Overview

Bumper is a novel DeFi protocol that enhances traditional derivatives markets by providing a simple, fair, and decentralized approach to hedging price risk. The protocol leverages a loss prevention tool that provides price protection against market crashes and downside volatility.

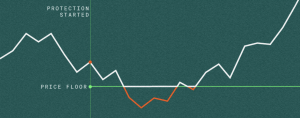

The underlying mechanisms share similarities with stop loss orders, options desk, and insurance policies. What differentiates Bumper is that the protocol protects the user’s crypto assets by preventing losses when the price goes down, while still enjoying the profits when the price bounces, even if it previously dropped below the chosen floor level.

When you use Bumper to protect your assets, they become “bumpered assets.” Bumpered assets represent your original asset with the downside volatility removed while your position remains open. In other words, Bumper eliminates the risk of losses resulting from market downturns or price drops. This protection allows you to maintain the value of your assets even if the price decreases.

Bumpered assets are represented by composable tokens (NFTs for v1.0 and NFTs + ERC20s for v2.0). For example, these tokens can be used as collateral for obtaining a loan. By using composable tokens as collateral, borrowers can access funds while reducing the risk of forced liquidation. Forced liquidation occurs when the value of the collateral falls below a certain threshold, leading to the lender seizing and selling the collateral to recover the loan amount. Bumper’s price protection mechanism removes the likelihood of such forced liquidations, making it an attractive option for borrowers.

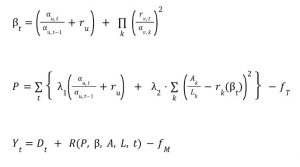

To provide price protection, Bumper charges premiums based on the measured volatility of the underlying asset over the duration of a position. Volatility refers to the degree of fluctuation in an asset’s price over time. Bumper measures the actual volatility of the asset whilst the protection position is open and calculates the premium accordingly alongside the protocol’s internal liquidity ratios. As a result, premiums act as the cost of obtaining protection against downside price movements.

How Bumper Works

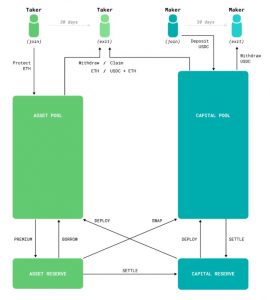

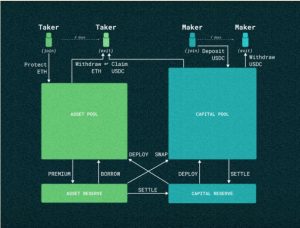

Bumper operates through a straightforward process that allows users to protect their assets (takers) or deposit stablecoins to earn yield (makers). The example below will delve into how Bumper works using $ETH as the protected asset and $USDC as the backing stablecoin.

Taking protection – Taker’s perspective

When participating in the protocol as a taker, users are buying protection against downside price volatility. To do so, they must make 3 decisions:

- The amount of the protected asset ($ETH) they want to protect.

- The $ETH floor price, which determines the price at which the protection activates.

- The length of time for which they want to have active protection.

Additionally, takers must hold a minimum amount of $BUMP tokens as bonding while using the protocol. Incidentally, both takers and makers are incentivised with $BUMP tokens for interacting with the protocol and doubly during the initial 3 month bootstrapping period.

After performing the necessary actions, the taker receives a Bumpered Asset token representing their protected position. This token can be traded, transferred, or used as collateral in other DeFi protocols.

Taker positions incur a dynamic premium, which is the cost of protection. This premium is deducted from the amount returned when the taker’s position closes.

Deposit stablecoins and earn yield – Maker’s perspective

Makers participate in the protocol by providing $USDC in their selected risk tranche, which will be used for underwriting taker liquidity. As a result, stablecoin depositors assume taker price risk but can earn rewards to compensate for the risk they are taking.

To open a position, a depositor must make the following decisions:

- The amount of $USDC they want to deposit.

- A tier that reflects their acceptable level of risk tolerance.

- The duration over which they wish to earn yield.

Similar to takers (users who want protection for their assets), depositors must also bond a certain amount of $BUMP tokens to the protocol.

Once the position is open, they receive a yield-bearing asset back from the protocol representing their position as a $USDC liquidity provider.

Protected (“Bumpered”) Assets

When a taker’s position ends, they return their Bumpered Asset token to the protocol, leading to one of the following outcomes:

- If the current price of $ETH is equal to or above the chosen floor price, the taker receives their original $ETH back, minus the premium paid.

- If the current price of $ETH is below the chosen floor, the taker receives $USDC and $ETH worth the floor price, minus the premium.

Notably, even if the price of $ETH falls below the floor price and then suddenly rebounds above it, the taker continues to benefit from the upside potential of $ETH’s value going up.

Bumpered Assets have two crucial properties: they are tradable tokens and have a guaranteed minimum value due to their floor price. This makes Bumpered Assets valuable for use in other DeFi protocols, such as for collateralizing loans. Since their minimum value is guaranteed, they are not subject to forced liquidation if the market continues to drop. In essence, Bumpered $ETH NFTs on v1.0 can wrap the whole position, and that NFT can be rewrapped to mint out $bETH, which is equivalent to $ETH but with the downside volatility removed.

How Bumper Pools Work

Bumper utilizes pools to collect and manage deposits within the protocol. User interactions within the Bumper protocol occur between users and the pools, eliminating the need for direct matching between buyers and sellers as seen in centralized exchanges.

Bumper employs four liquidity pools in total: two pools for each asset type (e.g., $ETH and $USDC). This allows Bumper to calculate premiums efficiently based on internal liquidity, manage beneficial ownership transfers between stablecoins and assets, and improve overall market depth for participants.

This pooling mechanism helps facilitate efficient price protection and yield generation. Additionally, Bumper incorporates pool rebalancing to ensure the proper maintenance of asset-to-stablecoin ratios within the pools.

Pool rebalancing

The ratio of the total value of assets to the number of stablecoins held in the protocol naturally fluctuates as the price of the protected asset changes and as takers and makers asynchronously open and close positions. Rebalancing is performed by a keeper bot that sends transactions via a dark pool. Whenever a position is opened or closed, Bumper recalculates premiums and incentives based on the aggregated liabilities of takers and makers.

Arbitrage

Arbitrage refers to the practice of taking advantage of price discrepancies between different markets or assets to make a profit. In the context of the Bumper protocol, arbitrage is used to rebalance the value between the protocol’s pools in situations where there is insufficient liquidity or a significant deviation from the target liquidity ratios.

When there is high volatility in the price of the protected asset, the Liquidity Ratios in the Bumper protocol may deviate from their target values. If the ratios change too rapidly for the protocol’s incentives to restore the balance, arbitrage is triggered to “hard” rebalance the pools.

There are two scenarios where arbitrage occurs in the Bumper protocol:

- Insufficient $USDC: In this case, the Asset Pool offers an increasing amount of $ETH for sale at a discount to the current market price. The proceeds from this sale are then deposited into the Capital Pool, increasing its liquidity.

