Introduction

DeFi offers plenty of yield opportunities, but few can underwrite them with confidence. Today’s onchain yield is a barbell: Liquid money markets and blue-chip fixed-income vaults that pay modest returns on one end; opaque, high-APR pools and structured products that stack protocol, smart-contract, and market risks that investors can’t price on the other. Users, funds, and treasuries want higher returns, but with risk visibility and predictable liquidity.

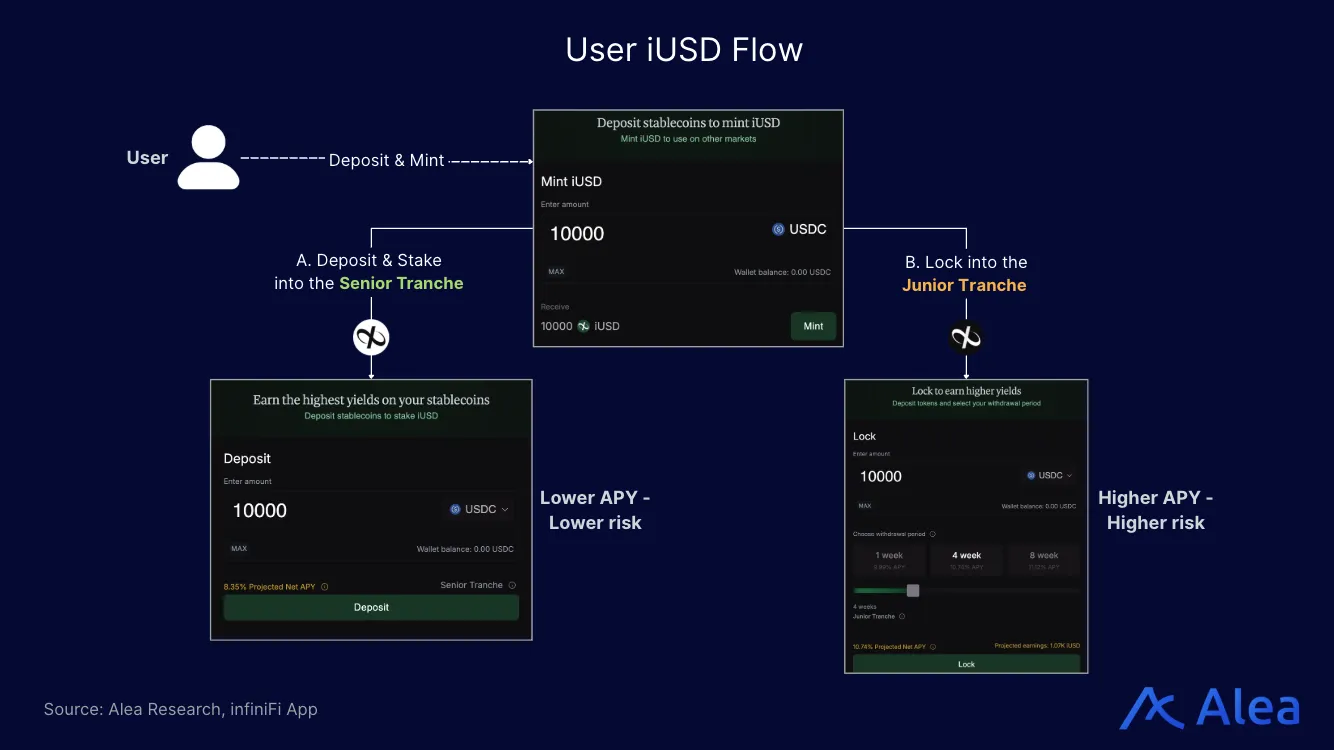

infiniFi targets that risk-and-liquidity transparency gap by making the duration and liquidity tradeoffs explicit. With an onchain fractional reserve that powers a structured stablecoin yield product, it issues iUSD as the base claim, then offers two yield tiers: a liquid senior tranche (siUSD) and a locked junior tranche (liUSD).

