Overview

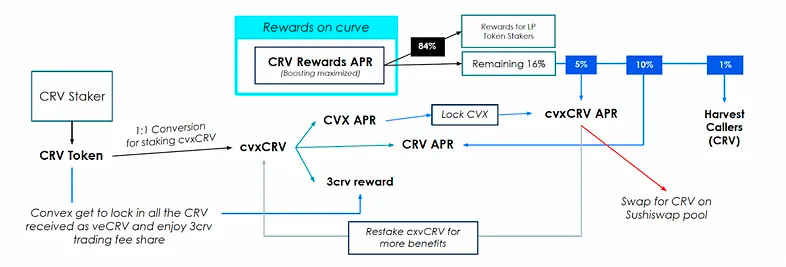

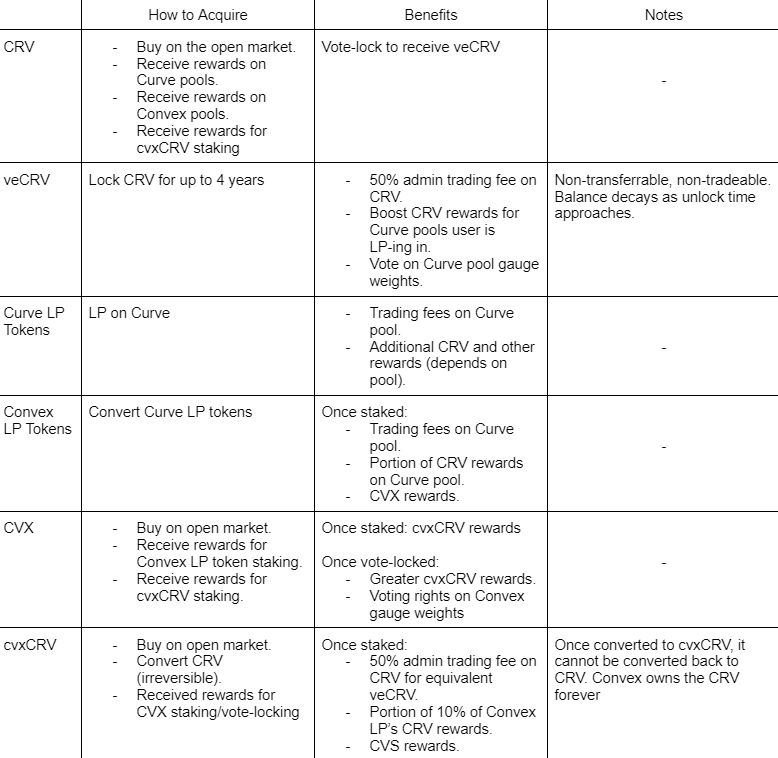

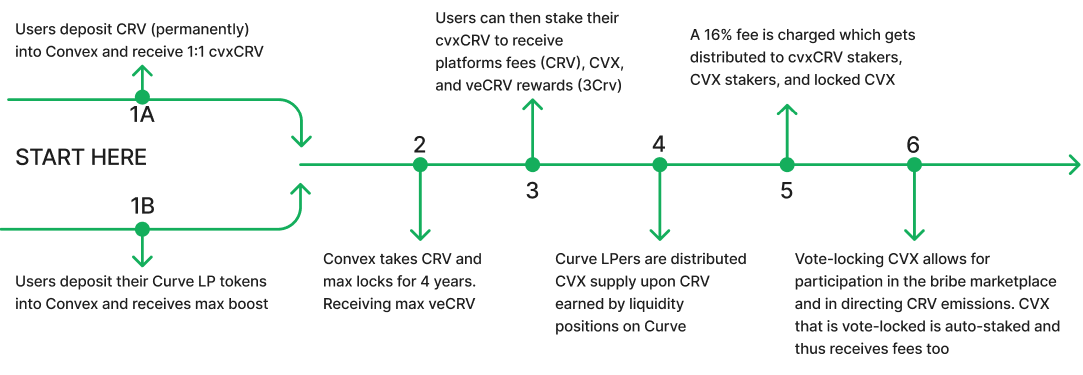

Convex is a protocol created to allow Curve users to boost their rewards (CRV stakers and Curve liquidity providers alike). The protocol’s mission is to simplify the user experience as well as the capital efficiency of the CRV-locking system with the help of its native protocol token, CVX.

Convex provides optimized returns for Curve and Frax LPs by stockpiling their respective governance tokens, veCRV and veFXS. The protocol uses these governance rights to boost returns to its users and allows them to participate in Curve and Frax governance.

Convex governance tokens, vlCVX, are minted by vote-locking native CVX tokens for 16-week periods. vlCVX token holders are responsible for allocating Convex’s voting power on Curve and Frax. This is achieved by acquiring the voting rights of Curve and Frax by obtaining and permanently locking their governance tokens.

Also, Curve and Frax users can deposit CRV and FXS tokens in Convex to receive cvxCRV and cvxFXS at a 1:1 exchange rate

CVX

CVX is the native token of the protocol:

- CVX is rewarded to CRV stakers and Curve liquidity providers pro-rata to the CRV tokens generated by Convex.

- The higher the CRV rewards your pool generates, the more CVX tokens you will receive.

- CVX can be staked on Convex Finance in order to earn a share of Curve and Frax LPs as CRV and FXS earnings.

- The platform fees (CRV, FXS) that are returned to CVX stakers are first locked by Convex as veCRV and veFXS respectively and then tokenized as cvxCRV and cvxFXS before being given to CVX stakers.

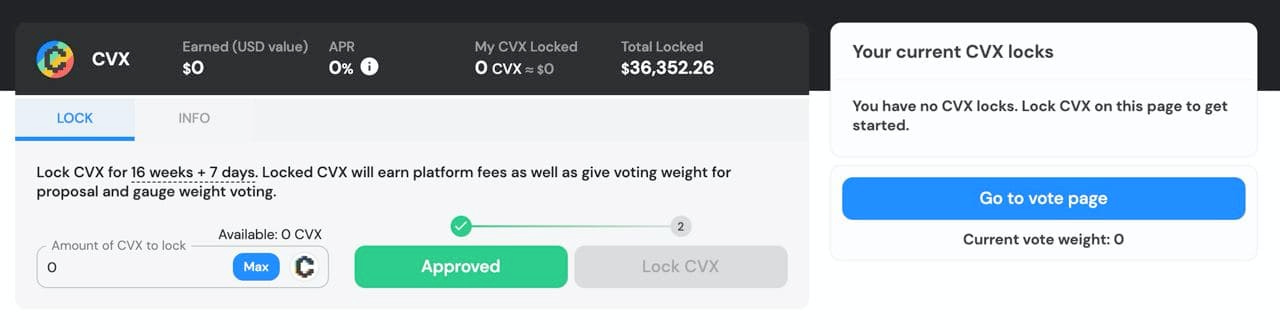

Vote Locking CVX

In order to participate in gauge weight votes and governance proposals, users must vote-lock their CVX tokens for a fixed time period (a minimum of 16 weeks).

- Vote-locked CVX is used for voting on how Convex allocates its veCRV and veFXS towards gauge weight votes and other proposals.

- Under a snapshot passed on September 19, 2023, vlCVX are no longer staked in CVX, removing cvxCRV rewards.

Vote-locking requires users to time-lock their CVX tokens for 16+ weeks. Locked tokens will be inaccessible until 16 full epochs have passed:

- If you lock immediately before a new epoch starts, your CVX will be locked for approximately 16 weeks.

- If you lock in the middle of an existing epoch, your CVX will be locked for 16 weeks + the time between your lock and the next epoch start.

Locks are grouped into weekly epochs that start on Thursday at 00:00 UTC. Deposits during the current epoch don’t count during the currently active vote weight.

CVX must be locked in a completed epoch prior to a vote starting in order to participate.

CVX tokens are automatically unlocked after 16 full epochs have passed:

- Unlocked CVX will sit idle in the locker contract until withdrawn by the user

- Unlocked tokens in the locker contract have the option to relock. Tokens locked in this manner will have vote weight allocated to the current epoch rather than the following epoch.

CVX tokens that sit idle longer than 4 epochs are subject to bounty from other users. Other users may kick idle CVX out of the locker contract and take a 1% bounty pre-epoch past the 4-epoch grace period. Each separate lock is subject to its own grace period.

For example, 100 CVX idle tokens for 5 weeks may be kicked out of the locker contract and the caller would get 1 CVX token, while the original user is left with 99 CVX tokens.

As another example, 100 CVX idle tokens for 6 weeks may be kicked out of the locker contract, and the caller would get 2 CVX tokens, while the original user is left with 98 CVX tokens.

