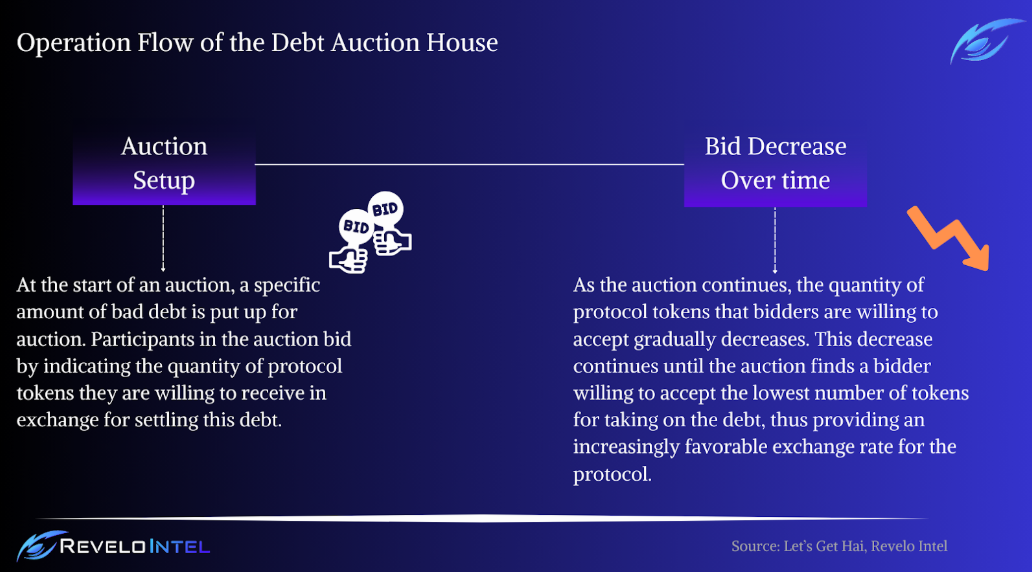

Debt Auction House

The Debt Auction House is tasked with managing and neutralizing bad debt within the system. It functions by minting and auctioning protocol tokens to users, who in return provide system coins. These coins are then used to offset the bad debt, effectively removing it from the protocol’s ledger and restoring balance to its financial ecosystem.

To efficiently manage the auctioning of bad debt, the Debt Auction House employs a descending bidding model. This model is structured to optimize the recovery of debts by making the auction conditions progressively more attractive to participants as the auction proceeds.

Here’s how it operates:

The bidding strategy incentivizes participants to enter the auction early to secure a more favorable rate, yet as the token quantity decreases, later bidders are encouraged to accept lower rewards for resolving the same amount of debt, optimizing the cost-efficiency for the protocol.

This model ensures that the protocol can effectively clear bad debts from its system by making the auctions attractive to participants, encouraging competitive bidding that leads to favorable exchange rates. The descending model also ensures that the debt is cleared in a manner that is economically efficient for the protocol, minimizing the impact of bad debt on the overall financial health of the system.

Surplus Auction House

The Surplus Auction House is designed to manage and redistribute the system’s financial surplus. This facility conducts auctions where surplus system coins are exchanged for protocol tokens, thereby ensuring the circulation and utility of both assets within the ecosystem.

The Surplus Auction House utilizes an ascending bidding model, where a fixed number of surplus system coins are offered in each auction. Participants compete by bidding higher amounts of protocol tokens to acquire the coins.

A portion of the protocol tokens obtained through these auctions is permanently burnt, creating a deflationary effect on the token supply. This action not only helps in controlling inflation but also adds value to the remaining tokens. The rest of the tokens are transferred to a predetermined target address, which could be used for further developmental, operational, or governance purposes within the HAI Protocol.

Settlement

Incorporated to the protocol there is a Settlement Module that is designed to manage the controlled shutdown of the system and ensure the orderly redemption of $HAI tokens for their underlying collateral. This module is activated under specific circumstances that require the system to cease operations, such as the discovery of critical bugs, significant governance decisions, or abnormal market conditions.

The module is triggered in scenarios deemed critical for the continued operation or security of the protocol. These situations could include technical vulnerabilities, fundamental changes mandated by governance, or extreme market disruptions.

The primary aim of the Settlement Module is to facilitate a structured and equitable unwinding of positions within the HAI Protocol. It ensures that all token holders have the opportunity to redeem their $HAI tokens for the respective underlying collateral, according to the prevailing terms of the protocol.

This module ensures a transparent redemption process and protocol integrity.

Global Settlement

The Global Settlement contract functions as the emergency brake and ultimate mechanism for winding down the system. It ensures that in the event of a system shutdown, all operations are halted safely and orderly, preserving the integrity and fairness of the process for all participants.

Its key responsibilities include:

| Triggering System Shutdown | The contract initiates the process to safely halt all operations across the protocol, ensuring no new transactions can be started. |

| Processing SAFEs | It settles all Simplified Agreement for Future Equity (SAFE) accounts to assess each collateral’s deficits and surpluses. |

| Terminating Auctions | The contract is responsible for prematurely ending all ongoing auctions, thus freeing up any tied-up assets. |

| Calculating Redemption Price | It determines the value at which system coin holders can redeem their coins for the backing collateral. |

| Redemption | Enables system coin holders to exchange their coins for the appropriate collateral, effectively completing the shutdown process. |

The design and implementation of the Global Settlement contract provide a comprehensive and balanced approach to winding down the HAI Protocol’s operations. This mechanism ensures that all parties can retrieve assets rightfully theirs, maintaining a fair and secure environment even in scenarios that necessitate a system shutdown.

Post Settlement Surplus Auction House

The Post Settlement Surplus Auction House plays a crucial role in the final stages of the HAI Protocol’s lifecycle, specifically after the activation of the Global Settlement. This specialized auction house is tasked with managing and auctioning off any surplus coins that remain in the system once the global settlement process has been triggered.

Differing from the regular Surplus Auction House, the Post Settlement Surplus Auction House burns all protocol tokens received from these auctions. This action is taken to prevent any outstanding tokens from affecting the market post-settlement, ensuring a clean and final closure of the protocol’s operations.

Settlement Surplus Auctioneer

The Settlement Surplus Auctioneer is responsible for managing the distribution of surplus coins following the activation of a global settlement. This module plays an important role in ensuring the financial equilibrium of the system during the unwinding process.

Following a global settlement, there may be discrepancies between the total circulating coins and the overall system debt. Such imbalances could inadvertently increase the redemption price for collateral, affecting the fair value exchange between coins and underlying assets.

The Settlement Surplus Auctioneer facilitates auctions of any surplus coins that remain within the system after settlement procedures have been initiated. These auctions are crucial for rebalancing the system’s financials and ensuring that the coin supply adequately covers all outstanding system debts. Additionally, by actively managing the surplus through auctions, the module helps prevent scenarios where ill-intentioned actors might exploit the global settlement process to acquire collateral at unfairly low prices. This safeguard maintains the integrity and fairness of the settlement process.

