Perpetuals may dominate crypto volumes, yet global options turnover is at record highs and inevitably seeks the same KYC-free, self-custodial rails that Hyperliquid proved workable: CEX-grade UX, instant onramps, and tokenomics that let holders monetize protocol flow. Even if only a modest slice of that demand moves onchain, the addressable market is already structurally meaningful.

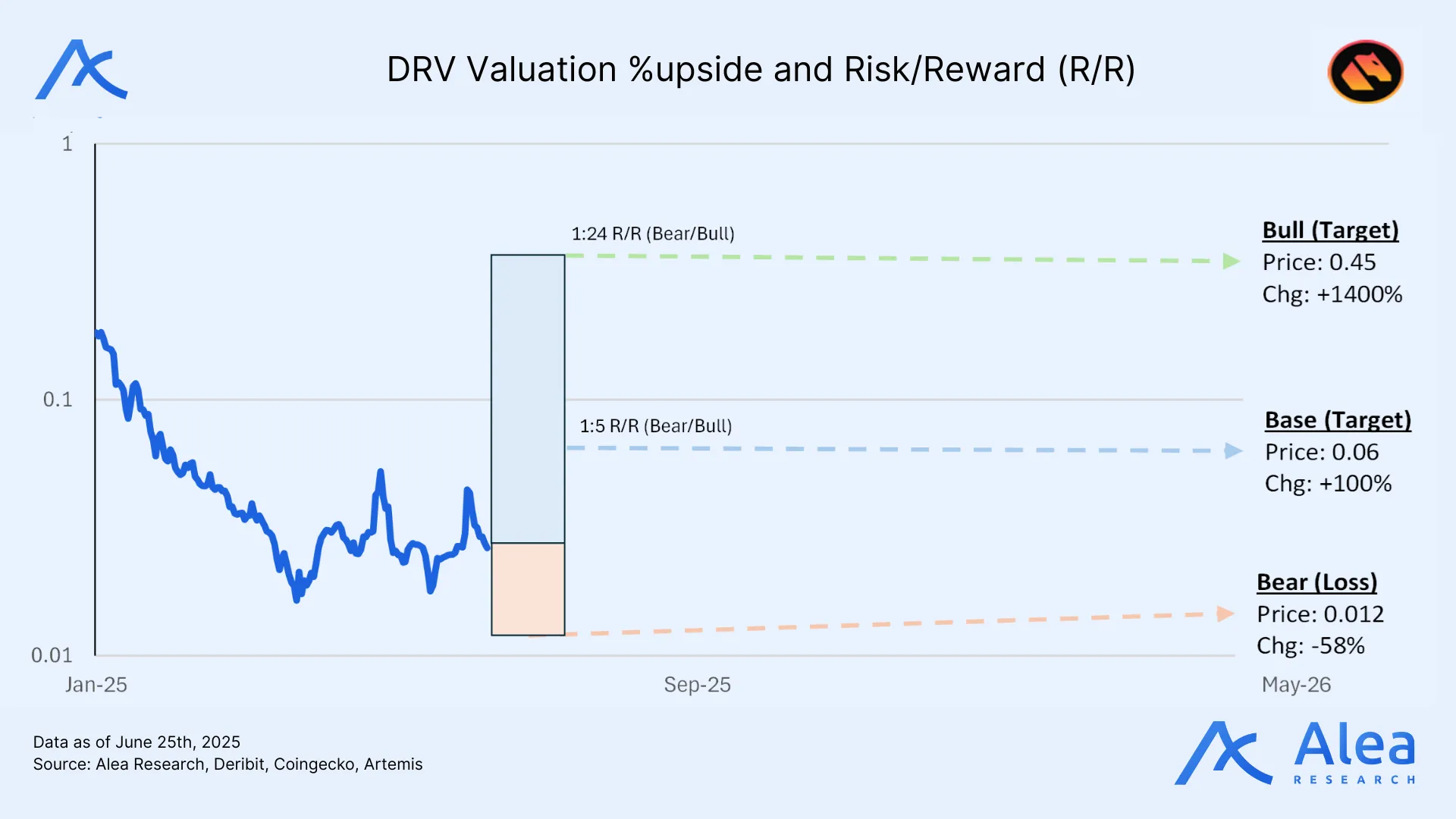

Derive is the market leader, commands the majority of that nascent flow onchain, and trades at < $30m FDV. For perspective, Coinbase just bought Deribit for $2.9b, with $700m (that’s 20× DRV’s valuation) in cash alone. Should “the Hyperliquid of options” be valued even at $300m fully-diluted, the reflexive chase for exposure begins. This bet seeks venture-style returns for backing a thesis that simply expects an alternative to CEXs for options and structured products to exist onchain.

The thesis hinges on Derive’s execution edge: a team with a background in equities options and market making, shipping in crypto since 2021, evolving from AMM roots as a dApp on L2s into the most recent Derive Pro. Beyond options, portfolio-margin, perps, structured-yield vaults and basis trades, every product strategy pipes fees into the same buyback loop, currently set to 25% of total fees.

Even if adoption is slow, liquidity begets liquidity and a head-start to compound those tailwinds matters; if even a fraction of Deribit’s $30b open interest migrates post-acquisition, DRV’s current price looks absurd. Risks—complex products, sticky CEX liquidity, last month’s failed $27m SNX bid—are real, but catalysts line up over the next 6-18 months, skewing pay-off sharply toward the upside.

This report is reserved for our Pro members. Upgrade your plan to gain access to in-depth analysis, actionable insights, and the tools you need to stay ahead in the crypto space.

Not ready for Exclusive Content? Sign up for free