TON is embedded into the daily transactions of Telegram’s 1 billion users. $TON sits inside Telegram’s core user flows: every message can be money, every app a payment rail. Onboarding is seamless, and stablecoins are a key unlock for emerging markets. In parallel, institutional capital has been accumulating, led by Nasdaq-listed $TONX. Investments by Coinbase Ventures and regulatory shifts have opened U.S. access. $TON is not yet listed on Coinbase, and Korean exchange Upbit has yet to add support.

The $TON-Telegram symbiosis is the first credible app-embedded economy at consumer scale, wired by default into a billion-user graph. Telegram’s huge user base, paired with an exclusive TON integration for mini-apps and ad-revenue, create a captive area that no other L1 or L2 ecosystem can match. It’s the world’s largest crypto top‑of‑funnel today. Stablecoin pulls create sticky demand; speculative pushes and DATs amplify price reflexivity. One builds the highway, the other draws the crowd.

Telegram’s distribution muscle turns crypto adoption from theory to default—money, identity, and distribution already baked in. A network that fuses messaging + AI moderation + crypto, is a cloud economy that bureaucrats can’t control. Telegram furnishes demand; TON is the settlement layer.

Key Takeaways

- Variant Perception: The market values $TON as a Telegram-adjacent L1 with unimpressive TVL or breakthrough apps, yet it still is a consumer payments and distribution rail embedded in a 1B-MAU super-app.

- Founder Alignment: Pavel Durov’s concentrated control and significant $TON holdings ensure Telegram’s product and monetization strategy are tightly aligned with TON’s success.

- $TON-Telegram Symbiosis: TON mini-apps and payments lock in distribution and monetization. This mass-adopted messaging app lever is an unlock for mass crypto adoption.

- Stablecoin Tailwinds: Even modest wallet balances across Telegram’s user base could create a substantial stablecoin float (in the order of hundreds of billions to a trillion), unlocking double-digit billion annual cash flows.

- Emerging Markets First: TON’s strategy targets unbanked and underbanked populations in emerging markets, where crypto penetration is already high and traditional finance is weak.

- $TONX Scale-Up & DAT Dynamics: recent Nasdaq listing, aiming to become a top $TON holder and set the standard for treasury vehicles; only using common equity (no debt) to defend book value with buybacks and staking yield.

- $TONX/$TON Strategy: From idea to $1 billion under a month, starting 75% in cash and 25% $TON, aiming for at least 5% of the circulating supply—more $TON than MicroStrategy owns $BTC.

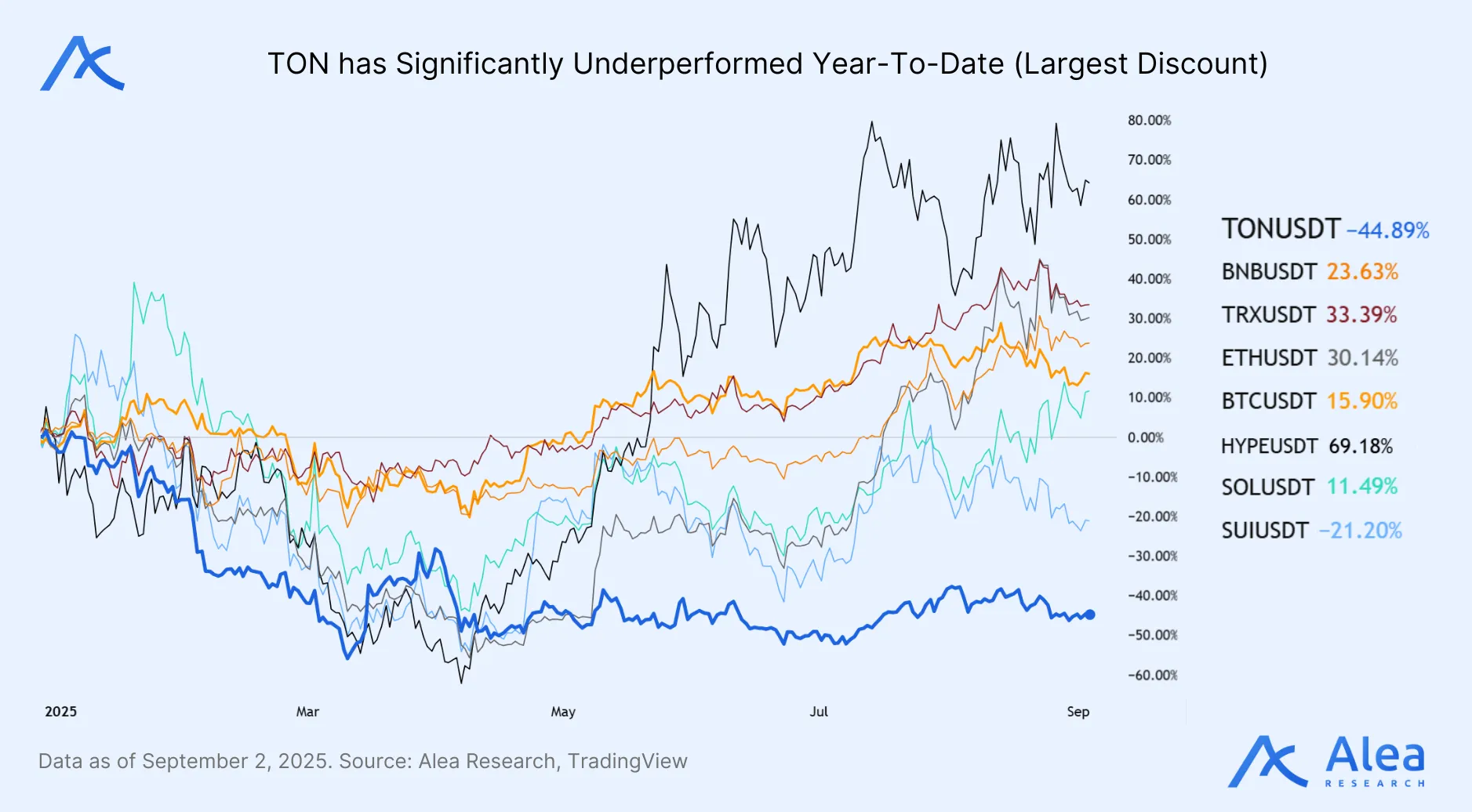

- Re-rating Catalysts: U.S. listing gaps and legal overhangs exert downwards pressure on price; forthcoming U.S. listings (Coinbase Ventures has invested, and $TON is among the few large L1 not listed on Coinbase; $BNB and $TRX joining as exceptions), Korean exchange additions and DAT’s buying are yet to unlock wider demand.

- U.S. Market Entry: A decisive push into the U.S. is imminent after removing wallet geoblocking and aiming for $TON listings on major exchanges. Capturing U.S. capital and developer talent is a top priority.

- Supply Overhang Ahead: The Believers Fund and frozen miner wallets lock up over 25% of supply, with a transparent vesting schedule starting October 2025—critical for float dynamics and price stability.

- Valuation Optionality: $TON’s upside is an option on future in-app engagement, with market cap per user offering a clean metric for tracking adoption.

- Bull Case – Catalyst-Driven Reflexive Upside: Pressing longs during favorable market conditions with the expectation of major catalysts like $TONX buys, U.S. and Korean exchange listings, and Token2049 announcements; trimming positions quickly on news-driven re-pricing runs (+20-40%) to lock in gains.

- Base Case – Hedge & Accumulate: Maintaining core long position but hedging around the Believers Fund unlock, and using unlock-induced dips or negative-funding spikes as tactical entry points; $TONX’s buying pressure can ensure orderly progress without sharp re-rating.

- Bear Case – Cut On Weakness: If large inflows to CEXs coincide with price weakening and no uptick by mid-October, cutting exposure is prudent; expect slow recovery and high opportunity cost afterwards, exit to cash if usage KPIs continue to disappoint.

- Risks and Invalidation: Concentrated ownership, supply unlocks, regulatory fragility, and potential policy reversals on TON exclusivity are critical risks; hedge positions around unlocks and exit based on usage KPIs as they continue to disappoint.

Telegram’s Path & Durov’s Control

TON emerged from Telegram’s abandoned 2018 token sale. It was originally conceived as “The Open Network” in 2018 by Telegram’s founders (the Durov brothers) to complement the messenger’s ecosystem. Telegram raised $1.7B in a 2018 token sale but was forced to abandon the project in 2020 after the U.S. SEC deemed the tokens an unregistered security. Settlement with the SEC involved $1.2B returned and a $18.5M penalty. The code was then open-sourced and handed out to the community. A group of independent developers then went on to incorporate the TON Foundation in Switzerland in 2021.

Pavel Durov, still sole and full owner of Telegram, remains the ultimate decision-maker. His concentrated control and significant $TON holdings bind Telegram’s monetization strategy directly to TON’s success. Founder of Vkontakte (Russia’s largest social network) before Telegram, he has built a strong reputation as Russia’s most prominent tech entrepreneur. Thought leaders like Balaji, who pioneered the concept of the Network State (digital-first communities with their own governance, economy, and identity), praise the founder’s approach to independence: “Telegram–TON partnership is the closest thing to a ‘Network State.’” Despite legal and regulatory challenges, 2024 marked Telegram’s first profitable year, with over $1B in revenue and significant debt reduction, supported by $2.4B raised through bond offerings since 2021.

The TON Foundation, a Swiss non-profit incorporated in Zug, is responsible for coordinating ecosystem growth (grants, partnerships, developer tooling, etc). Manuel Stotz, or Manny, was appointed President on January 14, 2025, succeeding Steve Yun (who remains on the Board). Passing the torch signaled the beginning of a strategic approach targeting U.S. expansion. Manny is a seasoned investor and founder of Kingsway Capital, managing several billion dollars across frontier markets. He has also invested in 50+ crypto firms, including Animoca Brands and Blockchain.com. Kingsway targets regions where billions remain un-banked or under-banked, shaping his vision for TON’s use in emerging markets.

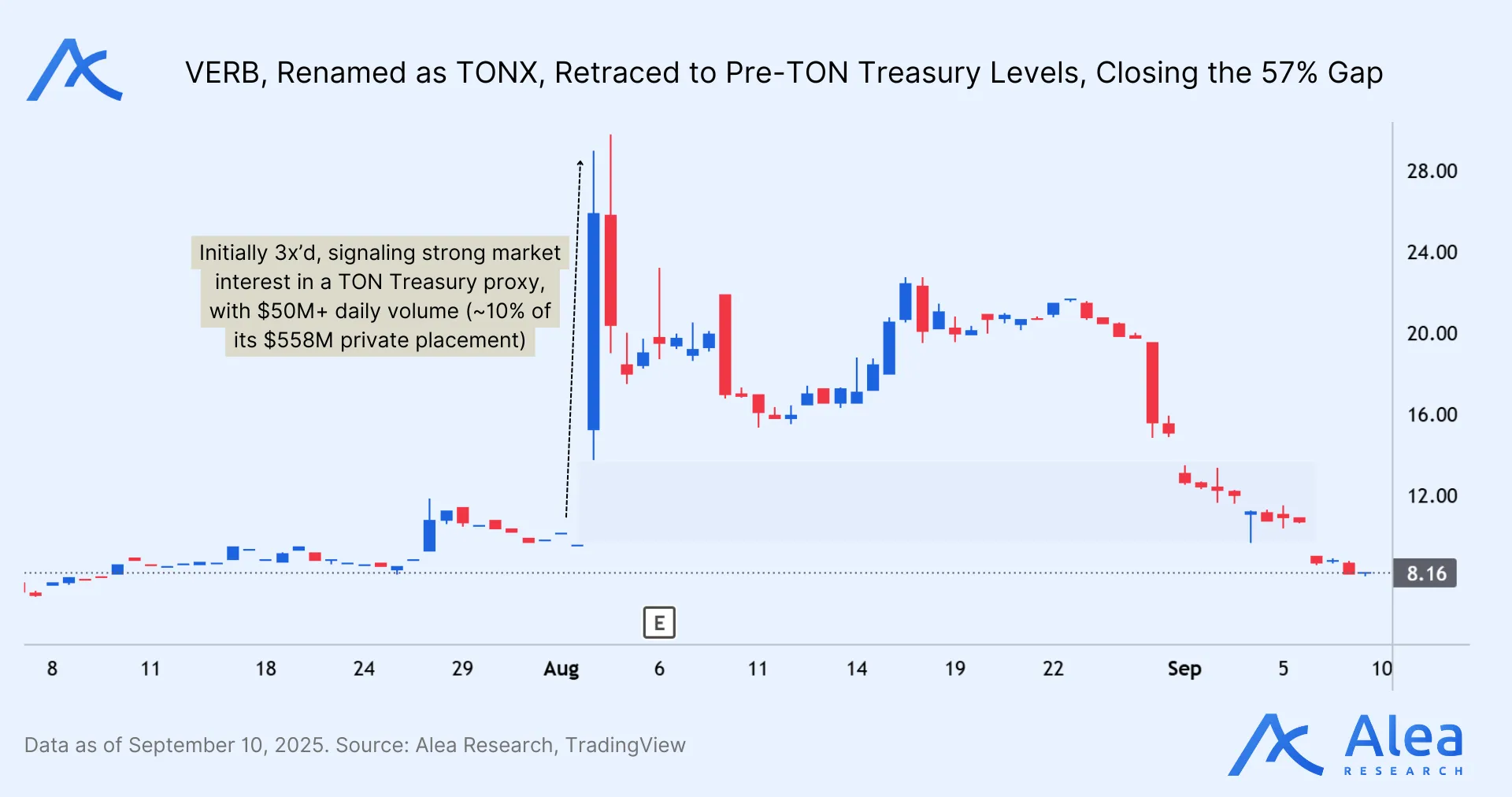

Stotz’s global LP network has recently proven critical for channeling fresh institutional capital into $TON. Today, he is also Chairman at Ton Strategy Co (Nasdaq: $TONX), which announced a ~$558M private placement and plans to rebrand as TON Strategy Co. to pursue a Toncoin treasury strategy. However, while $TONX’s staged accumulation brings new bids, it’s also pertinent to shift the attention to the upcoming Believers Fund unlock, where a large tranche of $TON is set to come back into circulation.

