Overview

As a protocol, Frax issues decentralized stablecoins and builds out subprotocols to support their stability and growth prospects. Currently, Frax issues 3 stablecoins: $FRAX (pegged to 1 USD), $FPI ( pegged to a basket of real-world consumer items as defined by the US CPI-U average), and $frxETH (pegged to $ETH and attempting to become a replacement for $WETH). These are backed by 3 main subprotocols: Fraxswap, Fraxlend, and Fraxferry. Besides, there is a fourth stablecoin on the horizon, $frxBTC, pegged to $BTC and with Fraxferry redemptions to the main Bitcoin PoW chain.

The Protocol is backed by collateral assets and stabilized through a monetary policy based on Algorithmic Market Operations. The Frax ecosystem is extensive and expands upon multiple verticals, from stablecoins to lending markets, dexes, bridges, and multiple other DeFi primitives such as AMOs (Algorithmic Market Operations), and BAMM (Borrow AMM).

Frax’s economy is built around the velocity of money, which is dictated by an algorithmic monetary policy built on the Frax AMM (Fraxswap), and the Frax money market (Fraxlend).

Frax Core Principles include:

- Fractional reserve stablecoin whose supply is partially backed by collateral in an algorithmically-adjusted manner that ensures peg stability to either USD or US CPI.

- Fraxswap native AMM, which facilitates protocol-specific operations such as Time Weighted Market Orders, collateral rebalances, mints/redemptions, phases of expansion and contraction of the monetary supply…

- Fraxlend permissionless lending market that allows non-custodial loans that onboard collateral into the Frax ecosystem.

- Frax Price Index as the crypto stablecoin pegged to a basket of consumer goods in the U.S.

- Governance and seigniorage revenue from excess collateral value.

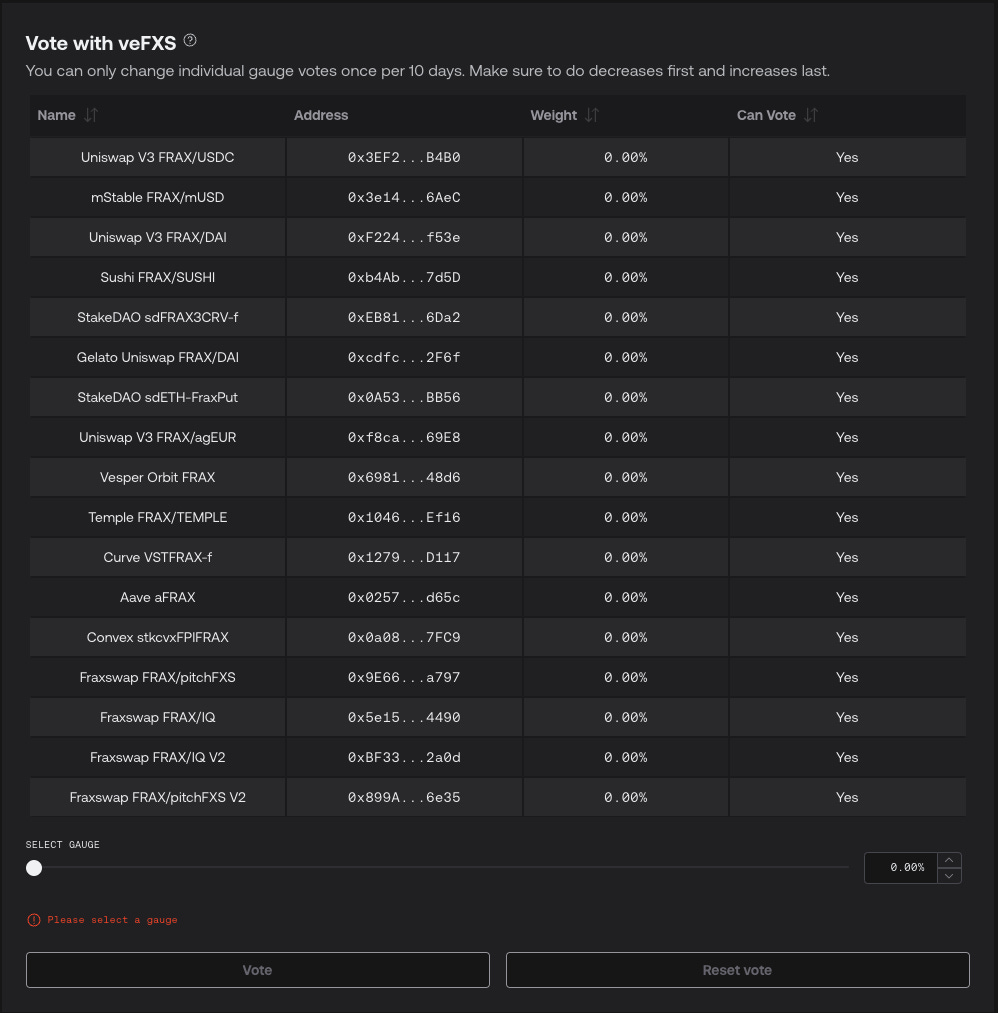

- Gauge Rewards System for FXS incentives that reward veFXS stakers, and fixed emissions of the Frax Shares Governance token, FXS, via yearly halving periods.

Monetary seigniorage is the sovereign revenue obtained by an entity through debt monetization, including the expansion of the money supply

There are no predetermined time frames for how quickly the amount of collateralization should change. As FRAX gains more market share, it’s expected that users will be more comfortable with higher supplies of algorithmic stabilization mechanisms rather than higher collateral reserves. This is because people will have more faith in the system, while at first they may be skeptical and want to see higher reserve balances of assets they’re familiar with, like USDC. This collateral ratio is the main driver behind the protocol’s capital efficiency. The collateral ratio adjustment function can be triggered by any user at least once every hour. At Genesis, this trigger can change the collateral ratio in steps of .25%

- If FRAX is above $1, the function lowers the collateral ratio by one step.

- If FRAX is below $1, the function increases the collateral ratio by one step.

The collateral ratio is an indicator representing the size of collateral compared to the value of a loan

Governance has full control over the refresh rate and step parameters. As far as price measurements go, the price of FRAX, FXS, and the protocol’s collateral assets are all calculated on-chain using Uniswap’s TWAP oracle (Time Weighted Average Price) and an ETH:USD Chainlink oracle.

TWAP stands for Time-Weighted Average Price, and it is a reliable measure to know the average price of an asset excluding short-term fluctuations or manipulation that might occur in the short term

In future protocol updates, price feed oracles for collateral can be deprecated so that the minting process can be moved to an auction-based system that limits the reliance on price data and further decentralizes the Frax. Instead, the protocol would run with no price data for FRAX or FXS. Minting and redemptions would happen through open auctions where bidders would post the highest/lowest ratio of the collateral plus FXS that they are willing to mint/redeem FRAX for. This hypothetical auction arrangement would lead to collateral price discovery from within the system itself and not require the intervention of price oracles.

FRAX can be minted by depositing collateral. In the beginning, the collateralization ratio is 100%, which means that minting FRAX only requires placing collateral into the minting contract. Progressively, as the collateral ratio decreases and the fractional reserve phase starts, minting FRAX requires burning FXS tokens on top of the appropriate ratio of collateral deposit (stablecoin assets will be favored as collateral to smoothen out the impact of volatility).

- When FRAX is in the 100% collateral phase, all of the value that is used to mint FRAX is collateral.

- As the protocol enters a fractional state, some of the value that enters the system is converted into FXS tokens. These tokens will be burned.

- For example, at a 96% collateral ratio, every unit FRAX requires $0.96 worth of collateral and $0.04 burning of FXS.

The FRAX redemption process consists in burning FXS as FRAX is minted during fractional stages. Similarly, FXS is minted when FRAX is redeemed.

Frax is an agnostic protocol that makes no assumptions about what collateral ratio the market will settle on in the long term. Instead, the protocol keeps a ratio that is enough to supply the demand by market participants while keeping the price close to $1.

The protocol only adjusts the collateral ratio as a result of demand for more FRAX and changes in the price of FRAX:

- When the price of FRAX falls below $1, the protocol recollateralizes itself by increasing the collateral ratio until confidence is restored and the price recovers.

- Once the peg is reached, the protocol will not de-collateralize itself and decrease the collateral ratio unless the demand for FRAX increases.

It could be possible that FRAX becomes entirely algorithmic but then recollateralizes to a higher collateral ratio as market participants demand more FRAX.

Overall, Frax Finance implements a deterministic and reflexive mechanism design to measure the market’s confidence in a non-backed stablecoin. This is different from previous algorithmic stablecoin attempts that had no intrinsic collateral on day 1. Those attempts failed to address the fact that the market might not have confidence in the stablecoin on day 1, which could lead to a complete failure in the adoption of the stablecoin asset.

As of February 23, 2023, under FIP-188, the community has voted to retire the algorithmic backing of FRAX over time.

- CR (Collateral ratio) target will be increased over time to 100% permanently.

- Algorithmic backing and de-collateralization retired.

- Retain protocol revenue to fund the increased CR.

- Authorize up to $3m per month in frxETH purchases to increase the CR.

Why The Protocol Was Created

On November 26, 2020, the testnet version was released for early users to report bugs. After 1 month, the protocol was deployed on the Ethereum mainnet on Monday, December 21, 2020. One hour after launch the TVL (Total Value Locked) was over $43M. As of January 2021, 100M FRAX tokens had been minted at an 85% collateral ratio.

- On January 2021, Frax Finance passed WBTC and become the 5th most liquid token on Uniswap with ~130M in liquidity.

- On February 2021, Frax became the first algorithmic stablecoin to be listed on Binance in their innovation zone with the FXS/BTC and FXS/BUSD pairs.

The protocol’s original vision was the creation of a new category for decentralized stablecoins: fractional stablecoin protocols. As the first protocol to fall under this categorization, it has been often mislabelled as an algorithmic stablecoin. While partially true, the novel mechanism design comes from the open-source and permissionless implementation of a fractional reserve monetary policy that is currently present on 13 chains. The protocol’s end goal is the creation of a highly scalable, decentralized, and algorithmic representation of money that will replace fixed-supply digital assets such as Bitcoin.

The mission is achieved through the creation of 2 stablecoins: Frax (pegged to 1 USD), and FPI (pegged to the US Consumer Price Index). These two assets are the base layer of an economy built around a native AMM (Fraxswap), and a lending facility or money market (Fraxlend).

