Overview

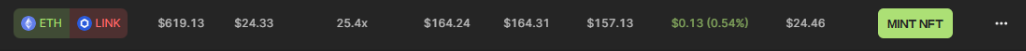

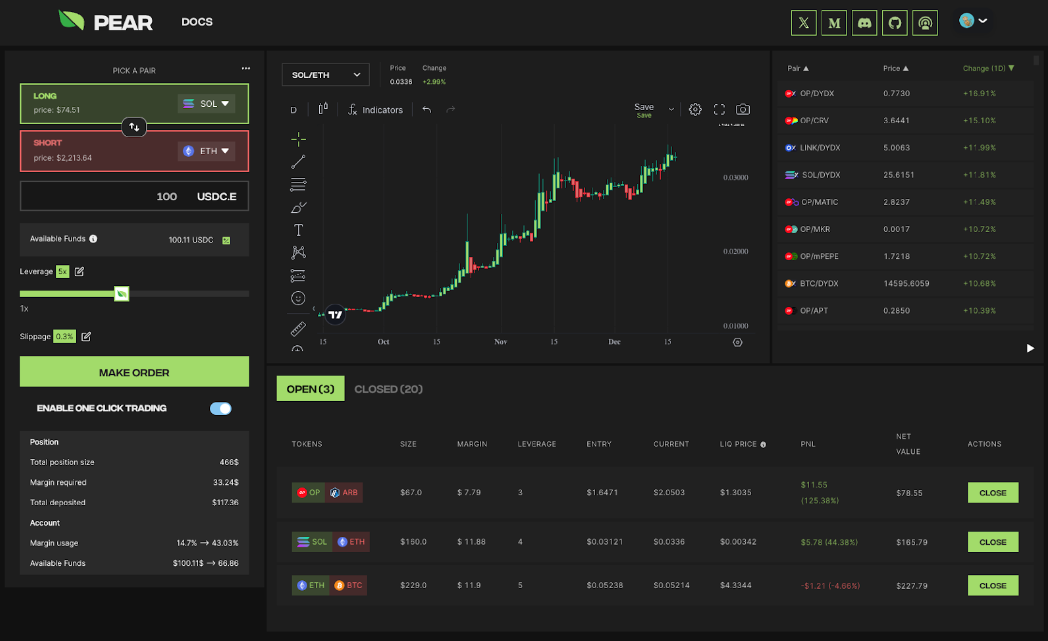

Pear Protocol offers an all-in-one decentralized exchange (DEX) for pairs trading. Traders can choose between Cross or Isolated margin mode, adjust leverage levels, and set their own slippage tolerance to trade any token against any other.

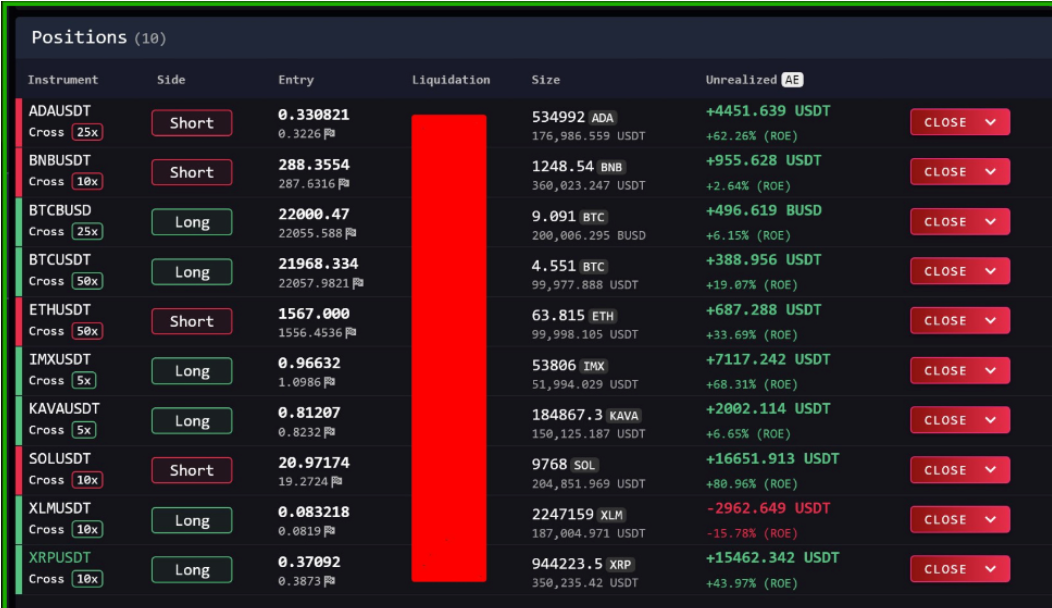

Historically, pairs trading has been prevalent in traditional markets, allowing traders to make narrative and thesis-driven decisions as well as achieve market-neutral positions. Due to its volatility, the importance of narratives, and social sentiment, crypto offers a great playground to execute some of the most common strategies used in pairs trading. However, most traders right now face issues such as capital inefficiency, operational complexity, and difficulties in execution on both centralized exchanges (CEXs) and on-chain platforms (deposit margin for two separate positions, track two different liquidation thresholds, pay for fees twice, etc.).

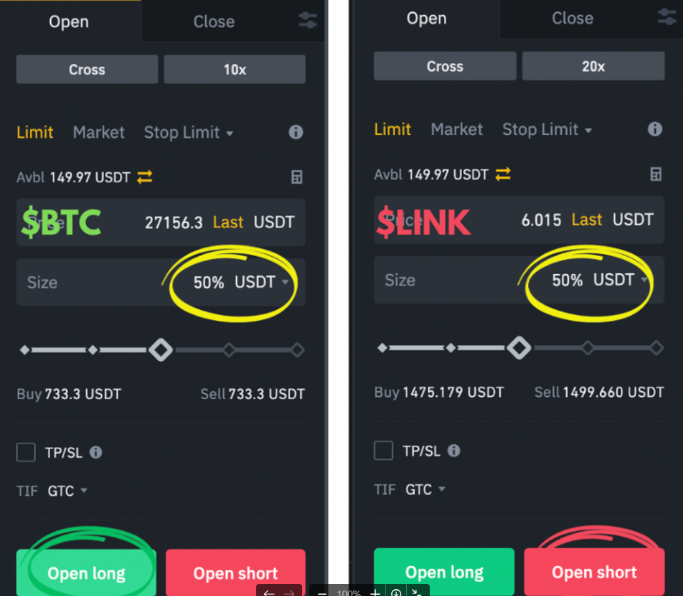

First off, opening up a pair trade already presents a significant hassle. Traders need to navigate through several steps and screens to open individual positions for each asset in the pair. This includes selecting leverage, allocating collateral, and specifying the long and short positions separately.

However, due to the time taken between opening the first and second positions in a pair trade, there’s a risk of slippage. The market price for the second position could change unfavorably by the time it’s executed. Each position (long and short) may also require separate collateral, complicating margin management, especially on exchanges that don’t support cross-margining for all trades.

When it comes to portfolio reconciliation, keeping track of multiple pair trades, each with its own long and short legs, can be cumbersome. Traders must navigate through their portfolio to monitor each position’s status, which may not even be paired together making it harder to track. PnL calculation has to be done manually too by calculating the difference in PnL of both legs of the pair.

Additionally, on exchanges that do not support cross-margin, opening pair trades becomes very capital intensive: 50% has to be specifically allocated to 1 leg and 50% to the other.

Pear Protocol addresses these challenges head-on by offering a capital-efficient, user-friendly, and accessible platform for pairs trading. By offering a dedicated trading platform specialized on this use case, traders can capitalize on market sentiment and the narrative rotations that usually inform their trading decisions.

Pear Protocol is integrated with 3 different trading engines and liquidity sources – GMX, Vertex and SYMMIO for each of their 3 different order types – Isolated, Cross, Intent-based, respectively. This is possible because Pear’s engine is liquidity agnostic, meaning that it can integrate and operate across various on-chain trading engines and liquidity pools (from GMX’s GLP to Vertex’s Edge order book and SYMMIO’s intents).

Pear offers both cross margin (through Vertex) and isolated (through GMX) margin modes, making it possible for users to tailor their risk exposure according to their preferences and trading strategies. In addition to that, it also offers an intent-based RFQ system, expanding the assets and amount of leverage that can be offered. We will delve into each of these trading modes in the sections below.

Introduction to Pairs Trading

Pair trading is frequently used in traditional finance, where it is often used to construct market-neutral trading strategies that involve simultaneously buying and selling two highly correlated financial instruments. However, pairs trading doesn’t necessarily mean “market neutral”, as it can also be used to capitalize on news or specific market opportunities that cause one asset to outperform relative to another.

The core idea behind pairs trading is to capitalize on the relative performance of two assets rather than predicting the direction of the market as a whole. This dual approach often hinges on the statistical expectation that the price differential between the paired assets will revert to its historical mean, thereby generating profit. The strength of pairs trading usually lies in its reliance on mean reversion and the hedging of industry-specific or market-wide risks. However, pair trading can also be directional when it involves a clear directional bias based on broader markets or sectoral trends, which will be explained further below.

Pair trading thrives in inefficient or immature markets, and there are plenty of opportunities to take advantage of inefficiencies in crypto markets compared to traditional markets. The reason for that is because crypto is a nascent industry where liquidity is fragmented across numerous exchanges, each with its own depth and order book dynamics. Opting for pair trades provides several benefits for investors, including:

- Profiting regardless of market conditions: Pairs trading is designed to be indifferent to the general market movements. Profits are derived from the relative performance of the two assets rather than the market’s direction, making it an attractive option during both bullish and bearish markets.

- Diversification: Pairs trading can add diversification to an investment portfolio, offering a different risk-return profile from traditional long-only investments or other types of trading strategies.

- Plenty of market inefficiency opportunities: This strategy thrives on the market’s temporary irrationality, allowing traders to profit from the inevitable correction as the prices of the paired assets return to their historical relationship.

However, a strategy like this also comes with its challenges:

- Identifying Suitable Pairs: This is the biggest challenge when it comes to pair trading. Identifying suitable pairs and determining the optimal timing for trades requires sophisticated statistical analysis, insider or fast access to new information, and a deep understanding of both the assets involved and broader market conditions.

- Execution Risk: The success of pairs trading hinges on precise execution. Delays in opening or closing positions can end up eroding potential profits.

- Model Risk: When automated or done algorithmical with strategies such as statistical arbitrage, the efficiency of the trade depends heavily on the reliability of statistical models, which are used to identify pairs and predict their price relationship. Any flaws in the model, such as overfitting to historical data, can lead to inaccurate predictions and losses.

There are 3 core ways to interact with Pear Protocol – Isolated margin through GMX, cross margin through Vertex, and Intents through Symmio.

Isolated Margin

For isolated margin positions, Pear Protocol sources liquidity from GMX v2. Therefore, it is restricted to its underlying asset pairs and amount of leverage, which is15markets ($BTC, $ETH, $LINK, $UNI….) and 50x respectively. Note that one leg of the pair trade can be liquidated while the other remains open, and the trader is also exposed to GMX’s fees.

