Overview

Soul is the first unified omnichain liquidity layer designed to enhance capital efficiency and borrowing power across DeFi ecosystems. By connecting multiple blockchains, Soul enables seamless cross-chain lending and borrowing while mitigating risks typically associated with traditional asset bridges or wrapped tokens.

Key features include:

- Multi-Protocol Lending: Users can supply assets in one blockchain protocol and use them as collateral to borrow from another. For instance, a user could supply assets as collateral on Compound on Ethereum and borrow on Aave on Polygon.

- Native Asset Utilization: Because assets remain native, there is no dependence on wrapped tokens for cross-chain lending. Not native assets are also available in the different lending protocols.

- Cross-Chain Communication: Soul leverages messaging layers like LayerZero to facilitate communication across blockchains, while cross-chain functionality remains optional to optimize costs and performance.

Unlike protocols like Radiant, Syno, or Venus, Soul is not a cross-chain or multi-chain money market but a unified omnichain liquidity layer interconnecting existing lending protocols from different chains. Instead of being the lending protocol itself, Soul differentiates from these protocols by being the middleware layer between various lending protocols, orchestrating and defragmenting liquidity.

Soul integrates with major lending protocols such as Aave, Compound, and Venus, orchestrating supply and borrowing actions to maximize user returns. Its modular architecture enables real-time monitoring and management of positions across multiple blockchains, improving performance, security, and liquidity efficiency. Initially focusing on EVM-compatible blockchains, the protocol is set to expand to non-EVM networks due to its chain-agnostic design.

Soul Features

Through integration with technologies like LayerZero, Soul streamlines user interactions for lending and borrowing across chains. Users can supply assets on one blockchain and use collateral on another, and they can borrow or repay debt across chains seamlessly.

Other features of Soul include:

Cross-Chain Leverage

Soul allows users to utilize staked assets (e.g., $stETH on Ethereum) as collateral to borrow other assets on a different blockchain ($ETH on Arbitrum). This allows users to increase their exposure to diverse assets while simultaneously maximizing returns through strategic leveraging and looping when staking rates are higher than borrow rates. Ultimately, this will drive higher market efficiency by facilitating capital movement and overcoming fragmentation.

Risk Diversification

By integrating multiple blockchains and lending protocols, Soul enables users to diversify both their collateral and borrowing activities. This reduces exposure to specific risks while allowing them to capitalize on varied interest rates and yield opportunities.

Resilient Infrastructure

Soul uses LayerZero as its default cross-chain communication layer, including fallback options like Axelar, CCIP, and Wormhole. This ensures uptime and security even if the primary communication layer encounters issues, making the protocol more robust and future-proof.

Cross-Chain Opportunities

Soul integrates multiple lending protocols across blockchains, unifying borrowing power while facilitating arbitrage and yield farming. Users can easily shift liquidity, take advantage of cross-chain opportunities, and leverage their assets effectively without friction.

Unifying Borrowing Power

Soul provides users with the ability to unify borrowing power across chains. By using native collateral on their respective blockchains, users can access a global borrowing power that spans all integrated chains, unlocking greater flexibility and efficiency.

Protocol Specifications

Soul’s specifications are designed to address the limitations of both single-chain and cross-chain lending while prioritizing user flexibility, security, and cost efficiency.

General Specifications:

- Base Protocol Compatibility: Users earn the same supply and borrowing APYs as offered by the respective base protocols (e.g., Aave, Compound). If the base protocol provides rewards, users can claim them as well.

- Native Asset Usage: Liquidity supplied by users remains on the same chain, avoiding asset bridging and associated risks.

- Interest-Bearing Tokens: Upon supplying assets, users receive interest-bearing ERC-20 tokens (e.g., SCDAI for Ethereum-Compound-DAI) representing their deposits plus accrued interest.

- Protocol Integration: Soul integrates directly with major lending protocols, orchestrating to optimize user yields without transferring base protocol-issued tokens to users. Also, using established robust protocols limits the attack surface and acts as an extension of those protocols rather than coming with new lending markets and introducing new layers of risk.

Cross-Chain Specifications:

- Communication Layer: Soul utilizes LayerZero as its default messaging layer, with fallback support for alternatives like Axelar, CCIP, or Wormhole. These layers facilitate cross-chain communication securely and efficiently.

- Selective Chain Inclusion: Users can customize cross-chain functionality by enabling it selectively for specific chains or creating “clusters” of interconnected chains.

- Security Mechanisms: Cross-chain risks are minimized through a modular architecture and enforcement of borrowing limits to prevent systemic vulnerabilities.

- Cost Optimization: Transactions within the cross-chain framework incur additional fees, but users can choose the chain hosting the main Controller to optimize gas costs.

These specifications serve more as guidelines rather than strict rules.

Multi-Protocol Lending

Soul’s Multi-Protocol Lending framework is the cornerstone of its design, allowing users to leverage liquidity across disparate blockchains and lending protocols while maintaining a seamless, unified interface. Each market is uniquely defined by the blockchain, base protocol (BP), and underlying asset, enabling fine-grained liquidity management. For example, the Ethereum-Compound-DAI market is represented distinctly within Soul as SCDAI, an interest-bearing ERC-20 token.

- Asset Tokenization: When users supply assets to Soul, the protocol issues interest-bearing tokens (e.g., SCDAI for Ethereum-Compound-DAI), representing the supplied amount plus accrued interest. These tokens are tied to specific markets and can be transferred between users.

- Collateral and Borrowing: Supplied assets can serve as collateral across supported chains and protocols, enabling cross-chain borrowing. For instance, a user can supply $WBTC on Ethereum-Compound and use it as collateral to borrow $USDC from Polygon-Aave. Soul orchestrates these interactions by handling asset deposits, borrow requests, and risk calculations.

- Direct Integration with Base Protocols: Soul supplies the user’s liquidity directly to the underlying protocols (e.g., Aave, Compound) and retains the respective protocol tokens (e.g., cTokens for Compound). This ensures that users earn the same supply and borrow APYs as if they were using the base protocol directly, without exposing them to the intricacies of token management.

When a user applies for a loan within Soul, the protocol performs a series of verifications to ensure the transaction is secure and compliant with its risk management framework. The user’s risk profile is assessed based on their supplied collateral and borrowing limits, ensuring they have sufficient liquidity to back the loan request.

Architecture

Soul’s architecture is designed to provide modularity, scalability, and security while facilitating multi-protocol and cross-chain lending interactions. It consists of several core components, each playing a distinct role in enabling specific operations and risk management across multiple blockchains and lending protocols.

Controller

The Controller is the on-chain risk and action management component responsible for overseeing operations within a blockchain’s Money Markets. Its role is particularly critical for ensuring that user actions adhere to the protocol’s rules and risk parameters. The Controller manages positions for both single-chain and cross-chain operations.

The Controller ensures strict compliance with the protocol’s borrowing and risk management rules, maintaining stability and security within individual blockchains.

- Action Validation: Determines whether a user’s action, such as supplying, borrowing, or redeeming assets, can be executed in a specific Money Market (SToken contract).

- Liquidity and Borrow Assessment: Computes the user’s aggregate liquidity and borrow amounts across all Money Markets to assess whether actions like borrowing or removing collateral are permissible.

- Liquidation Monitoring: Identifies accounts eligible for liquidation due to under-collateralization and ensures these positions are flagged for corrective actions.

- Liquidation Execution: Triggers liquidation processes to mitigate risk and restore solvency in Money Markets

Despite its advantages, the main Controller introduces some challenges. Cross-chain transactions are inherently asynchronous, creating potential delays or inconsistencies during high network activity. The system’s reliance on messaging layers, such as LayerZero, introduces dependencies that could affect operational stability if these layers experience disruptions. Additionally, the need to manage complex cross-chain interactions increases operational complexity.

However, the Controller’s ability to unify liquidity management and streamline user interactions makes it a critical enabler of Soul’s vision for interoperable DeFi solutions.