- Insufficient $ETH: In this scenario, the Capital Pool offers to buy an increasing amount of $ETH at a premium to the current market price. The purchased $ETH is then deposited into the Asset Pool, increasing its liquidity.

External actors, known as arbitrageurs, have the opportunity to execute these trades with the protocol. They assess the quantity available for trade and the discount or premium applied by the protocol to determine whether the trade would be marginally profitable. By engaging in arbitrage, these actors help the protocol rebalance its pools and simultaneously profit from the price discrepancies.

Liquidity and liabilities

All value within the system ($ETH and $USDC) is controlled between four pools:

- Asset Pool (AP): The main store of $ETH. Captures initial $ETH deposits for protection positions.

- Asset Reserve (AR): A secondary store of $ETH that collects $ETH premiums and $ETH that is left behind by takers when they make Claims.

- Capital Pool (CP): The main store of $USDC. Captures initial $USDC deposits for liquidity provider positions.

- Capital Reserve (CR): A secondary, prudential store of $USDC which assists the protocol to measure and manage short-term liquidity.

Bumper’s Reserves are a novel construct in DeFi. They serve multiple purposes, including covering short-term liquidity needs (BORROW, SETTLE), as well as providing a convenient method for measuring liquidity adequacy.

- Short-term liquidity coverage: The Reserves act as a source of liquidity to cover immediate borrowing and settlement needs within the protocol. They ensure that there is sufficient liquidity available to fulfill user transactions efficiently and without delays.

- Measurement of liquidity adequacy: The Reserves also provide a convenient way to assess liquidity adequacy within the protocol. The level of liquidity in the Reserves is used as input to calculate the premiums for price protection and to determine if there is a need for inter-pool rebalancing.

To understand the role of Reserves, let’s consider an example involving $ETH and $USDC. In the presence of price volatility, having Reserves of $ETH and $USDC can help mitigate the need for frequent swapping between the primary pools. For instance, instead of immediately swapping $ETH for $USDC when there is a demand for stablecoin liquidity, the protocol can utilize the Reserve of $USDC. This approach allows the protocol to provide time for the effects of protocol incentives to take place and assist in rebalancing.

By activating the Capital Reserve and temporarily providing $USDC liquidity to the Capital Pool, the need to perform a swap of $ETH to $USDC from the Asset Reserve is minimized. This strategy of utilizing Reserves helps prevent frequent and rapid rebalancing trades, which can lead to a lack of opportunity for actors to take advantage of incentives and result in undesirable slippage costs.

Pooled Value Exchange

Within the protocol, all user interactions occur between the user and a pool, rather than directly between users. The balance of each pool is determined based on the current state of the pools, the prevailing price, and new user interactions that either increase or decrease the pool balances. While the outcome of a single operation on the protocol’s state can be determined in advance, future states depend on the behavior of future users. All inputs to the protocol come from on-chain sources or user interactions, allowing for a probabilistic estimation of the protocol’s future state based on assumed future volatility and the effectiveness of incentives over time.

Whenever a stablecoin depositor initiates a position or a taker initiates a position (by selling risk, supplying assets, or paying premiums), the position is associated with the respective pool. Assets or stablecoins are debited from the user’s wallet and credited to the corresponding protocol pool.

Measuring Liability

Monitoring and addressing liability is a fundamental aspect of Bumper’s mechanics. When a taker enters the protocol, dual liabilities are created—one for $ETH and another for $USDC. However, while more liabilities are generated than there are assets to simultaneously service them, the same principle applies when a taker exits. A taker can only perform either a withdrawal of $ETH or a claim of $USDC, thereby eliminating both the $ETH and $USDC liabilities associated with that taker. This emphasizes the importance of maintaining balance between the pools in Bumper, as the target balance is determined by the expected liabilities between $ETH and $USDC within the protocol.

- The sum of all potential taker withdrawals is known as the “Book,” representing the total amount that takers can withdraw from the protocol.

- The sum of all potential taker claims is referred to simply as the “Liability.”

When a user deposits $USDC into the protocol, a single liability is recorded. The cumulative liabilities of all $USDC deposits are termed the “Debt.” Similar to taker liabilities, the value of the debt decreases as depositors exit the protocol with their respective positions. The debt also serves as a mechanism to gradually convert the value of accumulating $ETH premiums to $USDC in the Capital Pool. This is achieved by incrementally adding a “Yield Factor” to the Debt each time the Premium is calculated. As the value of the Debt increases for depositors, the protocol’s incentives and mechanisms work to rebalance the pools over time, ensuring sufficient $USDC liquidity for withdrawals.

The Premium

Within the Bumper protocol, there are three distinct liabilities:

- $ETH for takers.

- $USDC for takers.

- $USDC for makers.

The protocol has two sets of liquidity, which are the Asset Pool and Reserve, and the Capital Pool and Reserve. To meet these liabilities, Bumper dynamically shifts $ETH and $USDC liquidity to align with a pair of liquidity targets for $ETH and $USDC. These targets are internally calculated based on the probability of the Book and Liability materializing in a user payout. The liquidity targets are used as an input in calculating premiums.

The premium is determined by:

- The protocol’s current $ETH and $USDC liquidity across the four pools

- The current $ETH and $USDC liabilities, taking into account the Probability of Claim derived from the current price of $ETH, and the current sum of Taker $USDC Liabilities.

- The ETH price is measured as the median of a cluster of on-chain and off-chain sources using the Chainlink price oracle.

Pooled Premiums

In the implementation of Bumper, the premium is calculated incrementally triggered by changes in asset price. On average, premiums are calculated and applied every 15 minutes. The premium calculation is performed in aggregate for all takers at the same time, and at the end of a taker’s term, their individual share of the accumulated premiums is calculated. The premiums are payable from the value of the taker’s initial deposit. The Premium is denominated in the protected asset currency ($ETH) and is charged against the Asset Pool, accumulating in the Asset Reserve. This provides convenience to takers as they do not need separate currencies to pay their premiums.

Premium efficiency

Bumper achieves pricing efficiency by dynamically charging premiums in response to measured risk. Unlike traditional European Put Options where the premium is agreed upon upfront, the cost of protection with Bumper is unknown ahead of time. However, the formula for calculating the premium is known. This transparency sets Bumper apart from options where the pricing method is opaque to the buyer, including the seller’s profit.

With Bumper, the guesswork is eliminated, and premiums are charged only when necessary in response to price volatility. While there may be some uncertainty in the premium to be paid for users of the protocol, the benefit lies in the transparent calculation method, ensuring clarity between market participants about the fair value of their interaction.

The Network Bond

The Network Bond is a requirement for both interacting users to create new positions in the Bumper protocol. When initiating a position, users must provide a certain amount of $BUMP tokens to the protocol as a bond. This bond is calculated based on the value of the position being taken. The larger the position, the higher the bond required.

The purpose of the bond is to ensure that users have a stake in the protocol and to incentivize responsible behavior. By requiring users to bond $BUMP tokens, it creates a financial commitment and aligns their interests with the protocol’s success.

