Solv’s track record, combined with its market leadership and continuity across 5 bull and bear cycles, turns it into one of strongest protocols in crypto for pulling off the vision of becoming a full-stack liquidity hub, from BTCFi to RWAFi. With over $1.1B in TVL, Solv unifies vaults, fund management, and BTC‑backed assets. The product stack will now grow supporting RWAs—from tokenized commodities and stocks to U.S. Treasuries—leveraging real-time Proof of Reserves and distribution across DeFi, CeFi, and TradFi (from MiCa to Shariah compliance). Galaxy argues that more recently, “the pathways to tokenized securities are opening, setting up a plausible route from tokenized T-bills to tokenized equities and other asset classes.”

This Perspective is written for allocators who already hold (or underwrite) BTC exposure and are evaluating whether to convert passive BTC into managed yield exposure through Solv’s product sleeves. Whether to deploy BTC into SolvBTC (as a composable BTC rail), and/or allocate into yield-bearing wrappers and managed vaults (xSolvBTC and BTC+) dependent on return targets, liquidity, and operational simplicity.

Key Takeaways

- From BTCFi to RWAFi: Solv is building the operating layer for a full-stack liquidity hub with live Proof of Reserves and distribution across DeFi, CeFi, and TradFi.

- Multi-asset Stack: SolvBTC (1:1 reserve-backed Bitcoin), xSolvBTC (yield-bearing BTC), BTC+ (multi-strategy vault).

- Market Positioning: Not a single-venue wrapper; operates as a fund management platform— L2 validators (Core), basis trades, DeFi yield, and RWAs.

- Institutional Traction: ZNB $230M PIPE and Jiuzi $1B BTC treasury into yield-bearing BTC with Solv.

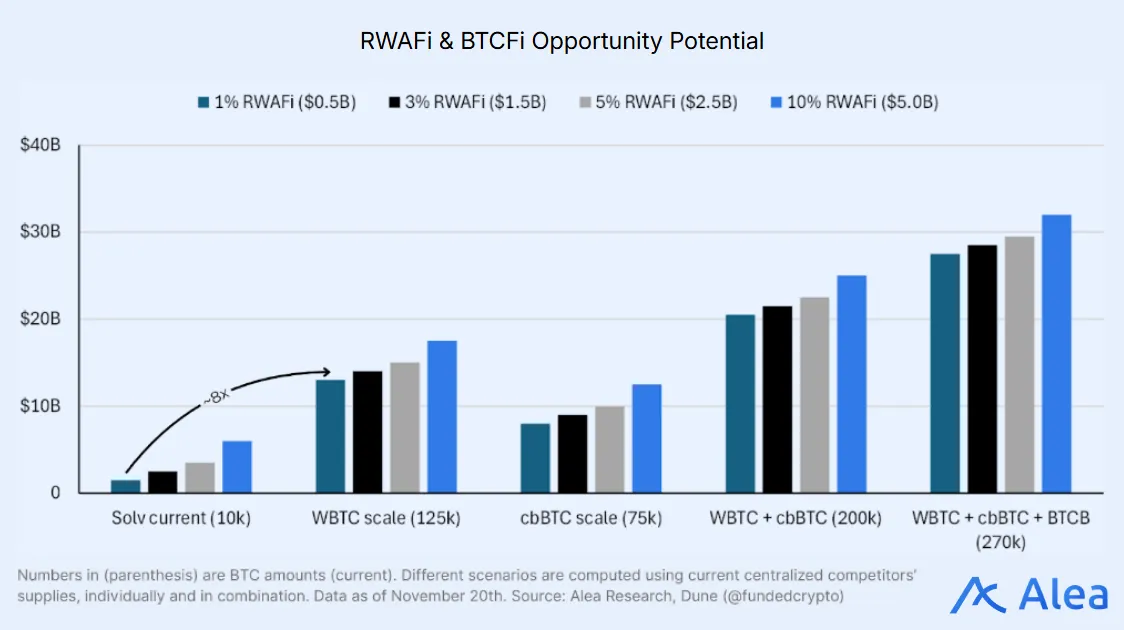

- Market Size: Only 2-3% of BTC is earning onchain yield; large unlock ahead (even more room for expansion with RWAs).

Introducing Solv

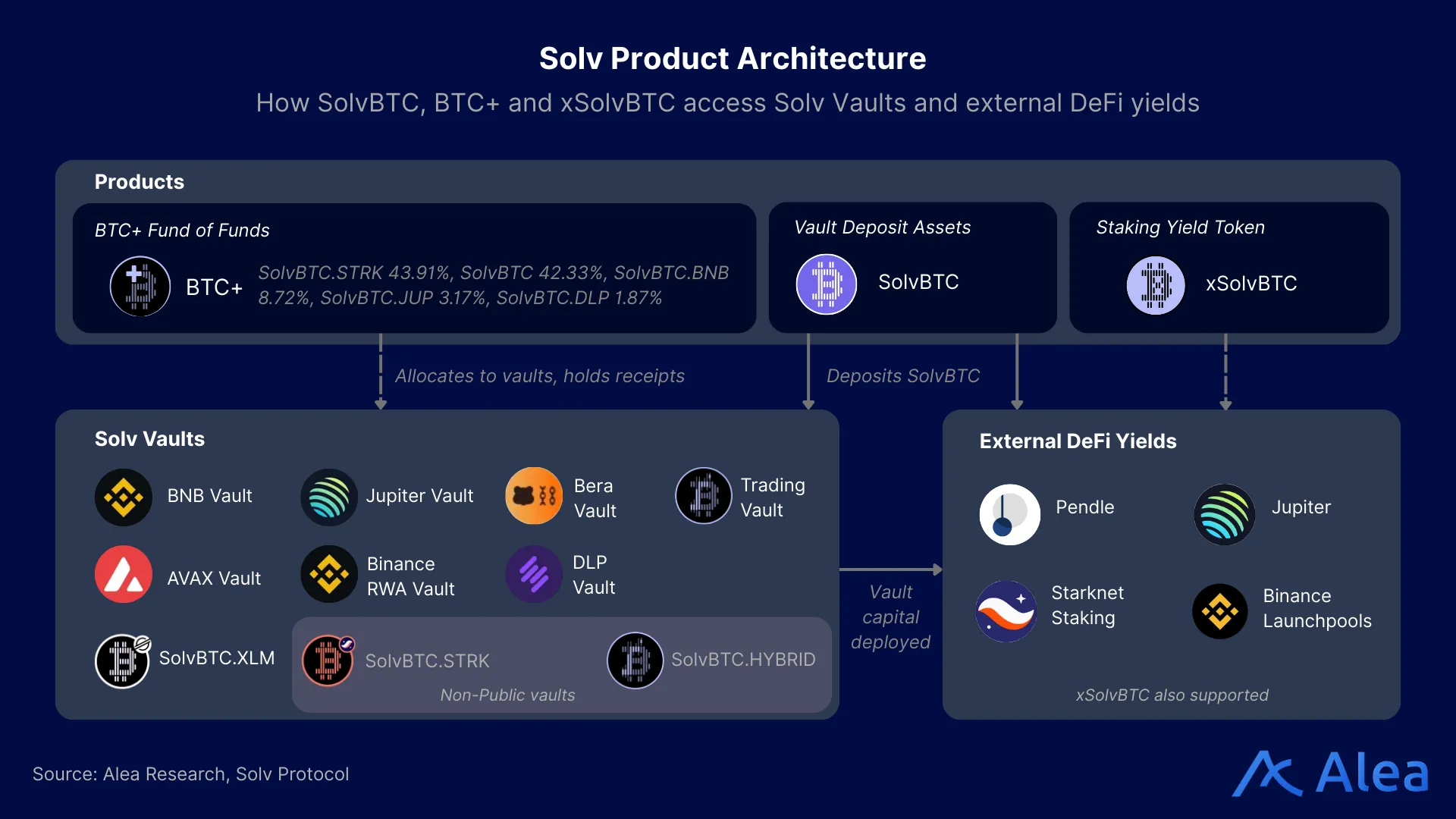

Solv is a Bitcoin‑first asset manager and infrastructure protocol with universal and composable BTC rails. It issues a 1:1 Bitcoin-backed token (SolvBTC), a yield‑bearing BTC instrument (xSolvBTC), and a multi-strategy vault (BTC+) that allocates across both onchain and offchain yield sources. The stack is built to route BTC liquidity across DeFi, CeFi, and TradFi with auditability and automated proof‑of‑reserves. Among wrappers, SolvBTC stands out for offering both institutional-grade transparency and DeFi composability.

