Key Takeaways

Onchain Neobank: Ether.fi is the first non-custodial, global defibank, blending onchain staking, restaking, and yield with credit and real-world payments. Ether.fi is the category leader in LRTs and second only to Lido in combined LST+LRT TVL; the vertical product stack—Stake, Liquid, and Cash—covers restaking, automated DeFi yield vaults and a payments card.

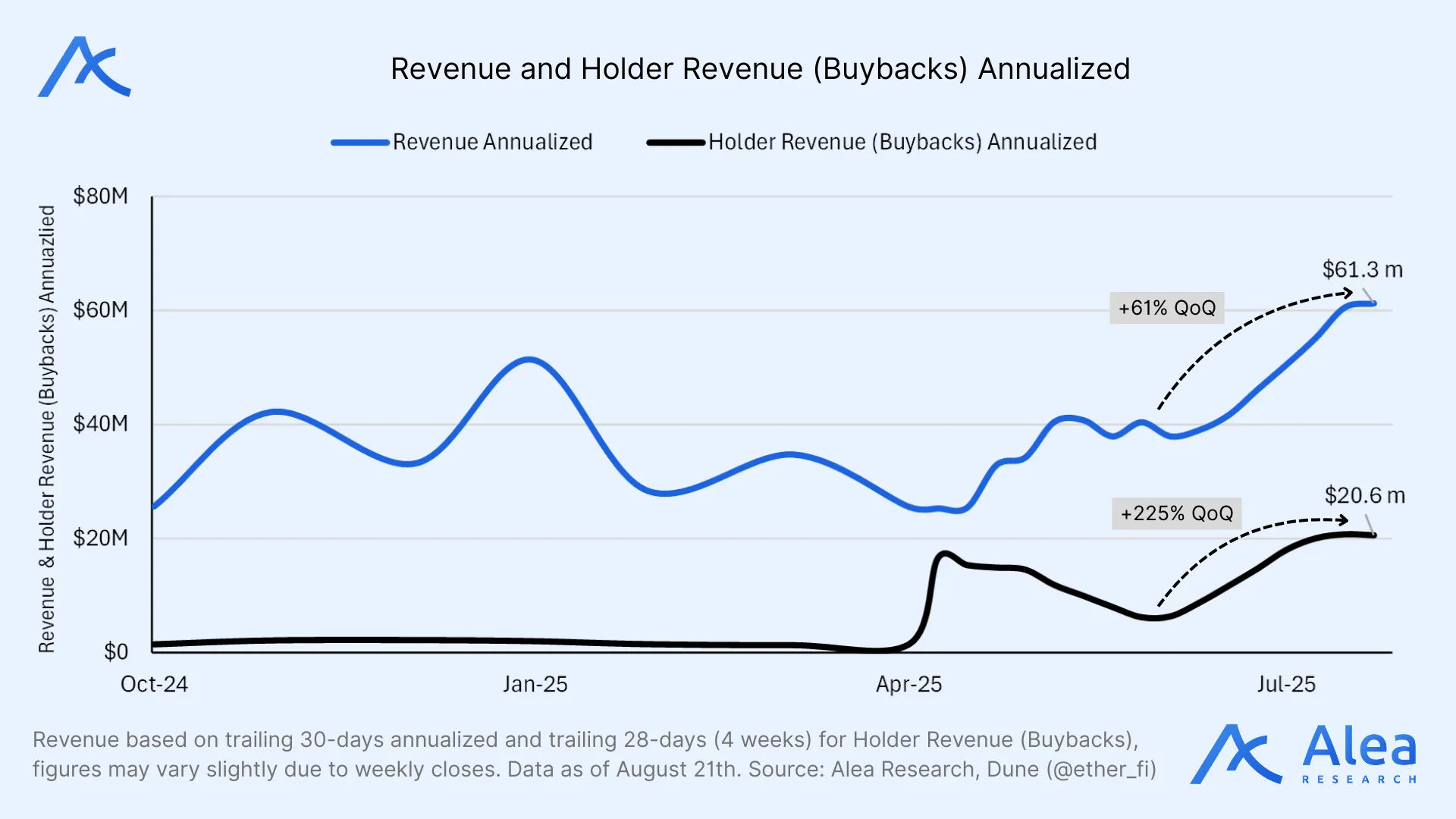

Scaling Revenue: Revenue and Holder Revenue (Buybacks) annualized reached new highs in Q3, at $61M (+61% QoQ) and $20.6M (+225% QoQ), respectively, with cumulative revenue totaling $36.6M. Revenue capture is expanding beyond Stake (revenue share dropped to 57% in Q3, down -30% from Q1; non-Stake products now drive 43% of revenue.)

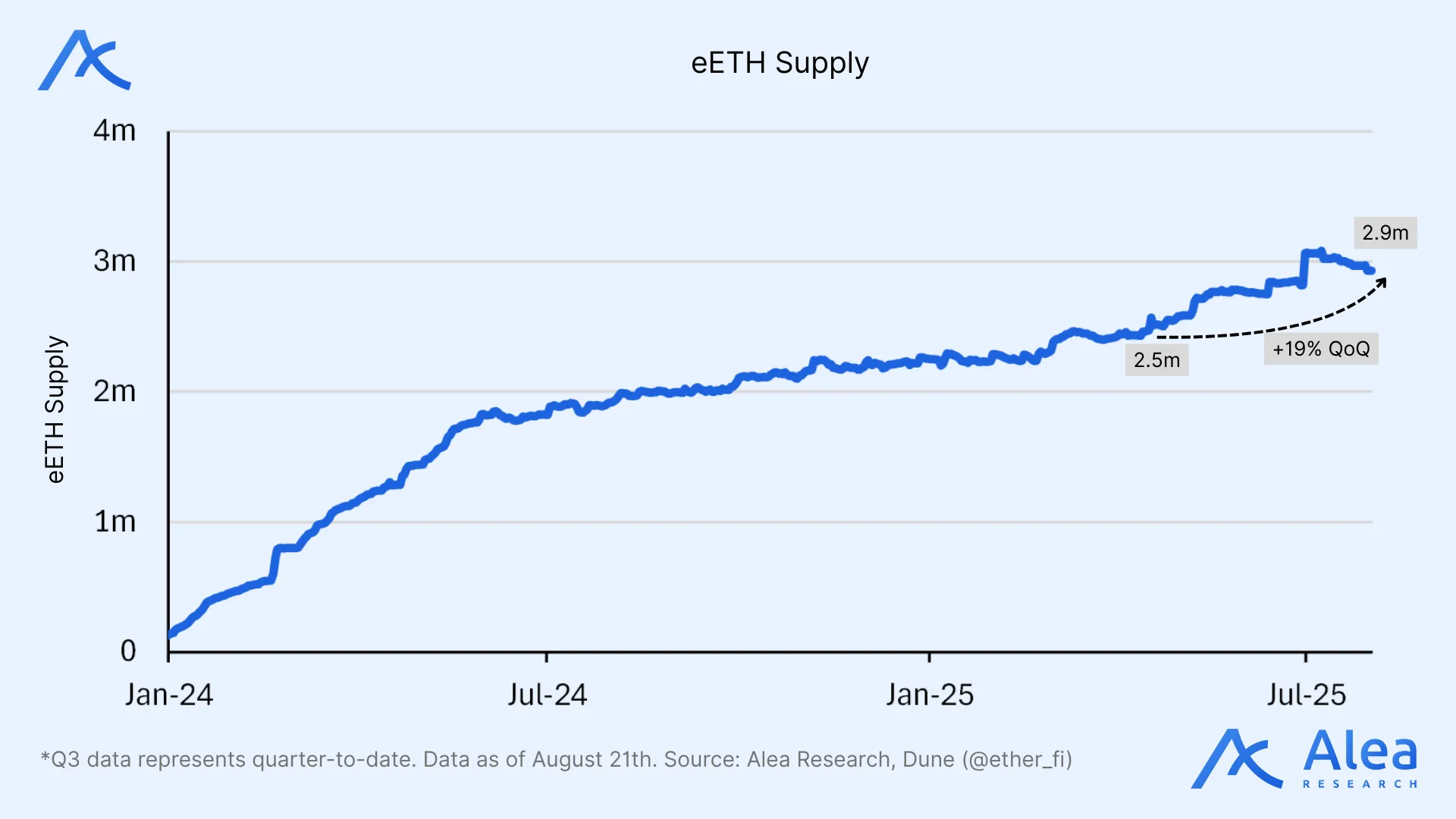

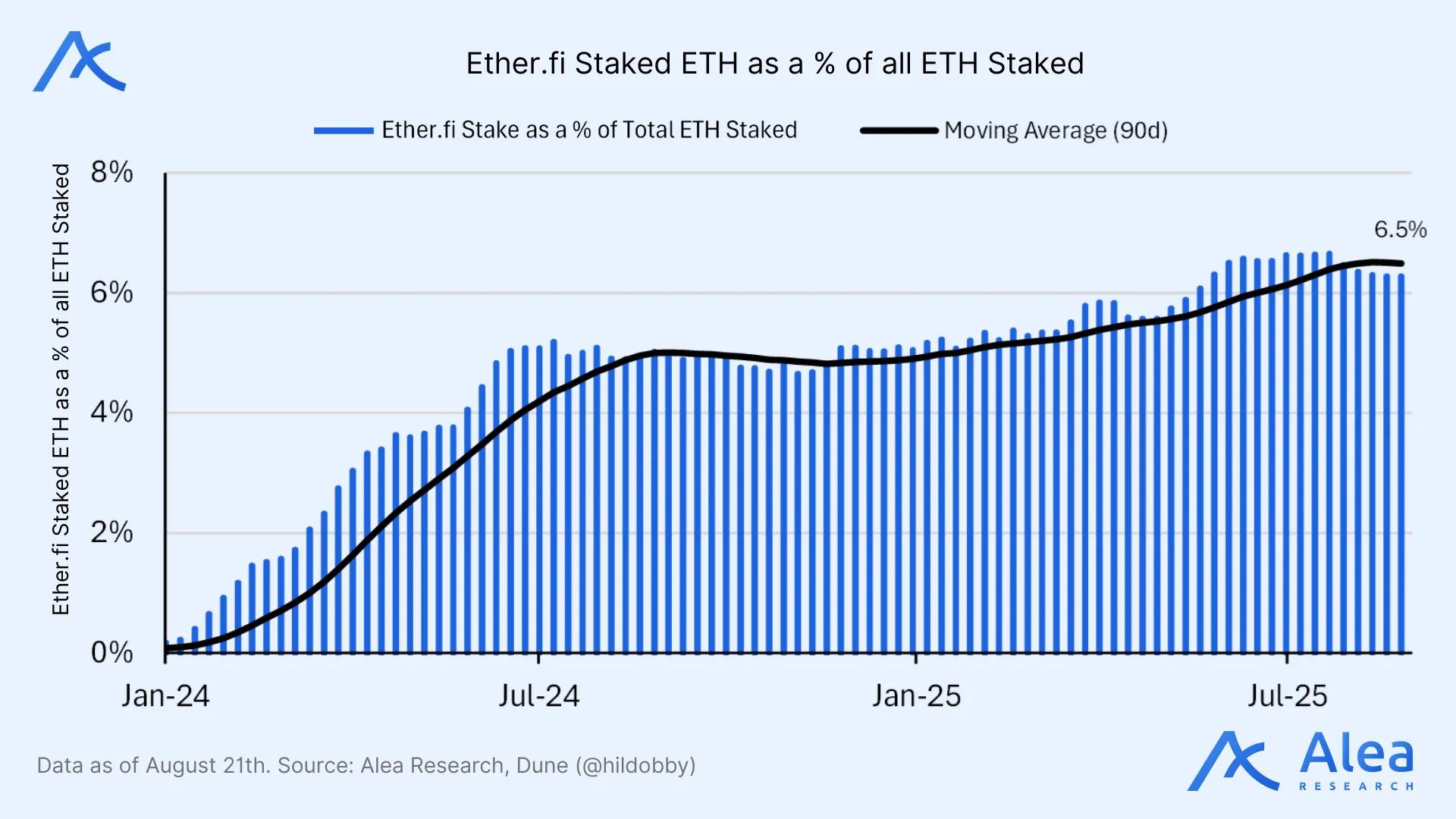

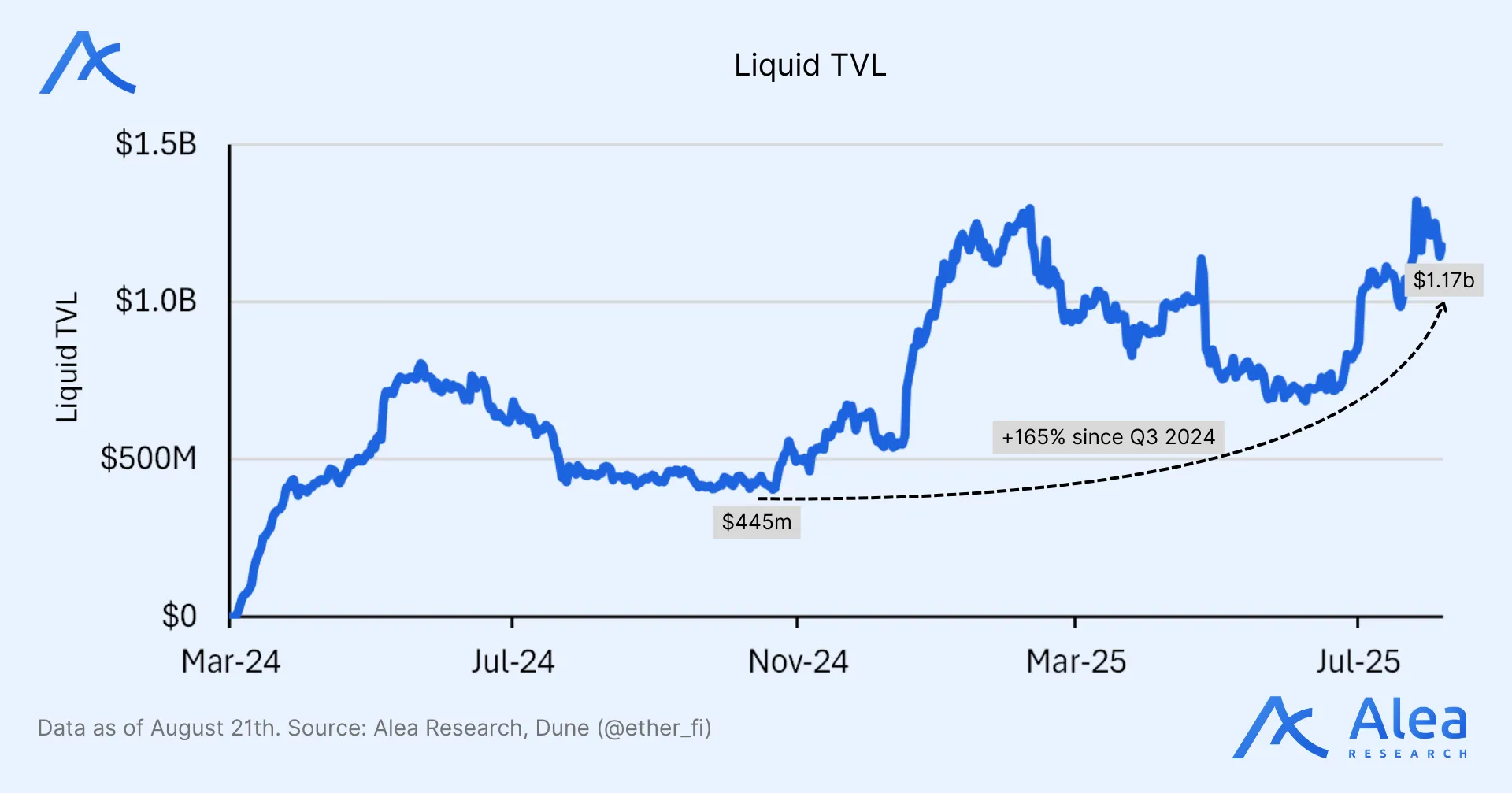

Metrics Growth: TVL rose +70% QoQ to $11B, largely driven by ETH price performance; eETH supply increased +6% QoQ to 2.9M, and Ether.fi’s share of total staked ETH grew +27% YoY to 6.3%. Liquid Vaults’ TVL was up +58% QoQ to $1.17B, Cash’s active cards rose +475% to 6.5k (with 72% of all cumulative cards added in Q2), and annualized spend volume increased +150% QoQ to $247M.

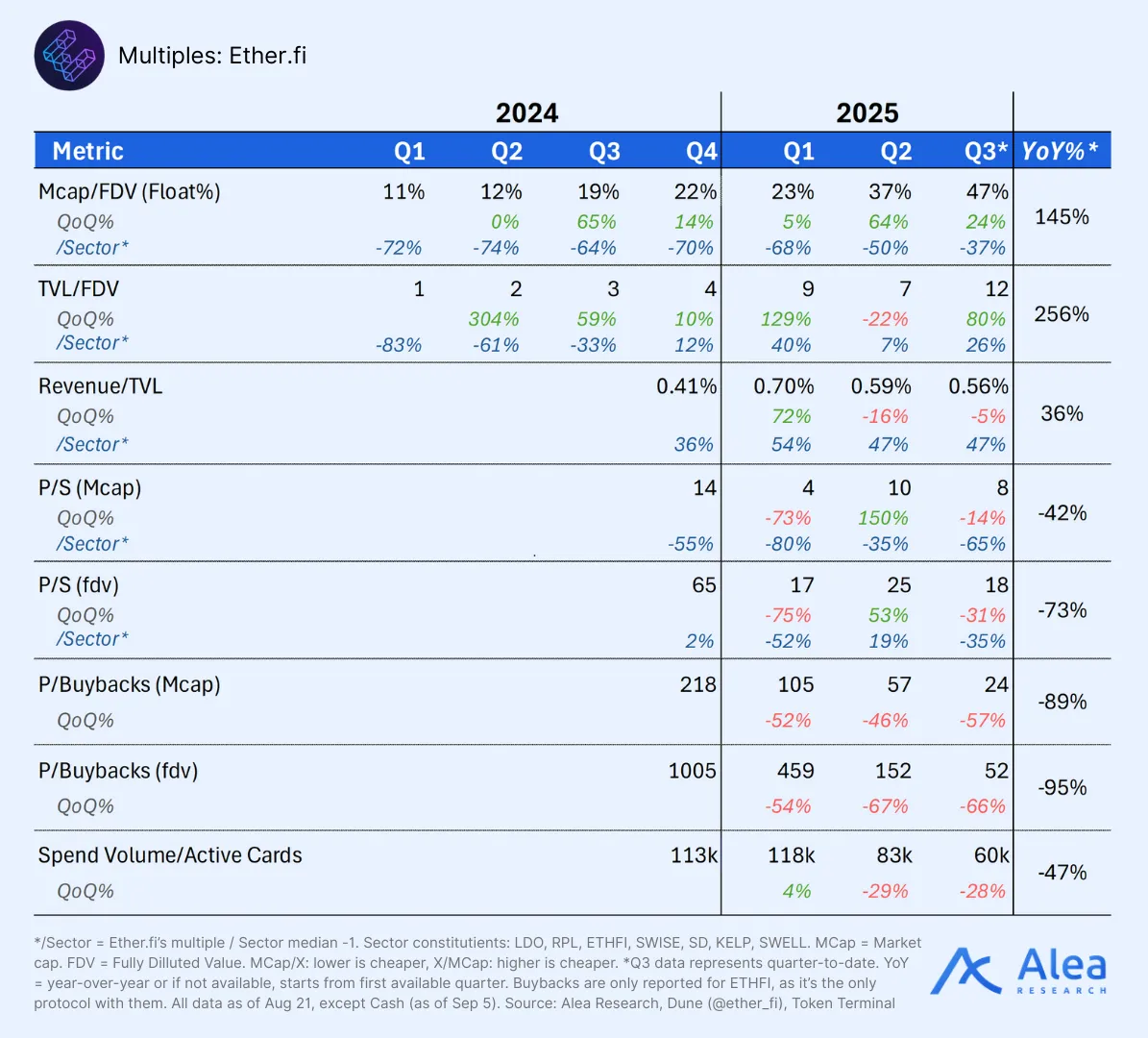

More Attractive than Peers: P/S (FDV) sits at ~18x, down -31% QoQ and -35% below the sector median; TVL/FDV has reached a new all-time high (+80% QoQ), standing 26% above the sector median. P/Buybacks (Holder Revenue, Mcap) has fallen -57%, primarily driven by increased buybacks. Ether.fi’s card has overtaken MetaMask to become the leading non-custodial DeFi card by a wide margin, and also leads in cashback rewards and card costs.

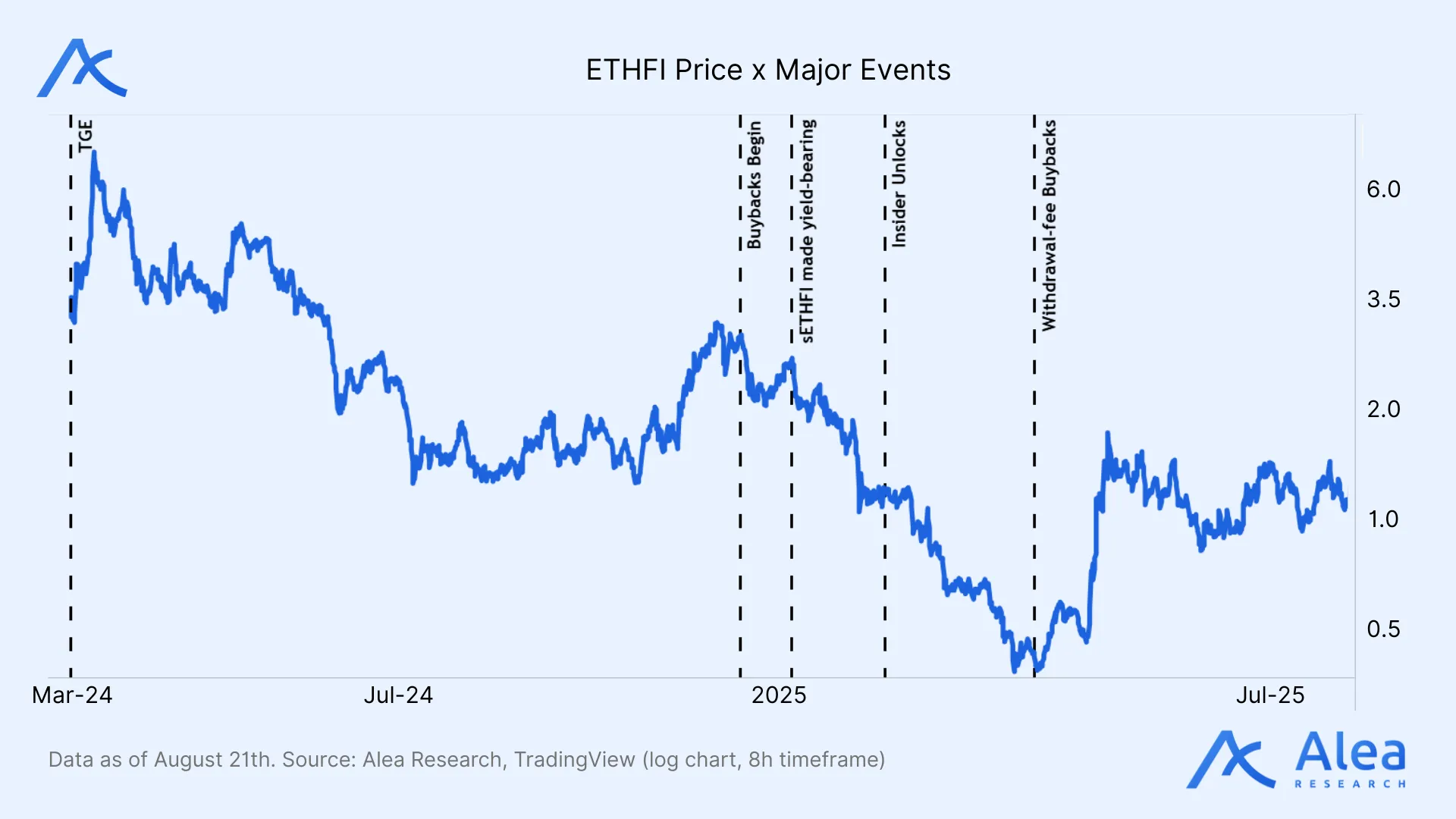

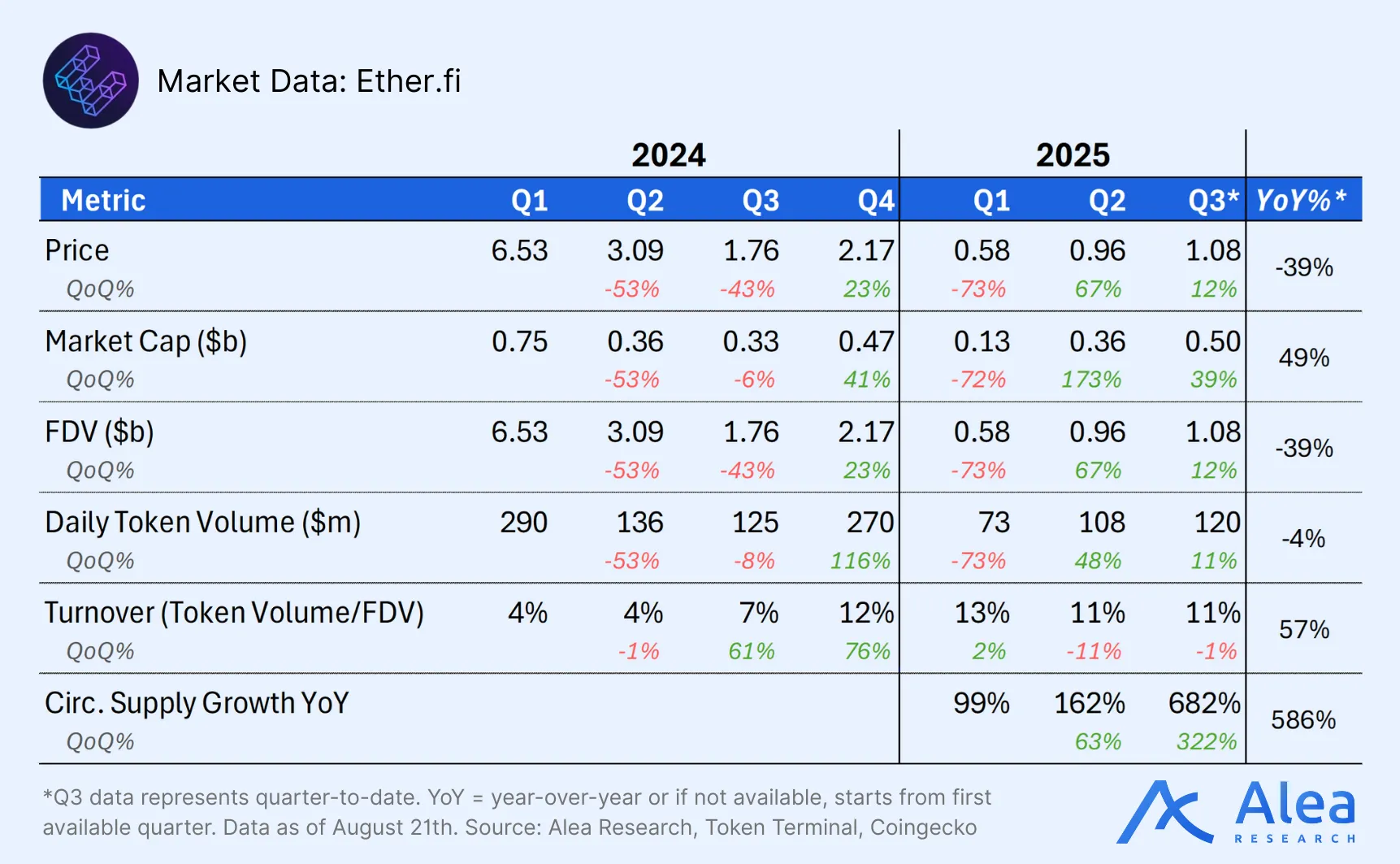

Market Data: ETHFI has rebounded strongly from its spring 2025 bottom, trading around $1.08 (~$1B psychological FDV), up +86% since Q1 2025 and +12% QoQ, supported by improved liquidity (Daily Token Volume up +11% QoQ and +64% since Q1 2025), stable turnover (10–13%), and high beta (~1.59) to ETH (well positioned to capture upside if the ETH rally continues).

