Overview

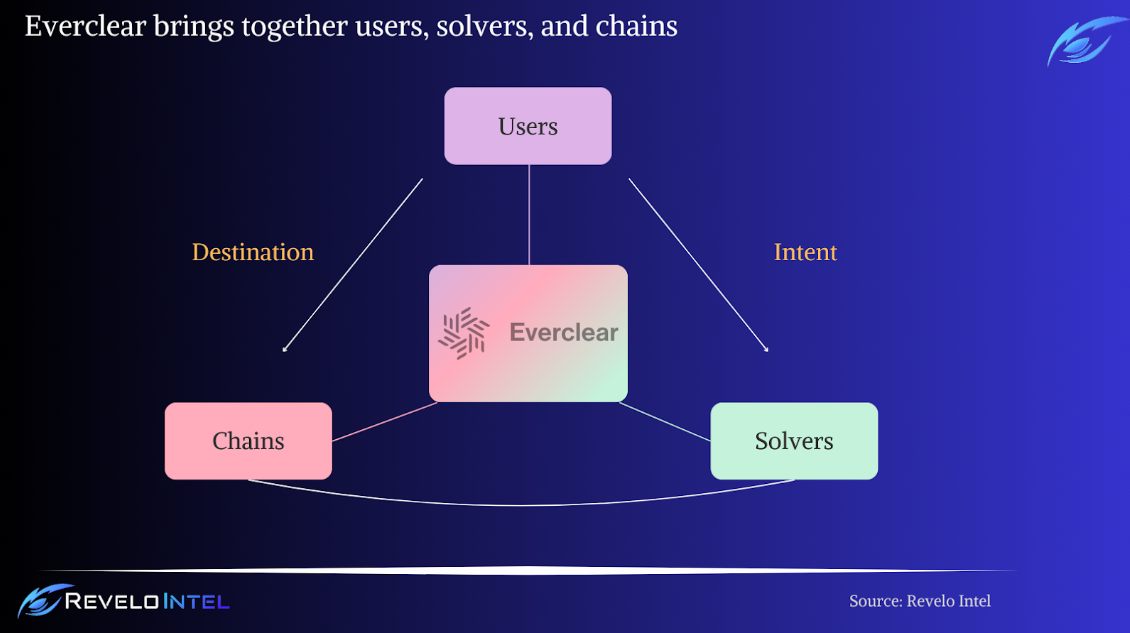

Everclear is the first Clearing Layer designed to coordinate the global liquidity settlement between chains, thereby solving fragmentation issues inherent in modular blockchains. Previously known as Connext, Everclear aims to become the prime settlement mechanism for all purposes.

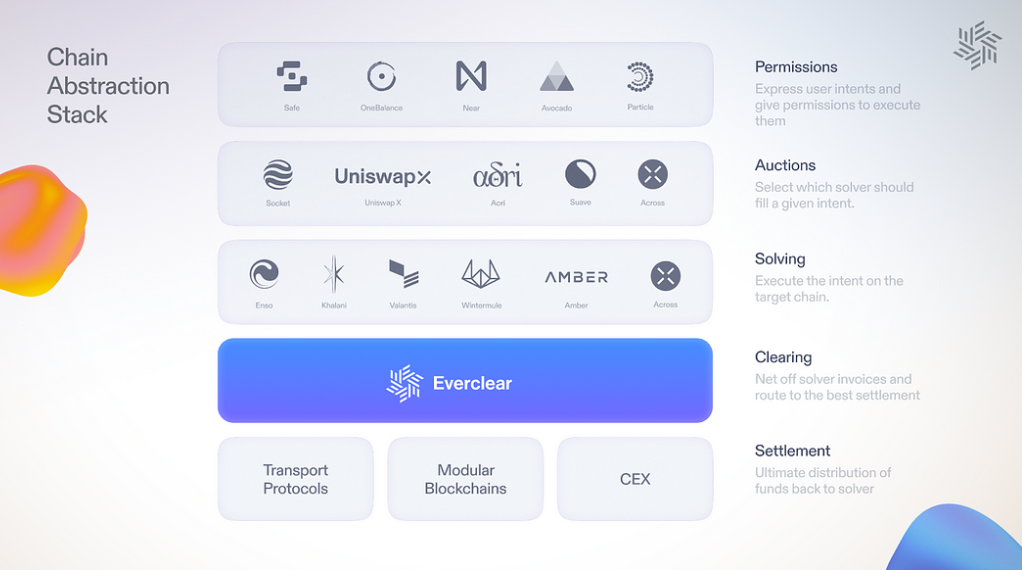

As the foundational element of the Chain Abstraction stack, the Clearing Layer is essential for powering seamless liquidity for intent protocols, solvers, chains, and applications, making it a significant innovation in the blockchain space.

Why the Project was Created

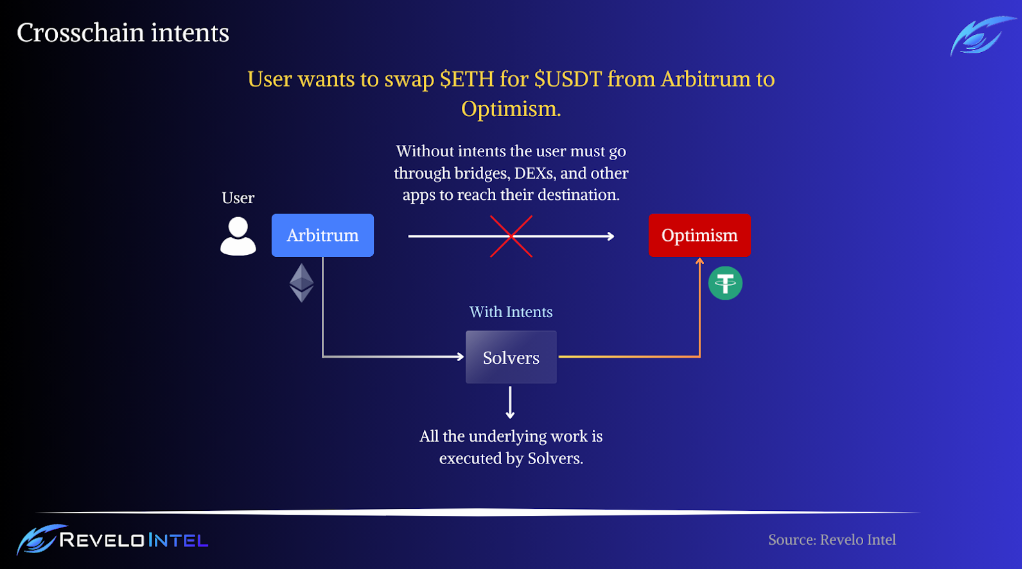

Everclear was created to enable users to seamlessly access applications across different blockchains without needing to understand or even be aware of the underlying chain, also known as Chain Abstraction, with the term itself being created by the team in 2023. This vision is primarily realized through intents, which are user requests fulfilled effectively and efficiently by service providers known as solvers. This model is inspired by everyday systems like Uber, Visa, and other service providers, where the user states a need, and the platform optimally fulfills it, abstracting the complexity away from the user.

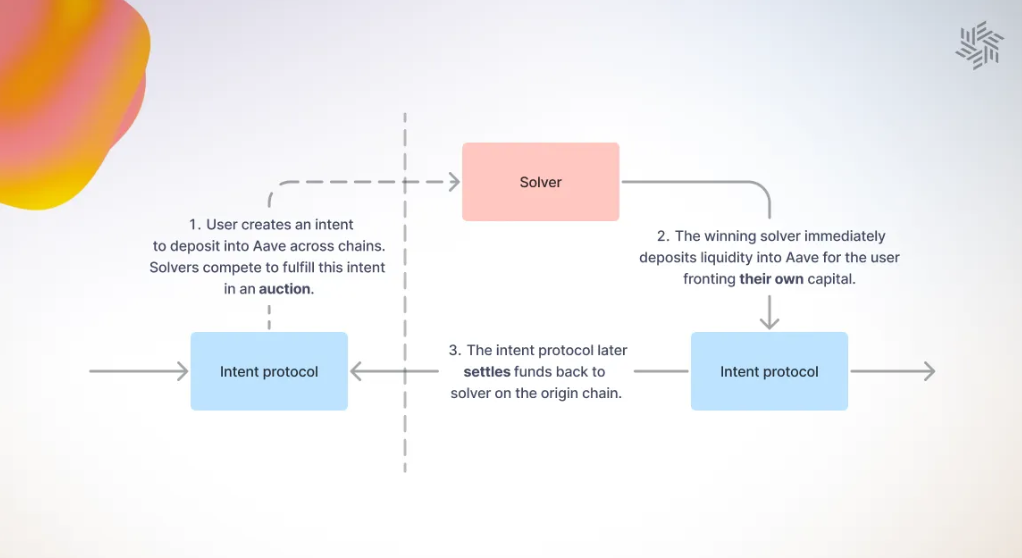

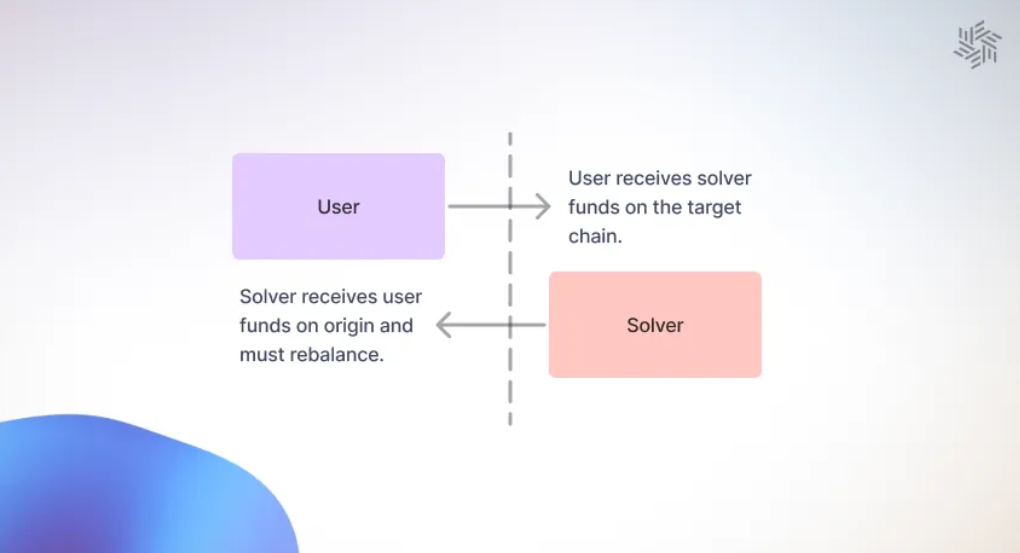

Currently, cross-chain intent protocols face significant fragmentation problems. Users on one blockchain express their intent for actions on another blockchain, and solvers bid to fulfill these intents efficiently. However, once a solver executes an intent, they face the challenge of being repaid by the protocol on the original chain and not on the destination chain, which introduces several issues:

- Liquidity Path Dependency: Solvers often end up being repaid in tokens or on chains that do not align with their preferences, which restricts their willingness to engage with certain chains and contributes to liquidity fragmentation.

