Betting on Betting

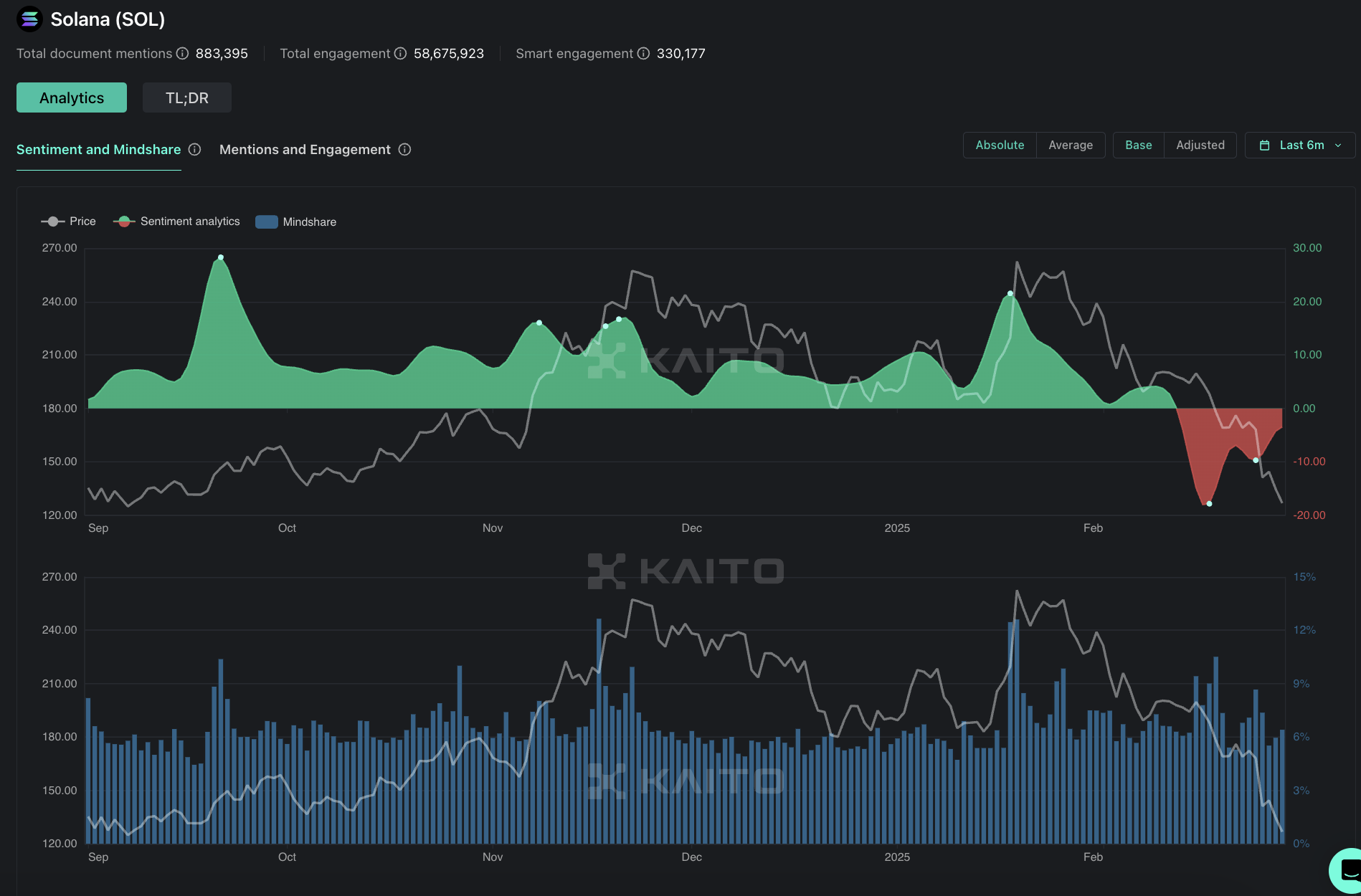

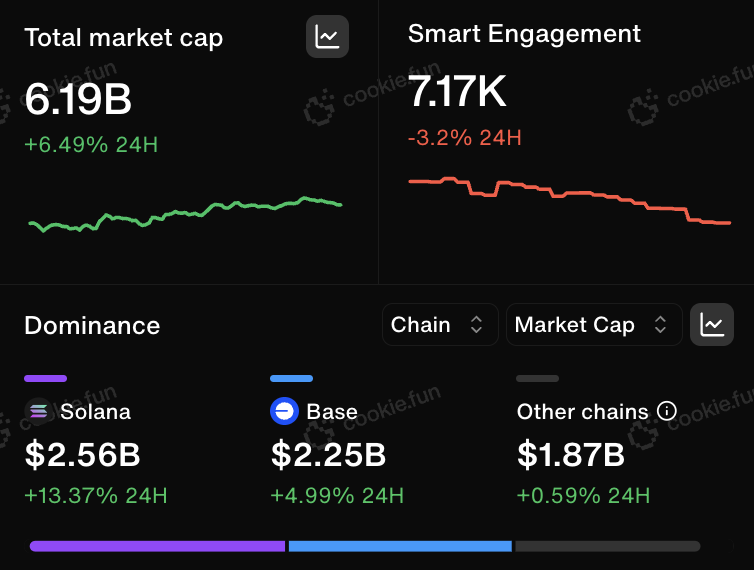

Some see memecoins as nothing more than gamified, unregulated, on-chain betting. It’s no secret that memecoins have been the driving factor behind Solana’s success over the past year or so. First with community-driven coins like $BONK, then with more absurd things like $WIF, and finally collapsing the narrative under its own weight with $TRUMP, $MELANIA, and $LIBRA. At least on the attention and mindshare side of things, owning $SOL gives you exposure to the casino. This isn’t necessarily to say that the memecoin casino is all that Solana is good for. The music stopped, yet Solana may be positioned as the leading chain for onboarding both developers and users. As a performant chain with an emphasis on UX, Solana is suited to facilitate all sorts of retail-dependent activity, from high-frequency trading to consumer applications.

There is no crying in the casino. Even though AI agents and DeFi provide other adjacent avenues for speculation, this cycle so far has seen the primary wave of Solana adoption come in the form of memecoins—or one could rather say “assets minting”, with Pump.Fun being the fabric and, as a result, one of the most profitable businesses the crypto industry will ever witness (not only crypto, also Web2 when you look at things like revenue per employee—all without launching a token).

