The Stablecoin Yield Engine Powering Sky’s Endgame

Originally conceptualized under MakerDAO’s Endgame plan, Spark has since evolved into a standalone protocol with its own mandate, governance, and growth trajectory. While closely integrated with Sky (formerly MakerDAO) through shared liquidity infrastructure and aligned incentives, Spark operates independently as a SubDAO with a distinct scope: building the core utility layer around stablecoins through savings, lending, and liquidity deployment.

Far more than a lending market, Spark combines three tightly linked products – Spark Savings, SparkLend, and the Spark Liquidity Layer—into a vertically integrated system that circulates, allocates, and stabilizes stablecoin capital at scale. Together, they position Spark as a self-directed protocol contributing to – and benefiting from – the broader DeFi and stablecoin economy on Ethereum and L2s.

Ahead lies the launch of SPK, designed as the coordination and incentive layer powering Spark’s governance and value-accrual. Issued on a 10-year schedule, SPK will bind its users’ long-term incentives to the protocol’s cash flows.

Key Takeaways

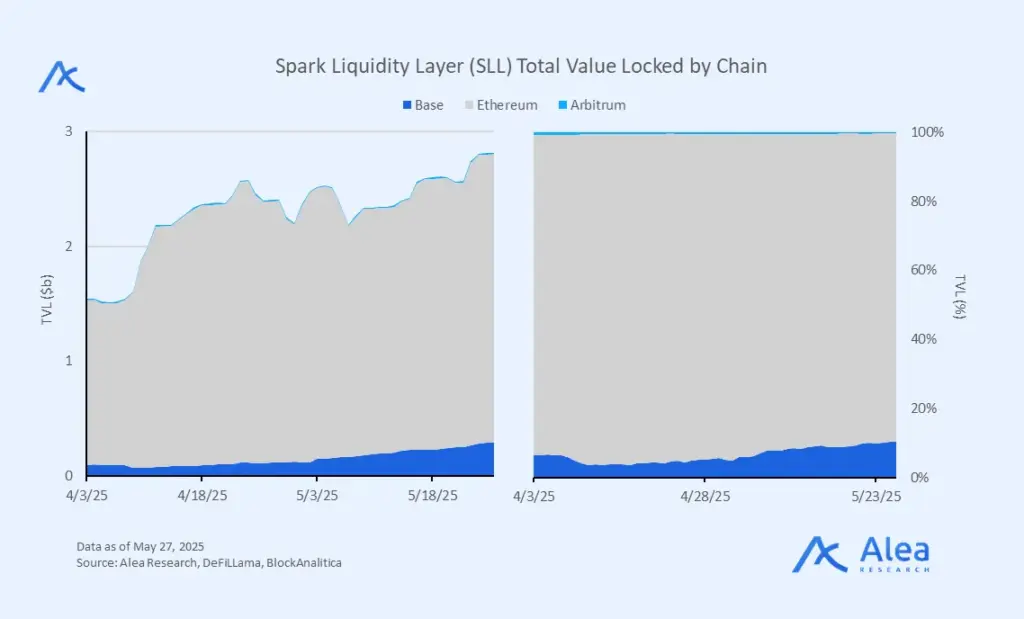

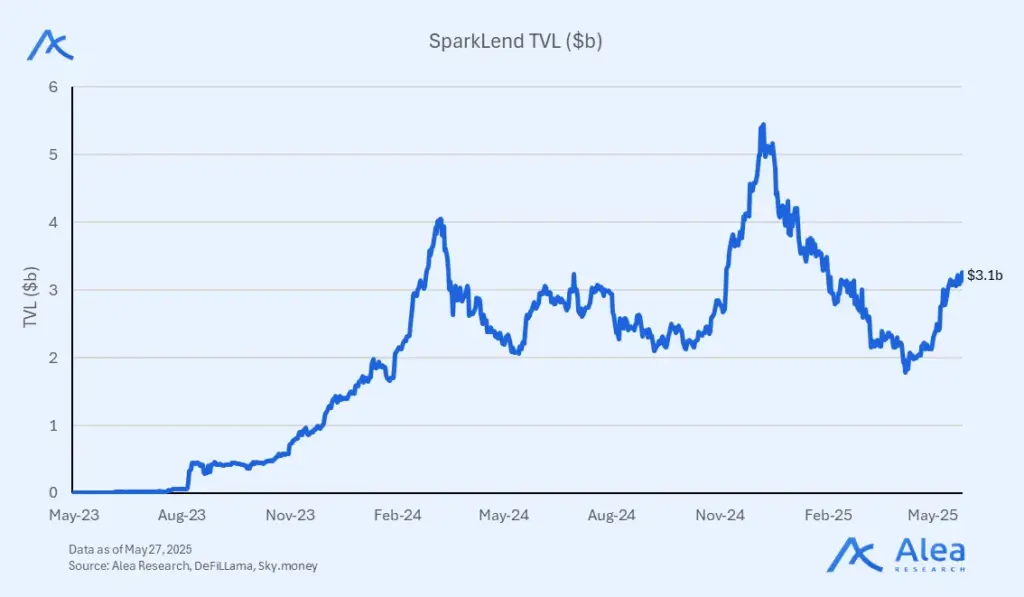

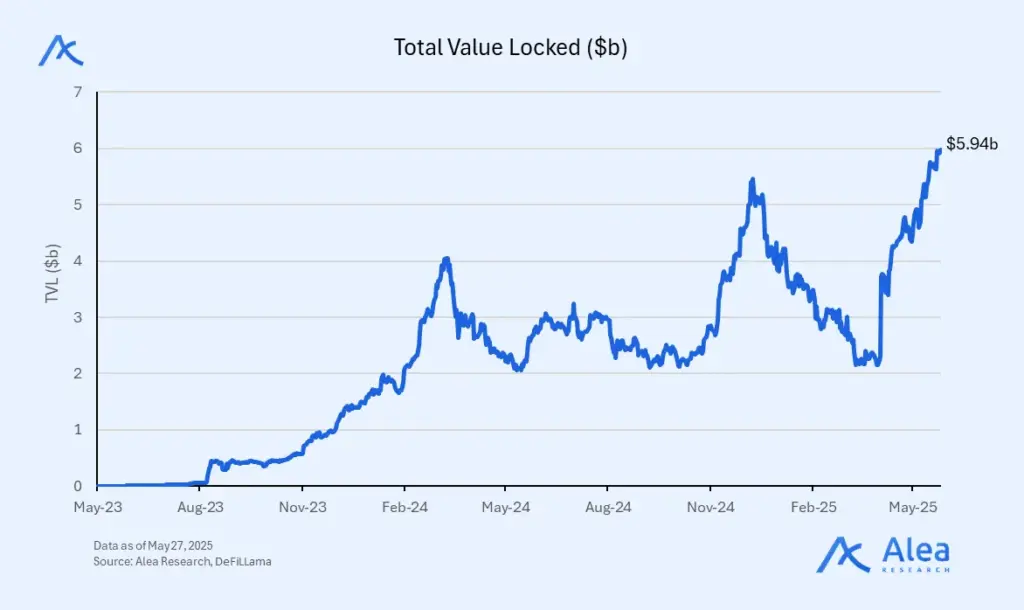

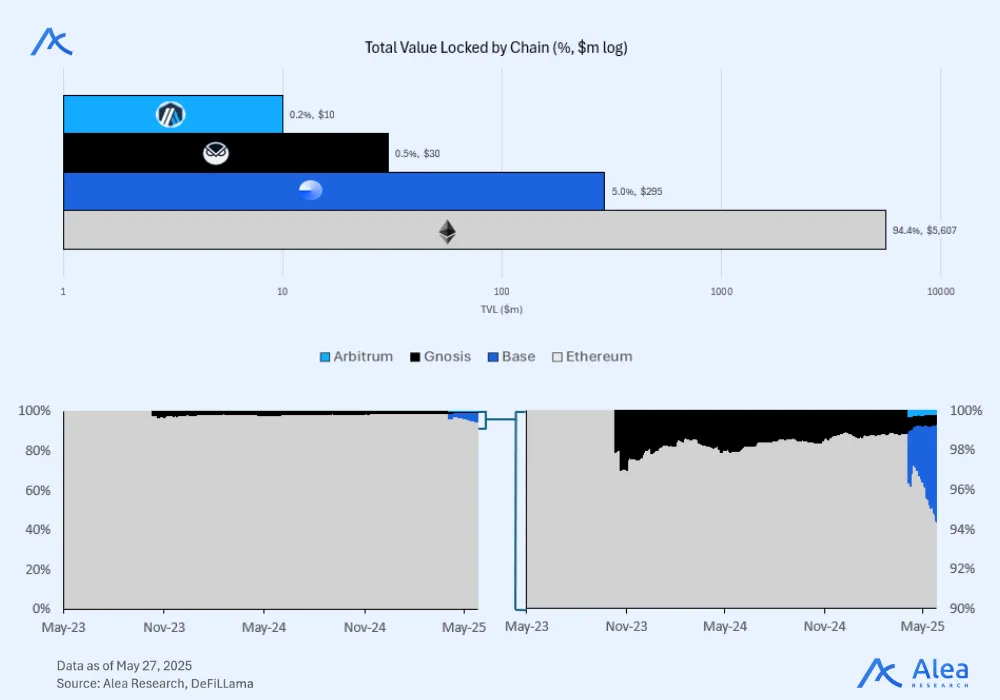

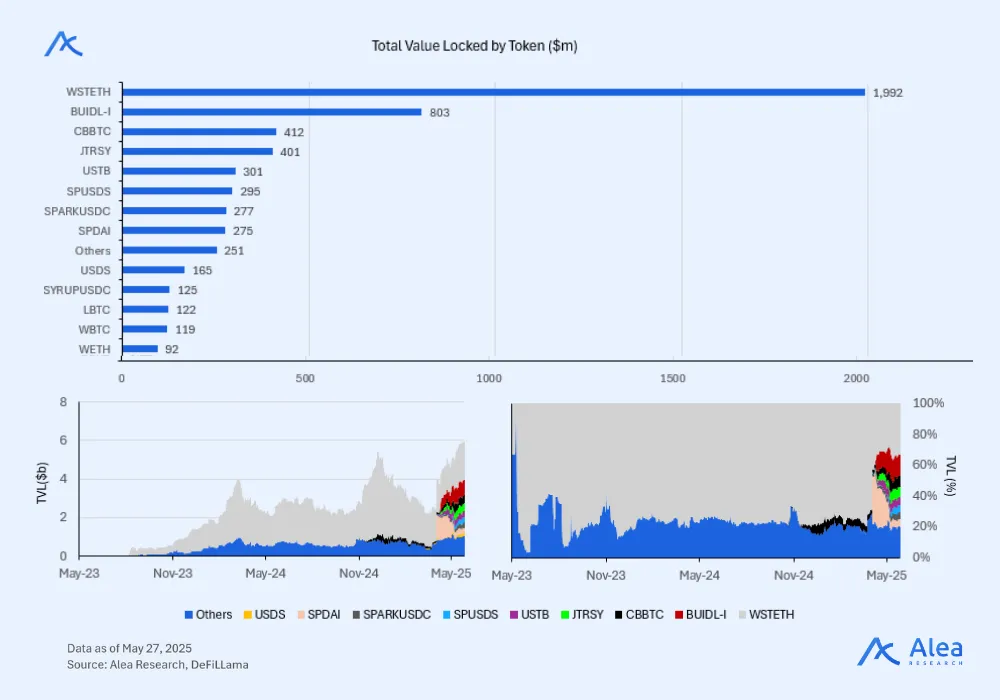

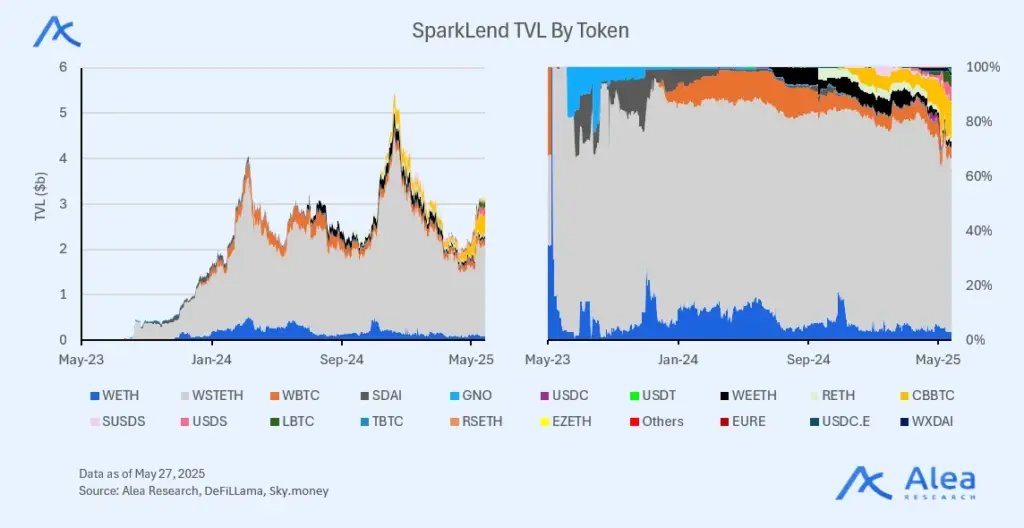

Rapid Growth at Scale: Since launch, Spark has grown into a multi-billion dollar lending platform, with SparkLend TVL on Ethereum exceeding $3.0 billion. Combined with the Spark Liquidity Layer, Spark manages over $5.5 billion of liquidity across DeFi on Ethereum mainnet and L2s.

Strategic Role in Sky’s Endgame: As the first major SubDAO (Star) in Sky’s roadmap, Spark directly expands DAI/USDS adoption and market share by turning Sky’s balance sheet into productive credit, savings yield, and liquidity for the entire DeFi stack.

