MetaDAO is the first practical implementation of Futarchy and decision markets, effectively using the results of prediction markets to actually make decisions, rather than just using this data informatively. The project’s native token, $META, currently stands as the only choice for those looking for exposure in some way, shape, or form, to the nascent narrative that is Futarchy and the use of decision markets in protocol governance. Crypto’s permissionless and decentralized markets have an inherent ‘put your money where your mouth is’ nature, or ‘don’t tell me what you think, tell me what you have in your portfolio.’

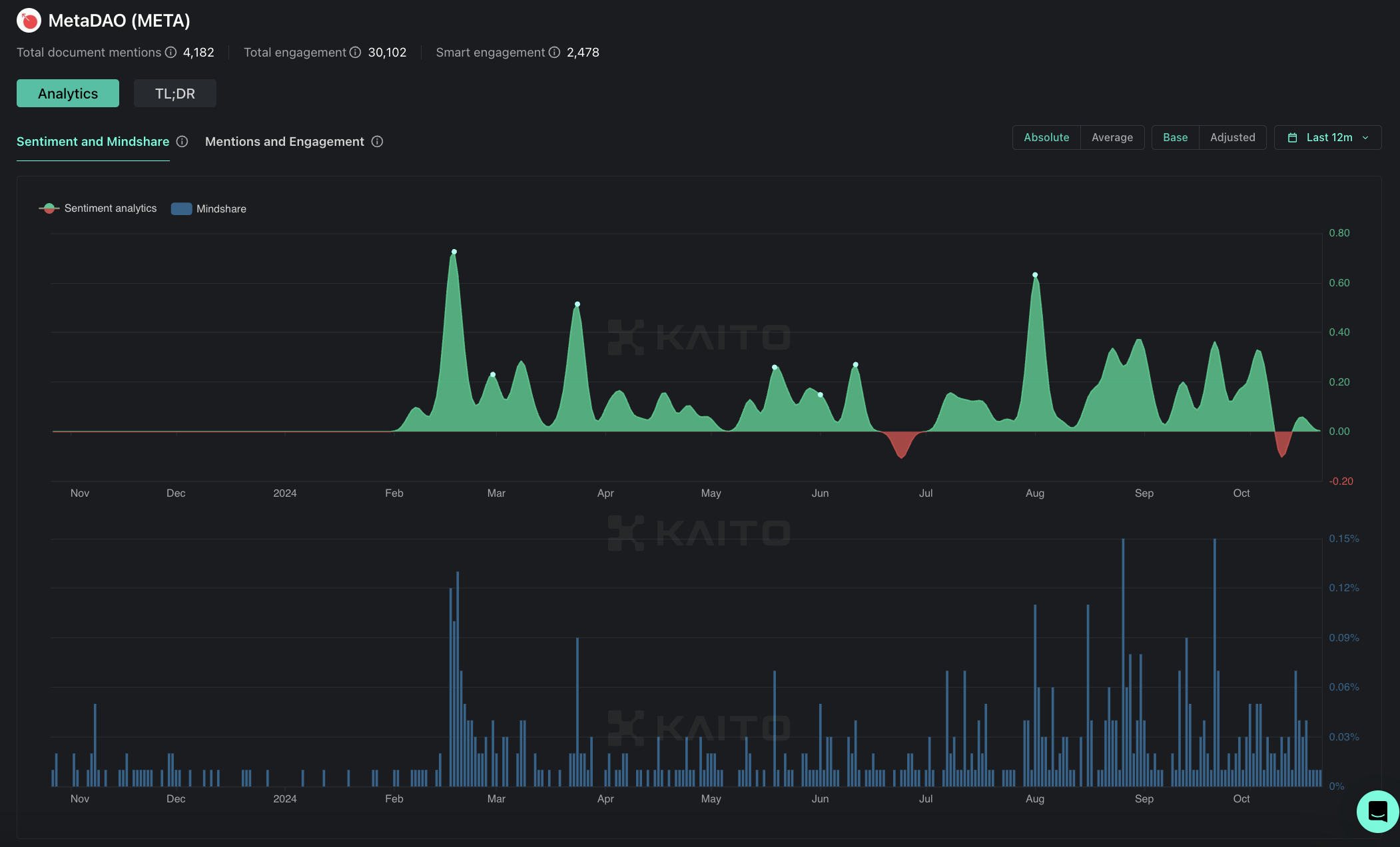

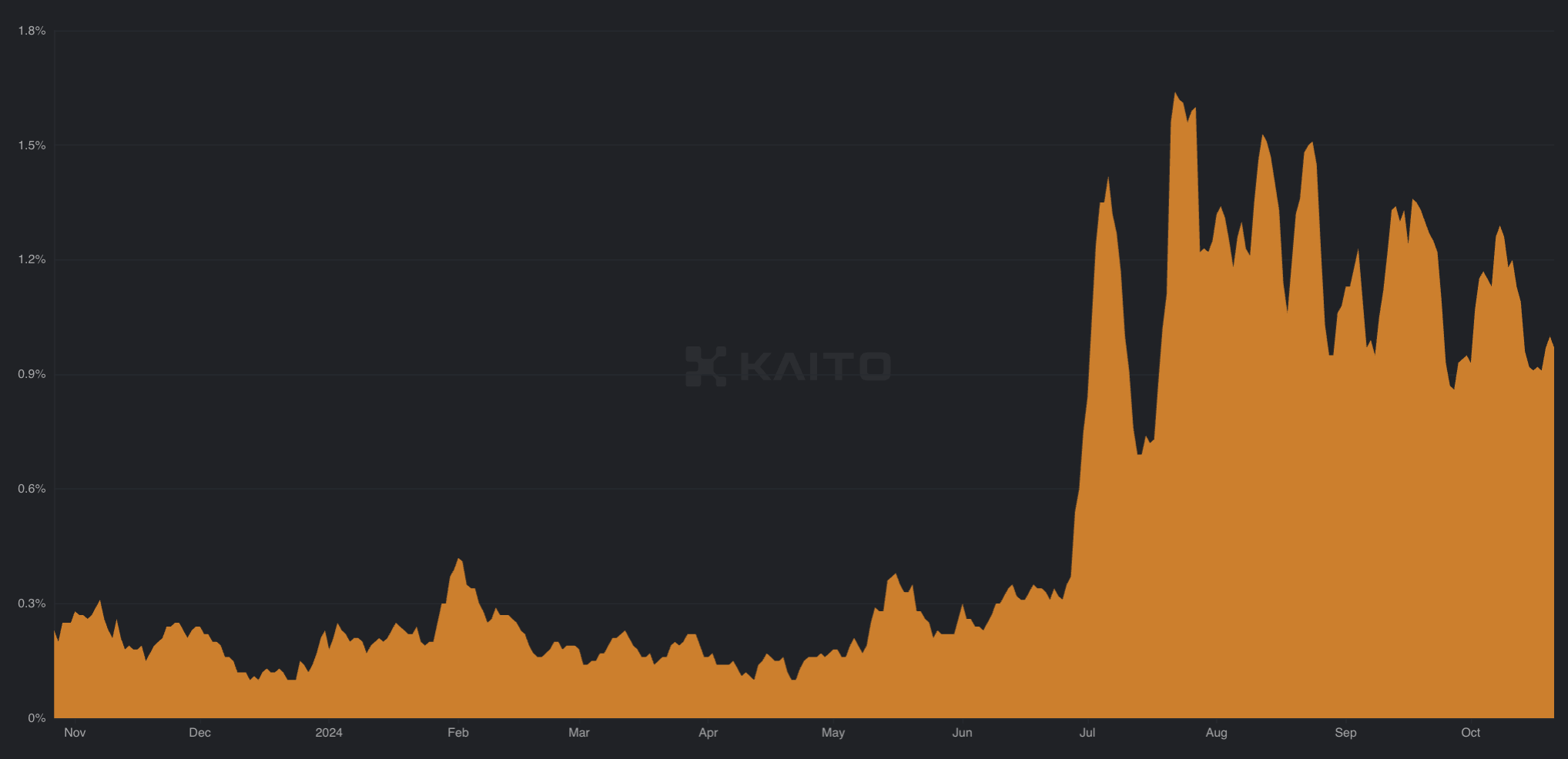

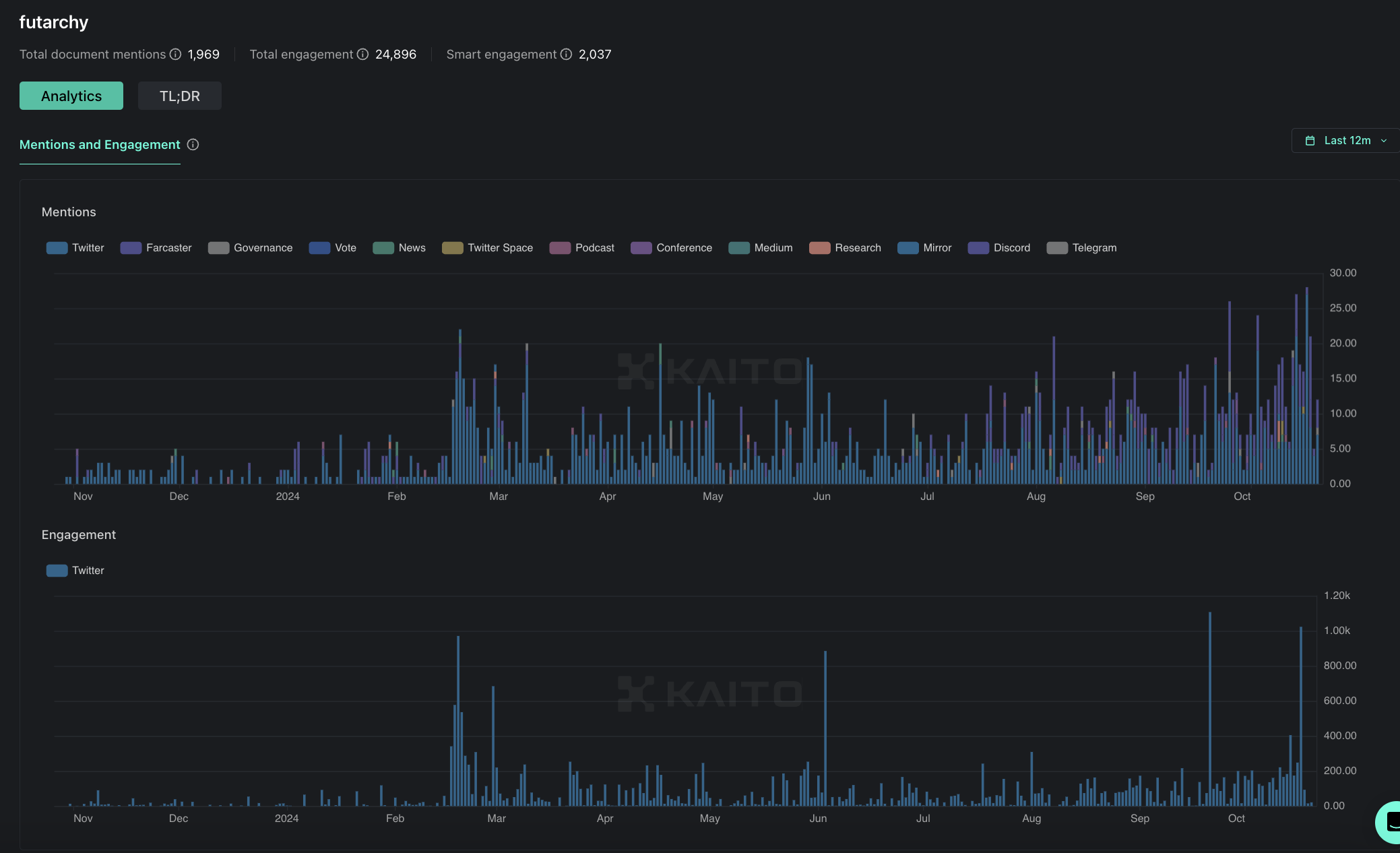

Source: Kaito.ai – MetaDAO sentiment and mindshare elevated in recent months compared to Q1 and Q2 2024.

Key Takeaways

- $META Tokenomics: A fully diluted supply with no sweetheart VC deals, combined with an initial airdrop to early power users, eases a lot of concerns that people express about tokens in the market today.