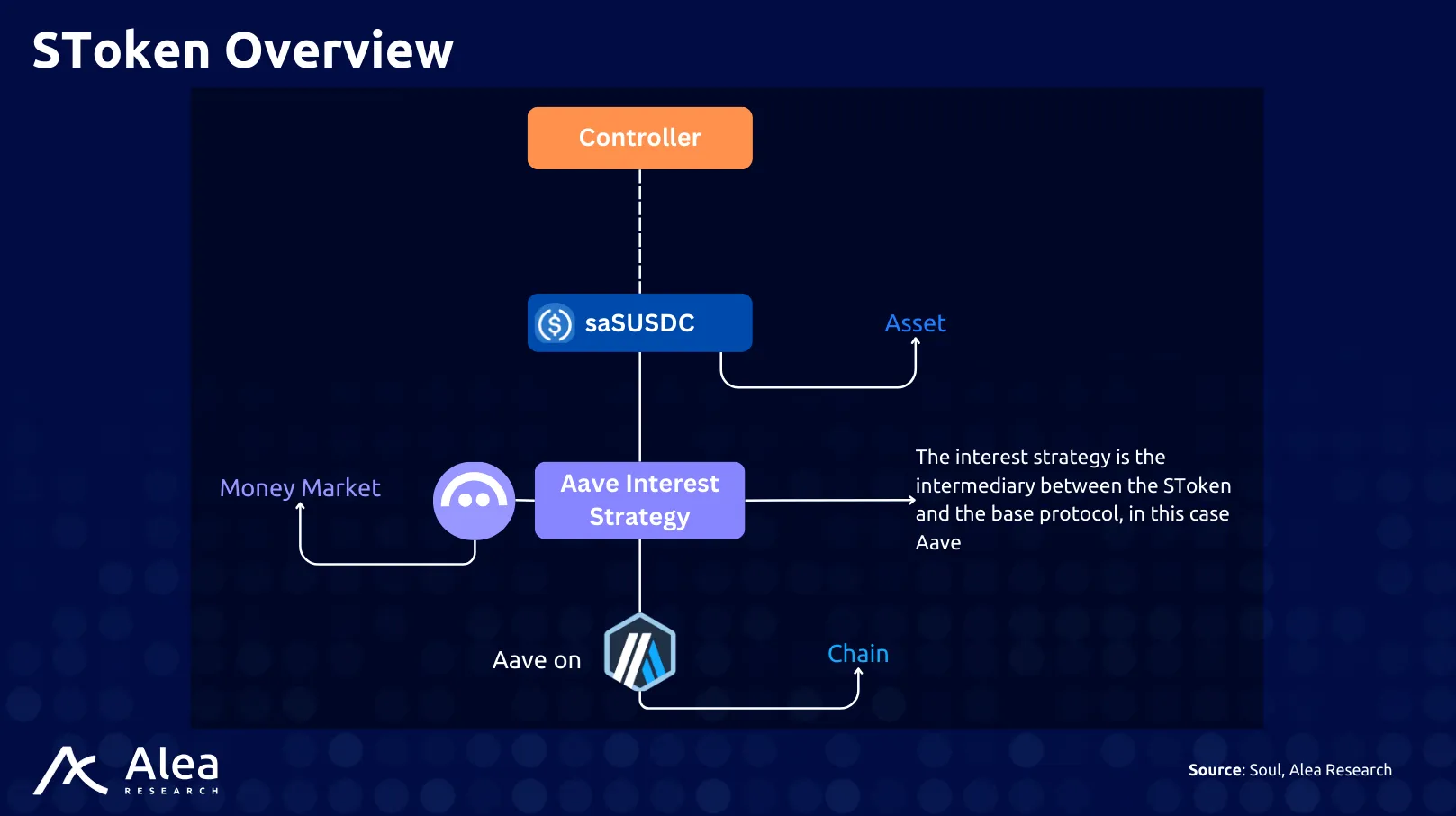

SToken

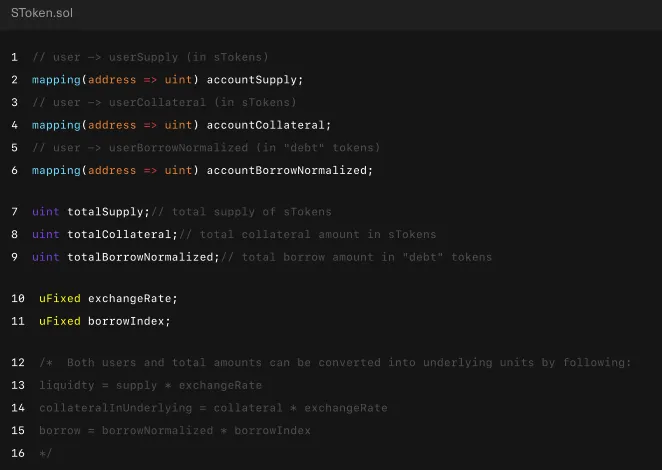

The SToken contract facilitates user interactions within a specific Money Market and manages operations with the underlying Base Protocol (BP). It handles key actions like supplying, borrowing, repaying, and collateral management while maintaining user and market balances. STokens indicate the collateral value supplied by a user. For example, if a user supplies $10,000 worth of $ETH, their SToken balance reflects this collateral and enables borrowing across chains. The SToken acts as proof of the user’s collateral position in Soul.

Each SToken is tied to a distinct Money Market, identified by the chain, base protocol, and asset (e.g., Soul-Aave-USDC). It integrates with the InterestStrategy contract to calculate and update interest rates, ensuring alignment with the BP’s model.

By abstracting direct interactions with BP-issued tokens (e.g., cTokens, aTokens), SToken ensures that liquidity and borrowing actions are securely executed while providing a unified experience for users. Its modular design allows independent operation within each Money Market.

InterestStrategy

The InterestStrategy contract is the intermediary between the SToken and the BP, as seen in the image above, ensuring seamless alignment with the base protocol’s interest rate mechanics. It facilitates interactions and adjusts liquidity strategies based on user actions.

It functions as a proxy for the SToken, handling the execution of operations like borrowing or redeeming assets within the base protocol. Additionally, it implements the interest rate model (see relevant section), which encodes Soul’s responses in the base protocol.

This design allows the protocol to dynamically manage liquidity while maintaining compatibility with the base protocol’s interest structures.