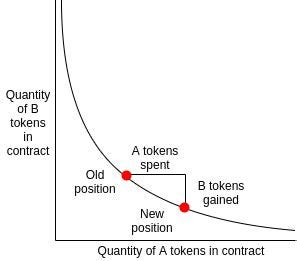

Frax uses ideas from Uniswap and AMM designs to build a novel hybrid stablecoin system that has never been seen before. For instance, in a Uniswap pool, the ratio of asset A and asset B has to be proportional due to the constant function formula. Because of this, LP tokens are just a pro-rata claim on the pool + fee revenue

Frax takes that idea and turns it into a unique stablecoin design where the LP token is represented by a stable asset pegged to 1 USD, FRAX. As the native stablecoin, FRAX will act as the stabilization mechanism, since it will always be redeemable for $1 worth of collateral and the corresponding FXS collateral ratio. This ratio of the two assets, collateral, and FXS, is dynamically adjusted based on the price of FRAX.

- If the price of FRAX is dropping, then the protocol tips the ratio in favor of more collateral and fewer FXS tokens, to regain confidence in FRAX.

- If the price of FRAX is increasing, then the protocol tips the ratio in favor of the FXS token to measure the market’s confidence in more FRAX supply being stabilized algorithmically.

This dynamic adjustment and price fluctuation is constantly happening. The AMM tests different ratios of collateralization based on signals from the market.

- Arbitrage swaps incentivize recollateralization.

- Buyback swaps redistribute excess value back to FXS holders.

In Frax V1, there was only a single AMO (Algorithmic Market Operation), the fractional algorithmic stability mechanism, also known as the base stability mechanism. This AMO adjusted the collateral ratio by rebalancing the ratio of collateral and FXS. Once the model manifested its resiliency, Frax came with its V2, which expands on the idea of fractional-algorithmic peg stability through autonomous contracts that enact arbitrary monetary policy so long as it does not change the FRAX price off its peg. These autonomous smart contracts are known as AMOs.

By creating a Turing-complete design space, the protocol is able to generalize the mechanism design of V1 and act as a central bank money lego. To make this possible, every AMO must have 4 properties

- Decollateralize whichever portion of the strategy lowers the target collateral ratio.

- Perform market operations that don’t change the collateral ratio and maintain the equilibrium.

- Recollateralize the portion of the strategy that increases the collateral ratio.

- Keep track of a formalized balance sheet accounting that defines exactly how much FXS can be burnt with the profits above the target collateral ratio.

The base layer keeps running as it did in V1:

- If FRAX is above peg, the collateral ratio is lowered and the FRAX supply expands.

- If FRAX is below peg, the collateral ratio is increased, and the FRAX supply contracts.

If the collateral ratio leads to a point where the peg slips, the AMOs will redeem the protocol liabilities and force the collateral ratio to return to peg. This allows all AMOs to operate with input from market forces while creating maximum flexibility without alternating the base stability mechanism.

As of February 23, 2023, under FIP-188, the community has voted to retire the algorithmic backing of FRAX over time.

- CR (Collateral ratio) target will be increased over time to 100% permanently.

- Algorithmic backing and de-collateralization retired.

- Retain protocol revenue to fund the increased CR.

- Authorize up to $3m per month in frxETH purchases to increase the CR.

Because AMOs are composable money legos, they can be deployed within the Frax ecosystem through Governance.

Roadmap

BAMM

BAMM, or Borrow Automated Market Maker (AMM), as an upcoming mechanism by the Frax team.

The primary challenge associated with AMMs is that when assets are deposited into a basic AMM, they become inaccessible for trading purposes beyond swaps. Traders expect that the fees generated from these swaps will outweigh the benefits of simply holding the assets. However, studies indicate that because AMMs are unable to adjust transaction fees, their returns are inferior compared to alternative market-making strategies. Even during periods of heightened market volatility, only a fraction of the Liquidity Provider (LP) pool is utilized for swaps.

A potential remedy to this issue involves permitting a portion of the liquidity to be withdrawn while concurrently virtualizing the swap curve. Balancer was among the pioneering projects to address this by introducing Boosted Pools, enhancing pools with external protocols such as Aave. This integration allows the pools to accumulate extra yield, such as lending fees, effectively virtualizing the liquidity and enabling it to remain productive even when not directly involved in swaps.

BAMM is an evolution of the virtualized AMM, where instead of allowing a single participant to determine where the idle liquidity is used, it creates a dual sided lending market for both assets in the LP.

By virtualizing the swap curve, BAMM will open up a host of new trading strategies and yield opportunities. Traders will now be able to consolidate their lending positions into AMM’s rather than single sided collateral provision. Liquidity will deepen on-chain as a result, leading to tighter swap markets and depth.

Team

Sam Kazemian is the co-founder and current CEO. He is an Iranian-American software developer. Before founding Frax he was the co-founder of Everipedia, a for-profit organization responsible for creating and maintaining a wiki-based encyclopedia. He graduated from the University of California Los Angeles, UCLA, in 2015

Team of 11-50 employees, out of which 10 are on LinkedIn:

- Jason Huan – Co-founder

- Travis Moore – Chief Technology Officer

- Drake Evans – Core engineer

- Amir Nader – Core developer

- Jack Cordry – Core developer

- Eli Calderon – Early community contributor

- Andy Cho – Director of Business Development

- Jae Yun Yi – Business development

- Ron Sade – Seed investor

- Arjun Sethi – Seed investor

- James Alston – Advisor

- Stephen Moore – Economic advisor

Github contributions: https://github.com/FraxFinance/frax-solidity/graphs/contributors

- Github contributors:

- FortisFortuna: https://github.com/FortisFortuna

- Drake Evans: https://github.com/FraxFinance/fraxlend/commits?author=DrakeEvans

- Jason Huan: https://github.com/jasonhuan

- Jack Corddry: https://github.com/corddry

- Denett: https://github.com/denett

- Sam Kazemian: https://github.com/samkazemian

- Fabio Hild: https://github.com/fabiohild

- Realisation: https://github.com/realisation

- Daniel Tedesco: https://github.com/dtedesco1

- Wen Zhen Xiang: https://github.com/wenzhenxiang

- 0xkowloon: https://github.com/0xkowloon

- OlyZeus: https://github.com/olyzeus

- Fullyallocated: https://github.com/fullyallocated

- Kassandra Oftroy: https://github.com/kassandraoftroy

DeFi Subsector

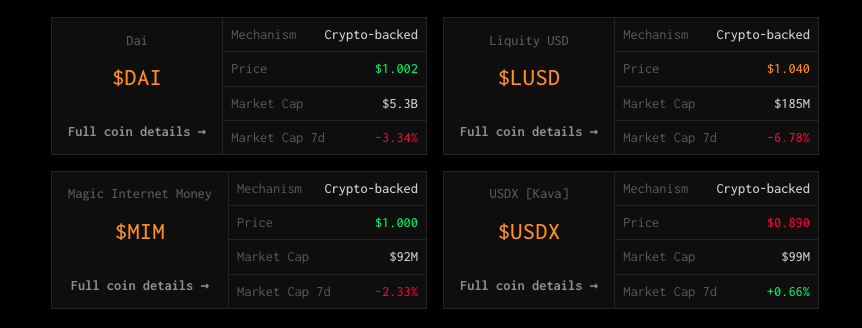

Despite the price of stablecoins being pegged to the value of a fiat currency or any other underlying asset, there are multiple ways to reach such price stability: over-collateralization, fiat backing, algorithmic minting/redemptions…

- Fiat-backed stablecoins are the most prominent due to their 1:1 issuance being backed by fiat reserves in a bank account. The direct backing of fiat provides an extra layer of protection as a store of value to hedge the volatility of the crypto markets. However, this comes at the expense of transparency and censorship-resistance

- The ability to create units of the stablecoin is dependent on the underlying issuer, such as Tether, which issues USDT.

- A centralized structure underpins the model, usually imposing requirements to ensure that customers comply with KYC (Know Your Customer) and AML (Anti Money Laundering) policies.

- Low transparency and a high need for trust in the underlying centralized issuer. For example, users need to trust that the information on Tether’s transparency site is factually correct.

- Over time, more users are raising awareness against the threat of censorship. Concerns have increased after the popular cryptocurrency mixer Tornado Cash was added to the OFAC sanctions list. The SEC also blacklisted wallets interacting with Tornado Cash smart contracts.

- No matter what, the future of fiat-backed stablecoins will remain highly dependent on the regulatory approaches and jurisdictions of entities such as the United States, the European Union…

- Overcollateralized stablecoins solve the shortcomings of centralized fiat-backed stablecoins at the expense of lower capital efficiency. These assets are backed by volatile tokens such as BTC, ETH, or even fiat-backed stablecoins like USDC, GUSD…

- Decentralized protocols issue and redeem tokens by locking excess collateral in the protocol smart contracts.

- Protocol governance has been known for being a slow and inefficient process when it comes to decision-making. While decentralized governance voting creates censorship resistance to a certain degree, this leads to capital inefficiency to ensure that the protocol can withstand the volatility of the crypto markets.

- Users need to deposit excess collateral for borrowing. For instance, the Maker protocol requires a collateral ratio of 150%. This means that users must deposit at least $150 of collateral value to borrow $100 worth of DAI.

- Lowering collateral ratios comes at the expense of price stability. As long as the liquidity depth is not enough to grant redemptions, the protocol risks losing the peg.

- Critics argue that by heavily relying on centralized stablecoins as collateral, the decentralized protocols expose themselves to the same censorship risks they were trying to mitigate.

- Algorithmic stablecoins avoid relying on both fiat-backing and over-collateralized crypto assets backing. A balancing algorithm dynamically adjusts the supply and demand forces by minting/burning units of the stablecoin. This is achieved by introducing a secondary token that ensures that investors can always swap one unit of the stablecoin for $1 worth of the secondary token.

- The two-token model is dependent on market arbitrageurs that are incentivized to buy the stablecoin on the market and trade it for the price-floating secondary token when the stablecoin is below pegged and vice versa.

- Critics argue that algorithmic stablecoins create value out of thin air and can only survive as long as investors maintain trust in the algorithm.

- Events such as the crash of UST have proven the risks associated with this model. Well-capitalized coordinated attacks might hit the market by causing a death spiral in which more and more secondary tokens have to be minted to support the peg of the stablecoin, consequently leading to heavy inflation of the secondary token’s price.

The key difference with respect to other stablecoin protocols is that Frax Finance does not fully embrace one single spectrum of design, such as an entirely collateralized reserve, or an entirely algorithmic uncollateralized backing. The ethos of the protocol is to differentiate itself from stable assets that carry on custodial risks (USDC, USDT…), and over-collateralized models who are capital inefficient and cannot scale (DAI).

- Custodial risks reduce decentralization and lead to a single point of failure from transaction censoring. This is often the case with fiat-backed stablecoins. These assets lack the transparency of on-chain reserves, because of the need to keep the underlying fiat money in bank accounts

- Purely algorithmic models such as Basis Cash, Empty Set Dollar, or Seigniorage Shares, while they provide a trustless and scalable model, are hard to bootstrap due to inherent confidence from the initial stakeholders. These models experience slow phases of growth and deteriorate quickly as long as they don’t catch significant traction. This exposes not only the underlying protocol but also spreads risks across the DeFi ecosystem by making it less resilient during periods of volatility that often lead to stablecoin depegging events.

