Overview

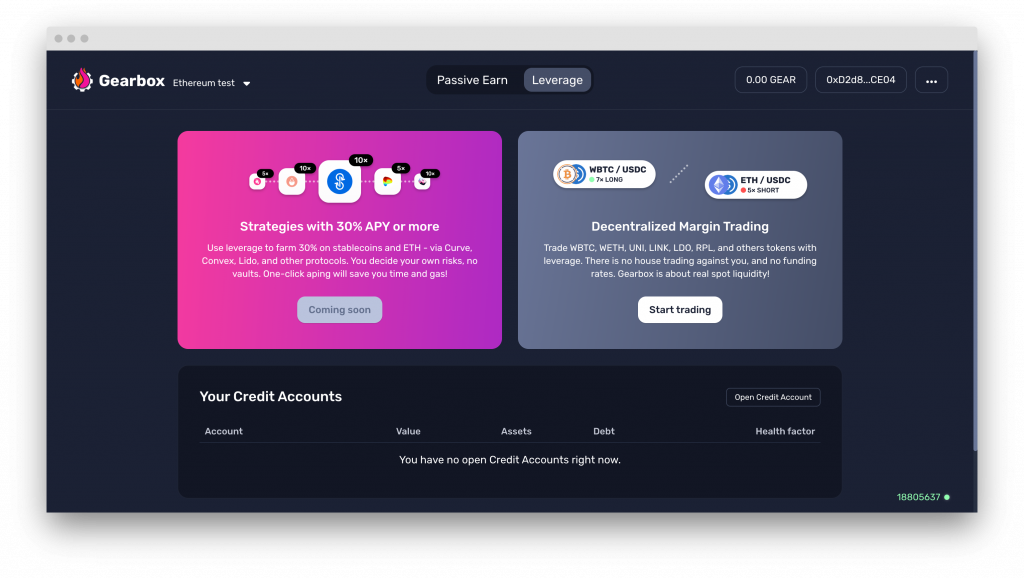

Gearbox is a protocol that introduces a new DeFi primitive termed “Credit Accounts”, facilitating loans where borrowers can deploy more capital than they’ve deposited. By bridging lending and prime brokerage functionalities within a single protocol, Gearbox empowers users to margin trade on Uniswap, leverage farm on Curve, and engage in various other DeFi activities with up to 10x more capital.

| Key Features | Description |

| Composability | Gearbox integrates seamlessly with other DeFi protocols, allowing users to utilize leverage across multiple assets and platforms, without isolating funds in proprietary pools. |

| Modularity | The protocol’s architecture is designed for plug-and-play functionality, enabling customization and risk segmentation to suit different use cases. |

| Zero funding rates | Unlike perps, Gearbox executes leverage trades with spot assets on third-party protocols, eliminating the need for funding rates (they only have borrow rates) and enhancing capital efficiency. |

| Leverage as a Service | External protocols can leverage Gearbox’s infrastructure to offer leverage to their users, without requiring modifications to their existing architecture. |

| Permissionless | Users have the freedom to execute complex trading strategies within Credit Accounts, utilizing Gearbox’s multicall features to streamline interactions. |

| Non-custodial | Gearbox ensures users retain control of their funds at all times, unlike centralized exchanges that impose leverage parameters and custody requirements. |

| Community-driven | With a focus on community governance, Gearbox operates without a central entity dictating on-chain actions, prioritizing the needs and preferences of its user base. |

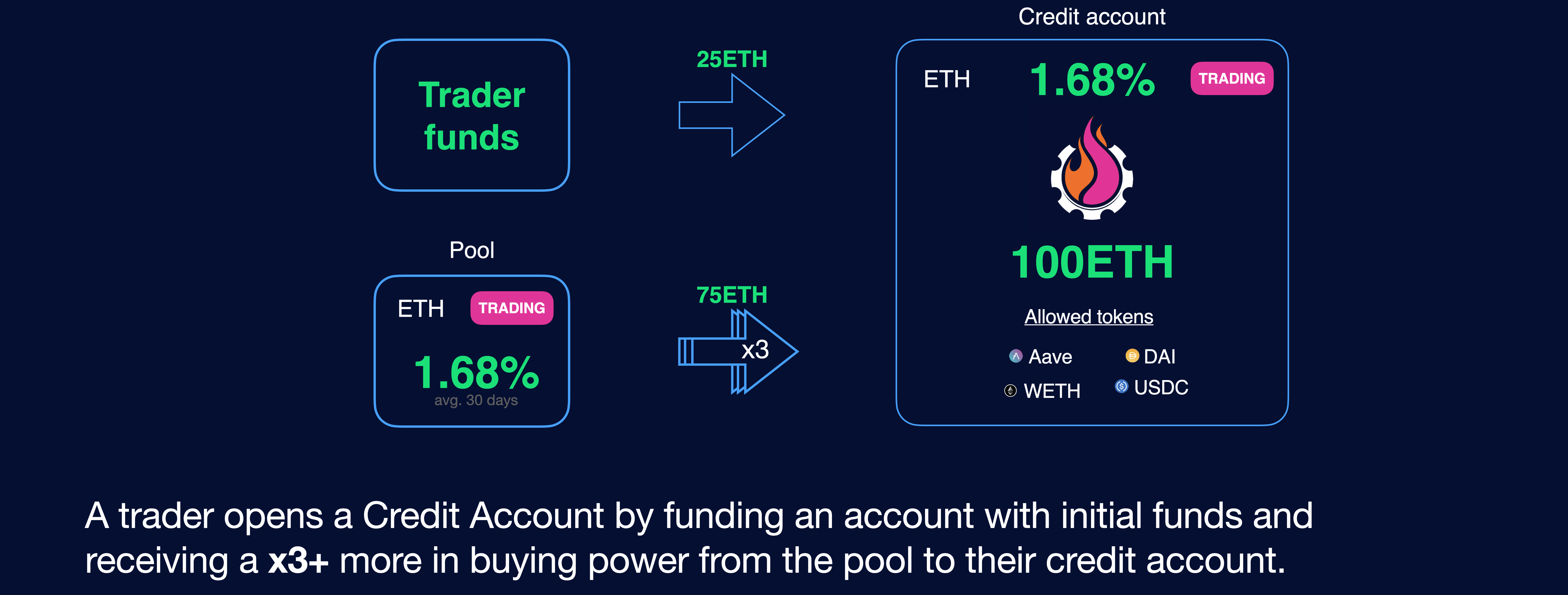

Unique to Gearbox is the concept of Credit Accounts, allowing borrowers to utilize multiple assets as collateral in order to access leverage offered by lenders in return for an interest rate payment.

Gearbox serves as a kind of “leveraged DeFi wallet” by providing a comprehensive platform for managing and maximizing your DeFi activities with leverage. Users decide their leverage, where to deploy the capital, and for how long.

While there are no predefined vaults or yield farming strategies that users are forced to abide by, Gearbox limits the number of assets and external protocols it supports. This is a security measure that is in place to ensure that funds are not lost through untrustworthy or badly engineered protocols.

Whitelist of allowed tokens and protocols

How It Works

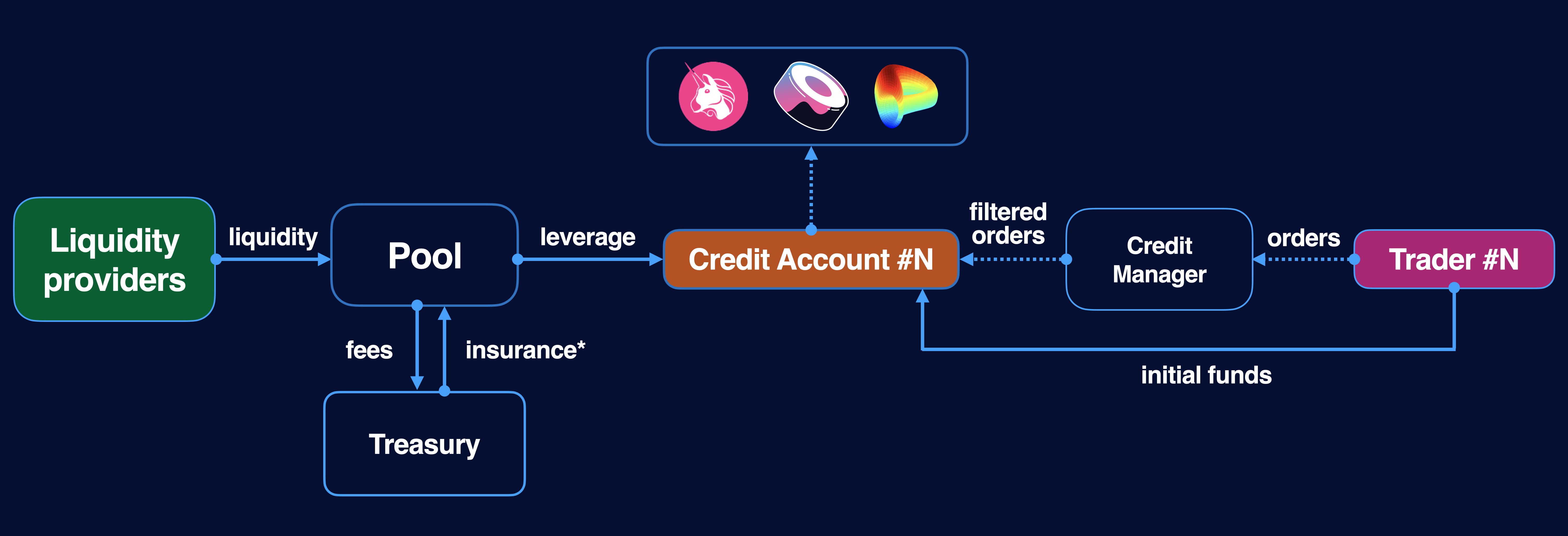

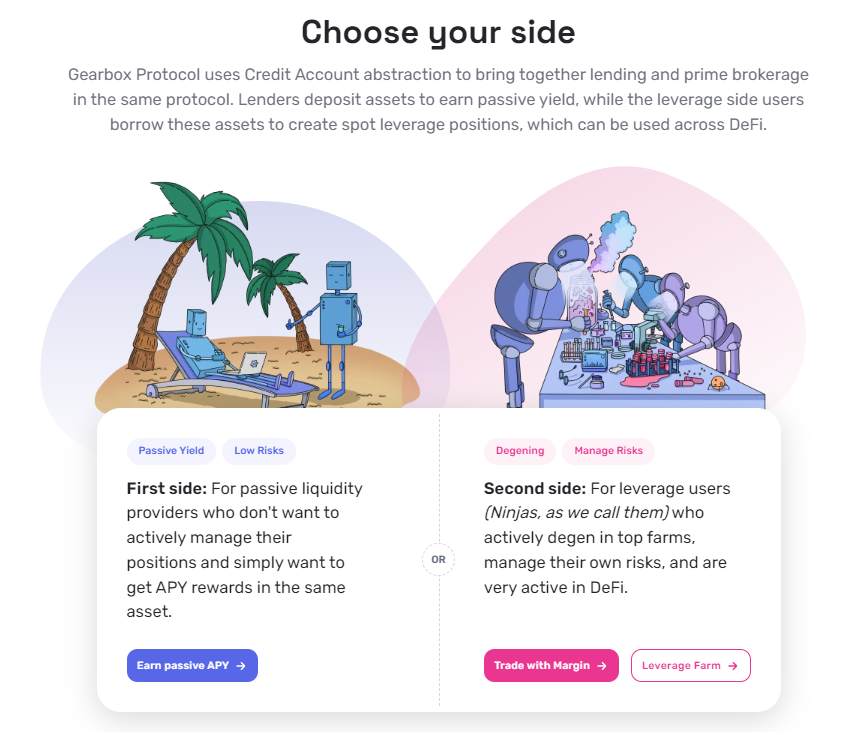

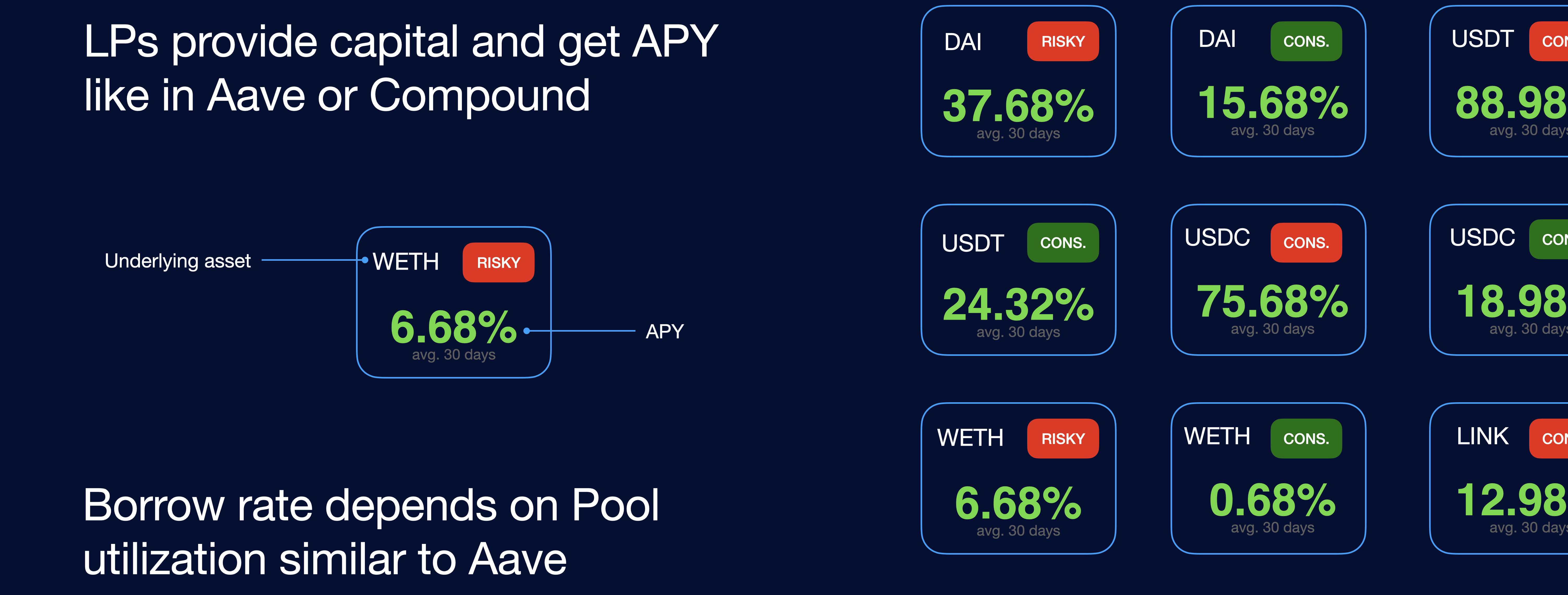

Gearbox operates by engaging and matching two types of user profiles: passive lenders and borrowers. Passive lenders provide liquidity to the protocol, earning yields on their deposited assets, while borrowers leverage this liquidity to enhance their trading or investment positions, paying interest in return.

| Passive Lenders (or Liquidity Providers) | Borrowers |

| These are individuals or entities who provide assets to the protocol seeking passive yield with lower risks.

Similar to platforms like Compound, lenders deposit their assets into Gearbox and receive interest-bearing tokens in return, representing their share of the liquidity pool. These assets are then utilized by borrowers within the protocol, generating APY for the lenders. |

Borrowers consist of traders and farmers seeking to increase their position by borrowing liquidity at multiples of their collateral.

Borrowers can access leverage up to 10x their notional size, amplifying their trading or investment activities. This leverage power allows borrowers to magnify their potential returns but also increases their risk exposure. |

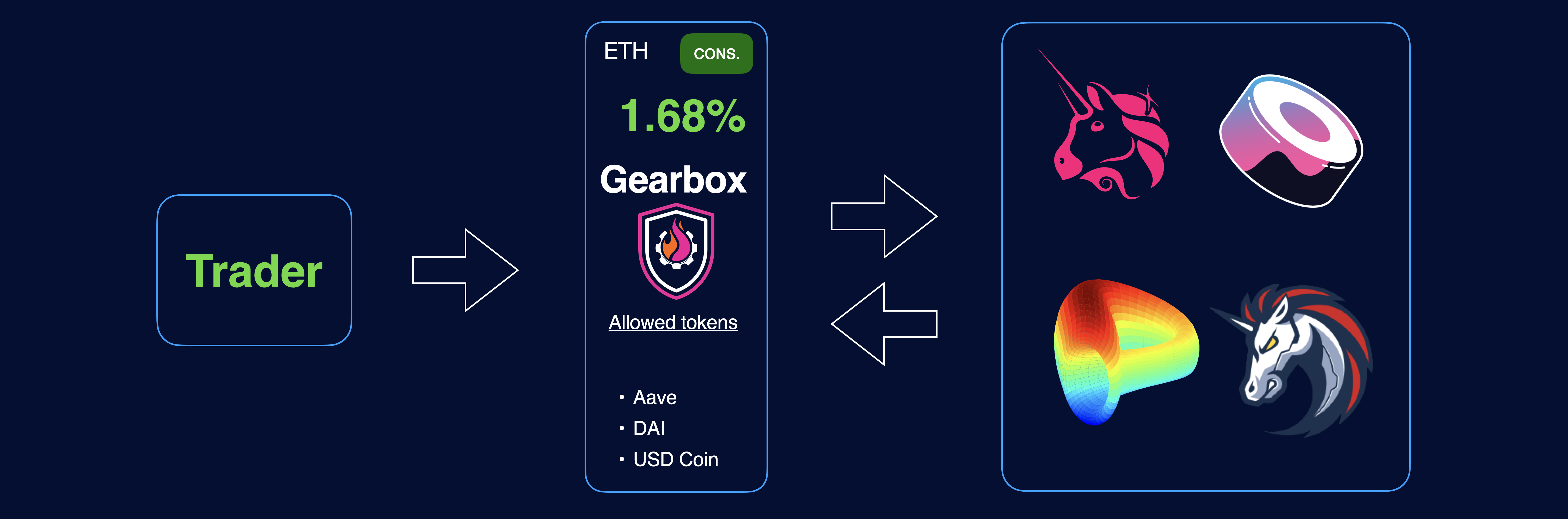

Unlike traditional trading platforms, Gearbox does not custody assets or control secondary market liquidity. Therefore, there are no funding rates associated with the protocol. Additionally, Gearbox ensures that assets are not isolated within its protocol by facilitating all trades and farming operations on third-party protocols such as Uniswap, Curve, and Yearn.

This approach enables Gearbox to integrate seamlessly with a wide range of protocols, leveraging composability to enhance liquidity and trading opportunities. Positions taken by traders and farmers are liquidated by third-party liquidators before the assets of passive lenders are exposed to downside risks.

In the event of liquidation, the protocol returns the assets to the protocol pools, ensuring that Gearbox can maintain the integrity of the underlying assets and minimize risks for passive lenders.

Credit Accounts

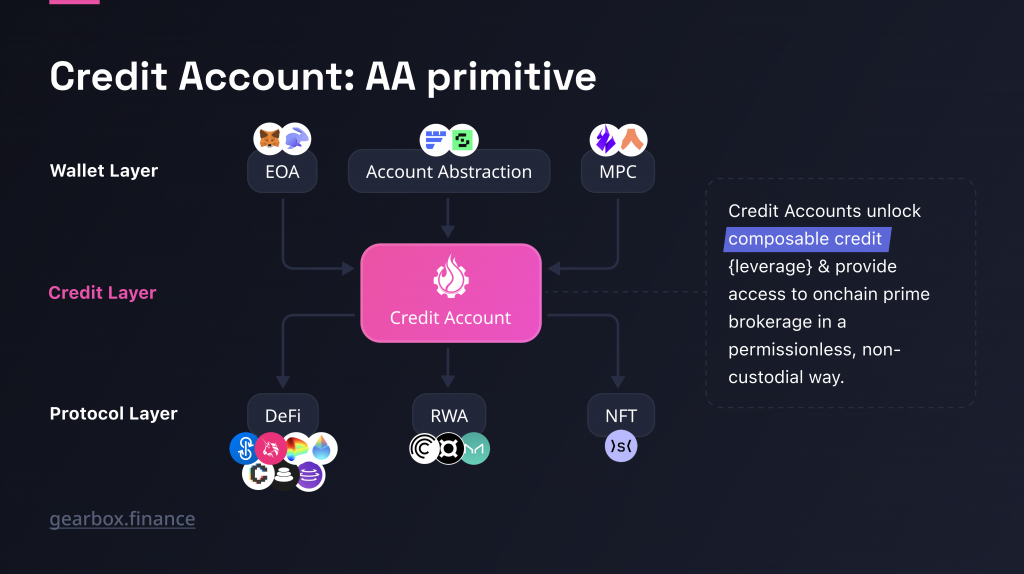

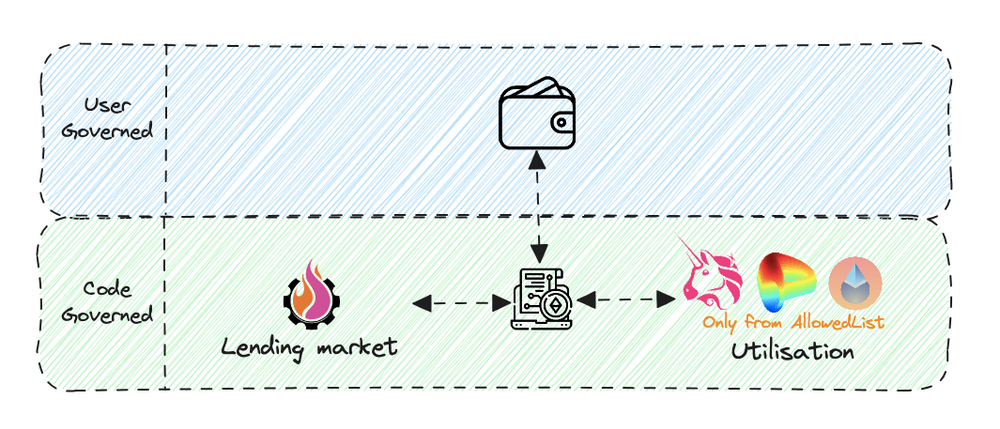

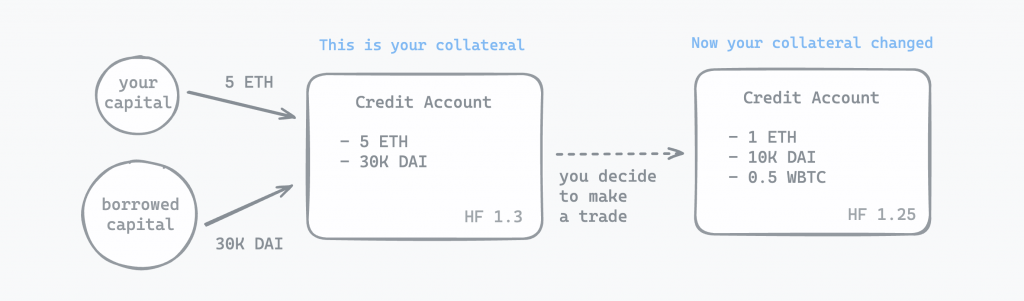

One of the key components of Gearbox are Credit Accounts, which match and connect passive lenders with borrowers moving funds through a Credit Manager smart contract. In Gearbox, Credit Accounts hold both the user funds and the borrowed funds. Each user in Gearbox has their own trading account – this is where leverage lives and from where all operations will be performed.

