Overview

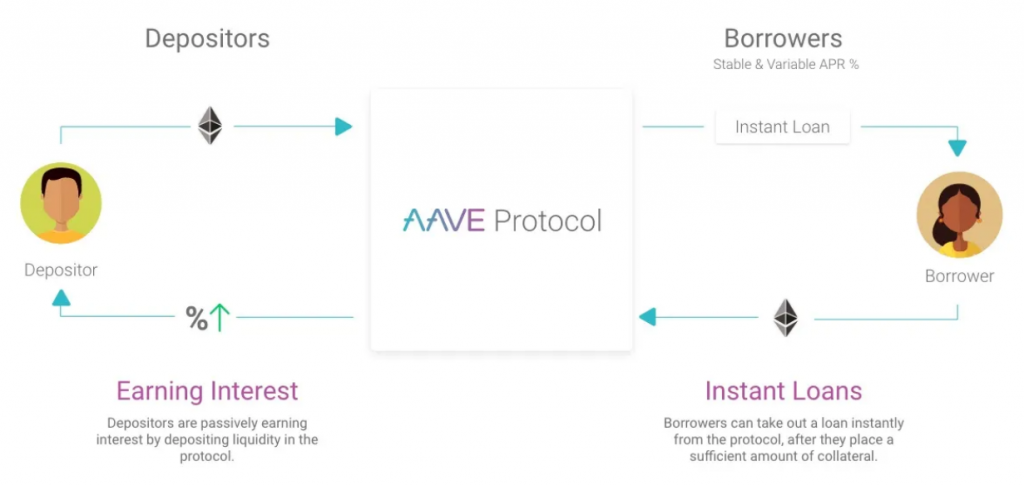

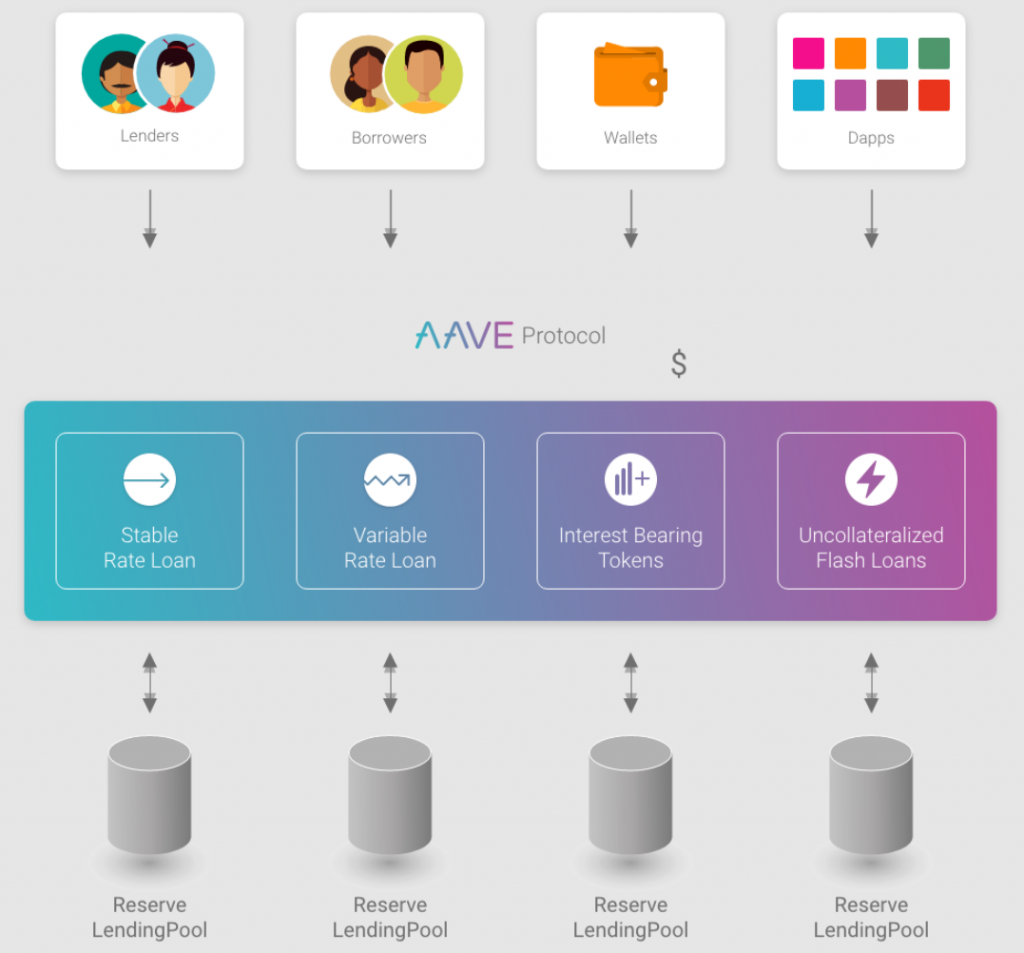

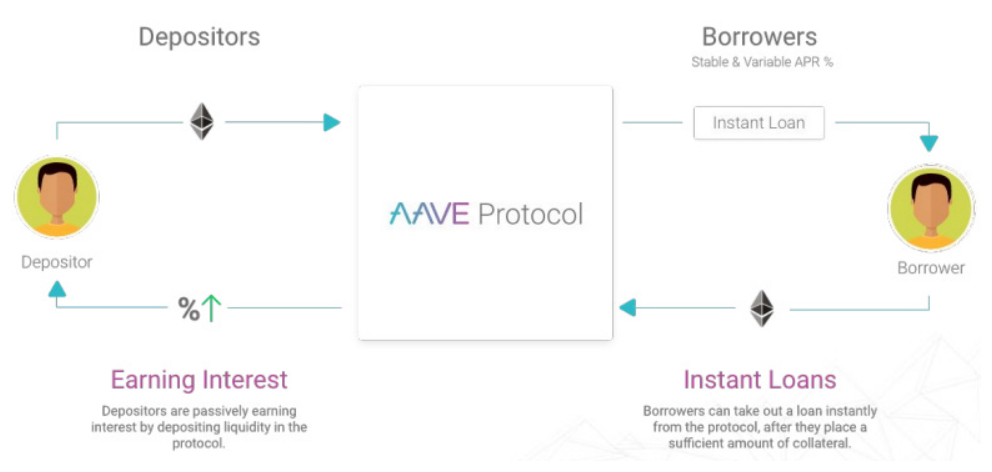

Aave has historically been the largest money market in crypto. Its decentralized borrow-lending peer-to-pool model has proven to be the most capital-efficient way for DeFi users to earn interest on their deposits, or to gain immediate access to an asset’s liquidity.

Users deposit assets into a lending pool and make them available for others to borrow. In exchange, borrowers will pay back their debt plus extra interest. By using a liquidation bonus, the protocol ensures that liquidators always have the incentive to close undercollateralized loans and ensure that the protocol remains solvent. All loans on Aave are overcollateralized by default.

As an extra layer of protection, the protocol’s Safety Module shares protocol revenue and incentives with its governance token, $AAVE. When staked, stkAave holders provide a safety net in extreme situations where the protocol could accrue bad debt due to untimely or inefficient liquidations. As a reward for this service, these stakeholders are rewarded with $AAVE tokens, which grant governance power.

The protocol’s Governance structure runs a Decentralized Autonomous Organization that leads proposals and ensures that they are put into practice by the core team. After years of running in production and gaining traction with an effective product-market fit strategy, Aave is now seeking to expand its business operations with a multi-chain strategy and the launch of its own stablecoin, $GHO. Aave also provides pools for real-world assets like real estate, cargo, and freight invoices. It also has an institutional branch, Aave arc, where institutional investors can use these RWAs (Real World Assets) as collateral to conduct business operations or borrow extra cash.

Aave is also branching out beyond DeFi with the launch of Lens Protocol, a decentralized social media platform where users can own their own social graph. This social graph is personal and can be ported to all platforms that integrate the Lens protocol within it. This allows for use cases such as bringing your own friends and connections from one social media to another (take your Youtube subscribers to Twitch, your Twitter followers to Facebook…)

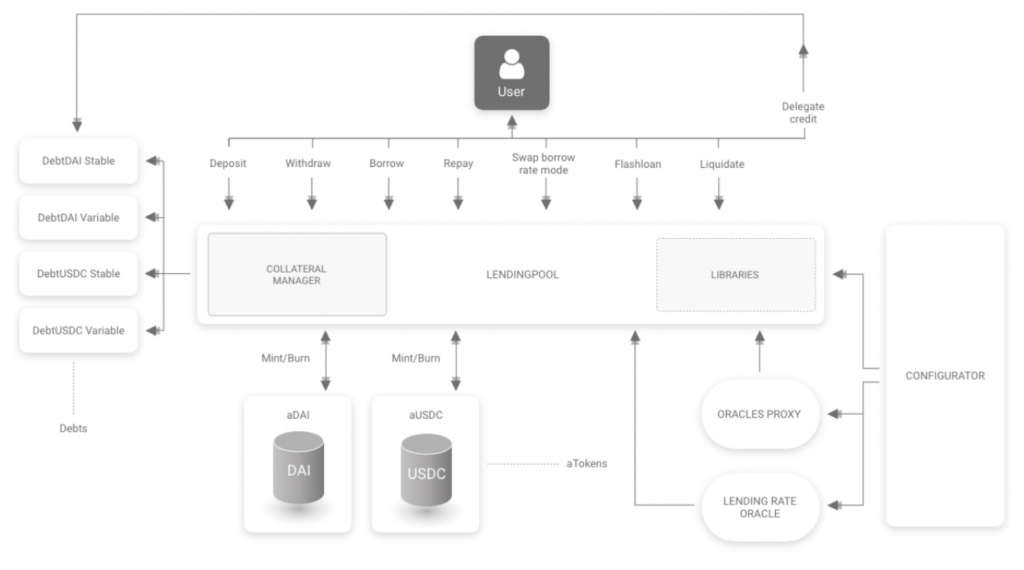

The Aave Protocol is a decentralized borrow-lending market that follows a peer-to-pool model where people can borrow and lend money without a third-party financial intermediary, like in TradFi. Because of this model, loans do not need to be individually matched between participants. Instead, all the liquidity remains in a pool from which borrowers can borrow by depositing collateral. This enables instant loans in a decentralized manner.

Money Market

As a money market, Aave enables the permissionless lending and borrowing of assets. It allows users to lend or borrow a variety of cryptocurrencies without the need for intermediaries like banks. This is because Aave operates through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

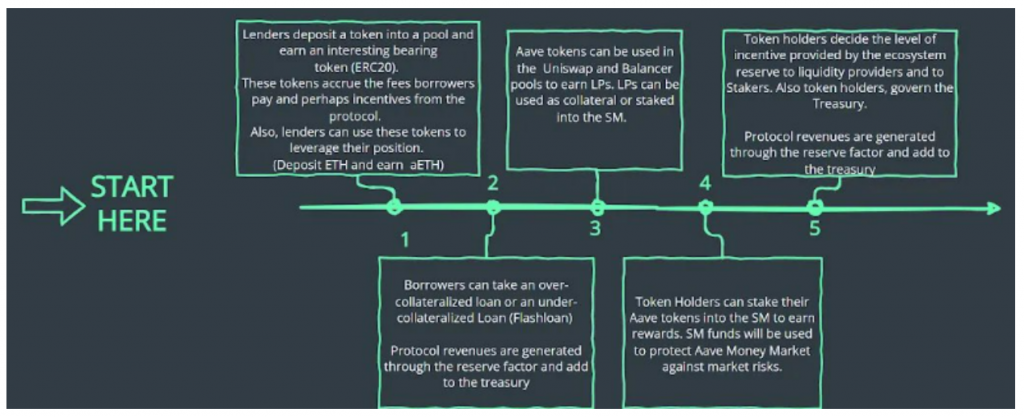

- Deposits: Users can deposit their assets into Aave’s liquidity pools. These pools are composed of funds provided by lenders, and they collectively form a lending pool for each supported cryptocurrency.

- Borrowing: Once funds are deposited, users can borrow from the pool by collateralizing their assets. Borrowers must deposit more valuable collateral than the borrowed amount to secure the loan. This collateral reduces the risk for lenders.

Aave offers two types of interest rates for borrowers: variable and stable. Variable rates fluctuate based on supply and demand dynamics in the market, while stable rates are fixed and provide more predictable borrowing costs.

Lenders earn interest on the funds they deposit into the liquidity pools. The interest rates vary based on the utilization rate of the pool, which reflects the ratio of borrowed funds to available funds. Aave charges borrowers a fee, which is a percentage of the borrowed amount, and this fee is distributed to the lenders as an incentive to provide liquidity.

Interest rates

Aave utilizes a unique interest rate model that dynamically adjusts borrowing and lending rates based on the supply and demand of each asset in its liquidity pools. The interest rates on Aave are determined by a mechanism known as the “Interest Rate Model,” which aims to achieve a balance between the supply of funds from lenders and the demand for funds from borrowers.

The following factors impact Aave’s interest rates:

- Asset Utilization Rate: The utilization rate represents the ratio of borrowed funds to available funds in a particular liquidity pool. A higher utilization rate indicates greater demand for borrowing a specific asset. As the utilization rate increases, Aave adjusts the interest rates accordingly to incentivize more lenders to supply funds to the pool and maintain a balanced utilization rate.

- Reserve Factors: Each asset on Aave has a reserve factor associated with it. The reserve factor represents the percentage of interest earned by lenders that is set aside as a reserve for the specific asset. It serves as a safety buffer in case of defaults or losses in the pool. A higher reserve factor reduces the interest earned by lenders and indirectly affects the borrowing rates.

- Interest Rate Curve: Aave employs an interest rate curve to determine the borrowing rate based on the utilization rate. The curve can be customized for each asset pool and is designed to be responsive to changes in utilization. It ensures that borrowing rates increase gradually as the utilization rate rises, encouraging responsible borrowing behavior.