Structural Competitive Advantage: By uniting high-yield savings, low-cost stablecoin borrowing, and composable cross-chain liquidity in one governed stack, Spark’s value proposition creates a feedback loop that strengthens other protocols while cementing its liquidity moat.

Positive-Sum Value Flows: While Sky benefits from larger USDS float and RWA yields that fund the Sky Savings Rate (SSR), Spark captures net interest margin on its lending market, and integrations with Aave, Morpho, Ethena, Maple, and other DeFi blue chips compound its unique selling points.

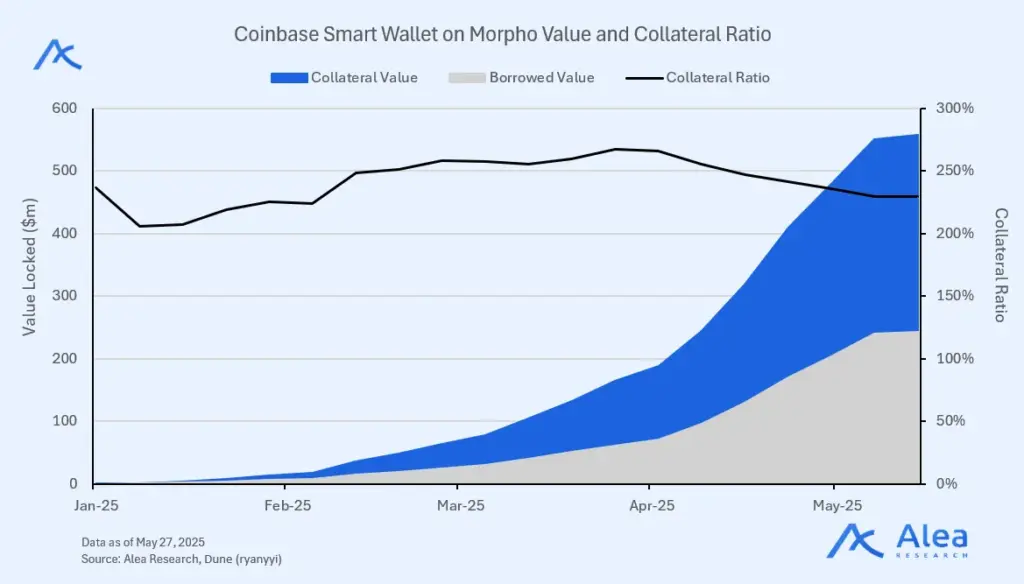

Onboarding New Users onchain: Through integrations like the Morpho Blue market with Coinbase, Spark is onboarding previously offchain users directly into DeFi, tapping into centralized exchange liquidity and introducing new participants to decentralized credit markets.

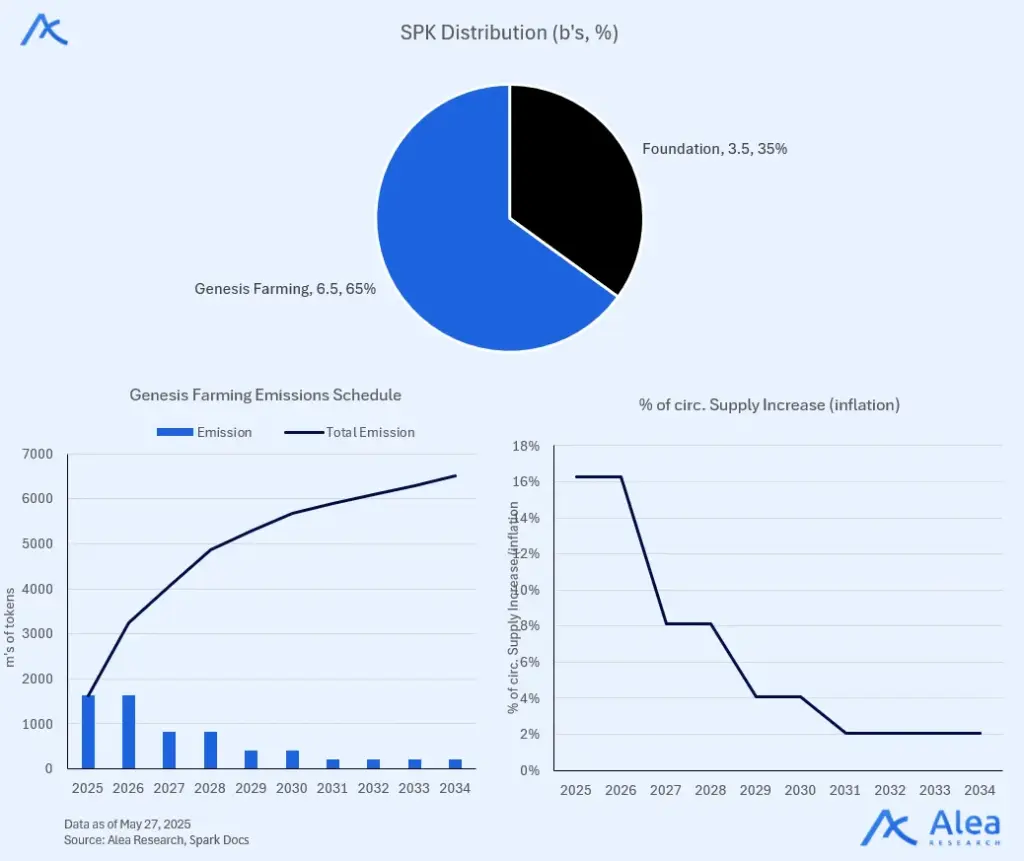

SPK Token: 10 B supply emitted over ten years, with 6.5 B distributed via “Genesis farming” and 3.5 B reserved for the Spark Foundation.

