Introduction

Appchains shift value capture from shared L1 blockspace to application-owned block production, letting teams align performance, economics, and governance with user needs rather than host-chain constraints. By controlling the execution pipeline, a project can tune block times to its specific UX targets, set bespoke fee logic, and push upgrades through its own governance process. The design, therefore, accrues value to the app’s token rather than leaking it to a generalized base layer.

Demand for that autonomy is growing as one-size-fits-all, monolithic blockchains expose clear limitations—congestion, throughput, volatile gas fees, and shared state forces conservative upgrade schedules. Teams that want full blockchain control often build on sovereign frameworks like Cosmos SDK or Substrate, gaining flexibility but facing technical burdens—validator setup, integrations, and heavy operational overhead that delay launches. Beyond technical friction, there are also structural limitations: chains remain fragmented, liquidity gets divided, and isolation from other dApps limits network effects.

RaaS platforms solve many of these pains by automating infrastructure and enabling a faster, easier time-to-market, but introduce new trade-offs like base-layer reliance and limits on customization. Tanssi addresses these issues by offering fast, permissionless launches, pooled security, and less operational burden, combining true sovereignty with efficiency.

The resulting market demand is for teams to have sovereignty, immediate economic security, and near-instant launch in a single package. This approach reduces both time-to-launch and maintenance demands, while assuring capital allocators that value capture will be predictable—not lost to operational drag.

Key Takeaways

- Sovereign L1 Control: Purpose-built L1s let projects optimize performance and economics around their own users and token models, instead of being constrained by shared blockspace or upstream governance.

- Market Frictions: Validator setup, interoperability, and operational overhead are pain points for new chains, driving demand for frameworks that offer a complete out-of-the-box package.

- Framework Spectrum: Builders must choose between full sovereignty and RaaS solutions, each with trade-offs in control, security, speed, finality, and operational load.

- Cost Efficiency: Tanssi’s cost model is usage-based and predictable, resulting in lower total costs for active protocols compared to fixed-fee RaaS platforms, especially as transaction volume grows.

- Economic Security: Restaked $ETH via Symbiotic enables appchains to inherit Ethereum-grade security from day one, bypassing months of bootstrapping validator sets.

- Stakeholder Value Flows: Every dollar paid by an appchain recirculates as operator rewards and security incentives, with $TANSSI as the unit that ties together operational, security, and governance flows.

- Developer Experience: Tanssi’s dApp abstracts away validator ops, explorers, RPCs, and integrations, letting teams launch, test, and iterate from one unified interface. The result is AWS-level simplicity with Web3 sovereignty.

Market Context

Growth has hit a ceiling for certain dApps running on shared blockchains, with teams exploring a migration toward sovereign chains to bypass the limits of shared blockspace. dApps seek full control to avoid resource constraints and capture more value for their own token. The recent shift by companies like Circle, with its Arc L1 for financial settlement, validates the growing demand for full control over execution, economics, and governance.

There are three main blockchain designs, each with distinct trade-offs:

- Appchains (L1) maximize sovereignty: one app, exclusive blockspace, custom governance, and fee logic—delivering dedicated throughput and control.

- Rollups borrow security from the base layer (like Ethereum), enjoying lower costs and compatibility but relying on shared consensus and suffering delayed finality.

- Shared L1s offer maximum composability, consolidating many dApps on one chain, but force apps to compete for blockspace, lose governance flexibility, and face upgrade constraints.

The choice is a direct trade-off between sovereignty, security dependency, and composability.

Yet, for teams pursuing full sovereignty, three structural frictions continue to slow adoption and complicate launches:

