Introduction

$BNB continues to face the pressure of $SOL to solidify its rank as the fourth largest crypto asset by market capitalization, only behind $BTC, $ETH, and $USDT. The token has recently experienced a small correction and has been consolidating sideways close to fresh all-time highs achieved in June. This shows strength in spite of the token not receiving as much attention as others like $SOL or new token launches creating their own narratives. Under the belief that price will create the narrative for $BNB, we are starting to pay attention to it as a token that is going largely unnoticed by the majority of the market and that can help us build robustness on the long side of the book alongside $BTC.

Source: Kaito.ai – In spite of being in the top 5 by market cap, $BNB doesn’t stand out in the top 20 tokens by mindshare over the last 12 months; despite rarely showing up in such ranking, we want to be in a position before attention starts coming in rapidly.

We don’t need to know with certainty when the actual release of CZ from prison will take place, and just knowing that that’s an option can already help us position in the market. A sideways move around all-time highs is as good as it gets for something that can receive positive catalysts at any time. At the same time, $BNB epitomizes the Lindy Effect, showing that CZ stepping down was not the end of the project, but rather the beginning of a new journey in which Binance is not going to stay with their arms crossed as Coinbase doubles down on their on-chain efforts with Base (and we think that chances are high of Binance investing and doubling down on ecosystem projects, similar to Aerodrome, $AERO, in Base). Overall, the current sentiment around Binance remains predominantly positive, with no significant negative spikes since the start of the year.

Source: Kaito.ai – Since a bounce off largely negative sentiment the token has been on an upward trajectory which it has managed to hold up pretty steadily, reflecting strength. This absence of sharp declines or volatility suggests market confidence and resilience. For $BNB price leads sentiment, creating the narrative as a result.

This setup can play in our favor as we observe strong positive correlation with $BTC, moving in tandem with the market’s compass as more favorable conditions wait around the corner. Unlike $ETH, $BNB is one of the few coins breaking previous all-time highs right after $BTC, which is significant since we are talking about a token with almost $90M in market cap (also fully diluted).

