Overview

ZetaChain is a Universal L1 that connects natively to any other blockchain network, from smart-contract platforms like Ethereum to non-programmable chains like Bitcoin. Acting as a decentralized hub, it unites all these disparate chains, providing a unified environment where users interact with multiple ecosystems as if they were one. By enabling direct cross-chain smart contract capabilities, ZetaChain allows developers to build Universal Apps that operate across multiple ecosystems from a single platform. With ZetaChain, developers can deploy smart contracts on a single chain that can read/write on any connected chain without wrapping assets, using a decentralized network of validators that observe and sign transactions on external chains.

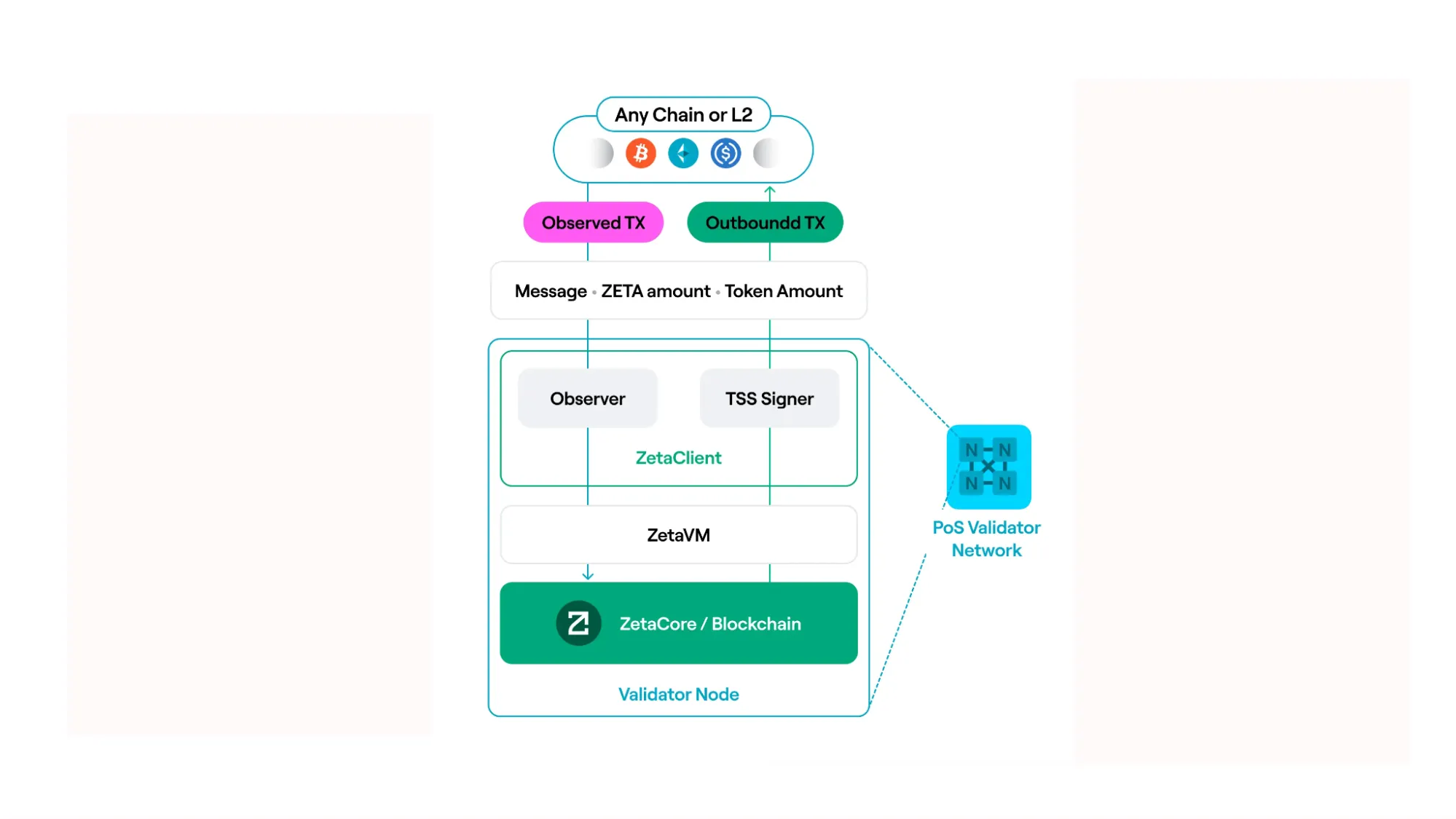

Operating on a hub-and-spoke model, ZetaChain serves as the central hub connecting various blockchains as spokes. This interoperability is facilitated by “hyper-connected” validator nodes that observe events on all connected chains and possess the ability to sign transactions on these chains through a Threshold Signature Scheme (TSS). This design enables smart contracts deployed on ZetaChain to directly access and interact with external blockchains, allowing for intricate cross-chain functionalities within a single user operation.

A key aspect of ZetaChain’s architecture lies in its native approach to cross-chain interoperability, which abstracts away the complexities associated with multiple blockchains into a unified platform. This is achieved without using wrapped tokens or external bridges, mitigating common security risks and enhancing user experience. For instance, a single smart contract on ZetaChain can orchestrate transactions involving Bitcoin, Ethereum, and BNB Chain triggered by a single user action. In effect, it facilitates cross-chain value transfer, data messaging, and function calls from a single platform.

ZetaChain uses the Cosmos SDK and CometBFT consensus engine as its foundational layer. Aiming to be the “universal connector” that allows any blockchain to communicate with any other natively, it bridges and consolidates liquidity, data, and users in one platform. The key differentiator is that, unlike purely messaging protocols or hubs, ZetaChain’s L1 has built-in cross-chain interoperability. Every contract on ZetaChain can orchestrate actions across chains, and the network itself manages external assets via a decentralized custody mechanism.

Why Build on ZetaChain

One Contract, Every Chain: Developers can deploy one smart contract on ZetaChain to reach users and assets on all major chains. This drastically reduces deployment time and complexity, as there’s no need to write separate contracts or integrate multiple bridges for each chain.

Familiar EVM Environment: ZetaChain’s Universal EVM is Solidity-compatible. Existing Ethereum contracts can be ported with minimal changes to gain cross-chain functionality. This lowers the adoption curve and increases network effects, as EVM developers can onboard quickly and leverage the current tooling they are familiar with.

Unified Liquidity & State: Projects can aggregate liquidity from multiple chains on ZetaChain, improving capital efficiency (e.g., a DEX on ZetaChain can tap into pools from Ethereum, BSC, and Polygon simultaneously). Also, maintaining a single state for a dApp across chains simplifies complex logic like multi-chain governance or multi-chain asset management.

Improved User Experience: By removing the need for users to switch networks or use bridges, dApps built on ZetaChain can offer a “single-click” experience while all complexity is abstracted away from the end user. This simplicity attracts more users (especially non-crypto-native ones) and drives higher engagement and retention.

Security and Reduced Attack Surface: Instead of integrating many bridges (each a potential point of failure), developers rely on ZetaChain’s built-in cross-chain framework. This decreases the overall attack surface, as ZetaChain’s standardized approach undergoes rigorous audits and collective security measures (see Security section).

Access to Non-Smart Contract Chains: ZetaChain allows developers to incorporate Bitcoin, Dogecoin, and other non-EVM chain functionality into their dApps. For example, a DeFi app on ZetaChain can accept Bitcoin deposits directly from Bitcoin wallets, enabling access to the large user base of Bitcoin holders without requiring them to use wrapped $BTC on Ethereum or similar tokens.

ZetaChain abstracts away multi-chain complexity, letting developers focus on dApp logic. By building on ZetaChain, projects can be future-proof as new chains emerge or gain popularity. ZetaChain’s architecture is built to integrate them (via governance decisions), and the existing Universal Apps automatically gain access to these new chains without redevelopment.

Protocol Architecture

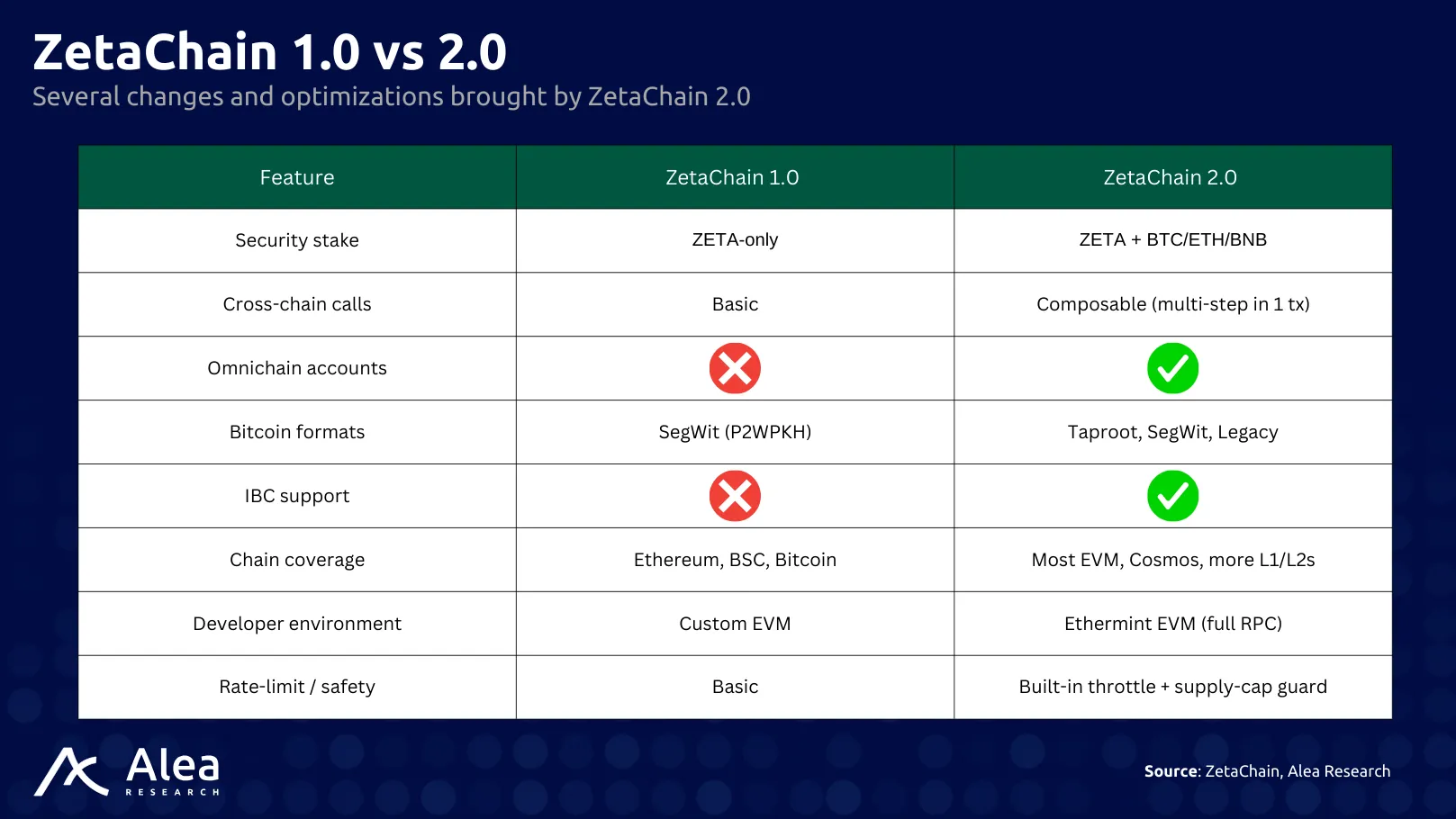

ZetaChain’s architecture is often described in terms of its Universal components that align with the core layers of the blockchain stack. Most of the core components were introduced in Zetachain’s 1.0 vision, with 2.0 building on the 1.0 architecture by broadening the security model, improving cross-chain composability, and integrating further with the wider blockchain ecosystem. Here’s a high-level breakdown of the core architecture:

Built on Cosmos SDK & CometBFT – ZetaChain’s protocol architecture is built upon the foundation of the Cosmos SDK and the Comet BFT consensus engine. This provides a robust and battle-tested base (similar to other Cosmos ecosystem chains) with fast finality (~5-second confirmation). Cosmos SDK’s modular design allows the project to custom-build modules for cross-chain functionality (e.g., tracking external transactions, issuing representative assets), which would be difficult on a monolithic chain like Ethereum. CometBFT (formerly Tendermint) provides Byzantine-Fault Tolerant consensus with near-instant finality, meaning once a block is confirmed, it won’t be forked or reversed.

