Overview

Ankr is a Web3 infrastructure company that offers a set of different products, such as liquid staking, appchain services, RPC endpoints, and developer APIs and SDKs.

The goal of the Ankr Network is to become the gateway through which developers and protocols connect to the node infrastructure and development tools they need in order to build secure, scalable, and decentralized applications.

Ankr aims to enhance the adoption of Web3 technology by offering a platform where users can easily deploy nodes or interact with PoS chains in order to stake their PoS tokens or access their respective DeFi applications.

In theory, anyone can run a node and support the ecosystem of any given blockchain. However, the economic and time costs, as well as the necessary expertise and skills, make it difficult for the average user to set up their own nodes. Ankr aims to solve this pain point with its suite of blockchain products and infrastructure tools:

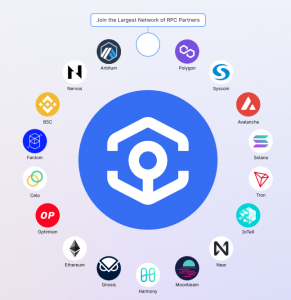

- RPC Service – Users can connect to a globally-distributed infrastructure of full nodes and interact with 21 blockchains.

- Advanced APIs – Is a single point of reference for multi-chain requests. Advanced APIs are a collection of JSON-RPC API endpoints that support the most popular EVM blockchains.

- Appchains – Enables developers to quickly spin up a blockchain dedicated to their dApp.

- Liquid Staking – Allows users to stake PoS assets and earn rewards for assets such as $ETH, $AVAX, and $MATIC while maintaining access to liquidity.

- Mirage Gaming – Ankr provides Web3 SDKs for the two most widely-used gaming engines, Unity and Unreal Engine. This allows developers to enable their game to interact with Web3 wallets, blockchains, and smart contracts.

Products

Whether developers wish to build a dApp or deploy a new layer one blockchain, Ankr can offer the infrastructure to make it happen. Its product suite aims for developers to not have to worry about the management and overhead of spinning up and maintaining the underlying infrastructure when building their products.

Staking

Delegated Staking

The functioning of the Ankr Network relies on dependable and high-quality node providers who handle RPC requests for supported blockchains. To ensure the reliability of the system, each node provider is required to have a significant deposit of $ANKR tokens, including their own self-stake.

Furthermore, token holders have the opportunity to express their support for specific node providers on the Ankr Network by staking $ANKR tokens to back those providers’ nodes. By delegating their $ANKR tokens, community members actively participate in evaluating the reputation and performance of service providers. In return, $ANKR token stakers receive a share of the rewards earned by the node providers they support.

$ANKR staking also grants delegators the ability to allocate voting power to node providers. This power allows them to contribute to decisions such as determining which independent node providers will be admitted in the near future to handle traffic on the Ankr Network.

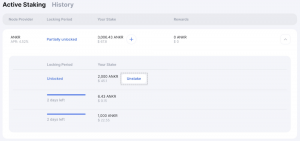

Unlike Liquid Staking, tokens that have been delegated are not liquid and no actions can be performed until the end of the lock period. While staked, delegated tokens earn a yield. There are currently 2 tokens that can be delegated on Ankr, which include:

- $ANKR

- Ankr token.

- Can only be staked on Ethereum mainnet.

- $mGNO

- Gnosis token.

- Can only be staked on Gnosis Chain.

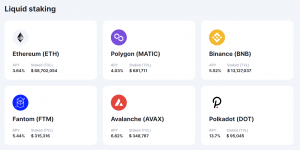

Liquid Staking

Liquid Staking offers a solution to the issue of liquidity being locked up when staking assets in PoS networks.

While staking rewards in these networks can provide a stable and reliable income stream, typically you have to wait until the staking period concludes to access your rewards.

Liquid Staking addresses this problem by introducing Liquid Staking Tokens (LSTs), which provide immediate liquidity for staked assets. These tokens represent the value of your staked assets and can be easily transferred, accessed, and utilized in various ways across DeFi. This newfound liquidity allows for greater flexibility and the ability to leverage your staked assets in different applications and transactions.

Liquid staking is currently available on the following platforms:

- Avalanche

- Binane

- Polkadot

- Ethereum Mainnet

- Fantom

- Kusama

- Polygon on both Ethereum and Polygon

Appchains

A unique feature of Ankr is offering developers the ability to spin up a dedicated appchain for their dApp. With crypto evolving and more users transacting on-chain as opposed to through a centralized exchange, the competition for blockspace has increased significantly.

Appchains are blockchains that provide exclusive services to developers for building their custom dApps. In the process of building on top of their own application-specific chain, Ankr will provide their expertise in supporting the development, launch, and operation of the chain.

This service provides developers with an easy plug-and-play tool to build their dApps efficiently, providing scalability without competition from other projects causing traffic and increased gas fees. It also offers customization features for developers by allowing them to make decisions on what consensus mechanism, development framework, or programming language to use. This allows teams to determine what their own fine-tuned balance between speed and security is.

AppChains are especially useful for developers who:

- Need help transitioning from Web2 to Web3 and want to own their infrastructure.

- Want to own their ecosystem without building it from scratch.

- Have an existing Web3 project looking to onboard the next billion users.

- Are limited by current L1s and L2s.

- Have a high-throughput use case needing to process lots of transactions.

- Have Web3 games that need custom wallet integration and marketplaces for in-game assets.

Building an AppChain

Starting an AppChain requires 6 main technical features, which are:

- RPC endpoint

- Validator nodes

- Testnet token faucet

- Block explorer

- Cross-chain bridge

- Staking UI

- Advanced APIs – A premium add-on feature for interested developers.

Ankr’s AppChain program provides developers multiple choices for these components for the self-sufficient builders, or with instructions and support provided for the newer developers. Ankr also provides access to its Exchange-Readiness program, which supports developers who are interested in applying for token listings on major exchanges with Ankr’s industry experience.

Enterprise Packages

AppChains on Microsoft Azure provides enterprises and developers with a comprehensive solution for building, scaling, and achieving widespread adoption for their Web3 initiatives. The platform offers a dedicated blockchain environment, facilitating the seamless launch of blockchain nodes and their connection while Ankr’s team provides complete maintenance and support for the blockchain nodes on Microsoft Azure, ensuring a smooth and hassle-free experience for users.

Ankr currently offers three package plans for enterprises:

- AppChain SMB Package

- An AppChain creation package for small and midsize enterprises.

- A Small and Midsize Business plan, which provides all infrastructure and engineering tools required to build a dedicated blockchain for the moderate traffic needs of new use cases. Ankr’s engineering team also offers complete blockchain creation and maintenance with tailor-made solutions to enhance application experiences.

- Package specs:

- End-to-end blockchain creation, support, maintenance, and security.

- 2 VMs (Virtual Machines) equipped with 2 RPC nodes running on Ankr’s load balancer technology.

- 4 Ankr-managed validators (running on Cloud) with 4 VMs.

- 1 Block Explorer (options: permissioned or permissionless).

- Pricing: 6200 USD/month + Azure infrastructure costs.

- AppChain Large Enterprise Package

- An AppChain creation package for large enterprises with robust infrastructure.

- The Large Enterprise plan provides enhanced node infrastructure for businesses that can accommodate an immediate need to scale traffic to an anticipated user base. Ankr’s engineering team offers complete blockchain creation and maintenance with tailor-made solutions to enhance application experiences.

- Package specs:

- End-to-end blockchain creation, support, maintenance, and security.

- 4 VMs equipped with 4 RPC nodes running on Ankr’s load balancer technology.

- 6 Ankr-managed validators (running on Cloud) with 6 VMs.

- 1 Block Explorer (options: permissioned or permissionless).

- Pricing: 9100 USD/month + Azure infrastructure costs.

- AppChain Global Enterprise and Banking Package

- An AppChain creation package for global organizations with top-tier infrastructure.

- The Global Enterprise and Banking plan provides comprehensive infrastructure to suit the most demanding traffic requirements of international corporations, financial applications, and governments. Ankr’s engineering team offers complete blockchain creation and maintenance with tailor-made solutions to enhance application experiences, bolster security, and meet regulatory frameworks.

- Package specs:

- End-to-end blockchain creation, support, maintenance, and security.

- 6 VMs equipped with 6 RPC nodes running on Ankr’s load balancer technology.

- 10 Ankr-managed validators (running on Cloud) with 10 VMs.

- 1 Block Explorer (options: permissioned or permissionless).

- Pricing: 16500 USD/month + Azure infrastructure costs.