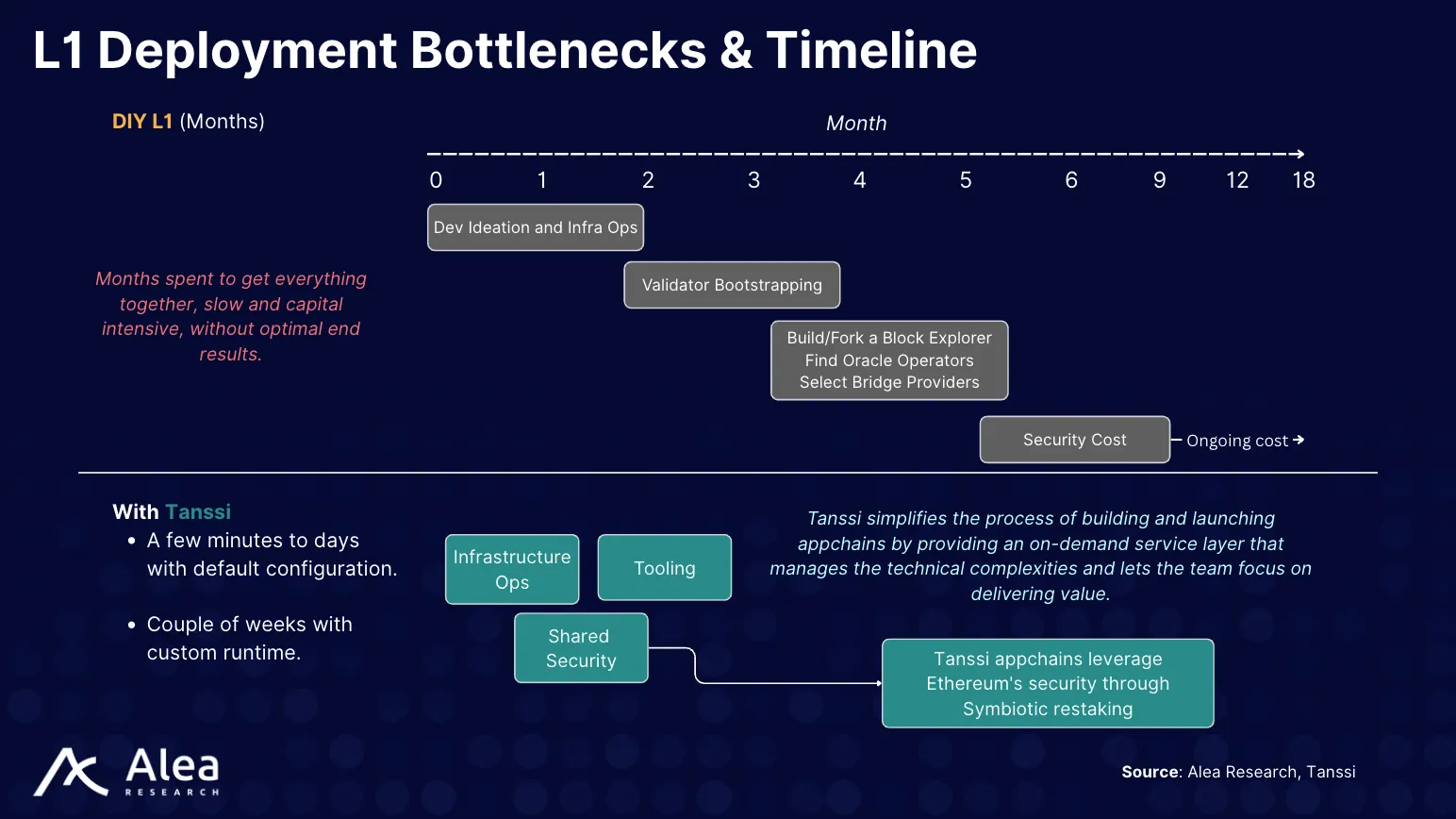

- Long Setup Times & Costs: First, spinning up an independent chain can take weeks to quarters as teams assemble sequencers, configure tooling, and manage operations.

- Fragmented Security & Bootstrap Challenges: Second, security is fragmented; new chains must persuade validators with inflationary rewards, exposing them to a death spiral risk if the token price starts to fall.

- Hidden Costs: Third, hidden costs accumulate in bridges, indexers, explorers, and upgrade coordination, removing engineering focus from the core product. These hurdles increase capital requirements and delay the emergence of network effects, creating a clear market gap for rapid launch, immediate economic security, and full sovereignty.

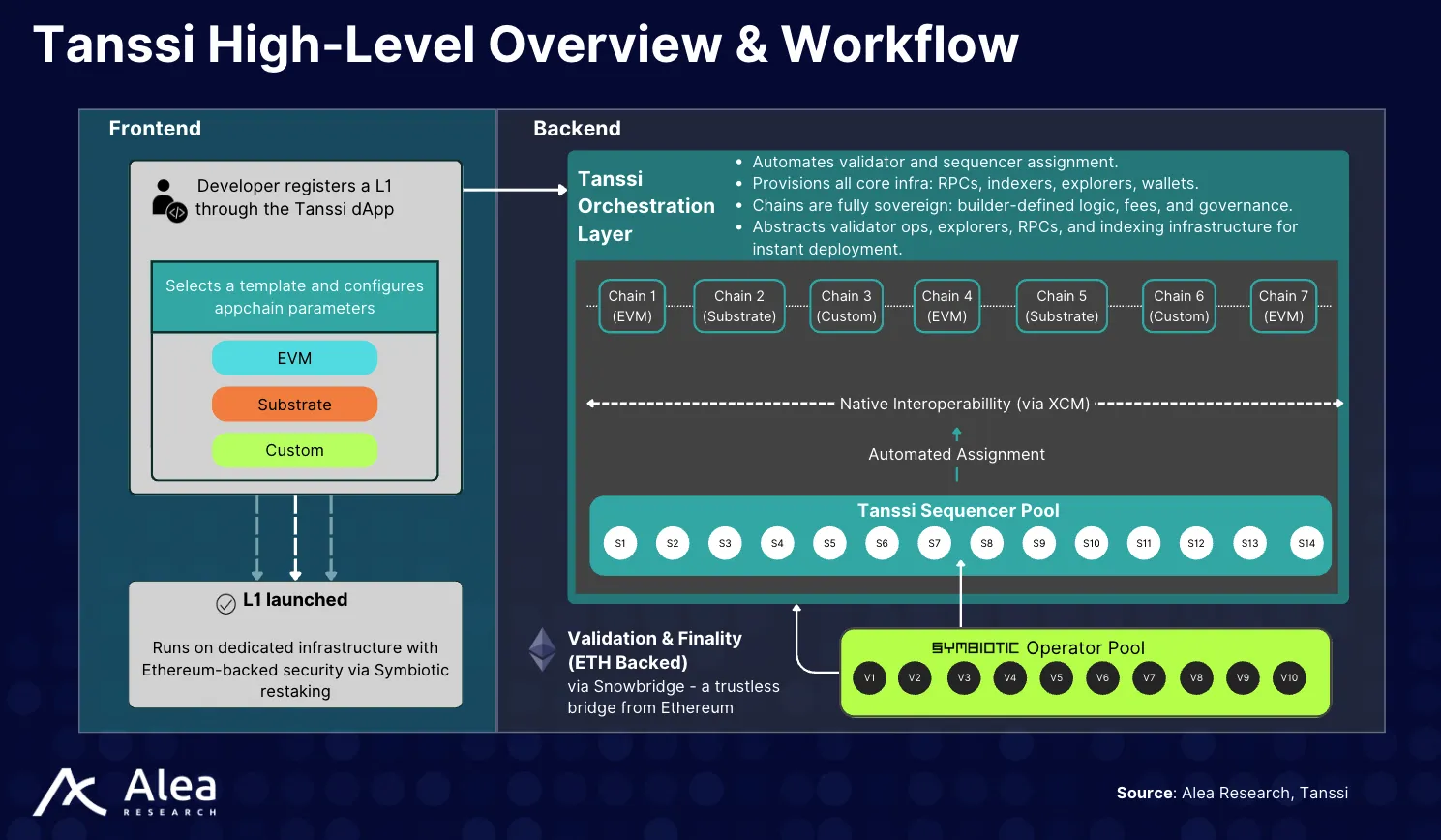

Tanssi fills that gap by turning block production and shared security into turnkey services. A team can move from a concept to a sovereign L1 live on mainnet in minutes. Each chain inherits Ethereum-grade economic security from day one through Symbiotic restaked collateral, sidestepping validator bootstrapping and removing early-stage death spiral risk.