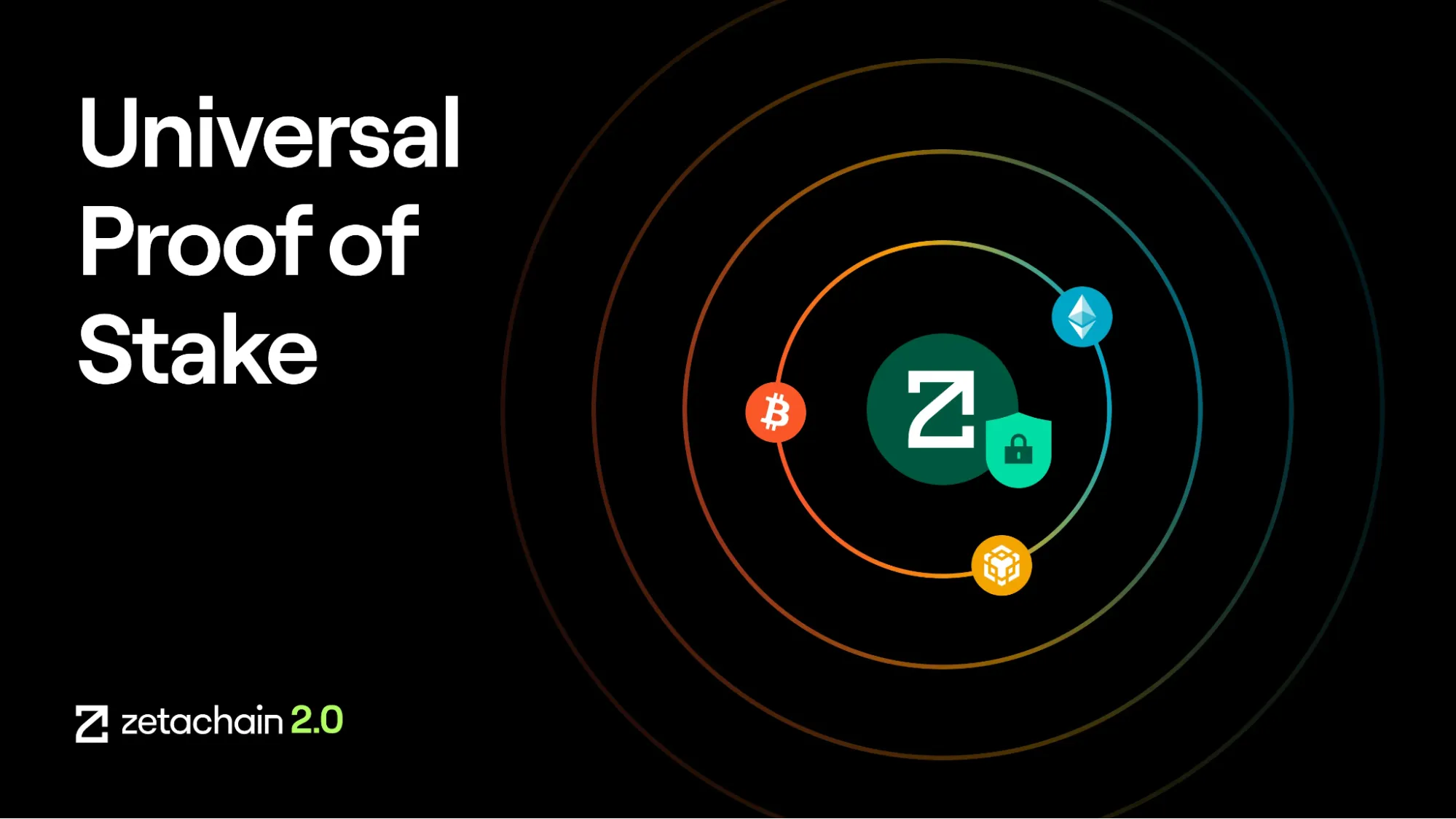

Universal Proof-of-Stake (PoS) Consensus Layer – In ZetaChain 1.0, this meant a classic Cosmos-style PoS: validators acquire and stake $ZETA to earn voting power and rewards. ZetaChain 2.0 allows validators and delegators to stake not only $ZETA but also $BTC, $ETH, $BNB, and other top assets (in the form of their ZRC-20 equivalents) to secure the network. In practice, this means a $BTC holder could earn staking rewards similar to a $ZETA staker, contributing to block production and cross-chain consensus. Doing this improves network security as it pools the economic security of other major ecosystems.

Note that this is still in R&D.

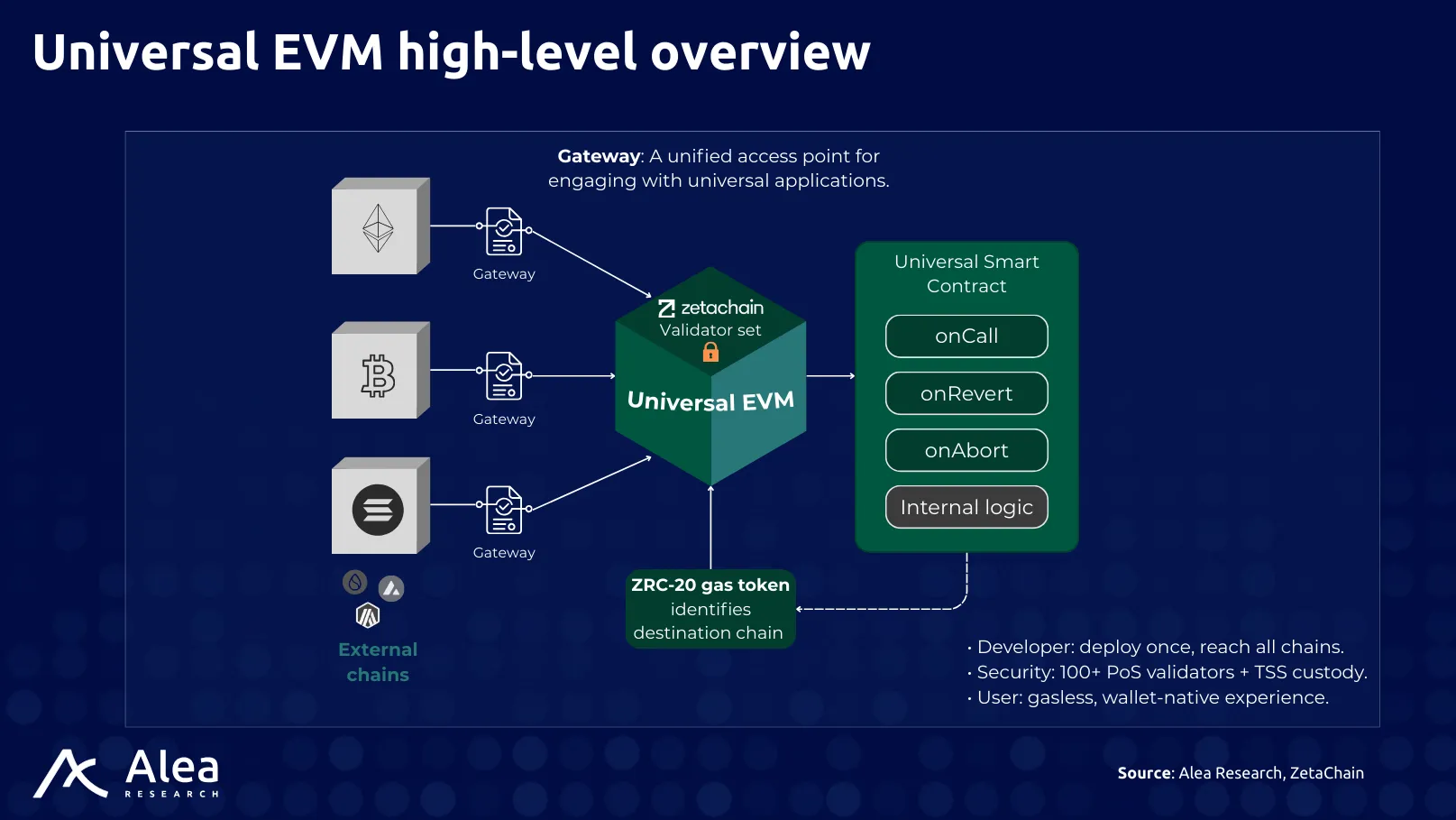

Universal EVM Execution Layer – ZetaChain includes an EVM-compatible execution environment extended with cross-chain capabilities. It’s often referred to as ZetaChain’s Universal EVM or ZetaEVM. Smart contracts run here, but unlike normal EVMs, they have native modules to initiate or respond to cross-chain events, effectively centralizing the logic. This is different from other interoperability solutions, where developers might need to deploy separate contracts on each chain and use a messaging layer to connect them.

Observer & TSS Layer – A specialized set of Observer-Signer validators runs additional client software (ZetaClient) that monitors external chains. They use a Threshold Signature Scheme (TSS) to collectively act as one signer on other chains (no single validator controls the keys). This enables ZetaChain to, for example, hold native $BTC in a secure multi-party scheme or to post transactions to Ethereum as an address controlled by the validator set. In effect, an attacker would need to compromise a supermajority of the stake, which is the same requirement to attack the ZetaChain blockchain itself. Thus, the security of cross-chain assets and messages is anchored to the economic security of the entire PoS network.

Cross-Chain Modules – Within the Cosmos SDK framework, ZetaChain has modules like CrossChain, Observer, Vault (for asset custody), etc., that coordinate cross-chain processes: tracking inbound/outbound transactions, orchestrating consensus on external events, and managing token custody.

ZetaChain’s architecture can be visualized as a multi-layer system: Cosmos-based L1 (for speed and finality) + EVM smart contract platform (ZetaVM) + Cross-chain communication layer (nodes + TSS), all working as one.

Alongside the headline features, ZetaChain 2.0 involves several under-the-hood improvements to optimize performance, compatibility, and security. Below are the core differences in ZetaChain 2.0:

Universal PoS

Universal PoS refers to ZetaChain’s Proof-of-Stake consensus (R&D), which is “universal” in two senses:

- Global Validator Set: Like many PoS networks, ZetaChain has validators staking the native $ZETA token to propose/verify blocks and secure the chain. There are currently 100 validators in mainnet, among them major companies like Google Cloud, Deutsche Telekom’s T-Systems, Coinbase Cloud, etc., pointing out institutional support.

- Extended Security through External Assets: ZetaChain’s vision of its Universal PoS is to allow staking of major external assets ($BTC, $ETH, $BNB, etc.) into its validator consensus, thereby tying the security of those assets into ZetaChain’s security. In practice, this could mean a validator’s bond, for example, $BTC, which then gets used (via a ZRC-20 representation on-chain) to increase the staking weight and thus network security. The incentive for validators is additional rewards in $ZETA for those multi-asset stakes.

ZetaChain uses the CometBFT consensus, which provides near-instant finality and fast block times.

Block rewards and fees (paid in $ZETA) are distributed to validators, rewarding honest behavior. Validators can be slashed for misbehavior, ensuring security through skin-in-the-game practices where positive incentive = rewards, and negative incentive = slashing.

ZetaChain’s PoS is permissionless, meaning anyone staking enough $ZETA can become a validator, always subject to being in the active set if their stake is high enough. This open design, combined with on-chain governance, means the validator set and rules can evolve over time via governance decisions.

Validators

The validators in ZetaChain fulfill two primary roles: Core Validators and Observer-Signer Validators. Core Validators are responsible for the traditional tasks of block production and maintaining the replicated state machine of the ZetaChain blockchain.

Observer-Signer Validators, on the other hand, have the dual responsibility of observing events and states on connected external blockchains and signing outbound transactions on those chains using distributed keys. Within each validator node, there are two key software components: ZetaCore, which handles the blockchain production and state maintenance, and ZetaClient, which is responsible for observing external chains and signing outbound transactions.

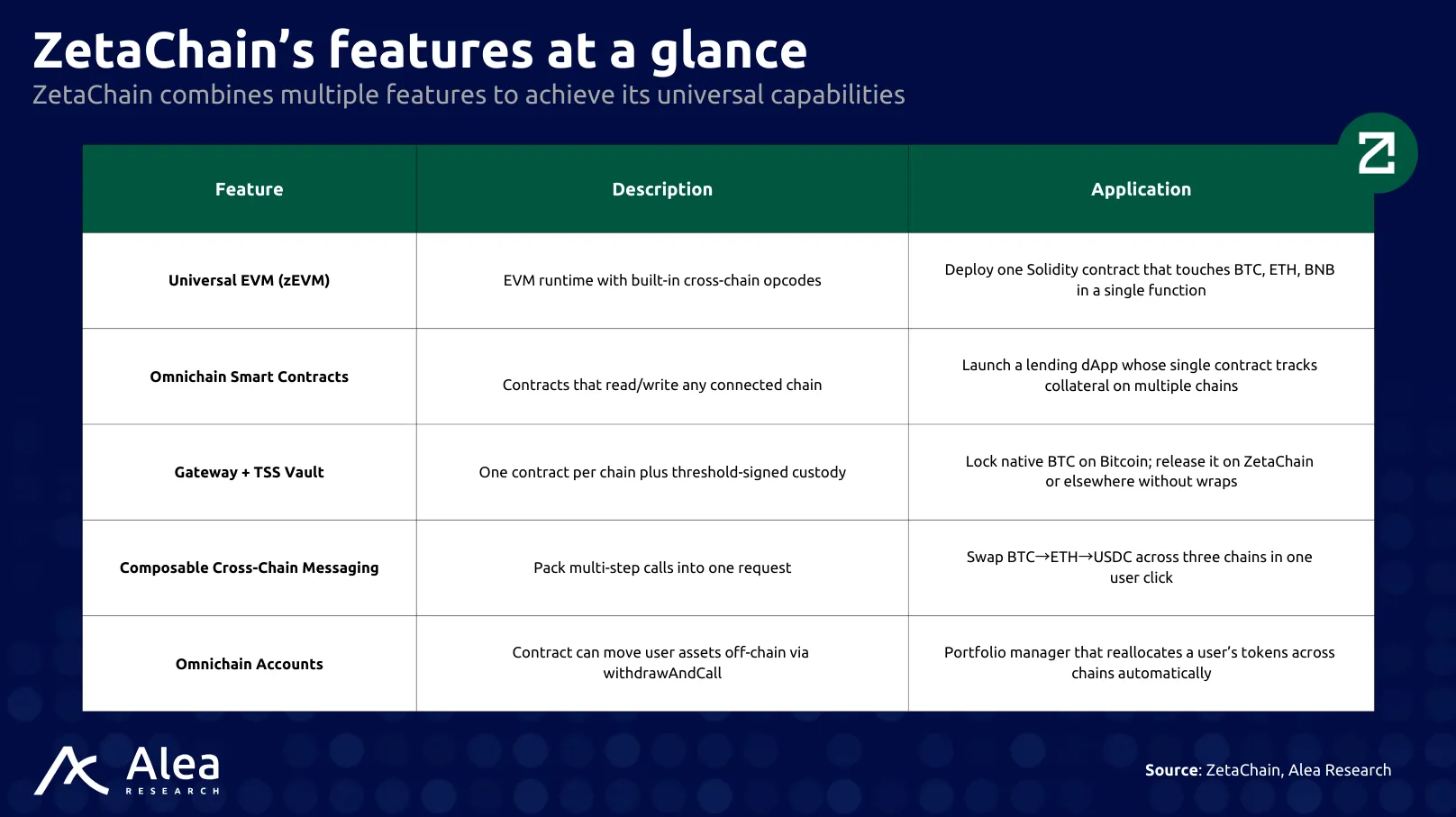

Universal EVM (zEVM)

ZetaChain’s Universal EVM is its smart contract platform, essentially an Ethereum-like instance with cross-chain features. The Universal EVM has several differentiating features:

EVM-Compatible: ZetaChain’s state transition function is EVM-based, meaning developers write contracts in Solidity/Vyper, and tools like Foundry, Hardhat, or Tenderly work out of the box. This lowers barriers for Ethereum developers to start on ZetaChain.