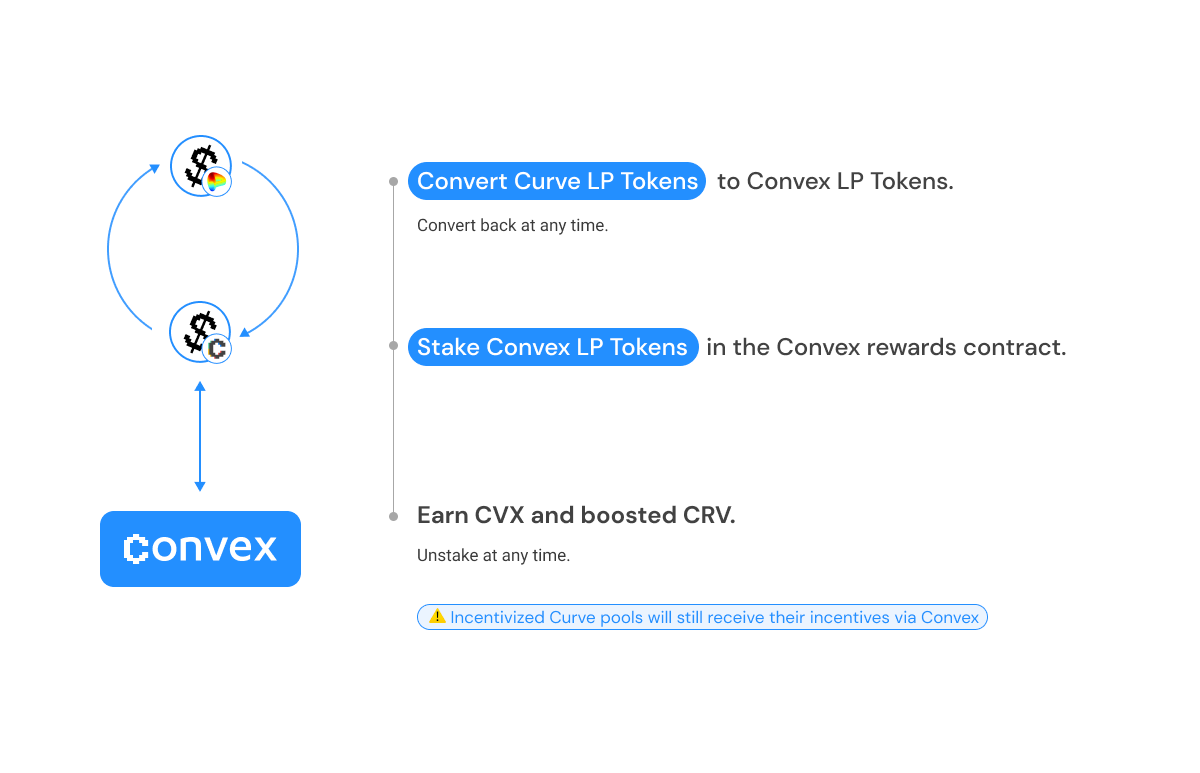

Convex for Curve

Convex is a protocol that allows Curve liquidity providers to earn trading fees and claim boosted CRV rewards without having to lock CRV themselves. Convex lets users receive trading fees as well as a share of boosted CRV received by liquidity providers. This allows for a better balance between liquidity providers and CRV stakers as well as better capital efficiency.

cvxCRV

The cvxCRV token is a tokenized version of veCRV. When users deposit CRV into Convex, those CRV tokens are locked forever on the platform as veCRV. In return, the user receives a tokenized version of veCRV, cvxCRV. This exchange is performed at a 1:1 rate and the cvxCRV conversion is 1-way (although liquidity pools may exist on the market to allow users to exchange CRV for cvxCRV).

cvxCRV staking

cvxCRV can be staked into the Convex platform to receive Curve admin fees (the fees you would get on Convex for staking CRV) paid out in 3CRV (the LP token of Curve’s 3pool, made out of USDT, USDC, and DAI).

Additionally, users staking cvxCRV will receive CRV from Convex’s performance fee, as well as rewards paid out in the native CVX token

- Before the announcement of cvxCRV v2 in 2023, cvxCRV stakers could choose to receive rewards as 100% 3CRV, 100% CRV/CVX, or any ratio in between.

- After the release of cvxCRV v2 in 2023, the protocol allows users to withdraw a blend of assets from the rewards earned in CRV, CVX, and 3CRV

Voting and Gauge weights

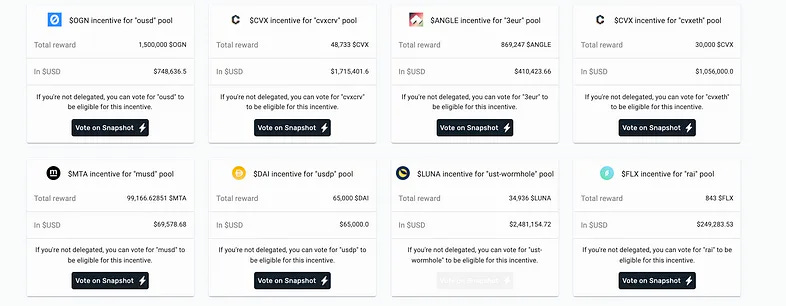

Curve allows veCRV holders to vote on how CRV inflation is distributed across pools by assigning weights to each of the pool’s gauges. As the largest holder of veCRV, Convex can participate in these voting procedures. To do that, the protocol delegates those voting rights to those users who vote-lock their CVX tokens. In return, voters may be rewarded with bribes (rewards given to gauge weight voters of specific pools)

Bribes are a DeFi construct that allows protocols to reward gauge weight voters with native tokens through Votium. For these protocols, the value of this additional liquidity is worth more than the bribes themselves.

By voting for a specific pool, bribers are making a bet that the votes gained from the bribes will attract additional liquidity due to the increased CRV rewards those votes trigger.

- Each gauge will have a hard cap of 50% of Convex’s veCRV assigned to it.

- In case of overflow, those votes will be distributed to other pools in proportion to their voting weight.

- Each gauge must receive at least 0.10% of the votes before weight is assigned

- CRV-paired gauges have a hard cap of 20%

- All non-Ethereum gauge weight will have a combined total cap of 10%

- In case of overflow, those votes will be distributed to other pools in proportion to their voting weight.

Convex has an open position when it comes to adding new gauges and letting voting take place in order to receive CRV rewards. If any of those gauges turns out to be a net negative for Curve or Convex, they can be taken away from the platform.

Convex reckons that new projects may need to be boosted early on in their development stages in order to, later on, accrue a lot in trading fees. At the same time, there should be a sizable amount of value in the Curve pool with healthy parameters in order to assess the potential of those gauges.

A committee of DeFi developers is responsible for looking at new gauges and checking if they uphold the minimum quality requirements. If they don’t, they will not be added to the system.

Voting rounds occur on a bi-weekly basis starting on Thursdays at 00:00 UTC and ending on Tuesdays at 00:00 UTC. They are performed via Snapshot and individual CVX holders may spread their votes among multiple pools in gauge weight votes.

- Curve ownership governance votes require a minimum quorum of 15%

- Curve parameter governance votes require a minimum quorum of 15%

- Gauge weight votes do not have a quorum

The Convex multisig is still required to sign in order to consolidate the outcomes of all CVX Snapshot votes. This applies to both governance and Curve gauge weight votes.

In most cases, Convex will vote in alignment with the results of the Snapshot. However, since Convex and Curve mutually benefit each other, the protocol will not sign any harmful proposal that goes against the interests of both protocols.

Convex for Frax Finance

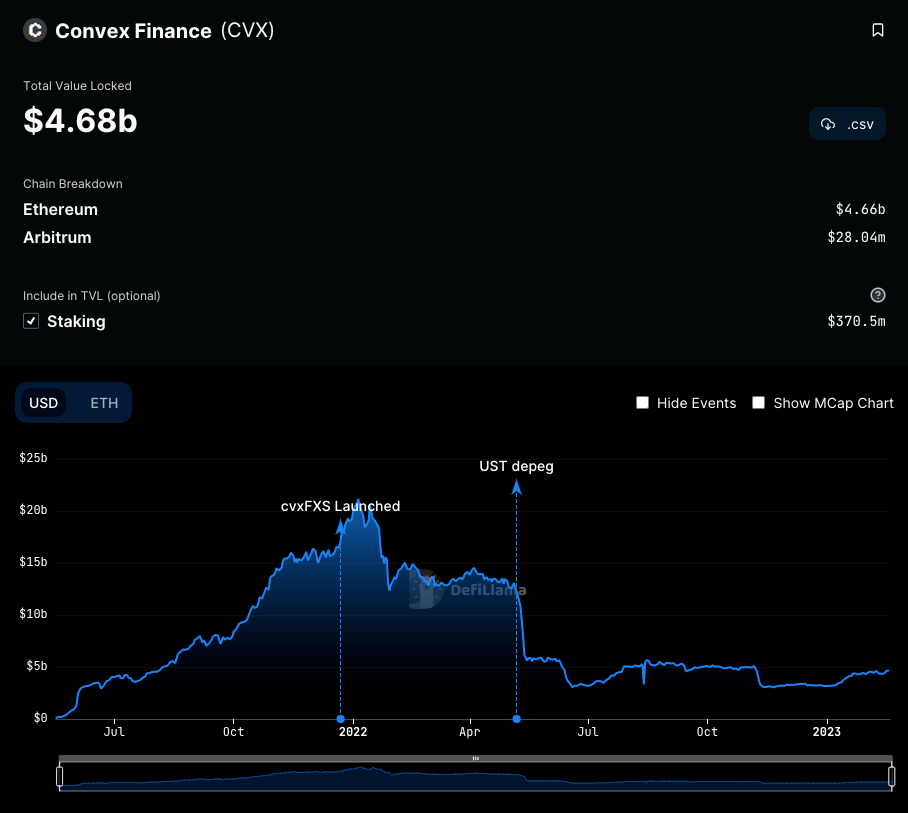

Convex Finance originally started out with the goal of optimizing and expanding the yield opportunities for users of Curve. However, as its positions on Curve started to grow, the protocol broadened its scope in order to increase its growth opportunities as a result of collaborating with other protocols. One of those protocols is Frax Finance, which early on built an outsized position on Convex in order to accumulate voting power on Curve.