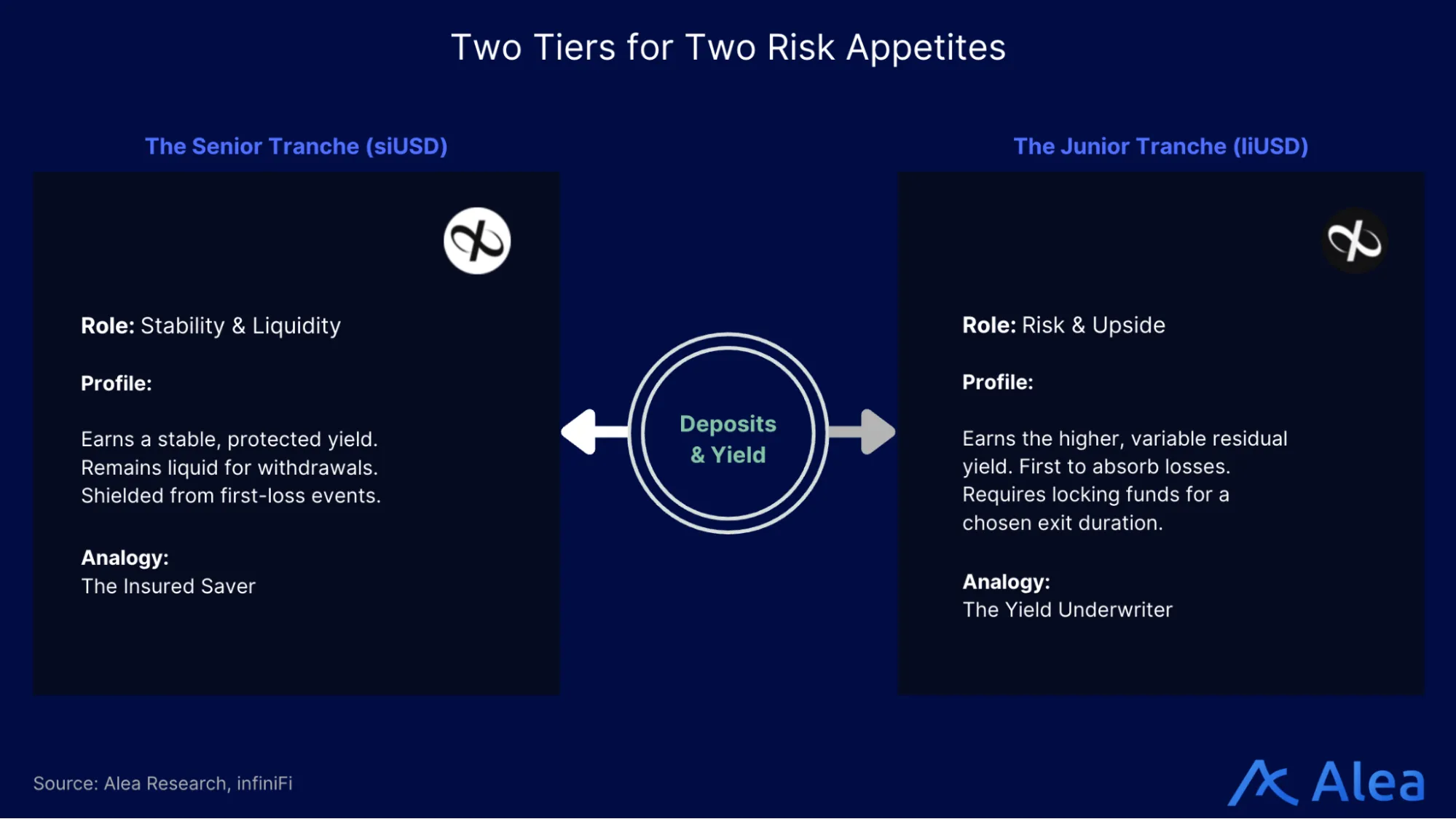

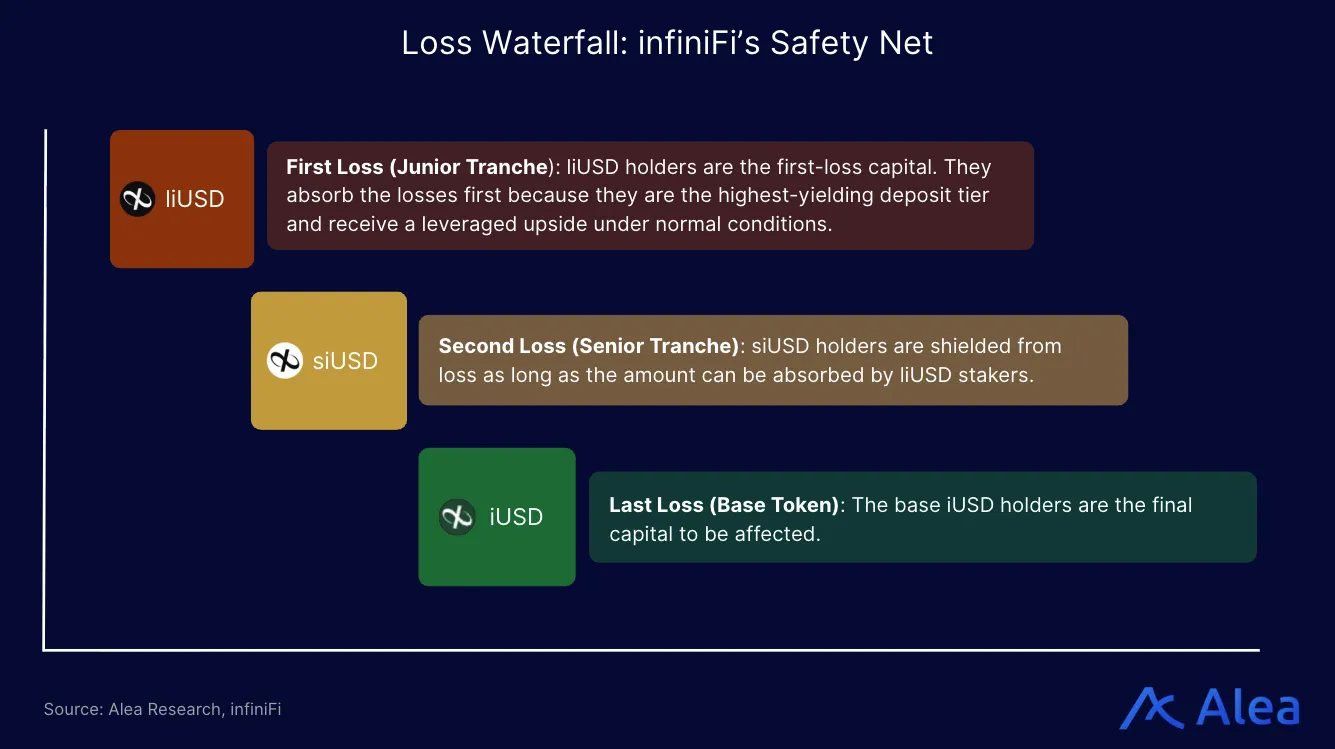

siUSD offers liquid, above-base yield from a curated mix of blue-chip DeFi and RWA strategies. liUSD locks capital and absorbs more duration and strategy risk in exchange for a higher rate. Together, the two tranches create a positive-sum setup: junior capital and lockups let the protocol run higher-yield positions without forced selling, while senior depositors keep liquidity and earn more than a standalone money-market. Losses follow a clear waterfall (liUSD, then siUSD, then iUSD), so depositors choose their position instead of sharing one blended pool.

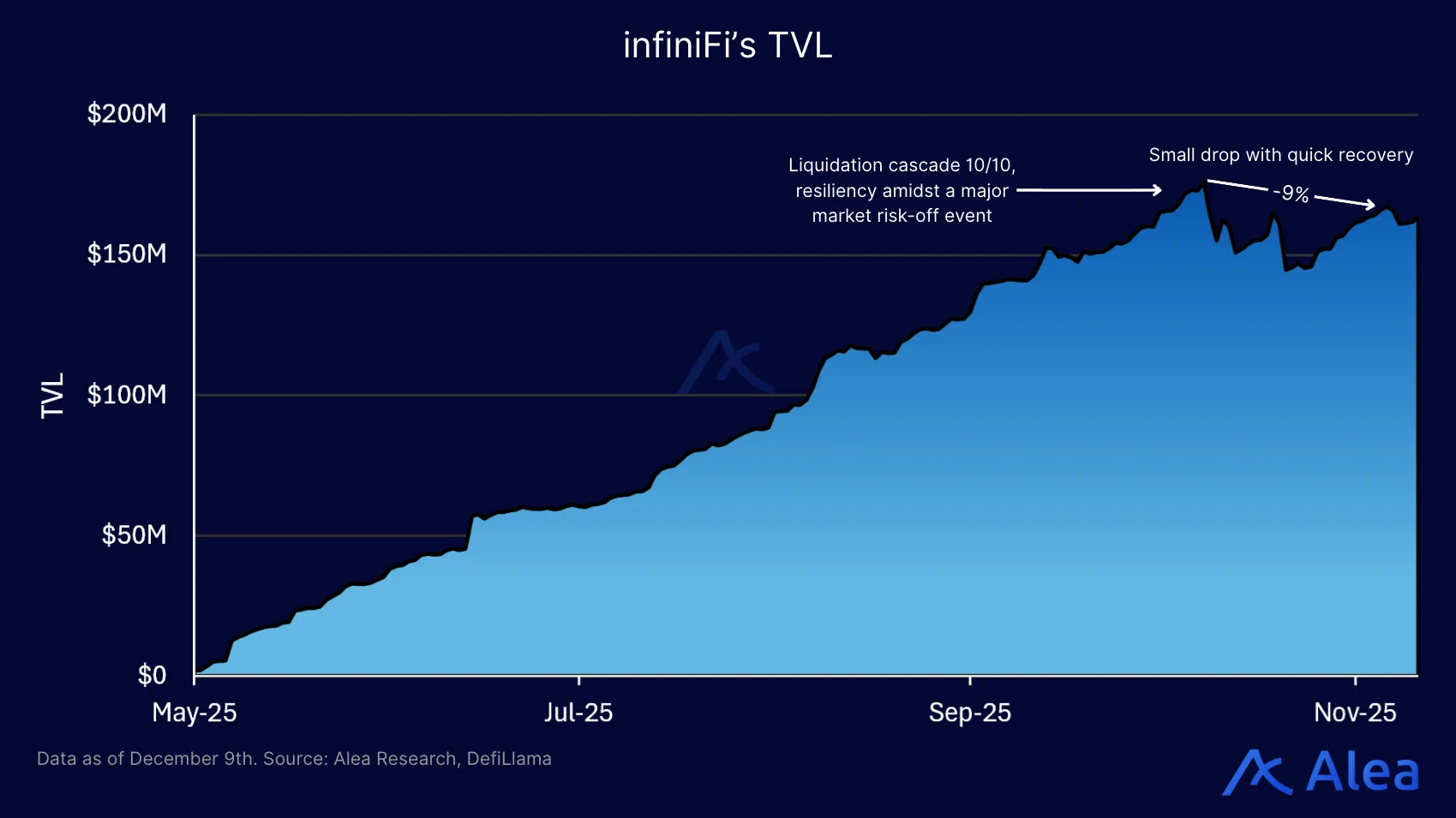

Architecturally, infiniFi acts as a yield transformation layer that sits on top of existing protocols such as Aave, Morpho, Pendle, Ethena, and RWA platforms. Rather than forcing users to understand the mechanics or risk profile of each vault, a stablecoin-like product provides a unified view of risk/reward tiers and a transparency dashboard. Launched before summer 2025, infiniFi reached an all-time high of ~$175M in TVL in November and has secured several notable integrations (Ethena, Pendle).

For allocators who prioritize liquidity, simple exits, and lower exposure to strategy losses, siUSD is the default way to earn stablecoin yield above baseline money market rates. For allocators who can lock capital and accept junior positioning in exchange for a higher risk premium, liUSD is the risk-bearing layer that takes first losses and earns the residual. The two-tier structure replaces one-size-fits-all stablecoin yield with a clear choice: liquidity and protection in siUSD, or underwriting risk and higher upside in liUSD.

Key Takeaways

- Yield without hidden risk: infiniFi offers opportunities for greater stablecoin yield to depositors by combining liquid and locked deposits while keeping the risk split transparent.

- Duration is explicit, not assumed: Users choose their liquidity needs through lock timers, giving the protocol real forward-looking data instead of relying on assumptions.

- Safety comes from structure: Unlike TradFi’s opaque fractional reserve model, a loss waterfall, reserve buffers, and onchain proof of reserves protect depositors and avoid the opaque risk buildup seen in TradFi/CeFi.

- Curation is the real edge: infiniFi declines high-risk yield sources and relies on vetted strategies, which kept it out of the recent security incidents.