Sovereignty is preserved: each L1 connected to Tanssi defines its own execution logic, fee market, and upgrade path while relying on Tanssi only for sequencing and finality import. A light-client, two-way bridge moves assets trustlessly between Tanssi and Ethereum, ensuring seamless liquidity and messaging.

Finally, Tanssi’s pre-integrated indexers, oracles, explorers, wallet adapters, and SDKs compress time-to-market and remove peripheral complexity for developers.

The above figure illustrates how Tanssi’s orchestration layer automates validator assignment, provides pooled economic security, and enables L1 deployment across EVM, Substrate, or custom runtimes.

Sector Outlook

Sovereign L1 frameworks and RaaS platforms sit at opposite ends of the control-plane spectrum for appchains. Choosing a framework dictates where value accrues, how blockspace performance is tuned, what customizability is allowed, and how much operational and developer overhead a team must carry before and after launch.

Sovereign stacks such as Cosmos SDK zones, Substrate-based, Polkadot parachains, and Avalanche subnets deliver full ownership of execution and governance. RaaS offerings like OP Stack, Arbitrum Orbit, and Polygon CDK trade some of that autonomy for speed to market. Understanding their respective trade-offs and risk surface is fundamental for appchain development.

A sovereign framework hands builders the entire stack: custom consensus, bespoke fee logic, and upgrade rights, enabling direct value capture and performance tuning unconstrained by a host chain (e.g., Arbitrum, OP). However, this control comes with its tradeoffs, as mentioned earlier. Validator recruitment, upgrades, monitoring, and ecosystem integrations are all the responsibility of the application team, shifting resources from product shipping. Security must also be bootstrapped until the stake and validator count reach a critical mass to avoid security difficulties.

Additionally, early decentralization is often more cosmetic than real, as most protocols only truly decentralize much later when they rely on their own token. In sum, sovereign frameworks maximize design freedom but externalize both capital costs and operational risk to the builder.

On the other side of the spectrum, there is RaaS. Rollup templates shorten launch timelines from months to weeks and inherit the economic security of a battle-tested L1, offering builders an instant benefit without a native token necessary for consensus. Also, by aligning with a large L1 like Ethereum for instance, an appchain can tap into that ecosystem’s network effects from day one.

These points are compelling but create dependencies and limitations, such as gas price spikes and increased network traffic, which could impact the rollup’s performance. Upgrades to the L1 must be closely monitored and updated accordingly. Additionally, a rollup’s throughput is ultimately constrained by the L1’s data capacity, which may limit the appchain’s scalability if it requires a massive scale beyond what the L1 can provide.

Additionally, time-to-market and network effects arrive with a centralized component: most deployments begin with a single sequencer, and the periodic outages on Arbitrum, Base, and others have shown how one node can freeze an entire network for 30-60 minutes. Even if a rollup operator plans to decentralize later, initially, users depend on the uptime and honesty of a single operator.

Teams want sovereignty without long launch cycles or new centralization vectors. Appchains must be free of throughput limits and other inherited limitations to hit their goals. Frameworks that compress setup time, provide immediate economic security, and reduce operational overhead across the board will be best positioned in the appchain era.

Competitive Landscape

To compare the launch-your-own-chain market, we need to separate into two cohorts based on their approach to sovereignty and infrastructure control. The two cohorts: Sovereign L1 frameworks (Tanssi, Saga) let apps own blockspace and economics while borrowing security; RaaS providers (Conduit, Caldera, Dymension, AltLayer) anchor apps to a settlement and DA layer to optimize for go-to-market speed and tooling familiarity. Tanssi’s position: full sovereignty and runtime-level customization, with a managed control plane (sequencing, security, interop) that enables near-instant launches and reduces operational overhead (automated maintenance) over time.

| Cohort | Examples | Why is it included (selection criteria) |

| Sovereign L1 frameworks | Tanssi, Saga | All give full L1 sovereignty and shared validator security. They capture the “own blockspace, keep value” path. |

| RaaS (rollups on Ethereum/DA) | Dymension, Conduit, Caldera, AltLayer | Modular L2/RaaS deployment: settlement on shared hub L1, pluggable DA. Fast launch, composable architecture, familiar frameworks (operate as an L2). |

The comparison highlights how Tanssi’s control-plane approach stands across key dimensions: time-to-deployment, sovereignty, economic security, developer experience, and operational sustainability. The cohorts reflect viable paths to own blockspace today and satisfy the selection criteria (market leaders/growth, architectural similarities, live mainnets, capital signal, public datapoints).

Deployment Speed

Historically, launching a sovereign L1 blockchain took months—requiring full-stack engineering, validator recruitment, and infrastructure integrations. Modern frameworks and RaaS can shorten this to days or even minutes (for simple configurations), depending on the level of automation and any required operator review.

| Provider | Grade | Notes |

| Tanssi | Minutes | Permissionless mainnet registration via the Tanssi dApp; mainnet process is fully decentralized and permissionless (no approval queue). Testnet reference times: ~10 min (Quick Trial) and ~2 hrs (Dedicated) |

| Saga | Minutes-Hours | Permissionless chainlets; public evidence: a Uniswap v3 chainlet deployed in <2 minutes. Mainnet launch flow is click-through in the Saga web app. Times are indicative, not guaranteed. |

| Dymension | Minutes-Hours | Since the 3D upgrade, RollApps can be launched permissionlessly (no governance gate). Community guides report channel/activation states flipping to active within minutes in typical flows. |

| Conduit | Minutes | Permissionless mainnet deployments in the app in minutes. Seven-step process to deploy a rollup. |

| Caldera | Minutes-Hours | On Caldera, you can deploy a ZK/OP/Arbitrum/Polygon rollup in minutes via one-click rollout. Post-launch wiring (bridges, domains, oracles) may add time. |

| AltLayer | Minutes | AltLayer is considered one of the fastest RaaS providers on the market, where developers can “spin up a customized execution layer within 5 mins through a few simple clicks” using its no-code dashboard. |

Appchain and RaaS stacks have converged on the time it takes to first block when the flow is permissionless and templated. Dymension’s 3D upgrade removes the earlier approval queue; Tanssi and Saga are already click-to-mainnet. RaaS providers (Conduit, Caldera, AltLayer) can also achieve “deploy in minutes” status. However, necessary add-ons (custom DA, private sequencing, compliance) can extend time-to-market outside the main pipeline measured here.