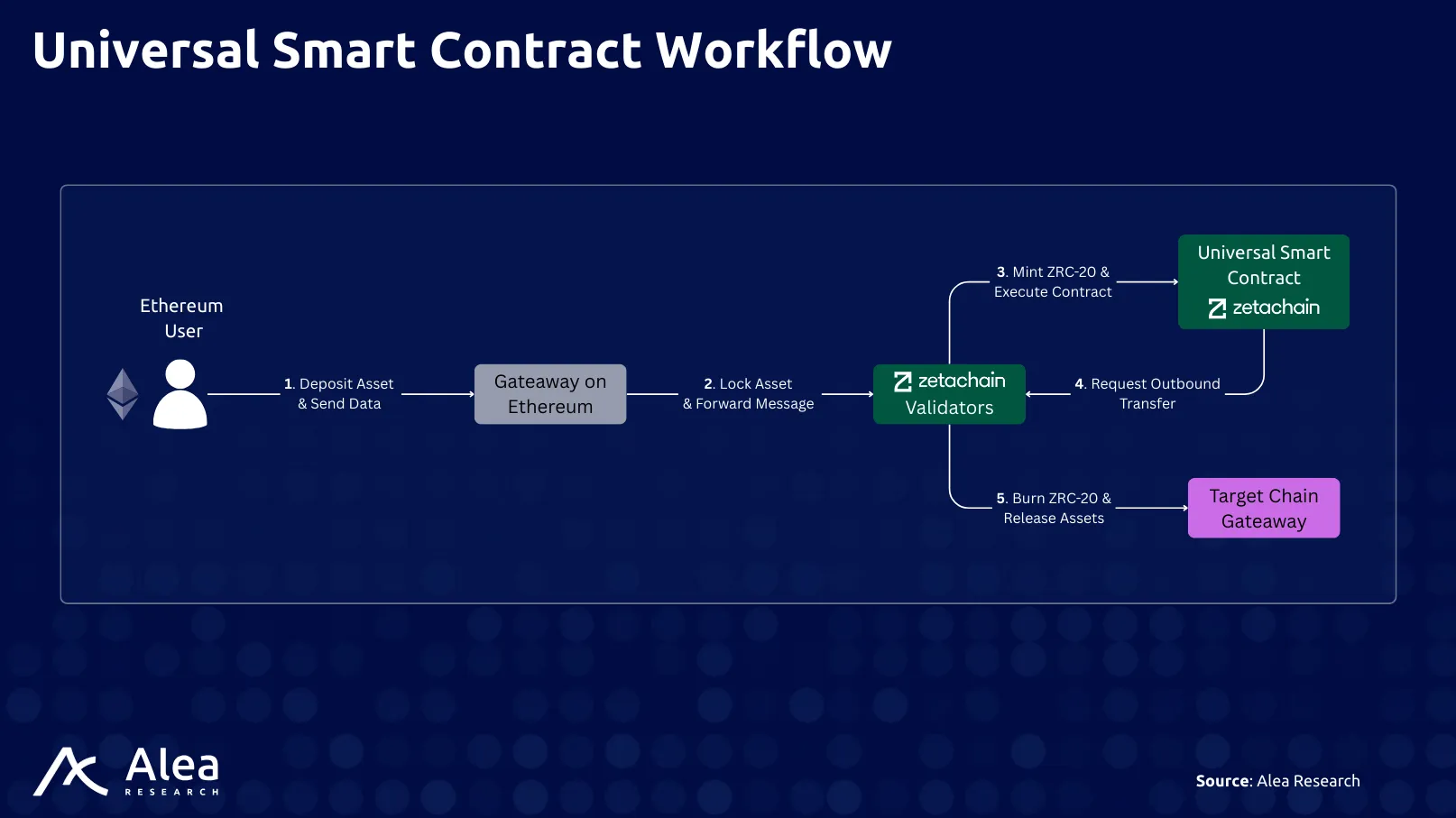

Built-In Cross-Chain Libraries: The Universal EVM comes with protocol-provided contracts and interfaces. For instance, there’s a Gateway contract on each connected chain that interacts with the ZetaChain interface. These libraries handle the workload of encoding cross-chain calls, minting/burning ZRC-20s on ZetaChain, and invoking remote chain actions. A gateway contract is the single smart contract that ZetaChain deploys on every connected chain to act as its doorway. For example, a user on Ethereum deposits 1 $ETH into the Ethereum gateway and specifies they want to swap it for $BNB on BNB Chain. ZetaChain sees the deposit, executes the swap logic, and then instructs the BNB Gateway to send the equivalent $BNB, all without the user touching a bridge UI or wrapped tokens.

Synchronous & Asynchronous Calls: Within ZetaChain, contracts can make synchronous calls to other ZetaChain contracts (normal EVM behavior) and asynchronous calls to external chains (via emitting events that observers will pick up and execute on the target chain). For instance, a ZetaChain contract might initiate a transfer on another chain and immediately continue executing (optimistically assuming success), with a separate function to handle a failure or confirmation. This is an asynchronous call. A ZetaChain contract calling another ZetaChain contract is synchronous; the second contract’s state change happens in the same transaction.

Gas & Fees: Transactions on ZetaChain’s EVM consume gas, priced in $ZETA. An important user-experience improvement is gas abstraction for external users: e.g., a Bitcoin user calling a ZetaChain contract doesn’t need to hold $ZETA for gas. In the background, when a user sends a $BTC transaction to the ZetaChain gateway, the protocol can manage the gas via relayers or by deducting fees in $BTC that are converted to $ZETA. From the user’s perspective, they use only $BTC, but the ZetaChain contract execution is still paid for in $ZETA behind the scenes.

State & Security: Since ZetaChain is a standalone L1, the EVM state is secured by ZetaChain’s validators. All cross-chain events that affect EVM state (like a user depositing an asset from Ethereum) go through ZetaChain’s consensus. The ZRC-20 model (minting tokens on deposit, burning on withdrawal) ensures that the EVM’s view of external assets is always consistent with what’s locked or controlled by the TSS key on the external chain.

The Universal EVM provides a familiar development environment augmented with cross-chain capabilities. It is the execution sandbox where universal smart contracts run, and it seamlessly ties into ZetaChain’s cross-chain messaging and signing infrastructure. For developers, it means they can build complex cross-chain logic in one place, with ZetaChain handling the heavy lifting of making it all work across networks.

Universal Smart Contract

Universal Smart Contracts on ZetaChain are cross-chain-enabled smart contracts that can orchestrate actions across multiple networks. Unlike traditional smart contracts limited to one blockchain, a Universal Smart Contract can incorporate logic that spans any number of chains within a single contract codebase and execution context.

- Single Source of Truth: Developers can maintain one contract (and one state) that represents their application logic, rather than fragmented states on each chain. This greatly simplifies state management. For instance, a lending platform could have a single contract on ZetaChain that keeps track of all loans and collaterals, even if the collaterals are on multiple chains.

- Future-Proof and Upgradable: Because these contracts are deployed on ZetaChain’s own blockchain, they can be upgraded or managed similarly to normal smart contracts (with proxy patterns or governance controls) if needed, without having to coordinate upgrades across several chains if a new blockchain is added to ZetaChain’s pool of connected chains; existing universal contracts can start interacting with that chain’s assets immediately.

How Universal Smart Contracts Work

A Universal Smart Contract is typically a Solidity contract on ZetaChain that inherits from a base like UniversalContract. It defines handlers (e.g., onCall) that the protocol invokes when an external call comes in. Here’s the cross-chain flow simplified:

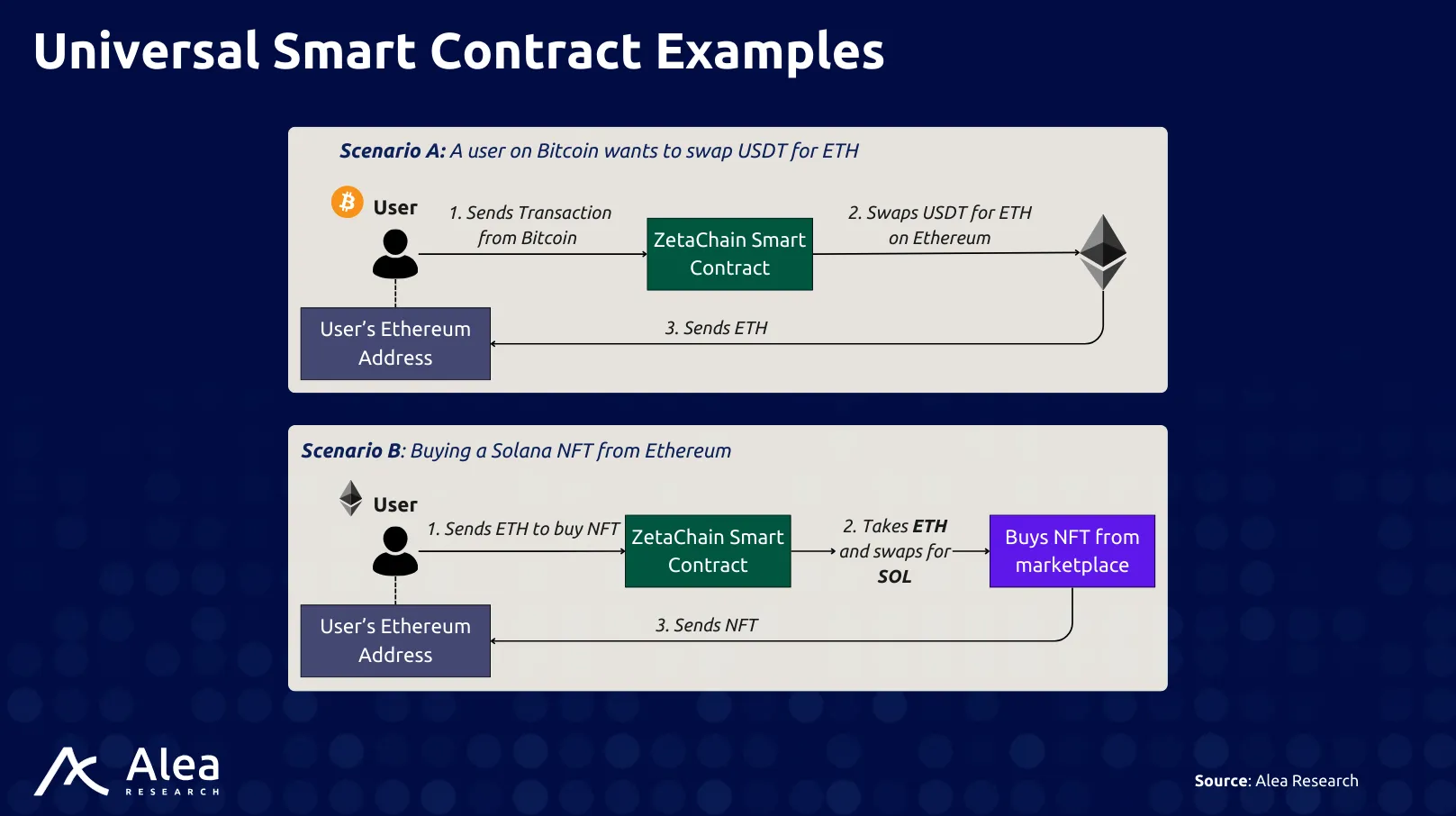

To further illustrate the use case of a Universal Smart Contract, here are two example scenarios:

ZetaChain’s approach treats a universal smart contract as a hub, with spokes out to various chains.

Universal Apps

Universal Apps are the end-user applications built on ZetaChain’s platform that leverage its cross-chain capabilities. The primary purpose of Universal Apps is to eliminate the fragmentation of today’s multi-chain landscape. From a user’s perspective, a Universal App provides a unified interface to interact with multiple blockchain ecosystems seamlessly without having to bridge, swap, and use different wallets.

For developers, Universal Apps enables them to deploy a single smart contract on ZetaChain’s Universal EVM that can interact with users and native assets across all connected blockchains. Also, it unlocks access to a broader, unified liquidity and user base from various ecosystems, allowing for dApps with enhanced capital efficiency and the ability to tap into previously siloed markets.

The key characteristics of Universal Apps include:

| Characteristic | Description |

| Multi-Chain User Experience | The user does not need to switch networks or hold multiple tokens for gas. They use their go-to wallet and assets. |

| Composable Transactions | Universal Apps can string together multi-step, multi-chain operations triggered by one transaction. |

| Single Deployment, Multi-Chain Reach | A Universal App is a single smart contract on ZetaChain that users on any chain can interact with. |

| Support for Non-EVM Chains | Universal Apps can interact with non-smart contract chains like Bitcoin without wrapping, bringing these ecosystems into DeFi and Web3. |

Universal Apps, unlike regular dApps, can receive calls, messages, and tokens from any connected chain and trigger actions like contract calls and token transfers on those chains. This is facilitated by the Gateway, a unified API that allows externally-owned accounts (EOAs) and apps on connected chains to interact with Universal Apps for tasks such as sending tokens and querying gas. Furthermore, Universal Apps utilize the ZRC-20 token standard to permissionlessly withdraw tokens to connected chains as native assets, enabling unified liquidity within ZetaChain’s hub-and-spoke model that simplifies cross-chain communication compared to point-to-point messaging.

