Overview

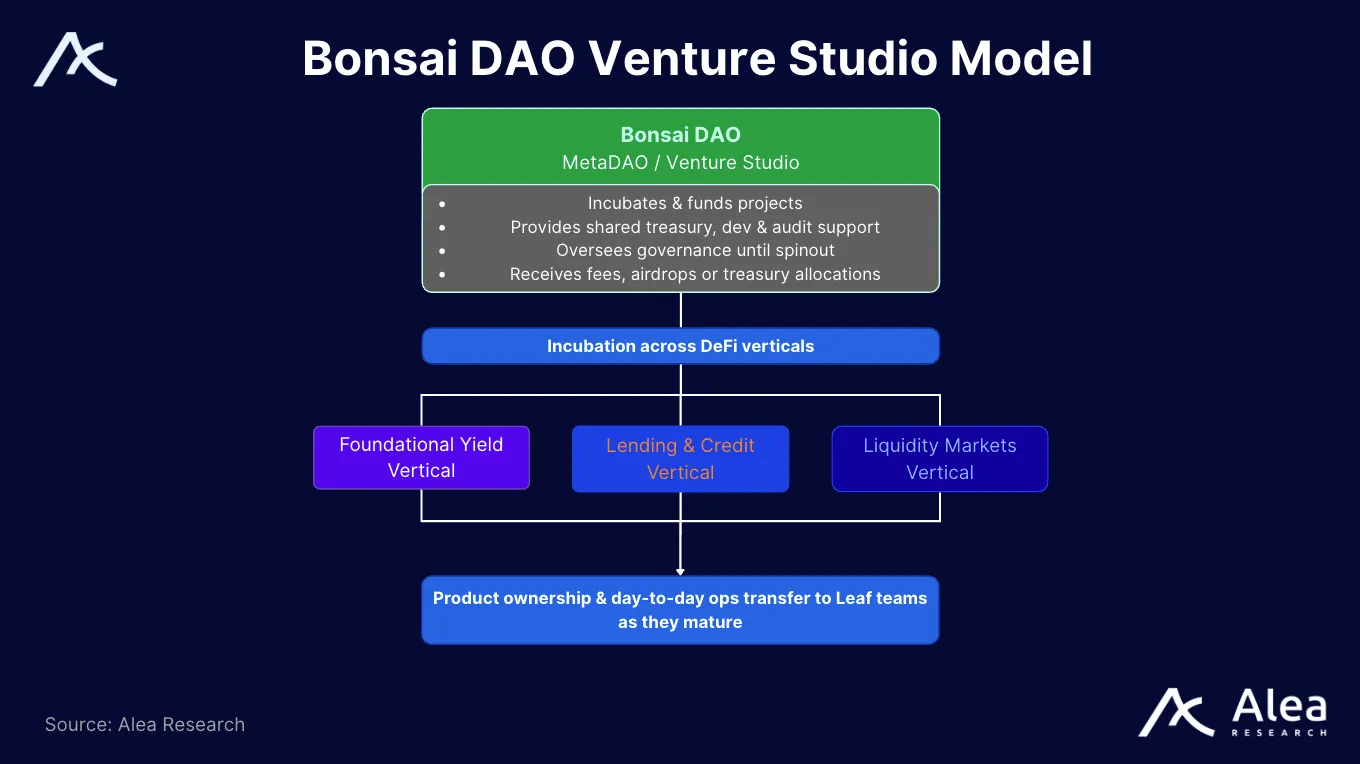

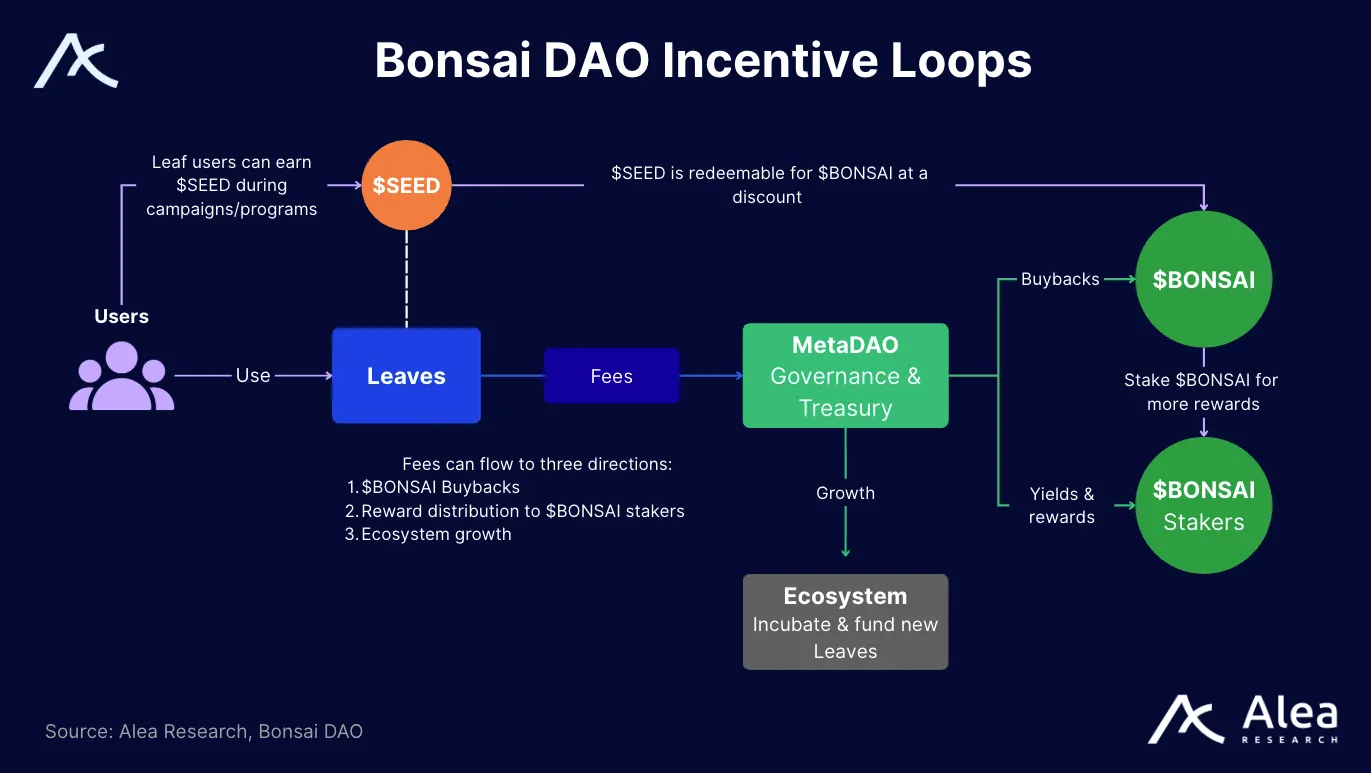

Bonsai DAO is a decentralized venture studio or MetaDAO that incubates, funds, and oversees DeFi protocols called Leaves. Each Leaf runs a distinct DeFi product with its own parameters, while fees, allocations, and a share of future token distributions flow back to $BONSAI via the MetaDAO treasury and governance.