Sector Outlook

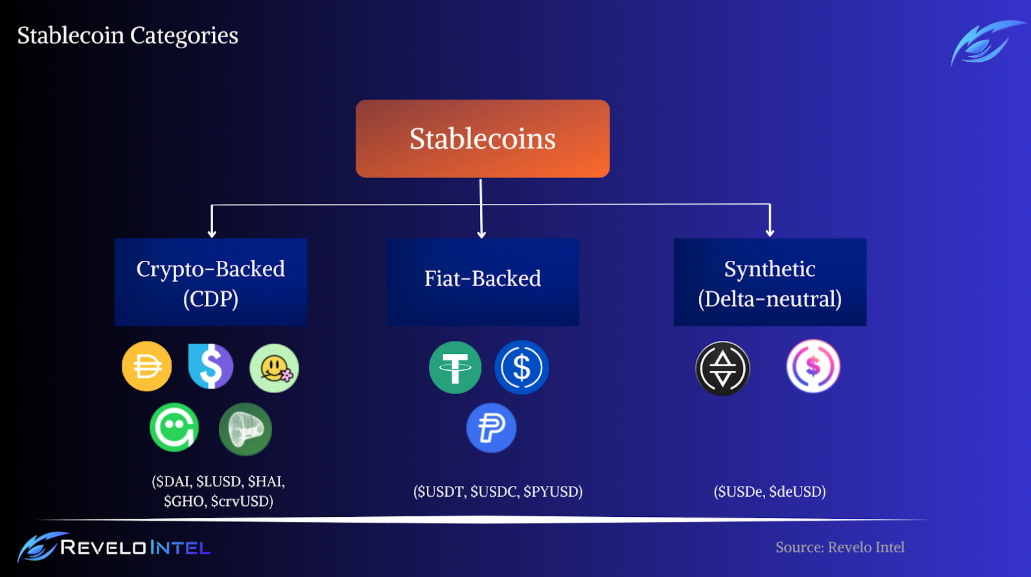

The stablecoin sector is undoubtedly a major part of the crypto ecosystem providing essential liquidity to the market. It is dominated by both centralized and decentralized variants. Traditional stablecoins like $USDT (Tether) and $USDC (Circle) are pegged directly to fiat currencies such as the USD, ensuring stability by maintaining reserves of real-world assets equivalent to the number of tokens in circulation. These centralized stablecoins offer a high degree of price stability but often face criticism for lack of transparency and central control.

On the other hand, decentralized stablecoins follow a different approach, using algorithms and smart contracts to manage their value without the need for centralized control. These tokens are not backed by physical reserves but by other cryptocurrencies or through algorithmic mechanisms, such as those employed by $DAI, $HAI, $RAI, and Terra’s $UST (before its collapse) which was a different case since it used endogenous collateral ($LUNA). This category of stablecoins aims to combine the price stability of traditional fiat currencies with the decentralization ethos of the cryptocurrency world.

However, the decentralized stablecoin landscape is marked by challenges related to maintaining their peg during market turmoil. Despite these challenges, decentralized stablecoins continue to innovate, offering mechanisms like overcollateralization, dynamic interest rates, and community-driven governance to enhance stability and user trust.

The ongoing development and acceptance of tokenized real-world assets (RWAs) also expand the scope of what stablecoins can represent, from digital versions of USD and EUR to gold or other commodities, broadening their utility and appeal. This intersection of traditional finance and decentralized technologies not only diversifies the stablecoin market but also introduces complex regulatory and operational challenges. Some notable examples are $USD0 (Usual) and $USDz (Anzen).

Looking ahead, the stablecoin sector is likely to witness further diversification and innovation as developers seek to combine stability with decentralization using new initiatives such as tokenized delta-neutral positions. The greatest examples of this are Ethena’s $USDe and $deUSD from Elixir.

Right now the stablecoin sector is divided into three main categories, each offering a different approach and underlying mechanism.

Lastly, the evolution of regulatory frameworks will play a critical role in shaping the sector’s trajectory, influencing the balance between innovation and consumer protection. As the market matures, the ultimate success of decentralized stablecoins will hinge on their ability to maintain stability, increase user trust, and in the future navigate the complex landscape of global finance regulations.

Competitive Landscape

The stablecoin landscape has become one of the most competitive ones in the crypto space. Some years ago the options were limited to a few but today the market is filled with all sorts of different stablecoins with different mechanics and philosophies. Let’s discuss some of them.

MakerDAO and $DAI: MakerDAO’s DAI is the forerunner in overcollateralized stablecoins, anchored at a 1:1 ratio with the USD. It operates on a system where users mint $DAI by locking up a higher value of collateral (150%) than the $DAI they wish to borrow, primarily in cryptocurrencies like $ETH or other supported assets creating a CDP. This excess collateral acts as a buffer against market volatility. $DAI is one of the oldest stablecoins and the most popular among decentralized stablecoins. Although, its decentralization can be questioned in the last couple of years.

Liquity Protocol and $LUSD: Liquity offers a slightly different model, allowing users to borrow its $LUSD stablecoin using $ETH as collateral at a collateralization ratio of 110%. This lower ratio enhances capital efficiency but also relies on a unique stability pool mechanism to manage defaults and maintain protocol solvency. Liquity’s $LUSD aims to maintain its peg through active liquidity provisions, which help cover debts from liquidated positions.

Aave and $GHO: Aave has joined the stablecoin space by introducing $GHO, a stablecoin minted against a variety of assets supplied to the Aave Protocol. $GHO is designed to remain pegged to the USD, with its value managed through the protocol’s governance processes. This integration within Aave’s broader lending services potentially enhances $GHO’s utility and adoption within the DeFi ecosystem making it a solid stablecoin solution.

Curve and $crvUSD: $crvUSD operates as a CDP stablecoin, where users deposit collateral to mint the stablecoin with various crypto assets and LP positions. Curve employs a liquidation algorithm that adjusts collateral requirements dynamically, aiming to prevent the harsh impacts of sudden market downturns and maintain the protocol’s health.

Reflexer and $RAI: $RAI was the inspiration behind $HAI. Unlike traditional stablecoins that aim to maintain a fixed exchange rate with fiat currencies, $RAI operates on a managed float regime, with its exchange rate determined by market dynamics of supply and demand. $RAI is backed by $ETH and its price stability is managed through adjustments in its valuation, either increasing or decreasing, in response to market conditions.

