Overview

Camelot is a community-driven and ecosystem-focused decentralized exchange (DEX) built on Arbitrum. The protocol was built with composability in mind in order to allow both users and development teams to leverage a custom infrastructure that can offer deep, sustainable, and adaptable liquidity for their protocols.

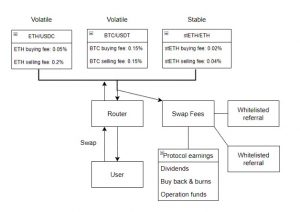

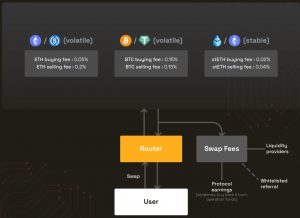

Camelot is dual AMM, meaning that it is able to support efficient trades for both volatile (Univ2-like) and stable pairs (Curve-like). Alongside the AMM, liquidity pools allow for dynamic directional fees that can be applied to all trading pairs. This way, each pool will have its own fees, which will also be adjusted depending on the direction of each swap (buying/selling).

On the liquidity provisioning side, Camelot innovates by introducing the concept of non-fungible staked positions. This creates yield-bearing positions on top of the traditional LP tokens. As a result, the protocol is able to handle locked staked positions and their associated yield boosts, improve its capital efficiency through custom staking strategies, and facilitate the integration of custom functionality, such as Nitro Pools.

AMM

The Camelot AMM has been designed with the following principles in mind:

- Offer high level of flexibility and customization

- Offer an optimized trading efficiency for users

- Provide support for other protocols in the Arbitrum ecosystem to accommodate their needs.

The AMM is based on a dual-liquidity model that introduces dynamic fees as well as a swap referral mechanism for partner protocols.

Each Camelot LP can have one of two types, depending on the expected price correlation between the two tokens in the pair.

Staked Positions (spNFTs)

Camelot introduces a new approach for providing liquidity based on non-fungible liquidity positions called spNFTs.

Each Camelot LP has its own staking positions (spNFTs). Users can mint staked positions (spNFTs) by wrapping LP tokens.

- Since staked positions act as a wrapping layer on LP tokens, every protocol could take advantage of this stack, whether they are listed on Camelot or not, and add locks to their liquidity, along with their own incentives layer, for instance, by using Nitro Pools.

- Users can create advanced custom strategies through an unlimited number of different staked positions for the same LP, with different amounts, locks settings, or boost mechanics.

- Liquidity providers benefit from more capital efficiency by owning an actual receipt of their deposits that can be reused to generate even more rewards

Protocol plugins

Plugins are smart contracts linked to the xGRAIL contract. These plugins can be native (created by the Camelot team, such as dividends, or yield booster), but other members from the community are welcome to integrate new functionalities.

Users will be able to benefit from plugins by allocating xGRAIL to them. This is done by directly staking into the xGRAIL contract.

One notable use of Camelot’s plugins is the Camelot launchpad, which allows projects to launch their token with Camelot’s fair launch model. Another plugin, the yield booster plugin, allows for xGRAIL tokens to be allocated to staked liquidity pairs for even more yield.

There is a default 0.5% deallocation fee on all xGRAIL plugins.

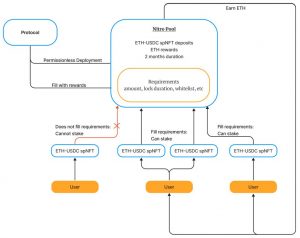

Nitro Pools

Nitro Pools are fixed duration pools made to receive spNFTs from users in order to be able to offer an additional layer of rewards in addition to the actual yield those staked positions are already generating.

Nitro Pools can be created for both LP tokens or single assets, making them highly adaptable and versatile to a wide range of use cases. These pools enable a permissionless way of distributing incentives to pools with the option to set multiple levels of requirements such as minimum amount, minimum lock, whitelisted contracts…

With Nitro Pools, protocols can generate higher returns for their emissions, while communities can be rewarded when they provide liquidity on a long-term basis. This is a permissionless avenue for protocols to incentivize their liquidity without any need for intermediaries. Besides, projects can target specific users based on their staking profiles in order to incentivize certain kinds of actions.

There are two types of Nitro Pools:

- Official Nitro Pools are created by the Camelot team or verified partners

- Community Nitro Pools are permissionless and can be deployed by anyone.

Why the Project was Created

Camelot was born with the goal of bootstrapping and supporting the development of the Arbitrum ecosystem by offering a wide range of solutions that could help other projects to raise and maintain liquidity within their own protocols. In order to make it a permissionless process, Camelot was built as a DAO whose infrastructure could accommodate the flexible needs of other protocols within the ecosystem.

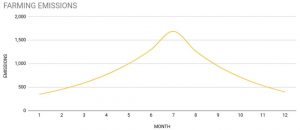

Camelot also applies the real yield narrative to a DEX through a series of innovative emission strategies that showcase sustainable tokenomics. This allows the protocol to align its own incentives with the motivations of users and other teams. This tackles one of the most common problems of Decentralized Exchanges: liquidity providers require competitive yields, but real yields only come from trading volume, which only takes off when there are enough liquidity providers.

Instead of distributing sufficiently heavy token emissions during the initial days of the protocol, Camelot emissions are controlled and targeted for long-term sustainability. This is achieved with a bootstrapping phase that incentivizes genesis pools, and a later growth stage where liquidity emissions will follow a different schedule. Instead of attracting mercenary farmers and short-term liquidity with unsustainable APY, Camelot’s yield is meant to result in a slower and more gradual emissions schedule.

Team

The team has stated that they prefer to remain anonymous. Members of the team that are active in the communities include:

- 0xMyrddin – Lead developer

- 0xPercival – Cofounder and Solidity lead developer

- SirIronBoots – Business development and community manager

- Vivi – Core team member

- Other fully anonymous members are in support roles or with part-time arrangements.

- Active on Github other than team members above

- Spaceturtleship, wenfix, mjs-12, nickf24, ksett737, beankirk, dappbeast, 0xngmi, realdealshaman.

The team is also planning to expand by hiring an additional developer, 1 to 2 people for marketing and business development. Camelot is creating a legal structure as well.

Roadmap

Camelot v2 will introduce concentrated liquidity, revamp the UI, and introduce high-efficiency farms. This will be rolled out in 3 stages.

The new AMM model is based on Algebra’s V2 codebase, a tick-based concentrated liquidity AMM built on top of Uniswap v3. This introduces performance benefits in the form of dynamic and directional fees based on volatility. The AMM will also support rebasing tokens such as stETH and offer limit orders.

DeFi Subsector

Camelot’s main objective is to become Arbitrum’s native DEX by providing its ecosystem with a wide range of innovative features such as Nitro Pools, a public sales launchpad, dynamic fees… This flexibility will allow ecosystem partners to have control over their own liquidity. Camelot achieves this by offering partner protocols all the tools they need to launch, bootstrap liquidity, and sustain their growth.

Camelot’s DEX is also particular in that every pair can have its own customized fees and can be set up with different values depending on the swap direction (buying/selling). This is a key differential that gives the protocol the ability to incentivize every pair differently, based on the correlation of its assets, the use case of the protocol, or even suit protocol-specific needs with custom fees redistribution schemes.

Because of the customizability of its fee structure, Camelot is the destination DEX for projects seeking to boost their trading volume, for newly launched projects aiming to stabilize and limit selling pressure… Its flexibility also enables custom implementations with automatic adjustment of fees based on market volatility.

Initially, every partner protocol launching on Camelot will have its LPs configured with specific swap rates tailored to suit Camelot’s own strategy.

Another unique feature of Camelot is the introduction of staked positions, which add a new layer of composability and increased capital efficiency by wrapping LP positions into NFTs. With this model, Camelot attempts to find the right balance for token emissions that result from farming incentives. For example, instead of rewarding every LP position equally, protocols can set different incentives to foster a more sustainable environment that differentiates between long-term users and mercenary farmers.

spNFTS are a solution for:

- Providing adequate rewards for every LP based on their degree on long-term commitment

- Offer a modular and permissionless architecture that can be adjusted to suit protocol-specific functionality

- Allow for more reusable and capital-efficiency staked positions

Also, staked positions have additional functionality beyond being a receipt for LPs:

- spNFTs have yield-bearing properties and can automatically generate yield rewards when their wrapped LPs have been configured to receive GRAIL incentives

- spNFTs can be lock positions for specific periods of time

- Each spNFT has its own properties: amount, APY, boosts from locks, lock bonus settings…

By applying spNFTs to its liquidity pools, Camelot has the ability to come up with innovative features such as Nitro Pools. Nitro pools are fixed-duration pools that can add an additional layer of rewards for spNFTs. This concept can be a game changer for permissionless deploying liquidity pools where the deployer can accurately target a subset of liquidity providers. This is possible by allowing positions to have a minimum lock period, offering rewards to the most loyal holders, allowing only whitelisted addresses to deposit their spNFTs to receive airdrops, distributing compensations.