The project emerged in 2024 from Umami DAO’s rebrand and structural reset, carrying forward Umami’s yield vaults as the foundational Leaf. It operates on Arbitrum and has expanded activity and incentives to Base to grow its user base and diversify liquidity.

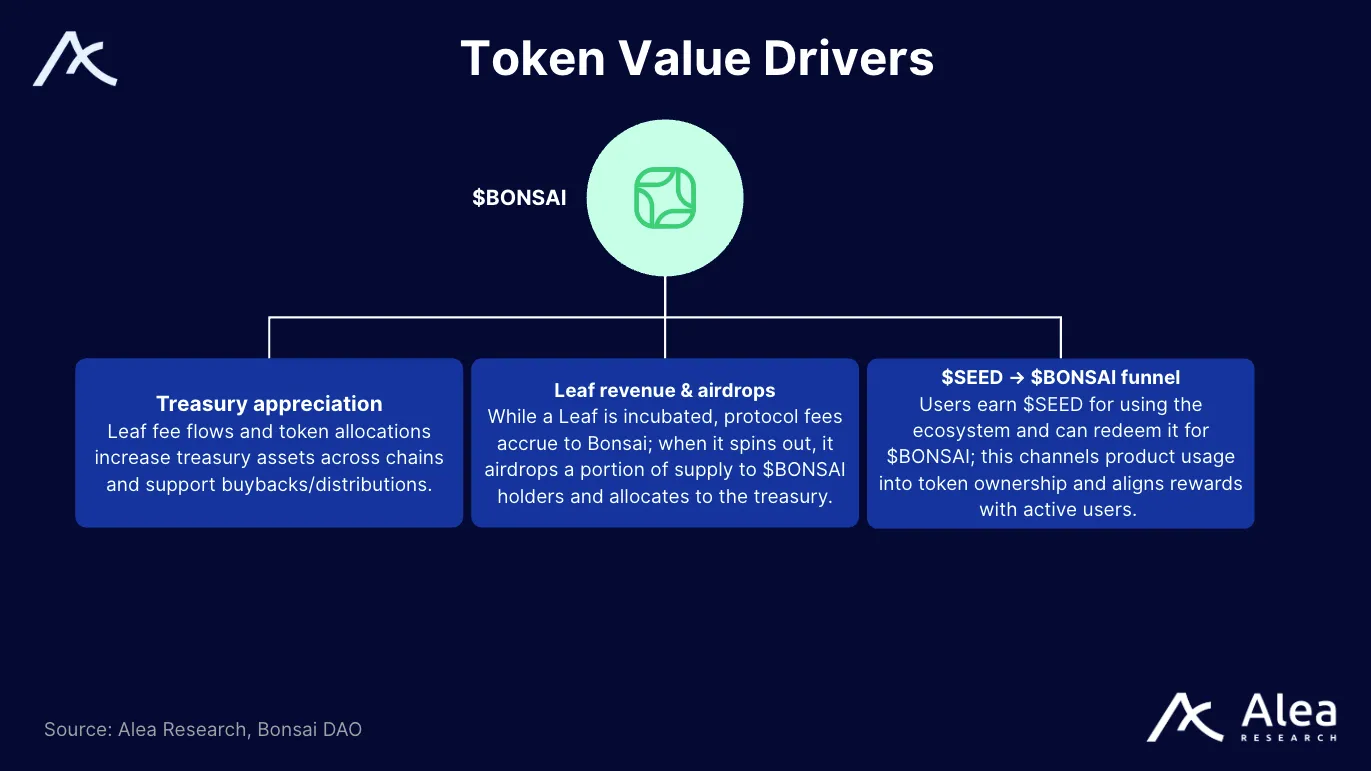

Bonsai aims to route each Leaf’s success back to $BONSAI via shared governance and treasury design. As Leaves mature or spinout, $BONSAI holders receive allocations/airdrops and the treasury retains exposure; $SEED incentives support growth and can be redeemed into $BONSAI to align participation.

Problem Statement

Many DAOs face certain challenges as they scale. A single token tries to cover every product, treasury grows but direction blurs, participation declines, and decision-making slows down. Umami experienced these issues first-hand—profitable vaults, yet a token trading below treasury value and a governance crisis that delayed new product development. Bonsai restructured around autonomous Leaves to separate execution from oversight, giving each product its own accountability and feedback loop.

DeFi remains fragmented across yield, credit, and liquidity. Users jump between isolated protocols, spread liquidity across many, and teams that try to expand increase risk and governance overhead. Bonsai solves this by creating separate Leaves for different verticals—Umami for yield, Vendor for credit, and Exit.tech for unlocking idle assets.

Bonsai targets distinct verticals, leaving development and governance to the teams. The structure lets Bonsai grow across markets without overextending and builds a diversified revenue base resilient to single-sector downturns.

The deeper issue is misaligned incentives where protocol sucess often fails to bring value to the token. Umami’s operations generated profit, but the token lagged. Bonsai’s solution is to route Leaf revenue and token allocations to $BONSAI holders and use $SEED for early participation that converts into long-term ownership.

As the ecosystem grows, undifferentiated governance becomes a liability. Bonsai separates strategy and execution—the MetaDAO handles capital and oversight, while Leaves run operations. Programs like Bonsai Gardens then coordinate crosschain growth and reward active users without endless liquidity mining.

Value Proposition

The core value proposition of Bonsai is to compound value for stakeholders. Bonsai aligns incentives through a MetaDAO that funds and governs Leaves, routes their fees and token allocations to a shared treasury, and directs airdrops to $BONSAI holders when Leaves launch their tokens.

The MetaDAO structure is designed to capture, rather than dilute, value across multiple ventures. This means that every new product launched under the Bonsai umbrella is intended to benefit the core stakeholders:

- For investors, $BONSAI is a single asset with diversified exposure across yield (Umami), credit (Vendor), and liquidity unlocks (Exit.tech), with upside via treasury growth, buybacks/distributions, and future Leaf airdrops.

- For builders, Bonsai provides capital, distribution, and governance autonomy at the Leaf level. Teams can design product-specific parameters and token models while leveraging the MetaDAO’s treasury and community support.

- For users, the ecosystem offers distinct DeFi products under one umbrella: vaults on Arbitrum, oracle-less fixed-term credit, and liquidity for locked/vesting assets. Plus $SEED rewards that tie usage to ownership.

Bonsai compounds value by coordinating launches, incentives, and treasury management across Leaves: as more products ship and mature, recurring revenue and token allocations accrue to the MetaDAO and $BONSAI stakers, creating repeatable value events.

Technical Overview

The MetaDAO sits at the parent layer on Arbitrum with contacts for governance, the $BONSAI token, staking, and treasury control. Governance allocates capital, greenlights new Leaves, and manages crosschain deployments; treasury tracking spans Arbitrum and Base with public dashboards for anyone to track, while bridging (via LayerZero) moves $BONSAI/$SEED to new networks when products launch there. Staking (carried over from Umami’s Marinate model) distributes programmatic rewards to long-term holders.