Integrations and Roadmap: expansion catalysts reinforce the growth moat, in Q2, Ether.fi shipped its iOS app (May 20), rolled out Cash in the U.S. with hotel booking integration (May 30) and corporate cards, launched the Hyperbeat Liquid vault (July 19), and integrated as collateral with blue chip DeFi protocols (Maple, June 30; Superstate USCC, July 11). Ahead, the roadmap includes a Hyperliquid Trade product, tokenized stocks support, Android app, and fiat rails (IBAN/SWIFT).

Refresher: What is Ether.fi?

Ether.fi is a non-custodial restaking and yield platform that issues LRTs through Stake (eETH, eBTC, eUSD), offers strategy vaults via Liquid, and provides card payment services with Cash. Users can earn, save, and spend from one non-custodial account. That is the functional footprint of a neobank, built on DeFi rails. Ether.fi’s ambition is to become the first non-custodial, global neobank (DeFi bank) by turning onchain staking/restaking and DeFi yield into bank-like margin that funds everyday payments. Ether.fi’s distribution advantage (ubiquitous integration depth within and across chain ecosystems) lowers CAC (customer acquisition costs) for offering banking–like features and onboarding a large-and-growing user base with a fraction of the headcount a traditional bank would employ (Ether.fi has 29 full-time employees vs hundreds or thousands in banks) thanks to crypto’s settlement and non-custodial nature.

Cash flows are allocated to programmatic buybacks, with Ether.fi’s revenue attributed to a diversified business model:

- Stake takes a 10% fee on staking yields, of which 5% is split with Node operators and 5% accrues as revenue.

- Liquid charges platform fees on curated vaults, which can also have performance fees (allocated to risk managers or curators).

- Cash earns revenue on interchange fees (~1%), FX fees, lending spreads through a direct Aave deployment (in development), and commissions on Travels (5% card cashback on top of 60%+ discounted hotels).

- A membership Club overlays all three, boosting LTV and smoothing churn.

ETHFI token holders capture upside linked to protocol performance as 10-25% of monthly revenue is allocated to ETHFI buybacks. These funds go to stakers (sETHFI) targeting ~10% APY, and the remainder is burned (1M+ burned so far; previously that amount was used for buyback-and-LP to grow onchain ETHFI liquidity).

Ether.fi Stake

Stake aggregates user deposits, stakes them with professional node operators, and restakes to augment base yield for ETH (EigenLayer and Symbiotic restaking), BTC (Babylon restaking with Lombard), and USD (EigenLayer restaking in collaboration with Ethena). Rewards flow to depositors (eETH rebases; weETH accrues with an exchange rate); node operators and the protocol each earn a parameterized 5% revenue taken from earned yield (10% total fees).

eETH: Rebasing LRT issued on Ethereum mainnet backed by staked ETH and powered by native restaking. Redemptions are fulfilled first from an unbonded ETH pool (without delays imposed by the underlying restaking protocol); if liquidity is short, validators are exited and withdrawals settle after the beacon‑chain process. Yield is earned from Ethereum’s consensus and execution rewards, and restaking emissions (aggregated and distributed weekly via King Protocol as KING, which can be unwrapped for the underlying ETHFI and EIGEN).

weETH: eETH wrapper at a share exchange rate (instead of rebasing balances); same redemption path and yield sources as eETH but more suitable for DeFi integrations (deterministic accounting and simpler pricing; most contracts assume fixed ERC20 balances).

weETH (EigenLayer restaking): Staking + restaking APR + KING points.

weETHs (Symbiotic restaking): Staking APR + Symbiotic & Veda points.

eBTC: BTC LRT backed by Lombard’s LBTC and WBTC. Restaking BTC-denominated yield via Babylon boosted with points from Babylon, Lombard, Symbiotic, Karak, and Veda; 7-day withdrawal period.

eUSD: Stablecoin LRT backed by Ethena’s USDe, earning dual yield from EigenLayer restaking and Ethena’s basis trade in addition to KING and Veda points. Users can enter with USDe/USDC/USDT/DAI and redeem the underlying (10-day withdrawal period).

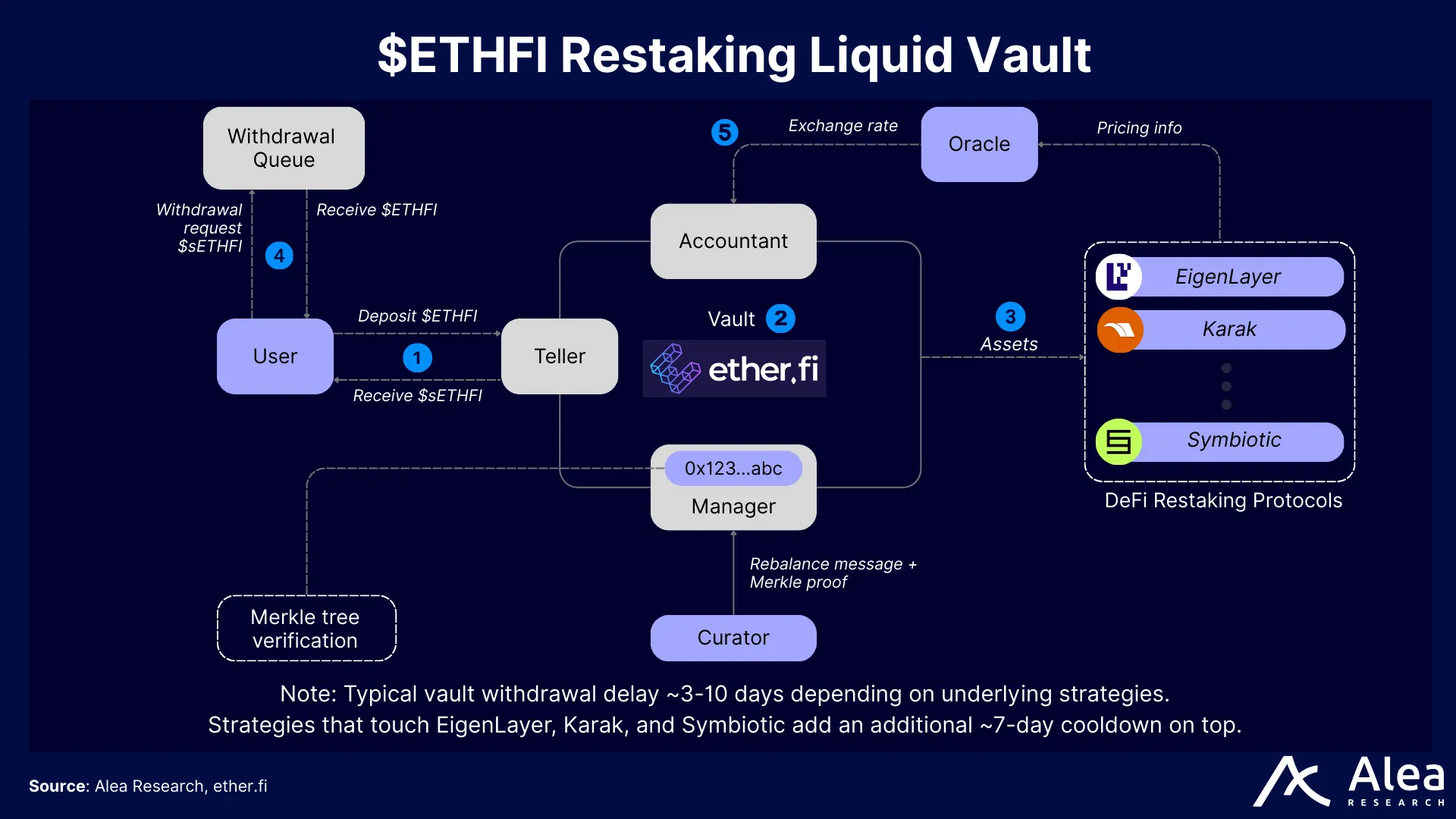

ETHFI: Governance token of the protocol. sETHFI stakers earn ~10% APY in ETHFI buyback distributions from 10-25% of protocol revenue (yield target APY is set; amount is dynamically adjusted based on the staking ratio). Because the underlying ETHFI is restaked, withdrawals go through a queue and can take up to 10 days.

500+ DeFi/CeFi integrations unlock network effects, deepen liquidity, enable broader accessibility, and facilitate low-friction onboarding for new users. Assets and products embedded across hundreds of platforms allow for more stickiness and resilience to competition or market shifts.

Ether.fi Liquid

Liquid is Ether.fi’s set of automated strategy vaults. Liquid vaults allocate Ether.fi’s LRTs and stables across DeFi to earn yield from auto-rebalanced, auto-compounded, risk-managed strategies. It abstracts strategy selection and execution while retaining onchain transparency and vault share accounting. Management (based on vault TVL and accrued to the protocol; ranging from 1.25% to 2%) and performance fees (based on yield and accrued to strategists/curators; ranging from 0% to 20%) are applied on a per-vault basis.

Most Liquid vaults are built on Veda’s BoringVault framework, while others use different infrastructure, such as Midas for Hyperbeat’s Liquid HYPE yield vault, or Sentora for Liquid ETH Katana. Strategies allocate across a whitelist of onchain protocols; rebalances use offchain calculations. Nexus Mutual offers bundled cover listings for Liquid.

Ether.fi Cash

Cash turns onchain balances into spend/credit. It is Ether.fi’s card + credit consumer product, letting users spend against their onchain Ether.fi portfolios without selling their assets and/or off-ramping.

Cash Card is a Visa-network credit card (virtual and physical; Apple/Google Pay supported) with up to 3% cashback (promo facilitated with SCR incentives through December 31, 2025) and two spend modes: a) direct spend, and b) borrow against crypto collateral.

Corporate Cards are treasury-backed (borrow mode) and will be rolled out globally with IBAN/SWIFT support (roadmap item).

As a non-custodial Visa-branded crypto credit card (and smart wallet), users can spend anywhere Visa is accepted while keeping their assets onchain. There are two spend modes, Direct Pay and Borrow Mode. Direct Pay uses your assets first (e.g. USDC) and liquid deposits (LiquidUSD) second; purchases debit those balances—no borrowing, no interest. Borrow Mode posts your vault deposits as collateral (e.g., weETH, WETH, eBTC, eUSD, Liquid vault tokens, USDC/USDT) and borrows against them to fund the purchase; users can repay anytime.

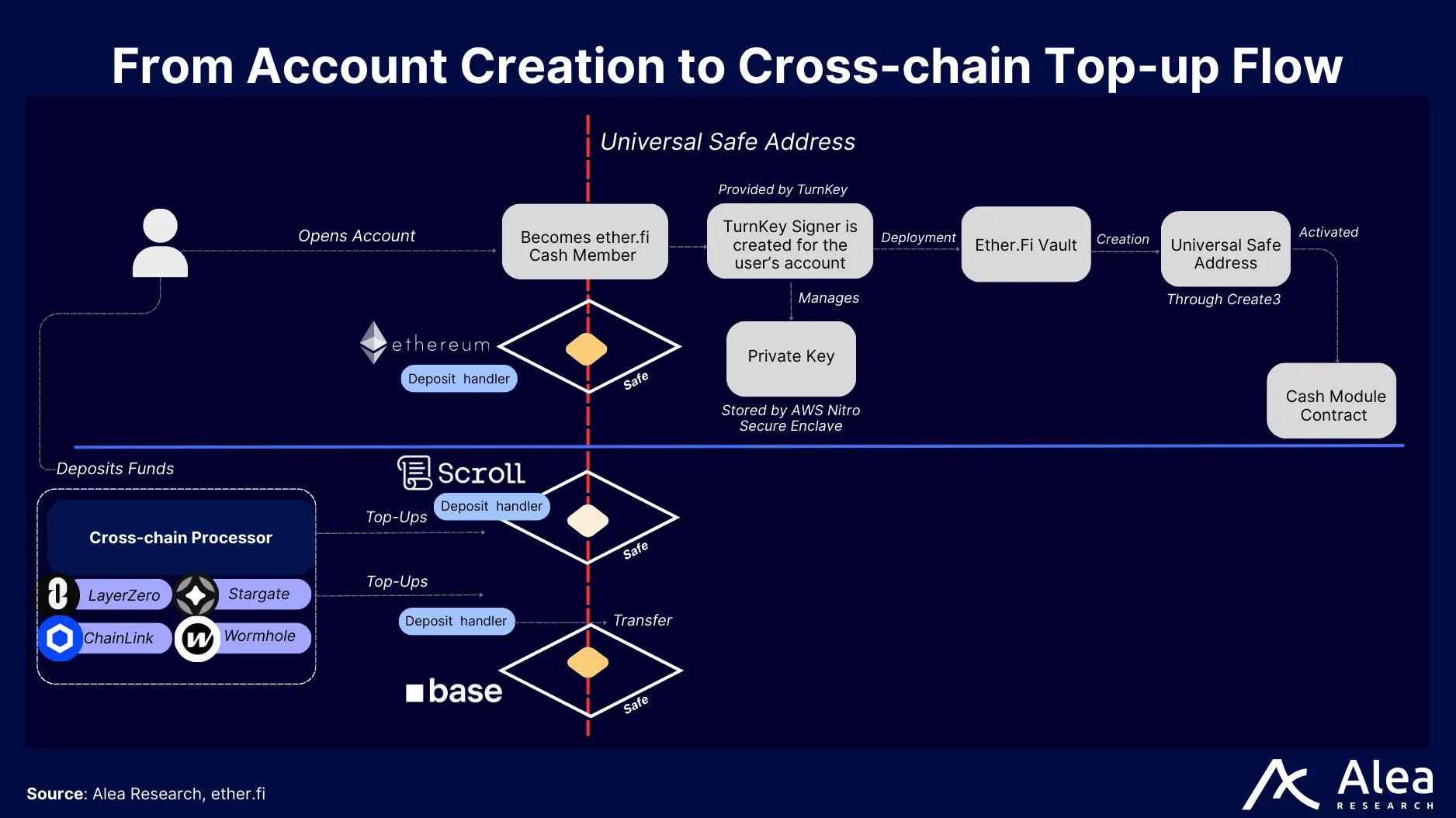

When users join, Ether.fi deploys a dedicated Vault smart contract. Keys are managed by Turnkey secure enclaves (TEE). A “CashModule” orchestrates Direct Pay vs Credit (Borrow) modes, spending limits, repayments, and cashback distribution; lending integrations (e.g., Aave) are whitelisted modules.

ETHFI

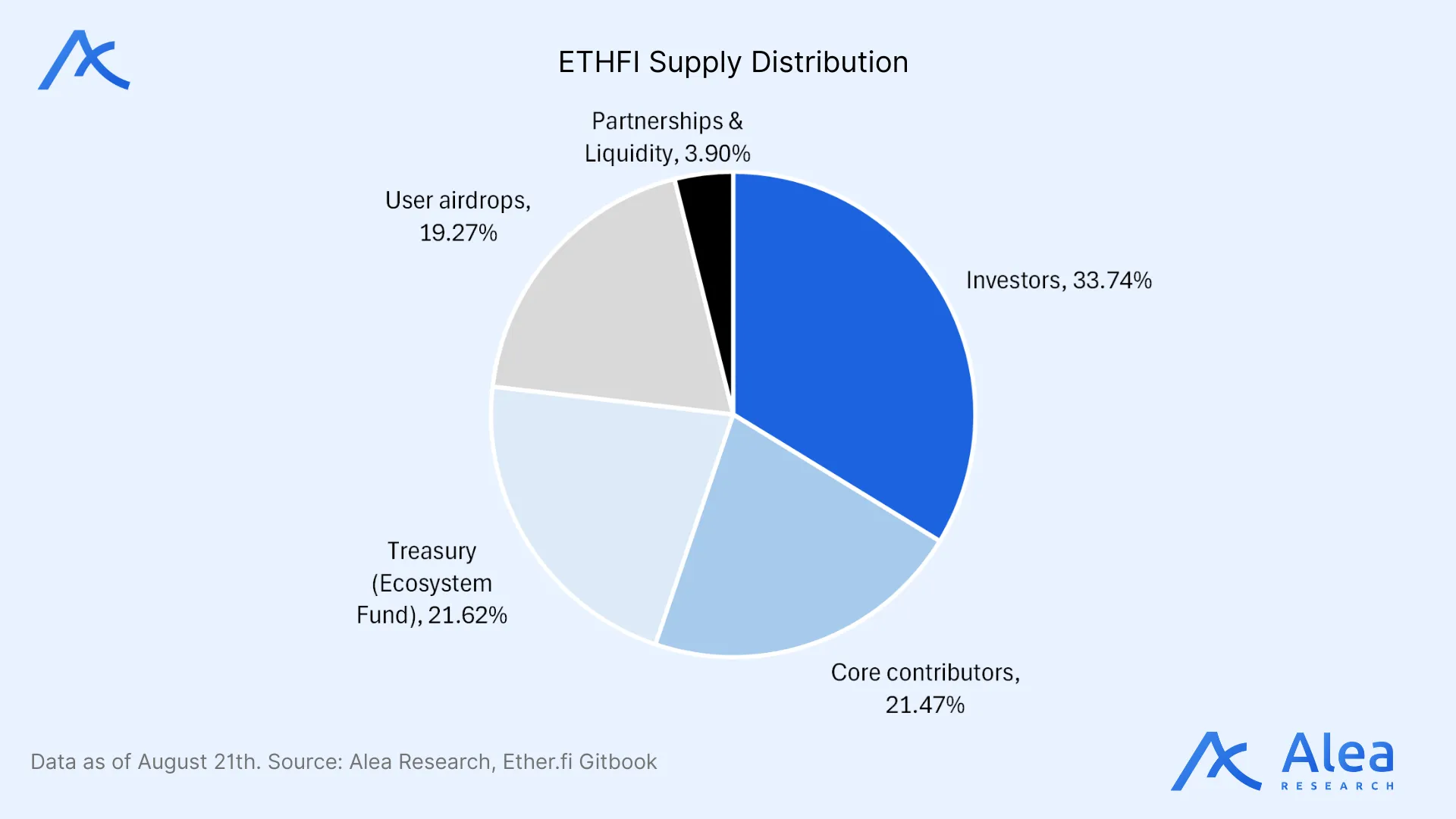

ETHFI is Ether.fi’s governance and value‑accrual token for its restaking and yield suite (Stake, Liquid, and Cash). Supply is fixed at 1.0B and fully minted at genesis to a foundation wallet. The current circulating supply sits at ~466.0M (46.6%).

Value accrues via protocol-funded buybacks where 10-25% of monthly revenue funds sETHFI yield (>10%) and the remainder goes toward ETHFI token burns (1M+ burned to date; burns started mid-August 2025, before allocating ETHFI to buyback-and-LP).

ETHFI was launched on March 18, 2024 (Airdrop Season 1 went live; 90‑day claim window). Major insider allocations (~55.1% of total) were locked 12-months post-TGE (token generation event), linearly vesting months 13-36, with vesting concluding by Feb 18, 2027.

- Investors: 33.74% — 2‑year vesting schedule with a 1‑year cliff.

- Core contributors: 21.47% — 3‑year schedule with a 1‑year cliff (12‑month cliff + 24‑month linear).

- Treasury (Ecosystem Fund): 21.62%.

- User airdrops: 19.27% — distributed across Seasons 1–4. S1: 7.5% (claims opened Mar 18, 2024; some whale tranches vested over 90 days). S2: 5.8% (claims opened Jul 17, 2024; some tranches with 30/60/90‑day releases). S3: 2.7% (claims opened Sep 25, 2024; distribution contracts published). S4: 1.3%. S5: 1%. Post-S5: 0.97%; rewards program for Club members (0.75%); Season 3 Diamond campaign top-up (≥0.10%); remainder for ad-hoc user promos.

- Partnerships & Liquidity: 3.9%, incl. 1% to Protocol Guild.

Governance is currently progressing under a Foundation-plus-DAO model (Snapshot voting + onchain execution):

- Foundation Charter + Multisig Committee: operational oversight and handling emergencies.

- Community Participation via voting stack: governance forum + Snapshot + onchain execution.

Key governance decisions impacting token economics include:

- June 24, 2024: ETHFI liquidity pool seeding with 5% of protocol monthly revenue (fee on staking rewards and Liquid vaults).

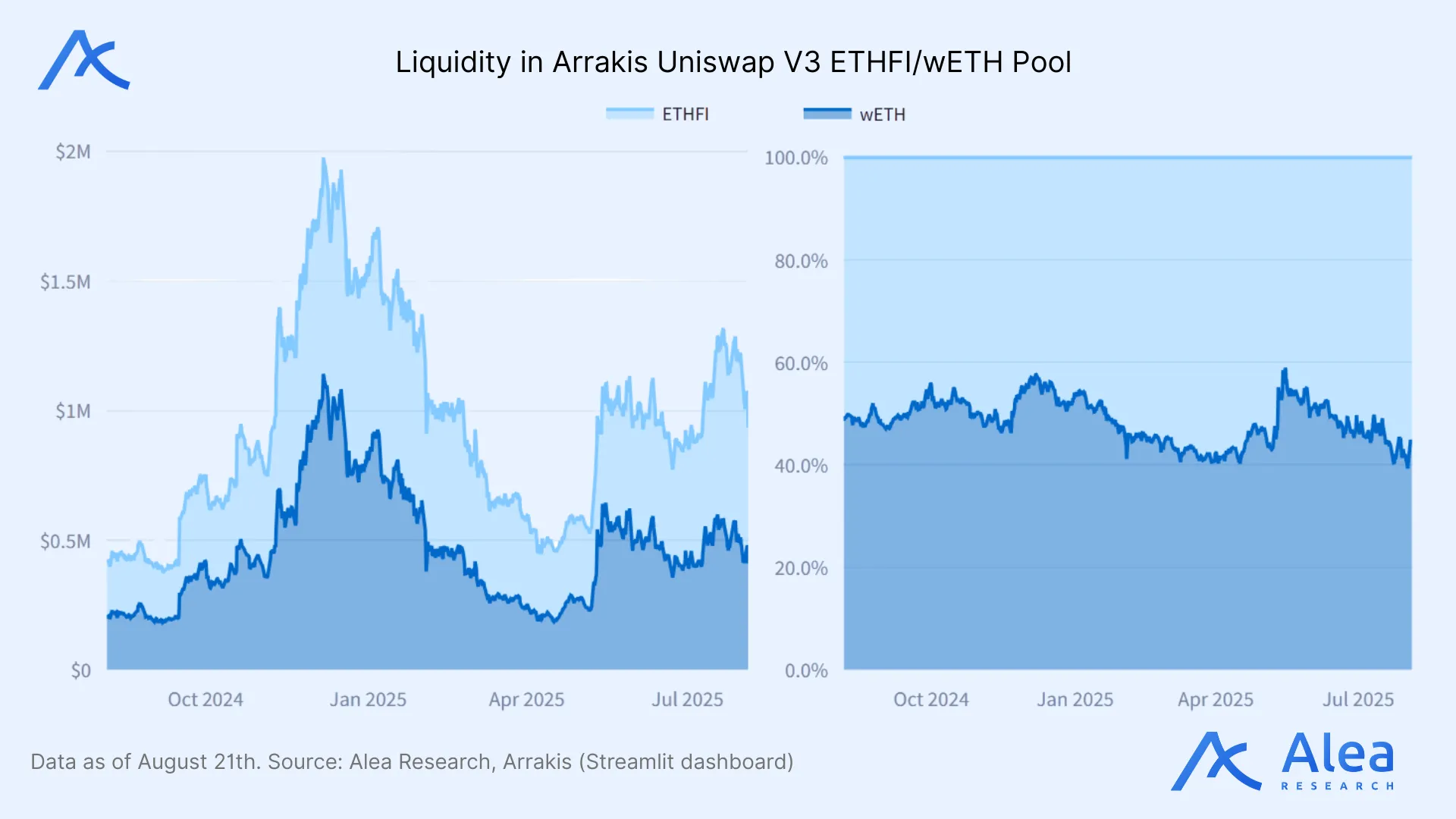

- Aug 13, 2024: The DAO raised the amount allocated to liquidity pool seeding to 25% of monthly revenue and shifted liquidity management to Arrakis Uniswap v3 vaults.