It is only when you detach from “memecoins” and view this trend as “fabrics for minting assets are probably the most profitable business one could ever build in crypto” you start to realize that owning the casino itself offers asymmetric upside to capitalize on human nature. Even with the events of $LIBRA not too far in the rearview mirror, speculation is never going away. Whether it comes in the form of dog breeds, chill dudes, or sloppy AI agents, the “fabrics of attention”, specially those on Solana, stand to gain.

Even if $SOL has been hit extremely hard the past month or so, Solana is still the place to be when it comes to activity in crypto, and there are a host of revenue-generating protocols and businesses profiting from this activity as price action has moved away from CEXs and more toward an on-chain environment. Solana DEXs and aggregators are attractive from this point of view, even if their revenues are declining due to the current market conditions.

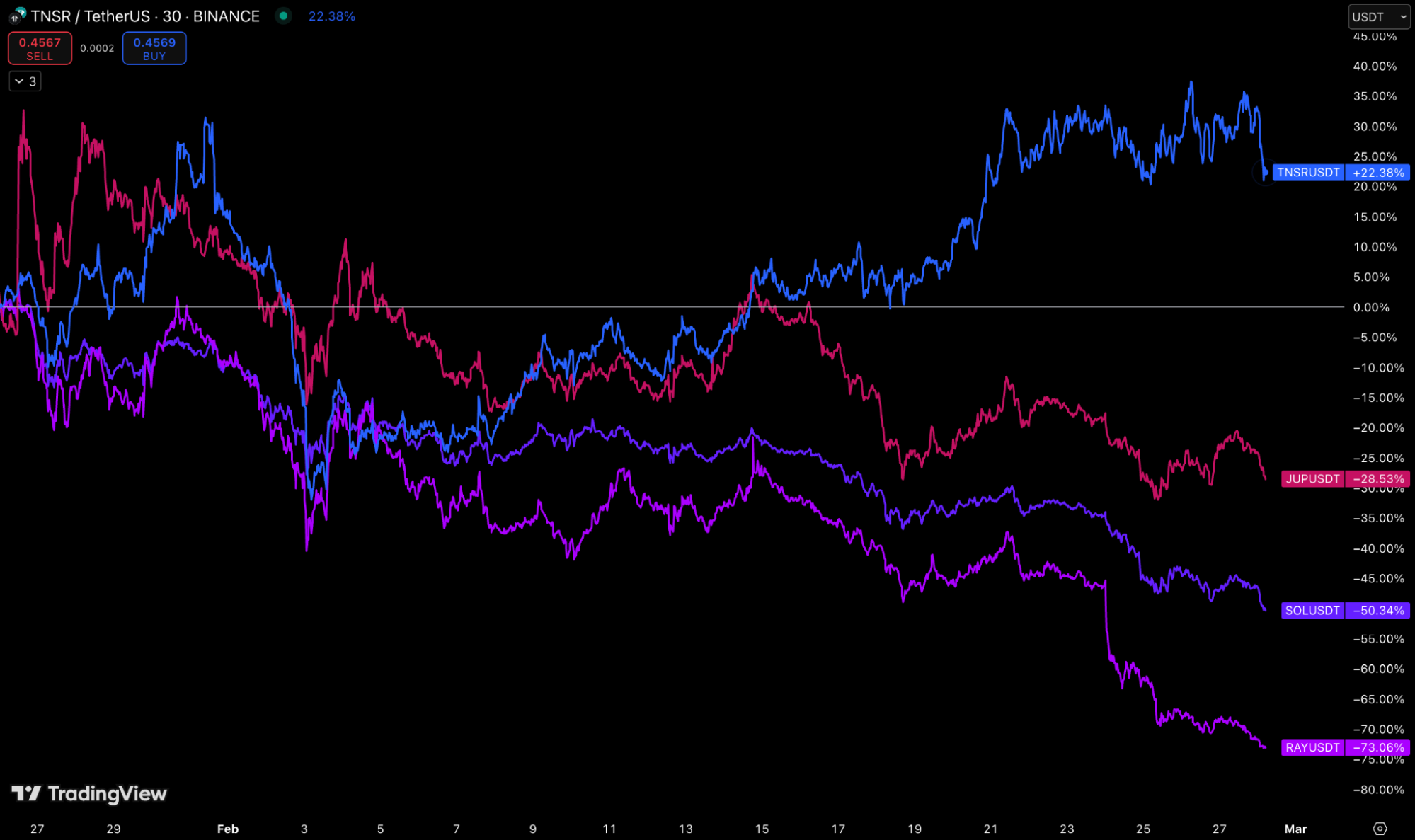

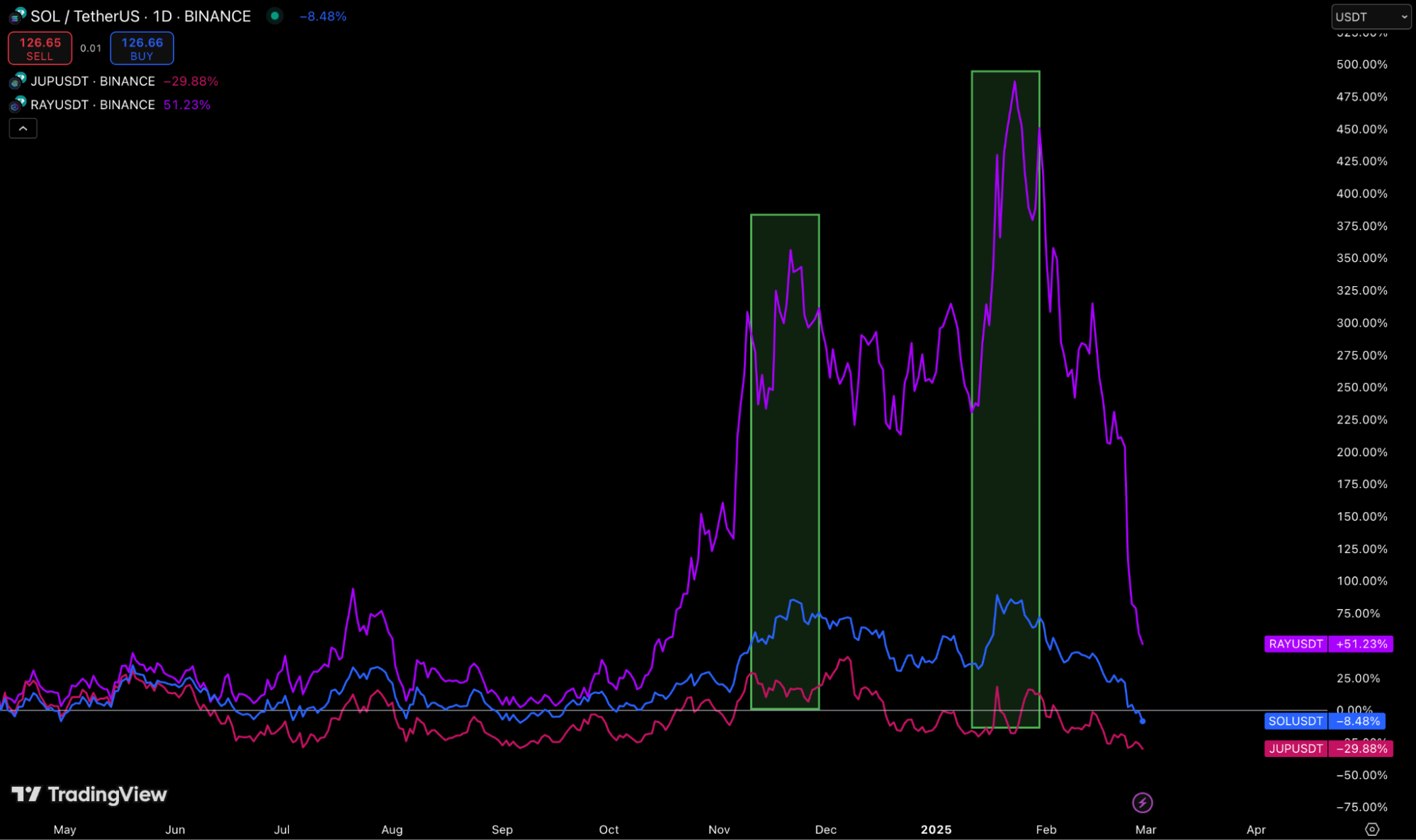

Current market conditions reflect a market in need of some kind of catalyst for a move higher. In the absence of such a catalyst, retaining exposure to fee-generating protocols in the Solana ecosystem is a must. While typical $SOL ecosystem plays like $RAY and $JUP are now well known and perhaps considered staples in a portfolio, $TNSR represents a more untapped opportunity.