Leaves are incubated as product-specific contracts (e.g., Umami vaults; Vendor isolated lending pools; Exit.tech escrow/claim markets). During incubation, Bonsai may control parameters and revenue sharing; as a Leaf matures, it graduates with its own token/TGE, airdrops a portion to $BONSAI holders, and sets up its own governance and treasury. Bonsai’s treasury usually retains an allocation, and some revenue share can persist, maintaining an economic link while the day-to-day control moves to the Leaf.

Security follows a progressive decentralization playbook. Early-stage contracts are commonly behind a Gnosis Safe multi-sig with upgradeable proxies to enable fixes and fast iteration; Leaves aim to remove upgradability once stable. New Leaves receive governance modules (e.g., Governor or multi-sig) that Bonsai can hand over at spinout.

Crosschain operations are coordinated at the MetaDAO: Bonsai bridges $BONSAI/$SEED to networks where Leaves deploy, incentives run locally, and value (fees and token allocations) is routed back to the MetaDAO and $BONSAI stakers on Arbitrum. Keeping accounting consolidated at the DAO level enables buybacks/distributions from multichain activity.

MetaDAO Layer & Governance

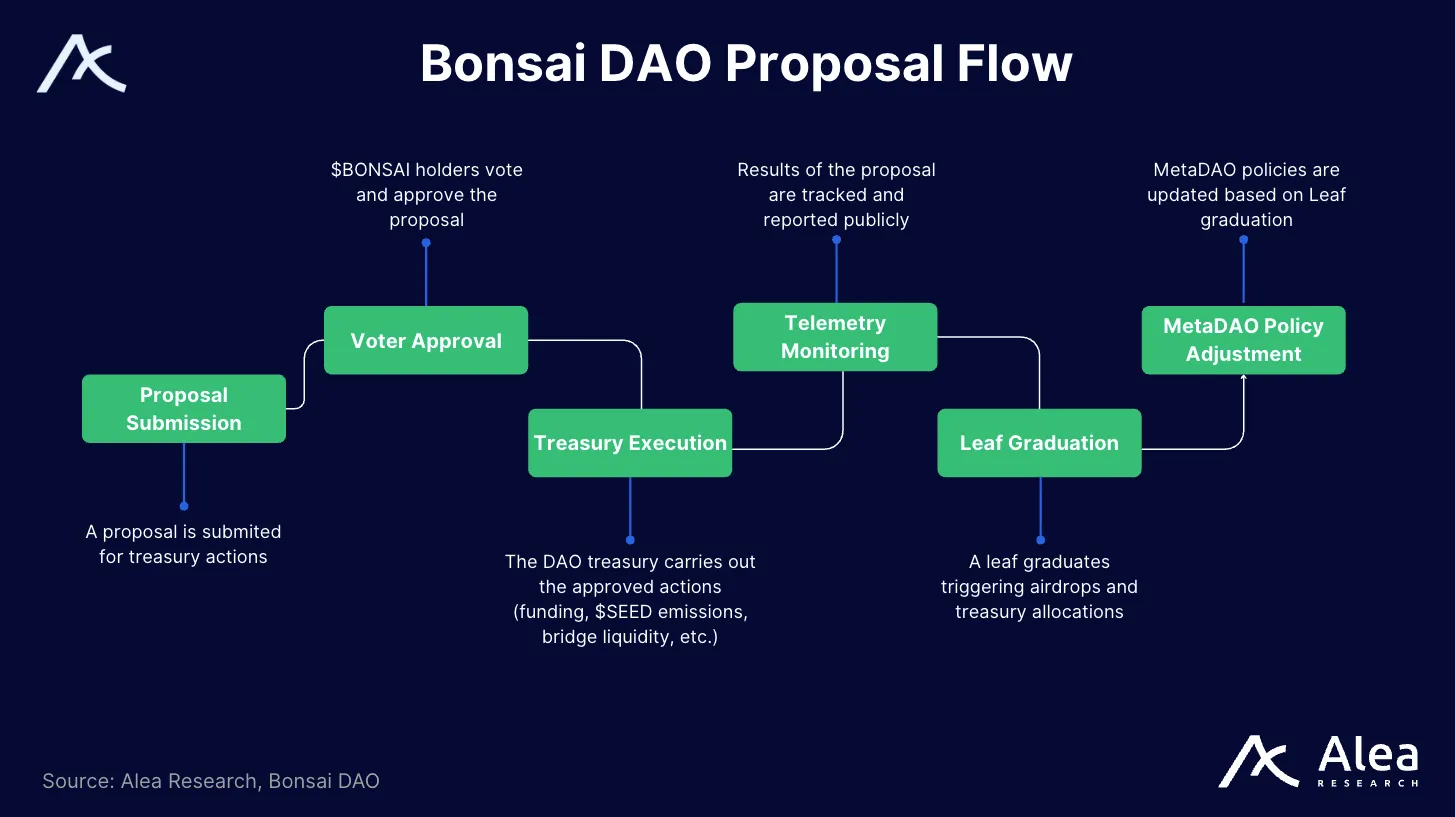

The MetaDAO governs with $BONSAI-weighted voting over treasury allocation, Leaf onboarding, emissions, and buybacks. In practice, token-holder decisions set policies (e.g., fund a new Leaf, authorize $SEED incentives, conduct buybacks), and execution is carried out by Bonsai’s onchain treasury and stakeholders; public dashboards are used to track positions and verify actions across chains.

Treasury mechanisms cover three loops:

- Funding: the MetaDAO deploys capital into Leaves during incubation (contract deployments, liquidity, grants).

- Accrual: fees and token allocations from Leaves are routed back to the Bonsai treasury while a Leaf remains under the DAO, with a portion of future Leaf tokens earmarked for $BONSAI holders at TGE.

- Distribution: governance can direct buybacks of $BONSAI from operating revenue and approve holder distributions.

Proposal flow follows a repeatable pattern: a governance proposal requests treasury actions (fund a Leaf, initiate buybacks, authorize $SEED emissions, bridge liquidity); if approved by $BONSAI voters, the treasury executes and monitors results via the public telemetry; when a Leaf graduates, a predefined airdrop/treasury allocation cements the ongoing link, and MetaDAO policies adjust accordingly.