Cost Model

Two patterns can be observed from the cost models. Sovereign L1 frameworks meter costs as protocol fees (deposits, per-session/per-block, DA) with little or no platform rent. RaaS platforms add a fixed monthly platform charge and, depending on the stack, protocol-level revenue sharing to the respective protocol (sequencer profit).

| Provider | Grade | Notes |

| Tanssi | Low | a) Up-front: one-time registration deposit sized to runtime – off for now. Recurring: b) per-session collator assignment cost ($50 $TANSSI each session), c) per-block production fee (0.03 $TANSSI), paid from the appchain governor via the dApp. Revenue share: none to a host. Fees accrue directly to sequencers and the appchain treasury. Security is inherited from Ethereum through Symbiotic without an external provider cost. |

| Saga | Moderate | All chainlets launched pay a setup cost. Chainlet fees paid from a deposit each epoch = Musical Chairs Price × active validators; paid in $SAGA and distributed to validators. Price resets via continuous auctions. |

| Dymension | Moderate | Operator bond required to sequence (minimum 100 $DYM today); bridging fee currently 0.1% on withdrawals (governance-set, burned); protocol AMM charges swap fees (portion burned/royalties). |

| Conduit | Moderate – High | Conduit’s pricing is transparent and tiered. A testnet costs $250 per month, with a $50 deployment fee (3 months free), while the Growth plan starts at $5,000 per month, plus 5% sequencer profit (deployment costs vary). Custom pricing might go higher than that. |

| Caldera | Moderate – High | Although the pricing plans are not communicated, visiting the dashboard to deploy a Rollup on Caldera, the pricing is as follows: Testnet starts at $99 per month, while mainnet deployment starts at $3,000 per month (no deployment cost). |

| AltLayer | Moderate – High* | *Docs list two service packages; pricing by contact only. |

All figures are indicative and reflect both setup and recurring costs, excluding optional add-ons or third-party integrations. Unlike fixed-fee RaaS models, Tanssi’s usage-based cost structure scales directly with network activity, aligning fees with actual demand.

Maintenance Overhead

Ongoing operations are where most projects lose value, since every hour spent on fixes, upgrades, and incident response is an hour not invested in product development. Operating burden varies depending on who runs the block production, sequencing, and infrastructure management. Sovereign L1 frameworks can externalize sequencing and infrastructure to a shared operator pool (low) or require the team to run a sequencer (medium). RaaS platforms fully centralize operations, minimizing maintenance for teams but introducing dependency on vendor-managed upgrades and incident handling.

| Provider | Grade | Notes |

| Tanssi | Low (fully managed) | Operational work post-launch is minimal for developers. Tanssi provides automated orchestration of critical infrastructure components, including validator coordination, sequencer assignment, data availability, and crosschain messaging. |

| Saga | Low (fully managed) | Chainlets are operated by validators selected/rotated via Saga’s mechanisms; Saga provides validator orchestration tools and decentralizes the validator set. Teams primarily handle their chainlet’s configuration, upgrades, and governance, while validators run infrastructure. |

| Dymension | Medium (shared ops) | A RollApp operator manages and maintains the infrastructure: an entity must run the sequencer, full nodes, relayer, and an optional eIBC client, each with its own lifecycle and on-call duty. That’s real, recurring operations. |

| Conduit | Low (provider-managed) | Conduit manages rollup/RPC infrastructure and automates upgrades; teams offload node operations, monitoring, and incident response to the vendor. Note the coordination trade-off: provider-side changes have, at times, coincided with outages (see the Degen L3 outage tied to a provider upgrade). |

| Caldera | Low (provider-managed) | The Rollup Engine lets teams upgrade node software and manage infra through a programmable control plane; Caldera also delivers fully-managed rollups (e.g., Solo), handling sequencer, batcher, and settlement operations. |

| AltLayer | Low (provider-managed) | RaaS is delivered like SaaS with no need to maintain or host the service; AltLayer’s restaked AVS stack (MACH/SQUAD/VITAL) adds decentralized verification/sequencing as managed components. Team overhead is largely governance/app-level. |

Maintenance overhead is a clear separator. Tanssi, Saga, and RaaS providers (Conduit, Caldera, AltLayer) externalize block production and routine operations into the control plane. Tanssi achieves low overhead while preserving sovereignty—sequencing/monitoring are pooled and automated, and forkless upgrades keep maintenance lightweight without hard forks.

Customizability

The more a team can tune the execution and control plane (VM, modules, DA, fee logic, governance, upgrade cadence), the more value it can accrue on its own blockspace. RaaS stacks tend to concentrate flexibility around which rollup stack + which DA, while sovereign appchain frameworks expose deeper levers (state-machine and governance). Tanssi belongs to the latter group—Substrate-level knobs (pallets/modules, governance, EVM parameters) are primary, while DA is supplied by Tanssi.

| Provider | Grade | Notes |

| Tanssi | High | Full Substrate runtime control (swap/extend pallets), optional EVM via Frontier, custom fee logic, and forkless upgrades governed onchain; teams own their chain’s governance and cadence. Bridge and external security integrations are out of the box (Ethereum light-client bridge; Symbiotic). |

| Saga | High | VM-agnostic chainlets (EVM first; others possible) with independently upgradable components; Cosmos-SDK modules and Realms let teams choose tech stack and security source while keeping app-level governance. |

| Dymension | Medium – High | RollApps built with RDK (Cosmos-SDK fork) choose VM (EVM via Ethermint, CosmWasm), compose SDK modules, and select DA layers (e.g., Celestia/Avail). Governance/fees are app-owned; Hub provides settlement/IBC. Certain upgrades must follow the Dymension RollApp Standards (DRS). |

| Conduit | Medium | Deep configuration and brand customization inside EVM stacks (OP Stack/Orbit/CDK): choose DA (Ethereum/Celestia/EigenDA via stack), gas token, block time, fee parameters, L2/L3 settlement; upgrades are provider-managed and bound to stack rules. |

| Caldera | Medium | Multiple frameworks (OP, Orbit, ZK) with alternative DA (EigenDA/Celestia/NEAR), custom gas token, block times; the Rollup Engine exposes programmable deployment/upgrade controls, still within EVM stack semantics. |

| AltLayer | Medium – High | Launch on OP/Orbit/ZK/CDK; add AVS modules (SQUAD sequencing, MACH fast finality, VITAL verification). DA follows chosen stack (incl. alt-DA options via integrations). Strong flexibility, but primarily EVM-stack. Developers can also customize the gas token and runtime to fit their specific needs. Upgrade path tied to chosen stack + AltLayer services. |