- A platform for term and RWA yields: infiniFi can hold assets to maturity and integrate RWAs whose redemption cycles don’t fit standard DeFi, creating new fixed-income products onchain.

Market Context

Most financial blow-ups—whether in TradFi or DeFi—come back to the same triangle: yield, liquidity, and solvency—you can’t maximize all three at once.

This is how banks operate: they run a fractional reserve system, keeping some deposits liquid and investing the rest in longer-dated, higher-yielding assets, assuming depositors will not all demand cash at the same time. That mismatch funds credit growth, but also creates a duration gap: depositors can withdraw money on demand, while banks can’t sell long-duration assets quickly without taking losses.

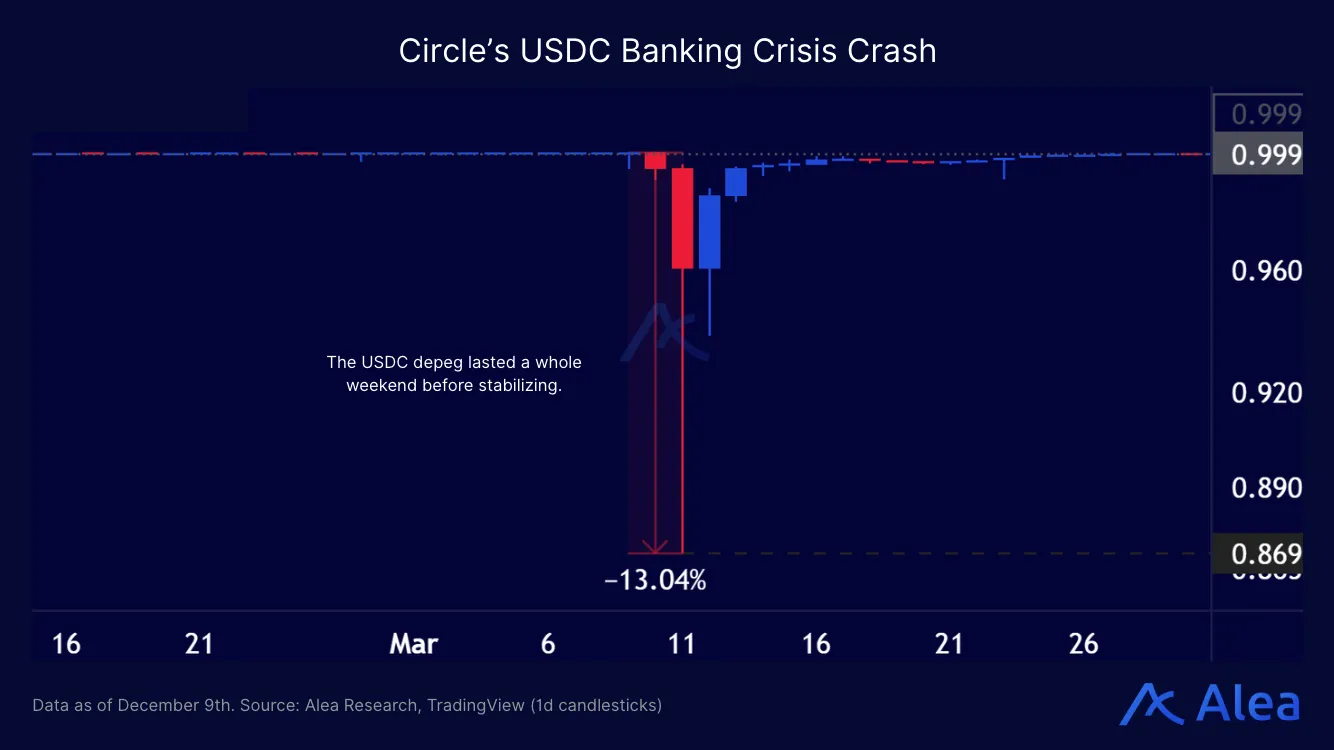

While this optimizes for capital efficiency, the consequence is that misreading outflows can trigger forced exits. When withdrawal behavior is misread, confidence breaks, people run to withdraw their funds, and black swans occur; the same structure that boosts returns becomes the source of bank runs. The most recent textbook case of this was the 2023 banking crisis, where unrealized bond losses became realized the instant depositors demanded their funds back.

DeFi tried to avoid this problem by overcollateralizing loans and making positions visible onchain. Money markets like Aave usually require borrowers to post more collateral than they borrow, which limits classic undercollateralized credit risk. But DeFi has rebuilt a similar mismatch through rehypothecation, yield stacking, and offchain counterparties.

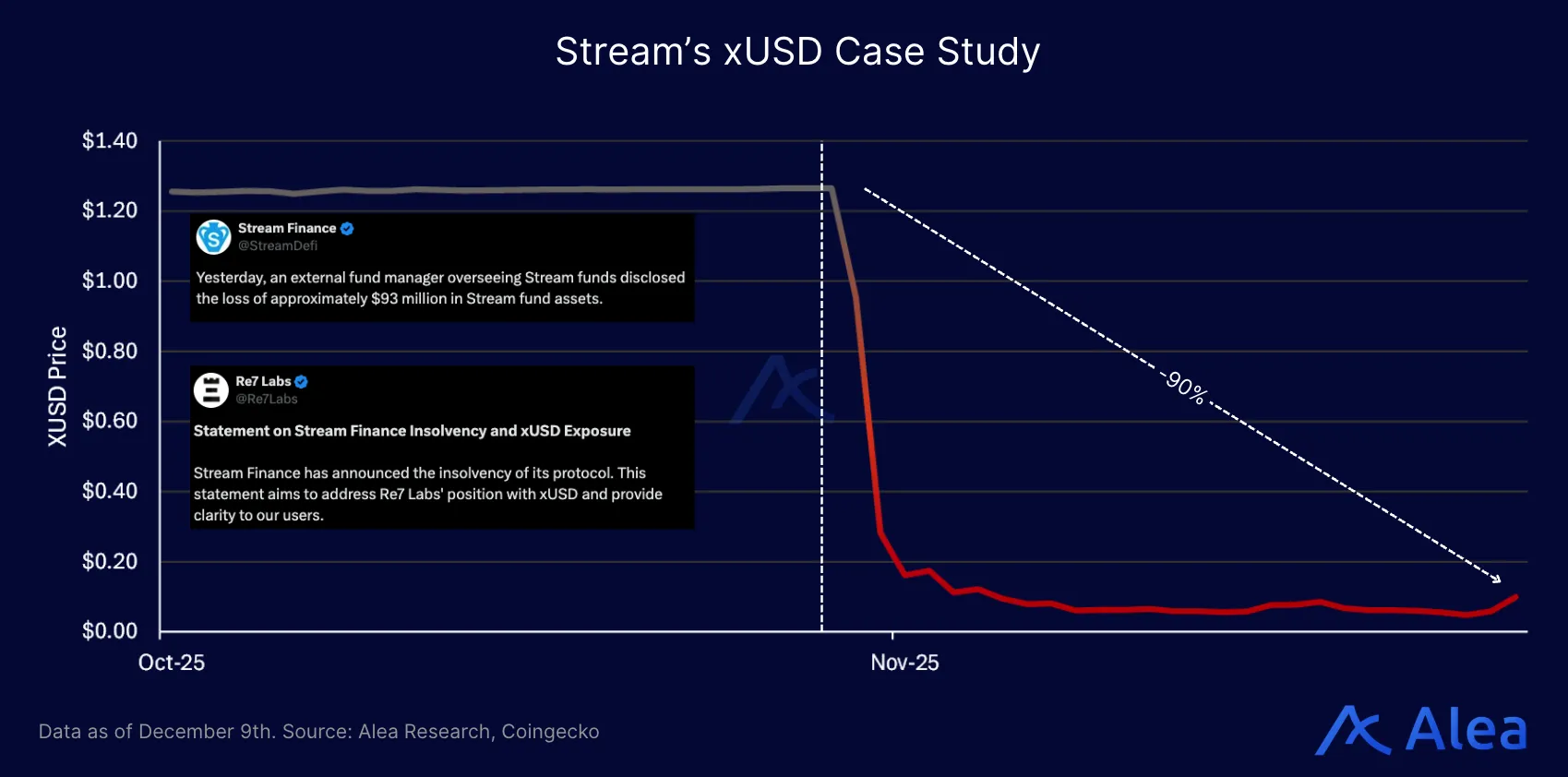

Stream’s xUSD used recursive leverage (repeated borrow-and-redeposit loops that boost both yield and liquidation risk) to turn about $170M of deposits into more than $500M of deployed positions, much of it run by an external fund manager. After the team disclosed a $93M loss and paused redemptions, the peg broke, liquidity disappeared, and xUSD fell more than 70% in a day.