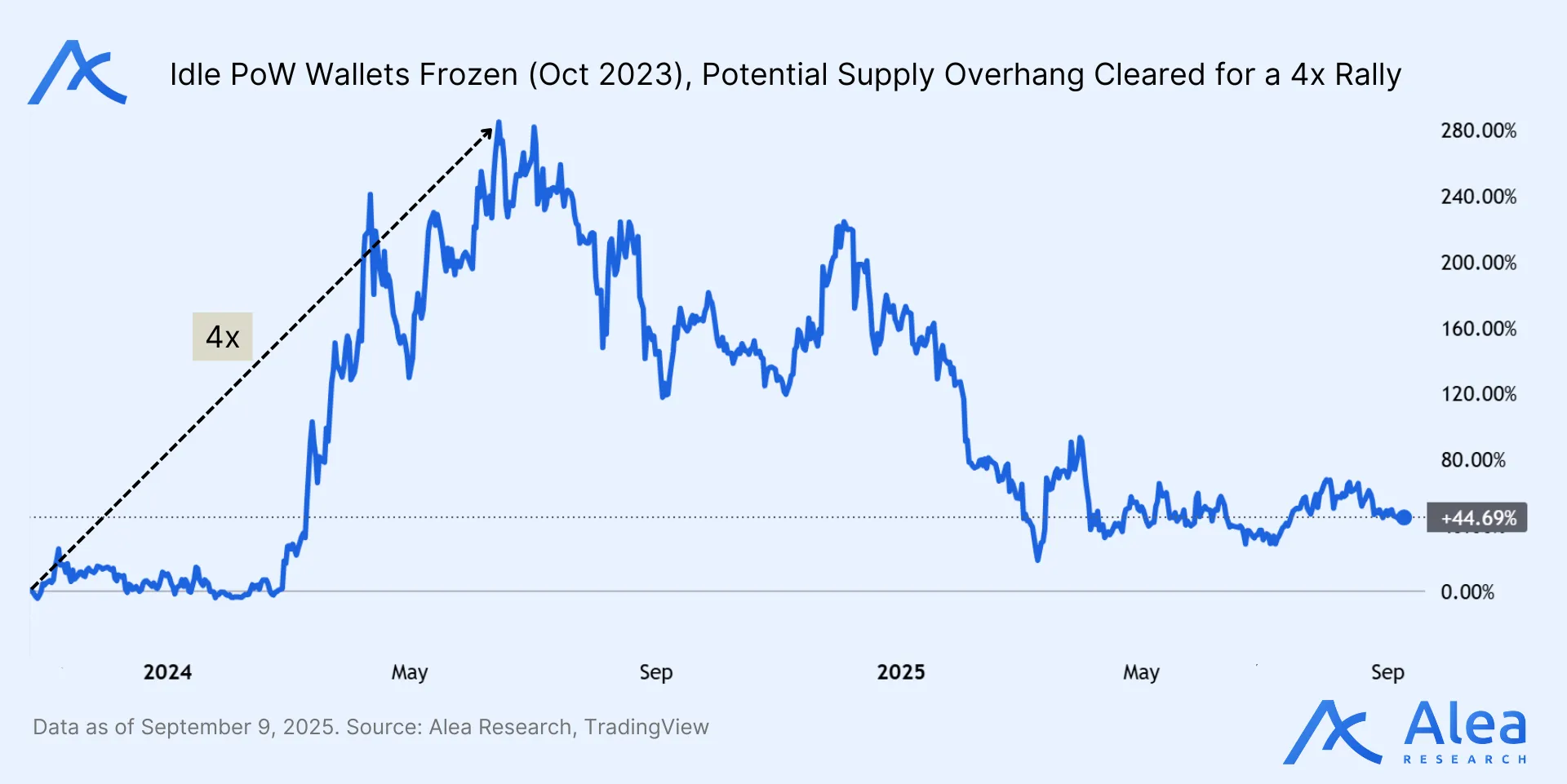

The TON Believers Fund locked ~1.3B TON (~26% of supply) under a 5-year schedule with a 2-year cliff and 3-year linear vesting. Deposits closed in October 2023; unlocks begin October 12, 2025, releasing ~36M TON/month (~0.7% of supply) through October 2028. Publicly supported by the TON Foundation, the mechanism replaced informal “no-dump” promises and concentration concerns with a transparent, enforceable schedule, still allowing participants to stake during the lock. This complements the February 2023 community vote to freeze ~1.081B TON in inactive PoW miner wallets for 48 months, which passed with ~90% of support, sidelining 182 dormant “genesis” wallets. That amount, roughly one-fifth of the supply, is locked until 2027, affecting dormant wallets that represent just 0.009% of all addresses and gives owners a 4-year timer to prove control.

Together, the freeze and the locker immobilized nearly half of TON’s supply, tightening float in the short term but concentrating future market structure around how much of the monthly vesting supply flows to staking versus exchanges. TON’s staking ratio currently hovers ~13%. While most trackers exclude Believers’ coins from the circulating supply, trackers like stakingrewards use eligible supply (portion of the supply that can be staked) in the denominator when calculating the staking ratio.

Ton’s Edge: Distribution, Identity & Embedded Payments

Toncoin, $TON is the native token of The Open Network (TON). It is Telegram’s L1—the exclusive blockchain integrated into Telegram’s ecosystem. TON offers the payment rails for the messaging apps. The token has a ~5.14B total supply, with ~2.56B circulating and a tiny inflation rate ~0.5-0.6% (≈ ~32 M $TON/year minted as staking rewards).

As a messaging super-app powered by blockchain, TON’s addressable market could be described as the intersection of Telegram users engaging in financial transactions from the app. If TON becomes a crypto-enabled WeChat, it can power global remittances, micropayments, gaming, and transfers for hundreds of millions of unbanked, digital-native users.

TON itself is a non-EVM L1 with smart contracts that run on the Ton VM, with FunC as the main programming language. For native deployments, Solidity/EVM porting isn’t trivial. Developers need to adapt to an async actor-model paradigm with unfamiliar libraries outside this niche. The result is higher upfront developer friction. In return you get unique distribution benefits. It’s a specialized environment, but not necessarily a small ecosystem. By being the embedded chain, TON has a built-in user acquisition channel that others lack.

Telegram also gives TON a native identity layer: every user already has a handle, phone-linked account, and contact list. Sending value to @username collapses crypto’s hardest UX step. That pairing—human-readable identity plus default distribution—raises switching costs to an extent that no other wallet can match without its own consumer app at Telegram’s scale. It also allows for context-aware commerce. Users move from a channel post or ad to a mini-app to payment with no app switch. Fewer hops cut customer acquisition costs, raise conversion, and make GMV measurable in a single funnel. Micro-payments, bot-native workflows, and global accessibility by default complement these selling points.

Importantly, TON can succeed and stay differentiated without the broad general-purpose DeFi ecosystem that characterizes EVM, SVM, and other L1s. Its edge is app-embedded distribution with enforced denomination inside Telegram. Upside hinges more on adoption as the only global super-app with native payment than on open-ended dApp composability. It can win even if it never becomes the favorite VM for crypto devs.

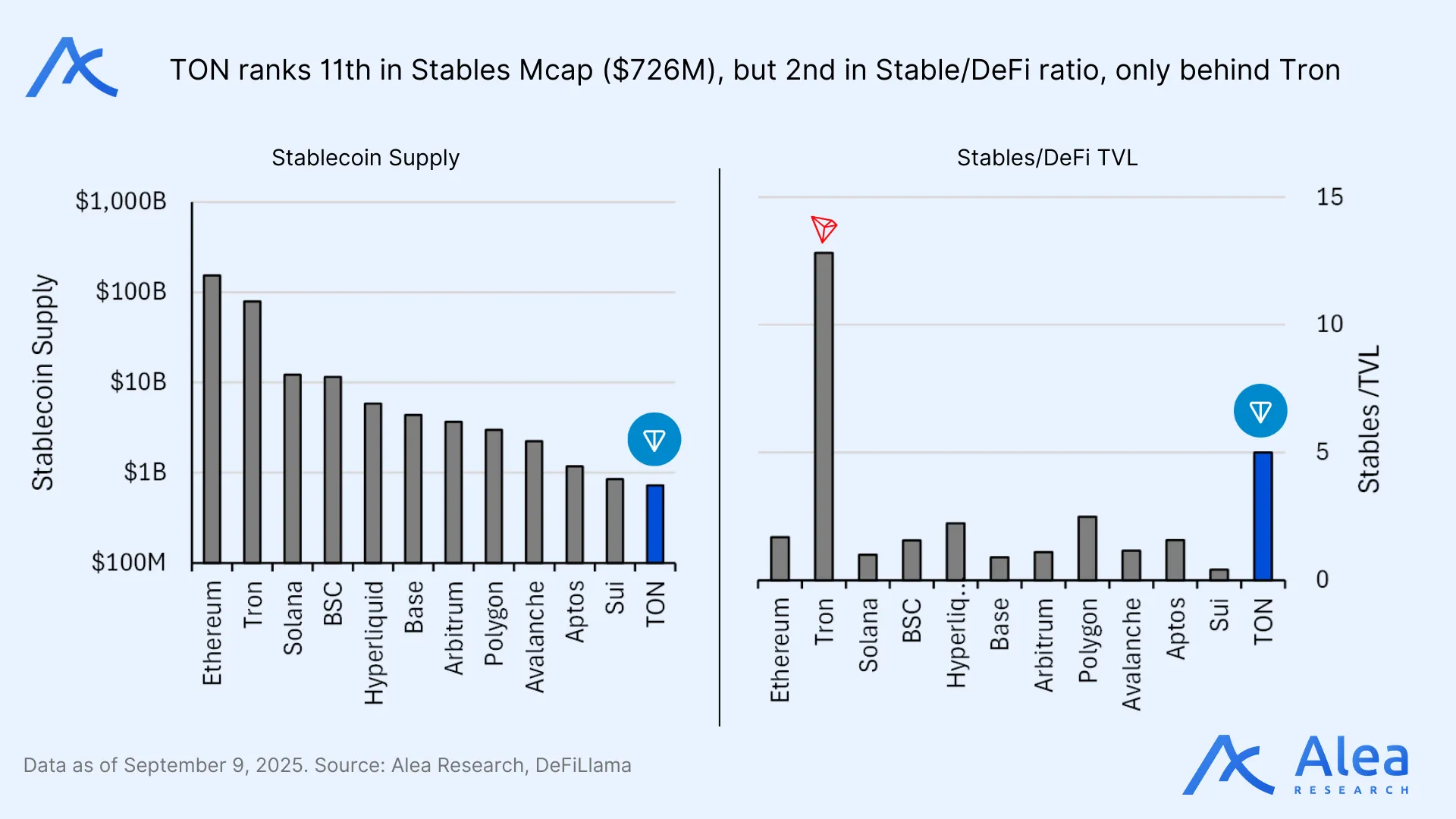

Many TON dApps won’t look like DeFi legos. Where TON is uniquely positioned to benefit is from revenue-sharing with creators, seamless in-app payments, efficient P2P payments and remittances, yield experiences, identity-based and native markets tailored to Telegram, and rapid adoption in emerging markets. Its integration with Telegram’s UX enables new economic activity with ubiquitous reach. Stablecoins, as an example, are the single largest driver of crypto activity in emerging markets. Assuming 10% of MAUs holding an average balance of $200, that’s a $20B float already.