Sovereign frameworks expose deeper customization and full control over important parameters that capture value, while RaaS platforms centralize choice around stack and DA: useful for time-to-market, but VM and state-machine changes are bounded by OP/Nitro/CDK/ZK defaults. Tanssi’s Substrate surface (modules, governance, fee logic, upgrades) enables true protocol-level differentiation.

Sovereignty

Sovereignty equals control of the execution pipeline and rules (VM/runtime, fee logic, upgrade path, and token/monetary parameters) without dependence on any higher-level authority (such as a parent chain) for settlement and validation. Rollup stacks centralize settlement and bridge contracts on a parent L1 by design; sovereign appchain frameworks remove that dependency.

| Provider | Grade | Notes |

| Tanssi | Full | Appchains run as independent L1s, with block production as a service from a decentralized sequencer pool coordinated by the Tanssi orchestration chain, removing parent-chain settlement. Teams control runtime logic and push forkless upgrades via onchain governance; fee policy and pallets/modules are owner-defined. Security is augmented via Symbiotic restaking without submitting rule-making to Ethereum. |

| Saga | Full | Chainlets are explicitly sovereign blockchains. They use shared security from Saga validators (ICS), but developers set parameters (e.g., base gas fee) and operate independent chains; autonomy is at the chain level, not gated by a parent L1’s settlement/upgrade contracts. |

| Dymension | Full | RollApps control execution, parameters, fees, and upgrades; the hub provides settlement/security but not app governance. |

| Conduit | Partial | Conduit chains run OP Stack/Arbitrum rollups. By construction, rollups offload settlement and fault/finality to L1 contracts; core protocol upgrades and bridging rely on L1 governance/contract control. (Conduit provides the stack; sovereignty remains bounded by the parent-L1 model.) |

| Caldera | Partial | Similar to Conduit, deployed rollups follow the chosen stack’s rules and parent chain’s governance/finality. |

| AltLayer | Partial | AltLayer restaked rollups enhance rollups with AVSs (decentralized sequencing, fast finality, verification), yet they remain rollups instantiated from OP/Orbit/ZK stacks where settlement and canonical contracts live on a L1. AVSs improve properties but do not remove parent-chain dependence. |

Sovereignty for appchains is important as it determines how value flows. Full sovereignty allows an appchain to own block production and the control plane, setting fee logic, governance, and upgrade cadence, so that performance and economics align with its users and accrue value to its own token, rather than leaking to the host chain.

Economic Security

Economic security sets the attack cost and credibility of finality for an appchain, and shared-security models let new chains rent a large, existing collateral base, bypassing the months of validator recruitment and incentives normally required to bootstrap their own security.

| Provider | Grade | Notes | Trade-offs |

| Tanssi | Restaked $ETH | Appchains use Symbiotic to source security from restaked $ETH (and other ERC-20 collateral) for instant Ethereum-grade security. | Large, external collateral base without bootstrapping a validator set; AVS slashing/parameters add an extra layer to reason about. |

| Saga | Native token | Every Chainlet is validated by Saga Mainnet validators via ICS; misbehavior is slashed on staked $SAGA (security chain). | Immediate shared security scales with $SAGA staking economics and validator set quality. |

| Dymension | Native token | RollApps settle to the Dymension Hub L1 secured by $DYM. Sequencers must bond $DYM; finality and bridging composability rely on the Hub’s validator set, while security scales with $DYM bonded ratio/market cap. | The security of the network is directly tied to the dollar value of the staked $DYM, which is a different model than restaking or shared validator pools. |

| Conduit | Ethereum L1 | Rollups settle to Exhereum and prove/resolve disputes on L1 (OP Stack / Arbitrum), thereby inheriting Ethereum security. | Solid base security; still subject to rollup-layer centralization (e.g., sequencer) and stack-governance specifics. |

| Caldera | Ethereum L1 | Caldera-deployed rollups derive canonical economic security from their settlement L1 (typically Ethereum). | Same settlement guarantees as chosen L1; rollup-layer ops/upgrade powers remain a separate consideration. |

| AltLayer | Restaked $ETH | Restaked Rollups add AVS for decentralized sequencing/verification/fast finality (EigenLayer-style), while rollups remain anchored to a base L1/L2. | AVSs can harden liveness/correctness, but canonical security still flows from the settlement L1. |

Security from restaked $ETH (Tanssi via Symbiotic) removes security bootstrapping while keeping sovereignty over the execution pipeline. For teams prioritizing immediate, large-scale collateral without a new token’s cold start, restaked $ETH offers one of the cleanest paths. For those aligning tightly with their own staking flywheel, native token models retain full internalization of security incentives.

Maturity Signal

RaaS frameworks have established their position in this market by being the go-to solution for rollup development. Conduit and Caldera now support 60+ networks each, with TVL exceeding billions, and transactions showcasing actual activity on those networks. AltLayer is growing on the back of restaked-rollup AVSs and notable partners supporting >$8b in top AVSs; AltLayer has partnered with the Polkadot Deployment Portal (PDP) to enable RaaS for Polkadot Native Rollups. Dymension shows seven active RollApps on its dashboard, showing limited traction considering how long it has been live, while transactions remain relatively low. Saga, currently on the Pegasus mainnet, counts more than 30 active chainlets.