- Dec 16, 2024: The DAO approved monthly protocol‑revenue buybacks distributed to sETHFI (initially 5% of revenue).

- Apr 25, 2025: The DAO approved using 100% of withdrawal‑fee revenue for weekly buybacks to sETHFI. Fast withdrawal fee is 0.3%.

Ether.fi has an audited score of 38/40 in Blockworks’ Token Transparency Framework. There is an explicit token–equity separation, along with a fixed supply and clear market‑structure arrangements. Two gaps keep it from a perfect score: incomplete airdrop recipient disclosure and only partial, onchain P&L visibility for the Foundation.

- Project & Team (10/10): Explicit stance that equity does not receive dividends/buybacks.

- Token Supply & Allocation (17/18): Full mint (1B), fixed supply, vesting and wallet labels are clear; airdrop process scored 1/2 for lacking an auditable CSV of recipients.

- Transactions & Market Structure (7/7): Prior fundraising and CeFi liquidity arrangements disclosed with terms and counterparties.

- Financial disclosure (4/5): Quarterly “analyst calls” and dashboards committed; foundation wallets labeled but flows not fully traced end‑to‑end (1/2).

Ether.fi states no intention to return cash to equity via dividends or buybacks. The operating entity (Ether.fi Labs) builds/operates, the Foundation supports the protocol, and the DAO governs treasury via proposals and onchain votes. A portion of protocol revenue is remitted monthly to staked ETHFI (sETHFI) per community snapshot; the Foundation communicates buybacks publicly.

Metrics

Financials

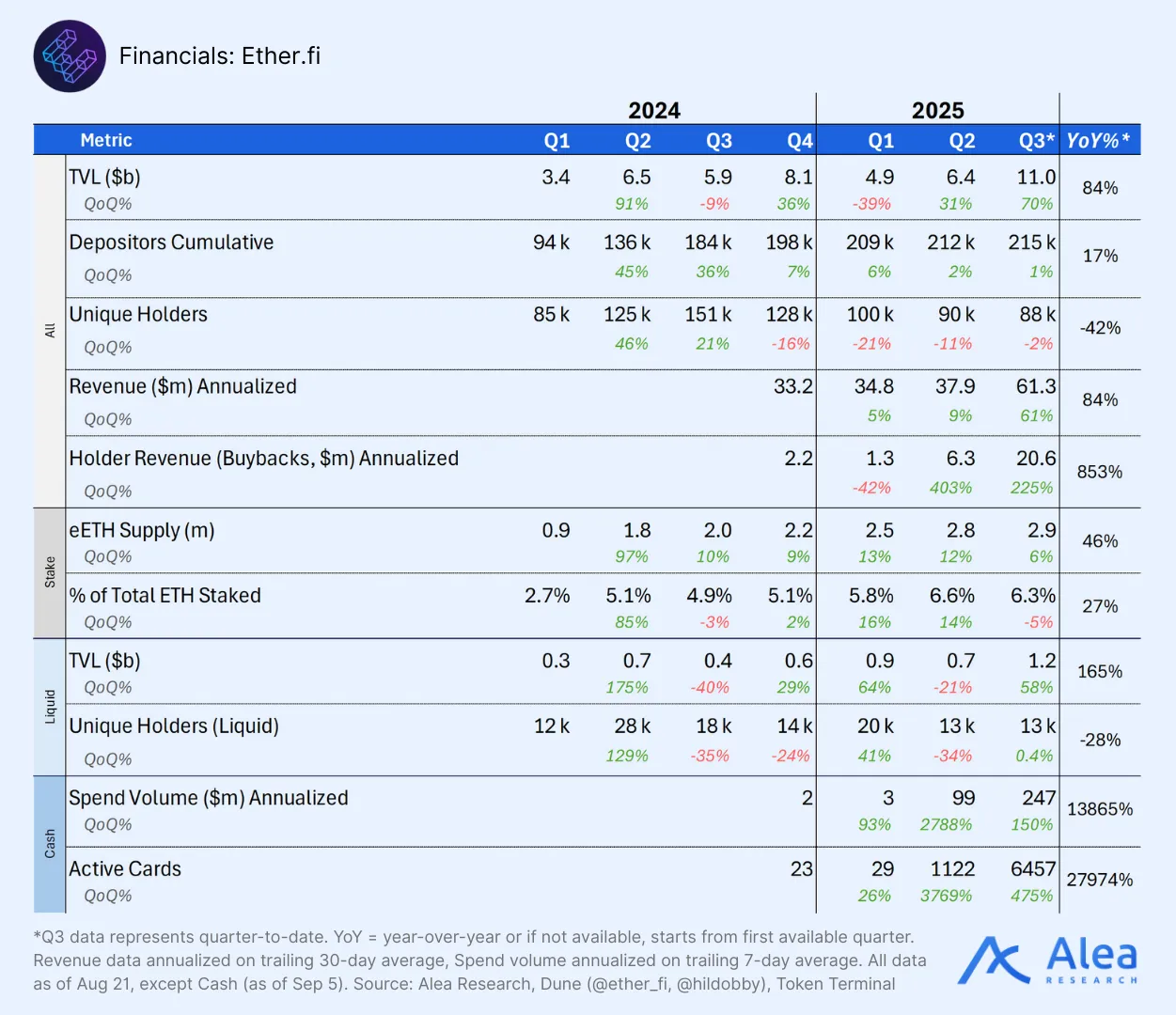

Ether.fi saw its major KPIs tick higher in Q3 (9 out of 11). As the protocol matures beyond Stake, we will increasingly observe empirical evidence of how the vertical stack model supports and enhances its diverse product offerings. Highlights include TVL at $11B (+70% QoQ), annualized revenue at $61.3M (+61% QoQ), annualized buybacks (Holder Revenue) at $20.6M (+225% QoQ) and Cash spend volume annualized at $247m (+150% QoQ).

Holder Revenue (Buybacks) represents the portion of revenue allocated to ETHFI repurchases (currently, 10-25% of protocol revenue is distributed to fund a target 10% APY sETHFI yield, with the remainder directed to token burns, with >1m burned since the program began in mid-August). Revenue represents the portion of revenue that the protocol retains (for example, in Stake, 5% of staking rewards or 50% of the 10% “performance fee” charged to stakers). Depositors include all addresses that have ever staked in Stake or deposited into Liquid, while Unique Holders are defined as addresses currently holding >$10 worth of Ether.fi’s LRTs or Liquid vault tokens.

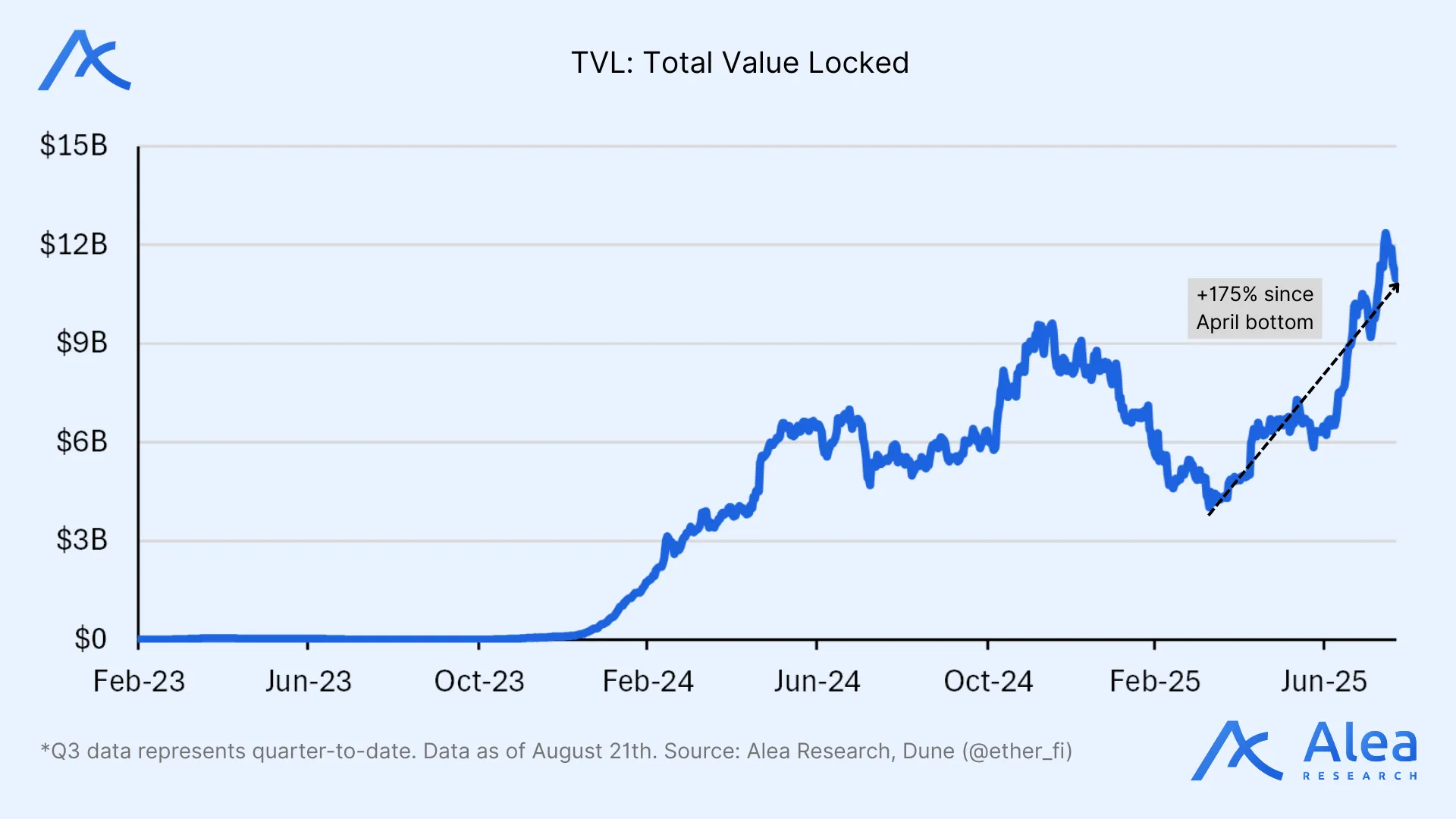

TVL (Total Value Locked, analogous to AUM in TradFi)

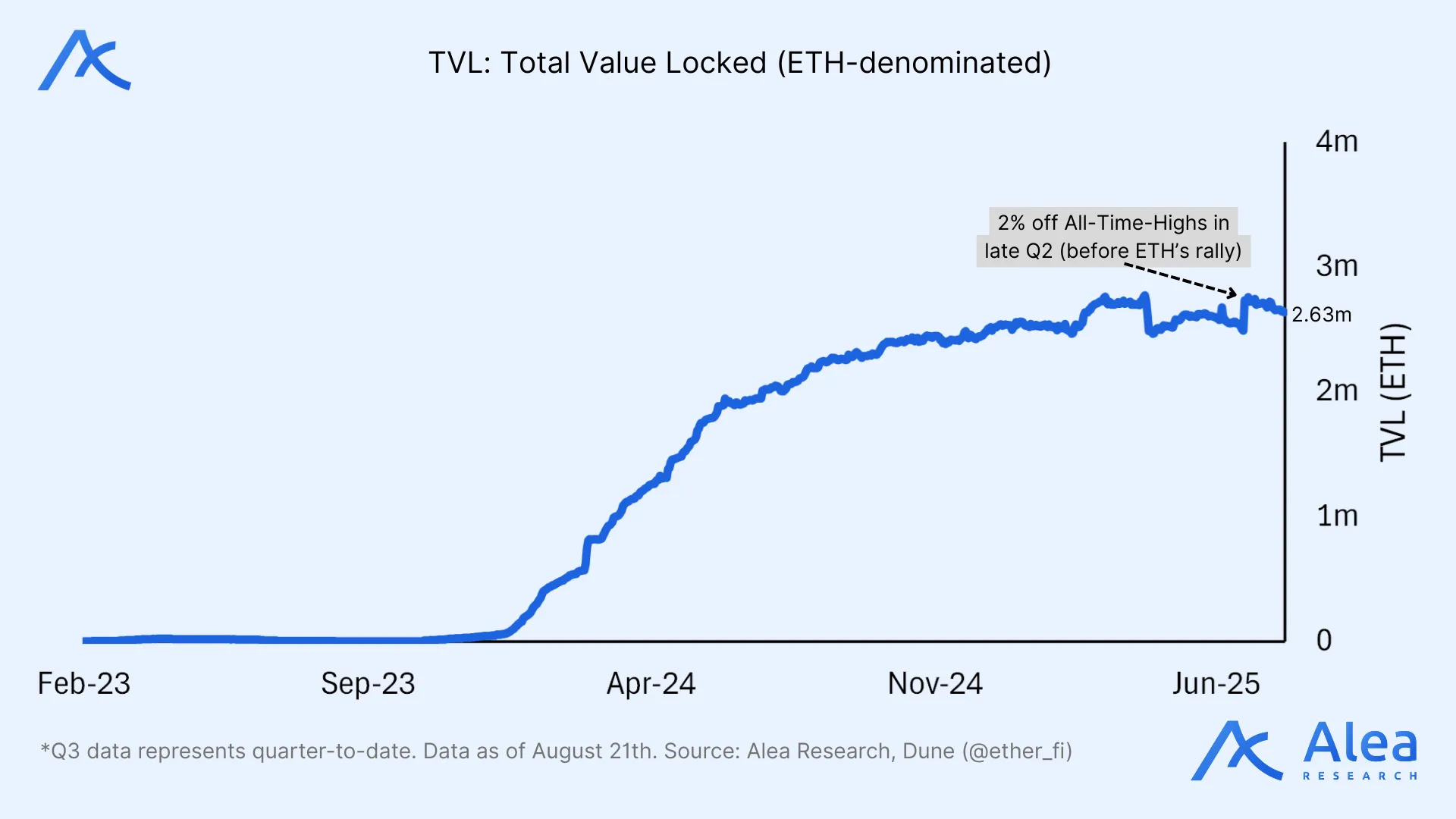

In Q3-2025 ($11B TVL), new all-time-highs in USD TVL were mostly ETH‑price upside, as ETH-denominated TVL didn’t reach new highs. USD TVL rebounded +175% from the April bottom; ETH price drives the most recent uptrend in USD terms. Notably, Ether.fi’s TVL has increased significantly following the token launch in Q1-2024 (up 3.8x since) despite the diminishing mindshare of the initial restaking hype.

ETH-denominated TVL is hovering near all-time highs, just about 2% below, at 2.63m ETH. Since late Q1, it has consolidated in a tight 2%range between 2.5-2.7m.

Stake, where most of the TVL is concentrated, is a low-margin business. Increase/reduction in TVL alone is not necessarily reflexive translating into revenue. With product diversification in place, the protocol can still generate convex income relative to TVL thanks to its expanding vertically-integrated product suite.

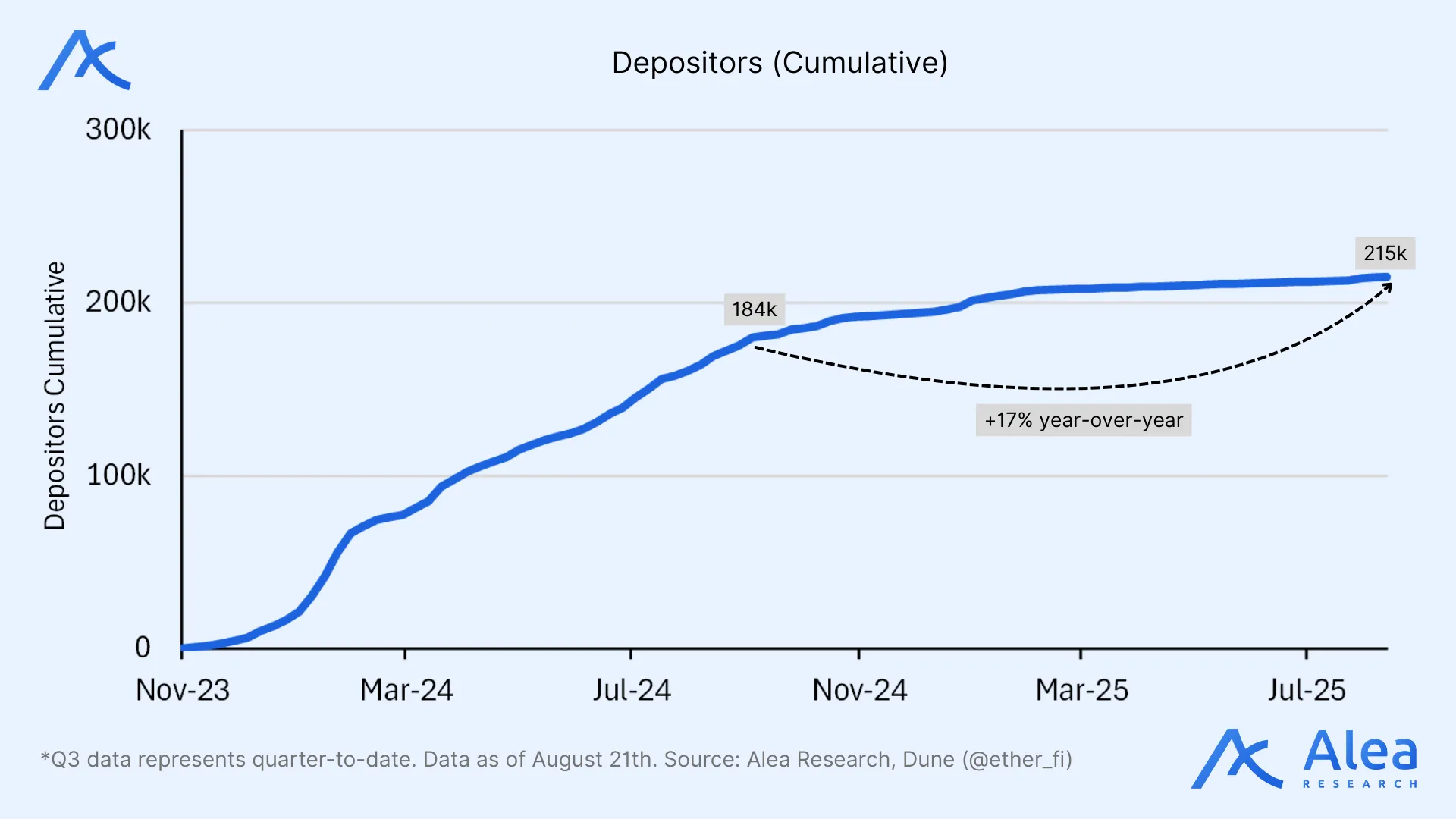

Depositors Cumulative

Cumulative addresses that have ever staked in Stake or deposited into Liquid are at ~215k, up from ~184k a year ago (+17% YoY); net new amounts to ~31k (~2.6k/mo). The slowdown in the trend since the initial 2024 spike can be explained by the protocol launch with likely participation from airdrop farmers and rewards chasers—this is expected, and it’s a good sign that the metric stabilized in a healthy uptrend.

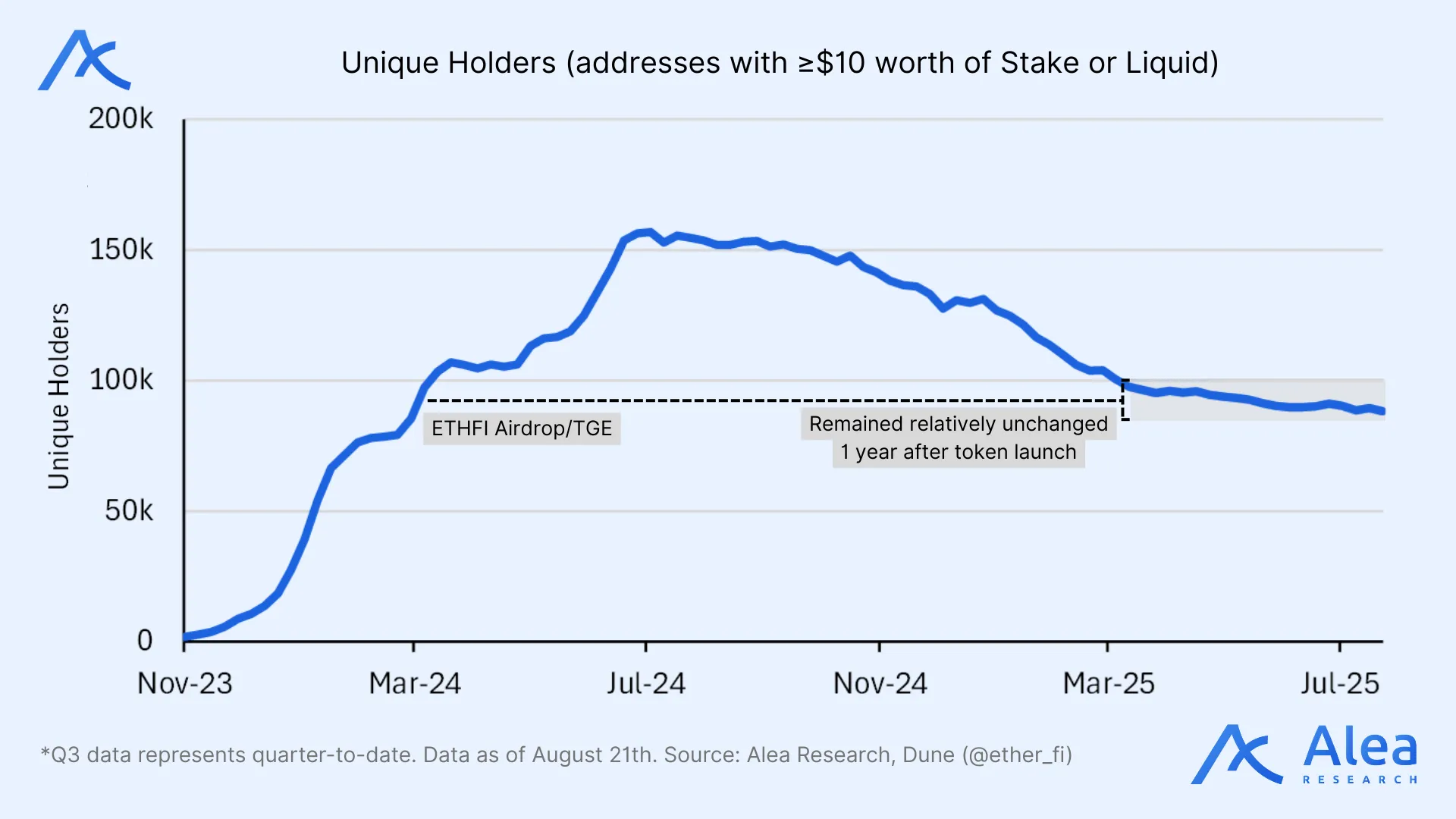

Unique Holders

Unique holders (owning over $10 in LRTs/Liquid) are now ~90–95k. Down from a ~155k peak in July 2024 (roughly ‑40% from peak), the metric is mostly unchanged vs March 2024 (~95k), one year after TGE (airdrop expectations baked in). Outflow rotations can be attributed to smaller holders post‑airdrop as incentives normalized.

The market has transitioned from airdrop‑driven breadth to aggregator‑driven depth. Ether.fi’s vertical integration strategy and large distribution channels will be key for pushing growth to the next level (more accurately measured in revenue terms instead of passively held AUM or holder counts).