HAI Protocol and $HAI: Following the steps of $RAI, $HAI distinguishes itself by utilizing control theory to dynamically adjust its pricing, a method pioneered by the Reflexer Finance team. Unlike traditional stablecoins that strictly peg to fiat currencies like the USD, $HAI offers a floating peg that adjusts according to real-time market conditions and governance decisions. This method not only provides a hedge against market volatility but also reduces reliance on centralization, addressing some of the vulnerabilities seen in other protocols.

Ethena and $USDe: Ethena’s $USDe is a synthetic dollar asset that uses delta-hedging strategies to stabilize its value against the USD. This approach involves opening and closing short positions in derivatives markets to manage the risks associated with its collateral, which can include a variety of high-cap cryptocurrencies. Ethena with $USDe took the market by storm when first launched and was the fastest growing stablecoin for a while hitting impressive milestones.

Elixir and $deUSD: Elixir Labs recently introduced $deUSD, a synthetic USD asset positioned as a more decentralized alternative to Ethena’s $USDe. Set for a mainnet launch in September, $deUSD operates within the Elixir network, which supports decentralized orderbook exchanges and has garnered significant traction with a TVL of $300 million. This platform allows users to mint $elxETH, an Ether-backed token, which in turn supports the collateralization of $deUSD along with $ETH shorts to establish a delta-neutral position. This setup enables $deUSD to earn yields from both staking rewards and short funding rates, enhancing its appeal as a stable investment vehicle.

Potential Adoption

Unlike most stablecoins, which are pegged directly to fiat currencies, HAI employs a floating peg system. This system is not tied to a specific value like $1 but adjusts based on market dynamics and a control-theory-based algorithm. This unique positioning sets it apart from the majority of stablecoins that are tied to the US dollar, such as $USDC or $USDT. Additionally, this approach allows HAI to aim for stability without direct dependence on external financial systems, making it appealing for users looking for alternatives to traditional fiat-pegged stablecoins.

$HAI operates as a fully decentralized stablecoin backed by a basket of various collateral types rather than a single asset. This is a feature that removes the limitation of having a specific asset for collateral and allows users to deposit various other assets. The diversification of collateral reduces the risk associated with the price volatility of any individual asset and gives users the option to choose the collateral of their choice. Moreover, being overcollateralized, it assures greater security against market downturns, offering a more robust and trustable medium for value storage and transactions.

The potential for $HAI to be widely adopted also hinges on its integration within the broader DeFi ecosystem. As a stablecoin, $HAI can be a fundamental asset in lending and borrowing platforms, yield farming protocols, and as a quotidian medium of exchange. Given its deployment on the Optimism chain, which offers lower costs and speed, HAI could be particularly appealing to DeFi users looking for a decentralized stablecoin for DeFi applications. Further integrations can extend to liquidity pools and lending platforms, where $HAI might offer a stable asset that pairs with other cryptocurrencies to facilitate trading and provide liquidity or be used as collateral in certain dApps.

The ability of stablecoin issuers to have more units in circulation is vital to their business strategy and adoption. The more stablecoin they have available, the more useful and liquid it is, which may increase demand for minting. Demand for stablecoins is vital for their stability.

Chains

The choice to build HAI on Optimism was a strategic decision to take advantage of the lower gas costs and faster transactions while benefiting from the security and robustness of the Ethereum network. This L2 solution not only makes operations more cost-effective but also enhances the scalability of the services HAI provides.

Use Cases

HAI, as a flexible and dynamic financial instrument within the DeFi ecosystem, opens up a variety of use cases. Below is an exploration of several applications that can be built with or on top of HAI, leveraging its financial mechanics and stability features.

- Unique Money Markets

- Let’s give an example. Borrowers like Alice who pay a money market interest rate (e.g., 5% per year) while experiencing a negative redemption rate (e.g., -10% per year) can effectively earn from their positions due to the expected decrease in $HAI market price. Conversely, lenders like Bob might face net negative earnings if the redemption rate diminishes the nominal interest gains.

- In scenarios where the redemption rate is positive, both lenders and borrowers need to adjust their strategies to account for the expected increase in $HAI value. For example, Bob earning 4% interest with a 10% positive redemption rate sees a substantial total yield, whereas Alice pays more due to the added appreciation of $HAI.

- Stacked Funding Rates

- Exchanges or protocols offering $HAI-based perpetual contracts can enable traders to stack funding rates. This includes the integration of platform-specific funding rates with $HAI intrinsic redemption rate, creating nuanced financial products that cater to sophisticated trading strategies.

- Options Trading

- Developers can create options protocols that utilize the redemption rate of $HAI as a proxy for its intrinsic interest rate. This rate significantly influences the pricing models for puts and calls, integrating an additional layer of financial complexity and opportunity.

- Pegged Coins/Synthetic Assets

- Projects aimed at creating pegged coins or synthetic assets can use $HAI as a stable collateral alternative to more volatile assets like $ETH. This stability is particularly valuable during market downturns, providing a buffer for unwinding positions.

- Yield Aggregation

- Yield aggregators such as Yearn can employ $HAI to enhance overall returns. By combining $HAI redemption rate with other DeFi lending platforms, these protocols can optimize earnings for their users.

- Sophisticated Arbitrage Strategies

- Arbitrageurs can analyze $HAI redemption price movements in conjunction with other market data to optimize their trading times and strategies. This could involve specialized trading services that utilize $HAI unique price behavior for profit-sharing schemes with capital pools.

- Portfolio Management Strategies

- Investors and financial product developers can create investment vehicles like Set Protocol sets or Balancer pools that incorporate $HAI. These vehicles would offer exposure to $HAI redemption rate alongside other yield-bearing assets, creating diversified portfolios that capitalize on various aspects of the DeFi yield landscape.

Using the Protocol

Users

The HAI protocol offers a platform for users to engage in various strategies typical in DeFi using their assets as collateral and using $HAI. Below is an explanation of how users can utilize the protocol and quick strategy example.

- Minting HAI:

- Users can deposit approved collateral types into Vaults and mint $HAI stablecoins against this collateral. This mechanism allows users to leverage their assets without selling them, providing liquidity while maintaining exposure to their underlying investments

- Liquidity Provision and Yield Farming:

- Users can provide liquidity by adding $HAI to liquidity pools on various DeFi platforms, earning transaction fees and other rewards based on the protocols they interact with.

- Debt Management and Trading:

- Traders and arbitrageurs can take advantage of the floating peg system to speculate on the price movements of $HAI relative to its redemption price, potentially profiting from trades that capitalize on deviations from the peg.

Here’s a simple strategy example using $HAI:

Alice wants to increase her exposure to Ethereum without selling her existing holdings. She uses the HAI protocol in the following way:

- Step 1: Alice deposits her $WETH into a HAI Vault as collateral.

- Step 2: She mints $HAI against her $WETH.

- Step 3: Alice uses the minted $HAI to purchase more $WETH on the open market, effectively leveraging her initial holdings.