Most users don’t choose a blockchain—they choose an app. In Telegram, if the TON wallet is one tap away and supports stablecoins, most won’t seek alternatives. This captive integration is a huge advantage. For mini-app developers, switching to another chain means losing native Telegram integration. If the target audience is Telegram users, the switching costs for developers are actually quite high. For advertisers or businesses, if they want to reach Telegram’s audiences (e.g. via Telegram Ads or bots), they must use $TON; no other currency is accepted. This forced usage is a key driver for $TON demand.

The Ton-telegram Symbiosis

The TON story itself hinges on Telegram’s reach. TON is the exclusive chain supporting non-fiat payments inside the app. With Telegram, distribution is solved. Telegram has ~1B MAUs, 500M+ daily. It is the only global top app able and willing to integrate blockchain rails, granting TON exclusive rights to its in-app wallet (available to U.S. users since July 2025), mini-app platform, bot economy, and ad payouts. All mini-apps require $TON for transactions, TON Connect is mandatory for wallet connections, and Telegram is committed to strictly using $TON as the only acceptable crypto asset for Telegram Stars, Telegram Premium, Telegram Ads, and Telegram Gateway.

$TON is Telegram’s default money, used for ad purchases and payouts, as well as for in-app rewards and purchases via Telegram Stars (compliant with both Apple and Google’s latest policies on sales of digital products). Non-fiat value circulates denominated in $TON. With mini-apps and wallets natively embedded, onchain onboarding takes seconds. Open Telegram, tap “Wallet,” and you’re already onchain, erasing customer acquisition costs. Besides, money rails via stablecoins are chat-native and can also be yield-native, keeping $USDT and Ethena’s $USDe balances and earnings inside the ecosystem. With low inflation and substantial staking, millions of daily transactions can support $TON’s economic engine.

True super-apps like WeChat or Kakao are constrained by domestic rails, while the global distribution of X (Twitter) lacks native, exclusive money rails. TON is open and globally embedded, operating on permissionless rails. Telegram’s open-source push and mini-app ecosystem lock the loop. Without requiring separate installations for apps and wallets, seed-phrase management, or costly marketing, Telegram’s preset exposes TON to its massive customer base; its users can transfer and spend money online without friction while businesses can accept payments worldwide (for both physical and digital goods; Telegram Stars playing a critical role on that). The path of least resistance suggests that the same swipe that sends a tip can stake. Base-layer economics naturally benefit from more onchain activity and staking demand.

Telegram’s Business Model & the $TON Engine

For Pavel, selling user data is off the table. $TON is Telegram’s currency. Durov’s vision to monetize Telegram without selling data involves routing value through $TON. Crypto cleverly helps bypass traditional payment fees. Benefitting from network effects, operational leverage is high once monetization kicks in. Unlike other super-apps like WeChat, Telegram can simply use TON and not build a dedicated payment system. Telegram is also an active supporter of ecosystem projects.

Telegram leverages TON in three ways: i) it embeds the token in its business model, ii) steers its vast user base into TON-powered mini-apps, and iii) creates feedback loops where Telegram’s growth directly lifts $TON’s value. $TON, for instance, is the exclusive currency for purchasing ads. Similarly, Telegram Stars cannot be separated from $TON. While users pay in fiat to get Stars, those Stars turn into $TON behind the scenes when developers cash out.

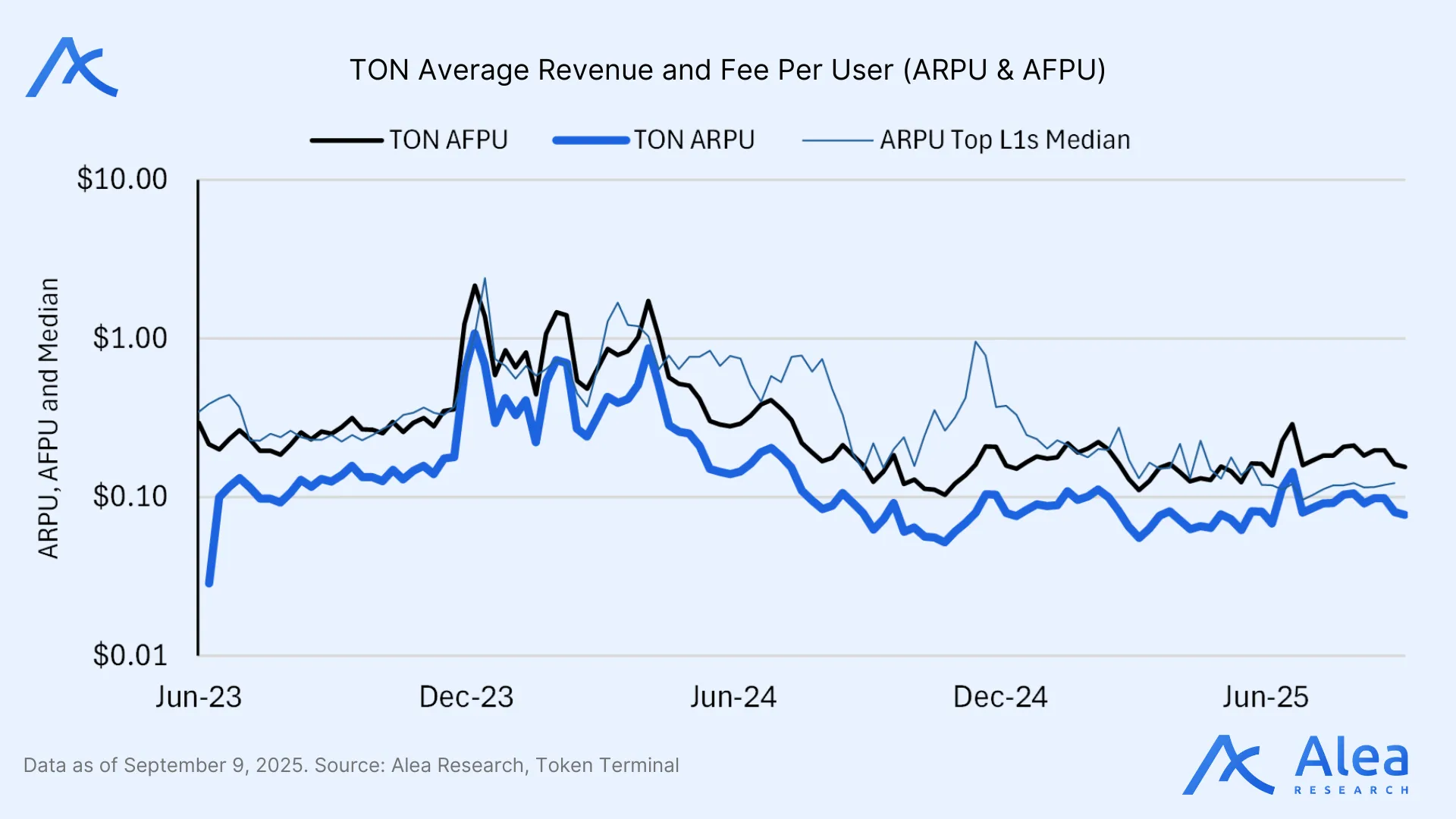

Average fee per user highlights how early we are in adoption, with low conversion rates but a trajectory in line with other chains. For now, the metric doesn’t carry strong signals, but this could shift as Telegram rolls out new partnerships and announcements. That could either bring larger ticket sizes per wallet (lifting the ratio) or broaden the user base, effectively raising margins for everyone.

Ads are the first pillar. Telegram serves contextual ads only in public broadcast channels, not in private chats, and does not sell personal data. Advertisers fund campaigns in $TON and Telegram’s ad revenue sharing pays channel owners 50% (also in $TON), denominating creator income and ad budgets in Telegram’s currency.

Premium is the second pillar. It adds higher limits, faster downloads, and other features for power users, providing a material revenue line without introducing user-tracking or ads in private spaces. In Telegram, Premium complements ads rather than replacing them, and it preserves the privacy stance: revenue is voluntary, not extracted from data. It costs $4.99 per month and already has 15 million paid subscribers (doubling on a yearly basis, $900M annualized top line revenue from this business line alone). Premium is also the gateway to Telegram’s new Business features (verified business pages with location/hours, chat folders with colored labels, auto-reply and greeting messages, and chatbot integrations).

Stars are the third pillar, powering micro-commerce. Developers sell digital goods within mini-apps in a way that complies with Apple and Google rules, and they can withdraw Stars to $TON. This turns countless small purchases into TON-settled flows, linking creator income and developer revenue to the same unit that funds ads. Stars make the “earn in app, settle on chain” pathway simple enough for non-crypto users.

Fragment is the fourth pillar and proves Telegram-specific asset demand. It auctions and trades assets like premium usernames and anonymous numbers that can be only recognized inside Telegram. Those assets are issued and traded on TON. Because the assets are inseparable from TON and Telegram, the economic activity they generate is also inseparable from $TON.

Payments and savings complete the stack. The TON Wallet sits inside Telegram, reducing onboarding to a tap. The most recent U.S. rollout brings this surface to the highest-value market. $USDT is native on TON for dollar-denominated transfers, and yield options such as $tsUSDe appear directly in wallet interfaces. Yield is just two taps away. Users can easily hold and move value in chat without leaving the app. Even when end users think in dollars, activity still rides TON’s rails, increasing base-layer usage.

Telegram topped $1 billion revenue in 2024 and now holds $500 million in cash. Profits helped retire a chunk of its $2 billion bond load. The latest 9%, five-year convertible issued in May 2025 raised $1.7 billion to replace 2021 notes, giving buyers discounted shares if Telegram goes public. High yield and IPO optionality attracted high-caliber backers like BlackRock and Citadel.

TonStrat’s & Capital-markets Tailwinds

Institutions are tuning in. Nasdaq’s $TONX converts Wall Street cash straight into $TON bids. The U.S. finally has a lever for Telegram exposure. Equity investors outnumber token buyers by orders of magnitude. Most institutions can’t buy tokens directly; they can buy listed equities. That gating difference re-sizes the demand curve. Listing a balance-sheet-rich vehicle on the Nasdaq makes it possible to channel latent demand straight into bid pressure on the underlying. Pending U.S. CEX listings, a U.S.‑listed Digital Asset Treasury (DAT) for $TON is key for unlocking more regulated capital and more quickly than the token market itself. This is fresh capital inflow looking for Telegram exposure.

TON Strategy Co. (TONStrat)—the rebrand of Nasdaq‑listed Verb Technology—is the first purpose‑built Toncoin DAT. In a $558M common‑equity private placement deal, $TONX provides market confidence with staged recurrent buys. Staking yields will fund ongoing $TON accumulation and operations. MicroStrategy currently holds over ~600k $BTC, which is about ~3% of the circulating supply. TON Strategy is targeting ~5% with $TON, and its deployment of capital is just getting started.