- Capital Utilization: Solvers must rebalance funds to continue solving, adding considerable complexity and cost, which the user ultimately has to pay to offset.

- Centralization: Due to the economics of rebalancing, only a few well-capitalized solvers can efficiently manage liquidity across multiple chains, leading to a centralization of service providers.

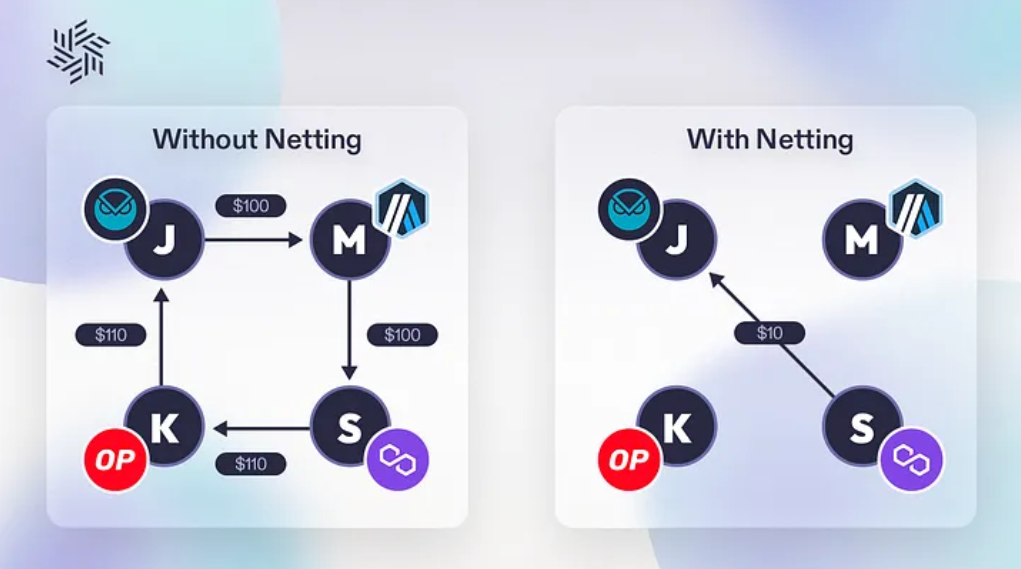

To address these systemic issues, Everclear introduces the Clearing Layer as part of the Chain Abstraction stack. This layer aims to coordinate the global settlement of liquidity between chains by netting cross-chain transactions, which can significantly reduce the operational costs and complexities associated with rebalancing. The Clearing Layer is adaptable to various transport protocols and bridges, allowing transactions to be settled at the most favorable rates, thus democratizing the ability to act as a solver.

With the implementation of the Clearing Layer, over 80% of daily cross-chain transaction volumes could be netted, indicating that current systems are moving up to five times more capital than necessary. This efficiency could drastically reduce the costs associated with cross-chain transactions and rebalancing, making it more economically feasible for a broader range of actors to participate as solvers. The Clearing Layer facilitates a more uniform and decentralized liquidity landscape by reducing dependency on specific paths and assets.

The ultimate goal of Everclear and the introduction of the Clearing Layer is to ensure that Chain Abstraction can be effectively implemented across an ever-growing number of chains and billions of users. The ability to add chains and manage liquidity without permissions opens the way for a truly scalable, decentralized blockchain ecosystem necessary for the widespread adoption of Web3. Everclear’s solution, therefore, not only addresses immediate operational inefficiencies but also sets the stage for a more inclusive and expansive blockchain future.

History and Background

Everclear, initially known as Connext, began its journey as a promising project to address the challenges of interoperability and liquidity management across different blockchain networks. Everclear was established to create a more connected and efficient blockchain ecosystem, allowing for seamless transactions and interactions across various chains.

The transition from Connext to Everclear significantly evolved the project’s focus and capabilities. This rebranding was not merely a name change but a more profound strategy and technological advancement shift. The rebranding to Everclear was driven by the need to better encapsulate the expanded scope of the platform, which had grown from a simple cross-chain bridging solution to a comprehensive Clearing Layer that solves fragmentation in modular blockchain architectures.

Design Philosophy and Mechanism Design

Everclear’s design philosophy is based on the concept of Chain Abstraction, which envisions a seamless user experience where the complexities of underlying blockchain infrastructure are invisible to the user. This vision is realized through the mechanism of intents, similar to how platforms like Uber simplify user experiences by abstracting the complexities behind a simple request. In the blockchain context, intents allow users to specify what they want to accomplish across different chains, which a solver then executes. This approach is aimed at overcoming the prevalent issue of fragmentation across multiple blockchains, where users typically have to navigate through several bridges, DEXes, and other infrastructures before reaching their preferred destination.

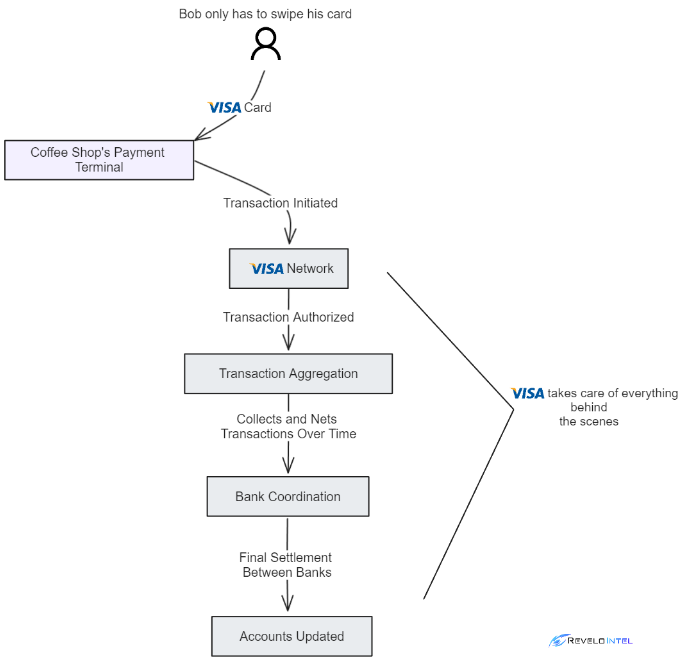

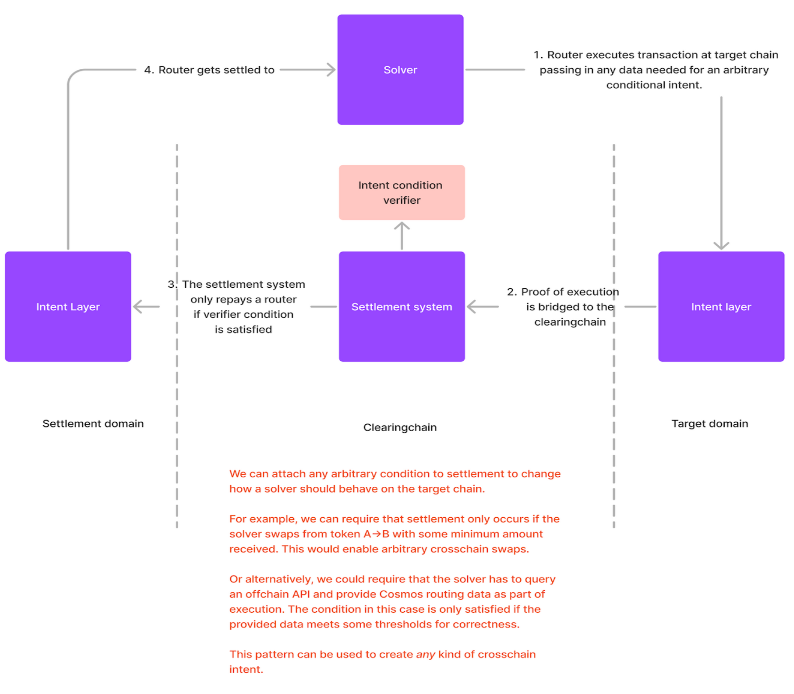

The prime architectural innovation of Everclear is the Clearing Layer. This decentralized network aims to synchronize and streamline liquidity movements across various blockchain ecosystems by enabling global netting and settlements. By processing and netting cross-chain transactions in aggregate over specified periods, Everclear significantly reduces the operational costs and complexities associated with managing liquidity across different chains. This mechanism not only simplifies rebalancing for solvers and market makers but also ensures that capital flows are optimized and efficient, mirroring systems used in traditional finance, such as the Visa payment network, which settles millions of transactions every day seamlessly.

Everclear operates as a roll-up solution that acts similarly to a centralized “computer” that calculates the optimal netting and settlement solutions for liquidity transfers across chains. This system supports a high degree of programmability and customization, allowing developers to deploy strategies for settling cross-chain intents such as Solidity smart contracts. This level of programmability introduces a new dimension to DeFi, where settlement strategies can be innovated upon, traded, and financialized.

Key to the functionality of Everclear is its ability to integrate seamlessly with various transport protocols, such as:

- IBC

- Hyperlane

- LayerZero

- Canonical Bridges

- Centralized Exchanges

This integration capacity is required for Everclear’s operation. It allows the system to tap into the best settlement mechanisms available for any given asset or ecosystem, thereby ensuring that liquidity is settled efficiently and at the best possible price.

Chain Abstraction

Everclear’s vision is to complete the Chain Abstraction stack, which will solve all the limitations and issues with the modular design and the settlement of liquidity between chains.

Chain Abstraction is the core philosophy of the Everclear ecosystem, designed to simplify how dApps interact across multiple blockchain layers radically. This feature enables dApps to execute logic from any chain without requiring users to switch networks, sign transactions on a different chain, or incur additional gas fees. By abstracting the chain layer from users, Everclear allows them to interact with applications seamlessly, focusing solely on its functionality rather than the underlying blockchain technology.

