Ether.fi is now a vertically-integrated DeFi protocol turned non-custodial neobank: Staking (savings) + Liquid (earnings; yield vaults) + Cash (credit and payments), and imminently Trade (spot/perps via Hyperliquid). The bundle concentrates distribution, boosts retention, and lifts ARPU by turning base DeFi rails into consumer products—from restaking infrastructure to consumer fintech (but with significantly fewer boots on the ground; 29 full-time employees vs traditional banks’ hundreds or thousands).

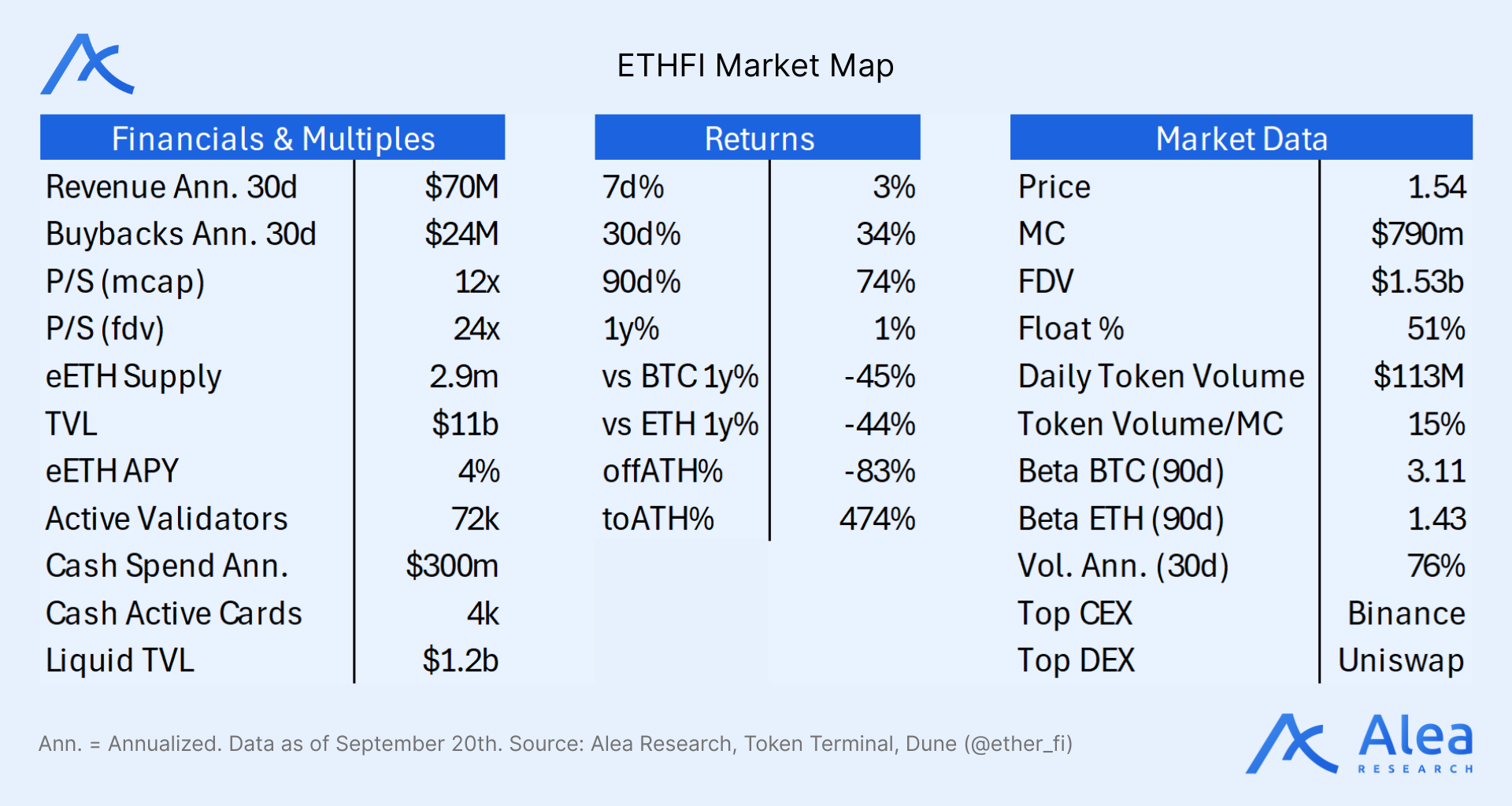

ETHFI accrues value from programmatic buybacks (> $6.5M cumulatively). Bids are executed onchain with 25% of protocol revenue, distributing a portion with stakers (sETHFI) to target ~10% APY (amount adjusted based on the staking ratio) and burning the rest. Currently trading at ~1.4 beta to ETH, it offers both clean idiosyncratic upside and levered exposure to ETH while keeping hedging options open. Product suite expansion and wider revenue funnels provide an extensive degree of optionality. Each new business line adds a fresh stream of revenue, diversifies income, and increases resilience for adverse market regimes. The result: more paths to upside, more levers to manage downside.