- Step 4: Over time, as $ETH appreciates, Alice’s leveraged position potentially increases in value faster than her original holdings alone would have.

- Step 5: She can choose to pay back the $HAI debt at any time to retrieve her collateral, ideally after her investments have appreciated, or continue holding if she expects further gains.

- Note that in times when the market is down Alice needs to manage her position to not get liquidated.

Investing Strategies

Here’s a different strategy for users using $WETH as collateral and minting $HAI to farm a stable pair on Velodrome.

- 1. Head over to the HAI app page here. Make sure you have funds in your wallet and on the Optimism chain ($ETH for gas, $WETH for collateral, and $LUSD for the strategy).

- 2. Connect your wallet in the upper right corner. Switch to the Optimism chain.

- 3. Scroll down to the Vaults tab. Click on the “WETH” option.

- 4. Choose the amount of $WETH you want to deposit and the amount of $HAI you want to mint. Note that the minimum amount of debt per vault is 150 $HAI. Anything less you’ll get an error.

- 5. Pay attention to these parameters: Liquidation price, collateral ratio, and the indicator showing you the safety of your position.

- 6. Confirm the transaction in your wallet. Now that we have acquired $HAI let’s move to the second part of the strategy.

- 7. Click the “EARN” option on the top. Scroll down to the available strategies.

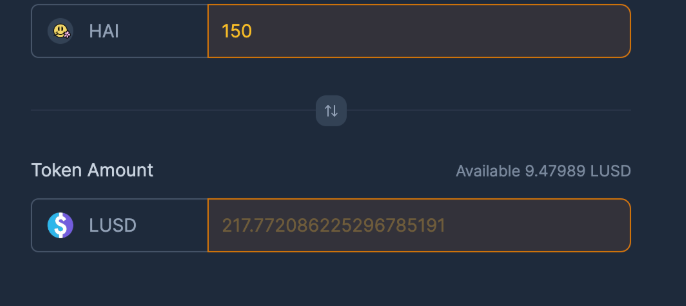

- 8. Before moving further, head over to Velodrome and purchase some $LUSD. Make sure to check how much $LUSD you need compared to your $HAI holdings when providing liquidity. You can check it on the pair page.

- 9. We are going to provide liquidity on the $HAI-$LUSD pair on Velodrome. After you click on it you’ll be redirected to the Velodrome liquidity page.

- 10. APR fluctuates so pay attention. Choose the amount for each asset and click Deposit. Confirm the transaction in your wallet. You can check your position on the Dashboard page.

That is all for this strategy.

Always pay attention to the value of your collateral and manage accordingly (in this case $ETH) to avoid being liquidated.

Business Model

The HAI protocol operates under a business model centered around its decentralized stablecoin system, leveraging various mechanisms to maintain stability, ensure scalability, and generate revenue. This model is powered by its native stablecoin, $HAI, and its governance token, $KITE.

$HAI achieves stability through a floating peg that adjusts based on market conditions and a control mechanism influenced by PID controller principles. This setup allows $HAI to react dynamically to market shifts, providing a stable yet flexible currency alternative that can protect against the volatility typical of standard cryptocurrencies.

Unlike single-collateral stablecoins, $HAI is backed by a variety of collateral types, enhancing its stability and appeal. This multi-collateral approach diversifies risk and potentially increases the robustness of the stablecoin against market downturns or the failure of a single collateral type.

The value of HAI’s business model lies in its ability to offer a truly decentralized stablecoin that is overcollateralized and has a mechanism that ensures stability and safety for users.

Revenue Streams

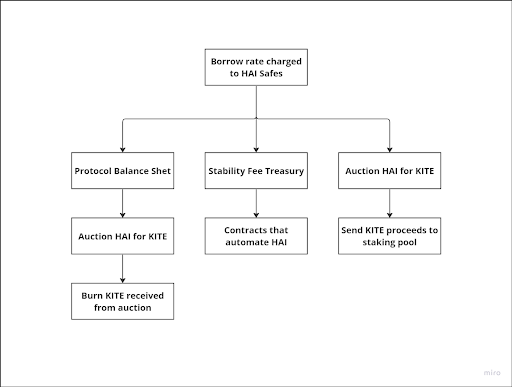

Generating revenue revolves around its operation as a decentralized stablecoin protocol, which generates revenue primarily through stability fees charged to users minting $HAI against locked collateral. Users who mint $HAI stablecoins by locking collateral in SAFEs are charged a stability fee. This fee is analogous to an interest rate and is one of the primary revenue sources for the protocol. It compensates the system for the risk of managing various collaterals and maintaining the stablecoin’s peg.

Additional revenue streams include liquidation penalties and proceeds from various types of auctions (collateral, debt, and surplus) that manage the protocol’s debt and liquidity. The protocol earns revenue from liquidation penalties when the value of collateral in a SAFE drops below a certain threshold, necessitating its sale. This mechanism not only protects the overall system by ensuring that all $HAI tokens are backed sufficiently by collateral but also provides an income stream from the penalties collected during these forced liquidations.

Fee Breakdown

Tokenomics

$HAI (System Coin)

$HAI serves as the primary stablecoin within the HAI Protocol. Unlike typical stablecoins that might be pegged directly to fiat currencies like the USD, $HAI stability and value are derived from the collateral locked by users within the protocol.

Users mint $HAI by depositing collateral into the protocol. This process ensures that each unit of $HAI in circulation is backed by a greater value of collateral, thereby maintaining its stability and trustworthiness.

The price of $HAI is influenced by two main factors:

- Market Price (MP): The current trading price of $HAI on various exchanges and trading platforms, reflecting real-time market dynamics and sentiment.

- Redemption Price (RP): Programmatically determined, the RP is set based on internal protocol mechanisms that aim to stabilize HAI around a target value, influenced by factors like the collateral’s performance and overall market conditions.

