Introduction

As the digital asset industry matures, the integration of institutional players is essential for driving liquidity, credibility, and market efficiency. However, the lack of institutional-grade trading infrastructure—defined by high performance, regulatory compliance, and scalability—remains a critical barrier.

DeFinity defines itself as a “hybrid decentralized exchange for institutions,” and its aim is to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi). While its model leans more towards TradFi, relying on credit-grade counterparties to back transactions and offering transparency through clear pricing and liquidity rather than on-chain visibility, it incorporates key DeFi principles by eliminating counterparty and custody risk. This is achieved through bank-backed credit transactions rather than the use of smart contracts.

This report explores how DeFinity’s approach, supported by the $DEFX token, strategic partnerships, and proactive regulatory efforts, addresses the growing demand for institutional engagement in the crypto industry.

Key Takeaways

- DeFinity’s mission: DeFinity bridges traditional finance and digital assets by combining the key strengths of DeFi with the compliance and reliability of institutional-grade systems, addressing important barriers to entry for traditional asset managers and institutional capital allocators..

- Proven track record: Built on DMALINK’s FX expertise, DeFinity has on boarded over 150 institutional clients and have a further 270 in their pipeline, with hundreds of millions in trading volume and plans for further expansion.

- Regulatory compliance advantage: Operating in highly regulated jurisdictions like Mauritius and Jersey, DeFinity adheres to global standards, giving it a competitive edge over platforms in less-regulated regions.

- $DEFX token utility: The $DEFX token serves as a deflationary utility token for institutional use, also acting as a proxy for retail participants who want to bet on the narrative of institutional crypto adoption.

Background

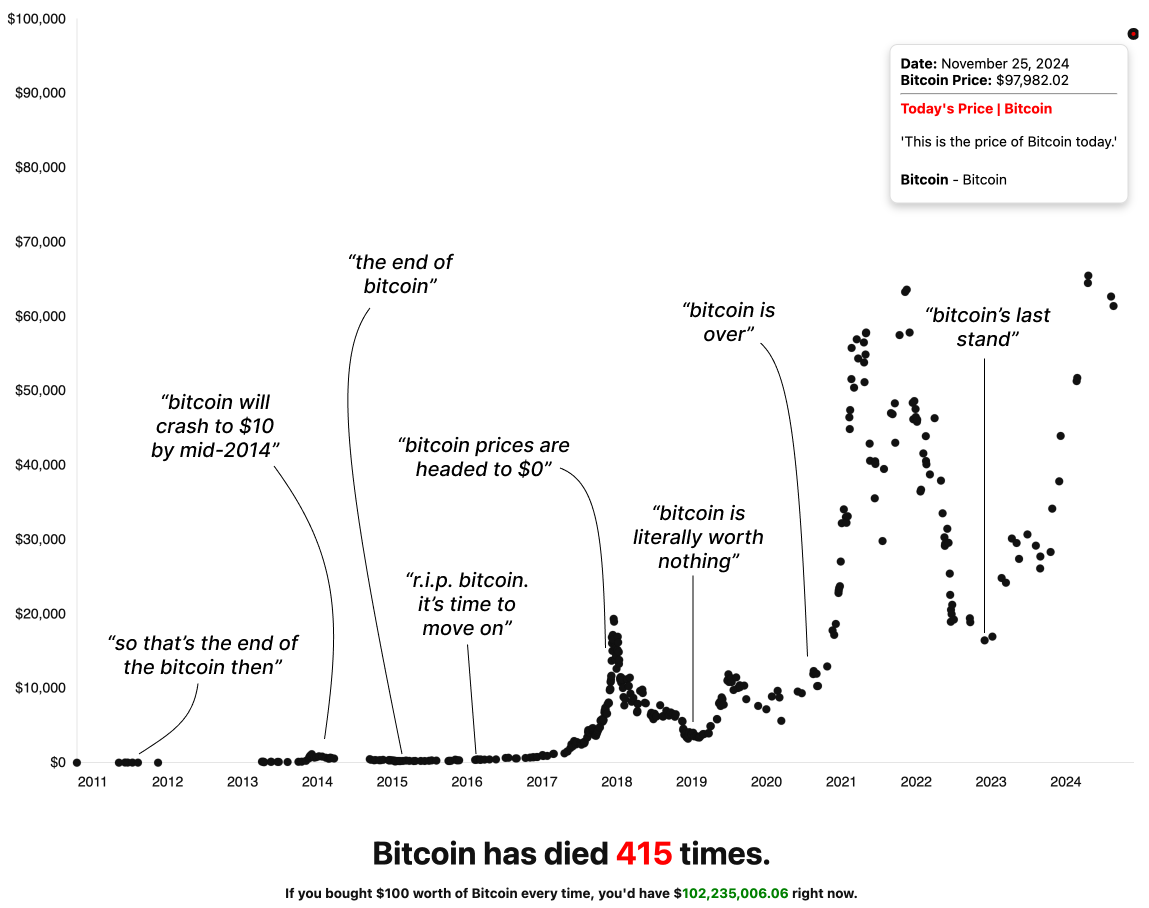

Since Bitcoin’s inception in 2009, $BTC as an asset has been dismissed and declared dead on multiple occasions, resulting in skepticism towards the entire crypto industry and entitlement as an emerging asset class. According to Bitcoin Is Dead, a manually curated database of Bitcoin obituaries, the cryptocurrency has been declared “dead” at least 415 times—along with similar predictions for the broader crypto market. Some of the most famous criticisms have also come from well-recognized investors like Warren Buffett and Charlie Munger. Munger was one of the earliest critics, calling Bitcoin “rat poison” in 2013 when it was worth just $150. Five years later, Buffett doubled down on this sentiment, describing Bitcoin as “probably rat poison squared” during Berkshire Hathaway’s 2018 annual shareholder meeting. In the same year, Munger added, “In my life, I try to avoid things that are stupid, and evil, and maybe look bad in comparison with somebody else. Bitcoin does all three.”