Frax adopted a similar monetary policy to Convex and implemented a token-locking mechanism for FXS, its governance token.

cvxFXS

cvxFXS is a tokenized version of veFXS. When a user deposits FXS into Convex, the protocol locks that FXS forever on the platform as veFXS. Next, a tokenized version of veFXS, cvxFXS, is returned to the user at a 1:1 ratio. Similar to cvxCRV, cvxFXS has a 1-way conversion, although liquidity pools may be opened to allow users to swap cvxFXS for FXS.

cvxFXS / FXS LP Staking

cvxFXS can be deposited as liquidity in the cvxFXS / FXS Curve pool. After providing liquidity, users can then stake the LP token on Convex and start receiving fees (same as if the user staked their veFXS on Frax).

LP stakers would be exposed to the price risks inherent to the underlying tokens: cvxFXS, and FXS.

Users staking cvxFXS will receive FXS from Convex’s performance fee, as well as Convex’s native governance token, CVX for the CRV rewards earned by the pool (until CVX emissions end).

Voting and Gauge Weights

vlCVX holders collect 7% of all FXS emissions from pools staked on Convex, paid out as cvxFXS.

Frax governance proposals are available for vlCVX holders to vote on Snapshot

- Convex allocates 20% of the protocol’s veFXS to optimize liquidity and FXS rewards for vlCVX holders and LPs during gauge-weight votes.

- The remaining veFXS weight is distributed proportionally according to the bi-weekly vlCVX gauge votes on pools that are both on Curve and Frax, e.g. Frax metapools.

Convex for Prisma Finance

Convex Finance originally started with the goal of optimizing and expanding opportunities for users of Curve.fi. Going forward, expansion into other protocols will allow further growth and opportunities for the protocol and $CVX holders.

Prisma Finance has adopted a similar token-locking model for it’s governance token, $PRISMA. Convex Finance has expanded to optimize opportunities for liquidity providers on Prisma the same way it has done so for Curve.fi LPs.

cvxPRISMA

cvxPRISMA is tokenized vePRISMA

- If a user deposits $PRISMA into Convex, that $PRISMA is locked forever on the platform as vePRISMA.

- A tokenized version of vePRISMA,, cvxPRISMA, is returned to the user at a 1:1 rate.

- cvxPRISMA conversion is unidirectional. Liquidity pools may exist that allow users to swap cvxPRISMA for PRISMA tokens.

cvxPRISMA Staking

- cvxPRISMA can be staked on Convex to receive a portion of fees one would get for staking their vePRISMA on Prisma Finance, as $PRISMA.

- Additionally, users staking cvxPRISMA may receive the platform native token CVX.

PRISMA Boosts

For Prisma Vaults

- Users with a lock weight are eligible to receive boosted $PRISMA emissions. Boost refers to a bonus on claimable $PRISMA tokens that a Prisma Vault recieves based on its locked $PRISMA weight through Prisma Finance.

- Prisma Finance uses a mechanic called “Boost Delegation”. At that point, users will have the chance to choose Convex to utilise Convex’s lock weight & enjoy boosted rewards.

For Prisma LP’s

- Similar to the way Convex works for Curve.fi, Prisma LPs can enjoy socialized (and simplified) boosting mechanics for their LP positions when staked on Convex Finance.

- Prisma may facilitate multiple liquidity pools from different protocols. All Prisma positions that is receiving $PRISMA rewards will be able to choose Convex for boosting their rewards.

- LP’s originating from Curve.fi will have the chance to be staked on Prisma and receive added boosts through Convex.

Emission Votes and Gauge Weights

Prisma’s governance allows vePRISMA holders to vote on how $PRISMA emissions will be distributed by assigning weights to each emission stream’s “gauge”. As a holder of vePRISMA, Convex Finance can participate in these voting procedures, and these voting rights are passed on to vlCVX holders.

Convex for FX Protocol

“FX Protocol” has implemented a comparable token-locking model for its governance token, FXN. Convex Finance has extended its optimization efforts to benefit liquidity providers on FX Protocol, similar to its approach with Curve.fi LPs.

Understanding cvxFXN

cvxFXN is tokenized veFXN

- If a user deposits $FXN into Convex, that $FXN is locked forever on the platform as veFXN.

- A tokenized version of veFXN, cvxFXN, is returned to the user at a 1:1 rate.

- cvxFXN conversion is unidirectional. Liquidity pools may exist that allow users to swap cvxFXN for $FXN tokens.

cvxFXN Staking

- cvxFXN can be staked on Convex to receive a portion of fees one would get for staking their veFXN on Prisma Finance, as $FXN.

- Additionally, users staking cvxFXN may receive the platform native token $CVX.

Voting and Governance

FX Protocol governance proposals through veFXN are available for vlCVX holders to vote on. Voting will take place on Snapshot. Governance proposals are weighted respectively by their vlCVX vote outcome. Thus if 60% of vlCVX votes for YES and 40% for NO, Convex will submit a vote for 60% YES and 40% NO.

For gauge-weight votes, Convex may allocate up to 20% the protocol’s veFXN for strategic reasons such as optimizing liquidity or FXN rewards for vlCVX holders. The remaining veFXN weight will be distributed proportionally according to the bi-weekly vlCVX votes.

Why the Project was Created

If you are a large LP or a protocol in some Curve pool, you want gauge weights to be high for your pool, so that you can get more CRV rewards from Curve. Those gauge weights, however, are allocated via voting by those who hold veCRV and, therefore, have the voting power on Curve. Because of that, bribes came up as the solution for incentivizing those who have the voting power to vote for your pool.

Bribes exist because bribers want to incentivize veCRV holders to vote for certain pools. There are to reasons to explain: those bribers are large LPs in those pools and want to maximize their CRV rewards, and those bribers want to attract large LPs to their pools.

Andre Cronje built bribe.crv.finance as a tool to simplify the voting process. This tool allowed bribers to specify a Curve pool, an ERC-20 token that the bribe would be denominated in, and the amount of the ERC-20 token being allocated to the bribe. Next, the bribers (veCRV holders) would vote on what Curve pools should receive the CRV incentives. To make that decision, they would take into consideration the active bribes being allocated to each pool, since they would be able to claim those tokens from the bribers along with the CRV rewards for that pool.

As an example, let’s suppose there was a 1M SPELL bribe for the MIM stablecoin. If you are a user who has 10,000 veCRV and there are a total of 1M veCRV votes for that pool, then you would be able to claim 10,000 SPELL tokens during the next active voting round.

Because of this, the briber is making a bet that the cost of the bribe they spend will ultimately be less than the value they accrue in the form of having more liquidity inside their pool and the additional CRV LP rewards they may get from being an LP.

After some time, the Convex core team saw a need for a platform that allowed users to maximize their boost on Curve in a simplified manner that did not force them to lock their tokens for long durations of time. The team also believed that CRV stakers should be rewarded more since they are also mining CRV incentives along with liquidity providers.

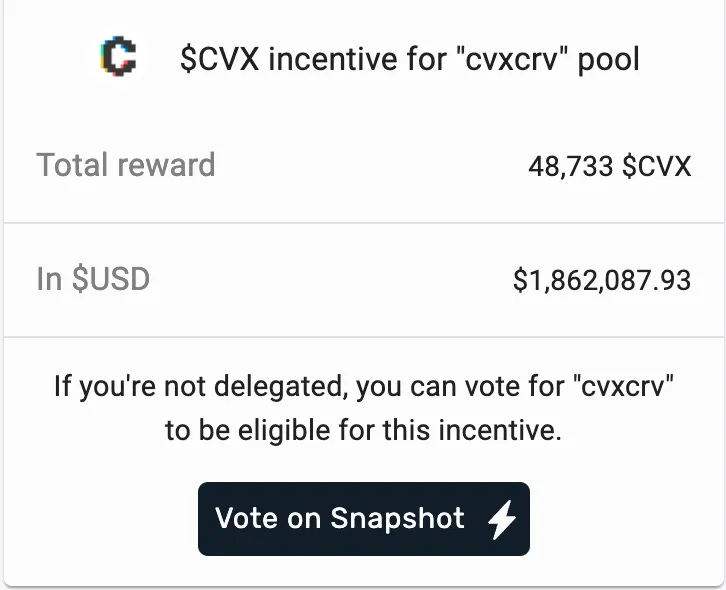

Afterward, just like bribe.crv.finance was created for Curve, Votium was created to allow vlCVX holders to vote on Convex gauge weights. This would largely impact the actual voting results on the Curve gauge due to Convex’s size.

Similar to Curve bribes, bribers can specify a Curve pool, a token, and an amount being distributed to vlCVX holders who vote for those pools.

Votium also allows for vote delegation: you can assign your vlCVX to Votium, and it will do the voting on your behalf. Votium tries to vote for incentives optimally in order to give vlCVX holders the best returns.

Roadmap

There are no public roadmaps, but plans and updates are usually announced on their social media channels, especially via Twitter and Discord announcements.

Team

Convex Finance was founded by a group of developers who have chosen to remain anonymous since its launch.

Multisig Members

- C2tp – Convex Finance

- Winthorpe – Convex Finance

- Sam Kazemian – Frax Finance

- Tommy – Votium

- Charlie – Curve Finance

DeFi Subsector

Due to their high-performance fees, yield aggregators like Yearn and Badger, who were previously thought of as Convex competitors, started deploying between 40-70% of their AUM into Convex in order to be able to stay on top of the Curve game.