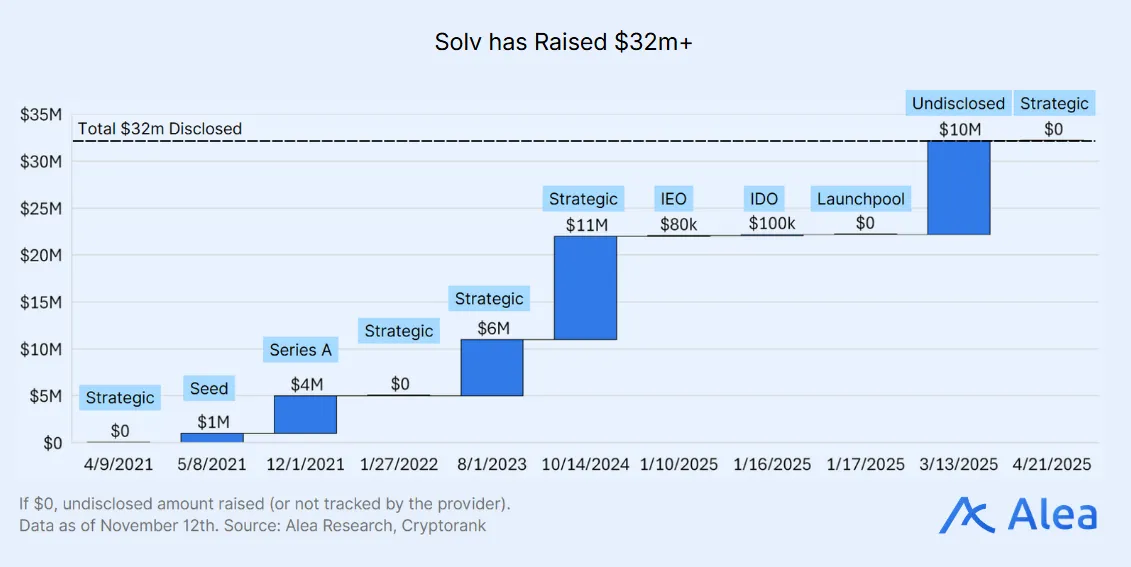

Solv was founded in 2020 and has proven durability across multiple market cycles. The early focus on asset standardization (e.g., ERC‑3525 work by co‑founders) evolved into today’s BTC liquidity and yield products. The core team includes Co‑founder & CEO Ryan Chow, Co‑founder and CTO Will WangThey bring a proven track record in both financial markets and engineering. Total funding exceeds $25M, with backers such YZi Labs (former Binance Labs), Blockchain Capital, Laser Digital, OKX Ventures, or CMT Digital.