Shaping Spark’s Trajectory

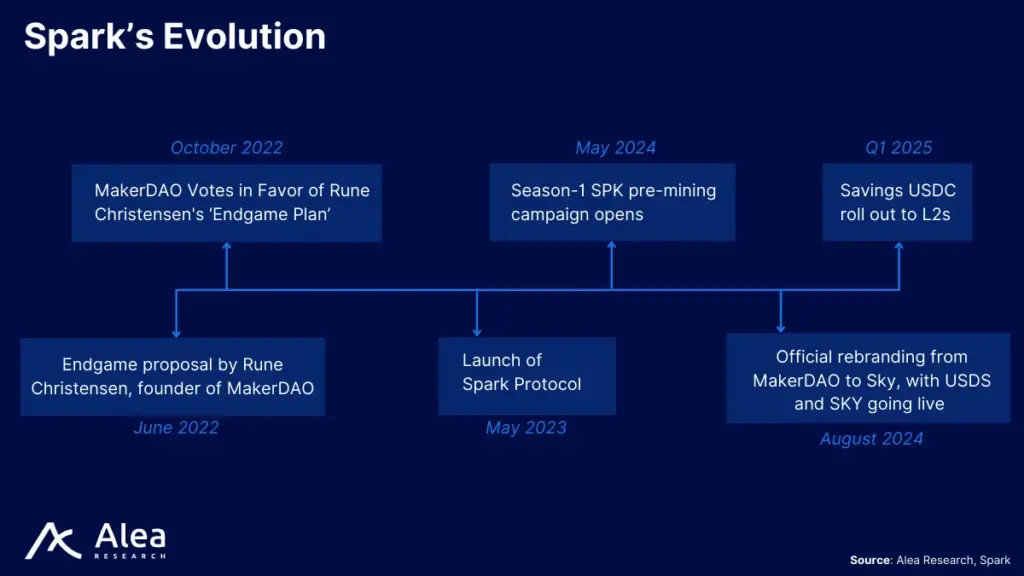

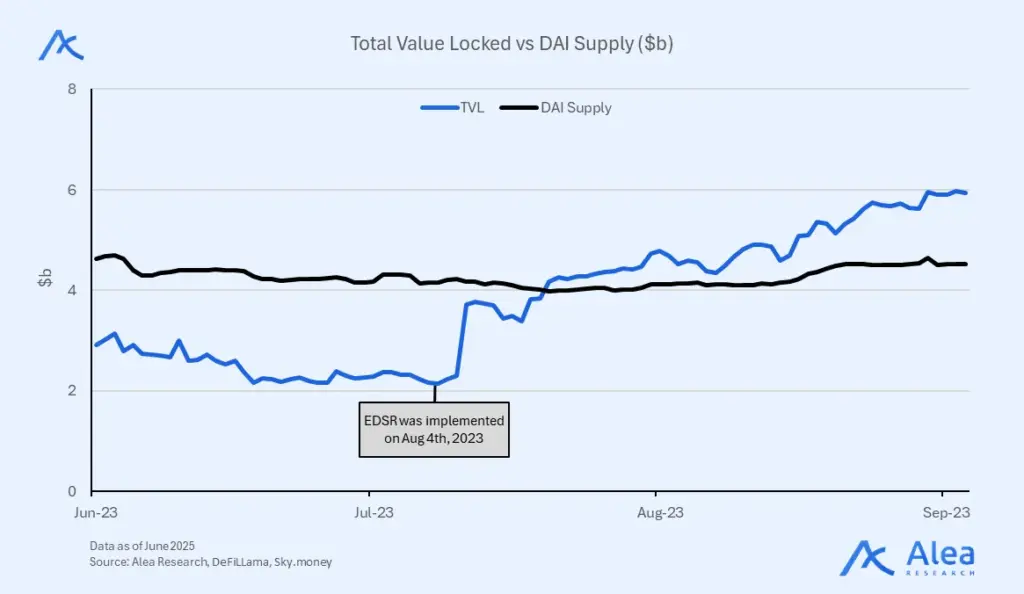

Spark originated as a response to both internal and external pressures in the stablecoin sector. Internally, MakerDAO’s Endgame Plan identified the need for a dedicated lending arm to drive DAI growth. Spark was conceived as this arm, launching in May 2023 as an Aave v3 fork (MakerDAO Governance, 2023). Externally, stablecoin competition had intensified, with USDC and USDT dominating the overall market cap. To offer an alternative to centralized issuance, Maker’s DAI needed new avenues for adoption. This culminated in the release of Spark to extend DAI’s utility beyond Maker’s core vault system and into broader DeFi use cases (MakerDAO Governance, 2023).

To jumpstart adoption, MakerDAO Governance implemented an Enhanced Dai Savings Rate (EDSR) up to 8%–12% on stablecoin deposits (MakerDAO Forum, 2023). Spark, being the gateway for Savings, saw its deposits surge as yield-seeking capital flooded in. Even though this served as a one-time catalyst, capital proved to be sticky, increasing both Spark’s TVL and DAI circulating supply (DefiLlama & Sky).

In August 2024, MakerDAO officially rebranded to Sky and introduced USDS as an upgraded, compliance-friendly version of DAI (Sky Ecosystem, 2024). Holders could convert to USDS at a 1:1 exchange rate. SparkLend added a USDS market right after, allowing users to complete the migration and start earning at the 6.5% Sky Savings Rate.

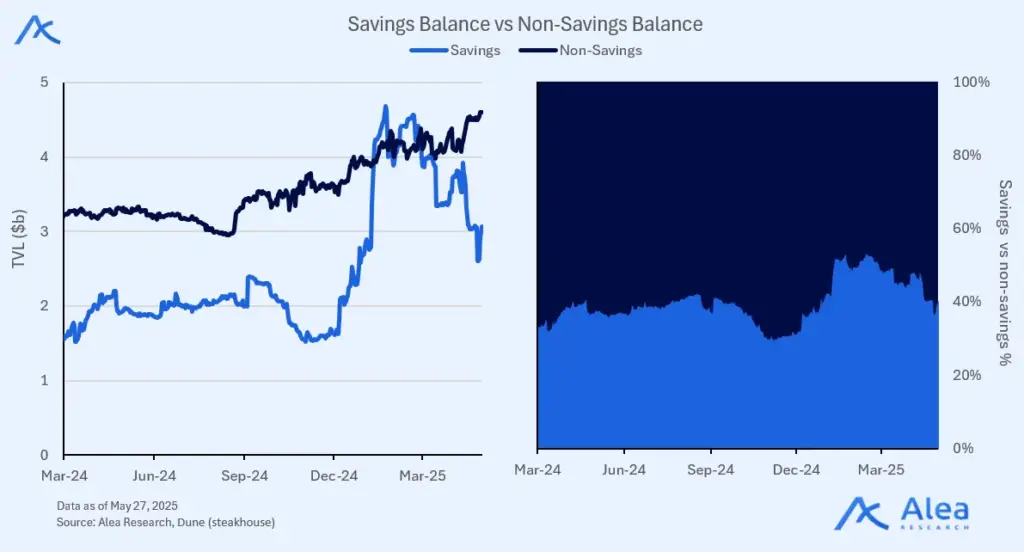

Today, despite 4 consecutive rate decreases in 2025 alone, interest has surged back up, with TVL now being almost 3x from the yearly lows in March. Starting the year at 12.5%, the SSR was reduced to 8.75%, then 6.5%, and by March 2025 down to 4.5% (Sky Money Forum). However, despite the sharp drop in yield, the resilience of Spark suggests that a significant portion of the capital parked in the protocol is longer-term or institutional, treating the 4–5% range as acceptable risk-adjusted return.

Spark Protocol Overview

Spark is a vertically-integrated protocol that combines three live products—Spark Savings (sUSDS vault earning the Sky Savings Rate), SparkLend (a money market with a fixed rate direct credit line to borrow USDS from Sky), and the Spark Liquidity Layer (SLL) that deploys idle liquidity across chains and DeFi protocols.

Spark’s edge stems from design choices such as the direct access to Sky’s balance sheet, which significantly slashes the cost of capital and increases capital efficiency and utilization not only on SparkLend, but across the entire DeFi ecosystem. Rather than directly competing head-on with peers, Spark embeds itself as a wholesale liquidity provider.