- MetaDAO Memetics: The rise in interest in memecoins and cult-like communities transfers very well to MetaDAO, which captures the most important bits of optimism and ambition of memes while also building toward a more tangible goal.

- The AI Cult Antithesis: The memetic value of $META increases when one considers that it is antagonistic to the futuristic view of AI agents driving governance decisions in decentralized protocols. Futarchy puts humans on the front, but there is simultaneously a scenario where AI agents are the ones who are actually betting and having skin in the game of these DAOs

- Utility & Historical Significance: MetaDAO is the first and only protocol to provide Futarchy as a Service (FaaS), taking a concept discussed by industry leaders like Vitalik Buterin as far back as 2016, and bringing it to the onchain governance landscape.

- Growing Credibility: A $2.2M token investment led by Paradigm and growing ties to the Solana ecosystem bolster consumer confidence in MetaDAO’s premise.

- Constantly Iterating: The team has begun solving blind spots in the Futarchy model, recently rolling out KPI markets to enable more participation from protocols.

- Synergistic Token Price and Protocol Operations Relationship: Decision-making through information markets is the most direct proxy to convey the idea that markets are the most reliable source of accurate information.

Memetics vs Tokenomics

This year we’ve seen a lot of negative sentiment around low-float, VC-backed tokens, as well as a boost in the popularity of memecoins—two themes that are likely connected. Both of these themes suit $META well compared to the broader alt market.

Memes are prevalent in the attention economy, where attention is scarce and the most valuable currency. The memetic value of $META capitalizes on this environment and thrives because of its ability to capture attention and spread as an idea, appealing to people’s beliefs and reminding them that an increasing number of AI agents will dominate betting markets—not humans clicking buttons.