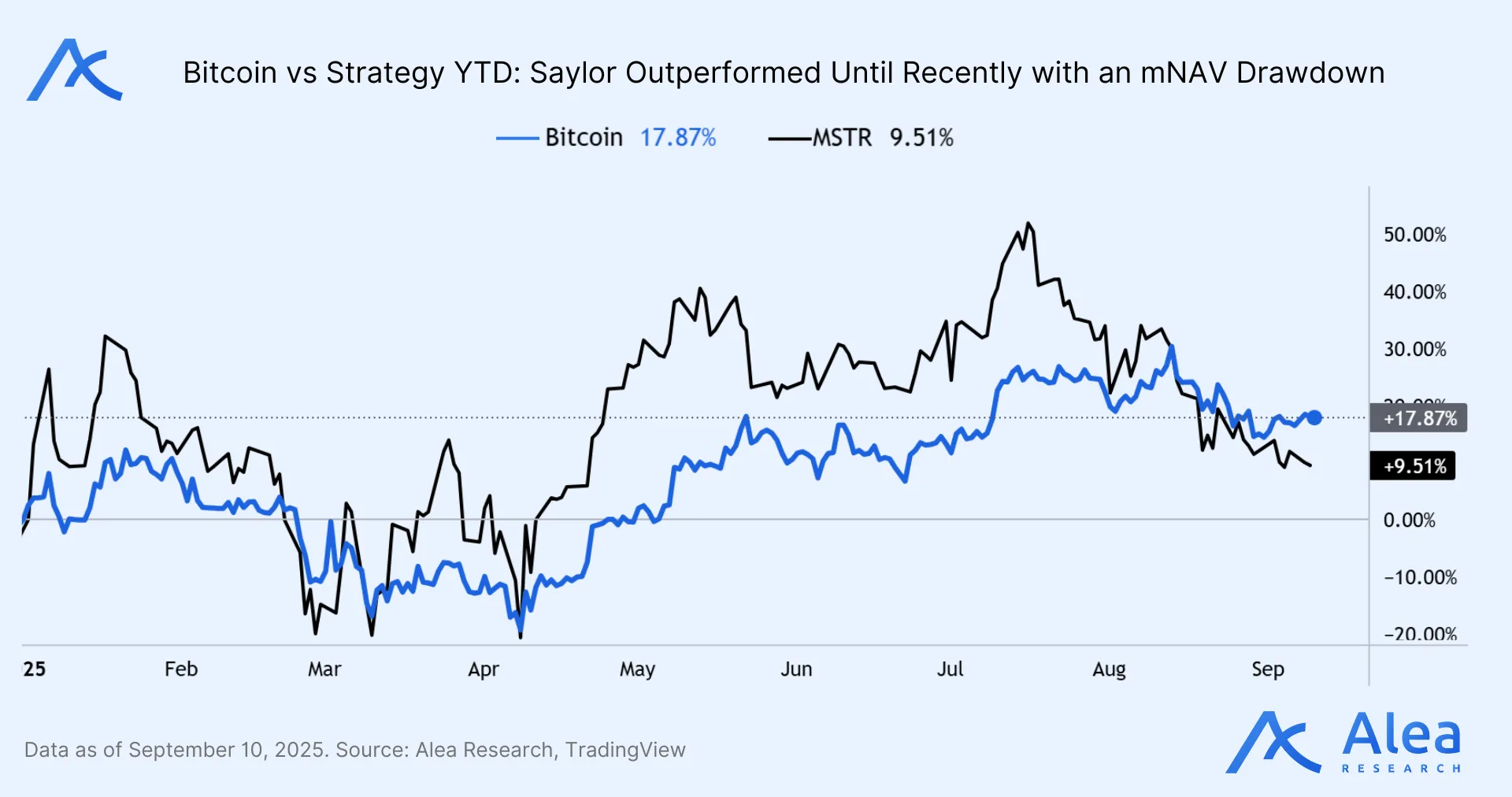

Treasury equities have historically outpaced their underlying assets during narrative expansions. They are perceived as a higher convexity instrument because they combine asset beta with issuance/buyback optionality and, often, a premium to NAV. When the market wants exposure fast, the treasury wrapper can move first and farther. The company filed an automatic shelf (Form S‑3ASR) and entered a $1B at‑the‑market (ATM) equity program that lets them sell stock when its equity trades at a premium, recycle proceeds into additional $TON, and compound exposure—the same financing loop that helped $MSTR become a structurally leveraged $BTC vehicle.

Manuel Stotz has already started evangelizing the vision on a podcast tour, with thought leaders like Balaji framing the Telegram–TON partnership as the closest thing to a “Network State.” This brings mainstream financial media attention. We can also expect frequent updates in the form of “Ton Strategy has acquired X million TON, representing Y% of the supply, and staking Y%.” For $TON specifically, the friction is real. $TON is not tradable on Coinbase and only recently was listed on Robinhood; a U.S.-listed $TON treasury company captures pools of capital that today can’t reach $TON—coinciding just as we wait for imminent listing tailwinds.

ETFs must meet creation/redemption flows; net outflows can force primary‑market redemptions of the underlying asset. However, a corporation with a treasury strategy can hold through volatility. If you sell the ETF, the ETF sells the coin, but if you sell $TONX, $TON stays. A listed treasury vehicle also accumulates through cycles without selling pressure. It can issue equity at a premium to book/NAV, buy more $TON, and repurchase shares when they trade at a discount. Additionally, $TON is Proof of Stake (PoS) asset that can generate native yield from staking rewards (currently ~5%). Treasuries like TON Strategy can easily turn their balance sheet into cash-generating inventory.

What this visible regulated equity does is: i) aggregation institutional capital that cannot buy tokens, ii) monetize staking to fund further accumulation, and iii) benefit from equity-market premiums that historically incentivize additional issuance and purchases.

Investment Thesis

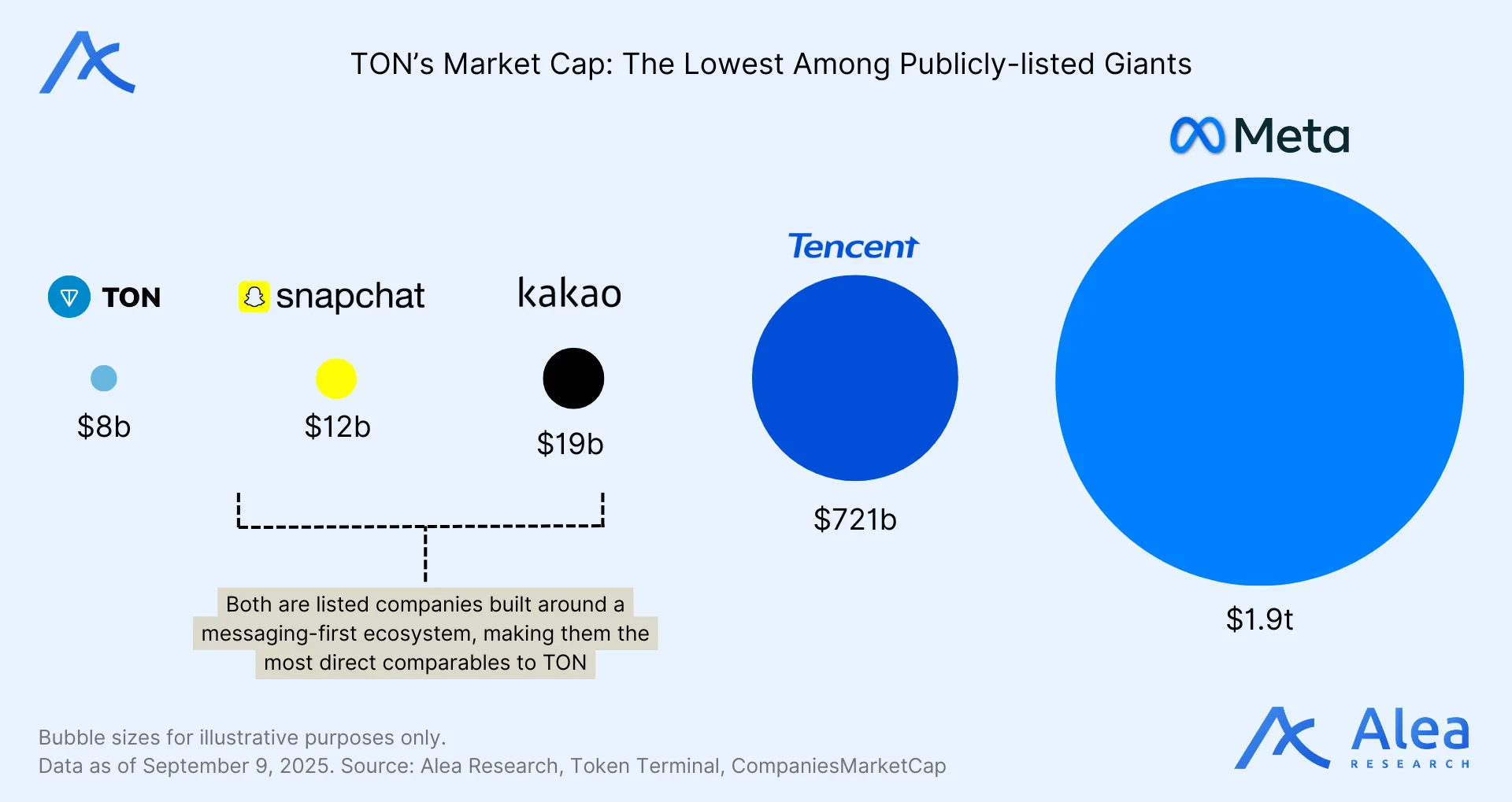

$TON is the only liquid, tokenized way to own the upside of a mega‑messaging network’s payments + mini‑app economy. All other large messengers—WhatsApp, WeChat, Kakao—are equity exposures where value accrues to the parent’s broader PnL instead of a widely distributed base‑layer token. Durov is the single owner of Telegram and largest holder of $TON, cautious of not exceeding ~10% of the total circulating to ensure decentralization. That skin-in-the-game signals meaningful founder alignment without still introducing a single-party choke-point.

The $TON thesis reduces to Distribution x Capture. Telegram furnishes demand; $TON must accrue the value generated. Telegram has scale and now formal rails accessible to the U.S. The central positioning strategy is to own $TON as Telegram’s app-embedded bet. Off-the-shelf, that carries exposure to the main denomination loop: ads, creator payouts, Star conversions, stablecoin volume transfers, and mini-app settlements. Tactically, when wallet activity, ad spend, and Stars-to-TON conversions rise, the position becomes more attractive.