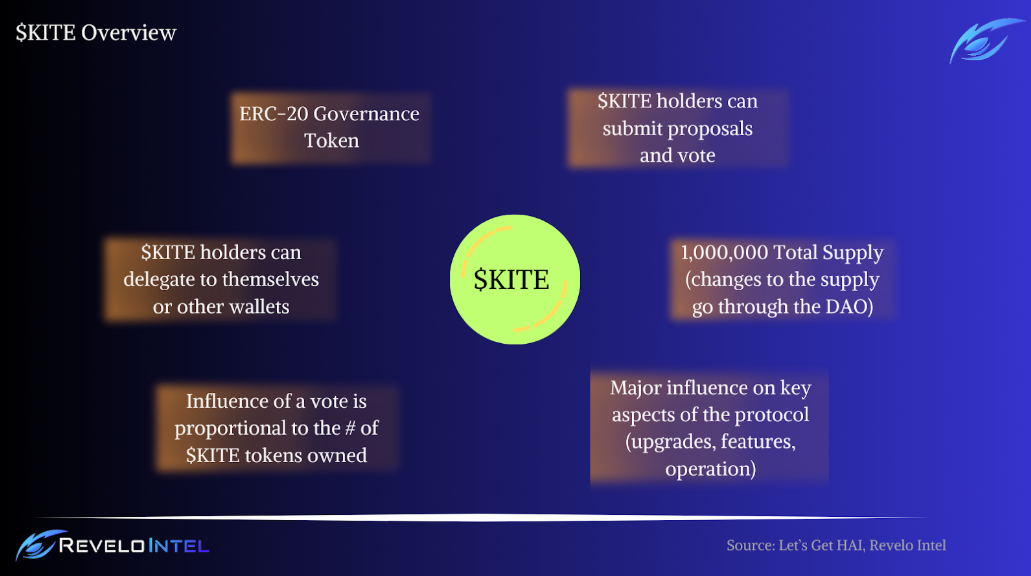

$KITE (Protocol Token)

$KITE acts as the governance token for the HAI Protocol, playing a crucial role in its decentralized management and operational evolution.

Holders of $KITE can vote on key protocol decisions, such as changes in system parameters, the introduction or removal of collateral types, and other significant adjustments that shape the protocol’s functionality and strategic direction.

In addition to its governance functions, $KITE is utilized within various protocol auction mechanisms. This includes being offered as a reward in debt auctions, where it can be used to purchase bad debt in exchange for $HAI, or in surplus auctions, where it might be bought back and burned to manage the token supply.

The value of $KITE is inherently tied to its utility and demand within the protocol’s ecosystem, driven by its role in governance and auctions, as well as its overall supply dynamics.

$KITE Mechanics

$KITE serves as a multifunctional token within the HAI Protocol, essential for maintaining the system’s stability and transitioning towards a more decentralized governance structure.

The two primary functions of $KITE are:

1. Backstop Mechanism:

$KITE delegates act as the primary defense line against scenarios where the HAI protocol faces financial shortfalls. In such events, $KITE provides a buffer, absorbing some of the impact through its staking mechanism.

In more severe cases, the protocol may initiate debt auctions where new $KITE tokens are minted and sold in exchange for $HAI to cover outstanding debts, further protecting the system’s integrity.

2. “Ungovernance”:

As the HAI protocol moves towards governance minimization, $KITE holders play a critical role in phasing out centralized control elements within the system. This process involves removing unnecessary governance layers, thereby enhancing the protocol’s decentralization.

For components that are difficult to decentralize completely, such as oracles or interactions with external protocols, $KITE holders may retain limited control to ensure continued operational stability and security.

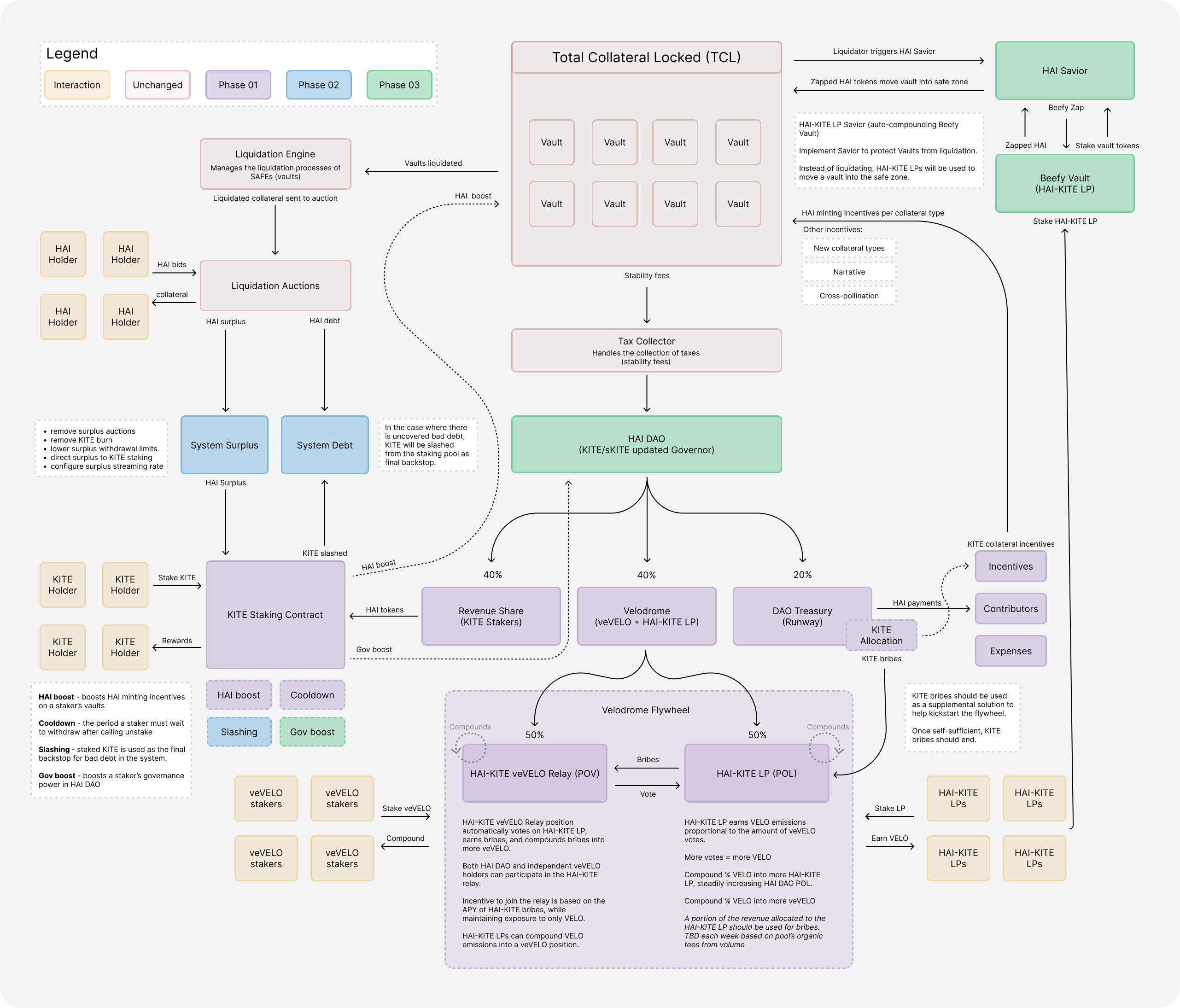

Below is a visual of how resources flow inside HAI:

Note that in situations where the borrowing rate is negative, indicating an excess of $HAI relative to demand, the protocol utilizes funds from its balance sheet to reduce the $HAI debt across all SAFEs. This mechanism ensures the stability of $HAI value and mitigates inflationary pressures.