- Crypto-backed stablecoins such as DAI from makerDAO are usually only mintable in decentralized protocols by providing excess collateral value, which reduces capital efficiency. The reason for that is that the value of collateral assets is volatile, and this model requires excess collateral value to ensure peg stability.

Frax is an attempt to become the first stablecoin protocol to implement a highly scalable, trustless, and robust on-chain representation of money via a two-token system encompassed by the FRAX stablecoin, and the Frax Shares (FXS) governance token. On top of this base layer, there is an extra level of security provided by the protocol’s USDC holdings, such that the peg management and collateral ratio can be managed more easily.

Current stablecoin landscape: https://dune.com/21shares_research/stablecoin-monitor

Industry Overview and Adoption Upside

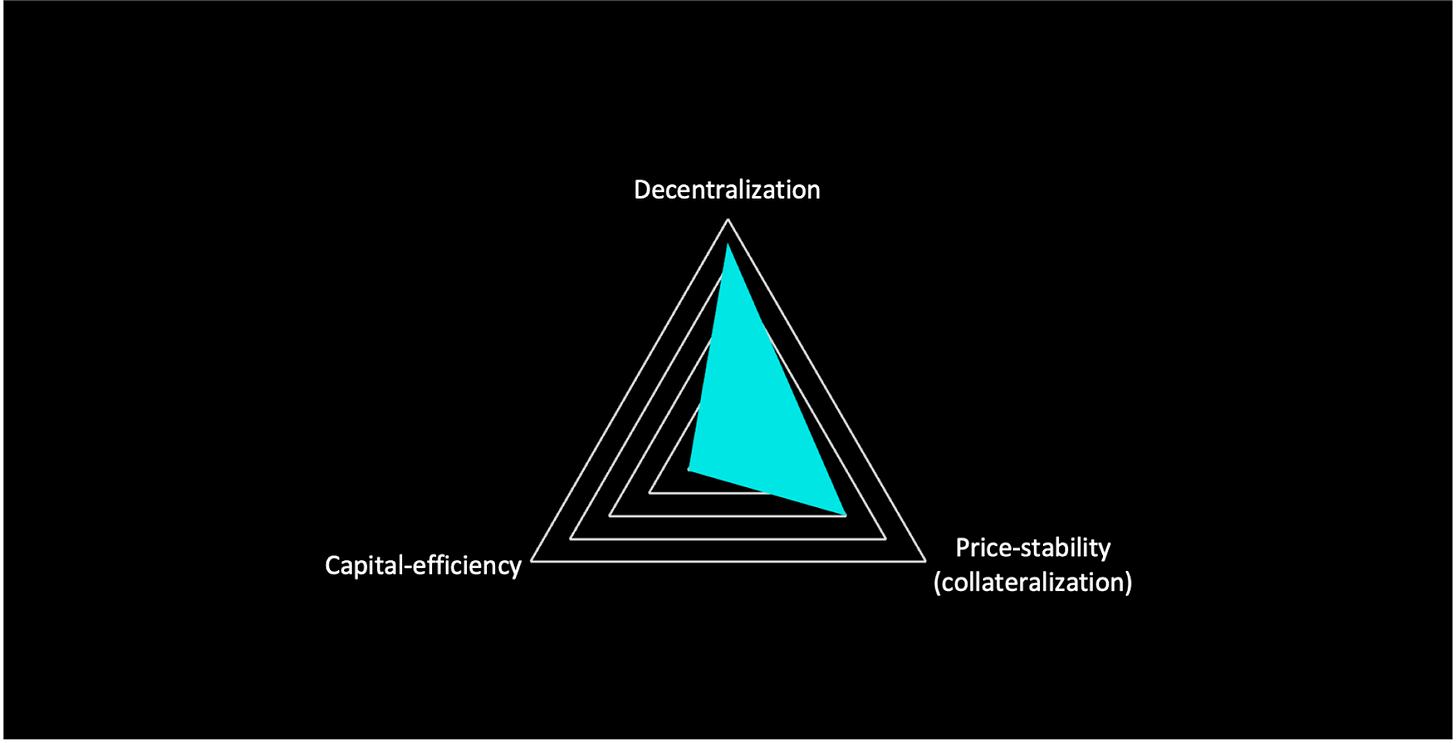

Over the upcoming years, there have been many attempts to solve the stablecoin trilemma. Until today, every stablecoin has to balance 3 main goals: hold a stable value pegged to the underlying asset, make the model capital efficient to increase demand and the velocity of money, and consider decentralization of the systems that issue the stablecoin

- Peg stability: the value of the stablecoin should always follow the value of the pegged asset in the long term at a 1:1 ratio. To achieve that, it is important for the mechanism design to align market expectations with the trust of investors and users such that redemptions can be made even under highly adversarial conditions

- Capital efficiency: the strong demand for the stablecoin will come from lower capital requirements that can also ensure a dynamic supply that satisfies users’ demands. This means that:

- If less than $1 is needed to mint one USD-pegged stablecoin, then the system is capital-efficient

- If more than $1 is needed to mint one USD-pegged stablecoin, then the system is capital-inefficient

- Decentralization: the goal is to achieve censorship resistance and transparency with a permissionless system.

The nature of the trilemma is that under no condition, can all 3 goals can be achieved at the same time. Price stability remains the main objective for most systems since that’s what most users demand. This explains why centralized fiat-backed stablecoins have dominated the market, followed by more decentralized but still capital-inefficient overcollateralized models such as DAI. Both of these models make large trade-offs in one of the other dimensions of the trilemma. Because of this, algorithmic models such as UST managed to capture a large market share. However, this comes at the expense of using a mint/burn mechanism that leads to a death spiral as soon as users lose trust in the model.

The collapse of Luna and UST has shed light on the underlying risks of purely algorithmic stablecoins. By relying on a fractional reserve system, Frax Finance’s design resembles the operations of a central bank. However, the entire cascade of events and liquidity crisis caused by the significant losses of Terra has further put stablecoins under the close radar of regulators and financial authorities in major jurisdictions.

As a matter of fact, purely algorithmic/rebase designs have wildly fluctuating prices as much as +-40% around $1, and take days/weeks to stabilize. This is counterproductive and assumes that the market actually wants/needs a stablecoin with 0% collateralization. Frax does not make this assumption. Instead, it measures the market’s preference and finds the actual collateral ratio which is enough for holding the stablecoin tightly around $1. This is achieved by periodically testing the small differences in the collateral ratio when the price of FRAX is slightly above or below peg.

Because of this, FRAX managed to hold tight to the $1 peg during the UST collapse. This proved that its fractional backing is able to maintain its peg and collateral ratio during adverse market conditions

As the system becomes more efficient and the velocity of money in the form of FRAX increases, collateral pools can then include other assets instead of USDC, such as ETH or wBTC

- When the price of the volatile collateral asset increases, users will buy back shares to distribute the excess value to FXS holders.

- When the price of the volatile collateral asset decreases, users will profit from the instant arbitrage opportunity to put more of that asset into the protocol for discounted FXS (to keep the target collateral ratio).

The narrative is based on the mass adoption of a fractional-algorithmic stablecoin design that self-rebalances its ratio in real-time through a governance-minimized and resilient design.

Beyond its stablecoin, Frax is expanding into all DeFi verticals, which makes the protocol unique in the sense that it supports the Frax economy across verticals such as lending, DEX, bridges, and liquid staking.

The introduction of Fraxlend brings in more demand for Frax, potentially making it the most attractive non-depeggable stablecoin yield possible on the market. In fact, Fraxlend could become the go-to tool for users to achieve a leveraged yield on their Convex LP tokens. This would work in 2 ways:

- Users will buy FRAX to earn a yield on Fraxlend, thus increasing FRAX’s supply.

- If users don’t buy FRAX, then the AMO will deploy newly minted FRAX to earn said yield, also increasing the FRAX supply.

This shows how Fraxlend increases the demand for FRAX while also creating a new and organic revenue stream for the protocol

The creation of the Frax Base Pool (FRAXBP) could also be the catalyst for being perceived by the market as the decentralized central bank of DeFi.

The original proposal in May 2022 to deploy a Frax Base pool would pair FRAX with Curve’s 3pool and drive a lot of volume towards FRAX’s stablecoin pairs, increasing its supply and expansion into the economy. In the long term, this can be a game changer since:

- There will be more demand for FRAX. For example, other protocols could create a meta pool with FRAXBP instead of the 3crv pool

- Extra profits for other protocols, since Frax would proportionally share the interest generated from the excess demand with these protocols who deploy their pairs with the FRAXBP.

- Reduced CRV and CVX selling pressure, since FRAX will be whitelisted to permanently lock the CRV yield it earns (up until this moment FRAX has been selling most of the CRV and CVX tokens it earned to fund bribes and get votes for its Curve pools).

The adoption of Frax Ether is also a catalyst since it gives users 2 choices to earn rewards:

- Stake frxETH to mint sfrxETH.

- Become liquidity providers for frxETH/ETH pool on Curve, and then deposit the LP tokens on Convex for an APY paid in FXS, CRV, and CVX.

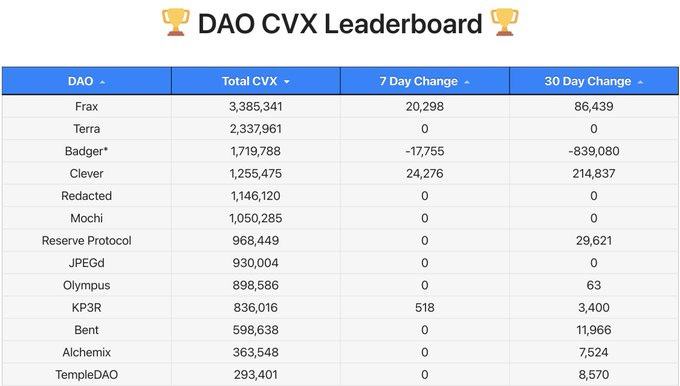

Since Frax is the largest holder of CVX, it can direct curve emissions toward the ETH/frxETH pool.

This new staking derivative has already shown exponential growth hitting 20M in TVL in November 2022.

Chains

As a multichain protocol that must maintain a global state across all deployments, FRAX and FXS tokens are a single distribution across all networks. This means that there is no single protocol implementation for each chain.

Frax is present on Ethereum, Moonbeam, Moonriver, Binance Smart Chain, Polygon, Fantom, Arbitrum, Harmony, Avalanche, Boba, Aurora, Dogechain, and Optimism.

FraxBridge and cross-chain strategy

Since there is no single protocol implementation for each chain, Frax has built its own bridging system to allow FRAX to maintain a tight peg and achieve unique fungibility across all chains.