Among its main competitors in Arbitrum, we find DEXes such as Zyberswap, Uniswap V3, SolidLizard, Sushi, Curve, Shell Protocol, Kyberswap, Balancer, Trader Joe V2…

Chains

Camelot is available on the following chains:

- Arbitrum

- XAI – Upcoming

How The Project Works

AMM

The Camelot AMM has been designed with the following principles in mind:

- Offer a high level of flexibility and customization

- Offer an optimized trading efficiency for users

- Provide support for other protocols in the Arbitrum ecosystem to accommodate their needs.

The AMM is based on a dual-liquidity model that introduces dynamic fees as well as a swap referral mechanism for partner protocols.

Each Camelot LP can have one of two types, depending on the expected price correlation between the two tokens in the pair.

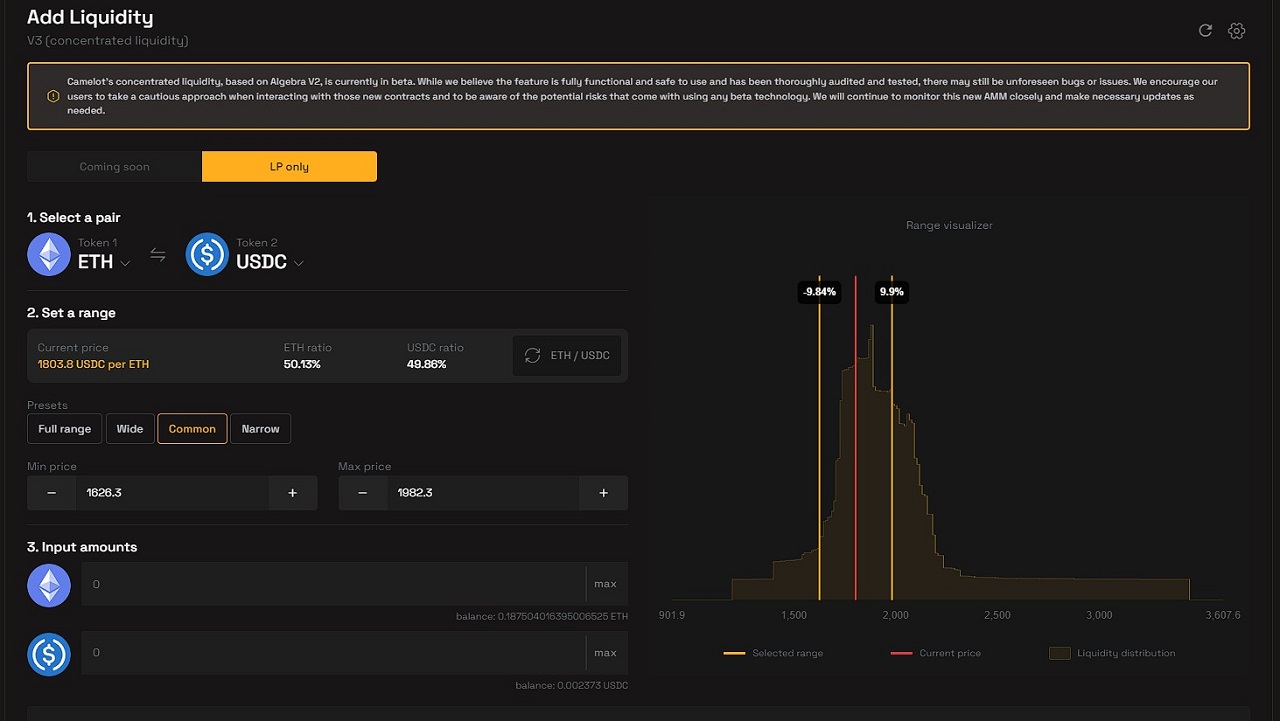

Volatile Pools

Volatile pairs are composed of uncorrelated assets and follow the constant-product AMM model introduced by Uniswap V2.

x * y = k;

Stable Pools

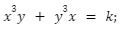

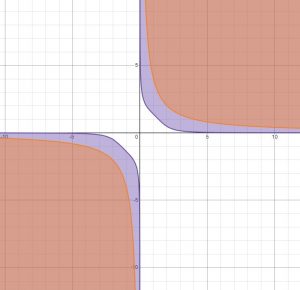

Stable pools are used for price-correlated assets where the AMM will attempt to maintain a 1:1 transfer ratio.

Stable pools implement the AMM originally designed by Solidly, which attempts to concentrate most of the liquidity at current prices. As trades occur, the pool can adjust the price so as to move the highest liquidity region without incurring losses.

Stableswaps tend to stick to the 1:1 ratio as much as possible until a certain point where they revert to an x*y=k model.

The process of becoming a liquidity provider in a stable pool is the same as that in a volatile pair pool. As a liquidity provider in a stable pool, you will gain exposure to all assets in the pool.

The purple region represents the stable pricing formula and the orange region represents the constant-product AMM.

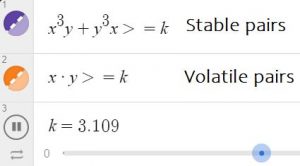

Concentrated Liquidity Pools

Concentrated liquidity pools were introduced on April 8, 2023, by integrating Algebra V2.

Algebra’s v2 is a tick-based concentrated liquidity AMM built on top of Univ3.

Among its general performance improvements on the vanilla Univ3 codebase, some major enhancements have been implemented.

Directional & dynamic volatility fees for each pool will automatically adjust to the underlying volatility, adding significant efficiency gains.

Therefore, the fees for each pool will be highly specific to the market, further boosting fees and volume.

Dynamic Directional Fees

Camelot’s AMM swap fees are dynamically adjusted based on market conditions and protocol parameters. Camelot pairs can be configured with their own swap fees, but it is also possible for each of them to be set up with different values based on the swap direction (buying or selling).

This allows Camelot to incentivize each pair differently, depending on the volatility or stability of its assets, as well as on the structure of protocols and their own custom needs (an established project seeking to reduce friction, a newly launched project aiming to stabilize selling pressure…).

Each project launching on Camelot can have its LP configured with specific swa rates tailored to suit its own strategy.

Swap Referrals

The swap referral is a built-in mechanism aimed directly at partners and protocols. Every partner protocol can add its referral address to each transaction made on Camelot in order to receive a part of their users’ generated swap fees. This results in a positive-sum relationship where all Camelot actors are adequately rewarded, which fosters a fair and more sustainable ecosystem.

Swap referrals can only be used by whitelisted partners and are not accessible to single users or unapproved users. To inquire about this service, new or existing projects should get in touch with the Camelot team

V3 AMM

V3 AMM went live on June 20, 2023.

Similar to V2, it utilizes Algebra’s v1.9 mechanism, allowing Camelot to relaunch its concentrated liquidity on a more battle-tested foundation.

The changes to Algebra’s v2 includes:

- Customizable Tickpacing

- In the first version of the protocol, tickspacing was an immutable constant within pools. In version 2, tickspacing can be changed at any time. This allows the protocol to more accurately and efficiently set up pools for different kinds of tokens. The default tickspacing is 60. Contracts interacting with Algebra V2 pools must take into account the possibility that tickspacing will change. MAX_LIQUIDITY_PER_TICK is fixed based on tickspacing value 1.

- Default Community Fee

- You can also now configure what value of communityFee will be set in new pools by default. This makes it easier to set up new pools.

- Decrease Rewards

- In version 1.9 the owner have the ability to withdraw some of the rewards from farms.

Camelot also integrates external liquidity managers directly into the app, making automated v3 strategies accessible to the average user.

Market Maker Incentives

The Market Maker incentives programmed was introduced on September 13, 2023.