Leaves

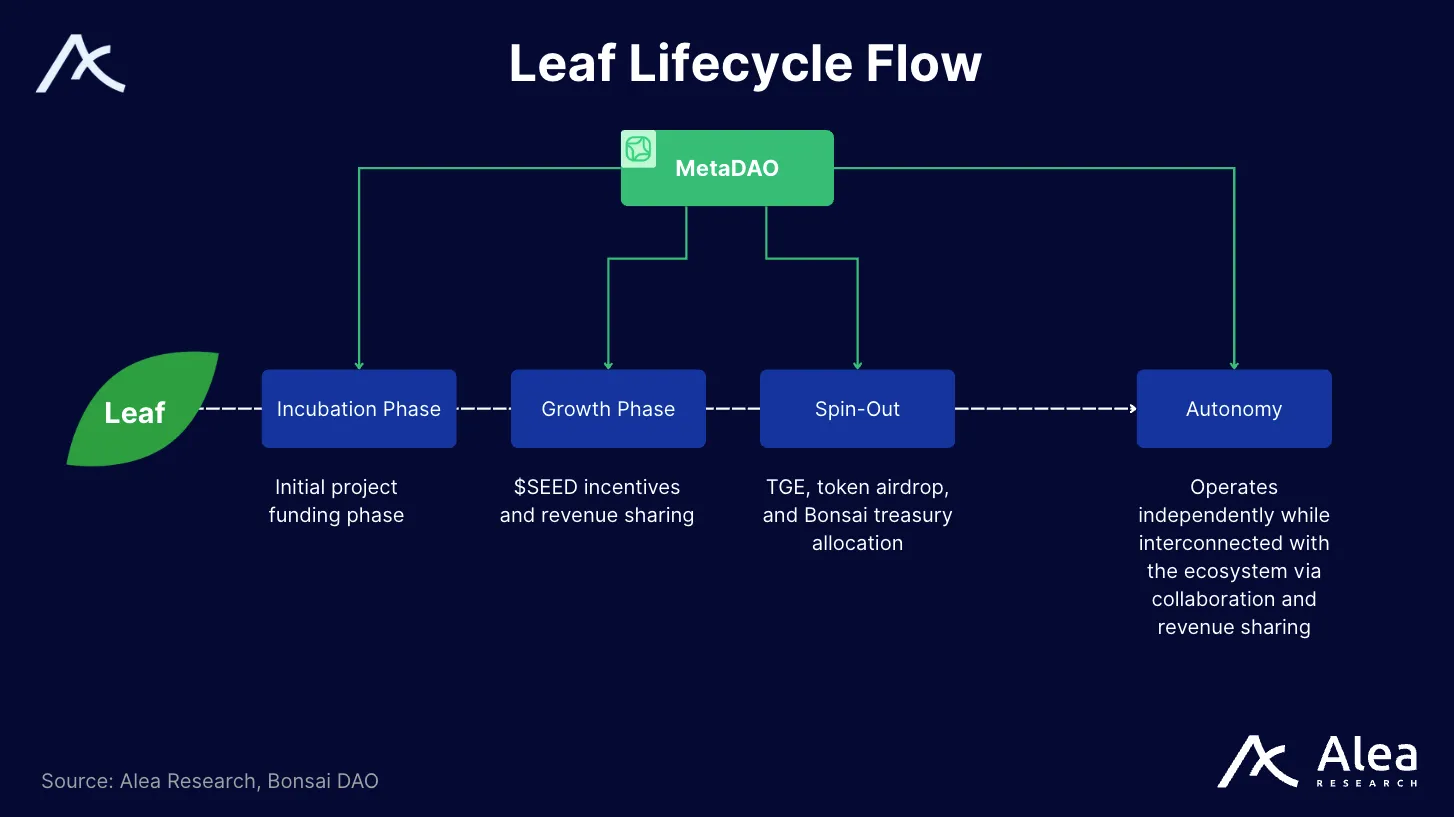

Leaves are the independent projects or SubDAOs that grow under the umbrella of the main MetaDAO. Each Leaf starts within Bonsai DAO (sharing its resources, treasury support, and governance structure) and focuses on a specific DeFi market. Over time, successful Leaves can spin out as autonomous protocols with their own tokens and governance, while still maintaining economic ties to the parent DAO through token airdrops and revenue sharing.

Together, the leaves create an ecosystem that captures and delivers value back to Bonsai.

| Leaf | Description |

| Umami Finance | Provides sustainable, hedged yield strategies. |

| Vendor Finance | Introduces oracle-free, fixed-term lending markets. |

| Exit.tech | Creates liquidity for locked or vesting tokens. |

Leaf Lifecycle

A Leaf starts in incubation under the MetaDAO: Bonsai funds development, deploys the initial contracts, and sets parameters while the product proves demand and basic unit economics. During this phase, the Leaf shares fees with the Bonsai treasury and receives ecosystem support (capital, distribution, $SEED incentives).

In growth, the Leaf scales users, TVL, and integrations. Revenue continues to flow to the MetaDAO while $SEED programs bootstrap activity (e.g., vaults, credit markets, claim markets) and convert participation into longer-term $BONSAI exposure via redemption. Governance prepares spinout criteria and an airdrop plan so existing $BONSAI holders are aligned for the next step.

At spinout, the Leaf conducts a TGE and establishes its own SubDAO. A portion of the new token supply is airdropped to $BONSAI holders and allocated to the Bonsai treasury, preserving the economic link as control shifts to the Leaf’s governance (multi-sig/governor).

Ongoing value share can persist post-spinout through two channels:

(i) Bonsai’s treasury retains a strategic allocation in the Leaf’s token; and/or

(ii) A negotiated fee share back to Bonsai, reflecting its role as incubator.