- Stable Rates: Aave also offers stable interest rates as an alternative to the variable rates. Stable rates are fixed, predictable rates that borrowers can choose if they prefer a more stable borrowing cost. These rates are determined separately from the variable rates and are typically higher than the variable rates to account for the reduced risk to lenders.

In the borrow rate technical implementation, the calculateCompoundedInterest method relies on an approximation that mostly affects high-interest rates. The resulting actual borrow rate can is:

The model parameters for each asset in Aave are set based on the asset’s risk profile, its role as collateral, and its liquidity within the Aave ecosystem:

- Risk Profile: Assets are categorized into clusters based on their risk profiles. This grouping helps in calibrating interest rate parameters that are appropriate for assets with similar characteristics. For example, volatile assets that are predominantly used as collateral for liquidations are assigned a lower Optimal Utilization rate.

- Collateral Assets: Certain assets in Aave serve as collateral for borrowers. These assets need to have sufficient liquidity to enable timely liquidations when necessary. To ensure liquidity for collateral assets, the Optimal Utilization rate is typically calibrated to be low, around 45%. This means that the utilization rate of these assets should be kept below 45% to ensure adequate liquidity for liquidations.

- Asset Liquidity: The liquidity of an asset within the Aave protocol is an essential factor in determining the interest rate parameters. Assets with higher liquidity tend to have more stable utilization rates. In contrast, assets with lower liquidity may experience higher volatility in their utilization rates. Consequently, assets with lower liquidity are assigned more conservative interest rate parameters.

- Stablecoins: Stablecoins, which are cryptocurrencies pegged to the value of a fiat currency, are given special consideration. The liquidity of stablecoins is particularly important, and stablecoins with higher liquidity are assigned more favorable parameters. Lower liquidity stablecoins may have a lower Optimal Utilization Ratio, reflecting the need for more cautious interest rate settings.

By taking into account the risk profile, collateral role, and liquidity characteristics of each asset, Aave’s interest rate parameters are calibrated to ensure efficient and stable lending and borrowing operations within the protocol. These parameters help in maintaining appropriate levels of liquidity, managing risk, and aligning the interest rates with the unique characteristics of each asset.

aTokens

aTokens, also known as Aave interest-bearing tokens, are tokens that represent a user’s share of a particular asset’s pool in Aave’s lending protocol. These tokens are generated when users deposit their assets into Aave’s liquidity pools and are minted in a 1:1 ratio with the deposited asset.

The valuation of aTokens is closely tied to the underlying asset and its interest-earning potential within Aave:

- Peg to the Underlying Asset: Each aToken is pegged to the value of the underlying asset at the time of deposit. For example, if a user deposits 1 ETH into Aave, they will receive 1 aETH (aToken representing their deposited ETH). The initial valuation of the aToken is the same as the underlying asset.

- Accrued Interest: As aTokens represent a user’s share of the lending pool, they accrue interest in real-time. The interest is earned by the user proportionally to their holdings of aTokens in the pool. The interest earned is added to the user’s balance of aTokens, increasing their valuation over time.

- Interest Rate Dynamics: The interest rates in Aave are determined by the utilization rate and the interest rate curve, as mentioned in the previous response. As demand for borrowing an asset increases, the interest rate for lending that asset rises, which in turn affects the interest earned by aToken holders. Higher interest rates can lead to an increase in the valuation of aTokens due to the additional interest being accrued.

- Market Factors: The market value of the underlying asset can impact the valuation of aTokens. If the market price of the asset rises, it generally reflects positively on the valuation of aTokens. However, it’s important to note that the valuation of aTokens is not solely determined by the market price but also by the interest-earning potential within the Aave protocol.

It’s worth mentioning that aTokens can be redeemed at any time, allowing users to convert their aTokens back into the underlying assets. When a user redeems their aTokens, they receive the underlying asset plus the interest earned during the holding period. The redemption value is based on the total interest accrued and the prevailing interest rates at the time of redemption.

Borrow interest rates

Aave’s borrowing interest rates are determined by a combination of factors, including the asset’s utilization rate, the interest rate curve, and the choice between variable and stable rates:

- Asset Utilization Rate: The utilization rate represents the ratio of borrowed funds to available funds in a specific asset pool. It indicates the level of demand for borrowing a particular asset. Aave’s interest rate model responds to changes in the utilization rate to maintain equilibrium. As the utilization rate increases, the interest rates for borrowing that asset tend to rise, incentivizing more lenders to deposit funds into the pool.

- When capital is available, low-interest rates encourage loans.

- When capital is scarce, high-interest rates encourage repayments of loans and additional deposits.

- Interest Rate Curve: Aave employs an interest rate curve to determine borrowing rates based on the asset’s utilization rate. The curve is customizable for each asset pool and influences the cost of borrowing as utilization changes. It ensures that borrowing rates increase gradually with higher utilization, discouraging excessive borrowing and encouraging responsible borrowing behavior.

- Variable Rates: Aave offers variable interest rates for borrowers. These rates fluctuate in real-time based on the supply and demand dynamics within the Aave ecosystem. When the utilization rate is low, variable rates tend to be relatively low. However, as demand for borrowing increases, the rates rise accordingly. Variable rates can be advantageous when borrowers anticipate a decreasing interest rate environment.

- Stable Rates: In addition to variable rates, Aave provides stable interest rates as an option for borrowers. Stable rates are fixed and predictable, offering borrowers more certainty about their borrowing costs. Stable rates are typically higher than variable rates to account for the reduced risk they provide to lenders. Stable rates are useful when borrowers anticipate an increasing interest rate environment or prefer a consistent borrowing cost.

It’s important to note that Aave’s interest rates are determined algorithmically based on the protocol’s rules and the behavior of users. They are not influenced by a centralized authority. Instead, the rates respond to changes in supply and demand dynamics within the Aave ecosystem, promoting an efficient allocation of funds.

Why the Protocol was Created

Aave was formerly known as ETHLend and came into existence in 2017. The rebranding happened in September 2018. In the beginning, the project was founded by Stani Kulechov, a law graduate student from Finland who envisioned the protocol as a peer-to-peer lending protocol. Without a lot of upfront capital compared to other ICOs (Initial Coin Offering) that were launching back in the day, Stani still decided to raise money via the traditional ICO way and managed to raise $16.2M. This funding allows the protocol to expand its team of developers, which soon realized that, due to the low liquidity in DeFi back in the day, a peer-to-pool lending model would be more appropriate.

In the peer-to-peer model, users would interact with each other via smart contracts. However, this was not capital efficient, since there needs to be someone else on the other side of the loan.

Similar to how other projects like Uniswap or Compound managed to use a peer-to-contract model, the team realized that this contract could act as a lending pool that would accumulate all user deposits and eliminate the need to find a counterparty.

Aave comes from the Finnish language, where it means “ghost”.

After a couple of years, the protocol managed to capture attention at the beginning of 2020, and the growth quickly escalated in May of that same year, when a period known as DeFi summer started.

- June TVL: $60M

- July TVL: $400M

- October TVL: $1B

- November TVL: $1.6B

At the time of launch, Aave and Compound were the only way for users to provide and obtain access to liquidity in an autonomous manner. In December 2020, a second version of Aave was deployed, featuring credit delegation, stable rates, gas optimizations… Around the same time, Aave Governance gained traction, and in November 2021, the first ARC with respect to Aave V3 was announced.

Roadmap

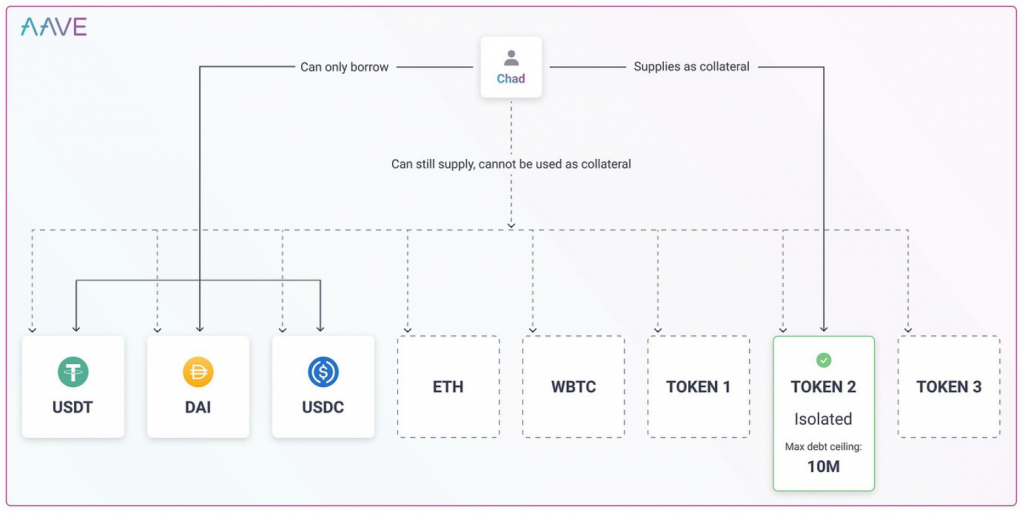

Aave V3 represents a technological improvement that will introduce features such as:

- Portals: allow assets to easily flow between Aave V3 markets across different networks.

- High-Efficiency Mode: this allows borrowers to get the highest borrowing power out of their collateral.

- Isolation Mode: limits protocol exposure to risk from newly listed assets by only allowing borrowing up to a specific debt ceiling.

- Risk Management Improvements: and additional protection through various risk caps and other tools.

- L2-specific features: to improve user experience and reliability.

- Community Contribution: to facilitate the ease of access and distribution of community incentives and contributions to a well-organized codebase.

Although the Aave protocol has been functional for years, the design of Aave v3 aims to create a Layer-0 optimal borrow-lending platform. This will provide users with key advancements on:

- Capital efficiency: V2 does not allow users to optimize their assets supplied to the Aave protocol in terms of yield generation. This is because the yield is constrained within its specific market and network.

- Risk mitigation adjustment: by adjusting borrowing power and maintenance margin.

- Decentralization: through community proposal and DAO management in order to further decentralize its functions and delegation of tasks.

- Cross-chain communication: users will be able to transfer liquidity seamlessly from one chain to another.

The core concepts of the protocol will remain working without changes. There will continue to be aTokens, stable borrowing rates, credit delegation…

Portals

Portals allow users to move their own assets seamlessly from one Aave deployment on one chain to another. This is possible by allowing users to supply liquidity on one chain and transfer it to another chain by burning aTokens on the original source network and minting them on the destination network.

Portals can help bridging protocol Connext, Hop Protocol, Anyswap, or xPollinate

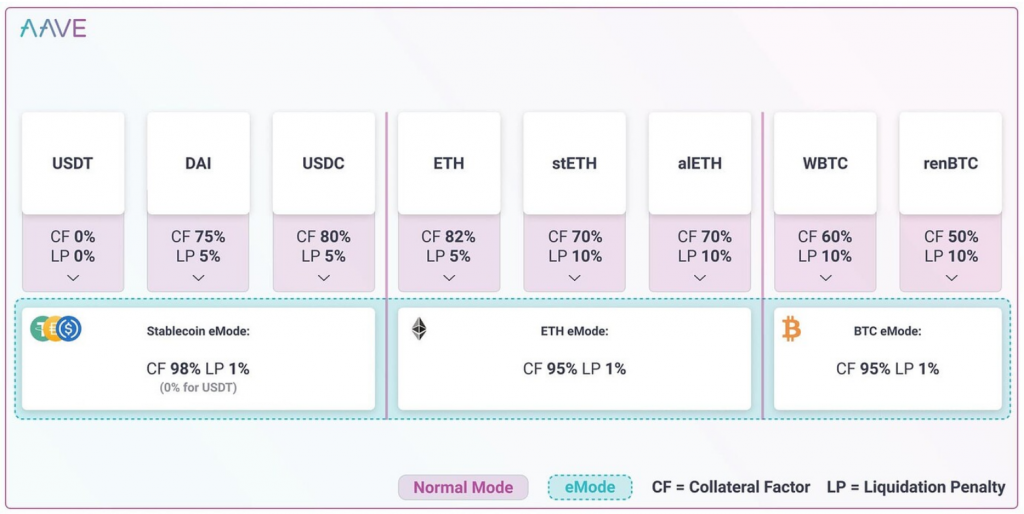

High Efficiency Mode (eMode)

High Efficiency Mode or eMode allows borrowers to ensure they are able to get the highest borrowing power for their collateral. This is possible by classifying the user assets based on LTV, liquidation threshold, liquidation bonus, and a custom price oracle. In eMode, borrowers can choose the category of assets they want to borrow. A category refers to a set of assets pegged to the same underlying asset (e.g. stablecoins pegged to USD, assets pegged to $ETH.

If a user selects to use the protocol in eMode, when that user supplies assets of the same category as collateral, then the borrowing power (given by the LTV), and the maintenance margin (given by the liquidation threshold) are overridden by the eMode category parameters in order to improve capital efficiency.

For example, assuming a category for stablecoins with a 97% LTV, a 98% liquidation threshold, and a 2% liquidation bonus, a user could supply $DAI and, instead of having a 75% LTV, the user could borrow other stablecoins with the borrowing power defined by the eMode category, which is 97%. Because of this, the user has access to 22% more capital-efficient liquidity.

Risk Management Parameter Updates

Isolation mode to enact risk mitigation features when a new market for newly listed assets is created. For example, a proposal could suggest listing an asset under isolation mode such that the isolated asset can only borrow stablecoins against it up to a specific debt ceiling. Therefore, users can only use that asset as collateral.

Supply and Borrow caps

- Borrow caps would allow Governance to set limits on how much of an asset can be borrowed.

- Borrow caps minimize liquidity pool insolvency.