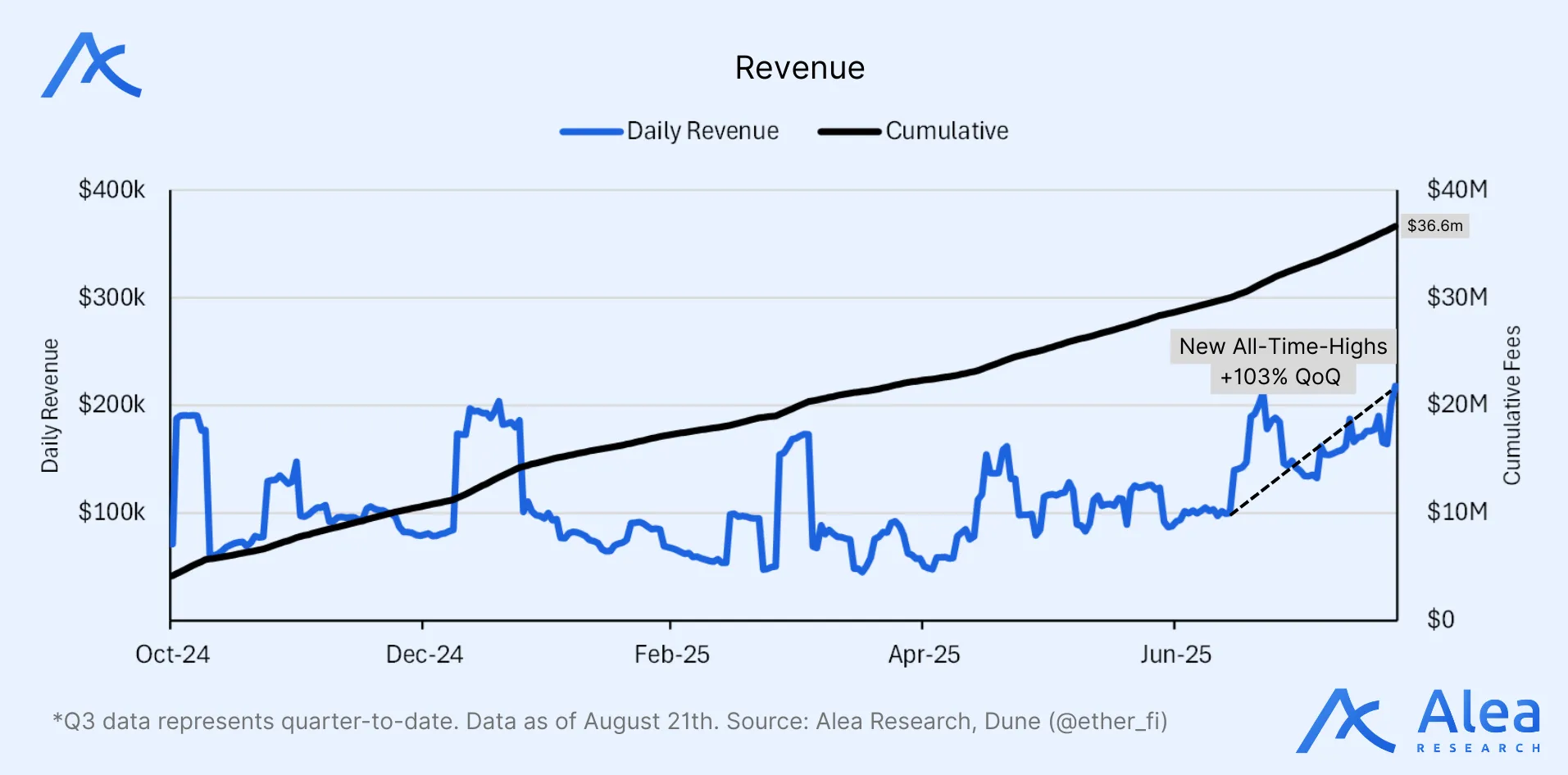

Revenue

Daily revenue (7‑day avg) set new highs in Q3, up +103% QoQ; cumulative revenue reached ~$36.6M since October 2024.

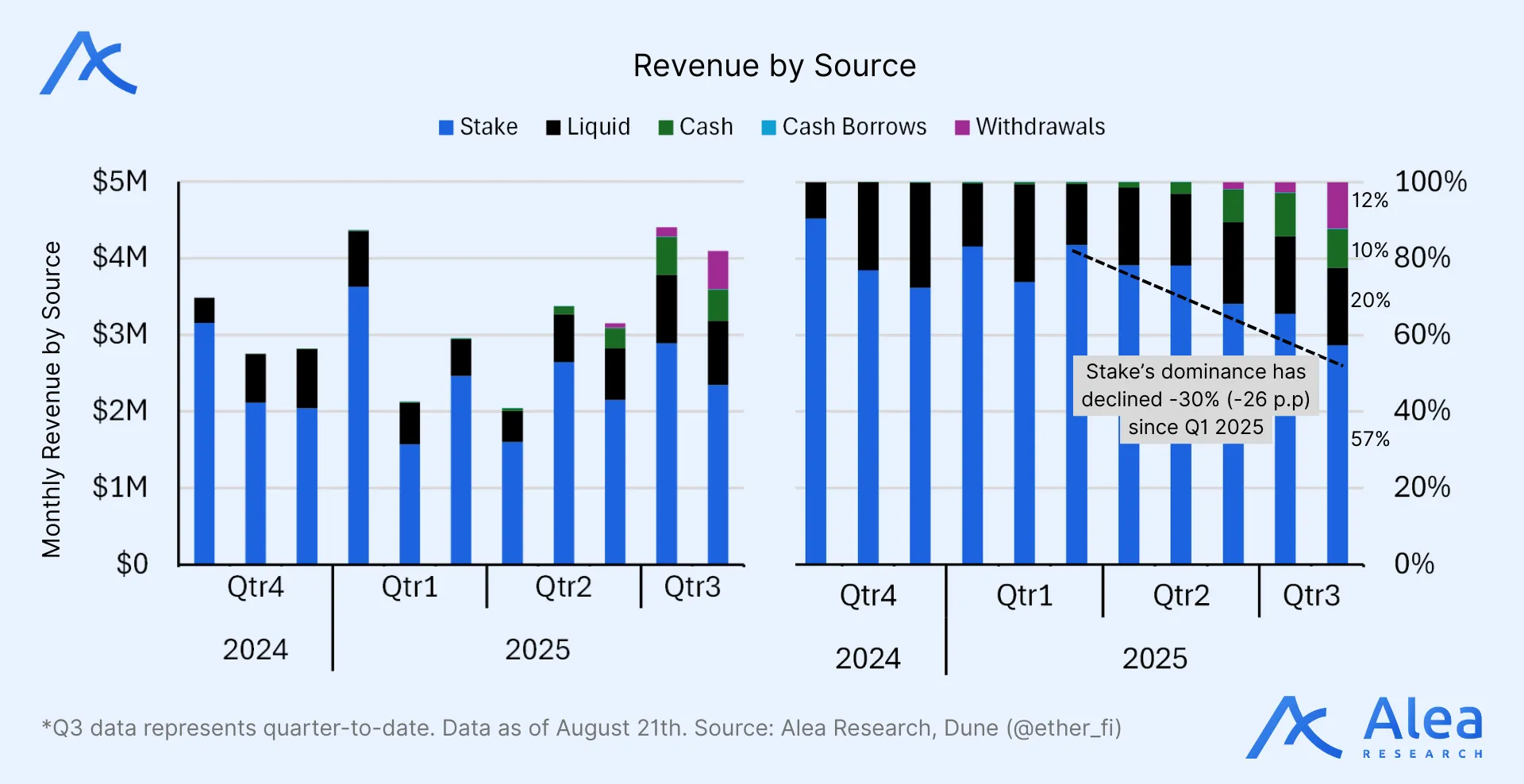

Mike Silagadze, Co-founder of Ether.fi, has noted that Cash is projected to become the protocol’s largest revenue stream, as interchange fees increase alongside user growth. Stake still leads but its share fell to ~57% in Q3, down ‑30% (‑26 p.p.) from Q1 2025; non-Stake lines now comprise ~43% of Q3 fees.

Revenue capture is broadening beyond core staking; new product rollouts grow the protocol’s existing recurring revenue base. Concentration is de-risked; as stake flows cool, the business now has multiple revenue taps to sustain topline.

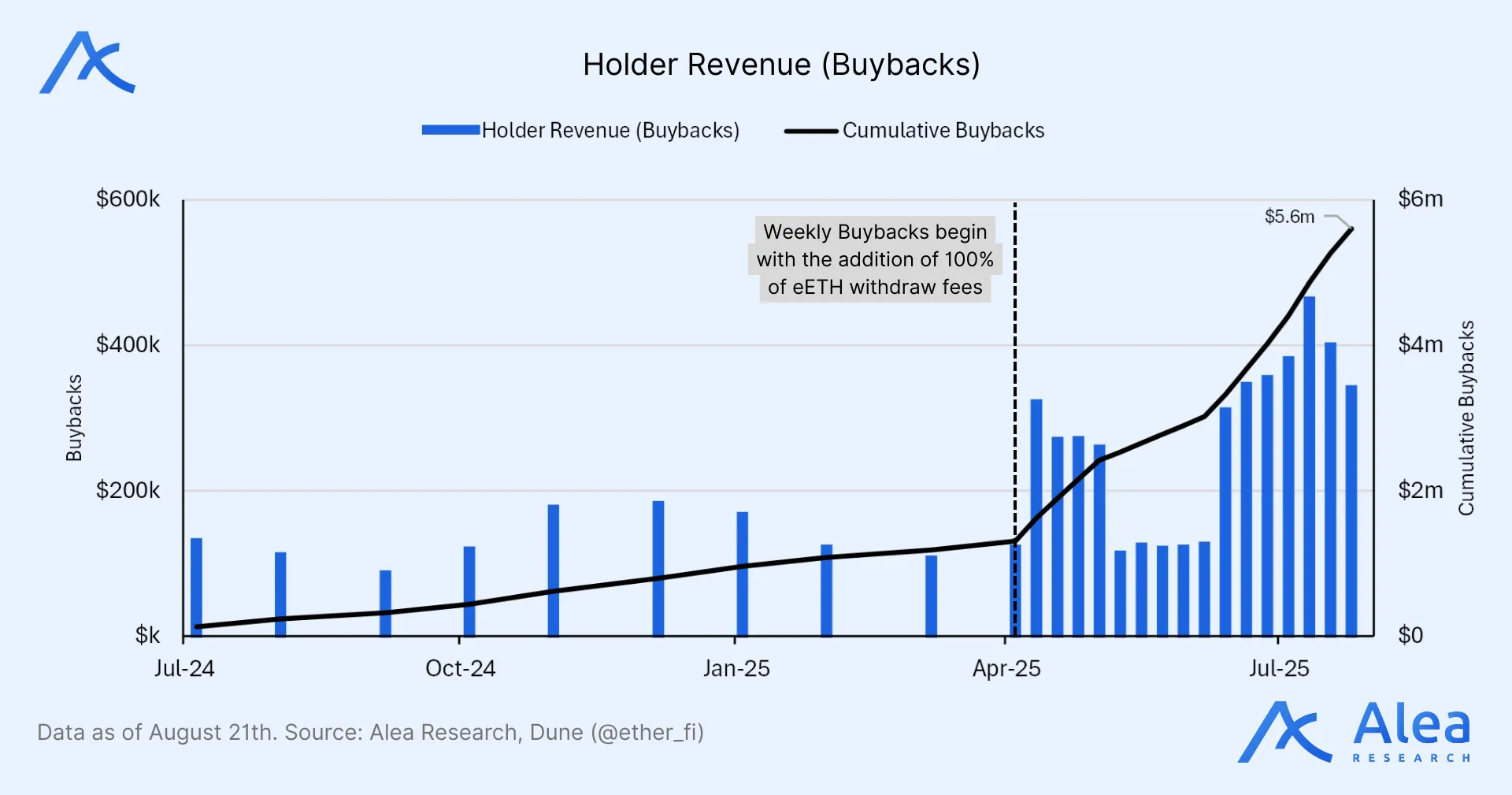

Holder Revenue (Buybacks)

Growth accelerated sharply in May 2025 following the DAO approval to allocate 100% of withdrawal-fee revenue to buybacks; ~80% of all buybacks occurred since then ($5.6m cumulative buybacks). Currently, 10-25% of monthly revenue funds sETHFI yield (to target ~10% APY) and the remainder is burned (1M+ in two weeks since the start).

Revenue and Holder Revenue (Buybacks) Annualized

Revenue Annualized was up 61% QoQ to $61M. Holder Revenue (Buybacks) Annualized saw a massive increase in Q2 2025, up +403%, followed by a +225% increase in Q3 2025 to $20.6M. As the protocol grows and diversifies beyond a single line of business (from Stake into Cash, Liquid and Trade coming soon), its continued revenue growth is less dependent on ETH price action, positioning it for a more resilient expansion phase.

eETH Supply

eETH has been established as a blue-chip DeFi asset, being utilized across multiple DeFi protocols and deployed on 17+ chains. Its supply at ~2.9M is up +19% QoQ (Q3‑to‑date). Growth is re‑accelerating after a mid‑2024 to early‑2025 plateau. These net new mints confirm organic growth in Ether.fi’s vertical stack.

Looking ahead, Ether.fi’s team is building relationships with DATs (Digital Asset Treasury companies), which can, and should, begin exploring yield opportunities for their idle assets. A key first step in this process is pursuing vanilla staking yields, which will drive flows into Stake and contribute to eETH supply growth.

% of Total ETH Staked

Ether.fi’s share of total staked ETH remains consistent, having climbed from ~5.0% in mid‑2024 to 6.5%. Momentum remains strong as aggregate deposits into the beacon chain continue trending higher and historically have not slowed meaningfully, bottoming in Q1 2025 at 33.8M ETH and rising to 36.1M ETH, showing that the overall market is growing while Ether.fi continues to maintain growth in absolute ETH terms.

Liquid: TVL

Liquid’s TVL at $1.17B is up +165% since Q3‑2024 from $445M. It remains ~10–15% below the early‑2025 local high. Similar to aggregate protocol TVL, part of the USD-denominated rise comes from underlying ETH appreciation (the Liquid ETH Yield vault represents ~80% of the total); the rest is net inflow.

Key updates coincide with the Summer 2025 uptick: Enso’s one-click crosschain deposits reduced friction; the HYPE (Hyperliquid) pre‑deposit vault went live within that timeframe (announced July 18, 2025 and configured to share 10M Hearts with pre‑depositors through August 31, 2025); and the Katana ETH pre‑deposit vault (14‑day pre‑launch; 125k ETHFI + KAT rewards).

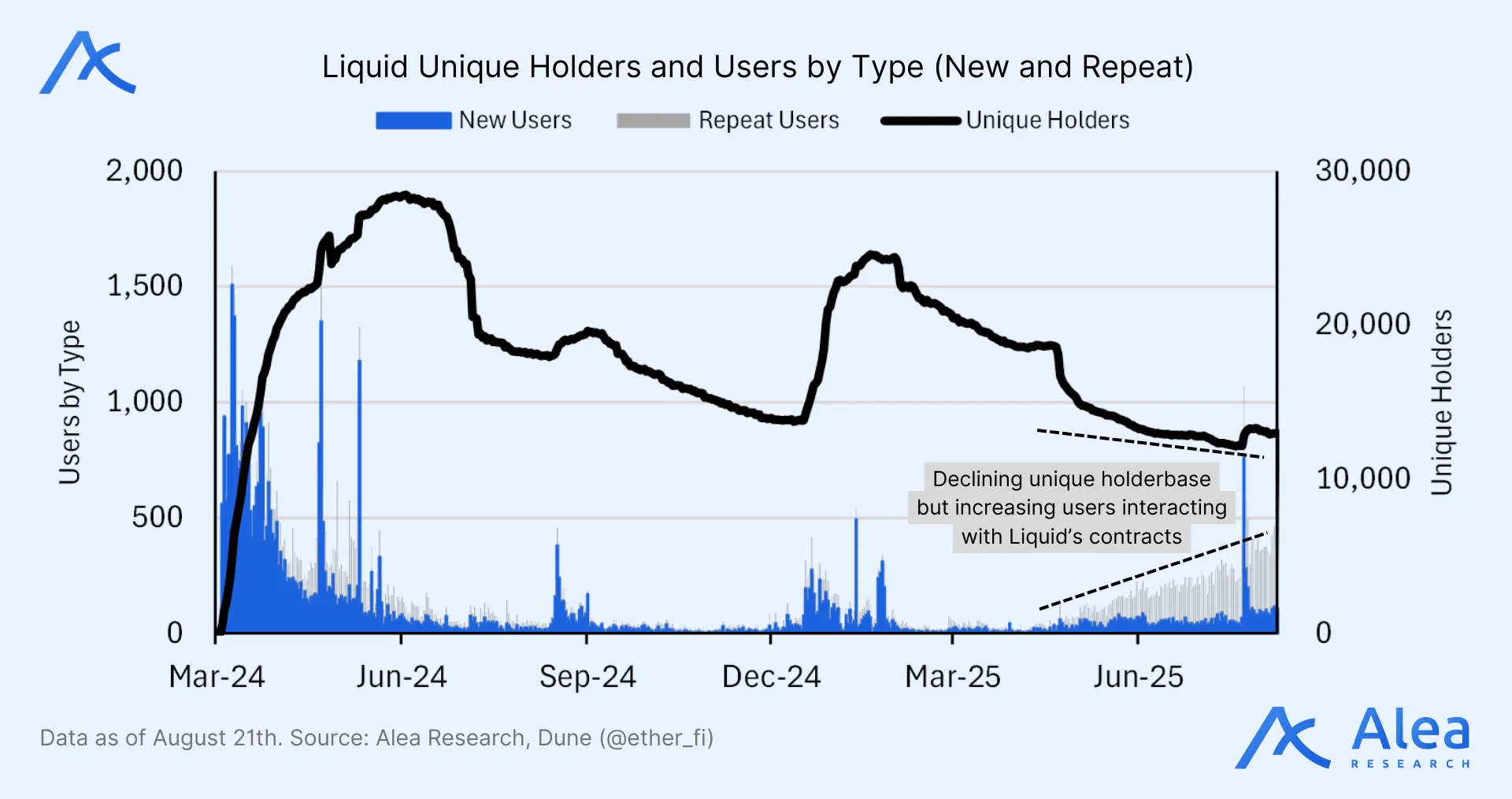

Liquid: Unique Holders

The number of addresses holding Liquid vaults fell from ~28k at the 2024 quarterly peak to ~13k now (-53%). Repeat users, however, consistently trended higher into mid‑2025 along with new users. Fewer addresses are interacting more often and TVL is primarily explained by a power law where few users drive most of the capital. TVL growth, therefore, is increasingly driven by larger tickets, not retail dispersion.

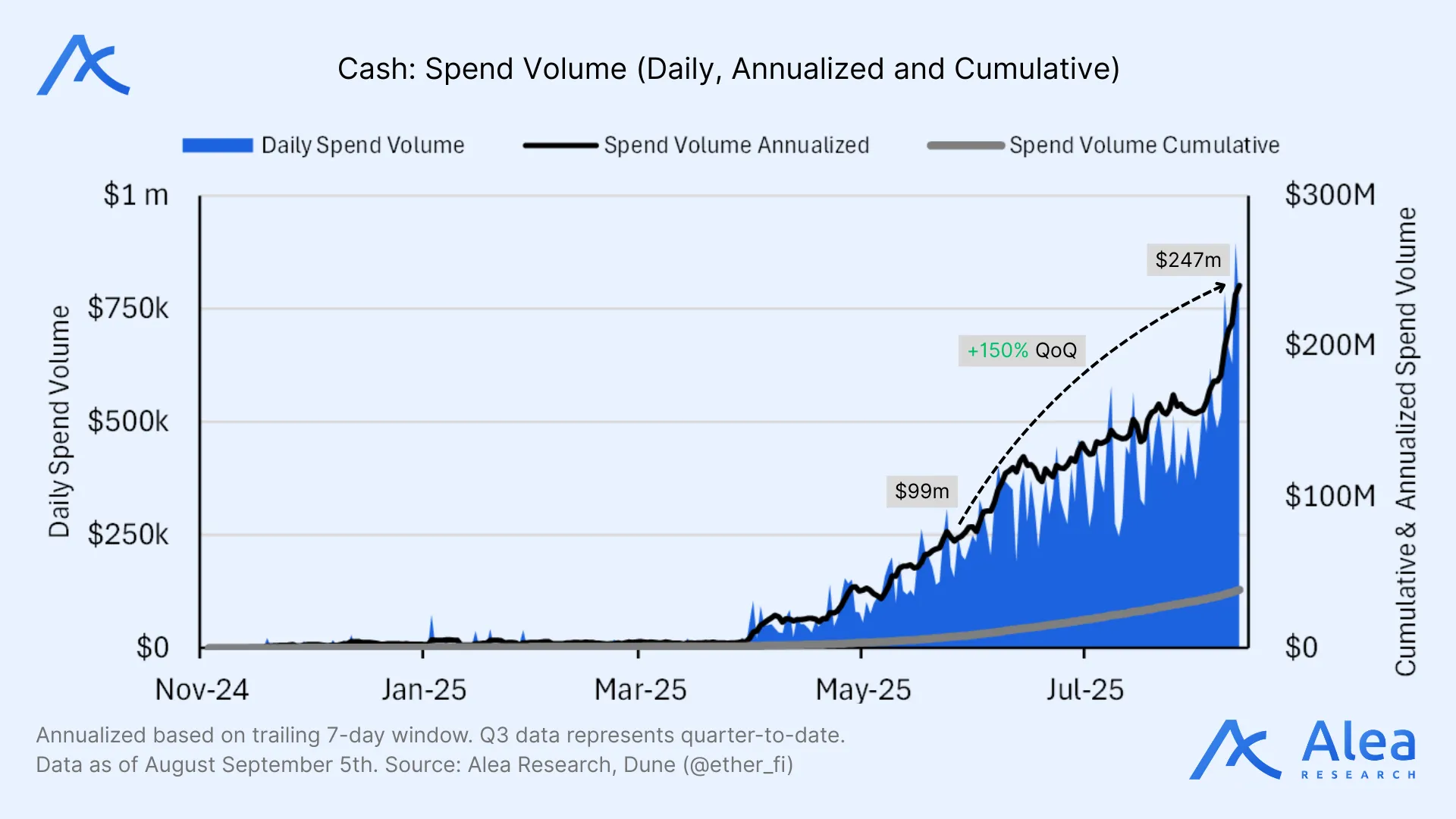

Cash: Spend Volume

Annualized spend volume stands at $247M, up +150% QoQ (from $99M). That’s an implied spend of ~$657k/day. In Q3 2025, the volume accounted for 72% of the all-time cumulative spend.

As noted by Mike, corporate spend is expected to increase in the coming months, as roughly 500 businesses are currently being onboarded. Unlike KYC (Know Your Customer), which on Ether.fi gets approved nearly instantly (requiring an allowed-country document and an address), KYB (Know Your Business) takes longer. Within that cohort, node operators can channel millions of dollars; EigenLayer, Maelstrom, Curve, LlamaRisk, and more are already utilizing Cash. This is expected to have a significant impact on both spend volume per card and overall transaction volume in the months ahead.

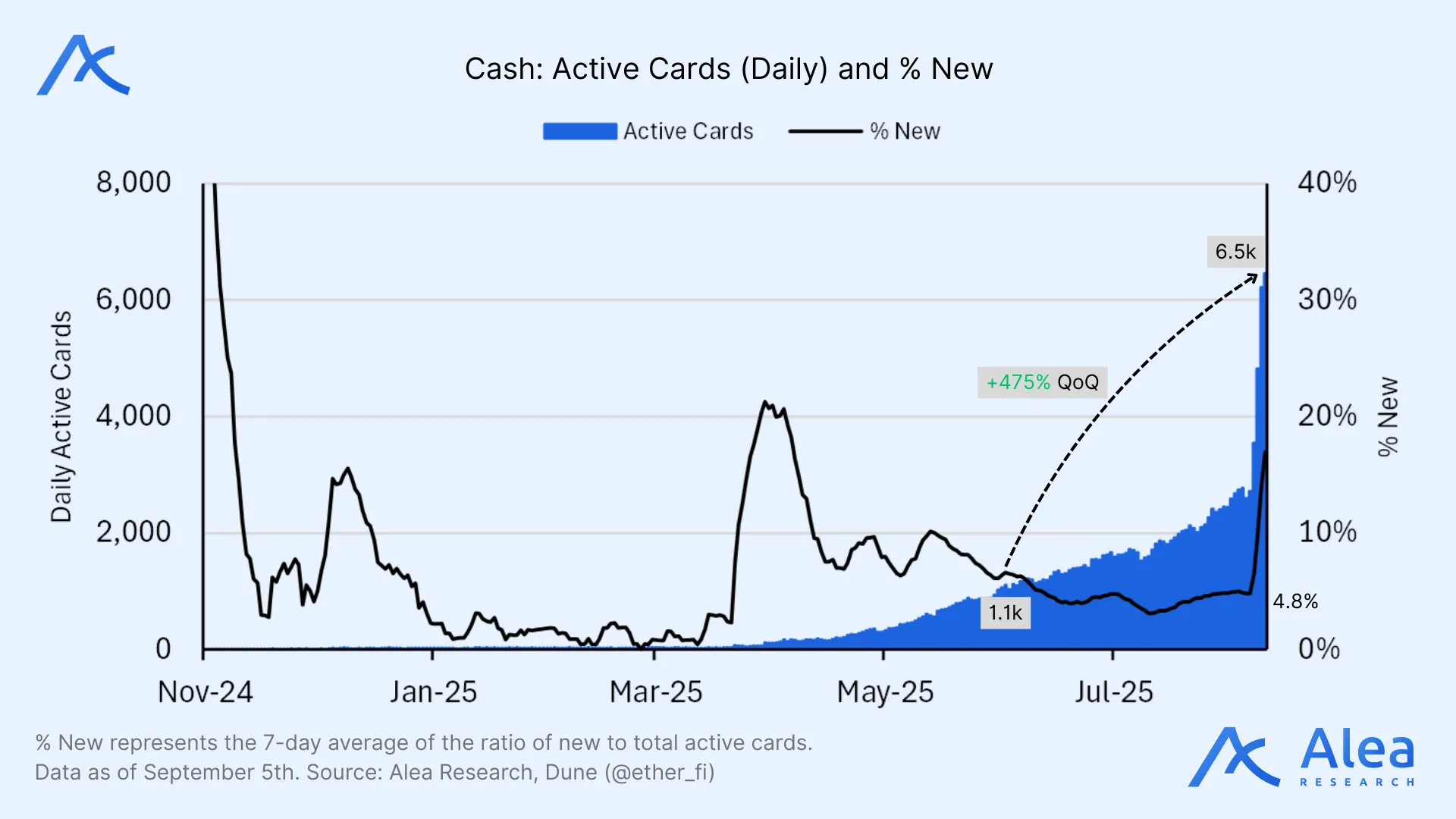

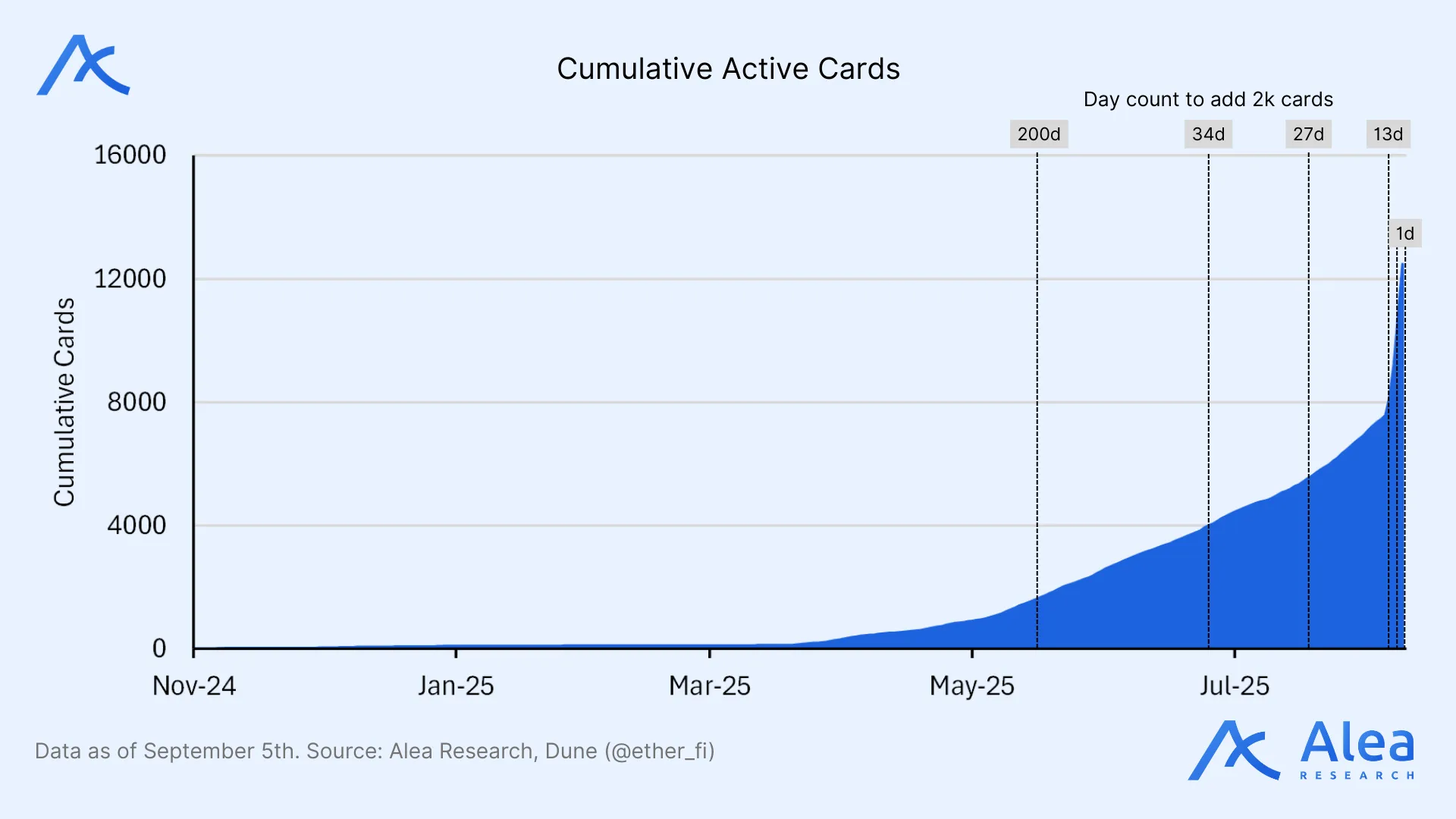

Cash: Active Cards

Daily Active Cards are up +475% in Q3, from 1.1k to 6.5k, showcasing early success after a U.S. rollout in April. Most usage continues to be driven by returning cardholders, despite % New rising to 17% in September, highlighting strong cohort retention.