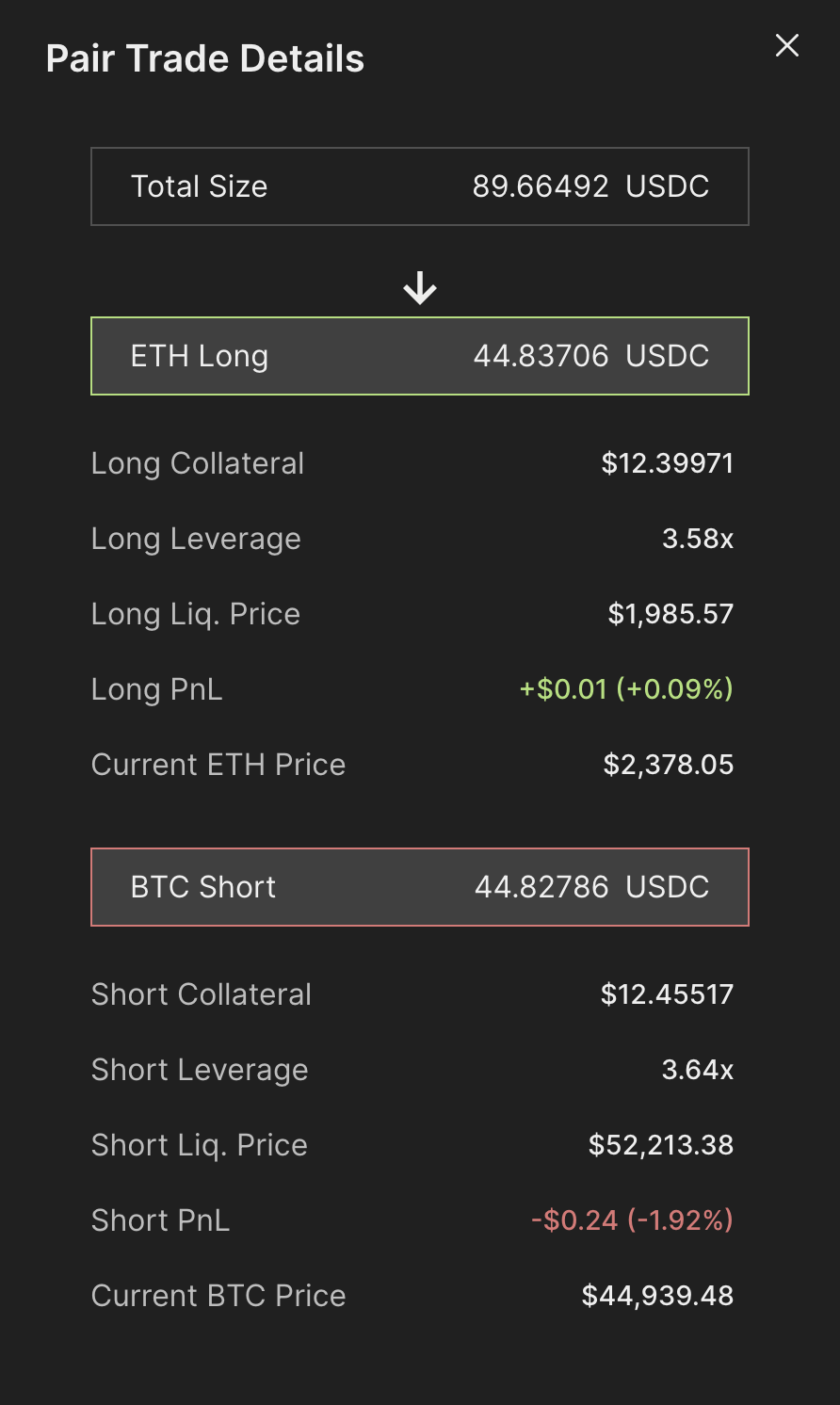

In isolated margin mode, users allocate half of their collateral to the long position and half to the short position of a specific pair trade. For instance, if a user enters a $100 long position with 10x leverage on an ETH/BTC pair trade, $50 of collateral is allocated to the long $ETH perpetual (leveraged at x10) and $50 to the short $BTC perpetual. This ensures that collateral is isolated and specific to each position, minimizing the risk of losses spreading across multiple trades.

Cross Margin

Cross margin entails sharing collateral between both legs of the pair trade. If a user enters a $100 long position with 10x leverage on an ETH/BTC pair trade, the $100 collateral is evenly split between the long and short positions initially, and any surplus collateral from one leg can automatically be utilized to meet margin requirements on the other leg. This approach provides greater flexibility and efficiency in managing margin requirements, especially in volatile market conditions.

Note that Pear Protocol currently does not offer portfolio-level margin, meaning gains from one pair trade cannot offset losses on another pair trade elsewhere in the user’s portfolio.

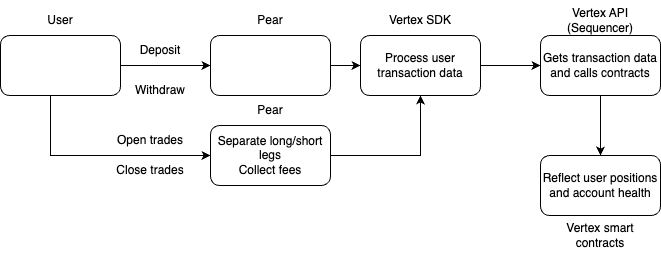

Cross-margin is enabled via an integration with Vertex, leveraging its off-chain CLOB and trading engine. This makes it possible to offer all trading pairs available on Vertex with their predefined leverage levels.

Intent-Based RFQ

Intent-based trading is possible through an integration with Symmio, connecting traders on one side with market makers on the other. This is achieved by entering bilateral agreements between both parties, who post collateral into an escrow contract.

The core of Symmio’s architecture is built around Symmetrical Contracts, inspired by traditional finance’s bilateral agreements but adapted for the decentralized world. These contracts allow for peer-to-peer over-the-counter (OTC) deals, effectively sidestepping the liquidity fragmentation seen across numerous DEXes and blockchains. Through an Automated Market for Quotation (AMFQ), it allows users to request quotes, reducing the complexity of on-chain orderbooks in a trust-minimized way. On the other side of the trade, market actors called “Hedgers” will provide the necessary liquidity to fill users’ orders. Meanwhile, economically motivated actors (Arbiters) will perform checks for verifying solvency and mediating disputes.

In a non-blockchain setting, intents are a concept that refer to the desire or want for something to happen. The ending is likely to be specified, but not the how and where to find it. Applied to blockchain terms, there is a desired end state (i.e. in Pear a user wants to go long a certain number of tokens and short another number of tokens) but the exact path or trace to follow about how to reach that end is not specified (professional and sophisticated market makers will take care of that).

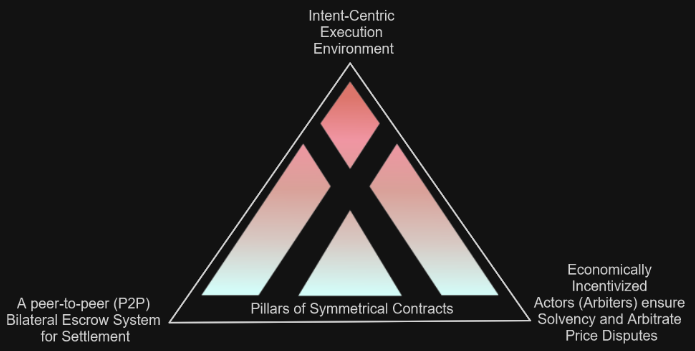

There are four key pillars in place within the system to sustain this premise:

Bilateral: Hedgers and users are bilaterally and immutably locked into a trade. There are no backdoors or special treatments for Hedgers. Once engaged in a trade, both parties are bound by the terms of the agreement.

User-Centric Design: Hedgers cannot prematurely close a trade; they can only sell or transfer it to another party. The ability to initiate a close request lies solely with the user, giving users control over their positions.

Peer-to-Peer: The protocol operates purely on a peer-to-peer assumption, with both parties being treated equally during insolvency situations. If a Hedger fails to provide sufficient collateral, they face the same risk of liquidation as the user.

Economic Incentives through Punishable Disputes: Hedgers are compelled by design and economic incentives to honor a user’s closing request. Failure to do so can result in streamlined disputes. These dispute mechanisms ensure that there are clear consequences for not abiding by the rules.

Intent-based systems ensure that users can achieve their transaction goal (e.g., acquiring the maximum amount of a target coin) more effectively than traditional, manual methods. Apart from significantly better user experience, intent-based systems also offer Maximum Extractable Value (MEV) protection. MEV represents the profit that block proposers can make by reordering, inserting, or censoring transactions within a block. MEV has implications for fairness and efficiency in blockchains, as it can lead to front-running, back-running, and other forms of transaction manipulation that can disadvantage regular users.

In addition to MEV protection, intent-based trading systems also provide users with a much wider range of assets. Solvers in intent-based systems work across multiple exchanges, hedging their quotes to find the best routes and pools of liquidity. This means that even if a specific asset isn’t widely available on one platform, the system can aggregate liquidity from several sources, making it easier for users to trade in less commonly traded assets.

To understand how Symmio is integrated with Pear Protocol, let’s go through the entire process, from a user placing a trade to the execution of that trade using Symmio intents.

Step 1: User Places a Trade

The journey begins with a user depositing collateral into the Symmio contracts. This collateral is crucial for initiating trading and is allocated to a subaccount that isolates each trading instance.

When the user decides to place a trade, instead of specifying the exact transaction details, the user expresses their trading intention or “Intent.” This Intent includes various parameters such as the type of position (long or short), the symbol (asset), desired price, quantity, and other trade-specific details like leverage or duration. The intent does not dictate how the trade should be executed but rather outlines what the user wants to achieve.

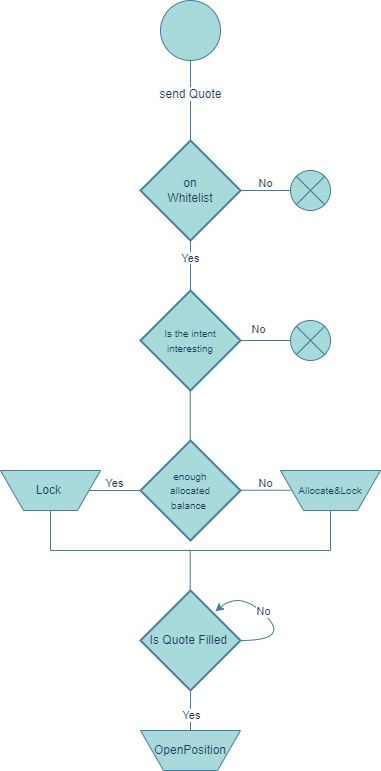

Step 2: The Intent Engine

Once the user submits their Intent, it is broadcast to the network. This Intent acts as a signal to potential liquidity providers (Hedgers) about the user’s desire to trade.

Hedgers monitor incoming Intents. They evaluate these based on their capabilities, inventory, and risk management strategies to decide whether they can and/or want to fulfill the Intent.