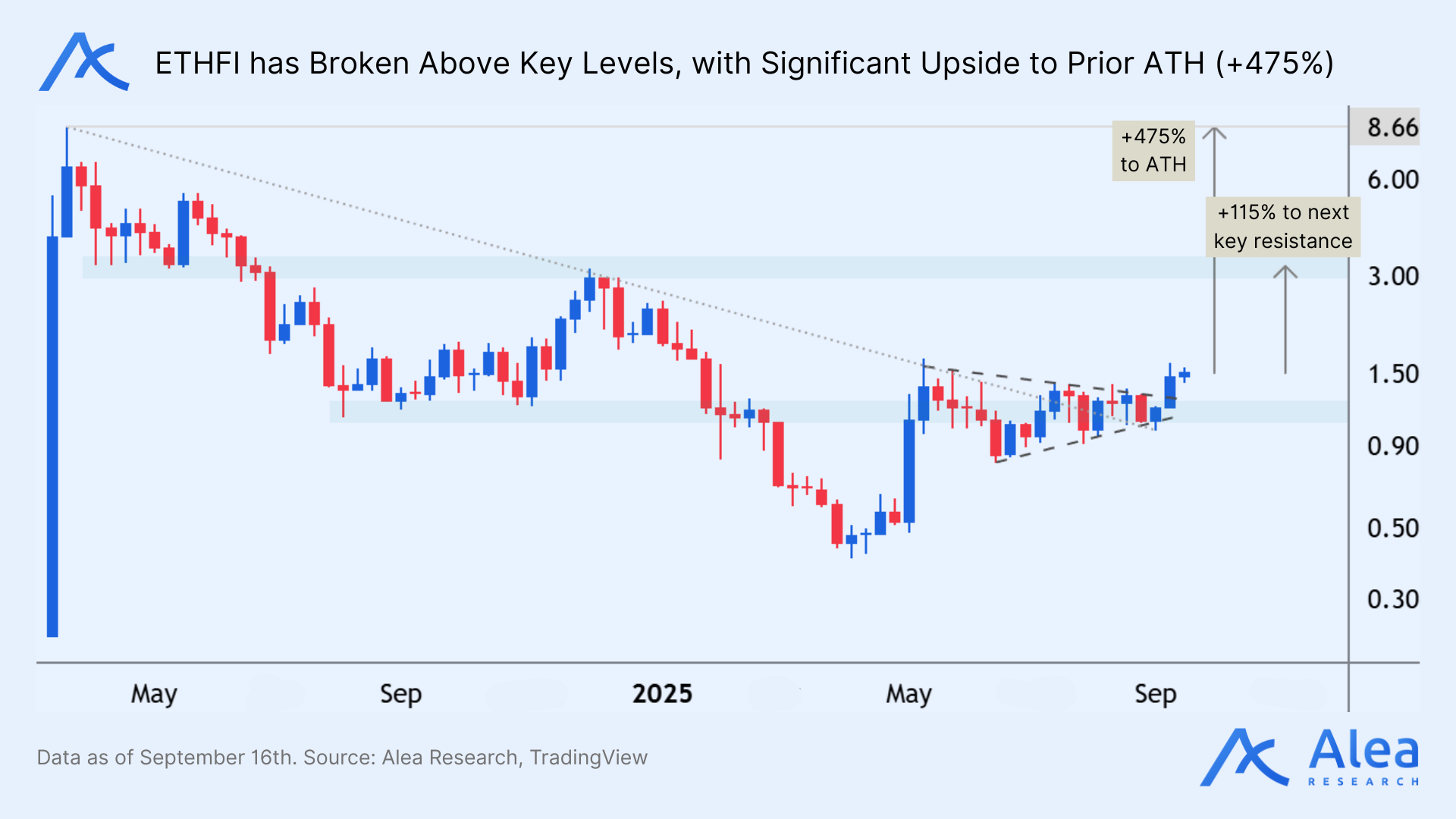

ETHFI trades near $1.5 after a ~94% peak‑to‑trough FDV drawdown from TGE to the bottom. The last break from this floor late 2024 ran >2x, from $1B to $3B in FDV terms. If revenue step up and ETH stays risk‑on, a re‑rating is on the table. Downside is visible (~$1 support levels) and hedgeable; catalysts are coming from multiple angles: DAT staking strategies (ETHZilla deploying already in $100M tranches), enterprise adoption of Cash, and new product releases (Hyperliquid’s Trade and support for tokenized stocks). ETHFI/ETH hasn’t seen much of a re-price despite these significant upgrades, which creates a strong case for rotation as ETH bulls shift weights into strong DeFi tokens with still-to-be-created revenue streams.