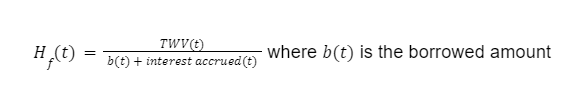

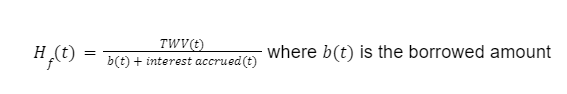

Each account operates under a fixed asset denomination, and its total value is calculated based on the assets it holds and their prices from a price oracle. The liabilities include the borrowed amount, interest accrued, and initial funds. The system ensures safety through a health factor, where accounts are liquidated if their health factor falls below 1, preventing undercollateralization in volatile market conditions.

Credit Accounts in Gearbox are non-custodial, smart contract-based accounts offering leverage to users for various DeFi strategies. Users can deposit collateral to open a Credit Account, then borrow assets to execute leveraged trades or investments across integrated DeFi protocols. The funds on a Credit Account represent the collateral being used for debt, and users can operate these funds by margin trading on DEXs like Uniswap or Sushiswap, earning yield on Yearn, arbitraging peg between stablecoins on Curve, capturing basis from interest rate differentials on money markets…

Credit Accounts isolate risks and enable efficient capital utilization, allowing for leverage up to 10x. Users manage risk through collateralization ratios, with liquidation mechanisms in place to protect borrowed funds. This design enhances DeFi investment strategies by providing flexible, leveraged exposure to a range of protocols without requiring asset transfer between protocols.

Allowed List Policy

Operations within Credit Accounts are restricted by two policies: the allowed contracts list and the allowed tokens list. These policies mitigate risks associated with vulnerable smart contracts and highly volatile assets, ensuring the security and stability of Credit Accounts. Gearbox maintains an evolving list of Allowed Tokens and Allowed Contracts, both being actively managed by governance.

Gearbox has already conceptualized integrations with prominent DeFi platforms such as Uniswap, Sushiswap, Convex, Yearn, Curve, Balancer, Aura, and others. However, the integration process may vary for farming or liquidity providing due to the diverse nature of asset pools and price oracles across different protocols.

Note that while the AllowedList serves as a permission box, the actions within it are permissionless. Users have the freedom to apply leverage, execute trades, and manage assets within the confines of the Allowed List permissions. There are no pre-made strategies or vaults, allowing for customizable and decentralized operations.

Furthermore, this AllowedList is regularly updated to reflect the latest additions and changes. Users can consult the on-chain contracts for the most up-to-date information, ensuring transparency and accuracy in protocol governance.

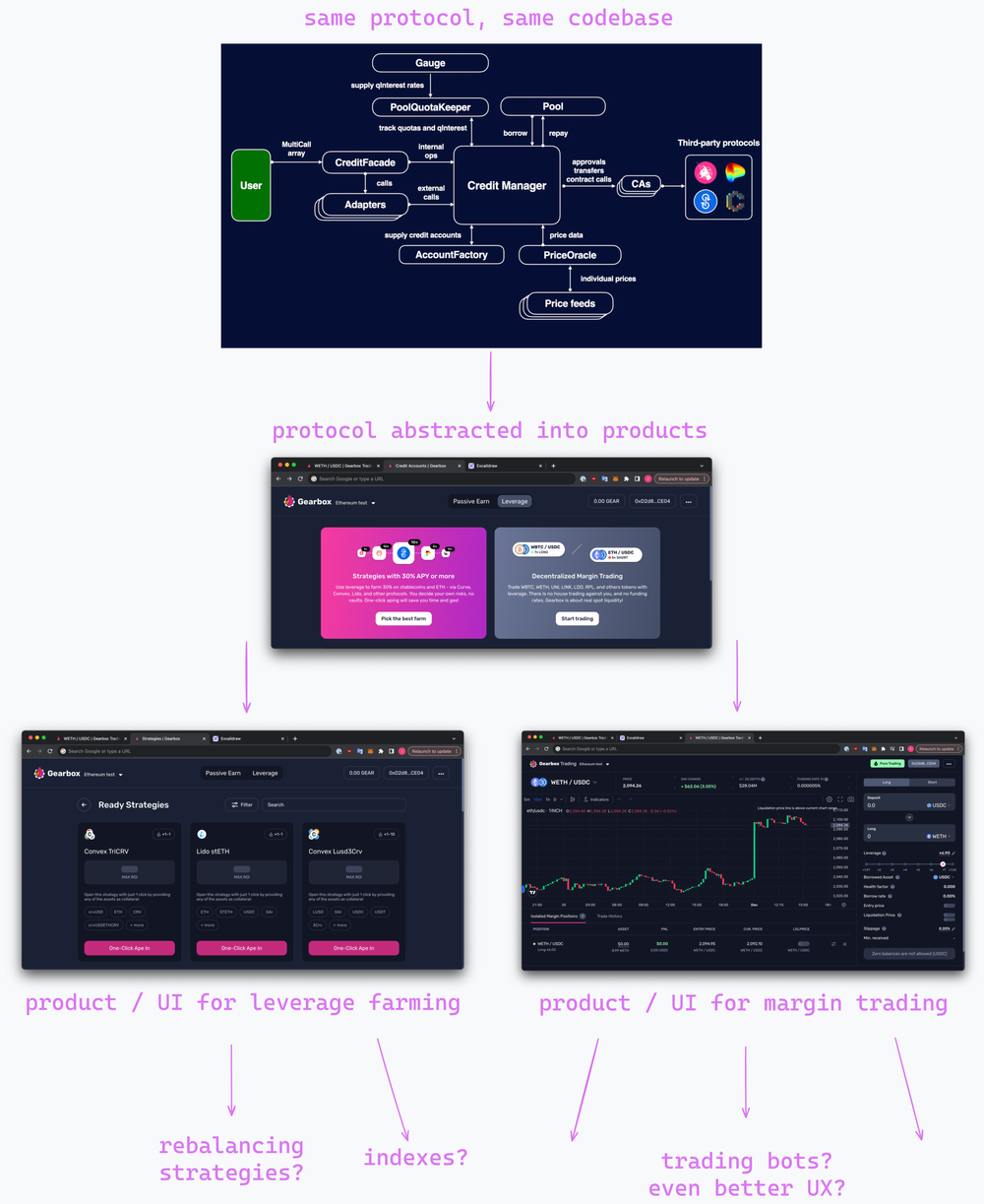

Protocol Architecture

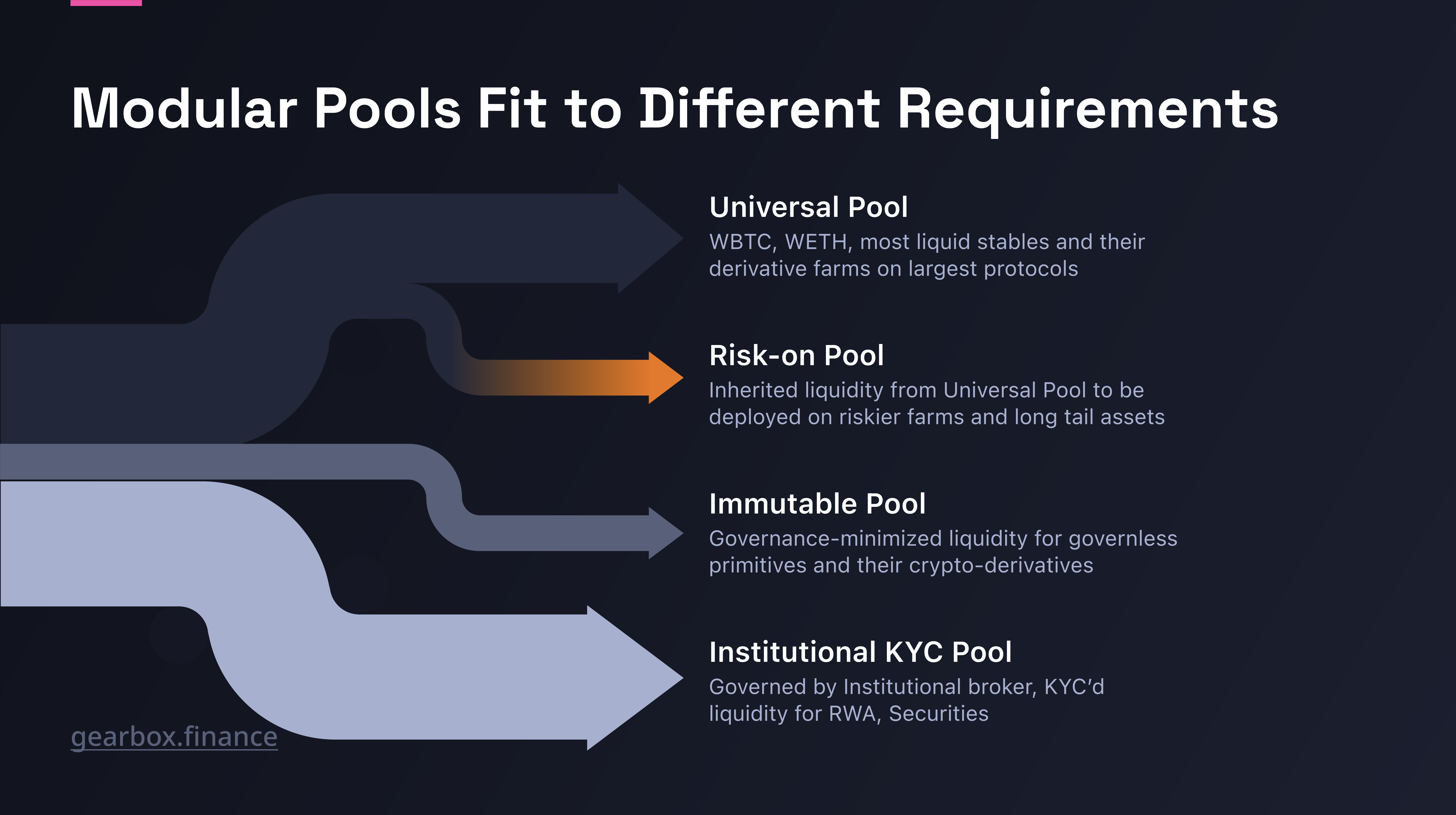

Gearbox features a modular architecture designed to support flexibility and seamless integration with other protocols. One of the reasons behind this approach is to be integrated with existing and new protocols in an open-source manner.

A modular architecture enables segmentation of risks, personalized rates, collateral limits, and other mechanisms. This customization empowers Gearbox to cater to different user groups, including farmers, traders, liquidity providers, and participants in sophisticated LP-ing, NFT, and RWA leveraging activities.

Leveraging its modularity, Gearbox can extend leverage to a wide range of assets, including long-tail assets, without significantly increasing risks for passive lenders. This diversification enhances the protocol’s ability to service diverse user needs and preferences.

Due to the modular architecture of Gearbox, each user has their own Credit Account(s), reducing gas costs associated with executing trades. Additionally, Credit Accounts are borrowed from the protocol, minimizing deployment costs for new users.

Liquidations

When trading on Gearbox, your Credit Account becomes the collateral for external protocols: both your initial funds and the amounts you borrowed from Gearbox’s passive lenders. By continuously monitoring the portfolio composition, the protocol can determine its value at all times, calculated in the underlying borrowed asset which the user opened the Credit Account in.

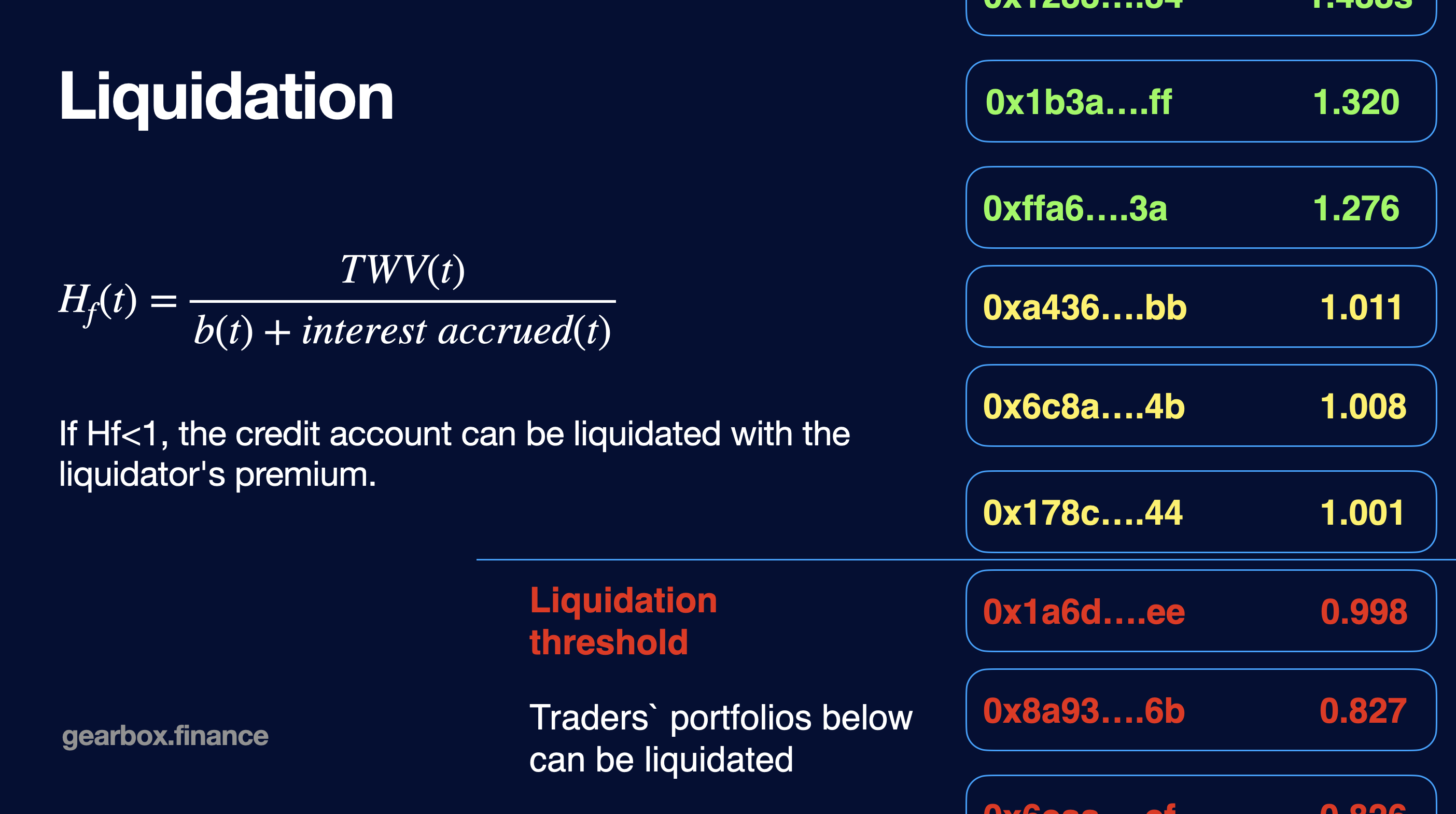

The protocol uses a risk model to continually assess the quality of a trader’s portfolio, and liquidations are based on the Health Factor (HF) and Threshold Weighted Value (TWV) of positions. Liquidations are critical for maintaining the health and stability of Credit Accounts, ensuring solvency while enabling leveraged operations.

- The Health Factor is a numerical representation of the health of a Credit Account. It is calculated based on the ratio of the total value of assets in the account to the borrowed amount. A health factor below 1 indicates a risky position, potentially leading to liquidation.

- The Threshold Weighted Value takes into account the liquidation threshold for each asset in the Credit Account. It is calculated by summing the products of each asset’s balance, price in the underlying asset, and its liquidation threshold.

TWV(t)=∑min(Qi(t), ci(t) * pi(t) * LTi where ci is the balance of an asset, pi is the price of that asset, Qi is the Quota amount for the ith asset and LTi is the liquidation threshold.

- The Total Value of a Credit Account represents its balance in terms of the underlying asset. takes into account the liquidation threshold for each asset in the Credit Account. It is calculated by summing the products of each asset’s balance, price in the underlying asset, and its liquidation threshold.

TV(t)=∑ ci(t) * pi(t) where ci is the balance of an asset and pi is the price of that asset

- The Liquidation Threshold represents the maximum allowable ratio of Loan-To-Value (LTV) for each asset in the Credit Account. It is determined based on statistical analysis of the asset’s price changes over a specific period. Typically it uses statistics of 5-min, 15-min, 1h change of i-th asset’s price (price is in the underlying asset) for the last 180 days. .

LTi = 100% – Liquidation Premium – Liquidation Fee

Any Credit Account with a health factor below 1 is at risk of being liquidated. Liquidations can be initiated by anyone, and they involve selling off assets from the Credit Account to repay the borrowed amount. This process helps to prevent losses for liquidity providers and maintain the overall health of the protocol.

Anybody can participate in liquidations in a permissionless manner by running a liquidator bot.

Quotas

Quotas are like individual credit limits, applied to each Credit Account. They determine the maximum exposure to a particular collateral asset for each Credit Account.

Quota Fees, established by main governance, are static and incurred when obtaining or increasing a quota.

Each allowed asset in the pool has parameters:

- Qi – the maximum cumulative Quota amount for the i-th asset.

- rqi – the minimum interest rate for using Quota.

- Rqi – the maximum interest rate for using Quota.

Each $GEAR voter can distribute their votes between different assets and choose whether to increase or decrease the interest rate.

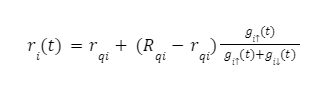

Let g↑i(t) be the number of votes to increase the interest rate for the i-th asset and g↑i(t) be the number of votes to decrease it. Then the interest rate is defined as:

Quotas Interest Rate Calculation

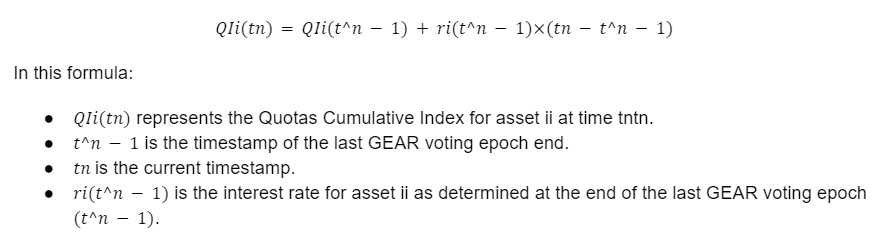

Gearbox has a dynamic approach to calculate Quota interest rates, aiming to balance liquidity within the protocol and ensure equitable compensation for lenders. A key component of this system is the Quotas Cumulative Index (QIi(t)), which aggregates the value of utilizing a quota for each asset over time. This index is adjusted with every modification in interest rates or quota usage, maintaining the cost of quota usage in line with the protocol’s financial health.

This mechanism ensures that the cost associated with quota usage is continuously updated to reflect the current market conditions and the protocol’s liquidity needs, allowing for a dynamic and responsive system for managing and pricing asset quotas within the Gearbox ecosystem.

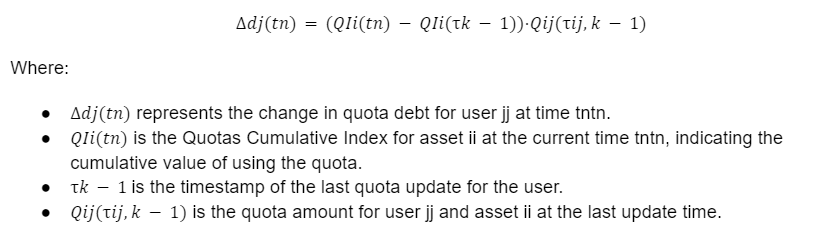

Interest charges for each user’s quota usage are determined based on changes in the Quotas Cumulative Index since their last activity. This method ensures that users are billed accurately for their usage over time. The change in a user’s quota debt (Δdj(tn)) is calculated as follows, illustrating the accrued interest based on their quota allocation and the time elapsed:

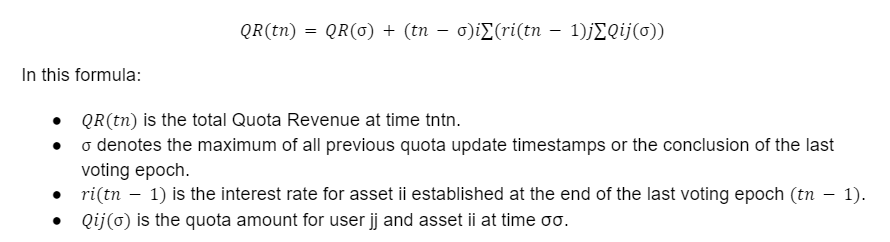

Quota Revenue (QR) encapsulates the total interest accrued from all users’ quota usage. It is refreshed with each rate adjustment, aligning the protocol’s revenue with the actual quota usage across all assets. This synchronization is vital for sustaining the protocol’s financial stability and providing transparency in its revenue generation from quotas.

This structured methodology for calculating interest rates and managing quotas enables Gearbox to adaptively respond to market dynamics and user activities, ensuring a sustainable and equitable system for leveraging digital assets.

Interest Rate Model

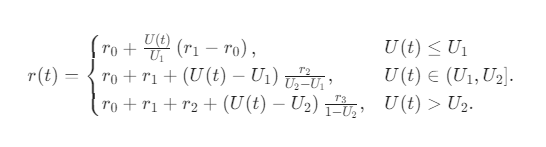

Gearbox has an organic interest rate model to dynamically adjust the borrow rates within its pools, based on the utilization parameter. This model is important for managing liquidity and ensuring that the rates are fair and responsive to the actual usage of the protocol’s resources. Similar to Aave’s linear interest rate model, Gearbox incorporates a nuanced approach with a two-point model, further refined by the addition of quota usage rates as determined by $GEAR voters.