$TNSR is not only the native token of the Tensor NFT marketplace, the clear #2 exchange on Solana, but now also represents Vector, a new trading app (currently proxied for memecoins) that brings something genuinely novel to the table. Built by the Tensor team, Vector serves as a new take on memecoin speculation with an emphasis on social trading—all with a seamless mobile-first and frictionless UX.

Key Takeaways:

- Market Setup: $TNSR is showing strength at a time where $SOL is the weakest it has been since the election—down more than 55% and with persistent negative sentiment. A potential $SOL resurgence, perhaps post-unlock, is likely to have a wealth effect that can reverberate around the Solana ecosystem, boosting prices and generating fees for protocols facilitating trading activity—an activity that, unlike most other experiments in crypto, has and will continue to have product-market fit.

- Adapting to the Tide: The Tensor team has demonstrated their success by originally overtaking MagicEden to become the dominant NFT marketplace on Solana, and then setting their sights elsewhere once it became clear that memecoins were the superior arena to build in. This is a lean team with two mission-driven co-founders who have proven to be adaptable and forward-looking in their ambitions.

- Building on the Social Trading Experience: Previous attempts at social platforms in crypto failed due to being too crypto-native and too exposed to the problem of fleeting attention spans and incentives farming within the space. In contrast, Vector turns declining attention spans into a feature, not a bug, making this a focal point of the app.