A Hedger who decides to take on the trade will “claim” the Intent. This action is essentially the Hedger expressing their willingness to fulfill the user’s request under the specified conditions.

Step 3: Execution Environment and Matching

Upon claiming an Intent, the Symmio system sets up a bilateral escrow mechanism between the user and the Hedger. Both parties lock in collateral to secure the trade, mitigating counterparty risk.

While the trade parameters are established on-chain through the Intent and escrow, the actual matching and execution of trades can happen off-chain. This approach allows for a more scalable and cost-effective system, as it reduces the burden on the blockchain network.

The Symmio intent engine works in the background to match the user’s Intent with the Hedger’s offer. This process considers various parameters beyond price, ensuring a more nuanced and precise match that aligns with the user’s trading goals.

Step 4: Finalizing the Trade

Once a match is found and both parties agree to the terms, the trade is executed. This process involves the transfer of assets according to the trade conditions, with Symmio’s backend overseeing the transaction to ensure compliance with the agreed terms.

The collateral locked in at the beginning is used to settle the trade. If the trade is successful, the collateral is returned or redistributed according to the profit and loss outcome of the trade.

In cases where the trade does not go as planned, either due to market volatility or other factors, the Symmio system includes mechanisms for liquidation and dispute resolution. This may involve third-party arbitrators or decentralized oracles to provide fair outcomes for both parties.

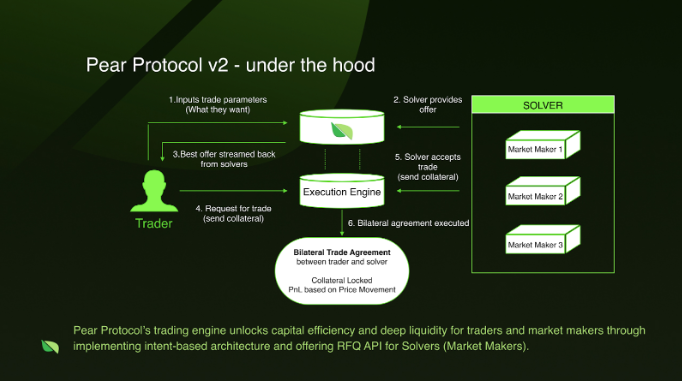

To summarize:

- Users express their trading preferences through an intent – long one asset and short another with a specific amount of collateral.

- Solvers monitor users requests and offer quotes that satisfy their preferences (intent).

- The best offer is streamed back to the user.

- The user submits the collateral to an execution engine and enters a bilateral agreement with the solver.

- The solver accepts the trade by also sending collateral to the execution engine.

- A bilateral agreement is settled on the execution engine, locking the collateral of both parties and adjusting their PnL based on price movements of the pair trade.

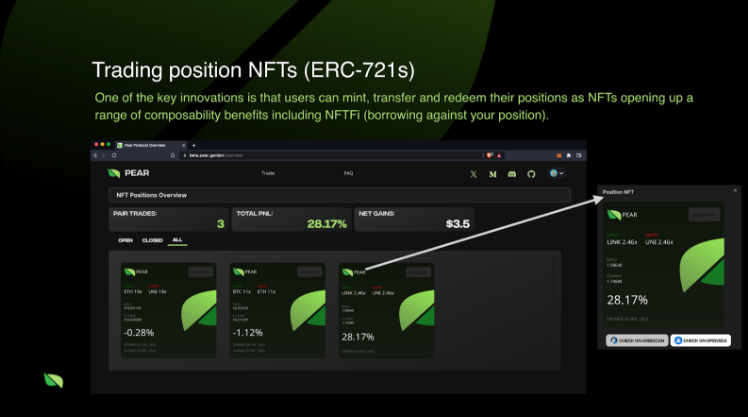

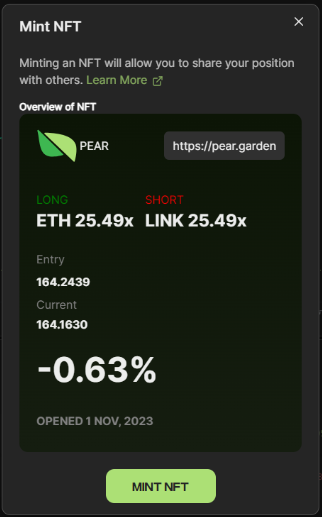

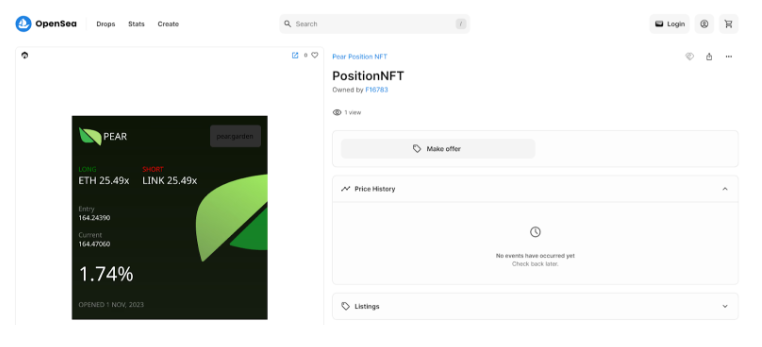

Tokenized Trading Positions

In Pear, all isolated trading positions can be tokenized as NFTs since both legs (long & short) are considered 1 trade. Due to the multiple combinations of assets and amounts, this position is non-fungible.This opens up a broader range of use cases thanks to the composability of DeFi, such as moving positions across wallets or borrowing against your tokenized position.

Tokenizing these positions is useful in situations where the users are managing a treasury or fund. The ability to create trades and seamlessly transfer them to a centralized treasury wallet or multisig significantly enhances operational security and simplifies reporting. These positions can be transferred from the trader opening the trade to any other party’s wallet, which allows for delegated trading, broadening the accessibility and collaborative potential of trading strategies. Tokenized positions also enhance portability since NFTs are transferable allowing for the flexibility of trading on-the-go. Positions can be opened using hot wallets and securely transferred to cold wallets, offering both convenience and security.

The tokenized positions provide traders with a convenient way to view essential data such as current profit and loss, trade date, tokens involved, and prices.

These positions can also be sold on secondary marketplaces like Opensea or Zora to sell attractive entry points to other traders.

Why the Project was Created

The motivation behind the creation of Pear stems from the inefficiencies and complexities inherent in current methods of pair trading within the crypto. Existing platforms (both centralized and decentralized) often lack streamlined processes for capturing trading opportunities arising from market narratives. This operational and cumbersome process makes it difficult to capitalize on news or catalyst events favoring specific assets or market sectors over others.

While Pairs Trading does exist in crypto, it is still a cumbersome and expensive process. Pear aims to address these challenges by providing a user-friendly platform specifically designed for pairs trading. By offering a solution that caters to both retail and sophisticated traders, Pear Protocol seeks to enable users to easily capture market narratives as well as exploit market inefficiencies and correlation breaks in one click.

For example, should the market sentiment favor $SOL, the trade idea would be to long $SOL and short a benchmark to hedge usual market movements, say $BTC or $ETH. The aim is to profit from the ‘spread’ between the two assets, and price appreciation should $SOL outperform.

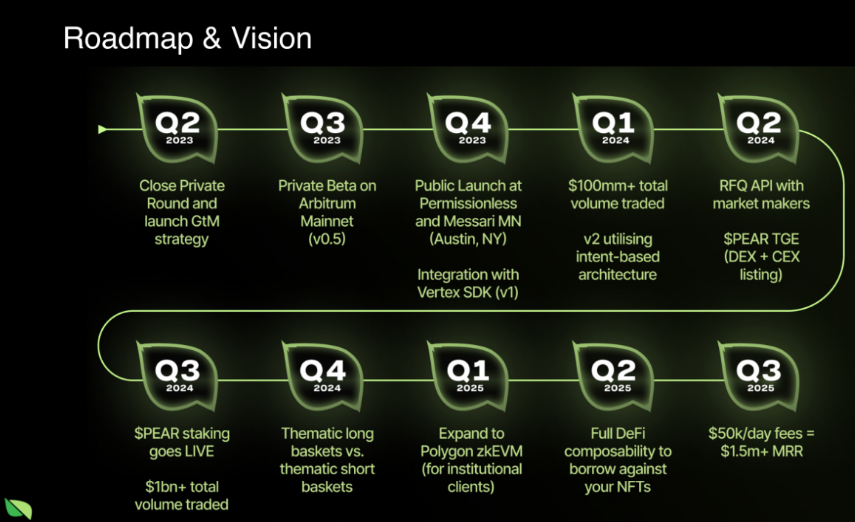

Pear protocol is currently the only platform that allows you to conduct pair trades from a single UI in 1 click using leverage. Their protocol design enables seamless integration with an array of on-chain liquidity sources and DeFi platforms as well as the ability to scale cross-chain and facilitate pair trading across multiple chains. Pear also has various product improvements within their roadmap to further extend their first-mover advantage by improving their pair trading product and making it more intuitive for all.

Roadmap

- Creating borrow markets against a tokenized trading position within NFTFi platforms such as Pine or DeFrag. This process unlocks additional liquidity from investments without needing to close potentially profitable positions. It allows traders to leverage their existing positions to enter into new trades or cover operational expenses, enhancing their capital efficiency.

- Ability to close one leg of the trade and keep the other one running. This feature allows traders to react more dynamically to market developments. If a trader believes that one asset in the pair (e.g., $SOL in SOL/ETH) will perform strongly while the other (e.g., ETH) might not decline as expected or might even rise, closing the weaker or riskier leg (ETH short) while maintaining the stronger leg (SOL long) can optimize the trade’s outcome. This not only optimizes risk, but improves capital efficiency by allowing traders to free up capital to pursue more profitable opportunities outside the pair since Pear does not support portfolio-level margin.

- Choose a gradual exposure and non 50/50 position, such as go long 80% $BTC and short 20% $ETH – assigning different weights to each leg. By adjusting the weightings of the long and short positions, traders can tailor the risk-reward profile of their pair trades to match their market outlook and risk tolerance. For example, going long 80% on $BTC and short 20% on $ETH might reflect a strong bullish stance on $BTC relative to $ETH.

- Pair trading vaults for users to deposit into, fostering a more socialized approach to generating pair-trading returns. This approach works essentially as a copy trading mechanic whereby users deposit into vaults run by other users and share a percentage of the PnL.

- Thematic baskets where users can go long a basket of say, AI tokens vs. short another asset like $ADA. This feature allows traders to capitalize on broader market trends or sentiments by going long on sectors or themes they believe will outperform and shorting those they expect to underperform.

- Dynamic rebalancing of positions based on certain parameters (beta, correlation, cointegration, etc.).

- More collateral assets beyond just $USDC

- Advanced execution types including VWAP and TWAP to appeal to larger institutional funds that are looking for efficiently engineered market-neutral trading by minimizing the market impact of their trades. These execution strategies help in achieving better prices by spreading the trades over time or according to volume, thereby reducing slippage and improving the overall entry and exit points for large orders.

