Overview

Possum is a DeFi yield protocol focused on developing positive-sum financial products and governance systems. The project aims to create an equitable ecosystem that rewards all participants without extracting value at others’ expense. Possum Labs has developed multiple products, each targeting a user base and meeting a specific purpose, but all of them accrue value to the $PSM token.

- Nexus is a decentralized exchange (DEX) that simplifies pair selection by using $PSM as the common base pairing asset.

- Possum Core is a capital allocation system that lets $PSM holders govern the treasury and participate in community decisions.

- Portals provide upfront yield by allowing users to stake assets and instantly claim future earnings.

- Time Rift incentivizes staking and active participation with rewards in $PSM.

Positive Sum Finance

Possum Labs builds DeFi products based on positive-sum finance principles. Their goal is to create systems that enable frictionless, value-generating financial interactions without extracting value from users.

The focus is on simplicity, security, and incentive alignment. By eliminating protocol fees and integrating the $PSM token as the core currency, Possum Labs aims to avoid the common issue of zero-sum competition, where fees benefit only investors. Instead, their model seeks to foster continuous value creation for users and investors alike.

In this framework, the $PSM token ensures maximum alignment by directly linking utility and value across all Possum products.

Products Overview

Nexus

Possum Nexus is a decentralized exchange (DEX) built as an automated market maker (AMM) designed to simplify liquidity pair selection for liquidity providers (LPs). It aims to enhance the scalability of the Possum ecosystem using $PSM as a “basket token” for all liquidity pairs.

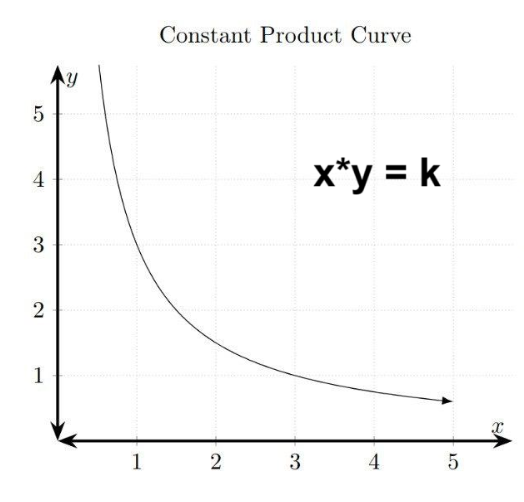

Nexus uses $PSM as the common base currency for all pairs, creating a single pool per token. This reduces complexity and enables efficient trade routing through on-chain processes. Nexus is built on the constant product AMM model familiar with Uniswap, which has been a reliable standard in DeFi, offering stable trading conditions for both traders and LPs.

Key Features

- Simplicity: Every token pairs with $PSM, allowing easy trade routing with single-hop or dual-hop swaps.

- Security: Proven concepts and battle-tested systems minimize security risks. Nexus contracts will undergo multiple security audits.

- Independence: Nexus doesn’t rely on oracles or active management, making it a pure DeFi primitive adhering to Hyperstructure principles.

- Incentive Alignment: No value extraction through protocol fees. LPs receive pure rewards in the non-$PSM token.

- Adaptive Fees: LPs can collectively set the trading fee within a defined range, allowing real-time adjustments based on market conditions.

Liquidity Provision

- Single-token fees: Fees are taken only in non-$PSM tokens, reducing trading costs and enhancing liquidity.

- Separate fees from LP capital: LPs can stake their tokens to receive trading fees without needing to auto-compound.

- Flexible entry/exit: LPs can join or exit pools using any token with a pool on Nexus, offering flexibility for liquidity provision.

Possum Core

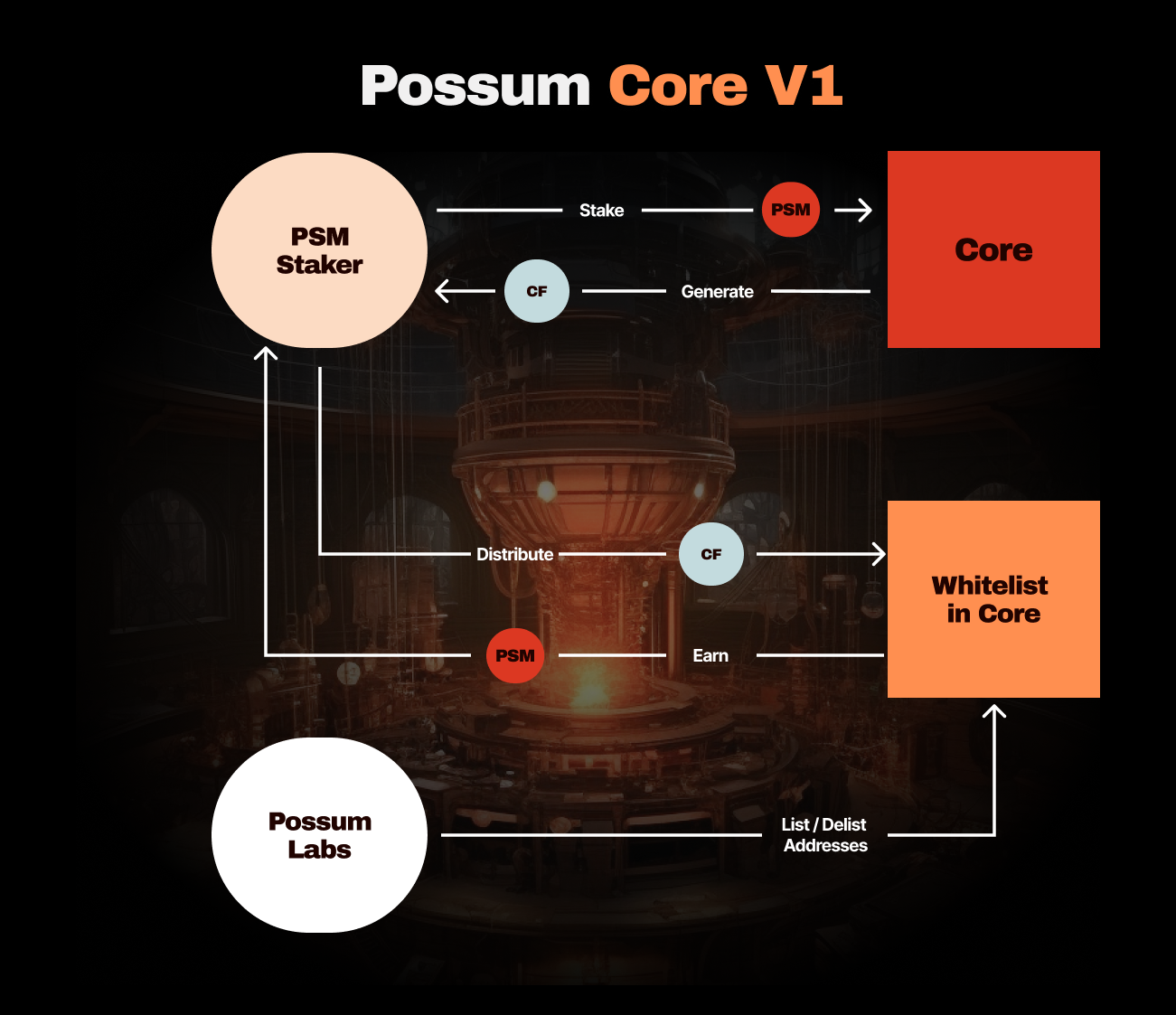

Possum Core is the on-chain treasury management solution based on community-driven governance decisions. It is designed to manage the Possum Treasury and transition decision-making from a multi-signature (multi-sig) setup to a community-owned model. This system empowers $PSM stakers by allowing them to manage capital distribution and be rewarded for their participation. The objective is to activate community involvement in budget management, reward active participation, and gather insights for future governance iterations.

Possum Core allows users to stake their $PSM tokens to earn Core Fragments (CF). CF represents the voting power and decision-making influence of stakers in Possum Core. The system introduces a flexible commitment period for staking, where stakers can choose the length of time they wish to lock their tokens. The longer the lock period, the higher the rate of CF accumulation, incentivizing longer-term commitment.

- CF Accrual Rate: CF accrues at an annual rate that ranges from 12% to 72%, depending on the length of the stake commitment period. For example, a one-year lock period will provide a 72% accrual rate.

- Penalty for Early Withdrawal: While stakers can withdraw their $PSM at any time, withdrawing early during the commitment period results in a proportional forfeiture of accumulated rewards of $PSM and CF, discouraging early exits and promoting long-term engagement.

Once CF has been accumulated, users can distribute their CF to whitelisted addresses within the system. Each CF distributed results in the transfer of $PSM tokens from the protocol’s treasury to the specified address. This mechanism allows the community to directly allocate the treasury’s funds based on collective decision-making.

Possum Core’s ultimate goal is to transition the entire treasury management process to the community. It will be released in multiple phases, with V1 focused on gaining insights and testing the governance system. V2 will hand off control of whitelists to the community, and V3—if needed—will fine-tune the governance model before the full transition to a community-driven treasury occurs.

- Core V1 serves as a pilot project to gather insights before fully transitioning to community governance. In this version, $PSM stakers can direct $PSM incentives to whitelisted addresses, and earn rewards for doing so. The whitelist is still controlled by the project multi-sig, and the contract is funded with a limited amount of tokens, intended to last at least one year.

- Based on the learnings from Core V1, Core V2 will be launched in 2025, transferring whitelist management from the multisig to the community. Depending on further feedback and the need for additional adjustments, a potential Core V3 might be introduced in 2026. If no further iteration is needed, Core V2 will assume control of all remaining treasury assets by 2026.

The ultimate goal of the Possum Core is to transition treasury management from a centralized multi-sig to a fully decentralized, community-owned model. This systematic, phased approach allows the project to refine and improve governance mechanisms, ensuring that the community is effectively engaged in managing the treasury.