The Foundational Leaf: Umami Finance

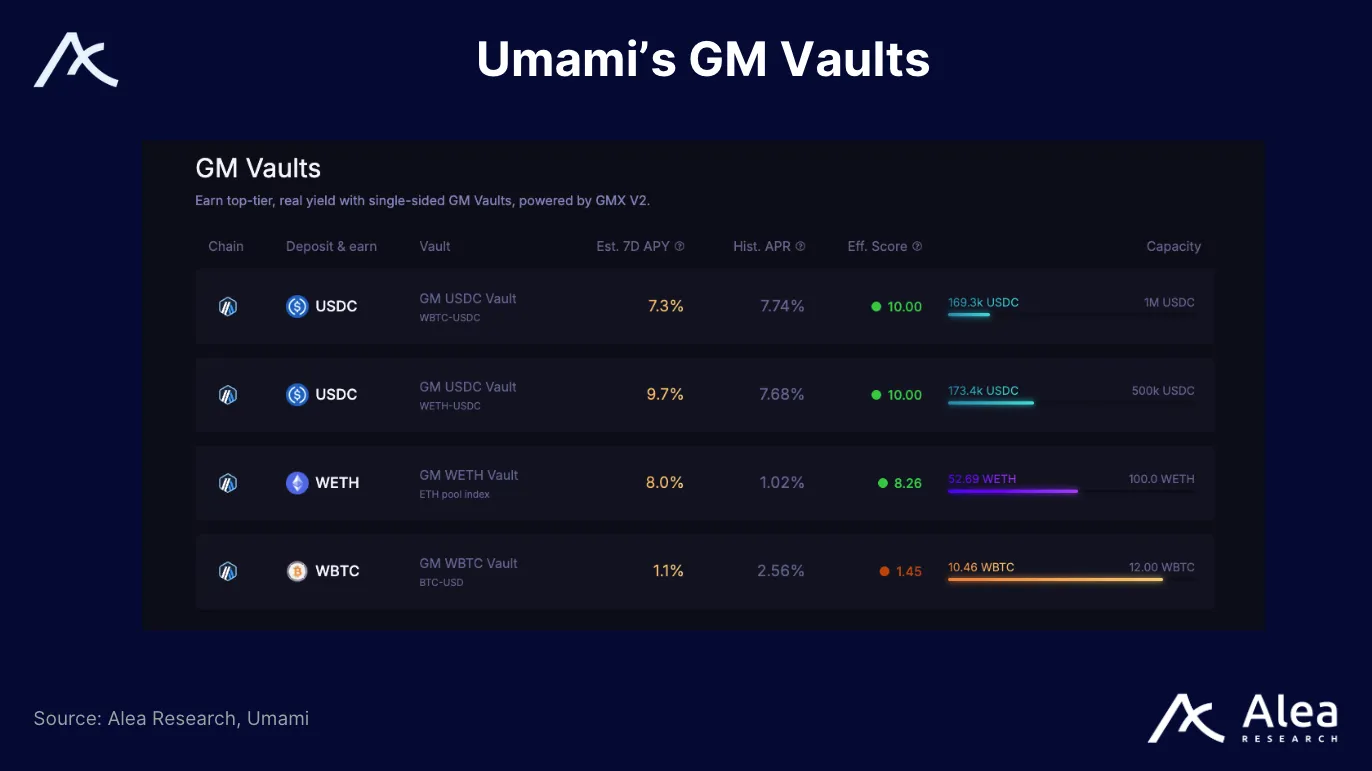

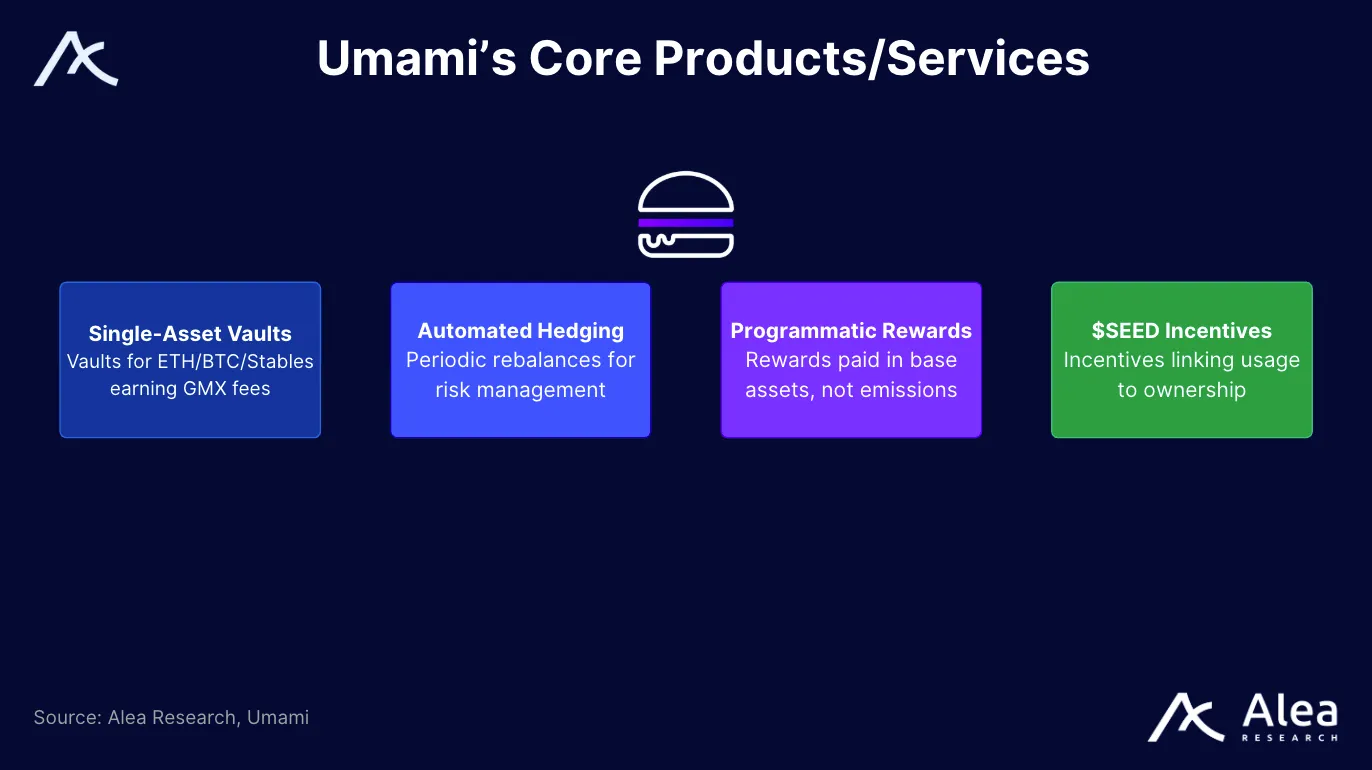

Umami Finance is Bonsai’s foundational Leaf: non-custodial yield vaults on Arbitrum that target delta-neutral or hedged returns on assets like $USDC, $WETH, and $WBTC. The vaults deploy liquidity into GMX markets to earn trading fees and rewards while minimizing price exposure.

The protocol began as Umami DAO and was restructured in 2024 into Bonsai’s MetaDAO model. $UMAMI was deprecated; value now accrues to $BONSAI via treasury flows and buybacks while the vault product continues to operate for end users. Umami remains a permanent product line rather than a future spinout.

How it works: users deposit a single asset ($USDC, $ETH, $BTC); the strategy provides liquidity in GMX v2 and continuously hedges directional risk to keep near-zero delta. An internal netting mechanism and offchain keepers rebalance within onchain constraints (e.g., when deltas drift), so depositors retain single-asset exposure while farming fee income. Returns tend to be lower in calm markets and rise during volatility as trading fees increase.

Within Bonsai, Umami functions as the liquidity engine and steady cash-flow source: vault fees and allocations accrue to the MetaDAO treasury and can fund operations, buybacks, and future Leaf incubation. Because Umami’s token evolved into $BONSAI, it is not intended to spin out; instead it supports Bonsai’s revenue base and can expand to additional networks (e.g., Base) as the MetaDAO grows.