Ether.fi’s team initially projected a 40k user base by the end of the year as the base case when they launched Cash in April, with a bull case target of 100k users. Since Sep 1, cumulative active cards have grown +64% to 12.5k, with the trajectory now clearly trending toward the set targets. At the current pace, the base target could be reached within 5 weeks.

Other Metrics

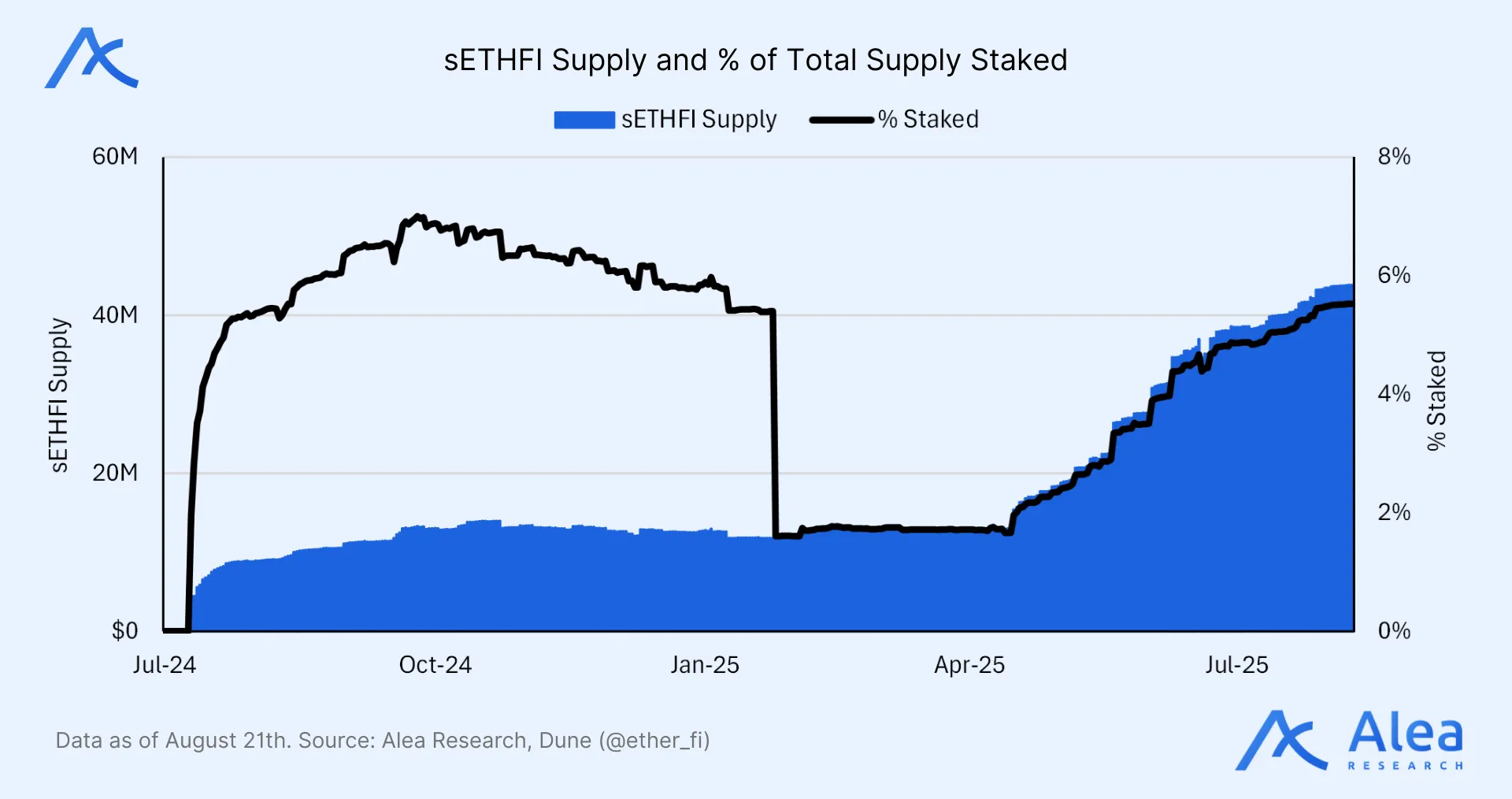

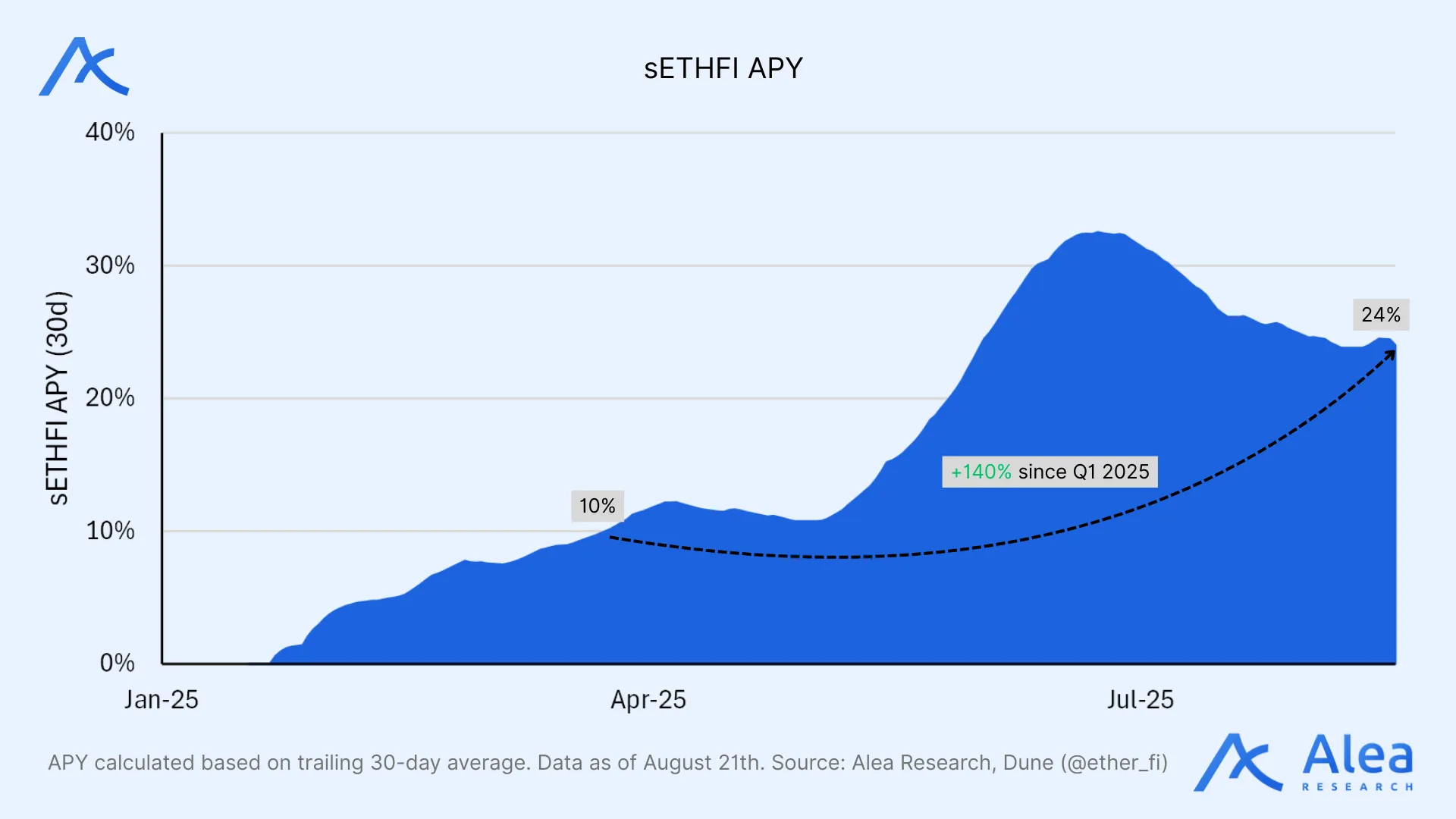

The percentage of ETHFI staked (sETHFI Supply / ETHFI Supply) is currently 5.5%, close to its all-time high of 6.9% but still relatively low. News surrounding buyback distributions with stakers explain the 2x since April 2025. Staking went live in July 2024, although the staking vault would only earn partner points. The early 2025 drop coincides with Season-5 (Feb 1–May 31, 2025) and sETHFI contract migrations for support on Arbitrum and Base.

The extra utility and value accrued from buybacks raised APY from 10% to 24%, peaking >30% in mid-July 2025, then smoothed as more ETHFI holders staked to capture their share. From April 2025 onward, higher APY plus improving fundamentals pulled new stakers in. Looking ahead, the target is to keep that APY close to ~10%, burning any extra proceeds.

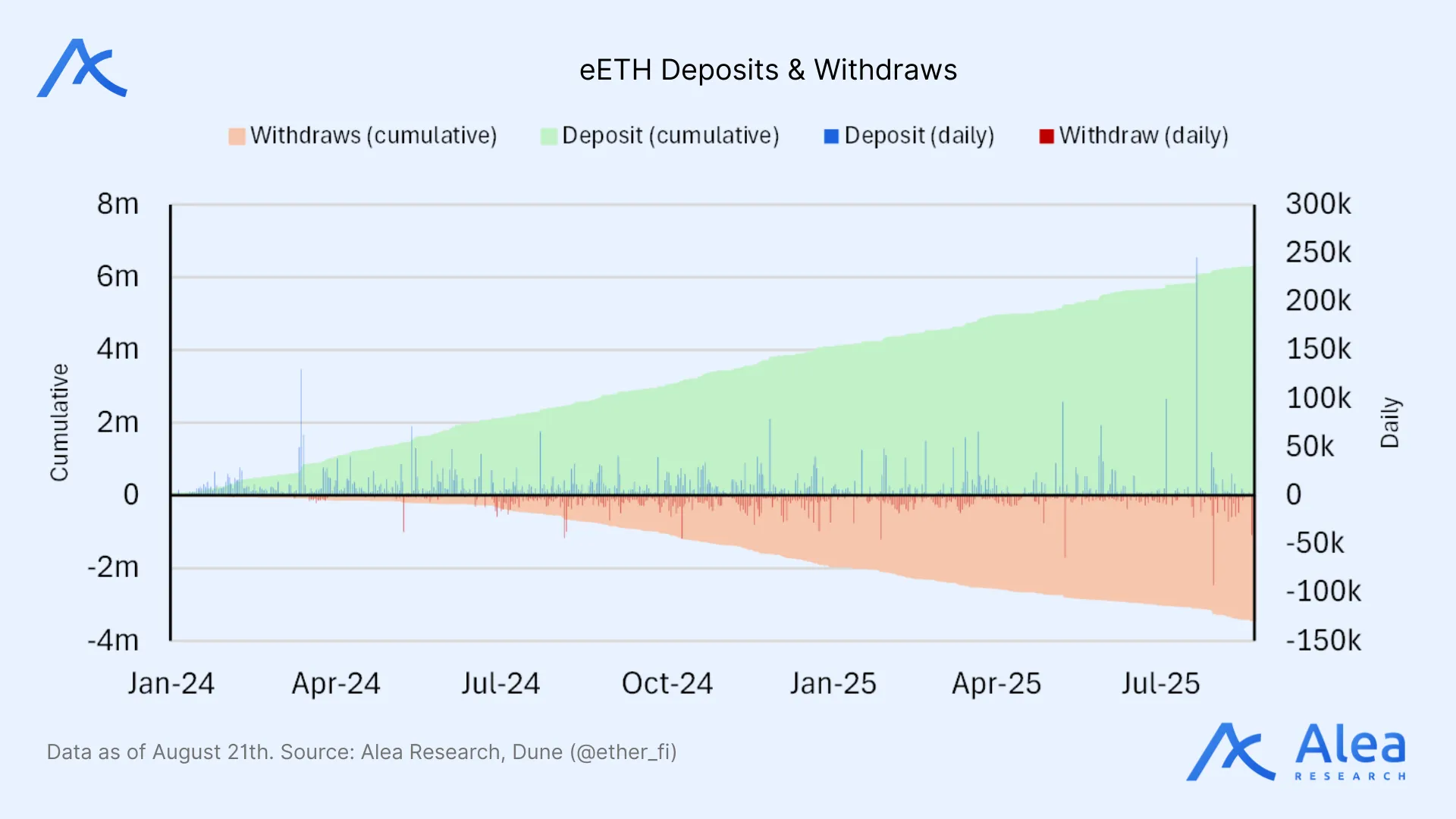

Both cumulative deposits and withdrawals rose substantially from early 2025 onwards. Daily deposit spikes dominate through mid-2024, while withdrawal spikes become more frequent in 2025. Net issuance remains positive, though growth is naturally slowing as the protocol scales and matures.

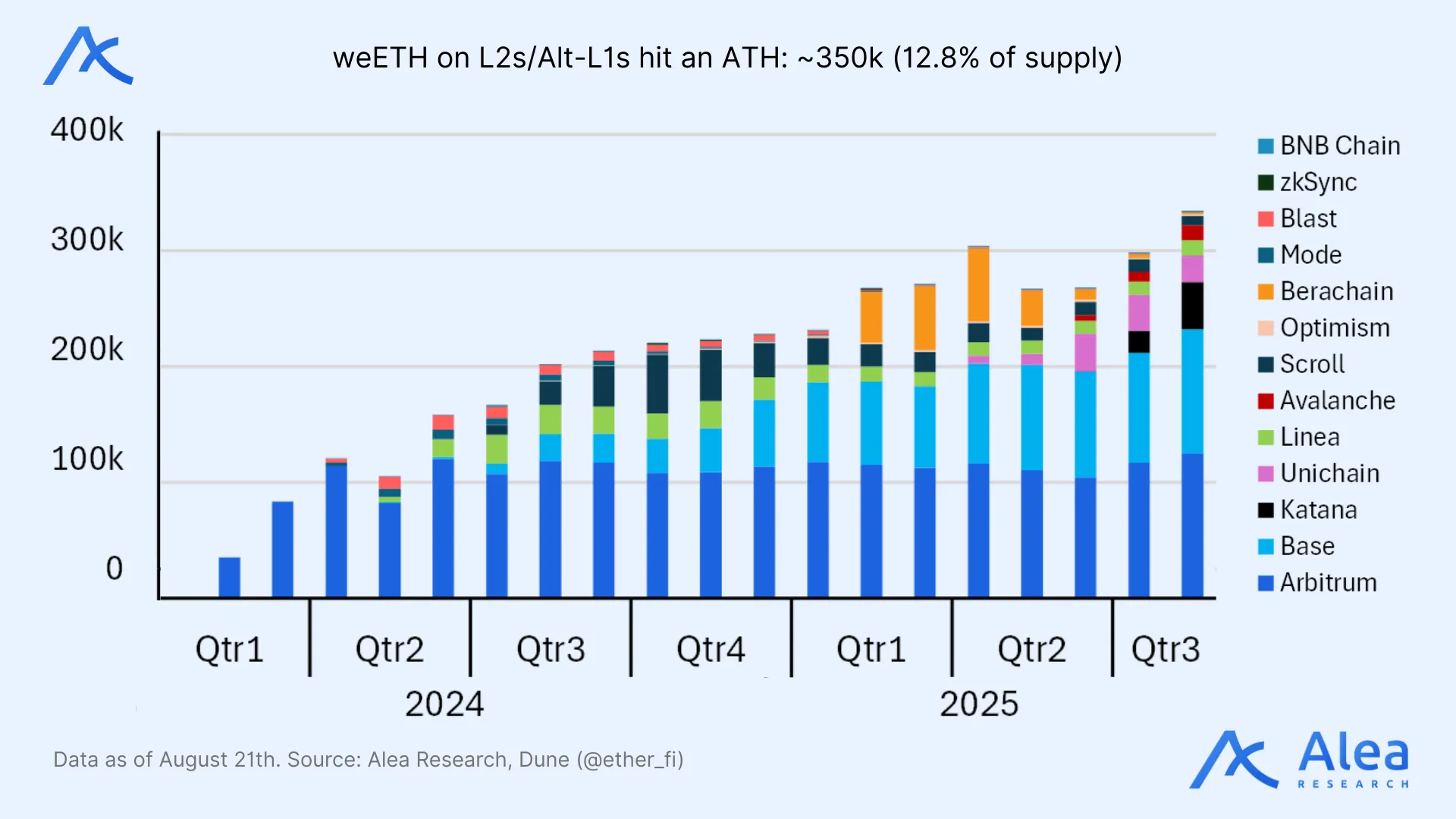

weETH Supply on L2s has been consistently increasing and reached a new all-time-high. Growth has been monotonic and benefited from a widening set of chains with incentives (Berachain & Katana); Arbitrum and Base dominate flows, attributed to DeFi utility and deeper liquidity. L2s have 12.8% of the total weETH supply, slightly below their all-time high of 14.5% in Q1 2024 and the yearly high of 13.77% in Q2 2025.

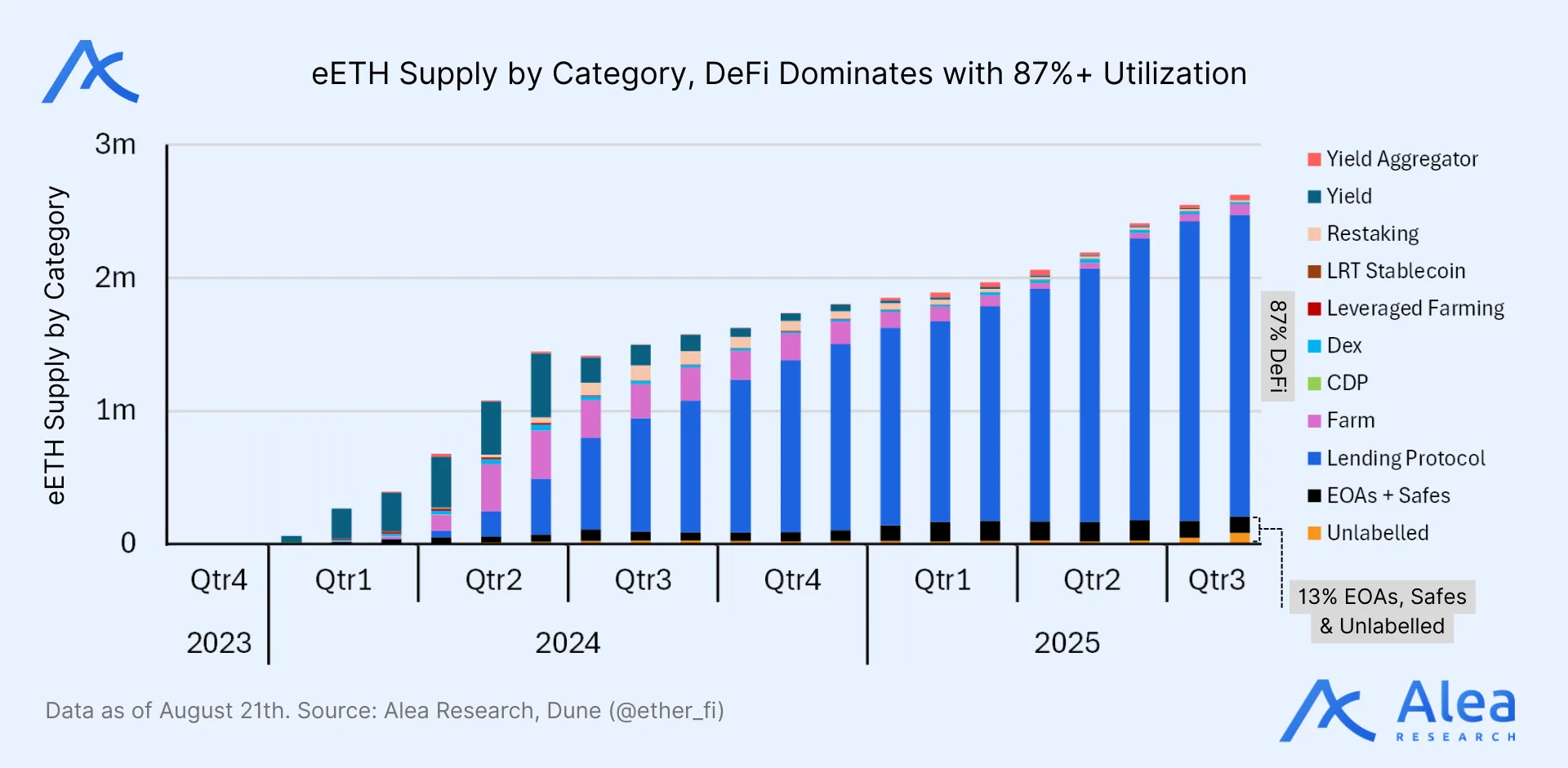

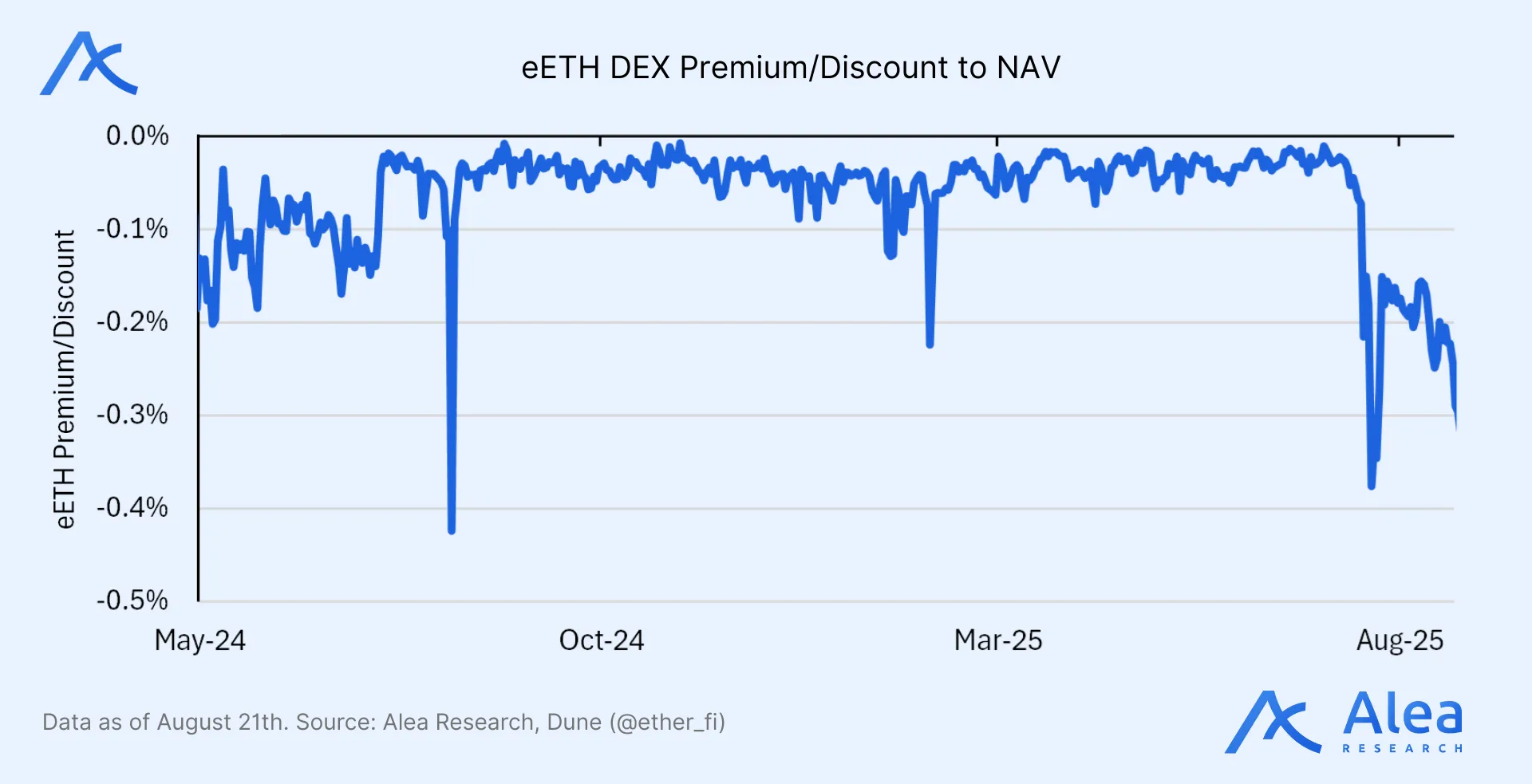

Utilization depth is a positive lead indicator for a liquidity moat: ~87% of eETH sits in DeFi and ~13% in EOAs/Safes/unlabeled. Within DeFi, DEX liquidity is the dominant sink (necessary condition for efficient looping on money markets), with lending/CDP, leveraged farming, yield aggregators, restaking and LRT‑stablecoin use as smaller but growing slices. Such a DEX-heavy footprint tightens eETH’s peg dynamics and reduces slippage costs, both of which support Lindy effects and continued adoption.