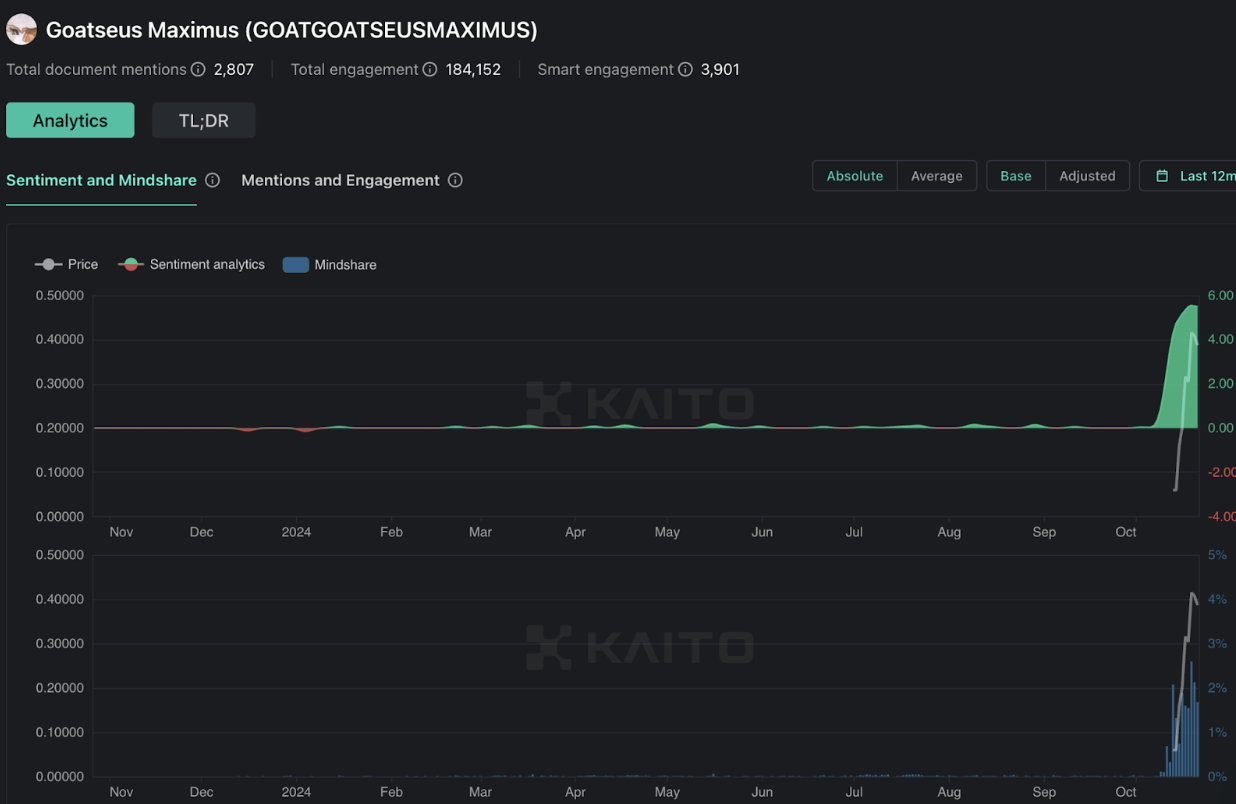

Source: Kaito.ai | We’ve seen $GOAT fetch a $600M+ valuation; futarchy enables AI agent voting and participation in governance.

Futarchy is a radical approach that appeals to the libertarian mentality of those crypto users who value sovereignty and favor interactive decision-making as an alternative to traditional voting, which contrasts with the inactivity that we see in most DAOs today. The “betting on governance” meme can be easily turned into taglines, and catchphrases, spreading quickly through social media and tapping into the mindshare that is currently going into all those AI-cult memecoins.

Crypto, with its permissionless and decentralized markets, has an inherent ‘put your money where your mouth is’ nature. MetaDAO and the $META token play into this very well. We can observe the MetaDAO protocol itself, which is more or less 1:1 synonymous with Futarchy, seeing some sustainable traction as of late.

$META Tokenomics

On the tokenomics side, $META’s supply is fully-circulating, today sitting at a market cap and FDV of ~$54M. Live since February of this year, $META has only recently gained traction, spending the majority of 2024 at a market cap of less than $10M. This has happened while supply has doubled. Distribution began as an airdrop of 10,000 tokens to ~60 wallets, who were deemed to be power users. MetaDAO’s community is still niche to this day, and this was especially true during the token’s airdrop, which occurred in November 2023. More tokens would later be minted through governance proposals. Today, the circulating supply sits at 20,885 tokens, with 5,087 tokens held by the DAO. While MetaDAO has raised capital, it was done through a liquid token sale, removing any fears of VC unlocks or early entry prices (more on this later).

$META Memetics

As we mentioned above, memecoins are only growing in popularity, with many comparisons to cult-like behavior and even the actual birth of neoreligions. It is MetaDAO’s uniqueness that gives it a distinct risk profile, but also what potentially allows it to be identified as a meme-like project, a double-edged sword that captures the upside but removes the downside by the protocol having actual utility and the $META token driving actual demand. Whether judging from the project’s Founder giving talks at TOKEN2049 dressed in a hood and mask, or just MetaDAO’s basic premise, which boldly declares that markets are more competent than people, $META is somewhere between a crypto protocol aiming to realize the originail vision of DAOs, and a token falling at the intersection of Solana DeFi protocols and memecoins.

While the team might not necessarily agree 100%, one can certainly see the parallels between MetaDAO’s presentation and a memecoin. As far as $META price goes, this is a good thing. It makes $META approachable during a regime where there is more animosity towards VC-backed governance tokens with elongated vesting schedules than there previously was.