As Convex carries the majority of the voting power for Curve, it can also monetize governance power through platforms like Votium, where other protocols can bribe voters to grant them a 2.5x boost

The Convex-Curve Flywheel

Chains

The majority of the liquidity is on Ethereum.

- In November 2022, Convex announced its first steps on a cross-chain strategy by deploying on Arbitrum.

- In March 2023, Convex announced its expansion to Polygon

There are some notable differences on the Arbitrum deployment with respect to Ethereum:

- Due to the lower gas costs on Arbitrum, there is an updated smart contract for the LP rewards distribution. This means that there is no longer a need for a trailing 7-day payout on pool rewards. This also means that there is no need to have an automated “harvester” that collects and distributes the rewards

- LP tokens for Convex pools on Arbitrum are transferable between addresses

- On Arbitum, CVX rewards will not be minted as a ratio of CRV earned. Instead, CVX rewards for LPs will be distributed according to the ratio of votes for pools in the bi-weekly vlCVX gauge weight votes. These CVX tokens are outsourced from the “Liquidity Mining” portion of tokens.

For Users

- Deposit any amount of CRV into Convex

- Receive cvxCRV in exchange for providing CRV

- Receive a share of total CRV rewards earned by Convex

- Earn trading fees from Curve

For Investors

Investing Strategies

If you are a Curve liquidity provider:

- Deposit Curve LP tokens on Convex and Convex will stake them in the Curve gauge with boosted reward rates

- Earn CRV rewards and extra incentives that you can claim periodically from the underlying gauge

- Receive CVX native tokens pro-rate for each CRV you receive

- Add or remove liquidity at any time with no deposit or withdrawal fee

If you are a CRV staker:

- Deposit CRV in Convex. Your CRV will be locked for 4 years and you will receive cvxCRV

- Deposit cvxCRV in the rewards contract (can be withdrawn at any time)

- Receive a share of boosted CRV

- Earn from veCRV rewards (Curve trading fees)

- Exchange cvxCRV for CRV at any time using the incentivized cvxCRV / CRV liquidity pool

- Receive CVX pro-rata for each CRV you deposit

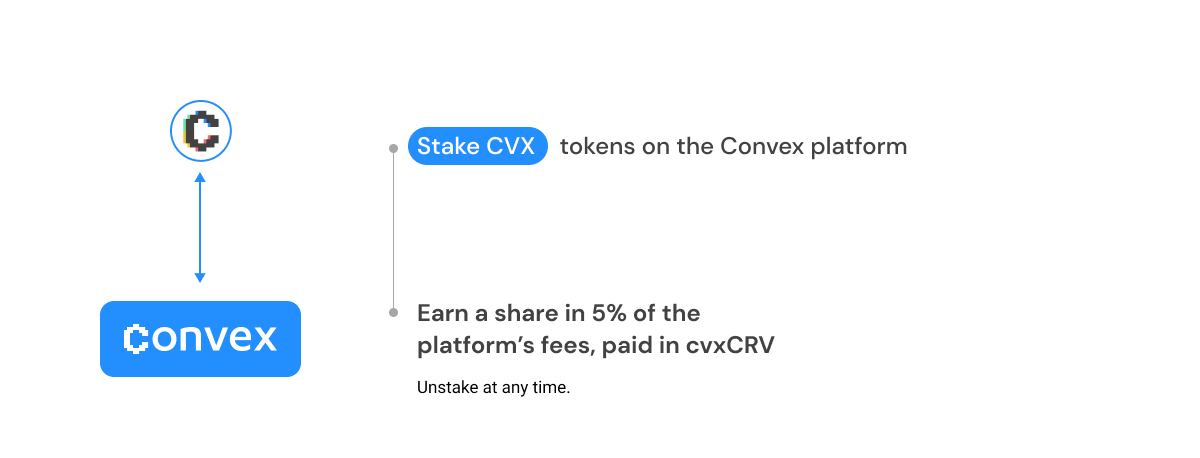

If you are a CVX staker:

- Deposit CVX in Convex (can be withdrawn at any time)

- Receive a portion of platform fees paid out in cvxCRV

Staking Curve LP Tokens

Users can take LP tokens from Curve and stake them with Convex in order to earn CVX and boosted CRV

Converting CRV and Staking cvxCRV

Users who are holding CRV can convert it into cvxCRV and stake it on the platform to earn the usual rewards accrued from veCRV (fees paid out in 3CRV) plus a share of 10% of the Convex LPs boosted CRV earnings, as well as CVX tokens on top of that.

By converting CRV to cvxCRV at a 1:1 rate, users can stake to become eligible for the same benefits as holding veCRV on Curve, as well as their share of 10% of all CRV generated by Convex and additional CVX rewards emissions.

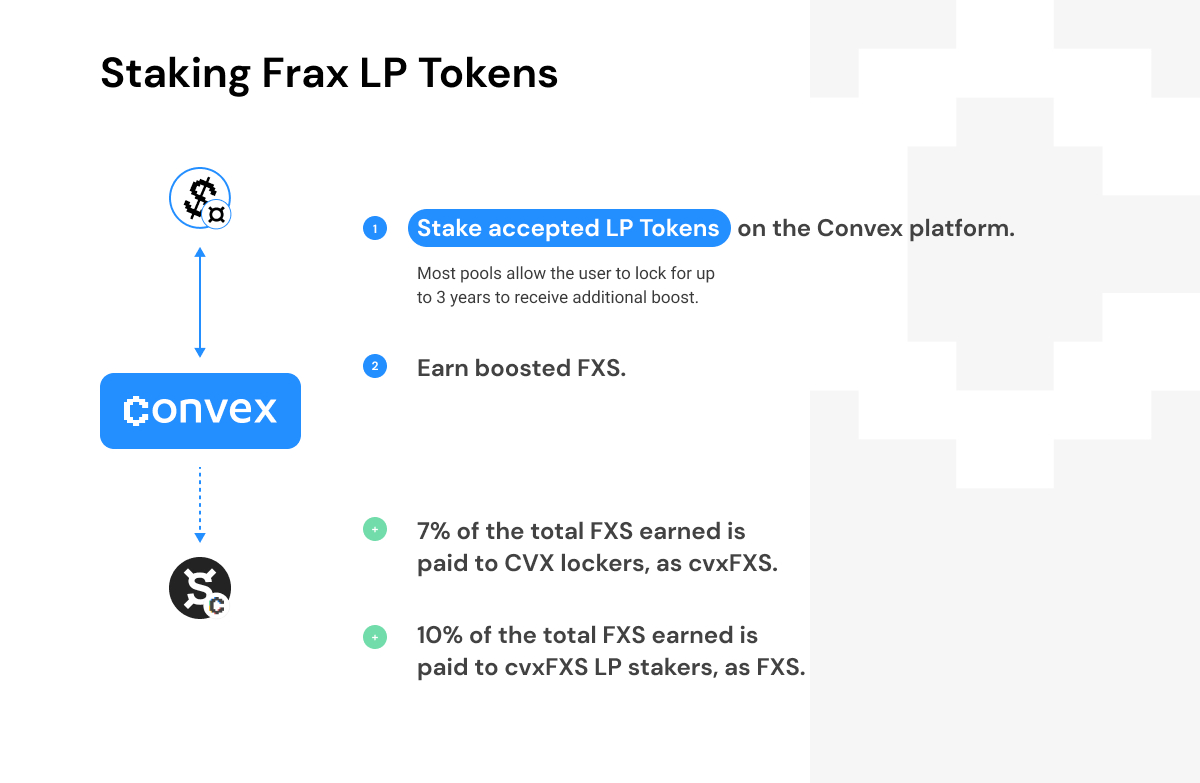

Staking FRAX LP Tokens

Users with Frax LP tokens can stake them on Convex. Frax LPs are subject to timelocks (all pools require a minimum of 1 day locked, and most pools allow locks of up to 3 years). Users can receive additional FXS earnings boosts based on their lock duration.

Convex veFXS socialized boosting is not affected by the time-lock duration the users select.

- 7% of the total FXS earned is paid to CVX lockers as cvxFXS.

Staking CVX

Users can stake CVX tokens on Convex to earn 5% from fees paid in cvxCRV.

Vote-Locking CVX

Users can vote-lock their CVX tokens in order to participate in gauge weight or governance votes.

Convex for CRV Stakers

Convex rewards CRV stakers with a share of the boosted CRV rewards accrued by Convex. This makes Convex an ideal destination for those users who wish to stake CRV while remaining liquid.

- Earn a share of the Convex fees in CRV

- Earn trading fees from Curve in 3CRV (LP of the 3pool: USDT, USDC, DAI)

- Receive liquid cvxCRV, which allows anyone to exit their staked CRV position

- Receive CVX rewards

- Claim veCRV airdrops (requires cooperation with external protocols)

Convex for Liquidity Providers

Convex allows liquidity providers to earn trading fees and claim boosted CRV from liquidity mining rewards without locking CRV themselves.