$KITE Overview

The protocol can initiate minting events for $KITE tokens, but such actions require a formal proposal and subsequent approval by the governance community, ensuring that any alterations to the token supply are made transparently and democratically.

20% of the $KITE supply is allocated into a Sablier stream on the Ethereum Mainnet, with the Altar contract designated as the recipient. Each month, a function can be called to withdraw the streamed $KITE to the Altar contract and to facilitate a bidding process using $FLX (another token) for $KITE on CowSwap.

Any $FLX received through this process is permanently burned, symbolically offered in sacrifice to the “Money God.” This ritual not only adds a unique cultural element to the tokenomics but also serves to decrease the circulating supply of $FLX, potentially affecting its market dynamics.

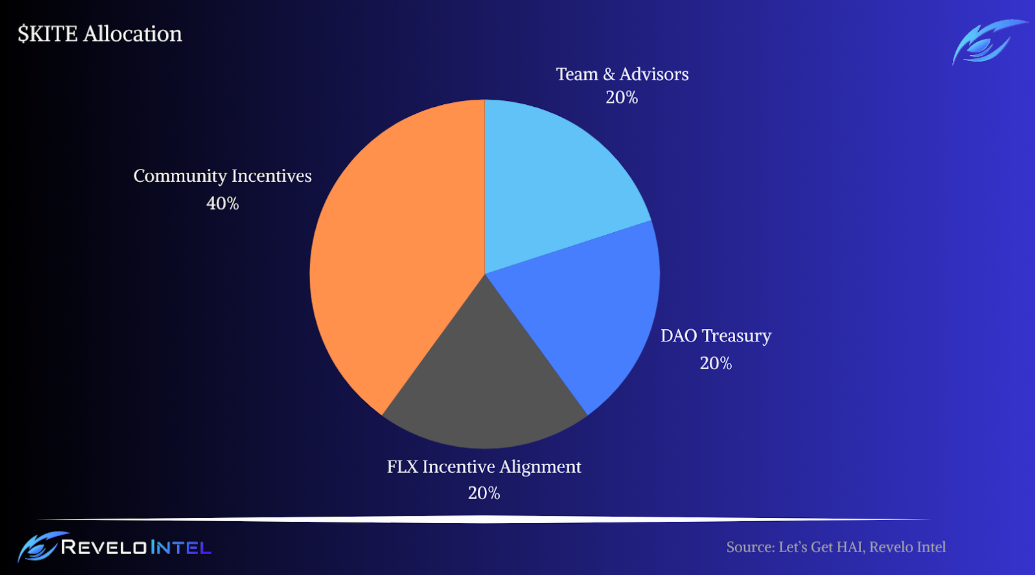

Token Distribution

$KITE Total Supply: 1,000,000

$KITE v2 (HAIwheel Effect)

The HAIwheel Effect is a protocol update to boost protocol sustainability, enhancing $KITE token value capture, and introducing new utilities for both $KITE and $HAI tokens. This update is structured into a three-phase roadmap, with each phase undergoing separate governance proposals to ensure thorough scrutiny.

Phase 1 – KITE Flyer

The objectives of Phase 1 are as follows:

- Implement $KITE staking.

- Set up revenue distribution channels.

1. KITE Staking: This phase introduces incentives that align with sustainable protocol growth and resilience against market volatility. Key activations for KITE stakers include:

- $HAI Booster: Enhances $HAI minting incentives for $KITE stakers based on their staked proportion and minted $HAI per collateral type.

- Revenue Sharing: A portion of the protocol’s stability fee revenue paid by vault owners in $HAI is allocated to $KITE stakers.

2. Revenue Split Strategy: The stability fee revenue is divided threefold to support:

Revenue share with $KITE stakers (discussed above).

Velodrome Flywheel initiatives.

DAO operational costs.

This arrangement allows HAI DAO to concentrate on expansion through integrations, new collateral types, and cross-chain capabilities while maintaining a self-regulating incentive and value distribution system.

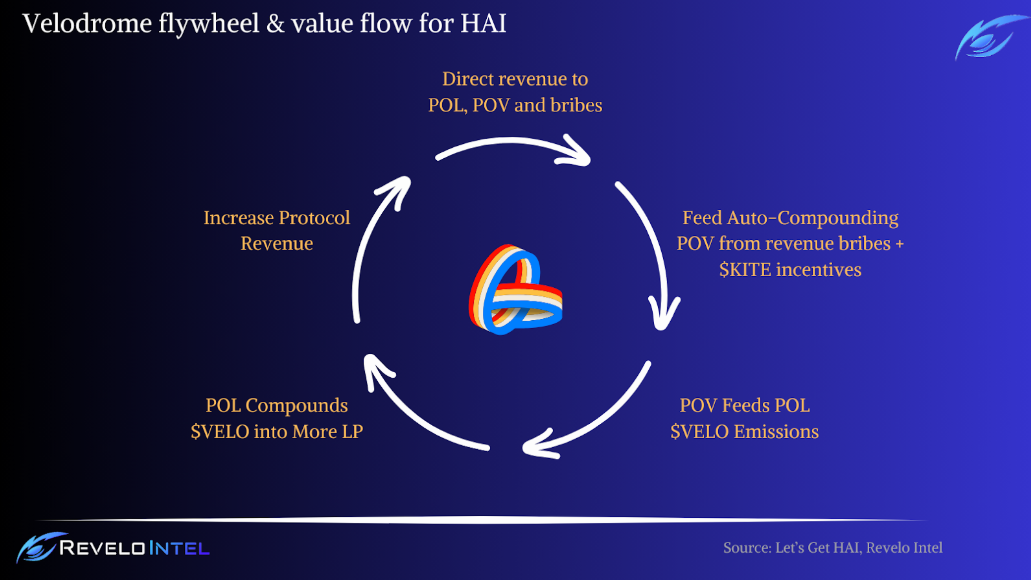

- Velodrome Flywheel

The Velodrome Flywheel strategy is critical for cross-chain expansion, utilizing the Velodrome platform to enhance liquidity and voting power:

- Protocol Owned Liquidity (POL): Maintains a $HAI-$KITE LP.

- Protocol Owned Votes (POV): Utilizes veVELO NFTs to increase DAO voting power through accumulated $VELO.

- Vote Incentive Market: Leverages protocol revenue to fund vote incentives, further enhancing the LP’s attractiveness and growth potential through increased $VELO emissions.

This mechanism aims to continuously boost HAI DAO’s liquidity and governance influence, establishing a robust support base for the $HAI/$KITE economy.

- DAO Operations

Revenue allocations to the DAO’s main treasury cover essential operational costs such as team compensations, infrastructure maintenance, and security audits. The phased introduction of KITE staking and revenue sharing is designed to transition HAI DAO towards greater self-sufficiency, reducing dependency on continuous external incentives and stabilizing the protocol’s financial footing for long-term sustainability.