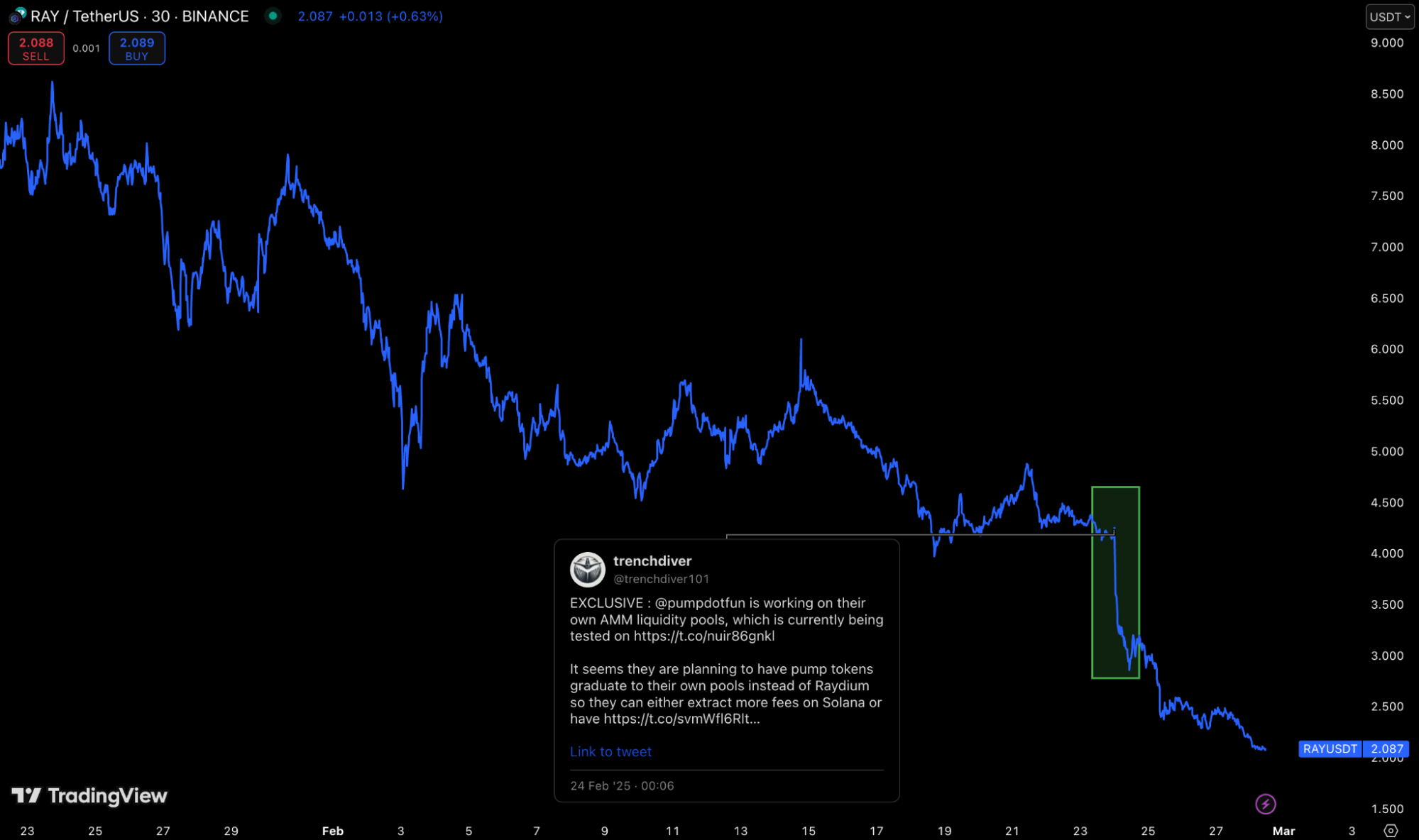

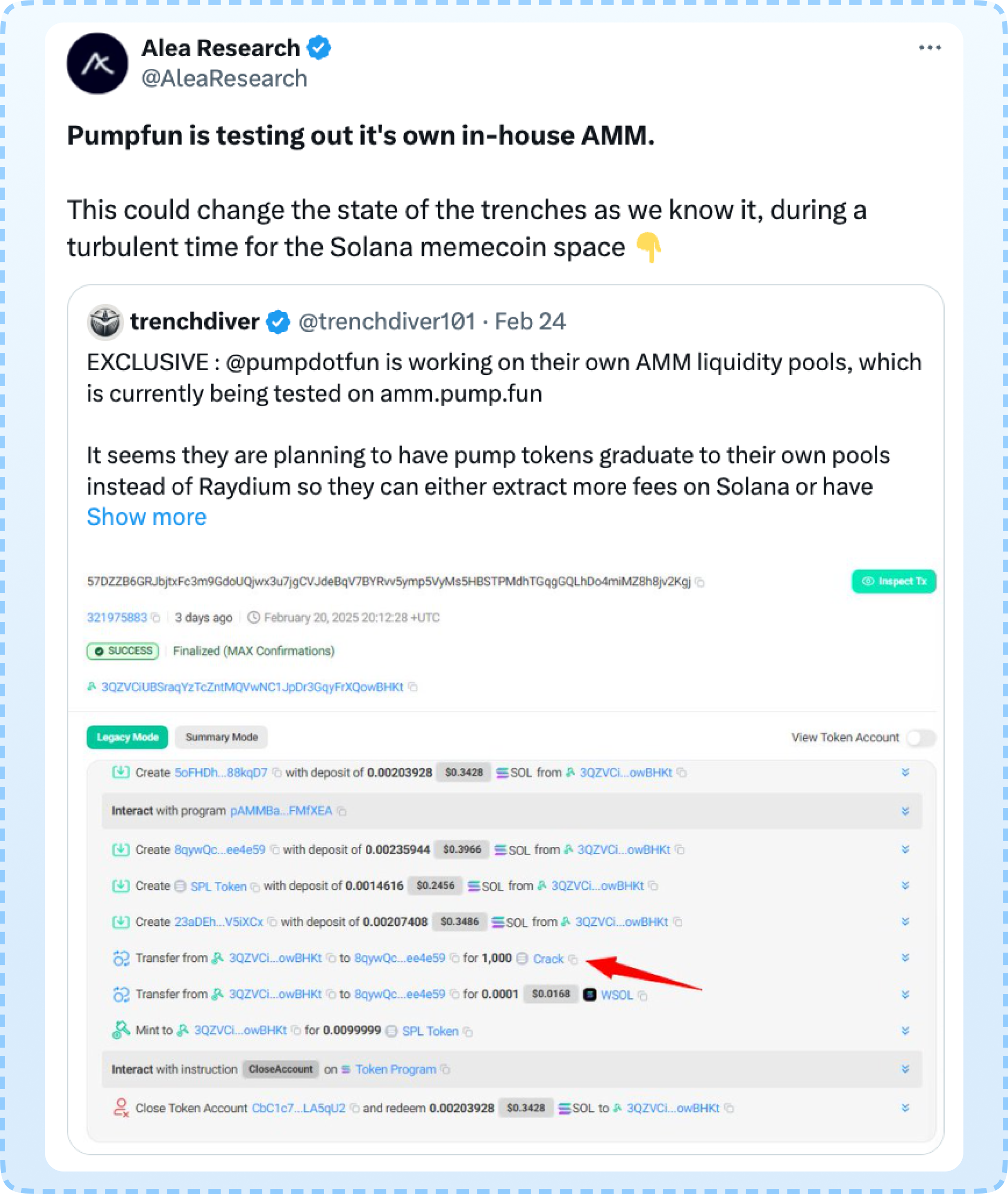

- Convex exposure: $TNSR is valued at a much lower premium than other Solana trading protocols. Even though it also generates much less fees and its new product, Vector, is not a completely proven concept, the opportunity lies in positioning for future upside rather than over-fitting valuations to historical norms that are fleeting and fragile in crypto (see $RAY 30% price decline on the news of Pump.Fun launching its own AMM. $TNSR’s resilience during this market dump has been inspiring during a time where it is probable that much of the downside risk for alts has already presented itself.

- Tough Sell?: Time and time again we have seen social apps in crypto fizzle out and lose attention. Without direct incentives, it has proven to be a difficult task to get users to substitute their time spent on Twitter/X with something new. With supply overhang and market risk, if there are question marks around Vector’s ability to draw and retain attention, new token holders might not be willing to stick around and find out.