- Earn claimable CRV with a high boost without having to lock CRV

- Earn CVX rewards

- Zero deposit and withdrawal fees

- Zero fees on extra incentive tokens

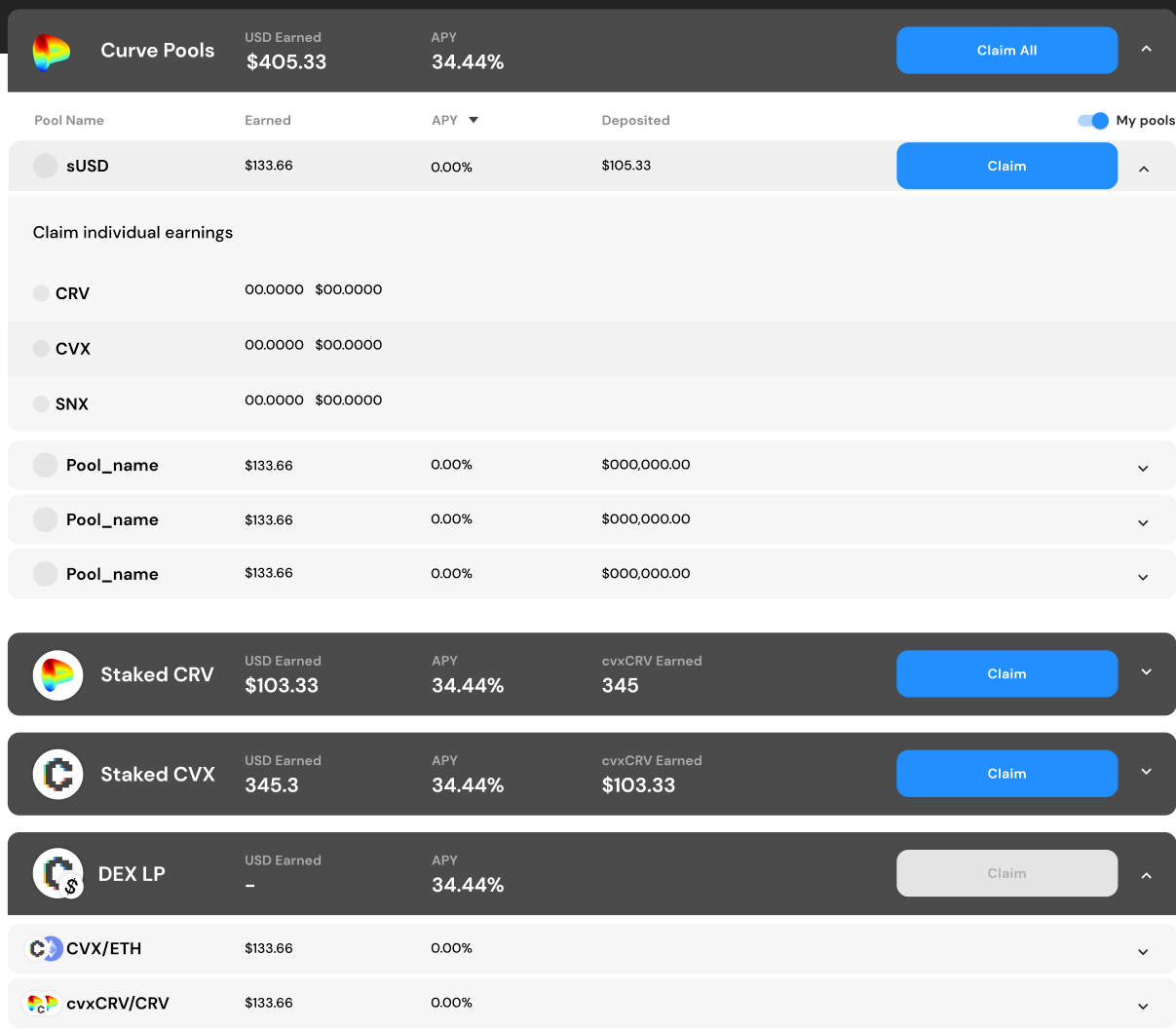

Rewards Claiming

Business Model

Convex allows Curve users to simplify the staking experience on Curve and allows anyone to benefit from Curve’s boost system.

Liquidity providers earn trading fees and claim boosted CRV without locking CRV themselves. Instead, Convex pools funds from all users and locks CRV for the maximum duration of 4 years in order to achieve the maximum boost for the 2.5x voting power multiplier. In return, Convex issues a derivative liquid representation of the underlying veCRV position, cvxCRV.

Revenue Streams

Convex boosts user returns and collects a 17% fee on all CRV and FXS earned by its LPs. The fees are redistributed to other users within the Convex ecosystem to align the interests of all groups using the protocol. Because of this, Convex LPs may earn additional incentive tokens (SNX, LDO…) depending on the liquidity pool their assets are deposited in (but fees are only taken on CRV and FXS rewards).

- Revenue share: https://tokenterminal.com/terminal/projects/convex-finance/revenue-share#revenue_share

Current APR

The current APR displays the net yield percentage that users get on their collateral when they are in the pool. All the fees are already abstracted from this number.

For example, if you have 100,000 in a pool with 100% APR, you would be receiving ~$274 worth of rewards per day.

This yield is based on all the currently active harvests that have already been called and are currently being forwarded to active LPs over a 7-day period from when the process started.

When you join the pool, you will instantly receive the yield of the current APR per block.

Projected APR

The projected APR represents the yield that is currently being generated by the pool based on the current TVL, the current Curve gauge boost active on that pool, and the rewards being priced in USD.

This means that if all parameters stayed exactly the same for a few weeks (TVL, CRV boost, CRV price, CVX price, and potential third-party incentives), this would eventually become the current APR.

Economics

Fee Breakdown

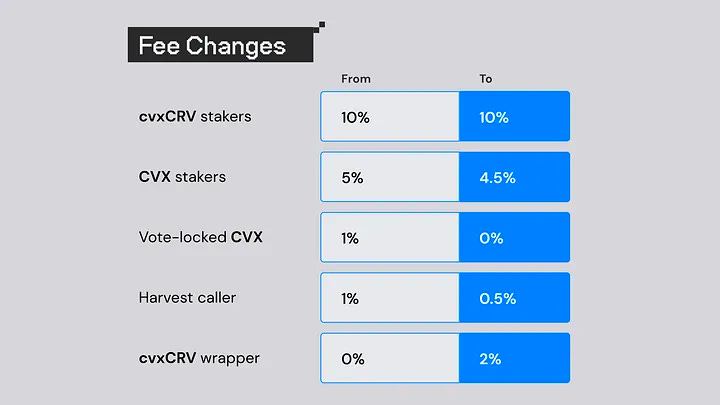

Convex has no withdrawal fees and charges minimal performance fees which are used to pay for gas and to distribute to CVX stakers.

Convex for Curve

There is a 17% total fee on all Curve revenue generated by Curve LPs:

- 10% goes to cvxCRV stakers. This is paid out as CRV.

- 4.5% goes to CVX stakers. This is paid out as cvxCRV.

- 2% goes to treasury, which is used to obtain cvxCRV.

- 0.5% goes to the harvest caller. This is paid out as CRV.

Fees are taken only from CRV revenue; no fees are taken from tokens from incentivized Curve pools, nor from veCRV admin fees

Fees paid as cvxCRV remain as CRV tokens while they sit in the rewards contract until users can claim their rewards individually. Once the user claims, the CRV tokens are locked in Convex as veCRV, and cvxCRV is minted 1:1 and returned back to the user.

Fees given to the treasury will support the crv/cvxCRV swap ratio by removing cvxCRV from circulation when favorable to do so and adding additional incentives to stake cvxCRV directly in the new wrapper contract.

The fees for Convex Curve can be adjusted between hard-coded ranges:

- 10-15% for cvxCRV stakers rewards

- 3-6% for CVX staker rewards

- 0-2% for treasury fees

- 0.1-1% for “caller” fees – gas reimbursement for calling gas-heavy functions to harvest and distribute rewards

Convex for Frax

There is a 20% total fee on all FXS revenue generated by Frax LP’s on the platform.

- 10% of all FXS earnings will be distributed to cvxFXS LPs as FXS

- 5% of all FXS earnings will be distributed to vlCVX holders, as cvxFXS

- 5% goes to treasury, which is used to obtain cvxFXS.

- 0-1% of the combined 20% fee is then taken for harvest caller.

Fees paid as cvxFXS remain as FXSt tokens while they sit in the rewards contract until users can claim their rewards individually. Once the user claims, the FXS tokens are locked in Convex as veFXS and cvxFXS are minted 1:1 and returned back to the user.

The fees for Convex Frax can be adjusted between hard-coded ranges:

- 0-20% for cvxFXS/FXS LP staker rewards

- 0-20% for cvxFXS to vlCVX

- 0-20% for platform fees

- 0-1% for harvest caller

For both Convex Curve and Convex Frax there is a 20% fee ceiling.

Operating Expenses

The Convex Treasury is given 9.7% of the total CVX supply vested over 1 year and is controlled by the Convex multisig.

CVX will be used by the treasury for awarding and incentivizing actions/protocols that are deemed to have a positive influence on the future of the platform.

- Concurrent payments:

- Pool incentives

- Gas reimbursements for development and deployment costs

- One-time payments

- Audits

- Planned payments

- Bug bounties

On March 29, 2023, Convex received 901,392 ARB tokens from the Arbitrum Foundation, which was sent to its treasury.

Tokens

CRV’s demand is the desire from LPs to increase the yield they earn on their assets. Because of this, the way Curve captures the demand for its token is through a veToken economic model that incentivizes LPs to buy or loc CRV in order to attain voting power as veCRV, which is the token required to vote on which pools will receive CRV emissions. Therefore, CRV finds its demand coming from 3 primary use cases:

- Utility, since LPs need to buy and lock CRV if they want to have voting power and direct emissions to their pools.

- Dividend, since veCRV holders get a revenue share from protocol fees and are often bribed by other protocols in exchange for their voting power.

