The current market environment presents a challenging backdrop for an asset like Ethereum ($ETH), which despite a recent spot ETF launch, has not managed to come out on top of a so-called “identity crisis”. Such sentiment setback has been caused by Ethereum L2s, which contrary to expectations that they would be the unlock for Ethereum scalability, have been perceived by the market as “parasitic to the L1”. The argument behind that claim is that L2s have decreased mainnet activity and caused $ETH to no longer be a deflationary asset.

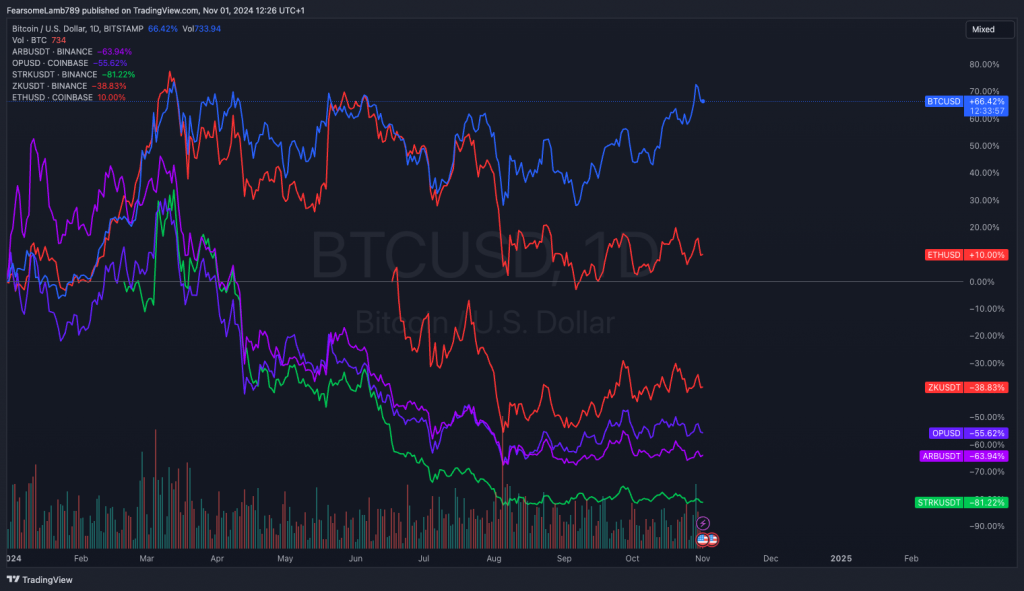

Source: TradingView – $ETH and Ethereum L2 tokens have notably underperformed $BTC since the start of the year.

Many investors already hold $ETH, resulting in limited rotation into the asset at current levels. Since the market doesn’t perceive the asset as “cheap”, the current large market cap is acting as a gravitational force against which it is very challenging to experience a “hated rally”.

This report is reserved for our Pro members. Upgrade your plan to gain access to in-depth analysis, actionable insights, and the tools you need to stay ahead in the crypto space.

Not ready for Exclusive Content? Sign up for free