Tanssi is the newest entrant in the cohort but directly addresses historical bottlenecks—slow launches, validator bootstrapping, centralized sequencing, and operational overhead. Its live deployments already show how these barriers can be removed with a permissionless, production-ready model.

| Provider | Grade |

| Tanssi | Early |

| Dymension | Growing |

| Saga | Growing |

| Conduit (RaaS) | Established |

| Caldera (RaaS) | Established |

| AltLayer (RaaS) | Growing |

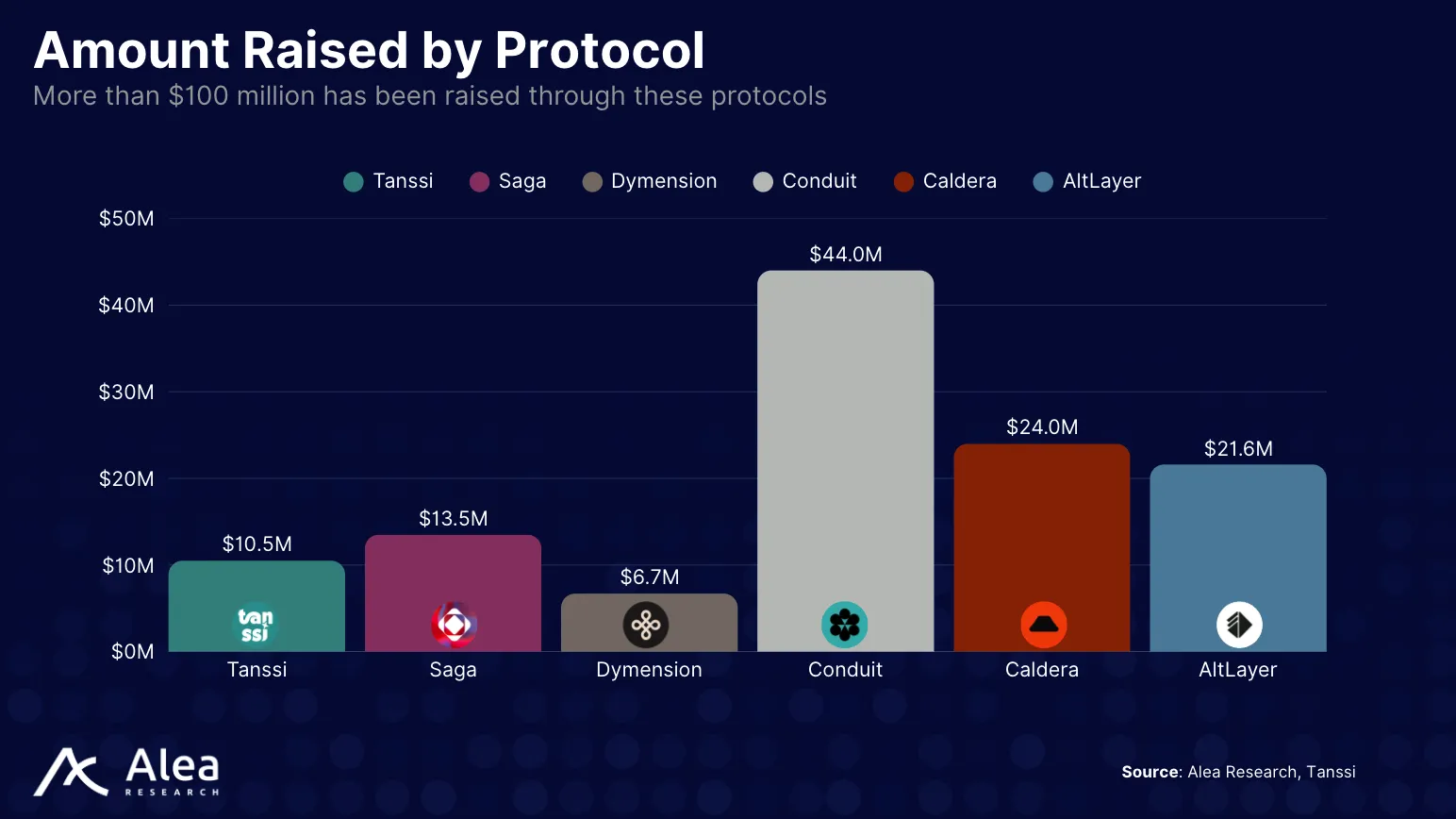

All protocols have raised substantial amounts from VCs, with Conduit raising the most with $44M. The blockchain infrastructure sector has been a top or near-top sink for crypto VC capital during the last year. During Q3 of 2024, the infrastructure sector has reached $745M in funding. In Q1 and Q2 of 2025, infrastructure has been a top-3 sector by funding, with more than $500M in Q1 and almost $200M in Q2.