Adapting to the Tide

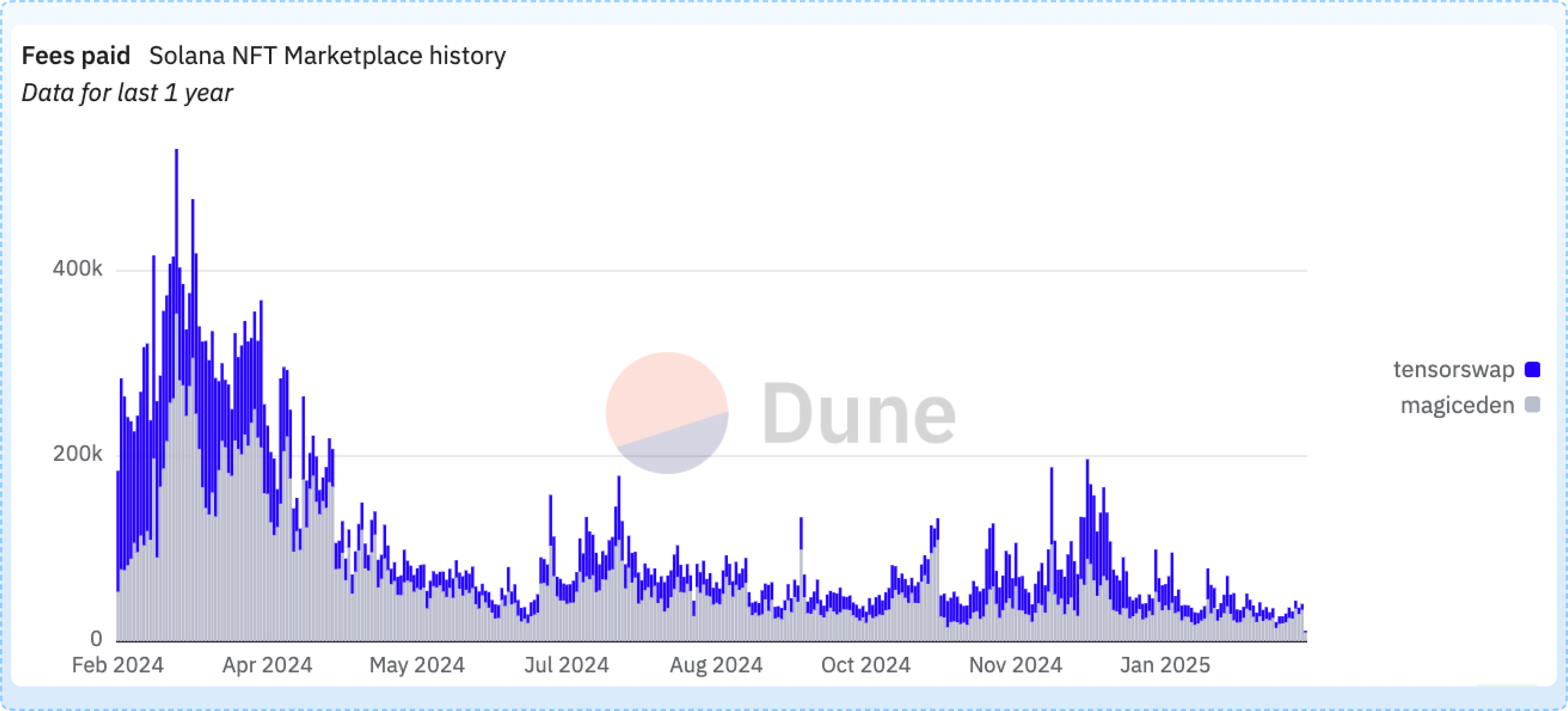

If anything can be said about the team behind Tensor/Vector, it’s that they don’t tend to stumble upon success. Tensor specifically honed in on the NFT market after observing a lack of resources going toward this area compared to the amount of teams and capital going toward fungible token or perps trading. Without going into too much detail, the Tensor team took a page out of Blur’s book, providing an advanced UI for sophisticated NFT traders on Solana, and using a rewards program to ultimately overtake the dominant NFT exchange on the chain, which was Magic Eden at the time.

However, after Q1, it slowly started to become apparent that the bump in NFT volumes in late 2023 and early 2024 was more of a revival bounce than anything—not indicative of sustainable volumes. As 2024 progressed, MagicEden took back its position as the primary Solana NFT exchange.

While NFTs can certainly make a comeback this cycle, when faced with the decision of building something in the memecoin space or going the route of MagicEden and expanding NFT exchange offerings to new chains, the former seems like a better bet in this current market. From memes, to animals, or social coins, it is the tokenization of attention with fungible units that drives most volume on-chain.