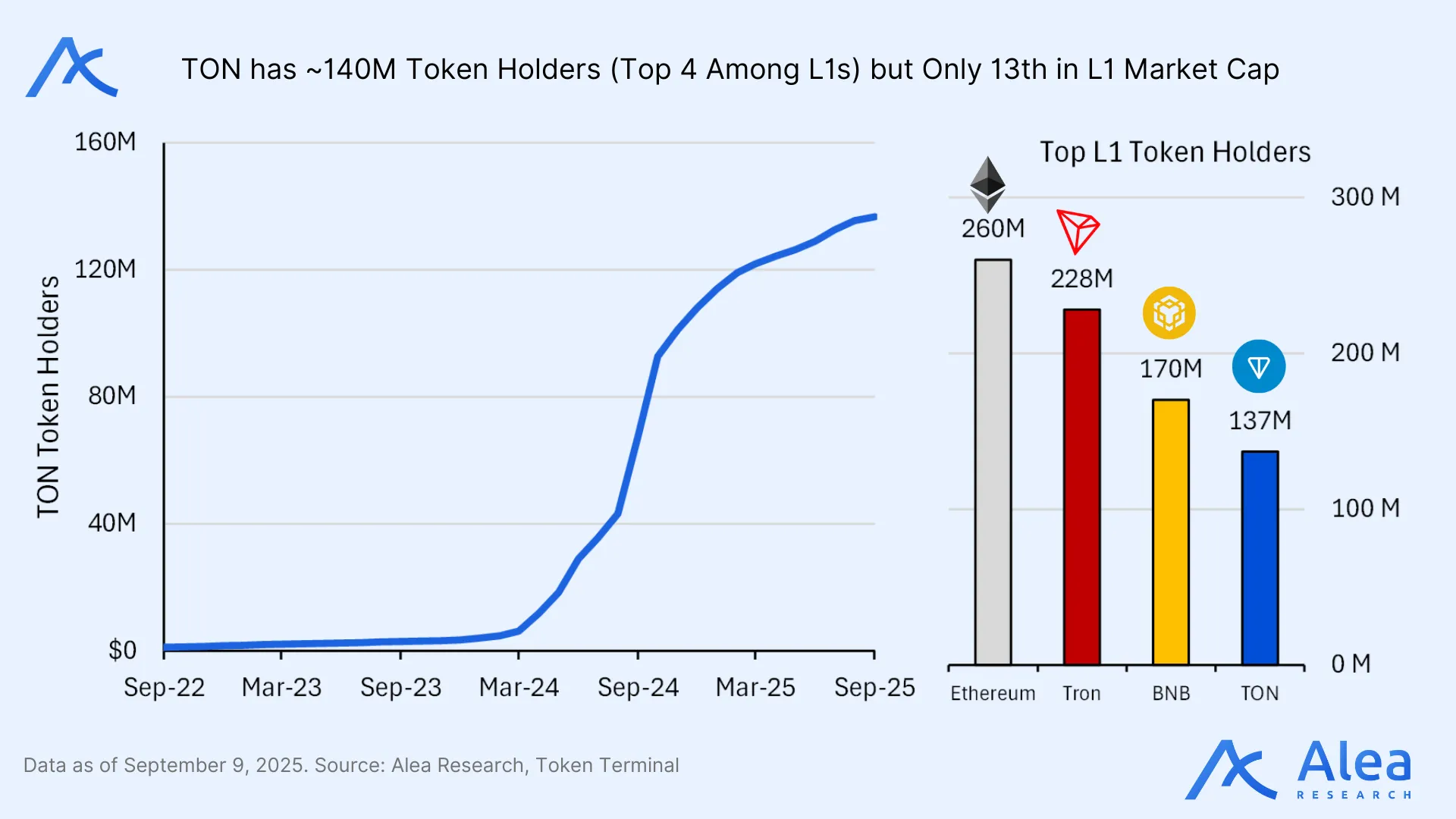

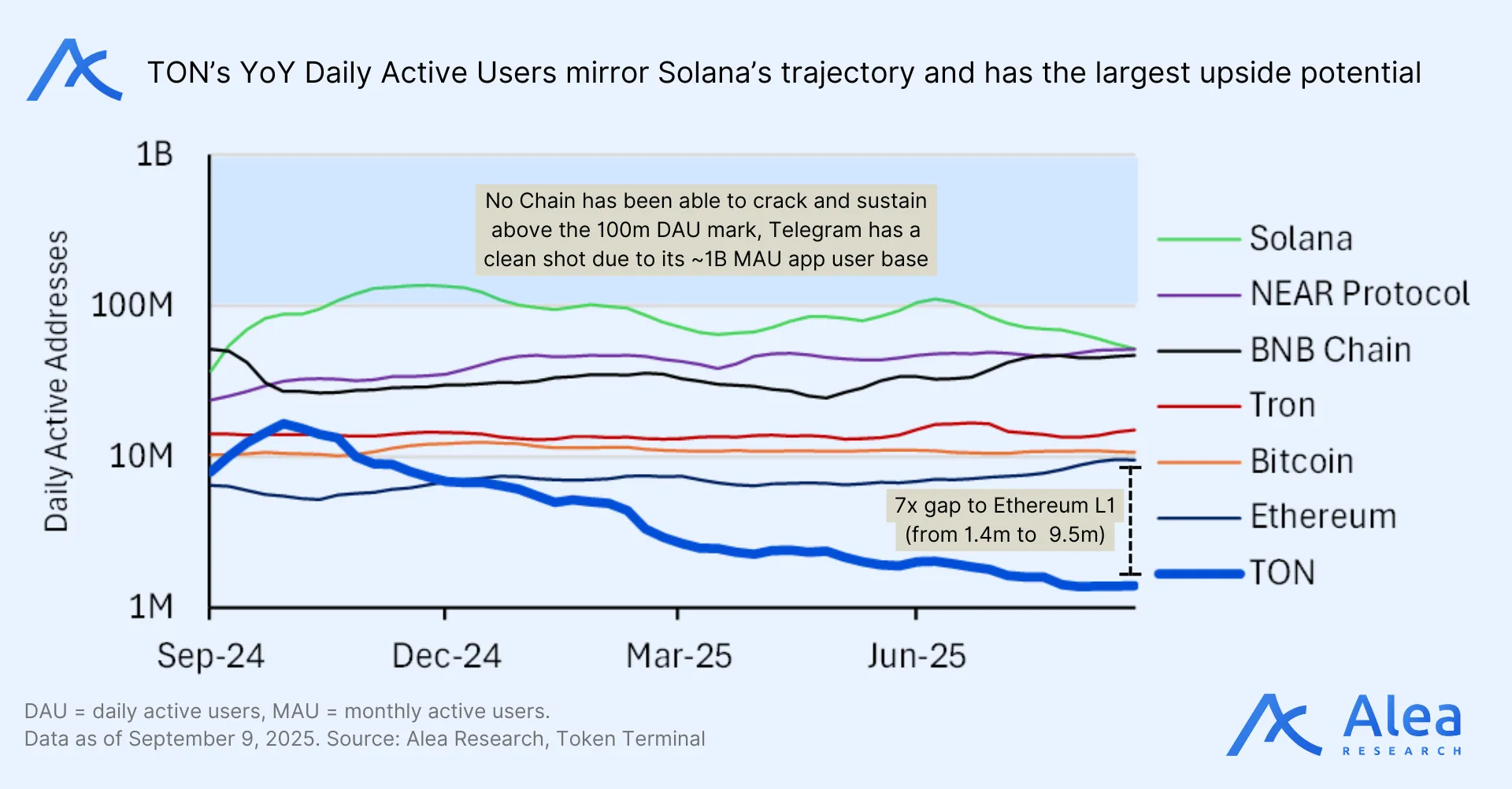

To this date, the market underappreciates Telegram’s distribution power, underestimating how even single-digit penetration of users adopting TON-based payments could dwarf today’s crypto user base. TON uniquely ties into big themes: crypto adoption, emerging markets, super-app exposure, etc. These are appealing to both fundamental and momentum investors. 10% of Telegram’s 1B MAUs adopting TON for transactions translates to ~100 M crypto users. Some may overlap, some may already be crypto-native, but it’s undeniable that a 100M users lift for any L1 or L2 would be an order-of-magnitude leap.

Pending a Coinbase spot listing, the odds are shifting in $TON’s favor. Coinbase Ventures holds $TON and the Telegram wallet rollout to U.S. users signals that CEX listings are probably a matter of time. Because of competitive dynamics between exchanges, it’ll also be worth tracking Korean listings in exchanges like Upbit. $TON’s institutional holders are also spread across the globe: Animoca Brands became the largest validator in 2023, Pantera Capital announced its “largest investment ever” for the firm in May 2024, and other firms disclosed by the TON Foundation on a $400m investment include Sequoia Capital, Ribbit, Benchmark, Kingsway Capital, Draper Associates, CoinFund, and more.

Valuation

We start from the premise that the market prices $TON on distribution optionality, not current fee capture. Structural emissions outweigh the limited fee‑burn today; near‑term price action is flow‑driven (U.S. access, DAT buys, listings) while fundamental monetization (ads/Stars/payments/DeFi) ramps. We are not betting on “burn > mint” near term. Instead, we see staking rewards as a feature and opportunity for treasuries (DATs) to compound holdings while the distribution → usage → fees flywheel builds.

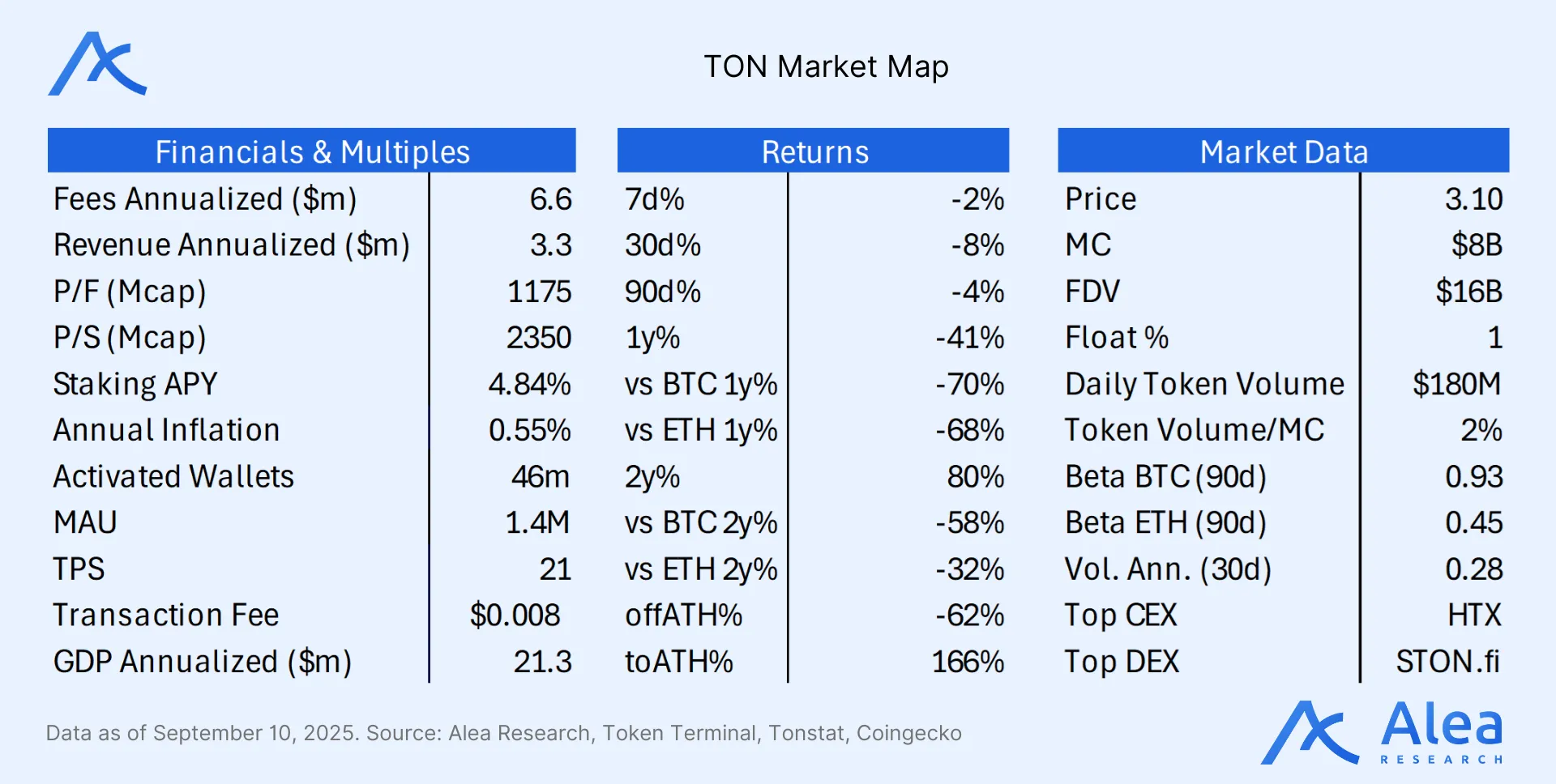

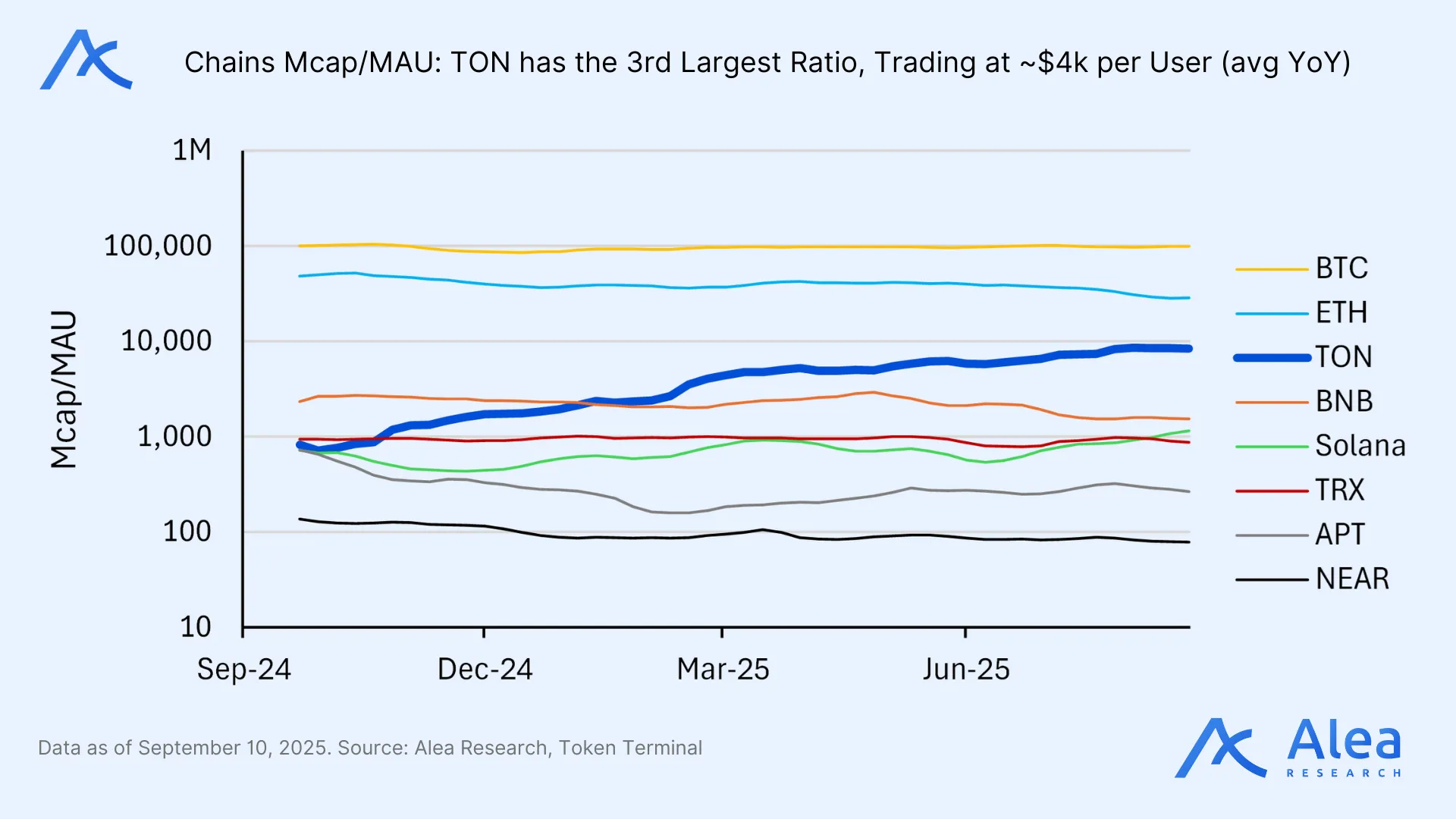

TON’s moat is captive distribution. Value scales with Telegram‑native active wallets and TON‑denominated rails. With ~1.62M MAW (Monthly Active Wallets) vs ~$8B market cap, the ratio looks punitive in comparison. The market discounts future adoption, not current onchain use.