The new Market Maker incentives will focus on rewarding the most efficient v3 LPs, achieving higher fees and more volume.

Market Maker incentives will allow active LPs to earn $GRAIL rewards by providing v3 liquidity, with the rewards distributed based on how many fees are generated.

This approach is mainly catered towards active and sophisticated LPs, since it is entirely manual, and rewards are allocated every 6 hours & can be claimed on the positions page.

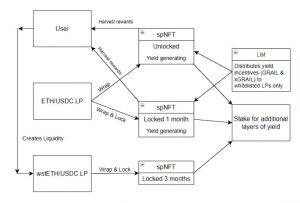

Staked Positions (spNFTs)

Camelot introduces a new approach for providing liquidity based on non-fungible liquidity positions called spNFTs.

Each Camelot LP has its own staking positions (spNFTs). Users can mint staked positions (spNFTs) by wrapping LP tokens.

- Since staked positions act as a wrapping layer on LP tokens, every protocol could take advantage of this stack, whether they are listed on Camelot or not, and add locks to their liquidity, along with their own incentives layer, for instance, by using Nitro Pools.

- Users can create advanced custom strategies through an unlimited number of different staked positions for the same LP, with different amounts, locks settings, or boost mechanics.

- Liquidity providers benefit from more capital efficiency by owning an actual receipt of their deposits that can be reused to generate even more rewards.

When a staked position is created, the deposit is sent to a specific NFTPool contract in exchange for a staking position NFT. This staking position NFT will act as a receipt, allowing users to withdraw the underlying funds of the LP refgardless of who is using them.

The owner of the staked position, even if not the original depositor, is the owner of the corresponding LP.

Every staked position is represented with:

- Unique ID

- Deposit LP token

- Deposit LP amount

- APY

- Optional lock settings

- Multipliers information

Owners of staked positions can perform the following actions:

- Deposit: add more tokens to the position

- If the position is locked, this will reset the lock

- Withdraw: withdraw a number of tokens from the position

- If the position is emptied, the spNFT is burned

- This function cannot be used if the position is locked

- Harvest: claim all pending rewards (xGRAIL and GRAIL) from the position

- Only used when yield incentives are allocated to the position’s LP token

- Lock: lock an unlocked position for a given duration

- Extend: renew or extend the lock duration (for already locked positions)

- Transfer: transfer the position to another address

- Split: split the position into two, dividing between them the original amount.

- If the original position is locked, the new one will be as well with the exact same settings

- Merge: merge positions into one

- The final position will use the longest lock duration and farthest end lock time among all the merged positions

Staked Positions Locks

Owners of staked positions can specify a lock duration when creating a position. Every wrapped Camelot LP (staked position) has its own lock settings (max lock durations, and max lock multiplier).

When a position is locked, it will be impossible to withdraw anything from the spNFT until the end of the lock.

Locks on staked positions provide a yield bonus based on the lock multiplier if the position’s LP is incentivized. The yield bonus is linearly calculated proportionally to the duration of the lock and the maximum lock multiplier.

Locking can be a requirement for staking on certain Nitro Pools.

Over time, Camelot will delegate control over lock settings and their associated multiplier to the protocol’s themselves.

Staked Positions APY

Every spNFT is yield-bearing and will have its own APY based on:

- The allocation set to the wrapped LP

- The lock multiplier

- The yield boost multiplier

From a user standpoint, the mechanics have a lot of similarities with regular DeFi yield farms. However, instead of allocating rewards to those regular farms, Camelot’s Master contract distributes incentives to all the staking positions of team-defined selected wrapped LPs.

It is not because a user owns a staking position that they will necessarily receive Camelot incentives: it will only be the case for those selected assets.

Once a staked position’s LP belongs to those listed pairs, the spNFT starts generating yield from rewards, as if its owners were actually staking into a regular farm.

List of incentivized positions: https://app.camelot.exchange/positions

Rewards

Camelot incentives are in the form of dual rewards, which means that the eligible wrapped Camelot LPs (owners of staked positions) will receive both GRAIL and xGRAIL. The share of both rewards in total varies depending on the asset, with a default being set to 80%xGRAIL and 20% GRAIL.

There are two ways to boost returns from yield-bearing positions: through locks, or through the yield booster plugin. Both values will vary depending on the staked assets, ranging from 0% to 150% (1x to 2.5x), but will usually be set to their default 100% (2x). The sum of those two multipliers is used to determine the total multiplier of the position.

Every pool will have its own maximum boost, with a 200% (3x) default cap and an absolute cap of 250% (3.5x).

Genesis Farms

Genesis Farms are pools based on Camelot’s Nitro pools structure and that are exclusive for the early adopters of the protocol. These pools are designed to bootstrap the initial liquidity for Camelot before the protocol’s native token goes live. This provides the community with an early and attractive opportunity to accumulate xGRAIL.

In some cases, Genesis Farms will not only distribute xGRAIL but also incentives from tokens provided by partner protocols.

To participate in Genesis Pools, the liquidity must first be converted into a staked position (spNFT). This will entitle the user to 6 months of xGRAIL emissions.

- Deposit assets and create a liquidity position at https://app.camelot.exchange/liquidity/

- Go to the Genesis Farms page and select the matching pool in which you will deposit your newly created position: https://app.camelot.exchange/genesis

Depositors are entitled to linearly earn xGRAIL emissions during the first 6 months following the public sale.

Genesis Pool depositors can withdraw at any time, but at that point, their share of emissions will be distributed among the remaining participants.

- 5% of the total GRAIL supply has been allocated for Genesis Pool rewards.

- Genesis Pool depositors earn both farming rewards and Genesis farm rewards, as well as any additional bonus from locking thor LPs.

The main pools consist of popular traded pairs as well as partnerships with other protocols on Arbitrum.

Nitro Pools

Nitro Pools are fixed duration pools made to receive spNFTs from users in order to be able to offer an additional layer of rewards in addition to the actual yield those staked positions are already generating.

Nitro Pools can be created for both LP tokens or single assets, making them highly adaptable and versatile to a wide range of use cases. These pools enable a permissionless way of distributing incentives to pools with the option to set multiple levels of requirements such as minimum amount, minimum lock, whitelisted contracts…

With Nitro Pools, protocols can generate higher returns for their emissions, while communities can be rewarded when they provide liquidity on a long-term basis. This is a permissionless avenue for protocols to incentivize their liquidity without any need for intermediaries. Besides, projects can target specific users based on their staking profiles in order to incentivize certain kinds of actions.

There are two types of Nitro Pools:

- Official Nitro Pools are created by the Camelot team or verified partners

- Community Nitro Pools are permissionless and can be deployed by anyone.

By default, a newly created Nitro pool will be marked as a Community Nitro Pool

Staking

Nitro Pools accept staked positions as deposits and have the following adjustable parameters:

- Accept a specific wrapped LP or single asset where only positions made from this deployer-defined assets can be deposited into the pool

- A reward token (additional rewards can be added at any time)

- A deposit start time before which nobody can stake

- A rewards’ distribution phase duration with start and end times

- An optional harvest start time before which no one can collect their earned rewards

Some Nitro Pools may have more additional settings than the ones displayed above. When that’s the case, it will be displayed in the UI

Users can deposit as much of their spNFTs as they want. The rewards calculations are consequently made based on the sum of all the user’s current deposits. It is also possible to add new positions at any time, as well as to withdraw staked positions completely or just some of them.

Protocol Plugins

Plugins are smart contracts linked to the xGRAIL contract. These plugins can be native (created by the Camelot team, such as dividends, or yield booster), but other members from the community are welcome to integrate new functionalities.

Users will be able to benefit from plugins by allocating xGRAIL to them. This is done by directly staking into the xGRAIL contract.

There is a default 0.5% deallocation fee on all xGRAIL plugins.

Dividends

The majority of the protocol earnings are redistributed to users allocating xGRAIL to the dividends plugin. The distribution of this dividend can be done with one or more tokens and happens continuously through weekly epochs. Every week, a fixed part of the owner-defined accumulated tokens are marked to be distributed.

Dividends are distributed continuously and users don’t need to wait until the end of the epoch to claim them.

The distribution of tokens over the epoch (week) is equally spread over the duration of the epoch and allocated on a second basis to every user with an xGRAIL allocation on the dividends plugin, proportionally to their share of the total allocation.