Portals

Portals offer a way to access upfront yield from yield-bearing assets without the risk of liquidation. By depositing these assets into a Portal, users receive immediate yield in $PSM tokens or supported assets. This upfront yield is made possible by pre-funding the Portal with $PSM, sourced from the community and Possum Labs treasury.

This mechanism works through smart contract vaults that allow users to deposit yield-bearing assets and receive upfront yield paid out in the $PSM token. These deposits are staked in underlying protocols to generate yield over time. Once received, the upfront yield can be used elsewhere for various purposes as a user wishes, such as reinvestment, trading, hedging or securing liquidity without the risks commonly associated with traditional DeFi leverage mechanisms (i.e. liquidations).

When a yield-bearing asset is deposited into a Portal, the deposited asset generates yield over time. This yield is used to repurchase $PSM, replenishing the Portal’s reserves and driving demand for the token. Unlike traditional systems, Portals use an internal liquidity pool composed of $PSM and a virtual asset called Portal Energy (PE). PE accrues based on the time value of the staked assets and can be swapped for $PSM when users withdraw their upfront yield. It is a mintable ERC20 token that is used for accounting purposes to keep track of the time value of staked assets.

Participants and Roles

Depositors

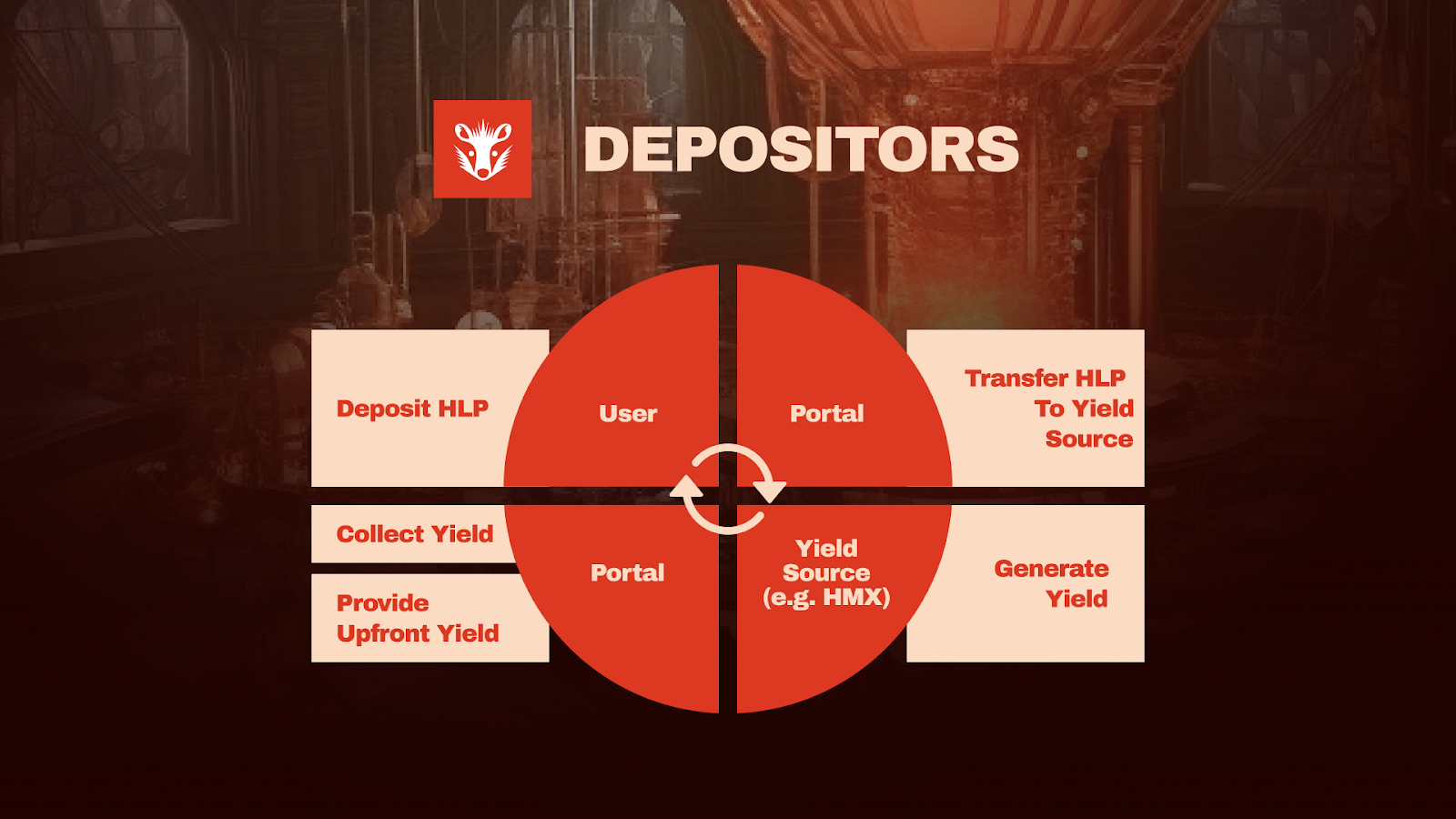

Depositors are the primary users of Portals, seeking to unlock upfront yield on their yield-bearing assets.

When a user deposits supported assets such as $ETH, $USDC, or $WBTC into a Portal, they immediately receive a credit balance of Portal Energy that can be exchanged and withdrawn in $PSM, representing upfront yield. The more upfront yield a depositor claims, the longer their assets must remain locked in the Portal. However, depositors have the flexibility to withdraw their assets early, though this increases the amount of time before a total withdrawal is possible.

A practical example of how this works with the HLP Portal is detailed as follows:

Step 1: Deposit $HLP

- You decide to deposit 100 $HLP into a Portal.

Step 2: Portal Transfers $HLP to Yield Source

- Once deposited, the Portal automatically transfers your 100 $HLP to a yield-generating protocol, such as HMX, where the $HLP is staked or used in a way that generates yield.

Step 3: Yield Source (HMX) Generates Yield

- HMX uses the staked $HLP to earn yield, which could be through trading fees, lending interest, or other mechanisms within HMX. Over time, this yield accumulates in the form of another asset, like $USDC.e, which HMX pays out as the yield.

Step 4: Portal Provides Upfront Yield

- Immediately after your $HLP is deposited, the user receives PE, which can be exchanged for $PSM. The upfront yield rate is based on the value of withdrawn $PSM relative to the duration and value of staked assets

Step 5: Collect Yield

- As HMX generates actual yield over time, this yield is collected by the Portal.

- If you do not withdraw your $HLP early, the accumulated yield in HMX eventually matches or exceeds the upfront yield you were given.

- Arbitrageurs or other mechanisms might step in to buy this yield with $PSM, ensuring the Portal remains balanced and can continue offering upfront yield to future depositors.