Pear Protocol is also focusing on growth through education and marketing:

- Releasing a series of educational videos on pair trading

- Paid media with Blockworks including 0xResearch, Blockworks Webinar, and DAS London 2024

- Twitter growth via Spaces, RT’s and threads from key integration partners

- KOL campaigns with crypto twitter traders who appeared on their Crypto Narratives Podcast.

- Launch of a point-based system to qualify for $PEAR tokens

Sector Outlook

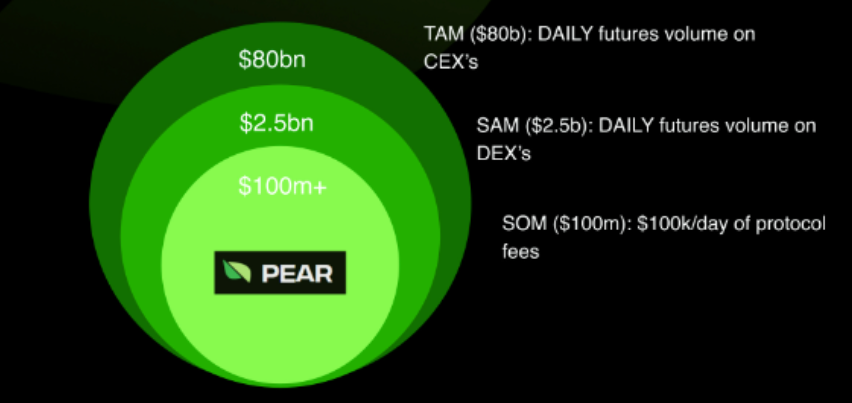

The sector outlook for derivatives trading in crypto indicates a significant volume disparity between derivatives and spot trading, with derivatives volume vastly surpassing spot volume. Centralized Exchanges (CEXs) dominate the derivatives market, while Decentralized Exchanges (DEXs) represent a smaller portion, particularly in perpetual futures trading on-chain.

Historically, dYdX led the DeFi perpetual futures market, operating on Ethereum before transitioning to an application-specific chain built on StarkEx and later migrating to Cosmos with v4 and the dYdX Chain. However, the rise of Layer 2 (L2) solutions and alternative Layer 1 (L1) networks with lower fees has propelled on-chain derivatives trading. Innovations like GMX on Avalanche and Arbitrum have demonstrated the feasibility of leverage trading against liquidity pools with minimal price impact, although challenges remain, such as high trader fees, capped open interest, and limited asset diversity. Most recently, other solutions have emerged to address these challenges, offering off-chain order books or intents with on-chain settlement. Platforms like Aevo, Hyperliquid, IntentX, and Vertex among others aim to provide a user experience resembling CEXs while retaining the benefits of non-custodial exchanges.

However, all current platforms focus on single-asset perpetual futures settled in stablecoins like $USDC or $USDT. Traders typically deposit a stablecoin as collateral to open leveraged positions on asset prices quoted in USD terms. However, this approach overlooks the potential for pair trading strategies.

Pear Protocol addresses this gap by enabling users to execute pair trades, such as going long on one asset and short on another, all in a single click. This functionality enhances user experience, expands trading opportunities, and adds more diversity to on-chain derivatives markets.

Narratives Trading

In crypto, narratives play a significant role in influencing market sentiment and asset values. These narratives, driven by stories, news, and events, shape perceptions and sentiment around certain tokens. Unlike traditional markets, the decentralized nature of the crypto market makes it highly susceptible to narrative influence. Positive narratives, such as technological advancements or strategic partnerships, can lead to increased demand and price surges, while negative narratives, like security breaches or regulatory crackdowns, can trigger sell-offs and price suppression. Identifying and understanding these narratives are crucial for traders and investors to navigate the market effectively.

Understanding the importance of narratives in crypto, Pear aims to provide a solution for efficiently capitalizing on market narratives through pairs trading. Current methods of pair trading on centralized and decentralized exchanges are often complex and capital inefficient, lacking a streamlined process for capturing trading opportunities arising from market narratives. By offering a platform specifically designed for pairs trading, Pear Protocol seeks to cater to both retail and sophisticated traders, enabling them to easily capitalize on market inefficiencies and correlation breaks while mitigating operational challenges and risks associated with existing trading methods.

Pairs Trading

Pairs trading on Pear Protocol offers a seamless on-chain experience for executing sophisticated trading strategies and capitalizing on market trends. By trading two assets against each other, users gain access to hedging and diversification opportunities.

Sophisticated traders can employ market-neutral strategies or exploit historical mean-reverting patterns on asset pairs with high positive correlation, presenting arbitrage opportunities. Pear Protocol supports a wide range of trading pairs, enhancing capital efficiency by allowing traders to open positions with collateral for both sides of the pair trade.

Furthermore, pairs trading also enables retail traders to engage in “narratives trading,” leveraging social sentiment and narratives to identify opportunities where one asset is expected to outperform another. For instance, traders can long $ETH and short $BTC during periods of heightened $ETH hype. Pear Protocol abstracts the need to own either asset, enabling traders to use stablecoins like $USDC as collateral for pair trades.

Each position created on Pear generates an ERC721 NFT, providing traders with visibility into the profit and loss of each pair trade. These NFTs can be traded on marketplaces or used as collateral for loans, enhancing capital efficiency and providing additional flexibility to traders. This emphasizes the unique use cases that can be unlocked with DeFi composability, all of which are out of the scope of CEXs.

Potential Adoption

The adoption of Pear hinges on its ability to capture an increasing market share in the volume and liquidity of Decentralized Exchanges (DEXs) relative to Centralized Exchanges (CEXs). Presently, DEXs are predominantly dominated by spot volume, primarily driven by asset swaps for memecoins or arbitrage opportunities, with on-chain derivatives representing a smaller portion.

Pear Protocol distinguishes itself by offering a unique value proposition not easily replicable on CEXs. Every position on Pear is tokenized as an NFT, enabling composability across DeFi and facilitating novel use cases such as subaccounts (by transferring pair trades across wallets) and social trading (by selling pair trades on NFT marketplaces like OpenSea or Blur).

Through its dedicated user interface, Pear becomes the sole platform facilitating narratives trading on-chain, without custodial risk and in a highly efficient and composable manner.

Chains

Pear Protocol will be initially deployed on Arbitrum, although it may support more chains in the future.

For Users

Pairs trading is often used as a strategic approach for traders seeking to capitalize on the correlation between two assets, essentially betting on one asset outperforming the other whereby you long one asset and short the other.

Pairs trading usually involves finding two highly correlated assets that tend to move together. This means that when one asset in the pair deviates from the other – either rising or falling out of step – you can look to profit from the likely mean reversion. This type of trading is also known as statistical arbitrage. Mean reversion is a statistical phenomenon observed in financial markets where the prices or returns of assets tend to move towards their historical mean or average over time. In pairs trading, this principle is applied by identifying two assets whose prices have historically moved together and are expected to continue doing so. When the spread—or the difference in prices—between these two deviates from its historical average, pairs traders see an opportunity. They anticipate that the spread will eventually revert back to its mean, allowing them to profit from this adjustment.

Reasons for Pair Trading

The primary reason for pair trading often stems from the ability to easily exploit pricing inefficiencies between two correlated assets. By identifying two assets that historically move together, traders can capitalize on moments when the price relationship between them deviates from the norm. This strategy is particularly appealing because it tends to be market-neutral, meaning it is designed to profit regardless of whether the overall market is going up or down.

However, pairs trading excels because of how versatile and flexible it is to be adapted to various market conditions, making it appealing under different market trends. Pairs trading can be effective in bull, stagnant (crab), and bear markets.

Bull Market

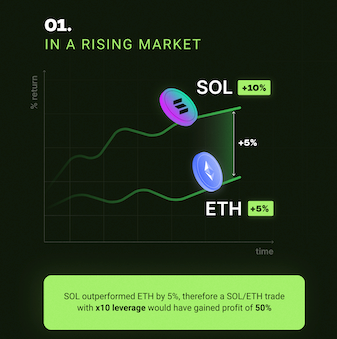

In a rising market, most assets may be trending upwards, but they do so at different rates. Pairs trading allows traders to capitalize on these discrepancies. By going long on assets that are expected to outperform the market or their sector (those with stronger fundamentals, better earnings, or more favorable market conditions) and shorting those that are likely to underperform or rise less rapidly, traders can profit from the relative performance, not just the overall market direction.

During a bull market, concerns about overvaluations become prevalent. Pairs trading provides a mechanism to hedge against potential corrections or overvalued assets by shorting them while still maintaining exposure to the market’s upside through long positions.

For example, suppose a trader identifies two assets, Asset A is a new project in a cutting-edge area with significant growth potential, and Asset B, while still solid, is in a more mature area with slower growth. In a rising market, both might go up, but Asset A might rise by 20% while Asset B rises by only 10%. By going long on Asset A and short on Asset B, the trader could potentially realize a return of approximately 10% on the pair, assuming other market and idiosyncratic risks are managed effectively.

Stagnant Markets

When the market is moving sideways or is in a consolidation phase, it can be challenging to achieve significant returns through traditional directional strategies (e.g. long-only). Pairs trading thrives in such environments by focusing on the relative movement between two correlated assets. Even if the overall market isn’t trending, the inefficiencies between pairs can be exploited for profit.

In a stagnant market, pairs trading reduces the dependency on market direction for generating returns. By focusing on the spread or price differences between two paired assets, traders can extract returns based on the convergence or divergence of these prices, irrespective of the broader market movement.

Bear Markets

Falling markets are often accompanied by increased volatility and uncertainty. Pairs trading can leverage this by shorting overvalued or fundamentally weak assets expected to decline more sharply and going long on those with stronger fundamentals likely to retain their value better or recover quicker. This strategy not only capitalizes on the downward movement but also helps in managing risk through diversification.

In bear markets, finding profitable opportunities through long-only strategies can be particularly challenging. Pairs trading allows traders to remain active and potentially profitable by using short positions effectively. By identifying pairs where one asset is expected to outperform or decline less than the other, traders can generate positive returns, even in a declining market.

Considerations When Pair Trading

There are a number of considerations that users should keep in mind before entering a pair trade. Fundamental considerations should include:

- Choosing which asset to long

- Choosing which asset to short

- Selecting the collateral asset

- Deciding on the degree of leverage

- Entry level

- Liquidation levels

- Fundamental analysis

- Technical analysis

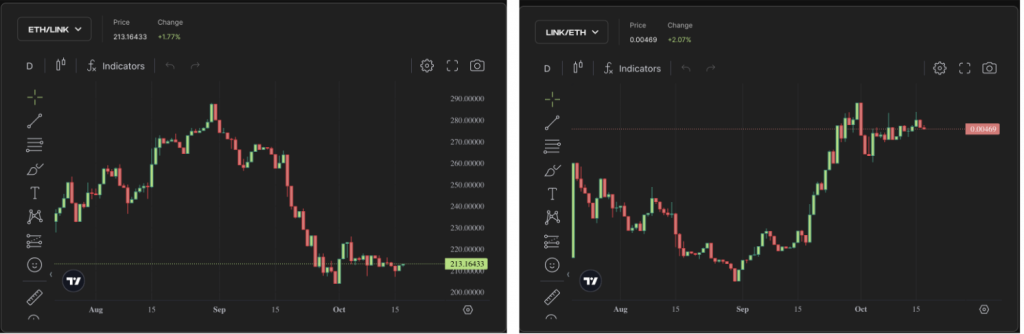

Choosing which asset to long/short will depend on which asset you think will outperform the other. For example, $ETH outperforms $LINK. Choosing the pair would automatically reflect the chart.