- Supply caps allow Governance to vote to limit how much of a certain asset can be supplied to the protocol.

- Supply caps reduce protocol exposure to a certain asset and prevent attacks like infinite minting or price oracle manipulation.

Granular Borrowing Power Control by granting Aave Governance the power to change the collateral factor for future borrow transactions without affecting existing borrow positions or triggering liquidations.

Risk admins allow Governance to register entities that have the ability to alter certain risk parameters without the need for a governance vote.

Price Oracle sentinel to allow Layer 2 protocols to handle eventual downtime of the sequencer and disable borrowing under specific circumstances.

Extra Features

- Decentralization when adding new assets. Get rid of the need for on-chain voting and list assets in a permissionless manner.

- EIP 2612 token transfer support.

- EIP 712 signature support for credit delegation.

- Users can repay borrowed positions using aTokens instead of the originally borrowed underlying asset.

- Aave Governance can change any fees provided by the Aave DAO Treasury.

- New Flash Loans reduce gas consumption by up to 20%.

- New interest rate calculation optimizations get rid of the need for lending rate oracles.

GHO

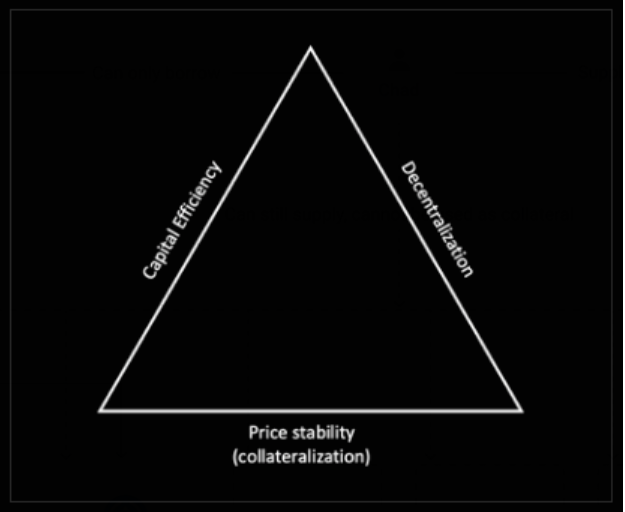

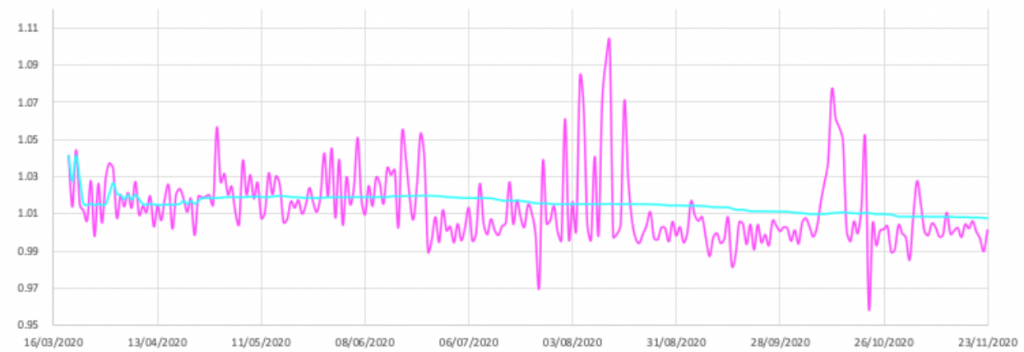

GHO is intended to be a decentralized, overcollateralized, and configurable token designed to maintain a stable value pegged to 1 USD. The mechanism design includes emission and destruction of GHO to maintain stability while allowing for the participation of Aave Governance and Facilitators to manage protocol parameters. Therefore, the market efficiency is the key driver that will programmatically align the value of $GHO with the US Dollar.

Stablecoins are digital assets pegged to a reserve asset by a stabilization mechanism that prevents fluctuations in value.

As a decentralized stablecoin, $GHO is minted by users in order to borrow against supplied collateral on Aave. Like other assets on Aave, the users supply collateral (at a specific collateral ratio) in order to be able to mint $GHO. Afterwards, when the debt is repaid by the borrower or the position is liquidated, $GHO is returned to the protocol and burnt.

All interest payments accrued by minters of $GHO go directly to the Aave DAO treasury (in contrast to the standard reserve factor collected when users borrow other assets and the principal is burned).

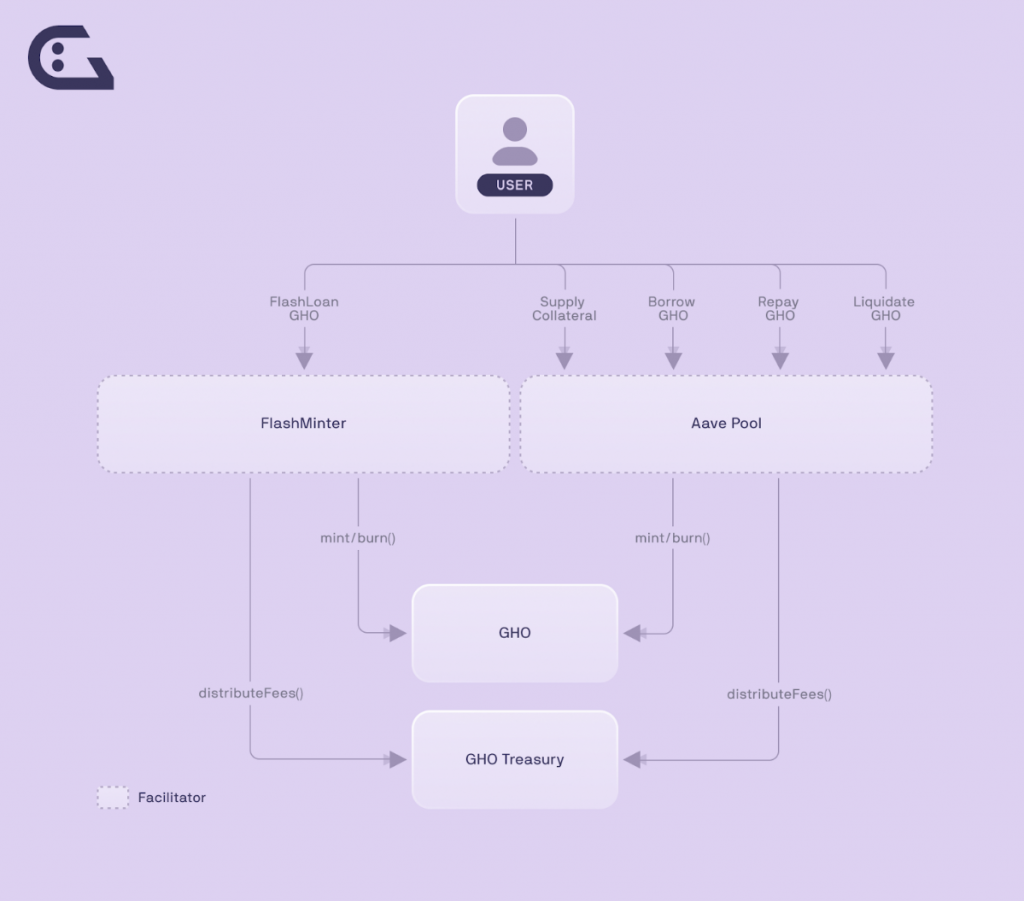

GHO is designed to reduce exposure to volatility as an ERC20 token that is minted/burned through different strategies. These strategies can be enacted by different entities known as Facilitators.

How it works:

- Supply collateral

- Borrow GHO

- Repay GHO Debt

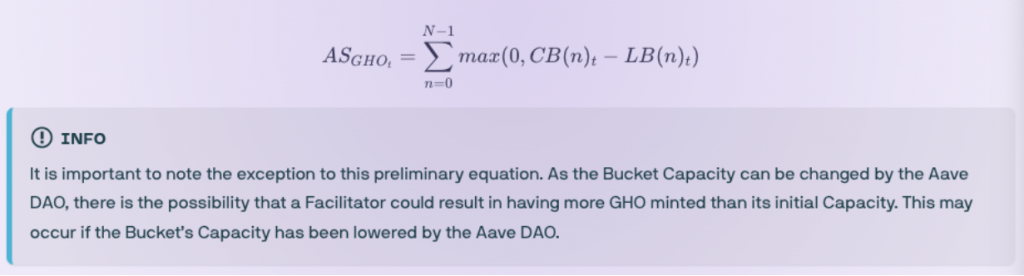

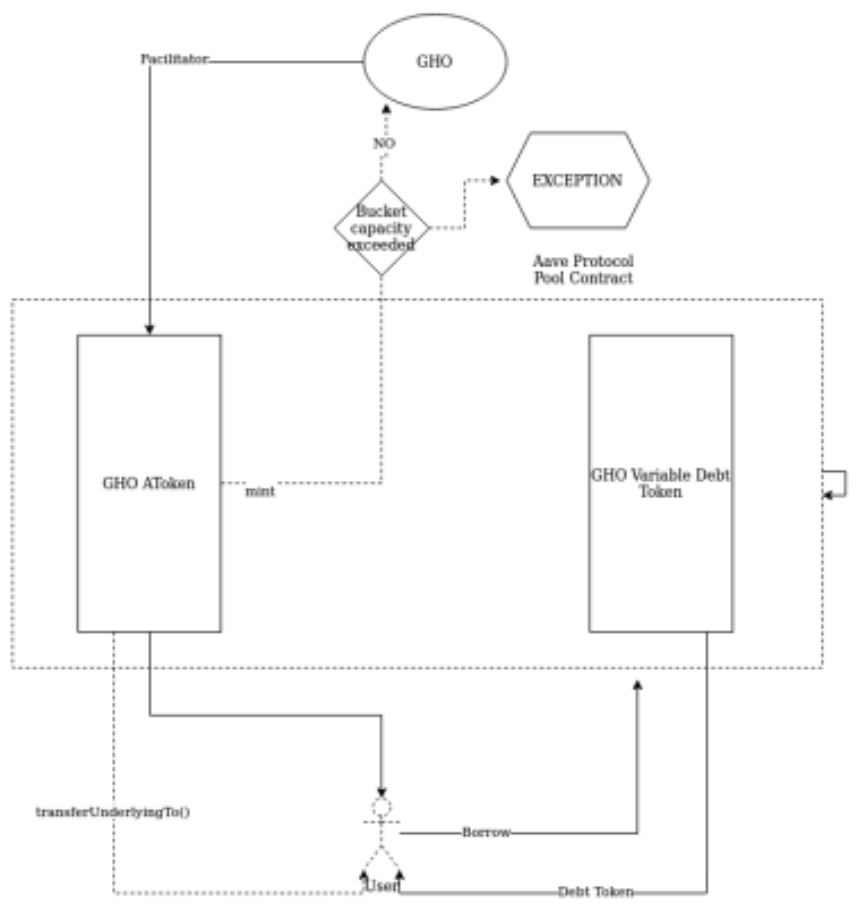

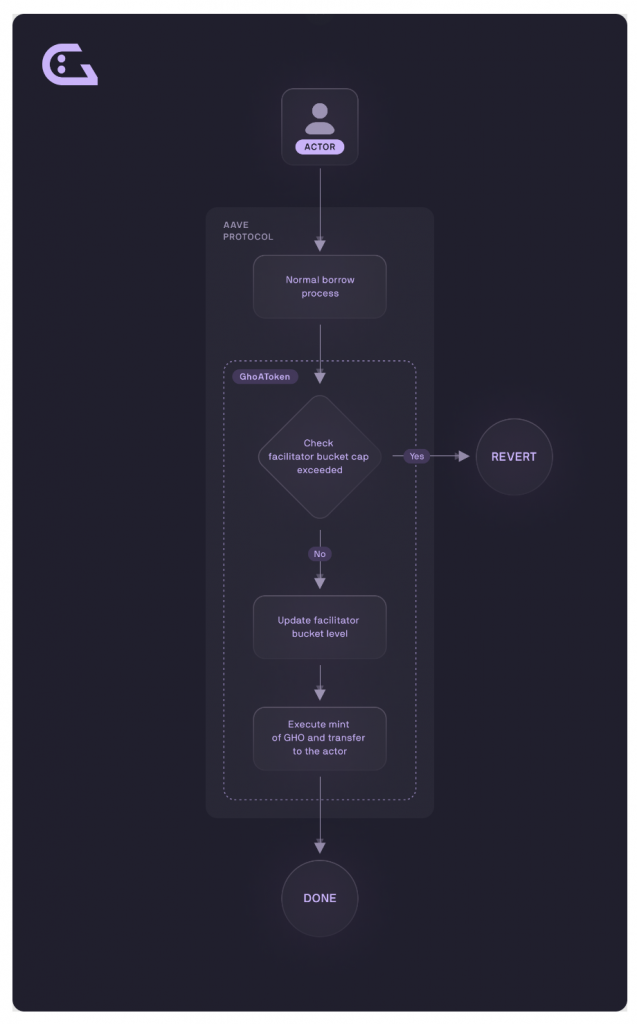

A Facilitator can truthfully mint and burn $GHO tokens. Each Facilitator (F) is assigned a Bucket with a specified capacity, (CB) and has a current bucket level (BL) at any given time. The Bucket represents the upward limit of $GHO that a Facilitator can mint of $GHO. These Facilitators can be different in technical nature based on the stabilization mechanism they use.

The available supply of $GHO (AS) is calculated as the maximum amount of $GHO available for minting through all facilitators at a given time.

