With the election in the bag, it seems some market participants are scrambling for positioning in DeFi tokens. Overnight, a promise of more regulatory clarity, less fear of tokens being perceived as securities, and more doors opening for revenue sharing with DeFi token holders, among other possibilities, became reality. It’s become clear that the discount at which the market was implying both $BTC, as well as DeFi tokens, should be valued during the Gensler era of regulatory uncertainty was significant, as evidenced by the dramatic run-up in token prices in the days immediately following the election. While some might chase higher-beta plays, including smaller perps protocols with low-floats or others, we advocate for a position in an established player: $AERO.

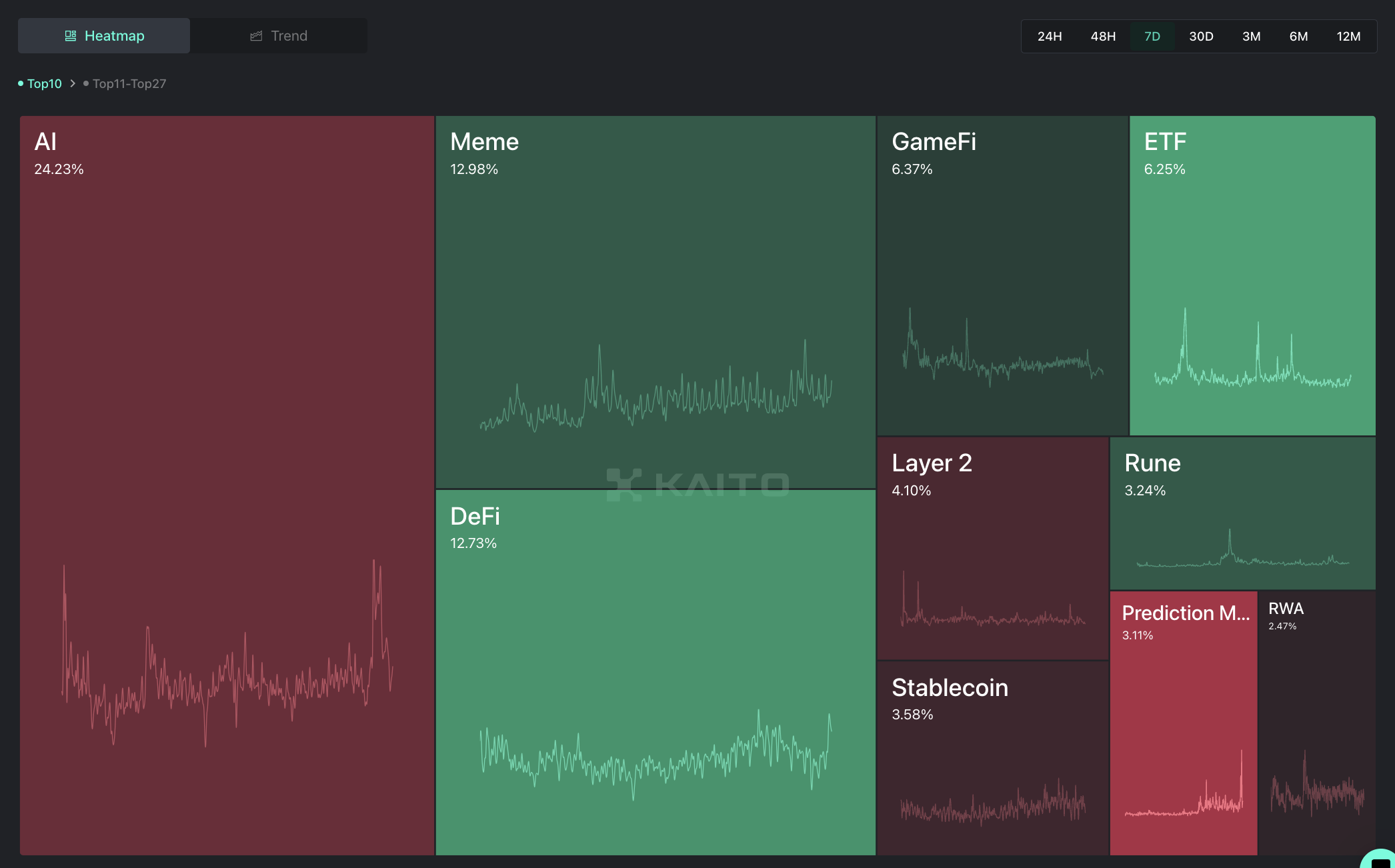

Source: Kaito.ai | DeFi is one of the narratives that has seen a dramatic increase in mindshare following the election.

There has also been renewed discussion about turning on fee switches for DeFi protocols when there previously wasn’t much interest in these assets (often labeled as useless governance tokens, or “memecoins” dressed up in suits). We may be entering a time where more productive crypto assets can finally receive their fair share of attention as opposed to more speculative, flash-in-the-pan narratives and trends. If this is the case, as many have recently hypothesized, then $AERO is arguably primed to benefit the most, with no changes to its existing structure needed for this to happen.

This report is reserved for our Pro members. Upgrade your plan to gain access to in-depth analysis, actionable insights, and the tools you need to stay ahead in the crypto space.

Not ready for Exclusive Content? Sign up for free