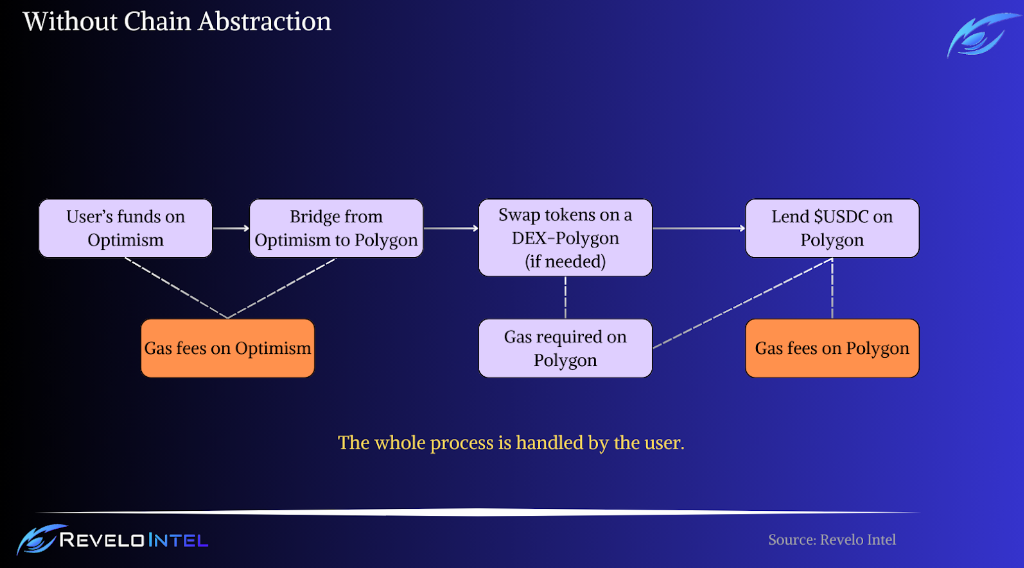

As more L2 and Layer 3 (L3) solutions emerge, offering faster and cheaper interactions, they complicate the user experience with requirements for bridging, managing different gas currencies, and navigating various chain infrastructures. A typical task like supplying liquidity to a cross-chain lending pool involves multiple steps: discovering the pool, bridging funds, acquiring target chain gas, and returning to the dApp to deposit funds. This complex process is daunting even for experienced cryptocurrency users and worsens as more layers are introduced.

Chain abstraction is the concept of hiding the technical specifics and modulations of blockchain operations from users, similar to how most internet users interact with web technologies without understanding protocols like HTTP or TCP/IP. In the blockchain context, this means abstracting away the details of which chain a user interacts with, allowing them to engage with dApps seamlessly across multiple chains.

How Does Chain Abstraction Work?

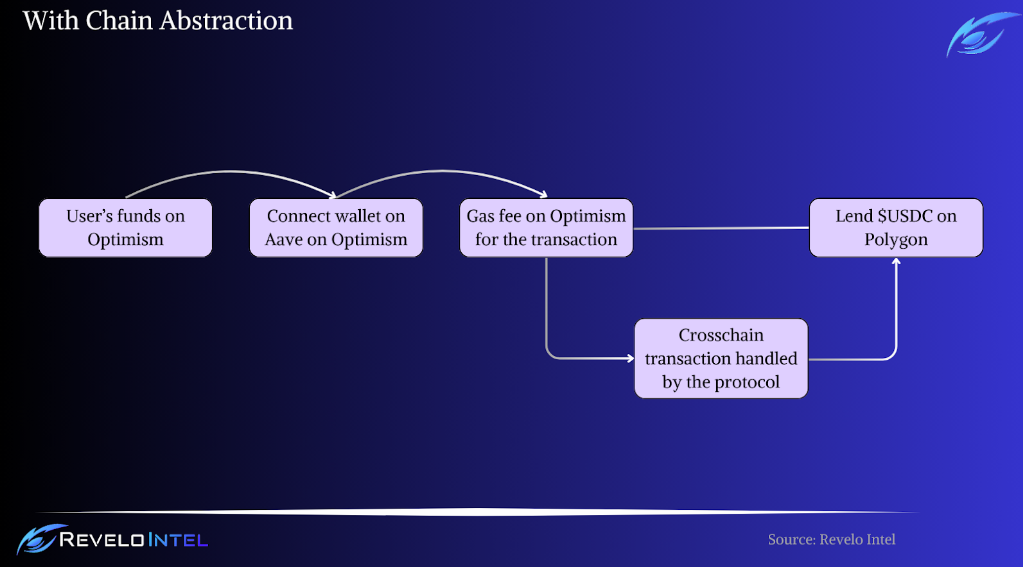

With Chain Abstraction, users can manage assets and engage with DeFi platforms across multiple chains using a single interface without understanding the underlying blockchain technology. Moreover, it allows users to utilize their capital on one chain to a dApp on another, directly saving time and fees. Here’s an example to better understand this process.

A user holding $USDC on Optimism wants to enter a position on Aave but on the Polygon blockchain. The process for the user is very simple: They only need to connect their wallet on Aave and start lending their $USDC. Behind the scenes, Aave initiates a cross-chain transaction that transfers the user’s funds from Optimism directly into the Aave app on Polygon. Note that the user only pays gas on Optimism for this transaction.

Everclear believes Chain Abstraction is improperly optimized and doesn’t work as intended. As a result, the protocol introduced a new layer to the stack, the Clearing Layer.

Clearing Layer

Per Everclear, the Clearing Layer is a “decentralized network that coordinates global netting and settlement of capital flows between chains.” It is the prime innovation and the core of the Everclear protocol. By introducing the Clearing Layer, the protocol seeks to solve the fragmentation issue and provide a chain abstracted environment for as many blockchains as possible.

The Clearing Layer is a decentralized network designed to orchestrate the global netting and settlement of capital flows across various blockchain networks. By facilitating netting and integrating into the most effective settlement mechanisms for any asset or ecosystem, Clearing Layers substantially reduce the costs and complexities involved in rebalancing activities for solvers, market makers, and centralized exchanges (CEXs), achieving up to a tenfold reduction.

The best analogy for understanding the Clearing Layer is the Visa payment network. When consumers make payments, such as buying coffee, Visa doesn’t immediately transfer funds between banks. Instead, it authorizes transactions, aggregates them over a period, and then coordinates the netted settlements between banks. Similarly, the Clearing Layer authorizes and consolidates blockchain transactions before finalizing settlements, making the process efficient and reducing the need for immediate fund transfers.

Similarly, the Clearing Layer authorizes and consolidates cross-chain transactions before finalizing settlements, making the process efficient and reducing the need for immediate fund transfers. Everclear hides all the background operations from the user, simplifying the experience.

The Clearing Layer is a critical component of the Chain Abstraction stack and is responsible for resolving specific challenges within the blockchain ecosystem. Within the Chain Abstraction stack, there are two important functionalities:

- Permissions: Enhancing user control over their assets across multiple chains.

- Auctions and Solving: Facilitating the efficient matching of user intents with solvers, whether the needs are specific (like trading) or general (such as acquiring an NFT).

The rapid expansion of modular blockchains demands solutions like the Clearing Layer to manage the increased complexity and connectivity needs. It leverages advanced transport protocols and security frameworks, such as Hyperlane and EigenLayer, to provide the infrastructure necessary for scaling to thousands of chains without compromising security or performance.

Everclear functions as a rollup that acts like a computational hub, determining the optimal settlement paths for solvers. This setup not only streamlines the settlement process but also enhances capital efficiency by allowing for significant netting of transactions. The platform allows developers to contribute settlement strategies, fostering a community-driven approach to improving blockchain interoperability.

Furthermore, the Clearing Layer can significantly benefit various parties in the blockchain ecosystem:

- dApps and Protocols: By simplifying the integration into multiple chains, dApps can easily expand their operations and manage liquidity more effectively.

- App Chains: Supporting new and emerging app chains by providing them with the necessary infrastructure for seamless user onboarding and interaction.

- Centralized Exchanges: By connecting to a unified clearing layer, CEXs can offer support for an extensive range of chains without the need to establish and maintain liquidity on each individually, thereby avoiding the fragmentation of their liquidity pools.

Intents

Intents are a relatively newly introduced concept within blockchain technology, with the purpose of simplifying cross-chain transactions. The foundational idea is to minimize the user’s need to manage the complexities of interchain activities such as path-finding, bridging, and gas payments. By summing the user’s desires into a single transaction, known as intent, the complexities are outsourced to a service provider or the solver, who handles the execution on the user’s behalf. This method streamlines operations and optimizes costs by ensuring transactions are executed at the minimal necessary fee.

Blockchain intents replicate everyday financial transactions but in a decentralized and automated environment. For instance, a user’s simple instruction to buy stocks through a bank can be likened to issuing an intent on a blockchain to exchange tokens or engage with a smart contract.

However, the practical application of blockchain intents today reveals several inefficiencies. Consider a user with $500 on Ethereum intending to stake $500 on a dApp on Arbitrum. Their intent is clear: to stake $500 on an Arbitrum dApp. The reality is different because the current process involves multiple steps: bridging assets between chains, ensuring sufficient gas for transactions on both chains, and connecting to the desired dApp to complete the stake. Each step must be executed manually by the user, contradicting the fundamental ease that intents aim to provide.

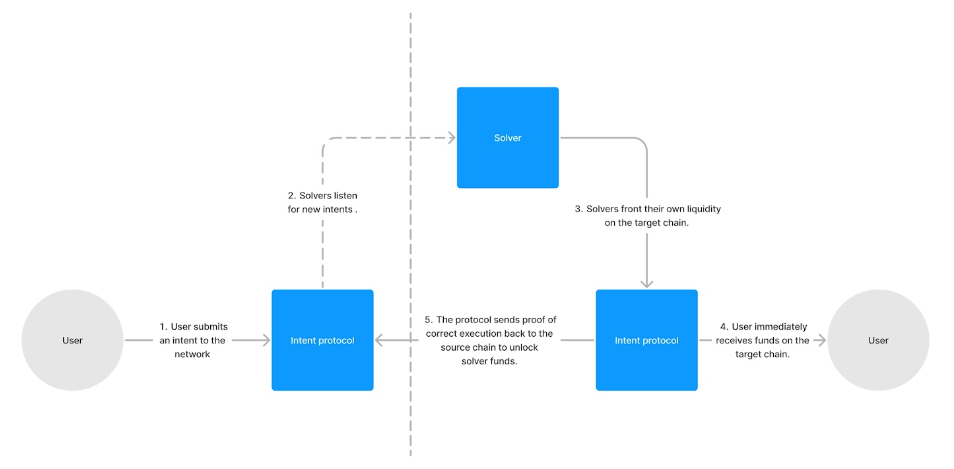

Intent systems operate through a structured three-step process:

- Intent Expression: Users articulate their desires to execute specific actions on another chain, indicating their readiness to cover associated fees. Service providers, including routers, fillers, and solvers, monitor these expressed intents to identify service opportunities.

- Intent Execution: Competition arises among service providers in an auction format, where they vie to execute the intent at the lowest price. The winning provider, typically a router or filler, then carries out the intent on the target blockchain.

- Intent Settlement: After successful execution, the protocol compensates the winning service provider using the funds initially earmarked for the intent on the origin chain.

This approach ensures that users achieve their cross-chain objectives at optimized costs without directly engaging in the underlying complex processes that require additional effort and cost.