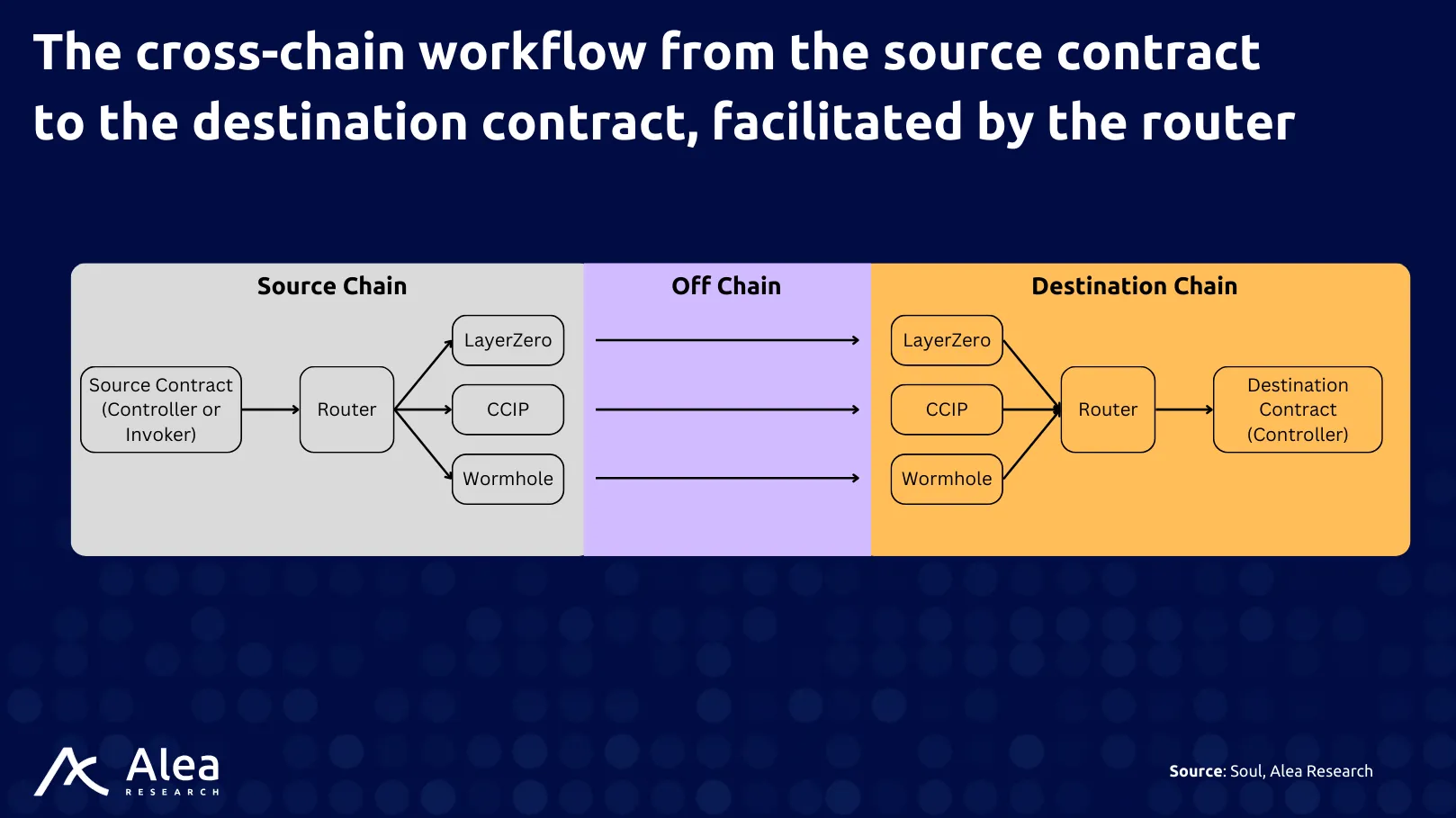

CrossChain Router

The Cross-Chain Router facilitates communication between blockchains. It serves as a mediator for transmitting messages related to user transactions, such as borrowing or collateral removal, across different networks. By decoupling cross-chain logic from borrowing and lending operations, the Router ensures that complex multi-chain interactions remain efficient and modular. This separation of concerns simplifies protocol maintenance and improves scalability.

A primary function of the CrossChain Router is to relay messages securely and reliably between contracts on different chains. Each message includes key transaction details, such as the target chain ID, destination address, and payload. The Router interacts with LayerZero as the default messaging provider, ensuring compatibility with multiple chains. Additionally, it supports fallback mechanisms, such as Axelar and Wormhole, to maintain functionality even if the primary provider experiences disruptions.

The Router also includes mechanisms to manage failed transactions. If a message fails to reach its destination, users can resend it through the Router using their preferred supported messaging provider. To prevent unauthorized activity, the Router maintains a whitelist of addresses permitted to send messages, with governance controlling access. By implementing these measures, the CrossChain Router mitigates risks associated with cross-chain communication, such as message loss or tampering, while maintaining user-centric flexibility.

Lending Dynamics

Soul’s lending dynamics are designed to provide users with seamless access to lending and borrowing opportunities across multiple blockchains. Each lending market within the protocol is uniquely tied to a specific blockchain, base protocol, and asset, ensuring isolated risk management and accountability for every market. Users can supply assets to these markets and borrow from them while utilizing Soul’s infrastructure to integrate with leading protocols like Aave and Compound. This setup enables a unified user experience across disparate ecosystems.

The storage of user balances for each money market is maintained within the corresponding SToken smart contract. Its storage follows the main layout below:

When users supply assets to a Soul money market, they receive interest-bearing ERC20 tokens known as STokens, representing their supply plus accrued interest. These STokens are non-interchangeable across markets and reflect the specific supply position of the user in a distinct pool. Soul deposits the supplied assets into the corresponding base protocol and retains the resulting interest-bearing tokens as collateral for potential future loans.

Borrowing within Soul is guided by stringent over-collateralization requirements tracking closely those found in the underlying markets. Users must provide collateral that exceeds the value of their loans, both calculated in USD. The protocol uses dynamic collateral factors to determine a user’s borrowing capacity. Borrowing and supply rates align with the underlying base protocols, ensuring competitive annual percentage yields. The system enforces strict security conditions, rejecting borrowing actions that would compromise the stability of a user’s or the protocol’s positions.

Single-Chain Interactions

In Soul’s single-chain interaction mode, all user activities, such as supplying, borrowing, and collateral management, are confined to a single blockchain. This mode operates independently of cross-chain functionality, simplifying transaction execution and minimizing costs and complexity. Each user maintains a distinct account per chain, with borrowing and collateral requirements enforced separately for each network. This isolation ensures that fluctuations in one chain do not impact the user’s positions on another, providing stability and predictability.

Within this framework, users can supply assets to one money market and borrow from another on the same chain, even if the two markets belong to different base protocols. For example, users can supply $USDC on Ethereum-Compound and borrow $ETH from Ethereum-Aave. Borrowing decisions are determined by the user’s risk profile, calculated based on the value of their supplied collateral and its associated collateral factor. This ensures that each transaction aligns with the protocol’s over-collateralization requirements.

Processes

Borrowing in Soul is a structured and multi-step process to ensure security, efficiency, and interoperability across supported blockchains. When a user initiates a borrow action, the system evaluates their eligibility based on their risk profile, collateral value, and the borrowing capacity of the specified money market. The borrowing process goes like this:

- The Controller evaluates the user’s eligibility by comparing their total collateral value against their current and requested borrow balances.

- If the user is deemed eligible, the SToken records the borrow action and updates its internal storage.