At the end of the user’s position, their bond (along with any earned $BUMP incentives) is returned to them. However, if a user decides to cancel their position early, the bond is forfeited, and the earned $BUMP tokens are used to increase the incentive pool for new maker and taker positions. This encourages users to fulfill their commitments and discourages premature cancellations, as forfeiting the bond can result in a loss of value for the user.

Why the project was created

Bumper’s philosophy revolves around establishing a fair procedure for the distribution of gains and losses in a risk market. Unlike traditional adversarial markets, where there is typically a winner and a loser, the motivation of Bumper is to create a system that promotes fairness and just distribution of resources.

The project draws inspiration from the Rawlsian theory of Distributive Justice, which posits that responsible individuals within a group will naturally establish a fair procedure for determining the equitable distribution of primary goods and resources. Bumper applies this concept to the crypto market, where it seeks to provide a fair and transparent mechanism for risk management.

Protocol objectives

Bumper’s purpose is to provide a mutual price risk facility, prioritizing the minimization of individual losses over maximizing individual profits. By focusing on risk management and protection, Bumper aims to create a more secure and reliable environment for participants in the DeFi ecosystem.

- Solvency: The protocol aims to maintain solvency for both parties by ensuring sufficient liquidity to meet their needs. Solvency is crucial to ensure that takers receive their protected assets and premiums back according to the terms of their protection, while stablecoin depositors are able to withdraw their yields and assets without encountering liquidity issues.

- Cost minimization for takers: Bumper strives to minimize the cost of price protection for Takers. This includes reducing premiums and other associated fees. By offering competitive pricing and efficient risk management mechanisms, the protocol aims to make price protection accessible and affordable for takers, allowing them to hedge against price volatility effectively.

- Yield maximization for depositors: The protocol seeks to maximize yields for the users who provide liquidity and assume price risk. By offering attractive incentives and opportunities for earning yields, Bumper incentivizes users to participate in the protocol. Maximizing yields also ensures the availability of sufficient liquidity and enhances the overall efficiency of the risk market within the protocol.

How Rawlsian Theory Underpins Bumper’s Philosophy

Bumper’s philosophy is underpinned by the Rawlsian theory of distributive justice. John Rawls, a prominent philosopher, proposed the concept of “Justice as Fairness” in his book “A Theory of Justice“. Rawls aimed to address the competing claims of freedom and equality by presenting an alternative to utilitarianism, which focused on maximizing the overall happiness of society.

Rawls argued that behind a hypothetical “veil of ignorance,” individuals would design a fair and just society without knowing their own personal circumstances or advantages. They would prioritize minimizing the risk of living in excessive hardship rather than maximizing individual advantage or privilege. Rawls believed that people would choose to spread opportunities widely to minimize the risk of starting in an unfair or disadvantaged position.

Bumper’s market design aligns with Rawlsian principles by striving for fairness and efficiency. Unlike traditional markets where participants compete against each other, Bumper aims to create a pool where risks and rewards are distributed across all participants proportionally to their deposits and chosen settings. This approach minimizes individual risk and ensures that no participant receives special treatment based on their wealth or status.

The Premiums and Yields in Bumper’s protocol are not predetermined but determined by the market based on real-time volatility. This eliminates the need to set prices in advance and allows for a fair and transparent pricing mechanism. The protocol calculates Premiums fairly, incentivizing liquidity providers (makers) while ensuring that takers are not penalized excessively in the event of market surges.

Furthermore, Bumper incorporates decentralized governance through its $BUMP token holders. Participants can propose and vote on changes to the protocol, allowing for collective decision-making and avoiding unilateral decisions by a central authority. The governance structure considers factors beyond token ownership, such as length of token holding, to ensure a more equitable representation of the community’s interests.

Roadmap

An updated roadmap is set to be published after the Layer-2 migration.

- Layer-2 migration – Achieved

- Integrating additional markets (including Staked ETH) – Achieved

- Fixed and/or estimated premia.

- Higher protection floors.

- Shorter terms.

Sector Outlook

In the context of risk management in cryptocurrency markets, the existing methods of price protection have their limitations.

- The first method, the stop-loss, is a commonly used mechanism on centralized exchanges. However, implementing stop-loss orders on blockchains like Ethereum presents challenges due to high latency and the risk of front-running. Additionally, the costs associated with transaction fees, spread, and slippage can be relatively high and may ultimately miss any subsequent pump.

- The second method, the put option, is a structured financial product typically utilized by professional traders. Options have complex pricing models with numerous inputs, and they are traded on bilateral exchanges where sellers determine the pricing. However, the competitive nature of options markets often leads to sellers managing their profit margins, resulting in uncertainty for buyers regarding the fairness of the pricing. Moreover, the availability of cryptocurrency options markets is limited, with centralized exchanges offering high-cost instruments and DeFi-based options protocols struggling to compete with their centralized counterparts in terms of market depth and transaction speed.

In this landscape, Bumper introduces a novel approach to price protection in decentralized finance (DeFi). By leveraging blockchain technology, Bumper aims to provide a more efficient and user-friendly solution for managing price risk. The protocol’s innovative design enables users to protect the value of their assets without relying on traditional stop-loss orders or complex options markets. Bumper pools play a crucial role in facilitating liquidity management and ensuring that market participants can freely deposit and withdraw their assets and stablecoins. This is achieved through the use of dynamic premiums calculated based on internal liquidity ratios in order to enhance the efficiency and effectiveness of price protection.

| STOP LOSS ORDER | OPTIONS CONTRACT | BUMPER | |

| Loss prevention | Yes | Yes | Yes |

| Upside exposure | No | Yes | Yes |

| User experience | Simple | Complex | Simple |

| Relative cost | Cheap | Expensive | Cheap |

| Pricing method | Spread and slippage | Fixed, but complex and time-consuming | Variable – Algorithmic |

While most DeFi protocols typically feature two pools, Bumper stands out with its four liquidity pools. This design allows Bumper to calculate premiums based on internal liquidity more efficiently and dynamically control the ownership of stablecoins and assets. Additionally, the quadrature liquidity pools enhance market depth and ensure participants have the flexibility to deposit or withdraw assets without encountering liquidity issues.

Bumper’s two additional pools, known as reserves of assets and capital, play a vital role in managing the risk of price volatility. These pools are used to monitor asset prices, liquidity levels, and balance the protocol’s assets and capital against its liabilities. By adjusting internal liquidity targets based on price behavior and liquidity, Bumper optimizes risk transfer pricing. The protocol shares risk among liquidity providers and distributes the cost of risk among protection buyers, ensuring fairness and efficiency in the risk management process.

In the context of pricing, Bumper deviates from the opaque pricing models commonly found in options markets. Instead, it charges premiums based on the real-time volatility of the crypto market. By aligning the cost of protection with the actual risk faced by liquidity providers at any given time, Bumper ensures that the pricing is directly proportional to the level of risk involved. This approach enhances transparency and ensures that users are paying a fair price for the protection they receive.