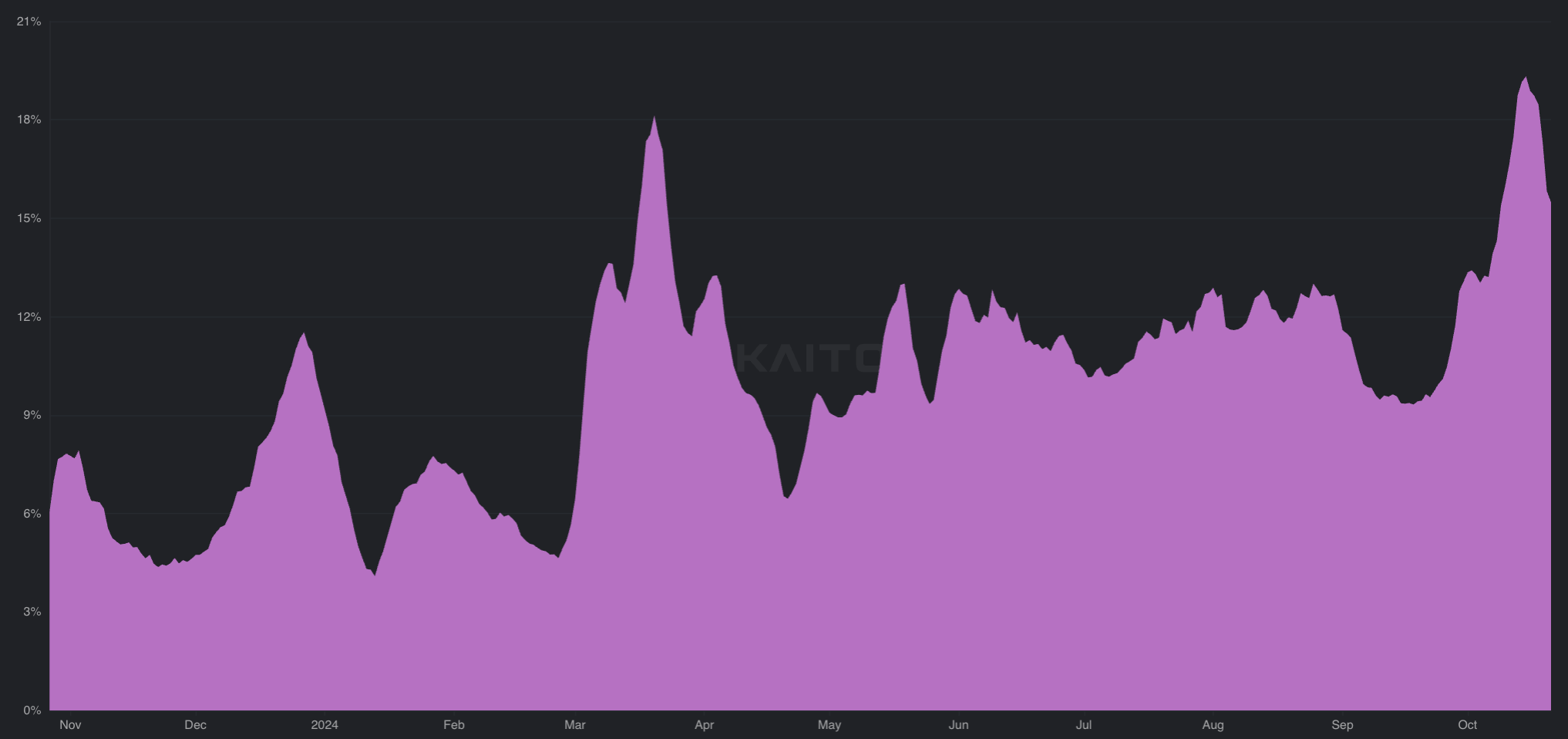

Source: Kaito.ai | Rising cliff of meme narrative mindshare.

Whether you agree with the likes of Murad or not, the notions perpetuated by him and others resonate with people, and even crypto-native fund managers have indirectly given some support for memes. $META is one of the very few non-memecoin projects that can seriously lay claim to being a cult. This is something that very few projects outside of memecoins can claim, with $TAO being the notable exception.