To earn yield, users deposit stablecoins (DAI, USDC, USDS) into Savings and receive sUSDS that auto-accrues the Sky Savings Rate (SSR). For borrowers looking for a cheap fixed rate, SparkLend can access Sky USDS liquidity at near zero-cost by minting USDS directly into the market through D3M-style (former Direct Dai Deposit Module, now DDM) hooks. Additionally, any surplus liquidity on Sky’s balance is routed by Spark’s Liquidity Layer (SLL) to the highest-yield venues among DeFi blue chips like AAVE, Morpho, and Ethena.

Tapping into Sky’s balance sheet, Spark has become foundational infrastructure for DeFi, routing liquidity to key protocols and increasing depth on Ethereum and L2s. Idle liquidity is swept by the Liquidity Layer to Ethereum, Base, Arbitrum and other networks in the future, keeping capital usage high and yields resilient while boosting the TVL of partners in positive-sum ways.

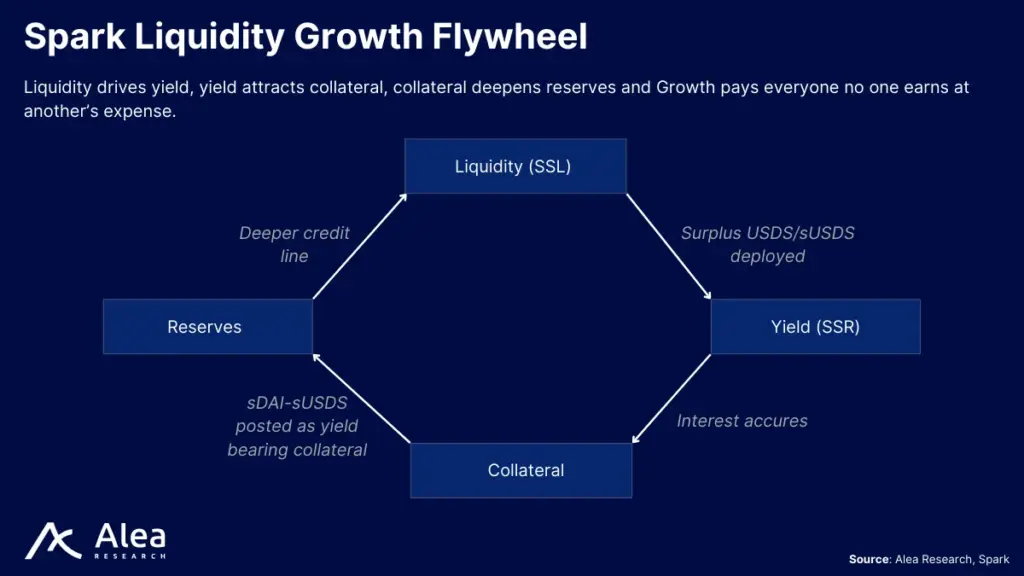

The result is a self-reinforcing loop: lower borrow costs attract demand, higher demand fuels SSR deposits, and the Liquidity Layer redeploys the growing float wherever risk-adjusted returns are best.

- A revenue-share agreement channels part of Spark Lend profits back to the Aave DAO for the ongoing maintenance of the code it relies on, turning what could have been a hostile fork into a recurring income stream for both sides (Aave Governance, 2024).

- Spark has deployed hundreds of millions in USDS liquidity to Morpho pools, enabling Coinbase’s new BTC-backed USDC loans and deepening order books for retail users (Coinbase onchain Loans, Dune).

- Pledging up to $1.1bn USDe and sUSDe, Spark expands Ethena’s capacity while earning additional yield (Mirror, 2025).

These integrations are some examples that demonstrate a positive-sum posture: Spark routes Sky’s balance-sheet strength into partner protocols, increasing ecosystem depth and aggregate fee revenue rather than cannibalizing it. That same collaborative model is driving onchain user acquisition. Through the Coinbase retail app, first-time users can lock BTC, which is wrapped into cbBTC and deposited into a Morpho<>Spark pool on Base, to borrow USDC instantly. Once onchain, they can sweep idle USDC into Spark Savings with a single click and start earning SSR. Because the Liquidity Layer ensures deep USDS and sUSDS markets on every major network, newcomers encounter consistent liquidity wherever they transact, lowering bridge friction and improving UX.

By abstracting complexity while quietly powering multiple DeFi venues, Spark can be described as a monetary infrastructure layer that compounds value for itself, its partners, and the broader Ethereum economy.

The Spark Suite: Savings, Lending, Liquidity

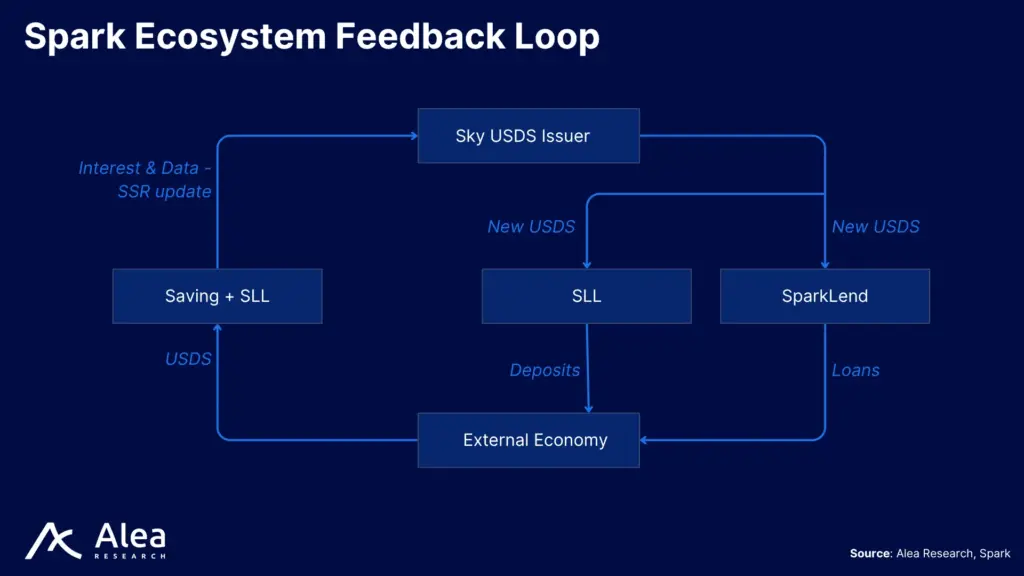

Spark’s three core offerings–Spark Savings, SparkLend, and the Spark Liquidity Layer (SLL)–are designed to work synergistically. They channel liquidity and revenue between each other in a positive-sum way, while integrating with major DeFi protocols to broaden USDS’s reach.

The protocol functions as a vertically integrated stablecoin bank with three tightly-coupled modules: Spark Savings converts idle USDS/DAI/USDC into interest-bearing sUSDS that earns the Sky Savings Rate (SSR); SparkLend enables low-cost USDS loans directly from Sky’s balance sheet through the Spark Liquidity Layer (SLL); and the Spark Liquidity Layer (SLL) programmatically deploys stablecoins and sUSDS on external lending pools and chains to earn yield and seed liquidity.

Sky mints USDS, SparkLend injects it into the market, Savings absorbs it as deposits, and the Liquidity Layer sends it wherever risk-adjusted returns are highest. This creates a positive feedback loop that drives USDS adoption while recycling interest income back into the system.