The contagion into Elixir’s deUSD exposed how many yield products sit on long, hard-to-see counterparty chains. deUSD reportedly held about 65% of its reserves as loans to Stream through private Morpho vaults. When xUSD failed, deUSD lost 98% of its value due to the exposure, and the team later halted redemptions. The fallout affected many counterparties, and the total exposure remains unclear.

infiniFi tries to avoid that setup by screening and whitelisting strategies up front (including explicitly avoiding Stream/Elixir-style rehypothecation risk), then making liquidity and loss-bearing visible in the product itself.

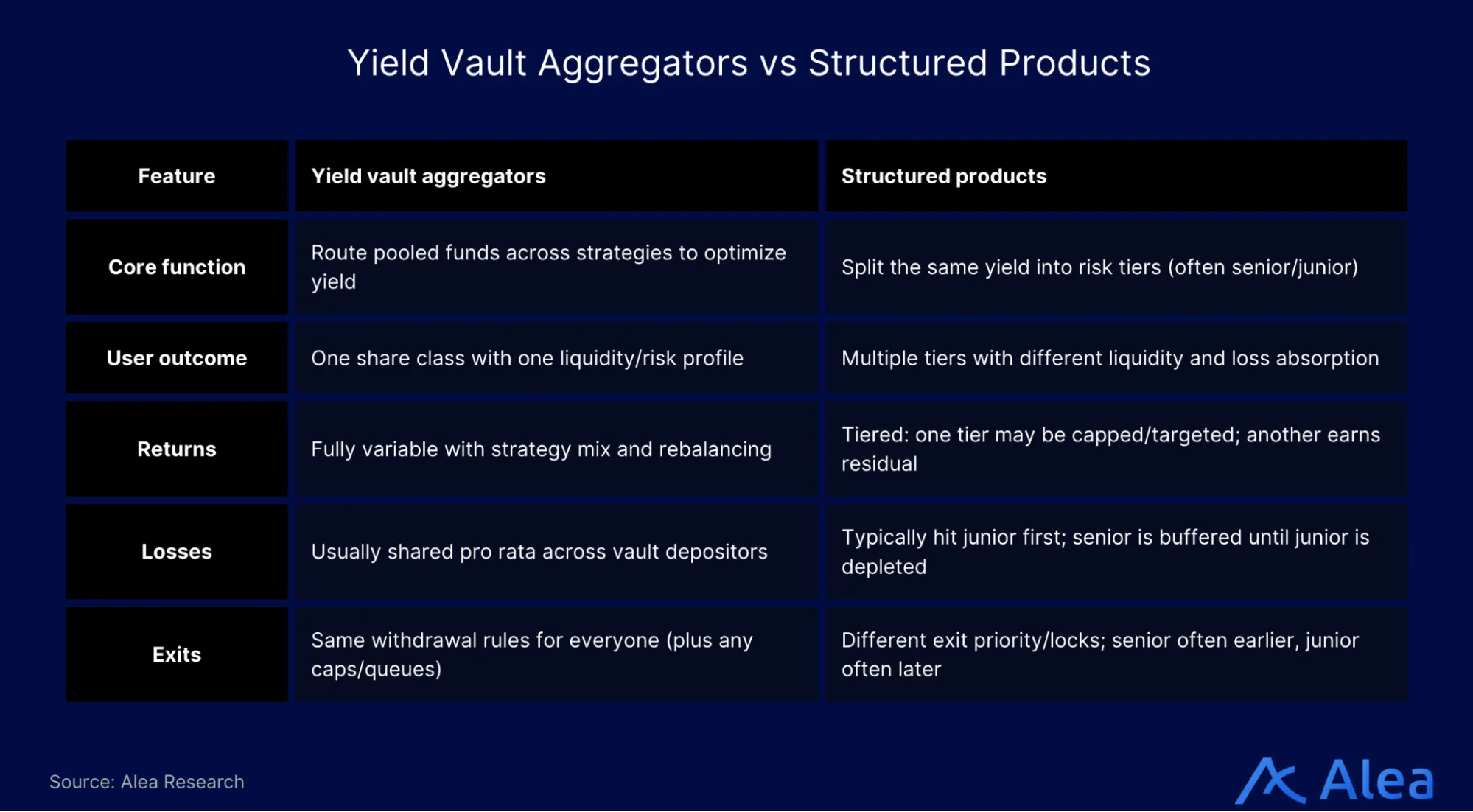

Structured products have started to outgrow simple vault aggregators. Aggregators mostly move funds across protocols and pools. Because there’s no tranching and the duration gap persists, every depositor ends up with the same liquidity and loss profile.

Structured products do the opposite: they cut the same cash flows into explicit tranches. Senior depositors take a lower rate in return for better liquidity and protection from first losses. Junior depositors take those first losses—and the upside—by running leveraged exposure to the same underlying strategies. This structure can put more capital to work than a one-size-fits-all lending pool and makes the risk handoff explicit rather than hidden.

infiniFi applies the structured model to stablecoin yield. It aggregates DeFi and RWA strategies behind a deposit and duration layer that keeps liquidity and risk rules visible. It serves users who want more than money-market rates but won’t accept products that hide risk in counterparty chains.

In a market that has experienced numerous blowups driven by hidden maturity and counterparty risks, the question is no longer whether DeFi will offer structured products, but which designs make the trade-offs explicit enough for institutions and treasuries to trust.

infiniFi’s Risk & Yield Tranching

infiniFi uses risk tranching to divide deposits into distinct tiers, managing risk, liquidity, and yield for different users. This two-tier system separates depositors into senior and junior tranches, mirroring the distinction between fixed-term and demand deposits in TradFi. Users can deposit USDC and mint iUSD, a 1:1 receipt token that represents a claim on the protocol’s reserves. Or they can skip minting and deposit stablecoins (USDC, USDT, USDe, sUSDe) directly into the senior tranche for staking.

iUSD is the base liability and redemption unit: it backs the tranches and is what users ultimately redeem into USDC. From there, depositors can stay in base iUSD or opt into two structured layers:

| Token | Role in Capital Stack | Liquidity / Access | Risk Position (Loss Waterfall) | Yield Profile / Use Case |

| siUSD | Senior, staked iUSD (liquid tranche) | Liquid under normal conditions; exit via redemptions/markets. | Losses after liUSD, before iUSD. | Boosted yield over money markets for users wanting a liquid, lower-risk yield. |

| liUSD | Junior, locked iUSD (illiquid tranche) | Locked for set periods (13 weeks max); exits via scheduled unlocks. | First to absorb strategy and reserve losses. | Highest expected yield for users targeting concentrated, higher-risk stablecoin yield. |

Any potential losses follow a core waterfall principle: any shortfall is absorbed by liUSD first, then by siUSD, and lastly by base iUSD. That tranching lets depositors choose their tranche and risk-reward profile, instead of sharing opaque blended risk.

