Overview

Chainlink is a Decentralized Oracle Network (DON) that enables the secure connection between on-chain smart contracts and off-chain data providers and services. Chainlink’s infrastructure has set an industry standard for decentralized Oracle networks. By providing tamper-proof inputs and outputs, Chainlink’s Oracle Network expands the capabilities of smart contracts by enabling access to real-world data and off-chain computation.

Furthermore, Chainlink can be categorized as an industry standard for building, accessing, and selling Oracle services that are needed to power dApps and smart contracts on any blockchain. This is achieved by relying on Oracle networks that have the ability to connect any API or off-chain computations to on-chain smart contracts across DeFi, insurance, gaming, and other major industries. Oracles are needed for all the best blockchain use cases to work, and Chainlink is the primary Oracle provider.

Chainlink connects smart contracts with external data APIs using its Oracle network. A Basic Request Model is used to request data from a single Oracle source. This oracle source will provide a robust and trustworthy response that results from the aggregation of data from many oracles. With on-chain aggregation, the data is put together by a decentralized network of independent Oracle nodes.

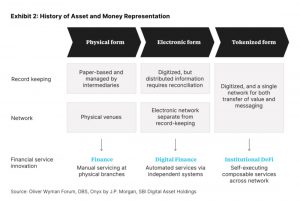

Contracts are meant to define the terms and obligations that must be met between two or more parties to exchange value with one another. Historically, a third party acts as an intermediary to verify that all terms and conditions are met. However, thanks to the advent of blockchain technology, smart contracts, and oracle networks that can bring real-world off-chain data on-chain, it is now possible to replace centralized intermediaries with decentralized infrastructure. This reduces counterparty risk and improves operational efficiency.

To overcome the lack of connectivity between different blockchains and data providers and API services, Chainlink enables hybrid smart contracts that can act as the middleware layer. As such, Chainlink facilitates the retrieval of external data inputs and pushes them on-chain. Not only do oracles serve as a two-way bridge between smart contracts and the outside world, but they also provide a security framework that protects against any single point of failure such as data manipulation or downtime.

Besides, it is worth noting that Chainlink is not a single Oracle network. Instead, it is an ecosystem consisting of multiple decentralized oracle networks running in parallel. Each oracle network can provide a multitude of oracle services without cross-dependencies on other oracle networks.

Chainlink provides the necessary developer tools required to construct any type of Oracle network, such as using multiple data sources, multiple Oracle nodes, various aggregation methods, payment penalties, reputation services, or visualization tools.

How Chainlink Works

Chainlink’s core functional objective is to bridge two environments: on-chain and off-chain. This is achieved through an on-chain workflow that has 3 steps: oracle selection, data reporting, and result aggregation.

Chainlink nodes are powered with the Chainlink Core software, which is responsible for interfacing with the blockchain, scheduling, and balancing work across its various external services. Node operators may then choose to add software extensions, known as external adapters, that allow operators to offer additional off-chain services.

Chainlink Architecture

Chainlink’s Data Feed Architecture is made out of 3 components: the Basic Request Model, the Decentralized Data Model, and Off-Chain Reporting.

Basic Request Model

The Basic Request Model connects smart contracts with external data by handling Chainlink API requests 1:1 by an oracle node.

This model uses a ChainlinkClient smart contract that enables other smart contracts to consume the data provided by Oracle nodes. The client constructs and sends requests to known Chainlink oracles by using a transferAndCall function that is implemented by the LINK token. This request will send encoded information in order to trigger a specific logic in the receiving contract within a single transaction.

The Oracle contracts that receive the encoded information are owned by Oracle node operators, which run alongside off-chain Oracle nodes. These contracts are responsible for handling the requests made through the LINK token. After execution, they send an event containing information about the original request. By emitting this event, the Oracle network can monitor the off-chain data being emitted.

Off-Chain Oracle Nodes will listen for the events emitted by Oracle contracts and, once they detect an event being emitted, they will use that data to perform a specific task. The most common job performed by these Off-Chain Nodes is to send a GET request to a given API in order to retrieve data from it, parse the response, convert the result into a blockchain-compatible data format, and submit the transaction back to the Oracle contract.

Decentralized Data Model

The Decentralized Data Model is based on the premise of on-chain data aggregation from many independent oracle nodes in order to provide a trustworthy data response. This is the underlying mechanism for updating Data Feeds.

Each Data Feed is updated by multiple independent Chainlink Oracle operators, whose results are aggregated on-chain by the AccessControlOffchainAggregator.

Data Feeds are built and funded by the community. Normally, these are users and protocols that rely on the accuracy of the data being used by their smart contracts. As more users rely on a specific Data Feed, the quality of its data will improve. Because of this, each Data Feed has its own properties based on the needs of its community users.

Each Data Feed is updated by a Decentralized Oracle Network, and each Oracle operator is rewarded for publishing the data to the network. The exact number of oracles contributing to each feed varies from one use case to another. However, for an update to take place, the Data Feed aggregator contract must receive responses from a predefined minimum number of nodes.

- Minimum number of oracles for each Data Feed: https://data.chain.link/

- Using Data Feeds: https://docs.chain.link/data-feeds/price-feeds/

Components of a Decentralized Oracle Network

- Consumer contract: uses Chainlink Data Feeds to consume aggregated data

- Proxy contract (AggregatorProxy.sol): smart contracts that point to the aggregator contract for a particular Data Feed. Using proxies enables the underlying aggregator to be upgraded without causing any interruption to consumer contracts.

- Aggregator contract (AggregatorV3Interface): receives periodic data updates from the oracle network and stores the aggregated data on-chain so that consumers can retrieve it and act upon it within the same transaction

Off-Chain Reporting (OCR)

Off-Chain Reporting (OCR) is an improvement in the degree of decentralization and scalability of Chainlink. By using Off-Chain Reporting data aggregators, all nodes can communicate using an off-chain peer-to-peer network. In this process, a lightweight consensus algorithm is run in each individual node in order to report observations and sign their validity.

- The nodes regularly elect a new leader who will request its followers to provide freshly signed observations in order to aggregate them into a single report.

- This report is then sent to the follower nodes in order to verify its validity.

- If a quorum of followers approves the report by sending a signed copy back to the leader, the leader assembles a final report with the quorum’s signatures and broadcasts it to all followers.

- The nodes attempt to transmit the final report to the aggregator contract according to a randomized schedule. Once the aggregator receives this report, it will verify the quorum signatures and expose the median value to data consumers with the corresponding block timestamp.

- All nodes watch the blockchain and remove any single point of failure during the data transmission. If the designated node were to fail to get the transmission confirmed, other nodes will intervene until the final report is confirmed.

The end result is a single aggregate transaction that is transmitted, saving a significant amount of gas. Submitting one aggregated transaction provides benefits such as:

- Reduced network congestion from Chainlink Oracle networks

- Fewer gas costs for node operators

- More scalable data feeds that can accommodate more nodes

- Increased decentralization of Oracle networks to benefit from additional accuracy and availability

Data Feeds

Chainlink Data Feeds are used by developers to connect their smart contracts with real-world data (can be historical data too). Data Feeds are aggregated from many data sources by a decentralized set of independent Node Operators, following the requirements of the Decentralized Data Model.

- First, data providers aggregate raw data from a series of centralized or decentralized sources. For instance, this could be centralized and decentralized exchanges whose raw data would account for time, volume, and outliers in price data.

- Second, independent Chainlink nodes fetch the data from the data providers and combine the results into a single aggregated value.

- Finally, multiple Chainlink nodes aggregate their results together off-chain to generate a tamper-resistant oracle report that is made available to smart contracts on-chain.

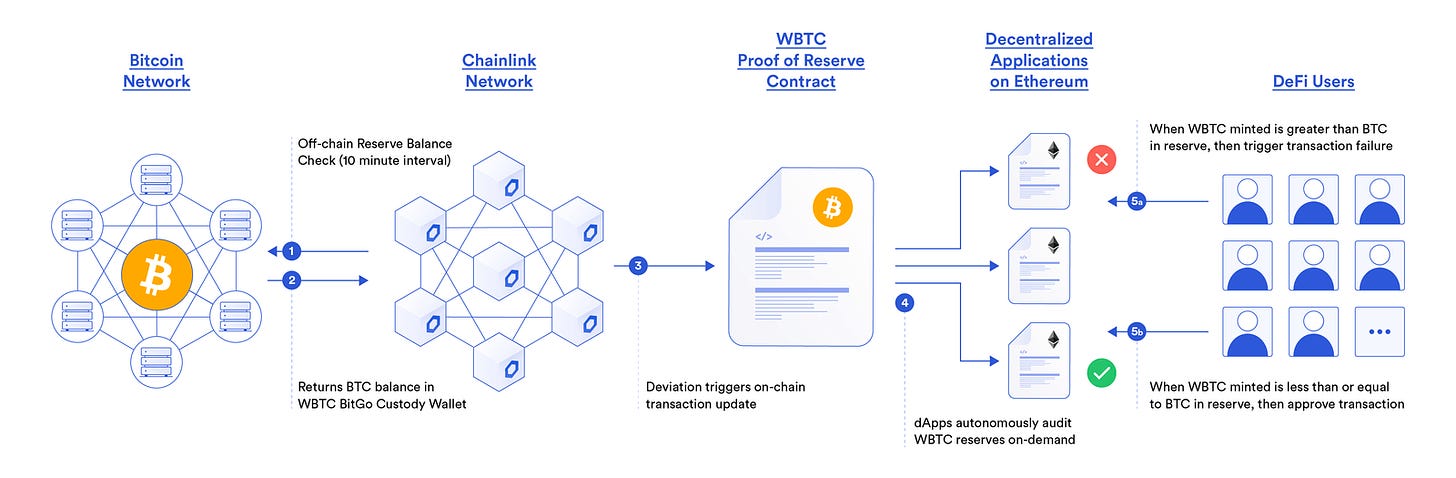

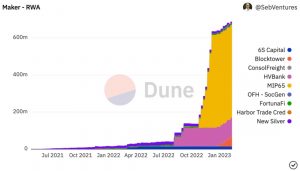

Proof of Reserve Feeds

Chainlink Proof of Reserve verifies the collateralization of any on-chain asset backed by off-chain or cross-chain reserves. This approach challenges the way the traditional financial system works, which operates in an opaque and undercollateralized manner that results in systemic risks and market-wide failures.