Each chain has 1 canonical (native) FRAX and 1 canonical FXS contract that is simply referred to as “FRAX” and “FXS” (no prefix) to signal the protocol that these tokens will be used to expand/contract FRAX supply.

- Canonical (native) FRAX/FXS: the protocol liability natively issued/minted/redeemed by the protocol and its AMOs

- Canonical FRAX has the default colors of the specific network and the logo of that network at the center

- Canonical FXS has the native colors and logo of the chain at the bottom right

- Bridged FRAX/FXS: the tokens that are brought from one chain to another using a bridge supported by the protocol

- Fraxbridge treats each individual bridged asset as a unique liability of that bridge system and names FRAX/FXS moved from other chains with the identifier of that bridge. For example, FRAX bridged through Anyswap is named “anyFRAX”, and FRAX bridged through Wormhole is named “wormFRAX”.

The introduction of FraxBridge allows for a price arbitrage between chains. Each canonical (native) FRAX/FXS ERC20 token contract has a 1-to-1 stableswap AMM built into the token. This allows swapping to/from the canonical asset of the network for any supported bridged implementation. The arbitrage window is very tight and also maintains a single distribution of FXS across all chains.

As an example, if canonical FRAX is trading at $0.99 on Fantom, an arbitrager can purchase as much canonical FRAX as possible knowing that it will be able to be swapped 1 to 1 for anyFrax (FRAX bridged from Anyswap) in the stableswap pool within the ERC20 contract. Next, the arbitrager will bridge anyFRAX back to another chain where FRAX is trading at or above $1 to make a profit.

Swaps can be done at https://app.frax.finance/crosschain or directly interact with the ERC20’s smart contract on any supported chain.

Guide for swapping between bridged and canonical FRAX/FXS: click here

- Canonical FRAX token address: https://docs.frax.finance/smart-contracts/frax

- Canonical FXS token address: https://docs.frax.finance/smart-contracts/fxs

For Users

Target users

Users who believe in decentralization and sound money will find huge value in the trust-minimized guarantees of FRAX. The Frax Decentralization Ratio can be used as a unit of measurement to represent the collateral value over the total stablecoin supply that is backed/redeemable for those assets.

For instance, collateral assets with excess off-chain risk, such as fiat, securities, gold, and oil… are counted as 0% decentralized.

Similarly, if we take the FRAX3CRV LP pool, we can break it down into 50% FRAX and 50% 3CRV (33% USDC, 33% USDT, and 33% DAI). DAI itself is about 60% stable fiatcoins. Therefore, each $1 worth of FRAX3CRV LP only has about 66 cents of value coming from decentralized sources.

Reward tokens from protocols deployed on Ethereum, such as $CVX or $CRV, are counted as 100% decentralized. The same applies to $FRAX minted through lending AMOs, due to the over-collateralization requirement satisfied by borrowers.

The Decentralization Ratio is tracked daily and made visible on the dApp’s website.

Users who care about the long-term sustainability of the Ethereum blockchain will also benefit from Frax Ether as a liquid staking derivative. If users did not rely on staking derivatives, they would need to stake Ether by themselves. This requires technical knowledge of setting up a validator and comes at the expense of a minimum of 32 ETH deposit. By using a liquid staking alternative such as $sfrxETH, users can earn staking rewards without having to run their own validator or depositing a big amount of $ETH.

Fraxtal

Fraxtal is a modular rollup blockchain operating as a Layer-2 solution with a focus on fractal scaling. It utilizes the OP stack to ensure full compatibility with the EVM, enabling integration and operation of existing Ethereum-based smart contracts. This approach allows developers to migrate and deploy applications efficiently, benefiting from reduced transaction costs and improved processing speeds typical of Layer-2 solutions.

On February 8, 2024, Frax Finance officially launched Fraxtal’s mainnet, initially available only to specific launch partners. This release marked Fraxtal’s entry into the market as an Ethereum-compatible optimistic rollup.

The architecture of Fraxtal is modular, designed to extend its functionalities through various components and middleware. This modularity facilitates connections with other chains and networks, allowing for the deployment of Layer-3 solutions and the development of new protocols on top of Fraxtal. A separate data availability module, developed by the Frax Core Team, ensures data management and enhances overall network security.

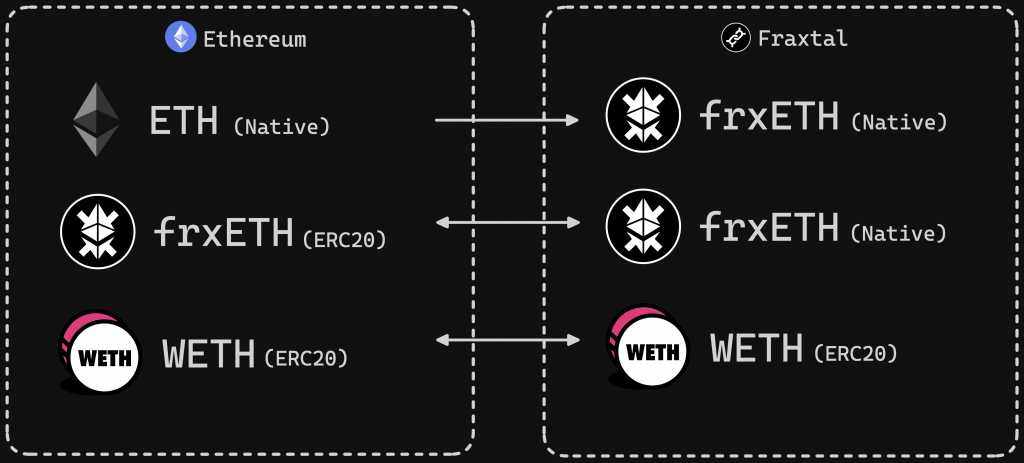

Fraxtal uses Frax Ether ($frxETH) as its native gas token to facilitate transaction processing. $frxETH can be obtained through a native L2 bridge that supports the bridging of ETH from the Ethereum mainnet, streamlining the user experience and maintaining cost-effectiveness in operations. Additionally, Wrapped ETH ($WETH) can also be bridged through the same mechanism, although it remains non-unwrappable to $ETH within Fraxtal, due to the primary use of $frxETH as the operational token.

An innovation within Fraxtal is the Fraxtal Points System (FXTL), which introduces a mechanism for rewarding ecosystem participants. This system issues FXTL points for activities such as creating and interacting with smart contracts, engaging with new protocols on the chain, and holding specific tokens. These points are managed through the main FraxtalPoints contract, which acts as a comprehensive ledger for all point-related transactions and balances. The system is designed with future tokenization in mind, potentially converting FXTL points into a standalone staking token or integrating them into the existing FXS token system.

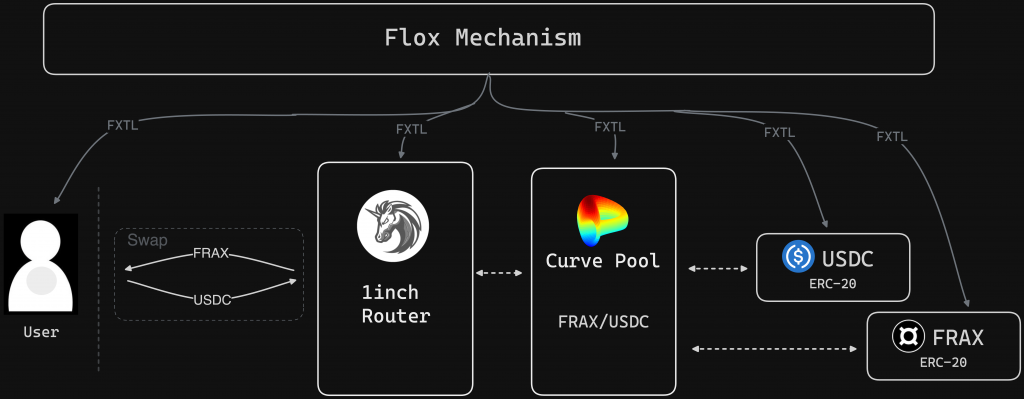

The Fraxtal ecosystem also includes an incentive structure known as the Fraxtal Blockspace Incentives system, or “Flox”. Flox operates on a recurring basis, rewarding users and developers every epoch—which is initially set to seven days—based on their contributions and gas expenditures on the network. The rewards are calculated using the “Flox Algorithm”, which assesses the amount of gas used by smart contracts and applies a ranking system to determine the significance of each contract and user within the ecosystem.

This system is designed to surpass traditional fee-sharing models by providing substantial incentives that not only refund gas costs but also reward active participation and development on the platform. The goal is to foster a vibrant and economically active network that supports both users and developers, aligning with Fraxtal’s long-term vision of sustainable and scalable blockchain solutions.

Flox incentives are calculated using a two-part algorithm that includes a transaction trace to assess gas usage and an additional algorithm to rank contracts and other criteria such as asset holdings at randomly selected blocks within the epoch. The incentives are then distributed according to the calculated Flox Rank, which is inspired by the PageRank algorithm and adjusted for blockchain-specific dynamics.

For instance, consider a transaction swapping $USDC for $FRAX through a Curve pool using the 1inch protocol. In this scenario, incentives would be distributed not just to the user executing the swap but also to the 1inch router contract, the Curve pool contract, and the involved token contracts ($USDC and $FRAX).

Incentives within Fraxtal are managed through the FloxIncentivesDistributor smart contract, which directly assigns FXTL points to each participant’s account or contract based on the computed Flox Rank and associated ratios. Smart contract developers have the option to designate a Flox proxy address for managing incentives, which can be the contract itself or a specified external address.

As Fraxtal evolves, the governance model will allow for modifications to the Flox Algorithm to include additional rewards for specific actions, such as deploying L3 solutions or using Fraxtal as a data availability layer. These changes are anticipated to further align with Fraxtal’s long-term vision of creating a sustainable and economically vibrant blockchain ecosystem.

Fraxswap

Fraxswap is the first constant product AMM with an embedded time-weighted average market maker (TWAMM) that allows for conducting large trades over long periods of time, trustlessly. While inspired by traditional OTC trading desks, the AMM follows the technical design of Uniswap V2. The goal is to help traders to execute large orders more efficiently. This will be beneficial for the Frax protocol itself since the protocol will use the Fraxswap AMM to increase the peg stability of both FRAX and FPI as well as return protocol excess profits to FXS holders through TWAMM purchases. More specifically, Frax Finance will use Fraxswap to:

- Enact algorithmic stablecoin monetary policy.

- Contract or expand the supply of stable assets by acquiring or selling collateral over a prolonged period of time.

- Buying back and burning FXS with AMO profits to stabilize the FRAX peg.

- Mint FRAX to purchase hard assets through seigniorage.