Potential adoption

Currently, there is a growing need for a risk market that addresses both upside risk and downside risk in DeFi. Traditional measures of price volatility used in structured finance consider both types of risks, assuming market actors have a profit-maximization motive. However, in DeFi, participants have diverse motives, strategies, and levels of sophistication, requiring a flexible and efficient risk management solution.

A risk market is a marketplace where investors can buy and sell financial products that provide protection against potential losses. These markets allow investors to transfer risk from one party to another through the trading of risk management instruments such as options and derivatives.

In a risk market, investors can hedge against potential losses or gain exposure to potential returns by taking on or transferring risks based on their risk preferences and investment strategies. This provides a way for investors to manage and mitigate potential losses while also offering opportunities for others to earn returns by assuming that risk.

The benefits of using risk markets include a more efficient allocation of risk, as investors who are better equipped to bear certain types of risk can take on more of it in exchange for earning a premium. This allows for a diversification of risk and helps to ensure that risk is held by those best suited to manage it.

Decentralized risk markets differ from traditional financial products in that they operate on a decentralized network using blockchain technology and smart contracts. This eliminates the need for a central intermediary or third-party custodian, reducing counterparty risk and ensuring the terms and conditions of the financial products are enforced effectively. Decentralization also brings transparency, security, and lower transaction costs to the market.

Examples of risk markets include options and derivatives markets, where investors can purchase contracts that give them the right to buy or sell an asset at a certain price or benefit if the price of the asset moves in a particular direction. These markets provide investors with the flexibility to tailor their risk exposure to their specific needs and objectives.

There are potential risks associated with using risk markets. Buyers of options contracts and other risk market products pay a premium upfront, and if the price does not meet the specified strike price, the option may expire worthless, resulting in a loss of the premium. However, if the price moves in their favor, buyers can make a profit.

Pooling liquidity is a common approach in DeFi to match buyers and sellers. Bumper protocol follows a similar approach by collecting deposits into protocol-controlled pools, eliminating the need for intermediaries between mutually untrusting parties. This pooling mechanism offers two key advantages:

- Minimizes the cost of slippage, spread, and transaction fees associated with individual trades.

- Ensures that buyers seeking short-term price volatility protection can be matched with long-term yield-chasing investors, creating a more efficient market compared to options exchanges where each position is matched only once.

The flexibility of Bumper’s design allows for the incorporation of various risk factors. It can accommodate derivatives, concentration risk (related to protection or asset concentration), operational risk, liability risk over time, external market prices, sentiment measures, and real-world information external to the blockchain. By considering a wide range of risk vectors, Bumper aims to provide a comprehensive risk management solution within the DeFi ecosystem.

How Bumper Is Different From Stop Losses

A stop loss is an order placed on an exchange that is designed to limit potential losses for an investor or trader. It is commonly used by both long buyers and short sellers in the financial markets.

In the case of a long position, this is likely to be a sell order if the price falls to a certain level, and the inverse is true for short sellers.

Type of Stop Losses

The types of advanced Stop Losses include:

- Stop Quote: A basic stop loss, often referred to as a Stop-Quote, triggers when an asset drops below a certain level. Regardless of price, it then attempts to sell the asset immediately. However, if there is no buyer at this price, this can push the execution price down even further, meaning your stop loss doesn’t always execute at the price you set.

- Stop Limit Orders: A Stop Limit order triggers only at a certain price when a threshold is triggered. However, the danger here occurs if there is no buyer, then you can end up with a sell order at a price higher than the current price, and not get your position filled. Thus, if you’re not paying attention, you can end up finding yourself riding the price down with the market, but your asset ends up getting sold when it’s on its way back up again.

- Trailing Stop Loss: Some traders use trailing stop losses, which are often used when the market is heading in the right direction. This means as the market continues to pump higher, the stop loss keeps moving upwards, keeping a roughly similar gap. The theory of using a trailing stop loss is to ensure that profits are locked in, and that flash crashes and market reversals do not wipe out already earned gains. However a trailing stop loss can cause the stop to be triggered due to a pullback even whilst it’s still trending upwards. As markets oscillate, the chances of you missing further upside gains whilst using a trailing stop loss are actually quite high.

Unintended Effects of Stop Losses

While stop losses are an important part of a good trader’s tools, it is important to acknowledge that there are unintended consequences that can arise from employing such orders.

- Selling lower than the current price

- By implementing a stop loss, you are essentially deciding to sell your crypto assets at a value lower than the current price. Consequently, this choice guarantees that any potential return on your initial investment will always be inferior to the current state. Naturally, you can choose to employ a take-profit order and leave it open on the order book.

- Assuming the asset experiences price movement, either the stop loss or take profit order will eventually be triggered. However, it becomes a matter of chance as to which one gets executed.

- Getting picked off by bots

- A stop-loss order is visible on the order book, which exposes potential price levels to other traders. Algorithmic high-frequency trading bots are likely to exploit this information and capitalize on stop-loss orders.

- Parasitic Slippage

- Whenever a stop loss is triggered, trading fees are typically incurred. Consequently, frequent usage of stop losses can unintentionally deplete your capital due to the accumulation of these fees. Although individual fees may be relatively small, their cumulative effect can create a situation similar to parasitic slippage.

- Trigger Points

- Different exchanges determine the trigger point for stop orders differently. While some utilize the last executed price, others rely on quotation prices, such as the highest bid or lowest ask price. In a market with low liquidity, this can result in a stop-loss order being triggered at a significantly lower price than anticipated. It is advisable to verify the specifics of stop order triggers on each exchange.

- Missing Out on Potential Gains

- The most unfortunate unintended consequence occurs when the market experiences a significant surge right after your stop loss is triggered. Not only did you sell your crypto at a discounted price, but now you will have to pay a substantially higher price to re-enter the market.

- Locked Assets with Limited Usage

- Implementing a stop-loss order requires keeping your crypto assets on an exchange, which restricts their utilization for staking, yield farming, or other purposes. Additionally, many crypto exchanges are centralized, meaning you do not have direct control over your private keys. This exposes users to custodial risks.

- No tradable asset asset

- Users are not returned a composable asset that represents your stop-loss

Bumper’s Stop Loss alternative

Bumper provides an alternative that preserves the upside while still providing you with protection from downside moves in the highly volatile crypto market, protecting the value of your crypto from downside moves, even while it simultaneously allows you to ride the rips.

The innovative architecture of the Bumper protocol allows users to take price protection but negates concerns about whether a stop loss is a good idea or not.

It does this by allowing you to deposit crypto into the protocol’s smart contracts, and in return, you are given a ‘Bumpered’ asset which represents the crypto you have locked up. The Bumpered asset has baked into it a protection floor which acts as a minimum value level for that asset. If your position closes and the price of your asset is under the floor, you get stablecoins to the floor value, but if the price is higher, you simply get your original token back (minus the premium of course).

How Bumper Is Different From Put Options

While both Bumper and put options are hedging strategies, there are key differences such as:

- Price protection

- Premiums

- Renewal

- Participant interaction

- Token bonding

- Yields

- Tokenized primitive

- Settlement

| Price Protection | Premiums | Renewal | Participant Interaction | |

| Put Options | Buyers don’t have to own the underlying token, and are a gamble on the future price.