- Bull Case: Watch funding (Believers-Fund lockers hedging, supply squeezes) and look for short-covering structure; press longs into catalysts and trim news-driven re-pricing runs (+20-40%) fast. The optimistic case contemplates $TONX buys while Coinbase follows Robinhood and lists $TON in the U.S. CEXs and Upbit does the same in Korea. Token2049 Singapore (Oct 1–3) brings added optionality. Durov often speaks there to present announcements, although so does every other project in the event.

- Base Case: Steady build, mitigated unlock, no sharp re-rating but orderly progress; tactically enter and maintain a core long, hedge around the unlock, and use unlock dips or negative-funding spikes as entries. This scenario would still keep waiting for CEX listings, fully relying on $TONX’s buying pressure and potentially seeing a ~10-20% dip caused by Believers’ unlock. The Foundation, however, is likely to counteract with announcements and positive news that could lift price back up.

- Bear Case: If by mid-Oct we see large exchange inflows and price weakening with no uptick, we’d cut exposure and/or short perps to cap downside. Any subsequent recovery is likely to be slow, raising opportunity cost.

Toncoin’s economics hinge less on today’s base-layer fee capture and more on the scale and intensity of economic activity that Telegram can funnel onto its native rails. The upside is best understood as an option on future in-app engagement (involving financial transactions, not just Telegram use) rather than a simple DCF on current protocol revenues. That makes the number of wallets transacting inside Telegram—and the dollar value each of those wallets represents—the critical bridge between product traction and token value.

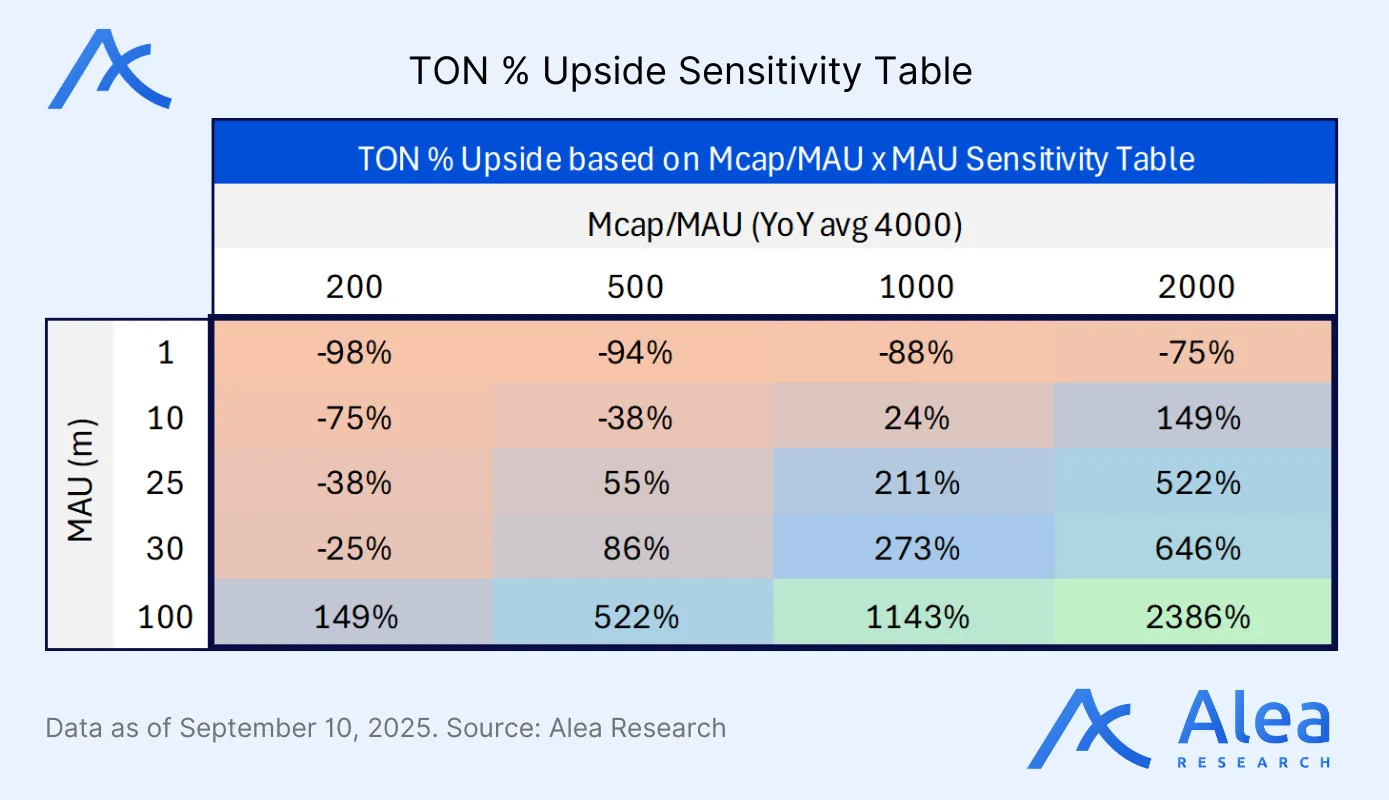

A comparison of monthly engaged Telegram wallets and implied economic value per user offers the cleanest view of how incremental adoption translates into market cap (Mcap/MAU). We anchor circulating supply at ~2.57B TON and leave token supply static with $200–$2000 Mcap/MAU range and 1–100M user bands reflecting Telegram’s ambition of converting 1–10% of its 1B MAUs into onchain actors over the next 12–24 months.

It’s worth noting that TON deliberately excludes from the circulating supply the coins held by Telegram, the TON Foundation, and the TON Believers Fund (~1.3B $TON). The supply dynamics are shaped by both protocol-level inflation and the scheduled release of locked tokens. The upcoming unlocks represent the largest source of potential float overhang in the next three years. This is a known overhang that starts on October 12, releasing ~36.6M $TON/month for 36 months (~0.71% of total supply/month).

Price triggers matter too—if $TON breaks above $4 on strong volume, that confirms bullish momentum and could target $5; a drop below $3 with heavy selling would warrant caution, possibly testing $2.5. Positioning adapts: in the base case, we hold moderate long exposure; in a bull case, we add on breakouts and trim on rapid news-driven re-ratings; in a bear case, we exit to cash. Bull scenarios call for maximum exposure to ride reflexive moves, with trailing stops. Base case means invested but not leveraged. Bear case means cutting positions or hedging with futures until the market stabilizes.

Risks & Invalidations

Key risks cluster around concentration and float overhang. This stems from historical concerns around high whale ownership and the legacy PoW distribution. Despite the U.S.’s friendlier stance toward crypto, regulatory fragility still persists in some shape or form. Apple and Google can still throttle in-app wallets, and Congress may rewrite the rules overnight. Given Durov’s Russian background and Telegram’s 2020 SEC history, any renewed scrutiny of Telegram and its monetization rails could affect integrations, fiat ramps, or U.S. app-store posture.

Onchain depth remains shallow and DeFi adoption is still limited. TVL and volumes are still modest. If we strip away Telegram’s distribution, TON trades at a dominant L1 valuation but earns micro-cap fees. This is a stark disconnect that can only be bridged by growth becoming real. At the moment, without Telegram’s captive user base, TON’s fee generation doesn’t justify its price. That being said, there is still a lot white space for developers to explore use cases for dApps that cannot be built on other chains. In addition to that, there is low-hanging-fruit for Telegram to catch up: make the wallet visible in the UI and active by default, improve the discovery on TON mini-apps, native in-app Tip/Pay button, etc.

The Believers Fund unlock schedule is another key risk—unlocks start October 12, 2025, and run for 36 months. A supply overhang could trigger steep price drops, especially if sell volume surges during unlock windows and $TON de-correlates from the broader market. Beyond the initial window, persistent selling is a 37M monthly threat that could turn into a prolonged price grind. Aggressive unloading by large whales would worsen the situation. The prudent response is to hedge through the unlock period, but if selling pressure continues and price keeps making new lows, the logical move is to cut losses. If $TON breaks below a strategic level such as $3 and usage KPIs don’t show explosive growth, it signals a miscalculation that warrants an exit.

An ugly path looks like this: the Believers Fund unlock hits spot liquidity; TONStrat steps in as buyer-of-last-resort, but that visible bid creates adverse selection, turning support into a supply magnet. Even uglier, negative headlines could be the shock that eventually exhaust $TONX dry powder; the equity flips to a discount (trapping future raises), and the strategy flips from “accumulator” to “bagholder,” with long-term damage to TON’s credibility and cost of capital.