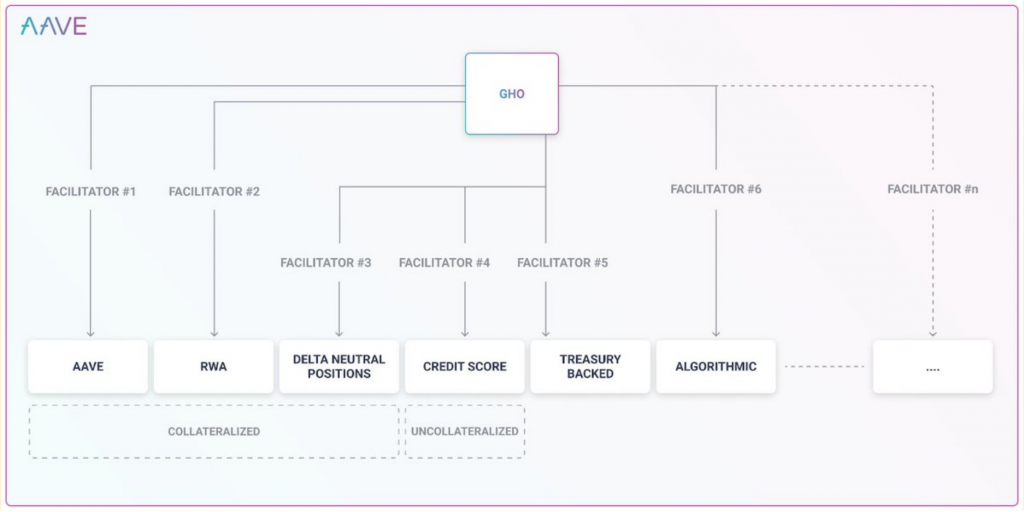

Facilitators are expected to be different in technical nature. As stablecoins can differ in the stabilization mechanisms they use, the idea is to employ multiple stabilization mechanisms in a controlled fashion orchestrated by the Aave DAO. This is achieved by balancing each bucket’s capacity to avoid compromising the overall stability and collateralization of the system.

$GHO is designed to accrue interest when supplied to a liquidity pool. The interest rate is determined by Aave Governance. The Aave protocol will be the first Facilitator.

A facilitator is an entity that can trustlessly mint and burn $GHO tokens.

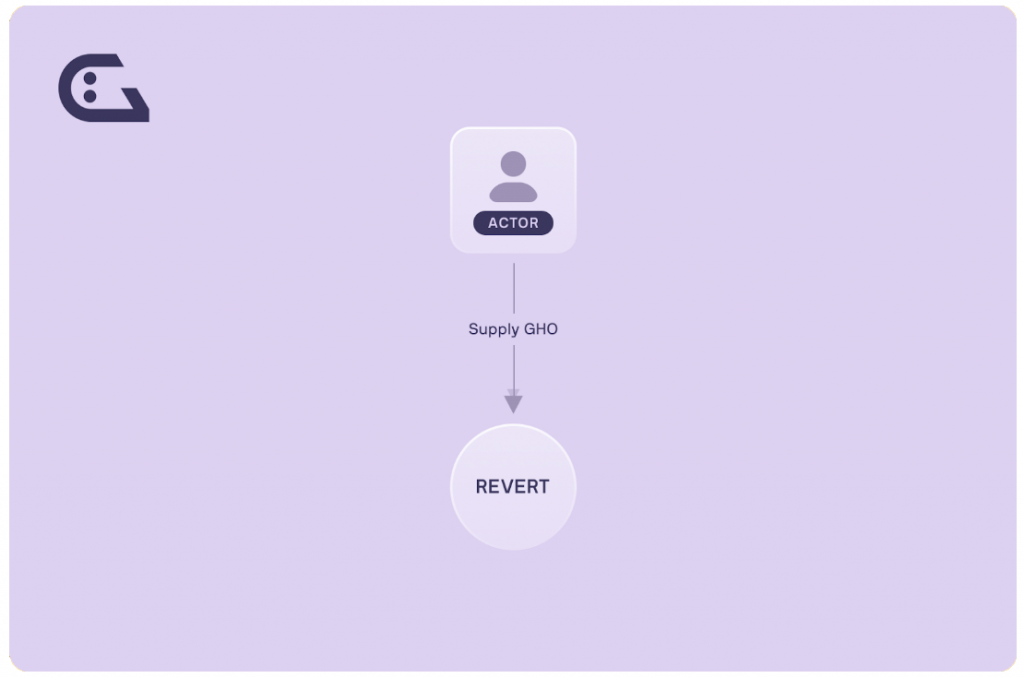

Given how $GHO interacts with the Aave protocol, it cannot be supplied on the Aave Ethereum market. Similarly, when $GHO is borrowed from the Ethereum market, new $GHO and $GHO debt tokens are minted and transferred to the users based on the collateralization requirements.

Facilitators

The initial facilitators are the Aave V3 Ethereum Pool and the FlashMinter Facilitator. Over time, $GHO will be minted through a series of different strategies. This will allow the Aave Governance to manage its exposure to different asset management strategies across the ecosystem in order to strengthen $GHO’s peg. Every Facilitator is responsible for providing its own strategy.

FlashMinting is especially important for $GHO, as it will help to facilitate arbitrage, provide instant liquidity, and have the ability to liquidate users.

Repayments and liquidations also play an important role in providing stability.

- $GHO is returned to the Aave market by users’ repayments or liquidators (if the user defaults on the loan) and the full $GHO amount is burned.

- The interest from loans goes to the Aave DAO Treasury.

- Since the original supply is burned, the Bucket Level for that Facilitator is decreased.

Interest and discount rate model

$GHO’s stability relies heavily on the interest rate, which is built into the code. When it comes to interest rates, these don’t follow supply/demand dynamics. Instead of being set algorithmically based on utilization, the Aave DAO Governance will statically adjust interest rates depending on the need for $GHO to expand or contract in value. The reason for this is due to the presence of the Borrow Discount Model implemented in the Safety Module. The goal of this module is to give additional utility to $stkAAVE holders. A maximum amount threshold and borrow discount rate will be set by Governance. This threshold determines the maximum amount of $GHO that can be minted at a discount per stkAave that the user holds.

Each time a user’s $GHO debt balance is updated, the protocol checks whether the user should receive a discount. If this is the case, the user’s interest is accumulated and their discount is applied to their balance increase.

Price stability is also achieved by arbitrage. Initially, the protocol has set the price of 1 GHO to $1 (there is no market pricing via oracles). Users can always borrow, repay, and liquidate GHO at $1.

- When the price of $GHO is less than $1, borrowers are incentivized to buy $GHO at a discount to repay/liquidate and earn the difference.

- When the price of $GHO is higher than $1, the incentive is to mint and sell $GHO for other stablecoins.

Here are some of the initial threshold details so far:

Discounts are available to borrowers by staking AAVE in the Safety Module, which is a smart contract-based risk mitigation tool used in shortfall events (when the protocol accumulates bad debt). To incentivize users to participate in stalking and reward them for assuming the risk, users who stake $AAVE can receive a discount on their interest rate.

For each unit of $stkAAVE, there will be a discount on the borrowing rate of 100 $GHO. For example, for each $stkAAVE token, a user can receive a 50% discount on interest for 1000 $GHO. If the interest rate is 3% and they stake 1 $AAVE and borrow 100 $GHO, they have then borrowed the maximum amount of $GHO available to them at a discount. In this situation, their interest rate goes from 3% to 1.5%. If the user borrows 200 $GHO, 100 $GHO will be at a 1.5% interest rate and the other 100 $GHO will be at a 3% interest rate. This would give an effective interest of 2.25%

The discount rate model can be updated easily as well. This discount rate is always available to users but can only be locked for a certain period of time. When a user receives a discount, this discount is assigned to them and can be locked for a certain period of time (e.g. 6 months). After that period has passed, if Aave Governance has set a new discount strategy and the user receives another discount rate, it may not be the same as before. This may also happen if a user triggers a discount update, such as borrowing and repaying $GHO and updating their $stkAAVE balance.

Multi-collateral-backed positions

Contrary to most stablecoins implemented as CDPs ($LUSD, $DAI…) where the stablecoin is minted via single asset vaults, $GHO is a multi-collateral-backed asset. This means that users can mint $GHO based on their entire set of supplied collateral assets across the Aave Protocol.

Using multiple different assets within the same borrowing position creates more flexibility for a user and allows for greater control over exposure to price fluctuations. This added flexibility brings in benefits for users who want to increase their health factor and not have to balance multiple positions and health factors.

In Aave, all assets that are borrowed must have been supplied by other users. This means that, only when an asset is supplied, can it be borrowed from the reserve. For example, if a user deposits $UDSC to borrow $LINK, another user must have supplied $LINK for the user to be able to borrow. This is not the case with $GHO. If a user deposits $USDC and would like to borrow $GHO, there is no requirement for a user to have supplied $GHO before. Instead, the Aave protocol calls the $GHO contract and mints $GHO on demand. Next, when the $GHO debt is repaid, $GHO tokens are burnt (rather than going back to suppliers).

Interest-earning collateral

When a user supplies collateral to Aave, other users borrow against the supplied assets. When this happens, interest will be earned on the supplied collateral, which effectively reduces the interest that a user is paying on their borrowed positions.

GHO oracle price

The $GHO Oracle Price is fixed at $1, regardless of the market price. This helps to maintain stability by favoring arbitrage opportunities. As the price is fixed, the opportunities to make a profit are immediate as soon as the peg breaks above or below.

- When the price of $GHO is above $1, users can mint 1 $GHO for $1 worth of debt, and if the price of $GHO is above $1 in the market, users can sell $GHO for more than $1. This increases the supply of $GHO while decreasing the asset price. The minter can later repay their debt at $1 and keep the difference of what they sold $GHO for.

- When the price of $GHO is below $1, minters can acquire $GHO on the market for less than $1 and pay off $1 worth of debt. This action shrinks the supply of $GHO wile increasing the asset price.

Interest rates

Aave Governance is responsible for statically setting interest rates, instead of following the usual supply and demand dynamics. Any changes to interest rates require a governance proposal.

- If the market price of $GHO is above $1, Aave Governance can decrease the interest rate to encourage additional minting of $GHO.

- If the market price of $GHO is below $1, Aave Governance can increase the interest rate to encourage more users to pay back their $GHO positions, which will decrease the outstanding $GHO supply.

Why GHO?

$GHO was built due to the market demand for a decentralized, and overcollateralized stablecoin that gives users the opportunity to transfer stable value in a fast, transparent, and censorship-resistant way. Due to the limited adoption of decentralized stablecoins and the current infrastructure that Aave provides to the Ethereum ecosystem, the protocol is aiming to capitalize on the opportunity of generating extra revenue for the Aave DAO by sending 100% of the interest payments accrued by minters of $GHO directly to the treasury.

Besides, there is a large opportunity to favor GHO’s expansion on different layer 2s (given their lower fees). This will increase the number of onboarded users as well as the number of transactions processed.

DeFi Subsector

Lending and borrowing in traditional finance is one of the most important elements to build a sustainable financial system. Lenders (a.k.a depositors) provide funds to borrowers in return for interest on their deposit and borrowers pay interest on the amount of money they borrowed in exchange for having access to the money immediately.

Industry Overview and Upside from potential adoption

One of the most common questions is, why would someone overcollateralize a borrowing position? There are a few reasons for this. For example, users may not want to sell their tokens because they need funds to cover unexpected expenses. Other reasons include delaying paying capital gain taxes on their tokes or using borrowed funds to increase leverage in a certain position

Chains

Aave is available on the following chains:

- Ethereum

- Base

- Arbitrum

- Avalanche

- Fantom

- Harmony

- Optimism

- Polygon

- Metis

- Gnosis

In its V3 version, the protocol provides new features such as Portals, which will allow for interoperability and liquidity flows between Aave V3 markets across different networks. This will also introduce governance-approved bridges to burn aTokens on the source network while instantly minting them on the destination network.

Using Aave

Aave is a decentralized non-custodial protocol where users can deposit or borrow assets. Depositors provide liquidity to the market to earn passive income from loan repayments, while borrowers borrow assets in an overcollateralized and perpetual manner.

When it comes to how the protocol works, users can become depositors or borrowers.

- Depositors provide funds to borrowers in return for interest on their deposit

- Borrowers are willing to pay interest on the amount they borrowed in exchange for having a lump sum of money available immediately.

For example, a user can deposit a stablecoin like DAI to earn interest on it according to DAI’s algorithmically set supply interest rate. This algorithmic rate is determined by the reaction between supplied and borrowed $DAI on Aave. This deposit of $DAI goes to a lending pool and can then be used by borrowers who want to borrow $DAI as a loan. In order for borrowers to access the funds, they have to deposit overcollateralized, or excess collateral.

In Aave, depositors who provide funds to a smart contract receive aTokens, whose value is pegged 1:1 to the underlying token. The difference is that the balance of aTokens will represent the deposit amount plus the accrued interest. Therefore, this balance keeps increasing according to the current borrowing rate of the protocol. You can think of this as similar to liquid staked tokens, such as $stETH, in that both of these tokens become worth more (in terms of the original token like ETH) over time.

All standard loans are overcollateralized, which means that the value of supplied collateral is higher than the amount that can be borrowed. This protects the protocol from the insolvency of borrowers repaying depositors while guaranteeing that there will always be enough liquidity to satisfy depositors’ withdrawals.

Users should be familiar with the following concepts:

Lending Pool: Protocol pool where users can deposit, withdraw, borrow, or repay their loans

aTokens: Yield-generating tokens that represent user deposits in the Aave protocol. They implement most standard functions of ERC20 tokens with additional functionality.

- aTokens are minted and burnt upon deposit and withdrawal into the protocol lending pool

- The aTokens’ value is pegged to the value of the corresponding deposited asset at a 1:1 ratio

- aTokens can be safely stored, traded, and transferred like any other ERC20 token

- All interest collected by aToken reserves are distributed to aToken holders by continuously increasing their wallet balance

Stable and Variable debt tokens: Tokenized borrowing positions on the protocol. These debt tokens are not transferable and they represent the debt owed by the token holder.