Options either expire profitably “in-the-money’ or are worthless “out-of-the-money” |

Premiums are determined by the seller and always paid in full when the contract is opened.

On some platforms, premiums may be calculated by the protocol, often using a standard model such as the Black Scholes method. |

Options cannot be renewed | Almost all Options contracts are adversarial between two individual participants, a buyer and a seller. |

| Bumper | Bumper protects the value of tokens owned by the user. | Bumper calculates premiums incrementally when the protocol’s state changes (normally as a result of volatility or change in the balance of locked assets).

Premiums are deducted when a position is closed. Agent Based Modelling projects 4.5pp lower premiums compared to Black-Scholes option pricing. Additionally, unlike Options, Bumper premiums reduce as the asset price rises above the protected floor. |

Positions can be automatically renewed at any point before the position is closed. | All interactions are between the user and either the protocol’s Asset pool or Capital pool. Users are never matched directly. |

| Token Bonding | Yields | Tokenized Primitive | Settlement | |

| Put Options | Almost all crypto Options desks do not require users to bond or even hold the protocol’s native token to participate | Contract sellers earn a yield derived from premiums levied on buyers | Not available | Almost all in-the-money crypto options contracts are cash-settled either at the point of expiry, or when the buyer exercises early (if available). |

| Bumper | Users opening positions must hold, and bond, BUMP tokens.

The specific amount required is determined by the system based on the size (value) of the position being opened. |

Liquidity providers earn yield derived from premiums AND automated yield farming. | When a position is opened and the user deposits their asset into the protocol, a tokenized asset is returned to them which represents their protected asset with the downside volatility removed (due to the protection floor level).

This asset, called a Bumpered Asset, is composable. |

Settlement occurs when a protection takers position is closed, with the form of settlement varying depending on whether the closing price is below or above the floor.

Option sellers are subject to lower haircut risk, compared to Black-Scholes option pricing, with Agent Based Modelling projecting 6p.p improved yield during 2022 pronounced bear market. See the table below for different modes of settlement. |

The table below outlines the different methods of settlement.

| Below floor or in the money | Above floor or out of the money | Premium | |

| Crypto put option | Normally cash-settled in stablecoins | No settlement | Paid in full when the contract is opened |

| Bumper | Protected asset + profit in stablecoins or entire settlement in stablecoins. | Closes and retrieves the protected asset | Deducted from protected assets over the position lifetime. |

How Bumper can become the ultimate platform for trading options

One of the challenges of crypto options trading is its inherent complexity, which can deter many newcomers to the crypto space. Bumper addresses this challenge by providing a user-friendly interface and eliminating the need to navigate the nuances of options contracts, strike prices, and expiry dates. Instead, users can set a desired price at which they wish to protect their assets and choose a term length. If the market crashes, the asset’s value will not sink below the protected price, while still allowing potential gains if the market surges.

Another disadvantage of traditional crypto options platforms is the cost associated with options contracts, especially in volatile markets. Bumper offers a more cost-efficient solution by providing a safety net for crypto investments without the substantial expenses typically incurred in options trading. This can make it a more attractive option for investors looking to manage their risk without incurring high costs.

Furthermore, Bumper operates as a decentralized protocol, allowing global accessibility without being restricted by regulatory limitations faced by traditional options platforms. This makes it accessible to users worldwide, providing them with an alternative that is not constrained by geographical boundaries.

Bumper also introduces a unique feature that allows users on the other side of the market to earn a yield by assuming some of the risk from those seeking asset protection. This creates a balanced ecosystem where participants can both protect their assets and earn a yield by providing pooled liquidity.

While Bumper may not fit the conventional definition of a crypto options platform, its simplicity, accessibility, and cost-effectiveness make a strong case for it being considered the ultimate platform for trading options. By offering a user-friendly interface, cost efficiency, and global accessibility, Bumper can disrupt the crypto options market and provide a more inclusive and efficient trading experience for users.

Chains

Bumper is available on the following chains:

- Arbitrum

Market Actors

Bumper involves two market participants: takers and makers.

- Takers seek to protect the price of their cryptocurrency assets from significant downside price movements.

- Makers provide liquidity to the Bumper protocol with stablecoins and earn a yield in return.

On the one hand, takers decide on the amount of their asset they wish to protect, the floor price at which protection activates, and the duration of the protection. On the other hand, makers deposit stablecoins into the protocol and assume taker price risk while benefiting from the advanced price protection ecosystem.

When a taker’s position ends, the outcome depends on whether the current asset price is above or below the chosen floor.

Protect your crypto – Takers

Takers are users who deposit assets into the Bumper protocol to obtain a protected price position. They have the following responsibilities and options:

- Deposit assets: Takers deposit their assets into the protocol to participate in the price protection mechanism.

- Choose term and floor: Takers select a term (duration) and a price floor for their position from a predefined list of options. The term determines the length of time their protection is active, and the floor represents the minimum price at which their protection “kicks in”.

- Close or claim: At the end of their term, takers have two options based on the current asset price:

- If the current asset price is above their floor, takers can close their position and retrieve their asset from the protocol, minus their individual premium.

- If the current asset price is below their floor, takers can claim on the protocol to receive stablecoins (minus the value of their individual premium or a combination of the original asset and stablecoins.

Taker Specific Functions

- Protect: Seeking to purchase protection against negative asset price movements, Takers Protect their asset by depositing a principal into the Asset Pool, choosing a fixed term and a price floor.

- Close: At the end of a protection term, a Taker Closes their protection and withdraws their asset from the Asset Pool, minus premiums, if the price is above their protection floor. This action is mutually exclusive with a Claim.

- Claim: At the end of a protection term, a Taker Claims their protection and withdraws $USDC or a combination of $ETH and $USDC, from the Capital Pool, minus premiums, if the price is below their protection floor. This action is mutually exclusive with a Close.

- Renew: Effectively a Close, followed immediately by a Protect, over the remaining assets, net premia and fees. Similar to taking out protection, renewals are also eligible for additional BUMP incentives.

Earn yield on stablecoins – Makers

Makers are users who deposit capital in stablecoins into the Bumper protocol and assume the risk associated with providing liquidity. They have the following responsibilities and options:

- Deposit capital: Users deposit their capital into the protocol to supply liquidity and participate in the risk market.

- Choose term and tier: Users select a fixed term (duration) and a tier of risk, which determines their level of exposure to potential yield and associated risk of loss. The tier reflects their risk appetite and desired yield potential.

- Yield and risk: Users earn yields based on their chosen tier and the duration of their deposit. The yield represents the return they receive for providing liquidity and assuming price risk. However, stablecoin deposits are at risk to claims, which can temporarily reduce their capacity to earn positive returns.

- Incentives: Depositors are incentivized to enter the protocol during times of market stress or for longer fixed terms. This incentivization helps ensure sufficient liquidity and balanced risk exposure within the protocol.