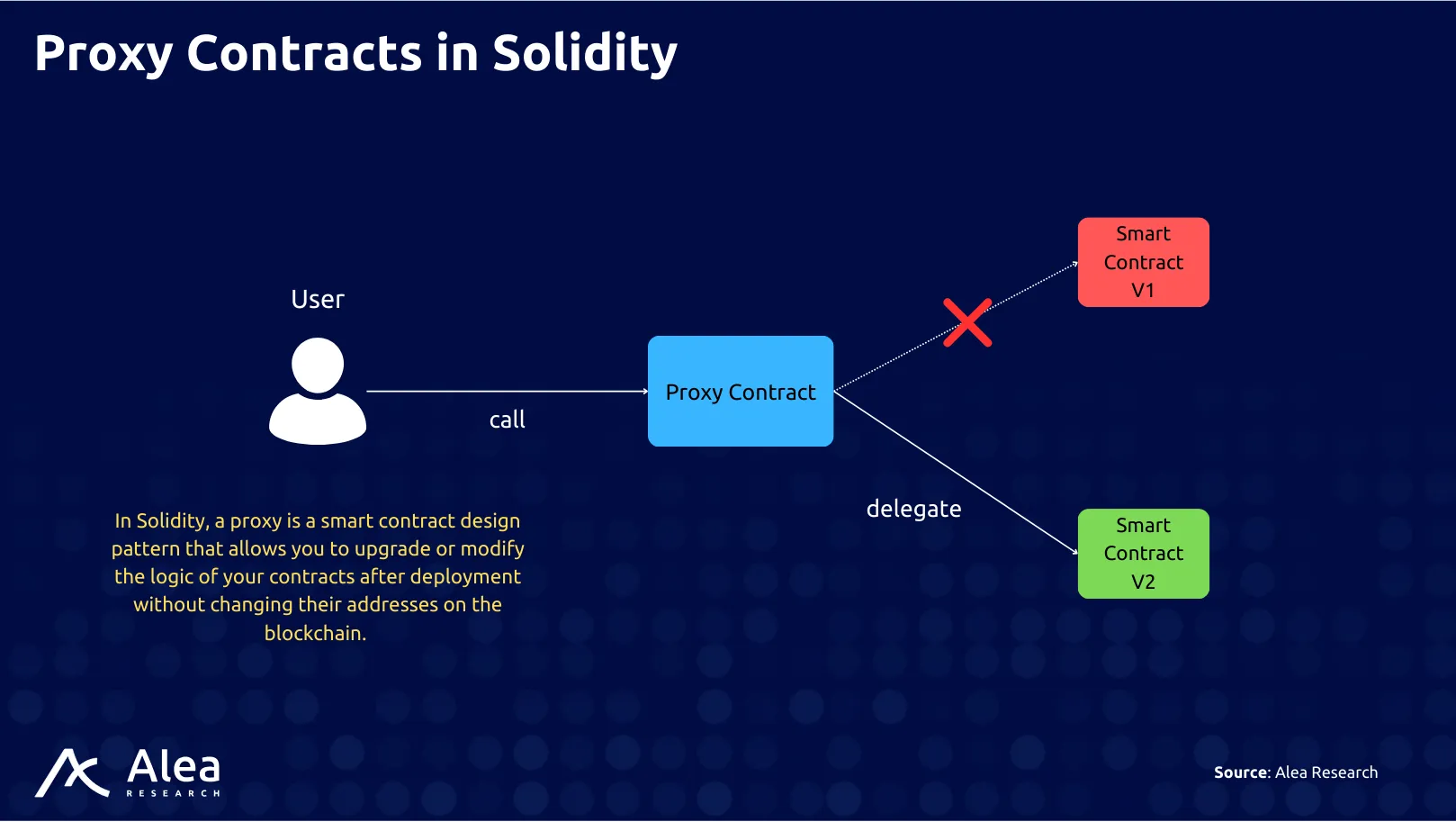

- The InterestStrategy contract is invoked via a delegatecall to execute the borrowing operation from the base protocol, ensuring the transaction aligns with the base protocol’s interest rate model.

A delegatecall allows a contract (caller) to execute a function from another contract (callee) while preserving the caller’s context, including its storage and execution permissions. In Soul, delegatecalls are used to integrate with base protocols and modular components like the InterestStrategy contract, ensuring that operations adhere to the protocol’s design without duplicating logic.

The supply, repay, and borrow flows resemble the borrow flow above. However, the processes for adding and removing collateral are a little easier because they don’t involve interacting with the InterestStrategy.

The liquidation process in all interactions within Soul protects the protocol’s stability while maintaining fair treatment for users. Liquidation occurs when a borrower’s total debt surpasses its liquidation threshold due to factors like asset price fluctuations or accrued interest. The process involves identifying at-risk borrowers, seizing their collateral, and compensating liquidators.

- Triggering Liquidation: A liquidator initiates the process by interacting with the Controller contract. The Controller first verifies the borrower’s risk profile, ensuring their total borrow balance exceeds the liquidation limit for the specific money market. If the borrower is deemed liquidatable, the transaction proceeds; otherwise, it is reverted.

- Collateral Seizure Calculation: The Controller computes the amount of collateral to be seized, factoring in the liquidation incentive and associated fees. This ensures liquidators are incentivized to participate while maintaining fairness to the borrower. The computation also includes checks for sufficient collateral availability.

- Repayment and Collateral Transfer: The liquidator repays a portion or the entire outstanding debt on behalf of the borrower. This triggers a repayment transaction in the base protocol through the SToken contract. Once the repayment is successful, the Controller executes a collateral seizure, transferring the calculated collateral amount from the borrower to the liquidator.

- Final Updates: The Controller updates the borrower’s balances in its storage to reflect the reduced debt and collateral amounts. Simultaneously, the liquidator’s account is credited with the seized collateral, and any fees are deducted according to protocol-defined rules. These updates ensure accurate accounting and maintain market stability.

The absence of cross-chain communication in single-chain mode offers significant benefits, including reduced transaction fees and faster execution times. It happens only when the user decides not to connect any chain to a remote controller. Since all actions remain within a single blockchain, transactions are atomic, meaning they are executed entirely or not at all. This design eliminates the risks of cross-chain transaction delays or failures and simplifies the user experience for those who do not require multi-chain capabilities.

Cross-Chain Interactions

Cross-chain interactions in Soul allow users to utilize collateral on one blockchain to borrow assets on another, facilitating a seamless and interconnected DeFi experience. These interactions rely on the coordination of multiple components, including the Controller, CrossChainRouter, and chain-specific smart contracts. By enabling cross-chain borrowing, collateral management, and liquidations, Soul eliminates liquidity silos and improves capital efficiency across supported networks.

Soul’s cross-chain design offers users significant advantages, including consolidating their financial positions across multiple chains and accessing liquidity wherever needed. However, the complexities of managing asynchronous operations and associated costs require users to plan and monitor them thoroughly. The protocol’s modular architecture and established security measures mitigate many risks. Still, cross-chain interactions remain best suited for users seeking advanced multi-chain strategies and aware of the associated risks.

Functions

supply() and redeem()

The supply() function allows users to deposit assets into a specific money market, receiving interest-bearing STokens that represent their supplied amount plus accrued interest. These STokens are tied to a particular market, ensuring clear accountability for supplied funds. The redeem() function enables users to withdraw their supplied assets, with the protocol updating their balances to reflect the reduction. Both actions are straightforward in single-chain mode but involve additional messaging steps in cross-chain mode to synchronize user data across chains.

addCollateral()

This function enables users to designate a portion of their supplied assets as collateral for borrowing. The collateral is evaluated based on its USD value and a predefined collateral factor, determining the user’s borrowing capacity. In cross-chain mode, the process requires synchronizing collateral data across chains via the Controller and CrossChainRouter. This function is required to enable multi-chain borrowing while accurately managing risk profiles.

repayBorrow()

The repayBorrow() function allows users to reduce their outstanding debt by repaying borrowed funds. The repayment amount updates the user’s borrow balance and decreases their risk profile, potentially freeing up collateral for withdrawal. In cross-chain mode, repayments involve message transmission between the borrowing chain and the Controller to ensure global synchronization.

Borrow()

The borrow() function enables users to draw funds against their collateral. The process involves evaluating the user’s risk profile and borrowing capacity through the Controller. In single-chain mode, borrowing is straightforward, with funds disbursed on the same chain as the collateral. In cross-chain mode, the function relies on asynchronous messaging to facilitate borrowing on a target chain using collateral from another, adding complexity but enhancing flexibility. The protocol strictly enforces over-collateralization and borrowing limits to mitigate risks.

removeCollateral()

This function allows users to withdraw previously designated collateral, provided their updated risk profile remains within acceptable limits. The operation involves verifying the user’s borrowing capacity and ensuring sufficient collateral remains to support outstanding debt. In cross-chain mode, the Controller synchronizes collateral removal data across chains to prevent inconsistencies or risks to the user’s solvency.

liquidate()

The liquidate() function is triggered when borrowers’ debt exceeds their liquidation threshold. A liquidator repays a portion of the borrower’s debt and receives a corresponding amount of collateral as compensation, including a liquidation incentive. The process involves multiple steps, such as verifying the borrower’s risk profile, seizing collateral, and updating user balances. The function requires chain coordination in cross-chain scenarios, with the Controller managing liquidation data and ensuring accurate execution. This function is necessary for maintaining protocol stability and incentivizing active market participation by liquidators.

Interest Rate Strategy

The InterestStrategy component embodies Soul’s approach to cross-protocol interest rate dynamics, implementing a dual-strategy system through the Borrow Strategy and Redeem Strategy models. Utilizing delegatecalls for protocol interaction achieves flexibility in managing protocol-specific behaviors while maintaining a unified interface, effectively decoupling the interest rate logic from the core protocol mechanics.

The implementation reflects a deep understanding of DeFi lending market dynamics, particularly in handling interest rate equilibrium across different protocols. Through its mathematical model adjusting rates based on utilization ratios (UB, US, USB, and BRSB), the strategy creates a self-balancing system to maintain optimal capital efficiency while preventing excessive risk accumulation. The protocol’s ability to dynamically switch between borrowing and redeeming in base protocols demonstrates effective capital management.

The technical architecture shows careful consideration of practical constraints. By implementing the interest rate model through delegatecall patterns, Soul achieves protocol upgradeability without requiring storage migrations. At the same time, the separation between SToken and InterestStrategy contracts enables protocol-specific optimizations without compromising the core system architecture. This design pattern significantly reduces integration complexity when adding new protocols or updating existing strategies.