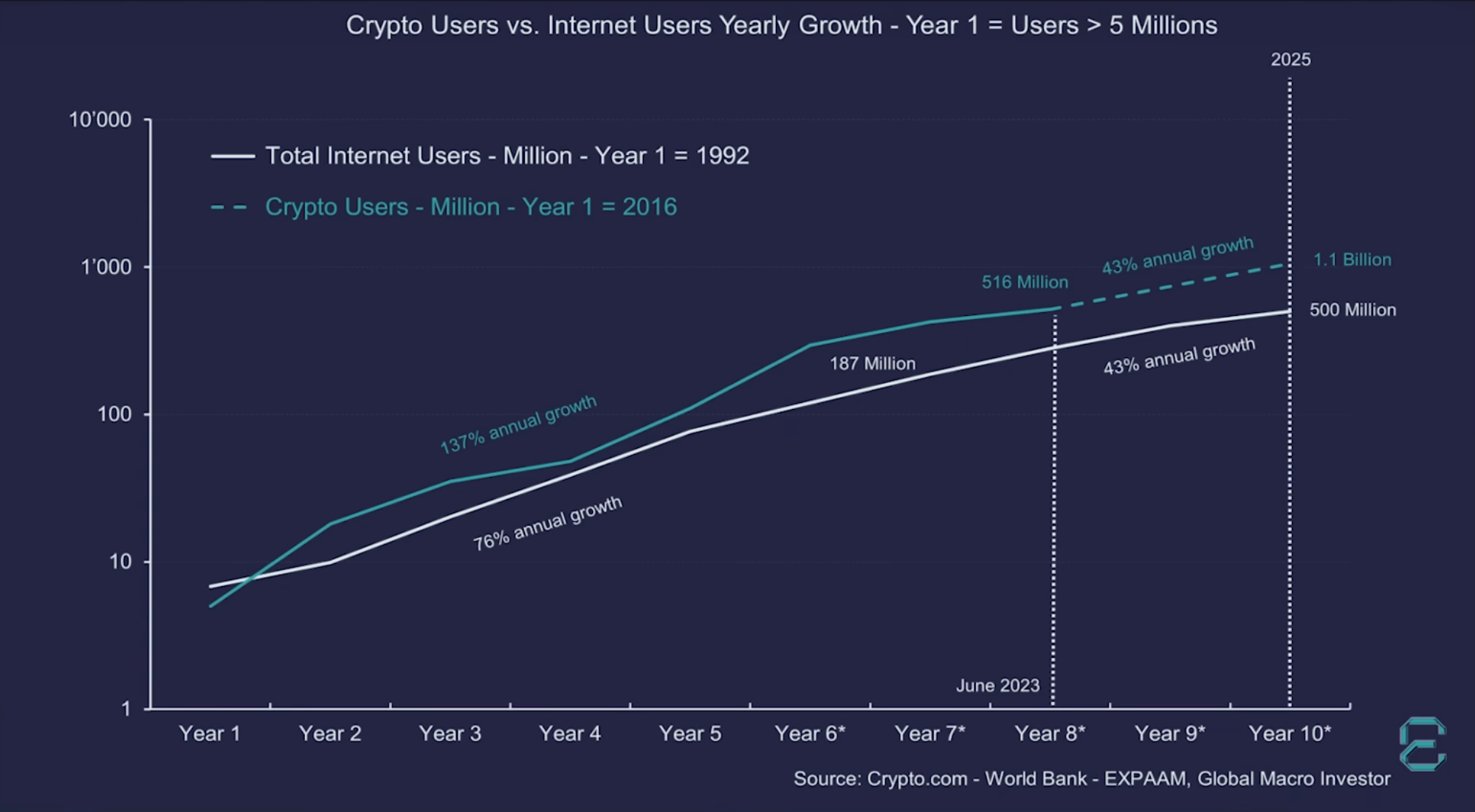

Despite these predictions, today, Bitcoin’s market capitalization stands at nearly $2 trillion, with the total crypto market reaching $3.3 trillion. This growth has been driven by a robust adoption rate, mirroring the trajectory of Internet user growth.