- Asset appreciation as a result of future market dominance and growth prospects.

Since liquidity follows yield, LPs would lock their CRV for the maximum allowed time (4 years) to maximize their voting power via Curve’s boost coming from the 2.5x multiplier. However, this comes at the cost of holding an illiquid position for long periods of time. This is where Convex comes in to solve the underlying mechanism.

Users would voluntarily deposit their CRV tokens on Convex and get access to a max boost in the form of a liquid wrapper cvxCRV.

cvxCRV (Tokenized veCRV)

- cvxCRV is the 1:1 tokenized representation of CRV deposits that are locked for the maximum duration in Curve (4 years) as veCRV

- cvxCRV can be staked on Convex to receive platform fees (in CRV), CVX, and veCRV rewards (in 3CRV)

On January 2023 a new wrapper contract for staked cvxCRV was announced in order to enable several enhancements to the existing cvxCRV staking:

- Ability to directly add additional incentives to cvxCRV stakers.

- Adjustable rewards or user-adjusted weight for CRV, CVX, and 3CRV rewards

- ERC-20 transferable staked cvxCRV.

At the protocol level, the goal is to divert 2% of platform fees to the treasury, to acquire and stake existing cvxCRV towards the new wrapper contract. The cvxCRV that is acquired and staked will add to the overall rewards while removing cvxCRV from circulation.

This also introduced changes to protocol fees:

In addition to the fee changes to acquire and remove cvxCRV from circulation and using said cvxCRV to boost wrapper rewards, Convex would also move some of the existing CVX emissions to provide extra incentives for cvxCRV stakers.

A snapshot was put up on January 4, 2023, with a 100% support quorum at the end of the vote on January 9, 2023.

cvxFXS (Tokenized veFXS)

- cvxFXS is the 1:1 tokenized representation of FXS deposits that are locked for the maximum duration in Frax Finance (4 years) as veFXS.

- cvxFXS/FXS LP tokens can be staked on Convex to receive platform fees (in FXS).

- cvxFXS single staking has been enabled after a proposal to enable it was passed on February 8, 2023.

- 10% Convex Frax protocol fee

- veFXS fees

cvxPRISMA (Tokenized vePRISMA)

Prisma Finance is a non-custodial and decentralized Ethereum LST-backed stablecoin called $mkUSD.

Prisma introduces a novel tokenomics framework, carefully designed to drive towards a path of decentralization and autonomy of the Prisma protocol. The approach covers governance mechanisms and financial incentives aimed to align various shareholders within the Prisma ecosystem. The PRISMA token is at the core of this framework, serving as a securing element of the Prisma protocol.

Participating in Prisma governance requires that a user lock a balance of PRISMA tokens. Once locked, the tokens give the user “lock weight”, which is used in determining voting power.

Prisma’s token locking is inspired by, and functions similarly to, the popular veToken model created by Curve.

cvxPRISMA will launch in sync with the locked $PRISMA airdrop distribution process. ALL eligible locked $PRISMA in the airdrop will optionally be claimable as liquid $cvxPRISMA directly on Convex.

As with other Convex derivatives, $PRISMA will be locked in perpetuity & voting rights will be managed by $vlCVX holders.

cvxFXN (Tokenized veFXN)

The f(x) Protocol is a solution designed to meet the demand for a stable asset while addressing concerns related to centralization risks and capital efficiency. Conceived by longstanding Curve/Convex friend Aladdin DAO, it emerged in response to the banking crisis in March and the depegging of $USDC, which underscored the necessity for a fresh approach to stable assets.

In contrast to conventional stablecoins that maintain a fixed value, typically $1, the f(x) Protocol introduces a novel concept known as a “floating stablecoin,” or $fETH. Unlike pegged assets, $fETH’s value isn’t fixed; instead, it tracks a portion of the price movements of $ETH. This design allows $fETH to maintain its value robustly, even in volatile market conditions.

The f(x) Protocol employs a strategy for achieving stability by introducing an accompanying asset known as $xETH. This asset functions as a cost-free leveraged long position on $ETH, effectively absorbing the brunt of Ethereum’s price volatility. Consequently, this stabilization mechanism ensures that $fETH experiences only minor fluctuations in its value, thanks to the protective layer provided by $xETH.

The $FXN token plays a pivotal role within the F(x) protocol by acting as its governance token. Token holders who choose to lock their tokens may engage in the decision-making processes of the protocol. Additionally, the protocol implements a revenue-sharing mechanism, aligning the interests of its users with those who hold veFXN.

cvxFSN mechanism is as follow:

- Similar to the CRV and cvxCRV relationship, the deposited veFXN tokens will be automatically transformed into cvxFXN, and the original FXN tokens will be permanently locked.

- FXN tokens locked within Convex will remain inaccessible for the maximum lock duration in perpetuity.

- The conversion process will be unidirectional; cvxFXN tokens cannot be reverted back to FXN tokens. Users will always have the option to exchange between the two tokens using liquidity pools on Curve Finance. (Exchange will be facilitated at the Curve Finance conversion rate.)

- vlCVX users will determine how Convex Finance allocates veFXN vote weighting in FX Protocol’s governance.

Users can stake cvxFXN on Convex Finance to earn a share of fees obtained by staking their veFXN tokens.

CVX – Convex Token

- CVX can be staked to receive a share of the platform fees as cvxCRV.

- CVX is the governance token used for voting on gauge weights.

- CVX is minted pro-rate for each CRV token claimed by Curve LPs on Convex.

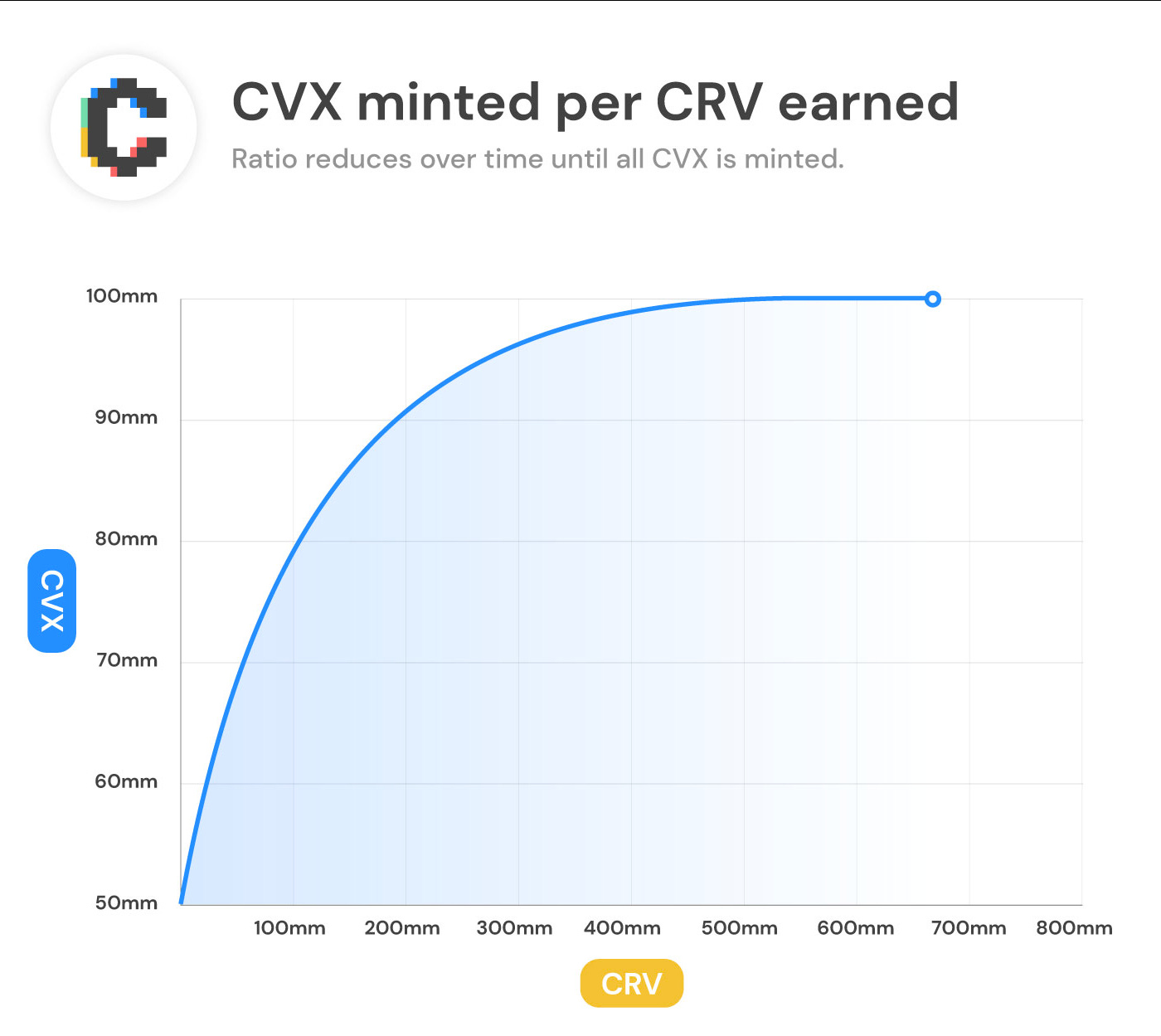

- The CVX/CRV mint ratio reduces every 100,000 CVX.