Organic Interest Rate Calculation:

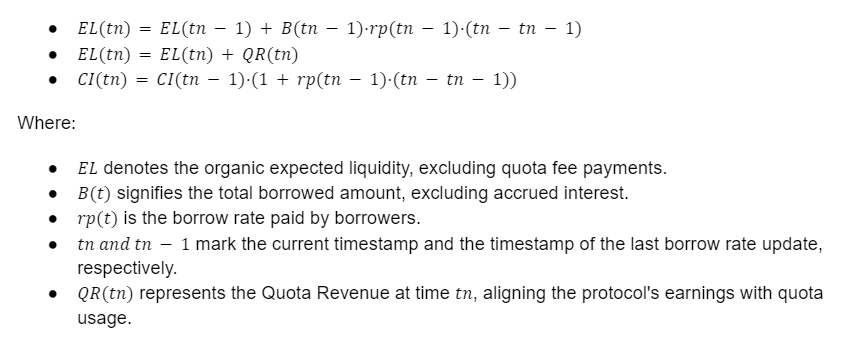

To compute the pool’s liquidity dynamics, Gearbox uses the Expected Liquidity (EL(t)) and Cumulative Index (CI(t)) metrics. Expected Liquidity reflects the anticipated amount of funds in the pool, assuming all users settle their Credit Accounts and repay their debts. The Cumulative Index aggregates the value of borrowed funds over time, capturing the cost of borrowing. These are formulated as:

Borrow Rate Determination:

The borrow rate (rp(t)) is then calculated based on the pool’s expected liquidity and the total borrowed amount, adjusted for quota interest payments (BI(t)), using a tiered model defined by governance through constants r0,r1,r2,r3, U1, U2. This model ensures that the borrow rates are adjusted according to the pool’s utilization ratio, with safeguards to prevent borrowing that would push the utilization ratio above a certain threshold (U2).

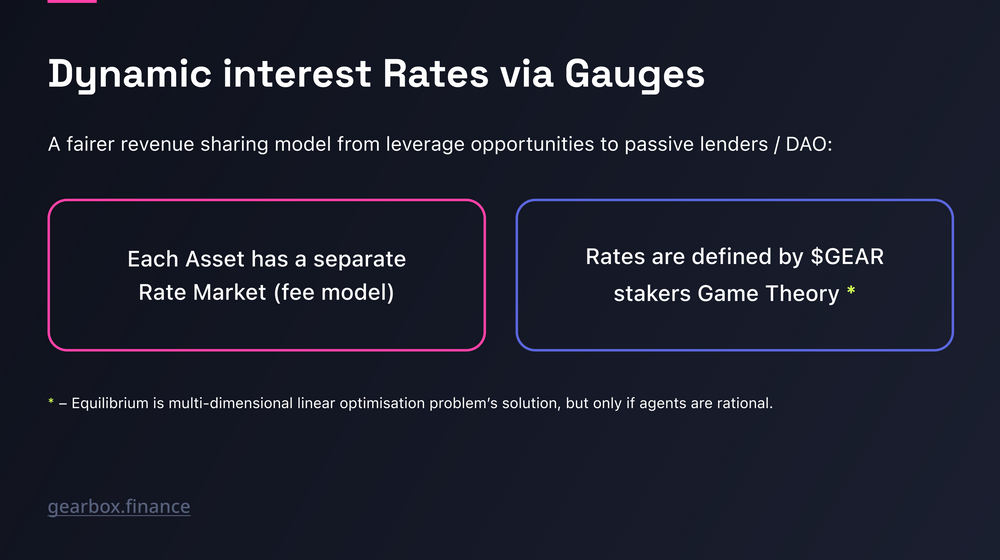

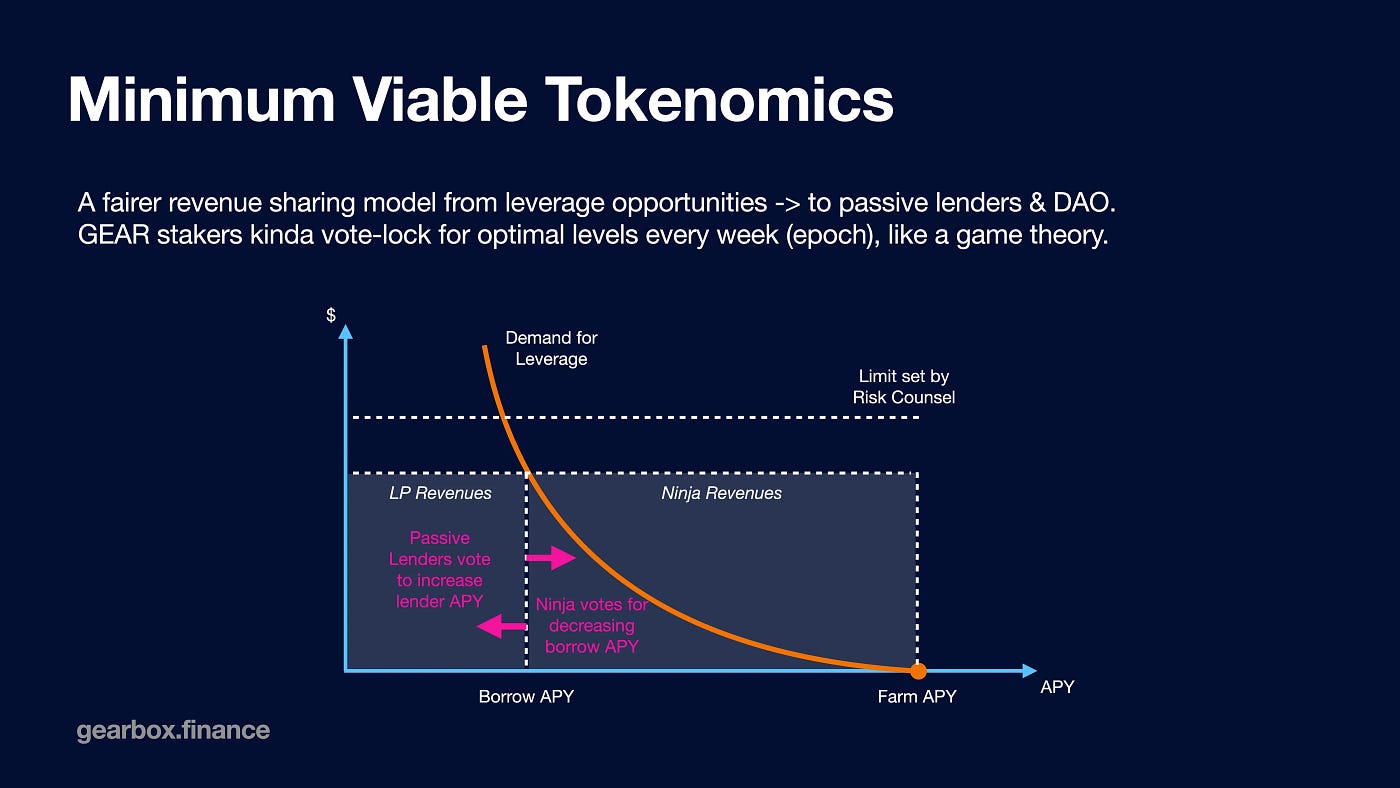

Gauges

Gauges decide the extra interest rates borrowers pay on their quotas. $GEAR stakers freeze tokens and vote to set these rates, similar to Curve Gauge’s distribution of rewards.

Rates change per epoch (typically 7 days), influencing borrowers’ costs and lenders’ rewards. Stakeholders can vote to adjust rates, aiming to balance borrower affordability and lender returns.

Gauges serve as a mechanism to determine the additional APY on top of the usual utilization curve for each asset, effectively billing extra for riskier collaterals held in a Credit Account. Stakeholders, including passive lenders, leverage borrowers, and protocol integrators, play pivotal roles in shaping these rates through $GEAR staking and voting.

Passive lenders typically aim to maximize their APY by voting for higher gauge rates across all assets. Conversely, leverage borrowers seek to minimize their borrowing costs by voting to decrease gauge rates for specific assets they utilize. Protocol integrators, desiring increased adoption of their services, may vote to decrease rates for relevant assets, making their protocols more attractive for Gearbox borrowers.

These rates, decided by $GEAR stakers on-chain, are applied per-block, similar to regular borrow rates, and are subject to periodic epochs lasting seven days or longer. Each epoch begins every Monday at 12:00 UTC, providing a structured framework for governance decisions. The extra rates collected from borrowers are shared with passive lenders and accumulated in the Fee Guard, contributing to the overall sustainability and incentive structure.

Why the Project was Created

The motivation for creating Gearbox stemmed from the need to innovate within the DeFi space of the time. The original idea was conceptualized during the MarketMake hackathon by ETHGlobal in January-February 2021.

Initially, the goal was to establish a secondary market utilizing liquidity from Uniswap pools, aiming to resolve issues related to liquidity pool balancing and enabling leverage without funding rates. However, as demand grew for more assets and higher leverage while maintaining decentralization, the protocol evolved to accommodate these needs.

Background and Project Evolution

Mikael first came up with the idea and took it to the finals of the ETHGlobal MarketMake 2021 Hackathon. This first proof of concept attempted to make a Uniswap leverage trading engine

The initial core members and contributors started working on the project between January and August 2021. During this initial period the technical paper, architecture, and overall framework for Gearbox were created. Next, efforts were made to educate the community about Gearbox and its forthcoming launch. Additionally, audits and security testing were conducted on the core contracts in preparation for the December 2021 launch.

The DAO-first launch model was proposed during the ETHGlobal Online event. In this model, control over the protocol was relinquished by the initial core members from day one, with decisions regarding collaterals, allowed policies, and more being made through DAO voting.

The initial distribution of tokens was carried out across several phases, with a diverse range of participants receiving tokens. These tokens were initially non-transferrable, and decisions regarding their transferability were left to the DAO. Later on a unique token distribution mechanism called Credit Account Mining was introduced. It involved designated wallets paying gas costs to deploy accounts and receiving $GEAR tokens in return.

The goal of Credit Account Mining was to ensure that Gearbox had a sufficient number of Credit Accounts available for leverage users to rent, thereby reducing the need for users to deploy expensive smart contracts each time they required leverage. Eligible addresses included early community members, developers, contributors, and governance participants of other protocols. The list included holders of LobsterDAO NFTs, snapshot governance participants of various protocols, on-chain governance participants, LPs of Element Finance, and GTC claimants, among others.

This approach aimed to select users familiar with governance processes, increase visibility for the protocol, and prevent any single group from dominating the distribution.

- Each eligible address could deploy only one Credit Account and receive a fixed reward of 100,000 $GEAR tokens.

- The ceremony had a 48-hour window for participation, after which DAO voting would commence.

- If not all 5,000 Credit Accounts were deployed within the timeframe, the remaining accounts would still be available for mining by the same list of eligible wallets.

- The deployment cost for each Credit Account was approximately 0.25 $ETH, depending on network congestion.

Multisig roles were established for financial-treasury and technical purposes, with delegates appointed to streamline community involvement. The initial core team ceased to have control over the protocol, and the DAO became the primary decision-maker.

As time passed, decisions regarding assets, protocols, and other financial parameters were made through DAO voting, with community participation facilitated through forum proposals and snapshot page voting.

Gearbox v2

The Gearbox v2 version aimed to validate the protocol’s design for safety and efficiency, focusing on achieving specific goals:

- Identifying Product Market Fit (PMF): The primary goal was to find initial PMF indicators in a new DeFi category, demonstrating the protocol’s ability to meet market demands and user needs effectively.

- Establishing a Risk Framework: A key objective was to develop a comprehensive risk management framework to ensure zero bad debt.

- Expanding Offerings: The expansion of services and features was targeted, including the introduction of leveraged stablecoin farming and LSTs, to broaden the protocol’s appeal and utility within the DeFi ecosystem.

Initially, it was assumed that Leverage Trading might not have a competitive advantage on Gearbox compared to competitors like GMX and other perps DEXs, given the curated UI for leverage farming. However, with Gearbox’s low cost of borrow, efficient Leverage Trading with size was observed.

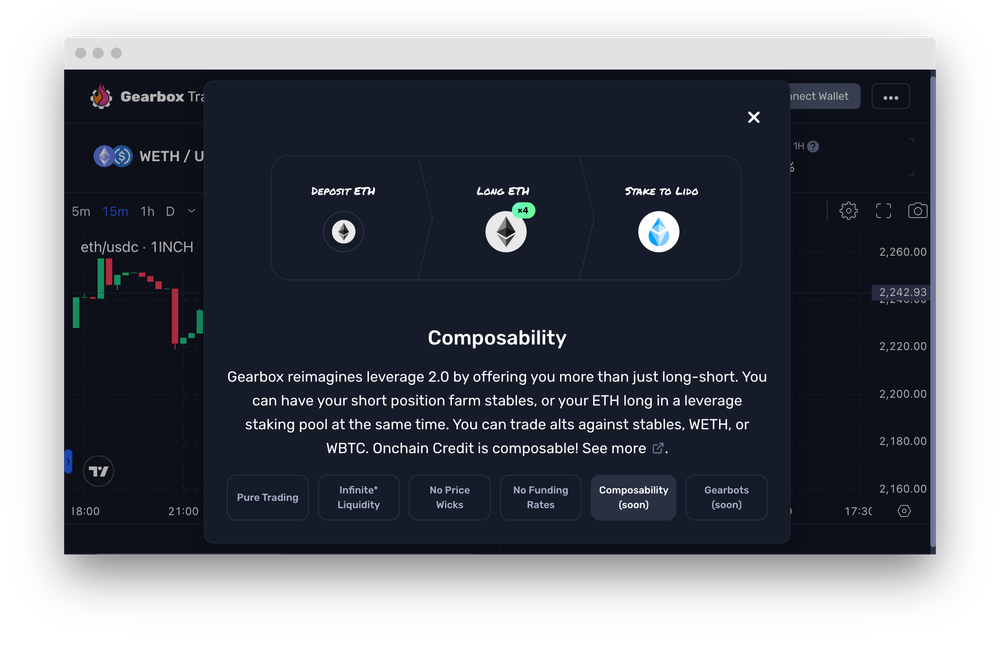

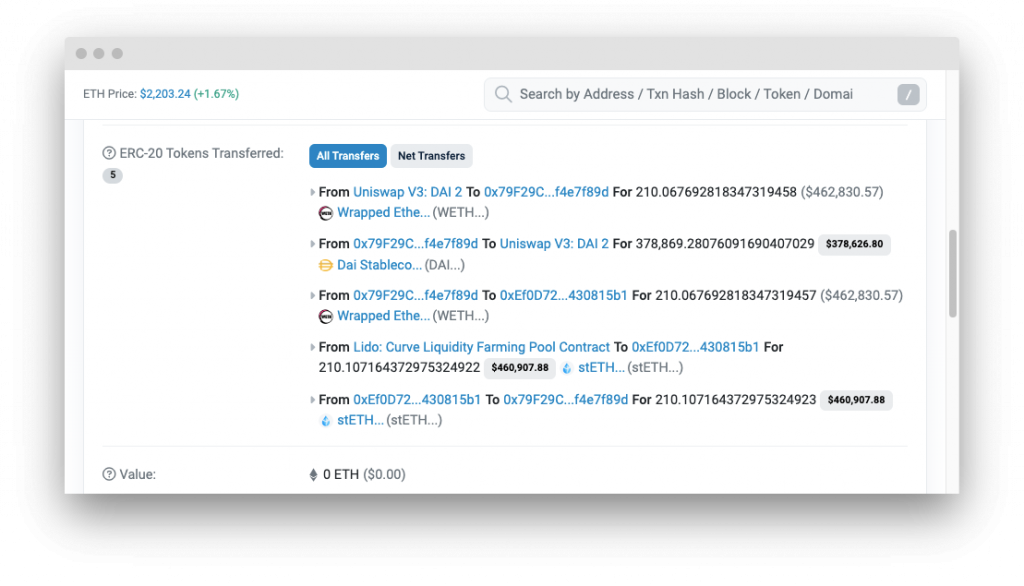

With v2, Gearbox aimed to offer composability without requiring users to navigate multiple protocols manually. The introduction of Multicall simplified leverage user interactions, with over 80% of positions being opened using this feature, exceeding initial expectations.

While initially expected to attract lower-risk lenders, the concept of lending pools took longer to gain traction, partially due to perceptions of post-FTX risk. Nevertheless, Gearbox achieved significant milestones across various aspects of its operations.

On the risk management and safety front, the protocol accrued $0 bad debt and experienced no emergency pauses. With over 75% organic utilization and $100M+ Total Value Locked (TVL) across major assets like $USDC, $DAI, and $ETH, Gearbox demonstrated robust performance. Additionally, the presence of numerous independent liquidators and multiple risk monitoring systems further enhanced security.

In terms of community engagement and partnerships, Gearbox has established strategic partnerships with prominent DeFi platforms like Yearn Finance, Balancer Boosted Pools, Frax Finance AMOs, and Brahma Finance, enhancing its ecosystem and attracting significant capital inflows.

The DAO also continued to move forward in terms of governance participating, promoting active participation in DAO discussions. Monthly DAO reports ensured accountability and provided insight into fund allocation. The transition to the OBRA governance framework and plans to move towards on-chain governance further reinforced the commitment to decentralized decision-making.

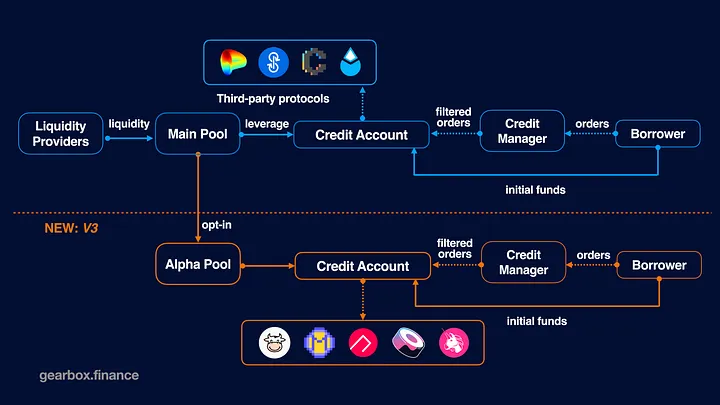

Gearbox v3

With v3 the goal was to introduce significant enhancements in lending, scalability, revenue generation, user experience, and tokenomics.

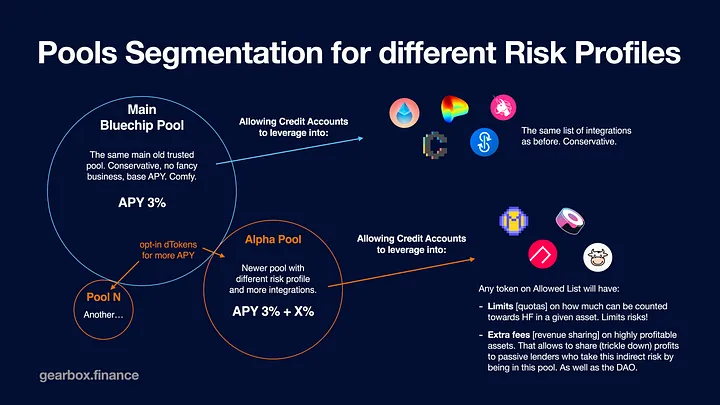

- Redefining Lending: Gearbox V3 introduced the concept of Alpha pools, allowing users to opt for higher APYs by taking on slightly more risk compared to the conservative Main Bluechip pool.

- Redefining Scale: The protocol introduces asset limits and quotas to mitigate risk and ensure the safe addition of long-tail and medium-tail assets. By capping exposure to individual assets, Gearbox can integrate assets with lower liquidity without increasing protocol risks.

- Redefining Revenue: A new revenue model based on quota interest is introduced, wherein borrowers pay interest based on their quota size for each asset.

- Redefining Tokenomics: The parameters governing the protocol can be altered through $GEAR DAO voting, ensuring community governance. Staking mechanisms allow $GEAR holders to participate in decision-making and earn rewards based on their contributions.

- Redefining UX: Gearbots, immutable automation contracts, enhanced user experience by enabling automated portfolio management features and trustless on-chain delegated fund management. Users can delegate certain account management tasks while retaining control and transparency.

Gearbox also evolved its governance model to address past limitations and enhance operational efficiency. The new model introduced permissionless execution of queued Governance Improvement Proposals (GIPs) and a Controller role for streamlined decision-making.

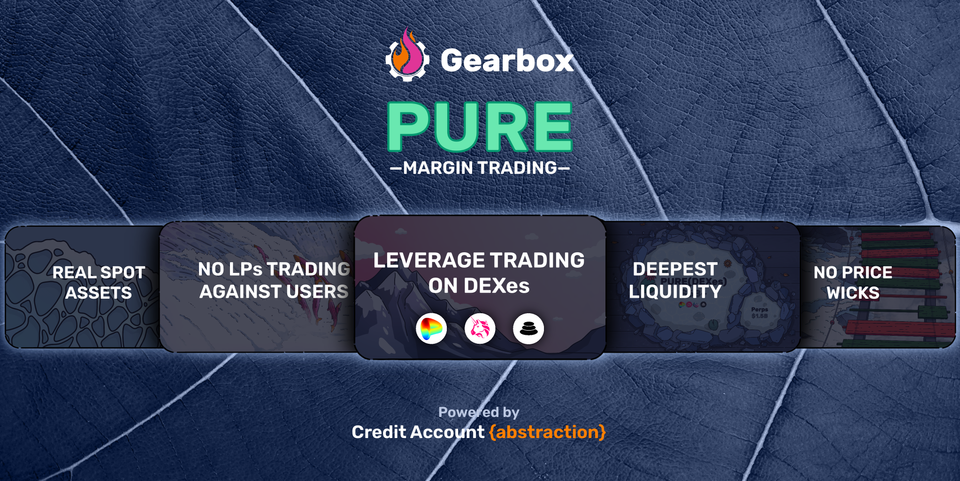

The deployment of v3 marked a significant advancement, introducing margin trading with PURE liquidity and specialized UIs for margin trading and farming.