- Debt tokens are minted and burnt upon borrows and repayments

- There are 2 types of debt tokens:

- Stable debt tokens represent protocol debt in a stable interest rate

- Variable debt tokens represent protocol debt in a variable interest rate

- Debt tokens are modeled after the ERC20 standard but they are not transferable.

- balanceOf() will always return the most updated debt accumulated by the user

- totalSupply() will always return the most updated total debt accrued by all protocol users

AAVE token is the ERC20 governance token of the protocol.

- Integrates EIP-2612 for gas-less transactions and one-transaction approval/transfers.

Interest rate strategy to calculate and update the interest rates of specific reserves and optimize the base yield curve parameters for each asset. This is basically a mathematical function that determines the interest rate of each asset pool where the interest rate changes based on the amount of borrowed funds and the total liquidity (i.e utilization) of the pool for that asset

Price oracle to provide a price feed using Chainlink and an alternative fallback price oracle

- The protocol first checks for a price using the Chainlink aggregator and, if the price is below or equal to zero, it will call the Aave fallback oracle price.

Investors

Depositing and Earning

Users deposit the asset/s of their preference and, once the transaction is confirmed, they will receive aTokens which allow them to start earning continuous interest. How much depositors earn is based on:

- Interest rate payment on loans

- The interest paid by borrowers is shared by all depositors

- The more assets are borrowed (higher utilization rate), the higher the yield for depositors

- The yield earn will be specific to the APY of the deposited asset, since each asset has its own market of supply and demand

- Flash loan fees

- Depositors receive a share of the Flash loan fees. This amounts to 0.09% of the flash loan volume

Borrowing

The calculation of interest rates accounts for:

- Liquidity of aTokens (whose exchange rate constantly changes due to the dynamic nature of the pool utilization)

- The interest for lenders/depositors is not only based on the interest paid by borrowers. This is the reason why the borrow APY and the deposit APY are different.

To come up with its rates calculation, Aave keeps track of two values:

- Rate: a utilization metric that represents the ratio of funds that are being borrowed from the lending pool

- Index: a reserve growth that takes into account a flash premium by using an index-based rate calculation. This index simply represents the interest accumulated by the reserve during the time interval since the last updated timestamp

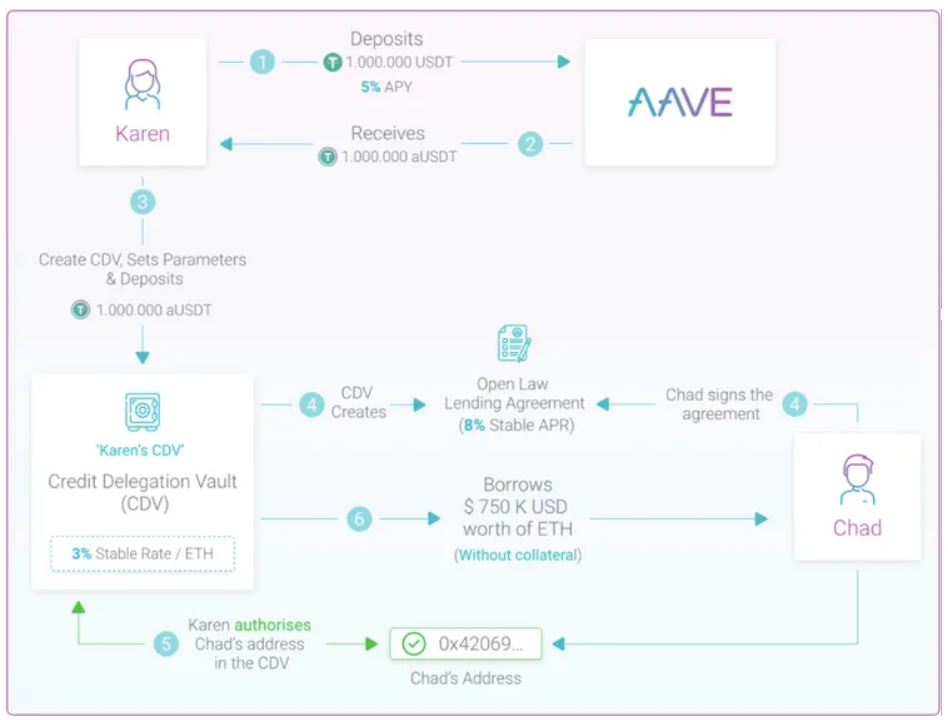

The protocol also features credit delegation, a method that allows a depositor to deposit funds to earn interest, and delegate borrowing power (their credit) to other users. The enforcement of the loan terms is agreed upon between depositor and borrower either via off-chain legal agreements or on-chain smart contracts. This enables:

- The depositor to earn an extra yield on top of the yield they are already earning from the protocol.

- The borrower to access an uncollateralized loan.

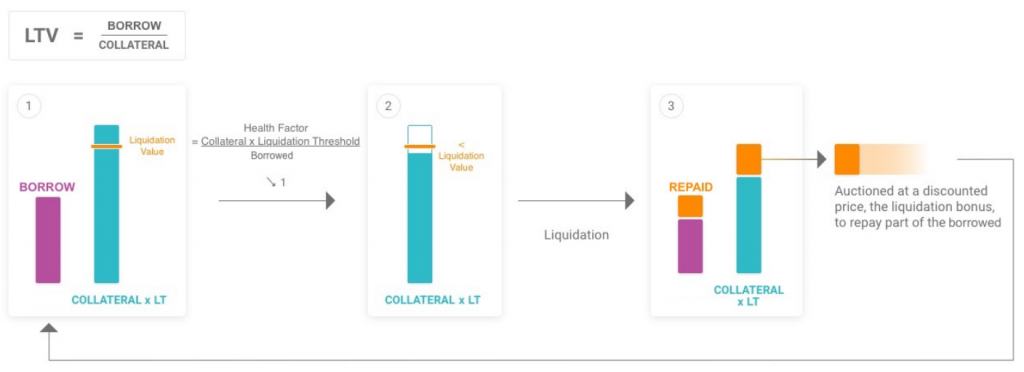

The maximum borrowing power of a specific collateral is given by the LTV (Loan to Value) ratio. For example, if a loan has a 75% LTV, then for every 1 $ETH worth of collateral, the user will be able to borrow 0.75 ETH worth of the principal currency. The loans are always overcollateralized, meaning that you always have to deposit more than what you are borrowing.

Based on the number of funds in the lending pool, which is measured by the utilization rate, the interest rate model can manage liquidity risk through user incentives such that:

- When capital is available, low-interest rates encourage more users to take loans.

- When capital is scarce, high-interest rates encourage more users to repay existing loans.

Debt Switch

The debt switch function was introduced on September 5, 2023.

It allows users to seamlessly switch their borrow positions, without having to manually repay and borrow.

Withdraw & Switch

The withdraw & switch function was introduced on September 5, 2023.

It allows users to withdraw their assets into another token of their choice.

Debt tokenization

- Borrower debt is tokenized into aTokens to help with protocol accounting.

- aTokens are minted when users borrow assets from the pool.

- aTokens are burnt, then loans are repaid and assets are deposited to the pool

- Users can hold multiple loans combining variable and stable rate positions.

- Multiple stable rate positions are handled through the weighted average of the rates of those stable rate loans being taken.

- Users can delegate credit to other wallet addresses by opening a credit line.

A loan with a stable rate behaves like a fixed rate loan with the difference that it is subject to being rebalanced by the DAO upon market fluctuations in the medium/long term.

Flash loans

Flash loans were first introduced in Aave V1 as a tool for developers with technical knowledge of the Aave protocol. To do a flash loan, the user needs to build a smart contract that requests a flash loan. The contract will then need to execute the steps required to perform a particular action, such as paying back loans, liquidating others’ positions…

- Flash loans allow you to borrow any available amount of assets without putting up any collateral as long as the debt is repaid in the same block. This enables use cases such as uncollateralized loans that allow borrowing an asset and repaying the borrowed amount plus a 0.09% fee before the next block is added to the blockchain.

- Flash loans can be used by liquidators to refinance the protocol, swap collateral assets, arbitrage opportunities across other money markets…

Change collateral from one or multiple assets to another without closing the current debt positions:

- E.g. A user has 100 $LINK and 20 $UNI in the protocol as collateral for a 100 $USDC debt.

- The user would like to swap the deposited $LINK and $UNI for $AAVE without needing to pay back its debt. Ideally, this would be done in one transaction.

- The user accesses a flash loan to swap the assets in a decentralized exchange.

- The flash loan contract would deposit the $AAVE tokens on behalf of the user in the Aave protocol.

- The flash loan contract would use the user’s $aLINK and $aUNI tokens to redeem the underlying $UNI and $LINK.

Partially or fully repay a loan with the existing collateral in the protocol:

- A user has 100 $AAVE tokens deposited in the protocol and an outstanding debt of 200 $USDC at a variable rate.

- The user would like to swap part of its $AAVE tokens for $USDC to repay a fraction of its loan.

- The user accesses a flash loan to swap a given amount of its $AAVE collateral to $USDC on a decentralized exchange and uses the resultant $USDC to repay its debt in the protocol.

- Create margin positions for trading.

- Change the debt exposure from one asset to another. Since all DeFi lending protocols allow for multi-collateral deposits, users might want to swap their collateral to add a passive “long” while keeping their current trading position.

- By removing the need to hold any upfront capital, liquidations can be democratized at the protocol level to enable faster and easier liquidations that will decrease the risk of protocol “bad debt”.

- Flash loans are a tool for developers. This primitive is an advanced concept targeted at experienced smart contract programmers on Ethereum.

- The contract calls the Aave lending pool and requests a flash loan for a certain amount of reserves.

- The lending pool transfers the reserves to the caller smart contract, which will execute its own logic with the funds that have been loaned to it. With these funds the contract is now able to execute any arbitrary operation as long as the reserves plus a 0.09% fee are returned to the lending pool within a single transaction (single Ethereum block).

- Tools like collateralswap or defisaver allow users to access flash loans without the need for coding their own implementation. For example, by clicking on “Close CDP”, what users are doing is:

- Flash loan $DAI equal to their CDP debt

- Pay back their CDP debt from their flash loan funds

- Withdraw $ETH from the CDP

- Swap $ETH to $DAI in a dex

- Repay the flash loan debt in $DAI

- Withdraw the remaining $ETH

Fees

The following are the fees involved in using Aave.

- Supplying & Earning

- Suppliers earn a fluctuating APY based on the current market rates.

- Flash Loan fees – Suppliers receive a share of the Flash Loan fees corresponding to .09% of the Flash Loan volume.

- Borrowing

- Borrowers pay either a stable rate or a variable rate with fluctuating APY based on the current market rates.

- The interest rate model can be found here.

- Liquidation Fee

- The liquidation penalty (or bonus for liquidators) depends on the asset used as collateral.

- You can find every asset’s liquidation fee in the risk parameters section.

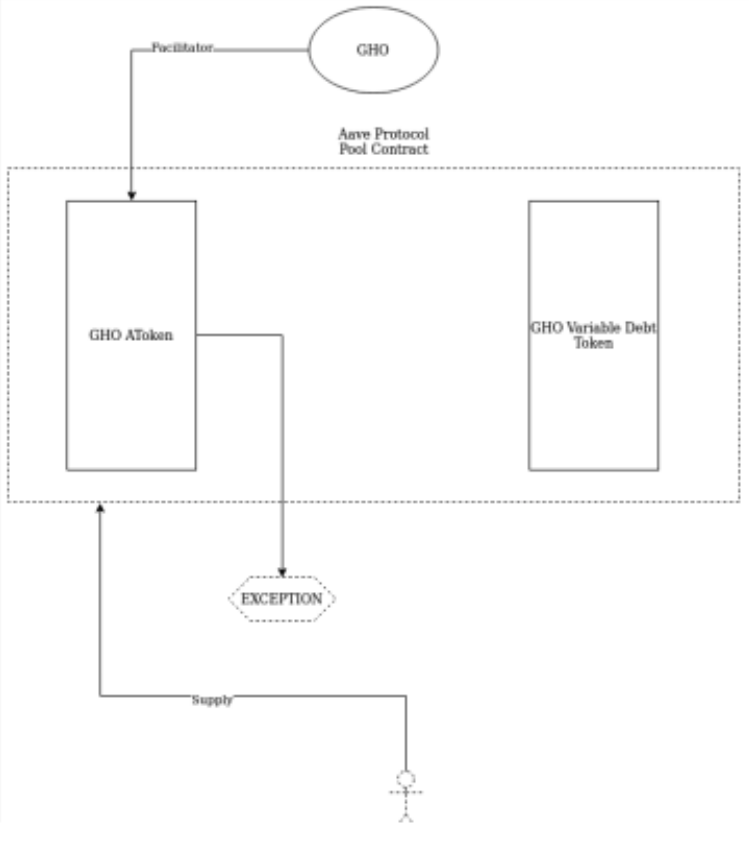

Supplying $GHO

As $GHO is not supplied, there are benefits to how $GHO works compared to other assets

- No one has to have supplied $GHO for another user to borrow it. Instead, the protocol can mint $GHO tokens on demand.

- Since there is no supply side, interest rates are not determined by utilization rates.

Borrowing $GHO

When borrowing $GHO, new $GHO and $GHO Debt TOkens are automatically generated and transferred to the user. During this borrow transaction, the Bucket level for each Facilitator is updated in order to reflect the new amount of GHO that has been minted. Because of that, the borrow transaction could fail if the amount requested exceeds the Bucket capacity assigned to the Facilitator.

Example:

- The user supplies 1 $ETH as collateral to Aave.

- The user receives 1 $aWETH in return.

- The user borrows (mints) 10 $GHO.

- The user receives 10 debt tokens.

- The debt becomes 10.0000008 variableDebtGHO because of the interest accrued after a short period of time.

As with any other asset, changes in collateral prices will impact the user’s health factor (and if it drops below 1, their collateral will be liquidated).