Case Study: Tanssi Speed & Cost Analysis

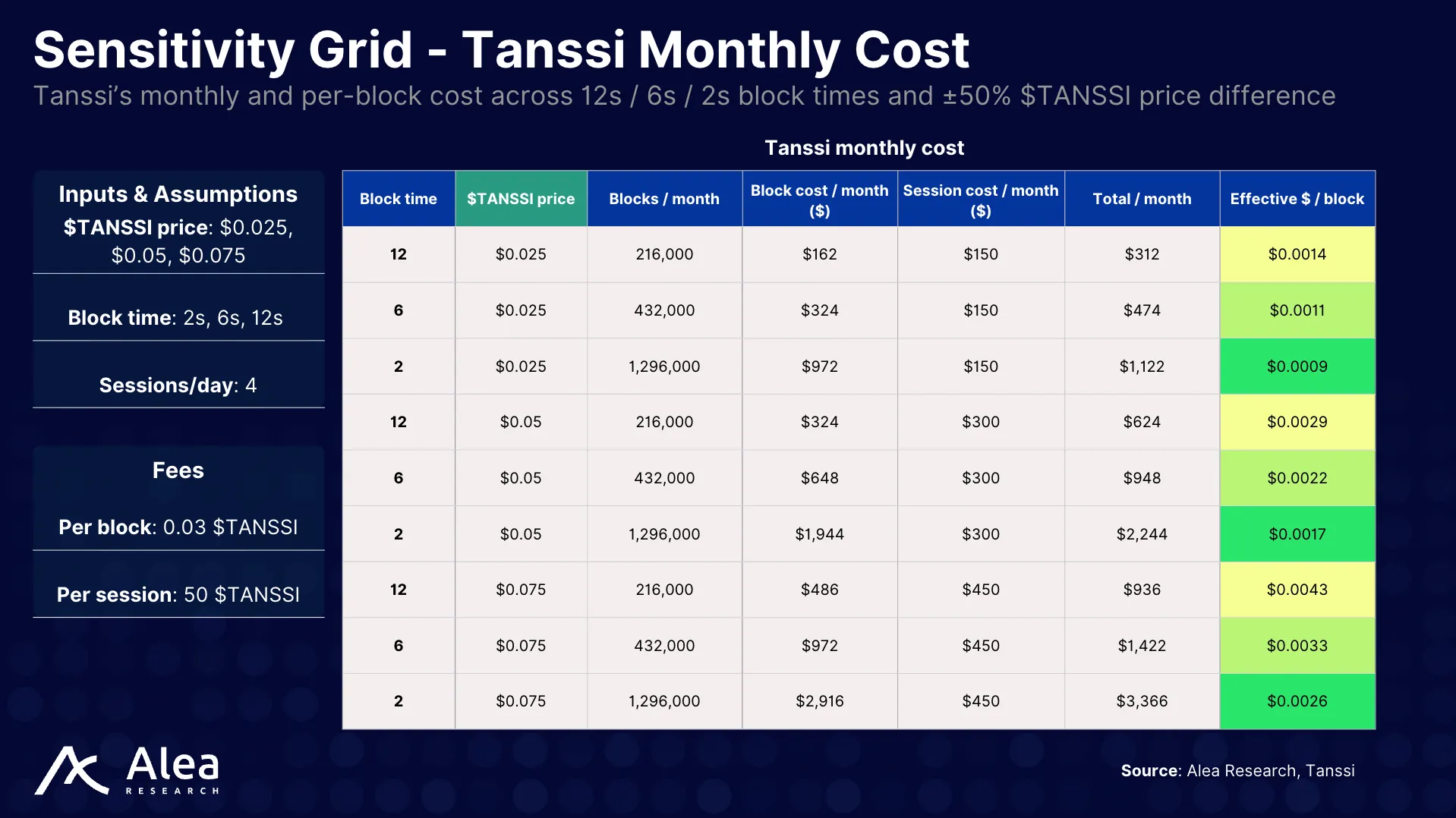

Tanssi’s cost model is time-based: a per-block fee and a per-session collator fee, independent of transaction count. With ~6s blocks, the baseline is roughly $950–$1,100 per month at $0.05/TANSSI (4 sessions/day). Since Tanssi bills per block and not per transaction, each additional transaction within a block lowers the average cost per transaction. Budgeting is predictable, but there is $TANSSI price exposure.

For time-to-market, using a pre-integrated stack reduces setup and upgrade work, so launching earlier can outweigh the monthly run-rate by a large margin if expected net revenue is meaningful. Compared with many L1/L2 setups that add variable per-tx, DA, or settlement costs, Tanssi tends to be cheaper at higher usage because its bill doesn’t scale with traffic.

Adding further assumptions and a ±50% $TANSSI price band—repeating those scenarios at $0.025 / $0.05 / $0.075—provides a more comprehensive overview of the cost model.

When comparing Tanssi’s pricing model to its competitors with clear, publicly available mainnet deployment monthly prices, an apples-to-apples cost comparison shows that Tanssi can be cheaper not only in terms of recurring monthly costs but also in opportunity costs. Compared to Conduit and Caldera under current assumptions, the cost difference is notable. Keep in mind that variable rates like L1 and DA fees are not included, which makes the total monthly costs for Conduit and Caldera higher.

Tanssi’s cost is linear and usage-linked. Across the assumed $TANSSI price band and block times, Tanssi remains cheaper in all scenarios. Fixed-fee RaaS catches up only at very high throughput or at a much higher $TANSSI price. Under current assumptions and without variable costs for RaaS, the break-even point at the base price ($0.05) is ~3M blocks/month vs Conduit and ~1.8M vs Caldera. Expressed as a steady cadence, that’s roughly 0.8s/block for Conduit and 1.4s/block for Caldera running continuously (near-constant load). Below those rates Tanssi is cheaper, and above them, the fixed sub may become cheaper under a few circumstances (variable costs will increase for RaaS). Still, it is highly unlikely this scenario will apply, as most apps experience periods with higher usage rather than continuous 24/7 maxed operation, so Tanssi’s advantage typically remains in real workloads and when $TANSSI price is higher.