Market Data

ETHFI has rebounded strongly from its spring 2025 bottom, trading around $1.08 (~$1B psychological FDV), up +86% since Q1 2025 and +12% QoQ, supported by improved liquidity (Daily Token Volume up +11% QoQ and +64% since Q1 2025). YoY, market cap grew by +49% while price and FDV declined by -39%, a divergence driven by a higher float with investors and core contributors cliff unlocked in March 2025, driving circulating supply up +682% in Q3.

FDV and Price

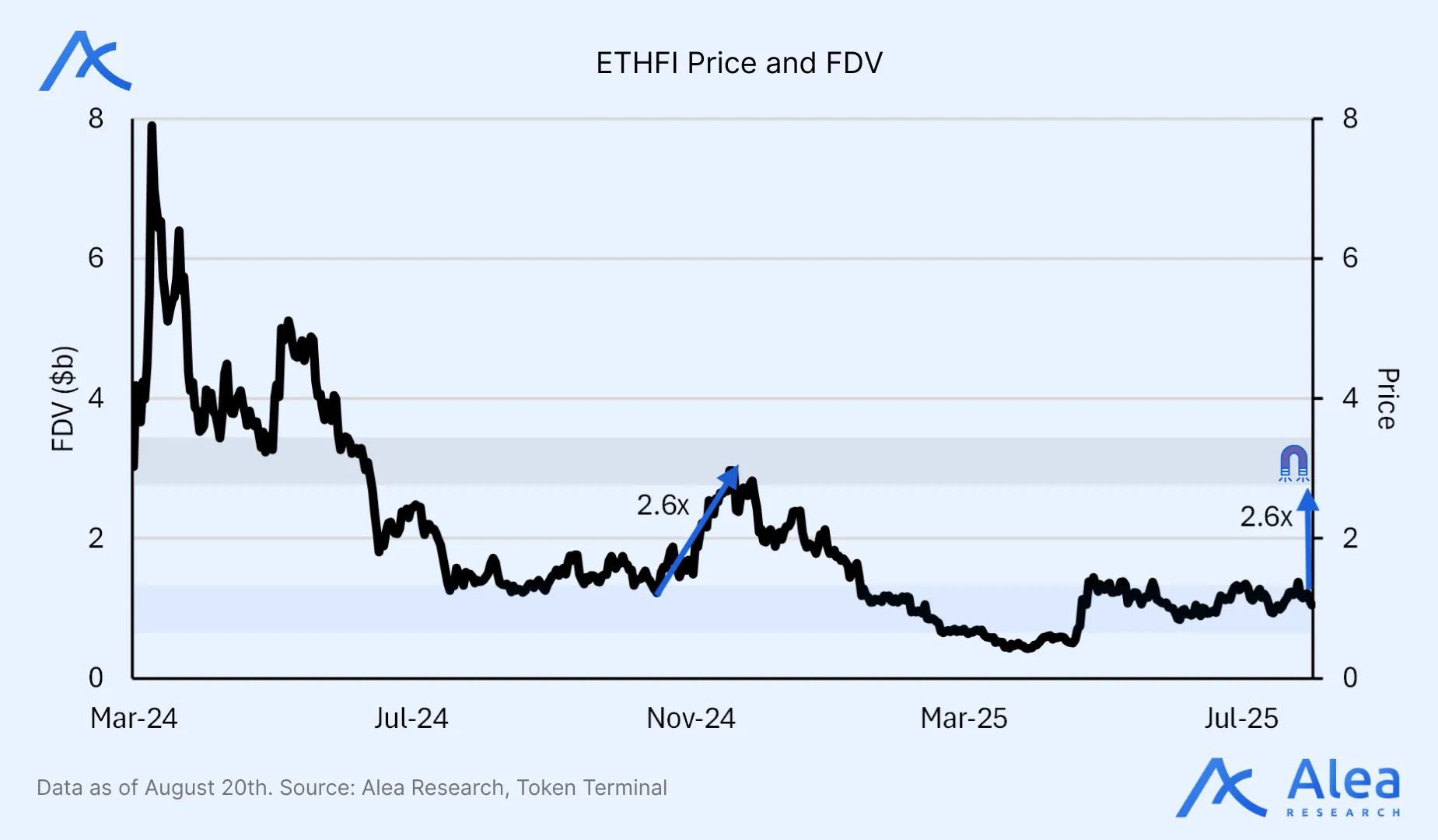

Currently at $1.08, ETHFI is up +12% QoQ and +86% since Q1 2025. ETHFI has been trading around the psychological ~$1 ($1 B FDV) level since May, which also marked 2024’s low and remained relatively sideways for three months, mirroring this year’s period of consolidation. Rising revenue and buybacks are establishing additional support for the next breakout.

From peak to trough, FDV had a -94% drawdown, falling from ~$8b in Q1 2024 to around $0.5b in Q2 2025. The largest YoY relief rallies were a 2.6x spike in Q4 2024 and a 4.1x re-price in Q2 2025 from the all-time-low of $0.4 ($400m FDV).

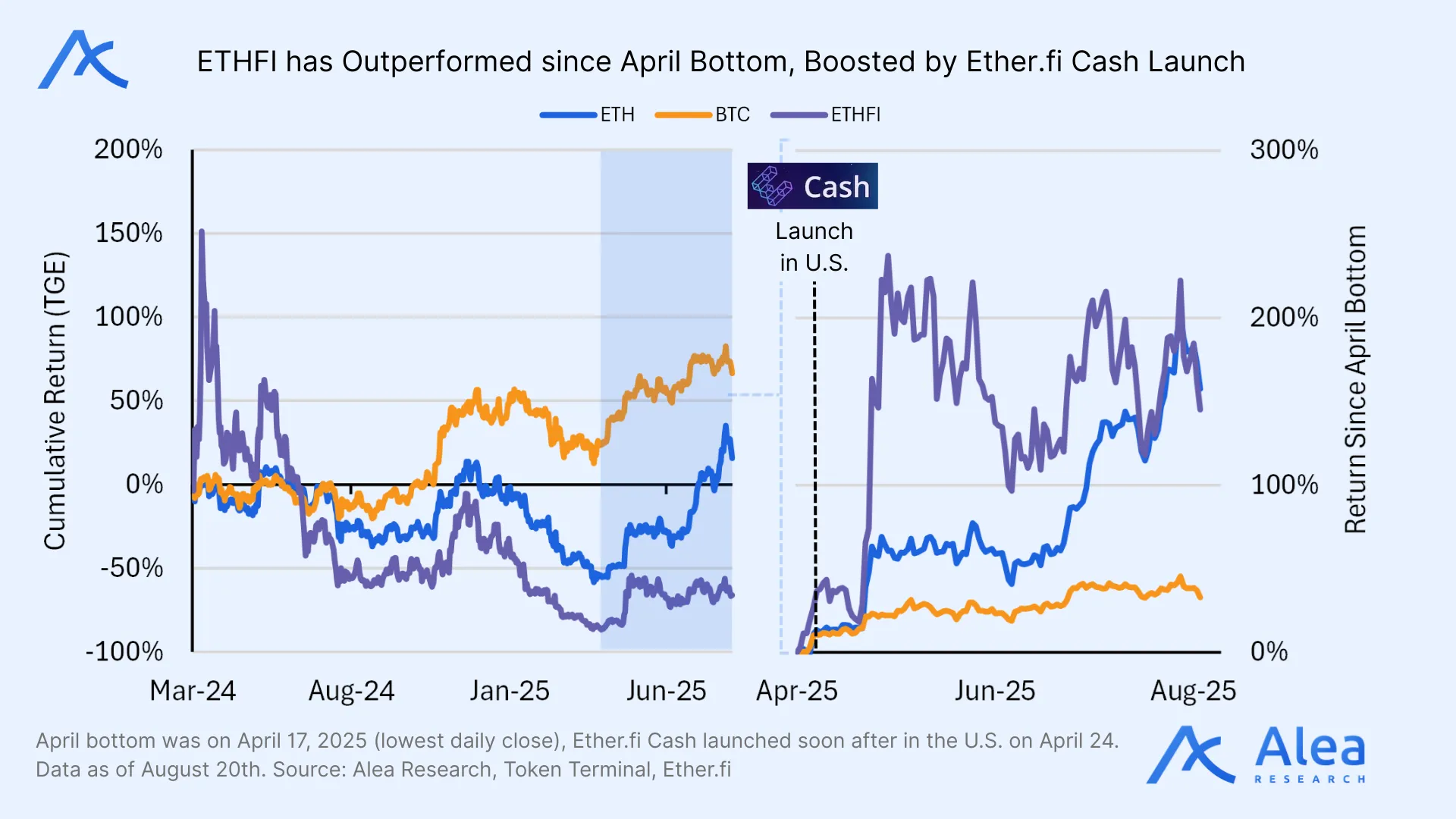

Cumulative Return

ETHFI launched at the height of EigenLayer hype, spiked 151% in 9 days, then slid as restaking interest faded (a cumulative -67% decline, versus ETH +18% and BTC +67%). A regime shift took place as ETHFI bottomed (lowest daily close) on Apr-17 2025. Cash was launched on Apr-24 2025 and ETHFI rallied ~150–180% net, peaking near ~200%+ shortly after the announcement, then oscillating in a 100–200% range. During that period ETH rose ~130–150% steadily to match ETHFI’s upside while BTC lagged, which is typical in later stages of the bull market, where dominance falls. Since April, ETHFI has beaten BTC on 90% of the days and ETH on 77% of the days.

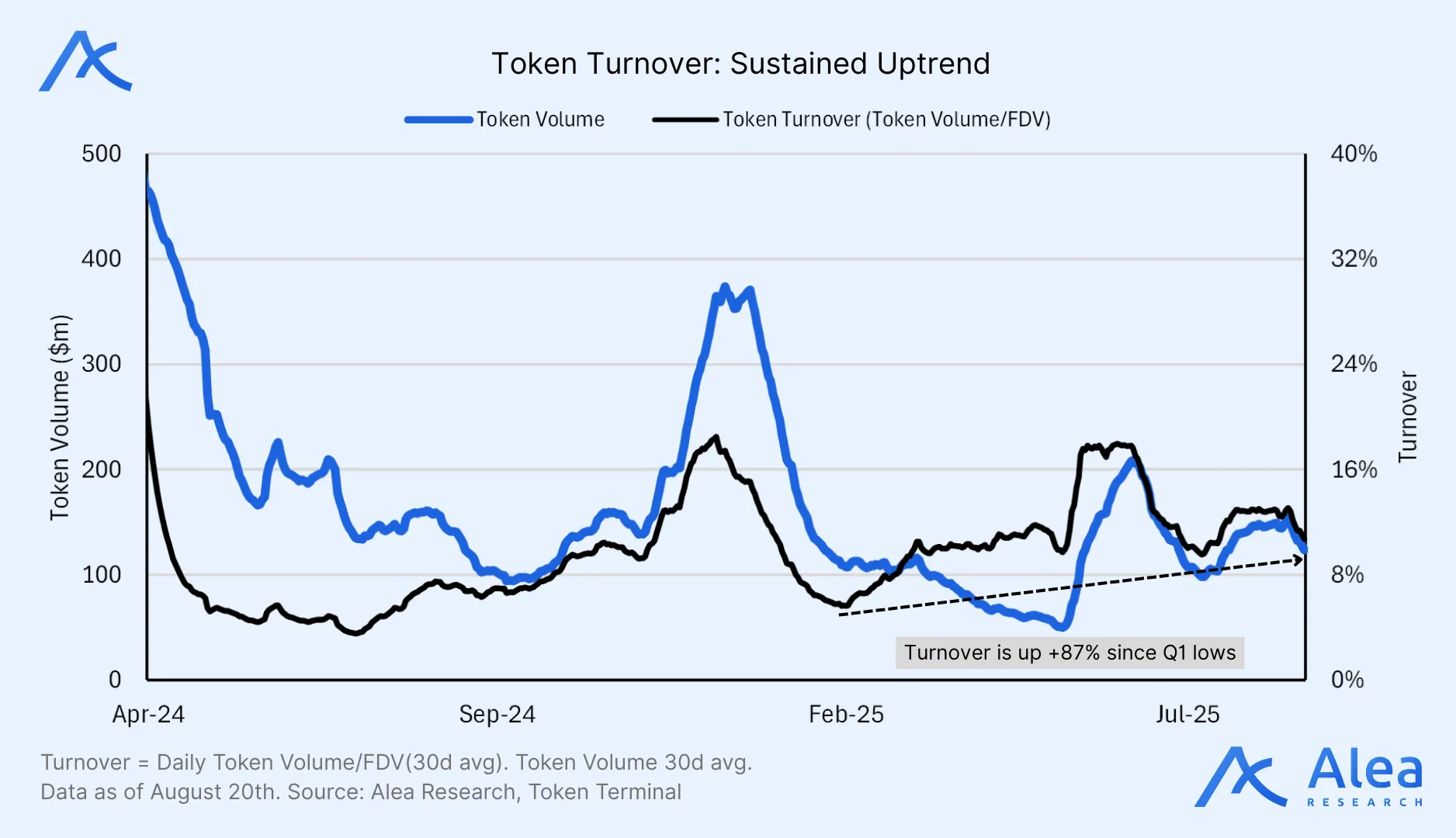

Volume & Turnover

Token turnover (fully diluted) is calculated dividing the average trading volume by the average FDV. It shows what share of a token’s valuation trades daily on both CEXs and DEXs (average 30 days). This ratio has risen 87% from the Q1 lows and remains below the late 2024 highs. Currently it’s at ~11%, which is a relatively high level when compared to the most liquid assets in crypto, such as ETH’s 7.5% or BTC’s 1.8%. Even in Q2, when the 30-day average daily token volume fell to an all-time low of just $51M, turnover remained resilient, holding well above the yearly average at the time.

Supported by 30+ venues offering more than $100k at ±2% orderbook depth and tier-1 CEXs exceeding $500k, ETHFI’s liquidity regime has improved; this reduces any liquidity discount large funds may apply for purchases. In 2025, after the Q2 peak ($200M volume, 18% turnover), turnover has stabilized in the 10–13% range. ETHFI is yet to be listed on Coinbase (U.S. exposure) and Upbit (Korea exposure) for added global liquidity.

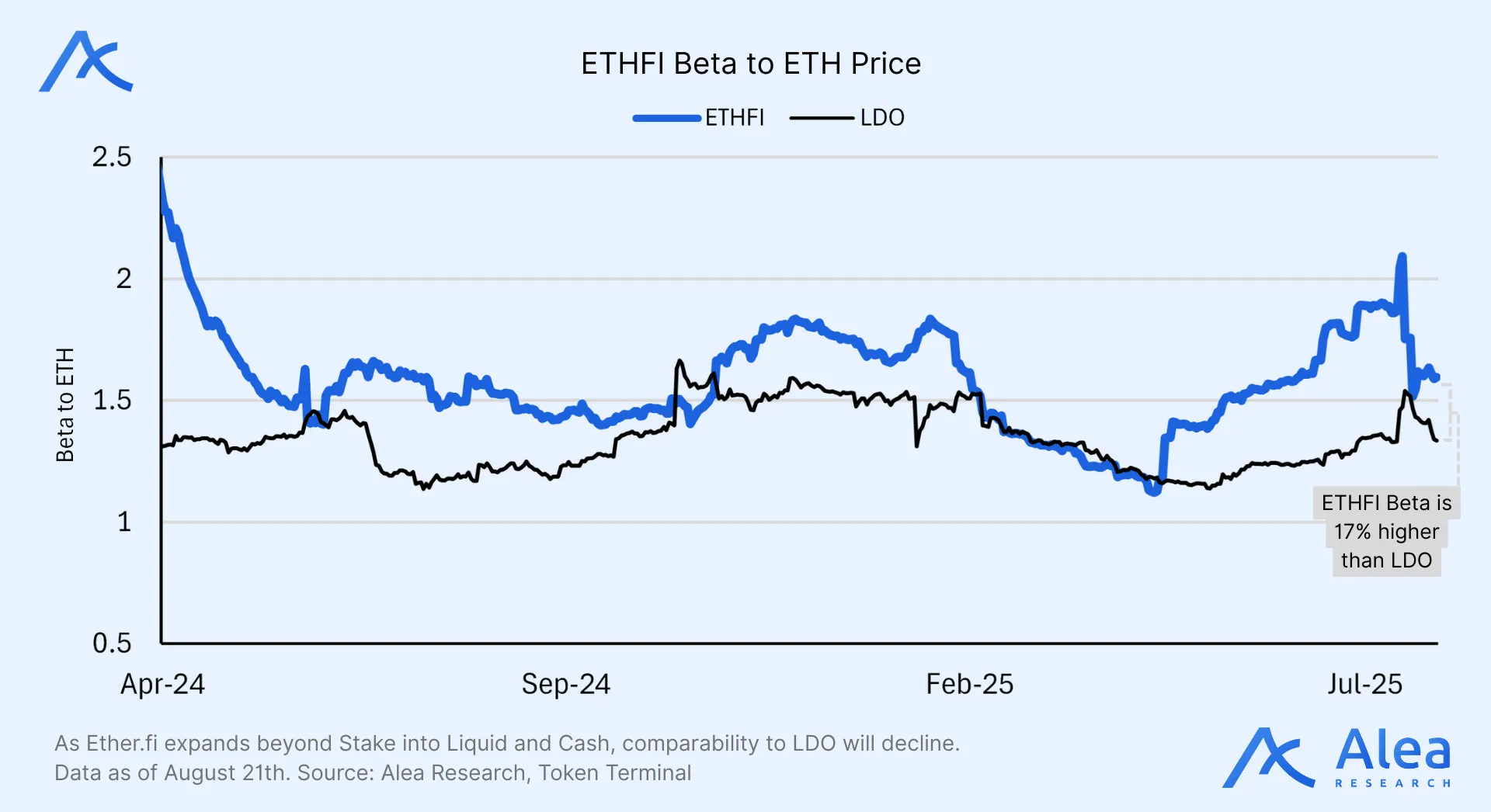

Beta

ETH beta measures the sensitivity of returns relative to a 1% move in ETH, e.g. a beta 2 asset moves 2% when ETH moves 1% (in the same direction).

ETHFI has historically traded as a high-beta asset to ETH, currently around 1.59, down from a recent all-time high (excluding the months post-TGE) slightly above 2 driven by the Cash launch and additional buyback news from April 2025. With the growing narrative around ETH driven by DATs (Digital Asset Treasuries), ETHFI being the sector’s highest-beta asset is well positioned to capture upside in the continuation of the rally.

ETHFI beta to ETH is currently 17% higher than LDO and has been the dominant high-beta asset over time, with only brief, isolated moments where it traded below. Post-launch, it fell from 2.4 to 1.4 by August 2024 due to the restaking narrative cooldown.

As Ether.fi’s revenue mix diverges from pure LST/LRT peers, comparability falls and idiosyncratic beta drift rises, making the sector comparison less indicative. ETHFI, however, has reliably delivered ETH-levered exposure. Idiosyncratic alpha could be found hedging the ETH leg, otherwise PnL remains dominated by ETH directionality.

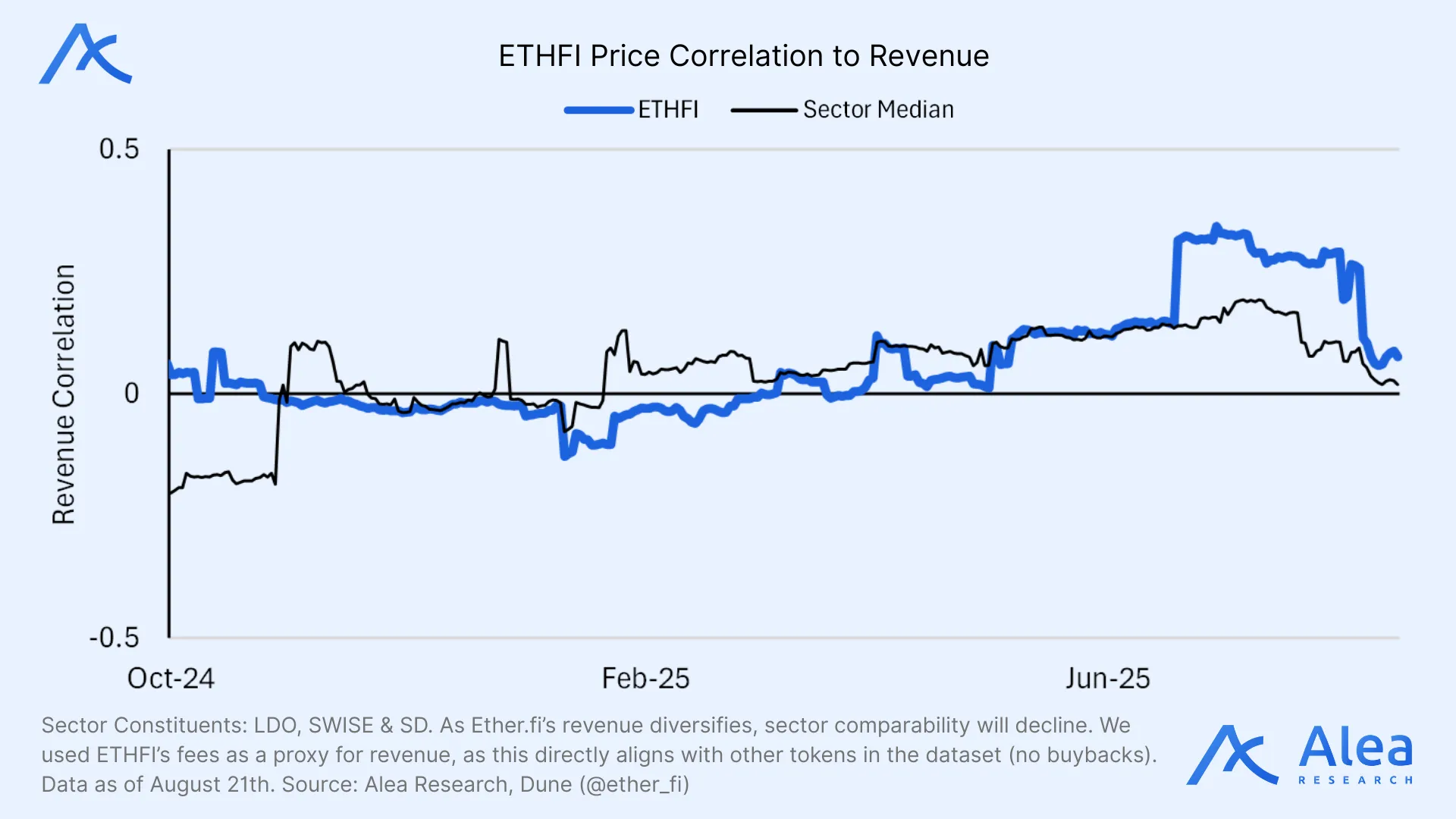

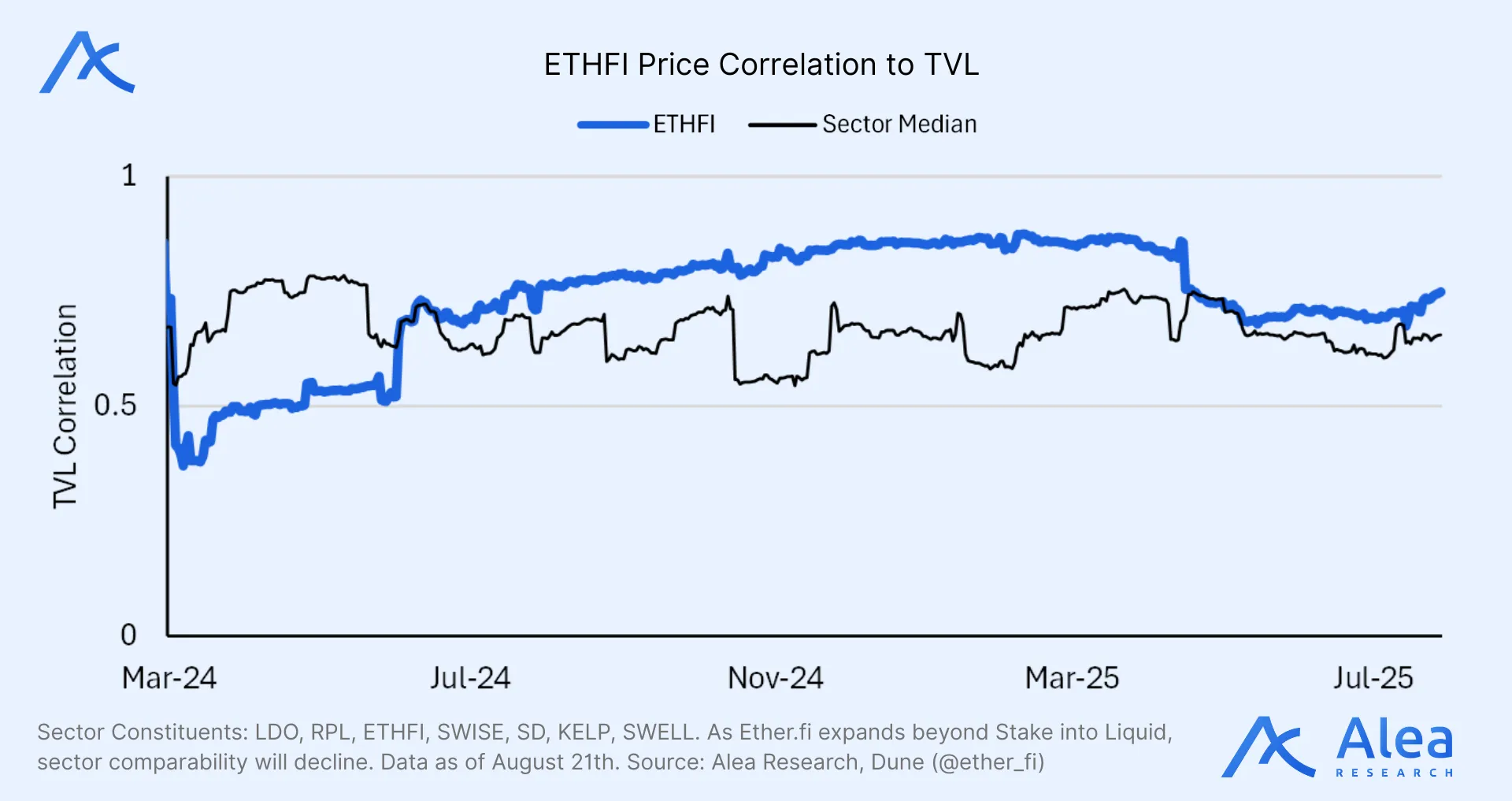

Correlations

The Cash launch and extra revenue buybacks caused a higher ETHFI price correlation to revenue, having climbed from 0.10 in Q2 to 0.25 in Q3, but then quickly resetting. From October 2024 to January 2025, price movements were dominated by positioning, sector beta, and the absence of unlocks, with protocol revenue having little explanatory power. Since April 2025, following the launch of Cash and the activation of larger-scale buybacks, price began to move in line with revenue, showing positive correlation and also tracking sector peers, marking a ‘re-anchoring’ period.