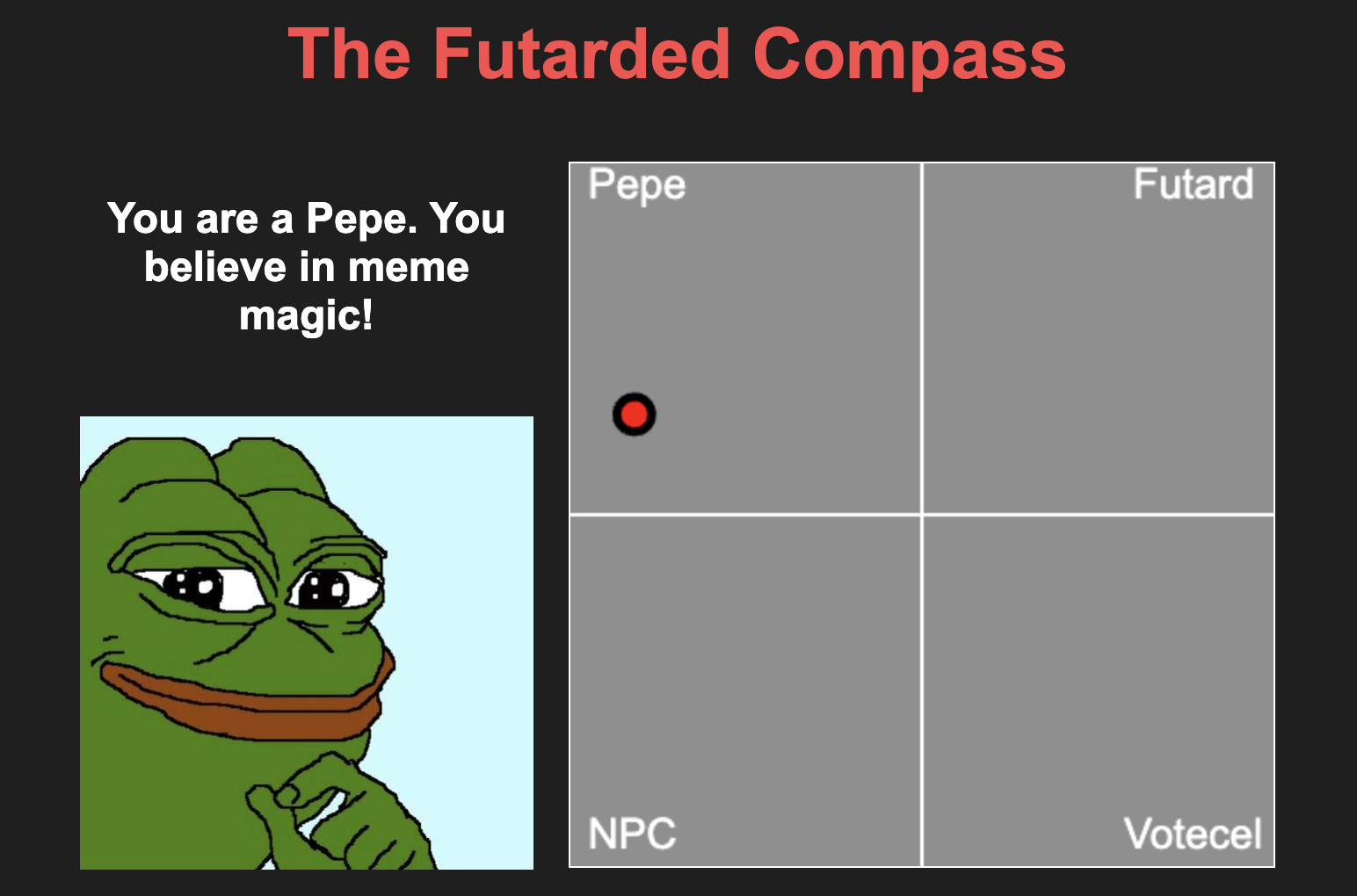

Source: MetaDAO Futarded Compass | MetaDAO has created an interactive political compass with a Futarchy theme, playing into the meme narrative somewhat.

$META actually has a leg up on memecoins in some ways. While memecoins are subject to extremely fast meta changes and narrative shifts, MetaDAO has been operating for nearly a year with no challengers emerging so far. MetaDAO has a significant first-mover advantage and has placed itself in probably the best ecosystem for its goals, Solana. Now with connections in the ecosystem and growing brand recognition, MetaDAO is about as synonymous with decision markets as Polymarket is with prediction markets, if not more so as it is the only player in town. Even Ethereum, where Vitalik has been praising information markets since the whitepaper release, still lacks a deployment for this governance primitive.

Source: Kaito.ai – A notable uptick in farcaster mentions can be seen starting and continuing since August. This is notable, as an Ethereum SocialFi platform can collectively recognize the merit behind MetaDAO despite it being deployed on Solana.

So far, token price has outstripped protocol performance. This is subjective, but $META’s $50M market cap relative to less than $1M in proposal trading volumes paints a picture of speculation trumping fundamentals. As with everything in crypto, it all boils down to relative value, and this is also a key consideration for measuring entries based on whatever expectatives an investor may have around the adoption of Futarchy across DeFi. We’ve seen numerous tokens fetch very lofty valuations, completely unjustified by protocol revenue. We’ve also seen very profitable apps fail to see this value accrue to the token. Friend.tech is one example of a project that had otherwise favorable tokenomics, but didn’t see the token garner the attention desired. In this case, the underlying project also was fleeting.

Source: Coingecko | After launching in Q1, $META saw significant token growth over the summer.

MetaDAO finds itself in a favorable position to thrive on the sensitivity of $META to market volatility, regardless of the overall macro conditions. The ideas of decision markets and Futarchy, which are conducive to $META price action, have and are likely to continue to spread much faster than the MetaDAO protocol itself. $META’s price is not capped by the success of the actual protocol but by the ceiling of what the market deems the experiment that decision markets and Futarchy is worth.

Decision Market Adoption

From its anon Founder, Proph3t, to the low volumes traded on the platform thus far, like many protocols in crypto, MetaDAO’s vision exceeds its current state of adoption. There are a few key points that point towards MetaDAO morphing from something resemblant of a passion project or a hobbyist’s endeavor, into a product that can see significant traction from retail and Solana-based DAOs.

Establishing Credibility with a Strategic $2.2M Raise

The protocol is operating on an unproven concept that is easy for naysayers to write off for the simple reason that there are no existing examples of Futarchy, even 25+ years into the term’s existence. Because of this, establishing a baseline of credibility and seriousness is necessary. Fortunately, MetaDAO has crossed an important chasm on this front, raising a total $2.2M, led by Paradigm with dozens of angel investors, mostly Solana-native founders. It also showcases a unique use case for crypto that cannot be replicated in meat space.