Decentralized Finance provides a more transparent and trust-minimized alternative to financial products that are powered by deterministic smart contracts and cryptographic truth. The latest developments of the industry have resulted in an increasing demand for new collateral types that extend beyond native on-chain assets, including cross-chain tokens, fiat-backed stablecoins, tokenized real-world assets… Because of that, it is critical that businesses that hold cryptocurrencies can create public attestations regarding the state of their reserves in order to prove solvency to their depositors via independent audits.

Chainlink Proof of Reserve Feeds provides the status of the reserves for several assets that belong to an entity. This is achieved by a decentralized network of oracles that enable the autonomous auditing of collateral in real-time.

There are two types of Proof of Reserve Feeds: cross-chain reserves and off-chain reserves.

- Cross-chain reserves are sourced from the network where the reserves are held. This is achieved by running an external adapter that queries the source-chain client directly.

- Off-chain reserves are sourced from APIs through an external adapter where the data can be provided by:

- Third-party auditor that verifies the reserves and provides the data through an API

- Custodian or bank responsible for holding the reserves

- Self-attested API from the token issuer

NFT Floor Pricing Feeds

Chainlink NFT Floor Pricing Feeds are supported by Coinbase Cloud’s aggregation algorithm to offer users a conservative and risk-averse estimation of the price floor for an NFT collection. Combined with Chainlink’s infrastructure, NFT Price Floor Feeds can eliminate extreme price outliers and make these feeds resistant to market manipulation. This is a critical feature for dynamic NFTs, on-chain derivatives, NFT borrowing and lending markets, gaming guilds, CeFi products, prediction markets…

NFT Floor Pricing Feeds can be used to derive the denominated pair in multiple currencies (BTC, ETH, stablecoins…)

Rate and Volatility Feeds

Chainlink rate and volatility feeds provide data for interest rates, interest rate curves, and asset volatility. You can read these feeds the same way that you read other Data Feeds.

There are 3 types of data feeds available under this category:

- Bitcoin Interest Rate Curve

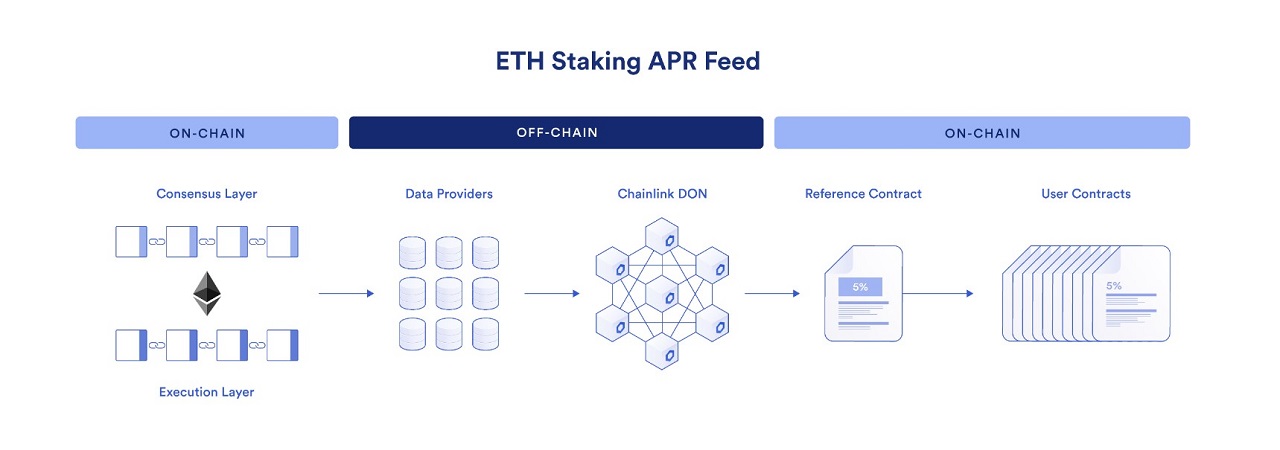

- ETH Staking APR

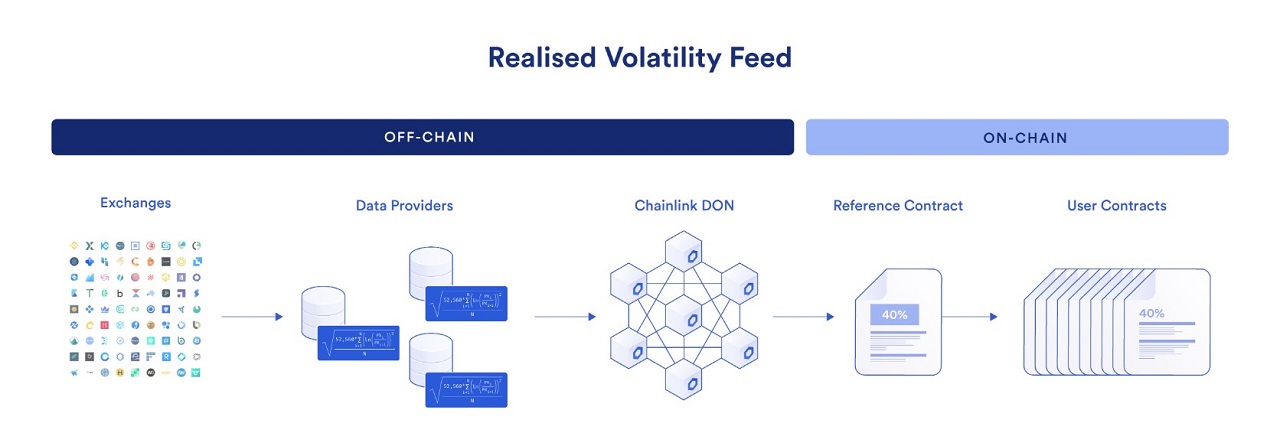

- Realized Volatility

The addresses for these feeds can be found here.

Bitcoin Interest Rate Curve

Lenders and borrowers use base rates to evaluate interest rate risk for lending and borrowing contracts, asset valuation for derivatives contracts, and an underlying rate for interest rate swap contracts.

Bitcoin Interest Rate Curve Data Feeds provide a base rate to assist with market decisions and quantify the risks of using certain protocols and products based on current and predicted baseline interest rates. The curve’s normalized methodology and daily rates introduce more consistency and predictability to the ebb and flow of digital asset markets.

Bitcoin Interest Rate Curve Feeds incorporate a wide range of data sources such as OTC lending desks, DeFi lending pools, and perpetual futures markets.

ETH Staking APR

The ETH Staking APR feeds provide a trust-minimized and tamper-proof source of truth for the global rate of return from staking as a validator to secure the Ethereum network. The annualized rate of return is calculated over 30-day and 90-day rolling windows. Data providers use off-chain computation to calculate returns at an epoch level, reach consensus on the APR, and then write the results on-chain to be used by decentralized protocols and Web 3 applications. Feeds are currently configured to update at a minimum of once per day.

Realized Volatility

Realized volatility measures asset price movement over a specific time interval. This value is expressed as a percent of the asset price. The more an asset price moves up or down over time, the higher the realized volatility is for that asset. Please note that realized volatility is not the same as implied volatility, which measures the market’s expectation about future volatility typically derived from options markets.

Each data feed reflects the volatility of an asset over a specific rolling window of time. For example, some data feeds provide volatility data for the last 24 hours, 7 days, and 30 days of time. You can compare the data across these windows to infer whether the volatility of an asset is trending up or down. For example, if realized volatility for the 24-hour window is higher than the 7-day window, volatility might increase.

The same high-quality data providers used in Chailink’s price feed sample price data every 10 minutes to refresh volatility estimates. On-chain values are updated when the feed heartbeat or deviation threshold is met.

L2 Sequencer Uptime Feeds

L2 Sequencer Uptime Feeds are used in the context of Layer2 chains, specifically optimistic rollups. Optimistic rollup protocols move all execution off of the Layer 1 chain and return the results of that execution from the Layer 2 back to the Layer 1. To do this, these protocols rely on a sequencer that will roll up the L2 transactions by batching multiple transactions into a single transaction.

If a sequencer becomes unavailable, it is no longer possible to read/write the APIs that consumer applications are using on the L2 network. The only way to do this would be to interact directly with the L1 optimistic rollup contracts. This would be unfair for users, for whom the L2 chain would be down and, therefore, it would be impossible for them to interact with any dApp on that chain.

By keeping track of a sequencer’s uptime, Chainlink can inform its users and applications about the status of the sequencer at any given point in time. This could, for example, help to prevent a cascade of liquidations on money markets.

- Every 30 seconds, Chainlink nodes trigger an OCR that updates the status of the sequencer by calling it through a proxy contract

- The validator contract on the L2 chain will check if the latest status is different from the previous message and will send the information back to the sequencer uptime feed

- The sequencer uptime feed will mark the status of the sequencer as 0 if the sequencer is up, and 1 if it is down

- A consumer contract on the L2 chain can read these values from the proxy contract and handle any possible outage.

For instance, if a Layer2 chain like Arbitrum becomes unavailable, the ArbitrumValidator contract will continue to send messages to the L2 network through a delayed inbox on the L1. This message will stay there until the sequencer is back up again. When the sequencer comes back online after its downtime period, it will process all transactions from the delayed inbox before it starts accepting new transactions.

This process is different on Optimism and Metis, where a network of node operators will run an external adapter on the L1 chain in order to relay the status to the Aggregator contract, which will update the status of the L2 validator contract. On the L2, the sequencer will post the message to the OptimismSequencerUptimeFeed contract, which contains all the instructions necessary to update the status and allow consumers to read the status of the sequencer.