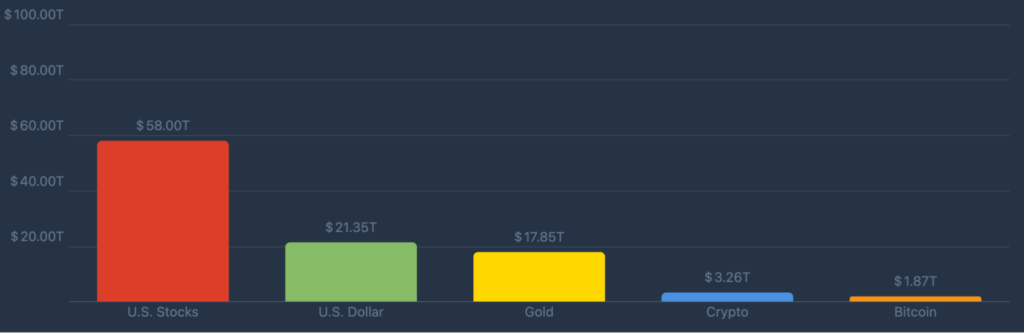

While these figures are encouraging and highlight global interest in the crypto market, there is still significant room for growth. For example, Bitcoin’s market capitalization is only about one-tenth that of gold, often cited as a comparable store of value. Similarly, the total crypto market cap of $3.3 trillion is a small fraction of larger asset classes such as U.S. stocks or the U.S. dollar. To expand its market share against these established assets, retail participation alone is insufficient; institutional validation and involvement are essential.

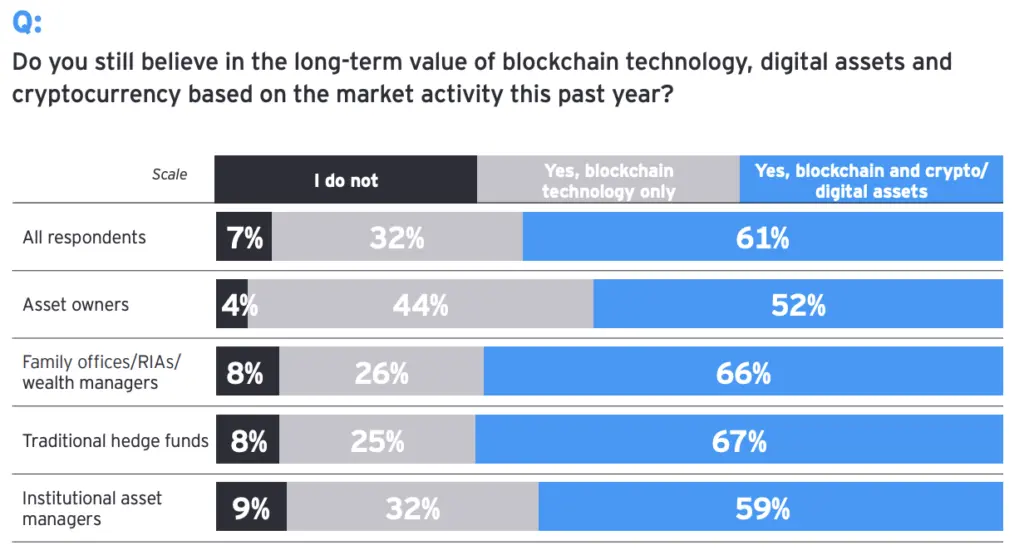

In 2023, EY conducted a survey to gauge institutional investor sentiment toward blockchain and digital assets. The study gathered insights from 256 decision-makers at buy-side firms across the globe. The findings revealed that the majority of institutional investors see long-term value in digital assets and blockchain technology, anticipate widespread adoption of blockchain, and recognize the potential of smart contract programmability to drive financial services use cases.

Despite growing recognition of digital assets as a legitimate investment class, institutional participation in cryptocurrency markets remains constrained by significant barriers to entry. Currently, the primary avenue for institutional investment in crypto is through vehicles like the spot Bitcoin and Ethereum ETFs launched in 2024. According to recent data, institutional investors now hold approximately 20% of all U.S.-traded spot Bitcoin ETFs, with around 1,179 institutions investing in these products. Notable participants include Millennium Management ($70 billion AUM), Jane Street ($438 billion AUM), and Goldman Sachs ($2.93 trillion AUM).

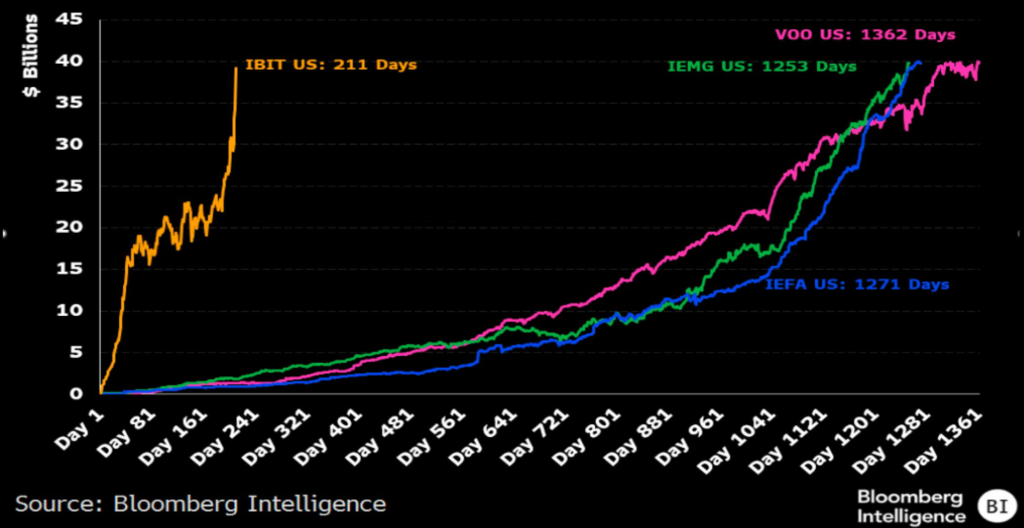

The demand for institutional exposure to crypto markets is evident. The BlackRock iShares Bitcoin Trust ETF ($IBIT) reached $40 billion in assets under management within just 211 days, shattering the previous record of 1,253 days set by the iShares Core MSCI Emerging Markets ETF ($IEMG). At only 10 months old, $IBIT ranks among the top 1% of all ETFs by assets, surpassing the size of all 2,800 ETFs launched in the past decade.