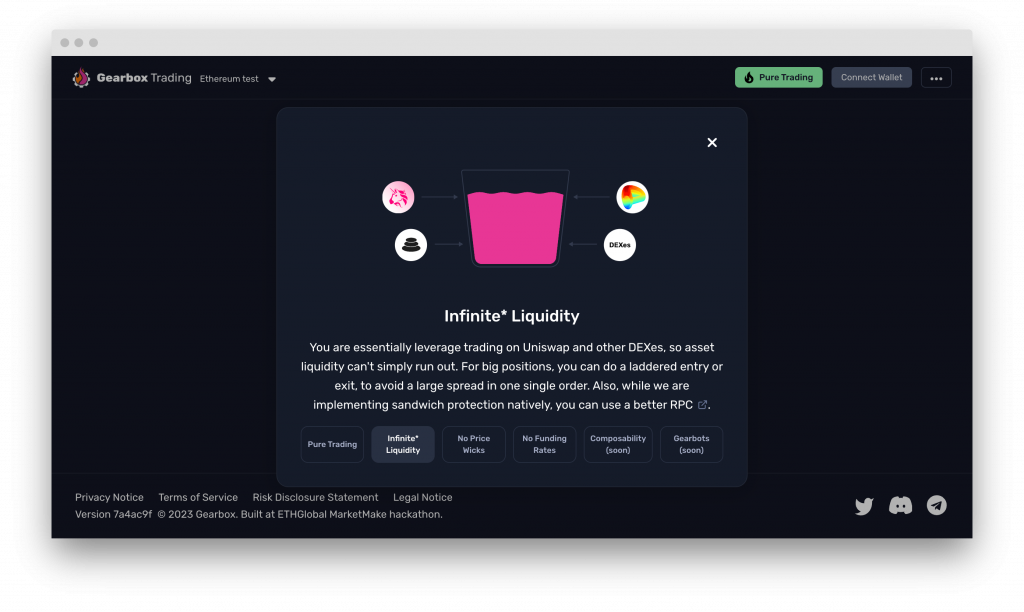

The protocol’s modular architecture facilitates diverse asset pools and risk segmentation, addressing the challenge of simplifying a generalized protocol into a user-friendly product interface. Leveraging v3’s composable leverage, users can engage in margin trading without derivatives or funding rates, tapping into spot liquidity from various sources.

With v3, Gearbox PURE introduced margin trading with real, spot assets, offering leverage without LPs or counterparties. Utilizing lending pools and Credit Accounts, users can borrow up to 10x funds against collateral from Gearbox. Trades are settled on DEXes like Uniswap and Curve, ensuring deep liquidity and fairer trading conditions. This design enhances margin trading by addressing backend concerns, offering users a seamless UX for efficient trading.

- Deep liquidity from DEXes like Uniswap and Curve, providing efficient trade settlement and controlled slippage.

- Elimination of counterparties, creating a non-zero-sum game and a fairer trading environment.

- Reduction in price wicks with Chainlink oracles providing spot prices aggregated from multiple sources.

- Absence of funding rates, with users only paying a borrow fee, resulting in lower costs.

- Composability by allowing leveraged positions to be used for other DeFi activities, reducing trading costs.

- Availability of more assets and trading pairs, with potential for expansion based on liquidity and risk profile.

Sector Outlook

Gearbox is not a standard DeFi money market where users deposit collateral to borrow in an overcollateralized manner. Unlike traditional models like Aave and Compound, Gearbox involves two types of users: borrowers who want access to leverage, and lenders who want to earn an interest on their deposit.

Composable leverage, a core feature of Gearbox, offers unprecedented flexibility and efficiency by allowing users to craft their yield farming strategies. Unlike conventional leverage, where users are restricted to long or short positions and subject to predetermined liquidation parameters, Gearbox empowers users to design intricate strategies within the boundaries of its allowed list policy, which safeguards against security risks.

At the heart of Gearbox’s spot leverage lies the concept of composability, epitomized by the integration of smart contracts across different protocols, often referred to as “money legos.” This interoperability enables users to maximize capital utilization by seamlessly deploying leverage across various DeFi platforms. Notably, Gearbox does not maintain its own order book or trading environment, allowing leverage obtained on the platform to be employed across multiple protocols.

Potential Adoption

Gearbox is a protocol offering a DeFi primitive for others to build on top of, aiming to become the base layer for other projects to innovate and offer leveraged strategies.

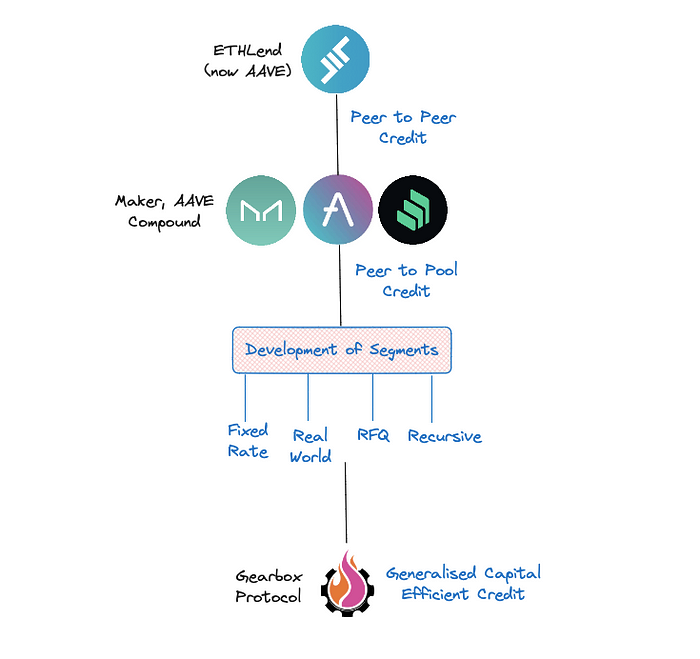

Credit on chain has evolved through various phases, each introducing innovative mechanisms and expanding the possibilities within DeFi:

- Peer to Peer Credit: Initiated by platforms like ETHLend, this model allowed direct lending between users without intermediaries, introducing yields and credit on chain.

- Peer to Pool Credit: Platforms such as AAVE, Compound, and Maker introduced the peer-to-pool lending model, enabling users to lend to a pool and borrow from it using their deposits as collateral. This innovation propelled DeFi, with AAVE surpassing $3 billion in Total Value Locked (TVL) and attracting over 1000 users.

- Rise of Credit Segments: With credit on chain gaining traction, specialized segments emerged, including:

- Real World Credit: Focused on providing on-chain credit for real-world applications, serving institutional investors (e.g., Maple) and small to medium-sized enterprises (e.g., Florence Finance).

- Fixed Rate Credit: Platforms like Notional, Pendle, and Term Finance introduced fixed-rate credit, where the interest rate remains constant throughout the loan term.

- RFQ (Request For Quote) Credit: Morpho Labs pioneered RFQ-based credit, allowing borrowers to request quotes for borrow rates, facilitating peer-to-peer lending over existing lending pools like AAVE and Compound.

- Recursive Credit: Platforms like DeFi Saver enabled borrowers to increase capital efficiency by borrowing against collateral, depositing the borrowed funds again to borrow more, and repeating the cycle.

The next opportunity for DeFi credit lies in improving capital efficiency while maintaining robustness and avoiding bad debt. Despite the advancements, most protocols fall short in providing optimal capital efficiency due to conservative collateralization ratios (Loan-to-Value ratio < 1). However, there’s a whitespace opportunity for highly capital-efficient protocols, aiming to achieve both robust collateral profiles and efficient borrowing.

With v3, Gearbox aims to address this whitespace by introducing a protocol that combines capital efficiency with robust collateralization, enabling users to go beyond current credit capabilities.

The adoption of Gearbox can also be measured based on the number of integrations. As Gearbox integrates with more protocols and offers new leveraged strategies, its network effects will become stronger, further making it more attractive for others to tap into its liquidity.

Chains

Gearbox is currently operational on Ethereum and Arbitrum, although the code is EVM compatible and the DAO has already started discussions to deploy on other Ethereum L2s.

Using the Protocol

Gearbox aims to improve capital efficiency in decentralized finance (DeFi) through the introduction of Credit Accounts. These are isolated smart contracts designed for undercollateralized interactions with DeFi protocols, allowing leveraged trading, farming, and other financial activities.

Credit Accounts function as decentralized custodies for assets, enhancing safety through liquidations when certain thresholds are breached. This allows the protocol to facilitate access to leverage across various DeFi instruments and projects, ensuring cross and isolated margin trading.

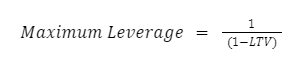

The formulas below are introduced in the whitepaper and describe relevant concepts to understand the protocol operations

- Total Value (TV): The balance of a Credit Account denominated in the underlying asset.

- TV(t) = ∑ci(t) * pi(t) where ci is the balance of an asset and pi is the price of that asset

- Secured Debt Condition: Ensures the total value is greater than the sum of borrowed amount, interest accrued, and initial funds.

- TV(t)> b(t) + bI(t) + Af(t) where Af(t) represents fees paid to the protocol.

- Threshold Weighed Value (TWV): Used to understand the quality of Credit Accounts portfolio or Health factor.

- TWV(t)=min{ci(t) × pi(t), Qi(t)} × LTi where LTi is the liquidation threshold, which is a constant showing the maximum allowable Loan-To-Value ratio for the i-th asset.

- Liquidation Threshold (LT): Depends on the volatility of assets priced in the underlying asset – the higher the volatility, the less value LT has. It can be imagined as a reciprocal of the overcollateralization ratio for the i-th asset.

- LTU=100% – lp – lf where lp is the liquidation premium and lf is the liquidation fee.

- Health Factor (HF): Used to understand the health and quality of a Credit Account’s portfolio.

- Debt Repayment: The total amount required to close a Credit Account

- D(t) = b(t) + bI(t) + Af(t)

- Liquidation Amount: The value calculated for the assets transferred during liquidation.

- Al(t) = TV(t) × (1 – lp)

- Pool Return (Ap): The minimum amount returned to the pool after liquidation.

- Ap(t)=min {Al(t), b(t) + bI(t) + fl(t)}

- Remainder to Account Owner: Funds returned to the Credit Account owner after liquidation.

- R(t)=max {0, Al(t) – Ap(t)}

- Profit and Loss (PnL): Calculated from the protocol’s perspective:

- PnL(t) = Ap(t) – b(t) – bI(t)

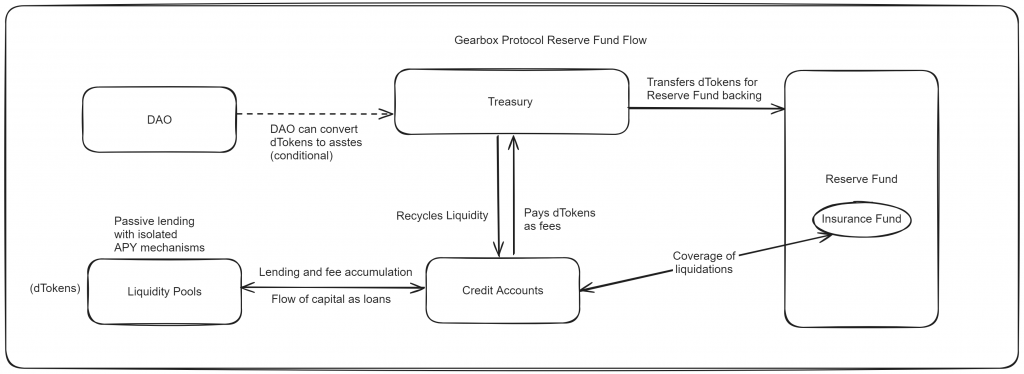

If PnL > 0 both the protocol and liquidity providers earn money. In that case the protocol mints additional LP tokens and sends them to the Treasury. Otherwise the protocol uses the Reserve Funds to protect LPs from losses.

Users

There are two primary types of users in Gearbox:

- Passive Lenders (or liquidity providers) deposit assets to earn passive yield on their assets.

- Borrowers access lenders’ liquidity to create spot leverage positions which they can use to participate in margin trading or yield farming strategies across DeFi.

Because of this dual participation, Gearbox attracts active market participants, passive investors, external projects, and other DAOs to build strategies on top or tap into the protocol’s liquidity.

Use Cases

Gearbox unlocks a multitude of potential use cases beyond traditional leverage trading, offering users enhanced flexibility and capital efficiency in their DeFi endeavors.

| Leveraged Farming | Users can amplify their yield from farming activities by leveraging stablecoins, staked ETH, and more, with leverage ratios of up to 10x. |

| Basis Trading | Gearbox enables users to engage in basis trading without funding rates, allowing for simultaneous short and long positions. This allows users to capitalize on differences in interest rates across platforms while maintaining a delta-neutral position. |

| Arbitrage of Correlated Assets | With leverage, users can exploit price differentials between correlated assets over mid to long time frames, maximizing arbitrage opportunities and potential profits. |

| Customized Strategies | Unlike traditional platforms with limited options, Gearbox empowers users to create and execute complex trading strategies tailored to their preferences. Users have full control over leverage levels, asset allocation, and trading decisions. |

| Undercollateralized Loans | Gearbox enables undercollateralized loans by leveraging on-chain data to assess the value of various assets, including tokens, LP positions, reputation scores, NFTs, and real-world assets (RWA). This opens up new avenues for borrowing and lending within DeFi. |

Essentially, Gearbox gives users more capital to work with, and they can decide where to deploy it. This flexibility makes it possible to capitalize on yield opportunities and amplify returns with leverage.

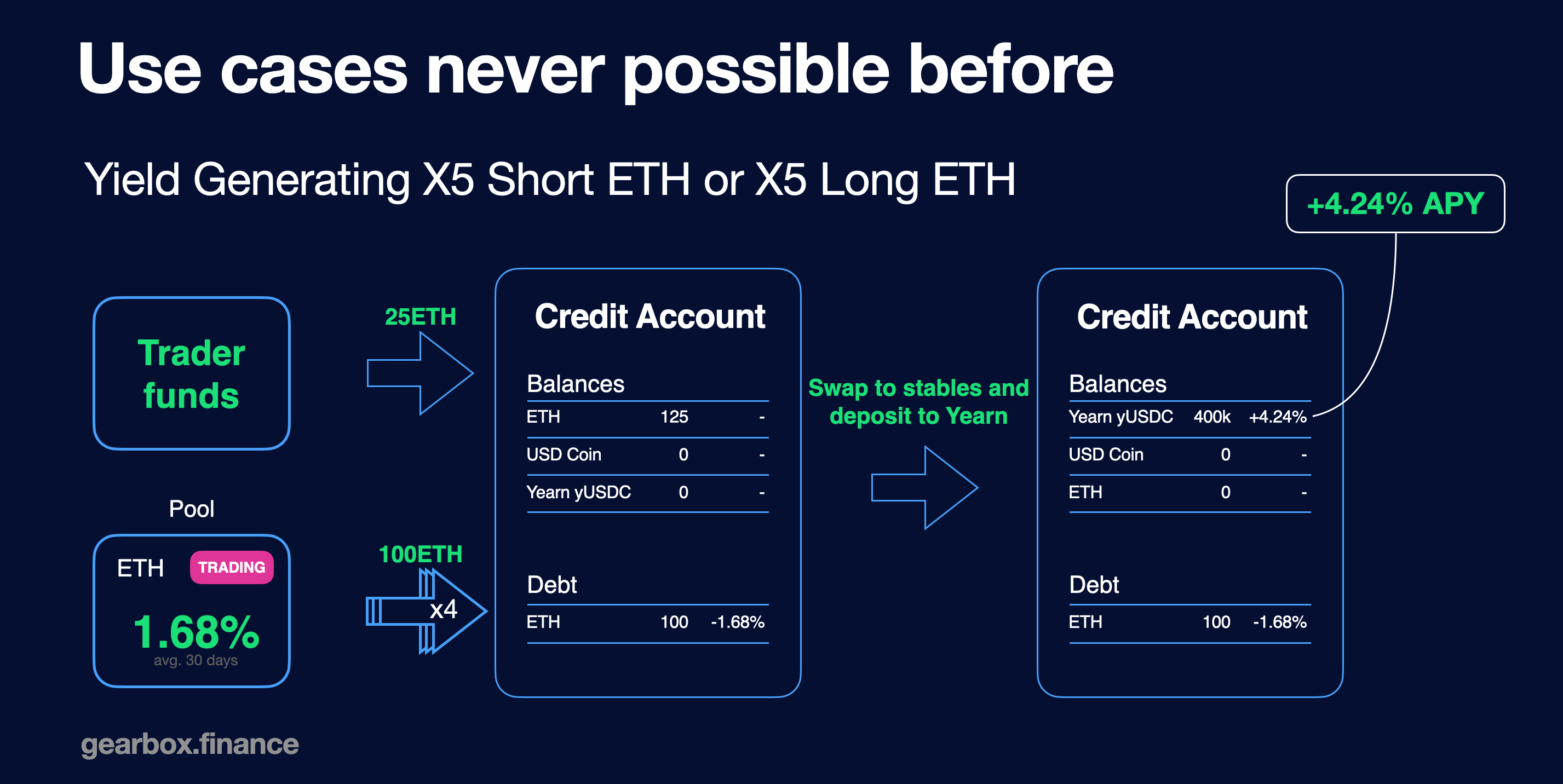

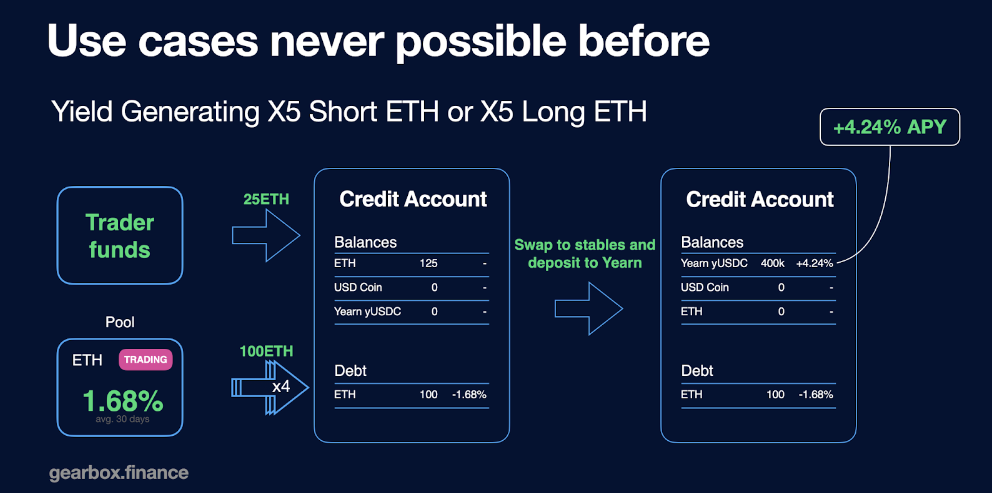

For instance, consider the example presented in the image below, where a user is selling $ETH for stables in order to earn yield on Yearn.

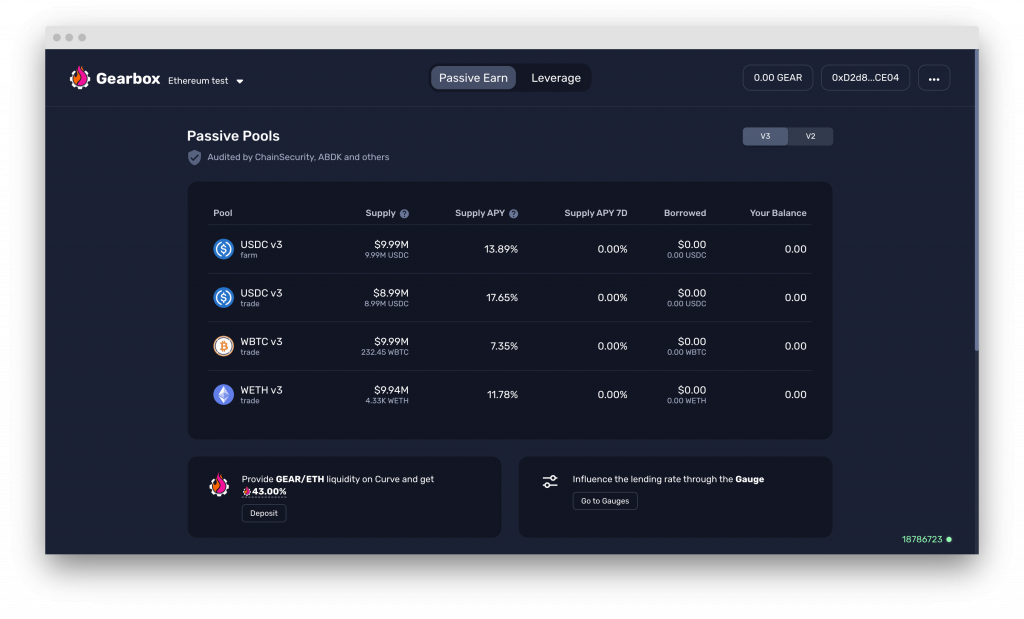

For Passive Lenders

Gearbox pools provide passive lending opportunities without impermanent loss, custody concerns, or liquidations. When you supply capital to a pool, you receive Diesel Tokens (dTokens), which automatically earn interest and fees proportional to your share of the pool. These tokens grow in value over time and can be staked to earn additional rewards, such as $GEAR tokens.

The yield in Gearbox comes from multiple sources:

- Borrowers pay rates based on the utilization curve of the liquidity pools. Higher utilization results in higher interest rates for passive lenders.

- Borrowers may also pay extra rates determined by gauges, which can be configured by $GEAR stakers.

- Additional rewards, such as $GEAR tokens, are available and accrue to staked dTokens.

Similar to standard money markets like Aave and Compound, the utilization curve determines the borrowing Annual Percentage Yield (APY) based on the utilization ratio of the pool. This curve introduces three states: cheap to borrow, acceptable rate for borrowing, and expensive to borrow.

The profitability of LPs depends on the pool utilization ratio U — the higher utilization, the higher interest rate. The borrow APY is calculated as:

Gauges establish extra interest rates on top of the regular ones, further increasing APYs for liquidity providers. These extra rates are shared between passive lending pools and the DAO.

In the future, the protocol may introduce Alpha pools, which are built on top of existing pools and offer additional APY. Alpha pools help isolate risks without fragmenting liquidity, allowing passive lenders to opt-in and earn additional rewards without compromising their existing positions.