Every unit of USDS minted deepens SparkLend’s borrowing books, SSR depositors earn a competitive savings rate, and partner protocols gain TVL from SLL deployments. Additionally, sDAI and sUSDS are yield-bearing cash-like assets that lending protocols support as collateral. This is a use case that receives a lot of demand by onchain borrowers, as the yield earned on the collateral helps to offset a portion of borrowing costs. The result is a self-reinforcing loop: liquidity begets yield, yield attracts collateral, and collateral deepens reserves. As the cycle repeats, every participant gets paid from growth rather than at one another’s expense.

Under this construct, capital stays productive everywhere. Users can post sUSDS as collateral on Aave, Morpho or Euler, earn SSR in the background, and simultaneously borrow against it. This allows protocols to gain TVL and widens USDS acceptance, which lifts borrow demand on SparkLend, grows funding for the SSR, and justifies larger SLL deployments.

Spark Savings

Spark Savings builds on top of the Sky Savings Rate module, providing users with a high-yield savings account. Users can deposit any of the supported stablecoins–USDS, DAI, or USDC–into Spark Savings and receive Savings USDS (sUSDS) tokens in return. These yield-bearing units represent the user’s claim on their deposited principal plus accrued interest, compounding in real time at the current SSR. Also, sUSDS is fully fungible and non-rebasing. In other words, sUSDS grows in value (greater exchange rate to USDS as interest accrues) rather than increasing in quantity, and can be transferred or utilized in DeFi while simultaneously earning yield.

Spark’s UI and smart contracts directly integrate with Sky’s Peg Stability Module (PSM), offering instant no-slippage swaps for deposits and withdrawals in USDS, DAI, or USDC. Another benefit of the SSR is that the rate itself is set by governance via onchain votes, and is not affected by market utilization. This is a differentiator from standard DeFi lending yields, which fluctuate with supply and demand. For that reason, the SSR is more analogous to a central bank rate or an admin-set savings rate.

The payouts come from Sky’s revenue streams: fees from crypto-collateralized loans, investments into U.S. T-Bills, and interest generated by deploying liquidity through SparkLend and the Liquidity Layer (SLL).

Sparklend

SparkLend refers to Spark’s lending market, which is a fork of AAVE v3. Similar to other lending protocols, users can supply collateral for borrowing. What differentiates SparkLend is its deep vertical integration with Sky and several custom risk-management enhancements. SparkLend is essentially Sky’s own liquidity market: it sources a large share of its stablecoin liquidity directly from Sky and aligns interest rates with Maker’s policies

Under the hood, Sky can inject USDS liquidity into SparkLend via a Direct Deposit Module (DDM) up to a certain debt ceiling, meaning SparkLend always has scalable stablecoin liquidity at predictable rates. This allows SparkLend to offer USDS borrowing at a fixed-rate cost. This borrow rate is set by governance and unaffected by pool utilization, empowering borrowers with more predictability as long as Sky’s DDM continues to supply fresh USDS to the market.

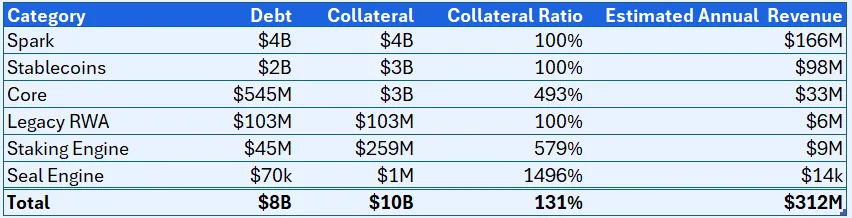

As of Q2 2025, SparkLend has grown to one of Ethereum’s top lending pools with over $3 billion TVL. The competitive advantage comes from being positioned as the protocol that makes USDS the cheapest stablecoin to borrow in DeFi, thus increasing USDS circulation and drawing borrowers away from competing platforms. This essentially routes Sky’s credit line directly to end-users, generating interest income for the protocol, and creating a demand sink for USDS.

SparkLend extends Sky’s influence into the lending market, driving USDS adoption and generating protocol revenue. By having its own money market, Sky effectively onboards more users and collateral types into the USDS ecosystem beyond what the core vaults support.

For borrowers, rates stability helps with risk management and more accurate income estimations. Rather than facing unpredictable variable APR elsewhere, SparkLend promotes USDS as the preferred stablecoin for leverage, increasing its circulation.

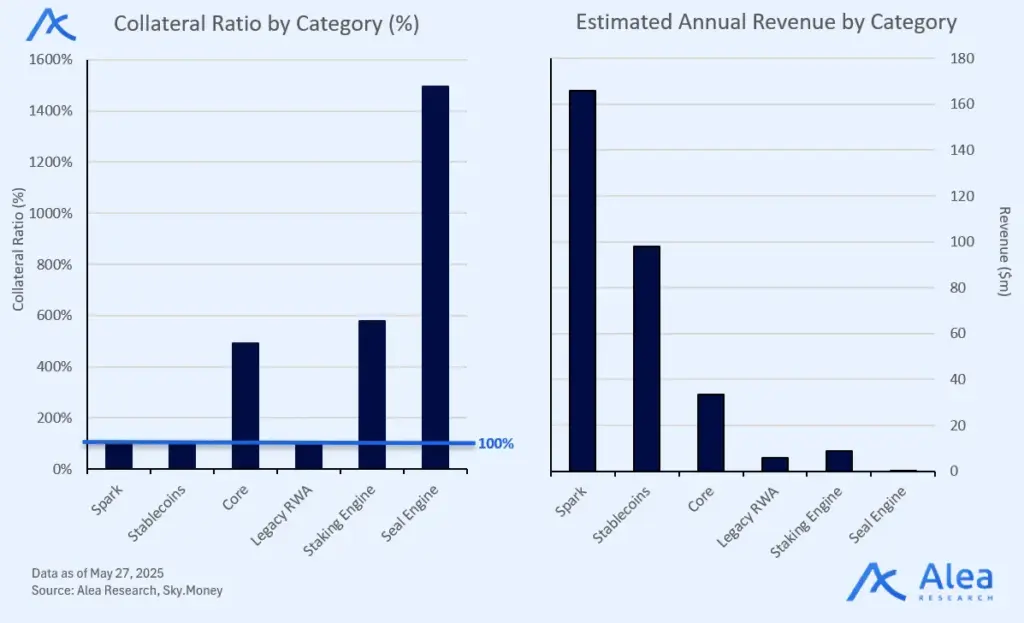

Simultaneously, SparkLend is a new revenue center for Sky, but also for Spark. When users borrow USDS, they pay interest; since much of the USDS liquidity is supplied by Sky’s own capital, those interest payments flow back to the Sky treasury (or can be used to offset SSR payouts). Essentially, Sky and Spark earn from the lending spread: SparkLend borrowers might pay 5.5% APY on USDS while Sky is paying out 4.5% SSR to depositors, capturing the 1% difference as profit.