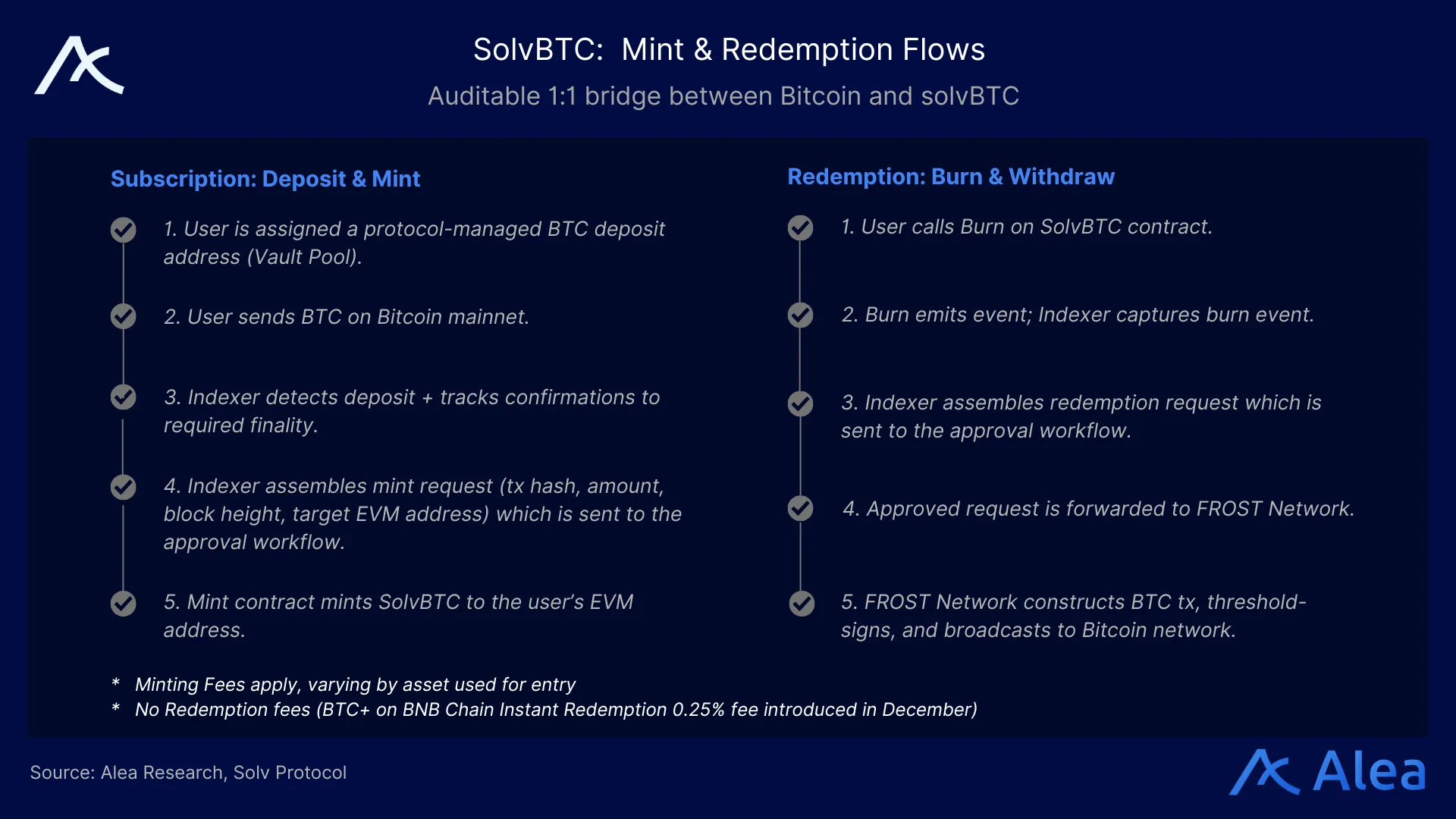

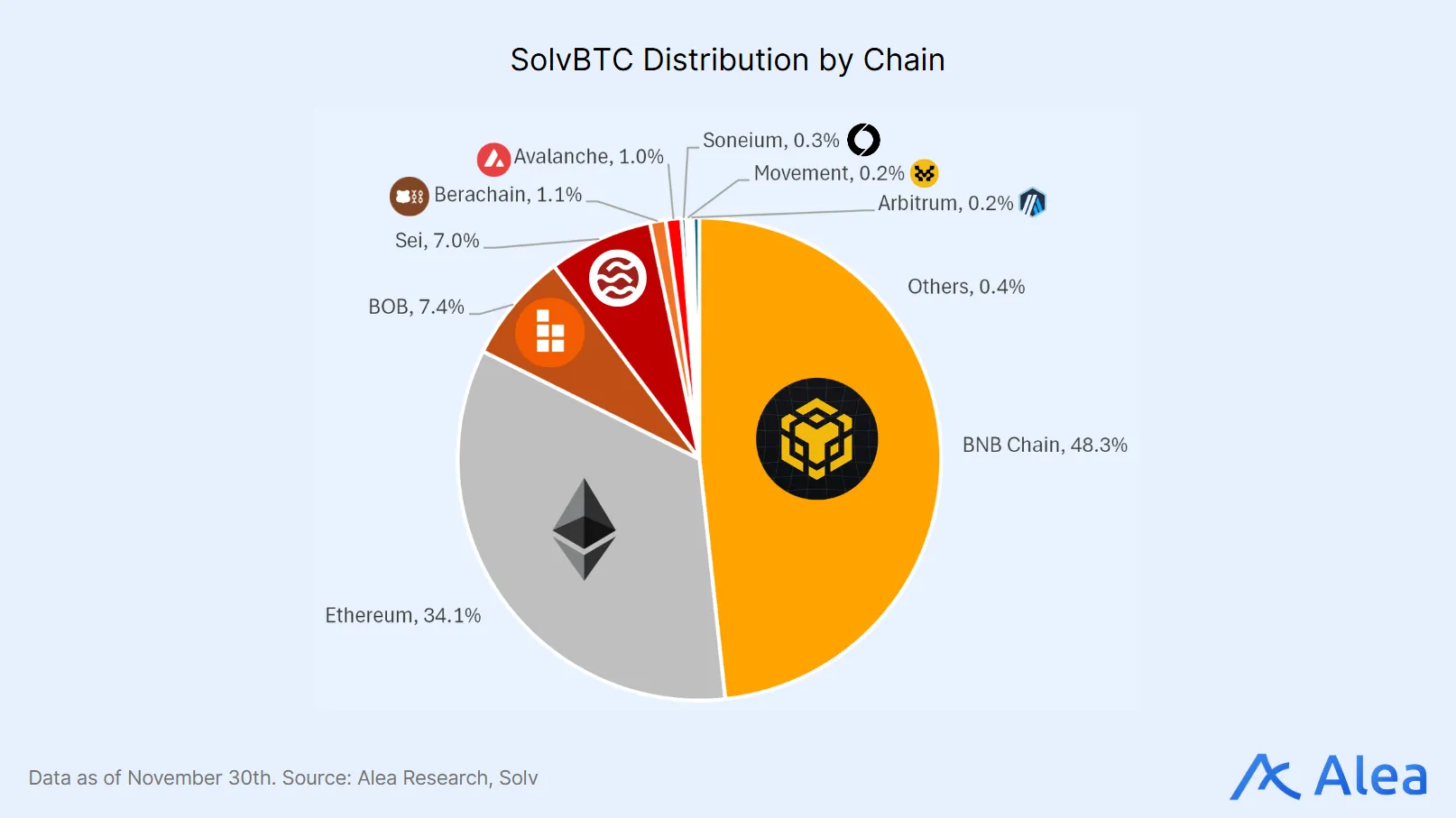

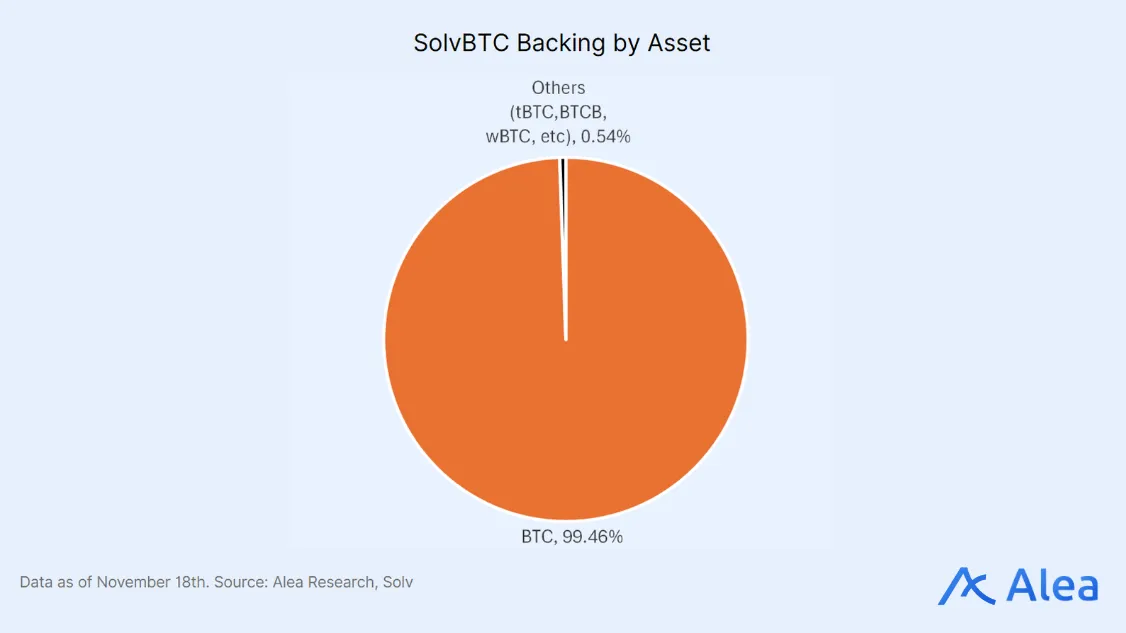

SolvBTC is the protocol’s flagship asset, issued as a “universal Bitcoin reserve token” backed 1:1 by a tiered reserve system (core reserve assets like BTC/BTCB/cbBTC plus isolated reserves for specific mints). The system was designed for crosschain composability, maximizing integration depth across ecosystems while still ensuring transparent backing and documented mint/redeem flows.

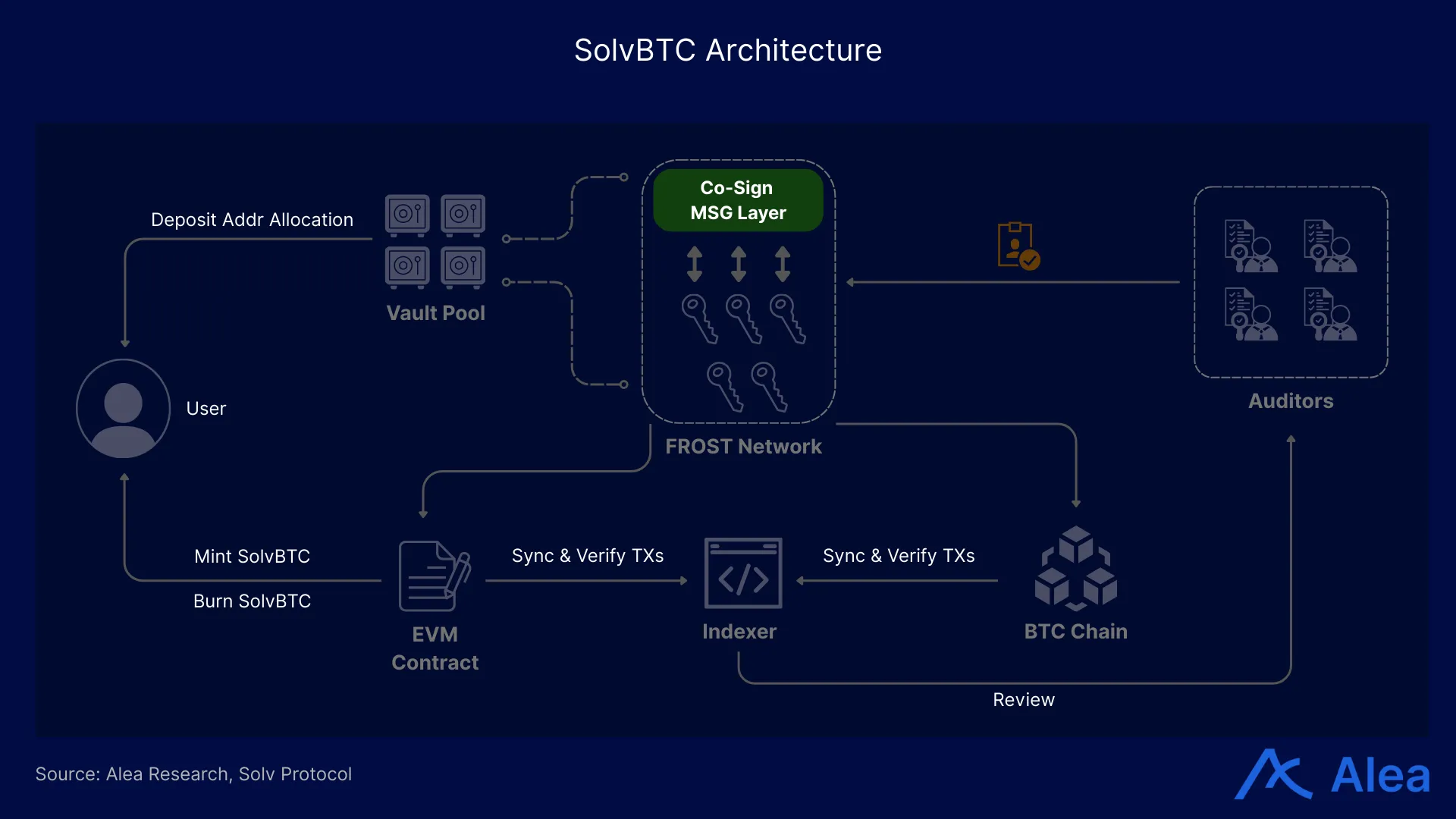

SolvBTC is secured by an event-driven custody and issuance pipeline. Users deposit BTC into protocol-managed Bitcoin addresses (Vault Pool). An Indexer monitors Bitcoin and EVM events, assembles mint/burn requests, and routes them through an approval workflow. For Bitcoin execution, SolvBTC uses a distributed threshold signing network based on FROST (Flexible Round-Optimized Schnorr Threshold), where independent nodes jointly produce valid signatures without any single party holding the full private key.