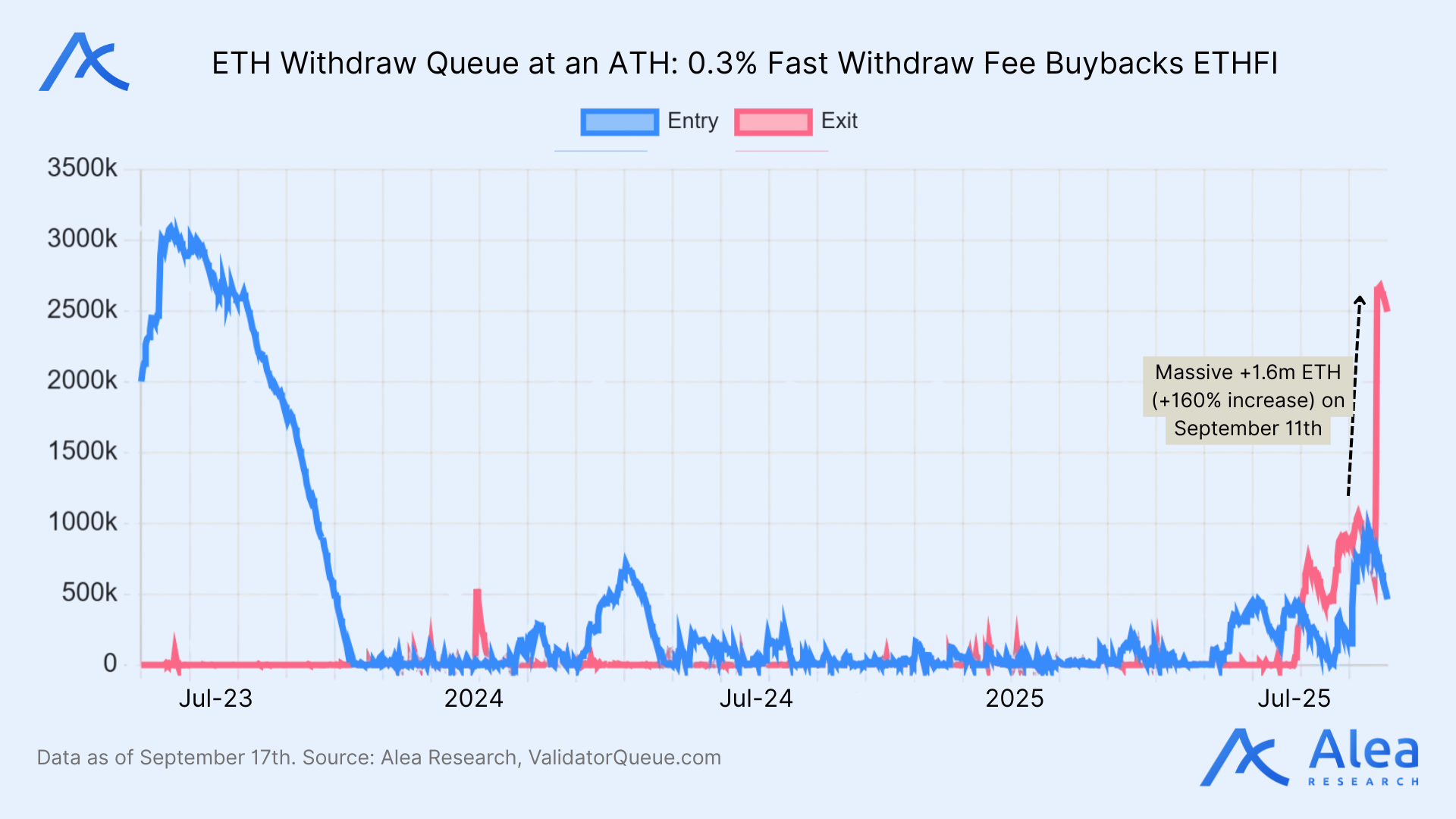

If ETH chops, programmatic buybacks add steady demand and soften drawdowns. Meanwhile, exits from the ETH staking queue signal a shift to liquidity (e.g. ETH stakers want to keep the asset in hand and be ready to sell at will whenever). In a year-end volatility cluster with tariffs and rate cuts uncertainty, we think it’s more prudent to hold liquid ETHFI to catch the buyback/LP bid (note that not all is distributed, and anything above the ~10% target APY is burned), avoiding the ~10‑day delay from sETHFI staking. That flexibility gives peace of mind to offset sETHFI’s relatively small carry denominated in a volatile asset like ETHFI—buybacks still indirectly add pressure for holders nevertheless, with burns as the cherry on top. Best case, an ETH breakout lands alongside Ether.fi headlines with idiosyncratic upside.

This report is reserved for our Pro members. Upgrade your plan to gain access to in-depth analysis, actionable insights, and the tools you need to stay ahead in the crypto space.

Not ready for Exclusive Content? Sign up for free