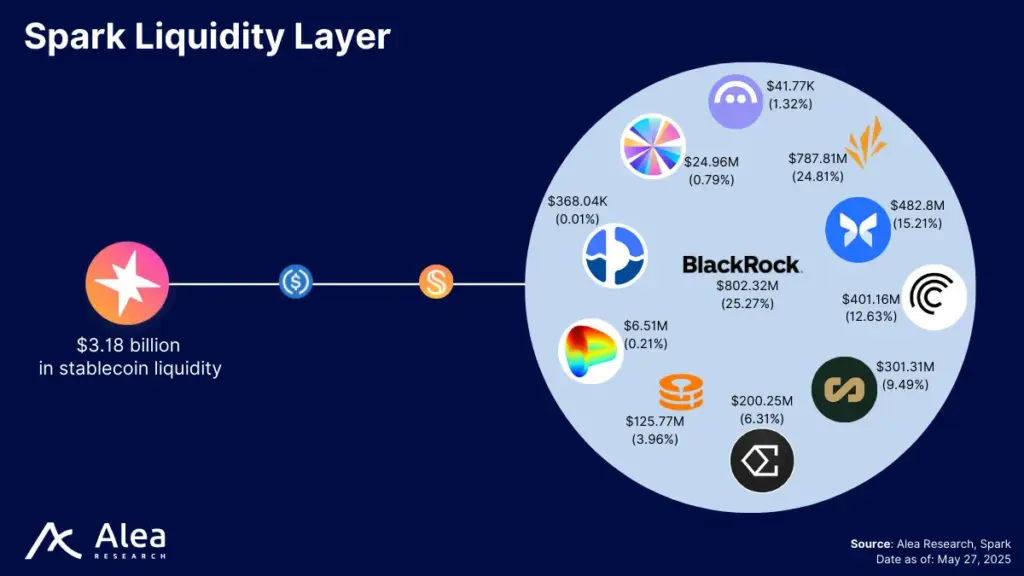

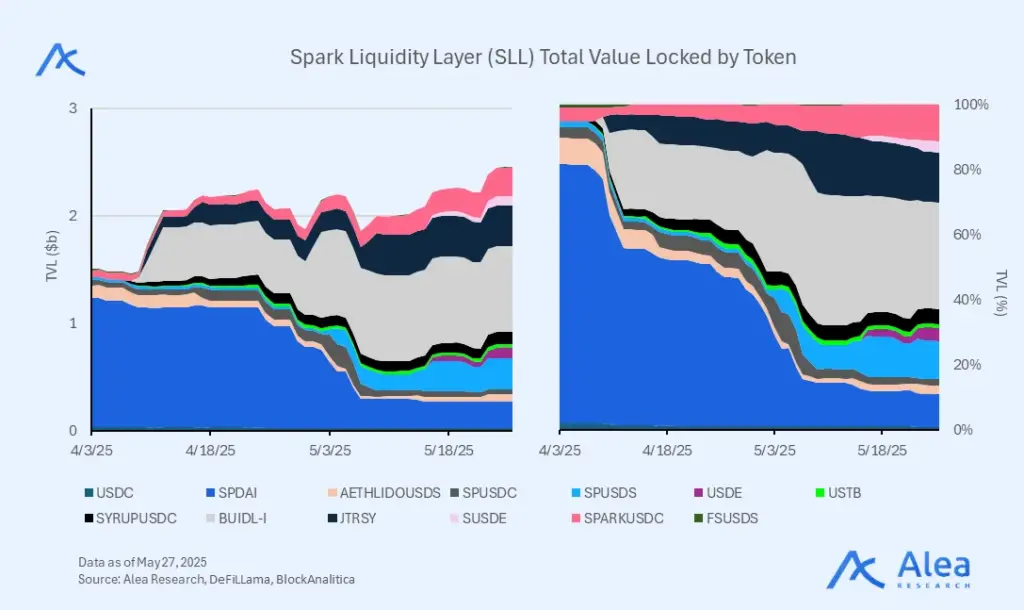

Spark Liquidity Layer

The Spark Liquidity Layer (SLL) is the protocol’s automated liquidity deployment system. Acting as the yield engine, it takes USDS, sUSDS, and USDC from Sky’s reserves, and supplies them to external markets to earn yield. This involves integrations spanning DeFi, CeFi, and TradFi.

Instead of idle capital, Sky’s reserves are actively managed programmatically and at scale. Effectively, the SLL is a revenue generator and yield optimizer for Sky. This helps sustain the high savings rate by finding external yield sources to subsidize it. For instance, Spark recently deployed over $200 million USDC to Morpho on Base, and these returns are then routed to Coinbase users that borrow USDC against their BTC (Coinbase onchain Loans, Dune).

Through this integration directly into Coinbase’s retail app, first-time crypto users are seamlessly tapping into the protocol with Spark providing backend liquidity. This makes Spark not just a liquidity allocator but a gateway protocol onboarding new users onchain, extending stablecoin utility to a mainstream audience.

The SLL takes the sizable stablecoin reserve that Sky holds (billions of USDC, USDS, etc.) and deploys it where it’s needed to maximize utility and yield. All of this is done abstracting away cross-chain or conversion rate complexities, as it enables 1:1 conversion between USDC and USDS (and sUSDS) for users, on demand and on various networks through Sky’s Peg Stability Module (PSM). By automating peg management and distribution, the SLL improves USDS’s market depth and stability. This also unlocks a strategic angle for protocols, since they know that, if they list USDS, the SLL can backstop liquidity and has an incentive to do so for driving USDS adoption.

The Spark Liquidity Layer is fundamentally a coordination tool that benefits the wider DeFi ecosystem. By injecting liquidity into external protocols, it strengthens those protocols while advancing Sky’s goals. For instance, when USDS was listed on Aave, the SLL began supplying USDS liquidity (with governance-approved limits, e.g. up to 50M per day). This meant Aave’s USDS market quickly had deep supply, keeping borrowing rates low and attracting usage. In return, Sky captured interest from any Aave USDS borrows, and USDS became a popular asset on Aave. Neither Aave nor Sky alone could have achieved this so efficiently; together it was positive-sum: Aave got a thriving market, and Sky grew USDS demand while earning yield.

The same pattern holds for other lending markets like Morpho or Syrup. Another example is Ethena, where having Sky as a major holder increases both confidence and liquidity. This integration created a symbiotic relationship that helped Ethena bootstrap its supply and gave Sky another yield source to diversify its balance sheet.