The process of minting follows a logarithmic curve where, the more CRV is earned, the less CVX is emitted. For every 100,000 CVX minted, the CVX/CRV ratio decreases as per the CVX minting formula

- As more CVX is accumulated, more CVX will be emitted until the maximum supply is reached.

- When the max CVX supply is reached, Convex will still accumulate CRV, which has the effect of increasing the CRV/CVX ratio

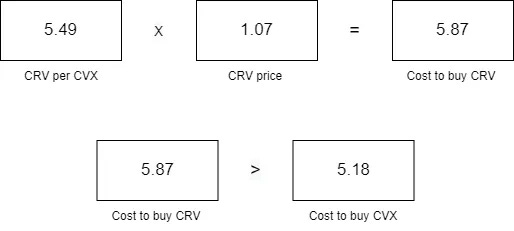

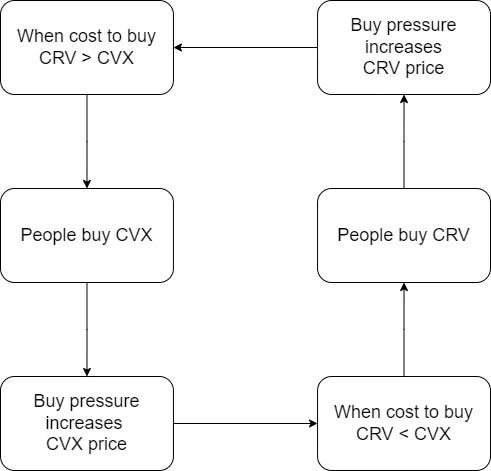

- Since each CVX implicitly contains an underlying amount of CRV, there is also an indirect relationship between the price of both tokens. A user who wants more voting power has two options:

- Buy CRV and lock it

- Buy CVX and lock it

To increase their voting power, users will default to the cheapest or most capital-efficient option

The value of CRV locked within Convex measures the efficiency of CVX. When the bribe efficiency is negative, vlCVX drives more CRV emissions per $1 of voting power than veCRV. In those situations, buying and locking CVX is more efficient than veCRV.

- If the line is below 0, it is cheaper to buy CVX.

- If the line is above 0, it is cheaper to buy CRV.

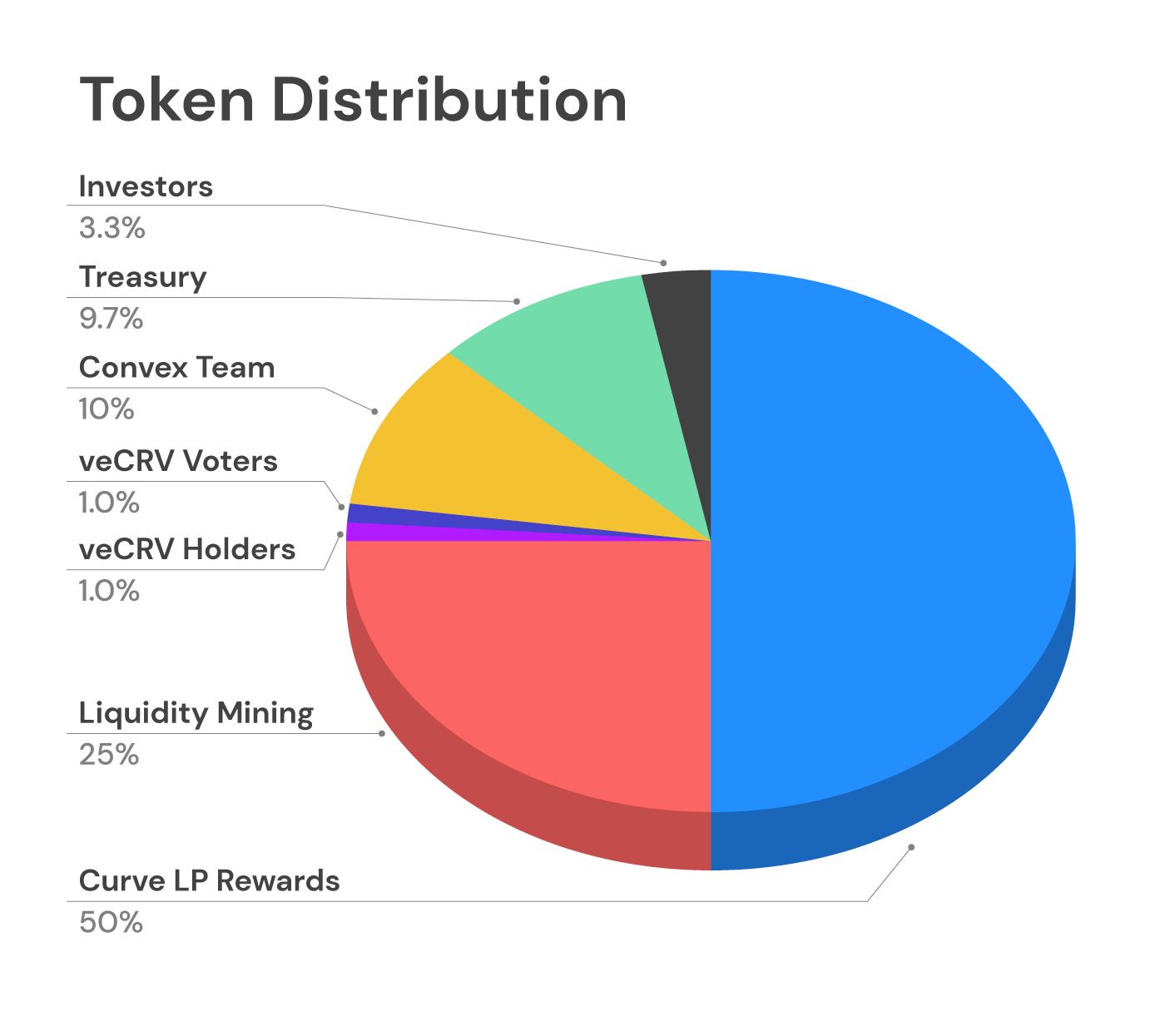

- Max supply: 100M

- 50% goes to Curve LP rewards (rewarded pro-rata for CRV received on Convex)

- 25% goes to liquidity mining incentives programs (distributed over 4 years)

- 10% to the Convex team (1-year vesting)

- 9.7% goes to the treasury (1-year vesting and used for future incentives or other community-driven activities)

- 3.3% for investors (1-year vesting). 100% of the investment funds were used to pre-seed boost functionalities by locking them forever (no cvxCRV minted)

- 1% for veCRV holders (instantly claimable airdrop)

- 1% for veCRV holders who vote to whitelist Convex (instantly claimable airdrop)