Institutional investors have unique expectations compared to retail investors, requiring specialized infrastructure to meet their needs. Institutional-grade trading infrastructure refers to a robust framework tailored for entities such as banks, hedge funds, asset managers, and corporations. This infrastructure must address key priorities such as security, regulatory compliance, scalability, and transparency—areas where many existing digital asset platforms fall short. Regulatory compliance, for example, often necessitates the separation of custody, execution, and settlement to reduce risks and ensure operational integrity. Additionally, institutions require adherence to best execution practices, which mandate offering multiple price options to achieve the best possible trade outcome (a.k.a. best execution). Currently, these standards are not met by crypto-native centralized exchanges (CEXes).

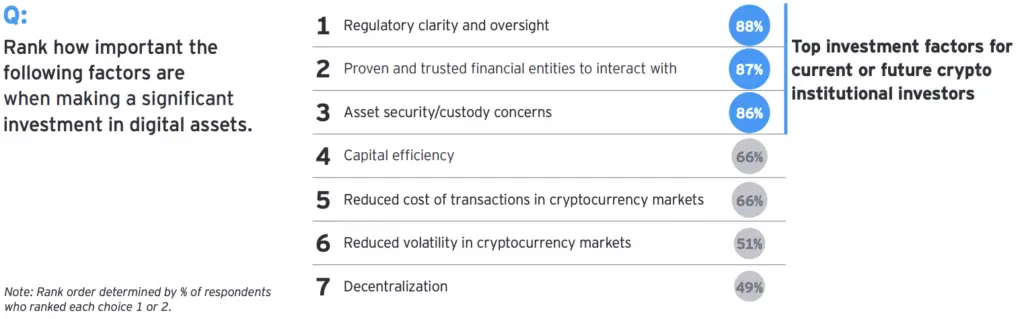

According to the EY survey, the top three barriers to institutional investment in digital assets are regulatory clarity and oversight, the availability of trusted and reputable entities to engage with, and concerns about asset custody and security. Additional considerations include capital efficiency—institutions operate at large volumes and demand high liquidity—and transaction costs, with expectations for competitive, transparent fee structures and volume-based discounts.

Regulatory uncertainties is the main factor that deters institutions from entering the crypto market. The absence of a globally consistent regulatory framework leaves institutions without clear legal protections or compliance pathways. Robust anti-money laundering (AML) and counter-terrorism financing regulations are critical for institutional investors, but these requirements are inconsistently applied across jurisdictions.

DeFinity addresses many of these challenges directly, providing solutions that mitigate institutional concerns. The platform works closely with regulators, including the FCA and SEC, to support the growth of a comprehensive regulatory framework. Additionally, DeFinity benefits from the backing of an AA-rated European investment bank which ensures credit risk is minimised. Further, most clients already have established credit lines with the bank, further increasing trust. Moreover, DeFinity offers significantly lower transaction costs compared to crypto-native CEXes and provides more cost-effective fiat on/off-ramp solutions, making it an attractive choice for institutional participants

Traditional financial institutions also face trust and safety concerns with the current crypto market infrastructure and entities. For instance, CEXes, which dominate the landscape, require custody of funds, exposing institutions to counterparty risks. The collapse of FTX and other high-profile failures have further underscored the vulnerabilities of these platforms. Additionally, unlike traditional financial institutions, centralized exchanges lack credit ratings from agencies like Moody’s or S&P Global, making them unreliable partners for institutional investors. Most of the focus of the existing platforms have prioritized retail users over institutions, which instead require seamless integration with traditional banking systems, real-time settlement capabilities, and access to reliable liquidity pools that can support large trades without disrupting market prices.

In summary, as confirmed by the launch of spot Bitcoin ETFs in January 2024, institutions want to get into crypto, but cannot easily access the market. While ETFs provide one entry point, it can not be the only one. Institutions don’t trust the exchanges and consider there to be too much risk involved with sending significant funds to a CEX. So there are huge sums of money that are waiting for the opportunity to enter.

Further, spot crypto trading presents numerous advantages over ETFs. Bitcoin ETFs incur annual management fees of around 0.25%, meaning spot trading offers the potential for significant cost savings. Spot trading also provides access to a wider range of cryptocurrencies beyond $BTC and $ETH, offering institutions greater diversification opportunities. Additionally, unlike ETFs, spot trading allows for self-custody of assets—aligning with the crypto principle of “not your keys, not your crypto”—which gives investors direct control and ownership of their funds.

Competitive Landscape

Key industry players are actively developing solutions tailored to meet the increasing demand and needs of wealth managers and institutional investors. The following provides a few notable examples.