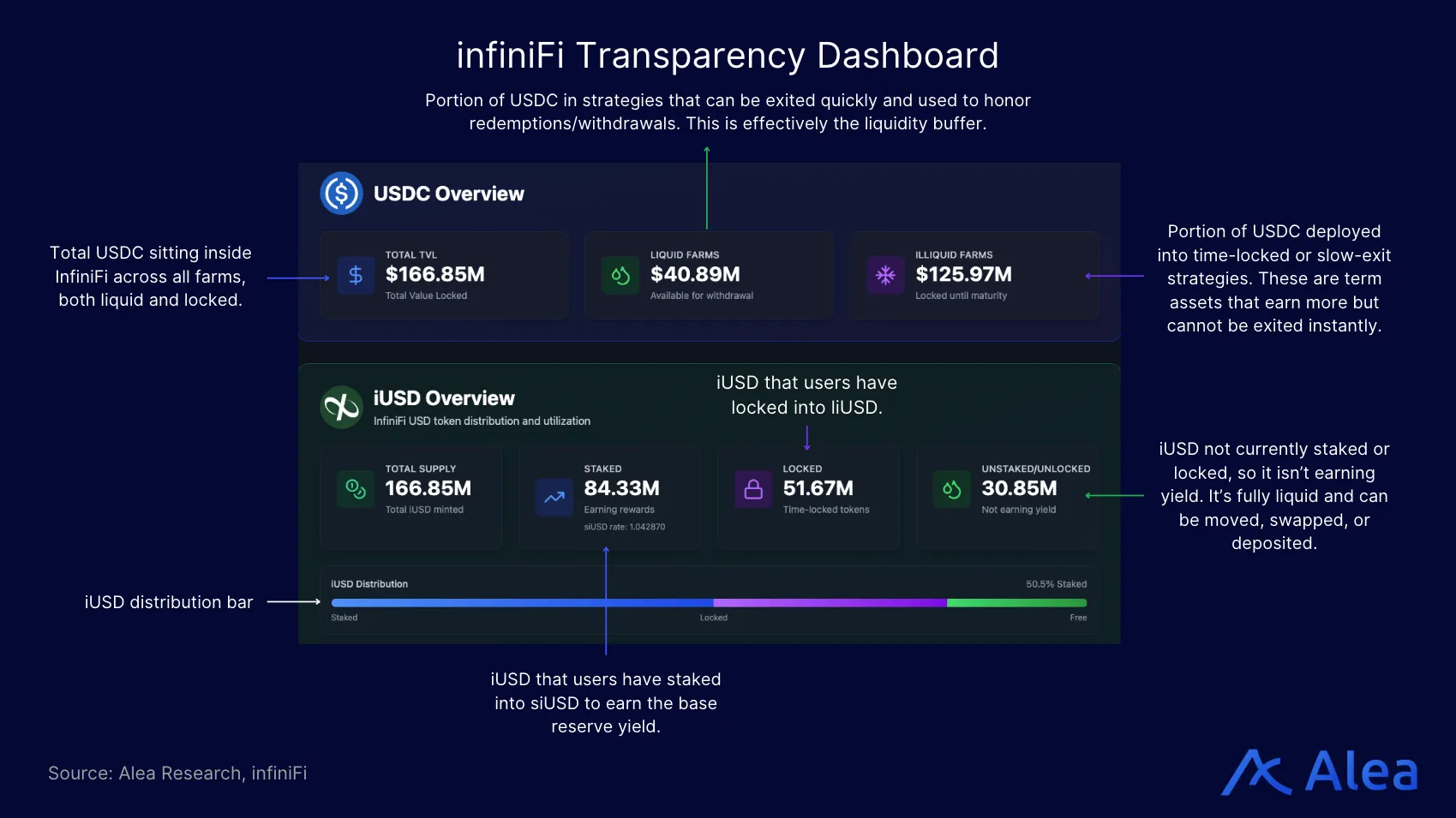

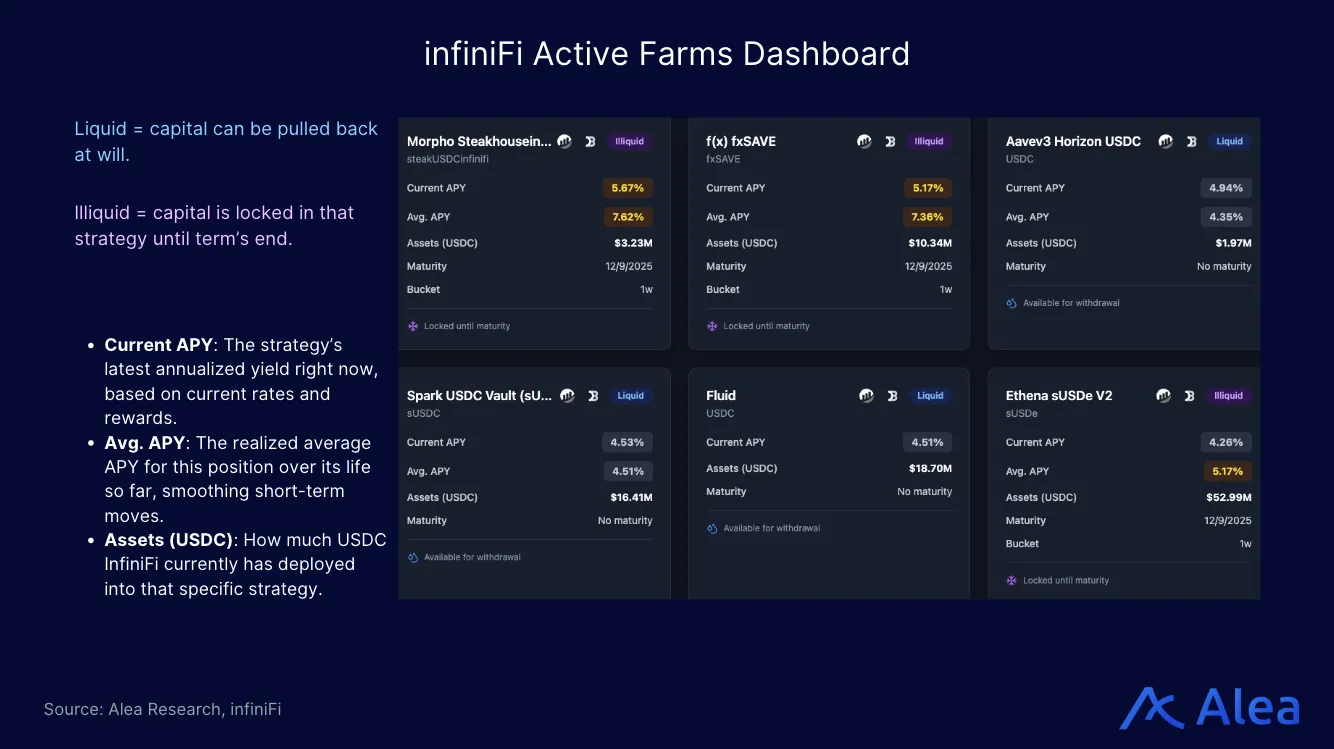

In the background, deposits form a shared reserve that infiniFi deploys into a mix of liquid and longer-dated strategies. A fixed share of reserves (dynamically set) must remain in liquid venues and explicit buffers to ensure redemptions can be met without forced selling. The rest can move into less liquid or longer-maturity pools such as fixed-term DeFi credit or RWA strategies, subject to per-strategy caps and limits. The reserve ratio is dynamic and adjusts with market conditions to balance liquidity and caution; it can be temporarily raised in stress events to protect orderly exits.

The result is an onchain borrow-short, lend-long profile applied to quality assets and strategies—liabilities redeemable on short notice, backed by a portfolio split between instant liquidity and yield‑seeking positions, all visible onchain.