Liquidations

The Aave protocol is built on the over-collateralization of loans. Users lock assets in the protocol and borrow up to 75% of their current value. Because of this, the health of the Aave Protocol is dependent on the health of the loans within the system. This is coordinated by the ‘health factor’ of all open positions.

- If the value of their deposit increases, the user’s borrowing power increases as well.

- If the value of their deposit decreases, the user’s deposit valuation declines as well.

When a user’s deposit devalues significantly, a liquidation event can be triggered. When this happens, any third-party liquidator can pay back the user’s debt on their behalf and get paid a liquidation bonus for their service.

The liquidation bonus is the reward received by liquidators in exchange for their service for purchasing collateral assets that have a health factor below 1.

Liquidation processes occur when a borrower’s health factor goes below 1 due to their collateral value not properly covering their loan/debt value. This might happen when the collateral decreases in value or the borrowed debt increases in value against each other.

The collateral-to-loan value is represented as a ratio called the health factor, calculated by:

When the health factor drops below 1 the position may be liquidated to maintain the solvency of the protocol. This incentivizes third parties to safeguard the protocol’s health by acting in their own interest (to receive a loan’s collateral at a discount).

When the health factor ratio goes below 1, the loan becomes undercollateralized and can be liquidated

Examples of liquidations

- Example 1:

- Bob deposits 10 $ETH and borrows 5 $ETH worth of $DAI.

- Bob’s health factor drops below 1 and his position becomes eligible for liquidation.

- A liquidator repays up to 50% of Bob’s loan, 2.5 $ETH worth of $DAI.

- In return for his service, the liquidator can claim an equal amount in Bob’s collateral plus a liquidation bonus. Therefore, the liquidator claims 2.5 + 0.125 (5% liquidation bonus) $ETH for repaying 2.5 $ETH worth of $DAI.

- Example 2

- Bob deposits 5 $ETH and 4 $ETH worth of $YFI and borrows 5 $ETH worth of $DAI.

- Bob’s health factor drops below 1 and his position becomes eligible for liquidation.

- A liquidator repays up to 50% of the loan, 2.5 $ETH worth of $DAI.

- In return for his service, the liquidator can claim an equal amount in Bob’s.

In order to avoid liquidation, as the health factor declines, users can lower their risk by depositing more collateral assets or repaying a part of the loan. There are tools that help users to track their positions, such as DeFi Saver and HAL.

The health factor of a user is calculated from the user’s collateral balance (in $ETH) multiplied by the current liquidations threshold for all the user’s outstanding assets, divided by 100, divided by the user’s borrow balance and fees. This calculation can be performed both on-chain and off-chain

- On-chain: GenericLogic library contract

- Off-chain: Aave.js

Due to the importance of liquidations for the whole DeFi ecosystem, liquidators are important to the safety of Aave. With the introduction of flash loans, liquidators do not need upfront capital to provide their service. In a single transaction, liquidators can borrow funds from Aave, pay back users’ debt, collect their deposit, trade it for the best available market price, and return the assets to Aave with a small fee while keeping the remaining assets as a reward for their service. Anyone can be a liquidator in a permissionless manner. The most accessible way of doing that is by developing custom software solutions and bots, with the goal to be the first ones liquidating loans to get the liquidation bonus.

Since setting up bots programmatically is the most efficient process, liquidators must take into account the following:

- Only users that have a health factor below 1 can be liquidated.

- Calculate the liquidation bonus.

- For liquidations to be profitable, liquidators must take into account the gas cost involved in the process:

- Retrieve the users’ collateral balance.

- Get the users’ collateral price.

- Calculate the maximum collateral bonus you can receive as a liquidator by multiplying the collateral balance by the liquidation bonus multiplied by the collateral asset’s price in ETH.

- Estimate the maximum cost of the transaction by multiplying the total amount of gas units by the price of ETH.

- The approximate profit will be the value of the collateral bonus minus the costs of transactions.

- Liquidators can gather account’s data from on-chain information by monitoring emitted events and reading the users’ health factor.

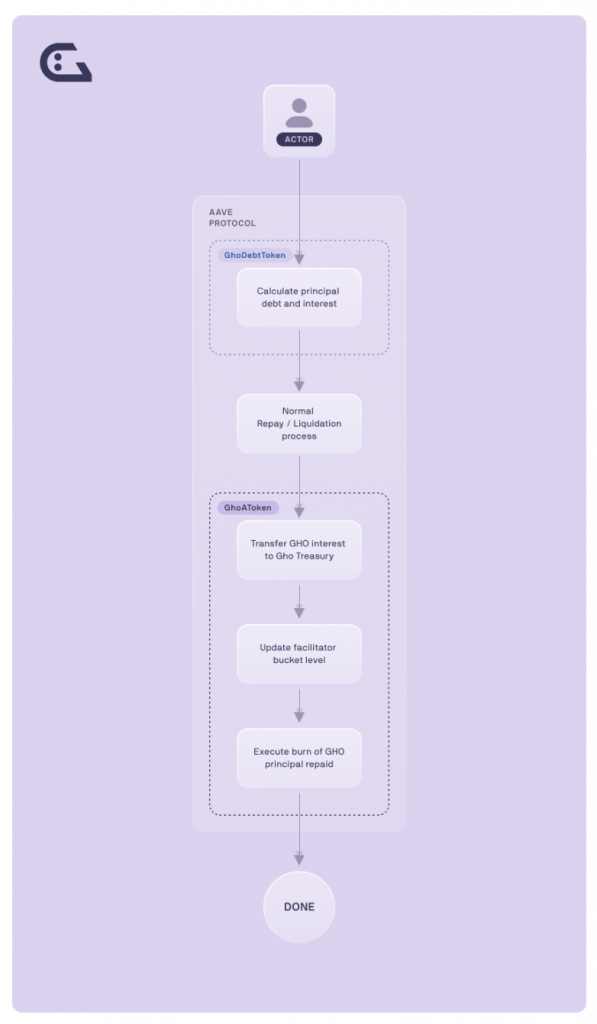

Repaying or liquidating $GHO

When repaying or liquidating $GHO, the $GHO tokens are sent back to the smart contract (pool) and are burnt and removed from circulation.

Example:

- The user has 10 debt tokens.

- The user purchases 90 $GHO tokens on the market, ending up with 100 $GHO tokens.

- The debt becomes 10.0000008 variableDebtGHO because of the interest accrued in a short period of time.

- The user has to approve the Aave protocol to pull funds from them to repay.

- The user then repays their $GHO debt position and the debt tokens are burnt

- The principal part (10 $GHO) gets burnt by the Facilitator

- The interest earned is transferred to the $GHO Treasury

Protocol Utility and Business Model

Aave is a pioneer in offering a DeFi exclusive product for RWAs (Real World Assets) in a permissioned and compliant platform for institutions, Aave ARC. Not only that, but thanks to its new social primitives, such as lens protocol, Aave is creating an ecosystem that stands out against its competitors because of its innovation and diversification.

Aave ARC

Since its launch in January 2020 and outstanding growth in TVL (Total Value Locked) with peak liquidity and over 1M total users, Aave quickly set itself up as the leading non-custodial liquidity protocol for institutional fintechs, hedge funds, family offices, and asset managers interested in Decentralized Finance.

Aave ARC provides institutions ranging from investment banks to pension funds and even central banks with the transparency, decentralized governance, and rapid innovation that comes from automated smart contracts execution, liquidity, and programmability. This comes at the expense of compliance and KYC enforcement policies for onboarding entities that must take AML regulations into account.

This integration was led by Fireblocks LLC, a registered money services business in the United States with money transmission licenses in several states. Fireblocks submitted an Aave Improvement Proposal to become the first whitelisted entity on Aave ARC for its leading MPC (multiparty computation) wallet product that would end up processing more than $1.5TN in transactions to date. This AIP was approved by Aave Governance.

Economics

Value Creation and Value Capture

As a protocol, Aave has come up with multiple DeFi primitives that allow for high capital efficient operations, such as Rate Switching, Flash loans, aTokens… By being a pioneer in borrowing/lending, Aave set itself apart from the competition and took advantage in the development of its multichain strategy.

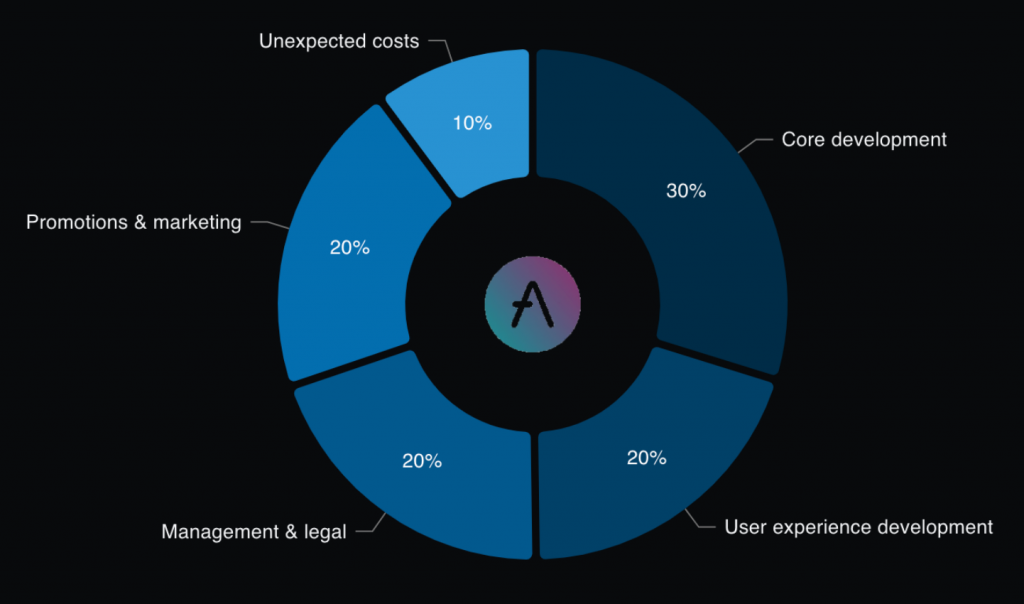

Operational Expenses

Compared to other protocols such as Balancer, Curve, or GMX, the protocol does not bring in excessive protocol revenue to its own native treasury, In fact, its evolving ecosystem is still too dependent on its well-designed economic incentive program. Combined with its decentralized distribution, long-term AAVE holders end up being rewarded for staking their tokens to secure the protocol while earning more governance tokens as a reward. This is crucial for maintaining the alignment between Aave and its community and agreeing on critical decisions that concern risk parameters, economic investments, asset listings, new chains…

Tokens

$AAVE use cases

The governance and staking utilities of the token define the main use cases of $AAVE tokens inside its own ecosystem. However, other protocol integrations such as LP collateral assets on Balancer and Uniswap also bring in extra protocol revenue in the form of trading fees.

$AAVE Token Utility

The migration of $LEND to $AAVE tokens after the protocol’s rebranding was executed at a 100:1 ratio.

The $AAVE token utility serves two purposes: governance and staking.

- The protocol is governed by token holders in the form of a DAO where voting power is proportional to the user’s token balance. The DAO votes on decisions such as:

- Amount of token issuance.

- Risk parameter changes in the Aave markets.

- Treasury funds allocation.

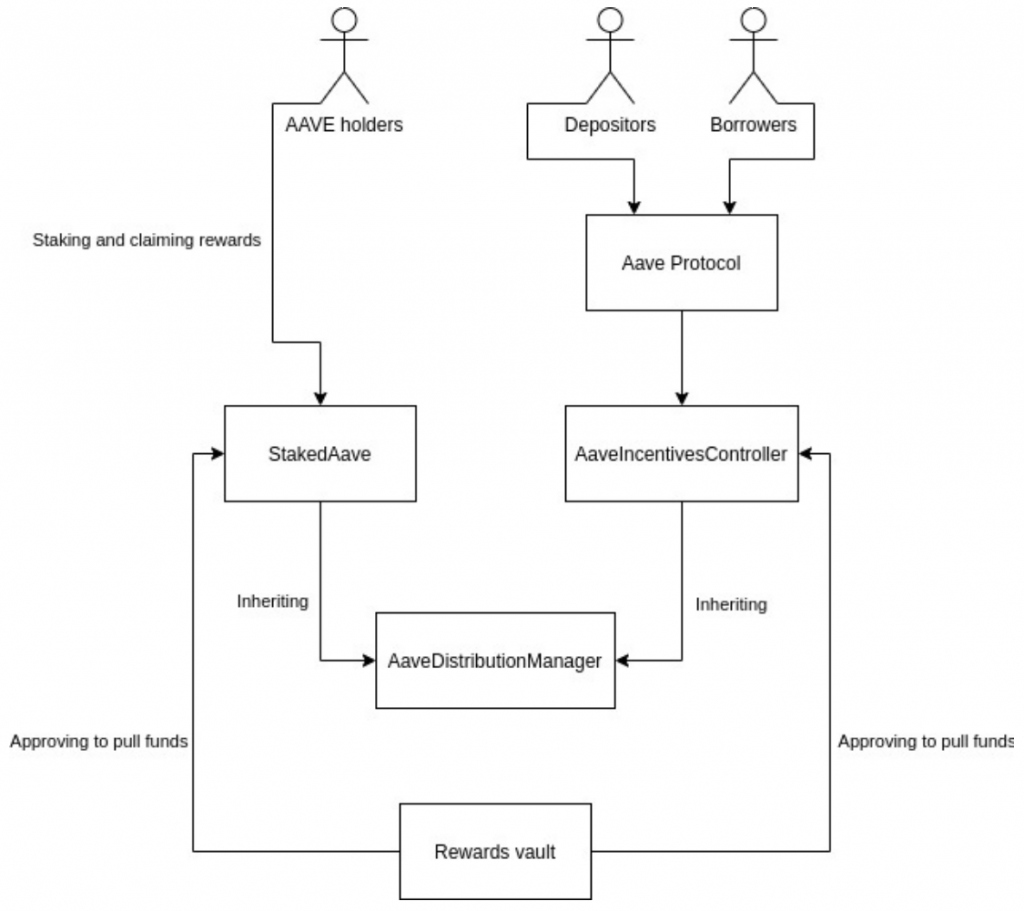

- By staking $AAVE in the Safety Modules, users are providing funds to secure the protocol in exchange for a reward paid in more $AAVE tokens that are issued by the ecosystem reserve as safety incentives.