Solver Selection

The mechanism of matching a user’s expressed intent with a solver can be approached in various ways, each presenting unique advantages and challenges:

| Approach | Benefits | Drawbacks | Protocol Examples |

| No selection/mempool | Simplest, most open approach. By using the chain’s mempool, you open up solving to anyone who is connected to the chain. High guarantees around latency as solvers compete to submit 1st to the chain. | Solvers need to race each other in the mempool. This opens up solving to MEV and burns gas in the case that solvers don’t win. You could submit TXs privately via Flashbots, but this is the same as private mempool. | Hop |

| Request for Quote | Decentralized, simple to implement, and highly efficient for pricing. Users run the RFQ from a browser, which gives great pricing guarantees. This model also has low latency -> effectively the same overhead as estimating gas. | Browsers are notoriously unstable environments and don’t have great support for p2p messages. This can mean users lose connection or fail to receive quotes from solvers. This approach also creates browser dependencies, making it tough to compose bridging into other transactions on the source chain. | Everclear v1 (nxtp), Hashflow, DLN, UniswapX (has a fallback to public solving) |

| Private Intentpool | Decouples the relationship between user to user and network. This means that only 1 solver needs to be liquid/available for the user’s TX to complete, giving fantastic reliability guarantees. | Introduces a centralized operator that can unfairly select solvers, censor, or have downtime. Also adds some latency overhead compared to an in-browser RFQ or open system. | Everclear v2 (Amarok), Across (I think?), Synapse RFQ |

| Public Intentpools | Similar to a private mempool, but with public verifiability and shared intent orderflow/solver set. Can be structured as a chain or rollup w/ a decentralized sequencer for high uptime. | Hard to convince competing intent protocols that they should give up their overflow to a public system. | Anoma, Suave |

Generalized Intents

While trading transactions dominate the discussion around intents, the concept is not confined to transferring fungible assets. Intents can incorporate conditions that invoke complex actions from solvers, broadening the utility of this system. For example, intents could be used beyond simple asset transfers for more complex operations like staking or participating in DeFi protocols.

Lifecycle of Intents

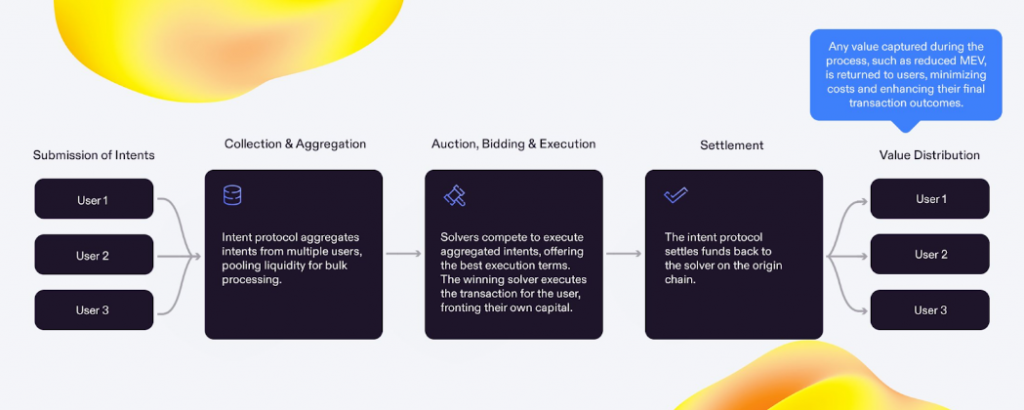

The lifecycle of intents within blockchain systems illustrates a mechanism where user transactions are streamlined by intent protocols. This process optimizes the user experience by abstracting the complex underlying mechanics of decentralized transactions across multiple chains.

- Intent Creation: The process begins when a user submits an intent, such as a token swap or transfer. This submission details the assets involved, the desired outcome (for example, swapping $ETH for $DAI), and any specific conditions like the minimum acceptable price. This first step is critical as it defines the exact requirements of the user’s transaction.

- Collection and Aggregation: Once submitted, the intent is captured by an intent protocol that aggregates similar intents from various users. This aggregation is pivotal as it pools multiple intents to consolidate liquidity and sets the stage for efficient bulk processing. This step not only streamlines transaction handling but also optimizes liquidity usage across the platform.

- Auction Preparation: Following aggregation, the batched intents are organized into an auction format. This setup allows solvers to bid for the opportunity to process the batch. The auction is a crucial component, ensuring competitive bidding and enabling the protocol to secure the best possible execution terms for the batch.

- Solver Bidding: In this phase, solvers enter a competitive bidding process. Each solver presents their strategy for executing the transactions, including the cost and the potential benefits such as best price execution or minimal slippage. This step is essential for determining which solver can efficiently fulfill the aggregated intents.

- Auction Execution: The solver who offers the most advantageous terms wins the bid and proceeds to execute the intents. This involves fronting their capital to carry out the transactions, ensuring that users’ intents are processed as desired.

- User Receives Outcome: The user receives the results of their intents. Whether it’s the completion of a token swap, a transfer, or any other desired transaction outcome, the user experiences a streamlined, efficient service that simplifies interactions within the decentralized finance landscape.

- Transaction Settlement: Once the transactions are executed, the intent protocol settles the funds back to the solver on the origin chain. This step finalizes the financial aspects of the transactions, ensuring that solvers are reimbursed and compensated according to the agreed terms.

- Value Distribution: During the execution process, any value captured, such as reductions in maximum extractable value (MEV), is distributed back to the users. This distribution often results in minimized costs and enhanced transaction outcomes for users, reflecting the efficiency of the intent protocol.

Intent protocols solve numerous issues that users face with the current number of blockchain solutions. Intents improve the Web3 UX complexity and minimize the impact of liquidity fragmentation.

Rebalancers

After the intent cycle is concluded and solvers are repaid, their funds are spread across chains. To continue providing services effectively, solvers must move their funds back to the target chain(s) where they operate. This process is known as rebalancing, and solvers rely on CEXs, bridges, or market makers for this task, which can be costly and complex. Having solvers do that eliminates the efficacy of such a system and creates a counterproductive effect. This is also prohibitive for new solvers to join the ecosystem.

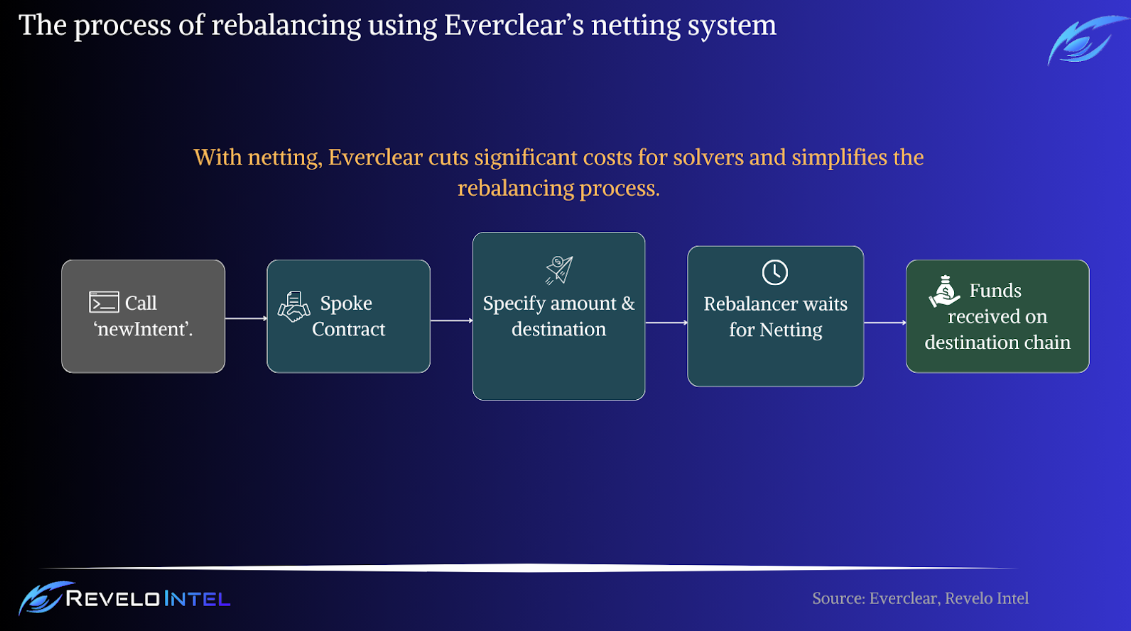

To restart the liquidity cycle, solvers need their funds available on the intended destination chain. Everclear addresses the rebalancing challenge through its netting system, simplifying the process to a single transaction. Rebalancers can call a function on a Spoke contract from the origin chain, specifying the amount and destination chain. After execution, the Rebalancer waits for the intent to be netted with a matching one, after which the funds are received on the destination chain, either in their wallet or sent to a specified recipient.

When rebalancers cannot be netted against each other, arbitrageurs are incentivized to join in and help.

Arbitrageurs

Arbitrageurs profit from price discrepancies across markets. Similarly, when it comes to Everclear, arbitrageurs look for invoices with profitable discounts and provide liquidity when Rebalancers cannot be netted against each other. This ensures that all parties are satisfied.

By leveraging Everclear, arbitrageurs can earn solid returns while taking minimal risk by purchasing discounted invoices on supported chains.

Protocol Architecture

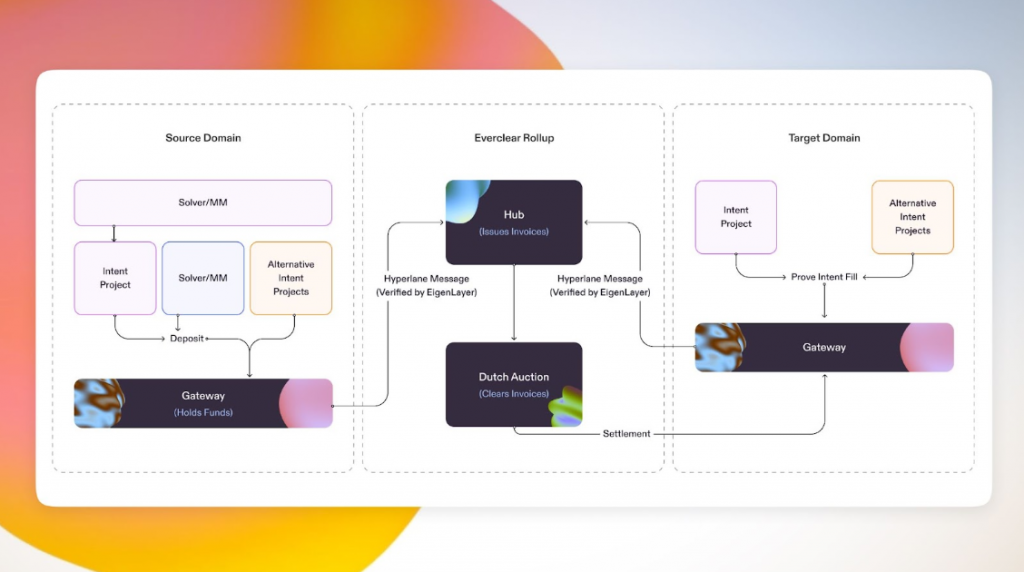

Everclear employs a Hub-and-Spoke model to manage intents and settlements across supported blockchain networks. The Spoke domains are individual chains like Ethereum Mainnet, Arbitrum, and Optimism. The Hub domain, known as the “Clearing rollup,” is where the protocol’s core logic is executed.