For example, if there are a total of 10,000 xGRAIL allocated to the dividends plugin and there is a daily distribution of 10,000 USDC, then if a user has allocated 200xGRAIL to the plugin, the user would own 2% of the allocations and would receive 2% of the daily rewards (i.e. 200 USDC).

Dividends distribute protocol revenue to users in 7-day cycles. This revenue is only distributed to those users who have allocated xGRAIL to the dividends plugin.

The accumulated tokens come from transaction fees paid by other users. The distribution happens on a weekly epoch basis: every week, a fixed part of the owner-defined accumulated tokens is whitelisted for distribution.

If the user decides to deallocate their xGRAIL position from the dividends plug-in, he will pay a 0.5% deallocation fee.

Pending rewards from dividends can be claimed at any time

Yield Booster

The yield booster plugin allows users to allocate xGRAIL to staked positions in order to increase their existing APR yield earned from farming emissions.

The induced yield boost multiplier is different based on the staking position’s wrapped LP (staked position). This value is calculated for every position based on:

- The position’s LP amount

- The total staked LP amount across all positions and users

- The position’s allocated xGRAIL amount

- The total allocated xGRAIL across all positions with the same LP

- The LP max boost multiplier (can’t exceed 2.5x)

boostMultiplier = (userLP * totalAllocation * maxBoostMultiplier)totalLP * userAllocation;

As more people allocate xGRAIL to a pair, the APR will be lower for the amount allocated by the user

The boost has no effect whatsoever on the rewards being earned from the LP trading fees and nitro/genesis pools

Example of using the yield booster:

- The user’s staked position (with yield-bearing properties) is currently earning 50% APR from farming emissions

- The user allocates 1 xGRAIL to their staked position through the yield booster plugin

- The user’s position now has a 1.5 multiplier bonus and will be earning 75% APR from farming emissions

- More users allocate xGRAIL to the same pair

- The user’s position bonus multiplier decreases to 1.25

- Now the user’s staked position is earning 62.5% APR from farming emissions.

Community Plugins

The xGRAIL allocation mechanism allows any protocol or user to provide their own plugins with custom functionality.

All additional xGRAIL allocations are handled by the xGRAIL contract itself and community plugins will have to comply with some technical requirements.

Camelot cannot be held responsible for any authorization given by users to any third-party plugin. Users must be aware that malicious and dishonest plugins can cause your xGRAIL to remain stuck forever.

Launchpad

Camelot’s launch plugin enables projects to launch on Arbitrum using Camelot’s fair-launch model.

More launch models will be added to the launchpad and it will become a permissionless process in the future.

Camelot is a set of decentralized smart contracts deployed on Arbitrum and bears no responsibility for any tokens purchased through its launchpad plugin. When participating, users are taking full responsibility that they are aware of the sale they are participating in and that external tokens are not associated with Camelot in any way.

Social media posts and visible information on the app do not count as an endorsement of an external protocol by the Camelot team.

For Users

- Trade:

- swap tokens

- Liquidity:

- Create staked positions (spNFTs)

- Add/unbind liquidity

- Earn:

- Wrap LPs of single assets into new staked positions (spNFTs)

- Harvest-earned rewards from active farms

- Adjust lock times on staked positions

- Boost and unboost staked positions

- Transfer your positions

- Split/Merge staked positions

- Withdraw from Genesis/Nitro pools

- xGRAIL:

- Convert GRAIL to xGRAIL

- Redeem xGRAIL for GRAIL

- Allocate xGRAIL to dividends, harvest rewards, and deallocate xGRAIL from dividends

- Boost staked positions

- Launchpad:

- View past and future sales

- Participate in public sales and claim public sale allocations

- Generate referral links

- Analytics:

- Real-time information about Camelot’s liquidity, transactions, fees, volume

- A calculator allows users to simulate the creation of a position before committing real funds to determine the APR of a particular strategy

- The earnings dashboard allows users to easily monitor their active positions, projected earnings…

How to Swap on Camelot

Token swaps work similarly to any other AMM Dex, where users simply choose the tokens and amounts of the assets they would like to trade.

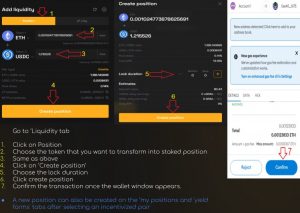

How to Farm on Camelot

After providing liquidity, users create a staked position in order to start automatically earning LP swap fees and farm incentives, which can be boosted with locks and xGRAIL’s yield booster. The staked positions can also be deposited into Nitro Pools to earn additional rewards.

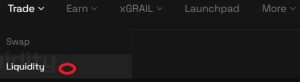

1. Go to trade -> liquidity

2. Check that position is selected

3. Select the token pair you would like to provide liquidity for, approve, and initialize the staked position.

By adding liquidity to a pool you will receive LP tokens.

Adding liquidity to a pool only allows your position to earn trading fees

If you would like to earn farming emissions as well, you must create a position, which can be created without first adding an LP. Otherwise, you could wrap your LP token into a staked position (spNFT) to access more utilities and earn additional rewards on top of trading fees.

You can remove your liquidity by unbinding your LP.

LP tokens wrapped in staked positions (spNFTS) must be first withdrawn before unbinding.

Staked positions can be created through the liquidity tab, the yield farms tab, and the my positions tab.

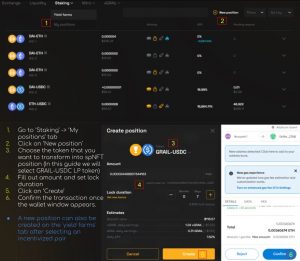

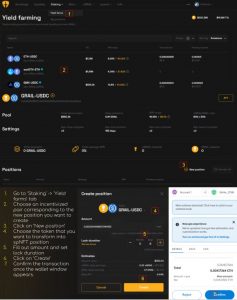

- Creating a staked position in the yield farms tab

- After creating the staked position you can go to earn -> Nitro Pools

- Select the pool you have provided liquidity to, or click on the “Matching Nitros” button on the position management panel

Staked positions farming incentives can be boosted by using the time-locked or yield booster features. The boosts are based on multipliers, where the maximum multiplier that can be achieved is 3x.

LP positions can earn swap fees, farming incentives (which can be boosted), and Nitro rewards.

There is no need to deposit LP positions on any farm, only participation in Nitro Pools requires deposits of staked positions.

LP trading fees and Nitro Pool rewards are not affected by either the lock duration or the boost multiplier. The only effect is that your existing farming incentives APR will now be increased.

- 2x multiplier, 100% boost

- 3x multiplier, 200% boost

Users can specify a lock duration when creating a staked position or lock it directly in the position management panel after the position was already created.

-

- The maximum boost can be achieved by setting a 6-month lock, but any number of days can be set.

- Max lock multiplier is 2x.

Through the yield booster plugin, users can allocate xGRAIL to a staked position in order to increase the existing APR yield earned from farming incentives.

- As more users allocate xGRAIL to a pair, the APR will be lower for the amount you allocated. Similarly, the lower the number of users allocating xGRAIL to a pair, the higher the APR.

- Max boost multiplier is 2x

Staking (Positions)

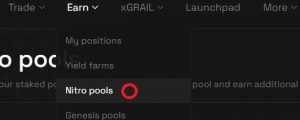

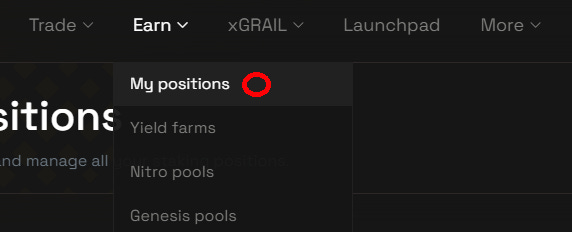

The Earn tab is divided into 4 specific categories:

- My positions: manage your staked positions

- Yield farms: shows what pairs are being incentivized and lets users manage their paired positions

- Nitro pools: deposit your staked positions to earn additional rewards

- Genesis pools: bootstrapped Camelot’s seed liquidity and accrue 6 months of xGRAIL emissions since their launch on November 23, 2022

A built-in calculator can be used to determine the expected APR based on the USD values of your active positions. This takes into account the amount of tokens, the lock duration, the xGRAIL allocated to the YieldBoosted, and the Nitro Pool participation.