Before Liquid, ETHFI’s price-to-TVL correlation simply echoed ETH correlation because deposits were all ETH-denominated. Correlation to TVL rose post-launch from approximately 0.35 to 0.60 between March and July 2024, entered a sideways range of 0.80–0.90 from August 2024 to April 2025,and has continued trending higher into Q3 2025 despite being lower due to ETH outperformance. ETHFI has historically exhibited higher correlation to TVL than its sector peers, falling below them only during the initial months post-launch.

Similar to TVL correlation, ETHFI’s price action has historically been correlated with ETH, which is expected given its staking-heavy foundations. Correlation starts ~0.4 post‑launch, climbs steadily, and sat at ~0.8 for most of H2 2024–Q1 2025. Currently at 0.81, it’s just below the Q3 high ~0.88. Meanwhile, the sector median ranges ~0.7 and trends slightly sideways in 2025.

The Apr 2025 discrete drop coincides with the release of Cash, approval of withdrawal fee buybacks, and ETH outperformance, creating idiosyncratic moves that have temporarily decoupled ETHFI from ETH.

Other Metrics

The DAO initially allocated a portion of protocol revenue to buy ETHFI and seed LPs—starting with 5% in June 2024, creating baseline onchain depth and growing pool liquidity above $2M by late Q4 2025. This program has since been discontinued in favor of a simplified revenue distribution: 10-25% of monthly revenue buybacks to fund sETHFI yield (~10% APY yield target) and directs the remainder to ETHFI token burns, reducing direct liquidity provision but reinforcing scarcity and long-term token value.

eETH’s peg to ETH has remained resilient over time; sharp discounts only reflect liquidity imbalances with quick recovery. The more prolonged current discount in Aug-25 coincides with the ETH validator queue hitting records (~$3.6B with 15-18 day waits; the longest since the Shanghai upgrade). Amidst ETH’s >70% price climb over the past three months, investors have a preference for staying liquid and having the optionality to sell past all-time-highs. During that same period, Lido’s stETH also experienced ~10-30bps discounts; eETH held relatively well given its deep DEX pools and redemption guarantees (also raking in more withdrawal revenue as a result).

Multiples

ETHFI stands out for delivering stronger value at lower multiples, being cheaper on revenue, buybacks and TVL, and still trading at a discount to peers.

- What Became Cheaper: P/S (FDV) from 25x to 18x (‑31% QoQ); P/S (Mcap) from 10 to 8 (-14% QoQ), TVL per $ of FDV +80% QoQ (from 7 to 12); P/Buybacks (Mcap) from 57x to 24x (-57% QoQ); P/Buybacks (fdv) from 152x to 52x (-66% QoQ).

- What Became More Expensive: none of the metrics became more expensive during Q3.

- Relative to the Sector: ETHFI has more TVL relative to FDV, +26% higher, more attractive revenue multiples, –65% cheaper on a P/S (Mcap) basis and -35% cheaper on a fully diluted basis, and trades at a lower float, -37% below the sector.

TVL/FDV

TVL/FDV trended upwards; TVL led by ETH’s price appreciation. After a mid-2025 correction, the ratio has broken out into a series of all-time-highs above 10. FDV rising at a slower pace than TVL, however, implies that FDV unperformed ETH materially (since TVL in ETH terms remained sideways).

The all-time-high is not evidence of accelerating adoption; it’s a pricing dislocation: ETH strength + ETHFI underperformance. Broader product penetration, however, isn’t reflected on TVL alone.

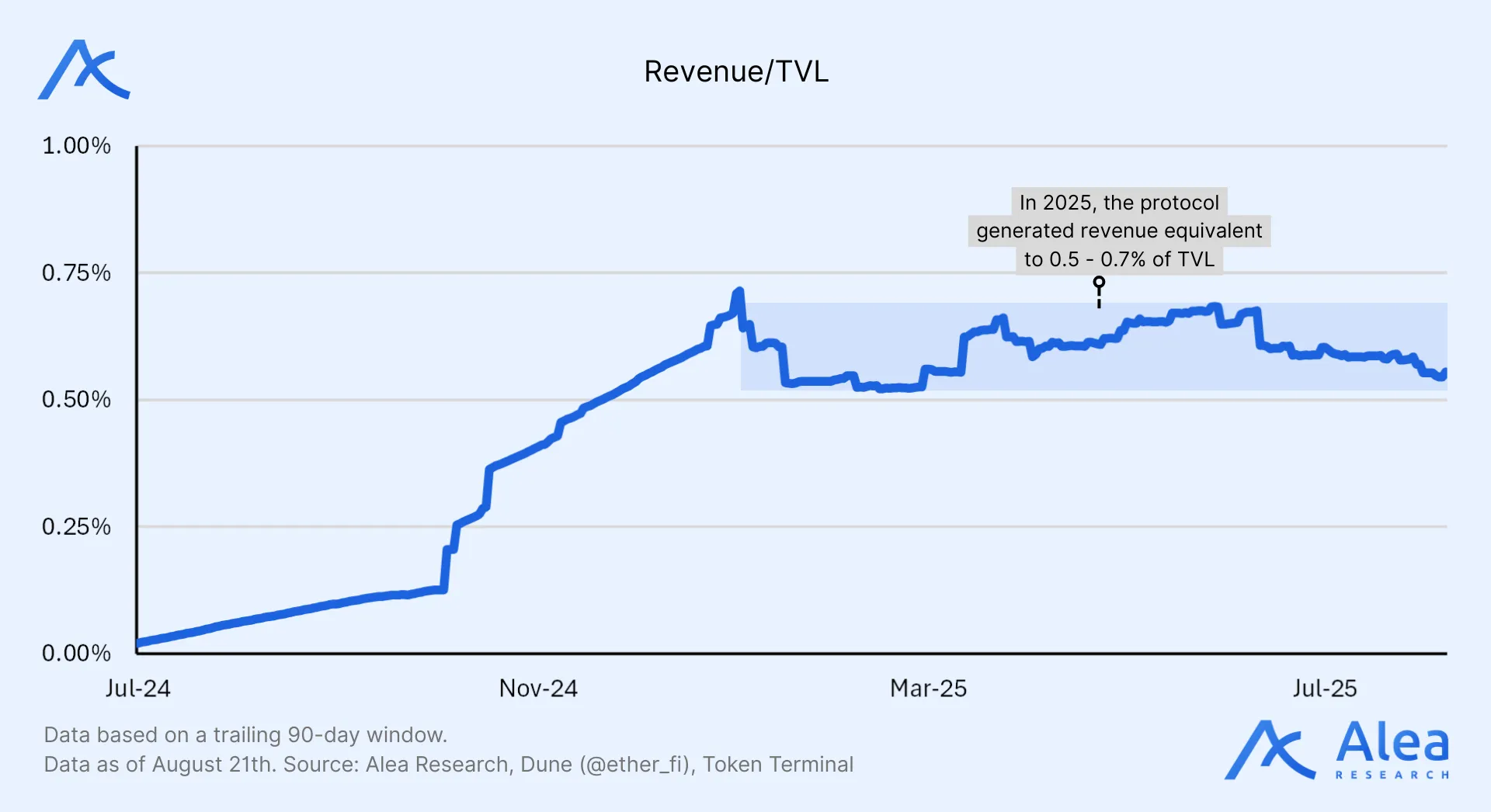

Revenue/TVL

Building upon the currently stable range of 0.5-0.7% in revenues on TVL indicates that the business has found its “unit-economics zone” within the existing product set. At the latest ~0.55%, every incremental $100M TVL adds ~$0.55M per quarter (~$2.2M/y) in revenues (buybacks).

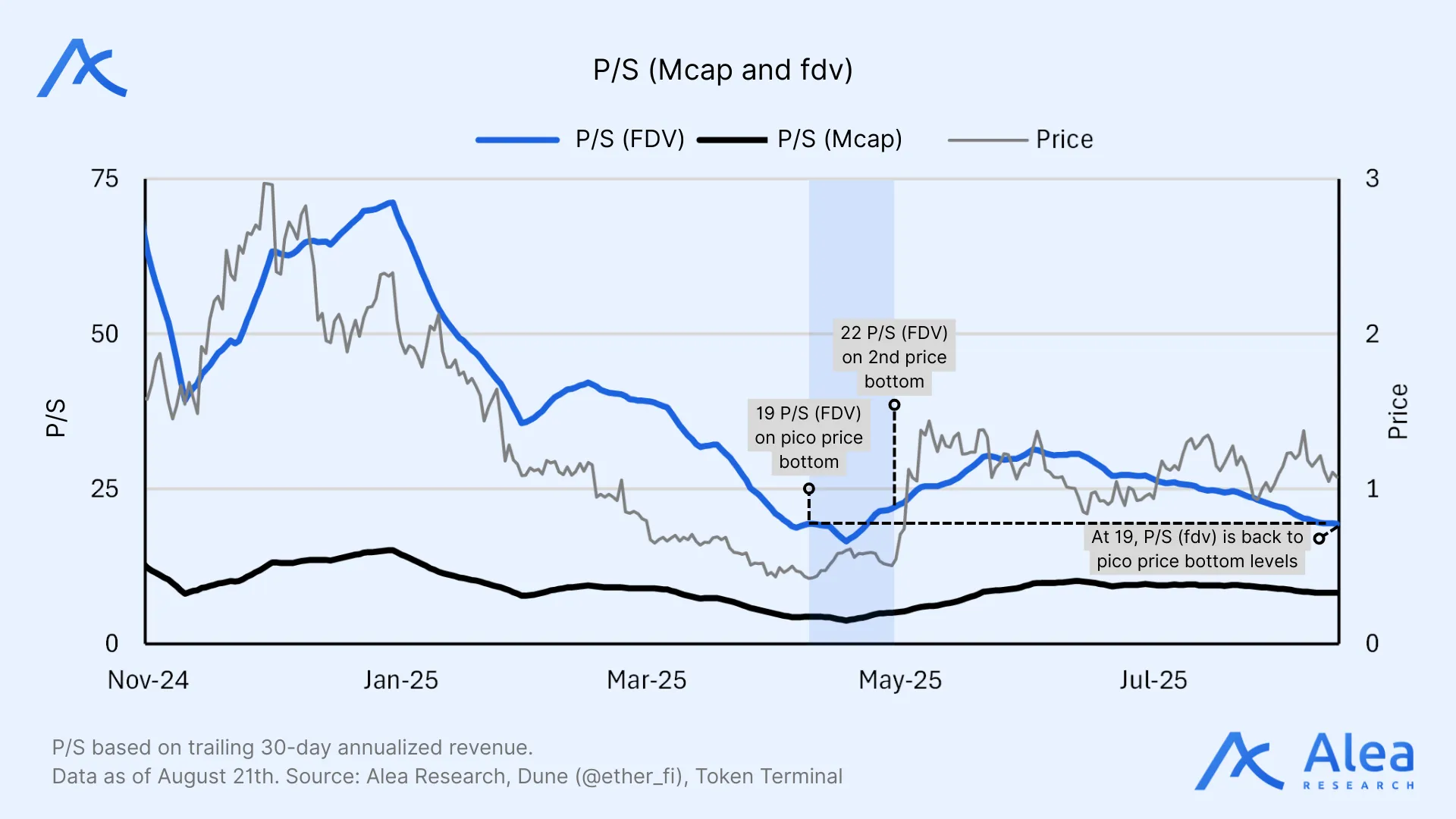

P/S (Mcap and FDV)

P/S stands for ETHFI’s Mcap or FDV divided by annualized revenue. Despite price bouncing significantly from the lows (+171%), the P/S (FDV) multiple has returned to the bottom range, highlighting a disconnect between price and fundamentals. With revenue now coming from a diversified set of sources (detailed in the financials section), these multiples are even more attractive than they were in April (price bottom).

From January to May 2025, ETHFI experienced a 73% P/S (FDV) compression as prices declined while revenues remained resilient. Currently, the 8x P/S (Mcap) sits above May lows but remains below early-year levels. At the peak, P/S (FDV) reached ~60–70x during the token’s launch.

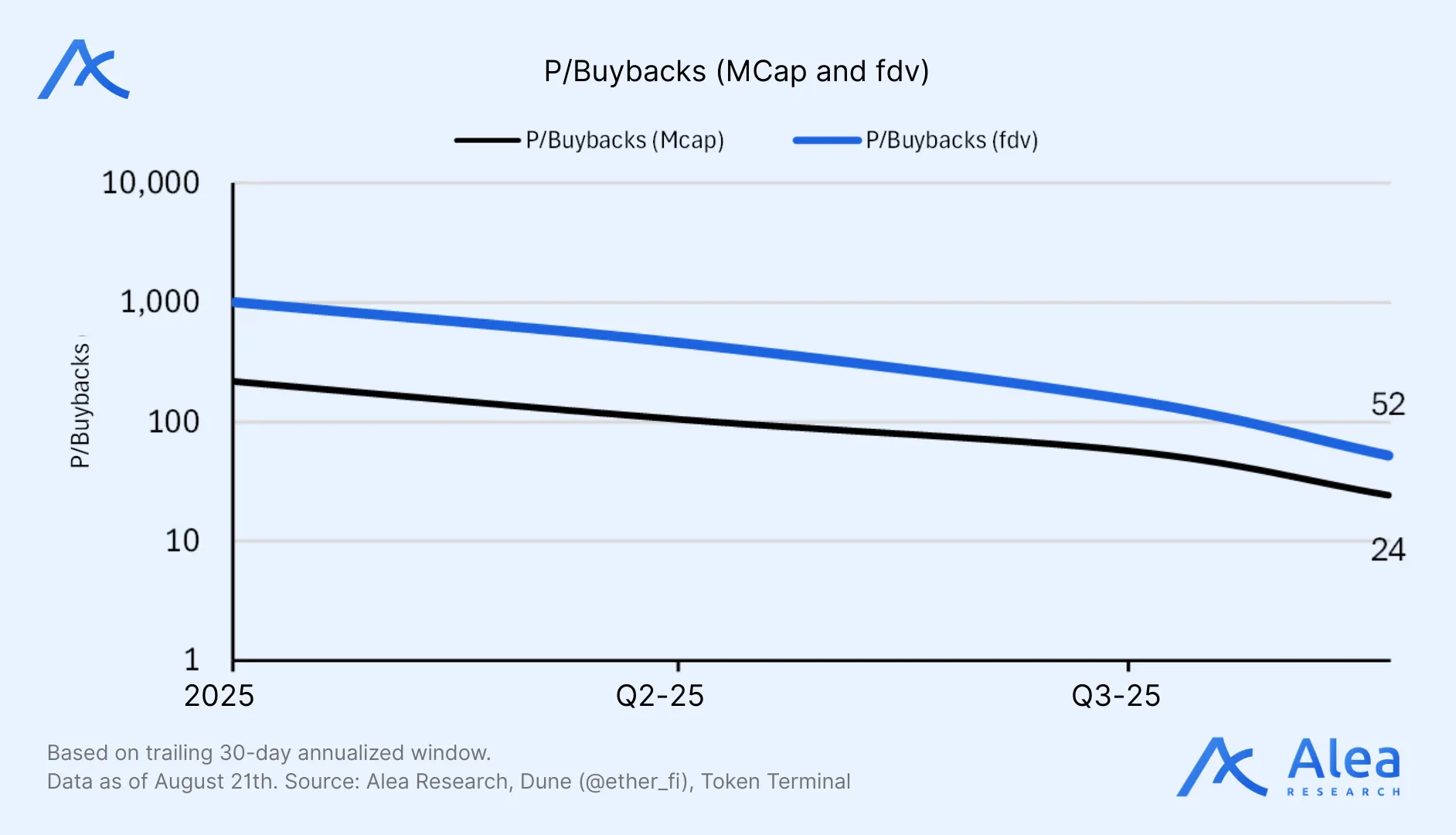

P/Buybacks (Holder Revenue) (Mcap and FDV)

P/Buybacks stands for ETHFI’s Mcap or FDV divided by annualized revenue (buybacks). The latest P/Buybacks (Mcap) ~24x and P/Buybacks (FDV) ~52x make the valuation more attractive relative to the past, where Holder Revenue (Buybacks) looked less appealing with fewer business lines and without 100% of withdrawal fees weekly buybacks. This comes on the back of a sharp multiple compression from early‑2025 high‑hundreds to double‑digits by Q3‑25. Directionally, that’s ~90–95% lower (cheaper) YTD.

Since buybacks are linked to revenue, durability directly drives token demand. The log scale highlights that most of the re‑rating occurred in H1‑2025, while Q3‑2025 shows continued multiple compression as revenue becomes more diversified. For the first time, the P/Buybacks (FDV) multiple is lower than the P/S (FDV) multiple of a past quarter, specifically Q4 2024, meaning current levels are as attractive from demand-driven flows (Buybacks) as they were from revenue generation at the end of 2024.

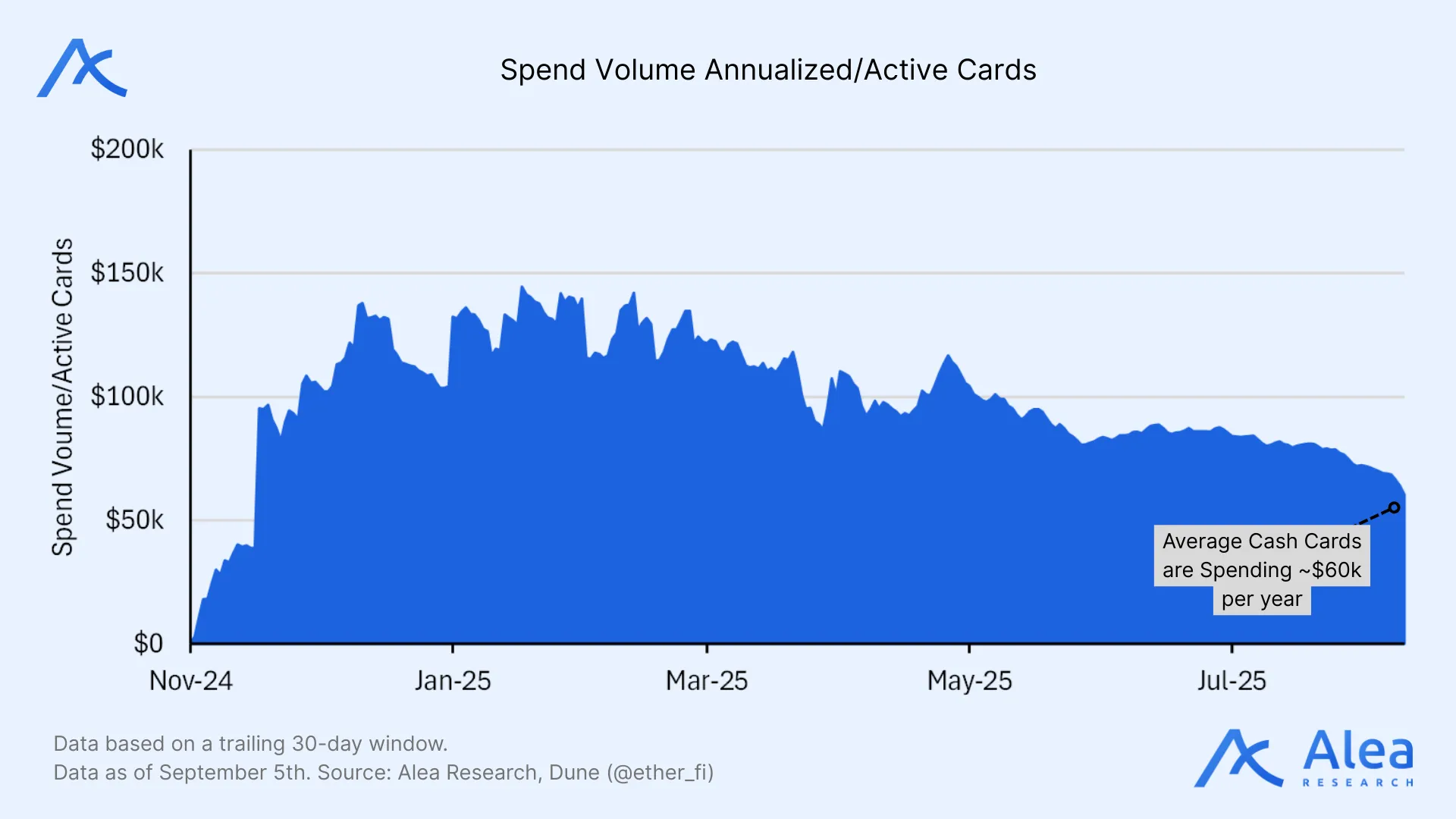

Spend Volume/Active Cards

Trailing annualized spend per active Cash card has consolidated in a sub-$100k downtrend, now at $60k, still above the U.S. median income of $42k. As the card expands into underserved markets with lower median incomes such as Brazil, the ratio may decline further. This reflects broader adoption, driving higher aggregate spend volume and ultimately increasing revenue and cross-product engagement, with Cash users likely to also deposit into Liquid.

The early uptick comes from a small base dominated by heavy users (as active cards scaled, average spend compressed). A 5-month sideways consolidation signals a mature usage mix between DeFi users and onboarding businesses, the latter carrying heavier transaction volumes that likely push the multiple higher, while the influence of smaller markets, such as Brazil, can exert pressure in the opposite direction.