Maker Specific Functions

-

- Deposit: Intending to earn a yield from Bumper’s mechanisms over time, Makers Deposit stablecoin to the Capital Pool, selecting both a fixed term and a risk exposure tier.

- Withdraw: When they wish to recall funds from the protocol, Makers terminate their position and Withdraw stablecoin from the Capital Pool after the expiry of the current term.

- Renew: One of Bumper’s defining differentiators to a Put Option, Makers can simply renew their position for another fixed term if their position is “out of the money” at the time of their withdrawal.

Investors

By involving both makers and takers, the Bumper protocol disperses liquidity risk and allows participants to segment themselves into different risk categories based on their chosen parameters. This segmentation enhances the overall efficiency and resilience of the protocol by attracting participants with varying risk preferences and investment strategies.

How Stablecoin Depositors (Makers) Earn Yield

Makers earn yield not only from premiums paid by Takers but also from potential profits and automated yield farming through external DeFi protocols.

The yield earned by makers can vary over time based on the volatility of asset prices and the liquidity available within the Bumper protocol. For instance, as market conditions change, the yield generated through automated yield farming may increase or decrease.

- Calculation of bUSDCETH: When a maker enters the protocol, their bUSDCETH (owned share) is calculated based on their initial deposit, selected risk tier, the amount of $USDC in the Capital Pool, the total bUSDCETH in circulation, and the amount of $ETH in the Asset Reserve. This calculation determines the maker’s share of the Capital Pool.

- Yield Increment: Yield is developed for makers by incrementally increasing the value of the Debt over time. The Debt represents the amount owed to makers. By increasing the Debt, the protocol’s incentives and rebalancing functions work to increase $USDC holdings and generate positive yields.

- Term and Bonus: Makers can select a fixed term for their position. The longer the term they choose, the higher the bonus applied to their bUSDCETH. This incentivizes makers to commit to longer-term positions and supports the stability of the protocol.

- Impermanent Loss: Impermanent loss occurs when the value in the Capital Pool is insufficient to cover both the Debt and the expected Liability at the same time, typically during rapid asset price declines. Impermanent loss is calculated based on the Capital Pool’s value. However, the Asset Reserve, which represents the maker’s yield and any excess capital, still owes value to makers. This mechanism minimizes capital flight and aligns with the assumption that makers have a neutral or positive outlook on asset price risk over longer time horizons.

- Consistency and Apportioning: The protocol apportions any calculated impermanent loss among makers according to their chosen risk tier. If a maker decides to exit the protocol with a non-zero impermanent loss, it is deducted from their final payout as a Realized Loss.

- Asset Price Increases: In situations where the asset price increases from a state of liquidity balance, the maker’s yield target can be exceeded, benefiting makers who maintain a positive price outlook. This incentivizes makers to stay in the protocol during instances of short-term volatility and aligns with the assumption of an “at-least neutral” price outlook.

Who can Use Bumper

The price protection aspect of Bumper is suitable for a variety of usages and strategies, and can be utilized for the following user base:

- New Crypto Users

- Bumper’s optimal low-cost solution to help newcomers keep their value intact without having to deposit onto a centralized exchange.

- Traders

- Bumper helps to preserve gains during the bull cycle, allowing traders to trade in and out of stablecoins passively without incurring slippage fees.

- Long-term Holders

- Bumper prevents massive loss during a market crash, allowing accumulation throughout a bear cycle.

- DeFi Natives

- Bumper protects assets while still allowing participation in other DeFi protocols. This is enabled by the composable Bumpered asset, which is the protected asset with downside volatility removed.

- Institutions

- Fund managers and institutions with a fiduciary responsibility to hedge risk on behalf of clients can use Bumper as a cost-effective solution against downside volatility.

- High-Value Investors

- Investors with higher net worth can utilize Bumper as a hedge against significant losses without having to trade.

- Inter-DeFi protocol usage

- 3rd party protocols plugging into Bumper in a permissionless fashion

Business Model

Premiums, fees, and incentives are calculated at the pool level and change over time based on asset price volatility and liquidity coverage.

- Premiums cover the cost of protection.

- Fees support the protocol’s Treasury.

- Incentives in the form of $BUMP tokens reward users for their engagement with the protocol.

Premiums

Premiums represent the cost of protection for takers and are incurred when opening a position. They are calculated at the pool level and change over time.

Premiums accumulate over time as the position remains active and are calculated based on two sets of risk measures: asset price volatility and liquidity coverage:

Takers pay the premium when they close their position, and it is deducted from the amount they receive back.

Fees

Bumper imposes a “Network Fee” at the start of a taker’s term. The Network Fee is calculated based on the value of the taker’s deposit.

This fee is levied to support the protocol’s Treasury and ensure sustainable operation and development of the Bumper ecosystem.

Incentives

To bootstrap liquidity and incentivize the growth of the protocol, $BUMP tokens are issued as incentives to users when they take out a position.

- Network Incentives: These incentives are designed to reward early adopters of the protocol. The amount of the Network Incentive is calculated based on the Total Value Locked (TVL) in the protocol. As the TVL increases, the Network Incentive diminishes. This means that users who join the protocol early when the TVL is relatively low have the opportunity to receive a higher Network Incentive in $BUMP tokens.

Tokenomics

The $BUMP token

The $BUMP token plays a crucial role in the protocol by serving as a utility and governance token that incentivizes participation and supports the network effect of the marketplace. Participants in the Bumper market are required to bond $BUMP tokens in escrow for the duration of their engagement with the protocol. In addition to that, they can also participate in governance decisions.

The utility of the $BUMP token is closely tied to the demand for using the protocol. As more actors seek price protection for on-chain assets or are willing to buy asset price risk in exchange for collecting premiums, the demand for $BUMP tokens increases. This creates a direct link between the utility value of the Bumper protocol and the market value of the token.

This way, by aligning protocol utility with token demand, the BUMP token’s market price becomes a reflection of the value and adoption of the Bumper protocol. This incentivizes real-world actors to interact with the protocol as they recognize the benefits and economic incentives associated with participating in the marketplace.

Voting in the Bumper governance system is designed to be time-weighted, which means that the voting power of token holders is determined based on the duration of time they have held their BUMP tokens. This time-weighted approach helps to prevent the disproportionate influence of wealthy individuals or groups who may temporarily acquire tokens to manipulate the voting process.

Token Metrics

- 250m total supply

- Circulating Supply (estimated) at IDO: 44m (21.37%)

- Circulating Market Cap (estimated) at IDO: $70 – 128m

- Fully Diluted Valuation at IDO: $331 – 600m (full dilution estimated 2025)

- VCs & Team on 18-month vesting

Token Emissions

- 3.5% for Private and Pre-Sale

- 1.5% for Farming (any remainder added to Pre-Sale)

- Public Sale (TBD)

Governance

Bumper’s DAO (Decentralized Autonomous Organization) allows $BUMP token holders to participate in the governance of the protocol by obtaining voting power, represented by vBUMP tokens. To gain voting power, token holders need to stake their $BUMP tokens into Bumper’s DAO contract.