Yield farms – Incentivized pairs

Yield-bearing positions (the ones that have “farms” in the UI) are incentivized by Camelot. However, anyone can leverage spNFTs and, for instance, directly incentivize liquidity through Nitro. These incentives are determined and controlled by Camelot.

Staked positions receive rewards in the form of GRAIL and xGRAIL if the underlying asset is incentivized (no stake is necessary to earn yield), although the rewards must be harvested manually.

To create a staked position:

- Device how much of the asset you wish to transform into an spNFT position

- Choose whether you want to lock your position or not

Upon creation, you will be informed about:

- Lock bonus: the longer the lock the higher the bonus

- Deposit value: the current value of the LP or single asset that you want to transform into an spNFT

- xGRAIL daily earnings: estimated xGRAIL daily earnings

- GRAIL daily earnings: estimated GRAIL daily earnings

- Daily APY: estimated daily APY

When creating a position, the deposited asset is transferred to a contract, and a new spNFT is minted. This NFT is a transferable deposit receipt that allows a user to withdraw its attached funds, no matter who made the original deposit.

Positions Management

Users can manage their existing positions to deposit, withdraw, harvest, adjust locks, boost/unboost positions, and transfer/split/merge staked positions.

- You can increase your staked position by depositing the same tokens with which you originally created the position

- Through the withdrawal function, staked positions can be withdrawn back into LP tokens or single assets (in full or in part)

- Users can claim their pending rewards and auto-compound their earnings

- The lock function lets users lock their staked positions for a duration of their choice

- The longer the lock the higher the multiplier bonus from farming emissions

- Locked positions can be renewed, but they must be renewed for at least the same number of days as are left on the ongoing lock

- Staked positions can be boosted

- The split function allows users to split staked positions, merge multiple staked positions that share the same pair, or transfer them from one wallet to another.

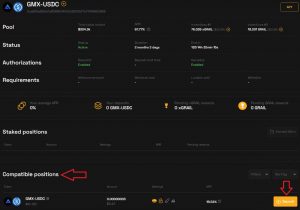

Staking into Nitro Pools

A Nitro Pool can work as an additional reward pool on top staked positions (spNFTs). If the pair used to create the Nitro Pool is incentivized, it will allow the user to earn yield from both farm incentives and the Nitro Pool at the same time.

For example, a user that creates an ETH/USDC staked position can deposit the spNFT (which has yield-bearing properties) into a Nitro Pool and the user’s position will earn both LP trading fees and rewards from the Nitro pool as well as the yield from the farm incentives.

Creating Nitro Pools

The creation of Nitro Pools is a permissionless process that can be done by anyone. This is designed for protocols that wish to enhance their liquidity incentives.

For example, a protocol that wishes to provide rewards to its liquidity providers on Camelot may set up a Nitro Pool only for those users who lock their deposits for more than 3 months, for those who deposit X amount …

xGRAIL

In the xGRAIL tab, users can:

- Convert GRAIL to xGRAIL

- Redeem xGRAIL to GRAIL through vesting

- Allocate xGRAIL to dividends to earn rewards

- Allocate xGRAIL to boost your positions’ APR

When converting GRAIL to xGRAIL, remember that redeeming xGRAIL requires a vesting period. Through the vesting process, the user will be able to redeem xGRAIL back to GRAIL.

There are two plug-ins where users can allocate their xGRAIL holdings:

- Dividends: from protocol revenue

- Yield booster: boost the yield of existing staked positions

As xGRAIL vests, 50% of the amount is automatically staked in the dividends plug-in, earning the user additional rewards while the vesting continues.

- Minimum duration: 15 days (50% GRAIL output)

- Maximum duration: 6 months (100% GRAIL output)

As an example, when you redeem 100xGRAIL for 3 months, you will get 72.3% of the GRAIL output. This means that, by the end of the 3 months period, you will get 72.3 GRAIL, and, during those 3 months, 50 xGRAIL is staked in dividends, which would earn you additional rewards.

For Investors

Users can go to the earnings dashboard tab to access a quick and easy way to monitor their positions and pending claims from earnings.

Investing Strategies

Liquidity Providing

Investors planning to acquire xGRAIL, GRAIL, or partner tokens without buying them directly can choose to provide liquidity in Yield farms or the Nitro Pools. Strategies include providing liquidity to one of the following:

- Volatile pair.

- Volatile-stable pair.

- Stable pair.

Volatile Pair

Volatile LP pairs expose investors to the volatile price action of both underlying tokens. However, the APR is usually higher for such farms.

Volatile-stable Pair

Volatile-stable pairs expose investors to the volatile price action of 1 of the token but are hedged by the other half consisting of stablecoins. These farms tend to have a lower APR than volatile pairs, but higher than stable pairs.

Stable Pairs

Stable pairs allow investors to yield-farm without exposing themselves to the price action of volatile tokens. However, these farms tend to have the lowest APR.

Investors then choose to either sell their yield rewards for profit, or to re-invest them back into the liquidity positions, or as xGRAIL.

xGRAIL

Locking up GRAIL into xGRAIL allows investors to utilize xGRAIL for different purposes, such as:

- Earning dividends.

- Boosting yields of staked positions.

Dividends

Investors can allocate xGRAIL to earn a share of protocol earnings in the form of real yield.

Boosting yields of staked positions

If the investors have staked positions in the yield farms or Nitro Pools, they are able to allocate xGRAIL in order to boost the yields.

Investors then choose to either vest their xGRAIL into GRAIL in order to make it fully liquid to provide liquidity, to sell, or to continue locking it up into xGRAIL to increase their positions.

Business Model & Revenue Streams

Protocol earnings, initially coming mostly from swap fees, are redistributed to xGRAIL holders and used to buy back and burn GRAIL tokens.

The protocol transaction fees are distributed as such:

- 60% for Liquidity Providers in LP tokens.

- 22.5% in dividends redistributed to xGRAIL holders.

- 12.5% dedicated to GRAIL buyback and burn.

- 5% to the Core Contributors funds.

The Core Contributors funds will be exclusively used to cover the operating expenses. Every month, the unused amount will be reallocated towards either Dividends or used for Buyback and Burn, up to the team’s discretion.

Economics

- TVL: https://defillama.com/protocol/camelo

- TVL tokens breakdown: https://defillama.com/protocol/camelot

- Yields: https://defillama.com/yields?project=camelot

Fee Breakdown

Camelot supports customizable, dynamic, and directional fee settings. These fees can be based on market conditions and protocols’ specifics. Every pair can have its own customized fees and can be set up with different values depending on the swap direction (buying/selling).

- 60% for liquidity providers in LP tokens

- 22.5% for xGRAIL holders

- 12.5% dedicated to GRAIL buyback and burn

- 5% to core contributor funds

Operating Expenses

The team has been using ~$700,000 (20% of the public sale) to fund the team and cover initial expenses: salaries, outsourcing design and development work, legal structure, lawyers, nodes…

Team salary is around $27,000 as of February 2023, but will increase with new hires.

Farming emissions are in xGRAIL, which requires redeeming in order to be traded. The farm incentives are expenses for the protocol that are provided in an 80/20 GRAIL ratio.

Nitro pool incentives provided by partner protocols come at no cost whatsoever for Camelot.

Deflationary Mechanisms

Besides the hard cap of GRAIL, some deflationary mechanisms are implemented in order to reduce the total supply.

Buyback and Burn

12.5% of the protocol earnings are dedicated to buying back and burning GRAIL in order to apply continuous buying pressure on it.

- GRAIL burned: https://dune.com/queries/1980763/3273835

xGRAIL Redemptions

If the vesting duration when converting xGRAIL to GRAIL isn’t the maximum, the xGRAIL:GRAIL ratio will be lower than 1:1, down to a minimum of 1:0.5. All of the excess GRAIL will be automatically burned.

Example: If a user redeems 1000 xGRAIL with the minimal 15-day vesting duration, he will obtain a 1:0.5 ratio, receiving 500 GRAIL in the end. The remaining 1000 – 500 = 500 GRAIL will be burned during the process.

- Camelot upcoming redemptions (cancellations not included): https://dune.com/queries/1742843/2872688

xGRAIL Deallocations

When deallocating xGRAIL from a Plugin, a deallocation tax is applied. This deallocation tax can vary between contracts, but will usually be 0.5%. The corresponding GRAIL amount will automatically be burned.