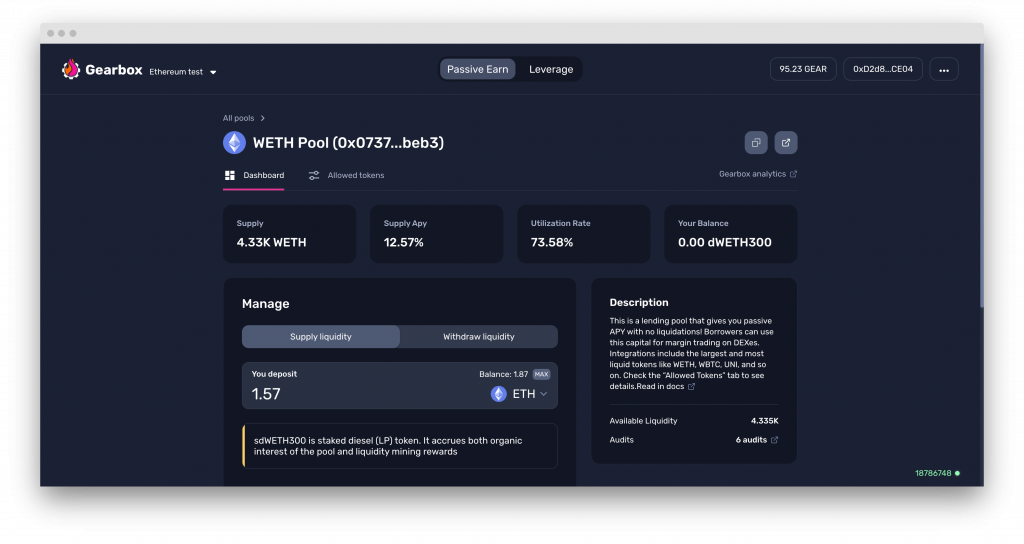

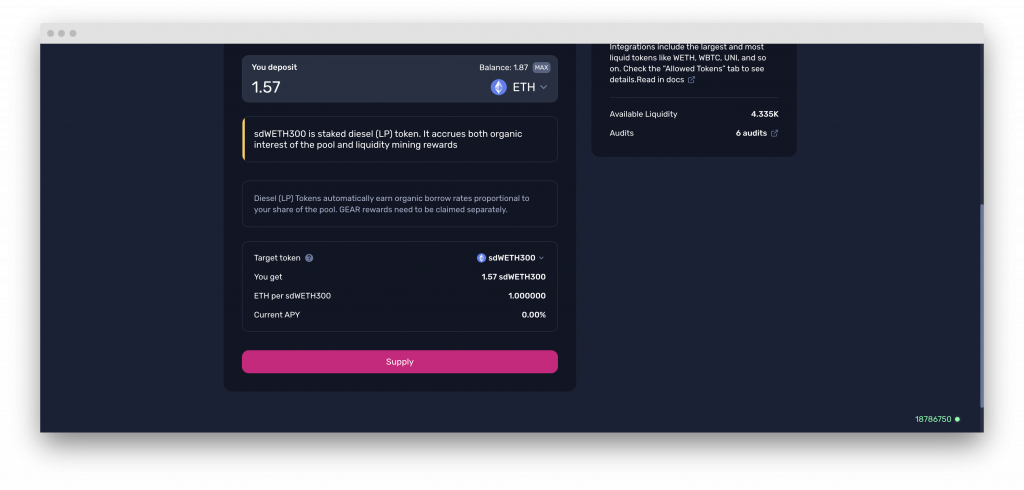

To participate as a passive lender on Gearbox, all you have to do is:

- Go to the dashboard page and select the asset pool you want to earn with.

- Specify the amount you want to supply or click on MAX.

- Click “Approve” and wait for confirmation. Then, click “Supply” and wait for confirmation. Once confirmed, you will receive staked dTokens.

Now you have staked dTokens, which automatically compound organic APY from borrow and quota rates. You don’t need to do anything else. Extra token yields, like $GEAR, accrue to your staked dTokens, but you need to claim them manually.

Gearbox’s extended view dashboard shows assets borrowers are trading and farming with, helping you assess risks in different pools. You can adjust your lending strategy based on this information or stake the $GEAR you earned to increase rates for certain borrowers, improving your risk/reward ratio.

To withdraw liquidity, follow the same steps as above, but click on the “withdraw liquidity” tab in Step 2.

Note that if a pool’s utilization is too high, governance can adjust lend-borrow parameters to make lending more expensive, incentivizing repayment of lender capital and reducing pool utilization.

For Traders and Farmers

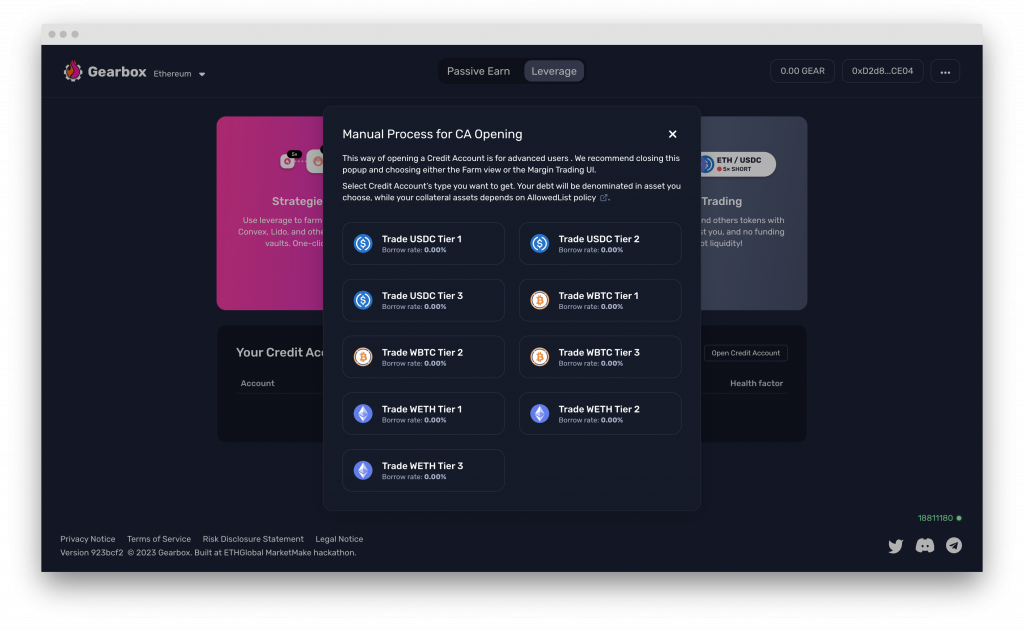

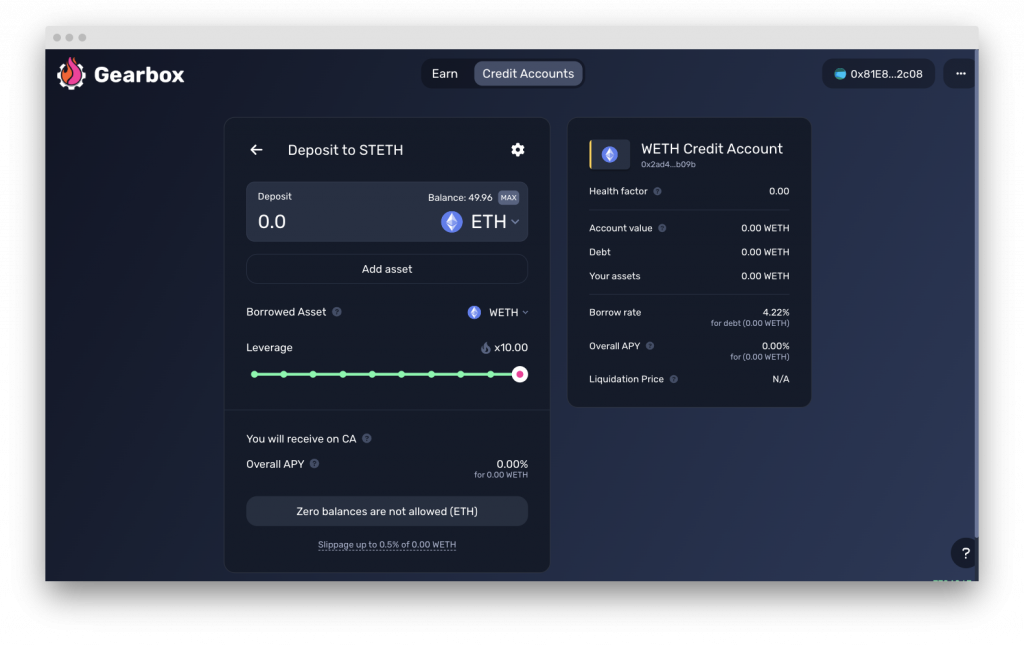

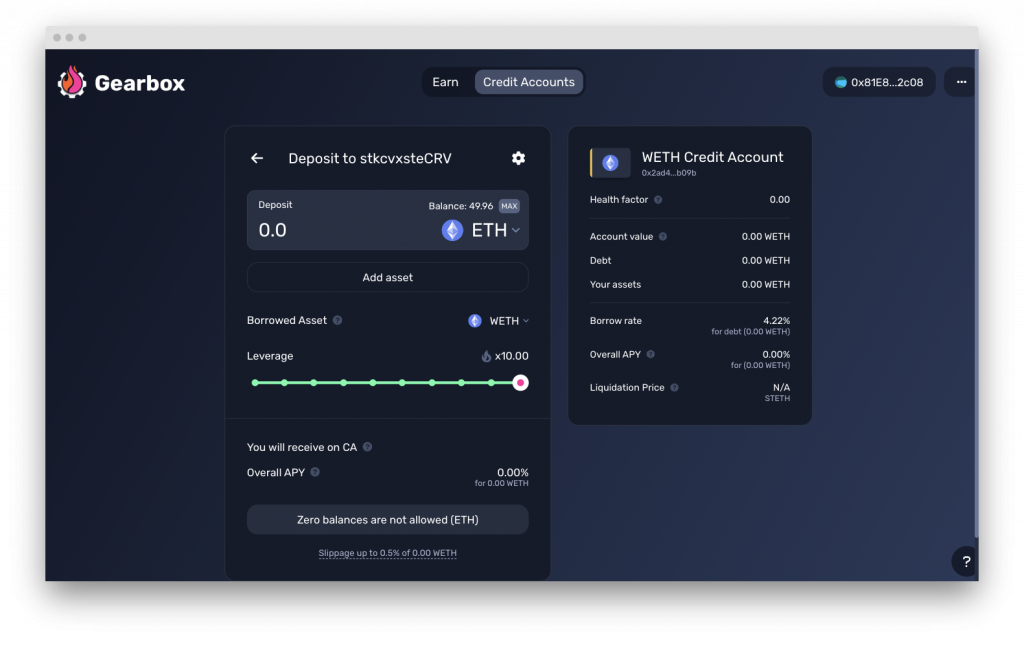

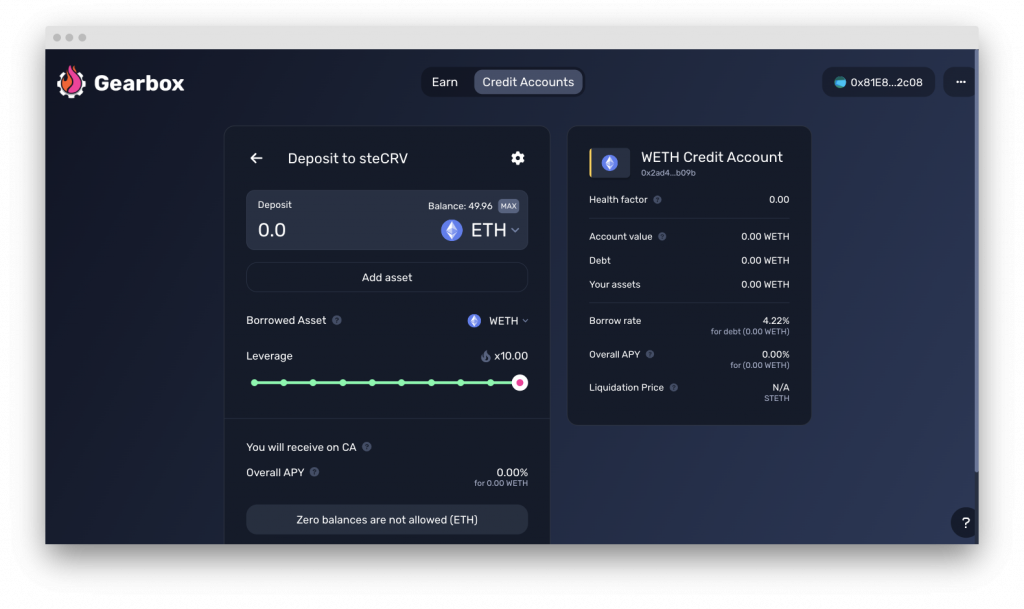

How to Open a Credit Account

| For Margin Trading | For Leverage Farming | For Manual Operations |

|

|

|

| https://pure.gearbox.fi/ | https://app.gearbox.fi/strategies/list | https://app.gearbox.fi/accounts |

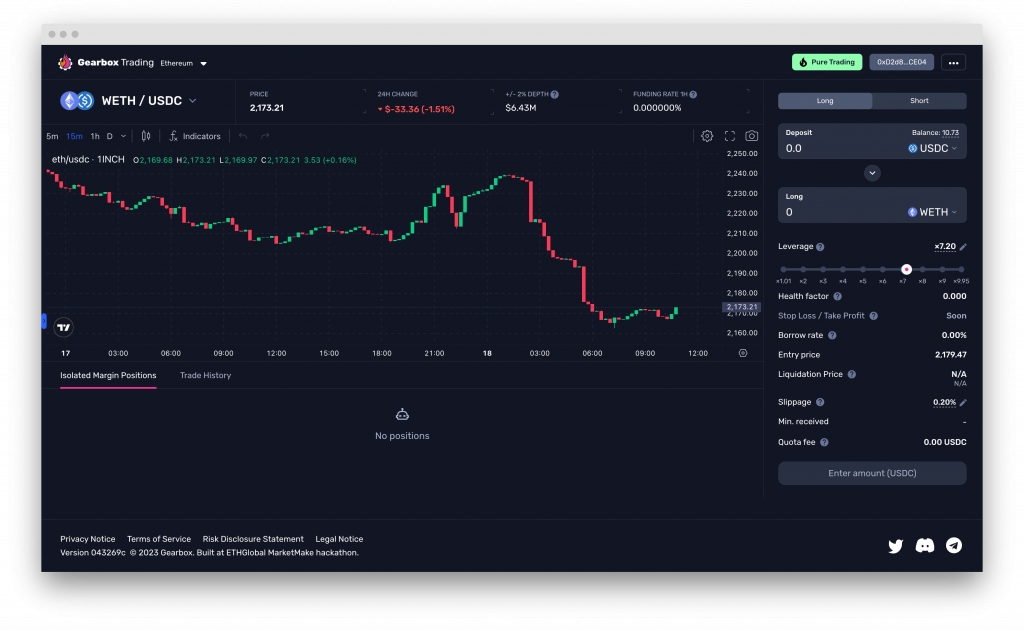

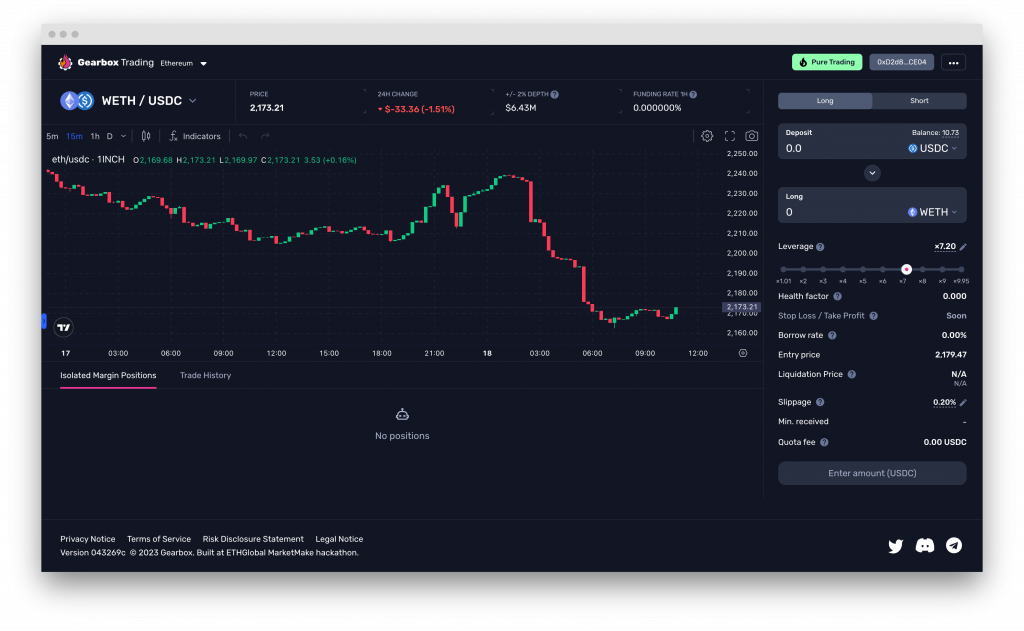

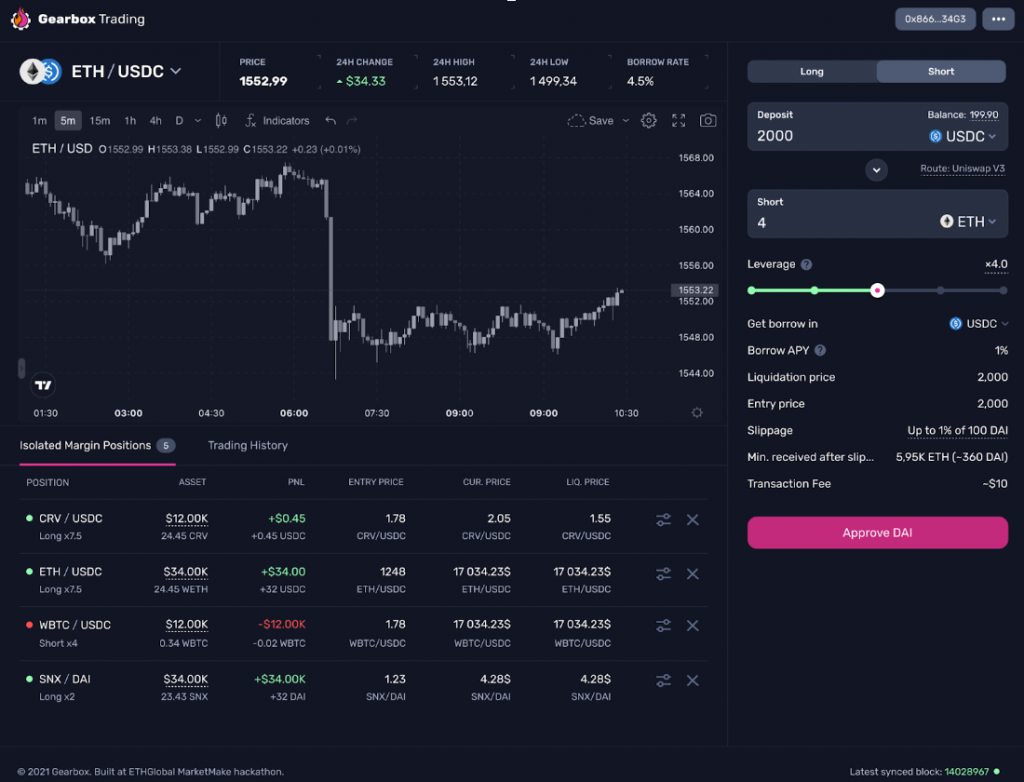

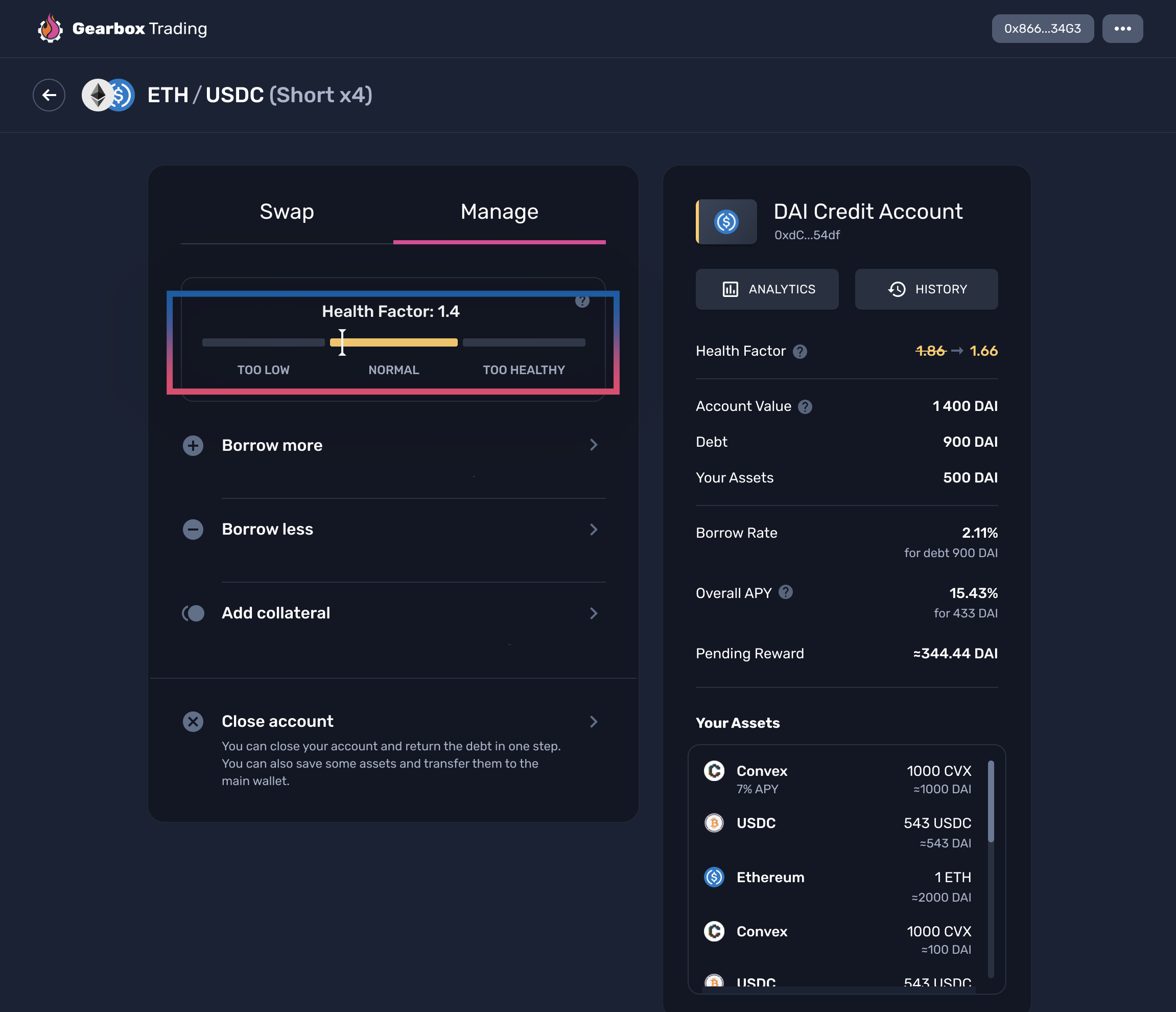

The PURE Margin Trading interface on Gearbox offers:

- Flexible Leverage: You can adjust your initial capital amount or leverage factor based on your trading strategy.