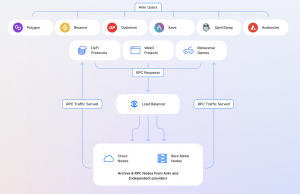

RPC Service

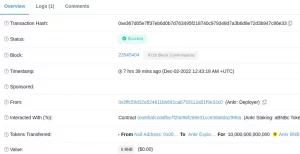

Ankr’s blockchain RPCs enable users to connect to Ankr’s distributed network of full nodes. These RPCs act as gateways that enable crypto wallets, dApps, DEXs, NFT platforms, and open-source software to communicate with on-chain data and perform tasks such as retrieving balances, and executing transactions.

Think of RPCs as portals that facilitate connections with different blockchain networks like Ethereum, the BNB Chain, or Avalanche. They provide the necessary infrastructure for developers and users to interface with these networks and leverage their functionalities.

Apart from development use cases, many users of Web3 wallets, including popular ones like MetaMask, utilize Ankr’s RPC endpoints to customize their connections. By doing so, they can enhance privacy, avoid data and address collection, and maintain greater control over their wallet interactions.

The platform has the following functionality to offer:

- JSON-RPC/REST API — the endpoints (either public or private) to provide your project with blockchain interaction.

- Advanced APIs — collections of endpoints that support simultaneous querying of multiple blockchains for the most popular Web3 scenarios at near-instant speeds; available via JavaScript/Python SDKs and React Hooks.

- Usage statistics — the means to have a full view of your blockchain interaction statistics.

- Query checker — a tool for a free test-querying of RPC methods before using them.

Node operators in Ankr’s network must stake 100,000 ANKR to their node and actively maintain the node to avoid slashing penalties similar to validator penalties on Ethereum. Maintaining the node means ensuring the node is synced, updating the node as network upgrades come out, and any other general maintenance.

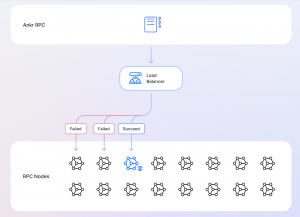

Load Balancing

Node operators on the network are indexed and RPC request traffic is assigned through a load balancer. The load balancer takes into account the node health, the geographic location and node’s workload to determine which node is best suited to handle any given RPC request.

Nodes that are not synced with the current state of the chain, geographically distanced from the user, or overloaded with requests from other users would not be selected. In its current state, the centralized nature of the load balancer is an area where Ankr can improve on its quest to decentralize.

This decision-making process is carried out by a load-balancing algorithm that uses a scoring system to determine the best possible node . The load balancer scores nodes on a scale of 1-10 based on how synced they are with the blockchain. If the node is a few blocks behind or does not respond to the block height queries, traffic will not be routed through it.

There is a failover mechanism in place to ensure that all requests are served rapidly. If a request reaches a node that experiences an outage or an error, the load balancer will automatically re-route the request to another node.

Every failover response will depend on the error, and depending on what type of error occurs, the request will either be sent to another node or be nullified (if there is missing transaction information – such as an unknown block hash or block does not exist).

A monitoring system observes the performance of all nodes with very high regularity and will disconnect nodes that are not in a performant state.

Load balancer requests are routed through a hybrid infrastructure of cloud and bare-metal servers running on multiple chains. This provides a unique combination of benefits in terms of decentralization, redundancy, speed, and reliability.

Ankr’s nodes are spread across the globe in multiple data centers and cloud regions, like North and South America, Europe, the Middle East, Asia, Oceania, and Africa.

Chains Supported

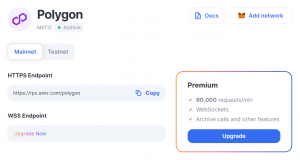

Ankr offers RPC endpoints that can be accessed via HTTPS or WebSockets in order to interact with 35+ supported blockchains

Plans

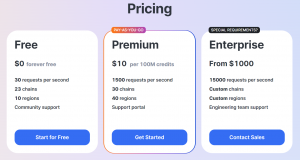

Ankr offers three different plans for RPC users:

- Free/Public Plan – up to 250k RPC requests per day.

- Premium Plan – unlimited requests

- Enterprise Plan – unlimited requests

Features

The following table shows the differences in features

| Feature | Public | Premium |

| Full and Archive Data | ✅ | ✅ |

| Global node coverage | ✅ | ✅ |

| Usage stats and reports | ❌ | ✅ |

| Private endpoints | ❌ | ✅ |

| Support Polkadot, Kusama, & HECO | ❌ | ✅ |

| Batch requests | ✅ | ✅ |

| eth_getLogs batch size | 10 per batch | up to 1000 per batch |

| Priority order | Limited during high traffic | Prioritized during high traffic |

| Connection | HTTPS | HTTPS and WebSocket |

| Support | Discord and Support Portal | Direct Email Support |

| Terms | No Contract | Both Contract and No Contract |

| Cost | Free | Pay-as-you-go |

Rate Limit

The following table shows the difference in rate limits

| Service | Public | Premium |

| RPC Service

(EVM-compatible chains) |

Requests across all endpoints:

≈1800 requests/minute — guaranteed; >1800 requests/minute — possible (depends on the load) |

Requests per endpoint:

Up to ≈1.5k requests/second |

| RPC Service

(Solana) |

Requests across all endpoints:

≈1800 requests/minute — guaranteed; >1800 requests/minute — possible (depends on the load) |

Requests per endpoint:

Up to ≈4k requests/second |

| Advanced APIs | 50 requests/minute | 1k+ requests/minute |

Pricing

Public Plan

Public plans are free to use, but have limitations compared to the paid plans.

Its features include:

- 30 requests per second

- 23 chains

- 10 regions

- Community support

Premium Plan

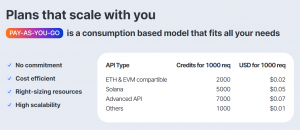

Premium plans are priced according to the Pay-As-You-Go (PAYG) model.

Its features include:

- 1500 requests per second

- 30 chains

- 40 regions

- Support portal

Users are charged based on the number of requests they make, rather than subscribing to a fixed plan. Users are not required to commit to any subscriptions. Instead, they can access the Premium features by depositing a minimum of 1000 ANKR tokens and creating an Ankr Premium account.

Usage is measured in API Credits. Each method used in a request carries a specific credit value, which is determined by the intensity of usage and various factors such as

- Computational

- Memory

- Storage

- Network resource

It’s important to note that charges are applied for each request, regardless of whether it is successful or not. This means that even if a request does not receive a response from the underlying node, a charge will still be incurred for the request that reaches Ankr’s worker.

Below you can find the summary on PAYG charging:

- Correct request (charged) — a request uses a supported method and has a valid JSON-RPC structure.

- Incorrect request (not charged) — a request has an invalid JSON-RPC structure or a batch request has the same ID in multiple requests. Ankr can’t parse such a request.

- Correct request + incorrect method (charged default amount) — a request uses an unsupported method though has a valid JSON-RPC structure. Ankr charges a default amount of credits for the infrastructure usage.

The cost of API Credits is pegged to USD. When using $ANKR tokens for PAYG, the conversion into API Credits is calculated based on the most recent ANKR/USD exchange rate.

For example, if the exchange rate is 0.10 $USD per 1 $ANKR token, then 1 million API Credits would be equivalent to $0.10 USD.

| API Type | Method | API Credits | in USD |

| Ethereum | all methods | 200 | $0.00002 |

| EVM compatible | all methods | 200 | $0.00002 |

| Solana | all methods | 500 | $0.00005 |

| Advanced APIs | all methods | 700 | $0.00007 |

| Other | 100 | $0.00001 |

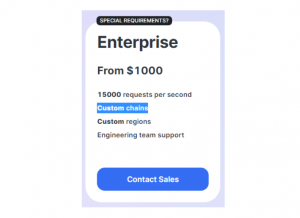

Enterprise Plan

Its features include:

- 15000 requests per second

- Custom chains

- Custom regions

- Engineering team support

Businesses interested in the enterprise plan will have to contact Ankr’s Sales team in order to obtain further information, as it is customized accordingly.

Getting Started

Public Plan

Developers can add the blockchain’s endpoint into the project’s library or config file in order to enable their project to interact with a blockchain.

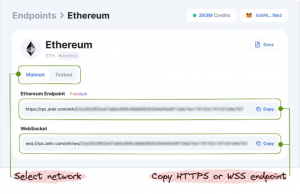

After selecting their desired network, they can choose either the Mainnet or Testnet function, and then copy the “Endpoint” field into their project’s library or config file.