Staking $AAVE

The $AAVE token can be staked in the Safety Module to earn rewards from helping the protocol in situations where a shortfall event might occur. When a user stakes $AAVE in the Safety Module, the user receives an equivalent amount of $stkAAVE in return. These assets entitle the user to claim rewards at any time and redeem them for the underlying $AAVE tokens.

The Safety Modules acts as an insurance fund against potential shortfall events. If an event like this occurs, 30% of the tokens staked could be slashed and used to repay everyone affected.

To calculate the APR:

emissionsPerSecond * secondsPerYear / balanceOfStkAave

To convert from APR to APY, the compounded per second formula is:

APY = (1 + (APR / secondsPerYear))^(secondsPerYear) – 1

To convert from APY to APR, the compounded per second formula is:

APR = ((1 + APY)^(1 / secondsPerYear) – 1) * secondsPerYear

The APR or Annual Percentage Rate is the interest after a year without taking compounding effects into account

The APY or Annual Percentage Yield is the interest after a year, which includes compounding interest

Liquidity Mining

Liquidity mining incentives were introduced via AIP-16 for both depositors and borrowers. Attracting liquidity is important for borrowing/lending protocols in order to provide utility to its users. Aave distributes liquidity mining rewards to incentivize protocol usage. These tokens are currently estimated as 3 million tokens from the Genesis supply allocated to the ecosystem reserve fund.

In addition to its token incentive programs, Aave has facilitated the LP tokens of Uniswap and Balancer to be used as collateral in the protocol.

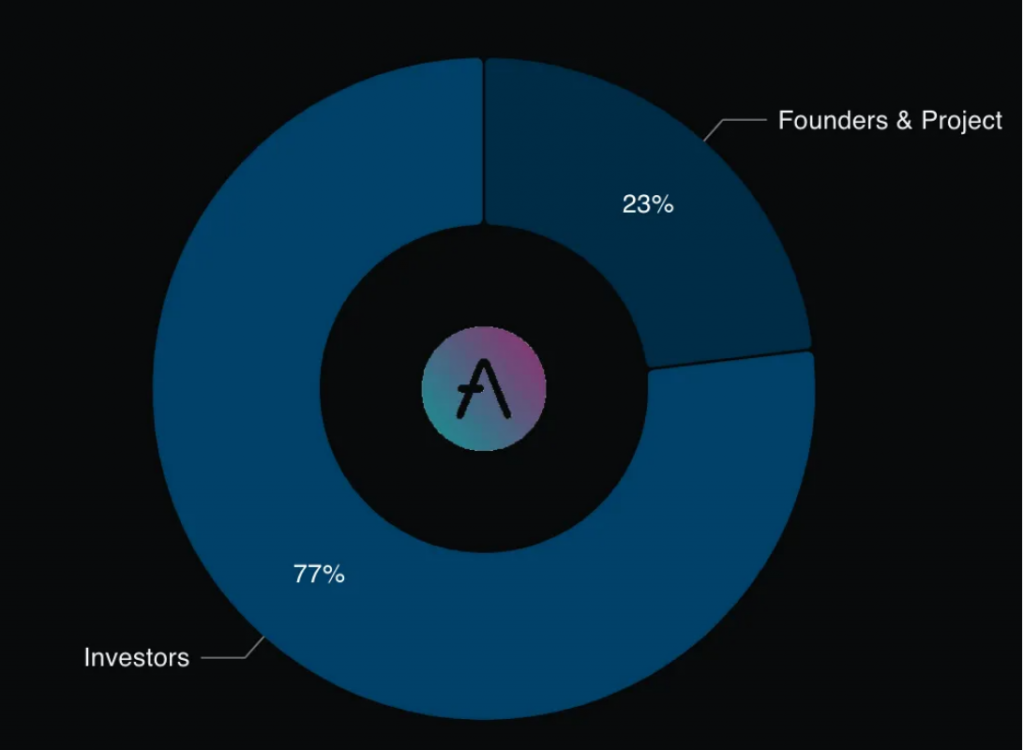

Supply and Distribution

- Total supply: 16M (all unlocked)

-

- Circulating supply: 13.9M

- Ecosystem fund: 2.1M

- Decentralized token distribution where no central entity holds any significant amount of tokens

- Aave started its operation with centralized token distribution and managed to fully distribute its token issuance via governance in a progressive process.

- Initial token distribution:

- Current token distribution:

- The $AAVE Safety Module is the largest holder with over 250,000 tokens (~1.6% of the circulating supply).

- The Ecosystem Reserve Fund is the second largest holder.

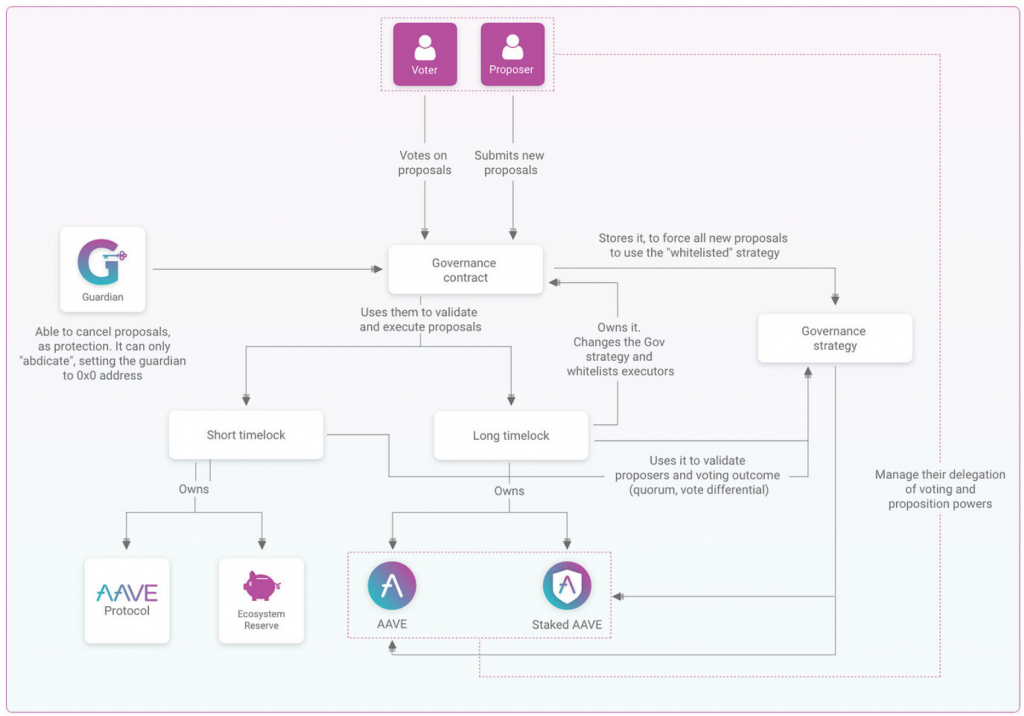

Governance

Governance is defined by the mechanisms and financial incentives described in the Aavenomics whitepaper. To participate in governance, users need $AAVE or $stkAAVE tokens to vote on proposals. For votes to be valid, the balance of voting tokens ($AAVE or $stkAAVE) must be the same or greater throughout the entire proposal voting and validating period. Reducing the amount of tokens you own would cancel your vote.

$AAVE and $stkAAVE token holders receive governance power in proportion to the sum of their balance. There are 2 powers associated with each governance token:

- The proposal power gives access to creating proposals. A creator must have a proposition power (given by its $AAVE/$stkAAVE tokens balance) higher than the PROPOSITION_THRESHOLD at the block before the proposal is created and until the proposal is executed.

- The voting power is used to vote for or against any existing proposal

Any user can choose to delegate one or both of its governance powers associated with a token. Users that have received delegated power cannot forward this delegated power to another delegate.

An account’s voting power at a given block is given by its AAVE/stkAAVE balance plus the balances of all delegators. A user can only vote once.

Off-chain process

- An Aave Request for Comment (ARC) is created and reviewed by the community

- Anyone can participate in the Governance Forum, create ARCs, and vote on improvements

- Minimum requirements:

- Short and concise title and description of the proposal including:

- The rationale of the proposal (why it is needed)

- Community poll

- A discussion where all questions are answered on the forum

- Snapshot vote to gather community feedback and maximize the chances of a positive outcome of the AIP submission

- If there are no problems with the ARC, then an Aave Improvement Proposal (AIP) can be created by any community member who has sufficient proposition power.

-

- The AIP should include all the relevant information as well as the links to the forum discussion and snapshot vote.

- The AIP needs to be submitted via Github by forking the AIP repository and following the template.

- When the AIP is reviewed and merged into the repository, it will be uploaded to IPFS using the AIP uploader tool.

The AIP is submitted on-chain for governance voting by a community member with enough proposition power. The AIP should be merged into the AIP repository with an associated IPFS hash of the parsed AIP file.

Proposal creation

- The proposer needs to maintain its proposal power higher than the PROPOSITION_THRESHOLD until the proposal is fully executed on-chain.

Proposal voting

- A snapshot of the voting power distribution is taken and users can submit votes while the proposal is active.

End of proposal

- For a proposal to pass:

- The voting power of votes in favor needs to reach the MINIMUM_QUORUM threshold

- The difference between the votes in favor and the votes against needs to exceed the VOTE_DIFFERENCIAL parameter.

Proposal queuing and execution

- If the proposal succeeds, it will be executed after the execution delay and before the grace expiration period. This is executed by a lock executor contract.

Proposal canceling (optional)

If the creator’s proposal power decrease and no longer meet the PROPOSITION_THRESHOLD, anyone can cancel the proposal.

As a safeguard mechanism, there is a guardian account controlled by a 6/10 community multisig. This account can cancel a proposal before execution. The goal is to:

- Protect the Aave Protocol against potential governance takeovers by having the ability to “veto” and AIP if it is deemed malicious.

- Fail safely in an emergency if there is a need to pause Aave markets.

- Current Community Guardians:

- Ernesto Boado (BGD Labs)

- Matthew Graham (Governance House)

- Fernando Martinelli (Balancer Labs)

- Coderdan (Aavegotchi)

- Corbin Page (ConsenSys Codefi, Aave Grants DAO)

- Gavi Galloway (Standard Crypto)

- Meltem Demirors (Coinshares)

- Marc Zeller (Aave Companies)

- Hilmar Maximilian Orth (Gelato)

- 0xmaki

There are 2 types of proposals with different parameters which affect the length and execution of a proposal. For example, proposals that are critical for the protocols require more voting time and higher bote differential than proposals that only affect some protocol parameters.

- Short-time lock executor

- Can execute proposals that change critical parts of the protocol and that require quick intervention

- Long-time lock executor

- Can execute proposals than change protocol parameters and that don’t require quick intervention.

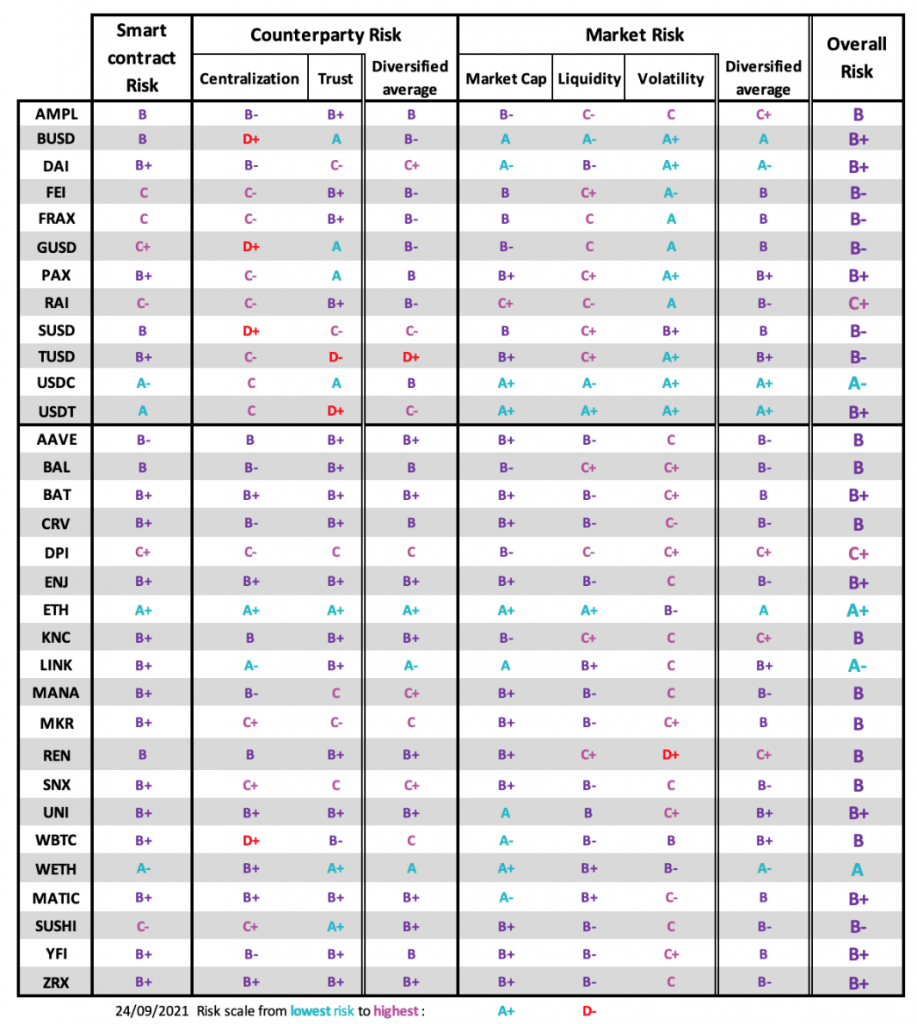

New Asset Listings are one of the most important protocol operations since Aave can support many different assets in many different markets. Each market operates as a separate risk pool. Adding a new asset influences the overall risk of that particular market. For a new asset to be added to the protocol, there needs to be a discussion and proposal process where the following factors are analyzed:

- The increased insolvency risk of the market the assets will be listed in

- The potential to expose the market to a single point of failure

- The risks associated with the acceptable collateral assets

- The benefits of the protocol in terms of market diversification

- The asset must have a Chainlink price feed

In addition to the ARC, AIP process, one of the risk analyses to be taken into account is the submission of the Aave Risk Score

V3

V3 was implemented on December 26, 2023, and is the next iteration of the Aave decentralized governance to control the whole ecosystem: multi-chain native and minimizing voting cost.