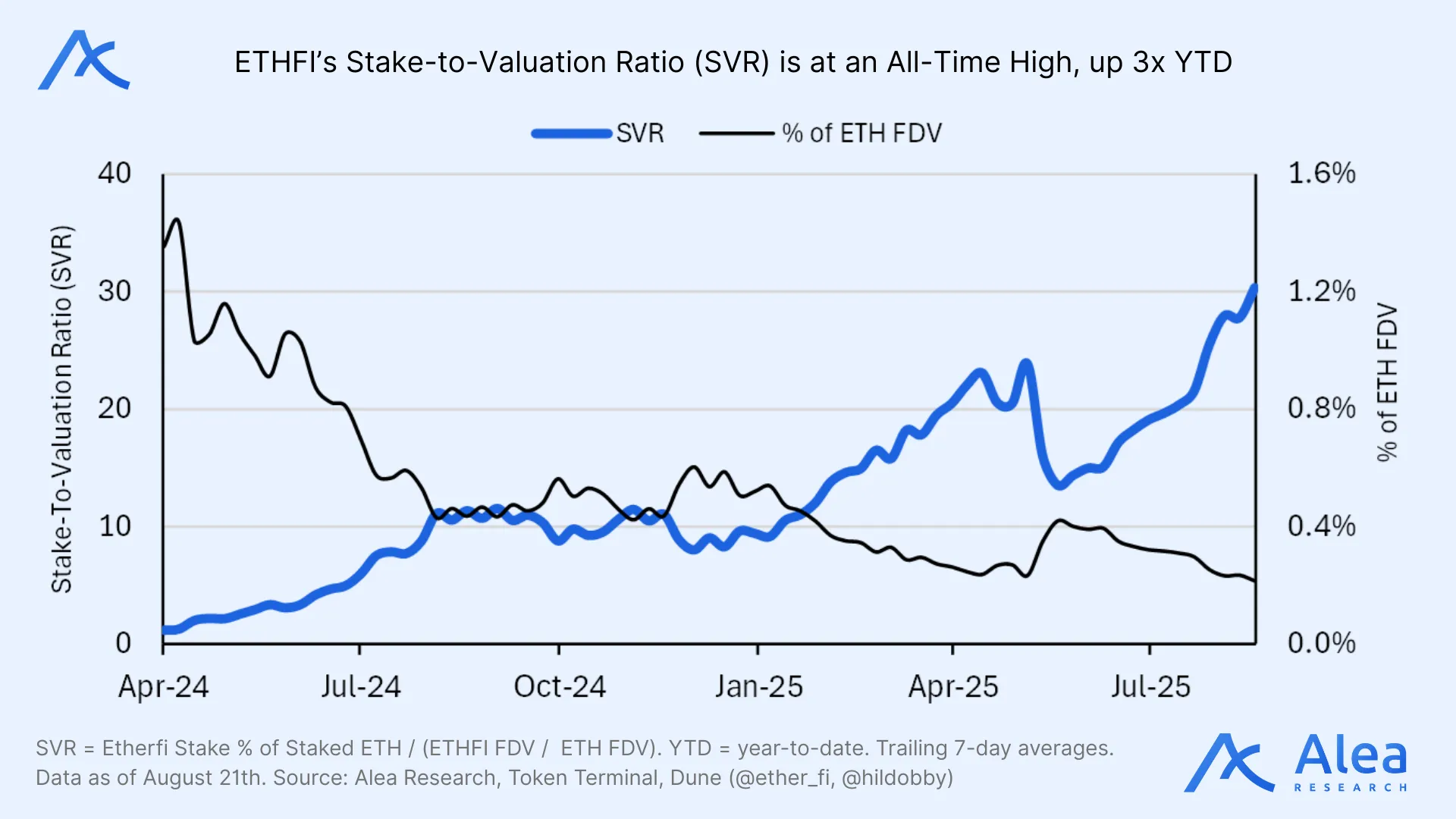

Stake-to-Valuation Ratio (SVR)

The Stake-to-Valuation Ratio (SVR) measures the proportion of Ether.fi Stake as a % of total Staked ETH, divided by ETHFI’s FDV as a share of Ethereum’s FDV. A higher SVR indicates that Ether.fi secures more of Ethereum’s stake relative to its valuation, implying stronger security coverage per valuation dollar.

As more users stake with Ether.fi (increasing stake share), SVR rises; if $ETHFI price lags, the ratio expands further. This can signal undervaluation and drive demand for LSTs/LRTs, often leading to ratio mean reversions on extremes (as seen during the most recent rally in April 2025).

SVR= Ether.fi Stake % of Staked ETH / (ETHFI FDV / ETH FDV)

SVR has increased 3.2x YTD, reaching an all-time high of 30.3, while ETHFI’s FDV as a share of ETH’s market cap has compressed from ~1.1% (Apr-2024) to ~0.21% today. This relative undervaluation creates a more attractive entry point for investors rotating from ETH. Historically, ETHFI as a % of ETH FDV upside pullbacks have averaged ~50% (modest by crypto standards). A full recovery would imply >6x upside versus ETH.

Comps

Customers are increasingly seeking an all-in-one financial app from which they can save, earn, and spend from their pocket. Ether.fi builds upon its DeFi bank vision to offer a solution for crypto users to operate their entire portfolio in a non-custodial manner (DeFi yield strategies, RWAs, tokenized stocks, collateral, payments, etc). Consumer financial applications have become mainstream across the globe, but to this date there has been no crypto go-to-app fulfilling that role. That’s changing now with Ether.fi.

Below we present a product-by-product comparison (Stake and Cash; no direct comparisons were produced for Liquid given the diversity in yield aggregation offerings), although it’s worth re-stating that product-specific comparisons will miss the broader picture that comes from offering everything as a vertically-integrated stack.

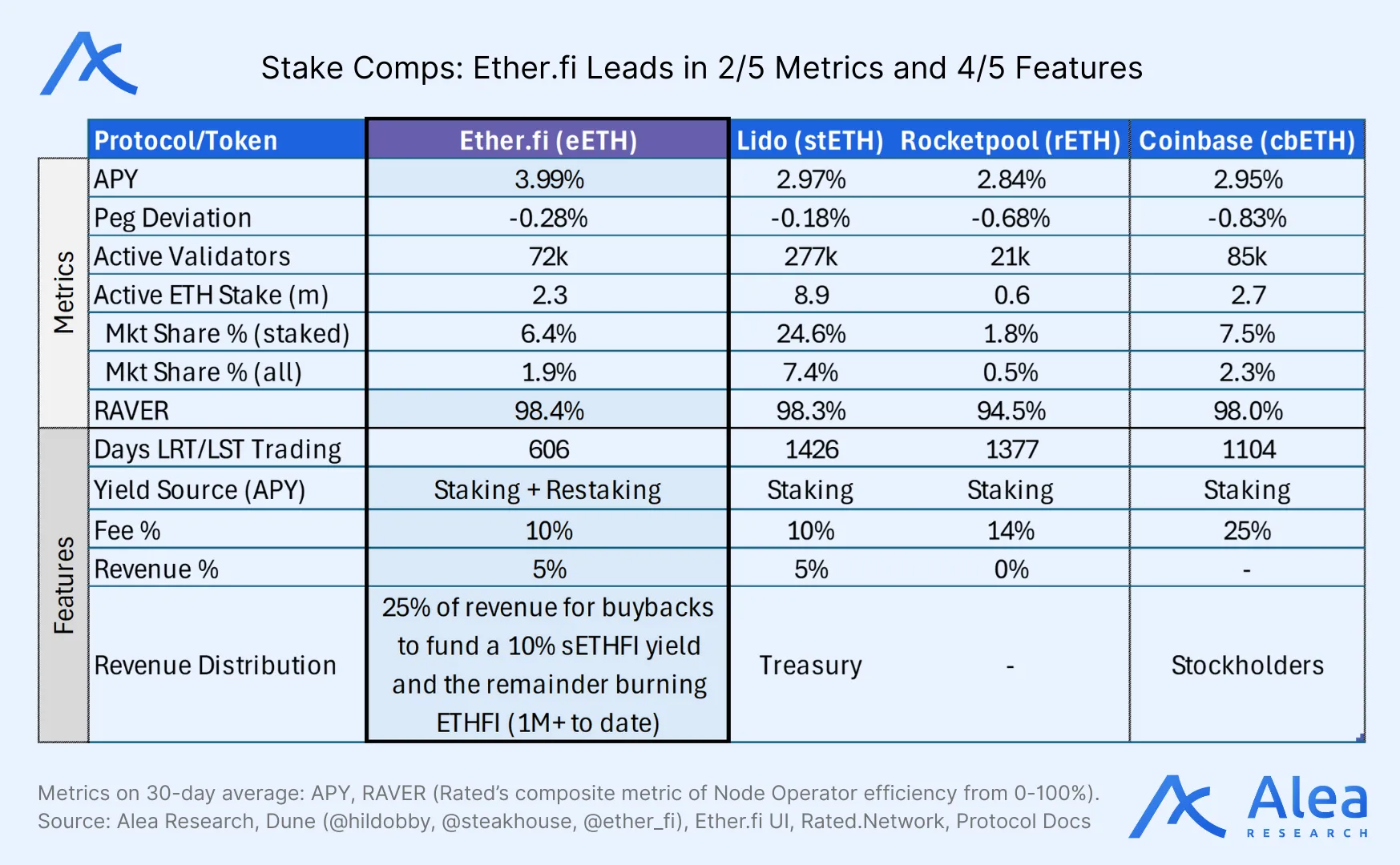

Ether.fi Stake (eETH) leads on APY at 3.99% (second-best is Lido at 2.97%) and on validator efficiency with a 98.4% RAVER score (second-best is Lido at 98.3%). The protocol runs 72k validators, far fewer than Lido’s 277k, and holds 6.4% of staked ETH versus Lido’s 24.6%.

Unlike other staking peers, Ether.fi has an attractive revenue design for token holders: 10-25% of revenue go to ETHFI buybacks, funding a hybrid model where a portion is distributed to target a 10% APY for stakers and the remainder is burned). Ether.fi, therefore, couples category-leading yields and operator efficiency with direct value capture through buybacks and burns, positioning it as the only protocol in the set with structural tokenholder upside.

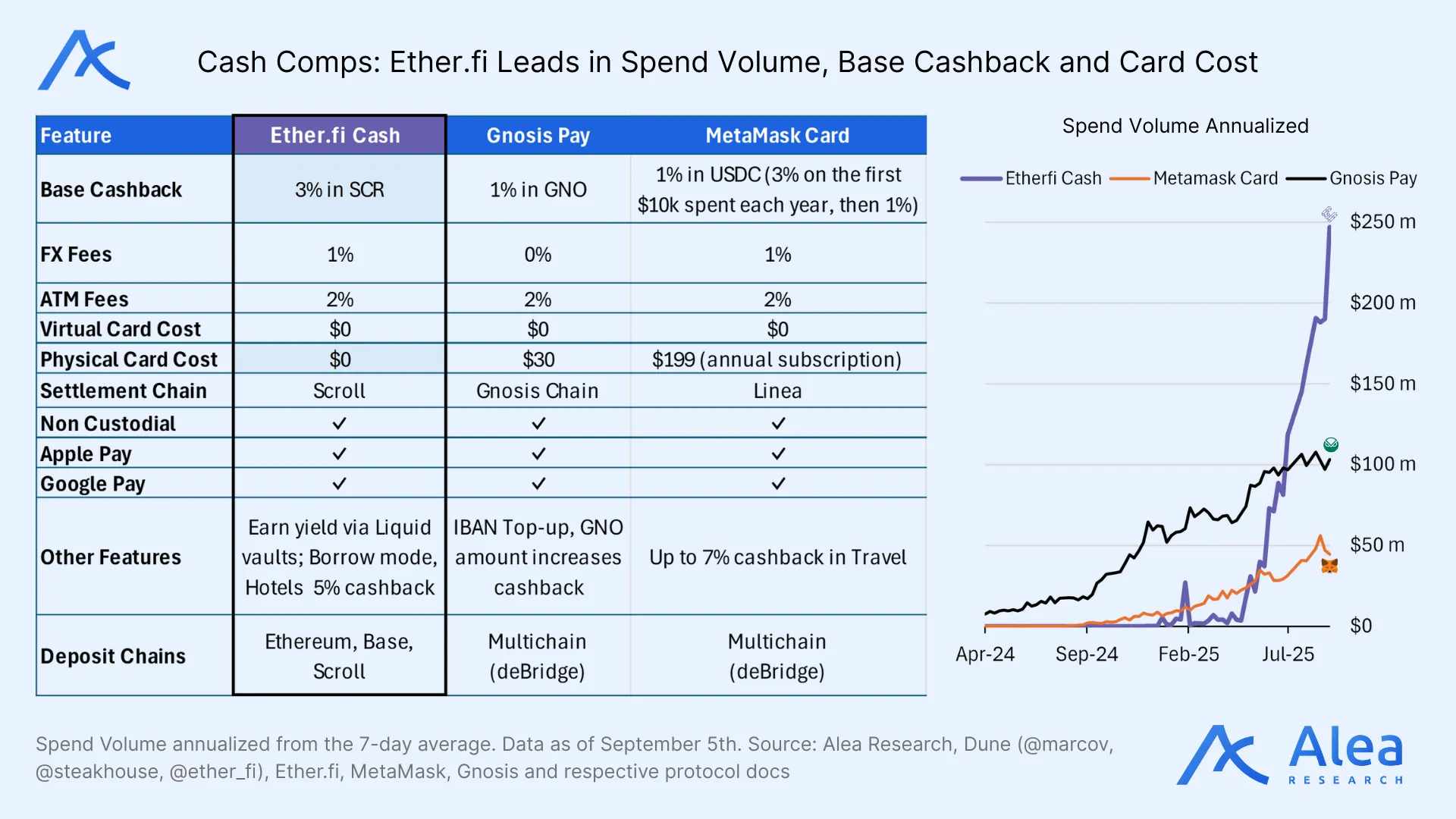

Recently launched (and continuously being rolled across an expanding set of regions), Ether.fi Cash has taken the lead in the DeFi card market, leading versus peers on spend volume (~$247M annualized vs. $103M Gnosis Pay and $44M MetaMask Card as of September 5th), cashback (3% in SCR vs. 1% in GNO or Metamask’s USDC), and cost (no annual or issuance fees, while Gnosis charges $30 and MetaMask $199). For apples-to-apples comparison, the table only includes leading non-custodial DeFi cards, excluding centralized or custodial offerings.

FX and ATM fees remain industry-standard (1% and 2%), but Ether.fi differentiates through added yield and borrowing features alongside Hotels cashbacks (5%). The zero-cost structure and higher base rewards explain Ether.fi’s faster adoption curve, while Gnosis maintains traction via multichain support and MetaMask leans on brand distribution. Unlike MetaMask, Ether.fi has a token, and its accelerating vertical platform signals growing revenue that turns into buybacks and value capture.

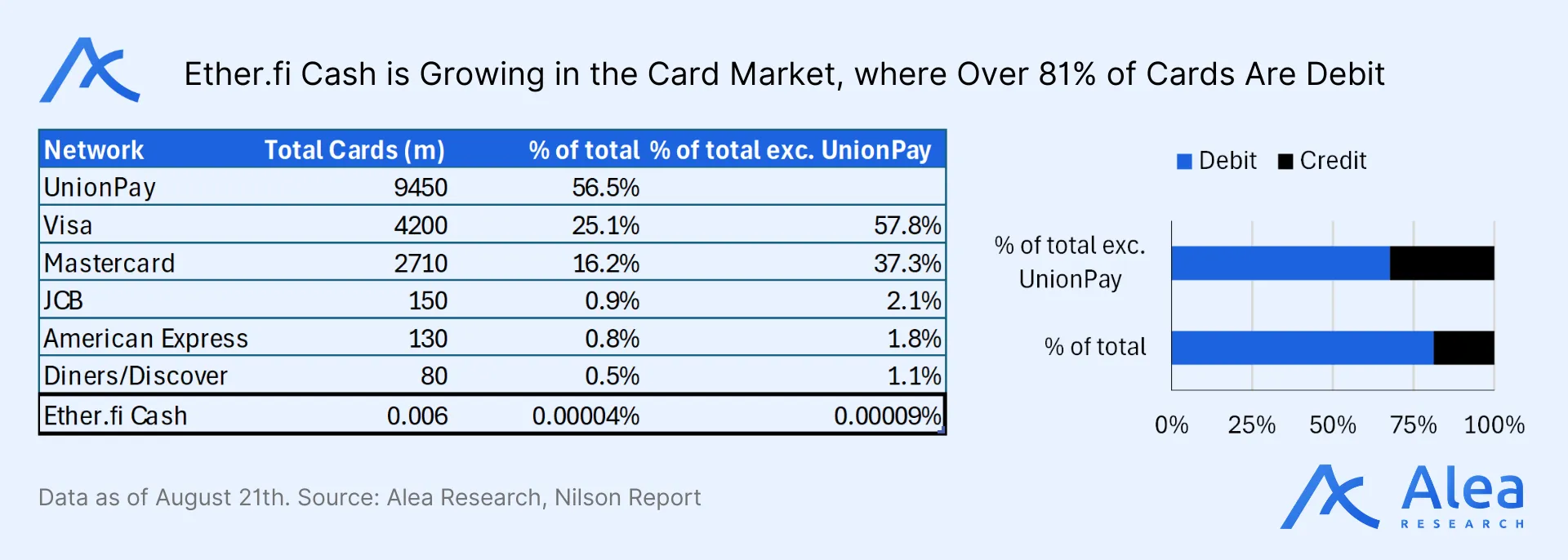

UnionPay (China’s state-owned payment network), Visa and Mastercard are the dominant players in the card game; over ~80% being debit. Within all cards, Ether.fi’s (Visa-based) penetration is still tiny at 0.00004% market share (large upside), but offers differentiation with a non-custodial design that also lets users spend and borrow against their portfolio.

With UnionPay included, the market is split 56.5/43.5 between UnionPay and everyone else. Excluding China, it’s an oligopoly: Visa 57.8% and Mastercard 37.3% control ~95% of cards; the rest is a long tail. Because Visa + Mastercard are ~95% of non‑UnionPay cards, aligning with either network gives near‑global acceptance.

Significant Updates

Eigenlayer Slashing Live

Since April 17th, EigenLayer AVSs can opt-in to onchain slashing. Operators delegating Ether.fi restake to AVSs face economic penalties per AVS rules; stakers are indirectly exposed via operator sets. This required no contract changes on Ether.fi’s end; risk simply moved from “theory” to “priced.”

Revenue/yield remained unchanged at activation; no TVL shocks either. Expected spreads may rise if AVSs pay for higher assurance as downside tail risk is introduced; stakers would benefit if AVSs pay for this premia.

Weekly Buybacks

Formalized in late April and implemented in May, Ether.fi added a weekly buyback on top of its monthly program. This amount comes from 100% of eETH withdrawal revenue (slow withdrawal yield forfeit + 0.3% fast-withdraw fee). Coming from users withdrawing, such a direct, recurring demand on ETHFI tied to real revenue improves the capital return profile for holders (cumulative >$5.6M repurchased; including both weekly/monthly buybacks).

Distribution Push

Cash’s U.S. Rollout: (card/spend + hotel bookings) added on/off-ramps and gathered ~$25M in deposits in month one.

- U.S. availability (Apr-24) for staking and the Cash card inside a consumer fintech‑style app.

- Hotels vertical live (May 30) with Entravel; 5% cashback when paying with Cash.

- Corporate cards available (Q2-Q3) with 2% base cashback, multi‑card issuance, and crypto‑collateralized “Borrow Mode.”

The Club Launched: Membership points and 3% cashback.

- “Summer Pump” event (Jul 23–Aug 9) allocated 2M ETHFI to new deposits.

- “Summer Mint” event (Aug 4-Aug 31) allocated 500k ETHFI (split 50/50 between new deposits into Liquid and spend on card purchases; only individual; business accounts excluded); promos through year-end.

Public Company Adoption (July31): Moss Genomics (CSE: MOSS/OTC: MSSGF; publicly listed biotech) moved its treasury (previously in Lido) to Ether.fi and announced it will be using Ether.fi’s corporate card for operations.

Institutional Collateral

More integrations and institutional demand for weETH supports TVL stickiness, indirectly supporting Ether.fi’s revenue base for sustaining ETHFI’s buyback capacity.

Compound on Unichain (2025-05-13): Compound deploys on Unichain live with weETH collateral for ETH borrowing.

Euler on Unichain (2025-06-03): Curators lift weETH’s borrow cap on strong demand, from 5k to 8k.

Spark on Optimism and Unichain (2025-06-04): weETH as supported asset on SparkLend.

Folks Finance (2025-06-09): weETH listed for Ethereum-Base crosschain lending/borrowing.

eETH on Avalanche (2025-06-11): weETH bridge via LayerZero.

Maple (2025‑06‑30): Over‑collateralized USDC loans vs weETH, minimum $5M, 2‑month terms; 2% ETHFI rebate on first $50M; the supply cap doubled two weeks later to $100M due to uptake.

Superstate USCC (2025‑07‑11): weETH accepted as fund collateral for USCC’s basis‑trade carry across BTC/ETH/SOL (staking included); Ether.fi adopts USCC for treasury.

Aave (2025-07-21): weETH supply caps increased on Base and Arbitrum. (2025-08-11): weETH supply caps increased on Linea.

Euler on Linea (2025-08-07): Market set includes weETH.

Product & Ecosystem Expansion

iOS App Live (2025-05-20); Ether.fi became available for >1.5b iPhone & iOS users, Android app is next on the roadmap.

One-click Crosschain Liquid Deposits (2025-07-29): Powered by Enso’s widget (built with LayerZero/Stargate) so users can fund Liquid vaults from “any chain or position” in a single transaction.

Hyperbeat Vault (2025-07-19): Ether.fi announced its expansion into the Hyperliquid ecosystem with preHYPE/beHYPE staking vaults (preHYPE for pre-deposits ahead of the full rollout) in collaboration with Hyperbeat; future fee streams and cross-protocol rewards (from Hyperbeat Hearts) can impact revenue.

Turtle Club (2025-08-20): The partnership gives every Turtle member instant access to the Luxe tier on the Ether.fi Card from day 1. This card will also be accessible via the Turtle Deals page for those who want to onboard through Turtle’s site.

Katana pre‑launch ETH vault (Q3): Liquid Katana ETH vault with a 14‑day pre‑deposit on Katana mainnet (assets auto‑deploy to Morpho strategies). 125k ETHFI + 5 bps of total KAT in rewards plus weETH yield; 30‑day post‑launch hold requirement for full eligibility.

Plasma’s ETH Partner (2025-08-29): Ether.fi partners with Plasma to deliver native ETH liquidity, yield strategies, and DeFi integrations at launch.

Roadmap

Hyperliquid (Ether.fi Trade): Leveraging Hyperliquid builder codes (similar to Phantom, which already generated ~$5m in rewards), Ether.fi will integrate both perpetuals and spot trading into the platform, moving another step closer to a full-fledged DeFi neobank.

Tokenized Stocks: support for trading and borrowing against them.

liquidHYPE and liquidSOL to be added to Liquid: covering the full suite of major crypto assets (BTC, ETH, USD, HYPE and SOL) that users hold.

ETH Digital Asset Treasuries (DATs): Ether.fi’s team is building relationships with DATs (Digital Asset Treasury companies), which can, and should, begin exploring yield opportunities for their idle assets to increase their value proposition.

Ether.fi Android App: by tapping into Android’s ~4b user base, Ether.fi will gain full mobile exposure.

IBAN/SWIFT Fiat Transfers for Ether.fi Cash: to enable a full banking experience, Ether.fi will enable fiat transfers.

Governance Hardening: Ether.fi plans to move from Snapshot to onchain voting via Agora, also supporting vote delegation.

Contract Ossification: Immutable contracts (no upgrade keys) and enshrining self-limiting (protocol hard cap at 25% of Ethereum validators) at the smart-contract level.

eBTC Yield Path: Babylon’s roadmap targets multi‑staking mainnet in Q4‑2025, unlocking broader BTC staking rewards.

Full roll-out of The Club loyalty program: KYC verification, annual membership tiers, and exclusive perks (e.g. premium support, lounge access).

Conclusion

Ether.fi’s arc runs from building and dominating restaking infrastructure to aggregating demand in a full‑stack consumer finance app where usage directly powers token demand via buybacks.

Ether.fi has significantly expanded its Financial metrics in Q3, now generating ~$61M in annualized revenue and ~$21m in recurring buybacks (Holder Revenue), with revenue increasingly diversified (Stake ~57%, Liquid and Cash ~43%). Metrics show strong product momentum: Cash active cards was up ~6x QoQ to 6.5k, Cash spend volume annualized expanded to $247m (+150% QoQ), TVL went up to $11B (+70% QoQ). While valuation multiples contracted, it leaves room for rerating; P/Revenue (FDV) sits at ~18x (-31% QoQ and -35% relative to the sector median), compressed as revenue accelerated since Q2. ETHFI is also one of the highest-beta plays on ETH at ~1.6, historically higher than LDO.

Expansion catalysts reinforce the growth moat. In Q2, Ether.fi shipped its iOS app (May 20), rolled out Cash in the U.S. with Hotels booking integration (May 30) and corporate cards, launched the Hyperbeat Liquid vault (July 19), and integrated as collateral with blue chip DeFi protocols (Maple, June 30; Superstate USCC, July 11). In parallel, 10-25% of protocol revenue was allocated to weekly buyback pressure. Ahead, the roadmap includes a Hyperliquid Trade product (perps and spot), tokenized stocks support, Android app, and fiat rails (IBAN/SWIFT), positioning Ether.fi to capture both DeFi-native and mainstream financial demand.

Altogether, Ether.fi exits Q3 2025 as a diversified, vertically integrated onchain bank: combining category-leading yields through Stake, market-leading card adoption and features via Cash, and sticky recurring users in Liquid.

References

Chaos Labs. Ether.fi Risk Overview.

CoinGecko. Ether.fi (ETHFI) Asset Page.

CryptoCardHub. Ether.Fi Cash Card.

DeFiLlama. Ether.fi Protocol Overview.

Dune. Dune Dashboards Portal (ether_fi).

Ether.fi. Governance Docs (GitBook).

Ether.fi. Official Links (Forum Thread).

Ether.fi. Token Transparency Framework Report (PDF).

Ether.fi Foundation. Medium Profile.

Token Terminal. Ether.fi Project Dashboard.

Disclosures

Alea Research is engaged in a commercial relationship with Ether.fi and receives compensation for research services. This report has been commissioned as part of this engagement.

Members of the Alea Research team, including analysts directly involved in this analysis, may hold positions in the tokens discussed.

This content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.