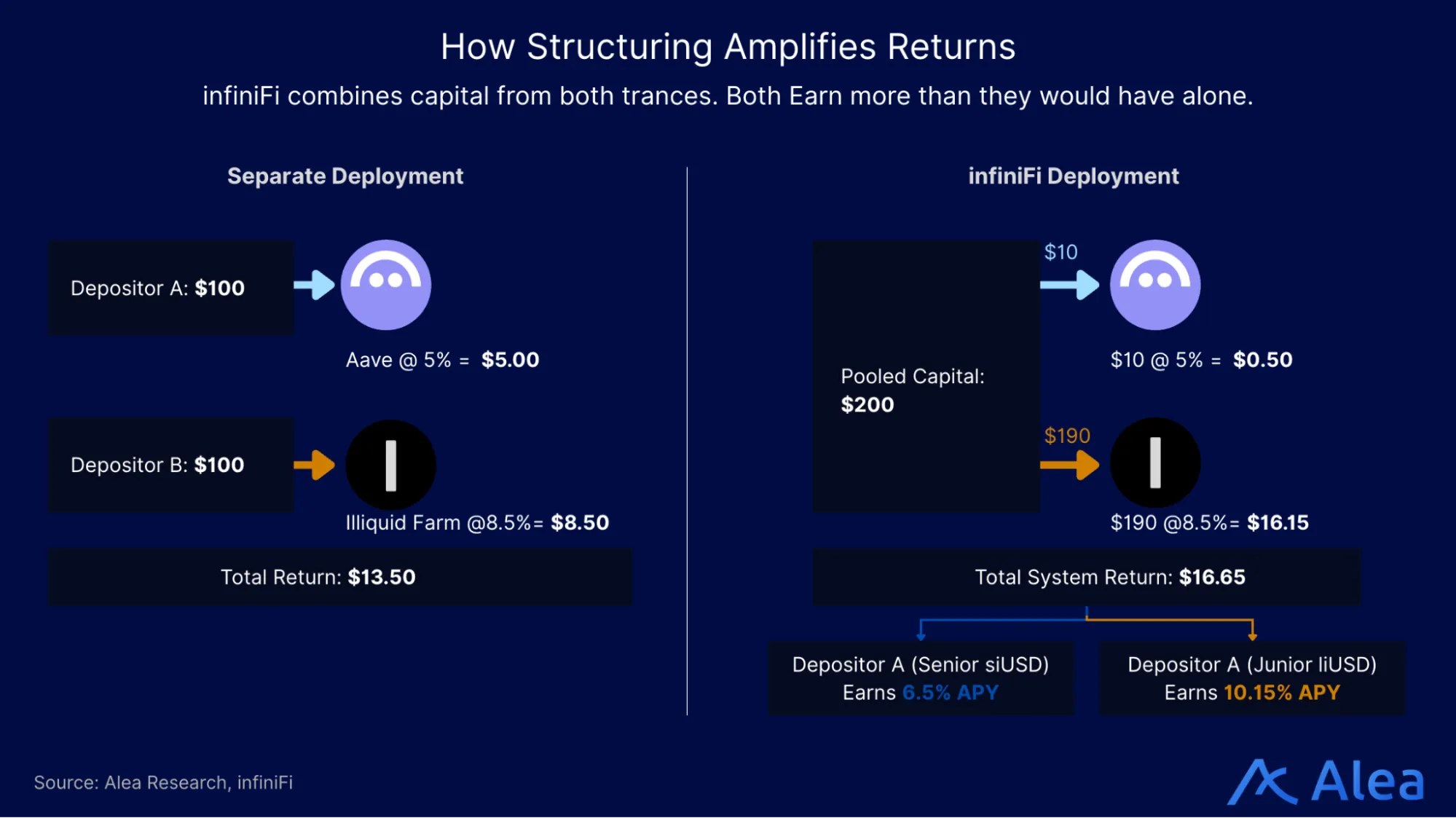

infiniFi earns yield from its mixed portfolio. Liquid money markets pay the base rate; longer-dated or more complex strategies pay more. siUSD holders earn more than a plain money-market rate because the reserve also holds higher-yield positions, and junior capital sits beneath them. liUSD holders earn even more because they lock up capital and take first-loss risk.

Redemptions follow two modes: normal and stress. In normal conditions, infiniFi pays redemptions from a liquid reserve held in money markets and buffers. iUSD holders redeem against that reserve and always get paid almost instantly, so a queue may exist but rarely appears in practice. siUSD holders can unstake to iUSD and redeem the same way, or swap in DEX pools. liUSD stays locked: you start an exit timer, keep earning during the notice period, and convert to iUSD at expiry, then redeem against the same liquid reserve.

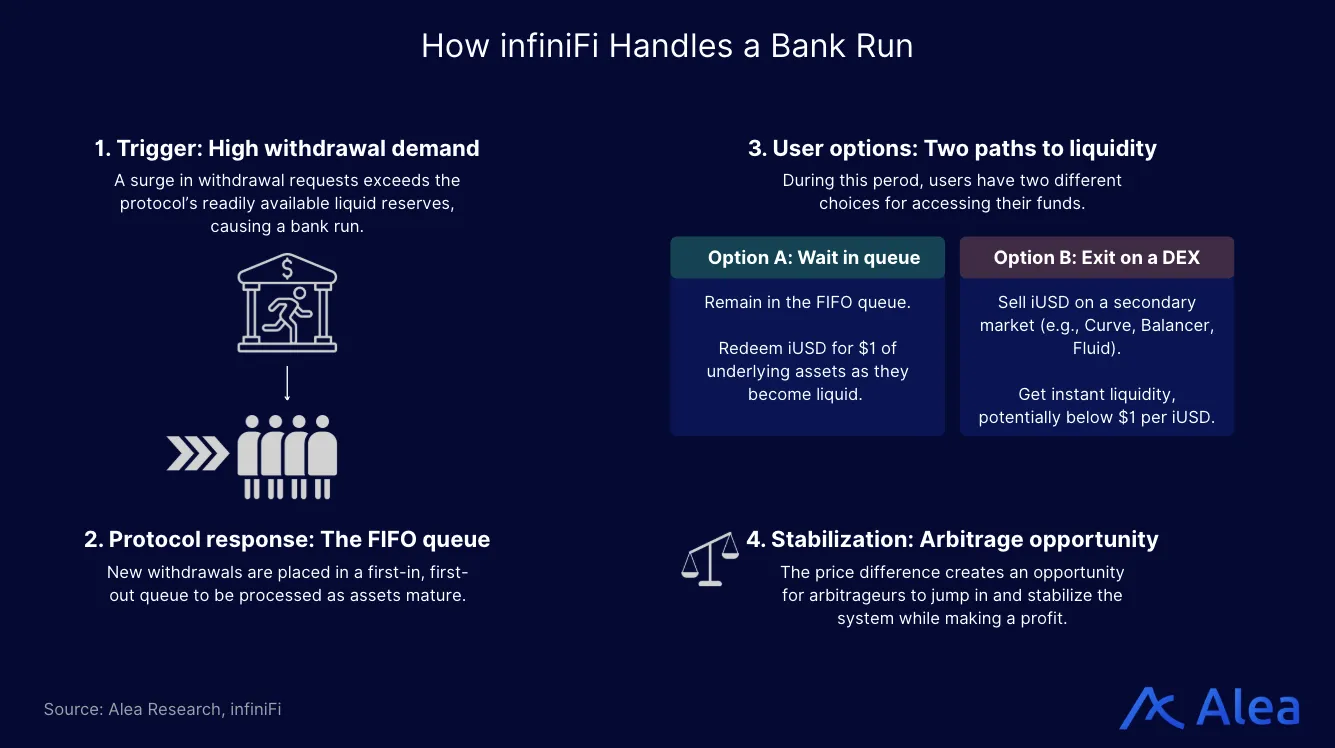

In a bank-run scenario, when iUSD and siUSD holders try to withdraw fast and in size, infiniFi shifts to a managed exit. It pays out from liquid buffers and the easiest positions first. Once liquidity falls past a set threshold, the protocol stops paying on demand and puts new withdrawals into a first-in, first-out (FIFO) queue. At this point redemptions are slowed, not gated. That lets it avoid dumping long-duration positions at bad prices.

During this period, DEX pools still offer another way out: some users may accept a discount (<$1) to exit instantly. Arbitrageurs and longer-horizon buyers can buy at that price, which helps shorten the queue over time. The protocol clears the queue as yield comes in, strategies mature, or it unwinds positions in controlled sizes. If it realizes losses, it applies the loss waterfall. As long as there is no bank run caused by an underlying loss, the protocol will hold assets to maturity and avoid selling at bad prices, with exceptions made only for explicit security or risk-related reasons.

In a bank run, infiniFi routes withdrawals through a transparent FIFO queue and a visible asset mix, rather than halting withdrawals or relying on opaque processes.

Risk Curation Process

infiniFi treats strategy selection like underwriting. It approves yield sources only when it can measure the risks, size the exposure, and exit within defined limits. The protocol doesn’t win by finding the highest-yielding opportunities. It wins by refusing the bad kind.

The work starts with internal underwriting, is checked by an external risk validator, and is ultimately overseen by an independent Risk Council with influence on important decisions. Some members of the risk council include Steakhouse Financial, Dialectic, CipherChain Capital, and DAMM Capital. Internal underwriting evaluates each candidate across these key areas:

- Credit & Counterparty Risk

- Redemption & Exit Liquidity

- Yield Sustainability & Dilution Risk

- Liquidity & Allocation Constraints

- Security Assurance

- Governance & Upgradeability

To proceed to scoring, all assets must meet specific quantitative and operational criteria:

| Criterion | Baseline requirement |

| Market capitalization | ~ $100M (fully diluted or circulating) |

| Core contract age | ≥ 1 month |

| Collateralization | Fully collateralized; no historical defaults |

| Security standards | ≥ 2 audits completed; no unresolved critical vulnerabilities |

| TVL stability | Demonstrated TVL consistency (“TVL × Days” analysis) |

Qualitative rules then cut tail risk: no algorithmic stablecoins; favor delta-neutral exposures and open, readable code (plus proof-of-reserves when backing sits offchain). The framework also limits rehypothecation or self-backing (exclude if >5%), over-composed products unless each sub-asset clears diligence or carries full insurance, and fast-changing compositions that the protocol cannot exit within a week. infiniFi will not use balance-sheet leverage; if it ever touches high-LTV looping exposures, it caps and monitors them tightly.