Because of the nature of MetaDAO and the fact that its $META token is already live, this was not a seed round, but rather a fundraising sale that took the form of a token swap. Specifically, 4,000 $META tokens were cumulatively swapped for the $2.2M raised. This is notable for two reasons:

- There is no question of equity shareholder vs token holder primacy, the token is the only vehicle of exit for both retail and institutions/angels.

- Investors bought at the market rate, easing any potential fears of upcoming unlocks (there’s no vesting) or speculation around investor entry prices.

Source: MetaDAO Announcement Tweet | Ecosystem-wide participation in MetaDAO’s raise.

This raise is important because, unlike most protocols, there is no comparison project for MetaDAO, and no competitor providing a similar product suite on a different chain. While incentives, marketing, and incremental improvements can siphon capital from one project to a competitor in many cases in crypto, there is no reason for anyone to use MetaDAO other than pure interest, right now. The Futarchy product is completely novel, not providing any necessary financial primitives such as perps trading, spot swaps, borrowing and lending, etc.

Without financial backing or even just vocal support from prominent industry leaders, there is a real possibility that a project like MetaDAO would face a cold-start problem unique to its genre since it can’t piggyback on existing users and liquidity from peer projects. So the Paradigm-led raise is more important to MetaDAO than a seed round might typically be for most crypto projects. Paradigm, and the other prominent investors, which include Solana Founder Anatoly Yakovenko, Ore Founder Hardhat Chad, and more, also can bring some unique value-add to the table. Pictured below,

Source: yang you Twitter | Paradigm Head of Design pitching in to optimize MetaDAO UI/UX

Besides adding some much-needed credibility, there is the obvious fact that raising money can support the progression of the development timeline, which brings us to our next point.

Product Expansion

Shortly after the raise announcement, MetaDAO announced they were hiring for a few key roles, including a couple of engineers and a marketing employee. Including the two Co-founders, Proph3t and Nallok, if we assume total headcount is at 5, the MetaDAO team seems to be making way with the limited time and resources they have had at their disposal. The company only created a corporate entity less than two months ago, as it simply needed a means to pay newly hired employees.

Despite its nascency, the project has begun iterating and building on top of its initial offerings. Recently, we’ve seen new projects onboarded to the core Futarchy protocol function. Last week, the team introduced KPI-based decision markets, specifically with the intention of using these for grants. This is a pain point acknowledged by MetaDAO’s initial offerings. The concept of Futarchy that MetaDAO is based upon actually prescribes a population to vote on what metric they want to use to measure success. By default, and probably for simplicity’s sake, this has defaulted to a project’s token price. But for smaller proposals that are less consequential, alternative measures need to be established – this is where KPI markets come in.

After a quick testing phase, KPI markets were made live. The first KPI market, for Drift protocol, uses potential views a marketing campaign might get to determine whether or not to go through with this initiative. The protocol DAO would set parameters that decide at what threshold a ‘pass’ result is secured.

Source: MetaDAO Drift Proposal | The 1st live KPI Market.

The team’s self-stated goal when designing the KPI market was to mimic the ease and usability of Polymarket. As we can see above, the question of how many views a Superteam campaign would get is asked, giving the specific threshold of 135.3K views. Users can essentially buy shares of the above or below outcomes, and of course, sell these shares while the proposal is still live as well.

These trades impact price (views), which, in this case, is set at 135.3K at the start. Because of low trading volumes, buys and sells can significantly impact the average amount of views that users collectively think the campaign would earn.

Source: Andrew T Twitter | Jito teasing use of MetaDAO for grants.

We’ve seen more projects express interest in the Futarchy model, though cautiously. The new KPI market detailed above allows teams to dip their toes into Futarchic governance, without committing themselves to anything too burdensome or unpredictable.

This bodes well for MetaDAO. As product offerings expand, the Futarchy protocol might be able to serve more protocols and interest new users without having to completely sell them on the idea of decision markets. This would be ideal, as the concept itself isn’t exactly mainstream-friendly. Like prediction markets, it needs to ease itself into a state of adoption through approachable vectors.

Source: Kaito.ai | Prediction markets, which are a subset of information and decision markets with a limited set of offerings, have gained massive traction this year. Futarchy adds another dimension as the first mover in decision markets, experimenting with a new primitive.

Upcoming protocols that don’t have established investors or restrictions on how they govern may be more open to governance via Futarchy. This may be especially true for smaller, anon projects like friend.tech, pump.fun, memecoins, etc., that presumably have less to lose.

Source: Joe McCann Twitter | A pump.fun competitor created by an ex-employee has teased Futarchy governance

Source: Hardhat Chad Twitter | $ORE, a $BTC-like asset on Solana, potentially putting Futarchy to use

Competitive Landscape

When it comes to competitors to MetaDAO, so far, there are none. There are a handful of projects that have opted to use MetaDAO for governance in some capacity. So perhaps some of the decision-market-related buying pressure might go to these projects’ tokens rather than $META. But there isn’t much risk of deflection or dilution of mindshare here—$META is still the only token that represents a protocol solely focused on implementing decision markets on-chain. Tokens of partner projects represent protocols whose execution and individual application success are likely to be much stronger factors for buyers to consider than whether or not they use decision markets for governance.