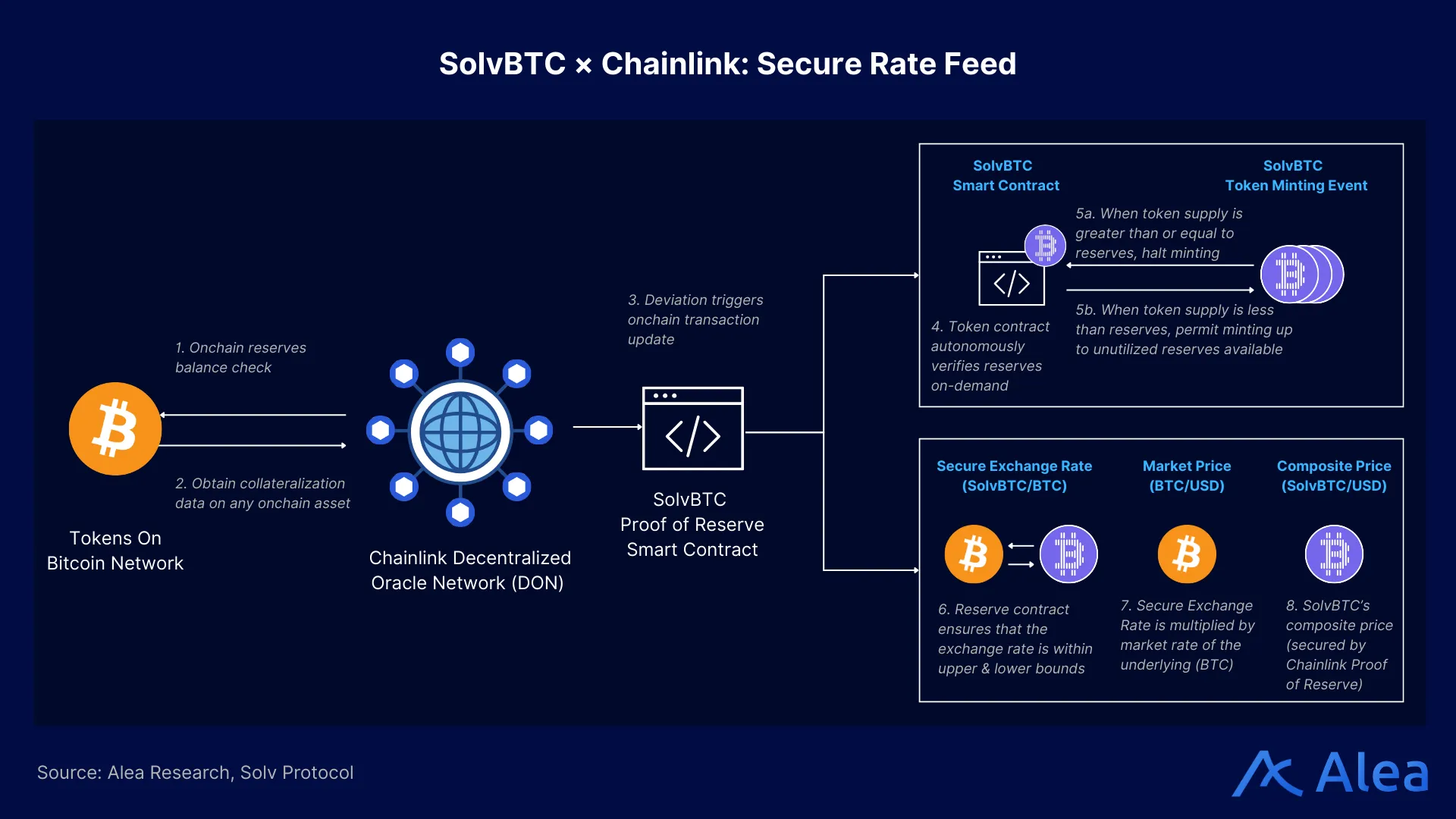

SolvBTC is powered by Chainlink’s Proof of Reserves, which provides a SolvBTC-BTC Secure Exchange Rate feed that matches Solv’s exchange-rate logic with its real-time reserves to produce a redemption rate that’s accurate with verified collateral. The feed also enforces upper/lower bounds in USD terms, improving resilience in lending markets. Chainlink’s CCIP makes this verifiable state portable across chains, facilitating faster and more secure integrations.

Beyond Wrappers: Proofs, Yield, Distribution

Traditional wrappers like WBTC (BitGo‑custodied 1:1), cbBTC (Coinbase‑wrapped on Base), and decentralized options like tBTC or yield‑bearing LBTC primarily tokenize or restake BTC for specific venues. Solv, however, is a universal and composable BTC rail with optional yield and multi-venue distribution. The ambition is to become the go-to institutional asset issuer for BTC, backed by live Proof of Reserves and supported by industry leaders like Binance and DATs.

Solv is Binance’s exclusive partner for BTC yield. Binance Wallet Earn lets BTC holders subscribe from exchange accounts and start earning onchain yield powered by Solv’s BTC strategies.

Beyond scaling thanks to CEX distribution, Solv provides access to a diverse opportunity set. It can tap into different risk-reward profiles while still ensuring Proof of Reserves, MiCA compliance, and a Shariah-aligned product suite.

Solv combines SolvBTC, yield-bearing BTC (xSolvBTC), and a multi-strategy vault (BTC+) with exchange distribution and PoR‑backed transparency (Chainlink, APRO).

- SolvBTC is designed to be a universal and composable asset(via Chainlink CCIP and LayerZero) with verifiable backing—it’s the currency that everything else in the stack builds on.

- xSolvBTC is an auto-compounding yield-bearing version of SolvBTC (SolvBTC is burned when xSolvBTC is minted and vice-versa)

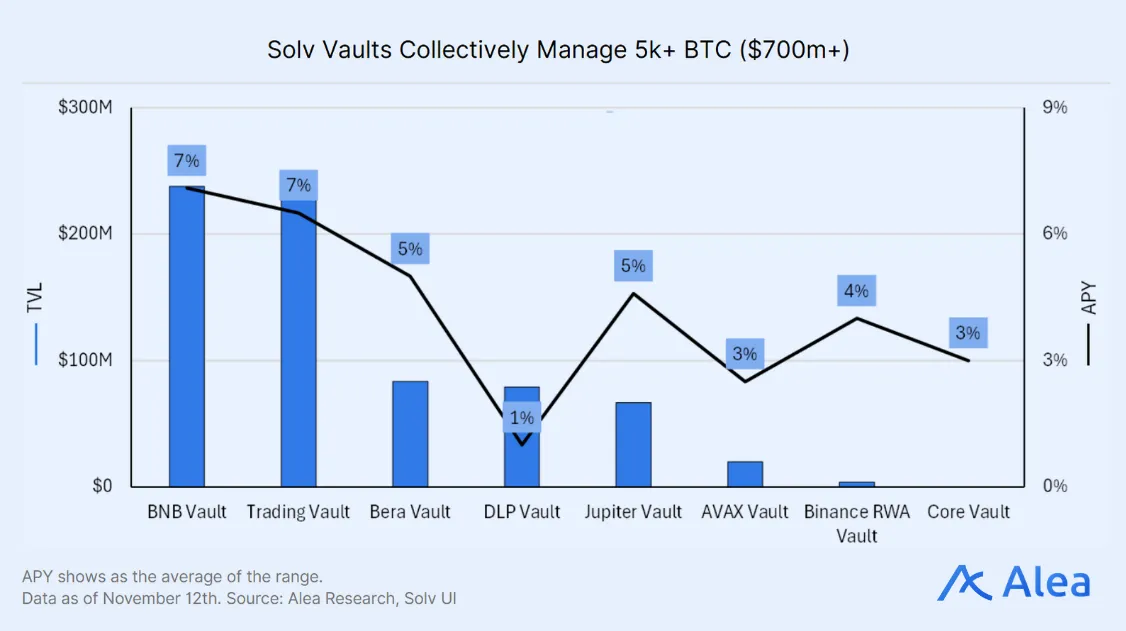

- BTC+ is Solv’s flagship vault that dynamically allocates BTC across a mix of yield strategies across onchain and Delta-neutral Funding Rate Arbitrage strategies. Examples include SolvBTC.AVAX (onchain credit/LP), SolvBTC.BERA (Berachain Proof‑of‑Liquidity), SolvBTC.DLP (DEX LP), SolvBTC.TRADING (funding‑rate/options), and more. BTC+ currently offers 3.17% APY.