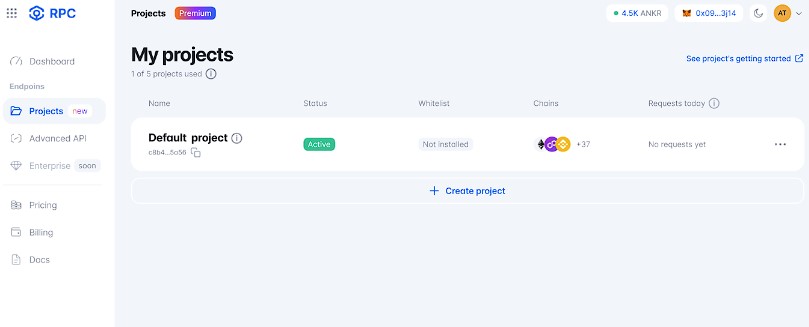

Premium Plan

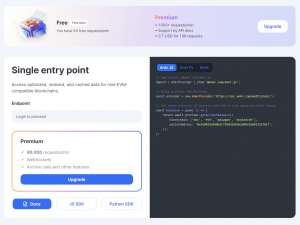

Getting started with the premium plan requires the user to do the following in this order:

- A Helpful UI layout for new users.

- Signing into account in order to utilize the private endpoints.

- This can be done via either a Google account or a Web3 wallet.

- A positive balance is required to query the endpoints.

- This can be done via either a Credit card or a Web3 wallet.

- Both require an initial deposit in order to generate a personal JWT token granting access to the plan.

- Users can start using private endpoints after finishing the 3 prior steps.

- As a Premium user, you have private Endpoints at hand to enable your projects to interact with a blockchain.

- A Premium URL consists of a connection protocol (https or wss), domain name (rpc.ankr.com), common path of a blockchain to use (/eth), and your personal JWT token as the last segment of the path:

- To enable a project to interact with a blockchain, add the blockchain’s URL into the project’s library or config file:

- In Navigation, click Endpoints to open the pane.

- In the Chain Selection area, click the chain you’d like to query.

- In the Chain opened, select a network (Mainnet/Testnet) needed for your project.

- In the Endpoints field, copy the “HTTPS” or “WebSocket URL” and paste it into your project’s library or config file.

APIs

Advanced APIs are a carefully designed set of JSON-RPC API endpoints that are optimized to cater to the most commonly used Web3 scenarios across multiple blockchain networks. These APIs are built with the aim of providing fast and efficient support for various interactions in the Web3 ecosystem.

- Reduce the number of requests that need to be made.

- Reduce the amount of time spent making requests.

- Save time and money by querying multiple chains at once.

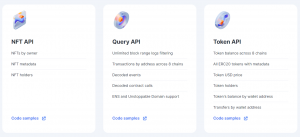

There are multiple types of APIs:

- The query API makes it simple to search for ranges of blocks, addresses or events, eliminating the very lengthy process of a manual search using RPCs. Ankr has leveraged its network of Ankr-owned nodes to index blockchain data from all chains supported by its Developer APIs. When a new block is minted, it is processed and indexed in the internal database.

- The token API is designed to help developers query information about tokens on any supported chain and query account balances, number of existing tokens, market valuations… Only on-chain data is used, there is no reliance on third-parties.

- The NFT API allows developers to easily query the ownership history and metadata of an NFT. This also allows them to get details about which collection a NFT belongs to, when it was minted, its past transaction history, who currently owns the token…

Chains Supported

Ankr’s Advanced APIs work with the following EVM-compatible chains:

- Mainnets:

- Ethereum, Fantom, BNB Smart Chain, Polygon, Polygon zkEVM, Avalanche, Arbitrum, Syscoin, Optimism

- Testnets:

- Ethereum Goerli, Polygon Mumbai, Avalanche Fuji

There will be more EVM and non-EVM chains in the future.

Methods Supported

All supported methods are available in the generated swagger.json in the OpenAPI format.

The user must register an account at Ankr AAPI to get a unique API key to begin queries.

The following is a list of methods that can be used:

As this is a premium plan feature, Advanced APIs usages are priced under the PAYG model, with all requests costing 700 API credits, or $0.00007 USD per request.

SDKs

Ankr.js SDK

Ankr.js SDK contains a compact JavaScript library that enables users to interact with Advanced APIs.

Getting Started

Users can install the latest package that is stored on npm.

| # with npm

npm install @ankr.com/ankr.js # with yarn yarn add @ankr.com/ankr.js |

Then they can initialize the provider.

| import { AnkrProvider } from ‘@ankr.com/ankr.js’;

const provider = new AnkrProvider(); // or if you have a premium account const provider = new AnkrProvider(‘YOUR_API_KEY’); |

And finally use the provider to call either of the supported methods.

| await provider.getNFTsByOwner({

blockchain: ‘eth’, walletAddress: ‘0x0E11A192d574b342C51be9e306694C41547185DD’, }); |

Chains Supported

The chains that support ankr.js interaction are:

- Ethereum: eth

- BNB Smart Chain: bsc

- Polygon: polygon

- Fantom: fantom

- Arbitrum: arbitrum

- Avalanche: avalanche

- Syscoin NEVM: syscoin

- Optimism: optimism

- Ethereum Goerly: eth_goerli

- Avalanche Fuji: avalanche_fuji

Methods Supported

The following are methods that are available to users:

- getLogs — retrieves the logs matching the filter indicated.

- getBlocks — retrieves the data on the blocks within the indicated range.

- getTransactionsByHash — retrieves transaction details for a transaction specified by hash.

- getAccountBalance — retrieves the coin and token balances of the wallet specified.

- getNFTsByOwner — retrieves the data on all the NFTs (collectibles) owned by the indicated wallet.

- getTokenHolders — retrieves the list of token holders for a given contract address.

- getTokenHoldersCount — retrieves current and historical data on the number of token holders for a given contract address.

- getCurrencies — retrieves a list of supported currencies for a given blockchain.

- getTokenPriceHistory — retrieves the particular token’s price history on the chain specified.

Ankr.py SDK

Getting Started

Users can install the latest package that is stored on PyPi.

| pip install ankr-sdk |

Initialize the SDK.

| from ankr import AnkrWeb3

ankr_w3 = AnkrWeb3() # Or, if you have an Ankr Protocol premium planankr_w3 = AnkrWeb3(“YOUR-TOKEN”) |

Use the SDK to call the methods supported:

- Node API

| eth_block = ankr_w3.eth.get_block(“latest”)

bsc_block = ankr_w3.bsc.get_block(“latest”) polygon_block = ankr_w3.polygon.get_block(“latest”) |

- NFT API

| from ankr.types import Blockchain

nfts = ankr_w3.nft.get_nfts( blockchain=[Blockchain.ETH, Blockchain.BSC], wallet_address=”0x0E11A192d574b342C51be9e306694C41547185DD”, filter=[ {“0x700b4b9f39bb1faf5d0d16a20488f2733550bff4”: []}, {“0xd8682bfa6918b0174f287b888e765b9a1b4dc9c3”: [“8937”]}, ], ) |

- Token API

| assets = ankr_w3.token.get_account_balance( wallet_address=”0x77A859A53D4de24bBC0CC80dD93Fbe391Df45527″

) |

- Query API

| logs = ankr_w3.query.get_logs(

blockchain=”eth”, from_block=”0xdaf6b1″, to_block=14350010, address=[“0xc02aaa39b223fe8d0a0e5c4f27ead9083c756cc2”], topics=[ [], [“0x000000000000000000000000def1c0ded9bec7f1a1670819833240f027b25eff”], ], decode_logs=True,) |

Chains Supported

The chains that support ankr.py interaction are:

- Ethereum: eth

- BNB Smart Chain: bsc

- Polygon: polygon

- Fantom: fantom

- Arbitrum: arbitrum

- Avalanche: avalanche

- Syscoin NEVM: syscoin

Methods Supported

The following are methods supported by ankr.py:

- nft.get_nfts — retrieves data on all the NFTs (collectibles) owned by a wallet.

- nft.get_nft_metadata — retrieves metadata of a particular NFT.

- token.get_token_holders — retrieves holders of a particular NFT.

- token.get_token_holders_count_history — retrieves the number of token holders for the particular period of time.

- token.get_token_holders_count — retrieves the number of token holders for the latest block.

- token.get_account_balance — retrieves the balance of a particular account.

- query.get_logs — retrieves history data of a particular block range.

- query.get_blocks — retrieves full info of a particular block.

- query.get_transaction — retrieves the details of a transaction specified by hash.

React Hooks

Getting Started

Users can install the package.

| # with npm

npm install ankr-react # with yarn yarn add ankr-react |

Then wrap the app with the “<Provider />” component.

| import { Provider } from ‘ankr-react’;

function MyApp({ Component, pageProps }) { return ( <Provider> <Component {…pageProps} /> </Provider> ); } export default MyApp; |

Then use the React Hooks.

| import { useNFTsByOwner } from ‘ankr-react’;

const Page = () => { const {data, error, isLoading} = useNFTsByOwner({ walletAddress: ‘0x0ED6Cec17F860fb54E21D154b49DAEFd9Ca04106’, blockchain: [‘eth’, ‘polygon’], }) return ( … ) } |

Hooks Available

The following are hooks available for usage:

- useAccountBalance — retrieves account balance.