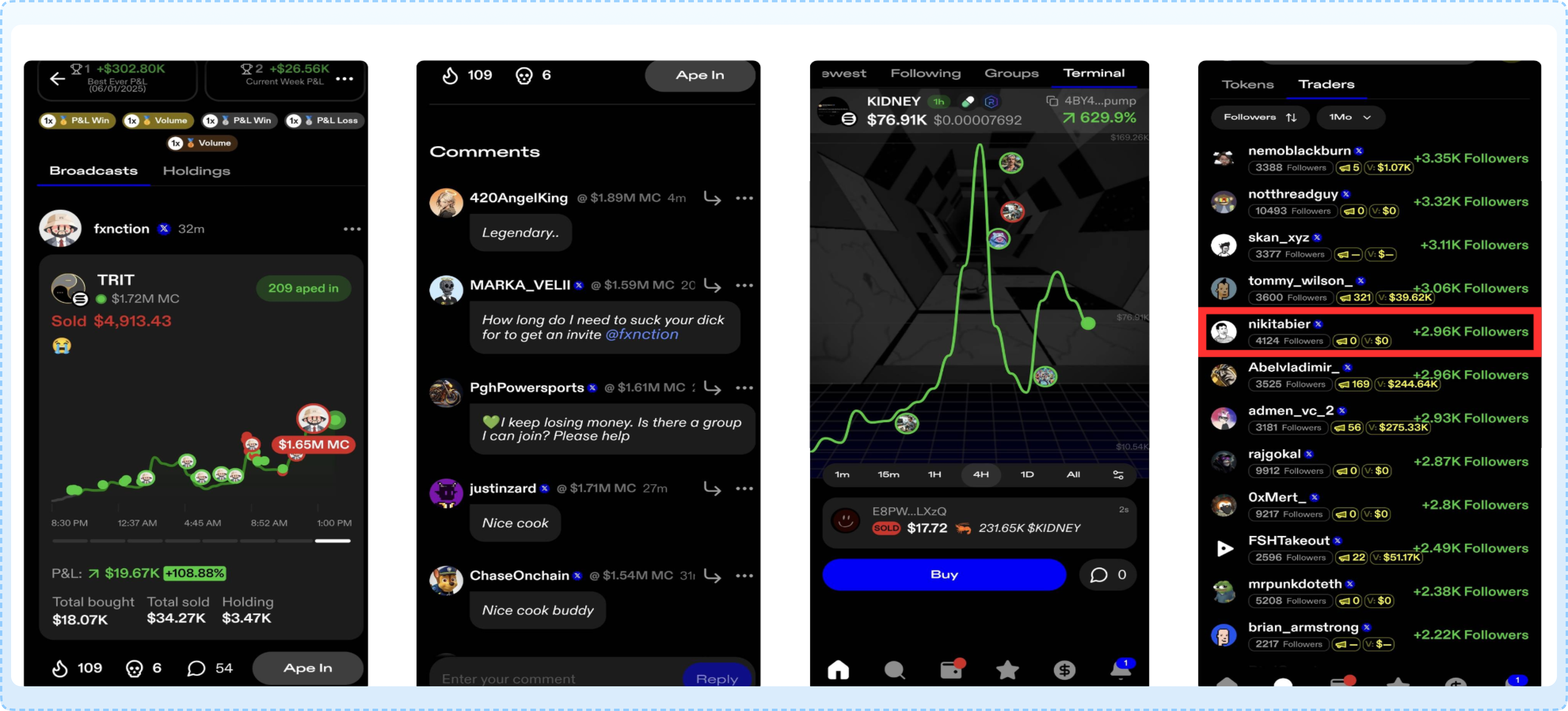

Memecoin trading has become a game in and of itself, with a unique set of users and market characteristics from other DeFi activities. Considering this, why should crypto natives settle for the existing tools that they are already familiar with? It’s unlikely that DexScreener, Photon, BullX, etc. are the pinnacle of innovation in this area—Vector provides the counter.Vector provides an app that taps into the fast, reactive nature of memecoin trading, making the social aspect a focal point instead of a byproduct.

Beyond just the speculative and social nature of the app, Vector reflects multiple trends in crypto in its UX. Moonshot has proven extremely successful during this memecoin run, onboarding 4 million users during the $TRUMP launch, before being acquired by Jupiter. Vector takes what works from Moonshot and apps like it, providing a mobile-first experience with simple fiat onboarding and an in-app wallet. Users can purchase $SOL or $ETH via Google/Apple pay, or other methods.

This is where the similarities end, as Vector provides a more sophisticated UI, and a focus on sharing trades, replying to posts, and tracking price performance publicly. Users can join groups and follow users they might recognize from X, or simply explore new traders and tokens.

Naturally, users can continuously scroll; if they don’t like what’s shown to them, they can see something new within half a second, with the ability to loop this over, and over, and over again. Like Pump.Fun, users can comment under specific tokens, and even specific trades—though the UI is much more slick and cannot be compared to the rudimentary style that Pump.Fun opts for. Additionally, Vector’s feature set seems to be constantly changing right now, with multiple series of updates being pushed this past month. This is a nimble team that deeply understands its users and is constantly receptive to their feedback.

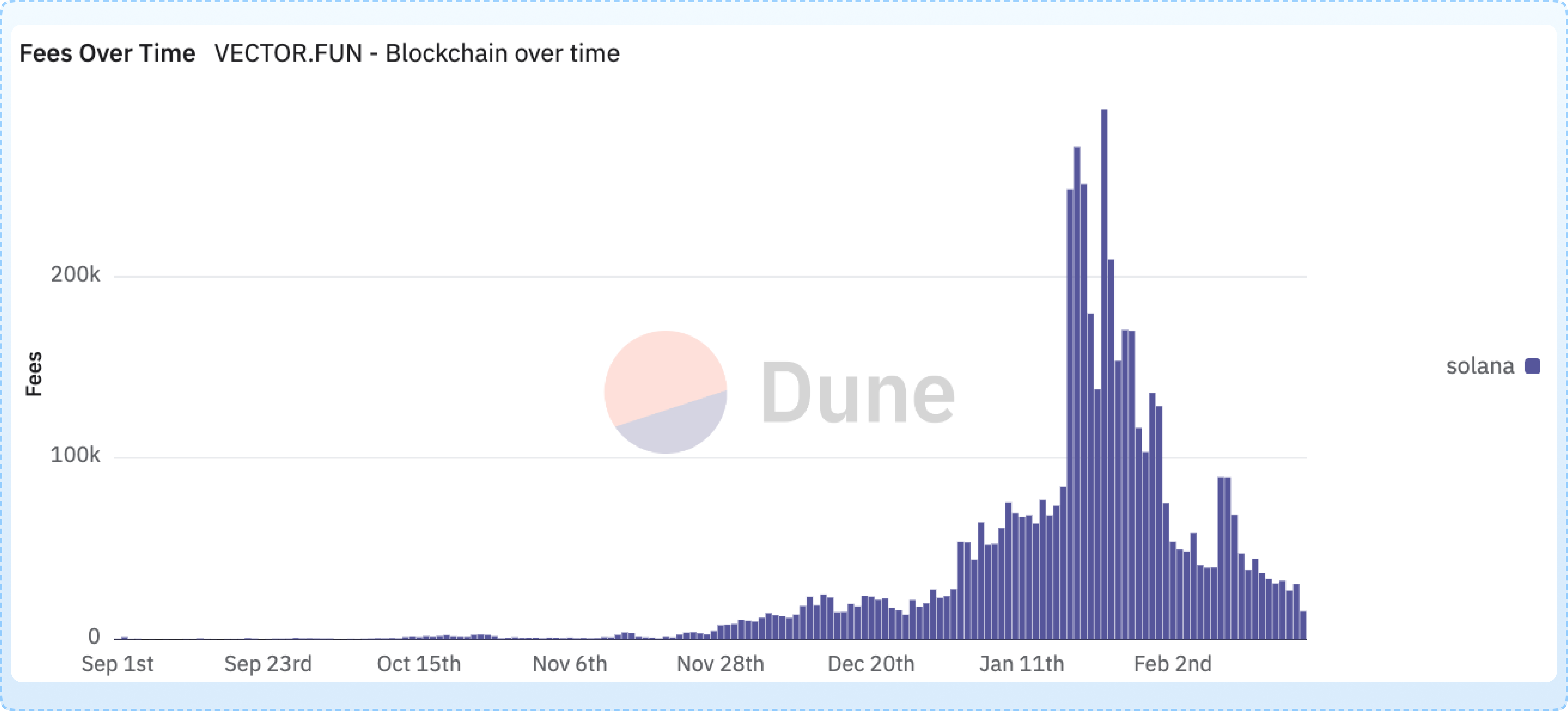

Vector has effectively found a way to monetize the memecoin attention game. While players like Jupiter and Pump.Fun make their revenue from the actual token creation and trading aspects of memecoins, Vector can monetize the side of trading that hasn’t been captured by protocols yet: the social aspect that takes place on Twitter.