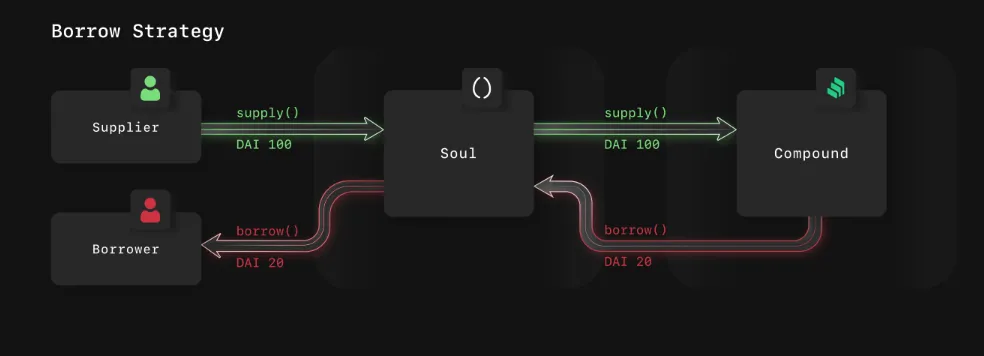

Borrow Strategy

The Borrow Strategy involves borrowing assets from base protocols to meet user demands. Its main advantage is that users receive rewards and the same rates as base protocols because the liquidity and borrowing actions directly mirror the base protocol’s utilization. However, this strategy exposes Soul to liquidation risks if it exceeds its base protocols’ borrow limit. To mitigate this, Soul may increment supply and borrowing rates or reject new transactions as it approaches these limits.

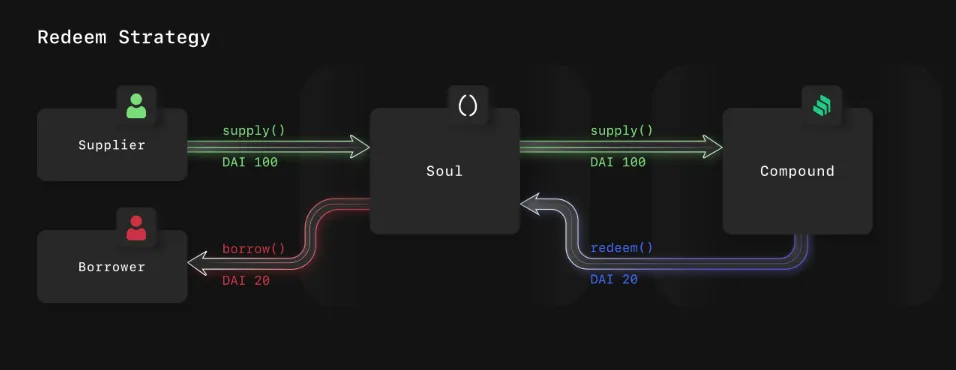

Redeem Strategy

The Redeem Strategy, in contrast, avoids liquidation risks entirely because Soul does not borrow from base protocols, relying instead on redeeming supplied liquidity to fulfill borrowing demands. This approach increases Soul’s effective borrowing limit compared to the Borrow Strategy and allows Soul to generate revenue even when offering users the same rates as base protocols. However, this strategy requires Soul to adapt its rates dynamically, as base protocol utilization is affected differently under this model, often requiring Soul to manage its own internal rates.

Why the Project was Created

Soul was created to address the inefficiencies and limitations in DeFi lending markets caused by isolated blockchain ecosystems and liquidity fragmentation. Liquidity fragmentation has become a very common issue since the crypto ecosystem has more chains than ever before. As a result, these chains host identical lending protocols, creating isolated liquidity pools and increasing capital inefficiency.

This fragmentation manifests in several critical ways:

- Supply-demand mismatches across chains, where some networks accumulate excess lending capacity while others face liquidity shortages.

- Severe rate divergence for identical assets (like $USDC) across different chains, creating artificial but costly arbitrage opportunities.

- Increased operational complexity for market participants who must monitor multiple chains, manage frequent bridge transactions, and absorb both direct and indirect costs (gas, bridge fees) (bridge delays, missed opportunities).

- Deteriorating price discovery as lending rates become less reliable market indicators due to segmented liquidity pools and localized supply-demand dynamics.

Soul addresses liquidity fragmentation by creating a unified omnichain liquidity layer that integrates multiple blockchains and lending protocols. Instead of relying on isolated liquidity pools, Soul allows users to leverage assets supplied on one blockchain as collateral for borrowing on another, effectively connecting previously siloed ecosystems. This eliminates the inefficiencies caused by mismatched supply and demand across chains and reduces operational complexity for users.

The protocol achieves this through native asset utilization, avoiding the risks of wrapped tokens or traditional bridges, and leveraging secure cross-chain messaging layers like LayerZero. By aggregating liquidity into a single system, Soul ensures more efficient price discovery and capital utilization, providing a seamless experience for users while fostering a more interconnected and accessible DeFi ecosystem.

Additionally, Soul’s architecture minimizes transaction costs and improves user flexibility by enabling optional cross-chain functionality. This approach ensures seamless integration with existing protocols like Aave and Compound while addressing the scalability and risk challenges of cross-chain lending.

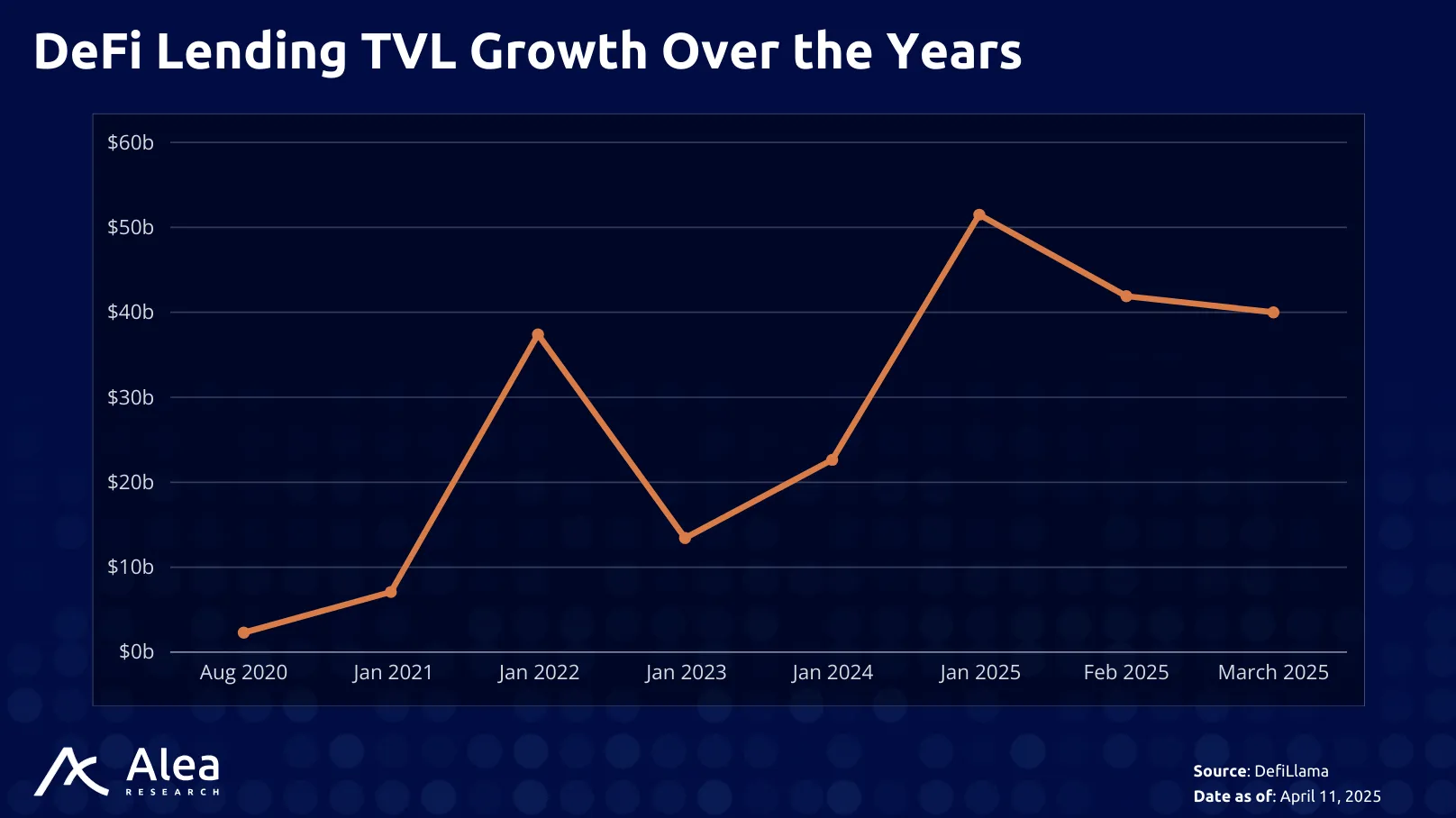

Sector Outlook

DeFi lending is the second sector with the largest TVL, behind liquid staking. Aave, one of the OGs of DeFi lending, captures almost half of that amount. Continuous updates and integrations have pushed Aave to the top, making it the go-to money market. Compound was also one of the first movers in this market but lost market share to new-generation lending markets such as Morpho, Kamino, Fluid, Euler, and others. Each has different futures and tradeoffs that appeal to users with distinct strategies and preferences.