When functions are triggered on Spoke or Hub contracts, they are sent to the corresponding SpokeGateway or HubGateway. These messages are transported between domains using Hyperlane, facilitating cross-chain communication.

The system involves two main participants: Rebalancers and Arbitrageurs. Rebalancers use the protocol to adjust their fund distribution across domains by submitting intents. These intents are netted against others moving in the opposite direction. If no matching intents are available, the transfer amount is discounted by set basis points (BPS) up to a maximum discount threshold every epoch.

Arbitrageurs monitor the network to purchase discounted intents when the discount is profitable. The discounting continues until a Rebalancer or Arbitrageur submits a matching intent, enabling the transfer and balancing of liquidity across chains.

Flow of Funds

When a Rebalancer or Arbitrageur creates an intent, funds are withdrawn from their wallet and deposited into the Spoke contract. This action increases the unclaimed balance in the Spoke contract by the intent amount. These funds are reserved to settle with a user who purchases the original intent through a new intent.

New intents are added to an intent queue, periodically transmitted from the Spoke to the Clearing chain (Hub domain). In the Hub domain, intents that cannot be matched with existing intents become invoices in the invoice queue, while intents that can be matched become deposits in the deposit queue. The invoice and deposit queues are processed at the end of each epoch. Matched items generate settlements that are added to a settlement queue.

Settlements in the queue are executed using different strategies based on the intent type. An intent suitable for netting is settled using the netting strategy, whereas xERC20 tokens being bridged are settled using the xERC20 strategy.

Finally, the settlement queue is processed by sending settlement messages from the Hub to the Spoke domains. Once these messages reach the corresponding Spoke domains—the destination domains for the matched intents—the user receives tokens in their wallet or an increased virtual balance, depending on their settlement preference.

Components

Everclear consists of several on-chain and off-chain components that enable its cross-chain functionality.

- Supported Domains

- Spoke: An on-chain contract deployed on each supported blockchain. It holds funds from created intents, providing liquidity for settlements. The Spoke formats messages from the intent queue and dispatches them through the SpokeGateway.

- SpokeGateway: An on-chain contract responsible for sending messages to the transport layer and formatting inbound settlement messages to invoke functions on the Spoke contract correctly.

- Clearing Layer (Hub)

- Hub: An on-chain contract located on the clearing chain. It handles inbound intent messages and dispatches settlements via the HubGateway.

- HubGateway: An on-chain contract that dispatches messages to the transport layer and formats inbound message payloads to properly call functions on the Hub contract.

- Agents

- Lighthouse: An off-chain agent responsible for managing queues and executing scheduled tasks within the network. It processes queues based on configured age and size thresholds for each chain.

- Cartographer: An off-chain agent that creates a native cross-chain view of the network state. This view is derived from an indexing layer, such as subgraphs on each chain.

Transport Layer (Hyperlane)

The transport layer is critical for moving messages across the network, and it is handled by the HubGateway and SpokeGateway contracts. This layer ensures that all network parts remain synchronized in real-time, facilitating the rapid processing of intents and settlements. Everclear uses Eigenlayer’s AVS to secure the cross-chain messages of the transport layer and guarantees enough financial stability to securely transfer invoices from the hub to the spokes.

Everclear Rollup

The protocol is implemented on an Arbitrum Orbit rollup, optimized for cross-chain communication and settlement. Using technologies like EigenDA and in partnership with Gelato RaaS, Everclear acts as a distributed computation platform that processes and settles transactions based on the consolidated state from various Gateway contracts. This setup supports a wide range of functionalities, from basic transaction settlements to complex financial operations like the trading and leveraging of invoices, projected through a future marketplace for settlement strategies.

How does Everclear Work?

Everclear enables Rebalancers, also known as solvers, fillers, or relayers, to deposit funds into a Spoke contract on any supported blockchain. They specify the destination chains where they want to receive these funds. When Rebalancers submit their intents, the Hub contract on the Clearing chain nets them against others moving in the opposite direction.

If no matching intents are available for netting, the Hub applies a discount to the original intent by configured basis points per epoch. This discount continues up to a maximum threshold until a new intent purchases it. The owner of the new intent receives the discount as a bonus. For example:

- An original intent of $100 is discounted to $99 for moving funds from Arbitrum to Optimism.

- A new intent of $99 is received to move funds from Optimism to Arbitrum.

- The original intent owner receives $99 on Optimism.

- The new intent owner receives $100 on Arbitrum.

This discount mechanism resembles a Dutch auction and incentivizes arbitrageurs to participate.

Uses Cases

The Everclear protocol introduces numerous use cases.

Restake from Anywhere

Everclear is launching this feature to overcome some of the restrictions of restaking. Despite the growth of restaking, several challenges persist, primarily related to the high costs of native restaking on the Ethereum Mainnet due to escalating gas prices. Additionally, the economic activity on L2 and L3 networks, where costs are generally lower and new incentives are often introduced, is not fully capitalized due to these challenges. This discrepancy makes restaking inconvenient for users with funds on L2/L3 networks and contradicts Ethereum’s goal of migrating activities to L2 networks.

Traditionally, restaking has been confined to L1 networks, causing a significant flow of TVL from L2 back to Ethereum Mainnet. This compelled L2 participants to leave their preferred ecosystems and complicated their participation in DeFi activities. Everclear’s solution allows for restaking on a user’s chain of choice, directly addressing the leakage of TVL and enabling a more integrated multilayer blockchain environment.

Everclear’s “Restake From Anywhere” feature streamlines the complex multi-step process into a straightforward action, allowing users to restake assets directly from any supported L2 network to Ethereum Mainnet or across different L2 networks. This integration drastically reduces transaction costs and promotes the retention and growth of TVL within L2 ecosystems, aligning with Ethereum’s scalability and decentralization objectives.

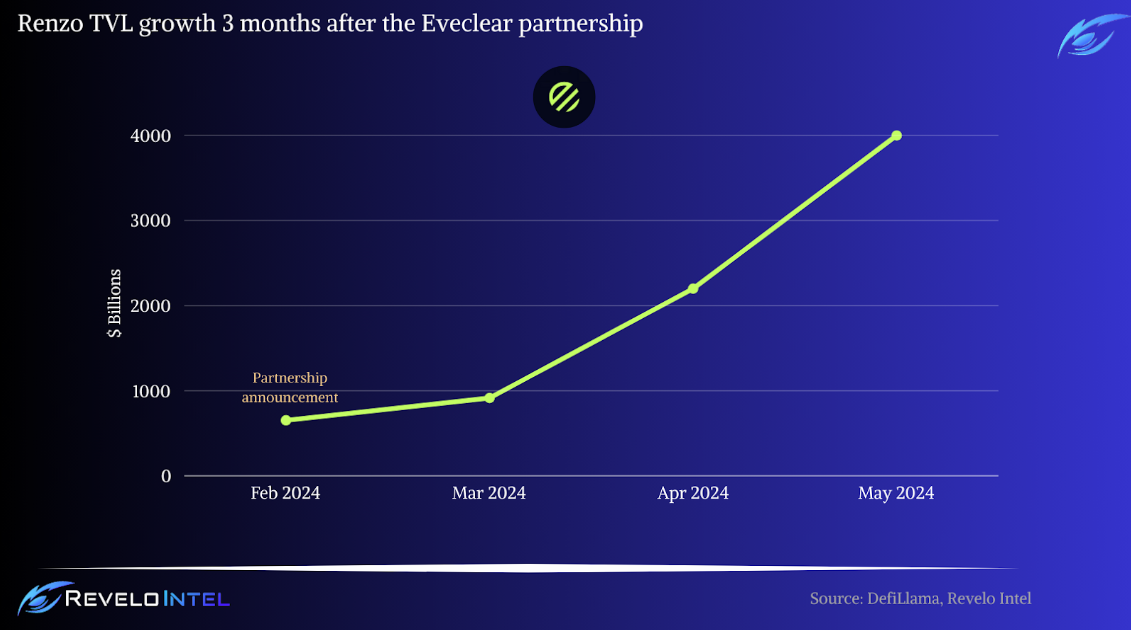

Application with Renzo Protocol

A prime example of this functionality in action is Everclear’s integration with Renzo Protocol, which has demonstrated the practical benefits of restaking. Through this partnership, users can effortlessly restake assets and engage in DeFi, using the liquid restaking tokens (LRTs) like $ezETH from Renzo for further financial activities within the L2 ecosystem they operate from. This partnership boosted Renzo’s TVL to billions, showcasing chain abstraction’s effect.

Here’s how this integration solves some practical issues with restaking:

- One-Step Restaking: Users can restake from the chain of their choice with a single transaction. There’s no need to bridge to the mainnet and go through multiple steps to restake.

- Lower Fees: Restaking on the mainnet requires a lot of gas, even when traffic is low. Using Everclear to restake saves a lot of fees, making the whole process more appealing and accessible to users.

- Liquidity Retention: This process minimizes the outflow of funds from L2/L3 networks, aligning with Ethereum’s vision for a decentralized ecosystem.

Everclear helped Renzo unlock a substantial size of capital that wanted access to restaking but didn’t want to interact with the mainnet.

Here’s how it works:

- Users restake their native $ETH from their chosen L2 network using Renzo Protocol.

- Immediately after restaking, users are issued Renzo’s LRT, known as $ezETH. This token can be used in DeFi to earn additional rewards.

- Concurrently, the restaked $ETH is aggregated and transferred to the Ethereum mainnet, where it undergoes the restaking process. Everclear’s infrastructure, designed to minimize trust and maximize efficiency, automates this process while ensuring top-notch security and reducing fees associated with the Ethereum mainnet. This is ideal for a protocol such as Renzo and its use because it allows $ETH to be moved on mainnet at the lowest possible cost.

As simple as that, a user can restake and avoid all the underlying complexities of this process.

Sector Outlook

The cryptocurrency sector is experiencing a notable shift towards an intent-centric approach, where DEXs and cross-chain bridges increasingly rely on solvers to fulfill user intents across multiple blockchains. This development represents a transformation in how transactions are conceived and executed within the decentralized landscape. Intent-centric approaches focus on what users want to accomplish, such as swapping tokens, lending assets, or transferring value across different chains, without requiring them to manage the complex mechanics typically associated with such operations.

Solvers play a crucial role in this evolving framework. They are specialized agents or algorithms tasked with finding the most efficient ways to fulfill these intents. Their job includes executing the transactions and optimizing the path and costs associated with these cross-chain activities. As the number and variety of blockchain platforms grow, the demand for such solvers is expected to increase significantly, highlighting the need for more sophisticated and efficient solutions to manage these operations at scale.