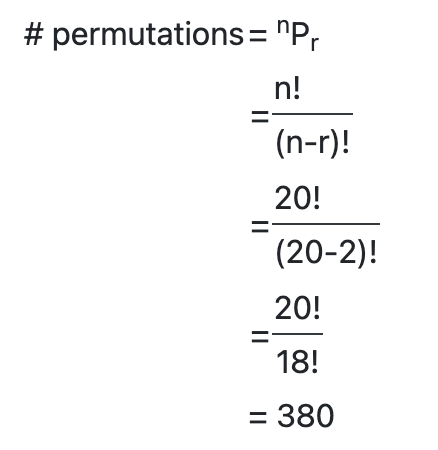

The number of potential pair permutations increases exponentially with every new asset added on Pear Protocol. Using the formula, you can see 20 underlying assets would equal 380 pair permutation:

Once the pairs have been selected, traders have to determine their optimal entry point, which can be done by identifying key levels based on the asset’s spread which can be calculated by dividing the asset prices. For example, ETH/LINK when $ETH is $1586 and $LINK $7.48 would result in a spread of 1586 / 7.48 = 212, vice versa if the pair is denominated as LINK/ETH.

Choosing the right leverage in pairs trading is crucial due to the amplified risks and potential rewards that leverage introduces to an investment strategy. In pairs trading, where the strategy typically involves taking simultaneous long and short positions, leverage can result in unfavorable risk if the market moves against one or both positions. This is especially risky if users are on isolated margin because the gains from the long leg, assuming the market is trending up, would not offset the loss from the short leg, resulting in a liquidation. As a result, market-neutral positions could end up as a single leg long/short position, which is good if the market continues to trend up, but exposes you to huge losses if it was a fakeout or liquidation event.

Net funding cost

Users will likely pay funding on one leg, and receive funding on the other leg. There could be a net difference in the funding rate between 2 assets, in which case, could either be positive or negative. However, based on the asset exposure you might as well be exposed to positive or negative funding on both legs. As a rule of thumb and simple heuristic, traders tend to be bullish on average, meaning that funding rates will often be positive (i.e. shorts receive periodical payments from long positions).

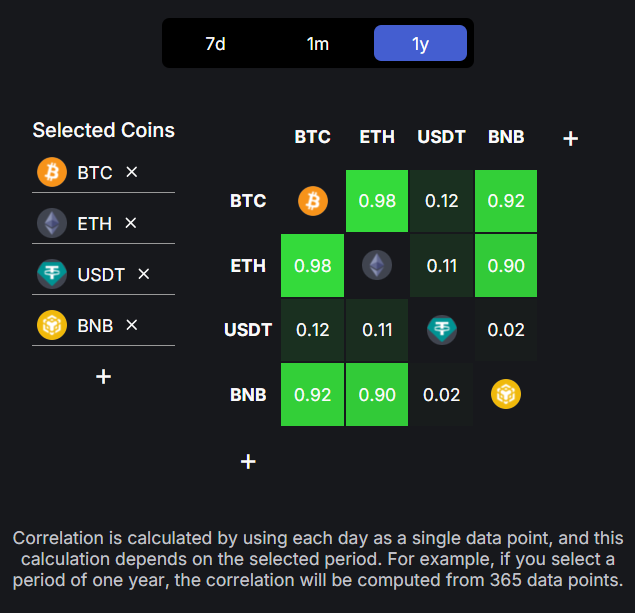

Correlation between the two assets

Considering the correlation between pairs in pairs trading is fundamental because it usually forms the backbone of the strategy’s effectiveness. Correlation measures the degree to which two assets move in relation to each other. In pairs trading, you typically look for two assets whose prices have historically moved together—either very closely positively correlated or inversely correlated.

This correlation is measured using the correlation coefficient, which falls within a range of -1.0 to +1.0. Positive correlation indicates that two assets move in the same direction. When one asset’s value increases, the other asset also experiences a rise. The strength of this correlation determines how closely the two assets move together. Negative correlation describes a relationship between assets that move in opposite directions. When one asset’s value rises, the value of the other asset decreases.

An opportunity would arise when there is some deviation between the two assets, or a mean reversion of some sort.You can do a simple check of pair correlations using Defillama’s correlation tool, although Pear Protocol is also working on a tool to display pair correlation on the trading UI.

Within crypto correlations can often be observed within each individual sector where money flows from one coin in 1 specific sector to another. For example, DeFi ($UNI, $DYDX, $CRV, $AAVE, $CAKE, etc.), AI ($RNDR, $FET, $AGIX, $TAO, etc.), and more. Plotting charts on tradingview against each other (toggle percentages on the vertical scale) also helps you identify such correlations, for example, between $XRP and $XLM:

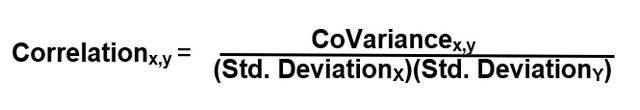

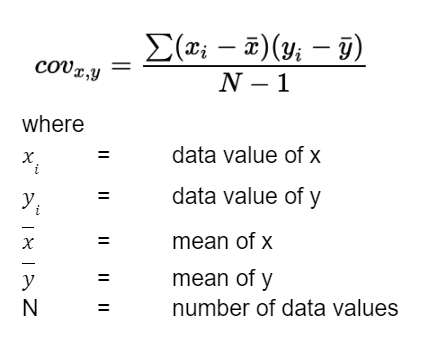

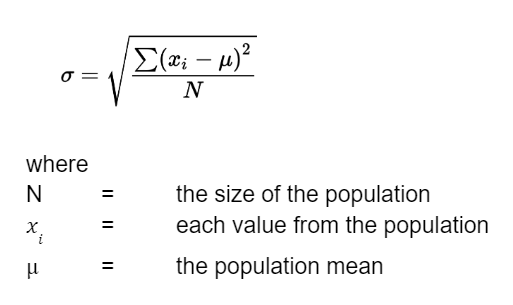

Calculating the correlation between 2 assets can be done by finding the covariance and standard deviation between the 2 assets.

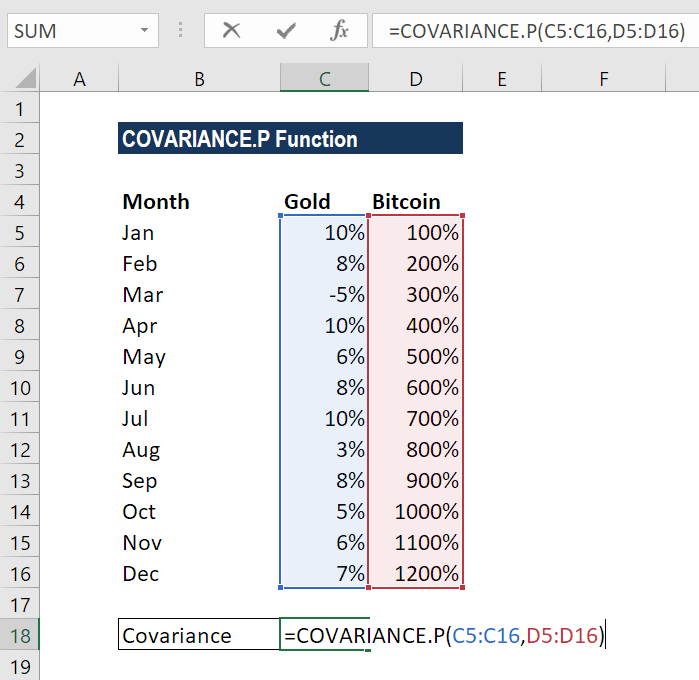

Covariance provides a measure of how much two random variables change together. If the variables tend to show similar behavior, the covariance is positive; if they show opposite behavior, it is negative. If there is no linear relationship, the covariance will be close to zero.

In the context of the Modern Portfolio Theory, covariance is essential for calculating the portfolio’s variance and subsequently its standard deviation. This calculation helps in finding the efficient frontier, which represents the set of portfolios that offer the maximum possible expected return for a given level of risk.

Covariance can be calculated as:

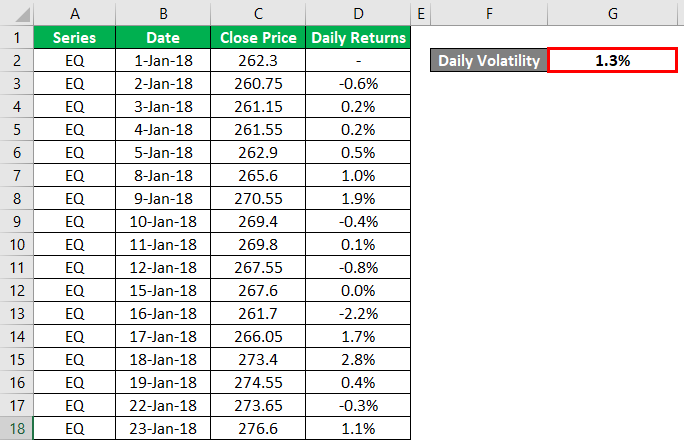

Alternatively, you can use the =COVARIANCE.S/P(range1, range2) function in excel:

Standard Deviation is a measure of the amount of variation or dispersion of a set of values. A low standard deviation means that the values tend to be close to the mean (expected value) of the set, while a high standard deviation means that the values are spread out over a wider range.

Standard deviation is a primary measure of an asset’s volatility, indicating the typical amount by which its returns deviate from the average return. A higher standard deviation implies greater volatility and higher risk.

Alternatively, you can use the =STDEV.S/P(range) function in excel:

Pair Spread

Pair spread in the context of trading refers to the difference in price or value between two correlated assets. This spread is central to pairs trading strategies, where traders seek to capitalize on temporary misalignments between two closely related assets.

The pair spread serves as the primary indicator for initiating and closing trades in pairs trading. Traders monitor the spread for deviations from a historical average or a predicted norm. When the spread widens beyond a certain threshold—indicating that one asset is outperforming or underperforming relative to its pair—it signals a potential trading opportunity. Traders will typically go long (buy) the underperforming asset and short (sell) the overperforming asset, anticipating that the spread will eventually revert to its mean.

Take ETH/BTC for example, a very common pair traders look at. The 0.05 level is a very regarded support level. ETHBTC is used to track the performance between $ETH and $BTC and it’s typically a sign for altcoin season.

When looking at pair spreads, there are plenty of ways for ETH/BTC to go from 0.05 to let’s say 0.055. A 10% gain.

Scenario 1 – $ETH Price Stays Flat, $BTC Price Decreases

$ETH Price: Remains at $3,300.