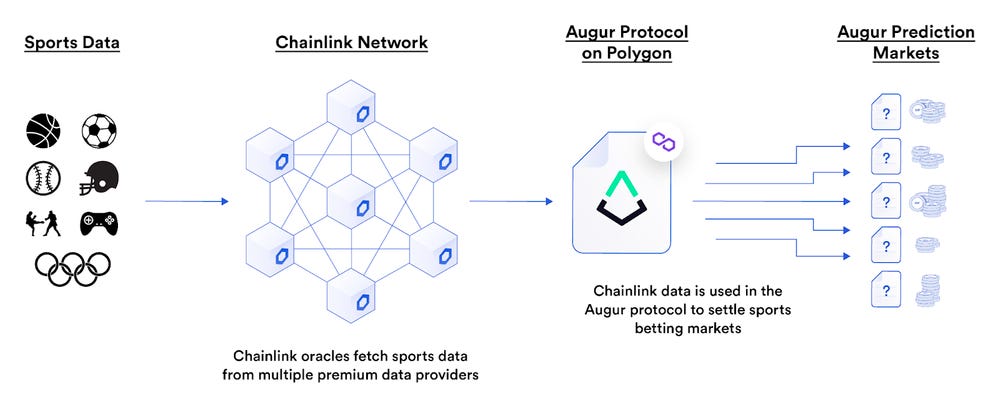

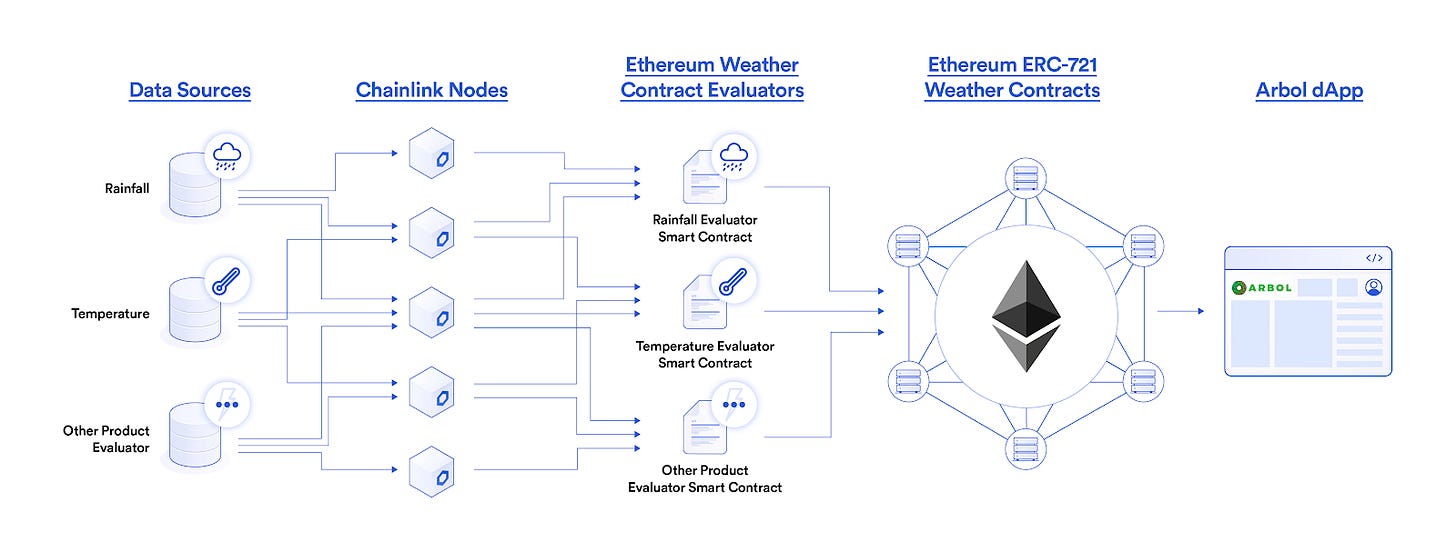

Real World Data

Smart contracts can be connected to the outside world with off-chain generalized data such as parametric insurance, weather data feeds, sports data, prediction markets that rely on sporting, or political events, predictive supply chains…

Feed Registry

The Chainlink Feed Registry is an on-chain mapping of assets to feeds. This allows anyone to query data feeds from asset addresses directly, without needing to know the feed contract addresses.

- Historical Price Data

- Cryptocurrency price pairs

- Price Feeds API Reference

- Price Feed Contract Addresses

- Proof of Reserve Feeds

- Proof of Reserve Feeds Contract Addresses

- NFT Floor Pricing Feeds

- NFT Floor Pricing Feeds Contract Addresses

- Forex pairs

- Data Feeds on Solana

- Solana data feeds addresses

Chainlink VRF

Chainlink VRF (Verifiable Random Function) is a provable and verifiable Random Number Generator (RNG) that enables smart contracts to access random values without compromising security or usability. For every request, Chainlink VRF generates one or more random values along with a cryptographic proof to show how those values were determined. This proof is then published and verified on-chain before any consuming application can use it. This process ensures that the results cannot be tampered with or manipulated by any single participating entity, including miners, oracle operators, or smart contract developers.

Chainlink VRF is helpful for building reliable smart contracts used in applications that rely on unpredictable outcomes, such as on-chain games, NFT rarities, random assignment of duties, and choosing a representative sample for consensus mechanisms.

Since its mainnet launch in October 2020, Chainlink VRF gas services over a million requests across multiple chains.

Why Chainlink VRF?

From selecting winners in games to generating unforeseen variations in digital artwork, entropy is a core component for unprecedented use cases in gaming, NFTs, art, and even science when it comes to blockchain applications. Accessing a secure, unpredictable, tamper-proof, and auditable source of entropy is a game changer for an industry where all outcomes are deterministic by design. For instance, if we had to generate a random number by using the properties offered by a blockchain itself, such as block hashes, we could introduce attack vulnerabilities where miners/validators choose to only publish a new block when it is a favorable situation for them.

In computer science and mathematics, a deterministic system is one where there is no randomness involved and, because of that, it produces the same output given the same inputs.

As an alternative to on-chain deterministic solutions, there are off-chain API providers. However, they are opaque and unverifiable. Because of that, users have no way to verify whether the results are true or manipulated.

Smart contract developers should not solely rely on block hashes as a source of randomness. For example, we could take a contract that makes decisions based on the parity of the last bit of a block hash. At first, we could think that this would yield a 50/50 outcome. However, it is possible for a miner (or coalition of miners) to discard blocks for which the last bit of the block hash is one, forgoing the block reward. In this case, the miner could bias the zero outcome from a reliable 50% likelihood to a ⅔ likelihood. This could lead to the loss of user funds from any smart contract relying on such a method for randomness generation.

To avoid this kind of scenario, developers should turn their attention to off-chain solutions where a random number that is generated off-chain is then brought on-chain. For this method to be effective, there must be a cryptographic proof supporting the evidence that the randomness has been produced fairly.

Chainlink Verifiable Random Function (VRF) overcomes all those limitations using off-chain oracle computation and on-chain cryptography. This method works by combining block data that is still unknown when the request is made with the Oracle node’s pre-committed private key to generate both a random number and a cryptographic proof. As a result, the consuming application will only accept the random number if it has valid cryptographic proof, which can only be generated if the VRF process is tamper-proof.

Chainlink VRF is powered by open-source code and all cryptographic proofs are verifiable on-chain by anyone.

How Chainlink VRF works

Chainlink VRF works by combining block data that is still unknown when the request is made with the oracle’s node pre-committed private key to generate both a random number and a cryptographic proof. For this process, each oracle uses its own private key.

When the result is published on-chain along with a proof, it is verified on-chain before being sent to the target smart contract. In fact, verifiable randomness is the fundamental benefit of using Chainlink VRF. Even if a node is compromised, it cannot manipulate or supply biased answers, since the on-chain cryptographic proof would fail.

The worst case scenario is that the compromised node does not return a response to a request for randomness, which will be forever visible on-chain. If this happens, users would no longer rely on those nodes that stop responding or refuse to provide randomness with a valid proof. Compromised nodes can only withhold a request by giving no response, for which they would be penalized using Chainlink’s upcoming staking capabilities and removed from future queries.

An additional benefit of VRF is that, as more users utilize it, the amount of fees paid to node operators increases as well. This creates an incentive for node operators to provide as many security guarantees as possible.

Use Cases of Chainlink VRF

Using Chainlink VRF it is possible to build reliable smart contracts that require unpredictable outcomes. This is useful for use cases such as generating provably random assignments of duties and resources (e.g. randomly assigning judges to cases or auditors to firms under scrutiny), choosing representative samples for consensus voting on proposals, making games more fun by generating challenging and unpredictable scenarios…

- Fair NFT minting

- Helpful for collections with numerous attributes and trait combinations with varying levels of rarity. For example, Polychain Monsters is a blockchain-based game inhabited by NFT-based monsters with 3 distinct categories of characteristics – color, horn types, and glitter – and several traits with varying rarities within each category.

- This helps to ensure that everyone has an equal chance of minting an NFT with rarity traits that potentially bring in additional value.

- Random NFT and loot box drops for art collections and in-game items.

- Chainlink VRF is used to determine which NFT a user receives during a drop, helping prevent anyone from being able to influence or tamper with the distribution mechanism.

- Some examples of metaverse projects using VRF include MTVE, and Evolution Land, which use it for creating loot boxes or distributing in-game prizes as random rewards. Blockchain games like DeRace are also using it for randomizing race outcomes. Other games see the opportunity in using random algorithms to generate new lands or maps. This is the case of OVR, an open-source AR game that thanks to VRF has the ability to spawn special items and experiences in unpredictable locations.