- useBlocks — retrieves the block’s data.

- useCurrencies — retrieves the blockchain’s currencies.

- useLogs — retrieves the block’s history data.

- useNFTMetadata — retrieves the NFTs metadata.

- useNFTsByOwner — retrieves the account’s NFT data.

- useTokenHolders — retrieves data on token holders.

- useTokenHoldersCount — retrieves the number of token holders.

- useTransactionsByHash — retrieves data for the hash-specified transaction.

Gaming SDKs

Gaming SDKs are done via the Mirage Platform, with the option of choosing either Unity or Unreal Engine SDK. Engine. This enables developers to build and scale Web3 games on all EVM-compatible blockchains. Using these SDKs, developers can integrate Web3 wallets and smart contract interactions into their games. Combined with the appchain product, a Web3 gaming developer has all the tools required to build a successful game with Ankr’s product offerings.

Gaming SDKs provide the following functionality:

- Interaction with Web3 wallets (either WalletConnect or MetaMask) for all supported platforms

- Interaction with EVM-compatible blockchains

- Interaction with smart contracts

They are compatible with all EVM-compatible blockchains and supports the following platforms along with their corresponding Web3 wallet solution:

- Android/iOS — WalletConnect via deep link.

- WebGL — MetaMask or any wallet that supports WalletConnect.

- Standalone — MetaMask or any wallet that supports WalletConnect.

Developers wishing to utilize the Gaming SDKs can take a look at the guides provided on the Mirage Docs.

Ankr Scan

Ankrscan is a comprehensive multi-chain explorer that offers users access to data from eight different blockchain networks. This powerful tool allows users to effortlessly browse and interact with a wide range of blockchain data without the need for login credentials.

One of the key features of Ankrscan is its interoperability, which enables seamless interaction with various blockchains. It provides a convenient and accessible solution for projects looking to engage with multiple blockchains using a single request.

With Ankrscan, users can take advantage of the API query functionality, which streamlines the process of interacting with multiple blockchains. By indexing data from all eight supported chains, Ankrscan allows for quick and efficient searching through large volumes of blockchain data.

The 8 supported chains are:

- Arbitrum

- Optimism

- Binance Smart Chain

- Ethereum

- Fantom

- Polygon

- Syscoin

- Avalanche C-chain

Enterprise Solutions

Ankr provides a multitude of full-scale solutions to power enterprise-level needs. These services include:

- Blockchain RPC & API

- Access 30+ blockchains through the world’s largest RPC platform.

- Tap into low latency responses with geo-distribution across 24 metros.

- Customize throughput requirements with requests per second over 25,000.

- Engage a fast-response engineering support team with a dedicated slack or telegram channel.

- Design dedicated and bespoke infrastructure by request.

- Choose fixed monthly payment options in ACH, Credit Card, ANKR Tokens, or USDT.

- White Label Liquid Staking

- Activate staking for any of your EVM PoS assets.

- Leverage prebuilt support for 6+ popular assets.

- Enable asset bridging to/from the most popular chains.

- Implement out-of-the-box and tailor-made solutions.

- Take advantage of low integration costs.

- Offer safe staking with multiple security audits.

- AppChains

- Launch a customized blockchain only serving your enterprise.

- Receive superior transaction speed, scalability, and affordability.

- Harness the performance of enterprise-grade infrastructure.

- Bring your customers to Web3 seamlessly with enhanced app features.

- Enable fiat onramp/offramp integrations for easy payments.

- Provide an all-in-one interface for interacting with your chain.

Developers who wish to utilize Ankr’s enterprise solutions may choose to contact their sales team for customized solutions.

Ultra-Sound Infrastructure

Ultra-Sound Infrastructure (USI) was introduced on July 25, 2023.

USI will soon launch a Node Partner Program to improve performance and efficiency for blockchain RPC connections across 30+ blockchain ecosystems. The program will see Ankr’s existing cloud provider partnerships beginning with Microsoft and Tencent Cloud, joining the network to offer our users the highest-quality and most distributed node network ever created.

Unlike other node partner programs, USI will deliver the highest performance possible by only deploying archive nodes. These nodes are specifically designed to handle high traffic volumes and ensure our customers can access the fastest and most reliable infrastructure possible. By utilizing archive nodes, Ankr can provide the highest level of performance without sacrificing security or stability.

The program was built so that those leveraging the external nodes within the USI network benefit from the archive nodes’ increased performance, reliability, and efficiency.

With this improved infrastructure, developers and enterprises can build complex and resource-intensive applications without worrying about slow or unstable network connections. By utilizing the archive nodes, developers can also ensure that their applications are accessible to a broader audience, as the nodes will be distributed across multiple regions. Additionally, Ankr’s focus on creating a sustainable and efficient network means that developers can have confidence in the long-term viability of their applications.

Benefits

By participating in the program, future node providers can earn a steady revenue stream by servicing paid traffic from Ankr’s RPC customers.

- Node Provider Partners: USI’s partner nodes combined with Ankr’s nodes offer the strongest foundation for the industry while benefiting from every request their nodes serve. The network will incentivize future node partners aside from Microsoft and Tencent Cloud to join by providing payment primarily in the $ANKR token. By servicing RPC traffic within the network, future node partners will earn $ANKR tokens as reward for serving all requests. Node Partners will also be able to choose the most profitable regions to place their nodes based on demand, ensuring they see an ROI on their node expenses. This way, they can maximize their profits while contributing to the distribution of Ankr’s network.

- Developers & Enterprises: Developers from Web3 startups and enterprises launching new Web3 strategies receive high-performance archive nodes delivering lower latency and the highest reliability to power their applications.

- Web3 End Users: All end users of the enterprise solutions and applications leveraging USI will receive the fastest, highest quality user experience possible.

By allowing node providers to choose where to place their nodes, the Ankr Network is creating a mutually beneficial relationship. Node providers can earn more rewards and increase their profitability, while Ankr’s customers can benefit from having access to a more distributed and reliable infrastructure network. This approach promotes a win-win situation where both parties can benefit from working together towards a common goal – to create the highest quality and most distributed blockchain infrastructure network for all of Web3.

ANKR token role in USI

The $ANKR token plays a significant role in the USI program, adding new layers of utility for the token.

New Utility for $ANKR: The $ANKR token’s utility as a payment for RPC customers to access blockchain data will be expanded to provide payment to the new node operator partners. The $ANKR token will effectively become the only gateway token for accessing the highest tier of infrastructure: archive nodes on USI.

A Critical Component of Web3 Access: As the ANKR token’s new attributes make it a necessity for accessing USI, the token will claim a critical role in facilitating Web3 operations for enterprises, dApps, and developers.

The ANKR token Receives a Revamped Utility:

- ANKR completes the final step in becoming a “gas” payment for multi-chain infrastructure

- Provides an essential gateway to Web3’s highest-quality infrastructure

Ankr Automate

Ankr Automate was introduced on July 6, 2023.

Automate allows developers and users to streamline their project’s operations and efficiency while unlocking the true potential of decentralized applications, and is a a decentralized, error-free solution to automate smart contracts across platforms and protocols.

Benefits

Automate provides the following benefits to developers and users.

- Automate your smart contract in the most decentralized way possible.

- Easily manage multiple tasks across various networks from one platform.

- Significantly reduce the risk of failed execution compared to running your own automation system.

- Trigger contracts with your own time schedule or a third-party contract execution as a condition.

- Receive instant notifications on execution, low-balance alerts, or task failure.

- Set up an automated contract in three minutes or less.

How it Works

In a few simple steps, developers can automate their project’s smart contracts by using the Ankr Automate platform.

- Define the Task: Provide your smart contract address, function, and input

- Set Timing Conditions or Other Triggers

- Set a time interval for execution or use a resolver contract to trigger

- Select Payment Method: Choose to be debited from your account or directly from the contract

- Sit Back and Relax: Once you’re set up with the above steps, Ankr Automate takes over while keeping you informed of all important updates

How it can be used

Automate opens up a variety of use cases.

- DEX & DeFi Trading: Automation can be very powerful in the world of DeFi, as you can use it to create applications that control trade executions, liquidations, incentive schemes, and more.

- NFT Projects: Mint new NFTs based on nearly any triggering event you can think of, deliver rewards to holders after a certain time, or create NFTs that change over time, among many other uses.