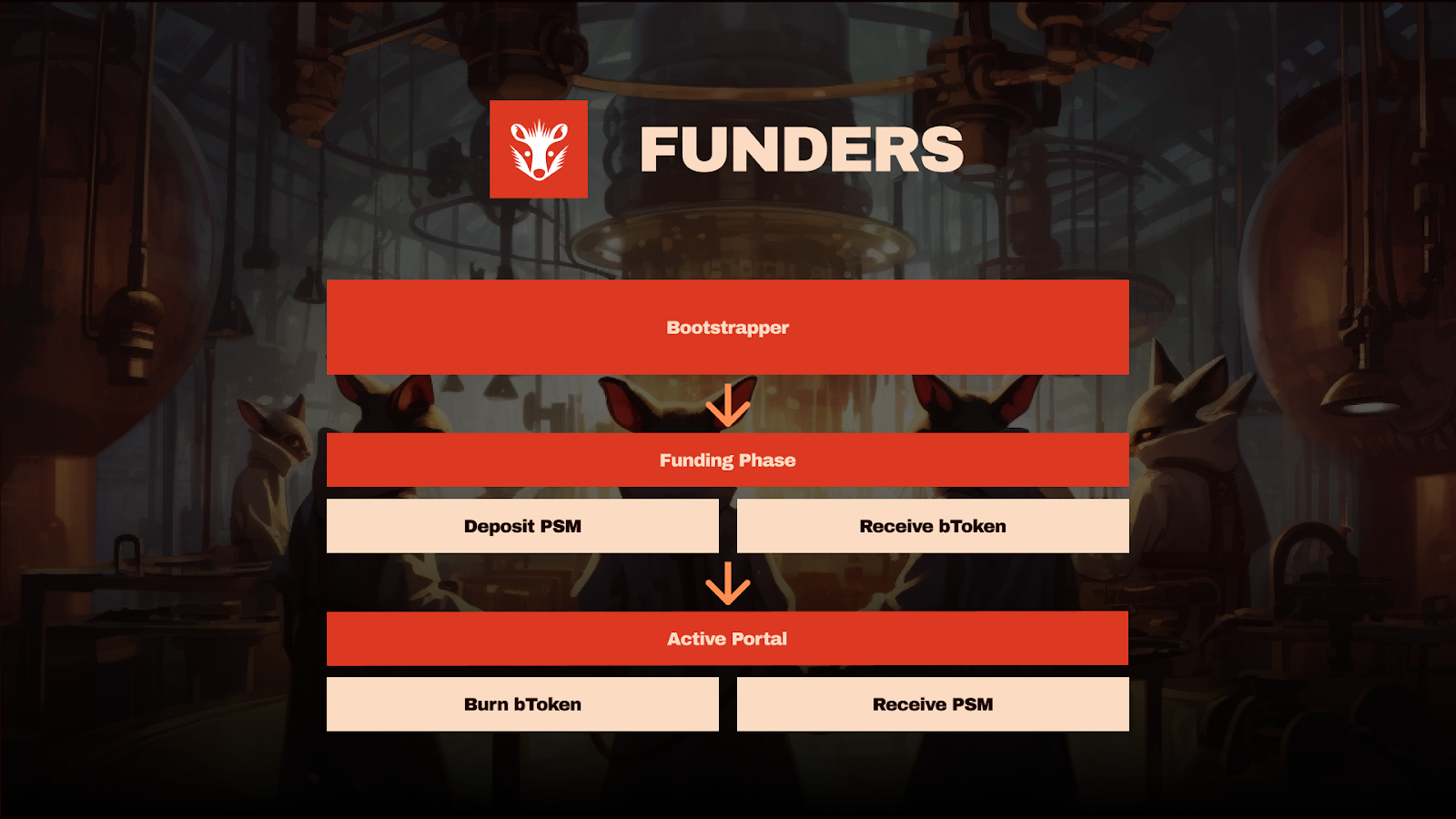

Funders

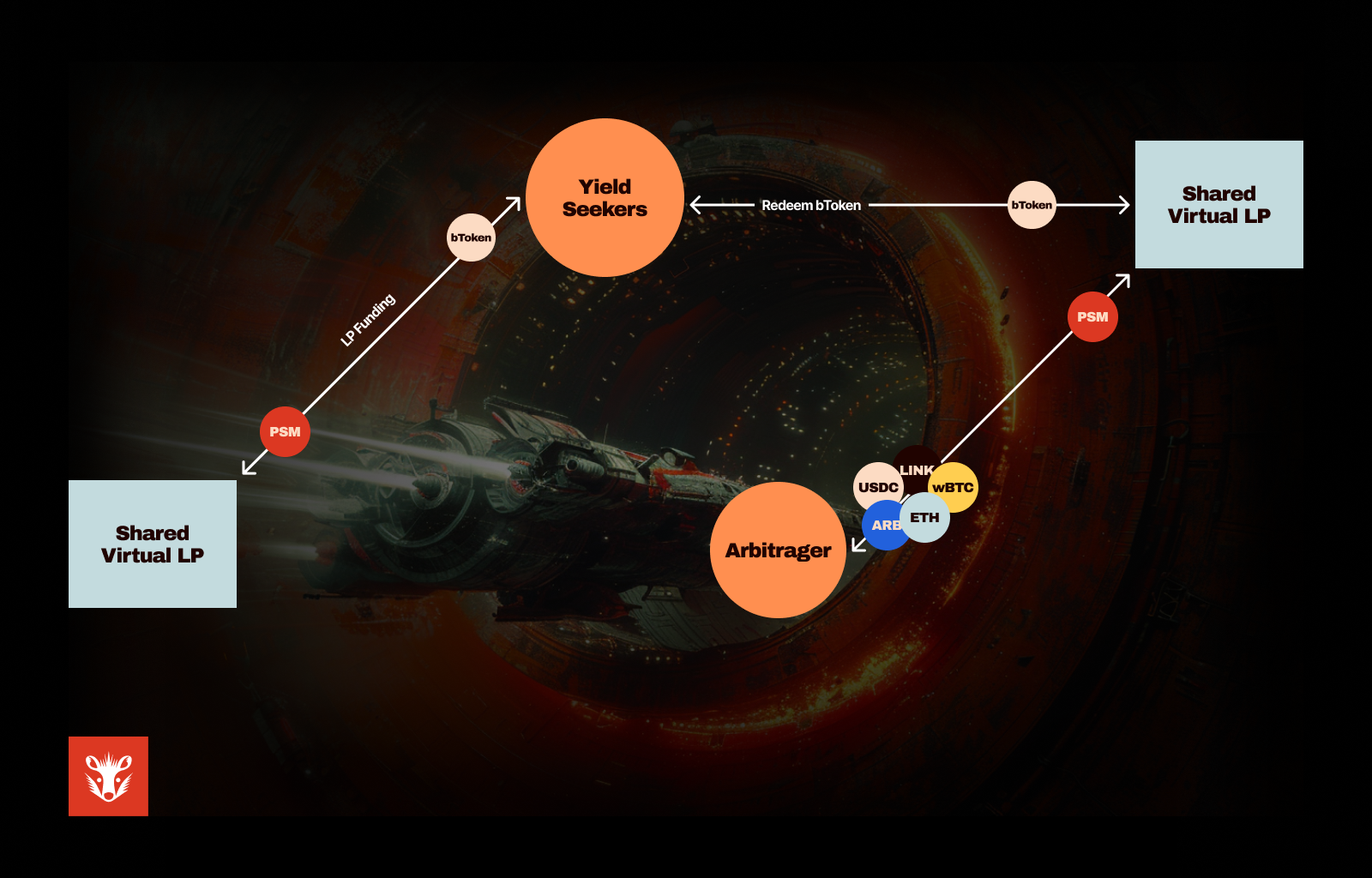

In both Portals v1 and v2, there is an initial funding phase where funders deposit $PSM tokens to supply liquidity for the Portal. The key difference in Portals v2 is that the liquidity pool is shared among a group of Portals, rather than being isolated for each asset as in v1. In v2, funders deposit $PSM directly into the Portal’s shared liquidity pool. In return, they receive a receipt token called bToken, which can later be redeemed for $PSM from the funding reward pool. The amount of bTokens received is determined by the “rewardRate” at the time of contribution. These bTokens can be burned at any time to claim a share of the accrued $PSM in the funding reward pool.

Funders are incentivized to participate early by the potential to receive more $PSM than they initially contributed, especially as the funding pool grows over time. Contributing $PSM during the funding phase of a Portal is an investment in the long-term success of that Portal. In Portals v2, this contribution supports the success of all connected Portals through the shared liquidity pool.

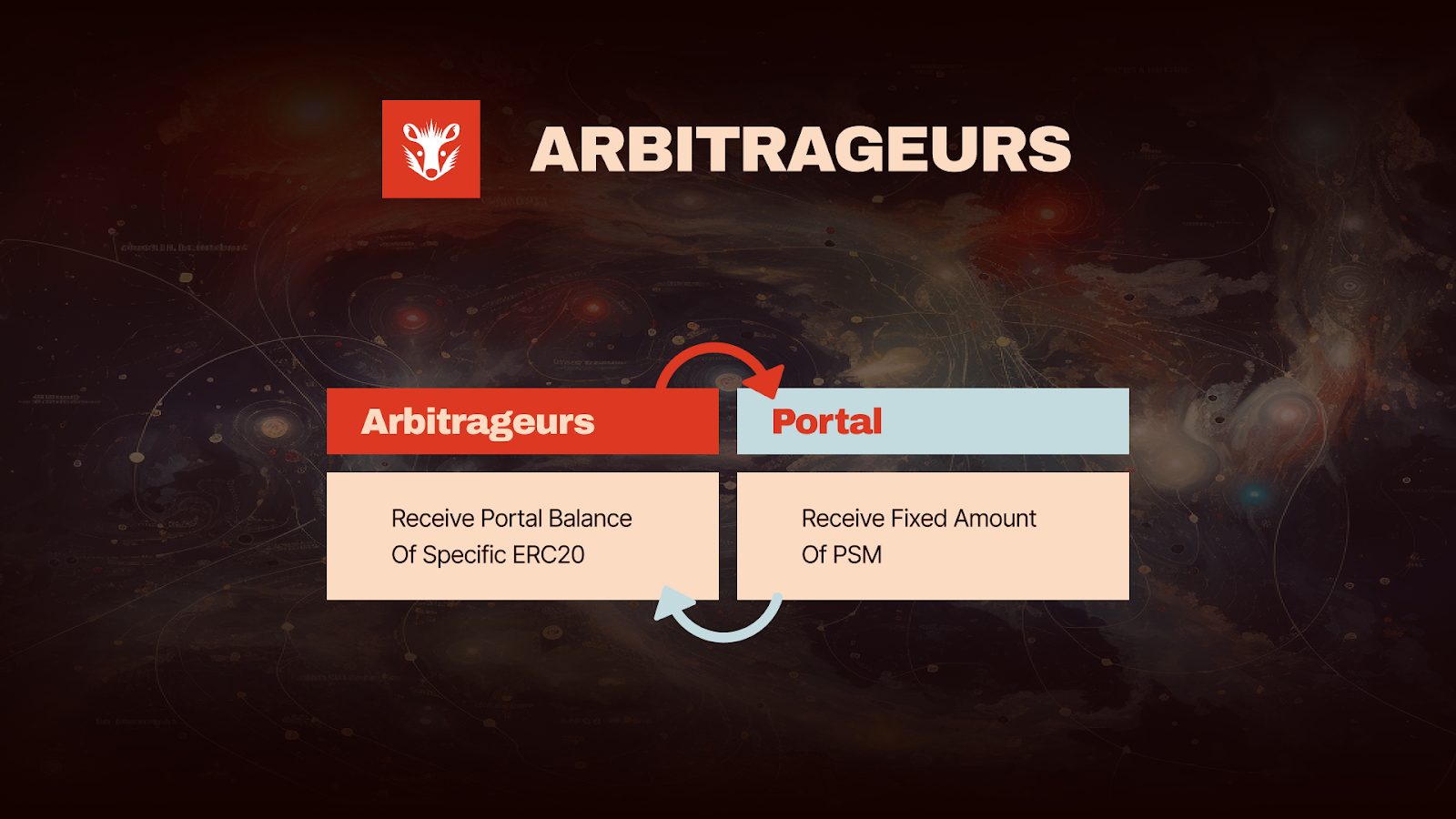

Arbitrageurs

Arbitrageurs ensure the efficiency and balance of the Portals by capitalizing on price discrepancies between $PSM and the accumulated yield in the Portals.

As Portals accumulate yield from the staked assets, there comes a point when the value of the accrued yield exceeds the value of the $PSM required to purchase it. Arbitrageurs take advantage and buy the entire balance of accrued yield with a fixed amount of $PSM, making a riskless profit. This mechanism is crucial for replenishing the $PSM in the Portal, which is then used to pay upfront yield to depositors.