Universal App Ideas

The development of Universal Apps opens up a wide range of possibilities for developers. They accommodate diverse sectors, facilitate connectivity with any ZetaChain-supported chain, and enable the development of novel applications that are uniquely feasible within this ecosystem. Below are four Universal App ideas that can be built on ZetaChain.

Universal App Idea #1

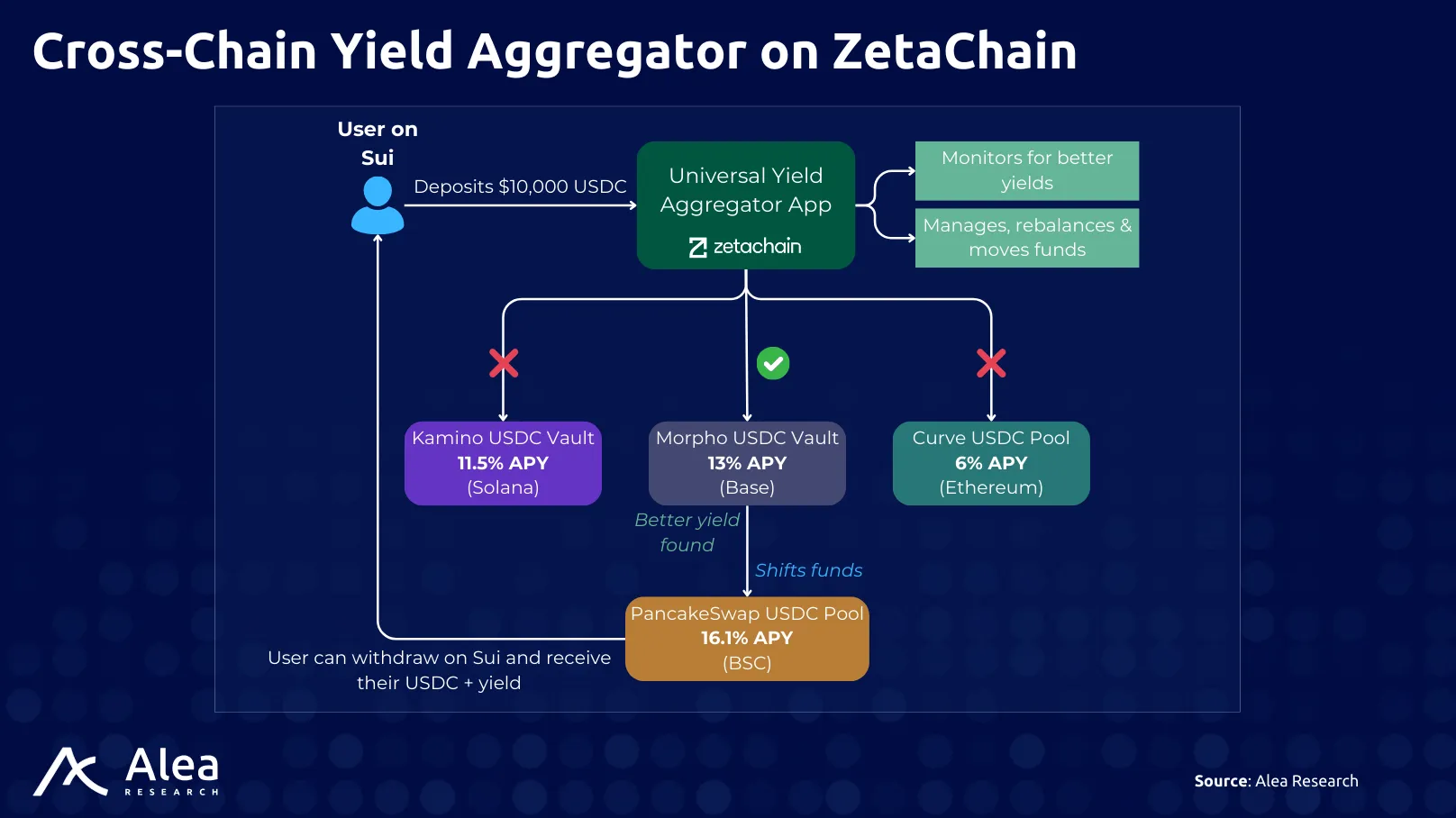

A yield optimizer that can allocate capital to promising opportunities across multiple blockchain networks. It can invest in Ethereum DeFi, Solana staking, BSC yield farms, and more, while adjusting these allocations in response to changes in yield.

ZetaChain enables “Cross-Chain Smart Contract Composability,” allowing smart contracts to interact with dApps on any chain.

Note that this application triggers external smart contracts that pose risks.

Universal App Idea #2

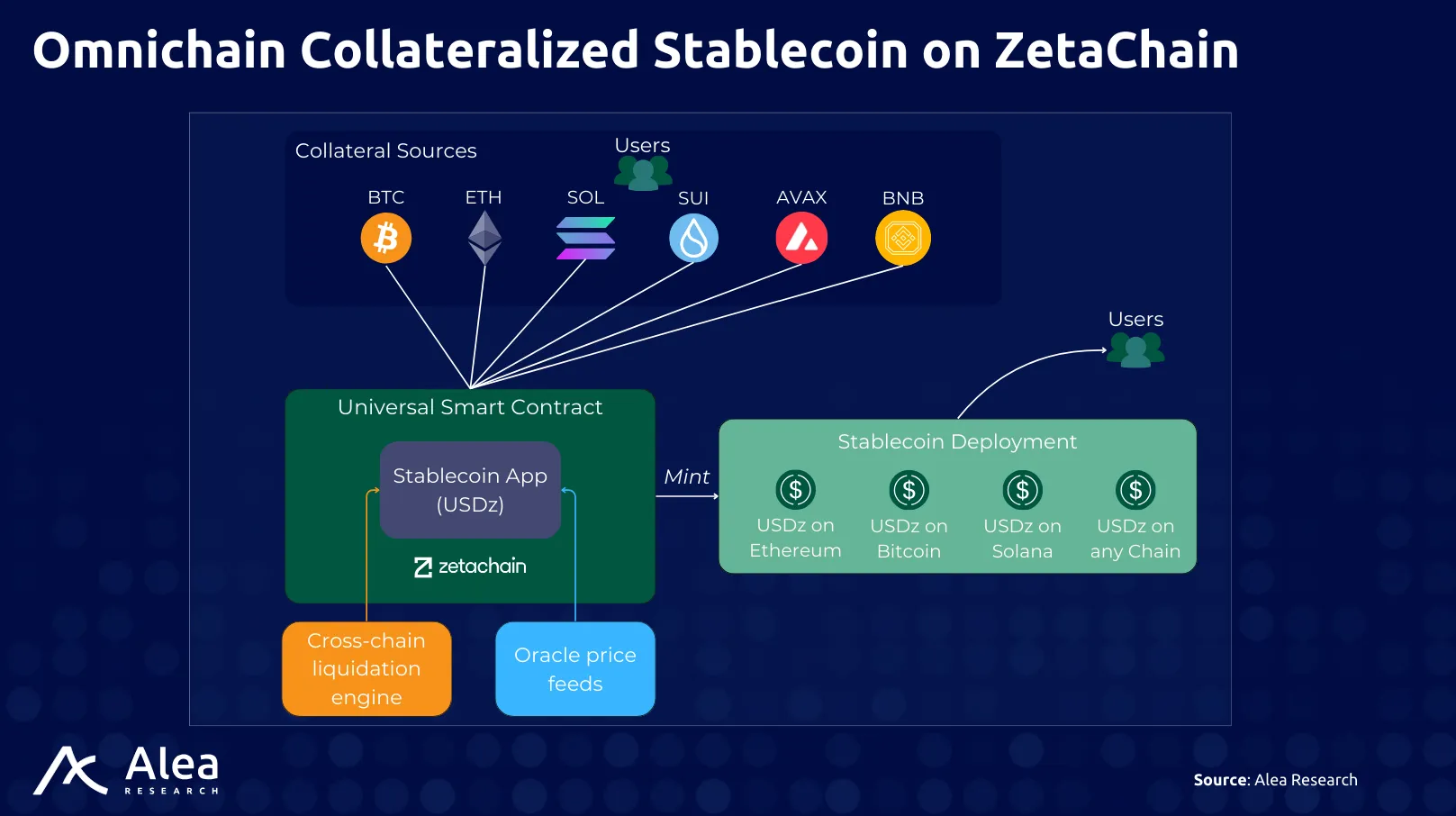

A multi-collateral, decentralized stablecoin supported by blue-chip assets from various chains. For example, a stablecoin could be backed simultaneously by $BTC, $ETH, $SOL, and $BNB, all secured within ZetaChain’s contract.

Users can lock these or other assets on their original chains and mint a stablecoin on ZetaChain.

Universal App Idea #3

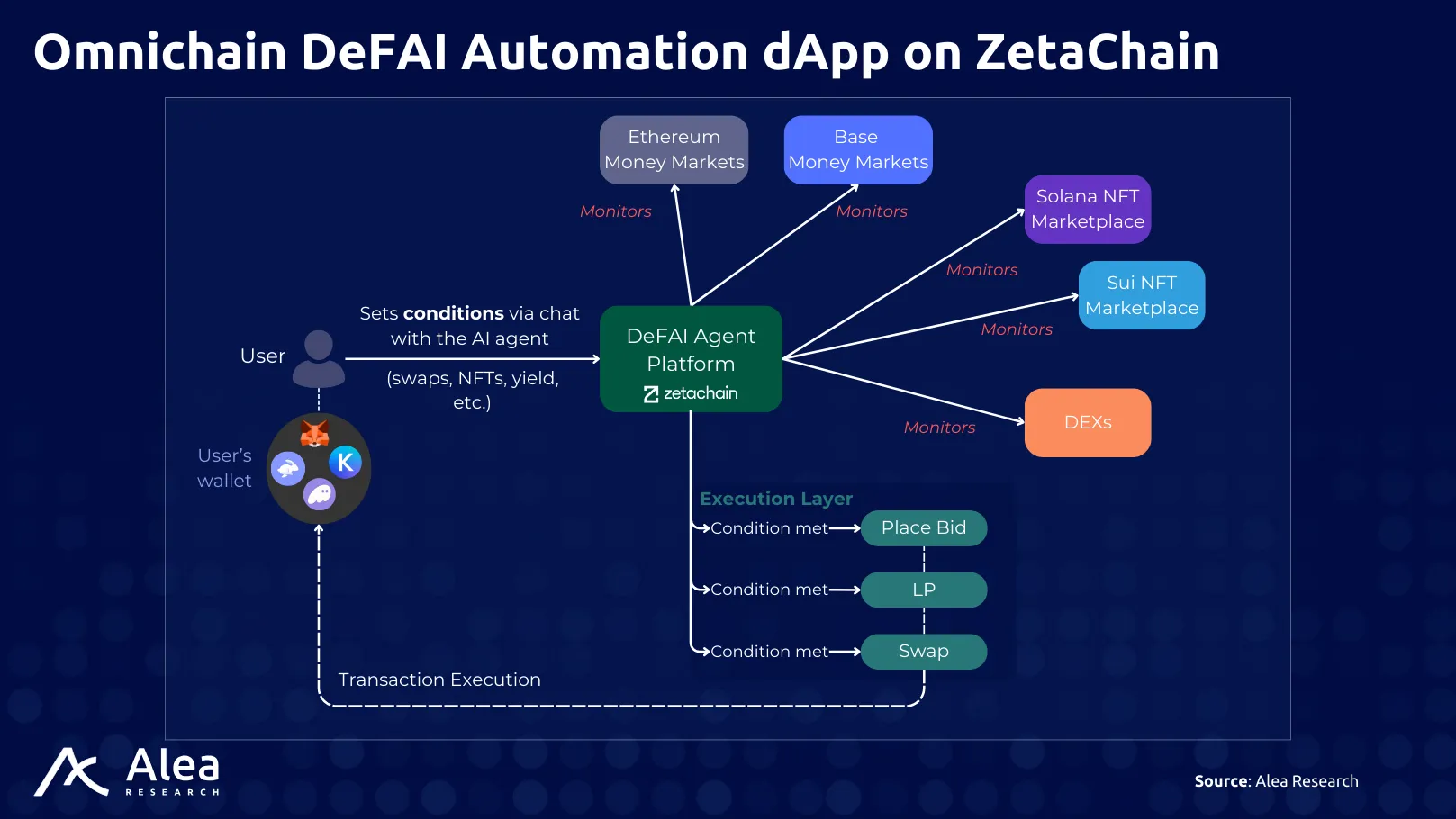

ZetaChain has the potential to support an AI-driven on-chain agent framework that functions across multiple blockchains, managing tasks around the clock. Users can communicate in everyday language with their agent, directing it to perform various actions in DeFi without user intervention.