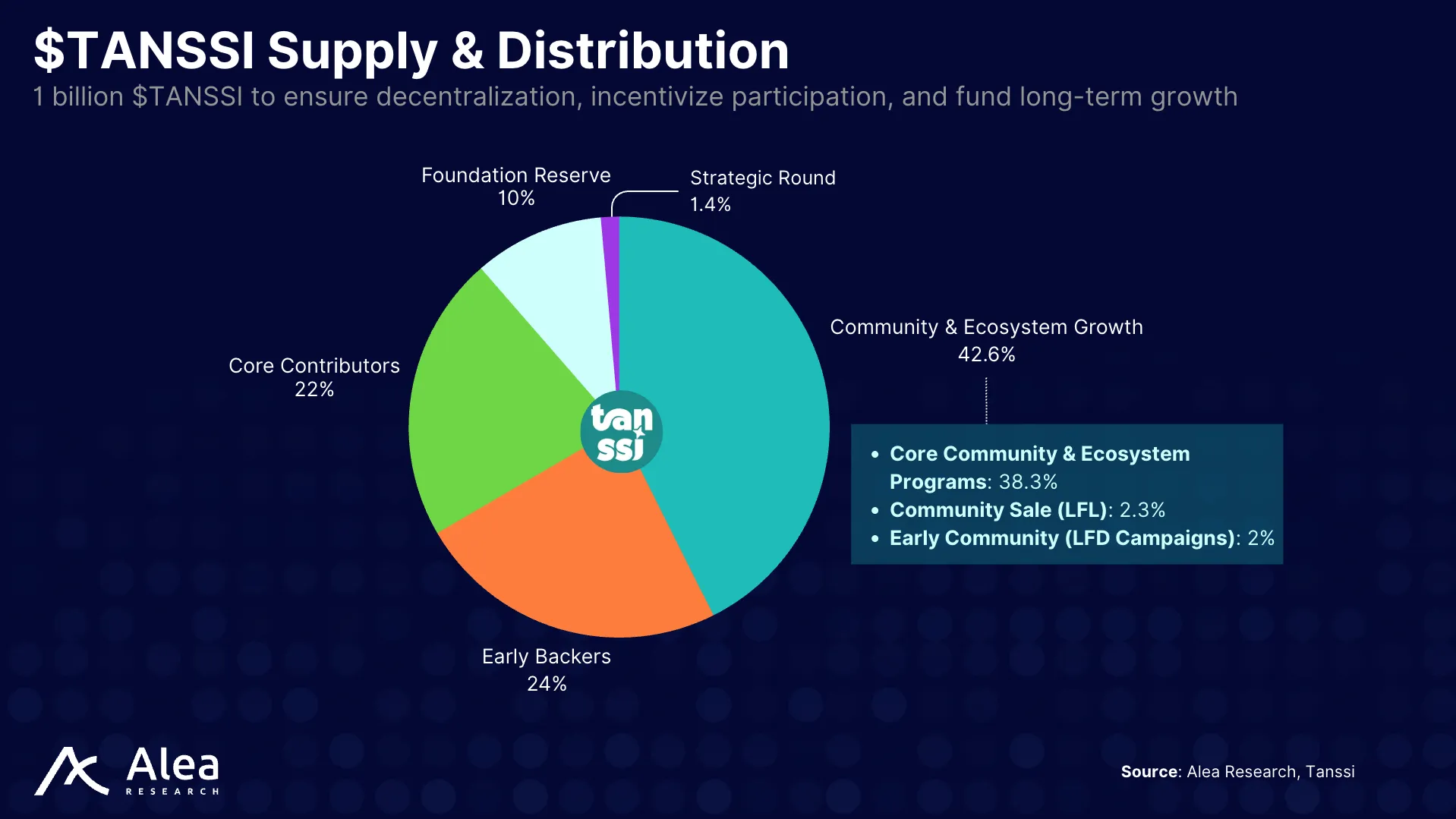

Tanssi Tokenomics Framework

$TANSSI is the system’s single coordination asset. It funds block production, backs security, and powers governance, so the control plane and its incentives stay closely together. $TANSSI comes in two synchronized forms: a native Substrate token for fees/staking/voting, and a trustlessly bridged 1:1 ERC-20 for Ethereum-based collateral, staking, and payouts. Appchains pay three usage fees for their operating costs, all paid in $TANSSI.

Governance is split into three segments where token holders propose/vote parameter changes and authorize runtime upgrades; appchains govern themselves independently, while Tanssi governs shared infrastructure (sequencer scheduling, crosschain interfaces, protocol fees).

Value flows in a tight, closed loop between stakeholders. Appchains begin the flow by posting a registration bond and paying recurring fees in $TANSSI, flowing back to the protocol that routes fees and emissions to three parties: 1) sequencers/operators for block production, 2) delegators who back those operators, and 3) external restakers who provide security.

- Sequencers/operators must stake $TANSSI to enter the active pool and earn these fees and $TANSSI rewards.

- Token holders can delegate their $TANSSI to sequencer pools and earn rewards without hardware or slashing risk.

- External security operators restake $TANSSI via Symbiotic to secure the network and get additional rewards.

This flow makes $TANSSI function as a security incentive, the medium for infrastructure payments, and a governance tool that guides future utility and value mechanisms.

| Stakeholder | Role in the system | Pays (in $TANSSI) | Earns (in $TANSSI) |

| Appchain teams | Register chain; consume block-production-as-a-service | Registration deposit; per-session assignment; per-block fees (deducted & burned) | — |

| Sequencers/Node Operators | Produces blocks when assigned by the orchestrator. Attract delegated stake. | Stake $TANSSI to join/scale weight. | Block fees + staking rewards |

| Delegators (token holders) | Allocates stake to operators, no hardware needed. | — | Share of staking rewards |

| Restakers (Symbiotic) | Supplies economic security on Ethereum | Stake $ETH/whitelisted ERC-20 (incl. $TANSSI ERC-20) | Restaking rewards; may receive protocol incentives |

| Data preservers (full/archive) | RPC, storage, indexing | — | Service rewards (and possibly appchain tokens) |

Tanssi reduces two historical burdens for teams—operational and economic security costs by pooling sequencers and importing security rather than forcing each appchain to recruit, subsidize, and harden its own validator set, often through diluting its own token. Shared security via Symbiotic gives day-one Ethereum-grade economic security, avoids fragmented stake, and externalizes slashing to Ethereum contracts, saving time and capital from appchains.

Pay-as-you-go block production and per-session rotation keep costs usage-linked and predictable while preserving liveness and latency targets. Because operators’ revenue (fees + inflation) and penalties (slashing) are tied to uptime and correctness, they rationally invest in resilient infrastructure; builders pay only for assigned sessions and produced blocks compared to fixed-fee subs.

This alignment—fees from appchains -> staked, slash exposed operators -> finalized blocks—cuts bootstrapping, monitoring, and incentive overheads that would otherwise leak value away from the host chain.

Conclusion

Tanssi is all about making life easier for appchain builders: fast launches, solid security, and the freedom to shape their protocol without numerous technical hurdles. By removing operational bottlenecks and introducing predictable, usage-based costs, Tanssi lets protocols focus their resources where they matter most. While still early relative to established RaaS providers, Tanssi’s path to the appchain process addresses directly what the market needs: sovereignty, configurability, and speed-to-market with value flowing back to the protocol itself. As the market shifts toward application-specific blockchains, Tanssi’s technical approach offers teams a practical pathway to greater autonomy and efficiency.

References

Crypto Investment Report Q3 2024

Galaxy Research Q1 2025 – Galaxy Research Q2 2025

Tanssi Deployment Documentation

Disclosures

Alea Research is engaged in a commercial relationship with Tanssi and receives compensation for research services. This report has been commissioned as part of this engagement. Members of the Alea Research team, including analysts directly involved in this analysis, may hold positions in the tokens discussed. This content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.