Upfront Yield

The primary objective of Portals is to enhance the utility of yield-bearing assets by allowing users to access future yield immediately. This approach caters to the growing demand for yield-bearing products in DeFi, providing a more flexible and efficient mechanism for yield realization.

Upfront yield in Possum Portals allows users to receive future yield immediately after depositing yield-bearing assets. This feature provides immediate access to earnings without waiting for the yield to accrue over time.

This is achieved because the Portal earns yield over time, but each Portal is funded with $PSM before it launches, bootstrapping upfront yield payments as a result. The yield earned by staked assets is then used to buy back $PSM and refill the Portal

To get Upfront Yield:

- Deposit: Users deposit any of the supported yield-bearing assets like $ETH, $USDC, or $WBTC into their respective Portal.

- Yield Payout: Upon deposit, users instantly receive upfront yield in $PSM tokens or supported assets.

- Time Value: The amount of upfront yield is based on the time value of the deposited assets, represented by Portal Energy (PE).

Upfront yield offers immediate liquidity to users, providing them with their yield without the risk of liquidation and offering a way to access funds without taking on debt or incurring interest. Users can withdraw their assets early but at the cost of accruing “time debt,” which increases the duration required to fully unlock their remaining assets. The more upfront yield claimed, the longer the user must wait to fully withdraw their deposit. Alternatively, users can purchase Portal Energy and pay back their time debt, unlocking staked assets.

Portal Energy (PE)

Portal Energy (PE) is a mintable ERC20 token within Portals that represents the time value of staked assets. It is important in the process of claiming upfront yield. It represents the potential yield a user’s staked assets will generate over time. PE accrues as soon as a user deposits assets into a Portal.

The “value” of PE is determined by the exchange rate of PE/PSM inside the virtual LP of the Portal.

When a user deposits assets (e.g., $ETH, $USDC) into a Portal, PE starts accruing. The accrual rate of 1 PE is 1 token staked for 1 year, for example, If a user deposits 1 $ETH into the $ETH Portal, you might earn 1 PE-ETH for each year the $ETH remains staked.

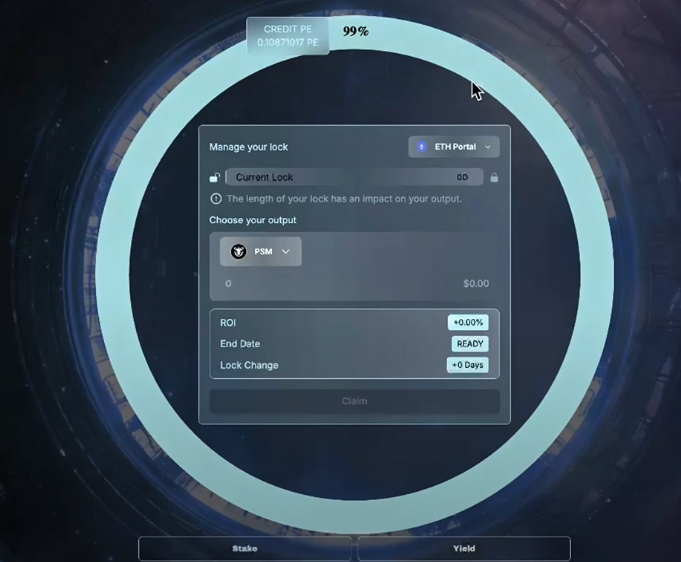

Portal Energy on the $ETH Portal after a 0.1 ETH Deposit.

PE can be converted into $PSM through the Portal’s internal PE/PSM liquidity pool. This allows users to claim their yield upfront without waiting for the natural accrual of interest over time. Once converted, $PSM can be withdrawn, traded, or used within the Possum ecosystem. The primary use of PE is to claim upfront yield. Instead of waiting for interest to accumulate naturally, users can immediately convert PE into $PSM tokens.

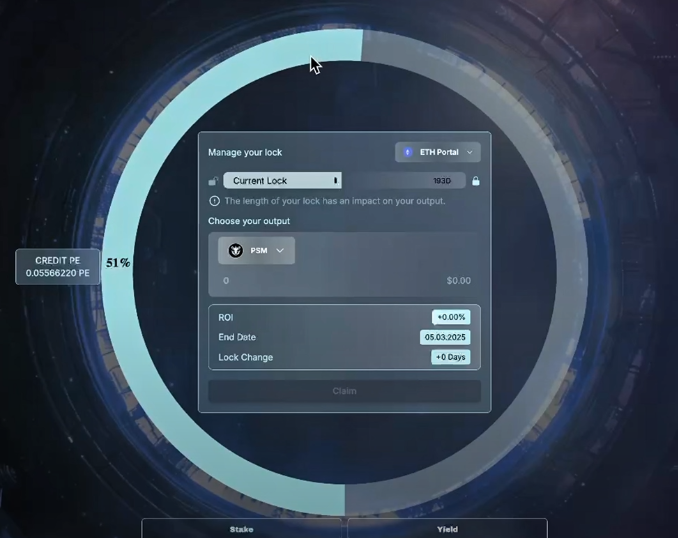

0.0556 PE remaining after a user immediately claims 6 months’ worth of upfront yield.

As an ERC20, PE can be minted and used as a way to trade time value. For example, in a Peer-to-Peer (P2P) trade situation, someone could buy someone else’s PE tokens and burn it to increase their own PE inside the Portal. As a result, users can manage their time debt by depositing more assets to accrue additional PE or by purchasing PE from others. This enables dynamic management of the yield generation process.

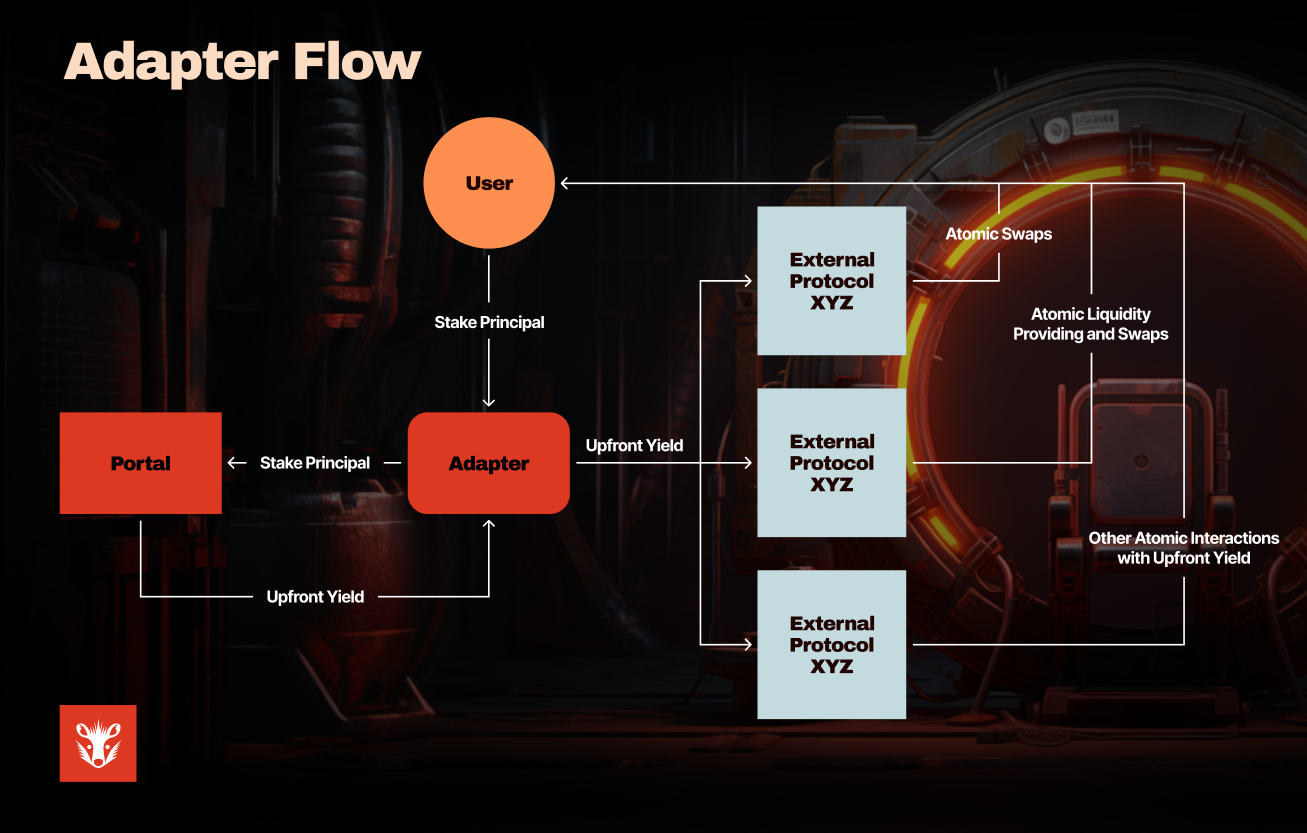

Adapters

Adapters refer to the actual smart contracts designed to integrate Possum with external protocols, allowing its users to claim upfront yield from any Portal in any liquid token available on Arbitrum’s DEXes. This process is seamless: users request $PSM as their upfront yield, which the Adapter automatically swaps for the desired token via the 1Inch router.

Portals v2

Portals v2 introduced two primary enhancements over the initial release:

- Shared Liquidity Pool (LP): All v2 Portals are connected to a single, shared LP. This pool serves six different assets ($ETH, $WBTC, $ARB, $LINK, $USDC, $USDC.e), avoiding liquidity fragmentation and resulting in more capital efficiency. Funders now contribute directly to this shared LP and receive bTokens, which earn 20% of arbitrage deposits from all connected Portals.