An OTC crypto desk refers to any trading activity that is not done via an automated exchange in the open market. This is often the case for massive off-market deals or peer-to-peer transactions that do not take place on a trading exchange

Fraxswap is the first live TWAMM implementation that adheres to the original TWAMM whitepaper specifications:

- Order pooling and hourly alignment of order expiries.

- Long-term orders are executed once per block prior to the first AMM interaction with Fraxswap.

- The TWAMM contains an embedded constant-product market maker for 2 assets.

Basically, the TWAMM breaks long-term orders into infinitely many small virtual sub-orders which trade against the embedded AMM at an even rate over time. As these long-term orders are executed, they will push the embedded AMM’s price away from prices on other markets over time. When this happens, arbitrageurs will trade against the embedded AMM price to bring it back in line.

- For example, if long-term sells have made ETH cheaper on the embedded AMM than on a particular exchange, arbitrageurs will buy ETH from the embedded AMM to sell it back for a profit, consequently, bringing the price back up on the embedded AMM.

Because of this, Fraxswap can fill the trading needs of large protocol treasuries and DAOs. This opens up the door for DAO to DAO swaps, critical protocol operations, Dollar Cost Averaging… Among the most popular use cases stand out:

- Accumulation of a treasury asset over time by selling governance tokens.

- Buying back governance tokens slowly over time with DAO revenues and protocol reserver.

- Acquire another protocol’s governance tokens slowly over time with the DAO’s own governance tokens (similar to what a permissionless corporate merger/acquisition would look like).

While Fraxswap follows the original implementation by Paradigm, some slight modifications were made for reducing gas costs.

- Interactive comparison of Paradigm’s TWAMM formula and Fraxswap’s TWAMM formula: https://www.desmos.com/calculator/wp4zrkh6uj

Fraxlend

Fraxlend is a lending platform that provides lending market pairs for ERC20 assets. These pairs are particular since they are isolated from each other.

- Lenders deposit ERC-20 assets into the pair and receive yield-bearing fTokens. As interest is earned, fTokens can be redeemed for an ever-increasing amount of the underlying asset.

- At any time a lender can exchange fTokens for the underlying Asset tokens at the rate given by the current price

- Borrowers provide collateral tokens and in exchange receive Asset Tokens. This will incur an interest rate that will be paid back to lenders upon redemption of fTokens

- As long as borrowers maintain an open position, interest rates accrue. Over time, the amount a borrower owes increases by an amount equal to the interest rate they owe

- In order to claim back the Collateral Asset, borrowers must return the original loan amount plus all accrued interest

- Each pair relies on one or more Chainlink oracles to determine the market rate of both the Asset token and the Collateral token.

- Each pair can have a different Rate calculator that calculates the interest rate based on the amount of available capital to borrow.

- Less borrowing will lead to lower interest rates.

- More borrowing will lead to higher interest rates.

Similar to other money markets like Aave and Compound, each borrower’s position has a loan-to-value ratio (LTV) that represents the ratio between the value of the borrowed assets and the value of the collateral deposited. The LTV changes when the exchange rate between Asset and Collateral tokens changes or when the interest is capitalized.

- If a borrower’s LTV rises above the maximum allowed for that position, the borrower can choose to either repay their debt (partially or fully), or add more collateral. Otherwise, the position will be opened up for liquidation.

- The maximum allowed LTV is immutable and decided when the lending pool is created.

When a deployer creates a lending pair, a specific rate calculated must be specified. This Rate Calculator will determine interest rates. Fraxlend supports 2 types of Rate Calculators:

- Time-Weighted Variable Rate Calculator allows the interest rate to change based on the amount of borrowed assets (also known as utilization rate)

- When the utilization rate is below target, interest rates will decrease.

- When the utilization rate is above target, interest rates will increase.

- Linear Rate Calculator calculates the interest rate purely as a function of utilization such that:

- Lower utilization results in lower borrowing rates

- Higher utilization results in higher borrowing rates

Fraxlend Dune dashboard by Blockworks: https://dune.com/blockworks_research/fraxlend

Frax Ether

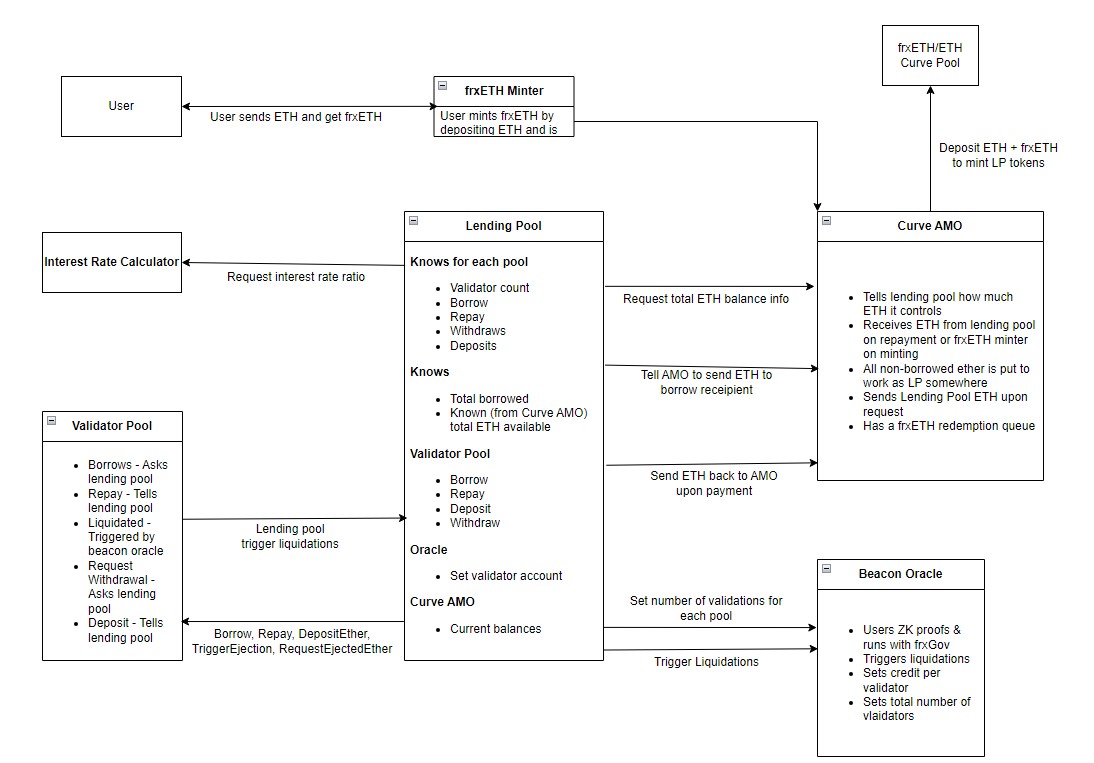

Frax Ether is a liquid ETH staking derivative designed to maximize yield from ETH staking rewards to benefit the Frax economy. At its core, the Frax Ether system consists of the following:

- frxETH acts as a stablecoin pegged to the value of ETH.

- frxETH always represents 1 ETH.

- The amount of frxETH in circulation matches the amount of ETH in the Frax Ether system.

- Holding frxETH on its own does not give yield. In fact, holding frxETH is basically like just holding ETH.

- sfrxETH acts as the liquid staking derivative version of frxETH. All profit generated from ETH staking rewards is distributed back to sfrxETH holders. sfrxETH is designed as an ERC-4626 vault that accrues staking yield to the Frax ETH validators.

- By exchanging sfrxETH for frxETH, users can redeem their share of the staking yield.

- By exchanging frxETH for sfrxETH, users become eligible for earning staking yield.

- At any time, frxETH can be exchanged for sfrxETH by depositing frxETHinto the sfrxETH vault. Over time, as validators accrue staking yield, an equivalent amount of frxETH is minted and added to the vault, allowing users to redeem their sfrxETH for a greater amount than they originally deposited.

- The exchange rate of frxETH per sfrxETH increases over time as staking rewards are added to the vault. By holding sfrxETH you are entitled to a % claim on an increasing amount of the vault’s frxETH. These staking rewards are split among sfrxETH holders proportional to their share of the total sfrxETH (similar to other auto-compounding tokens like aUSDC on Aave, or cUSDC on Compound)

- frxETHMinter allows the exchange of ETH for frxETH by spinning up validator nodes and minting a new frxETH amount equal to the amount of ETH staked into the validator

Frax Ether v2

FrxETH v2 is envisioned to be:

- The most efficient, decentralized lending market & ETH stablecoin backed by validator debt.

- The most programmable LSD base layer to build on top of for projects.

Some of its innovations include:

- World’s first market-set interest rate for borrowing validators.

- Naturally encourages the most competent & performant node operators since rates are set by Utilization Rate.

- If it’s cheap to borrow a validator, node operators can validate, pay the interest to lenders & keep the spread/MEV/tips etc.

- If interest rates spike & it’s unprofitable for the $ETH lender, the user can eject/repay their debt and wind down until rates suit their liking.

- Borrow rates propagate through the global LSD markets.

- The agnostic lending market allows for any kind of collateral, LTV, & loan terms approved by veFXS holders.

- frxETH stablecoin (pegged to $ETH) is backed by these overcollateralized validator loans.

Validators

FrxETH v2 creates a fully decentralized borrowing market for validators by enabling the following:

- Validators post collateral and take ETH loans.

- The sfrxETH yield APR becomes the interest rate paid by validators for their ETH loans.

- Validators will have to post 2-8 ETH collateral to maintain their loan. If they get slashed and their loan health declines, they can either eject or add additional collateral.

- The best-performing validators benefit the most, as they will be able to maximize their returns versus the base borrowing cost.

FraxFerry

FraxFerry is an alternative method for bridging tokens between chains. Its simple and secure design was motivated by:

- Too many bridge hacks from bugs, team rugs…

- Risk of infinite mints.

- Some chains’ bridges are slow (Arbitrum, Optimism…)

- User sends tokens to the FraxFerry smart contract.

- Captain queries the source chain to fetch the transactions that must be shipped.

- Captain send the transactions in batches to start the trip (depart).

- 24-hour waiting period.

- Crewmember check the batch and can dispute if it is invalid.

- Non-disputed batches are executed by providing the transactions as calldata on the destination chain.

- In case there was a fraudulent transaction, the owner can cancel a single transaction to avoid its execution. This also permits transaction owners to manually manage the tokens in the FraxFerry contract and make sure that the funds are enough.

FraxFerry provides the following benefits when compared to traditional bridges:

- Risk is capped by token amounts per bridge contract (no risk of infinite mints)

- Slower transactions are given more time to be detected as bad batches and can be stopped

- Crew members can pause contracts while any issues are being investigated

This comes at the expense of:

- When a batch with a false hash is submitted and no one disputes the transaction batch proposal, all crewmember bots are offline/censored/compromised.