DeFi lending creates essential price discovery mechanisms and capital efficiency loops critical for broader crypto market function. These protocols effectively serve as the banking layer of the ecosystem, enabling everything from leveraged trading to efficient treasury management for DAOs and protocols. Combined with DEXs and stables, lending protocols complete a powerful market infrastructure trifecta. This creates the foundational financial plumbing that enables more sophisticated DeFi applications and institutional participation. While over-collateralization remains a limitation, the sector has proven remarkably resilient through multiple market cycles, demonstrating its systemic importance to the broader crypto ecosystem.

DeFi lending’s biggest weakness is its over-reliance on overcollateralization, which creates massive capital inefficiency and limits real adoption beyond crypto-native traders. The liquidation mechanisms, while necessary, introduce systemic risk during periods of high volatility—we’ve seen this play out repeatedly with cascading liquidations amplifying market crashes. Smart contract risk remains a fundamental concern as well, especially as protocols rush to implement complex cross-chain functionality without proper security audits or battle-testing. The latest exploit on Radiant underpins this, where the hacker gained access to the multisig, executed a smart contract upgrade, and drained $58 million worth of assets.

Moreover, liquidity is the lifeblood of lending markets. Without deep liquidity pools, these protocols are just smart contracts with no practical utility. Large-scale borrowers need confidence that they can access capital instantly without moving the market, while lenders require assurance that they can exit positions efficiently during stress events. Shallow liquidity creates a dangerous feedback loop in which utilization spikes trigger higher rates, potentially sparking a self-reinforcing liquidity crisis that could crash the entire protocol. What’s overlooked is how liquidity depth directly impacts protocol revenue and sustainability. Higher liquidity attracts more users, generating more fees, which then attracts more liquidity providers in a virtuous cycle. The protocols that master this liquidity game can dominate, while those struggling with thin liquidity will fade into irrelevance as the market matures.

Cross-Chain Lending

Cross-chain lending protocols are solving the fundamental issue of liquidity fragmentation across blockchain ecosystems, but they’re not the silver bullet many claim. The real value proposition is unlocking trapped liquidity and enabling more efficient price discovery across previously isolated lending markets.

These protocols essentially create a unified liquidity layer that lets capital flow to where yields are highest, though this efficiency comes with heightened smart contract risk and potential for cross-chain contagion.

One compelling aspect is how cross-chain lending enables sophisticated borrowing strategies that were impossible in siloed markets. For example, borrowing on one chain against collateral on another fundamentally changes the game for all users. The innovation isn’t just about bridging assets anymore; it’s about creating truly unified lending markets that operate seamlessly across different blockchain environments.

The current cross-chain lending space’s fundamental limitation derives from its architectural approach to bridging. It essentially tries to force single-chain lending models into a multi-chain environment, which creates several critical vulnerabilities and inefficiencies.

The dependency on wrapped assets represents perhaps the most significant structural weakness. Every cross-chain interaction requires multiple bridge transactions, creating unnecessary security bottlenecks and capital inefficiency. Most protocols are effectively building elaborate workarounds for a fundamentally flawed asset representation model. The past bridge exploits we’ve seen aren’t outliers but inevitable consequences of this design pattern.

Current market signals suggest a paradigm shift in how the market views cross-chain lending. The sector’s immediate future will likely be shaped by three key dynamics: First, the emergence of specialized cross-chain infrastructure layers that abstract away complexity while maintaining security—something Soul’s Controller model hints at. Second, an increased focus on capital efficiency through improved liquidity management and collateral utilization models. Third, the evolution toward more sophisticated risk management frameworks that can handle cross-chain state uncertainty without excessive over-collateralization.

Competitive Landscape

Cross-chain lending protocols operate in a niche market, with a limited number of players competing to enable lending and borrowing across blockchains. These protocols differ significantly in operations, architecture, liquidity strategies, and ecosystem selection. Some prioritize interoperability through native asset use to reduce bridging risks, while others rely on isolated pools to mitigate systemic vulnerabilities. Liquidity aggregation strategies also vary, with some targeting deep pools on specific chains and others focusing on scalability across diverse ecosystems. This dichotomy extends to platform positioning, where specialized expertise in select established chains consistently outperforms generalized accessibility across many networks with thin liquidity.

Soul differentiates itself by functioning as a unified omnichain liquidity layer rather than a standalone cross-chain lending protocol. Instead of replicating lending markets across chains, Soul integrates established platforms like Aave and Compound into a single interface, orchestrating liquidity while preserving their individual strengths. Its design eliminates fragmented liquidity pools and the reliance on risk-prone mechanisms like wrapped tokens or bridging. By leveraging native assets, an optional cross-chain mode to optimize gas costs, and a refined interest rate model to prevent yield dilution, Soul offers capital efficiency and flexibility not found in competing solutions.

The Controller architecture further strengthens Soul’s position by enabling unified risk management across chains while maintaining protocol-specific optimizations. This approach ensures seamless coordination between chains without adding unnecessary complexity. By creating a cohesive liquidity network that addresses cross-chain inefficiencies, Soul resolves challenges inherent to other models, positioning itself as a secure and efficient solution in the evolving cross-chain lending landscape.

Potential Adoption

Soul Protocol represents a notable architectural shift in cross-chain lending, addressing several fundamental limitations that have historically constrained DeFi capital efficiency. The protocol’s Controller design eliminates the traditional overhead of bridging and wrapped assets, while its optional cross-chain mode demonstrates a deep understanding of gas cost dynamics.

Furthermore, the integration of LayerZero as the primary messaging layer, with fallback options through other cross-chain messaging layers, shows pragmatic thinking about cross-chain reliability. While many protocols build on single bridge dependencies, Soul’s multi-bridge architecture creates natural redundancy.

The protocol’s economic model creates a compelling game theory for early adopters through its dynamic interest rate mechanism. By calibrating rates based on both local and cross-chain utilization, the system naturally incentivizes liquidity provision across chains while maintaining competitive yields. This could trigger a network effect where initial liquidity bootstrapping attracts additional capital-seeking optimization opportunities.

Finally, Soul’s interest rate model is an alternative approach to handling capital efficiency. Rather than maintaining uniform rates across chains, they’ve designed a dynamic system that can operate independently when appropriate while maintaining cross-chain capital efficiency through their unified risk engine. This prevents the “race to the bottom” yield dynamics that plague many cross-chain protocols.

However, adoption hinges on execution. The critical metrics to monitor include cross-chain position growth relative to single-chain usage, liquidation efficiency across market conditions, and, most importantly, the protocol’s ability to maintain competitive yields while building sustainable liquidity depth.

Chains

Soul’s initial deployment strategy focuses on EVM-compatible chains to ensure seamless integration and scalability. The testnet rollout includes Ethereum, Arbitrum, Base, Optimism, and Avalanche. For mainnet, the plan is to expand to networks like Polygon, BNB Chain, and Scroll, targeting chains with strong user bases and liquidity ecosystems.