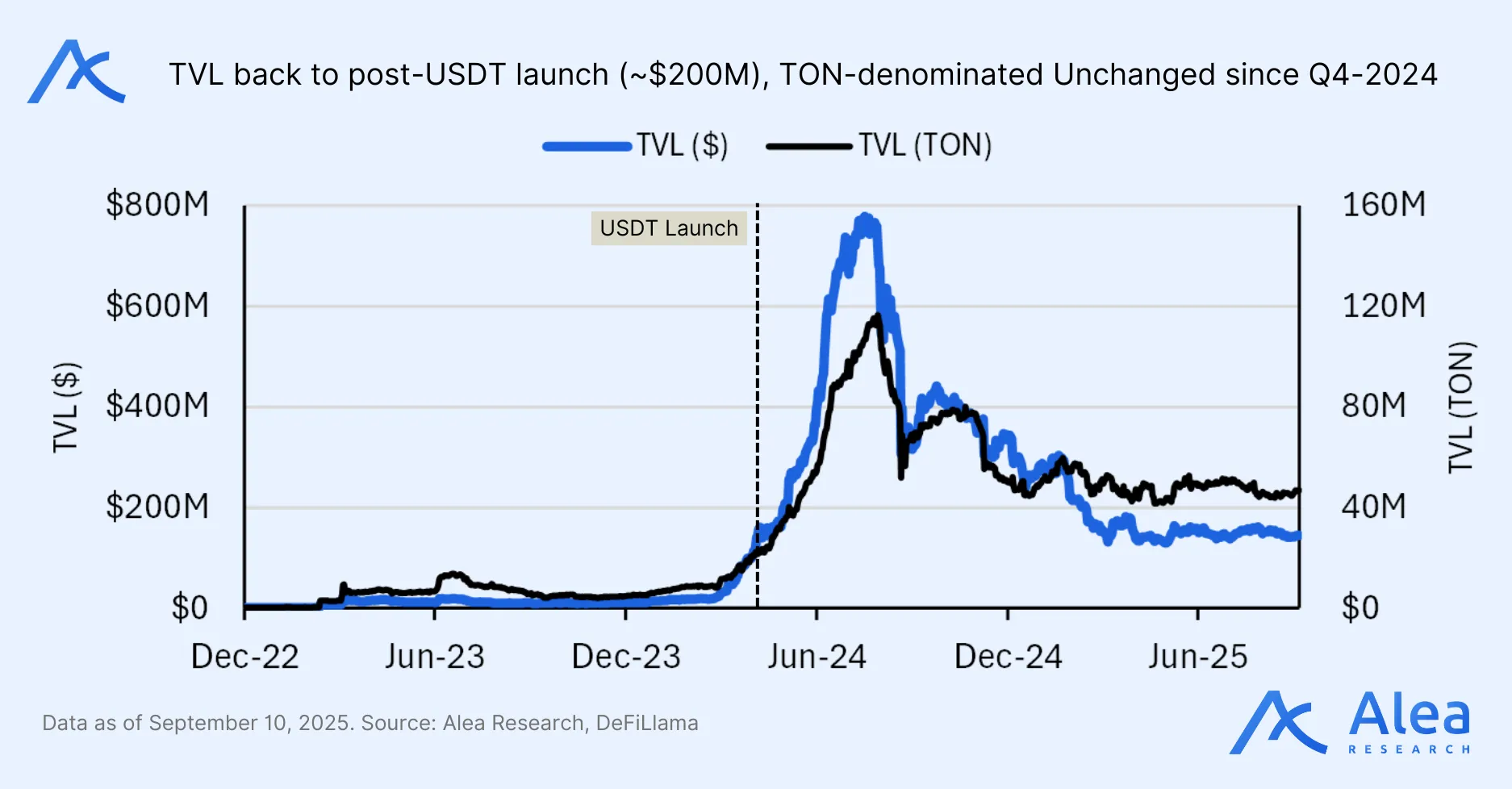

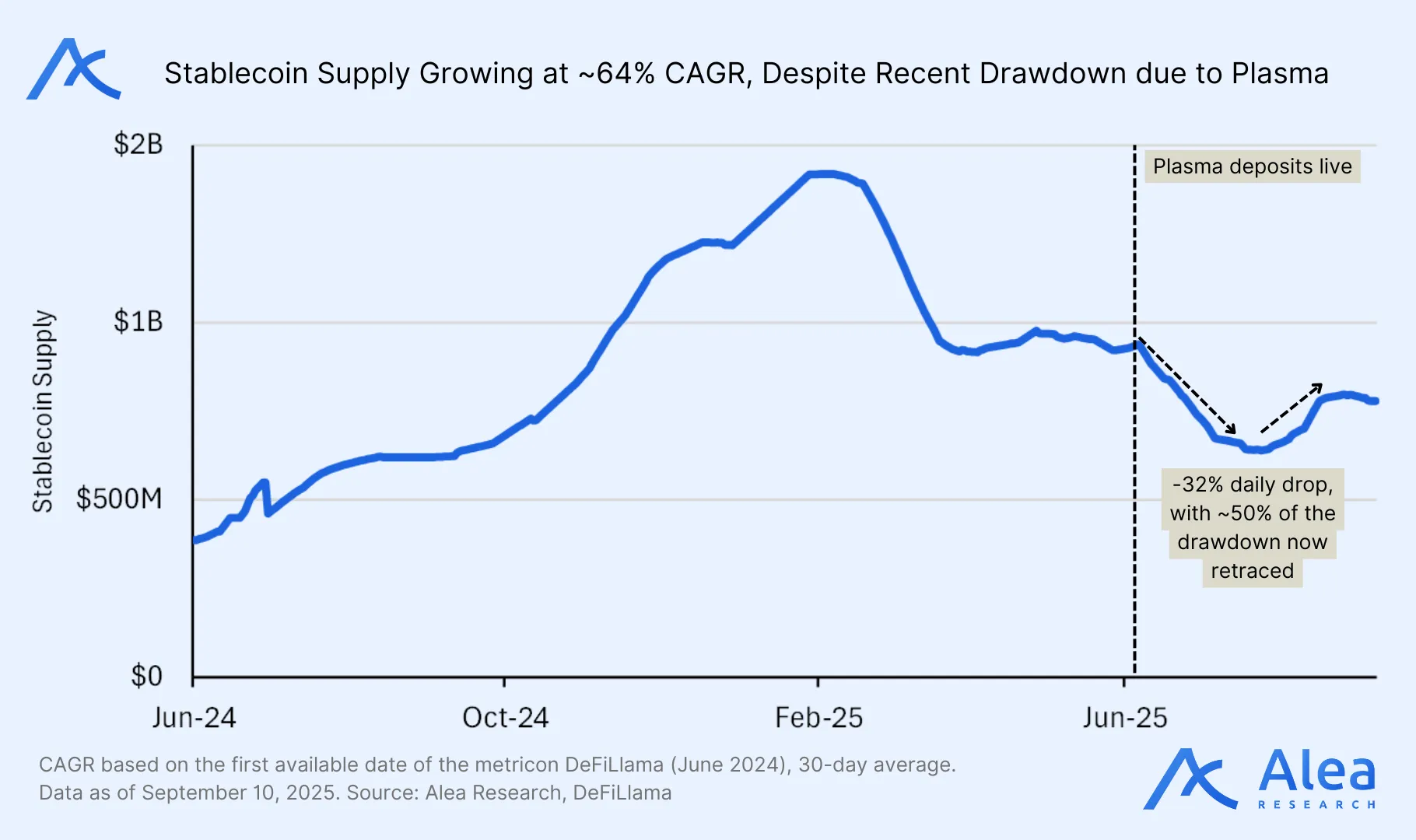

$USDT was launched on TON on April 19 2024, with 11M in $TON incentives: 5M to Wallet-in-Telegram’s Earn, 5M to boost USDT/TON LPs on DEXs, and the remainder to fund free CEX-to-TON withdrawals. This campaign, however, was time-limited. The growth hack onboarded users fast but didn’t lock sticky float. Lesson learnt for future incentive programs: balances retraced as subsidies ended.

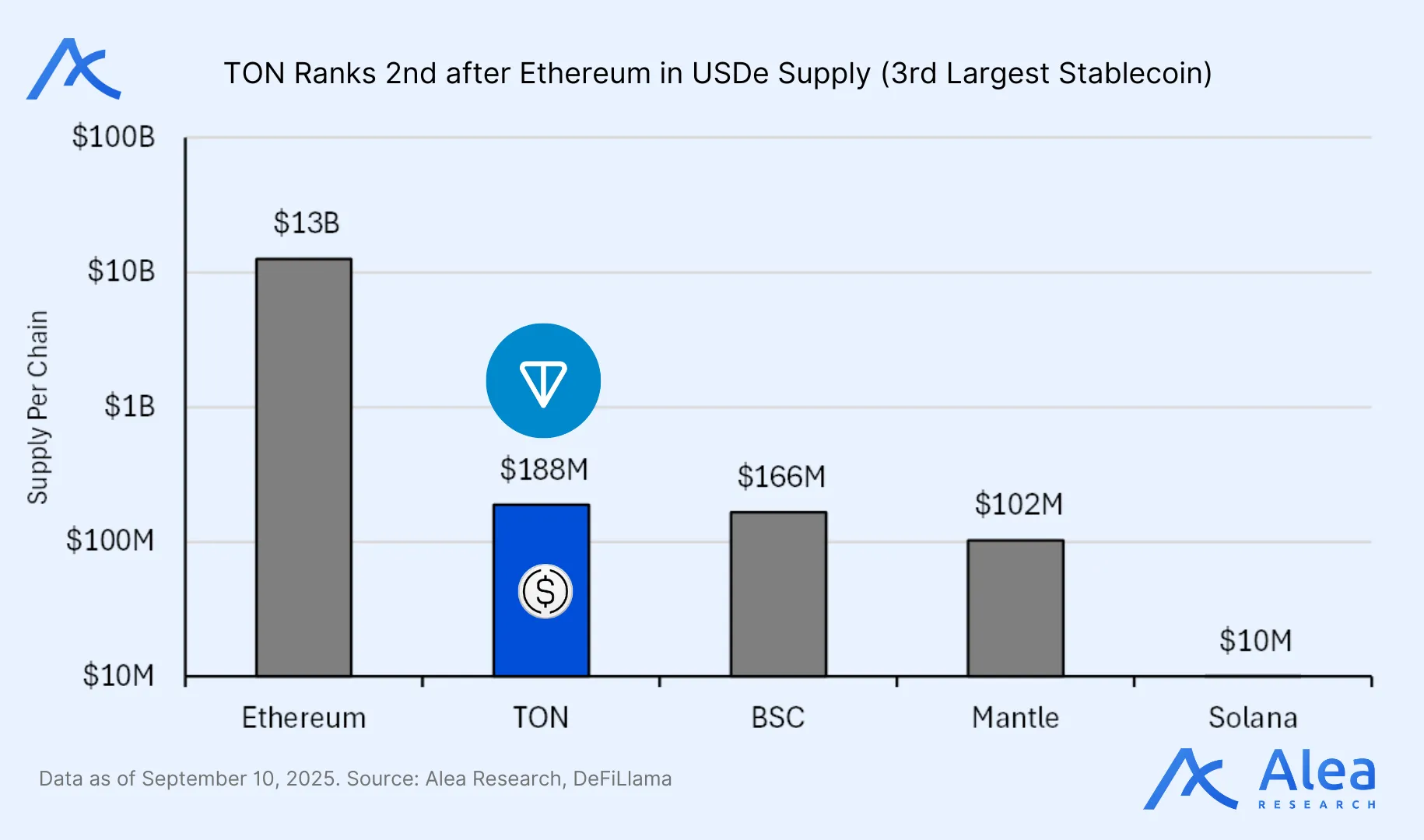

There’s a silver lining: stablecoin supply grew and stabilized, now at $~720M, with ~75% $USDT dominance (remainder on Ethena). TAC (TON Applications Chain) also increases the surface area of things users can do from their Telegram Wallet. It’s an EVM-compatible L1 that lets TON-wallet users run Solidity dApps inside Telegram without changing wallets; mainnet went live on July 15, 2025. For $TON, TAC functions as an EVM execution back-end plus distribution bridge: users pay in $TON inside Mini Apps while a network paymaster converts that $TON to $TAC to cover EVM gas, fully abstracted from end-users. Advantages: zero-rewrite EVM portability and Telegram-native UX with no wallet-switching or bridges.

If stablecoins are mainly used for transfers, there are other things to consider. On that note, the most recent wave of stablecoin-first chains like Plasma or Stable, don’t necessarily invalidate the thesis, but sharpen where it can be falsified. TON’s moat is distribution first and denomination within Telegram second. The exclusivity rule means that all mini-apps consume $TON and must use TON Connect, with other chains only allowed for bridging. Instead of prioritizing consumer apps, Plasma and Stable target $USDT velocity with zero-fee transfers. The direct risk is not that these chains exist, but that heavy incentives starve TON of $USDT depth. If Telegram-native flows remain siloed, TON’s payments wedge erodes.