Universal App Idea #4

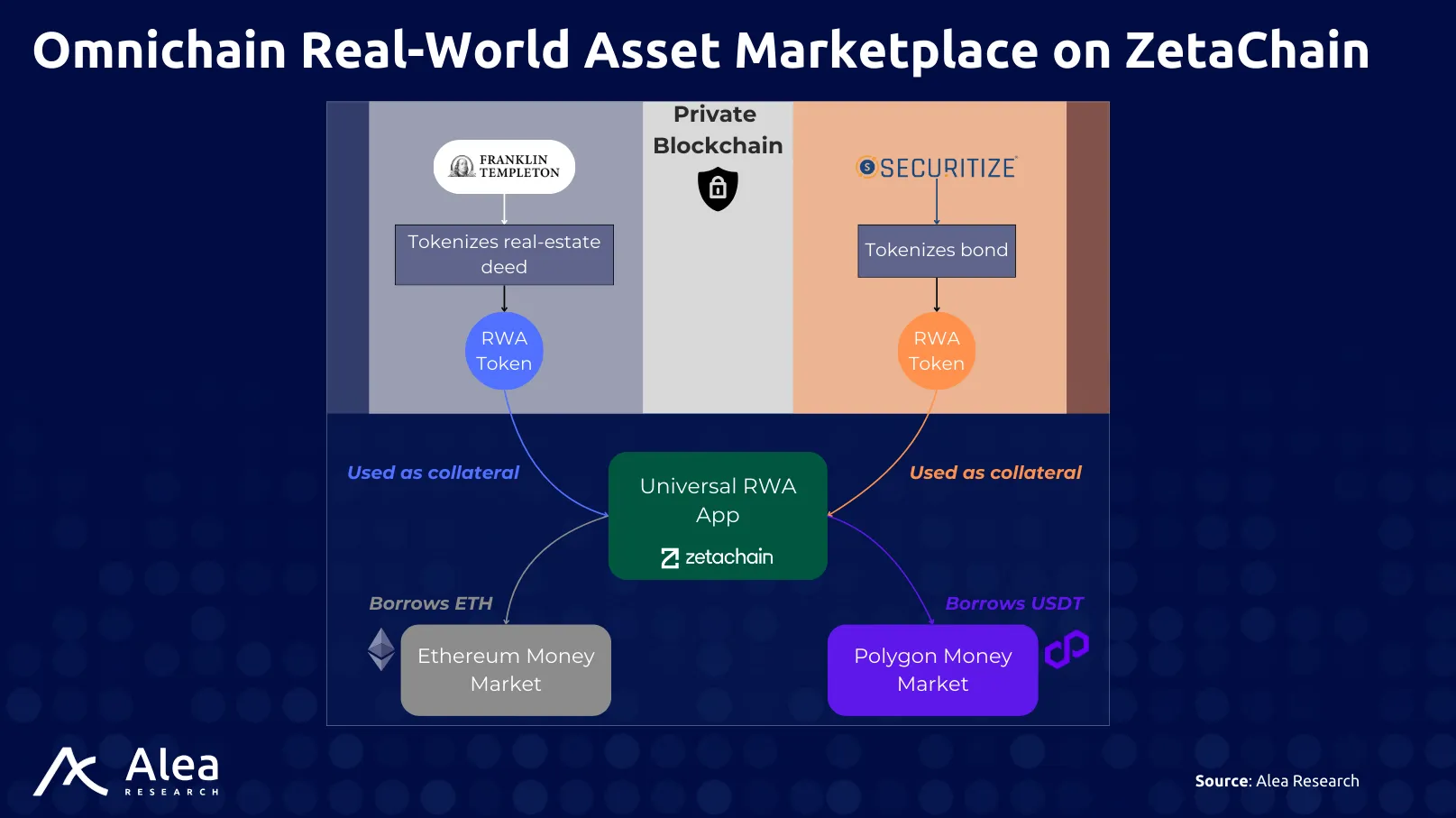

A universal app for tokenizing and trading real-world assets (RWAs) across chains.

It allows stocks, bonds, and real estate shares to be represented as tokens on one blockchain and utilized as collateral or yield-bearing assets on others.

ZetaChain’s Value Proposition

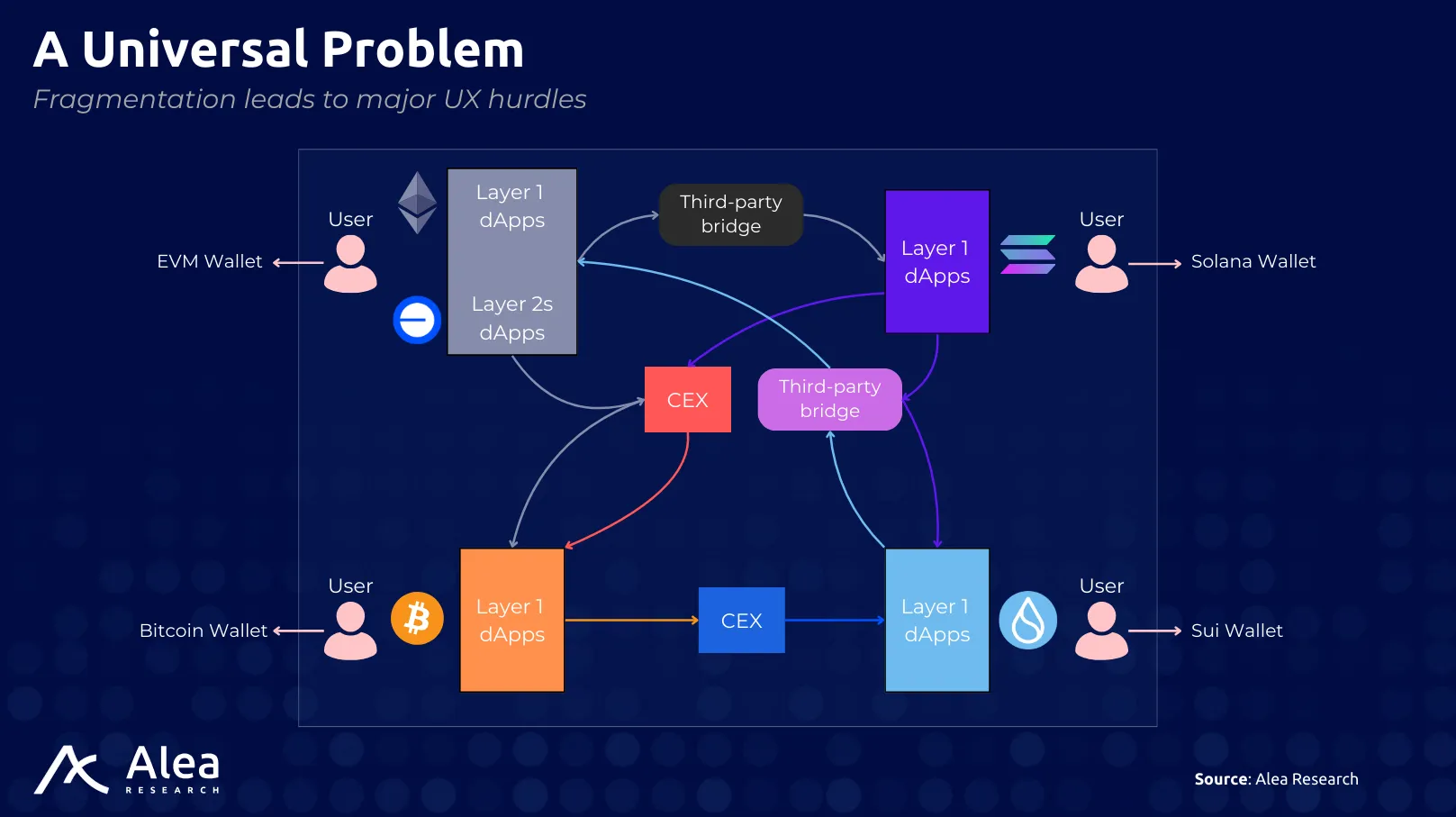

Blockchain ecosystems today are siloed, fragmenting both liquidity and users. Crossing from one chain to another typically requires cumbersome steps, including using third-party bridges, wrapping tokens, and managing multiple wallets, a process prone to poor user experience and security risks. Essential assets like Bitcoin are hard to use in DeFi without centralized wrapping, and dApps on one chain cannot easily leverage functionality on another, slowing mass adoption of blockchain technology.

ZetaChain was created to provide native interoperability by abstracting the complexity of multiple chains into one platform. It does this without wrapped tokens or external bridges.

By 2021, the crypto landscape had multiple L1 blockchains (Ethereum, BSC, Solana, etc.) and emerging L2 networks. Now, the situation is even worse since the number of L1s and L2s has increased substantially. Moving assets or data between them was and is still cumbersome and risky. Bridges at the time were mostly ad-hoc, often centralized or semi-centralized, and many had been hacked or exploited, resulting in billions lost. The current interoperability infrastructure has improved massively, but the UX still remains underwhelming.

The vision of ZetaChain as a Universal Blockchain is to create a single chain that any other network could plug into and gain interconnectivity without needing each pair of blockchains to build their own bridge.

History and Background

ZetaChain was founded in 2021 by individuals with a deep background in crypto (Coinbase, THORChain, etc) and several contributions. The team grew to include former members of projects like 0x, Cosmos, ConsenSys, etc., assembling a broad skill set in consensus, EVM, and interoperability.

Development Timeline:

- 2021: Project founded, initial design, seed whitepaper drafts, and internal testnets.

- 2022: Testnet launch (ZetaChain testnet saw rapid adoption, with reportedly over a million users interacting by mid-2023, likely driven by an early incentivized testnet program, ZetaLabs, which offered XP points for tasks and hinted at future airdrops).

- 2023: Funding milestone – raised $27M in August 2023, bringing in notable investors (Blockchain.com, VCs, Jane Street, etc.). By the end of 2023, testnet activity was high, and the team was preparing the mainnet. They also developed ecosystem programs (grants, XP points for users).

- Early 2024: Mainnet launch on Feb 1, 2024. Mainnet 1.0 initially connected Bitcoin, Ethereum, and BNB Chain. The launch was accompanied by a large airdrop (over 800k participants eligible). In May 2024, Zetachain 2.0 went live, introducing Universal Apps.

- 2025: In 2025, ZetaChain is focused on expanding its blockchain connectivity to include networks like Sui, TON, and Avalanche, while also concentrating on scaling its ecosystem of Universal Apps to drive wider adoption of its interoperability solutions. Numerous partnerships have also occurred with enterprises like Google Cloud, Telekom, and Coinbase.