The bulk of the thesis behind Vector is that the protocol can grow to facilitate a significant portion of trading volumes, earning fees as on-chain activity rises. The social dynamic of the app can provide an alternative to users splitting time between Jupiter or other trading terminals and Twitter, providing an amalgamation of the two.

The case for $TNSR is not purely built on speculation or around hypothetical adoption. Vector has already seen large trading volumes and fees earned previously. The team is well-backed, has a proven track record, and has given reasons to believe that they can steer the ship toward a successful outcome for $TNSR (they might as well have abandoned the project and launch a new token for Vector). This can provide some reassurance during the most volatile and fear-driven stages of the market—those that test one’s conviction. Importantly, the team has already demonstrated much more of an ability to pivot and find product-market-fit than other more static protocols like Raydium.

Price Strength Is All You Need

You’re hard pressed to find names that are in the green over the past weeks. Yet $TNSR has simply steadily climbed upward over the entire month of February, as almost all of the rest of the crypto market saw large drawdowns, especially $SOL and its ecosystem. This strength doesn’t necessarily mean a token is a good buy, especially if market conditions continue to worsen–but it is a testament of conviction that at a minimum, should implore informed investors to take a deeper look beneath the hood—things do eventually bounce.

In $TNSR’s case, this climb upward came after a token unlock comprising 4% of the max supply on January 31st. This saw the typical post-airdrop dump, which lasted a couple of days, before a strong bounce, leading into a consistent positive trend. At its peak of $0.50, $TNSR nearly doubled in price during the month of February.

Strength in this current market regime reflects that there is a market for $TNSR consisting of those willing to bet on a new player in the on-chain casino space. Tensor is not nearly as much of a staple in the memecoin and Solana trading game as $JUP and $RAY are, which have much more of a moat around their large share of Solana’s trading volumes, but Vector’s uniqueness and relatively nascency gives it the potential for much more explosive growth, especially now that it is available for all. One should position and express their views in forward-looking ways, rather than to what’s already priced in.

The recent positive price action has persisted despite fees declining significantly. This, paired with a muted reaction to Tensor pledging 50% of fees toward the $TNSR treasury for airdrops, grants, etc., shows that while fees have the potential to be significant for $TNSR in the future, it isn’t really what the market is thinking about at all right now. Vector’s strong team and captivating product with potential for growth can be enough to fuel a rally well beyond the current ~$119M market cap that $TNSR holds (a low enough float to move price rather easily).