- Illuvium uses VRF to reward community members with limited editions

- Lucky draws and community giveaways to select winners from a set of eligible participants. This brings transparency to the winner selection process.

- Bored Ape Yacht Club (BAYC), one of the top 10 NFT projects according to DappRadar used VRF to distribute their new Mutant Serum NFTs to current BAYC NFT holders, giving users the ability to mutate their Bored APE into a new limited edition NFT.

- PoolTogether integrated Chainlink VRF to select winners from weekly no-loss pools, helping ensure winners are chosen fairly based on their initial deposit amount.

- Moonpot integrated VRF to fairly distribute yield rewards by allowing users to buy tickets with which they could earn a percentage of all the aggregated yield from various protocol pools.

- Apeswap stopped relying on its team to select the winners of its BANANA weekly rewards.

- Bittrue uses VRF for its daily XRP Raffle.

- Player vs. player (PvP) battlers for player matchmaking or NFT battle royal contests. There are turn-based games where players can get an advantage based on the order of their participation. One of the first games to use VRF for turn-based use cases was Avaxcells, an NFT trading cards game that uses VRF to fairly determine which players get to attack first in a PvP duel.

- Queue ordering for games, sales, events, or any other type of turn-taking process.

- An NFT platform, UREEQA integrated VRF to release a limited edition set of baseball trading card NFTS as well as to randomly assign NFTs to special perks such as in-game tickets or memorabilia.

- Instead of releasing tickets on a first-come first-serve basis, GET Protocol integrates Chainlink VRF to randomize ticket queues based on the participants who signed up beforehand.

- Companies can drive up engagement for marketing campaigns by issuing rewards that are based on outcomes. Doing this they could have multiple tiers to drive increased interest to reach higher rewards. This would avoid problems such as McDonald’s Monopoly game, which increased the winning probabilities for insiders.

- Whitelisting users for ICO allocations has been a popular use case by multiple launchpads, such as Cardence, Cardstarter, MaticLaunch, Poolz, RoboFi, Seedify, Trustpad, or ZeroSwap

- Randomizing audits to ensure recordkeeping processes are accurate. This can be used by tax organizations or accounting firms. In traditional finance, these auditing systems are automated, but their selection processes are often opaque, meaning it is unclear why a particular entity ended up being selected. By using Chainlink VRF as a solution, governments and organizations can prove that their calls are impartial and fair to all parties involved.

- Sampling in polls and clinical trials could use VRF to remove any bias and provide transparency and integrity to the study in question. One way to increase accountability and help prevent sampling fraud is to use Chainlink VRF for the impartial selection of study participants.

- Ticket authentication to avoid fraud such as fake tickets, scamming, scalping… For instance, DigiTix issues tickets as NFTs so that anyone can verify the origin of the ticket on-chain. DigiTix also uses VRF to authenticate tickets in an unpredictable manner, helping eliminate the ability to reverse engineer the ticket authentication process.

Methods to Request Randomness

Chainlink VRF offers two methods for requesting randomness:

- Subscription model where users can fund their accounts with LINK tokens. This way, users can connect multiple consuming contracts to the subscription account so that when the consuming contracts request randomness, the transaction costs are deducted from the subscriber account.

- Direct funding allows consuming contracts to pay with LINK every time they request random values from Chainlink VRF. Users and projects and responsible for funding the consumer contracts to ensure that there are enough LINK tokens to pay for randomness requests.

Considerations for Choosing Request Methods

- If a use case needs regular requests, it is recommended to go for a subscription method, since it will simplify funding and reduce the overall costs.

- If an application has multiple consumer contracts, the subscription model will reduce the cost overhead

- The direct method is more suitable for infrequent one-off requests.

- The subscription model reduces the gas overhead and allows to have more control over the maximum acceptable gas price per user request.

- Because the direct funding method has a higher overhead, it cannot return as many random words in a single request as the subscription.

- For applications that want to transfer VRF costs to the end user, the direct funding method may be more suitable, since the cost is known and charged on every request.

Benefits of Chainlink VRF V2

- Pay-as-you-go at scale. The introduction of a subscription management app allows for a cost-efficient business model that enables smart contract applications to pre-fund multiple requests for randomness using a single LINK token balance.

- 60% savings in gas fees, since there is no need to transfer LINK tokens for each individual request

- After fulfilling a request, the amount of ETH needed to pay in gas is calculated and converted to LINK using an ETH/LINK Chainlink Price Feed that will charge the subscription contract along with a flat per-request fee.

- Variable Gas Limit and more flexibility for developers. Users can adjust the gas limit of their function calls whenever they request verifiable randomness for their smart contracts. This enables consuming contracts to execute more complex logic in the same transaction, which means that they can introduce randomness even during times of extreme network congestion.

- Configurability and more user control in defining security parameters

- Users can specify how many block confirmations must pass after a request transaction is made before verifiable randomness is generated and delivered on-chain (ranging from a minimum of 3 blocks to a maximum of 200 blocks).

- A configurable block confirmation parameter offers development teams the ability to strike their desired balance between security (protection against block reorgs) and performance (latency from request to response) for their application needs.

- Multiple random outputs in a single request

- Lower costs, since the VRF Coordinator contract can request multiple random numbers in a single on-chain transaction, which also reduces latency

- Users can batch multiple requests and responses into single transactions, achieving significant gas savings.

- Unified billed and delegation of subscription balances

- Multiple smart contract addresses (up to 100) can fund their requests from a single LINK subscription balance that is managed by the subscription owner.

Chainlink Automation

Chainlink Automation enables the conditional execution of smart contract functions using a variety of triggers.

- Time-based triggers execute smart contract functions according to a time schedule.

- Custom logic triggers execute smart contract functions based on custom logic that is evaluated by Chainlin’s Automation Nodes.

At the moment, the Chainlink Automation Network is not accepting node operators. For future participation, Chainlink encourages users to sign up for their mailing list or join the Discord server to be notified when this becomes available.

Chainlink Functions

Chainlink functions are a serverless developer platform that empowers anyone to easily connect a smart contract to any Web2 API and run computations using the Chainlink network. This gives developers an alternative to access social media signals, AI computation, and messaging services… without having to build up their own Web2 infrastructure.

Leading cloud providers such as AWS and Google Cloud, as well as companies like Meta, have already collaborated on example use cases such as AI integrations to DAO governance.

Chainlink functions act as a decentralized computing runtime environment where developers can run custom logic that powers off-chain Web3 applications. This is a similar version of what AWS Lambda or Google Cloud functions already do, but Chainlink enables trustless use cases and interconnectivity to a permissionless blockchain.

Thanks to Chainlink functions, it is no longer necessary to host and run external adapters to perform off-chain computation or to source/run a Chainlink node to connect smart contracts to the outside world.

Use Cases for Chainlink Functions

- Data connectivity to connect to any private or public API allows for use cases such as fetching gaming data, sports results, and pulling metrics from Token Terminal to track protocol revenue, user fees, and active users…

- IoT devices and traditional backend connectivity to any enterprise system: fetch data from a smartwatch, retrieve information from a sensor, connect to an enterprise ERP system such as SAP, access payment processing platforms…

- Data connectivity and transformation, to analyze social sentiments based on media posts, to trigger changes on NFTs…

- Off-chain computation and storage by allowing developers to connect to decentralized databases such as IPFS and Filecoin.

Fair Sequencing Services (FSS)

Fair Sequencing Services is a transaction ordering solution that aims to mitigate harmful forms of MEV to help decentralized systems become fairer for the end user. Harmful MEV often presents itself in malicious front run and sandwich attacks on ordinary DEX trades, causing unnecessary slippage, creating an invisible tax on users, and degrading the overall user experience.

FSS uses Chainlink decentralized oracle network to fairly order transactions based on one or a combination of two different techniques:

- Secure casual ordering: users send transactions to Oracle nodes that are threshold-encrypted, where the transaction is not revealed until after the transaction order has been agreed upon.

- Temporal ordering is a mechanism that aims to secure that transactions received first by the oracle are the first to be output, helping facilitate a first-in, first-out (FIFO) ordering policy.

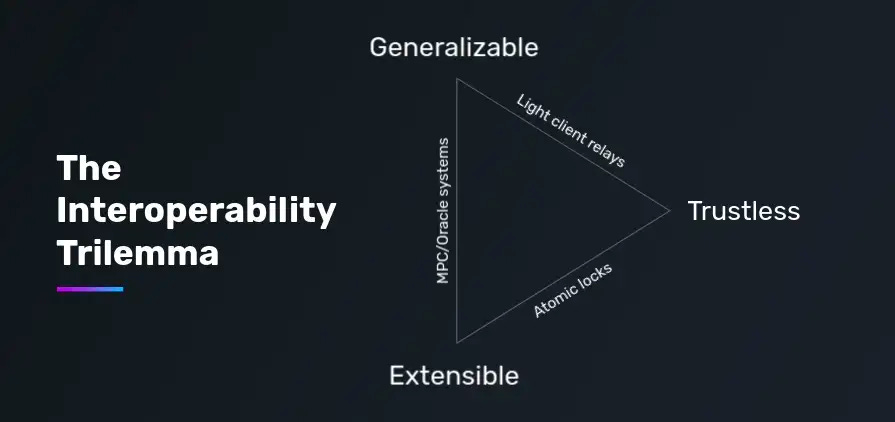

Cross-Chain Interoperability Protocol (CCIP)

Cross-Chain Interoperability Protocol (CCIP) is a universal and open standard for developers to build secure services and applications that can send messages, transfer tokens, and initiate actions across multiple networks. This protocol enables smart contracts to interoperate across all public and private blockchain networks, eliminating the need for developers to create custom code for cross-chain integrations.

Among the use cases that stand out:

- Cross-chain yield harvesting.

- Cross-chain collateralized loans (allowing users to borrow an asset on one chain while providing collateral on another).

- Low-cost transaction computations that can be processed on a high-throughput chain and then bridge the results to another higher-cost trusted chain for settlement.