V3 was conceived in order to improve non-optimal aspects of V2, such as the cost of voting and the coupling between governance and tokens.

Governance power in v3 is given to Aave itself, stkAAVE and $AAVE deposited on Ethereum V3.

The following are differences from V2:

- Proposal creation: Minor differences. Proposal creation happens on a governance smart contract on Ethereum and can only be done if the address has enough proposition power (balance and/or delegation). The only difference is that now the governance will be payload-contract oriented: before creation, the proposer or somebody else will need to deploy and register in an Aave contract the payload/s smart contract with the logic to be executed if/when the proposal passes, in the network/s where the changes will be executed if the proposal passes. This will be common for both Ethereum and non-Ethereum networks, and the proposer will only need to pass on the creation stage the id of said payload/s, and on which network they are deployed.

- Pre-voting delay: Almost the same as on v2: there will be a 1-day delay between proposal creation and the start of voting, with the “snapshot” of voting power to be taken just when that delay passes. For some technical reasons, on v3 this delay will not really always have the exact same duration, but it will mainly increase in the order of 1h difference.

- Voting: To vote, $AAVE holders/delegators will not be doing it on Ethereum in the big majority of the cases, voting will happen in other networks like Polygon, Avalanche, Arbitrum or Optimism. An important aspect is that for each proposal, voting will happen in only 1 network, not in multiple in parallel, but the proposer can choose where exactly to do it, depending on the preferences or other community decisions. So proposal 201 could be voted on Avalanche, while proposal 202 could be on Polygon.

- Execution: Technical differences apart, that will be explained later, the time-lock and execution phases of proposals will be exactly the same as before, and initially, any network on which the Aave ecosystem is present will be covered, including the ones not so possible right now, like Avalanche.

New features on V3 includes:

- Extremely cheap to vote, DAO potentially makes voting completely free for participants. Even if highly dependent on the voting network of the proposal and its congestion, the voting cost on Polygon for example would be in the range of $0.05-$0.10. For reference, this is approximately 100 times cheaper than voting in the current Aave Governance v2.

- Future proof. The modularity of the system and how components are agnostic from each other allows Aave to really improve it, whenever new opportunities or models pop up. For example, it will be pretty straightforward to add new assets with voting power, like a different flavor of AAVE. Another future option is to even expand to non-EVM networks if they fulfill the infrastructural requirements (bridging infrastructure, efficient and compatible storage-proofs over Ethereum state).

- No more history snapshots of balance on AAVE/stkAAVE. The new voting system doesn’t require any historic balances of the voting assets like AAVE. In practice, this means that after the upgrade of the token’s smart contract to be included on the release of Aave Governance V3, transfers of AAVE & stkAAVE will become approximately 75% cheaper.

- Permissionless automation under the hood. Aave Governance V3 will have some additional state transitions compared with V2, in addition to the well-known queue() and execute(). But both these and the new ones will be completely automated (and still fully permission-less) by using Chainlink Automation, on the new tool: Aave Robot.

GHO Governance

Aave Governance has full control over the entities that are added or removed as Facilitators. Every Facilitator will be subject to review by the DAO before receiving mint permissions and will have a governance-defined limit on how much GHO they can mint.

By attracting a diverse set of Facilitators, Aave Governance can manage the DAO’s exposure to multiple stabilization strategies. This could also include strategies for non-Aave users. For instance, the opportunities for non-Aave Facilitators are endless (e.g use within payment applications, e-commerce solutions, purchases of GHO on DEXes, use as a store of value during market volatility…).

Aave Governance can also set the interest rates of GHO, the discount threshold (the maximum amount of GHO that can be minted at a discount), and the discount rate to stimulate the expansion or contraction of the GHO supply. These interest rates can be set based on supply-demand parameters by the DAO as well.

Risks

Safety Module

Overview

The primary security mechanism for the Aave Protocol is incentivizing $AAVE token holders to lock their tokens in a Smart Contract-based component known as the Safety Module (SM). These locked $AAVE tokens act as a safety net in case of a Shortfall Event within the Aave ecosystem’s money markets. A Shortfall Event (SE) occurs when there’s a deficit, and the determination of such an event is subject to a vote in the Protocol Governance, as detailed in the governance rules.

In the event of a Shortfall Event, a portion of the locked $AAVE tokens is auctioned on the market to be sold for assets needed to cover the deficit. The SM has an in-built mechanism to prevent an excessive flood of $AAVE tokens into the open market, which could further devalue $AAVE itself. Participants choose to lock their AAVE into the SMe, understanding that this action secures the protocol and, in return, they receive rewards in the form of Safety Incentives (SI).

To contribute to the protocol’s safety and earn incentives, AAVE holders deposit their tokens into the SM, receiving a tokenized position in return. This tokenized position can be freely moved within the underlying network, and the holder can redeem their share from the SM at any time. However, this triggers a cooldown period of one week, which can be extended by governance if needed.

SI rewards have a cooldown period during which they cannot be claimed, and this period is set at seven days. Nonetheless, fees generated by the protocol are continually distributed to users participating in the SM and can be withdrawn. These fees are redistributed to SI participants. The SI reward plan is designed to encourage early-stage contributors to the protocol’s safety. The emission of SI rewards is controlled by governance and can be adjusted according to the protocol’s requirements. All fee distribution mechanisms are potential until they go through the AIP process and a governance vote.

In the event that the SM is unable to cover the entire deficit incurred, Protocol Governance has the authority to initiate a special Recovery Issuance event. In this scenario, new $AAVE tokens are created and sold in an open auction at market price, with priority given to the Backstop Module.

The issuance of AAVE tokens during a Shortfall Event is mitigated by the presence of the SM, which covers the protocol’s deficit before any new tokens are issued.

Architecture

The Safety Module is defined by the following components:

- Staking Module

- The main component of the architecture, where users lock their $AAVE tokens to protect the Aave Protocol in the instance of a Shortfall Event.

- The Safety Module is built on top of existing AMM technologies. An 80% AAVE/20% ETH liquidity pool using Balancer will be used to provide benefits in terms of market depth for the $AAVE token and earnings from locking $AAVE. This also extends to BAL tokens and trading fees on top of the SI and protocol fees, while reducing the impact of a Shortfall Event on the $AAVE token itself.

- Auction Module

- Auctioning system associated with the SM Module. Auctions are triggered upon the occurrence of a Shortfall Event.

- Backstop Module

- Part of the Auction module, contains the $ETH and stablecoins pre-deposited that have a priority position on the auction in the case of a Shortfall Event occurrence. The backstop is explained more extensively in Safety Module.

- Ecosystem Reserve

- Component receiving and managing the distribution of fees from the different Aave Markets.

- Oracles

- The Aave Protocol Oracle System leverages oracles provided by Chainlink and backed by Aave, with an emergency backup oracle run by Aave. The decentralization process will consider providing adequate incentives for oracle providers.

Safety Module In Detail

Users interact with the Safety Module by locking $AAVE and/or $ETH into the Safety Module contract. The interaction with the SM is facilitated by a UI that clearly explains the SM dynamics, its purpose within the Aave ecosystem and the risks involved. Users will have the choice of locking $AAVE directly or providing liquidity shares from the 80/20 AAVE/ETH Balancer Pool.

Using Balancer instead of other AMM solutions has a clear advantage with the ability to change how much is focused on $AAVE. This allows Aave to create a market and offer liquidity while still having a significant stake in $AAVE. Holding $AAVE/ETH liquidity with uneven weights is almost the same as just holding $AAVE, but with the added benefit of earning trading fees.

The Aave Governance can adjust the weights in the Balancer pool to better match the protocol’s and stakers’ needs as the market changes.

Since Balancer Labs is giving $BAL governance tokens to liquidity providers, having the Safety Module (SM) liquidity in Balancer lets users get $BAL tokens along with trading fees, protocol fees, and SI rewards.

By also allowing users to simply lock $AAVE, we make it easier for less experienced users to participate in staking without needing two different assets. The Safety Module will offer special incentives to attract liquidity if there’s an imbalance in the AMM.

The Safety Module and Recovery Issuance safety mechanisms are made stronger with a built-in Backstop Module. This module is like a deposit pool in a smart contract that lets the Aave Community deposit stablecoins and ETH. It acts as a buyer of last resort for AAVE tokens at a price agreed upon by the protocol governance in case of a deficit event.

Backstop participants are encouraged to have liquidity in the Backstop because they share in protocol fees. If a backstop event happens, the AAVE tokens bought by the backstop are distributed proportionally to backstop providers, or they can choose to deposit them back into the staking module.

Shortfall Events

The main role of the Safety Module is to protect the protocol against unexpected loss of funds stemming from:

- Smart contract risk

- Risk of a bug, design flaw or potential attack surfaces on the smart contract layer.

- Liquidation risk

- Risk of failure of an asset that is being used as collateral on Aave; risk of liquidators not capturing liquidation opportunities in a timely manner, or low market liquidity of the principal asset to be repaid.

- Oracle failure risk

- Risk of the Oracle system not properly updating the prices in case of extreme market downturn and network congestion; risk of the Oracle system not properly submitting prices, causing improper liquidations.

In case of loss of capital, the SM uses up to 30% of the assets locked to cover the deficit. If the amount seized from the SM is not enough to cover the whole debt, an ad-hoc AAVE issuance event is triggered called Recovery Issuance. The issued AAVE are used, together with the amount drawn from the SM, to cover the deficit.

The auction module oversees the market emission of the seized funds. The Auction module follows a Dutch auction scheme, where the AAVE and the ETH collected from the SM are auctioned in lots, with their size depending on the deficit to be covered. The Backstop Module triggers whenever a lot is about to be sold at a price that is below the backstop price.

Shortfall Event and Governance

A Shortfall Event has certain governance implications. Users with locked liquidity in the Safety Module will still be able to vote on that matter using their tokenized version of their locked assets. Conceptually, $AAVE holders participating in the SM will have to vote to safeguard the integrity of the protocol. Their choice to seize their own funds will need to take into account the long-term stability of the protocol and the future value of AAVE.

This poses certain limitations on the amount of funds that can be seized in the case of a Shortfall Event. A percentage that is too high might bring conflicting sentiment in the $AAVE holders participating in the SM, potentially compromising the long-term stability of the ecosystem. The protocol governance will always need to consider these implications whenever proposal discussing the SM funds management are submitted.

Asset Risk

The composability of DeFi implies that risks from an individual component can flow into all dependent systems. Since assets are at the core of the Aave Protocol, each of them must be carefully audited before being supported. Risk assessments are periodically conducted for all assets. These assessments consider market, counter-party, and smart contract risk.

Aave selects eligible assets based on the following:

- Each additional currency will slightly increase the gas cost of the borrow and redeem actions permanently. The reason for that is because the new asset must be included in the smart contract, adding complexity and thus gas costs.

- Each currency added to the protocol as collateral increases the protocol risk of insolvency. From a financial perspective, the assets of Aave Protocol are the collaterals, while the liabilities are the loaned amounts. The underlying currencies of assets and liabilities often differ, with loans mostly taken in stablecoins and backed by volatile tokens. This means the protocol is heavily exposed to the failure of supported token systems as well as market fluctuations.

- Accepting centralized assets as collateral increases the risk of centralization, which might introduce a single point of failure.

- Currencies that are only enabled for deposits and borrows (not useable as collateral) present lower risk for the protocol. This is because collateral assets are the actual assets of the protocol. In order to remain solvent, these assets must remain greater than the liabilities, the loans.

- Having volume from different assets in the protocol lending pools reduces risks via diversification benefits.

Smart Contract Risk

Counter-party Risk

Counter-party risk assesses qualitatively how and by who the currency is governed. There are different degrees of governance decentralization that may give direct control over funds (as backing, for example) or attack vectors to the governance architecture which could expose control and funds. The counter-party risk is measured from the level of centralization corresponding to the number of parties that control the protocol as well as the number of holders and the trust in the entity, project or processes.

Market Risk

Market risks are linked to the market size and fluctuations in offer and demand. These risks are particularly relevant for the assets of the protocol: the collateral. If the value of the collateral decreases, it might reach the liquidation threshold and start getting liquidated. The markets then need to hold sufficient volume for these liquidations – sells which tend to lower the price of the underlying asset through slippage affecting the value recovered.

Security

Aave is open source and has been audited. No protocol, no matter for how long it has been running, can be considered entirely risk-free. The risks associated with Aave come from smart contracts (risk of bugs within the protocol’s code). This risk has been minimized by making the code open source and conducting multiple security audits.

The liquidity of the protocol is the availability of the capital within the protocol to face business operations (e.g. borrowing and redeeming aTokens) is a key metric to analyzing protocol risk

Audits