- Web3 Gaming: Have your game’s smart contracts activate during critical gameplay moments, deliver time-based rewards for NFT characters, or enable any other creative on-chain interaction.

- All Other Web3 Use Cases: Almost all Web3 applications or projects can benefit from reliable and performant smart contract automation.

Ankr Verify

Ankr Verify was introduced on December 13, 2023.

It offers any blockchain or decentralized application the ability to define requirements for entry or use thanks to zero-knowledge user identity verification. The product has launched with clients Eclipse and Mina Protocol, already using the technology to advance user experience and compliance for Web3 apps deployed to their networks. As a tool for Web3 user authentication, Ankr Verify will be important for enterprise compliance when rolling out blockchain initiatives, as it allows organizations to meet the KYC requirements of their country or jurisdiction without sacrificing user privacy.

Unlike traditional KYC methods, Ankr Verify allows blockchains and Web3 apps to verify customer data and satisfy regulations without access to sensitive user data – made possible by zero-knowledge cryptography. Users will access Ankr Verify to prove attributes about their identity by providing proof to Ankr’s KYC partner, Synaps. Synaps will be the only party to ever see, verify, or hold user data as a trusted and regulated KYC company – Ankr, nor any other company, protocol, or app will have access. From there, blockchains and web3 applications will be able to verify that a user meets requirements such as citizenship by only receiving “yes/no” answers, without needing them to upload an ID or disclose all of the sensitive information that comes along with it.

Ankr Verify provides seamless identity verification for every blockchain or Web3 application, enabling them to enhance user experiences and attract enterprise development. Ankr Verify creates the ultimate builder environment for businesses and developers with:

- Streamlined Compliance: Meet country and industry-specific regulations and allow enterprises to build stress-free.

- Enhanced User Experiences: Provide one place for users to verify personal credentials to access Web3 networks and apps safely.

- Robust Security: Rely on the strength of IPFS storage and meticulously crafted smart contracts to safeguard against data breaches.

- Customizable Claims: Seamlessly set, enforce, and validate policy restrictions to boost security and refine user-access control.

- Automatic Updates: Always remain up-to-date with the latest identity verifications to streamline operations.

- Enhanced Privacy: Maintain the highest standards of confidentiality and strengthen your reputation among users.

- Future-Proofed Interoperability: Ensure your network is always equipped with upgraded tech and interoperability.

- Cost-Efficient Scalability: Leverage efficient node infrastructure for identity validation and achieve significant cost savings.

The Ankr Story

Ankr was founded in 2017 as an infrastructure project that would harness idle computing power from data centers all over the world and repurpose that energy to power bitcoin mining operations, host validator nodes for PoS, or use it in IoT (Internet of Things)… At that point in time, Ankr accumulated a globally distributed supply of dedicated servers that positioned it for the upcoming industry shift to Proof-of-Stake (PoS) blockchains. As PoS blockchains began to offer smart contract capabilities, Ankr shifted its focus to providing developer and staking infrastructure by running full nodes and validator nodes.

During its early days, Ankr used its infrastructure to provide services like node hosting and API access. Since then, the number of PoS blockchains started to grow considerably. In response to the adoption of new decentralized technologies, Ankr took advantage of the opportunity and started servicing the needs of multiple emerging dApps. As a result, Ankr combined developer infrastructure (full nodes) with staking infrastructure (validator nodes).

Over time, as Ankr began to specialize in PoS infrastructure, its business operations started to expand, covering a variety of use cases within the Web3 industry, such as RPC services, SDKs and APIs, liquid staking solutions, and more. The first iterations were highly scalable and performant, even comparable to the likes of well-established infrastructure providers like Alchemy or Infura.

However, the first version of Ankr was launched in a centralized manner. At the time, the goal was to address the crucial need for node infrastructure in the industry. Since then, the protocol would prioritize a process of gradual decentralization by geographically distributing nodes across the globe and concurrently running its operations with independent node providers.

Despite experiencing enormous growth over the past years, the vision of Ankr remains the same: reducing the dependence on centralized infrastructure providers will help the industry to increase its resilience against single points of failure, unexpected downtimes, and censorship resistance.

The evolution of Ankr now includes not only free and public RPC endpoints but also premium and enterprise plans packed with advanced developer tools – all powered by a globally distributed and decentralized network of nodes. Ankr V2 also introduces a new pay-as-you-go payment model for developers to access on-chain data and for node providers to serve on-chain requests and earn $ANKR tokens. Additionally, $ANKR holders can stake their tokens in full nodes to secure the network and earn their share of rewards.

Roadmap

Initially, only projects that pass KYC and meet the designated hardware and $ANKR token collateral requirements can become node providers. However, future iterations of the node provider program will eventually incorporate individual node operators that can run nodes from anywhere as long as they meet the performance requirements. This new business model will allow Ankr to scale its services exponentially across the board and increase decentralization.

There is no public roadmap available for Ankr. However, Ankr has published a blogpost that includes the resolutions for 2023, which are:

- Growing Their Decentralized Infrastructure Foundation

- The focus is on delivering services for web3 builders aligned with blockchain principles and without exploitative practices.

- The team aims to create solutions that adhere to the decentralized ethos of web3 and lead the industry in terms of performance and reliability.

- Innovation will be centered around the core RPC platform, providing builders with options to connect to multiple chains across Web3.

- The high-performance global RPC service will be further strengthened to benefit both builders and users.

- The hosting platform simplifies node deployment, allowing developers to concentrate on building their applications.

- The superior performing system is expected to attract more users to Ankr and increase the utility of the Ankr token, which is required to use the network.

- Strengthening $ANKR Token Utility

- The vision for Ankr Network, outlined in the Ankr 2.0 whitepaper, is to create a decentralized system where independent node operators work alongside Ankr nodes to support Web3 growth.

- Ankr has already achieved two out of three items on their token utility roadmap:

- ANKR Token is used as payment for infrastructure services.

- Staking to full nodes is enabled through ANKR Staking.

- The third item on the roadmap is currently in progress, which involves onboarding more independent node providers to handle blockchain requests.

- Once all elements of the roadmap are completed, the utility of the $ANKR token will be significantly improved, leading to increased demand.

- The $ANKR token will be essential for all aspects of the decentralized infrastructure marketplace.

- Providing More Tools to Build the Next generation of Web3 Apps

- Ankr has built a new vertical of Web3 developer tools and services in 2022.

- The focus in the coming year is to significantly improve existing services and introduce new products and features that simplify the development of high-performance dApps.

- Existing products so far include:

- RPC Services

- Advanced APIs

- Ankr AppChains

- Gaming SDKs

- Liquid Staking Integrations

- Ankr plans to release many more developer tools and services in the future.

- Events

- Ankr will be attending the following events in 2023 with exclusive and unique merchandise to give away.

- Blockchain Fest Singapore

- Blockchain Life Dubai

- Paris Blockchain Week

- Consensus 2023

- Messari Mainnet

- Permissionless 2023

- ETH global events and many more

- Building and Growing an Even Stronger Community

- Ankr aims to build and grow a stronger community.

- The company plans to organize online and in-person events to facilitate user connections, learning, and growth.

- Weekly Fireside Chats will be hosted on Twitter, providing opportunities for community engagement and discussions.

- A new initiative called “Ankr Off Topic” discussions will be introduced on the Discord channel, allowing community members to explore various topics beyond the core focus.

- These community-building efforts are designed to foster a more engaged and connected user base.

Sector Outlook

Node infrastructure is fundamental for the blockchain industry as a whole: layer1 blockchains, DeFi protocols, virtual experiences, NFT projects… all rely on the security and scalability of a reliable and efficient node infrastructure. By providing developers with a set of multi-chain tools and node infrastructure, Ankr acts as the gateway through which developers and nodes are connected.

At the user level, running a node for a PoS blockchain is often perceived as an attractive way to earn income while contributing to the security of the respective network. However, there are multiple hardware and technical requirements involved in that process. These are seen as barriers to entry for getting started. With its services, Ankr addresses these challenges by simplifying the node creation process to just a few clicks for dozens of blockchains. Node operators only have to pay a monthly fee to Ankr in return for the various services the platform provides.

Ankr also has a significant presence in the liquid staking sector, with 9 tokens available for staking over 8 chains. The introduction of Liquid Staking tokens expands the utility of staked assets, allowing users to maximize their potential and explore various financial opportunities. This innovation enhances the flexibility and accessibility of PoS networks, providing stakers with greater control over their assets and the ability to make immediate use of their holdings.