Phase 2 – KITE Runner

Phase 2 will follow after Phase 1 is approved and executed.

This phase focuses on two things:

- Update System Surplus.

- Update System Debt.

1. System Surplus

Currently, the system surplus buffer accumulates excess $HAI from liquidation auctions after debts are covered. When the surplus reaches 142,000 $HAI, a surplus auction is triggered to sell 42,000 $HAI for $KITE tokens, a portion of which is burned and the remainder allocated to a designated address by the HAI DAO.

The proposed changes for Phase 2 include:

Eliminate surplus auctions and the burning of $KITE tokens.

Reduce the threshold for surplus withdrawal.

Redirect all surplus directly to the $KITE staking contract.

Implement a configured streaming rate of surplus to the $KITE staking contract, ensuring a steady flow of benefits to $KITE stakers.

2. System Debt

The update of system debt is considered by the team to be the most important part of these development phases, due to its implications on risk management and protocol security.

$KITE stakers will now act as the ultimate backstop for bad debt within the system, effectively agreeing to have a portion of their staked $KITE slashed in scenarios where the system’s debt exceeds recoverable amounts through auctions. In exchange for their role in safeguarding the protocol, $KITE stakers will receive various incentives such as a $HAI minting boost, a governance boost, revenue sharing, and access to all system surplus.

This exchange aims to make the system more resilient by having a guaranteed backstop against bad debt rather than relying on auctions. The introduction of a $KITE staking cooldown period of a minimum of t+1, based on the time a debt auction runs for, prevents stakers from withdrawing their stake prematurely, thus ensuring their continued commitment to the protocol’s solvency.

Phase 3 – HAI as a KITE

Similarly to the previous phase, Phase 3 will follow after Phase 2 is successfully approved and executed.

The final phase of the HAIwheel Effect focuses on:

- Implementing a governance booster.

- Implementing a vault savior.

1. Governance Booster

To acknowledge the increased risk undertaken by $KITE stakers, Phase 3 will introduce a governance booster, offering a 1.5x multiplier on governance power for $KITE stakers within $HAI DAO. This adjustment aims to give those who are more heavily invested and at risk a proportionately greater influence in protocol decisions.

Implementing this change requires deploying a new governor contract that can differentiate between $KITE and $sKITE holdings, ensuring that governance adjustments are accurately reflected.

2. HAI-KITE LP Savior

The vault savior will be the final update of the HAIwheel Effect, a mechanism aimed at preventing liquidations. This update borrows from the original $RAI codebase, which includes a feature for staking $RAI/$ETH Uniswap LP tokens to protect vaults close to liquidation. For $HAI, the enhancement involves allowing vault owners to stake $HAI-$KITE LP tokens from auto-compounding Beefy vaults. In situations where a vault nears liquidation, the savior mechanism will convert these staked LP tokens into $HAI to restore the vault to a safe collateralization level.

The savior not only offers liquidation protection but also promotes further liquidity provision in the $HAI-$KITE pairing, benefiting users by enabling them to earn auto-compounding yields while safeguarding their positions in the protocol.

Governance

HAI governance is an important part of the operation and evolution of the protocol with $KITE being the token that enables that. Governance was active from the outset of the protocol, facilitated on-chain through the Governor and leveraging the Tally.xyz platform to ensure transparency and accessibility.

$KITE token holders wield influence over the HAI protocol by participating in the governance process, which includes submitting and voting on various proposals. The governance structure is token-weighted, meaning the voting power is proportional to the number of $KITE tokens held.

Holders have the flexibility to either vote directly or delegate their voting rights to other wallets. This can be particularly useful for those who prefer to entrust their voting decisions to more active community members or experts within the ecosystem. Delegation is a reversible action that can be managed through the Tally platform.

$KITE holders can vote on critical changes to the protocol, such as adjustments to collateral types, modification of the redemption rate, and more.

Decisions regarding the allocation and distribution of the $KITE treasury funds are also subject to governance. This includes directing funds toward community initiatives, liquidity incentives, or protocol sustainability measures. The community can decide to initiate buybacks and burns of $KITE tokens to adjust the supply or to create deflationary pressure.

Adopting a GEB framework, similar to that used by RAI, HAI aims to gradually minimize governance. The goal is to automate more functions and reduce the direct control by the DAO over time, increasing system resilience and reducing dependency on active governance. As the protocol matures, responsibilities can be transferred to smart contracts or external parties following rigorous criteria such as audits and surplus verification. This transition supports the long-term vision of creating a more decentralized and less governance-reliant protocol.

Governance Processes

The HAI protocol includes various processes regarding governance.

Delegation

Delegation enables $KITE token holders to participate in the decision-making process of the protocol, either actively or passively. This system is designed to be flexible, allowing for both direct involvement and representative voting through elected delegates.

Token holders who wish to engage directly with the governance process can choose to self-delegate their tokens. This option is ideal for those who prefer to have a hands-on approach when voting on proposals.

For those who prefer a more passive role or may not have the time to actively participate, delegation to other community members is available. This allows token holders to entrust their voting power to a representative who aligns with their views and values. Delegation is not a permanent commitment and can be changed or revoked at any time via the Tally platform. This flexibility ensures that token holders can adapt their approach to governance as their needs or the landscape evolves.

A delegate is a $KITE token holder who has been entrusted by other members of the community to vote on governance proposals on their behalf. These individuals are elected based on their commitment to the community and their alignment with the collective interests of the token holders they represent.

Delegates are expected to act in the best interests of those who have delegated their voting power to them. They play a critical role in shaping the protocol by participating in governance decisions that impact its future direction and operation.

Delegation allows token holders to participate in governance without the need to actively monitor and vote on every proposal, thus broadening the scope of community involvement. By choosing delegates who align with their views, token holders can ensure that their interests are represented in the governance process, even if they are not directly involved.

Token holders are not limited to delegating their voting power to a single delegate. Instead, they can distribute their voting power among multiple delegates, allowing for a more nuanced representation of their governance preferences.

Token holders can reclaim their delegated voting power at any time if they decide to participate directly in a specific proposal or if they wish to change their delegate alignment.

Note that when $KITE tokens are sold or transferred, any existing delegation is automatically revoked, ensuring that the new token holder can establish their own delegation preferences.

Phases of HAI Governance

The three stages of the HAI Governance process are: initial ideation and signaling, informal proposal submission (off-chain, or “Temperature Check”), and formal proposal submission (on-chain).