State of the Trenches

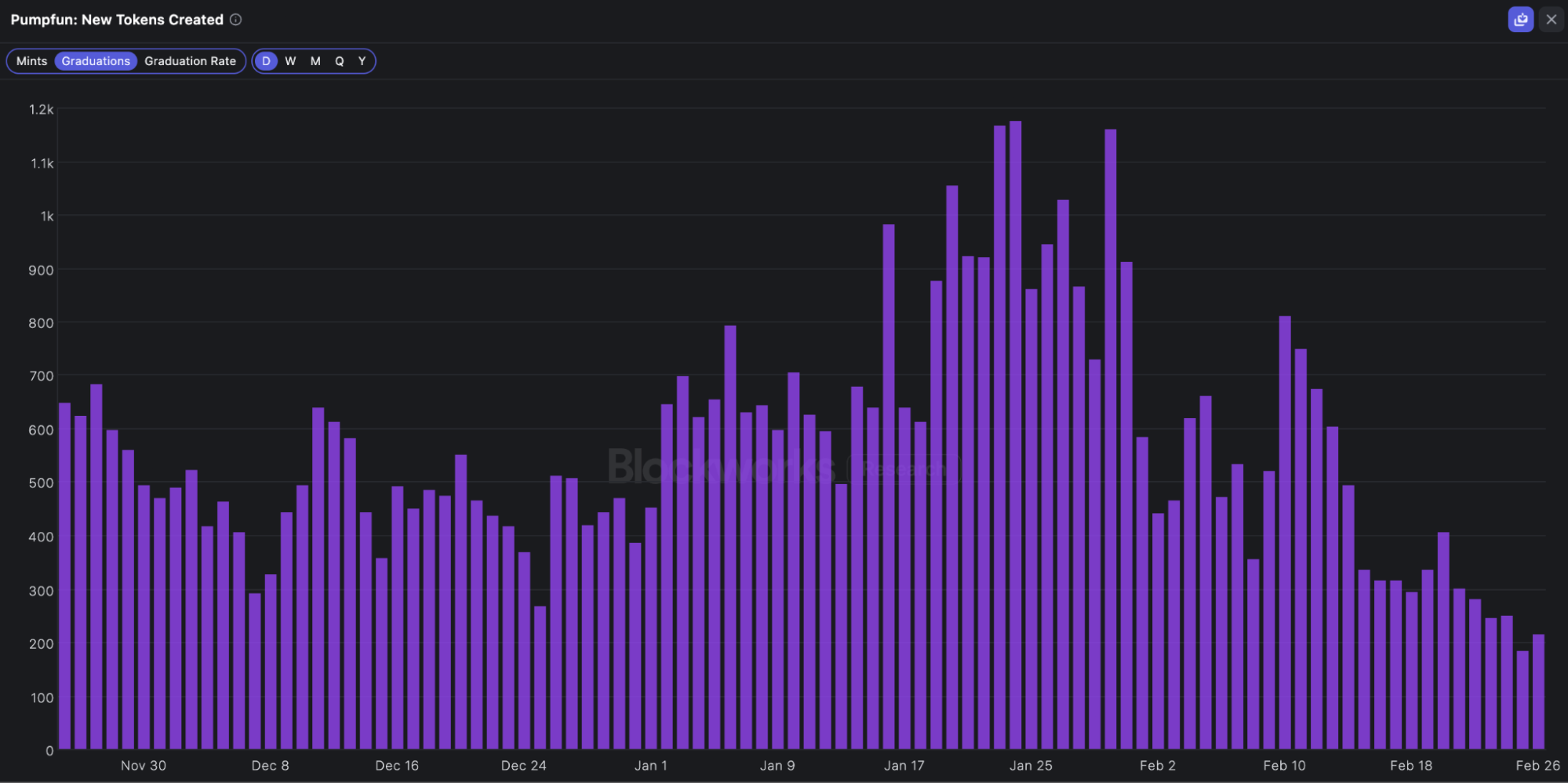

The memecoin space has been hit hard recently, and not just in terms of price. There are greater, existential concerns around the viability of memecoins that impact traders, protocols, the Solana ecosystem, and crypto in general, considering how much the memecoin space has grown.

In the past month or so, a pronounced shift has occurred where the number of memecoin launches that reach $50-$100M has decreased in favor of a handful of meticulously planned token launches that heavily reward insiders over anyone else. This has thrown a monkey wrench in the trench dynamics, to say the least. Part of this drama may resolve when more liquidity can find its way into the crypto markets; what might spark this remains to be seen.

The other side of this is that the state of memecoin trading itself can change. This has already been observed with the AI agents market, which reached a peak market cap of ~$20B. A significant chunk of the agents market could be attributed to Solana tokens deployed via Pump.Fun. This is just the latest example of a genre that is conducive to fast, dopamine-inducing trading, using fair-launch token mechanics via platforms like Pump.Fun or Virtuals.

Some question marks have emerged around the long-term ramifications of sophisticated teams using a fair-launch token model, especially in the AI agents space. Still, the ability for anyone to spin up a token remains intact, and the odds that people both in and outside of crypto stop taking advantage of this is slim.

Protocols like Vector, Pump.Fun, and even Virtuals to some extent, thrive off of the desire for trigger-happy retail to ape into new tokens. Whether these tokens take the form of memecoins, AI agents, celebrity tokens, or something new is somewhat irrelevant as long as trading volumes can remain high and the rate at which new tokens are launched also remains somewhat elevated. This is important, as the frequency at which tokens were created that reached significant market caps during the memecoin and AI agents run are what allowed these trading volumes to remain off of CEXs and stay in the hands of on-chain venues that can extract their own fees.

Risks & Invalidations

The main risk for $TNSR is that the Vector app simply doesn’t take off. Where there is novelty, there is risk. For instance, having a mobile app is something that Pump.Fun has also thought of. The thing that separates $TNSR from the more established DEX plays in Solana can also potentially doom the token if adoption doesn’t come. There is no real competitor to Vector as it is a new take on the memecoin and trading game—its success is tied to whether this idea can catch on, making the social aspect different to Pump.Fun’s mechanics, and betting on this team to foresee trends the market may be overlooking.

As it pertains to the success of Vector, it’s worth noting that Pump.Fun also has its own existing app— though at this stage, its offerings are not really comparable to Vector’s. For one, the Pump.Fun app is very similar to their website, which is very stimulating, but also has a crude UI that may not exactly be retail-friendly to say the least. Things like fiat-crypto onboarding and, obviously, the social trading element are missing—the emphasis is still very much on creating new coins and looking for ‘daily runners’.

However, the pump.Fun team does have a lot of resources to throw around and develop something better—the current version of their app is only a couple of weeks old. Not to mention, Pump.Fun is also testing its own AMM. This specific facet doesn’t really impact Vector directly, though it could start to create a snowball effect where more and more of the memecoin ecosystem starts and stays with Pump.Fun, with vast network effects casting shade on the growth of apps built on top of or around Pump.Fun tokens. Ideas are cheap. Execution is what matters.

On this note, it’s also worth considering that $TNSR is not completely dependent on Pump.Fun, memecoins, or even Solana in general. The app covers Solana, Base, Ethereum mainnet, Abstract Chain, Berachain, etc. Should another chain see activity begin to spring up, Vector will add it right away. When scanning the trending tokens tab, users can see that many of the top tokens at any given time aren’t memecoins at all, they might be majors, or even stablecoins. That being said, the Solana memecoin space does make up the majority of the token trades being broadcast at any given time; Vector even has integrated a pre-bonding dashboard for low market cap Pump.Fun tokens.

As explained above, current market conditions and lack of trading activity and memecoin creation serve as headwinds for something like $TNSR and much of the Solana ecosystem. The Vector app looks inspiring and it is very plausible that it can grow its revenues if on-chain trading activity has an uptick, but it also isn’t a given.

Timing

There’s a lot that can potentially stand in the way of Vector getting in front of its target audience; many corners of the market are even beginning to wonder whether this current crowd of retail will ever return to memecoin trading. This is where timing comes in; positioning near what could potentially be local lows for Solana in terms of price as well as ecosystem trading volume/activity serves as a buffer against stagnant adoption. Tailwinds for the Solana ecosystem can carry $TNSR higher for a period of time regardless of if its share of fees can rise relative to some competitors.

If $SOL were to get back up within ~5% of its ATH price or even exceed it, this is probably a good time to evaluate trimming or even dropping a $TNSR position entirely regardless of how it has performed. With a couple of fractals to look back on as precedent, $SOL has rarely sustained a new ATH for very long. Most recently, $SOL’s latest climb to ATH occurred shortly after the $TRUMP launch, which was the absolute top for memecoins collectively.

Conclusion

Vector represents a novel idea in crypto, a platform that is truly unique and not an iterative improvement upon existing DeFi primitives. Betting on $TNSR involves betting on relative strength, a rejuvenation in both $SOL price and activity, and an ability to generate fees in the future. While market dynamics can help, Vector’s success in the long term hinges on its ability to hook users—no small task considering the number of options crypto market participants have when it comes to selecting a venue to place bets. However, with an established team with a proven ability to pivot at the helm, combined with the catchy initial concept of the Vector app, $TNSR very well might be a bet worth taking at this time.

Disclosures

Alea Research has never had a commercial relationship with Vector and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.