- Position Management: Monitor key parameters such as liquidation price, borrow rate, and slippage. You can also modify these parameters after opening a position.

- Visualized Charts: The interface provides a visual representation of your liquidation price, allowing for better risk management.

Trading with PURE allows for trading with real spot assets, avoiding perpetuals or synthetic derivatives. This allows traders to access the existing deep liquidity of DEXs like Uniswap, Curve, or Balancer.

Unlike perpetuals, there are no funding rates, making it more capital efficient. Instead of paying a funding fee periodically, users will pay a borrowing rate. This is also helpful when we take into account the fact that there are no price wicks, mitigating liquidations from quick and price fluctuations.

Some of the trading strategies that can be performed include:

- Long Margin Trading: Borrow funds to buy assets with the expectation of price appreciation.

- Short Margin Trading: Borrow assets to sell with the anticipation of price decline.

- Boosted Longs/Shorts: Deploy leveraged positions on other protocols to earn APYs.

- Pairs Trading: Simultaneously trade correlated assets to profit from relative performance.

- Basis Trading: Profit from differences in borrow rates of the same asset across different markets.

Boosted Long/Short or “Free Leverage”

Users interested in going long on $ETH with $USDC can take advantage of the Boosted Long feature offered by Gearbox. This feature not only allows for a leveraged position but also enables users to earn farming rewards.

Initiating a Boosted Long:

- Credit Account Creation: Users begin by opening a Credit Account denominated in a stablecoin within the protocol.

- Navigating to PURE: Access the PURE margin trading interface at pure.gearbox.fi.

- Going Long on ETH: Choose to go long on $ETH and configure the trade parameters to suit your strategy.

- Activating Boosted Trade: Enable the Boosted Trade option, which converts the long position into an opportunity to earn farming rewards.

For Short Positions:

The process for establishing a Boosted Short position mirrors that of a Boosted Long, with the key difference being the market position users take. By activating Boosted Trade while going short on $ETH, users can receive rewards that may help cover or exceed the borrowing costs.

Gearbox’s approach to Boosted Trades streamlines complex trading strategies. The PURE interface is designed to be user-friendly, inviting users to take advantage of innovative trading options that enhance the benefits of their positions. Whether opting for a long or short stance, Gearbox’s features are geared towards enhancing user profitability and trading efficiency.

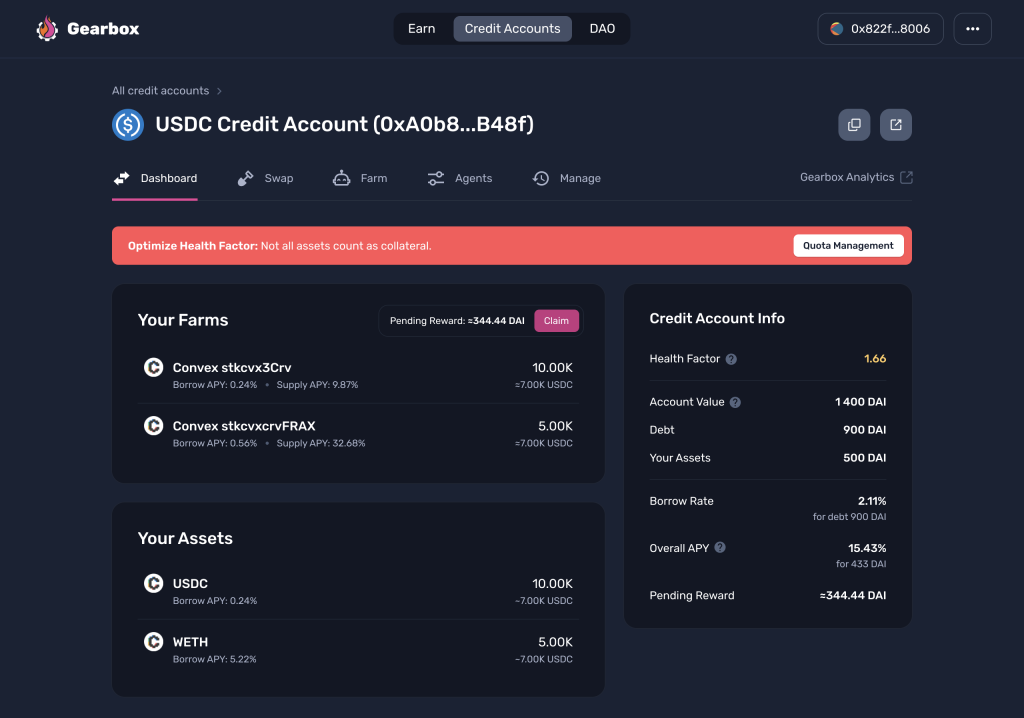

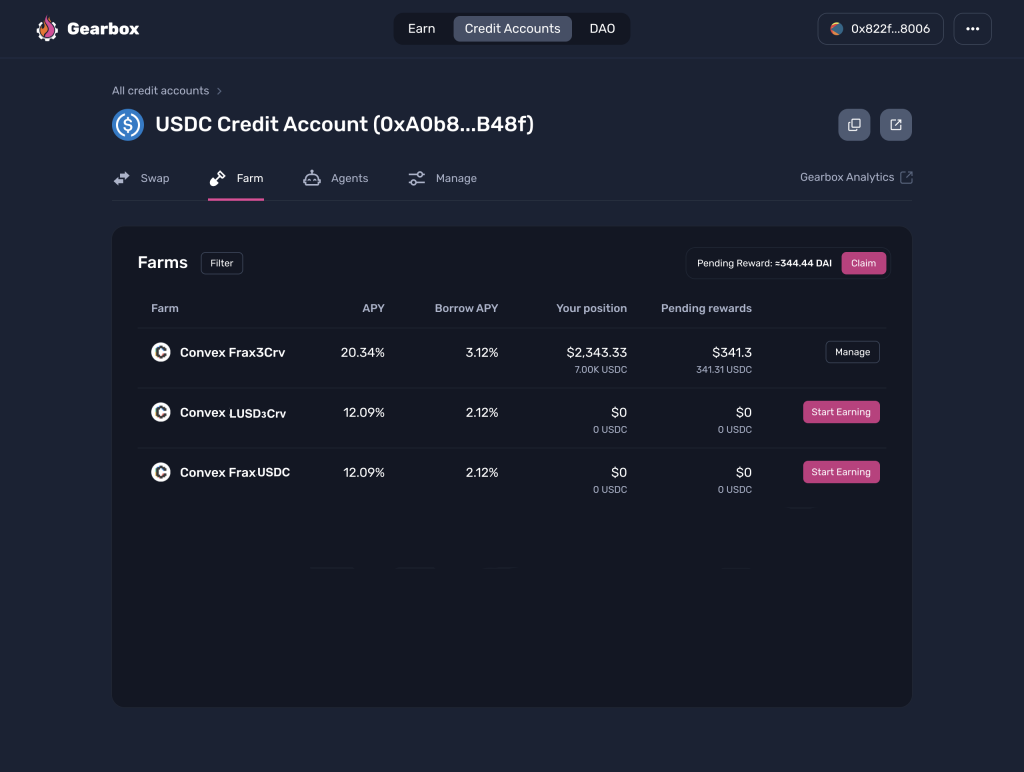

Leverage Farming

Leverage farming on Gearbox offers various opportunities for users to optimize their DeFi strategies:

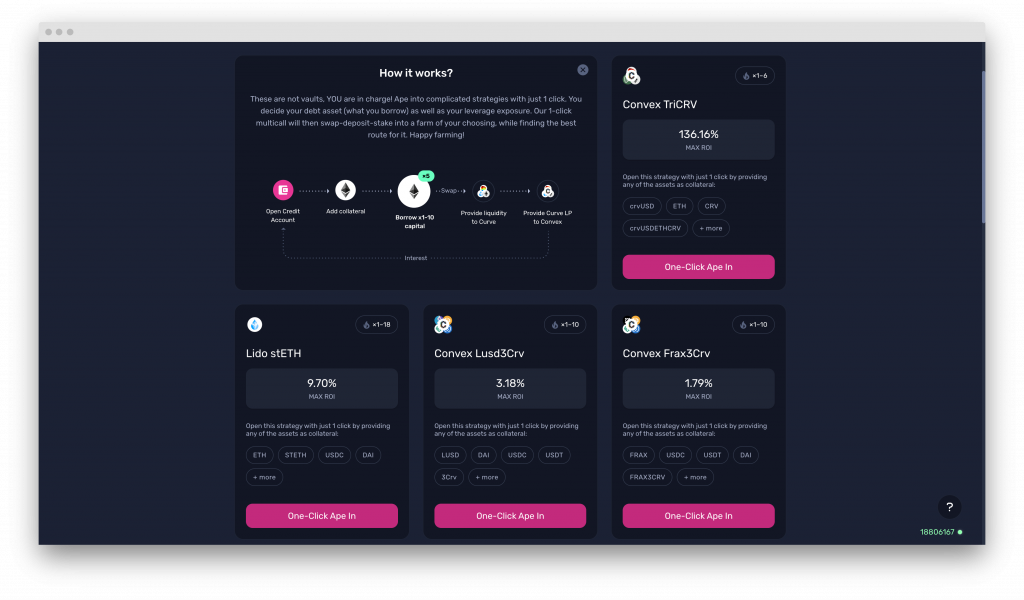

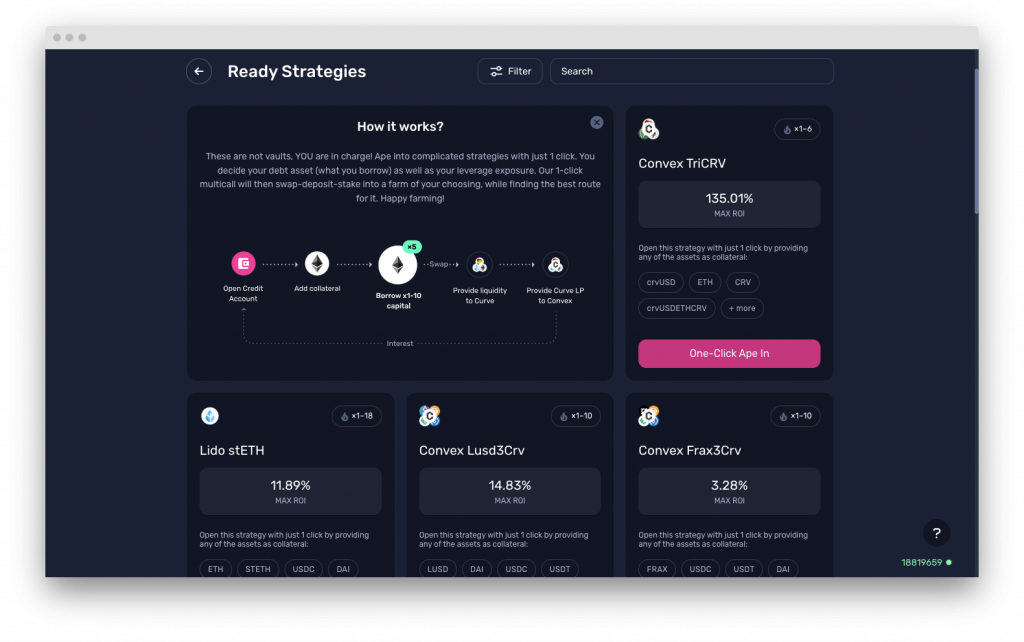

- One-Click Strategies: With Gearbox’s “One-Click Strategies,” users can easily open a Credit Account, swap assets, provide liquidity, stake, and execute complex strategies with just one click. This simplifies the process for non-technical users, allowing them to participate in yield farming without needing to navigate complex interactions between protocols.

- Vanilla Farming: Users can opt for straightforward yield farming strategies by configuring collateral assets, debt assets, and leverage factors to participate in various liquidity pools and farming opportunities available across DeFi platforms.

- Composable Leverage: Leverage can be utilized to enhance yield farming strategies by amplifying returns on invested capital. Users can borrow funds to increase their exposure to yield-bearing assets, thereby maximizing their earnings potential.

- Customized Strategies: For more advanced users, leverage farming opens up the possibility of implementing customized strategies tailored to specific risk profiles and investment goals. These strategies can involve a combination of lending, borrowing, swapping assets, providing liquidity, and staking to optimize returns while managing risks effectively.

- Automated Portfolio Management: Leveraging automation tools and smart contracts, users can automate portfolio management tasks such as rebalancing, asset allocation, and profit-taking, streamlining the process of optimizing yield farming strategies.

Leverage farming provides advantages to users by enhancing capital efficiency, and improving the user experience when interacting with a wide variety of DeFi dApps.

Some concrete examples of strategies include:

- One-click Strategies

- Leveraged Liquid Staking

- Leveraged Stablecoin Farming

- Leveraged Curve v2 and Convex

- Leveraged Vanilla yVaults

- Arbitrage of Correlated Assets

One-Click Strategies

Open leveraged positions in predefined protocols in 1 transaction. They let you go from not having a Credit Account to having a Credit Account open and ready to start farming the strategy of your choice. You still have the freedom to choose the leverage, the debt asset, the collateral…

Leveraged Liquid Staking

Leveraged liquid staking strategies offer opportunities to maximize yields by leveraging staked assets in various DeFi protocols:

- Pure Leveraged Staking Yields in Lido’s $stETH: Users can stake $ETH and receive $stETH, which represents their staked $ETH position. By leveraging their staked $ETH, users can amplify their staking rewards. However, it’s important to note that $stETH’s peg to $ETH may fluctuate based on market conditions, which can affect the health factor of the leveraged position.

- Convex stETHcrv: Convex Finance enables users to stake steCRV LP tokens into their vault, allowing them to earn rewards in $LDO, $CVX, boosted $CRV, and trading fees without the need to lock up $CRV themselves. Additionally, users can benefit from the staking APY of $stETH within the Curve pool, further enhancing their overall yield.

- Curve stETH Pool: The Curve $stETH Pool facilitates the pooling of Lido $stETH and vanilla $ETH, providing users with a mix of rewards including $LDO, $CRV, staking yields, and trading fees from the Curve pool. By participating in this pool, users can optimize their yield farming strategies by leveraging their staked $ETH position.

Leveraged Stablecoin Farming and Curve/Convex Strategies

Leveraged Convex offers a strategic approach to liquidity providing (LPing) in pools with potentially higher volatility and APYs. By leveraging assets like $ETH, users can deposit into pools to earn yields from a blend of major cryptocurrencies.

These strategies allow for leveraging various assets to farm in Convex, aiming for enhanced yields compared to direct participation. Current strategies available through Gearbox include:

- Convex crvUSD+ETH+CRV Farming: Offering up to 6x leverage with a maximum APY of 139.07%.

- Convex crvUSD+USDT Farming: Up to 7x leverage available with a 63.90% max APY.

- Convex crvUSD+USDC Farming: Also allows for up to 7x leverage, featuring a 49.82% max APY.

- Convex crvUSD+WBTC+ETH Farming: Provides up to 6x leverage with a 53.58% max APY.

These strategies highlight the diverse opportunities within the Convex ecosystem for leveraging assets in yield farming. Gearbox simplifies the process, enabling users to deploy capital efficiently across various Convex pools to optimize their yield strategies.

Leveraged Vanilla yVaults

Leveraged vanilla yVaults in the Gearbox enable users to exercise full control over their DeFi strategies, utilizing stablecoins like $USDC and $DAI. These strategies are part of the protocol’s offering to amplify users’ capital, extending up to ten times the leverage for farming in familiar protocols.

Leveraged Yield Farming with Yearn

- Yearn $USDC and $Yearn DAI: These offerings allow users to leverage stablecoin holdings for yield farming, potentially enhancing returns on well-established DeFi platforms curated by Yearn.

Leveraged Restaking and Points

Leveraged Restaking (LRTs) through Gearbox is designed to amplify participants’ earnings from staking points, notably from EigenLayer and other liquid restaking protocols. Unlike traditional leverage farming, LRTs allow users to accrue significant points, effectively backdating their participation to the earliest days of the protocol, without requiring specific approvals on Gearbox like the SBT ninja pass needed for other farming integrations on Gearbox. Gearbox has incorporated liquid restaking protocols like Stakewise, Ether.Fi, and Renzo, which cumulatively represent over a billion USD worth of $ETH staked.

Users can engage with Leveraged Restaking through a simplified process:

- Selecting the desired protocol from Gearbox’s restaking list.

- Choosing initial assets and deciding on whether to swap them or retain as is.

- Selecting a leverage factor and reviewing crucial details such as the liquidation price.

- Completing asset approval and the transaction.

Gearbox’s Leveraged Restaking model is similar to a two-tranche system but with complete liquidity:

- The Passive side resembles a Senior Tranche, offering lower risk and passive yield without the threat of liquidations, akin to Gearbox’s passive pools.

- The Credit Account side echoes a Junior Tranche, where leveraged users are positioned to gain higher yields but face the risk of liquidation. This side is shielded from minor slashes, ensuring that a small decline in staked assets doesn’t impact the passive lenders, while leveraged users could face losses.

Users of Credit Accounts need to actively manage their investments, monitoring different AVS providers to rebalance their capital for optimal rewards. In contrast, passive liquidity providers (LPs) earn a yield indexed from the best AVS providers, balancing risk and return.

Gearbox thus presents a suite of derivative products atop its restaking platform, catering to both passive earners and active leveraged users, who may encounter negative APYs but stand to gain significant leverage points. This allows users to earn a month’s worth of Eigen points in just four days, showcasing the power of 10x leverage points and airdrops. With a 30% APY or a 2x boost option available, participants can choose their earning strategy based on their risk appetite and investment goals. These ready strategies, such as the 18.0x multiplier for Ether.fi ETH and EigenLayer points, underline the potential of Leveraged Restaking.

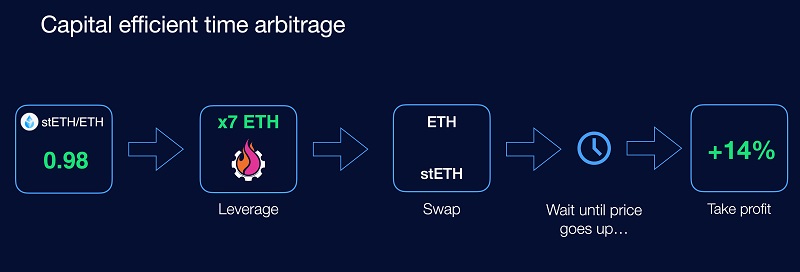

Arbitrage of Correlated Assets

Arbitrage strategies in the crypto market can be quite profitable, especially when it comes to assets that are expected to be price-correlated. One common situation is when two stablecoins that are typically pegged 1:1 with the USD diverge in value. Here’s how one might take advantage of such an opportunity using Gearbox and capitalizing on the exchange rate between $ETH and Lido’s $stETH:

- Identify the De-Peg: Monitor the market for instances when $stETH trades at a discount to $ETH due to liquidity issues or large sell-offs.

- Leverage and Swap:

- Open an $ETH-denominated Credit Account on Gearbox with leverage. For example, with $100,000 in $ETH and applying 7x leverage, you would control $700,000 in $ETH.

- Swap your leveraged ETH for stETH at the current discounted rate.

- Wait for the Peg Restoration: Hold your $stETH and wait for the peg to $ETH to restore. This step requires market knowledge and a belief in the peg’s stability and the mechanisms in place to correct the de-peg.

- Profit from the Re-Peg: Once $stETH returns to parity with $ETH, swap your $stETH back to $ETH and close the Credit Account. If $stETH was acquired at a 2% discount and the peg is restored, the trade would yield a profit proportional to the discount and the leverage, minus any incurred fees and slippage.

Risks and Considerations:

- Market Risks: It’s crucial to remember that there’s a risk the de-peg could worsen before it corrects, or it may not correct at all.

- Interest Rates: The cost of borrowing through leverage can eat into profits, especially if the peg takes a long time to restore.

- Slippage: In high-volume trades, slippage can significantly reduce expected profits.

- Flash Loans vs. Leveraged Positions: Unlike flash loans that allow for arbitrage within a single block, opening a Credit Account with Gearbox allows for a more extended position. This can be advantageous but also increases exposure to market risk.

Using Gearbox, traders can take advantage of this strategy not only with stablecoins or $ETH LSTs, but also with other assets that tend to have a stable price correlation, like wrapped versions of $BTC. It is important to remember, though, arbitrage involves risk, and profits are never guaranteed. Make sure to fully understand the protocol’s risk disclosures and have a risk management strategy in place before engaging in such activities.

Tips for Leverage Users

First of all, before diving into leverage farming or margin trading, it is recommended for users to familiarize themselves with the different tabs and functionalities available on the frontend interface.