Everclear emerges as a fundamental component within this shifting narrative. By functioning as a clearing layer that coordinates the settlement of liquidity across chains, Everclear significantly simplifies the process for solvers. It allows them to operate more efficiently by providing a platform that handles the intricacies of netting and settling transactions across multiple chains. This not only makes the process less costly by reducing the frequency and complexity of settlements needed but also faster and more reliable, thereby improving the overall efficiency of the intent-centric ecosystem.

There’s also growing interest in the concept of Chain Abstraction due to the increasing number of new chains and L2 solutions and the need for seamless interaction between these protocols. Chain abstraction addresses this need by hiding the complexities of the underlying blockchain layers from the end users, enabling a more intuitive and unified experience.

Both concepts aim to address the limitations and the fragmentation issues of the cross-chain environment where users are being clustered to specific chains and the process of interacting with other chains becomes increasingly complicated.

Potential Adoption

The Everclear protocol, designed as the first Clearing Layer for modular blockchains, promises to solve the fragmentation problem between different blockchains and their ability to communicate seamlessly. One of the primary reasons for its potential adoption is the significant cost efficiency it brings to cross-chain transactions. By utilizing a netting process that aggregates multiple transactions into fewer settlements, Everclear can drastically reduce the costs of these operations, making it the go-to settlement solution.

Another capability of Everclear is its ability to simplify the user experience in a multi-chain environment where many users must undergo a time-consuming and capital-consuming process. The protocol handles the complexities of cross-chain transactions internally, offering users a smooth experience and fulfilling their intents as formed initially. This level of abstraction is crucial as it lowers the barrier to entry for non-technical users, potentially expanding the protocol’s user base and promoting greater inclusion in the DeFi ecosystem.

Support for a multi-chain future is one of Everclear’s most strategic aspects. As the blockchain landscape continues to evolve towards greater fragmentation with numerous specialized chains, a protocol like Everclear that facilitates smooth interactions between these chains will be significant. This capability supports current blockchain operations and future-proof applications against the increasing complexity of the blockchain ecosystem.

Chains

Everclear supports the following chains: Ethereum, Optimism, Base, BNB Chain, and Arbitrum.

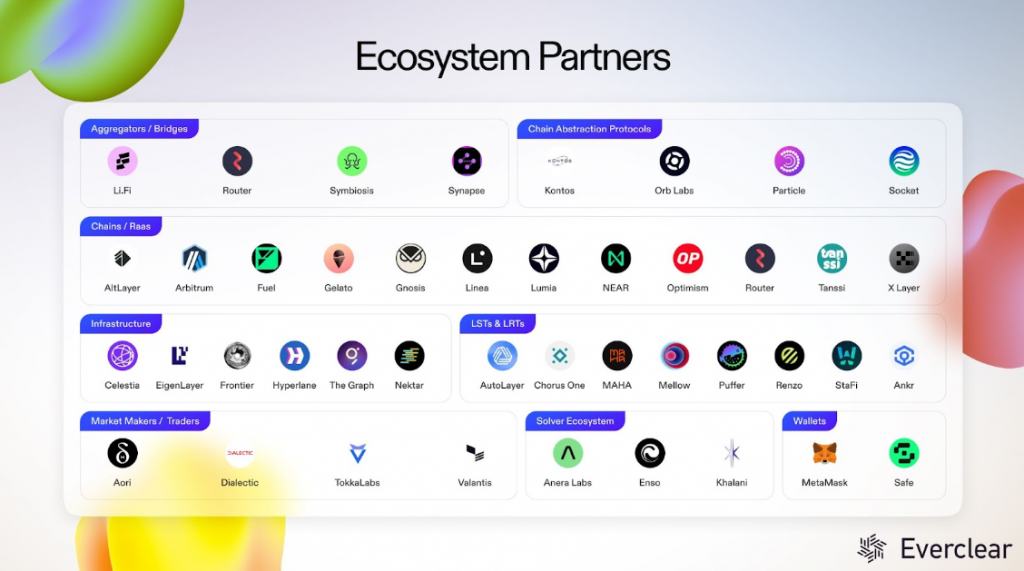

Ecosystem

Each partner falls under the corresponding section.

Business Model

Everclear’s business model revolves primarily around facilitating efficient cross-chain transactions and ensuring seamless liquidity management across different blockchain networks. In this regard, Everclear can be considered the middleman between the user, the solver, and the corresponding chain in every situation. For this service, Everclear collects fees from transactions using the protocol.

Fees Breakdown

When using Everclear, users will encounter several costs that affect the total amount received:

- Protocol Fee: Users are charged a protocol fee for using the netting system, which is currently set between 1 – 10 BPS.

- Gas: This is the usual fee for submitting an on-chain transaction.

- Solver Fee (if applicable): This fee is required if the user specifies ttl (time to live) > 0 when creating a new intent. It covers the gas cost for a solver to execute the intent on the destination.

- Discounts: If an intent is not filled within the ttl and no other intents are netted against it, it will be converted into an invoice and discounted.

These fees collectively determine the final amount a user will receive after processing transactions through Everclear.

Tokenomics

$CLEAR

$CLEAR is the governance and utility token of Everclear, deployed as an xERC20 token on all supported chains. It replaces the former $NEXT token and is integral to the protocol’s operations. Its main functions are:

- Governance Participation: Holders can stake $CLEAR to participate in the Everclear DAO, influencing protocol development and funding decisions.

- Vote-Bonding Mechanism: $CLEAR can be staked to receive vote-bonded $CLEAR (vbCLEAR), granting holders voting power over liquidity incentives and emissions distribution.

- Protocol Fee Sharing: vbCLEAR holders are entitled to receive a share of the protocol fees generated from liquidity settlement and solver rebalancing.

- Future Utilities: $CLEAR may enable permissionless activities like routing, chain support, and token listing through staking, pending DAO approval.

$CLEAR aligns the interests of all participants and promotes decentralization within the Everclear ecosystem.

vbCLEAR

Everclear introduces a vote-bonded mechanism (vbCLEAR) for liquidity incentives, inspired by Curve’s veToken model but with key improvements tailored for cross-chain rebalancing and solver participation. vbCLEAR enhances liquidity efficiency by directing incentives toward actively used chains and solvers

veToken systems are about aligning users’ common interests with the protocol. Users who lock their tokens for veTokens commit to the protocol and become part of its mission. To do that, there must be confidence and conviction in the protocol’s long-term success and viability. It is in the protocol’s best interest to create a solid framework for this mechanism that incentivizes users to participate.

Considering the nature of the crypto market, where many protocols don’t survive or underperform in the long term, veToken models can be challenging to adopt by users who fear that long-term commitment to a protocol may result in diminishing results for their capital. Also, the opportunity cost for users arises from locking a certain amount of their capital for a prolonged period. Additionally, there is the case of the price that is connected both to the performance of the protocol and the emissions schedule. Being illiquid in a market like crypto poses risks.

The main advantage of locking tokens is for the protocol. Because of this, protocols have developed ever more creative strategies and incentivization plans to persuade investors to voluntarily lock up their tokens. Locking a token ultimately depends on the benefits provided by the protocol and each token.

How vbCLEAR Works

- Staking & Governance: Holders stake $CLEAR for up to two years to receive vbCLEAR, which grants voting rights and access to protocol rewards.

- Emissions Voting: vbCLEAR holders decide how to allocate emissions to solvers and chains, creating an incentive-driven liquidity allocation system.

- Protocol Fee Sharing: Fees collected from transactions (ranging from 0.2 to 1 bps) are distributed to vbCLEAR holders, ensuring long-term alignment between governance and economic incentives.

The Need for vbCLEAR

- Solving the Liquidity Bootstrap Problem: vbCLEAR allows chains to directly incentivize solvers to bring liquidity to their ecosystem, reducing dependency on custom incentive agreements.

- Market-Driven Incentives: Chains and asset issuers can acquire and stake $CLEAR to vote for emissions allocation, ensuring that liquidity moves to where it’s needed most.

- Optimized Solver Capital Utilization: With reduced risk for solvers, vbCLEAR facilitates rapid expansion to new chains, enabling seamless cross-chain interactions..

The vbCLEAR system introduces a gauge mechanism that determines reward allocation based on governance votes. This system: 1) Incentivizes efficient liquidity management as solvers, market makers, and arbitrageurs are rewarded for directing liquidity toward underutilized chains and 2) Creates competition among chains as they can purchase and lock $CLEAR or incentivize existing vbCLEAR holders to direct gauges to their ecosystem, for a self-sustaining liquidity marketplace.

Long-Term Vision

vbCLEAR employs a deflationary mechanism. Everclear uses surplus revenue from system volume to reduce the overall supply of $CLEAR, minimizing inflation from emissions. When usage is low, incentives are increased to stimulate activity. When demand is high, the system becomes deflationary, with $CLEAR tokens burned to stabilize supply.

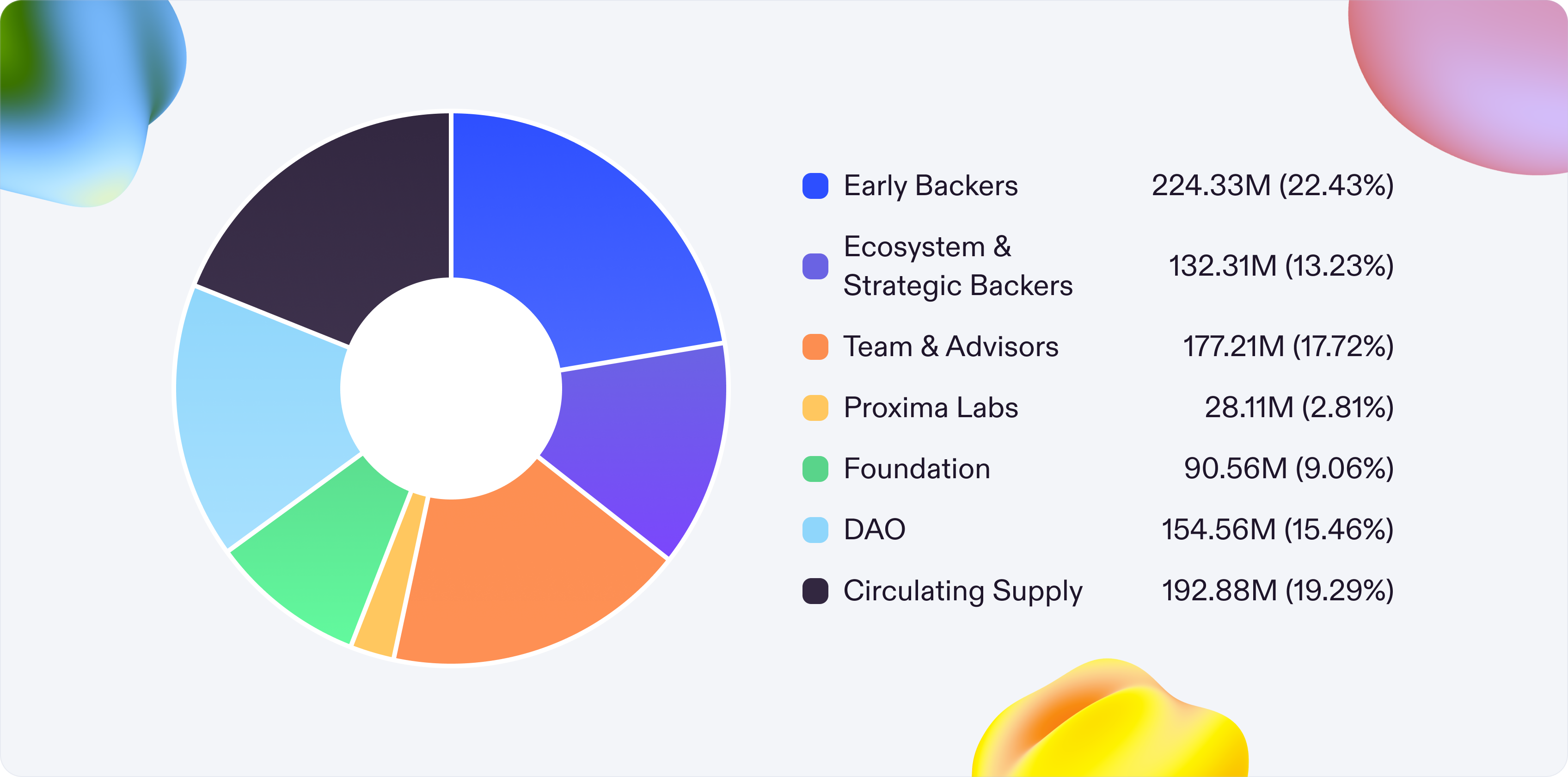

Token Distribution

The $CLEAR token is distributed as such:

| Category | % of Total Supply | Number of $CLEAR |

| Early Backers | 22.43% | 224.33M |

| Ecosystem & Strategic Backers | 13.23% | 132.3M |

| Team & Advisors | 17.72% | 177.21M |

| Proxima Labs | 2.81% | 28.11M |

The Community category is subdivided further as follows:

| Category | % of Total Supply | Number of $CLEAR |

| Everclear Foundation | 8.56% | 85.56M |

| DAO | 17.56% | 175.57M |

| Airdrop | 7.67% | 76.72M |

| Ecosystem Grants | 10.02% | 100.15M |

Supply Schedule

Everclear imposed a lockup period for the following categories:

- Early Backers

- Ecosystem & Strategic Backers

- Early Team & Advisors

- Routers & Community Advocates (50% of Airdrop, 2.15% of Total Supply)

The lockup period for Early Backers, Strategic Backers and Early Team & Advisors is structured to ensure a gradual release of tokens:

- Initial Lockup Period: 15 months from the date of the $CLEAR Airdrop.

- Release Schedule: After the initial lockup, tokens will be released linearly over 18 months.

Specifically:

- On December 6, 2024, 1/19 of the locked tokens will be released.

- The remaining tokens will unlock in equal monthly installments of 1/19 each month.

The tokens will be fully unlocked 33 months after the $CLEAR Airdrop.

Governance

Governance in the Everclear ecosystem includes various initiatives from different groups and individuals who come together for a single collective mission to advance the protocol’s growth. This is achieved through a collaborative multi-party governance model in which every group or individual has a specific position within the ecosystem.

Everclear Collective

Previously Connext Collective, the Everclear Collective is a diverse ecosystem comprising autonomous entities and individuals all aligned to realize and advance the Everclear vision. This ecosystem is structured to promote a collaborative and decentralized operational model, which is pivotal in driving the protocol’s development and adoption.

Here are the key components of the Everclear Collective:

- Everclear DAO (prev Connext DAO)

The Everclear DAO plays a central role in the protocol’s governance by directing critical aspects of the smart contracts and managing the allocation of resources from the DAO treasury. Composed of $CLEAR token holders, the DAO ensures that the development and expansion of the protocol are continuously supported through strategic resource deployment.

- Everclear Foundation (prev Connext Foundation)

Located in the Cayman Islands, the Everclear Foundation is designed to support the broader Everclear ecosystem through strategic stewardship, partnership initiatives, and grant administration. As an independent entity, it has fiduciary responsibilities to enhance the protocol’s reach and capabilities.

- Core Contributors

These are organizations funded by the DAO to engage in research and development to improve Everclear. They participate in an open Everclear Improvement Proposal process to solicit community input and propose protocol upgrades. This collective includes for-profit companies, developer guilds, and sub-DAOs, ensuring a diverse and robust development environment.

- Broader Everclear Community

This includes many users and infrastructure operators, such as routers, who use the protocol to provide valuable feedback and contribute to its robustness and security.

Core Contributors

Core Contributors are essential to developing and continuously improving the Everclear protocol. They comprise diverse organizations, including for-profit companies, developer guilds, and sub-DAOs. These contributors are instrumental in researching, developing, and managing various aspects of the protocol, ensuring its robustness and adaptability.

The Everclear DAO provides $CLEAR tokens as financial support for Core Contributors. This funding is subject to a vesting schedule that allows the DAO to modify payouts following contributor performance and output. This structure creates a dynamic environment that inspires high-quality execution and innovation by encouraging competition and collaboration among contributors.

The diversity of Core Contributors is a strategic approach to governance and development within the Everclear ecosystem. Everclear’s vision is to become a true, credibly neutral public good. By integrating a wide variety of perspectives and expertise from various backgrounds, Everclear hopes to achieve this goal. This diversity minimizes centralized governance and enhances the protocol’s universality and accessibility.

The table below details the organizations currently recognized as Core Contributors within the Everclear ecosystem, highlighting their types, roles, and focus areas:

| Contributor | Type | Focus Area(s) |

| Everclear Foundation | Foundation | DAO & CIP administration, communications, grants. |

| Proxima Labs | For-profit R&D Lab | R&D of core protocol, supplementary products, tooling, and developer onboarding/integrations. |

| Wonderland | For-profit R&D Lab | R&D of core protocol, supplementary products, and tooling. |

| Community Leaders | Sub-DAO | Community management, education, user support, and marketing. |

| P2P | For-profit Company | Router tooling development, router ecosystem administration. |

| CoinHippo | For-profit Contractor | Development of Everclear explorer, bridge, and other user interfaces. |

| Veil Capital | For-profit Fund | $CLEAR token distribution, economics, and institutional relationship management. |

| Creed | DAO | Protocol security research. |

Security Council

To guarantee the security and operational integrity of the protocol, the Security Council is a key component of Everclear’s governance framework. It does this by defending the rights of the Everclear DAO, its participants, and the community at large by:

- Conducting Maintenance: Performing essential software updates and configurations to maintain system integrity and functionality.

- Managing Emergencies: Taking decisive actions in situations that require immediate attention to prevent or mitigate risks.

The Security Council operates under the oversight of the Everclear DAO, which is responsible for the election and governance of council members. This setup ensures that the council’s actions are aligned with the interests and security requirements of the entire Everclear ecosystem.

Election Process

Here are the phases and steps taken for the election process within the Everclear Foundation.

- Initial Phase: During the first 6 months, known as the bootstrapping phase, the Everclear Foundation appoints the initial members of the Security Council. This phase is crucial for establishing the council’s foundation and operational protocols.

- Annual Elections: Following the initial phase, elections are held yearly. The election process begins with a month-long call for candidates, managed by the Everclear DAO, to ensure all community members have the opportunity to participate and propose candidates.

- Voting and Induction: After nomination, eligible candidates are presented to the DAO members for voting, and the top 12 candidates are inducted into the council.

Candidates aiming to join the Security Council must meet some criteria to ensure they are well-qualified and aligned with the protocol’s goals:

- Support Requirement: Candidates must receive backing from at least 0.4% of the voting supply.

- DAO Membership: A minimum of 3 months of active membership in the Everclear DAO is required.

- Organizational Representation: At most, three members from the same organization can serve on the council at the same time.

- Conflict of Interest: Candidates must disclose any potential conflicts of interest before starting their campaign.

Some parameters can lead to emergency removals from the council. If eight council members agree, a member can be removed immediately. Also, the DAO can remove members through a two-thirds majority vote, given minimum participation of 6% of the token supply.

While the long-term goal of Everclear is to achieve ungovernance, where the protocol operates autonomously without centralized oversight, the Security Council is necessary during the current stage. It provides administrative and operational control to effectively handle emergency and non-emergency situations. This structure allows the DAO to have experienced representatives managing the protocol while progressing towards more decentralized governance.

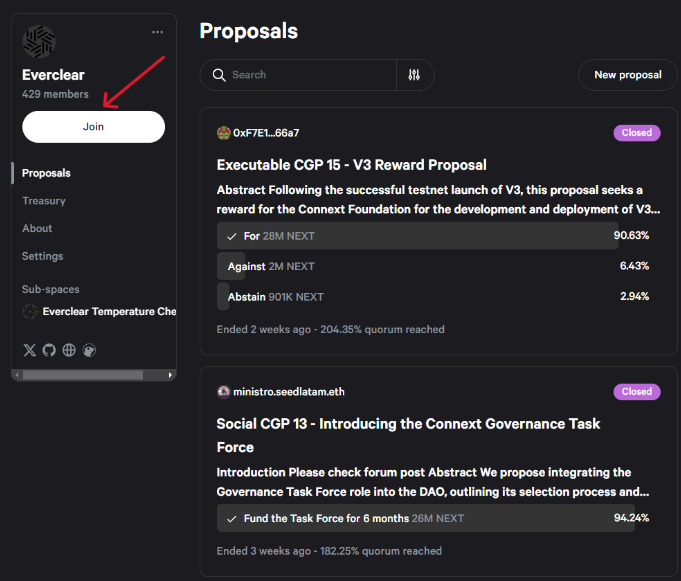

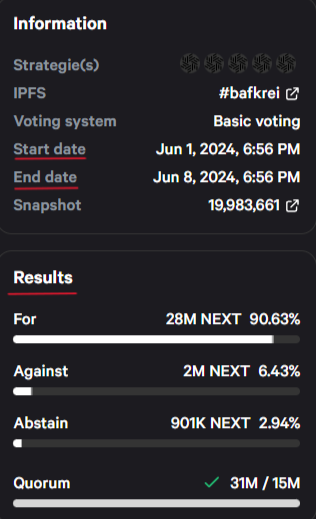

How to Vote on Everclear DAO

Any member of the Everclear DAO can actively participate in the DAO’s decision-making process by discussing and voting on active governance proposals that other DAO members have posted.

$CLEAR token holders or delegates have the authority to take part in Snapshot polls and discussions.

Here’s a guide on participating in discussions and voting on Snapshot.

- 1. Visit the Everclear DAO governance forum here. On this page, proposals are posted for discussion with other DAO members.

- 2. Navigate through the page and find the proposal you want to vote for. Read through the proposal details and the discussion thread at the end of the page.

- 3. You can participate in the discussion and help with the proposal if you have feedback.

- 4. The proposal page usually includes a link to the Snapshot poll. If there’s no direct link, use this link. You are now on the Everclear proposal page on Snapshot, where the voting happens.