- Block reorgs on the source chain can only be avoided by returning the transactions that are at least one hour old on the source chain.

- Operators might not have enough time to pause the contract after an invalid proposal is submitted.

- Centralization risk.

AMOs

Algorithmic Market Operations, or AMOs, are how Frax works. They provide the algorithm and guidelines for the different mechanisms in the Frax ecosystem. There are different AMOs for the different features of Frax, including Frax Lend, and most notably, keeping the FRAX stablecoin peg. AMOs can be deployed within the Frax ecosystem through Governance.

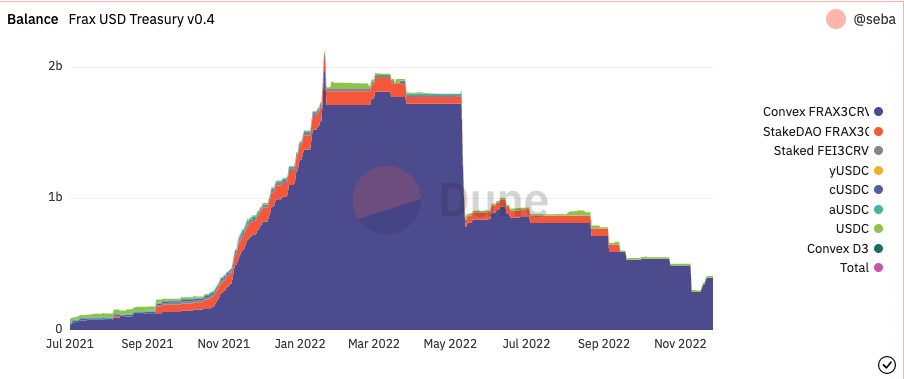

Curve AMO

The Curve AMO is a stableswap pool controlled by the protocol. This AMO deposits FRAX and USDC liquidity into Curve with the purpose of tightening the peg. Frax has deployed its own FRAX3CRV metapool, which means that the Frax deployer address owns the admin privileges of the pool. This allows the controller to set and collect admin fees for FXS holders. Besides, the protocol can move idle USDC collateral or new FRAX to its own pool to create even more liquidity and peg stability.

The protocol calculates the amount of underlying collateral that the AMO can access by finding the balance of USDC that it can withdraw if the price of FRAX were to drop the collateral ratio. This calculation allows the Curve AMO to mint FRAX and deposit it in the pool in addition to the USDC collateral to tighten the peg

The AMO’s overall strategy allows for optimizing the minimum FRAX supply so that selling all that amount at once into the pool would minimize the price impact. This means that the Curve AMO can put FRAX and USDC stablecoins into its own Curve pool and control its own TVL. Since the collateral ratio dynamically adjusts itself, FRAX can be sold directly into the Curve pool before a price drop causes the protocol to re-collateralize itself. Because of this, the protocol can have at least the amount needed to re-collateralize in this AMO, since the sale of the full amount into the Curve pool would not impact the price enough to cause the collateral ratio to move. For instance, a 330M TVL FRAX3Pool can support at minimum a $39.2M FRAX sell order without moving the price by more than 1 cent.

Additionally, Curve allocates CRV rewards for liquidity providers. Since the Frax protocol will likely be the largest LP to the FRAX3CRV pool, it can allocate all its FRAX3CRV LP tokens into the Curve gauges to earn a significant amount of the pool’s CRV rewards. These CRV tokens are held within the AMO and can be used to vote on Curve DAO governance as per the internal governance decisions of FXS holders. Indeed, the more the protocol deploys its owned liquidity to Curve, the more of the Curve protocol it will own and the more power it will have over the distribution of CRV rewards.

FRAX3CRV Dune Dashboard: https://dune.com/templedao/FRAX3CRV-Pool

- Decollateralize by placing idle collateral and newly minted FRAX into the FRAX3CRV pool.

- Perform market operations by earning transaction fees, and CRV rewards. In addition to that, the FRAX3CRV LP tokens are deposited to the crvFRAX yearn vault, StakeDAO, and Convex Finance to earn extra yield.

- Recollateralize by withdrawing excess FRAX from the pool first and then withdrawing USDC later to increase the collateral ratio.

- Keep track of a formalized balance sheet accounting the daily revenue towards FXS1559.

Fraxlend AMO

The Frax lending AMO earns APY by lending FRAX on other DeFi platforms. This controller mints FRAX into money markets like Aave and Compound to allow anyone to borrow FRAX by paying interest instead of the base minting mechanism. The FRAX that is minted into the money markets does not enter circulation unless the supply is overcollateralized by borrowers. This ensures that the AMO does not lower the collateral ratio. At the same time, it also allows the protocol to directly lend FRAX and earn interest from borrowers.

This cash flow can be compared to how MakerDAO burns MKR from stability fees.

The AMO can increase/decrease the interest rate on borrowing FRAX:

- By minting FRAX it can lower the rates

- By burning FRAX it can increase the rates

Since the AMO can mint/burn FRAX, it also makes the cost of shorting FRAX more or less expensive depending on which direction the protocol needs to target its collateral ratio. Furthermore, because the protocol itself can mint stablecoins at will until the market responds by selling FRAX and bringing the price below $1, this AMO has minimal money creation costs. This strategy is optimal for overcoming the rates of any other stablecoin.

- Decollateralize by minting FRAX into money markets without decreasing the collateral ratio, since all borrowed FRAX is guaranteed to be overcollateralized.

- Perform market operations by accruing interest rate payments from borrowers.

- Recollateralize by withdrawing FRAX from money markets.

- Keep track of a formalized balance sheet accounting the daily revenue towards FXS1559.

Fraxswap TWAMM AMO

The Fraxswap TWAMM AMO loads time-weighted average market maker orders into the Fraxswap AMM to buy or sell collateral over a long period of time.

This allows for the expansion of the $FRAX balance sheet by buying collateral with $FRAX stablecoins or contracting the supply of $FRAX by selling balance sheet assets through TWAMM orders. The AMO can also be used to repurchase $FXS tokens with protocol revenue/fees.

RWAs

FRAX v3 utilizes a real-world asset (RWA) strategy when the IORB oracle reports high rates. FRAX v3 only utilizes RWAs that yield very close to the IORB rate with as little duration risk as possible. Thus, only the following assets are considered at this time unless changed by the frxGov process:

- Short-dated United States treasury bills

- Federal Reserve Overnight Repurchase Agreements

- USD deposited at Federal Reserve Bank master accounts

- Select shares of money market mutual funds

FRAX v3 partner custodians primarily concentrate on only the above assets. RWA partners must report the custody, broker, banking, and trust arrangements employed in the course of holding the assets for FRAX v3 no later than monthly.

FIP-277 enshrined FinresPBC as the first RWA partner for FRAX v3. FinresPBC will concentrate on securing “cash equivalent” low risk RWAs and optimize for yielding close to the IORB rate for the sFRAX staking vault.

Additional RWA partners can be onboarded per governance voting through frxGov.

sFRAX

Staked FRAX ($sFRAX) is an ERC4626 staking vault that distributes part of the Frax Protocol yield weekly to stakers denominated in $FRAX stablecoins. The $sFRAX token represents pro rata deposits within the vault and is always withdrawable for $FRAX stablecoins at the pro rata rate at all times. $sFRAX APY attempts to roughly track the interest on reserve balances (IORB) rate of the United States Federal Reserve using the IORB oracle. This benchmark rate is generally accepted as the “risk free rate” of the US Dollar. The $FRAX staking vault attempts, but does not guarantee in any way, to target this rate.

The $sFRAX vault APY is based on a utilization function that can be set by the frxGov governance module. The utilization curve starts at a top end of 10% APY and theoretically has no bottom; however, as more $FRAX is staked in the vault, the protocol will attempt to deploy the staked $FRAX to sources that yield as close to the IORB rate as possible to keep the bottom APY close to the IORB oracle. Every Wednesday at 11:59:59 UTC the Frax Protocol adds newly minted $FRAX stablecoins into the $sFRAX vault. This newly minted $FRAX is one-to-one proportional to the earnings of the Frax Protocol over the prior week and thus fully backed at 100% CR. Each $sFRAX epoch is 1 week and identical in length and start time as the $FXS gauge and $sfrxETH epoch. There is no protocol guarantee that the deployed capital will be from a particular type of asset at any time. The frxGov governance module will control the deployment path and asset type for $sFRAX yield. The Staked $FRAX vault’s yield predominantly originates from real-world asset (RWA) strategies employed by Frax Protocol partner custodians including, but not limited to, FinresPBC.

FXBs

FXB tokens are simple, trustless tokens that resemble a zero-coupon bond that converts to the $FRAX stablecoin on maturity. FXBs are debt tokens denominated in $FRAX stablecoins, not a claim on any other asset or collateral. FXB tokens are only convertible to $FRAX stablecoins, they do not guarantee $FRAX peg, $FRAX value, or yield/interest denominated in any other asset except FRAX. FXBs do not entitle the holder to any asset offchain or onchain (other than $FRAX stablecoins). Thus, FXBs are not redeemable for US Treasury Bills nor any real-world asset, are not directly backed/collateralized by them (or any specific asset), and do not have any utility except trustlessly converting to $FRAX stablecoins at the pre-programmed maturity timestamp generated at their minting. This is important and not merely a semantic distinction because it directly defines the normative and economic property of FXBs. Frax Bond tokens only guarantee that they convert to $FRAX on a one-to-one basis through smart contracts that issue them.

FXBs allow the formation of a yield curve to price the time value of lending $FRAX back to the protocol itself. Each FXB token is a fungible ERC20 token deployed from an onchain factory contract. Immediately at minting time, $FRAX stablecoins are minted into the FXB redemption contract for conversion on maturity. This prevents any external actions being necessary for the full FXB cycle to occur and entirely remains trustless. There can be multiple FXB series circulating at all times (decided by frxGov) and no limit for the minimum or maximum maturity timestamp for FXBs deployed from the factory.

Series Auctions

FXB series price discovery happens through a unique gradual Dutch auction (GDA) auction system that has quantity and price limit set by frxGov. This guarantees that FXB tokens are not sold for prices lower than the floor limit. Auctions happen through the FXB Auctioneer AMO contract and are trustless, permissionless, and non-custodial. New auctions can happen at any time through frxGov initiated transactions.

For Investors

Income from farming rewards and yield strategies

Protocol Utility

The protocol’s main objective is the price stability of FRAX:

- FRAX can be minted and redeemed from the protocol for $1 worth of value

- Arbitrageurs will balance the demand/supply of FRAX by trading it in the open market as soon as it is slightly above or below peg.

- If the market price is above $1, then there is an arbitrage opportunity to mint tokens by placing $1 of value into the system and redeeming one unit of FRAX that can be sold for above $1 in the open market.