Umami’s fee structure for its GM Vaults covers operational costs while optimizing returns for depositors.

| Fee Type | Value | Purpose |

| Vault Usage Fee | 2% (annualized) | Covers the ongoing operation and management of the vaults. |

| Yield Fee | 20% of the generated yield | A performance-based fee taken from the annual yield generated by the vaults. |

| Deposit/Withdrawal Fees | ~0.1% to 0.2% | Applied dynamically based on asset and GM token weights in the index, plus an additional 0.1%. |

| Execution Fee | ~0.001 ETH per action | Covers gas costs for the keeper system and Chainlink low-latency price feeds during deposits and withdrawals. |

The Lending Leaf: Vendor Finance

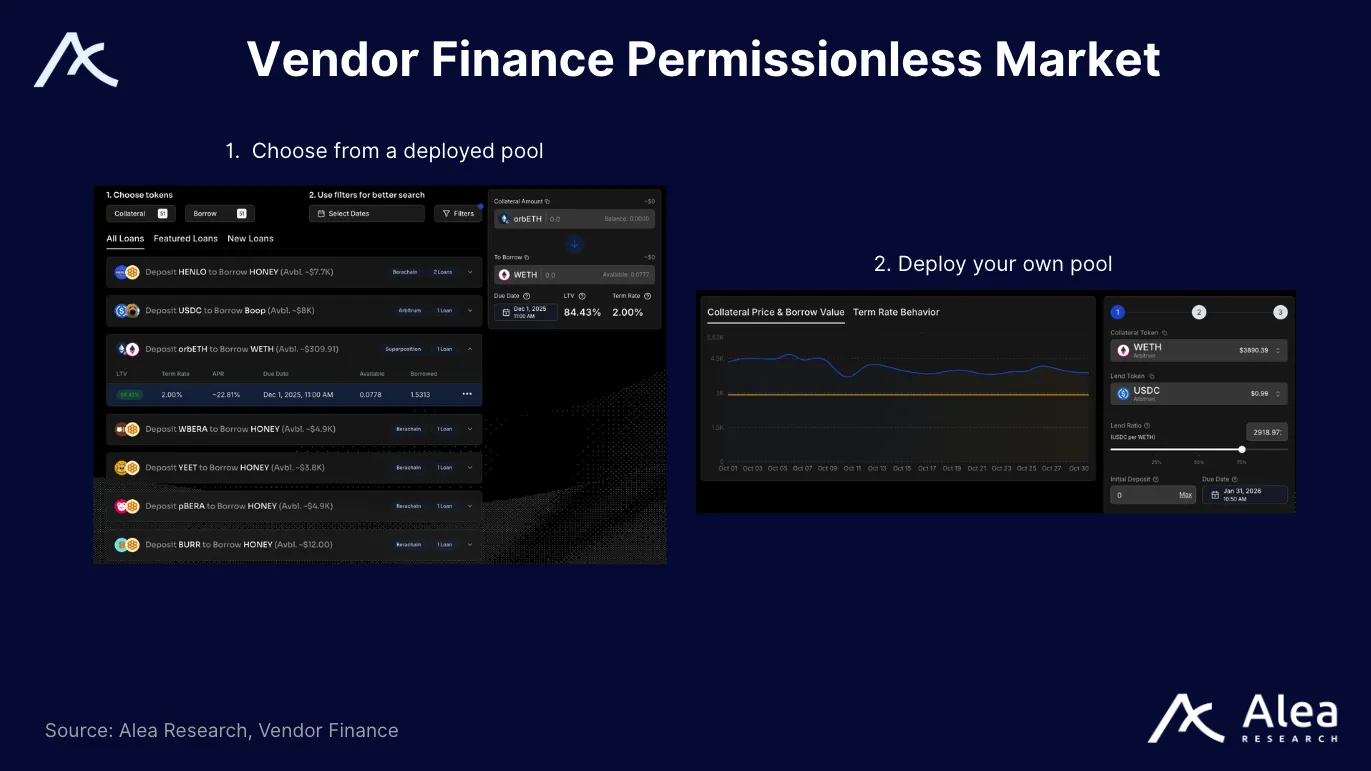

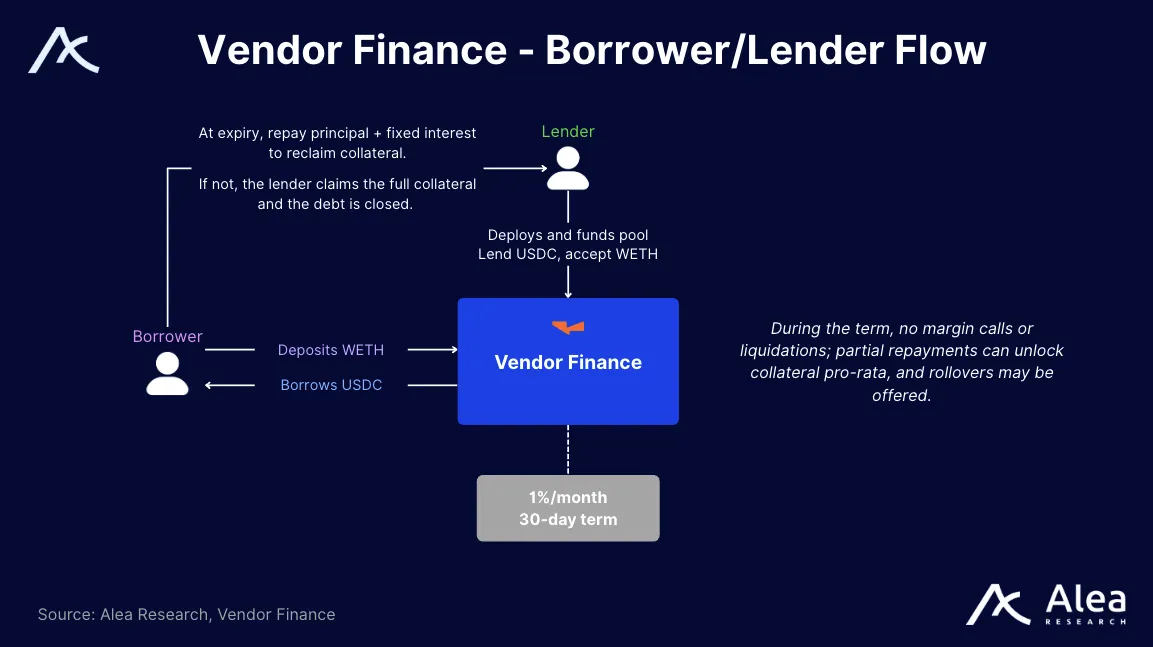

Vendor Finance is a decentralized loan marketplace for fixed-term, fixed-rate, non-liquidatable credit. Markets are permissionless: a lender deploys an isolated pool with its own parameters, and multiple borrowers draw from it. No continuous price oracles or mid-term margin calls; the loan resolves only at expiry via repayment or default.

In Bonsai, Vendor extends the stack into credit and diversifies MetaDAO cash flows beyond yield. While incubated as a Leaf, fees flow to the Bonsai treasury; over time, Vendor can operate as an independent SubDAO with an economic link through treasury allocation and potential airdrops to $BONSAI holders.

Architecturally, a Pool Factory deploys pool contracts on Arbitrum. Each pool specifies: lend asset, accepted collateral, fixed rate, term, and collateral requirement (lend ratio/LTV). V2 supports an optional oracle module for pools that want price feeds, but the core design assumes no ongoing price checks; collateral is posted upfront and locked until the outcome.

Lenders create a market with custom terms like duration, interest, and collateral, earning real yield for risk. Borrowers get liquidity by posting collateral, and their loans can’t be liquidated during the fixed term since the protocol avoids traditional price oracles.