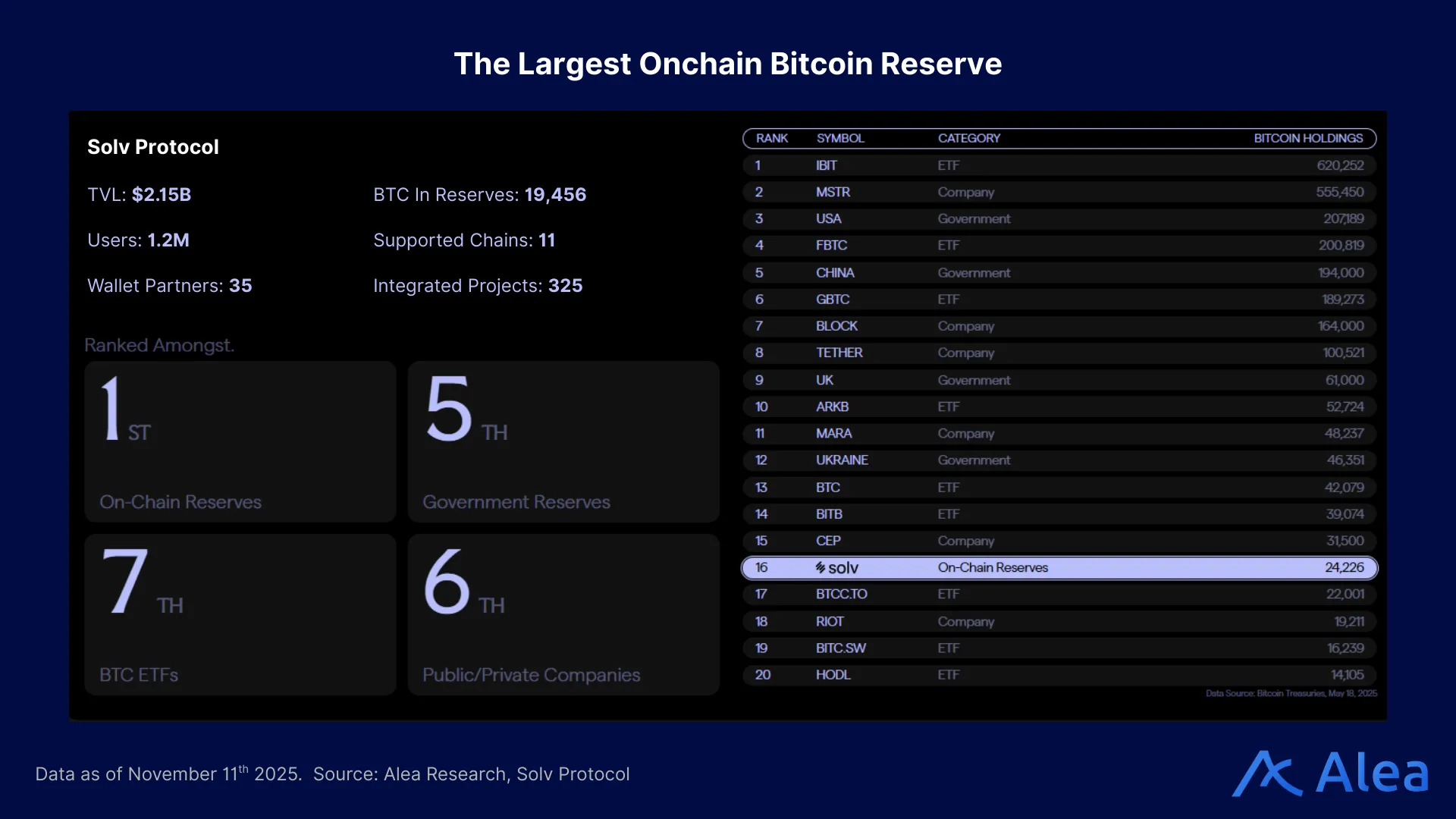

Durable Traction & Under‑the‑Radar KPIs

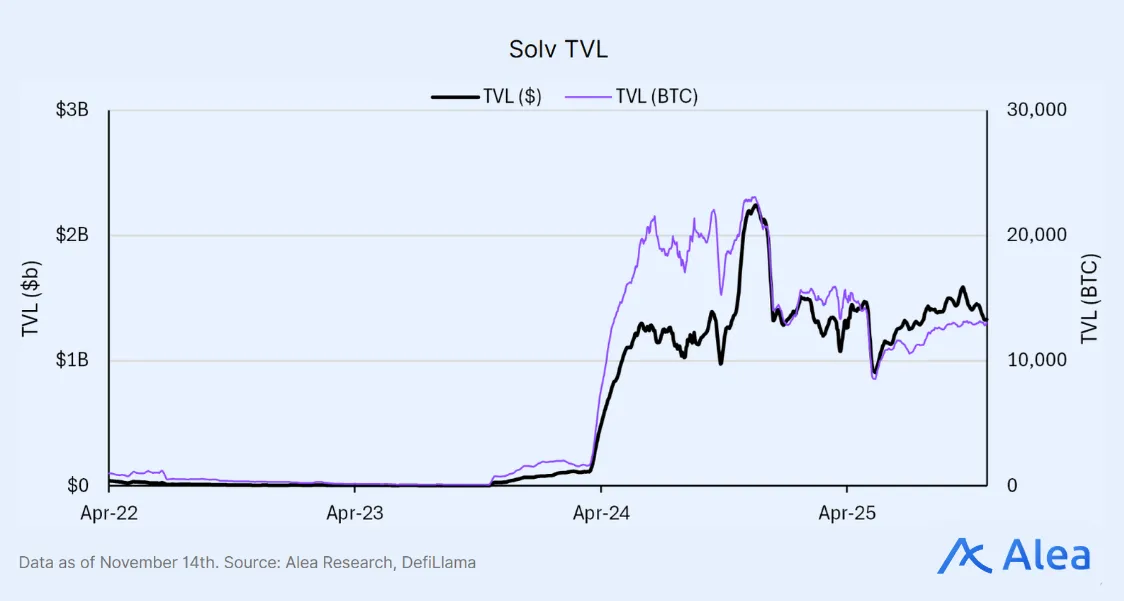

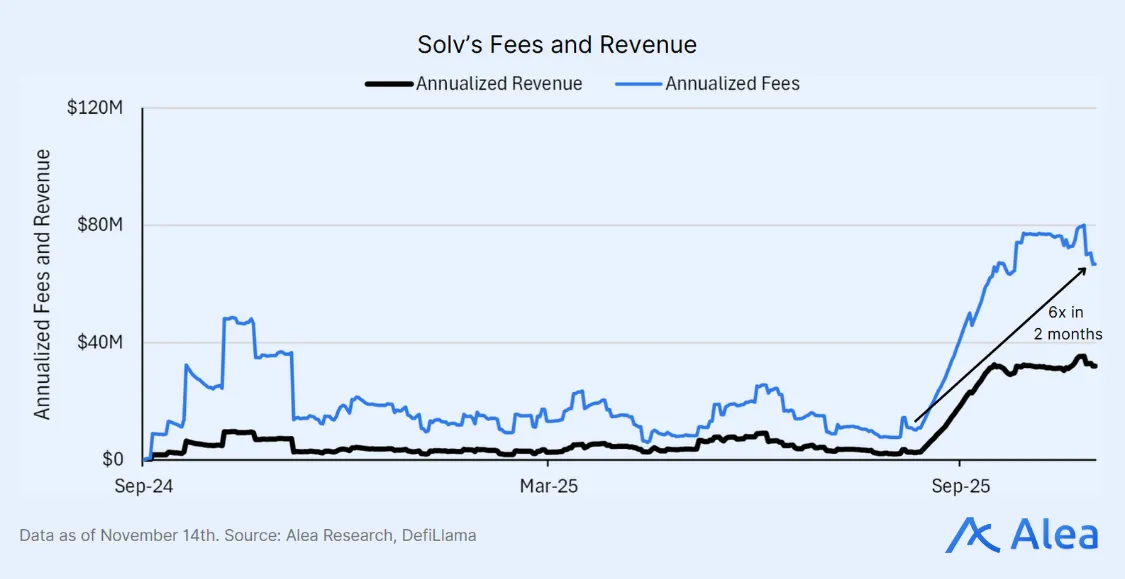

Since inception, Solv has survived market cycles and demonstrated a credible path to profitability, compounding network effects with an ever-expanding number of DeFi integrations across chains. Durable cash flows and steady liquidity are essential for institutional adoption, especially as large allocators start looking for BTC yield on top of price exposure.

Solv monetizes where BTC turns into managed products via vault management/performance economics and strategy-level spreads, with distribution partnerships (e.g. exchange “Earn” rails) acting as the scaling channel. Exact fee schedules and partner splits are not fully disclosed publicly. However, where relevant, we treat revenue as directionally linked to 1. SolvBTC circulation and external deployment, and 2. AUM in xSolvBTC/BTC+ and future RWA sleeves.

Solv has proven that it can operate across market regimes, retain liquidity despite market stress, and attain market leadership with live Proof of Reserves (PoR).

Institutions have taken notice. Their interest is now explicit. Zeta Network Group (NASDAQ: ZNB) entered a $230M strategic PIPE for BTC exposure fully collateralized by SolvBTC to merge institutional finance with onchain infrastructure. Jiuzi Holdings took it a step further, announcing a plan to earn yield on BTC with $1B, allocating up to 10,000 BTC (into SolvBTC.BNB deployed across DeFi (Venus, Lista, Pendle). The original DAT model pioneered by MicroStrategy is also being challenged with DAT2.0 as treasuries now look to tap into yields. Notably, Solv has partnered with Animoca Japan to expand BTC yield generation to Japan-based BTC treasuries such as Metaplanet (the 4th largest listed BTC treasury).