$BTC Price Adjustment: To achieve a spread of 0.055 with $ETH staying at $3,300, the $BTC price would need to adjust downward to ~$60,000.

Result: The spread would increase to 0.055 because $BTC’s price decreased to $60,000 from $66,000.

Scenario 2 – $ETH Price Increases, $BTC price also Increases but at a Slower Rate

$ETH Price Adjustment: $ETH price increases. Assume $ETH price goes up to $3,630.

$BTC Price Adjustment: $BTC price needs to increase but less proportionally compared to $ETH to achieve the desired spread. New $BTC price would be ~$66,000 if $ETH is $3,630 for a 0.055 spread

Result: In this scenario, despite both prices increasing, because $ETH price increases at a higher rate relative to $BTC (from $3,300 to $3,630), the spread increases to 0.055

Scenario 3: $ETH Price Decreases, $BTC Price Decreases More

$ETH Price Adjustment: $ETH price decreases. Assume $ETH price goes down to $3,135.

$BTC Price Adjustment: $BTC price also decreases but at a greater rate to widen the spread. New $BTC price would be ~$57,000 if $ETH is $3,135 for a 0.055 spread.

Result: Both $ETH and $BTC prices decrease, but $BTC decreases more from $66,000 to $57,000, which results in the spread widening to 0.055.

It’s this dynamic, where you can make money regardless of whether the broader market goes up, down or sideways that makes pair-trading so powerful. The only thing that is important is that you are right on your narrative, i.e. that Asset X will outperform Asset Y. Even better, in the example above, with 10x leverage, the user would have made a +10% * 10 = +100% gain on a pseudo market-neutral trade.

Understanding Beta

Beta is a measure of an asset’s volatility in relation to the overall market. In finance, beta is used to understand an investment’s relative risk compared to the market as a whole and is often used as a proxy for the risk associated with a particular asset or portfolio.

Beta = 1: An asset with a beta of 1 has returns that move with the market. If the market increases by 10%, an asset with a beta of 1 is also expected to increase by roughly 10%.

Beta > 1: An asset with a beta greater than 1 is more volatile than the market. For example, if the beta is 1.5, the asset is expected to increase by 15% if the market rises by 10%, and conversely, fall by 15% if the market drops by 10%.

Beta < 1: An asset with a beta less than 1 is less volatile than the market. For instance, if the beta is 0.5, the asset is expected to increase by 5% if the market rises by 10%, and decrease by 5% if the market falls by 10%.

Beta < 0: This rare scenario indicates that the asset moves in the opposite direction of the market. For example, a beta of -1 means if the market goes up by 10%, the asset would decrease by 10%.

Capital Asset Pricing Model (CAPM)

Beta is a central element in CAPM, which describes the relationship between systematic risk and expected return for assets. CAPM posits that the expected return on an asset is a function of its systematic risk as measured by beta. The formula provided by CAPM for the expected return of an asset is:

rp = rf + β(rm − rf)

where

- rp is the expected return on the asset,

- rf is the risk-free rate of return,

- rm is the expected return of the market,

- β is the asset’s sensitivity to movements in the overall market.

This equation suggests that the expected return on an asset is a linear function of the non-diversifiable risk (as measured by beta) and the excess return expected from the market over the risk-free rate.

CAPM can guide the selection of asset pairs. Traders look for pairs of assets with a high correlation but differing beta values. The goal is to capitalize on the beta differential under the assumption that while both assets may be influenced by market movements, their different sensitivities (betas) will lead to divergence in their relative prices, which can be traded profitably.

CAPM also introduces the concept of the market portfolio, which theoretically includes all investable assets, each weighted by its market value. This portfolio represents the entirety of market risk (systematic risk) and serves as a benchmark against which individual asset performance is measured.

In this model:

Systematic Component (rm): This is the part of an asset’s return that is attributable to market movements. It’s determined by the asset’s beta and the overall market return.

Residual Component (p): This is the component of the asset’s return not explained by market movements. It represents asset-specific or idiosyncratic risks and is presumed to average zero over time.

On platforms like Pear Protocol, understanding these components can help traders manage the risk of their pairs trading strategies more effectively. By analyzing the betas of potential pair assets and assessing their systematic and residual components, traders can make more informed decisions about which pairs are likely to offer returns that are not solely driven by broader market movements but by relative movements between the paired assets.

Dollar Neutrality in Pairs Trading

Dollar neutrality aims to reduce systemic risk (market risk) by balancing the investment dollars in long and short positions. This way, the strategy theoretically should not be affected significantly by whether the market goes up or down. The gains or losses on long positions are intended to be offset by the losses or gains on short positions, respectively.

Since the total dollar amounts invested in long and short positions are the same, the profit or loss of a dollar-neutral strategy comes from the relative performance of these positions. If the assets selected for the long positions perform better relative to the assets in the short positions, the strategy will yield a profit, regardless of the market’s overall direction. This is because dollar neutrality does not inherently guarantee beta neutrality. As described above, beta measures the volatility of an asset or portfolio relative to the market as a whole.

If the assets in the long positions have higher beta values than those in the short positions, the overall portfolio will have a ‘long beta.’ This occurs because the higher beta assets on the long side have a greater sensitivity to market movements than the lower beta assets on the short side. For example: If you have $10,000 in a high-beta asset (beta = 1.5) and $10,000 in a low-beta asset (beta = 0.5) short, the portfolio’s net beta would be positive, indicating an overall sensitivity to market increases.

Dollar neutrality should be paired with understanding of beta to achieve optimal results. Balancing the betas helps you to make informed decisions about how much leverage to use to avoid taking on too much risk.

Pairs Trading Strategies

When it comes to pair trading using Pear Protocol, there are various strategies that traders can deploy depending on the marketing conditions and the risk tolerance of the user.

For example:

Mean reversion trades: This involves identifying asset pairs that have high correlation, and the opportunity comes when there is an inefficiency whereby 1 asset is overperforming while the other is underperforming. This strategy is also known as statistical arbitrage. The theory is that these assets that are over/underperforming will eventually revert back to the historical mean performance. So the strategy in this case would be shorting the overperforming asset, longing the underperforming asset.

This trade is very common in the ETHBTC pair whereby $ETH is worth about 0.0506 $BTC on average

Narratives: This approach involves identifying a dominant market narrative or trend favoring one asset over another within a pair and trading accordingly—long the favored asset and short the less favored one. Suppose the market anticipates a “$SOL season,” where Solana is expected to outperform $ETH due to upcoming upgrades, increased adoption, or other favorable developments…or memecoins. Traders might choose to go long on $SOL (buying $SOL) and short on $ETH (selling $ETH) with a pair like SOL/ETH. The expectation is that $SOL will gain in value relative to $ETH, and the trade will profit from this differential.

Sector Rotations: This strategy involves identifying sectors expected to outperform the market and pairing trades within those sectors or between a sector and the broader market. For example, leading up to the Nvidia GTC conference has historically seen AI/GPU coins doing well, like $RNDR, $FET, etc. Traders can take a long on these AI coins and a short position on for example $ETH in hopes that either $ETH retraces and AI performs, or AI outperforms $ETH.

News Trading: News events can significantly impact market sentiment and prices of certain tokens resulting in a divergence between potentially correlated pairs. For example, when Hong Kong announced the approval of $BTC and $ETH ETFs, $CFX, a chinese-based regulatory-compliant blockchain saw a massive pump over $ETH.

Business Model

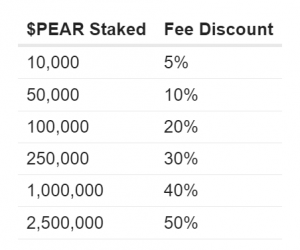

Transaction Fees: Pear Protocol generates revenue through transaction fees, with a fee of 0.25% for opening and closing pair trade positions. After TGE fees will vary depending on the $PEAR stake of the user.

Staking Incentives: To incentivize platform usage and retain users, Pear Protocol offers reduced trading fees for users who stake the protocol’s native token, $PEAR.

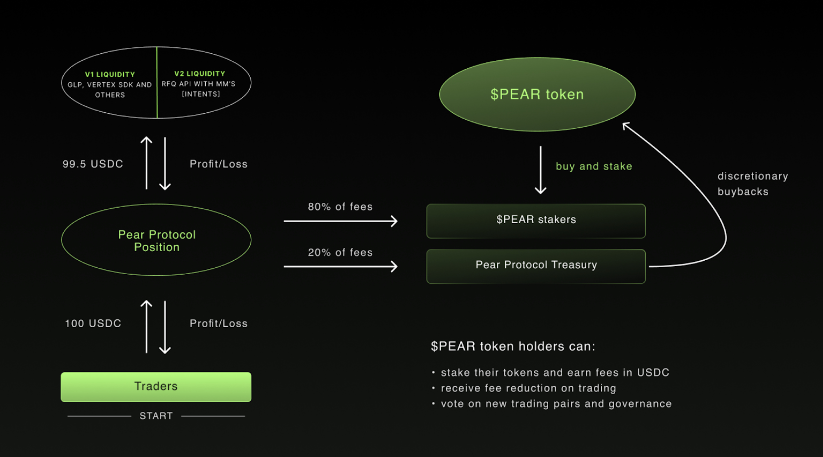

Revenue Sharing: 80% of trading fees collected by the protocol is shared with $PEAR token stakers.

The flywheel involves trading activities on Pear Protocol which generate fees, primarily through a platform fee of 0.25% in $USDC levied on the opening and closing of trades. These fees are crucial for the platform’s sustainability, covering operational costs such as development, maintenance, and third-party services essential for the platform’s functionality (e.g. MongoDB, Sentry, Render, Alchemy, Cloudinary, Eden and other APIs).

A portion of the revenue generated from trading fees is redistributed back to the users in several ways. Users staking $PEAR tokens benefit from reduced trading fees and earn 80% of platform’s revenue, creating an incentive for long-term holding and active participation in the platform’s governance. The remaining 20% goes towards building the protocol Treasury.

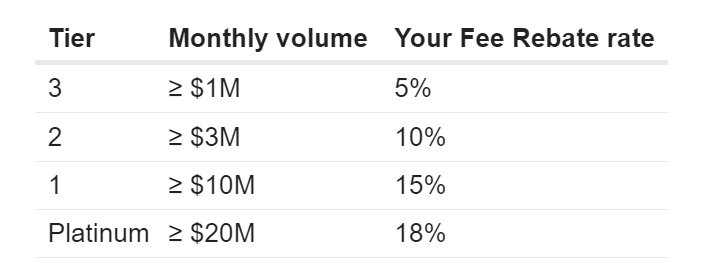

The Treasury pays out fee rebates to VIP users which are determined based on Monthly Trading Volumes. This is done to incentivize and retain trading volume from larger users. Note that this is different from the fee discount that $PEAR stakers get, as the fees are automatically discounted if your wallet holds a certain number of $PEAR based on the tiers presented below:

Temporary user incentives may also come in the form of grants. Pear has received 350K $ARB tokens in their application to Arbitrum’s LTIPP, for hitting the following milestones:

Milestone 1: $50,000,000 of total traded volume (50k ARB)

Milestone 2: $100,000,000 of total traded volume (100k ARB)

Milestone 3: $350,000,000 of total traded volume (remaining 200k ARB)

Fee Breakdown

- Opening/Closing of position: 0.25%

- Execution costs from the underlying protocol fee from GMX, Vertex (variable), and SYMMIO

- There is also a fixed $1 cost of minting their position as an NFT

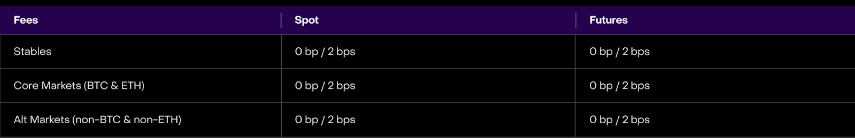

Pear is a taker (not a maker), since all trades are currently opened as market orders and not limit orders, thus when looking at GMX/Vertex fees, look at the taker portion.