It then applies liquidity standards. Liquid positions must redeem instantly at the deployed size and redeem 1:1 into USDC with zero slippage, with no floating price. Illiquid positions must model slippage (often via escrow buffers), report NAV on a predictable schedule, and stay within the protocol’s longest lock duration.

If a strategy passes this rigorous review, infiniFi builds a dedicated smart-contract adapter for it. Each adapter can only deposit, withdraw, and harvest for that specific pool. Adapter and core contracts undergo audits and formal checks, and only then is the strategy added to the onchain farm registry as whitelisted.

Post-deployment, infiniFi keeps the same risk lens: continuous monitoring, scheduled reviews, and event-driven reassessments (for example, around exploits/upgrades, material TVL drawdowns, or major governance changes), with regular reporting on portfolio composition, exposures/redemptions, and yield attribution.

The Stream xUSD and Elixir deUSD blowups show why this framework matters. Both products piled recursive leverage on top of lending markets, relied on offchain fund managers and private credit deals, and propped up their pegs with confidence instead of direct onchain redemptions. When fund losses surfaced and the supporting structure failed, the system cascaded through multiple counterparties.

From infiniFi’s perspective, the red flags were obvious: leveraged loops instead of organic yield, unrealistic yield claims, hidden counterparty chains, and weak peg mechanics. infiniFi declined any exposure to Stream-linked strategies despite their attractive yields, keeping its reserve entirely unaffected by the xUSD/deUSD risk chain.

infiniFi takes a different approach than past DeFi and CeFi failures, where users later learned that the yields were made up from excessive leverage and poor risk management. Positioning itself as a risk curator rather than a yield-maximizing aggregator, the moat lies as much in what it refuses to touch—leveraged loops and system-wide risk—as from what strategies it includes. That discipline is what its depositors are effectively buying.

Where do RWAs Fit In?

RWAs are built around fixed maturities and schedules. Credit funds, bond vaults, and T-bill ladders lock capital for set maturities, then pay coupons and principal on preset dates. Most DeFi vaults hide that timing. They pool RWA exposure, promise anytime exits as long as inflows outweigh outflows, and only face the maturity profile when withdrawals surge. Many also skip a public maturity ladder and a clear reserve ratio that tells depositors how much they can redeem today without selling long-dated assets.

infiniFi can host RWAs without changing its model. On the asset side, a tokenized credit fund, bond vault, or treasury ladder becomes an adapter-based strategy in the illiquid tranche, alongside positions like Pendle PTs. Each RWA adapter comes with a fixed liquidity schedule (coupon dates, redemption windows, lockups) and a clear risk profile (credit quality, jurisdiction, concentration).

On the liability side, the fractional-reserve and tranching framework remains unchanged: a defined share of reserves is held in liquid strategies and buffers to support iUSD and siUSD exits, while the RWA illiquid part runs for longer durations within caps.

Structurally, an RWA strategy looks like any other illiquid strategy on infiniFi:

- Adapter & whitelist: The risk council and governance add an RWA vault (e.g., a tokenized private credit fund or T-bill product) to the farm registry after diligence on code, NAV methodology, legal wrapper, and custodial setup. Only vetted strategies are whitelisted.

- Caps and concentration limits: Governance sets per-issuer and per-strategy caps (e.g., max 15–20% of TVL per RWA issuer, tighter limits for single-name credit). This keeps one potential incident from spreading across the entire pool.

- Duration-aware deployment: The allocator module maps the distribution of liUSD exit timers (1–13 weeks today) to asset durations. Quarterly RWA products can be funded primarily from longer exit-timer buckets, plus a small slice of iUSD/siUSD that the protocol is willing to lock (since only ~75% of liquid capital is ever deployed into term assets).

- Reserves and buffers: A target share of TVL (e.g., matching siUSD share plus a safety buffer) remains in highly liquid farms (Aave/Morpho, etc.) so that normal iUSD/siUSD redemptions clear without touching RWA positions except at scheduled maturities.

infiniFi’s capacity to support RWAs translates to actual use cases. RWA issuers can integrate their products into infiniFi as both a funding and distribution channel. Their tokenized credit or bond vault becomes an adapter in the illiquid tranche with clear rules and parameters. For issuers to treat infiniFi as a reliable funding line, the protocol needs enough scale, governance strength, and legal structure.

Allocators can hold iUSD, siUSD, or liUSD instead of buying individual RWA tokens. That lets them get curated, diversified exposure to a basket of RWA strategies without picking issuers and vaults one by one. In exchange, they rely on infiniFi’s risk process, reporting, and track record. They outsource due diligence instead of underwriting each vault themselves.

For treasuries, siUSD can sit between cash and direct RWA vault exposure. They hold a stablecoin-like asset that earns yield partly from RWA strategies, with protection from buffers, liquidity limits, and junior capital beneath them. The blockers are mostly internal: many mandates limit tranche-based products, and accounting teams may also hesitate to treat siUSD or liUSD as cash equivalents.

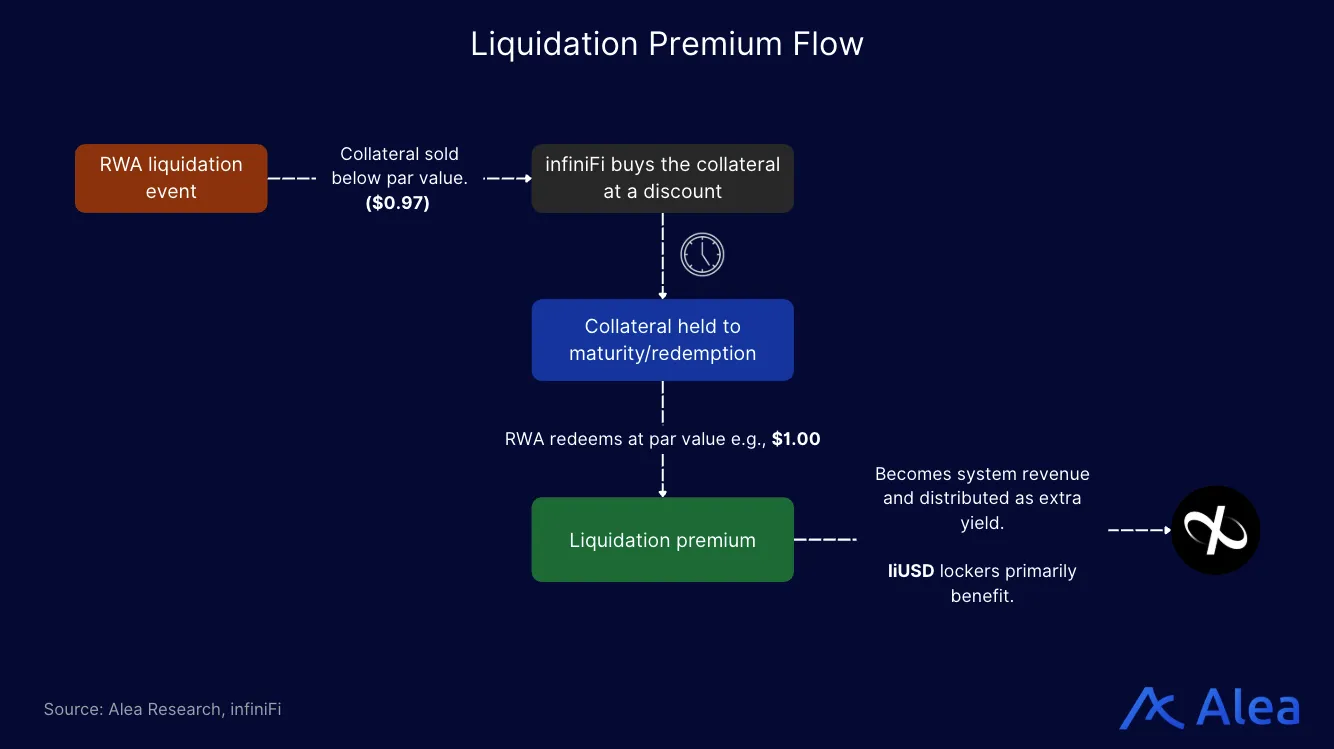

Another RWA angle is liquidation support for tokens with delayed redemptions, with infiniFi as a buyer of last resort. This case is narrower, but it’s realistic when borrowers post RWA tokens as collateral, and those tokens can’t be redeemed quickly. infiniFi could buy liquidated RWA collateral at a preset discount and hold it in the locked tranche until redemption. That gives lending protocols a backstop. Liquidators can sell the collateral to infiniFi instead of getting stuck with an illiquid token, which makes RWA-backed borrowing and looping easier to support.