Coinbase Institutional offers a comprehensive suite of solutions for asset managers, financial institutions, corporations, liquidity providers, and private clients. Coinbase provides trading options through its Coinbase Exchange or across multiple liquidity venues via Coinbase Prime. The latter also offers secure custody solutions—Coinbase was selected as the custodian powering 9 of 11 spot bitcoin ETFs and 8 of the 9 newly approved ETH ETFs—enabling clients to manage their digital-asset portfolios in a secure environment. However, it is important to note that Coinbase is not credit-rated, meaning custodying the actual $BTC for ETFs still implies a certain level of custody risk.

In October ‘24, Binance Institutional introduced “Binance Wealth”, a platform aimed at wealth managers looking for secure and efficient tools to oversee their clients’ crypto investments. This initiative follows Binance’s earlier innovation—a banking triparty solution launched in late 2023. The pilot program allowed institutional investors to maintain trading collateral off-exchange under the custody of a third-party banking partner, significantly addressing counterparty risk. Furthermore, the collateral could include fiat-equivalent assets such as Treasury Bills, offering the added advantage of yield generation.

Lastly, advancements in on-chain technology are also driving greater institutional adoption of digital assets. Consensys, the company behind MetaMask, Infura, and Linea, has launched MetaMask Institutional—a compliant version of its widely used web3 wallet tailored for institutional needs. This multi-custodial wallet integrates with various custody providers, such as BitGo, Fireblocks, Safe, and Cactus Custody, to facilitate secure key storage, multi-signature transaction approvals, and optimized trade flows. MetaMask Institutional also includes features essential for institutional use, such as team action controls, portfolio management, digital asset monitoring, and detailed transaction reporting.

DeFinity’s Approach to Institutional-Grade Solutions

DeFinity Markets’ (also “Definity”) mission is to address the challenges faced by institutions to invest in digital assets. It aims to do so through a platform designed to meet the expectations–trust, safety, regulatory compliance, and scalability–of institutional players while leveraging the benefits of decentralized finance. In other words, DeFinity aims to leverage the existing legal framework from traditional finance (TradFi) used for conventional asset trading and apply it to crypto trading and other digital assets, facilitating large-scale institutional adoption.

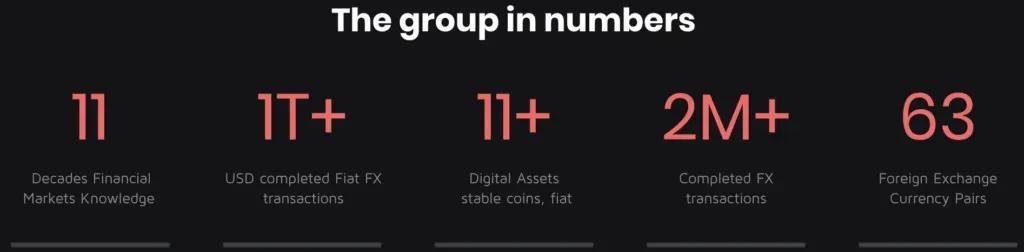

While being a crypto focused brand, DeFinity has been designed from a team with decades of experience in traditional finance and built on the shoulders of DMALINK, a successful and rapidly scaling FX business operating since 2017, with major international banks as partners and over $1T of completed transactions and daily volume of >$1B.

It is also well known that in business it is far easier to cross sell new products to existing customers than it is to secure new customers. DMALINK already has many of the largest funds and banks as clients. With these commercial relationships already embedded, the team is now expanding their offering to these clients through DeFinity. For instance, with over 16 bank prime brokers, DMALINK has been able to introduce traditional finance Prime Brokerage credit lines for crypto trading.

DeFinity’s trading services, launched in December 2023, have already facilitated hundreds of millions of dollars in trading volume. By November 2024, trading volume had grown significantly, reaching 300 times the levels of December 2023, with the platform now handling hundreds of millions of dollars in trading volume per month. The platform has onboarded over 150 institutional clients to date, with 270 more in the pipeline.

Regulatory Compliance: Handled by DeFinity

The regulatory landscape for institutional digital asset trading, while progressing, continues to face significant challenges and uncertainty. The absence of a cohesive and globally recognized regulatory framework for digital assets has made it challenging for institutions to navigate this market confidently. Financial regulations, anti-money laundering (AML) measures, and investor protection requirements add layers of complexity and costs for market participants.

DeFinity addresses these concerns with a solution that streamlines compliance and eliminates AML and regulatory due diligence burdens. Currently clients are onboarded through DeFinity’s regulated entity in Mauritius, which adheres to global financial regulations. As onboarding is undertaken by a regulated entity, all users in the ecosystem enjoy the security and assurance of adherence to current and evolving regulation. Additionally, DeFinity has recently been granted a VASP (Virtual Asset Service Provider) license by the Jersey Financial Services Commission in August 2024. The Jersey arm of the business is expected to begin trading in Q2 2025. Both of these jurisdictions adhere to the AMLD5 EU Directive, designed to strengthen the EU’s anti-money laundering and counter financing of terrorism (AML and CFT) regime.

In contrast, many of DeFinity’s competitors operate from jurisdictions (e.g. Cayman Islands, BVI, Bermuda, UAE) which are either on the Financial Action Task Force (FATF) Grey List or lack alignment with AMLD5 standards. This means none of them can get any type of partnership with European banks, giving DeFinity a strong competitive advantage.