These serve as precedents to kick off a blueprint effect: regulated issuers publicly endorsing a programmable DeFi operating layer for BTC over custodial wrappers.

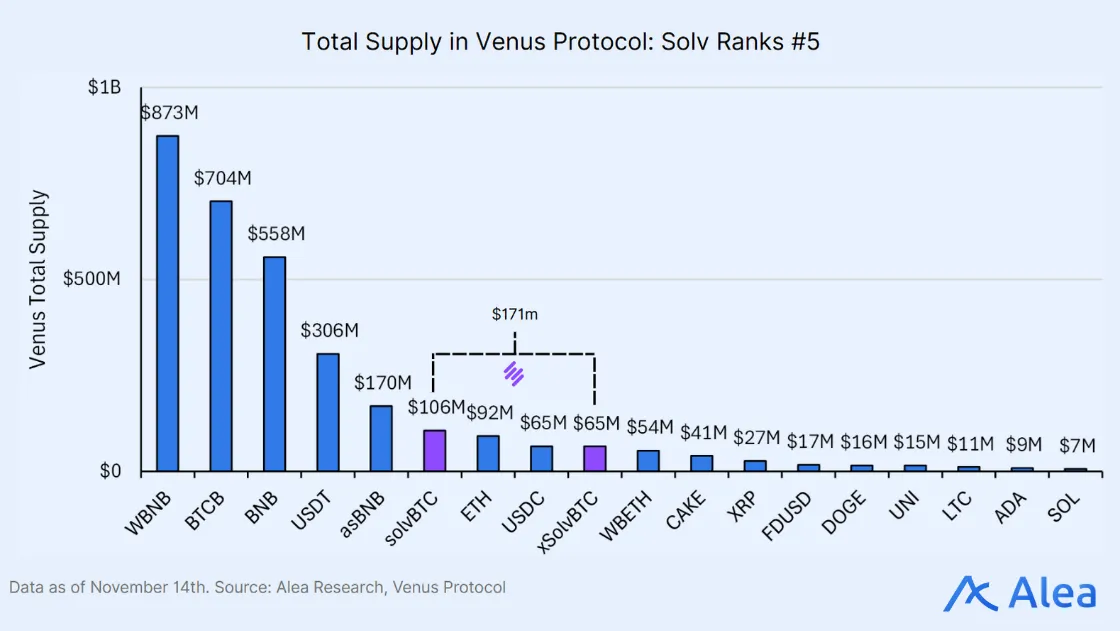

It’s also worth noting that, because of Defilama’s accounting methodology, TVL on the Solv protocol page excludes SolvBTC deployed on external dApps (meaning that TVL is counted toward dApps instead of the asset issuer). For instance, SolvBTC and xSolvBTC are highly demanded and used as collateral on lending markets, such as Venus on BNB Chain.

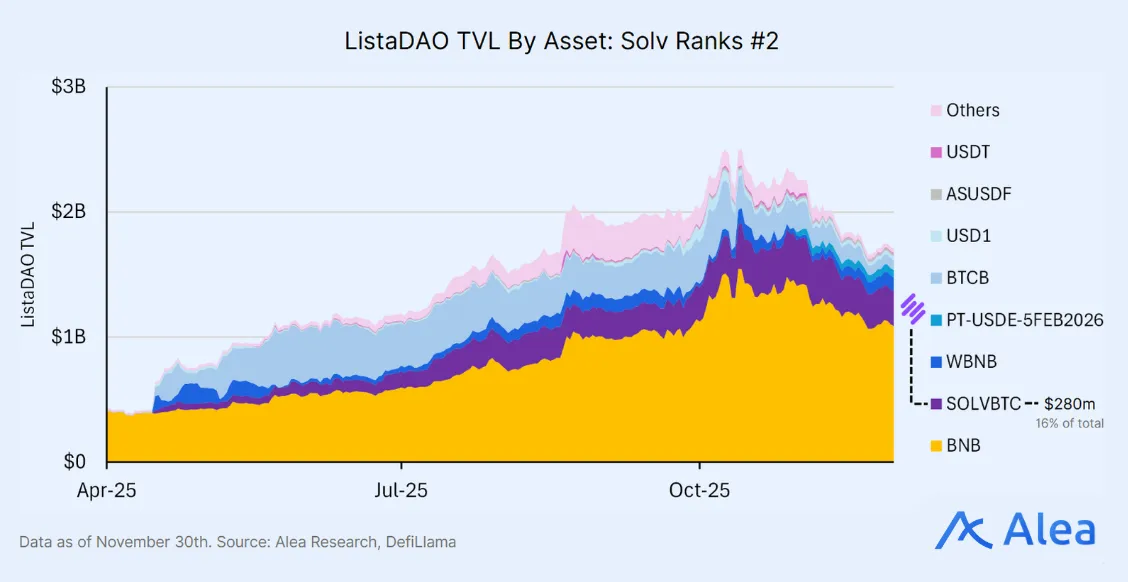

SolvBTC is also the second largest TVL asset on Lista at $280M, serving primarily as a collateral asset in Lista Lending pools.

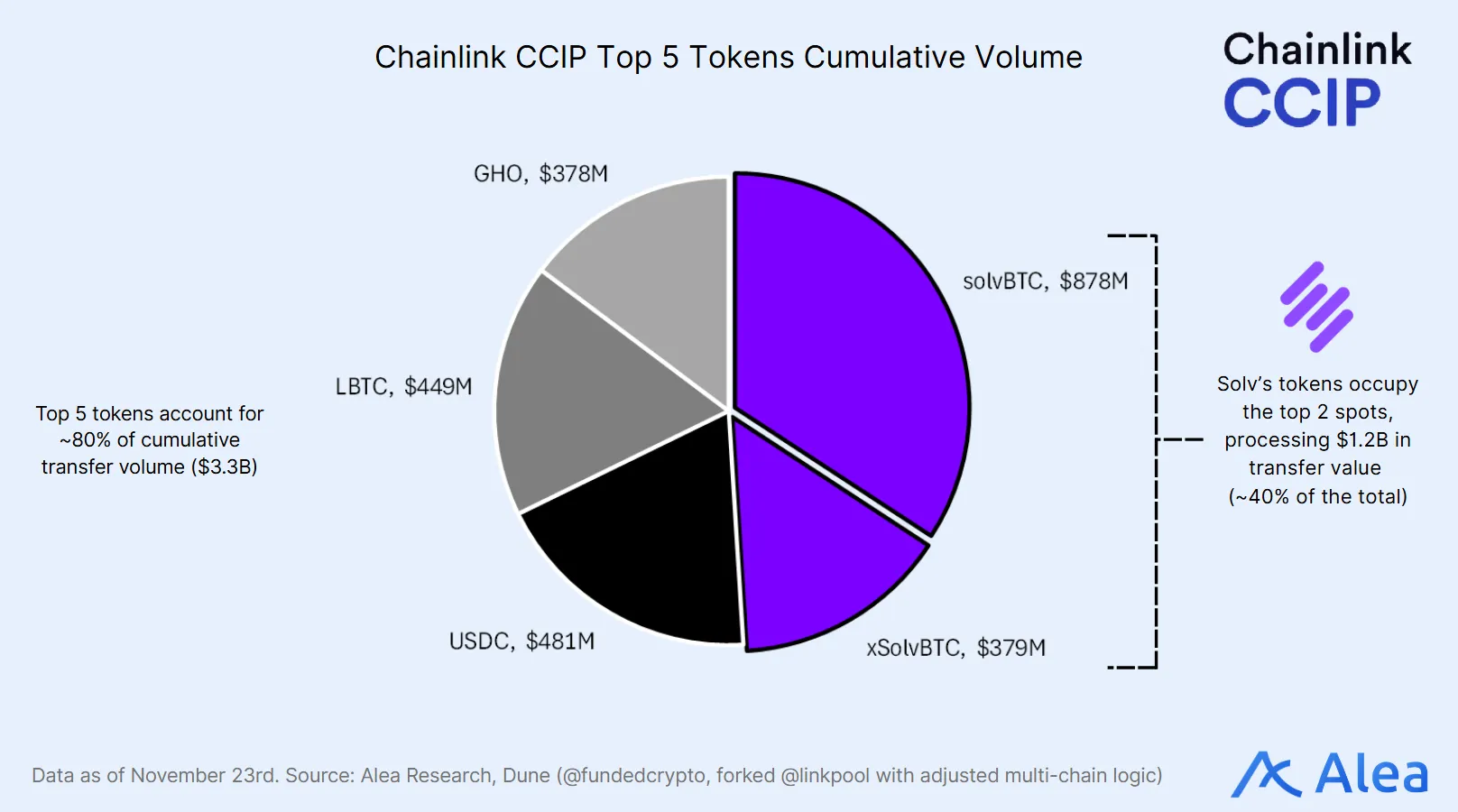

Chainlink CCIP has been one of the leading general messaging protocols since its launch in late 2023. It has consistently ranked among the top 3 GMP (General Messaging Passing) venues for monthly token-transfer volume. During the period from Q4 2024 to Q2 2025, when Solv used CCIP as its primary crosschain route, Solv’s assets (SolvBTC and xSolvBTC) climbed to the #1 position on CCIP with $1.2B+ transfer value (~40% of total to date).