Competitive Landscape

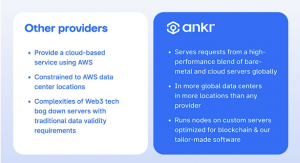

Ankr has multiple competitors in both sectors that it offers products in, being node and related infrastructure, and liquid staked tokens. Competing with the likes of Infura, Alchemy, and Pocket, Ankr’s unique pay-as-you-go (PAYG) model and plethora of services are its unique differentiators. Additionally, revamped $ANKR tokenomics and the introduction of the Ankr DAO have elevated Ankr as a key Web3 infrastructure provider.

It is worth noting that Ankr believes that it isn’t in direct competition with other node infrastructure providers, but it is here to make existing node infrastructure more resilient, secure, and decentralized. For example, a project exclusively using Alchemy for its node infrastructure can be more robust by leveraging Ankr Network’s decentralized node infrastructure in conjunction, for added redundancy and security.

Ankr Network users with Premium Plans pay under a pay-as-you-go model that ensures that developers don’t overpay for their subscriptions. The cost of an individual request averages to about $0.00004, with certain types of requests costing more or less based on their requirements. In turn, these fees are used to incentivize independent node operators and are redistributed amongst node providers and stakers. All things considered, this pricing is drastically cheaper than popular centralized node providers like Infura or Alchemy.

When paying for network fees with $ANKR tokens, users receive an additional discounted rate. Besides, certain features may only be accessible to users who use $ANKR to access the services.

Additionally, Ankr understands that its performance as a provider is directly responsible for its rapid growth. As such, Ankr constantly ensures that its services to developers are as competitive as possible, in areas such as:

- Reliability

- Low latency

- Affordability

- Global distribution

- Decentralization

Node Infrastructure

The following table showcases the differences between Ankr and its competitors.

| Name | Ankr | Alchemy | Infura | OMNIA | Quicknode |

| Chains | 22 (including testnets) | 7 | 11 | 8 | 6 |

| RPC | Yes | Yes | Yes | Yes | Yes |

| Products | RPC Service, Advanced APIs/SDKs, Gaming SDKs, AppChains, Liquid Staking, Ankr Scan, Enterprise Solutions. | Supernode, NFT API, Webhooks, Custom tbhooks, Token API, Transfer API, Transact, Transaction Simulation, Account Abstraction, Websockets, Spearmint. | Networks, NFT API+ SDK, Trace API. | API, Front-running protection. | Core API, Token API, NFT API, QuickAlerts, Graph API |

It can be seen that Ankr leads the way in terms of the number of chains supported, and also has the most number of unique product offerings.

Liquid Staking

The following image showcases the ranking of Ankr in the Liquid Staking sector.

Out of the top 10 protocols by TVL, Ankr has the most number of liquid staked token choices, with 7 offerings. The majority of liquid staking protocols are focused only on staked $ETH.

Ankr has also made progress in creating liquidity for its liquid staked tokens on DEXes, with $ankrBNB being its most widespread token, and $ankrFTM and $ankrMATIC coming in after.

Potential Adoption

Node infrastructure still has plenty of space to grow, especially as adoption and infrastructure becomes more palatable and widespread in the traditional markets. Ankr’s expertise and reputation in this sector has already managed to transfer over to deals with names that are well-known outside of the crypto markets.

While Ankr has had prior partnerships with such entities in the past, it has seen a steady rise in the external market in 2023.

Ankr’s portfolio includes:

- Microsoft

- Ankr and Microsoft have partnered to support enterprises and organizations needing access to blockchain data with a reliable, easy-to-use node hosting service.

- They are working toward a shared goal of making this service available soon through Microsoft’s Azure marketplace, providing a readily accessible gateway to blockchain infrastructure for millions of monthly customers.

- Launch enterprise-grade blockchain nodes with custom specifications for global location, memory, and bandwidth according to their unique use cases.

- Optimize data querying for high levels of speed and reliability on their choice of dozens of different blockchains with serverless functionality utilizing GeoIP, failovers, Caching Rules, and Monitoring.

- Easily track the performance of their nodes anytime, anywhere. Enterprise RPC clients can access usage data and advanced telemetry across 38+ blockchains.

- Tencent Cloud

- Signed an agreement to jointly develop a full suite of blockchain API services, provided by a high-performing, globally distributed, and decentralized network of Remote Procedure Call (RPC) nodes.

- The new services will cater to thousands of applications, games, virtual worlds, and companies needing connections to blockchain data while allowing any enterprise to launch a dedicated blockchain node cluster harnessing the Tencent Cloud in conjunction with Ankr’s globally distributed bare-metal servers.

- Dubai Multi Commodities Center (DMCC)

- The collaboration will provide support to over 500 member Web3 businesses in the DMCC Crypto Center, accelerating their growth and development through innovative products, infrastructure, and advisory incubation.

- Ankr’s extensive suite of solutions will be made available to businesses within the DMCC Crypto Center, empowering them with access to a wide variety of products and services, such as application-specific blockchain engineering, node infrastructure, Web3 gaming solutions, NFT marketplace solutions, staking, and decentralized finance products.

- These offerings will enable businesses to fast-track their development and go to market with every resource they need to thrive in emerging Web3 ecosystems.

- Lotte Data Communication

- This relationship builds further power and resiliency into the Ankr Cloud, with Lotte Data Communications providing compute resources from their top-tier data centers in South Korea, with plans for expansion across further locations in the future.

- Ankr has a very wide and active investor community in South Korea, which will recognise the significance of this partnership and the resulting increased global reach.

- Because of the large volume of compute power based in South Korea itself, Korean users will also be able to enjoy significantly improved latency from Ankr, when hosting their blockchain nodes and other cloud-based applications through Ankr’s Cloud platform.

In the liquid staking sector, Ankr already has the widest options available in DeFi for liquid staking. As it continues to prove its reliability and versatility in this sector, more token options should also be made available in the future.

Chains

Ankr services expand over 21 blockchains, handling over 2 billion RPC requests daily.

Staking

Liquid staking is available on the following chains:

- Ethereum

- $ETH, $MATIC

- Polygon

- $MATIC

- BNB Chain

- $BNB

- Fantom

- $FTM

- Avalanche

- $AVAX

- Polkadot

- $DOT

Delegated staking is available on the following chains:

- Ethereum

- $ANKR

- Gnosis

- $mGNO

AppChains

The following are the AppChains available:

- Meta Apes

- A player-owned, player-run post-apocalyptic Web3 mobile strategy game with rewarding gameplay.

- A player-owned, player-run post-apocalyptic Web3 mobile strategy game with rewarding gameplay.

Infrastructure Supported Chains

RPCs

The list of all chains available on RPC Service is as follow:

- Aptos

- Arbitrum

- Arbitrum Nova

- Base

- BNB Smart Chain

- BitTorrent Chain

- Blast

- Celo

- Chiliz

- Ethereum

- Ethereum Beacon

- Fantom

- Flare

- Gnosis

- Gnosis Beacon

- Filecoin

- Harmony

- HECO Chain

- Horizen EON

- IoTeX

- Kava

- Klaytn

- Kusama

- Mantle

- Metis

- Moonbeam

- NEAR

- Nervos

- Optimism

- Polkadot

- Polygon

- Polygon zkEVM

- Rolux

- Scroll

- Secret Network

- Sei

- Solana

- Sui

- Syscoin

- Tenet

- TRON

- XDC Network

- ZetaChain

- zkSync Era

Advanced APIs

Currently, Advanced APIs work with the following EVM-compatible chains:

- Mainnet:

- Ethereum

- Fantom

- BNB Smart Chain

- Polygon

- Polygon zkEVM

- Avalanche

- Arbiturm

- Syscoin

- Optimism

- Testnets:

- Ethereum Goerli

- Polygon Mumbai

- Avalanche Fuji

Using the Protocol

Staking

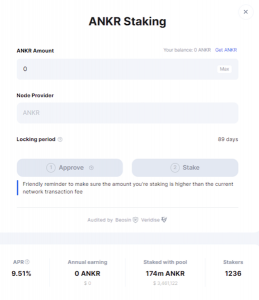

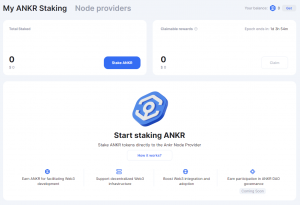

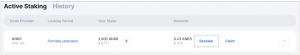

The tokens can be delegated on the Ankr site itself.

The UI will present information such as the APR, number of tokens already staked as while as the number of stakers. Users can select the amount they wish to stake, which is locked for a period of 84-91 days for the $ANKR token.

If the user wants to stake more tokens after already staking, a new locking period will apply to the new stake.

Rewards

Rewards accumulate on a weekly basis and can be claimed beginning after the epoch following the first stake. Rewards will also continue to accumulate even if the user does not unstake after the locking period is over.