In summary, by aligning its operations with stringent global standards, DeFinity ensures both the security of its clients and the long-term viability of its business model. This focus on compliance not only addresses institutional concerns about regulatory uncertainties but also sets DeFinity apart from competitors operating in less regulated jurisdictions.

Core Product and Service Offering

Definity’s core value proposition relies on the separation between asset custody and trade execution. Therefore, unlike centralized exchanges that require custody of funds, DeFinity ensures that institutions retain full control over their assets. This is why it calls itself a “hybrid decentralized exchange for institutions”. It is not an exchange and it does not take custody of either crypto or fiat, but it offers a turn-key solution for institutions to trade digital assets in a compliant and transparent environment, aligned with investment-grade credit-rated banking partners.

To date, there are no crypto exchanges or execution venues that have a Moodys, S&P or Fitch credit rating. Instead, thanks to its partnership with a Tier 1 European Investment Bank with an investment grade credit rating (AA-), DeFinity is the world’s first crypto execution venue operating through an investment grade credit rating. This way, fiat deposits are held securely with this banking partner enabling clients to trade within 20ms of making the collateral deposit.

On the other hand, crypto custody is either managed via accredited custodians–financial institutions that hold customers’ securities for safekeeping to prevent them from being stolen or lost–like BNY Mellon or through other institutional-grade solutions such as Fireblocks–a renowned digital asset custody, trading, and settlement platform. For instance, Fireblocks employs multi-party computation and distributed control mechanisms to protect private keys, ensuring institutions can trade without concerns about unauthorized access or potential breaches. This custody-agnostic mode is fundamental for institutional clients as it eliminates counterparty risk and aligns with the preferences of traditional finance.

On top of that, DeFinity’s platform integrates additional layers of protection to safeguard institutional trades. For example, the Delivery Versus Payment (DVP) mechanism ensures that asset transfer and payment occur simultaneously, eliminating settlement risks. This approach, widely used in traditional finance, adds an extra layer of assurance for clients.

The platform’s trading infrastructure mirrors the rigor of traditional financial systems. For this reason, DeFinity employs an ECN-style (Electronic Communication Network) execution model for spot crypto trading that does not require custody, while enabling institutions to directly access a network of liquidity providers, market makers, and other institutional participants. Being designed for high-frequency trading the platform currently supports trade sizes up to $100 million, or $500 million when leveraging algorithms.