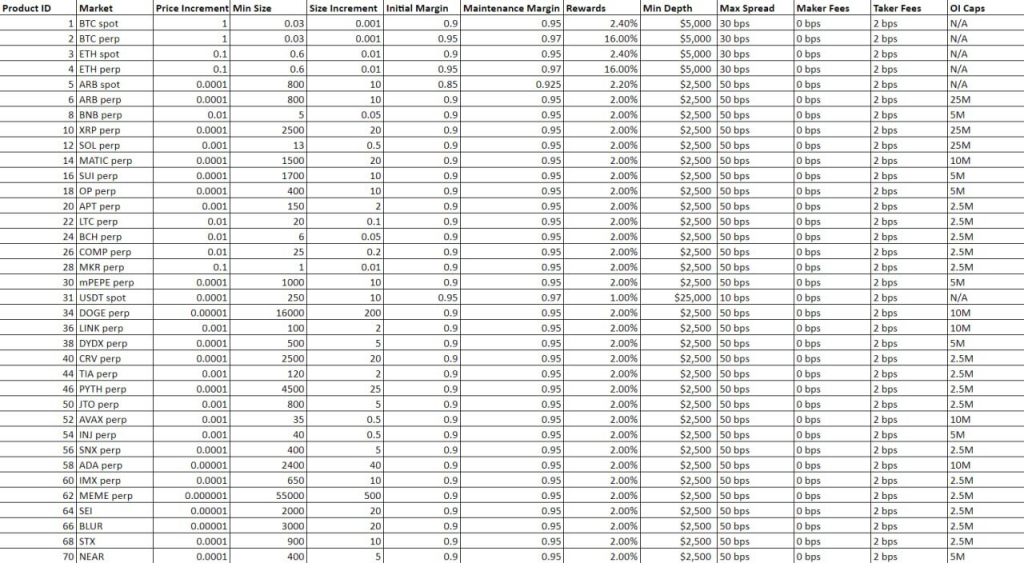

For reference, here are Vertex’s maker/taker fees:

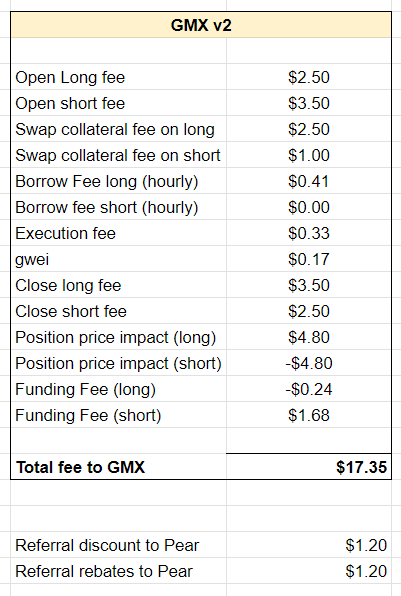

For example, these are the fees that users could see if they open a trade on v1 using GMX v2. A $10,000 pair trade position ($5,000 long, $5,000 short), held for 24 hours will incur an effective fee of 0.17%:

For v2 of Pear Protocol which uses the Symmio intent-based RFQ architecture, the fee structure would change drastically to a 0.04% taker fee.

Tokenomics

$PEAR serves as the governance and utility token of Pear Protocol, allowing users to:

- Stake and earn a portion of fees

- Get trading fee discounts

- Vote on new pairs and governance

Pear Protocol is launching its $PEAR token in Q2 of 2024. The full public launch of Pear is slated to go live in April along with Arbitrum LTIPP incentives to incentivize trading on the platform. After a period of 4-6 weeks of active trading on the platform, Pear Protocol will be conducting an LBP as part of their token generation event.

The $PEAR staking contract will also go live shortly after in Q3 2024, whereby users can stake their $PEAR tokens to get reduced trading fees and earn a share of protocol fees.

Token Distribution

Pear Protocol’s $PEAR token is distributed as such:

Public Sale – 0.51%

Private Sale – 20%

Treasury – 30.49%

Team – 17.07%

ReFi Community – 12.98%

Trading Incentives – 15%

Token Emissions

Governance

Pear Protocol will run in a decentralized manner, operated as a DAO and governed by $PEAR token holders.

- There is a UK Limited Liability Development Company responsible for development.

- Pear Protocol is the decentralized front-end hosted by the community

- The Pear DAO oversees all day to day governance of the protocol and protocol fees.

Risks

Bad Trade Execution

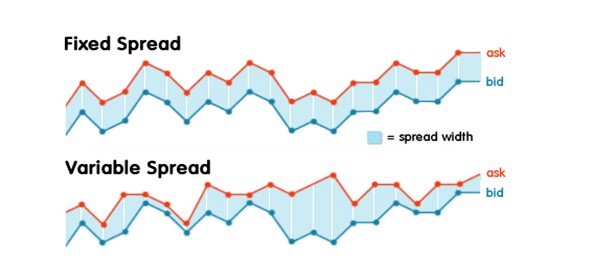

Bad trade execution can occur due to slippage, which is the difference between the expected price of a trade and the price at which the trade is actually executed. This can happen during periods of high volatility or when the market is moving rapidly. Traders might enter or exit positions at less favorable prices, leading to higher costs or reduced profits, and large orders might not be filled at desired price points, affecting the intended exposure and risk management of the pair trade.

Correlation breaks

Correlation risk is a critical factor in pair trading. It assumes that the price movements between two assets will maintain a consistent, predictable relationship over time. A correlation break occurs when this expected relationship suddenly diverges, which can be due to structural market changes, idiosyncratic news affecting one of the assets, or shifts in economic conditions.

Trades that are based on historical correlation might fail if the assets no longer move in tandem as expected. This can lead to one side of the pair trade moving against the position without the offsetting move in the correlated asset, leading to unanticipated losses. The strategy may require quick adjustments or unwinding, which could be costly and might not always recoup the initial losses.

Divergence Due to Asset-Specific Events

Pair trades often involve assets that, while historically correlated, can react differently to asset-specific news or events. For instance, project-specific announcements, internal team issues, lawsuits or even black swan events. An example of this can be seen when Uniswap got served with a Well’s notice, which could have caused huge divergences compared to other DeFi assets.

If an event significantly impacts one asset but not the other, the pair trade can become unbalanced, leading to potential losses or liquidations. This is particularly risky when the events are sudden and unpredictable, giving traders little time to react and adjust their position. However, on some occasions, this divergence can also be an opportunity to pair trade.

Security

Audits

Pear has undergone and passed comprehensive security audits by Shieldify and Sherlock to ensure the integrity and safety of its smart contracts, with two private audits from Shieldify and a public audit by Sherlock.

- Shieldify V0.9 Audit – Feb 24, 2024: This audit focused on the initial version of Pear Protocol’s contracts. You can review the detailed findings and recommendations in the Shieldify V0.9 Security Review.

- Shieldify V1 Audit – July 3, 2024: This audit was conducted on the subsequent version of the contracts, ensuring ongoing security enhancements and fixes. The full report is available in the Shieldify V1 Security Review.

Composability Risk

This risk arises from the interconnected nature of DeFi platforms. Pear Protocol’s functionality depends on the stability and integrity of the platforms it integrates with, such as GMX, Vertex, and SYMMIO. Any technical issues, exploits, or failures in these underlying platforms can directly impact Pear Protocol. For example, if GMX experiences price manipulation, it could affect the accuracy of trading data on isolated margin pairs used by Pear Protocol, leading to potential losses for its users.

Issues in one part of the DeFi ecosystem can cascade through interconnected protocols. An operational failure in Vertex’s off-chain orderbook, for example, could disrupt trading activities on Pear Protocol.

Liquidity Risks

Liquidity risk refers to the potential difficulty of trading an asset without causing a significant impact on its price due to a lack of market depth. For a perp dex like Pear Protocol, which integrates with platforms such as GMX, Vertex, and Symmio, managing liquidity risk is crucial for ensuring efficient market operations and maintaining trader confidence that they won’t eat huge slippage when sizing into trades.

Potential sources of liquidity risk:

Market Depth and Asset Availability: If Pear Protocol or its integrated platforms lack sufficient liquidity, traders may experience high slippage, particularly when executing large orders. This can result in slippage and trades being executed at prices that are significantly different from expected levels, potentially leading to substantial trading losses.

Rapid Market Movements: During periods of high volatility, liquidity can dry up as traders withdraw from the market to avoid risk, or when automated trading systems pause their operations. This situation can exacerbate liquidity shortages, making it difficult to enter or exit positions without considerable price concessions.

Concentration of Holdings: If a large portion of a pair’s open interest is held by a few participants, Pear Protocol could face situations where these major holders control significant portions of the asset’s liquidity, introducing further risk if these parties decide to liquidate their holdings simultaneously.