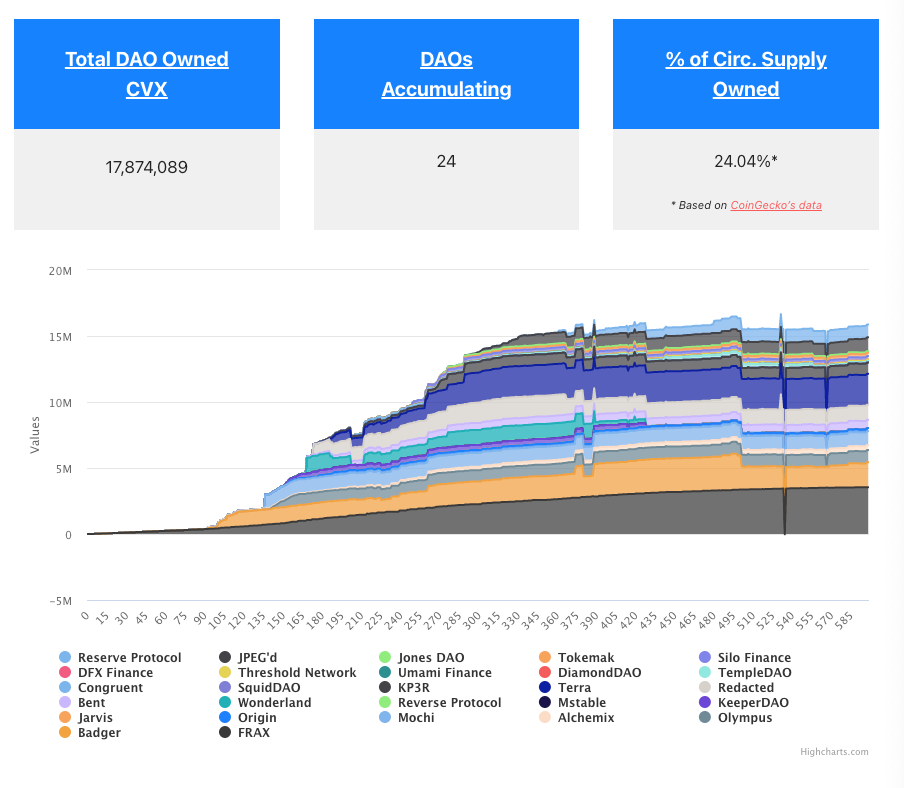

Total DAO-Owned CVX

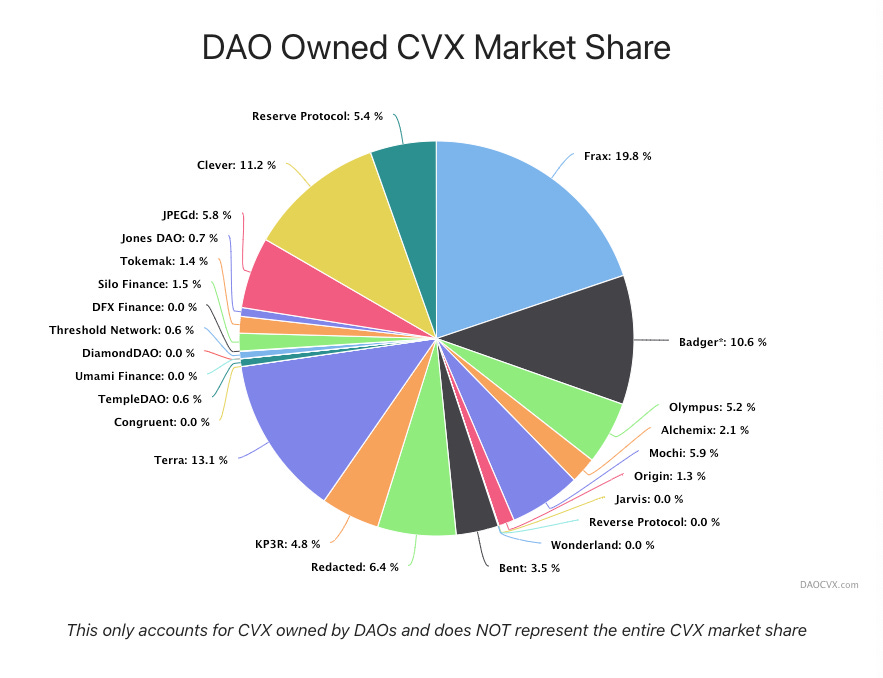

DAO-Owned CVX Market Share

Governance

Since Convex users do not own the underlying veCRV held by the protocol, that means that rather than using bribe.crv.finance, vlCVX holders would use votium.app to delegate their vlCVX and vote for the pools that yield the highest return

Even though both websites do the same thing – give people incentives in return for voting for their pools, there are a few differences:

- Bribe.crv incentives need to be claimed every week, which is expensive in gas costs.

- In Votium, incentives can be stacked and users can claim all of the accrued rewards at once

- When a user delegates to Votium, its position will automatically vote for whatever pool offers the highest reward for vlCVX holders

- If the user lets Votium vote on their behalf, it will usually spread votes across many pools, which can result in many token rewards.

Vote Delegation

Voting rights from CVX tokens may be delegated to another address/entity. This is ideal for those users who hold CVX tokens but are unsure or are uninterested in how they would vote on proposals or gauge weight votes. The core Convex team can also be an eligible entity to delegate tokens to.

Delegating is a separate action from locking: you don’t need to delegate if you lock, nor do you need to lock if you delegate.

- You delegate your voting power by delegating

- You increase your voting power by locking

If a user delegates without locking, the user would be delegating 0 voting power at the current time, but if the user locks in the future, this voting power will be delegated automatically.

Delegations can be changed or revoked at any time.

Risks

Apart from the inherent risks that might be present on Convex’s smart contracts, users are also exposed to any risks that pertain to Curve and Frax.

Multisig Functions

The Convex multisig can perform the following functions:

- Update the stash factory.

- This is to make sure we can handle new gauge types on the Curve platform. Stashes control extra rewards (SNX, BOR, PNT, LDO, etc.) by claiming them from the curve gauge and transferring them to Convex reward contracts.

- Update the pool manager.

- This is to make sure we can handle new types of pools on the Curve platform and/or add rules to adding new pools if needed.

- Control the arbitrator vault.

- Before Curve v3 gauges, if two gauges have the same extra reward (currently stkAave) it is impossible to tell exactly how much each pool is entitled to. Thus if two pools share the same reward, these rewards are pushed to an arbitrator vault to later use off-chain logs and redistribute to the appropriate pools.

- Change platform fees allocated to stakers within hard-coded ranges.

- 10-15% for cvxCRV stakers rewards

- 3-6% for CVX staker rewards

- 0-2% for “treasury” fees. (This is an arbitrary address that can be used for various functions, thus the low limit of 2%)

- 0.1 – 1.0% for “caller” fees. Gas reimbursement for calling gas-heavy functions to harvest and distribute rewards.

- There is an absolute fee ceiling of 20%

- Set the “treasury address” and allocate up to 2% of platform fees back to this address.

- Controls the Convex Treasury Account. (info)

- Vote for Curve DAO proposals.

- Vote for Curve gauge weights.

- Set distribution weights on the Convex Master Chef.

- Shutdown/pause new deposits to Curve Pool staking contracts.

- Allows users to withdraw all funds

- Shutdown/pause new deposits to everything.

- Allows users to withdraw all funds

- Apply a new “operator” on the whitelisted proxy contract if and ONLY if the current operator is completely shut down.

- After removing all liquidity from convex, the system can be shut down and rebooted as a new version.

- vlCVX: add a new reward

- vlCVX: change the distributor of each reward type

- vlCVX: set staking ratio of locked CVX

- vlCVX: set boost parameters for vlCVX

- vlCVX: set the kick incentive for vlCVX

- vlCVX: recover non-reward erc20 tokens

- vlCVX: shutdown vlCVX contract. (allows everyone to withdraw immediately)

Security

In June 2022, a Twitter user under the username of @alexintosh reported some abnormal activity on the Convex website with regards to suspicious contract approvals. Shortly after, well-known security researcher @samczsun communicated with the core team via Twitter DM and minutes later the official Convex account informed about a frontend issue.

After some investigation, it was confirmed that the DNS of www.convexfinance.com had been hijacked, taking users to a copy of that website where users would interact with malicious contracts.

Convex used NameCheap as its domain registrar and the attacker was able to access the NameCheap account, even with 2FA turned on, a strong password, and security alerts. Immediately after realizing the attacker had disabled all security alerts, the Convex team was able to point the frontend back to the real website and re-enable security notifications.

In total, an estimated 15,968 cvxCRV and 433 CRV tokens were suspected of being stolen from users. Convex published a list for affected users to revoke their approvals. After the approvals are revoked, the Convex team will reimburse the funds from the protocol treasury

Audits

Convex has been audited by MixBytes prior to launch (report) and by Peckshield (report) for its Frax Finance pools.

Curve, which Convex provides a boosting layer on top of, has been audited by Trail of Bits, Quantstamp, MixBytes, and ChainSecurity.

Frax finance pools, which are integrated into Curve, are the largest pools after the ETH/stETH pool. They have been audited by Certik, Trail of Bits, and an ongoing audit by Shipyard.

Bug Bounties

Convex has an in-house bug bounty program for bug disclosures. To be eligible for bounties, the user must satisfy the following conditions:

- Must be the first reporter of the vulnerability.

- Must be able to verify a signature from the same address.

- Provide enough information about the vulnerability.

Bounty payouts are separated into the following tiers:

- Almost Certain

- Low Severity – $10k

- Medium Severity – $50k

- High Severity – $250k

- Possible

- Low Severity – $1k

- Medium Severity – $10k

- High Severity – $50k

- Unlikely

- Low Severity – $1k

- Medium Severity – $1k

- High Severity – $10k

Dependencies and Access Controls

In Q1 2022, a security incident forced the team to migrate the vote-locked CVX contract. A bug made it possible for expired locks to relock directly to a new address, which, in turn, enabled them to claim more cvxCRV rewards than they had earned.

The bug was responsibly disclosed before anyone managed to profit from it; no loss of funds occurred and user deposits were not at risk. To migrate users to the new vlCVX contract, the active locked CVX at the time was unlocked from the old contract and relocked in the new one.

Project Investors

3.3% of CVX’s supply was allocated to investors who pre-seeded Convex’s boost and locked their CRV (with no cvxCRV minted). These funds are vested over 1 year.

FAQ

When do I have to lock/delegate CVX in order to be eligible for incentives?

- Gauge weight votes are bi-weekly, starting on Thursdays at 00:00 UTC and ending on Tuesdays at 00:00 UTC.

- To be eligible for incentives you need to lock in before the proposal starts.

- If you locked before the start of the proposal but didn’t delegate, you can still vote manually.

What are the advantages of delegating to Votium and participating in the Union?

- You don’t need to worry about how to vote (e.g. voting incorrectly for a pool with 0 rewards).

- You don’t need to spend gas claiming multiple tokens (it is all converted to compounding cvxCRV).

- Rewards compound even before you claim them, rather than sitting idle in the claim contract.

What’s the difference between staking and locking?

- Only CVX is eligible for voting rights and bribes.

- The downside of locking is the loss of liquidity for 16 weeks.

- Staking typically offers less APR, and there are no bribing or voting benefits.

What’s the thinking behind staking vs. locking CVX?

- CVX gives you exposure to the underlying assets controlled by Convex and you maintain governance rights for only locking for a 16-week period.

- If you don’t lock CVX, then your yield is lower and you will have no governance rights or profits from bribes.

- The main reason not to lock is if you plan to hold the token long-term and are planning to sell in the short term.

I locked CVX but vlCVX is not showing on my wallet

- Since vlCVX is a non-transferable asset, it does not show on wallets like a normal token.

- You can see your position on Zapper or on the Convex lock page.

Why does staked CVX have more TVL than locked CVX?

- Because all locked CVX is also staked.

What happens at the end of a lock period?

- You will be able to withdraw your tokens.

- To continue to accrue bribes and keep voting power, you will have to relock.

Community Links

- Website

- Docs

- Developer docs

- Blog

- Telegram chat

- Telegram Announcements

- Discord

- Github

- Convex/Curve yield calculator

- Coingecko

- DefiLlama