- Decentralized and Sybil-resistant token bridge secured through an independent anti-fraud network that proactively monitors the blockchain to detect issues and prevent malicious activities (e.g. halt the transfer of user funds).

Anti-Fraud Network

CCIP includes a new risk management system called Anti-Fraud Network, which consists of decentralized oracle networks whose sole purpose is to monitor CCIP services for malicious activity that could lead to financial loss.

The Anti-Fraud Network will have fully independent committees of nodes compared to the node committees they are responsible for monitoring. This completely separates anti-fraud detection processes and cross-chain services.

The Anti-Fraud Network acts as a verification layer that periodically submits heartbeat checks when the system is operating as normal. If the Anti-Fraud Network’s heartbeat messages stops or its nodes notice any nefarious activity, an emergency shutdown is automatically triggered to stop a particular cross-chain service.

How CCIP Enables Secure Cross-Chain Bridging

The goal of CCIP is to enable cross-chain communication and cross-chain asset transfers through a unified standard interface between hundreds of blockchain networks. To do that, CCIP will feature a Programmable Token Bridge which will empower users to move assets across chains in a highly secure, scalable, and cost-efficient manner. This will unlock liquidity between different networks, whether they are EVM chains or not.

At the most basic level, cross-chain bridges are a committee of nodes that collectively attest to information on one chain and relay it to another by cryptographically signing transactions. With OCR 2.0 (Off-Chain Reporting), Chainlink will scale the number of nodes that can sign committee-based reports, leading to increased security of locked funds while maintaining a high degree of cost efficiency for users.

Programmable Token Bridge

The Programmable Token Bridge is a reference bridge implementation built upon CCIP that allows developers to build cross-chain applications using a unified bridge system. With these methods, various bridge connections between chains are secured by unique committees of nodes that maintain a secure and universal standard for interoperability.

The Programmable Token Bridge will support existing token standards, meaning that all liquid assets can be instantly used within the smart contracts of multiple ecosystems.

Users don’t need to know how to use other blockchains. Instead, they just need to send instructions to the bridge about how they want to interact with other chains, and the bridge will automatically move the tokens cross-chain and deploy them in smart contracts on the destination chain. This means that a user can stay on their blockchain of choice while still benefiting from smart contract ecosystems on other networks.

Chainlink Node Operators

Chainlink Node Requirements

- LINK tokens to deposit as a penalty fee in the event that the node doesn’t fulfill the requests.

- It is possible to run a node with 0 LINK, but the node will not be able to participate in requests that require a deposit until it has earned some LINK first.

- Since penalty fees are optional, not all requests will require it

- Chainlink node

- The minimum requirements would be achieved with a machine that has at least 2 cores and 4GB of RAM

- The recommended requirements scale as the number of jobs to run in the node increases. For nodes with over 100 jobs, it is recommended to have a machine with at least 4 cores and 8GB of RAM.

- PostgreSQL Database

- The minimum requirement is to have at least 2 cores, 4GB of RAM, and 100GB of storage

- The recommended setup for more than 100 jobs is to have a database server with at least 4 cores, 16GB of RAM, and 100GB of storage

- Guide for connecting to an external database

- Ethereum client. Connectivity to an Ethereum client is required for communication with the blockchain. Users who plan to run their own Ethereum client will want to run it on a separate machine. The requirements of Ethereum clients can change over time

Chainlink Jobs

To do anything useful, Chainlink nodes execute jobs. Currently, Chainlink supports job types such as cron jobs (for scheduling tasks), direct requests, monitoring, keepers, off-chain reporting, or webhooks.

- Cron jobs allow you to execute tasks based on a predefined schedule. By using the Chainlink Job Scheduler, nodes can leverage the Chainlink Automation Network to execute calls on smart contract functions.

- Direct request jobs are executed upon receipt of an explicit request made by a user.

- Flux monitor jobs are responsible for continually updating data feeds that aggregate responses from multiple oracles. This can be achieved via the following triggers:

- An occasional poll that shows that there has been a sufficient deviation from an off-chain data source before a new result is submitted.

- New rounds are initiated by other oracles. If another oracle notices sufficient deviation, all other oracles will submit their current observations as well.

- A heartbeat that ensures that no deviation occurs.

- Keeper jobs occasionally poll a smart contract method that expresses whether something in the contract is ready to perform some action on-chain. When it is ready, the keeper job executes the on-chain action. This is used for liquidations, rebalancing portfolios, adjusting the supply of rebasing tokens, auto-compounding, and limit orders.

- Off-chain reporting jobs are used similarly to Flux Monitor jobs, They update data feeds from many Chainlink oracle nodes. The difference is that they do this aggregation using a cryptographically-secure off-chain protocol that makes it possible for a single node to submit all answers from all participating nodes during each round. This saves a significant amount of gas.

- Webhook jobs are initiated by HTTP requests that trigger an action in response to a change or update given by a specific web request.

External Initiators

External initiators allow jobs in a node to be initiated depending on some external condition. By having the ability to create Chainlink initiators, Chainlink nodes enable blockchain-agnostic cross-chain compatibility.

External Adapters

External adapters are how Chainlink enables the easy integration of custom computations and specialized APIs. These are services that Chainlink nodes use to communicate via their API (following a JSON specification). They are used for connecting to any off-chain resource, including premium data providers, authenticated web APIs, IoT sensors, bank payments, enterprise backends, other blockchains…

Information relative to external adapters is relevant for smart contract creators, developers who implement an external adapter for an API, and node operators. API calls in Solidity, the native language of Ethereum, is the method used by development teams to bring off-chain data into their smart-contract-based applications. By using Chainlink’s blockchain-agnostic decentralized oracles, developers can connect real-world data and events by configuring and validating the data provided by any open API.

There are two types of adapters:

- Core adapters are functions that are natively installed in a Chainlink core node client, such as Httpget, Copy, and Jsonparse. They allow the customization of the functionality of Oracle networks.

- External adapters enable the integration of custom computation and specialized APIs, such as asset prices, weather data…

It is possible to access this custom functionality without running a node. To do that, other nodes will host the adapter for you. This explains why multiple projects use Chainlink without running nodes themselves. This way, smart contract engineers can focus on the business logic of their applications and delegate this task to node operators.

- External adapters can be added to third-party node operator services such as market.link so that they host the adapter on your behalf

Developers can build external adapters using any programming language and even run them on separate machines. They should know Chainlink nodes request data from it and how the data should be formatted to get a response.

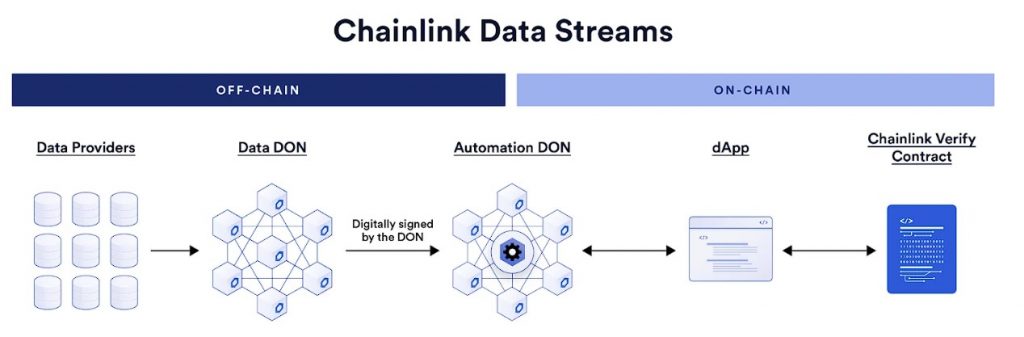

Chainlink Data Streams

Chainlink Data Streams provides low-latency delivery of market data off-chain that you can verify onchain. With Chainlink Data Streams, decentralized applications (dApps) now have on-demand access to high-frequency market data backed by decentralized and transparent infrastructure. When combined with Chainlink Automation, Data Streams allows decentralized applications to automate trade execution and mitigate frontrunning.

Traditional push-based oracles provide regular updates onchain when certain price thresholds or update time periods have been met. Chainlink Data Streams is built using a new pull-based oracle design that maintains trust-minimization using onchain verification.

Use Cases

Pull-based oracles allow decentralized applications to access data that is updated at a high frequency and delivered with low latency, which enables several new use cases:

- Perpetual Futures: Low-latency data and frontrunning prevention enable on-chain perpetual futures protocols that can compete on performance with centralized exchanges while still using more transparent and decentralized infrastructure.

- Options: Pull-based oracles allow timely and precise settlement of options contracts. Additionally, Data Streams provides more detailed market liquidity data that can support dynamic on-chain risk management logic.

- Prediction Markets: Higher frequency data updates allow for applications where users can act quickly in response to real-time events and be confident in the accuracy of the data used in the settlement.

Billing

Chainlink Data Streams supports fee payments in $LINK and in alternative assets, which currently include native blockchain gas tokens and their ERC20-wrapped version. Payments made in alternative assets have a surcharge when compared to $LINK payments. You pay to verify reports from Data Streams on-chain using the verifier contract. The price of verification depends on the stream ID that you are verifying. You pay per report verified. If you verify multiple reports in a batch, you pay for all of the reports included in that batch.

Architecture

Chainlink Data Streams has the following core components:

- A Chainlink Decentralized Oracle Network (DON): This DON operates similarly to the DONs that power Chainlink Data Feeds, but the key difference is that it signs and delivers reports to the Chainlink Data Engine rather than delivering answers onchain directly. This allows the Data Streams DON to deliver reports more frequently for time-sensitive applications. Nodes in the DON retrieve data from many different data providers, reach a concensus about the median price of an asset, sign a report including that data, and deliver the report to the Chainlink Data Engine.

- The Chainlink Data Engine: The Data Engine stores the signed reports and delivers them to Chainlink Automation when it is requested.

- The Chainlink Verifier Contract: This contract verifies the signature from the DON to cryptographically guarantee that the report has not been altered from the time that the DON reached concensus to the point where you use the data in your application.