BTCFi, Beyond Price Exposure

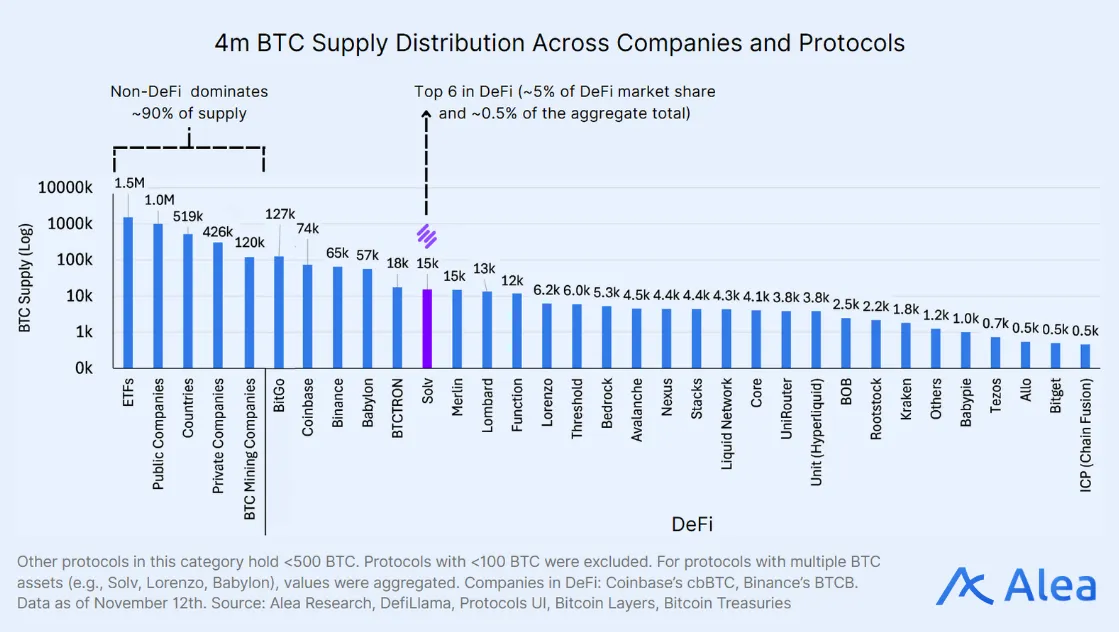

Most Bitcoin—$2+ trillion—sits idle. According to a16z’s recent State of Crypto report, “Publicly traded DAT companies now collectively hold about 4% of the total Bitcoin and Ethereum in circulation”. In modern finance, yield comes from deploying assets, not warehousing them. Bitcoin lacks that machinery—it’s not a productive asset by design.

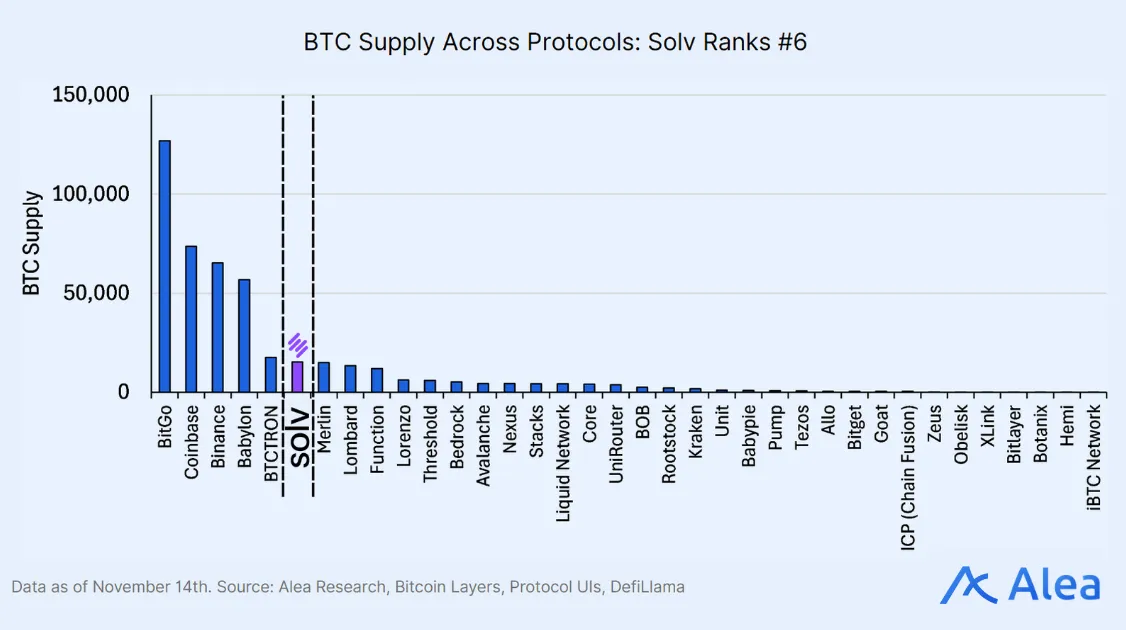

Solv builds it: an onchain reserve that turns BTC into a yield‑bearing asset. Its 1:1 token, SolvBTC, unifies cross‑chain liquidity and plugs into DeFi lending, trading, and real‑world yield. Across wrappers, restaking protocols, and Bitcoin L2s, under ~$50B worth of BTC have been deployed. That’s about ~2.25% of the total supply available for earning yield onchain.

The vast majority of the BTC supply is held as a store of value in cold storage, on exchanges, or on ETFs. Such a relatively small percentage deployed across chains is indicative of how much room there is for growth. Spot ETFs represent ~7% of the total BTC supply, governments ~2–3%, and corporate treasuries ~6–7%. BTC is steadily institutionalizing, looking for price exposure before taking the leap to start demanding yield. “68% of institutional investors have already invested or plan to invest in BTC exchange traded products” – State Street – Why bitcoin institutional demand is on the rise.

A growing slice of BTC supply now sits with ETFs and corporate treasuries. The next natural step is for them to move from buy-and-hold to managed-vaults and active yield-generating strategies—all while still meeting institutional policies and fully-transparent reserves auditability. “DATs can generate yield to grow net asset value per share, resulting in more underlying token ownership over time than just holding spot.” – Pantera Capital – DAT Value Creation.

BNB Chain is Solv’s clearest distribution proof. In April 2025, Binance’s On-Chain Yields introduced Solv’s BTC Staking, formalizing a model where users can keep BTC on Binance while subscribing to Solv-sourced strategies, outsourcing strategy and risk management to a DeFi-native manager while preserving exchange custody and UX. During the BNB DeFi Festival, Binance Wallet Earn then promoted Solv’s vault program (BTCB deposits to BTC+), attaching ecosystem-wide incentive budgets to accelerate vault deposits. During this period, over 500 BTC were deposited into BTC+. Lastly, BNB Chain Foundation’s open-market purchase program selected Solv which adds a lightweight but credible signal of ecosystem alignment.