- 5. Click ‘Join’ to receive updates and notifications about new proposals. Then, in the top right corner, connect your wallet.

- 6. Note that proposals can be Active, Pending, or Closed. Active means that the voting is ongoing. Pending means that the voting period hasn’t started yet but you can see the start and end date if you click on the proposal. Finally, Closed means that the proposal has been voted.

- 7. Navigate all the proposals and find the one you’d like to vote on. Follow all the prompts within Snapshot’s UI and cast your vote. The voting options are “For”, “Abstain”, and “Against”.

Risks

Like any DeFi protocol, Everclear faces some risks related to smart contracts, technical components, liquidity, and bridges.

A protocol that combines multiple technologies and integrates parts of other projects into its operation has a higher risk profile because the layers of risk are increased. Understanding these risks as a user, developer, or investor before interacting with the protocol is important.

For Everclear, some risk sources may negatively affect the protocol.

Bridge Risk

Whether users are using the Everclear bridge directly or a third-party bridge that uses Everclear, there is the risk of a bridge exploit. Bridge protocols are a common target for exploitation since they store a lot of liquidity (see Multichain & Wormhole) and require a lot of caution when interacting with them. Most bridges have a single-point where they store funds, and that attracts bad actors who want to exploit and steal the funds. In addition, most protocols are still developing and improving their design, and the possibility of having weak spots in their code is high.

Everclear is directly connected with bridge protocols, and potential exploits might also affect it.

System Failures

In the operation of Everclear, system failures such as liveness failures or downtime during upgrades pose significant risks. These interruptions could halt the clearing process, leading to transaction delays across all connected blockchains. Everclear operates with clearing windows estimated every 3–6 hours, meaning that short-term failures might not immediately impact operations; however, prolonged downtime could significantly affect user transactions and degrade the platform’s overall functionality. Extended failures primarily impact the user experience, making the platform appear less reliable, although they do not necessarily compromise the security of funds due to built-in safeguards.

Despite potential operational disruptions, the security of users’ funds remains protected. Everclear leverages features like Arbitrum Nitro’s “forced update,” which allows users to exit transactions directly on Layer 1 in case of downtime, ensuring no censorship or access restriction to funds.

Dependency on Market Makers

The platform’s design incorporates a mechanism to offset settlements between solvers through netting, aiming to streamline and economize the settlement process. However, when netting is insufficient or fails due to imbalances or lack of counterparties, Everclear relies on arbitrageurs to step in and purchase solver invoices. These invoices, representing claims on future settlements, are typically discounted, creating an economic incentive for market makers to participate.

Recognizing the crucial nature of this role, Everclear has established partnerships with major market makers to protect the system.

Auction Changes

Everclear’s operational model includes an auction mechanism to handle situations where netting of solver invoices is not feasible, such as when there is a shortage of solvers or an imbalance in transactions. This reliance on auctioning off invoices to arbitrageurs introduces a layer of volatility and unpredictability in the repayment process, potentially affecting users’ stability and reliability. However, the Everclear team believes that these concerns can be mitigated due to two main reasons:

- Firstly, arbitrageurs in the Everclear system are expected to operate based on predictable pricing curves. This setup reduces the uncertainty in their offers, making it easier for solvers and other participants to anticipate the outcomes of auctions.

- Secondly, by launching with an actively maintained and sufficiently liquid pool of arbitrageurs, Everclear aims to foster robust competition during auctions. This competitive environment will likely lead to more stable prices for the invoices being auctioned.

Such a structured approach should provide solvers a more predictable repayment landscape, maintaining trust and efficiency even in scenarios where direct netting is impossible.

Security

Everclear operates between multiple blockchains, coordinating the settlement of liquidity across these networks, so it is dependent on the security of the supported bridges. This position exposes it to several security challenges that must be managed to prevent vulnerabilities that could compromise user transactions and funds.

Like any platform that relies on smart contracts, Everclear is potentially vulnerable to bugs or flaws within its contract code, which could be exploited to initiate unauthorized transactions or lock funds. To address this, Everclear has undergone rigorous audits by third-party firms, ensuring that the smart contracts supporting the protocol are secure and without vulnerabilities.

Audits

Everclear has gone through multiple audits related to various protocol versions.

The audits listed below are all related to code that became relevant following Everclear’s Amarok network upgrade. Every issue that was found to have the potential to directly cause financial loss has been fixed.

Everclear (Connext) A-4 Security Audit – October 18, 2023 – Macro

- Total Findings: 6 ( 1 Low, 4 Code Quality, 1 Informational) – 5 Fixed

Everclear (Connext) A-3 Security Audit – July 6, 2023 – Macro

- Total Findings: 4 (4 Code Quality) – 3 Fixed, 1 Acknowledged

Everclear (Connext) A-2 Security Audit – July 12, 2023 – Macro

- Total Findings: 37 (7 High, 8 Medium, 6 Low, 15 Code Quality, 1 Informational) – 32 Fixed, 5 Acknowledged

Everclear (Connext) A-1 Security Audit – January 31, 2023 – Macro

- Total Findings: 28 (1 Critical, 4 High, 4 Medium, 5 Low, 9 Code Quality, 5 Gas Optimization) – 18 Fixed, 10 Acknowledged

Everclear (Connext) Security Review – December 15, 2022 – Spearbit

- Total Findings: 214 (15 High Risk, 19 Medium Risk, 48 Low Risk, 40 Gas Optimizations, 92 Informational) – 152 Fixed, 62 Acknowledged

Everclear (Connext) Security Review – August 30, 2022 – Spearbit

- Total Findings: 75 (4 Critical Risk, 16 High Risk, 10 Medium Risk, 11 Low Risk, 5 Gas Optimizations, 29 Informational)

Everclear (Connext) Amarok Contest Findings & Analysis Report – October 17, 2022 – 4rena

- Total Findings: 127: (6 High Risk, 20 Medium Risk, 57 Low Risk & Non-Critical, 44 Gas Optimizations)

Dependencies and Access Controls

Everclear relies on the underlying blockchain networks it supports for its core functionalities. The performance and security of these chains directly impact Everclear’s operations. Everclear relies on the underlying blockchain networks it supports for its core functionalities. The performance and security of these chains directly impact Everclear’s operations.

Furthermore, Everclear’s operation is merely dependent on offchain agents namely Routers, Sequencers, and Relayers, that are responsible for facilitating the flow of transactions across different chains. Each one of them plays an important role in Everclear’s operational model by ensuring liquidity, orderliness, and execution efficiency.

Team

The Everclear team is composed of several individuals with rich backgrounds in the crypto space and valuable contributions to the ecosystem.

Core Team Members

Founder: Arjun Bhuptani

Co-Founder: Layne Haber

CEO: Dima Khanarin

CTO: Rahul Sethuram

HR: Najdana Majors

Head of Growth: Matthew Hammond

Head of Product: Alex White

Engineer: Prathmesh Khandelwal

Ecosystem Lead: Massimo Lomuscio

Marketing & Community: Vavaenesh Sri, Aryan Jain

Advisors: Sarah Brooks

Project Investors

Before rebranding, Everclear (Connext) raised $23.2 million, with a valuation of $250 million. The protocol is backed by some notable institutions and angel investors, as seen below.

FAQ

Why was Everclear created?

A unique challenge for cross-chain intent protocols is optimizing settlements to provide the best experience for solvers.

Currently, cross-chain intent protocols allow users on one blockchain to express their intent for actions on another blockchain, and solvers bid to fulfill these intents efficiently. However, once a solver executes an intent, they face the challenge of being repaid by the protocol on the original chain, not the destination chain. Hence, one of the main issues limiting entry and competition in the solver space is the need for intent solvers (as well as market makers and centralized exchanges) to rebalance their liquidity, which is a complex and costly process.

Everclear aims to solve this problem by introducing the first Clearing Layer, a new layer within the current modular stack, designed to coordinate global liquidity settlement between chains, addressing fragmentation issues inherent in modular blockchains. The Clearing Layer acts as a decentralized network that coordinates global netting and settlement of capital flows between chains. By netting transactions and integrating with the most efficient settlement mechanisms for each asset or ecosystem, Clearing Layers can significantly reduce the costs and complexity of rebalancing for solvers, market makers, and centralized exchanges (CEXs).

How does the Clearing Layer work?

The Clearing Layer authorizes and consolidates blockchain transactions before finalizing settlements, similar to how the Visa payment network operates. Just as Visa sits between the user payment interaction and the final settlement, the Clearing Layer sits at the foundation of the Chain Abstraction stack, facilitating efficient fund transfers and settlements across different blockchain ecosystems.

By tracking all interchain flows as credits, Everclear can clear and offset capital flows in various directions, minimizing the need for actual settlement. This allows solvers to scale effortlessly, programmatically selecting how they prefer to be repaid and eliminating the costs and complexities associated with cross-chain rebalancing. This can substantially reduce operational costs and complexities associated with managing liquidity across different chains.

What is the role of the $CLEAR token in Everclear’s ecosystem?

The $CLEAR token serves as both a governance and utility token within the Everclear protocol, playing a crucial role in incentivizing participants such as solvers, intent protocols, and blockchains to actively engage in cross-chain transactions. It introduces a flexible vote bonding system, allowing stakeholders to lock their tokens as vbCLEAR, which grants voting power and a share of the system’s revenue.

What are the potential benefits of using Everclear for developers and users?

Everclear simplifies the integration of cross-chain functionalities for developers, reduces transaction costs, improves user experience by abstracting technical complexities, and supports a decentralized and scalable blockchain ecosystem.

In particular, Everclear:

- Allows fillers to socialize the costs of rebalancing by netting off settlements against other fillers and users in the network.

- Acts as a programmable layer for fillers or users to build and utilize any number of mechanisms for rebalancing/settling funds (e.g. by plugging into any messaging mechanism, liquidity pool, CEX, etc.)

- Enables permissionless expansion to new chains and rollups, making it possible for any application on any chain to onboard users from any other chain.

What is the primary source of revenue for Everclear?

Everclear’s primary revenue source comes from transaction fees collected from providing liquidity to enable cross-chain transactions. Routers, which are key components in the Everclear network, earn a fee of 5 basis points (0.05%) on all liquidity they provide to facilitate user transactions. This fee incentivizes routers to supply the necessary liquidity for executing transactions across various blockchains.

Can anyone become a router on Everclear?

Yes, anyone can participate as a router in Everclear without a minimum liquidity requirement, providing liquidity and earning fees for facilitating cross-chain transactions.

What role do sequencers play in Everclear?

Sequencers in Everclear collect bids from all chains and randomly select routers to fulfill these transactions, ensuring efficiency and fairness in processing large transfers.

How can developers or platforms integrate with Everclear?

Developers and platforms can integrate with Everclear by connecting to its APIs and following the integration guidelines provided in Everclear’s developer documentation, which offers comprehensive support for setting up and managing cross-chain interactions.