Sector Outlook

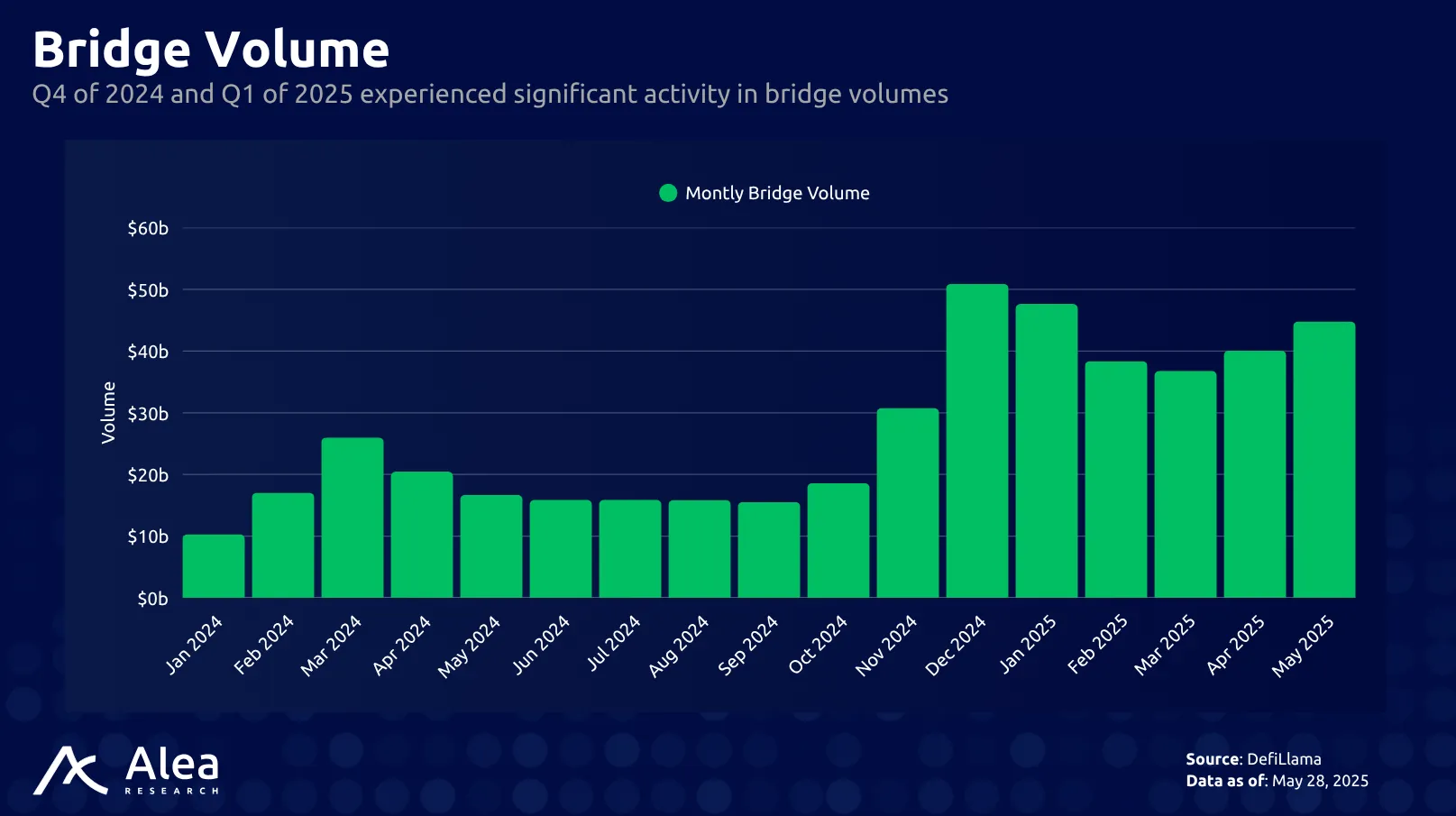

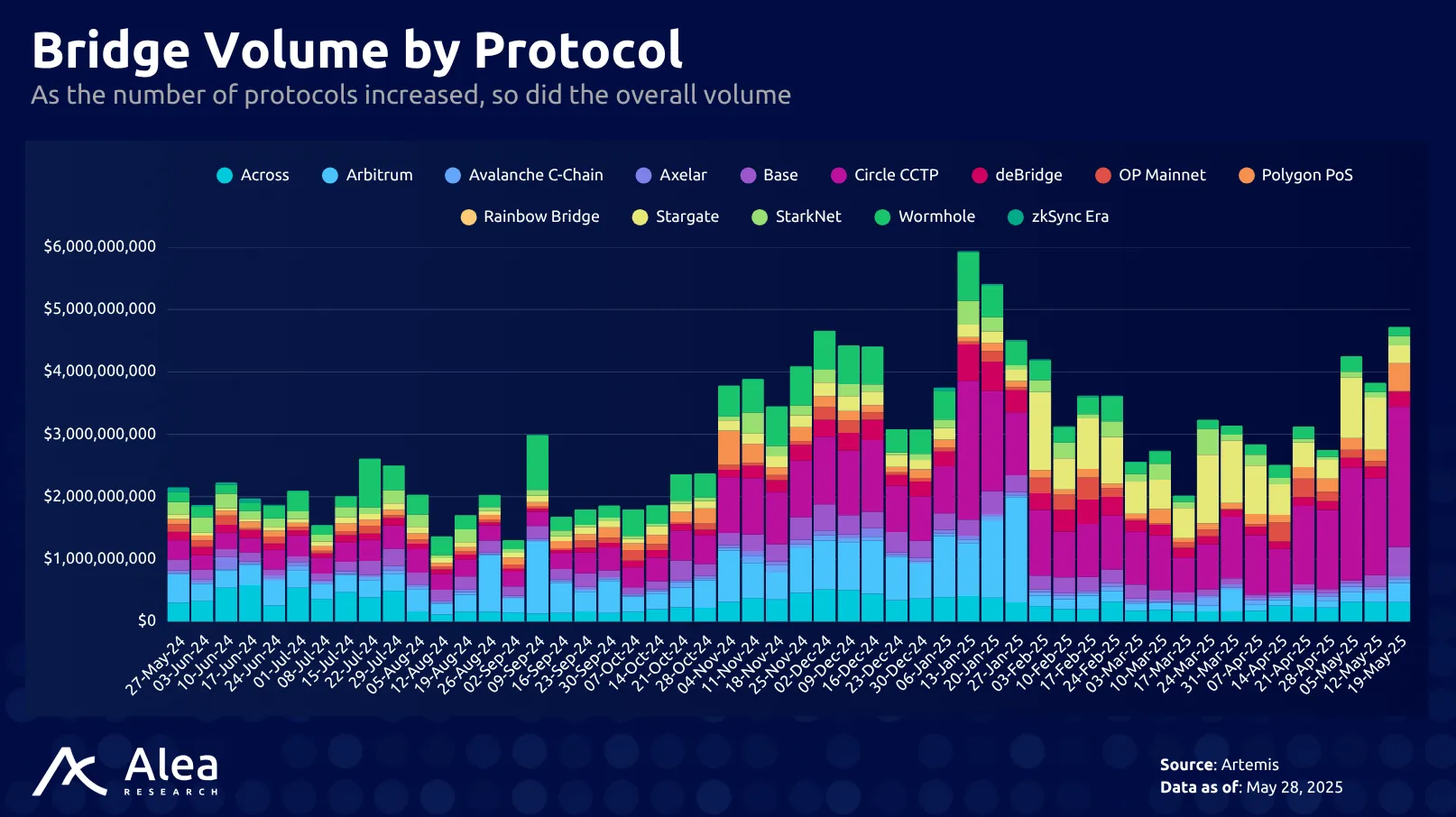

It’s widely accepted that no single blockchain will dominate every use case. Instead, we will have multiple chains, each excelling in certain areas (one for NFTs, one for DeFi, others for RWA, some for gaming, etc.). The demand for seamless cross-chain functionality is only growing as new L1s, L2 rollups, and app-specific chains (like Cosmos zones or subnets) continue to launch, and scaling demands continue to grow. On average, over $1B in crypto assets are bridged daily.

The current state of cross-chain interaction is often user-unfriendly, requiring manual bridging, multiple transactions, and a risk of errors. This is a major barrier to mainstream adoption of dApps. There is a trend toward abstracting away complexity, where users won’t need to know what chain they’re on. From a developer’s point of view, it involves building an application that can reach users on many chains (without fragmenting liquidity).

There is also a shift from simple token bridges toward cross-chain dApps and unified liquidity. Protocols like ZetaChain aim to make multiple blockchains function as one, offering “chain-agnostic” smart contracts that abstract away individual networks. At the same time, major ecosystems take different approaches. Ethereum’s rollup-centric model concentrates activity in L2s, whereas Cosmos and Polkadot promote an “Internet of Blockchains” with many sovereign chains. This monolithic vs. modular debate will influence interoperability demand. If activity consolidates on a few chains, cross-chain volume may drop. But if multiple specialized chains thrive, interoperability infrastructure becomes a necessity for success.

Competitive Landscape

ZetaChain’s proposition is to combine a L1 chain with built-in cross-chain smart contracts and messaging. That makes it a Universal chain that spans both EVM and non-EVM chains, as well as non-smart-contract chains like Bitcoin. The unique advantage is underpinned by the ZetaEVM, which allows developers to deploy cross-chain smart contracts that directly manage assets and data on external chains. This positions ZetaChain as the one-stop execution layer for cross-chain applications..

The full stack interoperability space can be categorized along key dimensions that include: Trust Model (who/what secures cross-chain transactions), Execution Layer (shared chain vs. sovereign app-chains vs. on-demand execution via messaging), Messaging Paradigm (e.g. light-client state proofs, optimistic verification, or intent-centric orchestration), Consensus Base and Settlement Layer (underlying base chain or validator set providing finality), and Developer UX (how developers deploy and interact, e.g. standard smart contracts vs. new SDKs or intent APIs).

- Intent-Centric Orchestration: Systems like Anoma, Particle, and Skate abstract chains entirely. Users submit high-level intents (e.g., “swap X for Y”), and off-chain solvers or executors determine the execution plan. These rely on economic incentives and, increasingly, cryptographic privacy (e.g., threshold encryption or ZKPs). While developer-facing tooling is immature, the user experience is frictionless and chain-agnostic.

- Execution-Enabled Messaging Hubs: Platforms like AxelarVM, Omni, and ZetaChain embed execution logic within their interoperability layer. Developers write contracts once and orchestrate multi-chain logic from a shared execution environment. These systems differ in their security anchoring; some restake Ethereum (Omni), others use PoS validators (ZetaChain, Axelar). They prioritize atomicity and composability over sovereign chain control.

- Sovereign Interop Frameworks: Saga, Dymension, and Hyperlane Sovereign SDK focus on composability between sovereign chains. Each app owns its own execution and (optionally) validator set. Interop happens via messaging layers like IBC, optimistic relays, or customizable security modules. This allows tailored performance and risk isolation but complicates developer onboarding.

- Programmable Bridging Protocols: Wormhole Native Relay, LayerZero, and Axelar Gateway are not execution layers but provide programmable messaging. They enhance traditional bridges with composability primitives (e.g., message payloads, native gas relay), often at the cost of trust assumptions (guardian sets, relayer/oracle models). These are widely integrated but limited in atomicity and synchronous logic.

While intent-based systems chase the smoothest UX, they introduce new actors (solvers) that must match and fill user intents. Meanwhile, sovereign approaches scale horizontally but push complexity back onto builders, whereas bridge-centric systems offer no native state coordination. As a central security hub, ZetaChain excels in atomic composability.

- Intents-Centric systems begin with the user’s desired outcome rather than discrete cross-chain calls, collecting high-level statements such as “swap X for Y” or “stake wherever yield is best”. These orders are then picked up by solvers that compete in a market to atomically compose the necessary multi-chain transactions. The promise is a one-click experience that hides every bridge and gas choice. The price is architectural complexity and new trust edges: users now rely on off-chain matchers to behave honestly.

- Shared-security hubs such as ZetaChain, AxelarVM, and Omni keep logic on a single EVM chain while tapping large validator sets for security. Developers can deploy once to the hub and gain automated reach into dozens of external chains because every cross-chain step is finalized under one consensus. The trade-off is concentration of risk: if the hub halts or its validator set colludes, every connected application inherits the outage.

- Sovereign-execution approaches like Saga’s chainlets or Dymension’s RollApps give each application its own chain or rollup. This grants full throughput isolation and lets teams pick custom virtual machines, fee models, and security budgets. The drawback is that interoperability remains asynchronous: moving assets or state between two chainlets or RollApps still involves IBC packets or optimistic proofs and thus cannot match the synchronous composability of a shared hub.

- Bridge-first networks like Wormhole’s Native Relay, Hyperlane’s Sovereign SDK, and LayerZero’s stay deliberately thin. They expose lightweight messaging contracts on every supported chain and leave execution to the destination application. At the same time, this maximizes flexibility; truly atomic multi-step workflows are either slow (when wrapped in timelocks) or impossible. Security rests on committees or configurable watch groups rather than on-chain light-client proofs, which is sufficient for moderate value flows but remains a weaker assumption than a fully verified cross-chain state.

ZetaChain centralizes cross-chain activity in a single secure hub with a unified validator set, offering atomicity and simplicity for developers and users. This contrasts with sovereign execution models that prioritize independent chains with their own security, potentially sacrificing synchronous composability for specialization. ZetaChain’s strategy focuses on ease of use and uniform security for cross-chain dApps, while sovereign models emphasize independence despite integration complexities.

Raw message passing systems offer a low-level, user-controlled approach to messaging, exemplified by early versions of Wormhole and LayerZero. In contrast, intent orchestration systems provide a high-level abstraction aimed at improving user experience and optimization. While intent systems offer benefits, they introduce additional complexity and trust assumptions due to the involvement of off-chain roles such as solvers. Raw messaging, on the other hand, is characterized by its directness and transparency.

ZetaChain uniquely integrates an EVM-compatible smart contract platform with core-level cross-chain capabilities. As a Universal chain, it’s a public blockchain enabling smart contracts to natively manage assets and data across multiple chains within a single contract. This streamlines cross-chain app development and simplifies user experience with features like gas abstraction. Users can interact with ZetaChain dApps via a Gateway contract on connected chains without needing $ZETA or switching networks.

From a competitive standpoint, ZetaChain’s decision to use an EVM-compatible execution layer (zEVM) also taps into the pool of Solidity developers currently dominating the market. This contrasts with other solutions requiring custom intent languages, messaging standards, or SDKs for launching sovereign chains. ZetaChain also provides a Universal Toolkit with modules for common scenarios such as querying user balances cross-chain or performing cross-chain swaps. This contributes to network effects among developers.

ZetaChain Differentiation Factors

Overall, the key differentiators include:

-

- Universal smart contracts: one Solidity contract orchestrates assets and logic across every connected chain.

- Unified Liquidity Execution Hub: atomic cross-chain steps finalized under ZetaChain’s consensus.

-

- Built-in light-client verification: validators natively verify Bitcoin, EVM, and IBC proofs, removing external oracles and reducing trust assumptions.

- Gas and account abstraction: users interact from their origin chain, pay fees in its native token, and never switch networks or wallets.

- Broad chain coverage: support for both EVM and non-EVM chains, as well as non-smart-contract chains like Bitcoin.

- EVM tooling and network effects: existing Solidity libraries work out-of-the-box, shortening developer onboarding time.

Interoperability has long been a choke point for user growth and large-scale adoption. In the race to make cross-chain complexity invisible, ZetaChain stakes its claim by offering an EVM-native hub that unifies assets, liquidity, and execution without forcing builders to abandon familiar tooling or users to juggle wallets and bridges.

Supply & Demand for Block Space

ZetaChain’s economic model centers on its network fees, token dynamics, and blockspace supply and demand, built around a usage-based structure where transaction volume and cross-chain interactions directly influence network revenue. As a Layer-1 blockchain, ZetaChain charges gas fees for every transaction and cross-chain operations.

Unlike typical single-chain gas, ZetaChain’s design bundles multiple steps (source chain, ZetaChain, destination chain) into one user action. Users pay fees in $ZETA, which cover execution on ZetaChain and the remote chain fees in one go. For instance, if a user triggers an Ethereum contract via ZetaChain, they pay in $ZETA, and the protocol internally swaps some of that to $ETH to pay the Ethereum gas.

While ZetaChain’s usage-based structure implies a supply of blockspace that can scale with demand, it also has inflationary and deflationary dynamics embedded in its token model to maintain network sustainability. To meet the demand for staked $ZETA (used by validators for security and to earn rewards), the network mints additional $ZETA tokens over time. This inflationary mechanism is tied to the staking demand, the more validators join the network to handle higher transaction volume and maintain security, the more ZETA is minted to reward them.

Cross-chain Liquidity

Beyond gas, ZetaChain’s use of the $ZETA token in cross-chain liquidity and messaging is another economic dimension. $ZETA acts as a routing asset for cross-chain swaps and value transfer.

In a cross-chain swap (say, swapping token A on Chain X for token B on Chain Y), $ZETA serves as the intermediary bridge asset. The transaction goes A→$ZETA→B across chains.

While users trade through third-party DEXs (like an AMM pool pairing $ZETA with other assets on each chain), ZetaChain benefits indirectly. It has allocated incentives to seed these pools, and the prevalence of $ZETA in swaps enhances the token’s utility and demand.

Stakeholders Value Accrual

For $ZETA token holders, value accrual comes from three angles: staking rewards, token utility, and potential fee burns.

Stakers (validators or delegators) earn transaction fees consisting of block rewards (inflationary issuance) and a fixed emission, directly profiting from network activity. As ZetaChain’s adoption grows, fees should become a larger component of rewards, creating a self-sustaining economy where usage pays for security.

All users of the network need $ZETA to pay gas or to serve as liquidity for cross-chain actions, which drives organic demand. A fee burn ensures that high throughput translates into deflationary supply, concentrating value to remaining holders.