Testament to Solv’s proven track record is the adoption by DATs. Moves such as Jiuzi Holdings (NASDAQ: JZXN) or Zeta Network Group (NASDAQ: ZNB) signal growing institutional trust in yield‑bearing Bitcoin as a treasury asset. Jiuzi targets up to $1B into SolvBTC.BNB; Zeta already raised $230.8M in BTC/SolvBTC; And Animoca’s push to DAT2.0 starting with Japanese companies with large BTC treasuries. Institutional risk controls, Proof of Reserves, and DeFi integrations stand out as decisive factors behind their respective decisions. Next targets: public miners, sovereign funds, neobanks, etc,

BTCFi Today, BTCFi + RWAFi Tomorrow

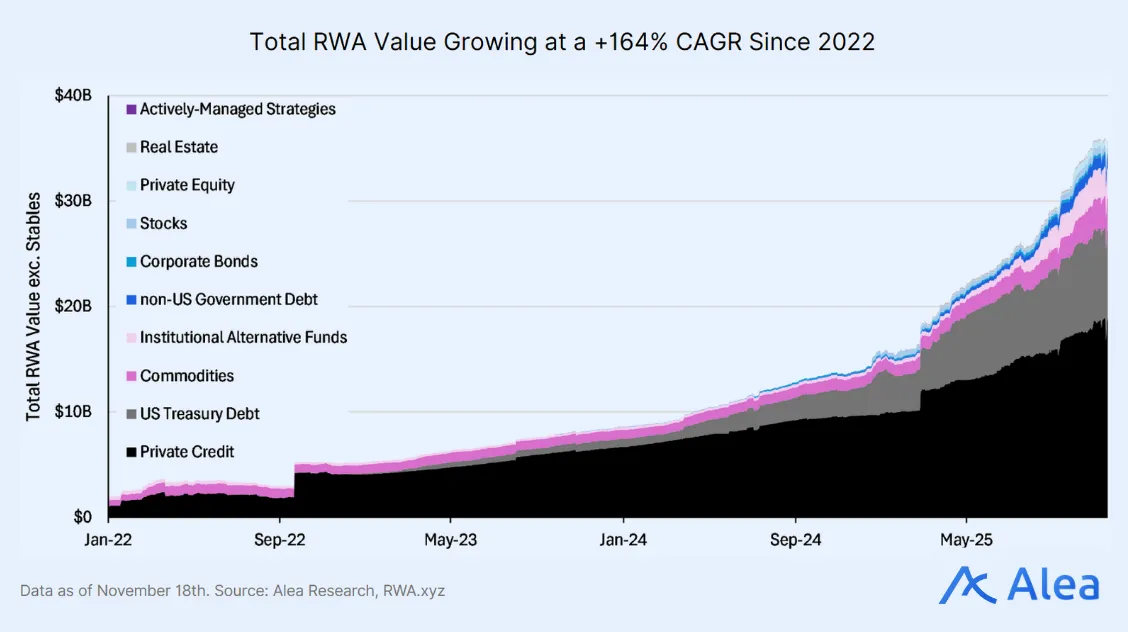

Solv is currently the largest protocol holding BTC TVL. But the TAM remains limited. The next step in its growth strategy will expand into RWAs—from tokenized commodities and equities to U.S. Treasuries. a16z estimates the “tokenized RWA market is already $30B, up nearly 4x in two years” with treasuries, money-market funds, private credit, and real estate moving onto programmable rails.

To kickstart that mission, Solv deployed $10M into Plume’s Nest vaults. Deeper RWA liquidity will strengthen Solv’s yield offerings, while also allowing for access to high-grade collateral backing BTC strategies across partner protocols. These vaults provide exposure to top-tier institutional issuers such as Securitize’s Apollo Global Management, Hamilton Lane, VanEck, or BlackRock. This is key for distribution, gaining leverage to increase scale and market share.

MiCA grants Solv EU‑wide passporting, removing multi‑license friction. In parallel, Solv’s Shariah alignment answers a long-standing constraint in Muslim-majority markets: yield without interest. And more recently, Solv partnered with Animoca to bring yields to Japanese BTC holders and companies with BTC on their balance sheet. Solv will act as the connecting tissue between BTC and traditional capital markets. This strategy diversifies yield, expands demand, and attracts multiple sources of capital. The team is looking to target $500M in RWAs by 2026, $5B by 2028.

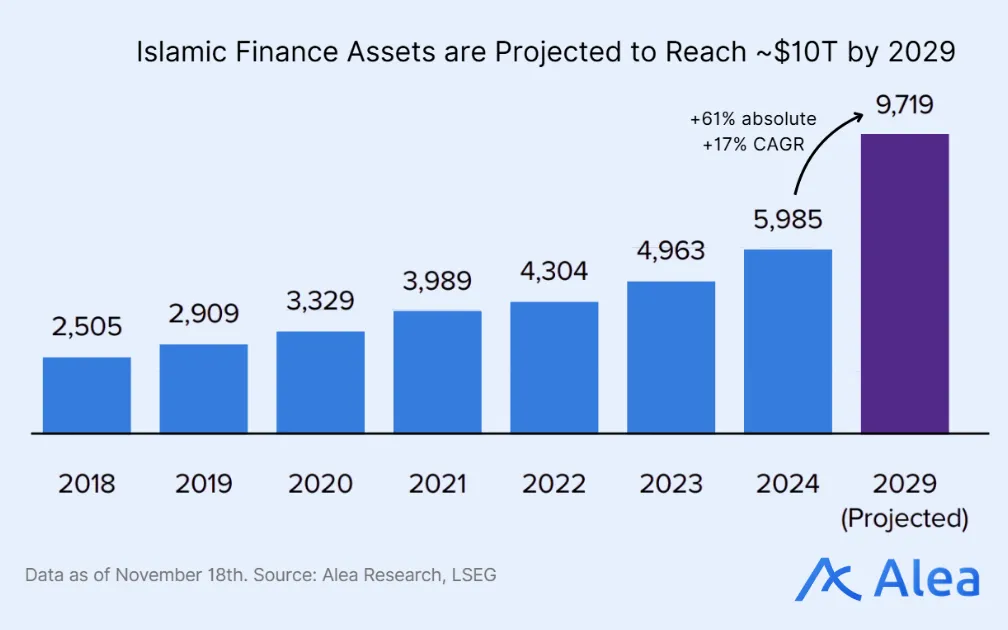

Islamic finance also presents a multi-trillion opportunity. For context, countries like Saudi Arabia, UAE, Indonesia, and Malaysia collectively have millions of Bitcoin users and high Bitcoin ownership rates but many have refrained from interest-based lending. Solv’s Shariah certification unlocks this “faith-aligned” capital. The Islamic finance sector is worth over $5T today, which means even conservative uptake could funnel tens of billions into crypto over time. Solv is one of the first movers here, giving it a chance to establish dominance in an underserved segment. Already, the narrative of “halal DeFi” is gaining attention, and Solv has positioned itself as a leader by working with Shariah advisory partners such as Amanie Advisors for approval.

Solv couples compliance with CeFi distribution; Binance Wallet Earn has already proven this at scale. The market expansion across Europe and MENA (Middle East & North Africa) regions will widen the gates. This comes in addition to existing and upcoming BTC treasury strategies. Each additional DeFi integration and chain expansion also extends the addressable market, drawing more interest and liquidity.

Together, compliance and CeFi rails form a positive feedback loop that increases distribution, The most recent deployment on a new chain is Canton Network, where Solv is setting out to establish BTC as onchain collateral for repo, credit, and RWA flows. Early alignment in this strategic segment (Canton is a chain designed for traditional institutions with both privacy and compliance as the core tenets) expands distribution and counterparty reach (including Goldman, HSBC, BNP, DRW, and Citadel among others).

What’s next: Solv v3 will be rolling out an omnichain yield layer—any BTC holder can deploy their holdings and make them productive across any chain, any strategy, and any RWA. A BTC‑backed RWA vault is also launching on Binance, similar to the current BTC Earn program. In partnership with BNB Chain, the SolvBTC.RWA vault will make it possible to route BTC collateral into tokenized Treasuries, money market funds, and corporate credit from issuers like Circle, VanEck, Franklin Templeton, or BlackRock.

Bitcoin in DeFi remains small at just 2.1% of total supply, but it is growing as trustless solutions develop stronger Lindy effects. “99% of Bitcoin is held idle not because of lack of interest but because of lack of trust. If you have a trustless protocol, then people come.” – David Tse, Co-Founder of Babylon – How to Stake Bitcoin Natively. “While BTC has been the de-facto store of value, there are numerous technological, institutional, and market catalysts propelling it toward something more productive than just a “lazy” digital gold” – Katrina Wang, Portal Ventures – The Panda Renaissance.

Conclusion

Solv is a BTCFi market leader expanding into RWAFi. It has partnerships with Binance Wallet Earn and corporate treasury deals with Jiuzi and Zeta. BTCFi is roughly $2T, and RWAFi is multi‑trillion. Two converging catalysts—BTC institutionalization (ETFs, treasuries) and compliant RWAs—set the stage for attracting large flows, unifying provable reserves, offering diverse yield opportunities, and achieving multi-venue distribution from a single stack.

Solv’s ambition is to reach double-digit billion TVL, converting passive BTC into institutional-grade productive collateral. Deposits can be collateralized to borrow stablecoins, allocate into RWA strategies, or leverage the benefits of DeFi composability across protocols like Pendle yield markets or onchain lending venues.

References

Chainalysis – Europe Crypto Adoption 2025

Chainalysis – Middle-East & North Africa (MENA) Crypto Adoption 2025

ICD – LSEG Islamic Finance Development Report 2025

A16z – State of Crypto Report 2025

State Street – Why Bitcoin Institutional Demand is on the Rise

Disclosures

Alea Research is engaged in a commercial relationship with Solv and receives compensation for research services. This report has been commissioned as part of this engagement. The content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.