Users can also choose to restake their rewards by clicking on “Restake”

Locked Period

While the locking period is expressed in days, it is actually counted in epochs, where the locked period is 12 epochs with each epoch lasting 7 days. Hence, the total locking period depends on which day the user stakes in their first epoch.

Unstaking

Users can click on the “Unstake” button in order to withdraw their staked tokens. This will start the Undelegate period which lasts a week. After the period ends, the user can repeat the process to withdraw their staked tokens.

Liquid Staking

Users can get liquid-staked tokens by either staking with Ankr on the respective chains or by buying them on DEXes.

The UI will present information such as the APR, number of tokens already staked as well as the number of stakers. Users can select the amount they wish to stake as there is no minimum amount required.

Rewards

Liquid-staked tokens provide yields depending on the token staked.

Users can also choose to deposit their liquid-staked tokens into DeFi protocols or pair them with other tokens on DEXes to earn additional rewards. However, this comes with the risk of exposing the assets to additional risks such as smart contract risks.

Unstaking

Unlike delegated staking which has a fixed locked period of epochs required to unlock the tokens, liquid staked tokens do not.Instead, staked tokens can be unstaked with the following methods:

- The unstaking queue

- The Flash unstake function

- Swapping for ETH or other tokens via a DEX

For example, at the time of writing, the standard unstaking period is 6-15 days for $ankrETH, but does not penalize the user with any fees.

Users can also choose to use the Flash unstake function, which has the following limitations:

- You have to pay a technical service fee for a flash unstake — 0.5% of the unstaked amount.

- Your unstake is limited by the current capacity of the flash-unstake pool. If you exceed it, the interface switches to the standard unstake with its regular release time.

Otherwise, the user can choose to sell their $ankrETH for other tokens on DEXes with liquidity, according to the market prices, but usually at a discount due to the unlocking time premium.

For Developers

Developers wishing to integrate Ankr staking into their projects can do so via the following integrations:

- Delegated Staking

- Currently none are available.

- Liquid Staking

- Liquid Staking SDK — a more convenient option with wider access and more conventional methods naming.

- Smart Contracts API — direct access to our Liquid Staking smart contracts.

- RESTful API for Liquid Staking metrics — addition to the smart contracts API to get richer statistical data.

- RESTful API for validators — addition to the smart contracts API to get such data as unbond time for rewards and amount of released rewards per validator.

- Oracles

- Liquid Crowdloan

- Parachain Crowdloan on Polkadot through the Liquid Crowdloan SDK.

The following documents will be useful for the respective chains:

- Avalanche staking mechanics

- Binance staking mechanics

- Ethereum staking mechanics

- Fantom staking mechanics

- Kusama staking mechanics

- Polkadot staking mechanics

- Polygon staking mechanics

- Ankr Bridge mechanics

- Ankr Switch mechanics

Projects Feature

The Projects feature was introduced on November 22, 2023, and is designed to cater to the intricate demands of businesses and developers in managing their Web3 initiatives.

It is an advancement for managing endpoints with Ankr and includes the following:

- Effortless Project Control: Create, delete, and freeze projects at will, staying organized and secure.

- Separate your production and testing environments.

- Delegate chains for different use cases (frontend usage, data dashboards, debug)

- Organize your work in the ways that work best for you

- Track your product metrics

- Streamlined Endpoint Management: Easily handle multiple endpoints across chains, all from a single management page. Organize, monitor, and exercise control over the endpoints designated for a specific project, ensuring optimal blockchain interactions. Initiate or halt the operation of your projects’ endpoints during critical situations in one click.

- Tailored Security: Ensure the security of your project through our whitelist mechanisms, permitting users to specify domains, IPs, or smart contracts for endpoint communications. Set unique security preferences for each project and manage your whitelist at will.

- Flexible Access Control: Now you have the option to use a different JWT token for each chain or use a single token to access all chains.

- Enhanced Analytics: Dive into granular data with insights tailored around individual project statistics. Access comprehensive insights on a particular project’s statistics, and empower your project or businesses with data-driven decision-making.

Investors

Liquid Staking

Liquid staking allows users to stake their tokens without having to meet either the minimum size requirement, hardware requirements or lock their tokens up for a certain period. For example, staking Ethereum directly as a validator requires at least 32 $ETH, a dedicated computer connected to the internet ~24/7, and some technical know-how.

However, staking with Ankr as ankrETH allows users to still obtain the staking yield less Ankr’s fees, while not having to provide the minimum size of 32 $ETH, dedicated hardware, and remaining liquid in order to participate in DeFi strategies.

AnkrETH can then be paired with $ETH in DeFi protocols to earn yields as a liquidity provider.

Business Model

The business model of Ankr relies primarily on 2 different areas, its Liquid Staking fees and infrastructure provider services.

Liquid Staking

Ankr charges technical service fees for Liquid Staking, amounting to the following:

- AVAX — 2% from the staking reward; network gas fee.

- BNB — 10% from the staking reward; network gas fee.

- DOT — 2% from the staking reward; network gas fee.

- ETH — 10% from the staking reward; network gas fee.

- FTM — network gas fee.

- KSM — network gas fee.

- MATIC — 5% from the staking reward, either on Ethereum or Polygon; network gas fee.

Infrastructure Services

Ankr charges for requests from its RPC and Advanced API users, and also its enterprise plans. The following are the fees that Ankr charges.

- RPC Service – Per Request

- Ethereum – $0.00002

- EVM compatible – $0.00002

- Solana all methods – $0.00005

- Advanced APIs – $0.00007

- Other – $0.00001

- Advanced APIs – Per Request

- NFT API Methods – $0.00007

- Query API Methods – $0.00007

- Token API Methods – $0.00007

- AppChains

- AppChain SMB Package – 6200 USD/month

- AppChain Large Enterprise Package – 9100 USD/month

- AppChain Global Enterprise and Banking Package – 16500 USD/month

Revenue Streams

Ankr generates revenue by collecting fees on the rewards of the Liquid Staked Tokens. This fee amount varies depending on each PoS network.

The following are the rewards that are distributed back to stakers, providers, and the DAO, after accounting for technical fees:

- AVAX — 98%

- BNB — 90%

- DOT — 98%

- ETH — 90%

- FTM — 100

- KSM —100

- MATIC — 95%

The fees are then split into the following allocation:

- Node providers – 21%

- Stakers – 49%

- DAO – 30%

Passive holders receive the underlying staking yield minus the fee. This allows users to earn additional yield by participating in the PoS validation of different chains to earn block rewards. Besides, they can also use the unlocked liquidity and use their yield-bearing assets across DeFi to generate additional yield.

Economics

Fee Breakdown

Ankr charges technical service fees for Liquid Staking, amounting to the following:

- AVAX — 2% from the staking reward; network gas fee.

- BNB — 10% from the staking reward; network gas fee.

- DOT — 2% from the staking reward; network gas fee.

- ETH — 10% from the staking reward; network gas fee.

- FTM — network gas fee.

- KSM — network gas fee.

- MATIC — 5% from the staking reward, either on Ethereum or Polygon; network gas fee.

Tokenomics

The $ANKR token is the native token of the protocol. It can be used for multiple purposes as a user, provider or staker.

- $ANKR can be spent in order to use the Ankr Network under the Pay-As-You-Go (PAYG) model. This allows users to make requests to the different blockchains they need to communicate with.

- Providers must deposit $ANKR as collateral in order to be a node provider, ensuring honest and optimal network participation. In return, they’ll be able to earn $ANKR rewards for serving traffic.

- Users can stake $ANKR to earn a share of the rewards for serving network traffic.

- Vote in proposals in the Ankr DAO.

$ANKR token holders can stake their tokens to earn 70% of rewards from all Ankr network fees – 49% to individual stakers, and 21% to node providers. The remaining 30% of fees go to the Ankr Treasury controlled by the Ankr DAO.

Ankr Network Premium Plan users are incentivized to pay for services with $ANKR tokens in order to take advantage of discounted rates and earn rewards for serving network traffic.

Notably, by introducing a staking system that incentivizes node independent node operators, $ANKR provides a solution for bootstrapping a distributed network of independent node providers serving the development layer (rather than validator nodes serving the consensus layer), which solves a fundamental problem that Web3 developers face.

In order to be eligible to serve traffic and earn rewards from the Ankr Network, independent node providers will need to provide a self-stake of 100,000 $ANKR per node. This self-stake serves as an insurance policy that ensures that node providers act in the best interest of the protocol users and meet their performance and uptime requirements. If a node provider fails to meet these requirements, their node will be slashed and funds will be removed from their self-stake and, in some cases, from the delegators who have staked $ANKR with that particular provider.