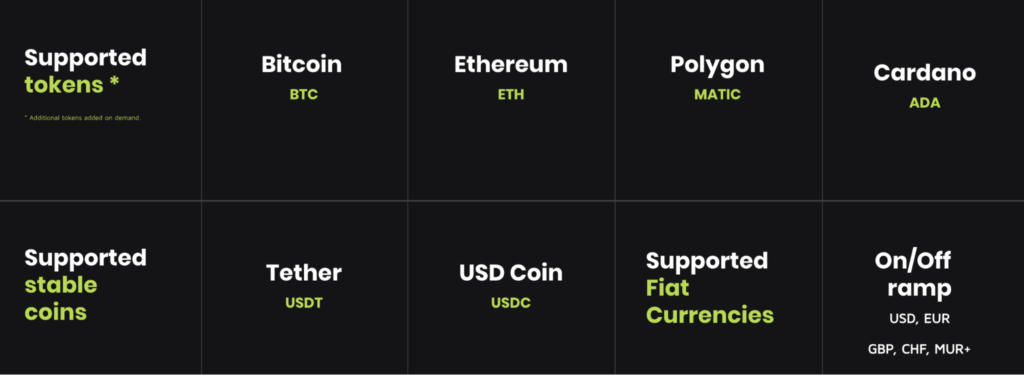

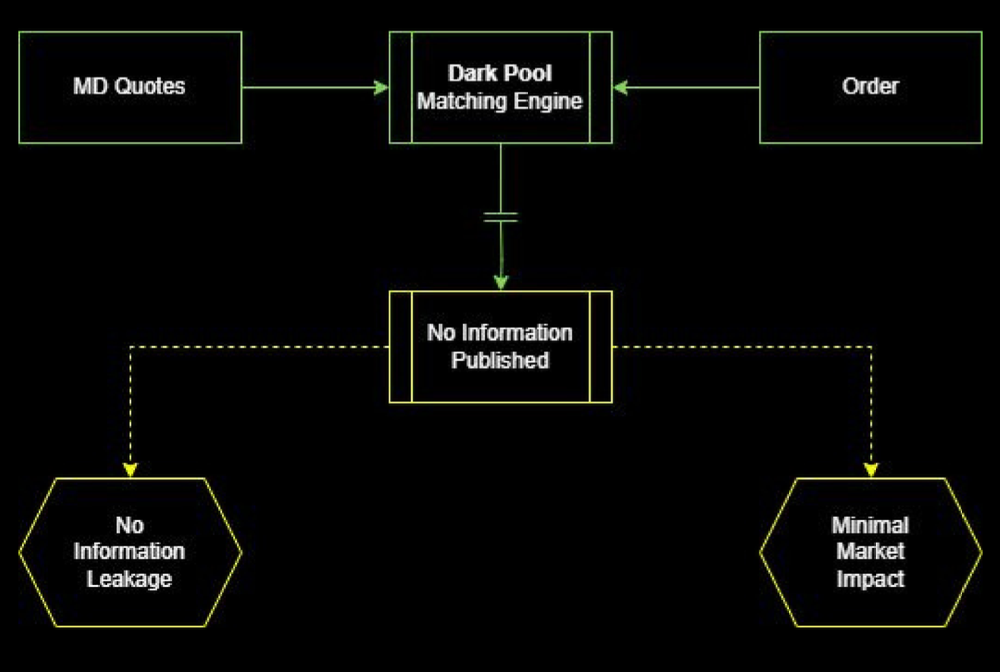

The platform’s liquidity aggregation capabilities address one of the most significant challenges for institutional traders by consolidating liquidity from non-exchange liquidity providers, and offering curated, on-demand pricing through a single API or graphical user interface (GUI). This ensures that institutions have access to deep and reliable liquidity pools, enabling efficient execution of large trades without impacting market prices. This structure minimizes intermediaries, reduces information asymmetry, and ensures transparent, competitive pricing. Additionally, DeFinity also offers advanced features such as anonymous trading via its ECN structure. By protecting user identities and providing dark pool liquidity to select clients, it minimizes the risk of information leakage, a process where some actors (e.g. liquidity providers) front-run an order to capture the performance of a sizable trade.

Another key component of DeFinity’s product suite is the Fiat On/Off-ramp service. Many crypto native businesses have struggled with losing their banking partner, and so losing the ability to do Fiat On/Off. This has been due to either bank closures (Signature Bank, Silicon Valley Bank, Silvergate Bank) or banks withdrawing their services (e.g. Paysafe and Binance). Thanks to its banking partners, DeFinity allows institutions to seamlessly convert–offering liquidity in sizes ranging up to $250M–between fiat currencies and digital assets, with support for same-day settlement (T+0) on trades executed before midday. Moreover, by supporting a range of major fiat currencies, including USD, EUR, GBP, and JPY, the platform ensures flexibility for institutions operating across global markets.

Finally, leveraging its parent company DMALINK’s extensive foreign exchange expertise, DeFinity also offers deliverable FX trading with access to liquidity up to 12 levels deep. This integration provides a strong value proposition, bridging the gap between traditional FX markets and the digital asset ecosystem.

$DEFX Token: Bridging Utility and Retail Opportunity

With a fixed supply of ~171M tokens, the $DEFX token is central to DeFinity’s ecosystem, serving as both a utility mechanism and a deflationary asset. Its design reflects the platform’s mission to deliver institutional-grade solutions while enabling retail investors to leverage it as a proxy for the growing narrative of institutional adoption in crypto.

The primary utility of $DEFX lies in facilitating discounts and fee payments across DeFinity’s services and products. Each DeFinity product (i.e. trading, crypto repo agreements, anomaly detection system, …) has an associated $DEFX utility that enables discounted fees. In particular, institutional clients can choose between two alternatives: (1) discounts on fees for holding a set amount of $DEFX, or (2) discounts for paying fees in $DEFX. In the first case, by holding $DEFX–to be defined and updated periodically to be responsive to market conditions–institutions get discounted fees which are reflected in the bid-offer spread. In the second case, if clients pay with $DEFX rather than fiat currency, they can receive a 20% discount on the monthly invoice.

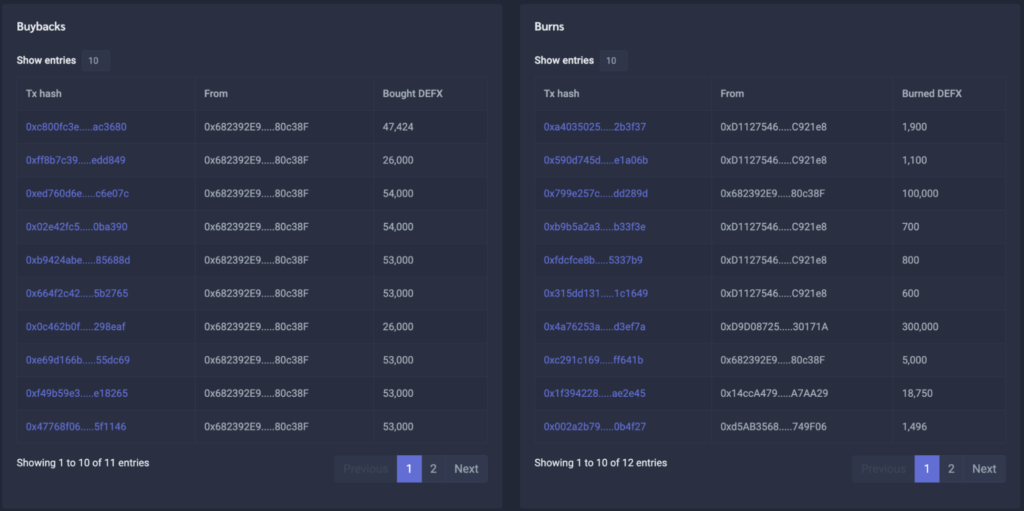

Worth noting, institutions that elect to pay fees with $DEFX benefit further from a deflationary mechanism built into the tokenomics: a portion of the tokens used for fee payments is burned, thus reducing the circulating supply over time. This burn mechanism operates at variable intervals, ensuring regulatory compliance by avoiding classification as a security while maintaining transparency through blockchain records. The strategic use of buy-backs and burns strengthens the token’s deflationary model, with the purpose of driving long-term value for holders. To date, 884.4k $DEFX buybacks and 969.6k burned $DEFX. All this information is public and visible through the DEFX Stats dashboard.