- If the market price is below, then there is an arbitrage opportunity to redeem FRAX tokens by purchasing them cheaply on the open market and redeeming FRAX for $1 of value from the system.

When there is demand for FRAX, redeeming it for FXS plus collateral starts the process of minting an equivalent amount of FRAX. This amount will enter into circulation by burning a similar amount of FXS. Therefore, the value that accrues to the FXS market cap is the sum of the non-collateralized value of FRAX’s market cap.

FXS token’s value is partially determined by the demand for FRAX. This value is represented as the sum of all past and future shaded areas under the curve displayed in the picture below.

The supply/demand curve illustrates how minting/redeeming FRAX leads to price stability:

- Q stands for quantity.

- P stands for price.

- At CD0 the FRAX’s price is p0 = $1 at q0.

- As demand for FRAX increases, the curve shifts to the right towards CD1. This moves p0 to p1 while keeping the same q0.

- In order to recover the price of $1, new FRAX is minted until q1 is reached and the price of p0 = $1 is reached.

Since the market cap is calculated by multiplying the price by quantity:

- The market cap of FRAX at q0 is the blue square.

- The market cap of FRAX at q1 is the sum of the areas of the blue and green squares.

When demand increases, the market increases, either by an increase in quantity (at a stable price) or an increase in price. The area of the green and red squares above is the same and, therefore, would contribute the same amount of value in terms of market cap.

- The half-shaded portion in the green square represents the total value of FXS shares that would be burned if the new quantity of FRAX was generated at a hypothetical collateral ratio (~66% collateral ratio in the picture above).

Because of all these premises, the FXS market cap is intrinsically linked to the demand for FRAX.

Business model

The protocol adjusts the collateral ratio during periods of FRAX expansion and contraction:

- During periods of expansion, the protocol lowers the collateral ratio so that less collateral and more FXS must be deposited to mint FRAX.

- During periods of retraction, the protocol increases the collateral ratio as a proportion of FRAX supply. The goal of this is to increase market confidence as the collateral backing FRAX increases.

Minting

All FRAX tokens are fungible with one another and are entitled to the same proportion of collateral regardless of the original collateral ratio they were minted at.

The price of the collateral affects how many units FRAX can be minted.

Note that FRAX is pegged to 1 USD, not 1 unit of USDC.

Here are some examples to understand how the minting of FRAX works.

Example 1:

When the protocol is fully collateralized (100% collateral ratio), no FXS is needed to mint FRAX. For example, minting FRAX with 200 USDC would give 200 FRAX

F = (200 * $1) + (0) = 200 FRAX

Example 2:

When the protocol is at an 80% collateral ratio, a user with 120 USDC and the price of FXS being $2, will need to deposit 15 FXS alongside the 120 USDC to get 150 FRAX

F = (120 * $1) + (15 * $2) = 150 FRAX

Out of the 150 FRAX minted, 120 units will be backed by USDC collateral and the remaining 30 units will be unbacked. Because of this unbacking, the protocol burns the FXS deposit to remove the tokens from circulation

Example 3:

When the protocol is at a collateral ratio of 50%, a user with 220 USDC and a price of $0.9995 per 1 USDC and an FXS price of $3.5 per FXS will need to deposit 62.54 units of FXS

F = (220 * $0.995) + (62.54% * $3.5) = 437.78 FRAX

Out of the 437.78 FRAX minted, half of it will be backed by USDC collateral and 62.54 FXS tokens will be burnt and removed from circulation.

*Note that these examples do not account for the minting fees

You can read more about the minting and redeeming function here.

Redeeming

Here are some examples to understand how the redeeming of FRAX works.

Example 1:

At a collateral of 65%, and the price of 1 USDC being $1 and $3.75/FXS we have:

- Y = (170 * 0.65) / 1.00 = 110.5

- Z = (170 * 0.35) / 3.75 = 15.867

This means that redeeming 170 FRAX returns $170 worth of value to the redeemer in the form of 110.5 USDC from the collateral pool and 15.867 newly minted FXS tokens at the current market price

*Note that this example does not account for the redemption fees

The redemptions are calculated by readjusting the formula for minting:

Economics

Revenue breakdown

Rather than having a token only meant for Governance purposes, the FXS token also represents the actual value accrued to the entire Frax economy. Indeed, all utility is concentrated into FXS.

FXS is a non-stable utility token that holds governance rights within the system. The FXS token benefits from the potential upside in its utility within the Frax economy. Frax Finance has been designed so that the FXS token is largely deflationary in supply as long as the demand for FRAX increases.

To come up with an efficient market capitalization calculation, you should consider:

- Future expected net value creation from seigniorage of FRAX tokens in perpetuity.

- Cash flow from minting and redemption fees.

- Utilization and capital efficiency of idle collateral.

As the market cap of FXS increases, so does the system’s ability to keep the price of FRAX stable and pegged to 1 USD.

As originally stated in the Seigniorage Shares whitepaper by Robert Sam’s, “share tokens are like the asset side of a central bank’s balance sheet. The market capitalization of shares at any point in time fixes the upper limit on how much the supply of the coin can be reduced”.

As the second stablecoin within the Frax economy, The Frax Price Index (FPI) is governed by Frax Price Index Shares or FPIS for short. Similar to the FXS structure, FPIS holders are entitled to the seigniorage of the protocol and can direct excess yield from the protocol treasury back to FPI holders.

The Frax economy as a whole captures value similar to how ETH accrues value from the sum of all dApps deployed on the Ethereum network. Just like ETH is needed to pay for transaction costs, FPI growth is similar to how a specific ERC20 token can track its native protocol’s growth with respect to the underlying L1 economy. For instance:

- Users who think the Frax economy is undervalued as a whole will want to own more FXS.

- Users who think the FPI is being undervalued as a whole will want to earn more FPI.

Similarly,

- Users who think the ETH economy is undervalued as a whole would buy more ETH

- Users who think a specific project will grow faster than the sum of the total economy would buy more tokens of that specific project.

Over the past year, FRAX supply has been sitting at ~20% of MakerDAO’s DAI’s supply. This means that the demand for FRAX could surge up to 400% before breaking even with DAI. This revenue would flow to FXS holders. One example of this was the vote on a $20M revenue-fueled buyback program by FraxSwap’s TWAMM, from which Frax stands to earn even more revenue from a 0.3% trading fee on all swaps.

By having its own AMM and money market, the Frax economy can act as a central bank whose entire revenue is shared back with the protocol token holders. For instance, all revenue generated by Frax Ether from its validator rewards is distributed back to sfrxETH holders.

This aligns with the concept of protocol-owned liquidity. For instance, Frax currently owns ~51% of FRAX supply as protocol-controlled value, since most of this FRAX is being used by AMOs.

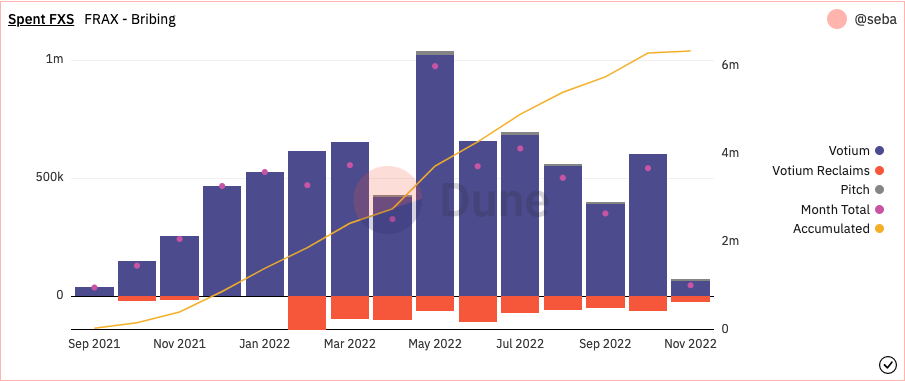

Operational expenses

Most expenses come from liquidity mining initiatives:

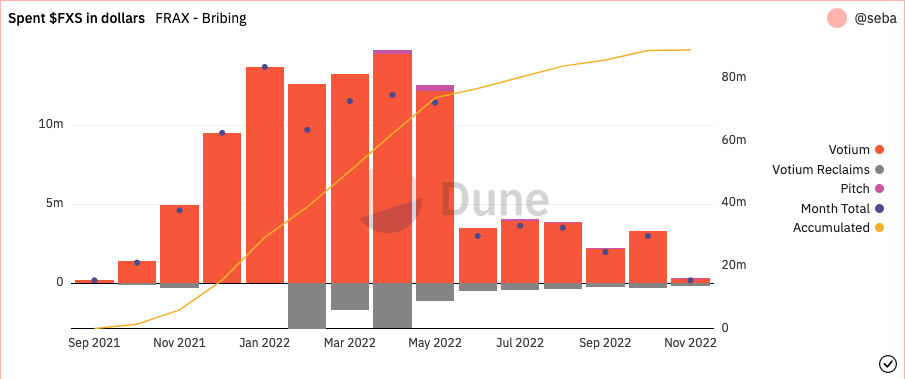

Dune dashboard with operational expenses: https://dune.com/seba/frax-curve-bribing

Tokens

FXS

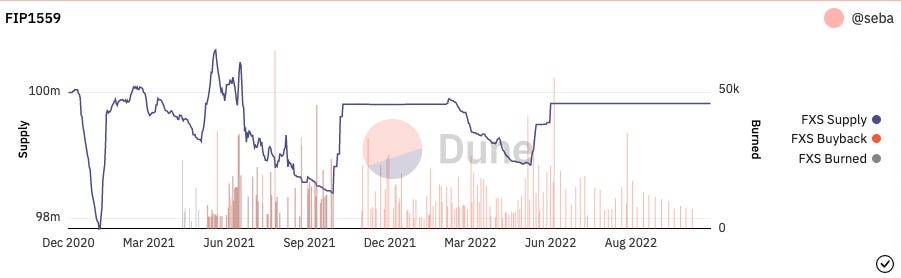

The Frax governance token, FXS (Frax Share) supply is initially set to 100M tokens at genesis. However, the amount in circulation will likely be deflationary, since FRAX is minted at higher collateral ratios. As per the original design, the FXS supply will halve every 12 months on December 20th each year.

FXS gauge emissions are given out as incentives for veFXS stakers. Since these emissions are fixed and halved every year, governance can decide whether to allocate part of the protocol’s cash flow or newly minted FRAX to gauge rewards after a few years. Because of this, veFXS stakers can feel more confident locking their tokens for a maximum 4 years duration knowing that the gauge incentives program won’t be deprecated.

FXS 1559

FXS1559 was originally created as the original protocol mechanism for the FXS token. Since its announcement, Governance has voted to move 100% of the protocol profits to veFXS yield.