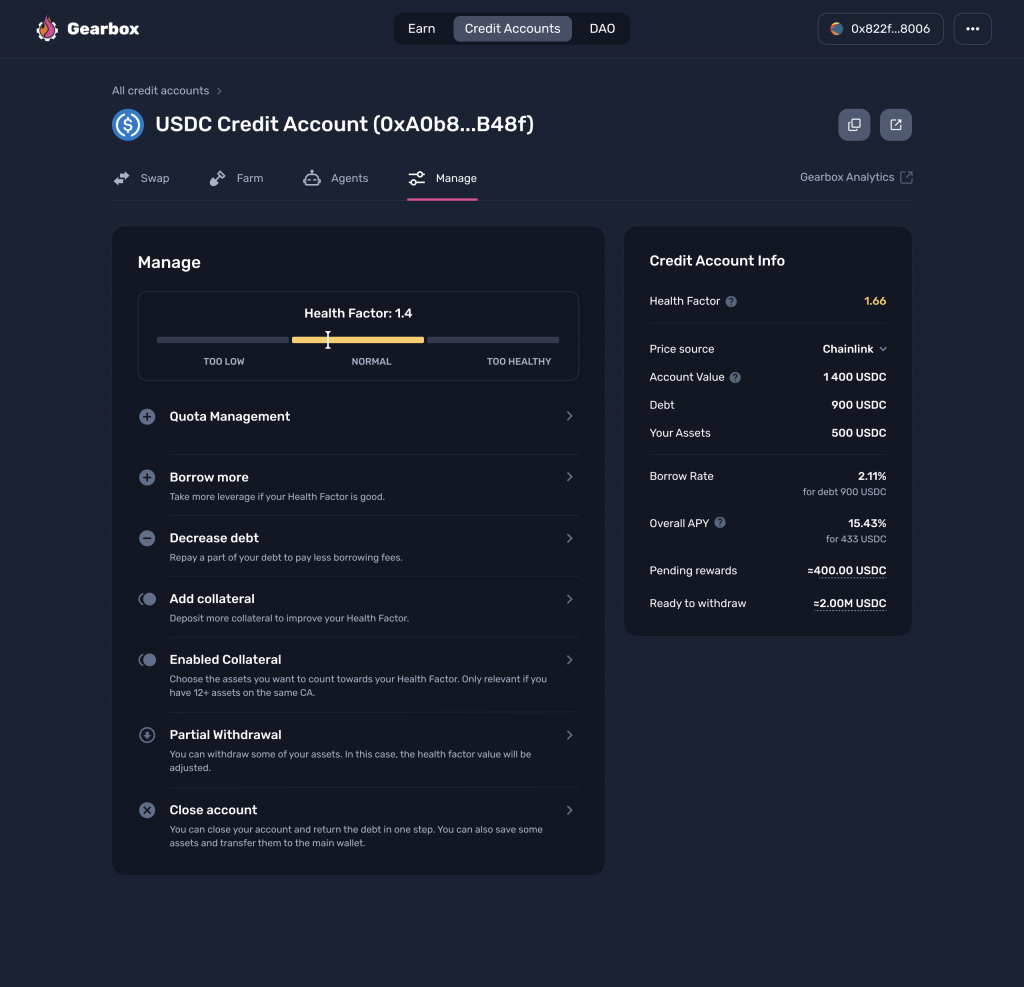

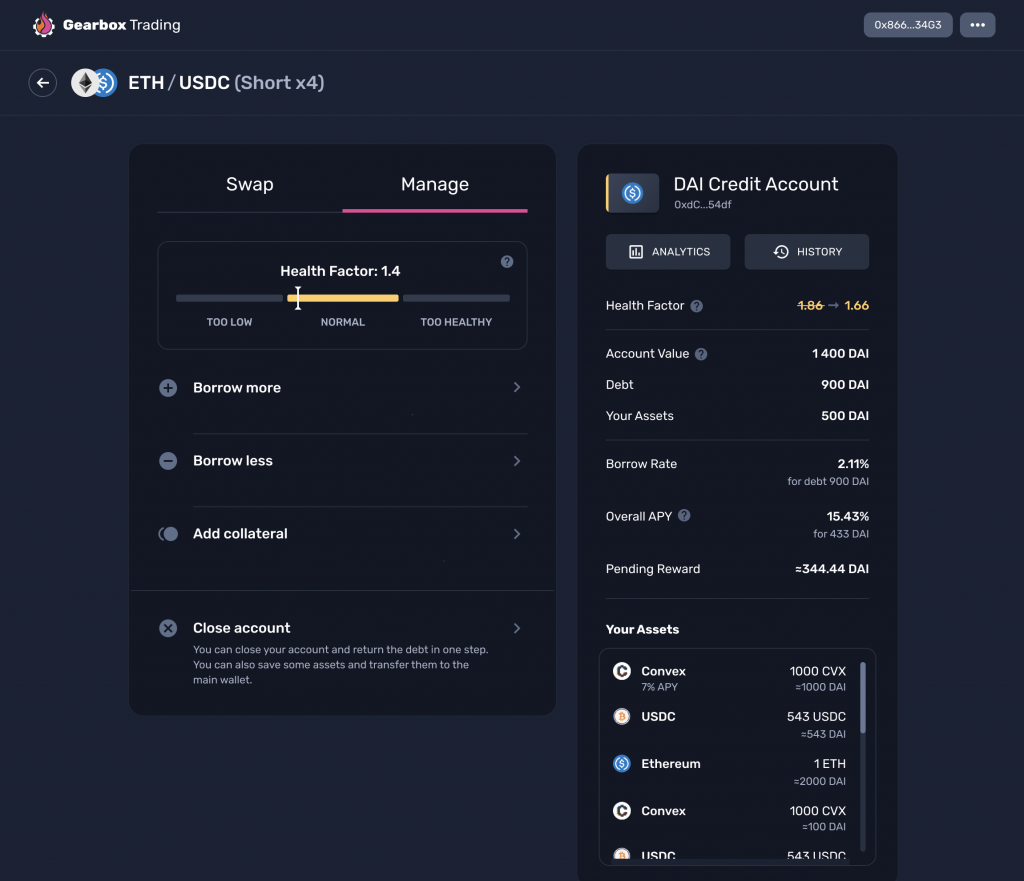

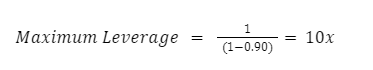

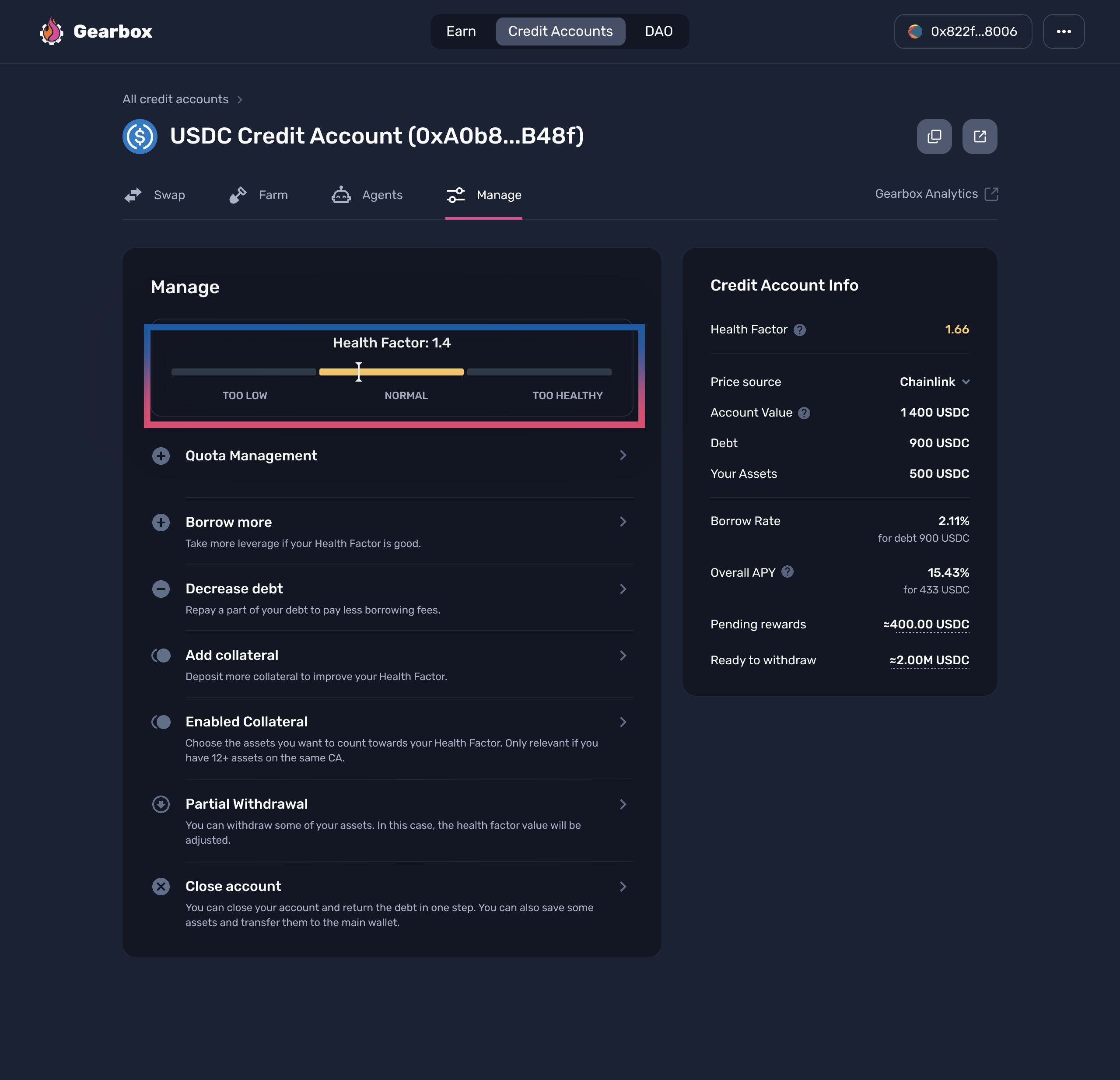

Once you have familiarized yourself with how the protocol works and you have opened a Credit Account, you can monitor your leverage positions navigating through the different tabs:

- Swap Tab: Monitor your leveraged funds and swap them for different assets if needed. Be mindful of how swapping affects your Health Factor (HF), displayed on the right side of the screen.

- Farm Tab: Explore various strategies available for farming within the largest DeFi vaults and pools. Select the pool or vault you want to deploy in, and the platform handles the rest.

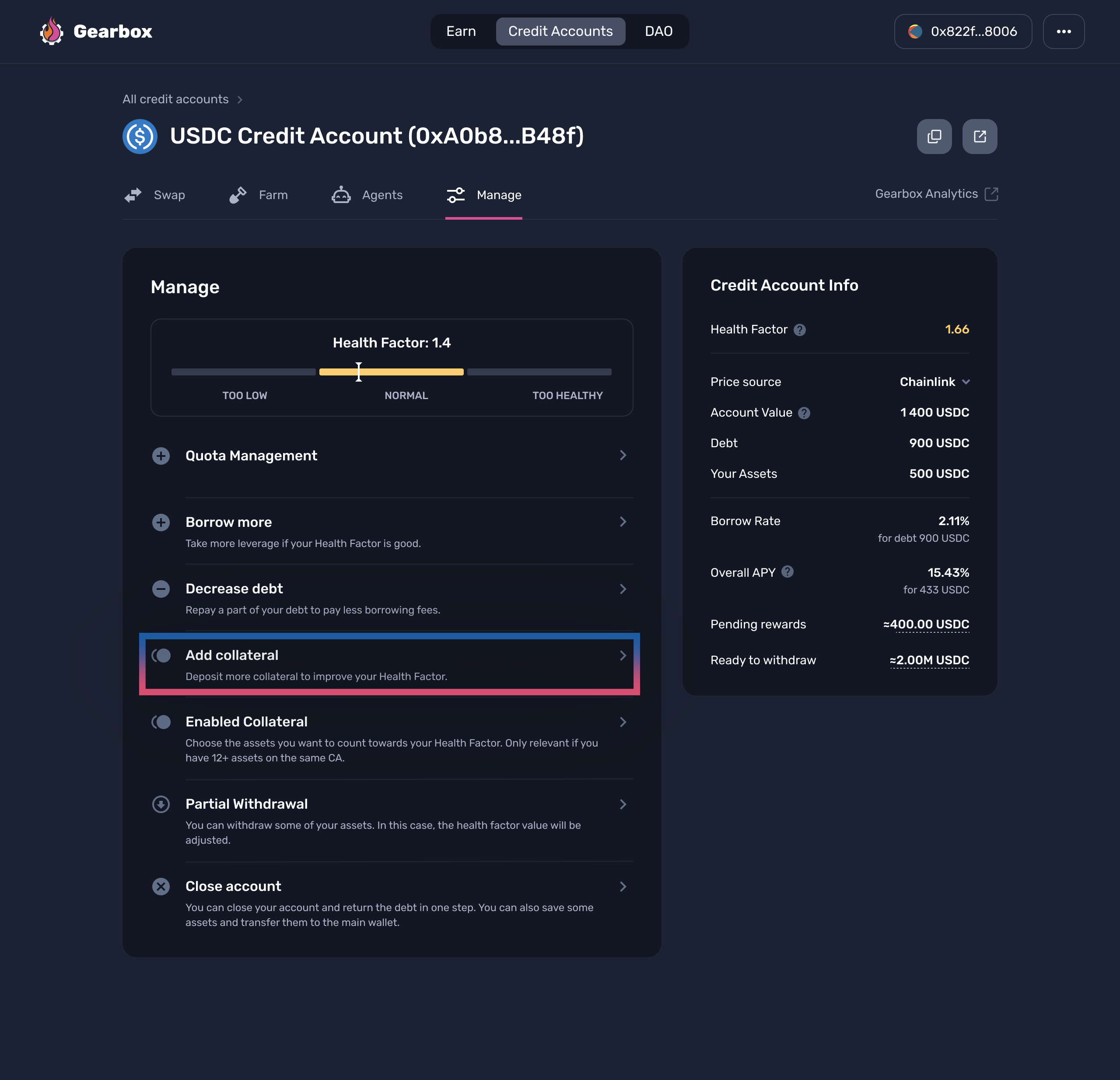

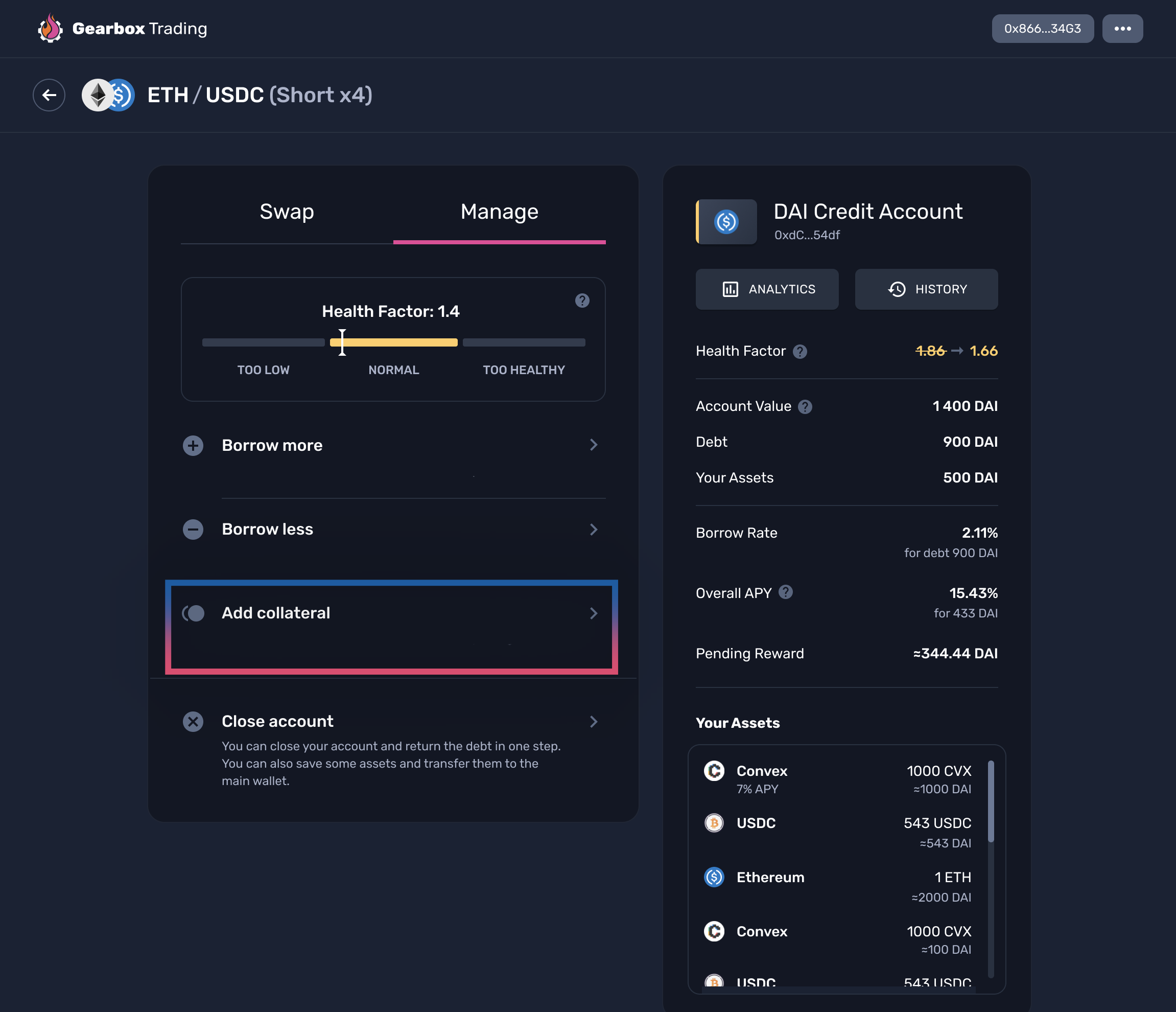

- Manage Tab: Manage your positions effectively to mitigate risk and optimize your leverage. Key actions include quota management, borrowing more or less, decreasing debt, adding collateral, and closing your Credit Account.

- Agents: Automate operations on your Credit Account with Gearbots, enabling features like limit orders, dollar-cost averaging (DCA), and stop-loss without active management.

If engaging in margin trading, you should consider the following operations:

- Quota Management: Quotas represent the maximum amount of funds that users can utilize within their leverage positions. They determine the size of the position and how much collateral is allocated to support it.

- Users may choose to increase their quotas if they want to enlarge their position or allocate more assets to support their HF. This action allows them to take on more leverage and potentially amplify their returns.

- Conversely, users can decrease their quotas if they want to reduce the size of their position or lower their exposure to risk. Decreasing quotas may be desirable if the user wants to conserve collateral or if their HF is approaching the liquidation level.

- Borrow More or Less: Adjust your leverage by borrowing more or repaying part of your debt to reduce risk or borrowing fees.

- Add Collateral: Improve your Health Factor by adding more collateral if it’s nearing liquidation levels.

- Close Credit Account: Close your margin position when necessary.

When managing quotas, users should carefully assess their risk tolerance, market conditions, and investment objectives. It’s essential to maintain a balance between maximizing potential returns and protecting against downside risks. Users should regularly monitor their positions and adjust quotas as needed to adapt to changing market dynamics. At all times it is recommended to monitor the account parameters displayed at the top of the interface, including Health Factor, Liquidation Price, Quota Fee, Account Value, Debt, and Your Assets.

| Health Factor (HF) | Your Credit Account can be liquidated if the HF falls below 1. |

| Liquidation Price | The price level at which an account can be liquidated. |

| Quota Fee | The fee that is paid to deploy a position. |

| Account Value | Current value of a Credit Account, denominated in the underlying asset. |

| Debt | The total value of the underlying asset that has been borrowed from the protocol. |

| Your assets | The total value in the underlying asset that is represented by your collateral . |

Other considerations to take into account include:

| Rethink Collateral | In Gearbox, all assets in your Credit Account act as collateral for your debt. Be mindful that even if you start with one asset, swapping it into another changes your collateral composition. |

| Minimum and Maximum Leverage | The minimum leverage is determined by the protocol’s minimum borrow amount, while the maximum leverage is more complex. It’s derived from the Loan-to-Value (LTV) ratio of your assets relative to your debt asset. |

| Calculate Maximum Leverage | Understand your assets’ LTV ratios to calculate the maximum leverage you can take. Consider potential asset price fluctuations to ensure your Health Factor remains above 1, accounting for risks. |

| Manage Risk | When aiming for maximum leverage, exercise caution. Consider factors like slippage, fast price changes, and historical price data to reduce risk exposure. Always be prepared to adjust your leverage based on market conditions. |

| Beware of Slippage | When swapping large amounts, expect slippage. Although it can result in losses, remember that they’re borne solely by your assets in the Credit Account, not the borrowed capital. |

| Claim Rewards | Before closing your Credit Account, ensure you’ve claimed all farming rewards. Unclaimed rewards may transfer to the next user of the account. |

| Understand Liquidations | In Gearbox, liquidation calculations differ from perpetual contracts due to the usage of spot assets. Stay informed about liquidation prices, especially when exercising maximum leverage. |

In Gearbox, collateral operates differently compared to traditional DeFi platforms. Instead of viewing collateral as idle assets that affect borrowing power, Gearbox considers the entire composition of assets in your Credit Account as collateral for your debt, all denominated in the debt asset.

For example, if you initially deposit $ETH and $WBTC but swap them for stablecoins to participate in a stablecoin farm, your collateral becomes the ERC20 representation of that stablecoin farm. This means your starting assets are less relevant; what matters is the assets on your Credit Account denominated in the debt asset.

If you want to maintain an asset as true collateral, such as $ETH, while borrowing stablecoins to increase your borrowing power, you must keep the asset idle in your Credit Account:

- Open a Credit Account with debt in stablecoin.

- Deposit $ETH as collateral but refrain from selling or swapping it.

- Borrow stablecoins against your $ETH collateral.

Although this approach may reduce capital efficiency since not all your assets are actively utilized, it allows you to retain exposure to ETH’s potential price appreciation, potentially enabling further borrowing against it as its value increases.

In Gearbox, the minimum leverage is determined by the minimum borrow amount, while the maximum leverage depends on various factors, including the Loan-to-Value (LTV) ratio of your positions.

The minimum leverage is essentially the minimum amount of capital you can borrow, while calculating the maximum leverage involves understanding the concept of Loan-to-Value (LTV) ratios. The LTV ratio represents the maximum amount of debt you can take relative to the value of your collateral. For example, if the LTV ratio for a specific farming position is 90%, it means you can borrow up to 90% of the value of your collateral.

For example, if the LTV ratio for a farming position is 90%, the maximum leverage would be:

This means you can borrow up to 10 times the value of your collateral. Keep in mind that higher LTV ratios allow for greater leverage, but they also increase the risk of liquidation if the value of your collateral decreases.

To maximize leverage while maintaining some level of safety, consider an approach where you imagine the worst-case scenarios and assess whether you’re comfortable with the potential outcomes. This will allow you to plan accordingly and mitigate risks by adjusting the desired leverage to account for uncertainty and market fluctuations.

How To Avoid Liquidations

To avoid liquidations, users are encouraged to keep a relatively high Health Factor and ensure that it remains above 1, especially during volatile market conditions.

| Check your HF for Farming | Check your HF for Margin Trading |

|

|

Users should also adjust their leverage cautiously, especially in positions with correlated collateral to debt, and be mindful of market fluctuations to avoid over-leveraging and prevent liquidation risk.

You can also increase the collateral in your Credit Account to strengthen your position and improve your HF. Adding more assets as collateral reduces the risk of liquidation. Similarly, you might also consider changing your strategy or farm if your current approach is leading to a drop in HF.

| Add Collateral for Farming | Add Collateral for Margin Trading |

|

|

Another alternative is to repay part of your debt by adding collateral back to your Credit Account. This reduces leverage and improves your HF, lowering the risk of liquidation.