Users have the option to lock their staked $BUMP tokens for a certain period, up to 1 year, and earn bonus vBUMP tokens. The bonus vBUMP tokens gradually decrease over the lock period and eventually reach a 1:1 ratio with the staked $BUMP tokens at the end of the lock period. This incentivizes users to lock their tokens for a longer duration and rewards them with additional voting power.

Furthermore, users can delegate their base vBUMP voting power (excluding bonus vBUMP) to other users who can vote on their behalf. Delegation can be done and revoked at any time, allowing token holders to appoint someone else as a proxy for their vote.

Bumper’s DAO has established governance thresholds to ensure that a minority of users cannot disproportionately influence decision-making. These thresholds include a minimum level of vBUMP required to create a proposal, a quorum requirement (minimum level of participation), and supermajority acceptance levels for a proposal to be approved.

Proposed changes to the protocol are submitted as Bumper Improvement Proposals, following a common practice among established decentralized protocols. These proposals are raised and published for review and discussion by the community. Token holders then have the opportunity to vote on these proposals, with the weight of their votes determined by the duration of their $BUMP token holdings.

Once the voting period concludes, there is a final approval and deployment process based on the outcome of the voting. This ensures that changes to the protocol are implemented in a decentralized manner, taking into account the preferences of the $BUMP token holders who actively participate in the governance process.

Risks

The protocol is built on 3 core assumptions that form the foundation of its market design and risk management approach.

- Maximum variance: The first assumption of Bumper is that there is a maximum expected cumulative variance or price volatility for future asset price changes over a given period of time. This assumption sets the configuration bounds of the protocol to withstand extreme scenarios of asset price movement. It ensures that the protocol can effectively handle significant price fluctuations without compromising its functionality.

- Minimum heterogeneity: Bumper assumes the presence of heterogeneous market participants with different risk perspectives. Takers and makers in the protocol exhibit distinct risk appetites and forward price perspectives compared to professional traders actively involved in cryptocurrency markets. Takers, who seek short-term price volatility protection, may have some exposure to cryptocurrencies but do not actively manage their positions. On the other hand, makers, who provide liquidity and assume price risk, have a long-term positive outlook on the protected asset. Bumper allows participants to choose risk markets or tiers based on their individual risk preferences and perspectives, blending their risk exposure accordingly.

- Minimum incentive: The protocol relies on appropriate calibration to ensure a balance of outcomes between takers and makers. Takers pay a premium for protection, while makers earn yields by assuming price risk. The average premium for takers is designed to be less than or equal to an equivalent Black-Scholes option price, considering their risk exposure and the availability of external yield opportunities. Bumper assumes that with the right pricing and incentives, there will be a non-zero set of actors motivated to engage with the protocol.

Security

Audits

Bumper has gone through audits with Block Hunters, Chainsulting, Sigma Prima, and Watchpug.

- Audit report – July 14, 2021 – Block Hunters

- Block Hunters had verified the test suite provided by Block8’s crew. It has been written in an exhaustive and correct manner, thus guaranteeing the correct operation of the system. Coverage of crucial logic is high (~90%). Based on that, they didn’t develop any additional tests.

- Smart contract audit – October 14, 2021 – Chainsulting

- Low 1 – 1 Acknowledged

- Informational 2 – 1 Fixed, 1 Acknowledged

- Smart Contract Audit – August 30, 2023 – Watchpug

- High 6

- Medium 1

- Low 2

- Informational 1

Bug Bounty

There are currently no bug bounty programs available.

Team

LinkedIn indicates that there are 13 employees. Some of them include:

- Jonathan ‘DeFi’ Decarteret, CEO

- PreviouslyCEO at INDX & Founder of Switch, UK’s 60th Fastest growing company.

- Bsc Artificial Intelligence and Psychology, Neuroscience, Development learning, Machine learning at University of Nottingham.

- Gareth Ward, COO

- Samuel G Brooks, CTO

- Jason Suttie, CMO

- Currently also a Consultant at Copper.

- Previously Founder and MD at Copper and Get Tasting.

- Bachelor of BUsiness, Marketing and Business Administration at Monash University.

- Giacomo Puri Purini, Senior Operations Manager

- Previously Co-founder at MONET.

- Master’s Degree, FInancial Mathematics at Columbia University.

Project Investors

There were 4 raises held by Bumper. These include:

- Pre-Seed funding round of $1.25m

- Private raise of $10m

- Held around April 28 2021.

- Investors include Alphabit, Autonomy, Beachhead, ChainLayer and others.

- Presale raise of $3.75m

- Held around October 31, 2021.

- Public Sale of $20m

Additional Information

Partnerships

Bumper has the following partnerships and integrations.

- blocbank – A cutting-edge fintech solution that seamlessly integrates multiple financial services into one convenient platform.

Glossary

- Taker: A user of the system who wishes to protect against downward asset price movements. Primary actor.

- Maker: A user of the system who wishes to earn a yield. Primary actor.

-

- Staker: A BUMP token holder who is not currently a protection market participant, who stakes their token into the protocol for a BUMP yield.

- Deposit: A Maker taking a position with the Protocol by supplying USDC. Generates bUSDCETH.

-

- Position: Taken by a Maker or Taker when engaging with the protocol.

- Term: The lock-in period for a given user’s position. Active until expiry.

- Floor: An individual Taker’s chosen protection price.

- Tier: An individual Maker’s chosen level of exposure to risk.

- Renew: When a Taker or Maker renews their position for another Term.

- Close: At the end of a protection term, a Taker Closes their protection and withdraws their asset from the Asset Pool, minus premiums, if the price is above their protection floor. This action is mutually exclusive with a Claim.

- Claim: At the end of a protection term, a Taker Claims their protection and withdraws USDC or a combination of ETH and USDC, from the Capital Pool, minus premiums, if the price is below their protection floor. This action is mutually exclusive with a Close.

- BUMP: The name of the Bumper protocol token.

- bETH: A token (or tokens) returned by the Bumper protocol which represents a Taker’s positions.

- bUSDCETH: A token (or tokens) returned by the Bumper protocol which represents a Maker’s position.

- Bond: Refers to locking BUMP tokens with the protocol in order to access a position. A Bond is required to access certain protocol functions, such as creating Maker and Taker positions. Bonding does not provide a reward.

- Network Incentive: An incentive for early participation. Only applies to Makers and Takers.

- Asset Pool: Primary pool of ETH in the protocol.

- Asset Reserve: A reserve of ETH that captures new ETH from Taker Premiums.

- Capital Pool: Primary pool of USDC in the protocol.

- Capital Reserve: A reserve of USDC used to regulate price volatility.

- Treasury: A fund composed of ETH and USDC that is captured to fund governance-approved activities, such as software upgrades.

- The Book: Total ETH liability to Takers.

- The Liability: Total USDC liability to Takers.

- The Debt: Total USDC liability to Makers.

- Impermanent Loss: Where the Capital Pool is lower than the Debt, typically due to Taker Claims.

- Realized Loss: Incurred when a Maker elects to exit the protocol under a condition of impermanent loss.