Together, these elements form ZetaChain’s economic model: capture the cross-chain transaction fees of a multi-chain economy and return that value to those securing and utilizing the network. As an investor-oriented note, the model is contingent on volume, where sufficient cross-chain activity is needed to generate meaningful fees, especially once initial incentives taper off.

$ZETA Token

ZetaChain $ZETA has an initial total supply of 2.1B with an elastic token supply. After approximately 4 years, based on a set curve, the ZetaChain will initiate a target of ~2.5% yearly inflation to meet the demand for staking and ecosystem growth, particularly as new validators join the network to secure cross-chain operations.

Initial inflation is typically directed toward validator rewards and staking incentives, ensuring that early adopters are incentivized to participate. This inflation rate is dynamic and influenced by transaction volume, staking activity, and validator participation.

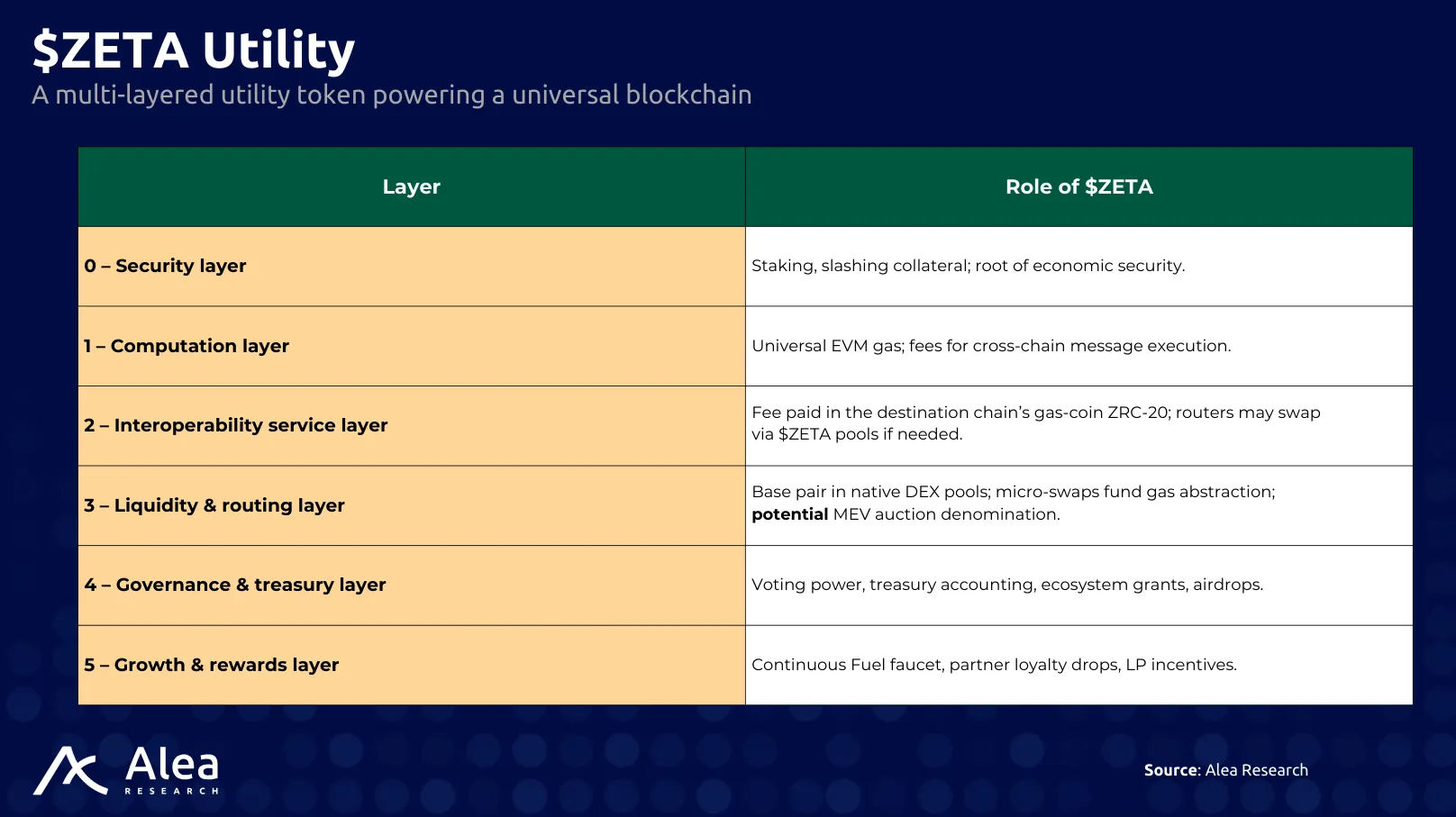

$ZETA Utility

$ZETA’s utility operates on multiple levels, ensuring that growth in areas like transactions, onboarding of new chains, and treasury programs contributes to an increase in token demand, thereby enhancing security and decentralization.

Furthermore, developers aiming to launch Universal Apps need $ZETA as a prerequisite in the deployment process.

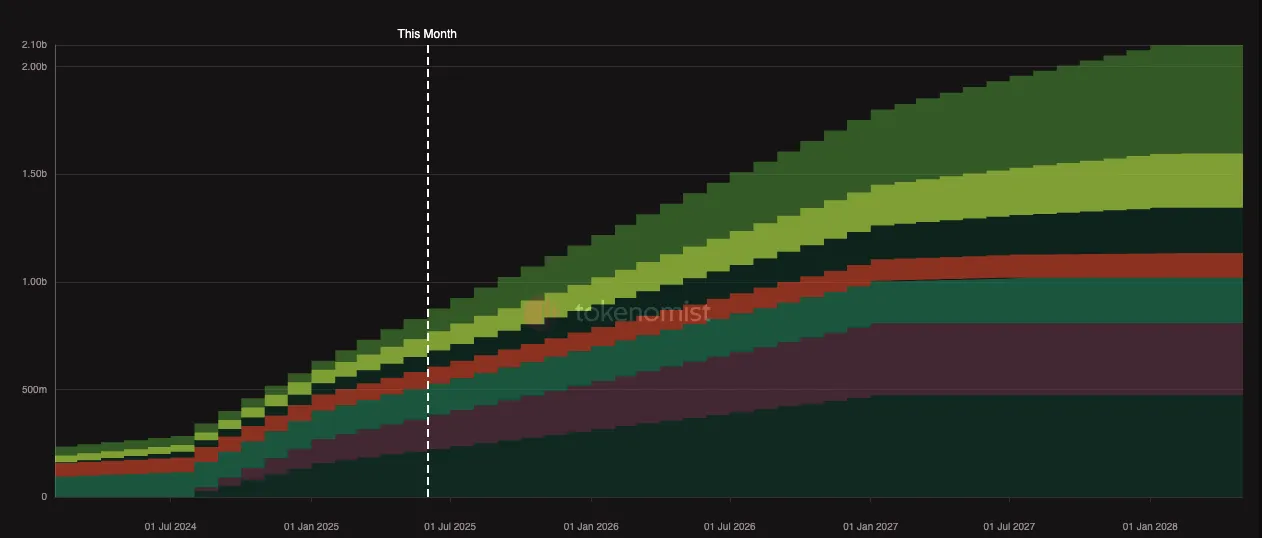

Tokenomics

The ZetaChain ecosystem is built around the $ZETA token, featuring a carefully designed tokenomics model that balances network incentives, decentralization, and long-term sustainability. Total supply is fixed at 2.1 billion $ZETA. The protocol plans to introduce an annual inflation target of approximately 2.5% based on the circulating supply at the time. This will occur approximately four years after, following a predetermined curve.

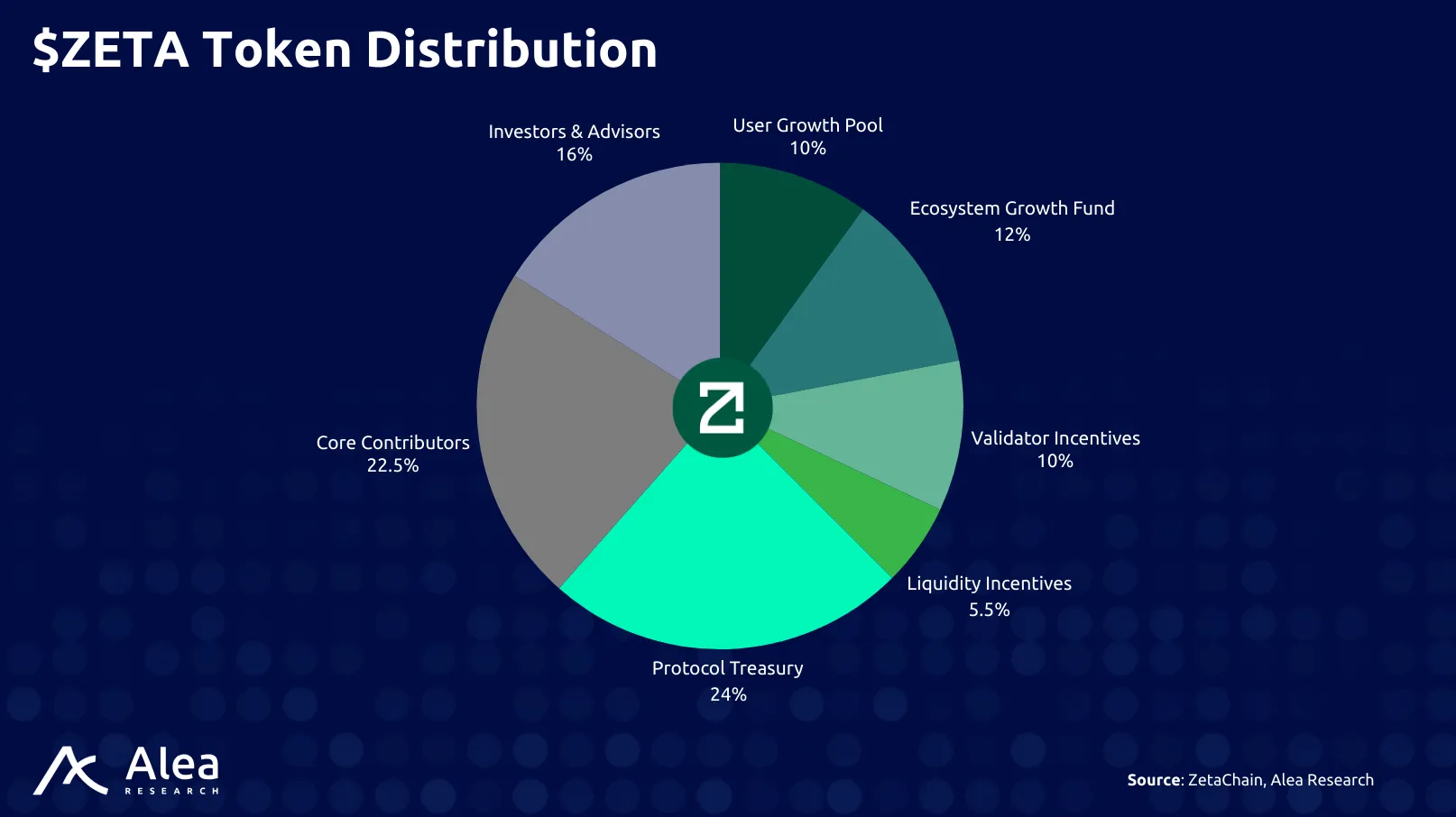

Token Distribution

This entire supply was created at genesis and is allocated across various stakeholders and strategic pools, with distribution scheduled over several years. The breakdown is as follows:

The allocation shows that 27.5% of the tokens are dedicated to expanding the network through the community (10%), ecosystem (12%), and liquidity (5.5%). An additional 10% is allocated for validator rewards to secure the network. The remaining tokens are split between the core team (approximately one-third) and investors (approximately one-sixth). Notably, 10% of $ZETA tokens are reserved specifically for community rewards.

Analytically:

- User Growth Pool – 10% (210M $ZETA): Reserved for community incentives and airdrops to bootstrap adoption. A small portion (4.5%) was unlocked at launch to begin rewards, with the rest vesting over about 3.5 years. These fund programs, like ZetaLabs (testnet rewards), referral campaigns, etc., reward active users and raise awareness of ZetaChain’s utility.

- Ecosystem Fund – 12% (252M $ZETA): Allocated to developers, partners, and ecosystem grants. This encourages projects to build on ZetaChain and integrates the network into wallets and services. It unlocks gradually (after 6 months, linearly over 42 months)

- Validator Incentives – 10% (210M $ZETA): Set aside as block rewards to bootstrap the network’s security. These tokens are emitted as block subsidies over the first ~4 years of mainnet. Effectively, this is an initial inflation pool that pays validators (and delegators) for their work before transaction fees alone can sustain them. After this pool is exhausted, ZetaChain plans to switch to a perpetual inflation (target ~2.5% annually) to continue incentivizing validators.

- Liquidity Incentives – 5.5% (115.5M $ZETA): Dedicated to seeding and rewarding liquidity in ZetaChain’s cross-chain pools. Because $ZETA is used as the intermediate asset in swaps, deep liquidity on various chains is needed. This allocation (some unlocked at launch, rest over 4 years ) is used for liquidity mining programs to encourage providing $ZETA in pools (e.g., $ZETA/$ETH, $ZETA/$BTC) to reduce slippage and create sufficient volume.

- Protocol Treasury – 24% (504M $ZETA): Held by the project for long-term development, partnerships, and possibly future community initiatives. This treasury unlocks slowly (2% liquid at TGE, then linearly over 3 years after a 12-month cliff). It ensures the foundation has resources for protocol upgrades, emergency funding, or strategic investments into the ecosystem.

- Core Contributors – 22.5% (472.5M $ZETA): Allocated to founders, team members, and future employees. These tokens vest over multiple years (with staged unlocks starting 6 months after launch, then monthly over ~2.5 years after a year cliff).