- NFT Depository Receipts: Users can mint NFTs representing their deposits. These NFTs reflect the total value of the user’s current deposit and can be used elsewhere in DeFi or transferred between wallets, which increases the flexibility and composability of staked assets.

bTokens

bTokens are specialized tokens issued to funders who contribute $PSM during the initial funding phase of a Portal. These tokens represent a claim on future $PSM rewards from the Portal’s funding reward pool.

The two main roles of bToken are as follows:

Funding Bootstrapping:

Funders deposit $PSM to bootstrap a Portal’s liquidity before it launches. In return, they receive bTokens, which are proportional to the amount of $PSM they contribute.

Redemption for Rewards:

bTokens can be burned in exchange for $PSM from the funding reward pool. The value of bTokens increases as more $PSM is deposited into the Portal through arbitrage opportunities.

However, there are two important conditions for bToken redemption:

- Funders can only redeem their bTokens when the Portal has sufficient $PSM in the reward pool.

- Redemptions are served in a first come first serve process. If the reward pool holds insufficient $PSM, later redemptions must wait for more inflows from arbitrage.

Time Rift

Time Rift is a tool designed to onboard users from other DeFi communities through a positive-sum incentive structure. It allows users to stake specific tokens and earn $PSM in return. Time Rift aims to avoid common pitfalls like “mercenary capital” and “sybil attacks,” aiming for long-term engagement and mutual benefits for both the Possum ecosystem and the communities it interacts with. Time Rift is designed to:

- Reward constructive activity & involvement with the project (more than bag holding).

- Create a positive value feedback loop for both communities, enabling a collaborative environment.

- Maintain freedom of choice for the user.

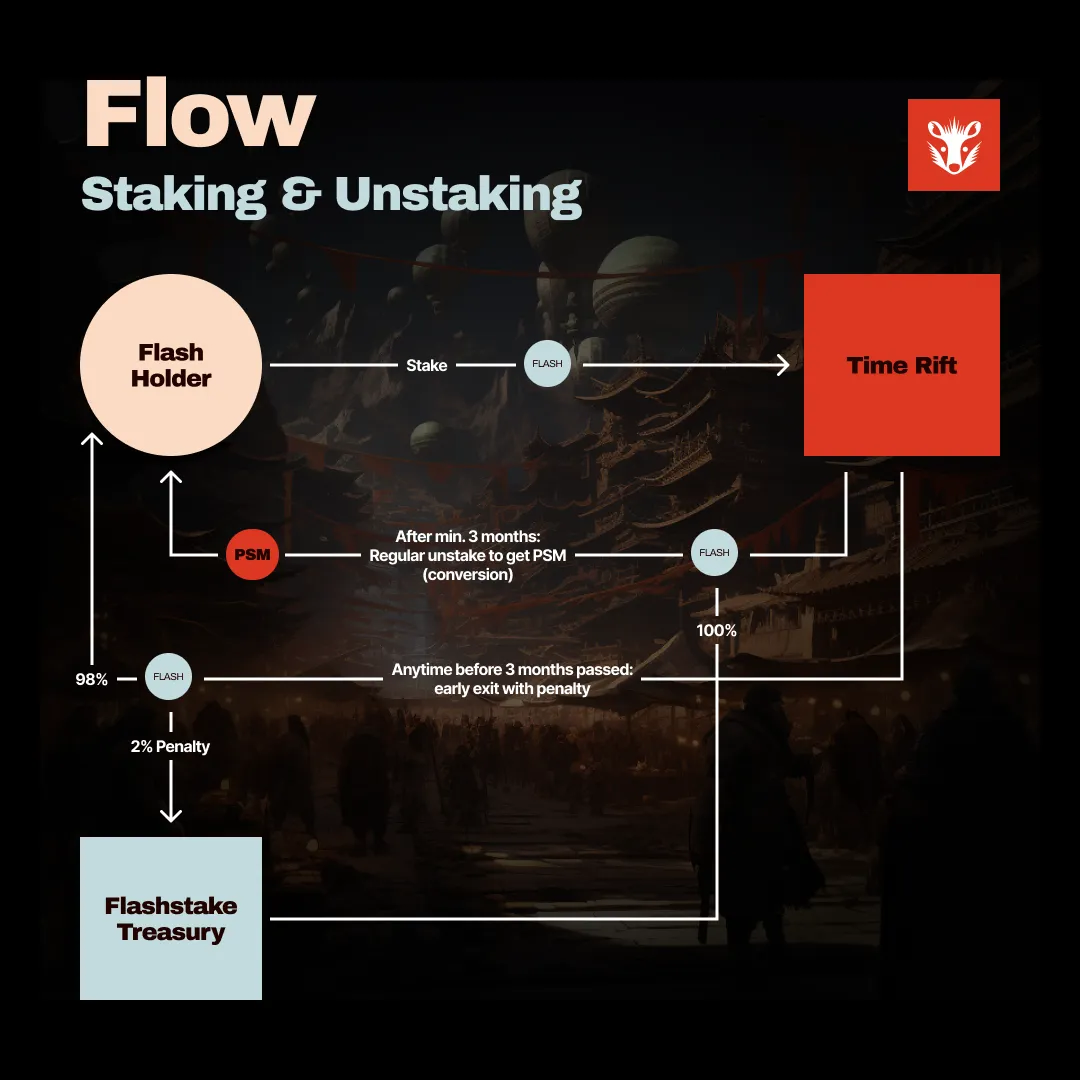

Time Rift avoids traditional incentive pitfalls like airdrops and liquidity mining, which often lead to short-term gains but long-term losses. Instead, it rewards constructive participation. Users stake tokens, such as $FLASH from Flashstake, into the Time Rift. The minimum waiting time until the conversion can be finalized is 90 days after the last stake by the user (multiple stakes reset the timer). After 90 days, at any time, users can execute the conversion with a second transaction and receive $PSM equal to their conversion balance. The conversion balance can be larger than the staked amount of $FLASH.

Upon execution of the conversion, staked $FLASH is sent to the Flashstake Treasury, improving the economic situation of the Flashstake DAO. This process is practically the opposite of a vampire attack as it rewards the strengthening of the targeted protocol (Flashstake) while also benefiting the originating project (Possum). The more $FLASH holders enter the Time Rift, the better for both projects. To reduce friction for $FLASH holders as much as possible, the staked $FLASH tokens can be withdrawn at any time before the conversion is executed. A small exit fee of 2% will be applied to the staked balance to prevent potential exploits. This exit fee is sent to the Flashstake treasury, reinforcing the positive effect for our partner community, while the conversion balance in $PSM is sent back to the Possum Treasury.

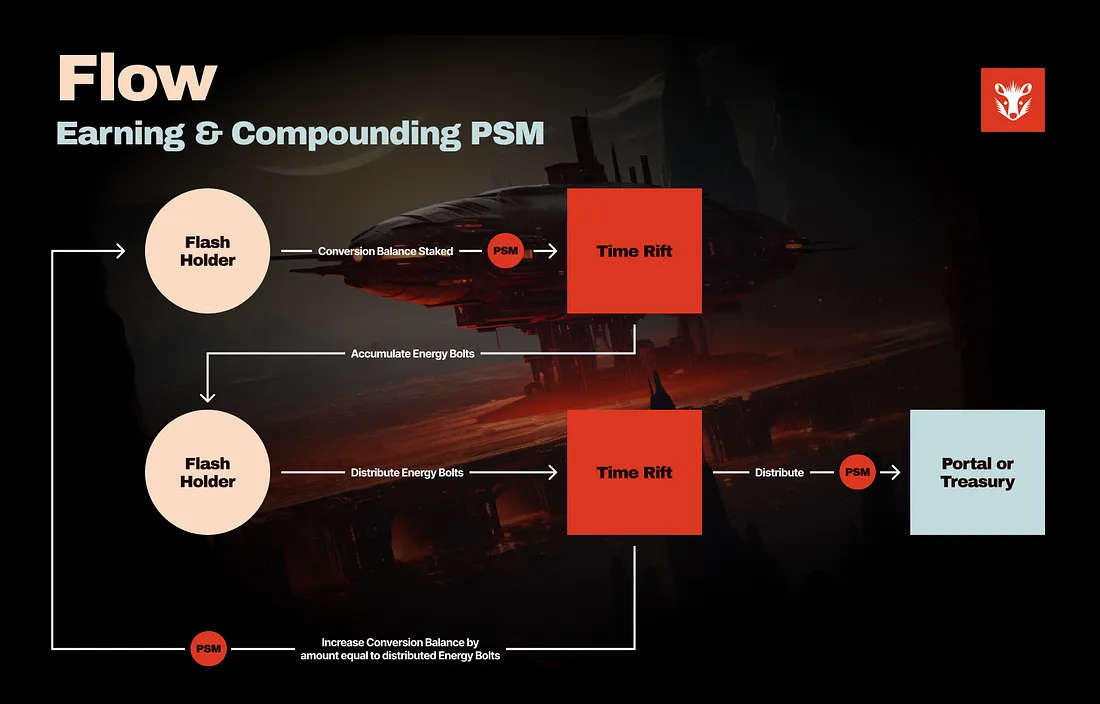

Energy Bolts

Energy Bolts direct incentives within the Possum ecosystem, funding different areas and ensuring balanced growth. For instance, during the 90-day period that the $FLASH is staked, the depositor receives Energy Bolts. Bolting is the act of distributing Energy Bolts to one of the whitelisted addresses in a Time Rift, thereby funding the Possum ecosystem

As Energy Bolts accrue, the depositor can distribute them to whitelisted addresses, which can be added and removed by the Possum Council. To keep a positive-sum environment, the Council will only be able to adjust this list, and will not be able to withdraw tokens from the Time Rift themselves. Additionally, users will have full discretion with whom they distribute their Energy Bolts to; and are not required to distribute any at all. Examples of whitelisted addresses will be Possum Portal addresses, as well as the Possum Treasury.