How to Close a Credit Account

Closing a Credit Account and avoiding liquidations in Gearbox can be done in two ways:

- Option 1: Swap all assets to the underlying and repay the debt.

- Click on the “Close” button.

- Choose the maximum slippage tolerance.

- Click on the “Swap and get tokens” button.

- Wait for the protocol to exchange non-underlying asset funds to the underlying asset on decentralized exchanges (DEXes) and repay your debt.

- You will receive the remaining funds to your personal wallet.

- Option 2: Repay debt and keep some assets.

- Repay the loan with your own funds, ensuring your personal wallet balance in the denominated asset is sufficient to cover the debt.

- After repayment, the assets held in your Credit Account will be transferred to your personal wallet.

- This option allows you to retain some assets from the Credit Account while settling the debt.

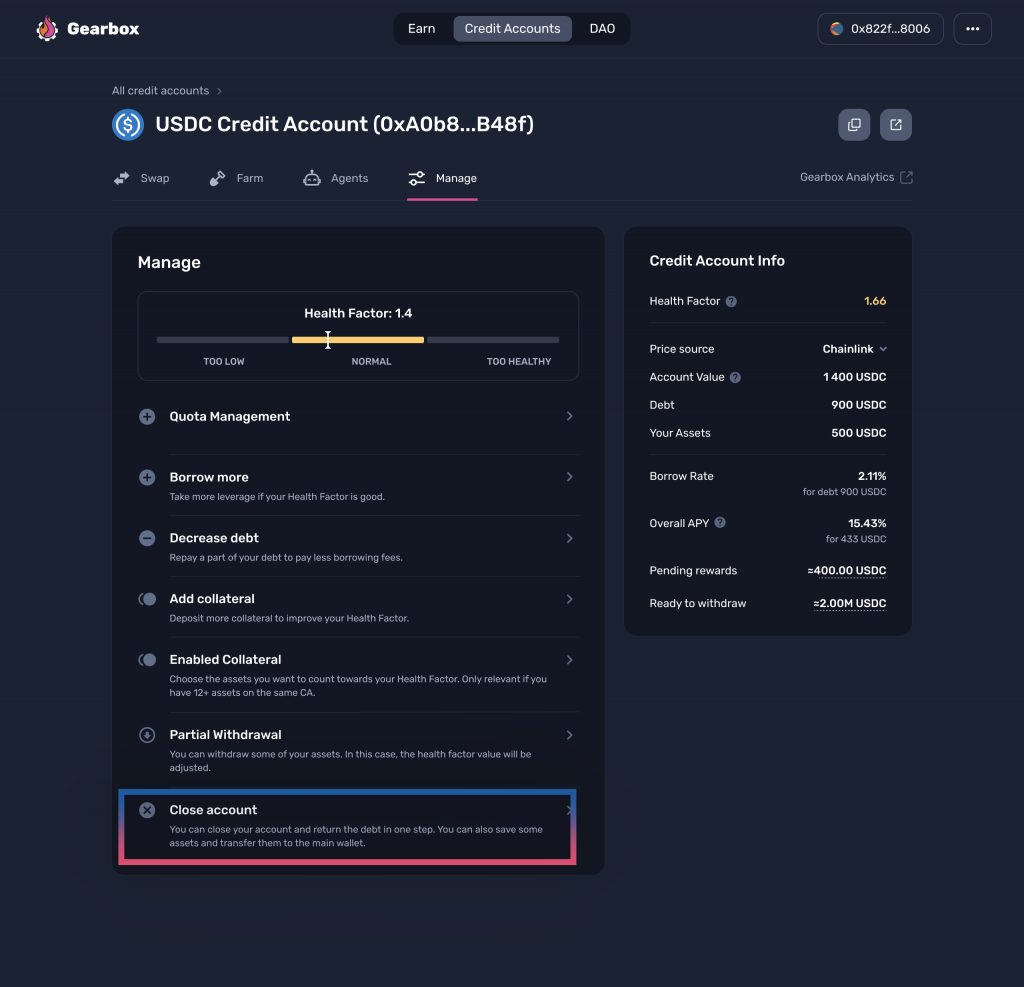

Gauge Voting

Gauge Voting involves deciding on the extra interest rates, or Quota APY, that borrowers pay for each asset. Unlike the incentives gauges found in other protocols (like Curve), Gearbox’s Gauges are designed as a strategic instrument for fine-tuning the platform’s economic balance. Through Gauge Voting, $GEAR stakers set additional APY rates on top of the protocol’s standard utilization curve. This dynamic tool empowers stakers to manage the risk-reward ratio thoughtfully and proactively.

The impact of Gauge Voting spans various user types within the protocol:

- Passive Lenders aim to enhance their returns by voting for higher rates, ensuring their strategy is aligned with maximizing yield.

- Leverage Borrowers seek to improve their financial efficiency, advocating for lower rates to diminish borrowing costs.

- Protocol Integrators strive for increased adoption of their services by voting for reduced rates on relevant assets, making their protocols more enticing.

Stakeholders can reallocate their votes anytime within an epoch, fostering a governance model that’s both responsive and reflective of a collective strategy. The additional APY rates agreed upon are implemented per block, akin to standard borrowing rates.

- Staking $GEAR: Users stake their $GEAR tokens, enabling them to participate in the voting process.

- Allocating Votes: After staking, users can vote to adjust the extra interest rates for each asset.

- Finalizing and Changing Votes: The voting page records the user’s selections, allowing for the finalization of multiple votes in a single session. Users retain the option to change their votes until the next epoch begins.

$GEAR stakers are instrumental in shaping Gearbox’s economic incentives, balancing lender returns against borrower costs, and managing the protocol’s exposure to riskier collateral types. Their decisions in Gauge Voting are central to the protocol’s financial equilibrium.

Gauge Voting is structured around epochs, each lasting typically 7 days, with new epochs commencing every Monday at 12:00 UTC. This regular cadence ensures a predictable governance process, where the additional APY rates, once set, apply per block like regular borrow rates until the epoch concludes.

A lock-in period is in place for withdrawing staked $GEAR to ensure the protocol’s stability. Currently, a withdrawal requires a four-epoch waiting period, equating to 28 days. This safety measure prevents abrupt changes that could impact the health of the protocol, maintaining a stable governance environment.

Business Model

Gearbox’s business model leverages the creation and management of Credit Accounts for users, enabling various financial activities such as lending, borrowing, and asset management on-chain.

The protocol is designed to operate autonomously, governed by community consensus through on-chain governance mechanisms. The $GEAR token serves as the governance token of the Gearbox ecosystem, allowing token holders to participate in protocol governance decisions, stake their tokens for rewards, and access platform features. $GEAR tokens also play a role in determining protocol fees and incentives.

Gearbox prioritizes community involvement and governance participation, empowering users to shape the direction of the protocol. Community members can propose and vote on protocol upgrades, fee adjustments, and other initiatives through transparent and decentralized governance processes.

Fee Breakdown

Protocol fees in Gearbox are designed to support the sustainability and growth of the ecosystem while ensuring fair compensation for various operations.

All protocol fees earned by the DAO go to the fee guard, and nothing is assumed to be reserved for contributors. The protocol is fully operated by $GEAR token holders through the DAO.

- When a user decides to close their Credit Account, the protocol accrues fees based on the spread between the borrow rate and the deposit rate. The formula for this fee is:

- Af(t)=bI(t)fs, where fs represents the share of accrued interest. This mechanism ensures that the protocol treasury benefits from the interest spread.

- In the event of a Credit Account liquidation, Gearbox collects a liquidation fee, which is calculated as follows:

- fl(t) = T V (t) ̃fl,, where ̃fl is the liquidation fee constant. This fee is split, with a portion going to the third-party liquidator and another to the Gearbox DAO.

- Gearbox assesses fees for the utilization of quotas within Credit Accounts. These fees contribute to the Treasury and are governed by dynamic parameters set by the protocol governance, allowing for nuanced financial and risk management.

Most of the fees are static and voted via governance, although Gauges are voted separately on a per-epoch basis on each separate chain. Also, since Gearbox interacts with many different protocols and assets, these fees will be paid out and denominated on different tokens.

| Fee | Description |

| Liquidation Fee | When a Credit Account is liquidated, a percentage of the liquidation proceeds is allocated to the third-party liquidator, while another percentage goes to the Gearbox DAO. |

| Base APY Rate | The DAO takes a spread as a fee between the APY received by lenders and the fee paid by borrowers for borrowing assets. |

| Quote APY Rate | Gauges apply an extra quota interest rate to each asset separately, with rates determined by $GEAR stakers through separate voting. |

| Quota Rate Flat Fee | This fee is applied when users buy a quota, such as when entering a position for the first time, rebalancing assets within an existing position, or adjusting leverage. The fee varies depending on the asset and can differ between Credit Managers. The entirety of this fee is allocated to the DAO. |

Since Gearbox has two sides to its operations, the amount of fees being paid depends on what type of user you are: a passive lender or a borrower.

There are no direct fees for passive lenders. Borrowers accessing leverage pay a borrow interest rate (which fluctuates based on pool utilization) and dynamic Quotas, as well as a liquidator fee split between the third-party liquidator and the protocol (only if the Credit Account is liquidated).

Quotas and gauges are also integral components of the governance and fee structure within the protocol, playing pivotal roles in managing collateral exposure and determining borrowing costs. Quotas function akin to individual credit limits, serving as a mechanism to regulate the maximum exposure a Credit Account can have to a specific collateral asset. They operate on a per-account basis, dictating the extent to which assets can be utilized as collateral. Essentially, quotas establish boundaries to ensure responsible leveraging within the protocol. These limits are determined by the main governance process, reflecting the collective decision-making of stakeholders.

Conversely, gauges influence the additional interest rates borrowers must pay on their quotas. Unlike quotas, which establish fixed limits, gauges are dynamic and subject to change based on periodic epochs, typically spanning seven days. $GEAR token holders participate in the governance process by staking their tokens and voting to set these rates. The rates established by gauges serve to adjust borrowing costs, with higher rates increasing the expense for borrowers and lower rates reducing it.

Tokenomics

Token Distribution

Gearbox features the $GEAR token, an ERC20 utility token that began as a governance token and may evolve with new functionalities as determined by the DAO. The total supply of $GEAR is fixed at 10B and is immutable as per the protocol’s smart contract.

The DAO, holding over 40% of the total supply, allocates approximately 3% annually towards initiatives and liquidity mining, with a long-term goal of reducing this percentage. The DAO’s distributions are detailed in the Gearbox documentation and encompass grants and rewards without introducing new inflation.

Circulation Details

Vesting began in 2022 and is nearing completion as of 2024. The DAO’s share has decreased from over 55% to about 40%, following multiple reward distributions. With vesting for 2024 nearly complete, the $GEAR supply is approaching full circulation.

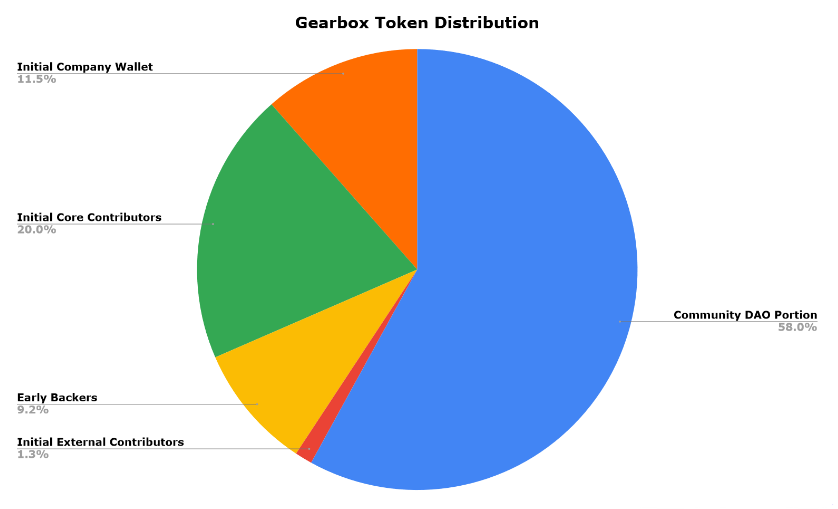

Gearbox Token Distribution

Community DAO Portion: 58%

The Community DAO Portion forms the backbone of Gearbox’s governance, empowering the community with the majority of the voting power. This segment is not subject to vesting, ensuring immediate influence for community members.

Subcategories within the Community DAO Portion:

- DAO Treasury Multisig: Initially allocated 51% of the total supply. Managed by a DAO-enacted treasury multisig, this portion is designated for various protocol initiatives and liquidity mining efforts. The treasury’s strategic decisions are guided by the collective input of the DAO members.

- DAO Round Part 1: 2.766% of the total supply is earmarked for this round. Following a lockup ending on July 15, 2023, it entered a 1-year linear vesting period ending in July 2024.

- DAO Round Part 2: Receives 1.057% of the total supply, with a lockup concluding on September 15, 2023, and subsequently entering a 1-year linear vesting phase ending in September 2024.

- Credit Account Mining: Accounts for 5% of the supply, distributed among 5,000 participants without vesting. This initiative aims to incentivize engagement and activity within the protocol.

- Community Testers: Approximately 1.085% is allocated to community members who contribute to the protocol’s integrity through testing. This segment saw an adjustment from an original allocation of 1.267%, refined based on the community’s investigative efforts.

- Early Discord Members: Around 0.348% of the supply is reserved for early community engagement on Discord. This allocation was reduced from an initial 0.476% after a reevaluation of claimant activity.

- Retroactive Rewards for 2021: Constitutes about 0.5% of the supply, designed to honor early supporters and contributors. Despite potential technical challenges, community-led initiatives ensured the optimization of this allocation.

Initial External Contributors: 1.28%

A special allocation is reserved for the individuals who contributed significantly to Gearbox’s technical development without direct capital investment. These contributors are rewarded with a 1.28% stake, subject to a 12-month lockup from the token deployment date, followed by an 18-month linear vesting period ending in June 2024.

Early Backers: 9.20%

Early backers, pivotal to the protocol’s initial phases, are allocated 9.20% of the $GEAR supply. Contrary to traditional investor roles, these backers dedicated not just capital but substantial time and effort, blurring the lines between investors and active contributors. Following a 12-month lockup post-launch, their shares underwent a 12-month linear vesting process, emphasizing their foundational role in the protocol’s evolution.

Initial Core Contributors: 20%

Recognizing the core team’s instrumental role, 20% of the $GEAR supply is allocated to these individuals. The DAO’s emergence during the launch redefined traditional team dynamics, with a 12-month lockup and an 18-month vesting period ensuring long-term commitment.

Initial Company Wallet: 11.52%

The initial company wallet, holding 11.52% of the $GEAR supply, facilitated the protocol’s early development stages before the DAO’s formation. This portion, locked for 12 months and vested over 18 months ending in June 2024, supported pre-DAO activities, including onboarding contributors and engaging auditors.

On-Chain Verification and Transparency

Gearbox champions transparency and trustlessness, allowing all token distributions and vesting contracts to be verified on-chain. This approach ensures that community members can independently verify allocations, reinforcing the protocol’s commitment to openness.

- TokenDistributor Contract Verification: Community members can verify personal or other contributors’ vesting contracts via the TokenDistributor contract on Etherscan, providing a clear view of individual allocations and vesting schedules.

Token Emissions

- Strategic Vesting Commencement: The vesting process initiated in 2022 is now nearing completion. This phased approach was pivotal in managing the token supply effectively, ensuring that tokens were released into circulation in a controlled manner to support the ecosystem’s growth and stability.

- Approaching Full Circulation: With the vesting period concluding for most allocations by 2024, the $GEAR token supply is close to reaching its full circulation potential.

- Annual Allocation for Growth: Approximately 3% of the total supply, primarily from the DAO’s holdings, is allocated annually towards initiatives such as liquidity mining and other incentives. This allocation, while instrumental in driving protocol engagement and growth, is under continuous evaluation with the objective to reduce the percentage over time, reflecting the protocol’s goal to maximize token value retention.

Token Utility

The $GEAR token, an ERC20 utility token integral to the Gearbox, serves multiple roles within the ecosystem, primarily starting as a governance token. Its utility has been designed to expand based on the evolving needs and decisions of the DAO.

Utility and Staking Mechanisms

- Main DAO Governance: $GEAR token holders play a crucial role in directing the protocol’s treasury and grants, voting on critical parameters, and deciding on the onboarding of new assets and protocols. This governance occurs on Snapshot, where $GEAR holders can either vote on existing proposals or propose new initiatives. Importantly, the governance model is inclusive, allowing for $GEAR held in the GEAR-ETH Curve LP to count towards voting power, thereby broadening participation and ensuring a diverse range of voices in decision-making processes.

- Quotas and Gauges: Staking $GEAR tokens unlocks the ability for holders to vote on extra rates that borrowers pay for different assets, marking a significant function within the protocol. This mechanism not only fosters more equitable rate markets but also distributes the extra fees collected between passive lenders and the DAO, supporting liquidity providers and contributing to the protocol’s treasury. The voting system is structured around epochs, lasting 28 days, offering a recurring opportunity for stakeholders to influence borrowing costs directly.

- GEAR-ETH Curve Pool: The liquidity mining program for the GEAR-ETH pair on Curve V2 provides LPs with an APR that can potentially offset the risks associated with impermanent loss. Participants are encouraged to “Deposit & Stake” their Curve LP tokens to earn rewards, highlighting an active engagement avenue for token holders looking to contribute to liquidity while earning incentives.

The Gearbox DAO invites all $GEAR holders to explore the existing utility sinks, propose new ones, or even develop their own staking contracts. This participatory model not only diversifies the token’s utility but also empowers the community to shape the protocol’s future actively.

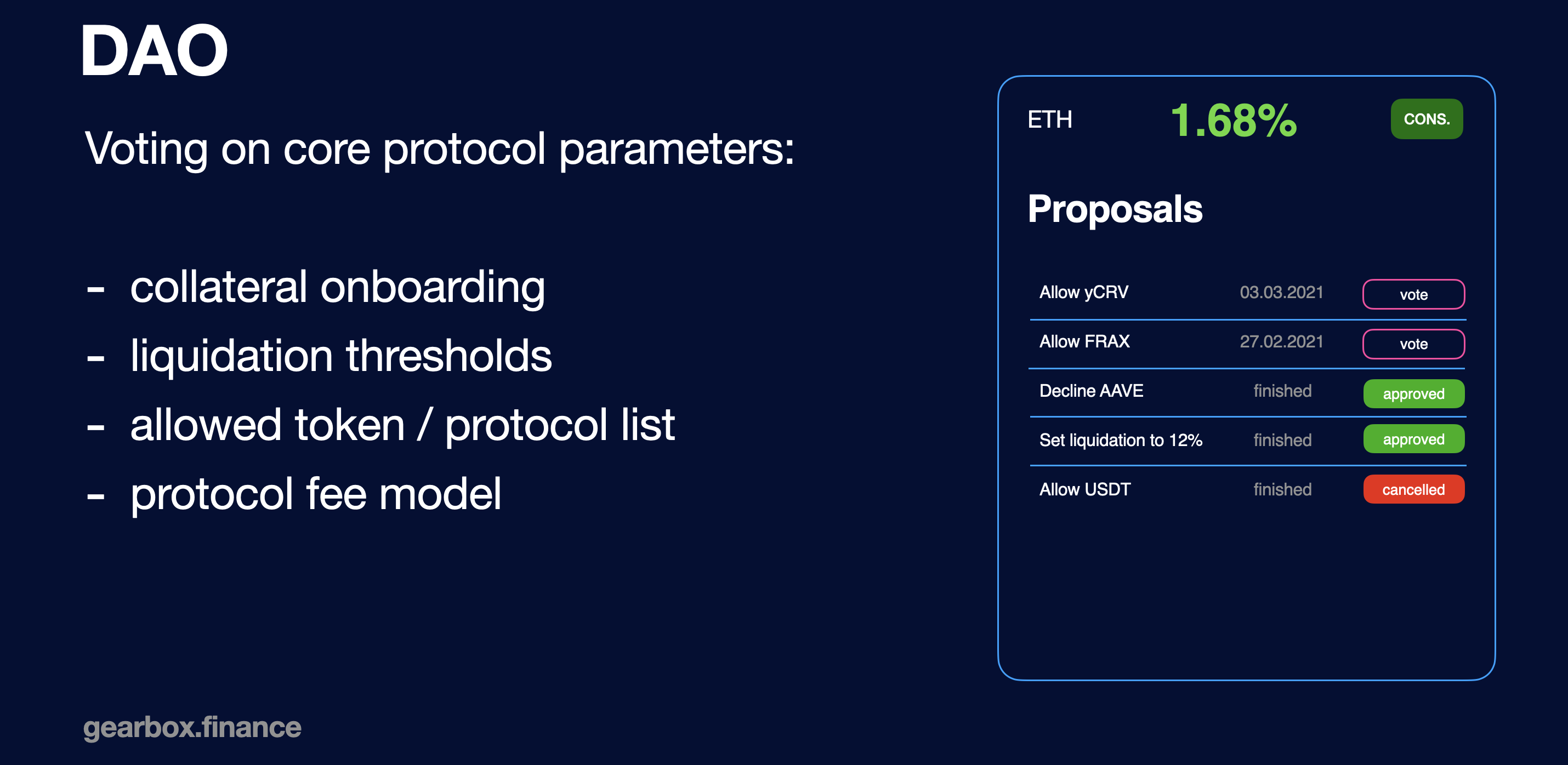

Governance

Gearbox thrives on a community-driven governance model, empowering $GEAR token holders to shape the protocol’s future. The governance framework is designed to be inclusive, transparent, and adaptable, ensuring that all stakeholders have a voice in critical decisions affecting the protocol. Governance activities include:

- Voting on core protocol parameters such as collateral onboarding, liquidation thresholds, allowed token/protocol list, and the protocol fee model.

- Discussions and ideations in Discord channels.

- Formulating proposals and voting through Snapshot.

- Execution of decisions via a multisig guard with community consensus.

The governance process involves the following steps:

- Ideation and Discussion: The journey of governance begins in Gearbox’s Discord, where community members can freely discuss ideas, suggestions, and improvements for the protocol. This open forum encourages the exploration of new concepts and the refinement of proposals before formal submission.

- Proposal Submission and Voting: Once an idea has been sufficiently discussed and refined, it progresses to a formal proposal stage. Proposals are documented and presented for community voting on Snapshot, a decentralized decision-making platform. Here, $GEAR token holders vote on various aspects of the protocol, including but not limited to:

- Protocol treasury and grant allocations

- Parameter adjustments

- Asset and protocol onboarding

- The proposal must outline clear voting options and transaction details to ensure transparency and minimize subjectivity in the execution phase.