Using Chainlink Automation with Data Streams automates trade execution and mitigates frontrunning by executing the transaction before the data is recorded onchain. Chainlink Automation executes transactions only in response to the data and the verified report, so the transaction is executed correctly and independently from the decentralized application itself.

Comparison to push-based oracles

Chainlink’s push-based oracles provide regular updates onchain. Chainlink Data Streams operates as a pull-based oracle where you can retrieve the data in a report and use it on-chain any time. Verifying the report on-chain confirms that the data was agreed upon and signed by the DON. While many applications benefit from push-based oracles and require data only after it has been verified on-chain, some applications require access to data that is updated at a higher frequency and delivered with lower latency. Pull-based oracles deliver these benefits while still cryptographically signing the data to ensure its veracity.

Additionally, pull-based oracles deliver data onchain more efficiently by retrieving and verifying the data only when the application needs it. For example, a decentralized exchange might retrieve a Data Streams report and verify the data onchain when a user executes a trade. A push-based oracle repeatedly delivers data onchain even when that data is not immediately required by users.

Example trading flow

One example of how to use Data Streams is in a decentralized exchange. An example flow might work using the following process:

- A user initiates a trade by confirming an

initiateTradetransaction in their wallet. - The onchain contract for the decentralized exchange responds by emitting a Log Trigger event.

- The Chainlink Automation upkeep monitors the contract for the event. When Automation detects the event, it runs the

checkLogfunction specified in the upkeep contract. The upkeep is defined by the decentralized exchange. - The

checkLogfunction emits an event calledStreamsLookup. - Data Streams detects the

StreamsLookupevent and returns the requested report in thecheckCallbackfunction for Chainlink Automation. - Chainlink Automation passes the report to the Automation Registry, which executes the

performUpkeepfunction defined by the decentralized exchange. The report is included as a variable in theperformUpkeepfunction. - The

performUpkeepfunction calls theverifyfunction on the Data Streams onchain verifier contract and passes the report as a variable. - The verifier contract returns a

verifierResponsebytes value to the upkeep. - If the response indicates that the report is valid, the upkeep executes the user’s requested trade. If the response is invalid, the upkeep rejects the trade and notifies the user.

This is one example for how you can use Data Streams and Chainlink Automation in combination, but the systems is highly configurable. You can write your own log triggers to initiate upkeeps on Chainlink Automation for a various array of events. You can configure the StreamsLookup to retrieve multiple reports. You can configure the performUpkeep function to perform a wide variety of actions using the report.

Why the Project was Created

Due to the consensus protocols used by blockchains, it is not possible to connect smart contracts with external systems that provide or retrieve information for one chain. Before Chainlink, the solution to this problem was to introduce a new functionality called “oracle” that would provide connectivity to the outside world. However, this comes at the cost of centralization risk. Any smart contract using such services would be exposed to a single point of failure, making it no more secure than a traditional centrally run digital agreement.

The vast majority of smart contract applications rely on data reliable from the real world provided by key sources, specifically data feeds, and APIs. To solve this problem of trust, Chainlink provides external connectivity for smart contracts through an on-chain data aggregation contract and an off-chain consensus mechanism. At the beginning, what differentiated Chainlink’s connectivity from other Oracle solutions is its ability to operate as a fully decentralized network. This decentralized approach would limit the trust in any single party, enabling the tamperproof properties of smart contracts to be extended to end-to-end operations between smart contracts and the APIs they rely on.

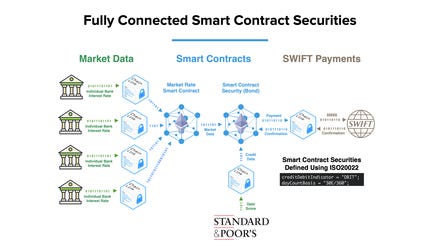

Chainlink’s vision is that when smart contracts replace the traditional contractual digital contracts in use today, those smart contracts will require high-assurance versions of the same types of inputs and outputs. Currently, the main use cases of smart contracts are related to the management of tokens. However, Chainlink believes that the focus on tokens ignores other possible applications due to a lack of adequate Oracle services. By solving the problem, a plethora of new use cases would open up, such as:

- Securities smart contracts: bonds, interest rates, derivatives…

- Insurance smart contracts that require data feeds about IoT data related to the event in question

- Trade finance smart contracts, like GPS data about shipments, data from supply chain ERP systems, custom data about goods being shipped in order to confirm the fulfillment of contractual obligations…

Upon this premise, Chainlink’s roadmap in 2019 conceived a long-term development strategy that would take into consideration better confidential protections, the use of trusted hardware, infrastructure changes, and general oracle programmability.

Roadmap

Chainlink’s roadmap is built on the premise that the demand for cryptographic truth and trust-minimized guarantees will increase exponentially over time. This will be the result of less predictable economic outcomes (crisis, inflation…), less reliable incentives (increased downtime, data leaks, cyberattacks…), and less safety for users who rely on unverifiable sources of trust (such as insolvent centralized exchanges). The recent mass adoption of proof of reserves is one of the most notable examples that reinforce the goal of achieving cryptographic trust.

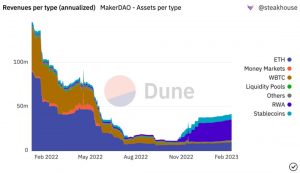

In 2022, Chainlink has achieved major network and community milestones:

- $6.9 trillion in TVE (Transaction Value Enabled)

- TVE is the sum of the USD value of all transactions enabled by a protocol

- $5.8 billion data points delivered on-chain have helped to fuel dApp innovation across multiple Layer1 and Layer2 chains

- 700,000 verifications of off-chain and cross-chain reserves through Chainlink Proof of Reserve have helped to provide transparency around the reserves backing stablecoins, wrapped assets, and other digital tokens.

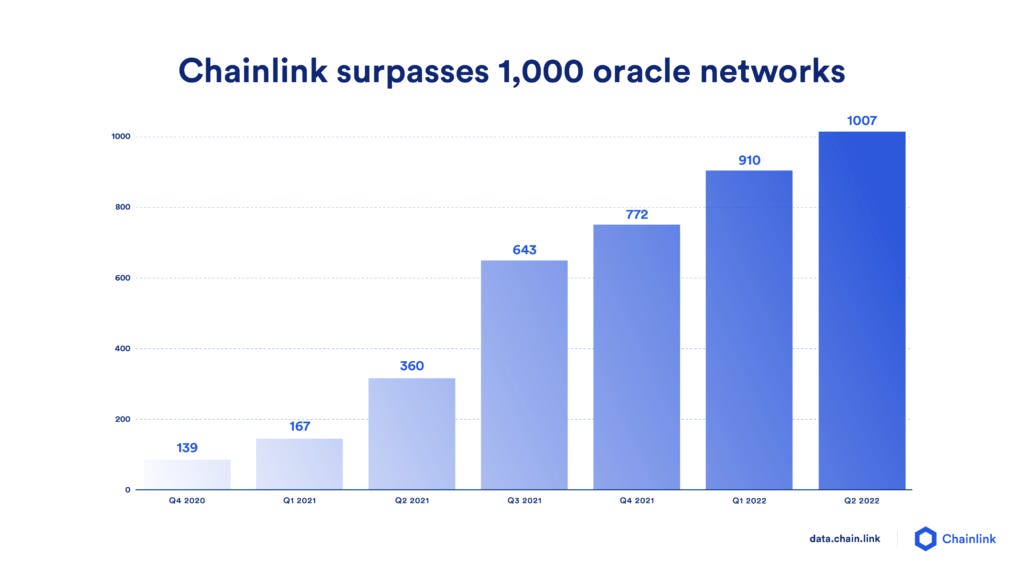

- The Chainlink ecosystem has grown to 1,600+ projects and has become one of the largest ecosystems across DeFi, gaming, NFTs, insurance, randomness, automation…

- 1,000+ Oracle networks launched to support new asset categories (commodities, FX rates…), NFT floor prices, cryptocurrency prices…

- 10.5M randomness requests have been served by Chainlink VRF

- 18,000+ public Github repositories are currently using Chainlink.

- Chainlink Hackathons have played a significant role in onboarding and accelerating the growth of Web3 developers

- 19,000+ SmartCon 2022 attendees (in-person and virtual)

Market Demand

Moving forward in 2023, Chainlink has 3 main categories of market activity that they have expressed interest in.

- Moving information/market data and commands/event messages from traditional systems into blockchains.

- Effectively making Chainlink a key conduit for all commands and information both to and from all blockchains.

- Connecting all blockchains into a large interoperable network for both value transfer and smart contract interoperability.

- Developers should be able to connect smart contracts across multiple chains, just like they connect code across multiple clouds.

- Adding key off-chain computations that make advanced trust-minimized applications possible.

- Existing examples are VRF, Chainlink Automation, and zero-knowledge proofs with DECO, with many additional types of computation being worked on.

The first two priorities focus on making Chainlink into the system that moves all key information and value into, out of, and across blockchain ecosystems while the third priority continues the expansion of Chainlink into the sphere of a general-purpose trust-minimized computing environment.

What’s Next?

- Expansion of the data products that are available on-chain. This includes volatility measures, real-world asset prices…

- In addition to existing Chainlink price feeds, which deliver a single data point, Chainlink is planning to publish additional data points via the low-latency Oracle infrastructure. This will be for use cases in order books that require to know the market price, the bid price, and the ask price to better represent liquidity conditions in the market.

- Mainnet release of the CF Bitcoin Interest Rate Curve (BIRC). BIRC serves as a standard market gauge of current and forecasted Bitcoin interest rates that are representative of economic reality and resistant to manipulation.

- Introduction of a Digital Asset Classification System that will be used to coherently segment the digital asset ecosystem along industry standards. This will allow users to conduct more in-depth analysis for portfolio allocation and risk mitigation.