Phase One: Signaling

| Purpose | Gauge community interest and gather feedback on potential proposals. |

| Location | HAI Discord. |

| Goal | Members can introduce ideas informally to see if there is enough support or interest to move forward. |

| Duration | Variable, based on the need for feedback. |

| Approach | Pose general questions about potential changes or improvements to the protocol, such as the addition of new collateral types |

| Note | Direct submission to the forum is possible without signaling if the proposer is confident in community support. |

Phase Two: Informal Proposal (Temperature Check)

| Purpose | Evaluate the viability of a proposal through community discussion and non-binding polls. |

| Location | ChamVerse. |

| Duration | Minimum of one week to allow comprehensive community participation. |

| Content |

|

| Note | Outcomes from this phase are indicative and may not predict on-chain voting results. This phase serves to refine the proposal based on community input. |

Phase Three: Formal Proposal

| Purpose | Finalize and vote on proposals that have shown significant community backing in earlier phases. |

| Location | Tally. |

| Requirements | Proposals should only advance to this stage if they have demonstrated substantial support in the Temperature Check phase. |

| Activities |

|

| Note | This phase concludes with a formal community vote, determining whether the proposal will be implemented. |

Authorities & Examples

$KITE token holders have many governance responsibilities, influencing various aspects of the HAI protocol operations.

Here are some examples:

- Modifications to the HAI Protocol: KITE holders have the authority to vote on crucial protocol changes. This includes adjustments to the redemption rate, modifications to the types of accepted collateral, and changes to the fee structures. Such decisions directly impact the protocol’s stability and functionality.

- Management of the KITE Treasury: The community has control over the KITE treasury, deciding on its allocation and distribution. Decisions may involve directing funds towards community initiatives, conducting buyback and burn operations to manage token supply, or distributing rewards to liquidity providers.

- Community-Driven Decisions: $KITE holders engage in broader decisions that affect the protocol’s market presence and security aspects, such as forming partnerships, launching marketing campaigns, or commissioning security audits.

Also, a few examples of potential questions/proposals:

- “Should we introduce a new type of collateral to diversify the assets backing the HAI stablecoin?”

- “Should we allocate funds to support a new community-driven development project?”

Proposal Types

There are two types of proposals on the HAI protocol:

- HIP (HAI Improvement Proposals)

- RFS HIP Proposals (Really Fucking Serious Proposal)

How to Delegate and Vote

Delegation is necessary for $KITE token holders to engage in both direct and passive governance of HAI. Holders may either vote directly through self-delegation or delegate their voting power to a representative. Below are the steps to delegate your voting power to yourself:

- Prepare Your Wallet: Ensure you have an Ethereum wallet like MetaMask containing $KITE tokens. You can buy $KITE tokens through Velodrome on Optimism.

- Access Tally: Visit the HAI governance page on Tally, a decentralized governance platform used by HAI.

- Connect Your Wallet: Select “Connect Wallet” on Tally and choose your wallet with $KITE tokens.

- Delegate:

- Navigate to the “Delegate” tab.

- Click the “Myself” option.

- Confirm in your wallet.

- Confirmation: After confirming the transaction, your voting power should be assigned to your address. To verify, click the “View details” option on Tally.

Now that you have delegated $KITE tokens you are ready to participate in governance.

Here’s how:

- Head over to the governance page of HAI on Tally here.

- Navigate the proposals and choose the one you want to vote on.

- Vote directly on the proposal using your delegated $KITE tokens.

A proposal will move on to an on-chain vote facilitated by Tally if it passes the temperature check. The proposal must satisfy the following requirements to move on to the next stage:

- Obtain a greater number of votes in support than against.

- A minimum of 5% of voteable tokens are needed to support a constitutional HIP (HAI Improvement Proposal), whereas a minimum of 3% of voteable tokens are needed for a non-constitutional HIP.

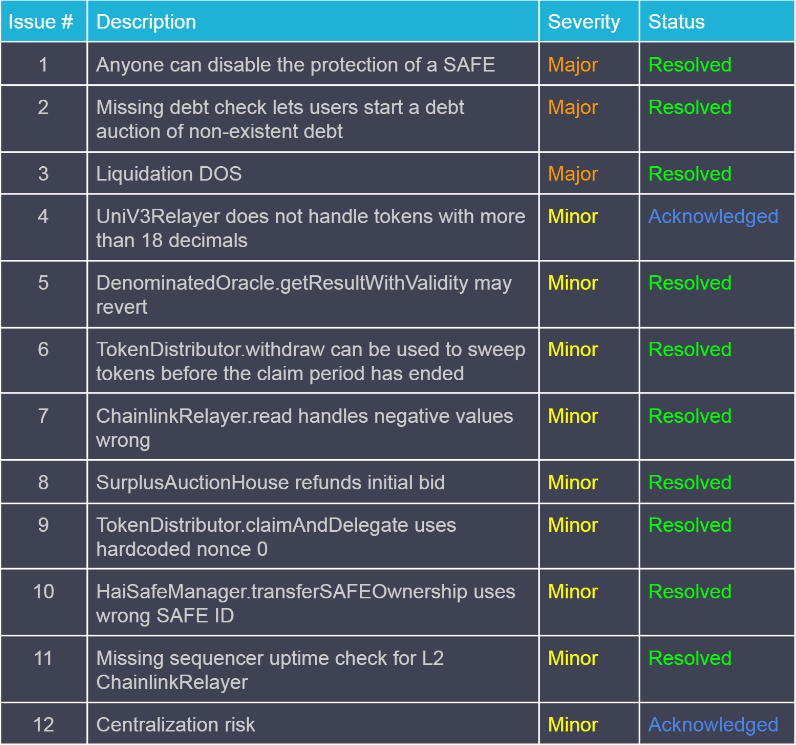

Risks

Like all DeFi protocols, HAI relies on smart contracts. Despite rigorous testing and auditing, there’s always a risk of undiscovered bugs or vulnerabilities that could be exploited and harm the protocol and its users.

Besides smart contracts, there are some risk factors related to the HAI protocol itself.

Collateral Volatility

The value of collateral assets can be highly volatile. If the market value of the collateral decreases significantly and rapidly, it may not sufficiently cover the value of the minted HAI, leading to undercollateralized positions. This could trigger widespread liquidations, potentially destabilizing the protocol and causing losses for users whose collateral is sold off during market downturns.

Governance Risk

Despite the intention to minimize governance intervention, HAI is a protocol that is governed by $KITE token holders and, therefore, there is a risk of governance attacks where malicious actors might accumulate enough tokens to influence decisions that could benefit them at the expense of the protocol’s health. In addition, poor governance decisions could lead to suboptimal changes in protocol parameters, such as collateral factors or stability fees, which might compromise the system’s security and functionality.

HAI has taken many cautionary steps to prevent these risks with a well-structured governance process that allows only quality proposals to go through voting. In addition, the $KITE token is designed in a way that protects against the bulk accumulation of tokens to achieve a unilateral majority that could manipulate the voting process.

Protocol Design Risk