Staking ANKR to independent node providers

The Ankr Network requires each node provider to be backed by a large quantity of $ANKR tokens in order to maintain the quality of node providers, ensuring that RPC requests on supported networks are processed. This includes $ANKR tokens staked by the node providers themselves, which are subjected to slashing in the event of malicious acts or poor performance by the provider.

Additionally, token holders will be able to stake $ANKR tokens to back their nodes and act as an indicator of the service provider’s reputation, performance, and worthiness of a reputation boost. Stakers then get to share a portion of the yield earned by the node providers they have staked with but also bear part of the slashing risk. Lastly, staking $ANKR will also allow delegators to allocate voting power to node providers to decide on certain actions, such as which independent node providers to be admitted in the near term to service traffic on Ankr Network.

The initial $ANKR taking pool will have the following limitations:

- Capped in size.

- Allotments to existing node providers, community members, and other active Ankr ecosystem members.

A fair entry mechanism will also be used to fill a portion of the initial allotment, ensuring participation from a range of stakeholders.

Node Auditing Mechanisms

Ankr will partner with other blockchains, projects, and foundations to conduct audits to ensure that node providers are kept to the highest standards, with assisting partners receiving payment in the form of $ANKR tokens.

This is required as independent nodes can apply to join Ank network, and will have to be vetted to ensure that KYC, equipment, and performance requirements are satisfied.

Token Distribution

The total number of $ANKR tokens is 10 billion and there is no inflation built in.

There was an initial token supply of 40%, with an additional unlocked supply of 60% over 36 months between August 2019 to August 2022, and all tokens have been fully unlocked. The allocation is as follows:

- Mining and Community – 40%

- Private pre-sale – 30%

- Team and Advisor – 20%

- Public sale – 5%

- Marketing – 5%

Approximately 2% of Ankr tokens were burned, and it’s unlikely that more burns will occur.

Governance

Ankr plans to move to a DAO governance system utilizing staked $ANKR tokens. The system is still in progress and an announcement will be made by Ankr when finalized.

According to the current documents, the governance would be according to a proposal model that is seen in the majority of protocols, where a proposal is submitted before being voted on by the community.

The steps for governance participation are:

- Creating a proposal

- The proposer must lock 5M $ANKR.

- One wallet can raise a maximum of 2 proposals per month.

- Proposal submitted

- A submitted proposal is queued for 2 days in order to allow the Governance admit team to review it.

- Proposal approved

- The community starts voting.

- Voting period

- While being voted on, the proposer’s $ANKR is locked for 14 days.

- Each $ANKR equals 1 vote, and the $ANKR is locked for the duration of the vote.

- Locked $ANKR can be used to cast votes for multiple proposals.

- Proposal agreed on

- If successful, the proposal is then implemented by the Ankr team.

Ankr DAO

The Ankr DAO is still in the midst of being designed.

On July 21, 2022, Ankr had published a post detailing the Ankr 2.0 upgrade which also detailed the Ankr DAO governance that was targeted to be established in 2023.

The system of community governance over Ankr Network would be formalized, with an initial focus on three core areas:

- Allocating treasury funds to support the growth and expansion of Ankr Network.

- Ensuring Ankr Network pricing reflects user demand and Ankr ecosystem projects support ongoing maintenance of Ankr Network via revenue sharing and license fees.

- Voting to add chosen blockchains to be onboarded to Ankr Network’s industry-leading RPC services.

Voting would be done with staked $ANKR tokens.

Risks

Ankr has been expanding its suite of products since 2017, and provides services to help its users manage their risks and monitor the different attack vectors that might negatively impact their products:

- Audited and non-custodial staking products: All of Ankr’s staking and bridging products are audited to provide the highest security guarantees. As the products are non-custodial, Ankr Staking user funds are not exposed to risks from the market that could stem from decisions made by Ankr or any other platform.

- DevOps team operating with 24/7 coverage: Ankr has a DevOps team that deployed any security updates with speed and ensures that all Ankr services and blockchains are up and running, and uncompromised.

- Customer data is secure: As Ankr requires payments and data for some of their products, only the necessary information is collected and kept confidential while following all pertinent regulations and guidelines. There is a privacy policy in place to ensure that sensitive customer information is always protected.

Security

Liquid staking has become one of the most popular ways to engage with staking services. All liquid staking services are exposed to a series of common risks and it is up to the users to make a decision about which solution minimizes most of them.

The most significant risk associated with liquid staking is security. When assets are staked, they are typically locked away in a smart contract or another secure environment where they cannot be easily stolen or misappropriated. Depending on the liquidity staking provider, the smart contract risk will vary, however, all smart contracts holding the original unstaked assets may have bugs or be susceptible to attacks. Because of that, it is worth keeping in mind that, when liquid staking, the original assets are in the hands of a third party, which increases the exposure to counterparty risk.

Liquidity Risk

A risk associated with liquid staking is low liquidity risk. One of the benefits of Liquid Staking Tokens (LSTs) is that they can be swapped for their base asset counterpart instantly in Dexs without having to wait for the lengthy unbonding period that comes with staked assets. That being said, if the TVL in the liquidity pools runs dry, then the token can lose its peg, which also causes a high slippage when trying to swap between the assets.

One of the ways that liquid staking tokens hold their peg is because of arbitrage mechanisms in Dexs. Therefore, if the TVL in the liquidity pools drops dramatically this could alter the arbitrage incentives and spiral into a situation where the token doesn’t hold its peg. Arbitrageurs can then buy the discounted tokens in liquidity pools and unstake them for full price, making a premium.

Validator Slashing and Counterparty Risk

Liquid staking providers are responsible for maintaining the infrastructure and technology that supports the staking process. If there are any operational issues, such as system downtime, network outages, or other technical problems, the staked assets could be at risk.

More specifically, the assets that were originally provided to the liquid staking protocol have to be staked with validators. Because of that, if the protocol chooses untrustworthy or validators that underperform, then the staked assets could get slashed. Therefore, one should carefully consider the operational risks associated with liquid staking and only invest with trusted and reputable providers.

Audits

There have been multiple audits done by Beosin, Veridise, Peckshield, and Salus.

- Smart contract security audit report – November 10 2020 – Beosin

- Coding Conventions – 8 Subitems – 8 Passes

- General Vulnerability – 11 Subitems – 11 Passes

- Business Security – 2 Subitems – 2 Passes

- Smart contract security audit report – February 16 2022 – Beosin

- Critical – 2 ( 2 Fixed)

- Medium – 2 (2 Fixed)

- Low – 1 (1 Fixed)

- Info – 6 (5 Fixed, 1 Acknowledged)

- FTM Smart contract security audit report – March 24 2022 – Beosin

- High – 1 (1 Fixed)

- Low – 3 (2 Fixed, 1 Acknowledged)

- Info – 3 (2 Fixed, 1 Partially Fixed)

- BNB Smart contract security audit report – April 4 2022 – Beosin

- High – 3 (2 Fixed, 1 Acknowledged)

- Medium – 3 (3 Fixed)

- Low – 2 (2 Fixed)

- Info – 4 (3 Fixed, 1 Partially Fixed)

- Polygon Smart contract security audit report – June 15 2022 – Beosin

- High – 2 (1 Fixed, 1 Acknowledged)

- Medium – 1 (1 Fixed)

- Low – 3 (3 Acknowledged)

- Info 2 (1 Fixed, 1 Acknowledged)

- Smart contract security audit report – July 9 2022 – Peckshield

- High – 1 (1 Fixed)

- Medium – 1 (1 Confirmed)

- Low – 1 (1 Fixed)

- Avalanche Smart contract security audit report – July 12 2022 – Beosin

- High – 1 (1 Fixed)

- Medium – 3 (3 Fixed)

- Low – 2 (1 Fixed, 1 Acknowledged)

- Info – 1 Fixed

- Avalanche Smart contract security audit report – November 15 2022 – Beosin

- High – 1 (1 Fixed)

- Medium – 1 (1 Fixed)

- Low – 1 (1 Partially Fixed)

- Info – 1 (1 Partially Fixed)

- Ankr-staking Smart contract security audit report – December 6 2022 – Beosin

- High – 1 (1 Fixed)

- Medium – 5 (4 Fixed, 1 Acknowledged)

- Low – 9 (7 Fixed, 2 Acknowledged)

- Info – (5 Fixed, 2 Acknowledged)

- Native BNB Token Staking – February 17 2023 – Veridise Inc.

- Critical – 1 (1 Resolved)

- High – 1 (1 Resolved)

- Medium – 2 (2 Resolved)

- Low – 7 (6 Resolved)

- Warning – 6 (5 Resolved)

- Ankr Token Staking – February 21 2023 – Veridise Inc.

- High – 2 (2 Resolved)

- Medium – 1

- Low – 3 (3 Resolved)