- Further development of the Staked ETH APR fee, which represents the “cost of capital” or “risk-free” rate of return for ETH and provides a better understanding of the Ethereum economy, allowing investors with staked ETH positions to swap the variable return from staking for a fixed return using tokenized interest rate swaps.

Chainlink Economics 2.0 and Staking

Chainlink Economics 2.0 consists of an array of initiatives, including Chainlink’s BUILD Program, the Chainlink Scale Program, and Chainlink Staking.

V0.1 was launched on December 6, 2022. This was the first step in allowing the community to help secure the Chainlink Network.

V0.2 was launched on November 28, 2023, and builds on v0.1 lessons, focusing on the following goals:

- Greater flexibility for Community and Node Operator Stakers via a new unbonding mechanism, while retaining a secure non-custodial design.

- Improved security guarantees for oracle services secured by Chainlink Staking via the slashing of node operator stake.

- Modular architecture to iteratively support future improvements and additions to Chainlink Staking, such as expansion to more services.

- Dynamic rewards mechanism that can seamlessly support new external sources of rewards in the future, such as user fees.

v0.1 Migration and Phased Rollout

The launch of Chainlink Staking v0.2 will involve multiple entry phases so that a wide diversity of Chainlink community members can contribute to the crypto economic security of the Chainlink Network. By increasing the likelihood that the v0.2 staking pool is distributed across a large number of entities, including smaller participants, the security assurances provided by Chainlink Staking are strengthened.

Phase 1: Priority Migration

At launch, v0.1 stakers will have the opportunity to migrate their v0.1 stake and accrued $LINK rewards to v0.2 or withdraw. This Priority Migration period will last for seven days, where v0.1 stakers can choose to migrate all or a portion of their v0.1 stake and $LINK rewards. If choosing to migrate a portion, then all non-migrated v0.1 stake or rewards will be withdrawn. If a v0.1 staker takes no action, then their staked $LINK and rewards will remain in v0.1 and no longer earn additional rewards.

Given that the v0.2 pool is larger than the v0.1 pool, and accounting for accrued rewards, v0.1 stakers have guaranteed access to v0.2 if they participate in the Priority Migration phase. Once the Priority Migration period ends, v0.1 stakers can still migrate or withdraw during Early Access and General Access; however, entry to v0.2 will not be guaranteed due to the capped pool size.

Note that v0.1 stakers are only eligible to migrate an amount equal to the sum of their staked $LINK and any $LINK rewards accumulated in v0.1 during the Priority Migration phase. v0.1 stakers who want to stake more $LINK, up to the per-address cap, have the opportunity during later entry periods.

Phase 2: Early Access

After the Priority Migration period ends, $LINK token holders who meet at least one predefined criterion on the updated Early Access Eligibility List will have the opportunity to stake $LINK in v0.2 up to the per-wallet maximum. Similar to the Early Access period during the v0.1 launch, being on the eligibility list provides an opportunity to stake in v0.2 but does not serve as a guarantee of entry given the capped pool size. The Early Access entry period will last for two days. The Early Access Eligibility List builds upon the list previously used in v0.1. Similar to v0.1, there will also be an Early Access Eligibility App made available before launch that can be used to check eligibility for Early Access.

Phase 3: General Access

After Early Access ends, the v0.2 staking pool will open to General Access, at which point anyone will have the chance to stake up to the per-wallet maximum, provided that the v0.2 pool has not yet been filled.

Modular Framework For Iterative Upgrades

The Chainlink Staking v0.2 codebase has been rearchitected to operate as a modular set of smart contracts. This modularity allows a broad scope of upgrades, including new features and configuration changes, to be applied without requiring a full staker migration to a new set of smart contracts.

Expanded Pool Size and Accessibility

Staking v0.2 will feature an expanded total pool size of 45M $LINK to increase the accessibility of Chainlink Staking to a broader diversity of $LINK token holders. The pool size represents an 80% increase from the pool cap of v0.1 and would account for over 8% of the current circulating supply of $LINK.

Unbonding Mechanism

A key design principle in the development of Chainlink Staking v0.2 has been to provide $LINK stakers greater flexibility and predictability around how they manage their staked $LINK. Instead of locking up staked $LINK until the next version of staking is released, v0.2 introduces an un-bonding mechanism for withdrawing staked $LINK.

Claimable Rewards and Ramp-Up Period

v0.2 features a new $LINK rewards mechanism designed to further incentivize the stability of the v0.2 staking pool, support the security assurance provided by staking, and provide greater flexibility around staking rewards.

Dynamic Reward Rates

The reward rate calculation for v0.2 has been rearchitected to incentivize a fully filled Staking pool and improve support for new sources of staking rewards in the future (e.g., user fees). While v0.1 has a fixed reward rate (i.e., a single rate for all Community Stakers regardless of pool fill rate), v0.2 will have a variable reward rate.

Staked LINK Slashing For Node Operator Stakers

Chainlink Staking v0.2 offers increased crypto-economic security by supporting the ability to slash a portion of staked $LINK by Node Operator Stakers who help power oracle services secured by Staking. When a valid alert is raised and a slashing condition is met, these Node Operator Stakers will see a portion of their staked $LINK slashed as a penalty for failing to meet performance requirements.

Timelocked Upgradability

For any iterative upgrade to the modular Chainlink Staking v0.2 codebase that materially impacts stakers, such as the modification of slashing conditions, upgrades will be announced proactively such that stakers can choose to initiate and complete a withdrawal of their staked $LINK before the upgrade is completed on-chain.

Staking Roadmap

The Evolution of Chainlink VRF

Chainlink’s upcoming approach towards a highly scalable and cost-effective decentralized infrastructure network will rely on threshold signatures not only to provide verifiable randomness but also to guarantee the uptime and availability of nodes.

By allowing the wider ecosystem of Chainlink nodes to participate in Chainlink VRF random number generation, Chainlink becomes a globally distributed network of node operators that are economically incentivized to both generate and broadcast verifiable data on-chain.

This means that not only will the responses from VRF be verifiable on-chain, but Threshold Signatures will also help to prevent adversaries from stealing user funds.

Threshold Signatures are a cryptographic technique used for distributed key generation and signing.

Team

Chainlink Labs has around 400 employees.

The first whitepaper published on September 4, 2017, was co-authored by:

- Sergey Nazarov, Co-Founder

- Steve Ellis, Co-Founder, and Chief Technology Officer

- Ari Juels, Chief Scientist

The second whitepaper published on April 15, 2021, was co-authored by:

- Sergey Nazaro, Co-Founder

- Steve Ellis, Co-Founder, and Chief Technology Officer

- Ari Juels, Chief Scientist

- Benedict Chan, VP of Engineering

- Brendan Magauran, Chief of Staff

- Lorenz Breidenbach, Head of R&D

- Fan Zhang, Security Researcher

- Alexandru Topliceanu, Research Engineer

- Alex Coventry, Researcher/Developer

- Farinaz Koushanfar, Research Scientist/Advisor

- Daniel Moroz, Research Scientist/Advisor

- Christian Cachin, Advisor

- Andrew Miller, Advisor

- Florian Tramer, Advisor

Other notable employees are:

- Mark Wagner, Chief Financial Officer, and Managing General Partner

- Dahlia Malkhi, Chief Research Officer

- Kemal El Moujahid, Chief Product Officer

- Adelyn Zhou, Chief Ecosystem Growth Officer

- Todd Barr, Chief Marketing Officer

- Mickey Graham, Head of Growth

- Yaser Jazouane, Head of Data Products

- Chris Barrett, Head of Public Relations

Sector Outlook

Oracle infrastructure is critical for the integration of blockchain technology in a wide variety of industries. By connecting smart contracts with off-chain information from the real world, Chainlink can replace the need for legal agreements and centrally automated digital agreements. The potential of an Oracle network can bring a lot of upside to the cryptocurrency industry as a whole, since the blockchains where smart contracts run cannot support native communication with external systems. As an overall thesis, by allowing smart contracts to interact with off-chain resources, the sector of Decentralized Oracle Networks has the potential to replace all sorts of digital agreements that are used nowadays. Besides, Chainlink’s ability to securely push data to APIs and various legacy systems on behalf of a smart contract permits the creation of externally-aware tamperproof contracts.

Large Ecosystem Support Across Blockchains

With CCIP, Chainlink has access to larger network effects than its competitors. These network effects lead to increased security of users’ funds, increased token access, a simplified user experience, better tooling and documentation for developers, and more revenue opportunities.

With over a hundred Layer1 chains and many Layer2 solutions already integrated, Chainlink is becoming the de-facto solution across all chains. Not only does Chainlink already work with the top lending, insurance, and DeFi protocols, but it is also innovating the open-source development of new use cases through the Chainlink Community Grant Program.

Reliability and Uniqueness

Chainlink is the most widely used and adopted oracle solution in DeFi, securing billions in value in production for innovative DeFi protocols such as Aave, Synthetix, and Compound. This benefits the protocol in terms of achieving growing network effects and attracting more users.

The Chainlink Network is a blockchain-agnostic oracle framework. Because of this, it is utilized by DeFi applications, web services, and traditional enterprises alike. Besides, it is operated by leading DevOps and security teams, such as Deutsche Telekom’s T-Systems, that have decades of experience running mission-critical infrastructure. Users can check the performance metadata of the network at market.link.

Chainlink is supported by a multitude of leading engineers and academics, such as Chainlink Labs, Chief Scientist Ari Juels, Chainlink Labs Chief Research Officer Dahlia Malkhi, and Chainlink Labs Chief Product Officer Kemal El Moujahid. The researchers working on the Chainlink protocol are industry experts in blockchain oracles and are responsible for some of the most innovative developments in the space such as DECO and Town Crier mentioned above, VRF, Mixicles, and more.