Looking ahead, Soul aims to extend compatibility to non-EVM chains. This phased approach ensures security and reliability by prioritizing protocols with strong liquidity and security standards. By carefully selecting integrations, Soul maintains a secure and scalable cross-chain liquidity layer.

Business Model

Soul’s business model focuses on transforming fragmented DeFi lending markets into a unified, cross-chain lending ecosystem. The core model operates through an intermediary layer that connects previously isolated lending protocols while abstracting away the underlying complexity from end users.

The yield in Soul comes from the underlying base protocols, such as Aave and Compound, where user-supplied assets generate interest from borrowers. These base protocols pay supply APYs to lenders while borrowers pay interest on their loans. Soul makes money by applying a small fee on top of the supply and borrow APYs offered by the base protocols.

This model provides multiple revenue streams for Soul, each tied to a specific user interaction and protocol function:

| Stream | Description |

| Supply and Borrow APY Fees | A fee is applied to both the supply and borrow interest rates (APY), effectively generating revenue from user activity on both sides of the lending market.

For instance, if the Base Protocol offers a 5% supply APY, Soul might offer users 4.5% and allocate the remaining 0.5% as protocol revenue while also providing additional incentives in Soul Tokens ($SO). Similarly, for borrowing, if the Base Protocol’s APY is 5%, Soul could charge 5.5%, taking a 0.5% fee. This fee structure is flexible and configurable per market, allowing the protocol to adjust fees dynamically. Initially, fees can be set to zero to provide more attractive APYs, incentivizing liquidity inflow and fostering adoption. |

| Loan Optimizer Mode | Soul’s loan optimizer generates revenue by automatically managing loans to maximize efficiency and returns for users, with a share of the profits accruing to the protocol.

For example, if a user’s current position on Aave Arbitrum offers lower yields than Compound Polygon, Soul identifies the better rate and seamlessly transfers the position to Compound. The process is automated, reducing user effort and transaction complexity. A base fee is applied to the optimized amount, providing a revenue stream for Soul while ensuring users maximize their returns across multiple chains and protocols. |

| Flash Loan Fees | Fees are charged on flash loans, calculated as a percentage of the borrowed amount. |

| Cross-Chain Borrow Fees | A base fee is applied whenever users perform borrowing across chains, leveraging Soul’s cross-chain lending functionality. |

| Cross-Chain Swap Fees | The protocol collects fees from cross-chain asset swaps facilitated by the protocol, further monetizing its interoperability features. |

| Liquidation Penalties | A portion of the penalties collected during the liquidation of under-collateralized positions contributes to the protocol’s revenue. |

Soul is a capital efficiency optimizer, leveraging its cross-chain architecture to identify and exploit rate differentials across disparate lending markets. This creates natural arbitrage opportunities that the protocol can capture while simultaneously providing users with boosted yields through automated capital reallocation.

The model’s sustainability derives from its ability to reduce traditional cross-chain friction points while maintaining competitive rates relative to single-chain alternatives. By absorbing the complexity of cross-chain operations internally, Soul can offer sophisticated lending functionality to users while extracting value from the efficiency gains generated by its architectural advantages.

Fee Breakdown

Soul’s approach to generating fees is multidimensional, leveraging the integration with base protocols and its cross-chain capabilities:

- Supply and Borrow Fees: Additional fees are charged on top of the underlying base protocol’s fees for both suppliers and borrowers. This incremental fee is designed to improve revenue without significantly impacting user participation.

- Cross-Chain Borrow Fees: A fee is applied to cross-chain borrow operations, calculated based on transaction volume rather than TVL. This ensures fees scale with activity rather than static liquidity.

- Liquidation Fees: Since all liquidations occur at the Soul protocol level rather than within the base protocol, Soul retains the associated liquidation fees. This design centralizes the liquidation process and allows Soul to capture additional revenue.

- Flash Loan Fees: Fees are charged for flash loans, a popular DeFi tool allowing users to borrow and repay within a single transaction. This feature aligns with Soul’s emphasis on capital efficiency.

- Optimization Feature Fees: Users can access the best possible lending and borrowing rates across all integrated protocols and chains. Fees are applied for each position adjustment, regardless of whether the user currently has an active loan, monetizing this flexibility.

- Cross-Chain Operations Fees: Integration with protocols like Stargate allows users to perform operations such as borrowing or repaying loans across different blockchains. For instance, users can repay a loan on Ethereum using assets from Avalanche, with transaction fees shared between Soul and the integrated protocol.

Soul’s fee structure is designed to adapt to market conditions. Initially, fees can be set to zero to offer competitive APYs, attracting liquidity and users. Fees are configurable per market, allowing dynamic changes as needed to optimize revenue without deterring participation.

Soul Token ($SO)

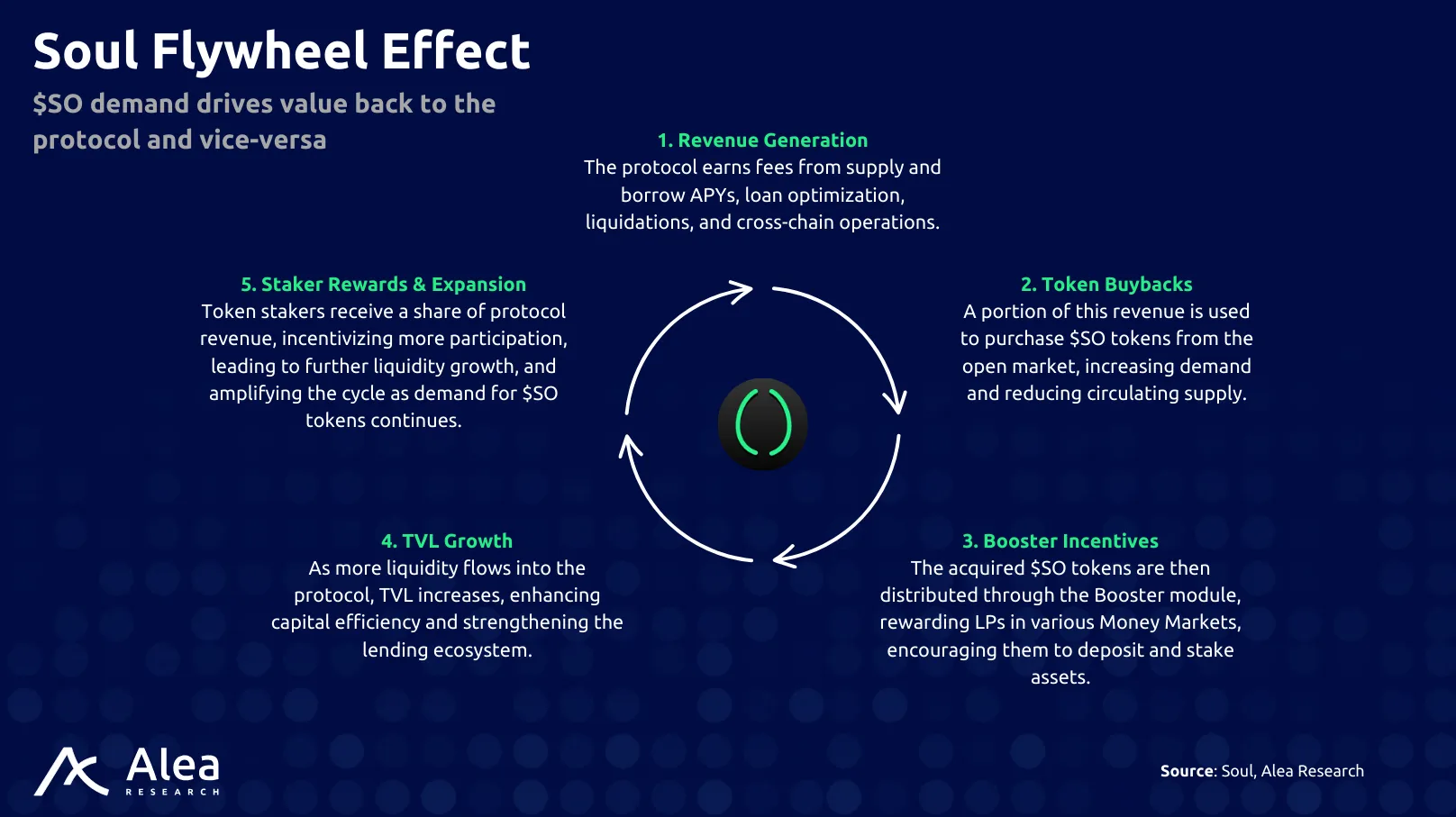

Soul is focused on generating sustainable revenue through intrinsic utility rather than relying on traditional liquidity mining practices, often creating unsustainable token emissions and selling pressure. By tying its revenue generation to the protocol’s infrastructure, Soul incentivizes participation in its Money Markets by offering additional rewards that complement the base APYs of integrated protocols.