$DEFX holders can also earn rewards by providing liquidity to a DEX pool—either $DEFX + $ETH on Ethereum or $DEFX + $USDT on Binance Smart Chain. The DEFX farm offers a dynamic return rate that depends on your average entry price. This rate is calculated within a price range of $0.05 to $1.00, offering an annual return between 75% and 100% on the $DEFX you have farmed.

The token is already listed on major decentralized exchanges, such as Uniswap and PancakeSwap, as well as a CEX, MEXC. Plans are in place for a listing on “One Trading”, an EU-regulated exchange, in 2025. This move is expected to improve the token’s accessibility while reinforcing its alignment with regulatory standards.

Key Partnerships: Q1 2025

DeFinity Markets has aligned itself with a network of partners both from the TradFi and crypto native space.

European Investment Bank

DeFinity has partnered with an AA- rated European investment bank. This bank will provide the credit intermediation to transactions that happen on the DeFinity platform.

Rather than sending funds to a CEX, with all the associated concentration risks, customers will send either cash or government bonds to the bank, to act as collateral against their trading. With the bank having a $1.5 trillion balance sheet, there are the controls and governance that institutions require to face in counterparties. The bank will then use these funds to make good any trade that is not completed. Clients can utilise their own choice independent custody solutions as the platform is custody agnostic unlike most CEXes.

Another big advantage of this structure is that many potential DeFinity customers already have credit lines into this bank, meaning that it’s a much simpler and quicker process to on-board them.

Fasset

DeFinity has partnered with Fasset ‘the Coinbase for emerging markets’. Fasset is a digital asset exchange that already has regulatory licences covering over 2 billion people. They aim to improve financial empowerment and access to investment opportunities to people in emerging market economies.

DeFinity will provide the institutional backing in terms of access to liquidity at low costs, that Fasset will then take forward to their customers. Working closely with regulators to grow in a compliant and sustainable way, Fasset aims to on-board over 30m customers to its platform by 2030.

Fasset already has regulatory licenses in UAE, Indonesia, Turkey, Malaysia, the EU, Pakistan and more. They are also launching Own, an Ethereum layer 2 platform for tokenised Real World Assets (RWA).

Kima

DeFinity has partnered with Kima Network to create an institutional digital asset settlement layer. Currently the process from off-chain execution to on-chain settlement is something that is very cumbersome, and mostly done manually across the institutional crypto market.

Kima is creating something unique in the Web3 space that is very much needed, an omni-chain settlement layer that has eliminated all the main attack vectors in traditional methods of transferring value between chains. Kima’s protocol will not have any smart contracts, oracles, or external relayers. DeFinity considers this is absolutely essential to get institutions trading at scale, as smart contracts have proven too vulnerable to attack: they are not fit for purpose for institutional adoption. Their protocol also uses game theory and financial incentives to maximise capital efficiency, something that has been sorely lacking within blockchains to date.

Global Top 20 Hedge Fund

DeFinity has partnered with leading European Investor, one of the world’s leading hedge funds. The fund has been entirely private and acting across an increasing number of asset classes for over a decade.

The DeFinity platform will be seamlessly integrated into the fund’s platform, a new institutional trading platform. This will allow over 200 institutional customers direct access to DeFinity’s crypto trading offering through a single sign- on. Crucially this is not a white label agreement, and DeFinity’s brand will be front and centre.

Bitline / Everi

DeFinity has also partnered with Bitline, a subsidiary of Ibanera. Bitline is the only industry provider of casino chip access directly from cryptocurrency and digital asset holdings in the physical casino environment. Together with DeFinity, Bitline will offer a ‘Gaming Repo’ product which will allow high net worth individuals to access casino chips by using their crypto holdings as collateral.

This partnership also includes Everi Holdings, the world’s leading provider of technology solutions to casinos. Everi are present in over 600 casinos and 2000 cages in the USA, as well as over 70% of land-based casinos worldwide. DeFinity has an exclusivity agreement with Bitline, meaning no competitor will be able to create a similar product. Trial periods have been completed and the first approved venue will be live as of early March on-shore in the US.

Conclusion

DeFinity represents an advancement in bridging the gap between traditional finance and digital assets, offering a platform that combines the security, transparency, and decentralization of DeFi with the reliability and regulatory alignment of traditional financial systems. By addressing key institutional challenges such as asset custody, compliance, and counterparty risk, DeFinity positions itself as a leading solution for institutional engagement in the digital asset ecosystem.

Through its innovative hybrid model, DeFinity ensures that institutions retain full control over their assets while benefiting from robust liquidity, low latency, and advanced trading infrastructure. Its partnerships with Tier 1 financial institutions and adoption of investment-grade credit-rated banking standards highlight its commitment to trust and safety.

The $DEFX token further strengthens DeFinity’s ecosystem, acting as a utility and deflationary mechanism that incentivizes engagement while aligning with regulatory guidelines. Additionally, it offers retail users an opportunity to participate in the growing narrative of institutional adoption in the crypto market, serving as a proxy for this trend.

References

DeFinity / DEFX – The Hybrid DEX for Institutions (updated November 2024)

Disclosures

Alea Research is engaged in a commercial relationship with DeFinity Markets as part of an educational initiative and this report was commissioned as part of that engagement.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.