- Liquidity Ratio: A core measure of the protocol’s economic health. Several liquidity ratios are used as inputs to the premium and rebalancing logic.

- Adequacy: The extent to which ETH and USDC liquidity provisions match their target.

- Configuration: Protocol settings that relate to static values, which can only be changed on-chain via Governance proposals.

FAQ

- How does Bumper price protection work?

- Users of protection set a floor price for their ‘unstable’ asset (eg. ETH), and if the price crashes, their asset will never fall below that floor price. Importantly, if the price rises, they retain their native asset as the value increases, thus removing downside risk but still capturing the upside potential.

- The Bumper protocol aggregates sellers of risk (Takers) and buyers of risk (Makers) into separate but decentralized, non-custodial pools. The protocol is constantly monitoring a variety of ratios governing the balance of those pools, and then uses incentivised mechanisms to retain that balance to provide the required price protection.

- What benefits can Bumper provide to users?

- Put simply, Bumper can provide protection for the price of your crypto assets. This means that the volatility that we have all become aware of in the crypto market can be mitigated in exchange for a fee. As a result, you can invest into a cryptocurrency, ‘Bumper’ a large portion of it and wait until the value of that asset rises.

- Then, at whatever point you want to sell your assets, you’ll never lose less than your set price floor. Considering this, you could wait until the asset price rises and then Bumper that price, effectively removing any chance that your whole crypto portfolio will suffer from heavy losses.

- On the other side, Makers have the opportunity to earn yield, not only from premiums which are collected by the Bumper protocol, but also from the automated Yield farming capabilities which the system makes possible. All of these benefits mean that using Bumper can make crypto a sustainable long-term investment choice.

- Isn’t Bumper just a Stop Loss?

- A Stop Loss places a sell order to an exchanges order book when the threshold is triggered, converting your crypto asset to stablecoins or fiat (assuming the order is filled, which it isn’t guaranteed to be). But if the price rebounds, you end up missing out on upside gains.

- Bumper preserves upside gains whilst protecting your wallets value from drops without transferring your tokens to an exchange. Your token isn’t sold when the floor is crossed, unlike when using a Stop Loss.

- Isn’t Bumper just a Put Option?

- Bumper’s price protection is a novel alternative to the Put Option with significant benefits for both sides of the market.

- Bumper protects tokens that you already own, and its premiums are calculated dynamically and applied incrementally, based on actual market volatility. When your position is closed you either claim stablecoins to the value of your floor, or you retrieve your original token (minus the premium).

- Unlike a Put option, Bumper returns a composable ‘Bumpered asset’ to protection taker. It also allows protection terms to be renewed (extended) if required.

- On the other side of the market, yield seekers generate income over time without the need to continually price, write and locate buyers for Put contracts. Bumper’s pooled architecture facilitates earning from multiple different positions even while reducing exposure to losses from individual contracts.

- Do I need to verify my identity?

- There are no KYC (Know Your Customer) or AML (Anti-Money Laundering) requirements, and we do not require users to register to use Bumper. Simply connect a compatible wallet, and use the protocol.

- What are the tax implications of the protocol swapping my assets?

- Each jurisdiction has its own rules relating to tax on crypto gains, and Bumper recommends speaking to a financial advisor in your domiciled country.

- Does Bumper have any fees?

- Yes, and the protocol seeks to minimize fees to be as low as possible. There are two kinds of fee: the Premium (for Takers), and the protocol fee (for both Takers and Makers). The premia levied on Takers are a function of market risk; so as the market conditions degrade (i.e. with increased volatility or down-side risk markers), Taker premia will adjust accordingly. This ensures that the cost of protection only accumulates for the risk that the protected asset presents, meaning that they can be as low as possible.

- The beauty in Bumper with this approach is that it doesn’t have any long term unsustainable incentives that we find in other protocols. The incentives balance in real time based on the internal state of the protocol and a measure of the external prices of the protected assets, including the fees for Takers and yields for Makers.

- Doesn’t the high number of daily transactions for a user’s account incur some kind of additional risk?

- No, the clever thing about the protocol is there’s no real need to do lots of transactions. Bumper works like an aggregated ledger, monitoring and maintaining the relevant ratios that keep the protocol stable, it limits that transaction security risk and reduces things like slippage down to an irrelevant problem.

- Will Bumper expand to multiple networks?

- Currently, the native BUMP token is an ERC-20 token on the Ethereum network. In the future, Bumper is looking at possibilities in expanding to other networks to reach more users in the crypto space.

- How is Bumper able to deal with large drops in the market?

- The protocol is extremely efficient and robust and more than capable of dealing with BlackSwan events.

- Drops in price are a two-part problem. Firstly, the actual level of drop and secondly, the time it takes to drop and/or recover. The worst-case scenario is a big and fast drop with an elongated flatline. Bumper is well-equipped to handle those kinds of drops.

- So, yes, Bumper can be tuned to in fact withstand any kind of market drop, and has undergone in-depth modeling of many different scenarios to ensure that the protocol is as robust and cost-effective as possible.

- There is only one theoretical kind of market drop that Bumper cannot withstand, and that is if the price of ETH goes to 0 instantaneously and stays there for an infinite amount of time. So as long as that doesn’t occur, then there are a set of parameters under which the protocol works.

- You’ll need to read the Litepaper and/or Whitepaper to fully understand the mechanics of how Bumper deals with flash crashes, but the protocol is extremely efficient and robust and more than capable of dealing with BlackSwan events and the kind of drops recently witnessed.

- What is the purpose of the $BUMP token?

- The $BUMP token is an integral part of the Bumper ecosystem, and along with the near-zero slippage engine, reserve rebalancing system, and multiple layers of redundancy, $BUMP tokens further assist in maintaining the resiliency of the protocol.

- The token is woven into every facet of the platform and is the first entry point to the Bumper ecosystem — since both price protection “takers” and liquidity providing “makers” need to deposit $BUMP tokens to begin interacting with the protocol.

- How do I add my $BUMP to Metamask?

-

- To add the $BUMP token to your Metamask wallet or to other web3 wallets manually, please follow the instructions below:

- METHOD 1. Use the widget to add $BUMP tokens to Metamask

- 1. Open MetaMask on your browser and select the account which holds your $BUMP tokens.

- 2. Go to the widget here: https://bit.ly/3yZFDrw

- 3. Click on “Add to Metamask”.

- 4. In the MetaMask Notification, click “Add Token”.

- 5. You can now view BUMP tokens in MetaMask.

- METHOD 2. Add $BUMP tokens manually to Metamask

- Follow the instructions below to add the BUMP token manually to Metamask

- 1. Open Metamask

- 2. Click on “Import Tokens”

- 3. Click on the “Custom Token” tab

- 4. Enter the BUMP token contract address:

- Token Contract Address:0x785c34312dfA6B74F6f1829f79ADe39042222168

- Token Symbol: BUMP

- Decimals of Precision: 18

Community Links

- Website

- Liquidity Mining dApp

- Documentation

- Medium

- Blog

- Discord

- Telegram

- Coingecko

- DefiLlama