To access these boosted yields, users must stake a portion of their collateral value in $SO tokens, aligning the token’s demand with the protocol’s TVL. This mechanism establishes a feedback loop where the token’s growth is directly linked to protocol adoption and liquidity. The approach enables an organic and self-reinforcing cycle, rewarding liquidity providers and active participants while creating long-term value and growth potential for $SO token holders. This model reduces the speculative nature often seen in token-based incentives.

$SO token features include:

Moreover, Soul plans to implement a mechanism known as the Booster, a module designed to enhance user yields by allowing them to stake Soul Tokens in exchange for increased APYs across their collateral. This feature will incentivize deeper participation by rewarding users who stake more tokens with higher returns. The Booster will serve as a core utility module, reinforcing $SO’s role within the ecosystem while driving protocol revenue and long-term engagement.

Soul’s token features and protocol design create a flywheel mechanism that benefits the entire Soul ecosystem.

Unlike most lending protocols that generate revenue solely from borrowed funds via the Reserve Factor, Soul leverages cross-chain swaps to optimize user positions across multiple chains, applying a fee on each swap. This shifts revenue generation from borrowing activity to transaction volume, where even a small base fee (e.g., 0.03%) can drive significant earnings. Soul’s buyback mechanism, similar to Hyperliquid’s Assistance Fund, strengthens its flywheel effect by reinvesting revenue into the ecosystem, improving liquidity incentives, and allowing Soul to offer the most competitive yields across integrated money markets.

Security

Soul implements security measures to safeguard its Money Markets and ensure stability across its lending framework. These measures address risks at both the protocol and user levels, reducing the likelihood of systemic failures or exploit scenarios.

The protocol enforces strict borrowing limits within each Money Market, calculated based on liquidity and the collateral factor of the base protocol. This ensures that borrowing activities remain within safe thresholds, even during periods of market volatility. For instance, if a Money Market has $100 in liquidity with a collateral factor of 80%, new borrow requests that exceed $80 will be automatically rejected.

Soul also segregates the liquidity and collateral for each Money Market, meaning that fluctuations in asset values within one market do not affect the solvency of others. This structure minimizes the risk of cascading liquidations across multiple chains or protocols.

Additionally, the protocol features real-time position monitoring and liquidation mechanisms. Positions are actively tracked to maintain user solvency, and if a position becomes under-collateralized, the protocol can initiate liquidations to restore balance and protect liquidity providers. These mechanisms are designed to operate efficiently even in volatile market conditions.

Finally, Soul avoids systemic risks associated with cross-chain operations by using native assets instead of wrapped tokens and implementing optional cross-chain functionality. This ensures that cross-chain interactions do not compromise the security of individual Money Markets.

Risks

While promising in its approach with advanced design principles, Soul Protocol faces several risks that must be carefully managed and mitigated. These risks span operational, technical, and market-related challenges.

Smart Contract Vulnerabilities

As with any DeFi protocol, Soul relies heavily on smart contracts, which are prone to coding errors or vulnerabilities. Exploits, whether in Soul’s contracts or its integrated base protocols (e.g., Aave, Compound, etc), could lead to financial losses. To mitigate this issue, vigorous audits and continuous code development are needed.

Cross-Chain Communication Risks

Soul’s reliance on cross-chain messaging layers, such as LayerZero or Axelar, introduces risks related to message delays, inaccuracies, or potential exploits in the messaging protocols. A failure in these layers could disrupt cross-chain operations and lead to liquidity issues or user losses. Although the fallback mechanism mitigates this risk to a great extent, reliance is still present.

Reliance on Base Protocols

Soul’s functionality depends on the stability and performance of integrated base protocols like Aave and Compound. If these protocols face exploits, governance attacks, or insolvency events, Soul’s operations could be severely impacted. The complexity of supporting multiple base protocols means Soul inherits all their individual vulnerabilities while adding new attack surfaces through the cross-chain integrations.

To mitigate this, Soul chooses established protocols to integrate with, but there’s always the risk of unforeseen events.

Governance Risks

As a decentralized protocol, Soul relies on token-based governance. Concentrated ownership of governance tokens could lead to decisions that favor a small group of stakeholders over the broader community, introducing centralization risks.

Audits

Soul is undergoing audits and formal verifications as a first layer of security. The team is preparing a solid initial codebase before testnet. Future plans include several audits with reputable third-party security firms.

Team

The team behind Soul Protocol consists of experienced professionals with strong backgrounds in DeFi, blockchain development, engineering, and traditional finance:

- Ahmed Serghini. (CEO at Soul Labs)

- Founder and CEO of Soul Labs, leading the development of DeFi solutions.

- CEO of Hatom, a major lending and liquid staking platform on MultiversX, reaching over $280M+ TVL.

- Experienced in managing DeFi protocols and blockchain-based financial services.

- Ramiro Vignolo. (CTO at Soul Labs)

- Nuclear engineer with expertise in system architecture and blockchain interoperability.

- Over five years of experience in both traditional finance and DeFi.

- Skilled in team leadership and scaling blockchain infrastructure.

- Diego Pontello. (Senior Blockchain Engineer)

- PhD in Physics, with a focus on mathematical modelling and blockchain security.

- Research Associate at SISSA, working on DeFi protocol design and optimization.

- Specializes in building secure and efficient blockchain solutions.

- Alvaro De La Iglesia. (Senior Project Manager)

- Civil engineer with a postgraduate degree in project management.

- 6+ years of experience in blockchain, focusing on DeFi, cross-chain interoperability, and protocol integrations.

- Manages execution and operations across Soul’s ecosystem.

FAQ

What is Soul Protocol?

Soul is a unified omnichain liquidity layer that facilitates seamless cross-chain lending and borrowing while leveraging native assets and integrating with existing money markets like Aave and Compound.

How does Soul differ from other lending protocols?

Soul focuses on native cross-chain operations without relying on wrapped tokens, uses modular architecture for scalability, and offers features like cross-chain borrowing, optimization tools, and flexible fee structures.

Does Soul integrate with other protocols?

Yes, Soul integrates with leading money markets like Aave, Compound, and Morpho. It also uses LayerZero and other similar protocols to enable cross-chain functionality.

What advantages does Soul offer over single-chain lending protocols?

Soul’s primary advantage lies in its capital efficiency optimization through cross-chain liquidity aggregation. Users can access unified lending markets across multiple chains while maintaining singular risk profiles. This reduces over-collateralization requirements and enables more efficient capital utilization compared to isolated lending markets.

What role does LayerZero play in Soul’s architecture?

LayerZero serves as the primary messaging layer, with additional bridge protocols providing fallback options. This multi-provider approach ensures reliable cross-chain communication while mitigating single points of failure in the messaging infrastructure.

What is the role of the Soul Token?

The Soul Token serves as a governance token, enables staking for yield boosts, and is integral to reward distribution, position optimization, and fee sharing within the ecosystem.

Can Soul adapt to market changes?

Yes, Soul’s fee structure and interest rates are configurable per market, allowing it to adjust to market dynamics while maintaining competitive APYs for users.

How does Soul handle security?

Soul uses native assets, redundant cross-chain communication layers (e.g., LayerZero, Axelar), strict borrowing limits, and modular risk management to protect against exploits and systemic risks.

What mechanisms prevent cascading liquidations in cross-chain positions?

Soul’s dual collateral factor system separates borrowing limits from liquidation thresholds, creating natural buffers against cascade risks. The Controller maintains global position oversight, enabling coordinated risk management across chains while preventing localized market stress from triggering system-wide liquidations.