Tokens

Camelot is based on a dual token system consisting of liquid GRAIL and escrowed GRAIL (xGRAIL). xGRAIL is a non-transferable governance token that is also used to distribute yield farming rewards.

The xGRAIL value is directly correlated to the GRAIL value and 1 xGRAIL equals 1 GRAIL

By distributing most token emissions as xGRAIL, the protocol ensures that it will have granular control over the liquid supply of GRAIL in the market at all times. Combined with a supply hard cap, carefully crafted emissions, and a variety of deflationary mechanisms, Camelot aims to secure the sustainability of its token economy in the long term.

GRAIL

GRAIL is Camelot’s native token. It can be earned as yield rewards on incentivized staking positions.

- Max supply: 100,000 GRAIL

GRAIL supply release

xGRAIL

xGRAIL is an illiquid and non-transferable escrowed governance token that represents staked GRAIL. It can be earned from yield-generating staking positions (spNFTs), or through direct GRAIL conversion.

The central use case for xGRAIL is the ability to allocate it to Plugins. This operation consists of staking xGRAIL into the token contract and assigning the deposited amount to a specific plugin in exchange for various benefits.

Users can freely allocate their available xGRAIL to any plugin to take advantage of its benefits. While xGRAIL is allocated and deposited on the token contract, it can’t be used for anything else.

Deallocating allocated xGRAIL will withdraw the amount from the contract back into the user’s wallet and a default 0.5% fee will be applied.

- Allocated xGRAIL user counts: https://dune.com/queries/1754288/2892621

Conversion – Redemption

GRAIL and xGRAIL are mutually convertible into each other, but the process is different depending on the direction.

- GRAIL > xGRAIL (Conversion): GRAIL can be freely converted into xGRAIL any time at a 1:1 ratio

- xGRAIL > GRAIL (Redemption): The redemption process to convert xGRAIL to GRAIL implies vesting, the duration of which is selected by the user

- The minimum vesting duration of 15 days will provide a 1:0.5 ratio

- The maximum vesting duration of 6 months will provide a 1:1 ratio

If the selected vesting duration is lower than the maximum (ratio < 1:1), the unclaimed excess GRAIL is burned

While being redeemed, the xGRAIL is automatically allocated to the dividends plugin, but only for 50% of its value. For instance, if a user was to redeem 1000 xGRAIL, the user will earn dividends as if he allocated 500 of them to the dividends plugin. This allocation is automatically canceled once the vesting duration has ended.

Any xGRAIL redeeming process can be freely interrupted at any time by the user

Token Distribution

GRAIL allocation is as follows:

GRAIL

- 22.5% to Liquidity Mining over the next 3 years.

- 20% to Core Contributors vested linearly over 3 years.

- 10% to Partnerships with a 6-month cliff and 2 years vesting.

- 8% to Reserves, pre-minted in a multi-sig.

- 5% to the Ecosystem.

- 2.5% to the Development Fund vested linearly over 3 years.

- 2% to Advisors vested linearly over 3 years.

Except for the Reserves and Development Fund, all emissions are a combination of GRAIL and xGRAIL.

xGRAIL

Public sale

The public sale offered 15% of the GRAIL supply with 10% in GRAIL and 5% in xGRAIL, where any unsold tokens would be burned.

A total of $3.8M was raised in the public sale, with a final price of $254 per GRAIL and a circulating market cap of $5.7M. There were no unsold tokens.

Public sale proceeds will be directed in the following proportions:

- 50% will be immediately paired with 7.5% of GRAIL from Protocol Owned Liquidity to provide Uni v2-style liquidity.

- 30% towards dividends.

- 20% towards the Treasury to fund core contributors.

Genesis Liquidity Mining

The Genesis liquidity mining program started 10 days before the start of the public sale and ran until the end of the public sale, for a total of 16 days.

Depositors will linearly earn emissions in xGRAIL during the 6 months after the public sale.

Liquidity Mining Emissions

Around 15% of liquidity incentives emissions will be in GRAIL and 85% in xGRAIL.

The ratio earned will differ by pool and the exact emission rate will follow the target rate specified in the release schedule.

Both native and riskier pools will generally earn a higher percentage of GRAIL vs xGRAIL.

Governance

As a DEX, Camelot believes in the permissionless nature of free markets and allows external projects to have full control over their own incentives, without requiring any intervention from the Camelot core team. Similarly, Camelot’s permissionless launchpad also gives all projects equal opportunities to bootstrap their own token launches and liquidity.

Community members are able to use their xGRAIL balance as a governance token to vote for official proposals. Both users’ wallet holdings and allocated xGRAIL balances are taken into account, but not the xGRAIL in a pending redemption.

The more xGRAIL balance a user owns, the higher the voting power

A vote will systematically happen for any funds movement from the Treasury, and will progressively be established for deciding the general protocol direction.

When a proposal is approved by the community through this process, a DAO multi-sig consisting of team members and advisors will implement the necessary contracts or transactions required to execute the final decisions.

The final result of the vote will always have to go through the DAO validation process in order to prevent bugs or ill-intended actors from pushing for malicious changes.

Risks

Security

In the official docs, Camelot refers to their own developers as industry veterans who have a wealth of experience in creating smart contracts. The protocol consolidates this statement by having its codebase audited by Paladin, one of the leading smart contract security and auditing firms.

Audits

- Smart Contract Security Assessment – 30 October 2022

- High risk: 5 (5 Resolved)

- Medium risk: 7 (7 Resolved)

- Low risk: 19 (17 Resolved, 1 Partially resolved, 1 Acknowledged)

- Informational risk: 39 (34 Resolved, 2 Partial resolved, 3 Acknowledged)

- Smart Contract Security Assessment (Nitro and Presale) – 14 November 2022

- High risk: 1 (1 Resolved)

- Medium risk: 2 (2 Resolved)

- Low risk: 8 (8 Resolved)

- Informational risk: 8 (6 Resolved, 2 Acknowledged)

There is currently no bug bounty program existing.

Project Investors

There are no VCs or seed rounds for Camelot. Funds were raised via a fair public sale, with a discount for holders of legacy tokens (EXC and GRAIL v1).

Public Sale

Camelot was designed to be a community-driven protocol and, because of that, there was no presale or VC investment. Instead, the initial seed of liquidity was raised from the community in a public sale that began on November 29, 2022, and finished on December 5, 2022. The token launch was on December 6, 2022 and one day later the liquidity mining started.

- The auction started at a fully diluted valuation of $2M, fixing a floor price of $20 per GRAIL and increasing after the first $300,000 raise.

- After the initial $300,000 raise, the token enters a price-discovery phase

- All purchases were settled at the same price based on the amount of assets invested (decided at the end of the auction).

- 15% of the total GRAIL supply

- 10% in liquid GRAIL

- 5% in xGRAIL

- The sale was conducted in USDC and there was no hard cap or limit on the amount that could be allocated by each wallet.

- Any unsold tokens from the public sale were burned.

- The earliest participants would also get an airdrop with the snapshot taken at 12 AM UTC on December 1st.

- On March 29, it was announced that all contributions before Dec 1st, 12 am UTC would be eligible to receive a ~25% bonus in $xGRAIL. The bonus would be on contributed amounts, e.g. a $100 contributor will receive a ~$25 airdrop.

Referrals

After the sale, every user could share a referral link and claim 3% of all the referred investments made through it.

V1 holders discount

Legacy holders of the IEXC token were eligible for a 10% discount during the public sale. There was a set of capped amounts for which the discount could be applied:

- At least 100 IEXC: $1,000 cap

- At least 2,000 IEXC: $2,000 cap

- At least 5,000 IEXC: $5,000 cap

- More than 10,000 IEXC: $10,000 cap

Additional Information

Partnerships

As an AMM with a launchpad service, Camelot has a variety of partners and integrations. Partners that joined before the official launch of Camelot were known as Key Launch partners, while partners that came after were “invited” to the Round Table.

- Nitro Cartel – Nitro Cartel is an Arbitrum-native project that aims to improve chain-level governance structures and fix the incentive misalignment issue of chains, project founders, users, and investors.

- Buffer Finance – Buffer Finance is a non-custodial, exotic options trading platform built to trade short-term price volatility and hedge the risk of high-leverage positions.