This specification calculates all excess value in the system that is above the collateral ratio and uses these profits to buyback and burn FXS in the open market. The proposal is based on Ethereum’s EIP 1559, which burns ETH during block production based on usage metrics.

Specifically, every time interval, FXS1559 calculates the excess value above the collateral amount and mints FRAX in proportion to the collateral ratio against that value. It then uses the newly minted FRAX to purchase FXS on FRAX-FXS AMM pairs and burn it.

Example

There is 100M FRAX in circulation with $86M worth of collateral (86% collateral ratio). When FRAX is trading at $1 the system is in equilibrium. Collateral is then deployed through multiple AMOs so that Frax can earn yield, transaction fees, and interest.

For example, if each day the protocol AMOs generate $20,000 worth of revenue, this would increase the collateral ratio by 0.23% each day. Therefore, after 24 hours, the collateral ratio will have gone from 86% to 86.023%.

In this scenario, the protocol could use the $20,000 worth of collateral profit to purchase FXS on the open market. However, a more efficient method is to mint 20,000 / 0.86 = 23,255.814 FRAX and then take the newly minted 23,255.814 FRAX and purchase FXS. The recently bought FXS is immediately burned. This alternative method is more capital efficient since it can expand the FRAX supply, accrue value to FXS holders, and rebalance the protocol’s collateral ratio.

veFXS

veFXS also plays a key role in the protocol’s governance. It is a vesting and yield system based on Curve’s veCRV mechanism. Users lock up their FXS tokens for up to 4 years to receive 4 times the amount of veFXS tokens (e.g. 100 FXS locked for 4 years would return 400 veFXS). veFXS tokens are neither transferable nor tradeable on liquid markets. Instead, they entitled their holders to an account-based points system where the voting power linearly decreases as the vested tokens approach their lock expiry. Once the voting power fully decays after 4 years, the user can redeem the veFXS back for FXS. In the meantime, users can also increase their veFXS balance by locking up FXS, extending the lock duration, or both.

The main cash flow distribution mechanism of the Frax Protocol is to veFXS holders. The cash flow that is earned from AMOs, Fraxlend loans, and Fraxswap fees goes towards buying back FXS from the market and then redistributing it to veFXS stakers as yield. Because of this, the emission rate varies depending on the protocol’s profitability, sources of cash flow, FXS market price, and governance.

Token distribution

FRAX Treasury

Frax Crypto assets:

FXS distribution

- 65% to the Community

- 60% to yield farming, liquidity incentives, and exclusive governance proposals:

- Governance can change this distribution schedule after 2 weeks of discussion followed by a token holder vote

- Governance can decide which pools, programs, and initiatives to support.

- No more than 60M FXS tokens can be allocated to these purposes.

- The emission rate was chosen to balance the need for a large amount of rewards for early adopters while not distributing all FXS too early.

- 5 % to the project treasury for grants, partnerships, and bug bounties:

- The project treasury is community-driven and governed by FXS token holders.

- Grants should be given to open-source projects that benefit the Frax economy.

- Bug bounties must be security oriented and disclosed to the core team.

- 35% to team and investors:

- 20% to the team over 12 months and a 6-month cliff.

- 3% to strategic advisors and early contributors vested over 36 months.

- 12% to accredited private investors.

- 2% unlocked at launch.

- 5% vested over the first 6 months.

- 5% vested over 1 year with a 6 months cliff.

veFXS locked

FPI

FPI is a novel stablecoin pegged to a basket of real-world consumer items as defined by the United States CPI-U (CPI Unadjusted) average. FPI is intended to keep its price constant to the price of all items within the CPI basket. For that reason, the Frax Price Index stablecoin is meant to hold its purchasing power.

- Excess protocol revenue in the treasury can be directed to FPIS (governance token for FPI) holders.

- During times when the FPI treasury does not create enough yield to maintain the increased backing per FPI due to rising US inflation, new FPIs may be minted and sold to increase the treasury holdings.

A Chainlink oracle is responsible for committing the US CPI-U 12-month inflation rate on chain as stated by the US Federal Government. The oracle’s reported inflation rate is then applied to the redemption price of FPI. This redemption price then grows every second if there is inflation, or declines if there is deflation. This peg calculation rate is updated once every 30 days when bls.gov releases new CPI monthly data.

The Consumer Price Index measures the monthly change in prices paid by US customers. It is calculated by the US Bureau of Labor Statistics as a weighted average of prices for a basket of goods and services representation of aggregate US consumer spending

FPI tracks the above 12-month inflation rate and pegs a redemption contract to its dynamic pricing at all times.

- When buying FPI stablecoins for another asset, such as ETH, the trader is betting the CPI purchasing power is growing faster over time than the sold ETH.

- When selling FPI stablecoins for another asset, such as ETH, the trader is betting that the ETH growth is outpacing the US CPI inflation rate.

- FPI aims to become the first on-chain stablecoin to have its own unit of account derived from a basket of both crypto and non-crypto goods.

- FPI seeks to become the first on-chain representation for denominating transactions value and debt.

- FPI is modeled to keep a 100% collateral ratio at all times, which means that the protocol’s balance sheet must be growing at least at the rate of CPI inflation.

- AMO (Algorithmic Market Operation) contracts must earn a yield proportional to CPI, since otherwise, the collateral ratio would decrease below 100%.

- When the AMO yield is under the CPI rate, a TWAMM (Time Weighted Automated Market Maker) AMO will sell FPIS tokens for FRAX stablecoins to keep the 100% collateral ratio.

- When the yield surpasses the CPI rate, the FPIS TWAMM will be stopped.

FPI Controller Pool

The FPI Controller Pool has all the functions related to FPI and its peg:

- Users can mint FPI with FRAX or redeem FPI for FRAX.

- TWAMM to Peg function is used by the protocol to introduce market pressure and bring the market price of FPI up or down to the target peg price.

- Contract that gives or receives FRAX from an AMO to earn yield.

FPI distribution

No FPIS tokens can be minted beyond the 100M genesis supply except to keep the FPI peg to the CPI rate (and keep the 100% collateral ratio constant).

- 35% Frax Finance Treasury

- FXS votes have total control in voting on how to distribute these tokens.

- 30% FPI Protocol Treasury

- FPIS voters themselves have total control over how to distribute these tokens.

- 25% core developers and contributors

- 4-year back-vested to start from February 20, 200 with a 6-month cliff.

- This treasury will be staked in the veFPIS system in 4-week intervals between monthly distributions.

- 10% airdrop to FXS holders

- Snapshot was taken on February 20, 2022, and was claimable until August 20, 2022.

Governance

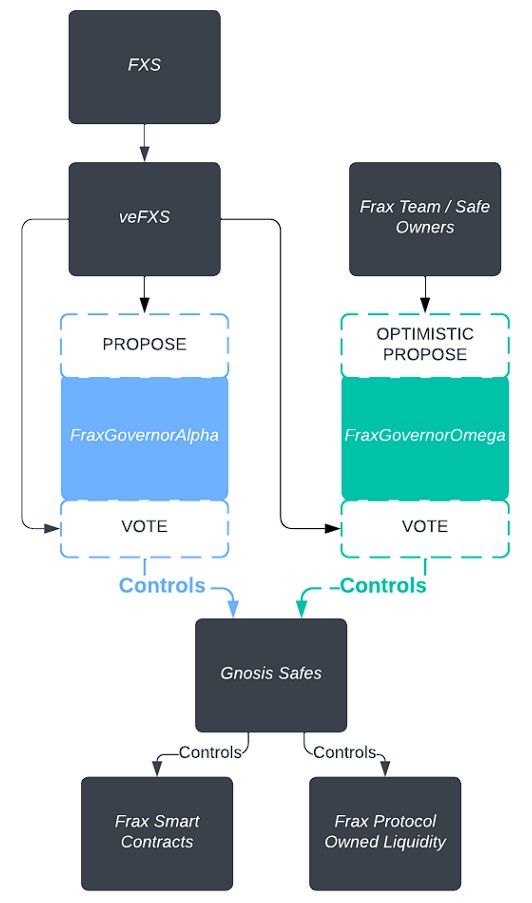

The final state of Frax Governance will have full control of all major safes, giving $veFXS holders the final say over everything in the protocol. $veFXS holders can vote for or against all proposals and can replace Frax team members as owners on the underlying Safes and execute any action, if it reaches quorum and passes.Frax team members have the ability to create optimistic proposals through FraxGovernorOmega which succeed by default. Typically proposals fail by default, but with Frax Governance, $veFXS holders can vote for or against optimistic proposals as well. If an optimistic proposal reaches quorum and there are more against than for votes, the proposal will fail.

How it works

Frax Governance is a dual Governor system consisting of FraxGovernorAlpha and FraxGovernorOmega. Alpha and Omega have different uses and configurations.

FraxGovernorOmega

FraxGovernorOmega has limited control over the underlying Safes. Only the Frax Team / Safe owners can create Omega proposals. Each proposal is mapped 1 to 1 to a Safe transaction. Omega is configured as an additional Safe owner and must approve of a Safe transaction before Safe owners can execute it. This is enforced using a custom Gnosis Safe Guard.

Omega has a very short voting delay, a short voting period, and a low quorum value. Safe owners can only add proposals to Omega after getting the Safe’s threshold number of signatures for that Safe transaction. For example, if a Safe is a 3/6 (5 owners + Omega) 3 owners must sign before the proposal can be put into Omega.

After adding a proposal to Omega, it follows the same lifecycle as a Governor proposal. If it passes, Omega calls approveHash on the Safe and the proposal can be executed by any owner through the Gnosis Safe UI as usual. If the proposal fails, rejectTransaction can be called on Omega to approve a 0 ether transfer. Other owners can sign and execute the same 0 ether transfer, which just increments the nonce on the Safe, allowing creation of new Gnosis transactions.

Omega has a feature called the short circuit threshold. If 51% of the total veFXS supply votes for an Omega proposal, it will immediately succeed and be executable. This helps in extraordinary circumstances, when the Frax team needs to take quick action to protect the protocol.

Omega cannot change its own governance parameters or change any configuration on the underlying Safes. FraxGovernorAlpha must be used to change these values.

FraxGovernorAlpha

FraxGovernorAlpha has full control over underlying Safes. Any veFXS holder with a veFXS balance meeting or exceeding the proposal threshold can create a proposal. FraxGovernorAlpha is nearly identical to OpenZeppelin Governor. It has full control over each Gnosis Safe because its TimelockController is configured as a module on the Safe and can execute any action. Modules are not constrained by Gnosis Safe Guards.

Alpha has a long voting delay, long voting period, and much higher quorum than Omega. Once an Alpha proposal passes, it must be queued and after the configured timelock period, it can be executed.

veFXS

veFXS holders are the most important part of the system. Proposals succeeding or failing is ultimately up to veFXS holders because they directly vote on them. Your veFXS balance is equal to your voting power.