The Incubated Leaf: Exit.tech

Exit.tech is Bonsai’s incubated marketplace for unlocking liquidity from locked or vesting tokens (e.g., esGMX). It lets a holder (Exitor) convert a future unlock into liquidity today, while outside stakers supply the needed collateral and earn the stream of vested rewards in return. As a Leaf, Exit.tech is funded and governed by the MetaDAO until its own TGE and spinout.

It expands Bonsai into the locked-asset liquidity vertical, bringing new users from external protocols (GMX first; ve-style tokens like veAERO/veVELO next) and diversifying MetaDAO cash flows alongside Umami (yield) and Vendor (credit). It improves capital efficiency at the ecosystem level by turning illiquid rewards into productive positions and reducing sell pressure for partner protocols.

How it works: An Exitor creates a pool for a specific locked asset (esGMX on Arbitrum). The Factory deploys a dedicated pool contract that receives the Exitor’s position and interfaces with the underlying vesting system (e.g., GMX transfers/vesting hooks). Stakers deposit the required backing assets (GMX/GLP) for the vest to proceed at full speed.

As the asset vests linearly, the contract splits unlocked tokens between the Exitor and stakers per the incentive percentage set at pool creation; stakers’ principal unlocks at term end (≈12 months). No mid-term withdrawals of principal; rewards are claimable throughout.

Key features of Exit.tech:

- Dedicated per-exit pools with fixed unlock timelines and clear end dates.

- Two-sided value: exitors gain staged liquidity without dumping; stakers earn base rewards plus boosted incentives from the Exitor’s vest.

- Contract-level integrations with the source protocol’s vesting/transfer primitives.

- Referral and fee modules to support growth and platform sustainability.

Exit.tech charges a platform fee on activity, which—while Exit remains a Leaf, accrues to the Bonsai treasury and supports $BONSAI value policies (e.g., buybacks) per MetaDAO governance. Upon spinout, the native token will launch, with an airdrop to $BONSAI holders and continuing economic links as defined at launch.

Primary Users & Incentives

Bonsai’s users split into five archetypes, each with direct, earned upside that links product activity to $BONSAI. Yield depositors, credit participants, and liquidity traders drive fees; builders ship new Leaves; and $BONSAI stakers consolidate value through treasury policy, airdrops, and $SEED to $BONSAI conversion. The outcome is a portfolio where participation becomes ownership and risk is separated at the product level while coordinated at the MetaDAO.

Users at the product level:

- Yield depositors (Umami): Deposit a single asset into hedged GMX-based vaults to earn market fees with near-zero delta. Their incentives are organic yield from GMX activity and occasional $SEED on top, which can be redeemed for $BONSAI to turn usage into ownership. Their deposits generate vault fees that feed the MetaDAO treasury and, by governance, $BONSAI value policies.

- Lenders/borrowers (Vendor): Lenders deploy isolated, fixed-term pools; borrowers post collateral and draw principal with no mid-term liquidations. They earn a predictable lender yield from fixed rates; borrowers get certainty (repay at expiry or forfeit collateral). Protocol fees during incubation accrue to Bonsai; at spinout, $BONSAI holders receive an airdrop/treasury allocation.

- Liquidity traders (Exit.tech): Exitors sell future unlocks (e.g., esGMX) into dedicated pools; stakers supply backing assets and earn the vest stream. Exitors gain staged liquidity without dumping; stakers earn base rewards plus boosted incentives; the platform takes a trade/usage fee that routes to Bonsai while Exit remains a Leaf.

At the protocol level, there are the $BONSAI stakers that stake to align with the whole portfolio. They get exposure to treasury growth from Leaf fees, buybacks/distributions set by governance, and allocation/airdrops from Leaf spinouts. $SEED rewards are an additional reward layer for $BONSAI holders that also incentivizes them to use Leaf products.

Builders who launch new leaves are also important to the Bonsai ecosystem. Teams get funding, distribution, and Leaf-level autonomy. In addition, they receive incubation resources, potential $SEED programs to bootstrap usage, and a defined spinout path with their own token and governance. At the same time, Bonsai receives an allocation and airdrop for $BONSAI holders at spinout.

Economic Model

Bonsai generates revenue at the product level and consolidates it at the MetaDAO. Leaf revenue (fees and token allocations) routes to the Bonsai treasury during incubation; at spinout, $BONSAI holders and the treasury receive allocations/airdrops that preserve the relationship. Governance then decides on buybacks, distributions, and new incubation funding.

Tokenomics Breakdown

Bonsai DAO employs a two-token system to separate long-term ownership and governance ($BONSAI) from short-term incentives and growth mechanisms ($SEED).

$BONSAI & $SEED Utility

$BONSAI is the governance and value-capture token for Bonsai. Treasury inflows from Leaves can be used for $BONSAI buybacks or holder distributions through governance. $BONSAI also provides portfolio exposure to future Leaf airdrops/allocations at spinout. Staking $BONSAI provides portfolio-wide governance (pre-spinout), direct exposure to the value returned by Leaves, and $BONSAI emissions.

$SEED is the incentive token used to reward actions that grow the ecosystem (vault usage, lending activity, Gardens tasks, etc). $SEED is redeemable for $BONSAI at a discount (~10%) and after 1 week of vesting; aimed to convert short-term participants into $BONSAI holders . A user must complete the redemption within 4 weeks after vesting, or the redemption right will expire.

Their roles differ: $BONSAI supports governance and treasury policy while $SEED funds growth without inflating $BONSAI. Fees from active Leaves accrue to the treasury (while incubated), enabling buybacks/distributions and new-Leaf funding; $SEED programs steer user activity that later converts into $BONSAI.

$BONSAI Buyback Program

The Bonsai DAO Buyback Program uses revenue generated across ecosystem protocols to periodically buy back and permanently remove $BONSAI tokens from circulation.

All the details of the buyback program can be found here.

$BONSAI Distribution

Bonsai launched in 2024 via a 1:10 swap from $UMAMI to $BONSAI (1,000,000 $UMAMI = 10,000,000 $BONSAI total). No additional emissions were announced alongside the swap; later value accrual relies on fees, buybacks, and Leaf airdrops/allocations rather than $BONSAI inflation.

Holders of $UMAMI received $BONSAI at the 1:10 ratio as part of the rebrand. Subsequent programs (e.g., $SEED snapshots) reference $BONSAI balances and ecosystem activity for eligibility.