The more the depositor distributes their Energy Bolts, the faster their conversion balance increases. Assuming the depositor doesn’t distribute any Bolts, they’ll accrue at a 150% APR on the conversion balance. However, frequent distribution, or “bolting,” can increase that rate to 346% APY. Converting $FLASH to $PSM increases the value that depositors will receive in the end.

Why the Project was Created

Possum Labs was created in response to several challenges and inefficiencies observed in the existing DeFi landscape. The founders identified a need for financial products that could provide sustainable yield without the pitfalls of traditional incentive structures, such as those seen in many early DeFi protocols. Many of these systems relied on high-yield farming and speculative incentives, which often led to unsustainable growth, rapid user exit, and ultimately, a death spiral of the protocol.

Recognizing these issues, Possum Labs set out to develop a suite of products that emphasize credible neutrality, transparency, and collaboration for all participants. The goal was to create a positive-sum ecosystem where no party benefits at the expense of another. A secure, immutable, and permissionless protocol that intends to contribute to a more equitable and transparent DeFi ecosystem.

Possum Labs as a Hyperstructure

A Hyperstructure refers to a decentralized protocol that runs on blockchain technology. The core feature of a Hyperstructure is its ability to operate without maintenance, intermediaries, or the risk of shutdowns. It runs autonomously for as long as the blockchain it resides on exists, enabling users to interact with it freely and securely. Hyperstructures are built to be unstoppable, free, permissionless, valuable, and expansive, allowing anyone to use or build on top of them without restrictions. These characteristics align perfectly with the ethos of decentralization in blockchain ecosystems, offering a truly permissionless financial system that empowers users to participate without third-party control.

Possum Labs is designed to embed key characteristics of a Hyperstructure such as unstoppable, free, valuable, expansive, permissionless, and credibly neutral into its ecosystem. The protocol aims to ensure that they can function independently, without central control, and provide ongoing value to users.

The features of a Hyperstructure as embodied by Possum are:

Unstoppable

Possum Labs operates through immutable contracts, meaning that once the protocol is deployed, it cannot be altered or controlled by any single entity, including its creators. This ensures that Possum will continue to function without interruption for as long as the underlying blockchain (such as Ethereum or Arbitrum) operates.

Free

A Hyperstructure operates without charging fees, staying true to a free-to-use nature. By removing protocol fees, Possum ensures that users are not burdened with additional costs, making interactions with the system frictionless. The cost of interaction within the Possum ecosystem is limited to the gas fees necessary to execute blockchain transactions.

Valuable

Even though Possum does not extract value through fees, it still creates value for users and participants through $PSM. As demand for the protocol grows and more users interact with it, the value of $PSM is directly tied to the success and utility of the system. This ensures that Possum provides ongoing value while remaining free for users.

Expansive

The protocol encourages participation and value creation through built-in incentives, for its products through its Ambassador Program. This system allows anyone to contribute to the ecosystem and capture value based on their contribution. This is also shown in the workings of the as for example, funders and arbitrageurs play crucial roles in the Portals system by ensuring liquidity and market efficiency, all while benefiting from the value they help create.

Permissionless

Anyone can interact with Possum without requiring permission or the need to trust third-party intermediaries. The system is open to all, ensuring that the utility it offers is available to the entire DeFi community.

Credibly Neutral

Possum does not favor any particular group of users. Its protocols treat all participants equally, offering them the same opportunities and benefits. Whether you are a depositor, funder, or arbitrageur, the system is neutral, creating a fair playing field for all participants.

Roadmap

The Possum roadmap outlines a comprehensive plan for the development and launch of the Possum Nexus and associated projects.

| Q3 – 2024 | Q4 – 2024 | Q1 – 2025 | Q2 – 2025 |

|

|

|

|

Sector Outlook

The yield sector has become one of the most popular ways to grow investments in DeFi. As traditional financial systems offer limited access to high-yield opportunities, DeFi has opened up new avenues for earning returns on digital assets. At its core, it is dominated by protocols that allow users to lend, borrow, stake, and farm assets to earn returns. These returns come in various forms such as interest, governance tokens, or other native protocol rewards.

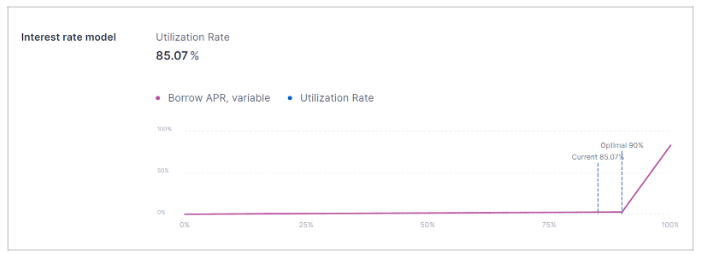

Platforms like Aave, Compound, and Euler allow users to lend their crypto assets as liquidity to earn interest. Borrowers pay an interest rate for the assets they borrow, and lenders receive a portion of this as yield. The yield rates are usually variable and depend on supply and demand dynamics within the protocol.

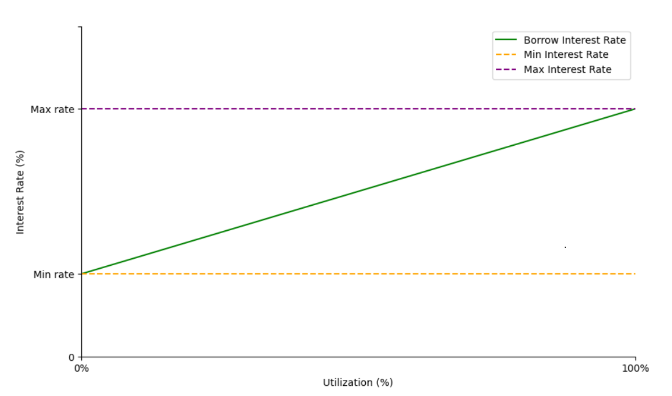

Source: Kinked Interest Rate model on Aave V3

With this model; When utilization rises: (indicative of high demand for borrowing), borrow and supply interest rates increase, lending is incentivized and borrowing is disincentivized. As a consequence, idle liquidity increases, and borrow demand falls, leading to a lower level of utilization.

Source: RareSkills

When utilization falls: (indicative of excess idle liquidity), borrow and supply rates decrease, borrowing is incentivized and lending is disincentivized. As a result, idle liquidity decreases, and borrow demand rises, leading to a higher level of utilization.

In proof-of-stake (PoS) blockchains, users can stake their tokens to help secure the network. In return, they receive staking rewards, which can be a fixed or variable yield. Prominent examples include Ethereum staking with liquid staking protocols like Lido and Rocket Pool.

Yield farming involves providing liquidity to decentralized exchanges (DEXs) or other DeFi protocols in exchange for rewards. Dominated by DEXs like Uniswap, users earn a portion of the fees and often receive additional rewards in the form of the protocol’s native token. Finally, protocols like Yearn Finance, Curve, and Balancer exemplify the strategy of liquidity mining, where users provide liquidity to a protocol and receive its native token as a reward, allowing users to optimize their yield by participating in multiple strategies simultaneously.

Despite its success, the yield sector is at a crossroads, balancing the immense opportunities it offers with the challenges and risks it presents. Participating meaningfully in yield farming and staking still requires substantial capital, which disproportionately benefits wealthier participants and creates a landscape where smaller investors struggle to achieve significant yields. Many protocols embed fee structures that extract from users’ earnings to reward token holders or fund the protocol. These misaligned incentives between users seeking low fees and token holders who benefit from higher fees, result in a zero-sum environment as PvP (Player versus Player) dynamics create a competitive environment that often rewards sophisticated players at the expense of others. Furthermore, the knowledge required to navigate DeFi yield strategies, optimize returns, and manage risks is substantial, concentrating opportunities among a small group of experienced users and insiders. Most notably, the pursuit of high yield fosters a short-term mentality, with participants frequently moving mercenary capital between protocols in search of the highest returns, destabilizing protocols and leading to unsustainable growth patterns.

Why Upfront Yield?

Unlike traditional yield strategies that accrue returns over time, upfront yield allows users to access future yield immediately. Upfront yield addresses many of the challenges inherent in the current DeFi yield sector among which are:

Immediate Liquidity

Users can access future returns immediately, providing liquidity that can be used for other investment opportunities, compounding potential returns. For example, a user could use their upfront yield for other DeFi strategies like staking, supplying liquidity on another protocol or hedging.

Risk Management

In volatile markets, upfront yield allows users to lock in their yield at current rates, mitigating risks associated with future rate drops or adverse market conditions.

Elimination of PvP Competition

Users do not compete directly against each other for higher APYs. Since the yield is provided upfront based on predetermined conditions, there is less of a PvP dynamic, allowing for a more predictable and stable yield environment.

Flexibility

The ability to take advantage of market opportunities without waiting for yield to accrue over time is particularly valuable in fast-moving markets where timing is critical.

No Liquidation Risk

Unlike traditional yield farming and staking, which often involve liquidation risks, upfront yield strategies eliminate this risk by providing yield upfront without the need for leverage.

Possum Value Proposition

The protocol’s value proposition lies in its comprehensive approach to creating a sustainable upfront yield model that addresses the pitfalls seen in earlier projects. Unlike Flashstake, which struggled with long-term sustainability, Possum’s Portals are designed to be self-sustaining through community funding, arbitrage mechanisms, and yield accrual, ensuring ongoing liquidity and user rewards. Additionally, Possum integrates this with a broader ecosystem of positive-sum products that align incentives between users, funders, and the protocol itself, fostering a more resilient and community-driven financial model. This holistic approach differentiates Possum from its predecessors by focusing on sustainability, community engagement, and long-term value creation.

Chains

Possum is deployed on the Arbitrum network, for faster transactions and lower fees while maintaining the security and decentralization of Ethereum.