Oracle Failure

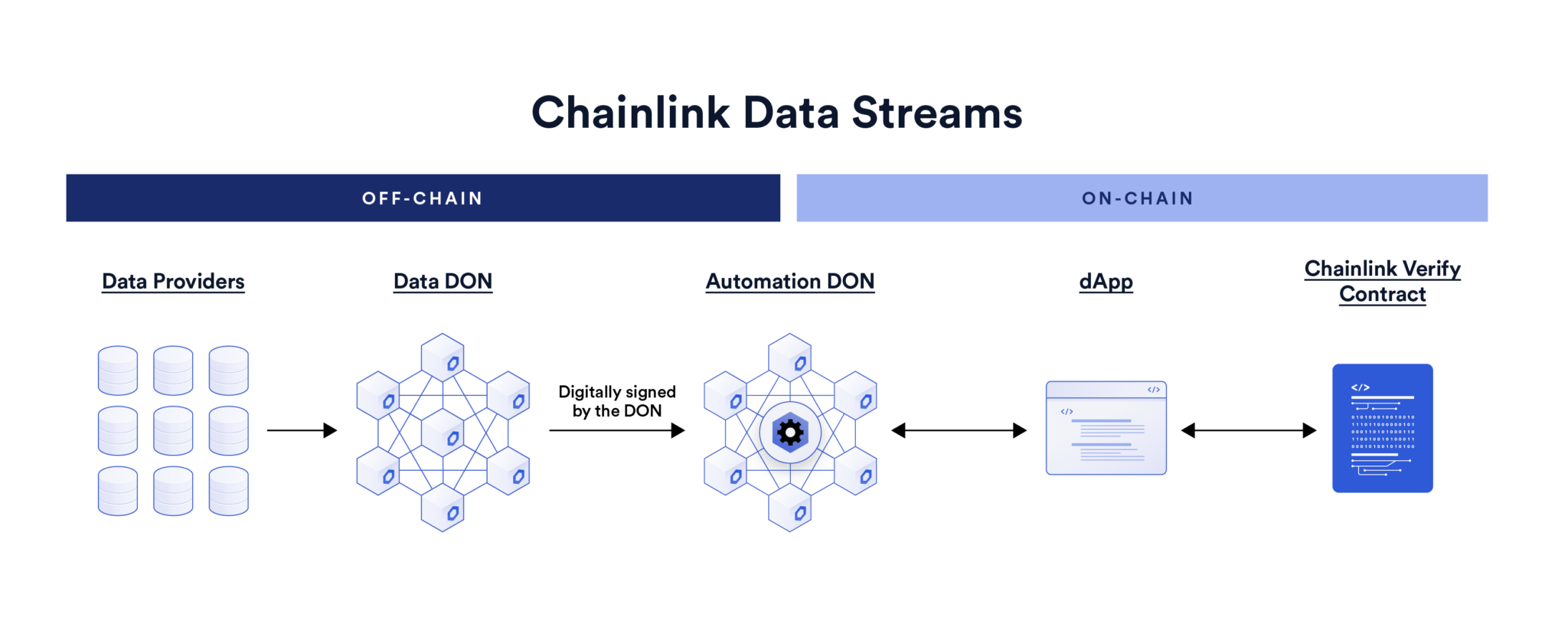

Oracle risk pertains to the dangers associated with relying on third-party services to provide accurate and timely pricing data which is crucial for DEXes like Pear Protocol. Their reliance on backend trading engines like GMX and Vertex exposes them to potential oracle or price manipulation that could potentially happen on these third party platforms. Symmio does not use an oracle so this does not apply to them, although specialized market makers will be quoting based on the prices of CEXs.

Both GMX and Vertex have integrated Chainlink’s low latency oracle which is designed specifically for the fast-moving DeFi derivatives market. Low latency oracles are designed to minimize the delay between the generation of data in traditional or decentralized markets and its availability on a blockchain. These oracles focus on rapid data retrieval, processing, and dissemination to ensure that blockchain applications receive market data almost instantaneously. This capability is crucial for applications where prices are highly volatile and market conditions change rapidly.

Vertex’s markets are supported mainly by Stork, which is an ultra-low-latency, decentralized, hybrid oracle network for EVM-compatible price feeds. Stork operates using a hybrid on/off-chain architecture. This means that much of the data processing is performed off-chain before the results are pushed onto the blockchain. This method allows for rapid data processing and updating without incurring high blockchain transaction fees or experiencing delays typical of fully on-chain systems. Stork’s infrastructure itself (e.g., the off-chain components, WebSocket servers) could become a single point of failure if key components are compromised or fail.

Oracle manipulation can also happen in the form of:

Price Feed Source Manipulation

Low latency oracles often pull data from various external sources such as centralized exchanges, decentralized exchanges, or direct feeds from market makers. If any of these sources can be manipulated, the oracle itself can transmit incorrect data:

Small or Illiquid Markets: Manipulators might target smaller or less liquid exchanges where large trades disproportionately impact market prices. Since low latency oracles require rapid data retrieval, they frequently update from such sources, making them vulnerable to this type of manipulation.

Flash Loan Attacks: Utilizing flash loans to temporarily drive up prices on key oracle data sources right before an oracle update can alter the data being fed into DeFi protocols. This type of attack leverages the high speed of low latency oracles to maximize the impact of the price manipulation before the market can correct itself.

Direct Oracle Attack

Front-Running: Attackers might predict when an oracle update will occur and make trades that capitalize on the knowledge of upcoming price movements, exploiting the slight delays in data processing and transmission—even if these delays are minimal. Chainlink’s low latency oracle design keeps prices private until transactions are settled, which shields pricing data from potential arbitrageurs. However, there could still be a residual risk whereby exploiters can use tools or even insider information for a large transaction, which is enough for some types of market manipulation or decision-making, even without specific price details.

Insider Attacks: If the oracle relies on proprietary software or hardware that is not fully decentralized, insiders or entities with access to the oracle infrastructure might alter data outputs or the processing logic itself.

Data Transmission Interference

Even though the data is retrieved and transmitted quickly, any interference during its transmission to the blockchain can lead to manipulated outputs. This can happen through:

Network Attacks: Interception or alteration of data as it travels from the source to the oracle and eventually to the blockchain.

Sybil Attacks: In a decentralized oracle network, an attacker might control multiple nodes and influence the data being reported to the blockchain, although this is more challenging to achieve in networks designed with strong sybil resistance measures.

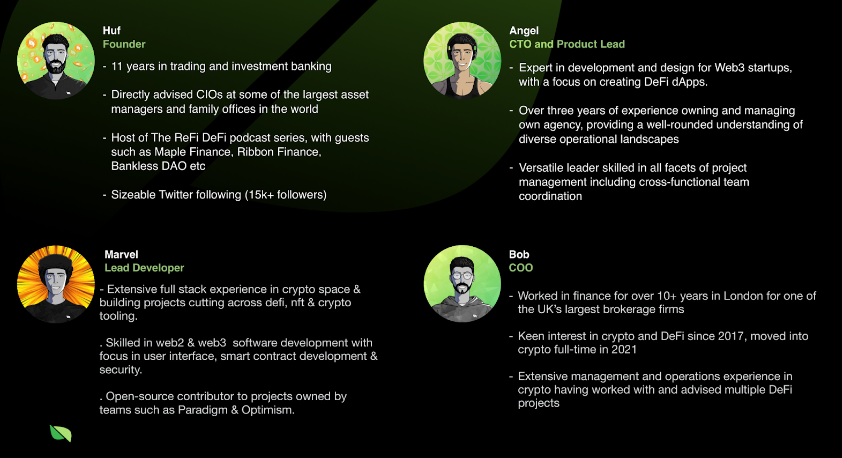

Team

The Pear Protocol team comes from a diverse background bringing both TradFi and DeFi expertise in the form of both investments and tech.

Huf – Founder, 11 Years in Investment Banking and 5 years in crypto full time. Directly advised CIOs at some of the largest Asset Managers and Family Offices in the world. Active investor in crypto and DeFi yield farming for years. He is also the host of the Crypto Narratives podcast, with more than 10k downloads

Bob – COO, 10+ years of traditional finance experience working for one of the UK’s largest brokerage firms. Extensive management and operations experience having advised multiple international companies.

Marvel – CTO, 5+ years of full stack experience in crypto, cutting across DeFi, NFT & Crypto tooling. Skilled in Web2 & Web3 software development with focus on smart contract development (Rust, Solidity) & security.

Angel – Product Lead, 7+ years in development and design for Web3 startups with a focus on creating DeFi dApps. Previously ran a software development agency, managing global projects with diverse tech requirements. Specialist in UI and UX.

Space – Lead Moderator

In terms of marketing and PR efforts, the team has built a brand for themselves, with some of their team members being thought leaders in DeFi and crypto despite being anonymous to the public.

Project Investors

Public Sale

Pear Protocol raised $125,000 from their token generation event through a public sale, allocating 0.51% (5.1M tokens) of the total supply of 1,000,000,000, at $0.025 per token.

Seed Funding

Pear Protocol secured $1.25 million in its seed investment round, backed by investors from Flow Ventures, RNR Capital, Portico Ventures, and JY Capital among others.

Builders Grants

Grant Received: 100k $ARB

Milestone 1: Launch v2 contracts (40k $ARB)

Milestone 2: Cumulative Target volume $25m, 50 unique wallets (20k $ARB)

Milestone 3: Cumulative Target volume $50m+, 100 unique wallets ($40k ARB)

Arbitrum Long-term Incentive Pilot Programme (LTIPP) Grant

Grant Received: 350,000 $ARB

Milestone 1: $50,000,000 of total traded volume ($50k ARB)

Milestone 2: $100,000,000 of total traded volume ($100k ARB)

Milestone 3: $350,000,000 of total traded volume (remaining $200k ARB)

These grants are ready to be distributed as incentives.

FAQ

How do isolated margin and cross margin differ in the context of pair trading on Pear Protocol?

In isolated margin, each trade or pair trade has a margin that is treated independently. This means the losses or gains in one position don’t affect the margin of other positions. In contrast, cross margin pools all available balances and positions to manage risk across multiple trades. If one position moves into a loss, excess margin from another position can cover it, reducing the likelihood of liquidation but potentially exposing more of your capital to risk

If my long and short positions in a pair trade are equal in dollar value, why am I observing a loss?

In pair trading, even if your long and short positions are balanced in terms of dollar value, differences in asset volatility or beta can result in losses. Asset beta reflects an asset’s volatility relative to the market; thus, if one asset in the pair is significantly more volatile or reacts differently to market movements than the other, it can cause an imbalance in the pair’s performance, leading to potential losses.

Can you explain what pair correlation means in the context of trading on Pear Protocol?

Pair correlation refers to the statistical relationship between two assets. In pair trading, a high correlation (close to 1) typically means the assets move in a similar direction and magnitude. Traders look for pairs with a stable historical correlation, betting on the continuation of this relationship, or they might seek pairs where the correlation has temporarily weakened, betting on a reversion to the historical mean.

What factors should I consider when selecting assets for pair trading on Pear Protocol?

When choosing assets for pair trading, consider factors such as historical correlation, market volatility, liquidity of each asset, and economic or sectoral influences that might affect each asset differently. It’s crucial to perform a thorough analysis to ensure that the chosen assets have behaved in predictably correlated ways in the past and that there are reasons to believe this behavior will continue or revert to a mean if divergences occur.

What is the importance of monitoring funding rates in pair trading on Pear Protocol?

Funding rates are periodic payments made based on the difference between perpetual contract markets and spot prices. If you’re holding positions open over multiple funding intervals, these rates can significantly affect the profitability of your trades, especially in volatile markets. Positive funding rates imply that longs pay shorts, and vice versa; therefore, if you’re on the paying side, it could erode your profits or increase your losses.

Why was one of the legs of my trade not executed?

This sometimes happens because the engine we’re using to execute different trades fails to open due to many reasons (price changed too quickly, liquidity ran out because some pairs have open interest caps, slippage issues, etc). The best thing to do in this scenario may be to close the remaining leg.

What triggers a liquidation in pair trading, and how is it calculated on Pear Protocol?

Liquidations in pair trading occur when the total value of your account falls below the required maintenance margin level due to adverse price movements in your positions. On Pear Protocol, in Isolated Margin, each asset in a pair trade is subject to its own collateral and margin requirements. If the market moves significantly against your position and your account balance isn’t sufficient to maintain the required margin, Pear Protocol may automatically liquidate your positions to cover the shortfall. Whereas in cross-margin, the collateral is shared across both assets.