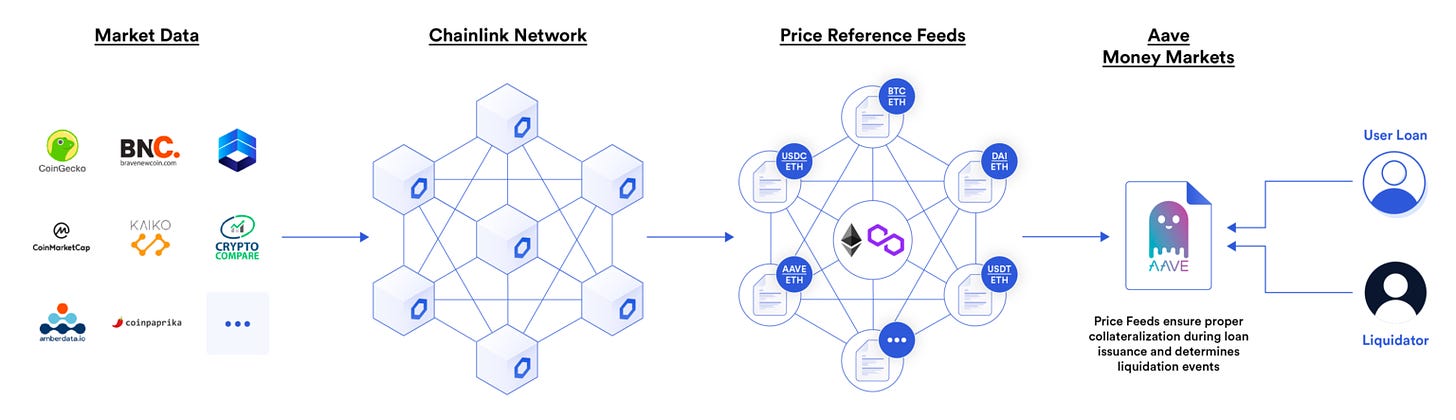

Chainlink oracle networks operate using multiple layers of data aggregation to ensure there is no single point of failure or any reliance on a single source of truth that could be corrupted. This redundancy is not only required to ensure high-value smart contracts consume highly refined data but also to ensure Chainlink Price Feeds provide full market coverage that reflects the true market price of assets. With Price Feeds securing tens of billions in user funds, these layers of aggregation secure the DeFi ecosystem.

- The first aggregation layer is at the data source level, where professional data aggregation firms (e.g. BraveNewCoin, CoinGecko) fetch market data from hundreds of exchanges (taking into account volume and liquidity differences) and generate a single weighted reference price point.

- The second aggregation layer is at the node operator level, where each individual Chainlink oracle node sources price data from multiple data aggregation firms and takes the median. This measure mitigates the effects of outliers, APIs downtime, and ensures that nodes do not solely rely on one source.

- The third aggregation layer is at the Oracle network level. This is where the responses from multiple Oracle nodes are aggregated by taking the median. Because of this, no individual node has control over the resulting data point delivered to smart contracts.

Accelerating Adoption

Similar to the block reward incentivization model of blockchains, Chainlink oracle networks generate early-stage economic incentives through the use of oracle rewards – incentives paid to node operators in addition to user fees.

For instance, Chainlink Data Feeds are decentralized oracle networks that provide DeFi applications access to high-quality financial market data. Chainlink Data Feeds are launched based on demand from users for a specific piece of data on a specific blockchain (e.g. the BTC/USD exchange rate on Ethereum). After launch, Data Feeds are initially supported through Oracle rewards, in addition to user fees paid by the feed’s active sponsors.

Since Chainlink Data Feeds function as shared public goods, any number of users can consume and fund the same feed. With each new paying sponsor of a Data Feed, and as existing sponsors generate more fees, a greater portion of the Data Feed’s costs can be covered by user fees. Eventually, once user fees surpass the network’s operation costs, the Data Feed’s operation no longer requires oracle reward support and the feed becomes economically sustainable. In fact, multiple Chainlink Data Feeds have already reached a state of sustainability on higher-throughput blockchains such as BNB Chain and Polygon.

To accelerate the rate at which Chainlink Data Feeds and other Chainlink services reach economic sustainability, numerous cost-reduction solutions have been deployed to allow Oracle rewards to be used more efficiently. For example, the launch of Off-Chain Reporting reduced the operating costs of Data Feeds by up to 90%, enabling 10x more data to be delivered on-chain, which resulted in a rapid increase in the number of Data Feeds deployed. In combination with the increased scalability of blockchains, additional cost-reduction solutions are underway to fuel the growth of the Chainlink ecosystem, including:

- OCR 2.0: An upgrade to the Off-Chain Reporting protocol powering Chainlink Data Feeds that will facilitate increased cost-efficiency for data delivery, allowing for a greater number of Oracle networks to be deployed and user fees to be generated.

- Fast-Lanes: A technical solution where a blockchain allocates a portion of its bandwidth to or establishes priority transaction ordering for public goods such as Oracle networks. This can significantly reduce or eliminate the on-chain costs associated with Oracle updates, increasing response times and reliability during blockchain network congestion.

- Blockchain Gas Grants: An initiative where blockchain projects commit to offsetting the on-chain gas costs of Oracle networks. This approach is backward-compatible and doesn’t require technical changes to the underlying blockchain network. Grants from a number of leading blockchain ecosystems are expected to be announced in the near future.

As more Chainlink Oracle networks reach economic sustainability, oracle rewards can be reallocated to support new Data Feeds and other Chainlink services, opening up additional potential fee opportunities for node operators and rewards for community stakers over time. This approach to Oracle network economics helped ensure individual users are not required to pay the full costs of a Data Feed’s operation, cultivating a strong network effect around Chainlink.

Chains

For Users

EVM Node Operators

Node operators can choose to run a single or multi-node setup.

Single Node Setup

A single-node setup is the most basic and default deployment. This configuration relies on the default settings and runs on a single primary node.

This configuration is appropriate for small or simple workloads that only need a few jobs that execute infrequently. For more complex runs that require hundreds of jobs and thousands of transactions per hour, the Chainlink and RPC nodes will require a more advanced configuration.

An RPC node is a computer that runs a blockchain client software – for example, a server that is running a consensus and an execution client for Ethereum.

A node with the proper software to respond to RPC requests is capable of retrieving information for blockchain users. RPC nodes work by connecting a dApp to all of the blockchain’s information so that when a program initiates a subroutine, an RPC node is able to retrieve the necessary requests through the blockchain and send its payload back to the dApp.

Multi Nodes Setup

These Chainlink configurations consist of multiple primary nodes and send-only nodes with automatic liveness detection and failover mechanisms. Because of this, it is no longer necessary to run a load-balancing failover RPC proxy between Chainlink and its EVM RPC nodes.

It is possible to have as many primary nodes as desired. Since requests are evenly distributed across all nodes, the performance increase will be linear as more nodes are added.

If a node fails with a failed liveness check, send-only nodes will broadcast transactions and not process regular RPC calls.

Best Practices for Deploying Nodes on AWS

Chainlink nodes can be deployed on AWS Cloud using the AWS Quick Start guide. This will create public resources such as an Elastic Load Balancer (to access the graphical interface), a Linux Bastion host in an Auto Scaling Group (to allow SSH access to EC2 instances in public and private subnets), and managed NAT gateways for internet access.

For a more detailed overview of the AWS resources being created and best practices, read Chainlink’s recommended setup.

Use Cases Enabled by Chainlink

Decentralized Finance

Since money is the primary medium for exchanging value and assets, current financial products provide different vehicles for people to maximize the value of their money via different strategies like hedging, speculation, earning interest, collateralizing loans… However, traditional finance is often gated by intermediaries that have disproportionate control over the issuance of money and the creation and offering of financial products. This results in a lack of universal access to certain financial products and also introduces counterparty risk.

Blockchains and smart contracts can bring deterministic execution to financial products, which allows for the creation of tamper-proof monetary policies that can be applied to assets on-chain. Chainlink oracles play a critical role for representing financial products and monetary instruments such as FX rates, interest rates, asset prices, indices, etc.

Money Markets

Blockchain-based money markets are a critical piece of infrastructure to connect lenders, who want to earn yield on their assets, with borrowers, who want to gain access to extra capital. Decentralized money markets allow users to increase the utility of their crypto holdings and participate in both the supply and demand side. Hence, decentralized money markets need to ensure that the platform is solvent. To do that, they use Chainlink price feds in order to track the valuation of assets that are used on the platform. This gives money markets a guarantee that its loans are issued at fair market prices and that liquidations can occur automatically on loans that become undercollateralized.

Some examples include Aave, Compound, or Liquity, all of which rely on Chainlink to access real-time pricing data to calculate their users’ collateral and debt requirements to determine when liquidations should be initiated.

Decentralized Stablecoins

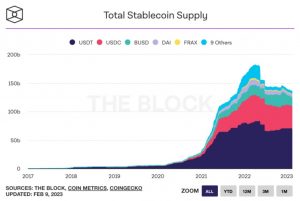

Stablecoins are assets that are pegged 1:1 to the value of a given fiat currency, most often the US dollar. They provide users with the ability to hold non-volatile assets. Most stablecoins are backed by fiat in an off-chain bank account, which means that they are not decentralized. However, there are some stablecoins that are decentralized in nature, since they are overcollateralized by other on-chain assets. These decentralized stablecoins require price data to maintain full over-collateralization (e.g. a user’s collateral is worth 150% of their loan).

DeFiDollar (DUSD) is one example of a decentralized meta-stablecoins (a stablecoin that is backed by multiple stablecoins) that uses Chainlink Price Feeds to track the price of the underlying assets, which include $sUSD, $USDT, $DAI, and $USDC. If one or multiple of those assets deviate from their 1:1 USD peg, this would cause $DUSD to also lose its peg. When this happens, a rebalance is triggered between the four reserves in order to preserve the dollar parity of $DUSD.

Another example includes algorithmic stablecoins, which maintain their peg using automated rewards and penalties to drive the price toward the peg. Most of the time this is achieved by burning the stablecoin when it is under its peg (deflation) and minting more units when it is over its peg (inflation).