While none currently exists, it is possible for a true peer competitor to emerge, challenging MetaDAO. The actual implementation of decision markets isn’t particularly complex compared to other problems in crypto—a lack of interest is simply what has previously stopped anyone from trying. Furthermore, the tooling is actually much more developed on the Ethereum Ecosystem, where teams like Gnosis have built trading engines such as the Conditional Token Framework leveraged by multiple prediction markets. We have seen Drift launch its prediction market, BET, and even dYdX developing prediction market capabilities. Nonetheless, this hasn’t detracted much from Polymarket’s dominance—if anything just confirmed that prediction markets in crypto are here to stay.

These aren’t 1:1 comparisons, but the same thing could potentially happen with MetaDAO should competitors emerge. It is also likely that any potential competitors would launch on different chains, expanding Futarchy mindshare to other ecosystems outside of Solana. This could be a net positive for MetaDAO, growing the pie of Futarchy.

Source: Kaito.ai | Consistent rising trend in Futarchy mentions and engagement.

Timing Entries/Exits

The 1st clear test of sustainability and staying power for MetaDAO and $META is just around the corner, after the upcoming November 5th U.S. presidential elections. For one, the outcome of this election could prove consequential for crypto as a whole, though industry consensus now seems to dictate that either candidate winning doesn’t matter as much as some originally thought. MetaDAO operates in the U.S. but it doesn’t seem that this has hindered the protocol or token launch in any way so far. Nonetheless, it’s worth mentioning the potential ramifications, positive or negative, on crypto as a whole considering how close the election is.

More importantly, the upcoming election will prove as a proving point for prediction markets as a concept, whether warranted or not. This matters due to the proximity of Futarchy to prediction markets. No matter who wins, if the Polymarket odds get this outcome right beforehand, prediction markets will appear vindicated in a sense.

The need for Polymarket to get it right has only increased, as now the betting market’s odds have deviated significantly from the traditional polls. For better or worse, if these odds hold up, and the election doesn’t go Trump’s way, prediction markets as a whole are sure to catch a lot of flack. A potential layman’s thought process might look something like this: ‘if prediction markets can’t even predict the winner of a 50/50 election, why should we use them to make decisions’. MetaDAO’s product expansion and roots-building in the Solana ecosystem help to buffer against this possibility, hoping to ensure some level of interest regardless of what the sentiment of prediction markets look like.

This doesn’t change the greater thesis around Futarchy, but the election will have an impact on Polymarket’s perceived credibility, which could have a downstream effect on decision markets. A significant impact is likely to be felt on crypto markets as a whole. Whether this is to the upside or downside remains to be seen. For those interested, it might be best to take a position shortly before, during, or after elections, depending on if one wants to maximize for certainty or market timing.

When it comes to $META and the greater concept of Futarchy, there are no clear catalysts beyond the election. $META may be a good hold for the duration of the adoption process of decision markets, should it continue at its current pace. We’ve seen decision markets gain more popularity as a real tool for decision-making this year. This path of adoption is unpredictable, so for those looking for broad exposure to the proliferation of this idea, weaving in and out of a position is likely inadvisable. Key industry figureheads have floated the idea of implementing Futarchy as a potential solution to the flaws in governance, in both crypto and real life.

Source: Eric Wall TOKEN2049 talk – Youtube | Futarchy’s potential role in age of AI

Invalidations

As we discussed above, there is the possibility for competitors to emerge. This is unlikely to negatively affect MetaDAO or $META in the short to mid-term. Should a particularly negative election result play out, which would probably look like Polymarket odds for Trump surging above 60% but Kamala still winning, this also might change short-term desire for exposure to assets related to prediction markets.

Beyond elections and competitors, there is also a more existential challenge that MetaDAO faces. Because of the unproven nature of Futarchy and decision markets, there is a risk that the concept simply does not take off, and the project fails to capture enough interest to sustain itself. As the sole operator of a protocol that only focuses on decision markets, both the upside and downside of Futarchy succeeding or failing will likely be felt the most by $META’s token price, which is also not very liquid and not listed on dominant CEXs.

There is the possibility that a bull market could be in full swing, with adjacent projects all around the Solana ecosystem all doing favorably, but the market simply doesn’t value MetaDAO’s premise much—$JTO, $JUP, and $DRIFT are the usual suspects that come to mind most of the time. While MetaDAO has raised funds, $2.2M can only buy so much runway, even when operating with a lean team, likely just several members.

The risk of simply failing to gain user and protocol adoption is present in all protocols, but because of the novelty of decision markets, this risk is elevated. Some protocols perform well but fail to see this success translate positively for token price. So far, MetaDAO does not seem to have this problem. If anything, it is the opposite.

Conclusion

MetaDAO has come a long way since inception. Futarchy and decision markets are getting a bump from the booming adjacent narrative of prediction markets, which is likely to continue until the election concludes. Elections aside, MetaDAO is seeing some significant adoption, and appears to be executing at a quickened pace after their $2.2M raise has allowed for the expansion of the team. With favorable tokenomics and governance that is likely considered to be more productive than most protocols, the native $META token stands to gain from multiple tailwinds headed its way. For those looking for exposure to a potential decision market meta, $META is the clear choice with no real competitors.

Disclosures

Alea Research has never had a commercial relationship with MetaDAO and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.