- Jones DAO – Jones DAO is a yield, strategy, and liquidity protocol with vaults that enable 1-click access to institutional-grade strategies.

- Umami Finance – Umami Finance is pioneering the mass adoption of DeFi with its expanding array of DeFi Yield products tailored to institutional investors.

- GMX – GMX is a decentralized perpetual exchange that supports low swap fees and zero price impact trades, allowing users to take up to x50 leverage.

- GMD – GMD Protocol is a yield optimizing and aggregating platform built on top of existing applications and GMD’s reserve token on Arbitrum.

- Abracadabra – Abracadabra is a lending platform that uses interest-bearing tokens (ibTKNs) as collateral to borrow a USD-pegged stablecoin (Magic Internet Money — MIM) that can be used as any other traditional stablecoin. SPELL is the protocol’s reward token and can be staked to be used in fee sharing and governance.

- D-Squared Finance – D-Squared Finance is a DeFi Quant Vault-based protocol built for the crypto-native ETH community. It is a joint venture between BWS Labs and DopexNFT that delivers actively managed quant trading strategies to DeFi-native users on Arbitrum.

- Byte Masons – Byte Masons are an experienced collective of builders who are well-known for their innovative suite of DeFi protocols, including their lending market, Granary Finance, and their yield aggregator, Reaper Farm.

- Liquity Protocol – Liquity Protocol is a decentralized borrowing protocol built on Ethereum, home to the immutable stablecoin $LUSD. With over $400m TVL, Liquity provides the DeFi space with a robust and capital-efficient stablecoin alternative.

- Hop Protocol – Hop Protocol is a scalable rollup-to-rollup general token bridge. It allows users to send tokens from one rollup or sidechain to another almost immediately without waiting for the network’s challenge period.

- Tarot Finance – Tarot Finance is a multi-chain, decentralized lending protocol where users can participate as lenders or borrowers in isolated lending pools.

- Lexer Markets – Lexer Markets is an upcoming Arbitrum native perp DEX that will support trading for crypto, FX, and other assets. Lexer is powered by its innovative Hybrid Liquidity Engine and Smart Router on top of an evolving group of Oracle-based Settlement Algorithms.

- Factor DAO – Factor DAO is an on-chain asset management platform launching on Arbitrum in February. They are uniting DeFi liquidity and yield under one easy to use protocol via managed vaults with access to yield-bearing assets, tokenized baskets, and derivatives.

- Vela Exchange – Vela Exchange is a decentralized exchange with advanced perpetual trading capabilities, community-focused incentives, and scalable infrastructure.

- JustBet – JustBet is a decentralized and provably fair on-chain casino built using the revolutionary WINR Protocol, native to Arbitrum. Games are implemented on transparent and immutable smart contracts, and Supra Oracles generate randomness in the games. This ensures that payouts are tamper-proof and the casino experience is fast-paced and realistic.

- Bond Protocol – Bond Protocol is the next evolution of bonds-as-a-service, providing protocols with a permissionless solution to treasury dilution & token issuance. Bond Protocol was borne out of Olympus DAO and has since branched off to be laser-focused on supporting other protocols with capital raise needs.

- Redacted Cartel – Redacted Cartel is an outstanding team of DeFi builders delivering innovative products across multiple chains, such as Hidden Hand, Pirex, and soon Dinero. Redacted & $BTRFLY have a powerful presence across several ecosystems

- Perpy Finance – Perpy Finance is a social trading protocol built on top of GMX and native to Arbitrum. With their open beta already live, Perpy enables fully on-chain access to copy trading on decentralized perpetual exchanges. Users can follow the most successful traders in a fully transparent way, and traders can monetize their skills through performance fees.

- Relay Chain – Relay Chain is a fast and user-friendly portal that facilitates cross-chain token transfers by aggregating bridge liquidity between the leading blockchains.

- Plutus DAO – Plutus DAO is an Arbitrum-native governance aggregator aiming to maximize users’ liquidity and rewards while simultaneously aggregating governance behind the PLS token. Plutus’ objective is to become the de-facto Layer 2 governance blackhole for projects with veTokens.

- Lyra Finance – Lyra Finance is a leading protocol for options trading, allowing users to buy and sell options that are priced with the first market-based, skew-adjusted pricing model.

- Pendle Finance – Pendle Finance is a permissionless yield-trading protocol, enabling you to purchase assets at a discount or long DeFi yield.

- Neutra Finance – Neutra Finance is an investment protocol that delivers risk-hedged, sustainable investment strategies easily accessible for anyone, anywhere.

- WINR Protocol – WINR Protocol is an autonomous liquidity and incentive infrastructure built for games of chance.

- Perpy Finance – Perpy Finance is a Web3 Social Trading protocol built atop of a Decentralized Perpetual Exchange.

- Sector Finance – Sector Finance builds risk tools and investment products to empower the next generation of DeFi users.

- Silo Finance – Silo Finance is a non-custodial lending protocol that enables users to create permissionless and risk-isolated markets.

- Stride Zone – Stride Zone is a blockchain that provides liquidity for staked tokens.

- DeFi Edge – DeFi Edge provides advanced features for concentrated liquidity management.

- Harvest Finance – A community-built platform for DeFi yield farming.

- Equilibria Finance – A yield booster built on top of Pendle Financ

- unshETH – A novel DeFi primitive that promotes validator decentralization by fostering competition among ETH liquid staking protocols to bring the best ETH staking experience to millions of users.

- Arcton – First public marketplace for start-up equity.

- Dopex – Decentralized Options Exchange.

- Lodestar Finance – Arbitrum’s Native Money Market for its yield bearing assets

- Aurory Project – A next generation entertainment franchise anchored in innovative, F2P, interoperable gaming experiences

- Good Entry – A protocol utilizing protected perpetuals mechanism.

- Premia – Decentralized Options Protocol.

- Vertex Protocol – Lightning-fast orderbook DEX with powerful trading features & cross margining for max efficiency.

- Jones DAO – DeFi strategies made simple.

FAQ

GRAIL and xGRAIL tokens

- I would like to obtain GRAIL. How do I do that?

- GRAIL can be purchased through the exchange tab or earned through farming after creating a staked position.

- What is the process for obtaining xGRAIL?

- GRAIL can be converted to xGRAIL at a 1:1 ratio under the xGRAIL tab. You can also earn xGRAIL from yield-bearing positions on incentivized active farms.

- What is the value of one xGRAIL?

- The xGRAIL value is directly correlated to the GRAIL value. One xGRAIL equals one GRAIL.

- Does GRAIL have a capped supply?

- Yes, the GRAIL will reach its hard cap approximately 3 years after emissions begin.

- In addition to the hard cap set on GRAIL, we also implemented some deflationary mechanisms in order to reduce the total supply.

- Can I swap xGRAIL for any other token?

- xGRAIL is not transferable. You can only redeem it to GRAIL.

- How long does it take for xGRAIL to redeem (vest)?

- Minimum duration – 15 days (50% GRAIL output).

- Maximum duration – 180 days (100% GRAIL output).

- As your xGRAIL vest, 50% of the amount is automatically staked in the dividends, earning you rewards while the vesting period continues.

Exchange and Liquidity

- Why does the frontend exchange page not let me set the amount in the lower ‘to’ box?

- Stable logic prevents us from doing the calculation in that direction.

- I added liquidity, what should I do next to earn yield?

- The next step is to convert your LP token into a staked position. It can either be done in the ‘liquidity, ‘my positions’ or the ‘yield farm’ tabs after choosing the incentivized pair of your choice.

- If I provide ETH-USDC liquidity, will I receive an spNFT as my share of the ETH-USDC pool?

- Providing liquidity and creating a position are two different things. After you add liquidity you have to create a position using that LP.

- What is the process for withdrawing my liquidity?

- The LP tokens will appear under the liquidity tab (Your LP tokens).

- If you created a new position using the LP token, you must withdraw your position first.

Staking (Positions)

- How can I view the spNFTs?

- spNFTs are staked positions resembling tech aspects rather than a visual aspect. A position is essentially created as an spNFT once it is created, it is a single asset or LP that is transformed into an spNFT.

- What is the purpose of creating a position with the LP?

- When you make an LP from a combined asset you effectively add liquidity to the protocol. By creating a position, you transform it into a staked position (spNFT), which works similarly to staking your positions in yield farms. The staked position can also be locked, managed in various ways, yield boosted using xGRAIL, and deposited into a nitro pool for even greater rewards.