Using the Protocol

Using Portals for Upfront Yield

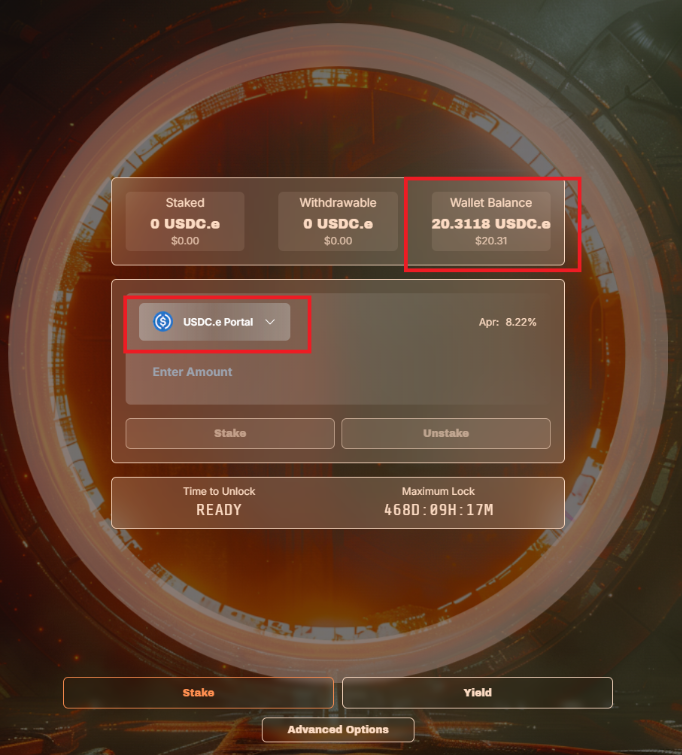

Step 1: Choose an asset you wish to deposit (e.g.,$HLP, $ETH, $WBTC, $LINK, $USDC.e).

Step 2: Go to the Portals Interface and select the Portal corresponding to your asset.

Step 3: Deposit your yield-bearing asset into the Portal. Upon depositing, you will immediately unlock available as CREDIT PE of the staked asset. More PE is accruing every second, leading to a surplus if users don‘t withdraw upfront yield. Surplus PE can be exchanged to PSM without locking staked tokens, effectively representing the ongoing yield.

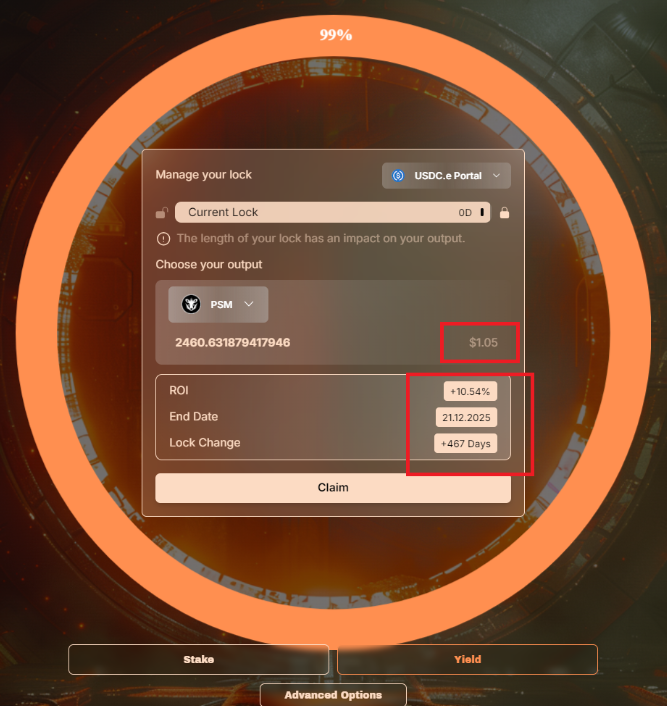

Step 4: Navigate to the Yield section and toggle the Current Lock interface to determine your ROI based on the lock time.

Step 5: Claim your upfront yield immediately. While $PSM is recommended, a user can claim with any of the supported assets.

Unstaking from Portals

To unstake from Portals, users must recharge the PE worth of the assets staked in $PSM. Although immediately after claiming yield on a specific portal, the PE will accrue for the total time staked and will eventually repay itself after the selected Lock Period.

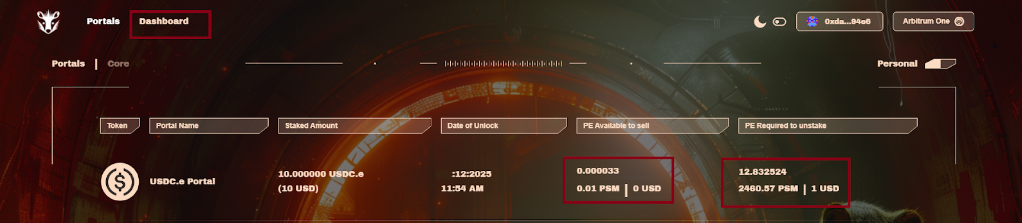

The Dashboard gives an overview of the asset and amount staked, PE Accrued, and the PE required to unstake from the Portal.

To unstake immediately, users must recharge the portal with the total $PSM required. The only asset required to unstake is $PSM. This is part of the underlying flywheel of the Possum ecosystem that increases demand for $PSM, thereby increasing its value. This also reduces staking with mercenary capital.

The asset becomes Withdrawable and available for unstaking once the required $PSM has been recharged.

After unstaking your assets, the SURPLUS PE remains available, ensuring the user never loses yield that is rightfully theirs.

Using the Time Rift

- Step 1: Deposit $FLASH tokens into the Time Rift to earn $PSM. Staking $FLASH will lock the tokens for a minimum of 90 days.

- Step 2: During the staking period, accrue Energy Bolts, which can be distributed to whitelisted addresses in the Possum ecosystem, increasing your $PSM claim balance.

- Step 3: After 90 days, you can claim $PSM based on your conversion balance, or you can continue staking to increase your rewards by bolting frequently.

Business Model

Possum Labs’ business model revolves around the utility of $PSM as the ecosystem’s core currency, with the value being created through its usage and the overall growth of the Possum ecosystem.

The protocol’s design does not involve revenue extraction or fees from users. Instead, $PSM’s fixed supply ensures that as demand for the token increases with the growth of the ecosystem, the value of $PSM rises accordingly. This model contrasts with traditional DeFi protocols that rely on fees or other revenue streams.

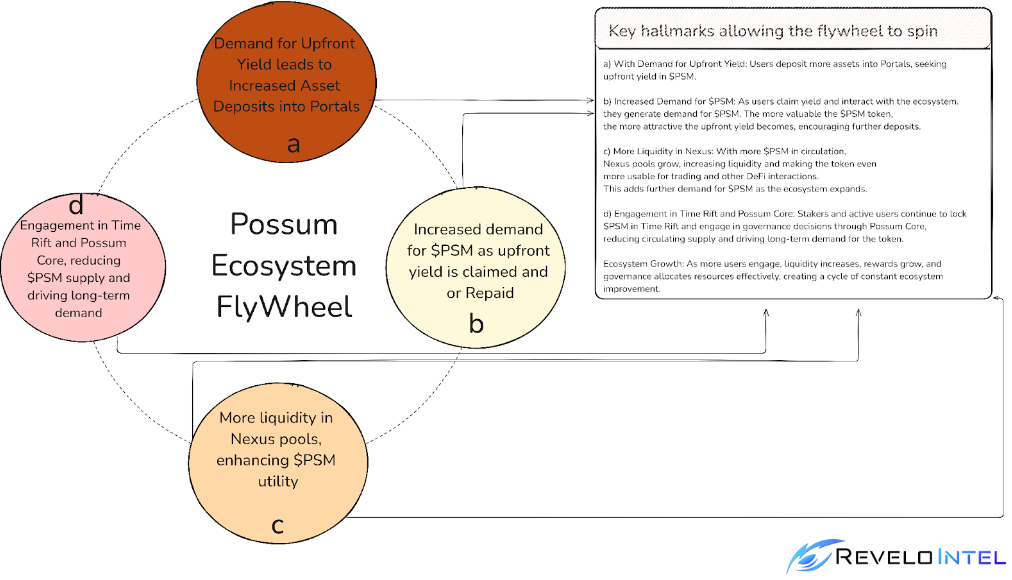

Possum Ecosystem Flywheel

Fee Breakdown

There are no protocol fees within the Possum ecosystem. The only cost to users interacting with the protocol comes from blockchain gas fees.

Tokenomics

The $PSM Token

The $PSM token is the native utility token of the Possum Ecosystem. It is designed to serve as the central currency for all products and protocols within the platform. It is crucial to the operation and growth of the Possum ecosystem. $PSM is used to pay upfront yield to depositors. This allows users to receive future yield instantly when they deposit yield-bearing assets into a Portal. It is designed to avoid value extraction from users. There are no protocol fees or dividends associated with holding $PSM and the token’s value is purely linked to its utility within the Possum ecosystem. Utilities of $PSM include:

- Funding Mechanism: $PSM is used by funders to bootstrap the liquidity of new Portals. In return, funders receive bTokens, which can later be redeemed for $PSM.

- Arbitrage Mechanism: $PSM is essential in the arbitrage process within Portals. Arbitrageurs can buy the yield accrued in a Portal by paying a fixed amount of $PSM, which helps replenish the Portal’s liquidity and supports ongoing yield payments.

- Possum Core: $PSM will play a role in Possum Core, the governance and capital allocation system. Stakers will earn rewards in $PSM and use it to influence budget decisions within the ecosystem.

- Possum Nexus: $PSM is the common base currency of all liquidity pools and facilitates efficient on-chain routing.

$PSM is integrated across all Possum Labs products, creating a unified currency that captures the utility value of the entire ecosystem. This integration is designed to align the incentives of users and token holders, as the success of the ecosystem directly impacts the value of $PSM.