- Purchasers & Advisors – 16% (336M $ZETA): Allocated to early investors (seed/strategic rounds) and project advisors. Vesting is similar to the team’s schedule (6-month delay, then over 30 months).

Token Emissions

Currently, 42% of $ZETA supply is unlocked.

Governance

ZetaChain is envisioned as a community-governed protocol, with on-chain mechanisms for managing upgrades, parameters, and the network’s evolution. Governance is centered around the $ZETA token, following a DAO-like model common to many L1s: token holders can propose and vote on changes to the network. Proposals can be found on the governance forum.

In practice, ZetaChain’s governance resembles Cosmos-style on-chain governance (since it’s built on Cosmos SDK), where proposals are submitted on-chain and voted on over a defined period. $ZETA holders (staked and delegated) have voting power proportional to their stake, meaning validators (and by proxy their delegators) play a major role in votes. This ensures that those with skin in the game (securing the network) influence its direction.

In addition to network-level governance, ZetaChain supports the concept of cross-chain DAO operations as a use case. Through its smart contracts, it’s possible for DAOs to allow members on different chains to participate in votes.

Risks

Technical Risks

One major risk is in its Threshold Signature Scheme (TSS) and cross-chain validation mechanism. Validators must securely manage private key shares for multiple external chains. If the TSS implementation has a flaw or if enough validators are compromised, an attacker could potentially forge cross-chain transactions or steal bridged assets. This is a similar risk that cross-chain hubs like THORChain and Axelar face, where a break in the cryptographic custody can be catastrophic. ZetaChain needs rigorous audits and perhaps insurance or circuit breakers to mitigate this.

The complexity of supporting many chains means a large attack surface where issues like replay attacks, chain reorg handling, or consensus desynchronization are all possible. On a more operational level, running ZetaChain nodes is demanding (full nodes for every chain, heavy computation), which could lead to the centralization of validators where only well-resourced entities participate. This is a risk to decentralization and security if not managed (though incentives are meant to offset this).

Economic Risks

One risk is inflation and selling pressure. In the first 4 years, a considerable amount of $ZETA will be unlocked or emitted as rewards. ZetaChain needs to maintain high network usage and demand for $ZETA to avoid the effects of increasing supply and potential sell pressure. A declining token value can hurt network security (since lower price = lower cost to acquire 2/3 of the supply to attack) and affect the image of the protocol, since current day evaluation metrics often tie token performance to protocol success/failure. To offset these risks, ZetaChain has a tight vesting schedule for purchasers and core contributors, and more than 50% of these allocations are already unlocked.

Another design risk is whether $ZETA’s utility will be strong enough to sustain demand. If, hypothetically, users find ways to use ZetaChain’s cross-chain features without holding much $ZETA (for example, if an application subsidizes gas or if competing bridges offer routes that use stablecoins instead), $ZETA could struggle for adoption. The protocol forces $ZETA usage by design, but market dynamics (like popular intent-based routers that abstract away intermediate tokens) could reduce direct demand in favor of competing alternatives.

Liquidity is also a risk for $ZETA on external chains. If cross-chain pools are shallow, slippage and volatility could make cross-chain swaps inefficient, undermining the “unified liquidity” narrative. While liquidity incentives are allocated, there’s a risk that the protocol might not sustain deep liquidity once incentives run dry, impacting usability.

Security

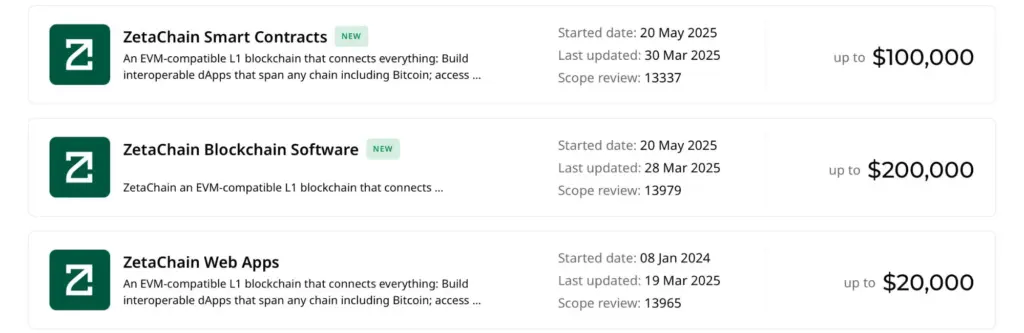

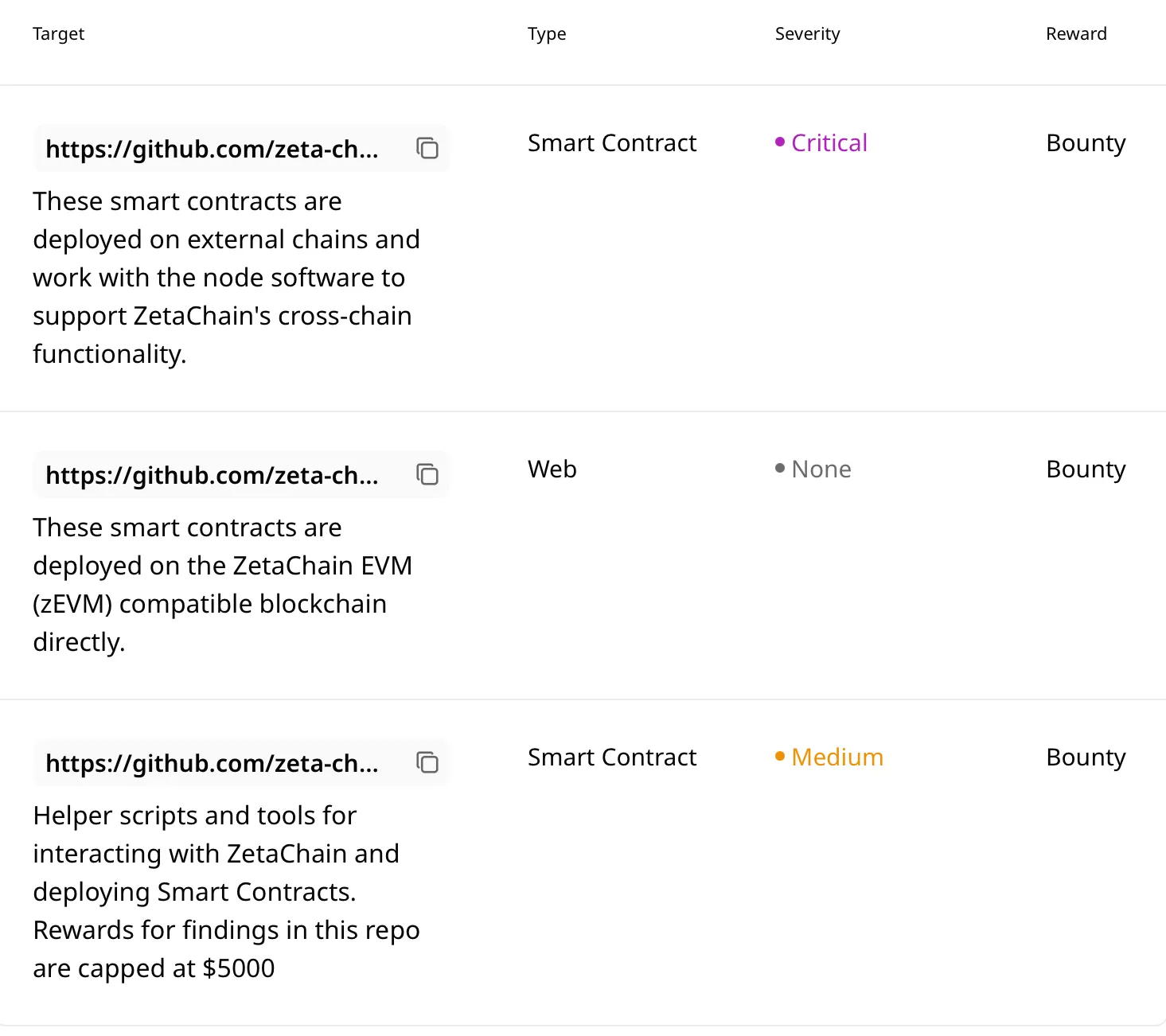

Hackenproof Bug Bounty

ZetaChain launched a bug bounty to leverage the white-hat community for additional review. Through Hackenproof, ethical hackers are incentivized with rewards (often substantial, in the tens or hundreds of thousands of dollars) for finding vulnerabilities.

This open testing increases the chances of catching edge-case bugs that audits might miss, especially as the code evolves. The bounty falls under various categories like smart contracts, software, and web apps. Within each category, there are sub-categories to find bugs in each GitHub repo. For example, under the smart contract umbrella:

Chainalysis Crypto Incident Response

ZetaChain partnered with Chainalysis for Crypto Incident Response. This is a rapid response retainer service used by crypto businesses and large organizations that are high-risk targets for cyber attacks or unauthorized network intrusions that involve cryptocurrency theft or demand.

In the event that a breach occurs, despite all precautions, ZetaChain has a hotline to expert investigators to track and potentially freeze stolen funds. While this is reactive (post-incident) and not preventative, it’s an important part of the security strategy to mitigate damage. Chainalysis’s involvement also aids in compliance and monitoring ongoing activity for anomalies.

Halborn Preventive Measures

Halborn implements a multiphase preventative solution alongside Chainalysis. The phases can be broken down into:

- Phase 1 involves initial risk assessments and architecture security reviews.

- Phase 2 features numerous security services from cloud configuration, DevOps, to logical network segmentation.

- Phase 3 is a development phase with smart contract and infrastructure audits, powered by tools like Halborn’s ZIION.

- Phase 4 is focused on pen testing and additional enterprise audits.

- Phase 5 is the deployment phase with Blue team monitoring, Threat intelligence, Red team exercises, and employee security training.

Audits

Over the years, Zetachain has undergone multiple audits. These were done by leading security firms like Zellic, Hacken, Certik, Trail of bits, and Peckshield.

ZetaChain appears to be taking a comprehensive security approach: rigorous audits, layered security design (BFT + MPC), active monitoring, and community oversight via bounties and governance. No system is 100% risk-free, but ZetaChain has in place many of the best practices in the industry to minimize vulnerabilities and respond quickly if issues arise.

Project Investors

In the most recent funding round in August 2023, Zetachain raised $27M from investors including Blockchain.com Ventures, Jane Street, Sky9 Capital, Human Capital, Vy Capital, CMT Digital, GSR, Lingfeng Capital, Foundation Capital, and others.

FAQ

What is ZetaChain?

ZetaChain is a public Layer‑1 blockchain built on the Cosmos SDK that natively connects disparate blockchains, both smart‑contract platforms (Ethereum, BNB Chain, Polygon, etc.) and non‑programmable networks (Bitcoin, Dogecoin). The core innovation is Universal smart contracts, which let one contract execute cross‑chain workflows atomically, without wrapped tokens or external bridges.

What is the $ZETA token used for?

$ZETA is ZetaChain’s single gas token and staking asset. It serves four main purposes:

- Gas fees for all on‑chain and cross‑chain transactions (users pay fees in $ZETA, which the protocol splits into native chain gas via built‑in conversion).

- Staking & security, where validators and delegators lock $ZETA to secure consensus and cross‑chain operations.

- Cross‑chain value routing, acting as an intermediary asset in cross-chain swaps (e.g., token A on Chain X → $ZETA → token B on Chain Y).

- Governance, granting holders voting power over protocol upgrades, parameter changes, and ecosystem fund allocations.

- Rewards and incentives for users, stakers, and validators.

- $ZETA is used in core liquidity pools that the protocol utilizes to trade external ZRC-20 gas assets for covering and executing outbound transactions to external chains.

What is ZetaChain’s Universal EVM (zEVM), and what are its key advantages for developers?

ZetaChain’s zEVM lets developers build cross-chain compatible dApps in Solidity, similar to Ethereum. zEVM simplifies cross-chain transactions, enabling the creation of Universal Apps with built-in cross-chain functionalities.

How does ZetaChain’s cross‑chain messaging work?

Validators run observer modules that monitor external chains for relevant events (deposits, contract calls). Once a two‑thirds majority of validators observe and agree on an event via Tendermint consensus, ZetaChain automatically initiates the corresponding action (e.g., releasing funds or calling a contract) on the target chain using threshold signatures. This fully on‑chain approach removes reliance on oracles or federated multisigs.

How is user liquidity pooled for cross-chain swaps?

On ZetaChain, assets from any connected chain are represented as ZRC‑20 tokens. Liquidity pools (AMMs) on ZetaChain can contain ZRC‑20 representations of Ethereum, Bitcoin, BNB, etc., alongside $ZETA. When you add liquidity, you deposit $ZETA plus another ZRC‑20 asset; swaps draw from this shared pool, enabling native cross‑chain token exchanges with minimal slippage.

What security measures protect ZetaChain?

- CometBFT consensus with fast finality.

- Threshold Signature Scheme (TSS) for multi‑party custody of external chain keys, no single node holds full control.

- Full‑node observers: validators run nodes for each integrated chain, verifying events themselves rather than trusting third‑party oracles.

- Multiple professional audits (Halborn, Zellic, etc.) and a public bug bounty to catch vulnerabilities.

- Chainalysis partnership for real‑time monitoring and incident response.

How do I participate in governance?

$ZETA holders stake or delegate their tokens to validators and can then submit or vote on on‑chain proposals. Governance covers network upgrades, fee parameter adjustments, adding new chain integrations, and allocation of ecosystem funds. Voting power is proportional to staked $ZETA, aligning decision‑making with network security.

How can I earn rewards beyond staking?

ZetaChain’s XP program lets you earn “experience points” for activities like staking, providing liquidity, making cross‑chain swaps, or interacting with dApps. Higher XP tiers can unlock special rewards or future airdrops. Activities are tracked on‑chain via ZetaHub and require no additional claims beyond your on‑chain actions.