$SEED Distribution

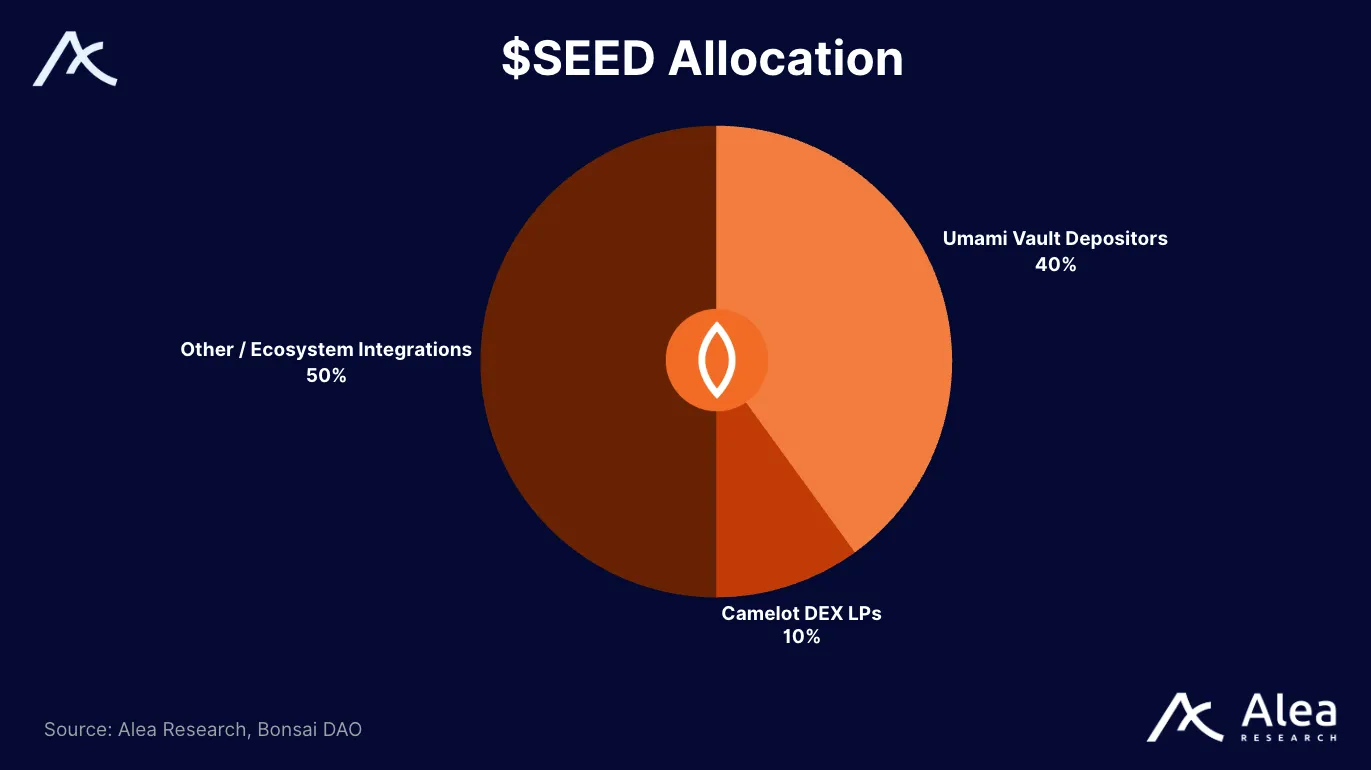

Total Supply: The total supply of $SEED is 10,000,000 $SEED.

Supply Limit: The supply is hard-capped, meaning there is no inflation beyond this 10,000,000 limit.

$SEED emissions are paced by the team to prevent dilution and front-running. The token is distributed gradually across airdrops, staking, and LP rewards, all of which are backed by real $BONSAI in the redemption pool.

The allocation of the total 10,000,000 $SEED supply is categorized as such:

| Category | Amount ($SEED) | Purpose / Description |

| Umami Vault Depositors | 4,000,000 | Incentives for GM Vault stakers on Umami Finance, focusing on the USDC vault. |

| Camelot DEX LPs | 1,000,000 | Rewards for providing $SEED/ETH liquidity to deepen onchain markets. |

| Other / Ecosystem Integrations | 5,000,000 | Reserved for future campaigns, partnerships, and DAO-driven incentives. |

| Total Supply | 10,000,000 | Hard-capped. |

A significant portion of $SEED was allocated for the initial airdrop to multiple groups, based on snapshot data collected between June 2024 and September 2025. The maximum distributed via this initial phase was 7,000,000 $SEED.

Risks and Safeguards

Bonsai’s model spreads execution across Leaves but centralizes policy at the MetaDAO. The table maps major risks to concrete mitigations documented in product materials.

| Risk Type | Example | Countermeasure |

| Smart-contract | Bugs in Umami vault logic; Vendor pool factories; Exi.tech pool/fees modules. | Umami security audits; Vendor security audits; Exit.tech audits. |

| Treasury | Concentration in a few assets; stablecoin depeg; directional exposure | Treasury tracked across chains with public telemetry (Dune, DeBank); policy‐based allocation (buybacks, distributions, incubation budgets) to diversify sources; disclosure of positions and deployment venues. |

| Governance | Voter apathy; capture by large holders; execution risk. | $BONSAI holder votes at MetaDAO; execution via multisig signers; staged permissions and (where applied) timelocks/thresholds; Leaf autonomy reduces the scope of any single failure. |

| Product (Vendor) | Oracle-less, fixed-term loans can end in borrower default at expiry. | Risk is isolated per pool; collateral posted upfront; two terminal outcomes (repay or default); optional oracle module in V2. |

| Product (Exit.tech) | Vest/claim disputes; mis-configured incentive splits; integration bugs with source protocol (e.g., GMX vesting) | Per-exit dedicated pool contracts; factory/registry; direct integration with GMX transfer/vesting; clear unlock dates; fee/referral modules; audited launch and roadmap with staged expansions. |

| Crosschain | Bridge failure or accounting mismatch between Arbitrum and Base | Use LayerZero’s OFT for $BONSAI and $SEED transfers with Stargate as a supported route, avoiding custodial lock-and-wrap bridges and keeping a unified supply across Arbitrum-Base; restrict allowed endpoints by governance and verify flows via mirrored treasury telemetry. |

FAQ

What is Bonsai DAO?

A decentralized venture-studio “MetaDAO” that incubates, funds, and launches multiple DeFi products (Leaves).

What are Leaves?

Independent products initially built under Bonsai that can later spinout as SubDAOs; their success feeds value back to the parent DAO.

Which core Leaves exist today?

Umami Finance (yield vaults), Vendor Finance (oracle-less term lending), and Exit.tech (liquidity for locked/vesting tokens).

How does value accrue to $BONSAI holders?

Via revenue flowing to the DAO and token distributions when Leaves launch; spinouts airdrop a portion of the supply to $BONSAI holders and the treasury.

What’s the difference between $BONSAI and $SEED?

$BONSAI is the governance/value token; $SEED is an incentive token you earn and can redeem for $BONSAI at a discount.

How do I earn $SEED?

By using ecosystem products and joining Garden Seasons community campaigns (as a $BONSAI-holding Guardian).

Is Umami spinning out?

No. Umami is the foundational Leaf and remains a permanent product line after the UMAMI – BONSAI transition.

What makes Vendor Finance different?

Fixed-term, fixed-rate loans with no mid-loan liquidations and minimal oracle reliance; repay at maturity or forfeit collateral.

What does Exit.tech do?

Creates a neutral marketplace so holders can unlock liquidity from locked/vesting tokens (e.g., esGMX) while buyers earn the ongoing rewards.

Where does Bonsai operate?

Rooted on Arbitrum, with deployments/expansion to other chains such as Base.