$PSM had no presale, premine, or lockdrop. All tokens were made available to the public at the same time. This approach aligns with the project’s goal of building a fair and community-driven system.

By avoiding private sales or early access, Possum Labs ensures that tokens aren’t used as exit liquidity, maintaining fairness for all participants.

Token Distribution

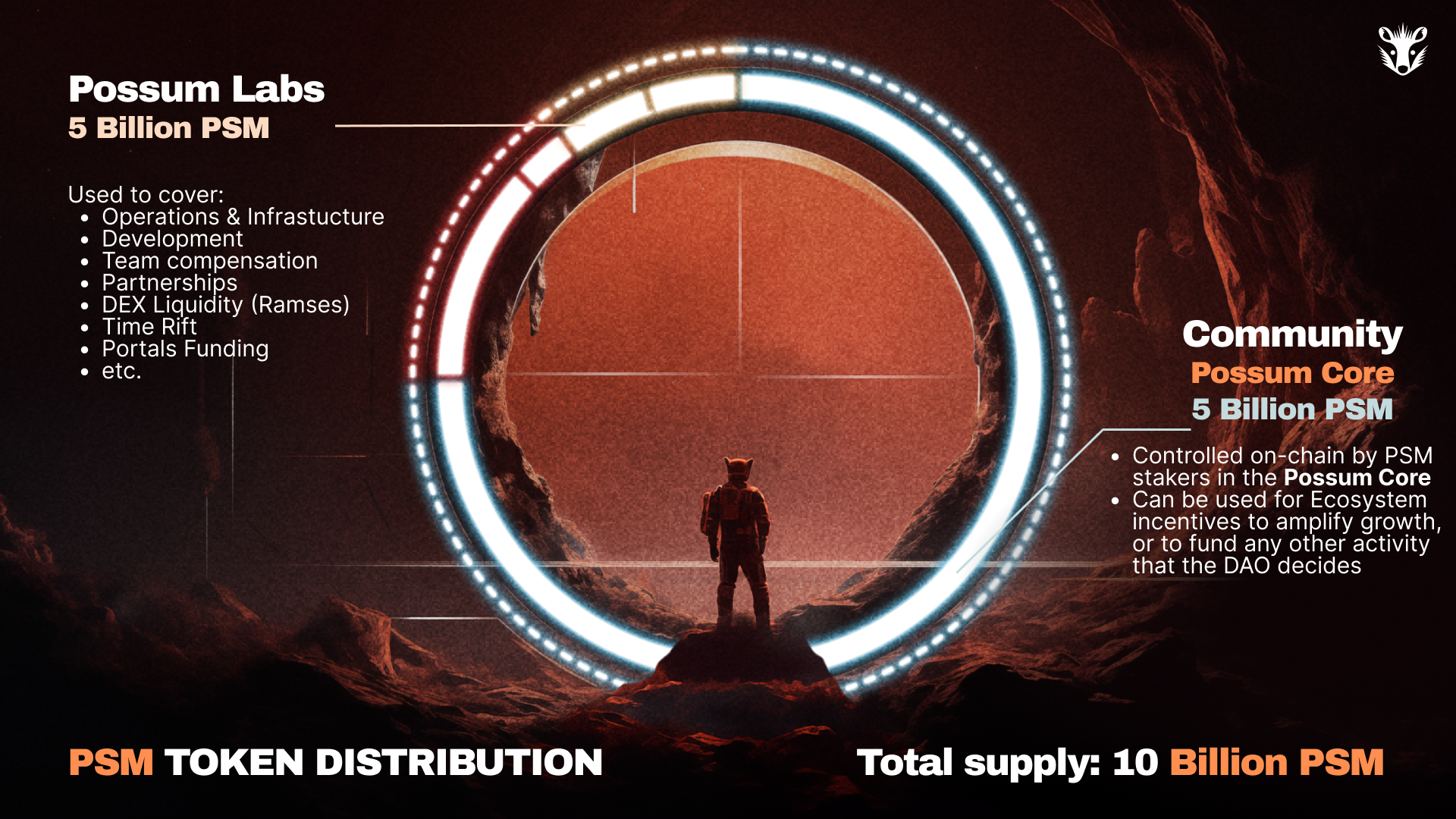

The total supply of $PSM is 10 billion tokens. Half (5 billion $PSM) is controlled by Possum Labs to fund operations, development, partnerships, team compensation, DEX liquidity, Time Rift, and Portals funding.

The other half (5 billion $PSM) will be managed by the community through Possum Core. These tokens will support ecosystem growth and other community-decided initiatives. With no dividends or voting rights, $PSM’s utility is tied to the performance and adoption of Possum Labs’ products.

Governance

Governance in the Possum Ecosystem is handled through Possum Core is built on the principle of community ownership. By allowing stakers to earn and distribute CF, the system ensures that all $PSM token holders have a say in how funds are allocated. Governance power is distributed based on active participation, which means that the more involved a participant is, the more influence they can wield. Most notably, the Possum Founder’s decision to return all of his allocated $PSM tokens aligns with the overall mission of decentralization by relinquishing control over a significant amount of tokens. This change meant the Possum Core V1 had a larger pool of 588M $PSM tokens, available for stakers to allocate and govern.

Risks

Third-Party Smart Contract Risk

Portals are integrated with protocols like HMX and Vaultka, which themselves could harbor hidden vulnerabilities. Any malicious attack to these external protocols could directly jeopardize user funds. The reality is clear: users must remain vigilant, as the consequences of a single flaw could be catastrophic.

Market Risk

Staked assets in Possum Portals are not immune to the inherent risks of volatility and sudden market shifts, which can result in significant financial losses for users with restricted access to their funds. $PSM could face severe price fluctuations, making it difficult, if not impossible, for users to repay their time-debt or access liquidity. In extreme cases, users may be forced to endure the entire lock duration before recovering their capital. This situation is compounded by the potential for liquidity shortages in $PSM, making swaps and redemptions impractical or economically unviable. Additionally, the underlying protocols—HMX and Vaultka—carry their own operational risks, including the possibility of bad debt or unprecedented trader profitability, which can impact yields and asset values. Users must understand these economic risks fully before committing.

Centralization Risk

Staking assets in Possum Labs Portals may face risks from centralized control, including blacklisting and custodial issues, such as with $USDC.e and $wBTC. Upgrades to staked assets like $HLP or the underlying protocols (HMX and Vaultka) can disrupt compatibility and cause a total loss of user funds. Possum Labs cannot influence the decisions made by these centralized managers, and due to the immutability of Portals, they cannot adapt to changes, leaving users vulnerable to these risks.

Security

Audits

Possum Labs has prioritized security through comprehensive audits for its protocols.

- Possum Core underwent two audits by Mahdi Rostami and Mario Poneder, both experienced auditors.

- Portals v1 was audited by Shieldify, Sayfer and a competition on Hats Finance.

- Portals v2 was audited by Hacken and Shieldify.

- Time Rift underwent a pay-per-vulnerability competition organized by Shieldify, where 15 auditors participated, finding only one low-severity issue.

Team

Some founding members of Possum Labs include:

FAQ

Portals

Is there a way to stake PSM tokens?

Not yet, but the upcoming Possum Core will allow PSM staking. For more details, check the Possum Core deep dive here.

Why buy, hold, or farm $PSM?

Possum Labs uses $PSM as the core currency for its DeFi ecosystem. As the protocols and products expand, $PSM’s utility grows.

Where does Portals’ yield come from?

The yield comes from the underlying protocol’s yield-generating pools. Initially, funders provide liquidity in exchange for bTokens, and over time, the yield becomes self-sustaining.

What risks are involved with using Possum Portals?

There are two layers of risk: smart contract risks from the yield source projects and the smart contracts of the Portals themselves. However, unlike other DeFi products, there is no liquidation or counterparty risk in Portals. Centralization and economic risks may vary depending on the staked assets.

How much upfront yield can I claim from Portals?

The amount depends on the state of the Portal’s internal liquidity pool. Portal Energy (PE) is exchanged for PSM. The easiest way to check is through the Portals frontend at portals.possumlabs.io.

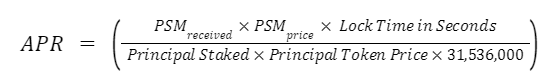

How is the APR calculated?

1 staked token for 1 year generates 1 Portal Energy (PE). PE is sold for PSM, which has a market value in USD. The APR formula is:

Who is the counterparty for upfront yield stakers?

Three groups act as counterparties:

- Yield speculators who buy PE, expecting future yields to increase.

- Portal funders who provide PSM for upfront yield.

- PSM holders collectively, as the circulating supply increases when PSM is paid out as upfront yield.

Why use Possum Portals instead of directly staking in the underlying protocol?

Portals offer the benefit of upfront yield without liquidation risk, unlike traditional lending. You can unlock capital anytime by repaying the unearned yield, functioning as a loan with no compounding borrowing costs.

Can a Portal run out of $PSM tokens?

Theoretically, yes, if all $PSM tokens are paid out as yield. However, the internal PE/PSM liquidity pool and arbitrage opportunities help maintain and refill liquidity.

How can I become a funder for a new Portal?

Acquire PSM and deposit it during the funding phase to receive bTokens, which can be redeemed for PSM later. Reward rates vary for each new Portal, so follow announcements for updates.

Time Rift

Does the 90-day timer reset with each $FLASH deposit?

Yes, the 90-day timer and the APR reset each time you deposit FLASH.

What is the conversion balance/claim balance?

The claim balance shows how much PSM you can withdraw after the 90-day staking period. It increases with each distribution of Energy Bolts.

How does bolting daily improve my APY?

Distributing Energy Bolts increases the amount of Energy Bolts generated, compounding the growth of your claim balance. The accrual rate starts at 150% APR but can grow to 340% APY with daily bolting.