- Where do I add liquidity and create a staked position?

- The liquidity tab is where you add liquidity and create a staked position. A staked position can be also created on ‘My Positions’ tab and also after selecting incentivized active farm on the yield farms tab.

- What’s the difference between a yield-bearing and a non-yield-bearing position?

- Yield-bearing positions are only the ones that are currently being incentivized (the ones that have “farms” on the UI). spNFTs can be leveraged by anyone, and be directly rewarded through Nitro, which is where non-yield-bearing positions will come into play.

- What’s the difference between stable and volatile pairs?

- Stable pairs are made up of stablecoins and will try to maintain the same price, whereas volatile pairs are made up of assets that may fluctuate.

- When rewards are set to 80% xGRAIL and 20% GRAIL by default in the farms tab, what does that mean?

- You will receive 80% of your rewards in xGRAIL and the remaining 20% in GRAIL. Most incentivized pools will share this ratio by default, but you should check the pool before you create a position as the ratio may vary.

- How can I maximize my position’s boost?

- Through the combination of locking and yield boosting. It is possible to achieve the highest boost on staked position APR by locking for the longest duration and allocating a sufficient amount of xGRAIL to boost it even more. On top of it, your position can be deposited into a nitro pool, from which you can receive additional rewards as long as the nitro pool pair corresponds to the yield-bearing pair.

- What should I do with my staked position if I want to withdraw my funds from the protocol?

- To access the assets you used to add liquidity, withdraw your staked position, then unbind the LP token.

Position management and tools

- What are the benefits of locking my position?

- By locking a yield-bearing position you will get bonus rewards according to the duration of the lock. Every incentivized pair has its own configuration in that regard.

- Am I also locked out of my rewards if my position is locked?

- There is no lock on your rewards, so you can harvest them whenever you want.

- Is it possible to renew my locked position at any time?

- Yes, the only constraint is that you must renew it for at least the same duration of days that are left on any existing lock.

- Using the transfer function, can I send my position to another person’s address?

- Yes, once you send your position to another address, that address will become the owner of the position.

- What is the split function’s purpose?

- Whenever you want, you can split the position. Splitting a position keeps the original settings, such as lock duration.

- Why can I lock my position for longer than six months, as that already gives me 100% which is the maximum?

- The max lock bonus is 6 months, but that doesn’t mean that other protocols might not want to incentivize longer locks.

- What is the purpose of transforming a single asset into a staked position when there are no active farms to earn yield from?

- Depending on the Nitro pool, only a single asset spNFT may need to be staked.

Nitro Pools

- What is the purpose of nitro pools?

- A nitro pool is an incentive for more people to add and/or lock their liquidity.

- Do Nitro pools boost a staked position in any way?

- From a user’s perspective, the process is fairly simple: you stake a staked position into a Nitro Pool and get rewards depending on the share of the total deposits. Users can deposit as many staked positions as they wish to, as long as they meet the requirements.

- Nitro Pools are fixed-duration pools that act as an additional layer of yield rewards for Camelot’s staked positions. They have been designed so that anyone can freely deploy them, directly from the Camelot front end.

- How does this + button next to ‘incentives’ work?

- Using this feature, pool deployers and Camelot partners can deposit additional incentives in a permissionless manner

- Please be aware that it’s not possible to retrieve back-deposited incentives!

- Can I deposit positions into the nitro pool with an active xGRAIL boost?

- Yes, you can deposit a position with an active yield boost, the boost will affect the yields earned from the active farm, but not from nitro pools.

- Do staked positions in the Nitro pool receive rewards from the active farm and Nitro pool?

- The position will receive nitro pool rewards as well as yield rewards from the active farm if the position has yield-bearing properties.

- Will my rewards be locked if the nitro pool requires a lock?

- You can harvest rewards from the nitro pool whenever you want.

- How do I whitelist a wallet address for a Nitro pool?

- It will be up to the Nitro pool’s deployer to decide if whitelisting will be required. The deployer will have to manually add your wallet address to the whitelist to allow you to participate in the nitro pool.

- After I staked my position in the nitro pool, why can’t I change management settings?

- If your positions are deposited in a nitro pool, most of the position management functions are not available. However, you can still harvest rewards from the active farm, boost and unboost (xGRAIL), and harvest rewards from the nitro pool.

- Is ‘permissionless’ regarding Nitro Pools mean that there won’t be a community vote on whether the pool will be deployed?

- Permissionless means anyone can create it, which is why there are “official” and “community” Nitro pools tabs. Regardless of whether we directly incentivize a pool, users are still allowed to create nitro pools.

- When I try to deposit a position into the Nitro Pool, it says that the position is incompatible. Why is that?

- In order to be able to deposit your position into the nitro pool, your position has to fulfill the following requirements:

- Lock Duration.

- A minimum end lock.

- Minimal deposit amount.

- In some cases, your address has to be whitelisted if the deployer of the pool chooses this option.

- A customized external requirement may also be required in some cases.

xGRAIL plugins

- How can I utilize the xGRAIL tab?

- Convert GRAIL to xGRAIL.

- Redeem xGRAIL to GRAIL through vesting.

- Allocate xGRAIL to dividends to earn rewards.

- Allocate xGRAIL through yield booster to boost your positions’ APR.

- What are the benefits of yield booster, and how does it work?

- You maximize your APR percentage by allocating xGRAIL through the yield booster to a particular staked position. The xGRAIL allocation boost is determined by the number of users allocating to a particular asset. Since you will have to share the boost with others if more users allocate xGRAIL to a particular asset, your APR will be lower as more users allocate xGRAIL to a particular position.

- How are dividends distributed?

- Every week a slice of the transaction fees is distributed through dividends and can be claimed at any moment.

- Does the epoch (cycle) always consist of 7 days?

- Yes.

- In which tokens are the dividends distributed?

- It will usually be in ETH/USDC LP tokens (65%) and xGRAIL (35%). Always check on the dividends tab which type of tokens will be distributed in the next cycle as it may change on various occasions.

Launchpad

- What is Camelot Launchpad?

- Camelot provides the infrastructure for projects wishing to launch on Arbitrum. Launchpad currently uses the same fairlaunch model that launched Camelot, but we are aiming to make it fully permissionless and to also provide more launch models in the near future.

- How can I find out more about the project that is launching on Camelot?

- Despite providing some brief information about upcoming launches, Camelot only provides infrastructure for upcoming projects. For more detailed information, it is always best to refer to the project’s Discord/Telegram channels.

- What tokens do I need to participate in the Camelot public sales?

- Most of the time, it will be USDC but it can vary, you should always double-check with the project that is launching on Camelot directly.

- Are all projects being featured in the launchpad safe?

- Camelot supports protocols that use their infrastructure but does not provide advice or recommendations for teams or tokens totally independent of Camelot.

- Does the Camelot team audit projects looking to use Launchpad?

- Camelot is a permissionless infrastructure designed to support the entire Arbitrum ecosystem – just because a protocol uses Camelot does not mean we have verified or endorsed its security or safety. Camelot makes every effort to filter out bad actors; however, we strongly encourage everyone to do their own research before participating in any of the public sales.

- What is FDV?

- Fully diluted valuation (FDV) – refers to the market cap of a project once all its tokens have been released into circulation. It is basically an estimation of a project’s future market capitalization.

- How to calculate Circ. market cap?

- Circulating market cap = current price x circulating supply.

- How is the price of the public sale determined?

- It depends on the launch model. Detailed information for every public sale is available at the bottom of the public sale app page.

- How to use the referral links?

- Referral links need to be generated and copied; when someone allocates funds via your link to the public sale, you get 3% in USDC (Claimable on the public sale page).

- When can I claim my public sale allocation?

- Look for the ”Claiming process” description on the public sale page.

Community Links

- Camelot: https://excalibur.exchange/

- dApp: https://app.camelot.exchange/

- Docs: https://docs.camelot.exchange/

- Discord: https://discord.com/invite/r9V7rry3nz

- Twitter: https://twitter.com/camelotdex

- Telegram: https://t.me/camelotdexann

- Telegram announcements: https://t.me/camelotdexann

- Medium: https://camelotdex.medium.com/

- Github: https://github.com/CamelotLabs

- Coingecko: https://www.coingecko.com/en/coins/camelot-token