The discount at which infiniFi acquires this collateral becomes a liquidation premium: when the RWA eventually redeems at par, the spread between purchase price and redemption flows through as extra yield, primarily to liUSD depositors who are underwriting the duration and credit risk.

infiniFi would need clear rules for what it buys, what discount it demands, and which tranche takes the risk. To execute this properly, a funded backstop strategy is needed, strict bidding rules (size limits, max price vs. NAV, target duration), and integrations with lending markets. Those integrations would let the vault join liquidations automatically and move the acquired RWA into infiniFi’s illiquid tranche.

infiniFi’s Traction & Metrics

As of December 2025, infiniFi’s TVL hovers around $165M on Ethereum, up from roughly $5M back in May 2025, implying a ~33x growth in under one year. Despite negative market sentiment from October’s liquidations, November’s incidents (Balancer exploit and Stream-Elixir blowups), and a slight dip in TVL, infiniFi quickly bounced back, recovering the drop within a short period.

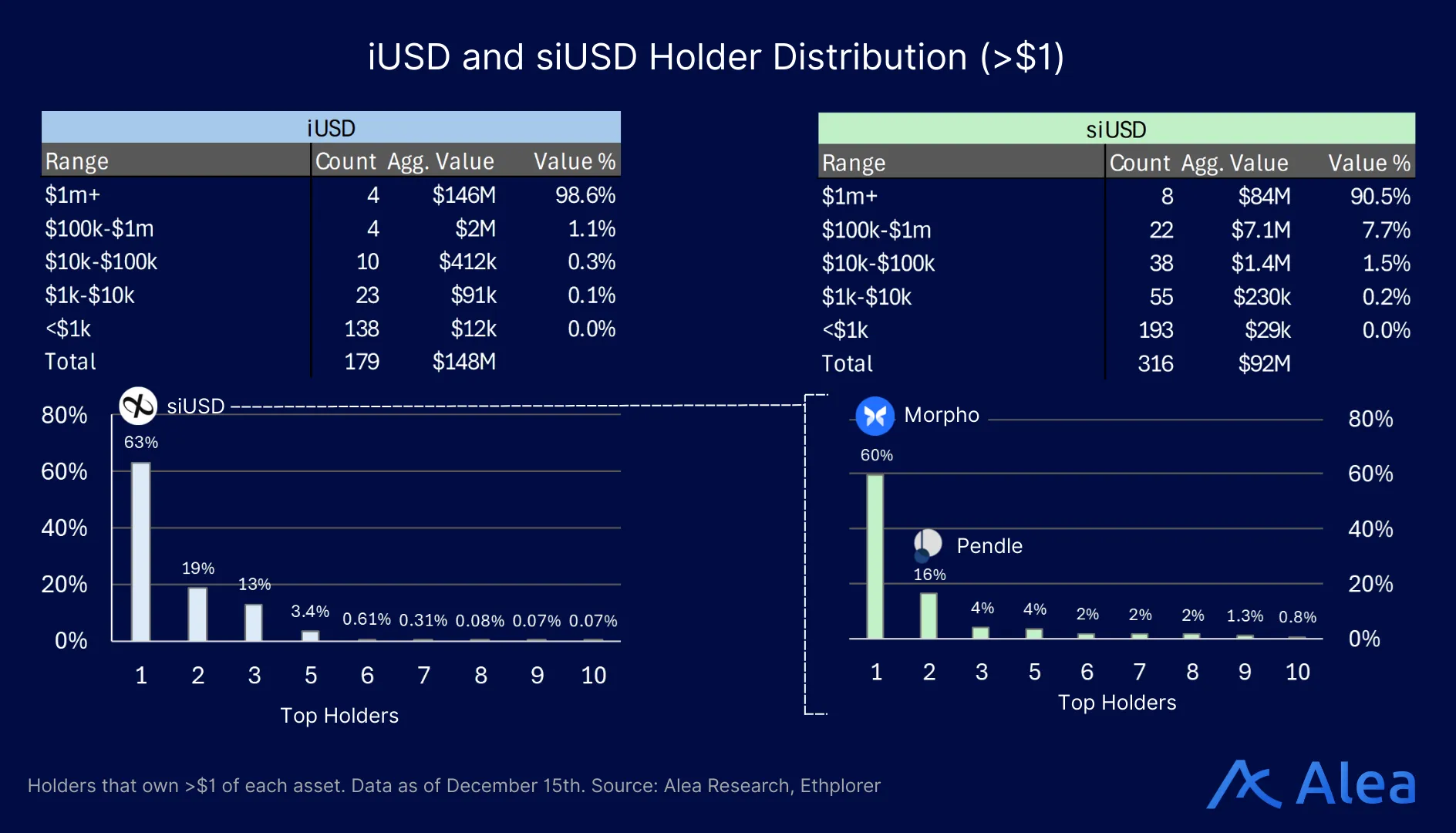

Total unique depositors on infiniFi have surpassed 2,000. Broken down by group: more than 750 users hold iUSD, and more than 860 hold siUSD. In liUSD, lockers are split by their lockup periods. Across the junior stack, liUSD-1w is the workhorse: it has the largest circulating supply (18M) and holder count (~430), making it the preferred way users take junior exposure. The 4- and 8-week tranches sit below in usage, with smaller but still meaningful supply (3.1M and 3.7M) and fewer holders (300 and 295), indicating more selective adoption by users willing to lock longer for a higher quoted APY. The 13-week tranche has the smallest supply (~1M) and holder count (198), suggesting a more cautious approach to longer lockups, potentially influenced by November’s incidents and the overall market conditions.

Since launch, infiniFi has distributed more than $3.5M in yield. The yield profile has sat above basic money-market lending but below the most aggressive, leveraged, and incentive-heavy farms.

Through 2025, siUSD typically earned around 7–10% APY, versus roughly 4–6% average on blue-chip stablecoin lending markets over the same period. liUSD has typically been priced in the low teens APY range, roughly 10–12%, depending on maturity and campaign period, reflecting both the unbonding period and the first-loss position.

infiniFi already integrates with several major venues. Its reserves are spread across yield-bearing stablecoin positions like sUSDe, cUSD, and fxUSD, Pendle PTs, and money-market allocations on platforms like Aave, Morpho, Fluid, and Spark. A dedicated USDC vault on Morpho lets users borrow against iUSD, PT-iUSD, siUSD, and liUSD, which makes looping and fixed-yield strategies around infiniFi possible.

Regarding liquidity, pools are available on Curve, Fluid, and Balancer, including both iUSD and siUSD pools. Depth on Curve and Fluid is above $1M, while Balancer pools are relatively thinner due to the pairs offered (sUSDe/siUSD and iUSD/GHO). These LP positions earn infiniFi points up to 4.5x and a Sats boost for pools including USDe–sUSDe.

If you want flexibility, start with siUSD and treat it as your default strategy with exits via unstaking to iUSD and redeeming (or swapping via DEXs). For maximum incentives pre-TGE, provide liquidity on various DEX pools (Curve, Balancer, Fluid), buy YTs or LP Pendle, deposit on TAU Labs vaults, or follow other strategies to earn points and any pool-specific boosts, then use the dashboard to track liquidity depth and redemption conditions before sizing up.

Conclusion

infiniFi shows that stablecoin yield can stay structured without hiding the risk. It blends DeFi and RWA strategies, then stacks them into a clear capital structure. Yield becomes a choice between senior and junior exposure, not a single opaque pool.

siUSD has consistently stayed above base money-market yields, while liUSD has usually traded in the low teens, with no protocol-level loss events so far. That performance reflects a risk-first process: defined liquidity buffers, tranche-level loss ordering, and ongoing monitoring designed to keep redemptions orderly under stress.

infiniFi runs this model by saying no to excessive risk and finding the sweet spot between risk and reward. It treats yield as a risk product, filters out recursive leverage, fragile pegs, and opaque offchain black boxes. Looking ahead, the main questions are whether infiniFi can scale its strategies and TVL without relaxing its risk-curation process. The answers will decide whether it becomes a trusted gateway for structured stablecoin yield.

References

Stream / xUSD commentary – @yieldsandmore on X

Disclosures

Alea Research is engaged in a commercial relationship with infiniFi and receives compensation for research services. This report has been commissioned as part of this engagement. The content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.