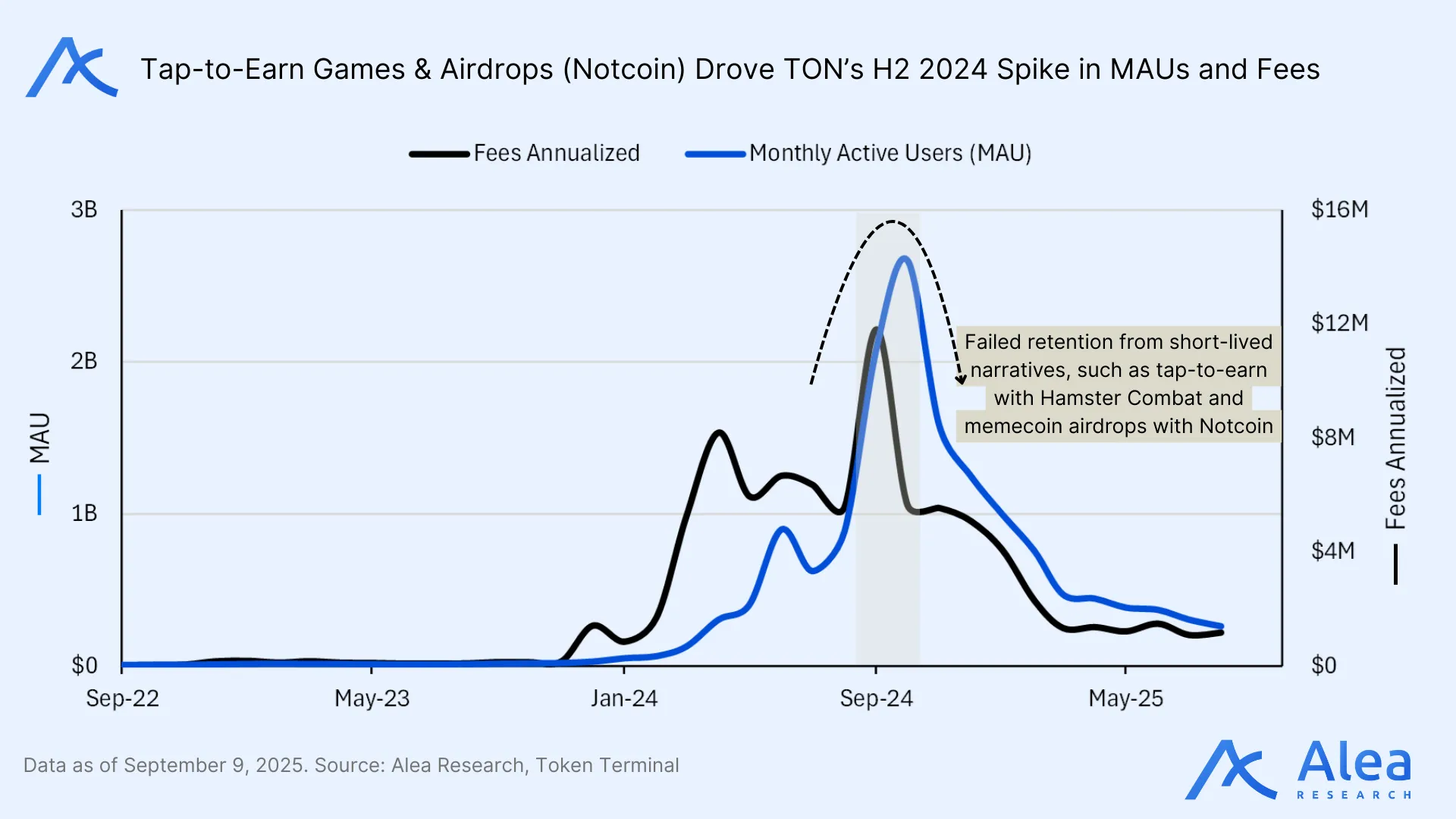

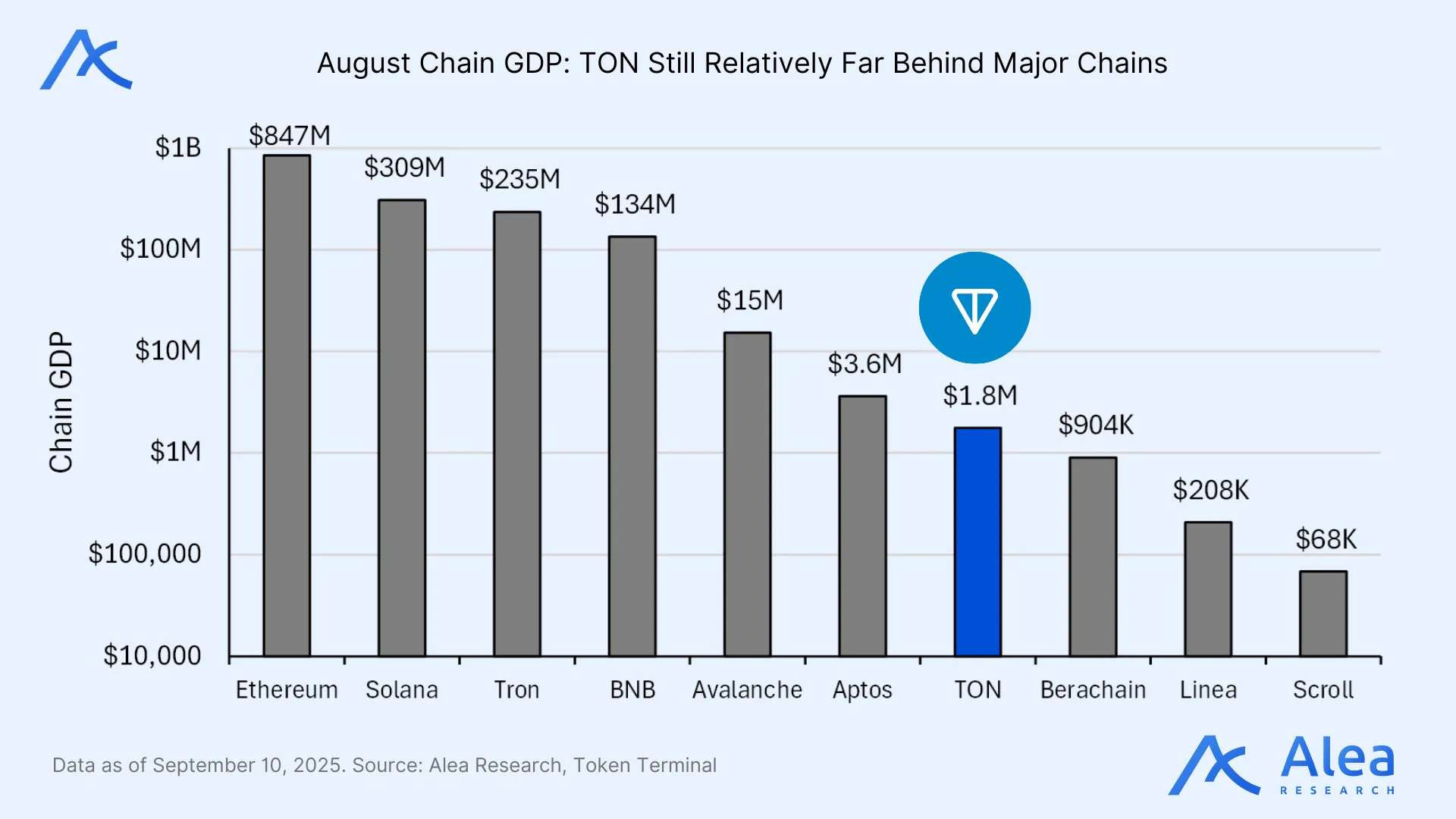

TON DeFi at the moment is under-developed. So far, tap-to-earn funnels (Notcoin, Hamster, etc) have inflated user headlines while real liquidity and fees remain anemic. With TVL at ~$147M and chain fees at low 5 digits a day ($16k), numbers signal thin engagement despite massive distribution. Chain GDP reflects the underperformance in the ecosystem growth, however not so far behind newer Alt-L1s and L2s.

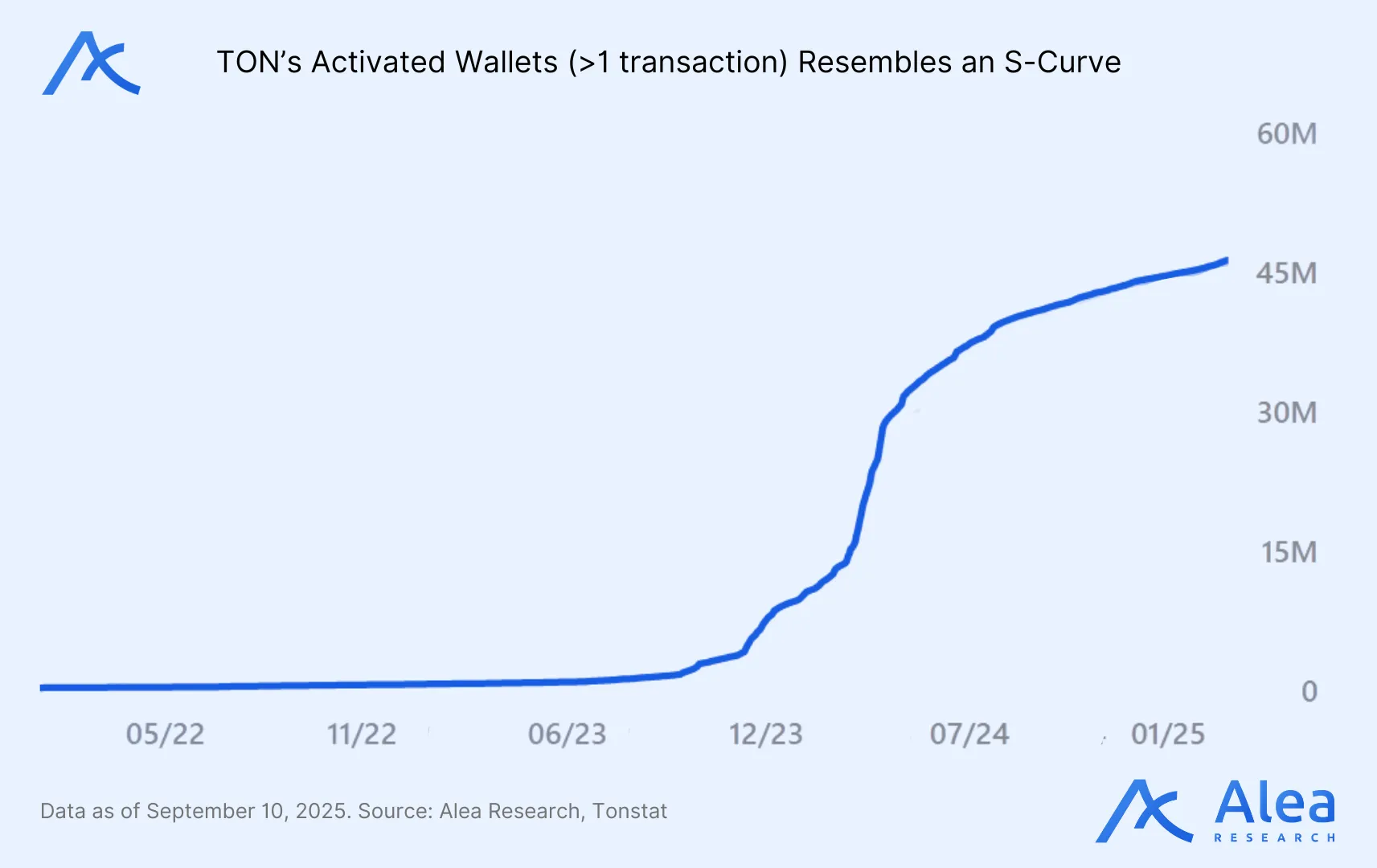

At the moment, adoption is not the edge; catalysts and microstructure are. Data show a decay in activity: daily activations hover near ~30k with lower highs, daily active wallets slid to ~115k from >200k, and monthly active wallets fell to ~1.62 M from ~3.5 M over six months. This suggests that, when it comes to taking onchain action, retention is relatively weak: only ~3–4% of activated wallets are monthly active and ~0.25% are daily active. With usage flat-to-down, fee growth remains muted. Portfolio-wise, de-risk the adoption sleeve and treat $TON as a catalyst-driven trade until the curve bends up.

Despite lackluster onchain metrics, the core question is whether new sources of $TON demand can drive prices higher. Broader $TON accessibility via DATs in the U.S. have the potential to spark a reflexive price loop, yet the thesis is falsifiable: if U.S. CEX listings stall, $TONX is slow to deploy capital, or the U.S. expansion strategy proves weak, the reflexive loop breaks and the expected price impact fails to materialize. Other risks curbing upside include Durov’s legal drag, opaque whale balances or over-concentration of supply in a few large holders, combined with slim fee capture accruing to $TON.

Overall, the major risk is if, for some highly unlikely reason, a policy reversal removed the TON-exclusivity rule. The entire value proposition relies on Telegram enforcing $TON as the sole currency for mini-apps, ads, and digital payments. If Telegram shifts strategy—allowing other blockchains or currencies, or relaxing exclusivity—the demand engine for $TON breaks. Ultimately, the sustainability of $TON’s moat depends on Telegram’s ongoing commitment to strict denomination rules and the interests of its leadership remaining closely tied to TON’s success.

Conclusion

Telegram is the distribution monopoly that crypto has lacked. $TON is the vehicle to own the distribution option and rent the reflexivity.

TON is the first blockchain to achieve deep integration with a global consumer app. Its value flows directly from Telegram’s scale, embedded payments, and enforced denomination. The $TON thesis hinges on Telegram supplying demand and $TON capturing it. Distribution is solved; the challenge is converting users into onchain actors.

Over the next 2–12 weeks, flows—not fees—drive price: TonStrat accumulation and potential U.S./KR listings versus an October supply overhang. Trade the catalysts; manage the float. The next quarter will center on market access and microstructure. Investors looking for exposure to an 1B MAU communication platform that has only converted 0.1% into onchain are left with no other options, therefore we expect them to start bidding, which should be reflected on the charts.

$TON is an option on future in-app engagement, with asymmetric upside if Telegram’s rails become the default for payments, remittances, and digital commerce. Success depends on sustained Telegram commitment, regulatory stability, and real product traction. If these hold, $TON offers exposure to the largest top-of-funnel in crypto—where everyday messaging meets embedded value transfer.

References

TON Viewer. TON Believers Fund.

TON Vote. TON Foundation Support TON Believers Fund.

Disclosures

Alea Research has never had a commercial relationship with the TON Foundation and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.