Value Flows & the Economics of Spk

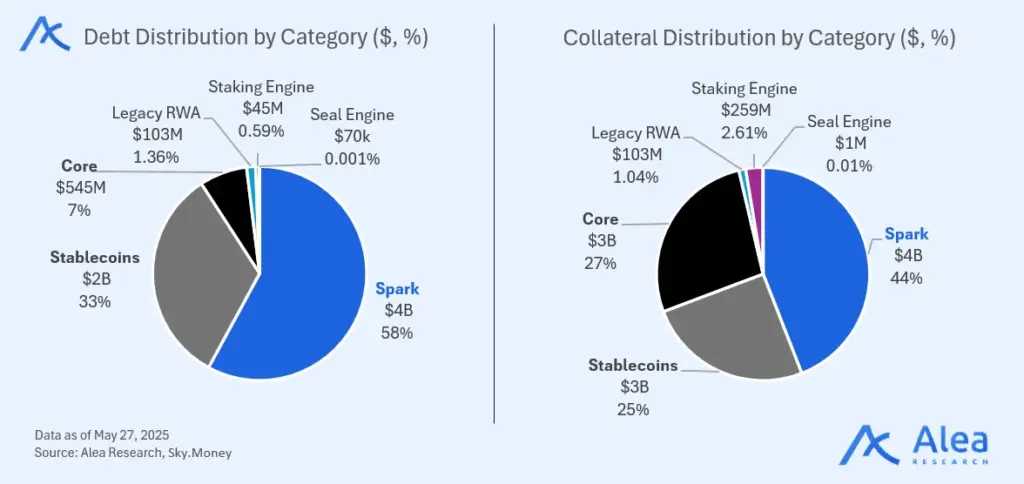

Spark turns liquidity into cash-flow through SparkLend interest income, and could charge a fee on the yield generated by the Spark Liquidity Layer (SLL). With borrowers paying a spread on top of the Sky Savings Rate (SSR), the protocol pockets a net margin. With gross inflows coming from interest payments and SLL yield, the protocol routes net operating surplus to the Spark Treasury. In parallel, DAO governance controls the fee split and provides guidance on liquidity incentives.

- Supply: 10 B SPK over the first 10 years, fixed thereafter.

- Genesis farming: 6.5 B distributed to users via “Genesis” emissions that halve after Year 2 and follow a 50 % decay every two-year cycle.

- Foundation allocation: 3.5 B vested to the Spark Foundation for runway, partnerships, and strategic buybacks.

- Schedule: 1.625 B SPK/year in Years 1–2, dropping to 812.5 M in Years 3–4, and tapering to 203 M by Year 7 onward.

Governance rights span risk parameters, fee splits, and SLL allocation caps, also with direct influence over treasury inflows. Going forward, the growth strategy is to increase liquidity deployments on L2s, continuing to supply liquidity across the ecosystem, and expanding the fee surface with partner protocols. The fixed-supply, decaying-emission schedule gives long-term holders a clear path to proportional ownership growth as protocol revenue scales.

Conclusion

Spark has matured into a self-directed stablecoin yield engine that extends Sky’s monetary policy into every corner of DeFi. Its vertically-integrated stack—Savings, Lending, Liquidity Layer—converts Sky’s balance sheet into reinforcing revenue lines that grow the pie for the DeFi ecosystem as a whole.

For allocators, the SPK token crystallizes this economic flywheel. A fixed 10 B supply, front-loaded “Genesis” emissions, and direct control over fee splits and risk parameters align token ownership with the protocol’s expanding cash flows. As the emission curve decays, treasury-funded buy-backs and staking rewards are positioned to transition SPK from an incentive instrument to a yield-bearing governance stake.

Going forward, cross-chain Liquidity Layer deployments, Coinbase’s retail loan funnel, and deeper integrations with Aave, Morpho, Syrup, Ethena, and more, are set to compound USDS velocity and fee income. Each new venue widens Spark’s liquidity moat and creates incremental earnings with a clear positive-sum dynamic for the broader ecosystem.

References

Aave Governance. (2024). ARFC: Framework for Instances and Friendly Forks.

BlockAnalitica. Spark Protocol. Spark Protocol Data Dashboard.

DeFiLlama. Spark Protocol Overview.

DeFiLlama. SparkLend.

DeFiLlama. Spark Liquidity Layer.

MakerDAO Governance. (2023). Polling Proposal: Project-Based Funding for Phoenix Labs Including Spark Protocol Launch and Maintenance.

MakerDAO Forum. (May, 2023). The 5 Phases of Endgame.

MakerDAO Forum. (July, 2023). Request for GOV12.1.2: Edit to the Stability Scope to Quickly Implement Enhanced DSR.

Mirror. Ethena Labs. (2025). Spark Enables Direct Holdings of up to $1.1bn USDe and sUSDe.

Sky. Sky Documentation Portal.

Sky.money. Sky Ecosystem Official Website.

Sky. Sky Ecosystem Information Hub.

Sky Money Forum. (2024). Announcement: Spark Tokenization Grand Prix – Request for Proposal.

Sky Money Forum. Posts Tagged “Spark”.

Sky Money Forum. Posts Tagged “SSR”.

Spark Protocol. Spark App.

Spark Protocol. Spark Protocol Documentation.

Spark Protocol. SPK Airdrop Governance.

Rune Christensen, founder of MakerDAO. (August, 2024). Sky.money goes live.

Sky Ecosystem. Official X Account.

Sky Ecosystem. (May, 2023). Sky Announces Spark Protocol Launch.

Spark Protocol. Official X Account.

Spark Protocol. Spark features the Sky Savings Rate on its frontend (October, 2024).

@ryanyyi. Dune. Coinbase Onchain Loans Dashboard.

Glossary

Sky: The re-branded successor to MakerDAO. Holds the core balance sheet, sets monetary policy, and issues USDS.

Endgame Plan: Sky’s long-term restructuring blueprint that spins out product-focused SubDAOs (“Stars”) like Spark.

Spark: A Sky SubDAO focused on stablecoin utility. Runs Spark Savings, SparkLend, and the Spark Liquidity Layer.

Sky SubDAO/Star: Maker/Sky semi-autonomous business unit with its own revenue model and token.

USDS: Dollar-pegged stablecoin minted by Sky; 1 USDS is fully redeemable for $1 of reserves.

sUSDS: Non-rebasing yield-bearing token received when depositing USDS (or DAI/USDC) into Spark Savings; accrues the SSR.

Sky Savings Rate (SSR): Governance-set interest rate paid on sUSDS deposits; analogous to a central-bank base rate.

Spark Savings: Front-end to Sky’s savings module. Converts USDS/DAI/USDC into sUSDS and pays the SSR in real time.

SparkLend: Spark’s lending market as an Aave v3 fork that offers fixed-rate USDS borrowing via Sky’s Direct Deposit Module.

DDM (Direct Deposit Module): Contract that lets Sky mint USDS directly into SparkLend up to a governance-set ceiling. Formerly called D3M.

PSM (Peg Stability Module): onchain 1:1 swap facility between USDS, DAI, and major stablecoins; keeps the peg tight.

Spark Liquidity Layer (SLL): Automated treasury router that deploys idle USDS/sUSDS/USDC across chains and partner protocols for yield.

SPK Token: Spark’s governance and value-accrual token. Fixed 10 B supply emitted over 10 years; controls fees, risk, and treasury spend.

Genesis Farming: Initial SPK distribution program that allocates 6.5 B SPK to early users over the first two years.

Disclosures

Alea Research is engaged in a commercial relationship with Spark as part of an educational initiative and this report was commissioned as part of that engagement. Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed. This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform, and not an investment or financial advisor.