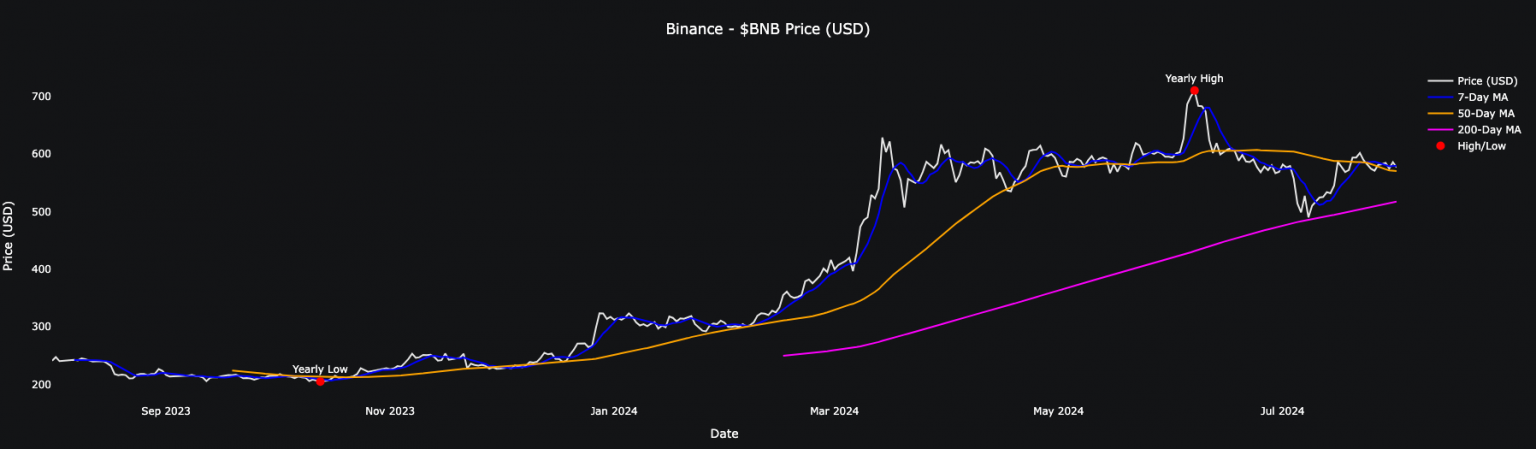

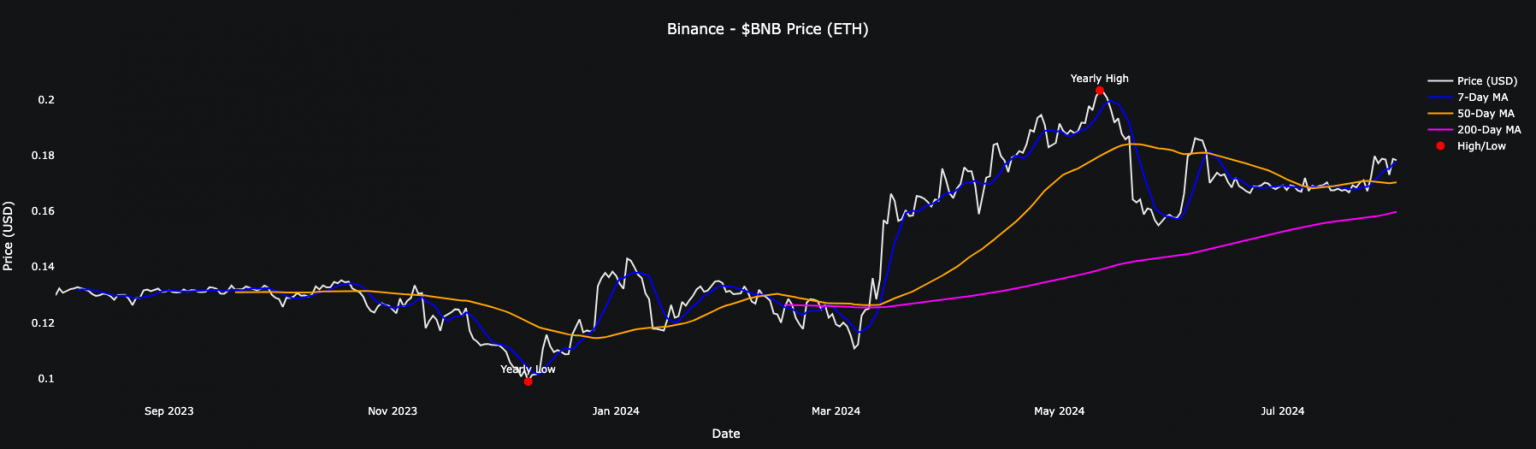

Source: Coingecko – Price is currently touching a critical level around the 7-day and 50-day moving averages; after reaching the yearly high, $BNB faced a correction, with prices pulling back from the peak.

Most recently the United States Federal Court has rejected several major claims from the SEC against Binance, notably the assertion that crypto tokens are inherently securities. CZ’s release from prison also acts as a “memetic” tailwind to gain more mindshare during this transitory period where Mt.Gox and national governments are running out of coins to sell, FTX payouts are expected to start, and US Election candidates start showing a more favorable stance towards crypto as a strategic asset class.

Key Takeaways

- Compelling Price Action: $BNB is nearing all-time highs reached in June and we believe that, even if flipped by $SOL, it is ultimately poised to solidify its ranking in the top 5 of tokens by market capitalization.

- Leading Market Position: Binance is the largest global crypto exchange by volume and web traffic, with $BNB offering the most direct proxy and exposure to the whole industry as regulatory conditions improve and become more favorable.

- Robust and Simple Business and Token Model: Despite the overwhelming reliance on a single centralized entity like Binance, $BNB offers diverse exposure to a robust business model and token utility ranging from reduced trading fees, staking, participation in launchpools, BSC DeFi, and a dual token burn mechanism.

- Favorable Market Exposure (but beware the Black Swan): Sentiment analysis shows sustained positive sentiment, favoring correlation with $BTC and indicating market confidence. This can benefit from other catalysts such as reduced regulatory risk, CZ’s impending release, Binance’s performance and reputation, and overall better macroeconomic conditions from rate cuts and US elections.

Overview

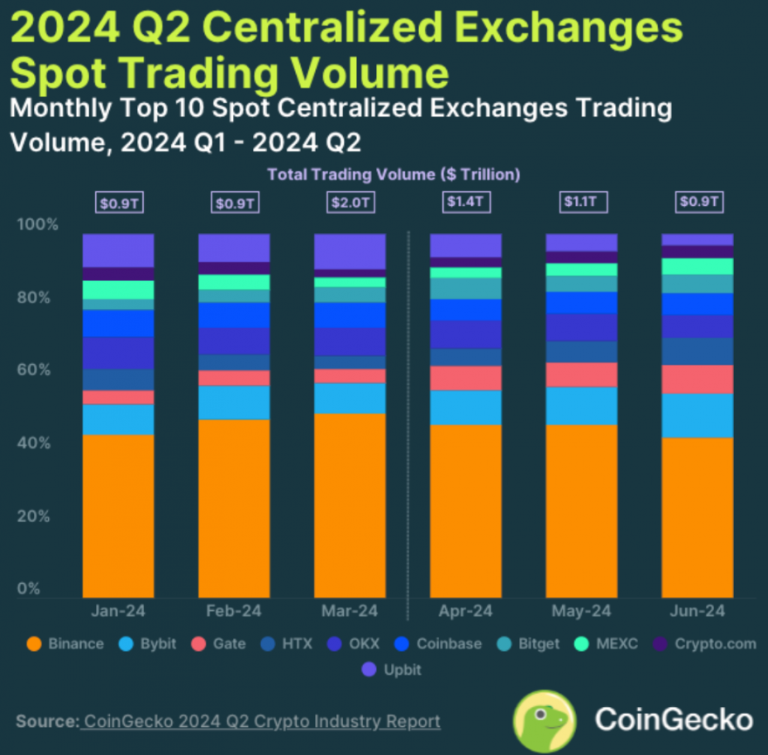

Binance is the largest international crypto exchange by volume and web traffic with over 40% market share in June 2024, while $BNB has consistently ranked in the top 5 of cryptocurrencies by market cap. We have a positive outlook for the second half of the year, and we believe that $BNB is a key asset to own in the long book, especially as $BTC approaches or breaks new highs. $BNB has been showing remarkable strength while most altcoins continued to bleed against $BTC during Q2, especially new launches. This gives us exposure to the leading crypto exchange and one of the most active L1s, as Binance Smart Chain (BSC) ranks third in TVL, second in number of unique protocols, and third in stablecoin liquidity behind Ethereum and Tron.

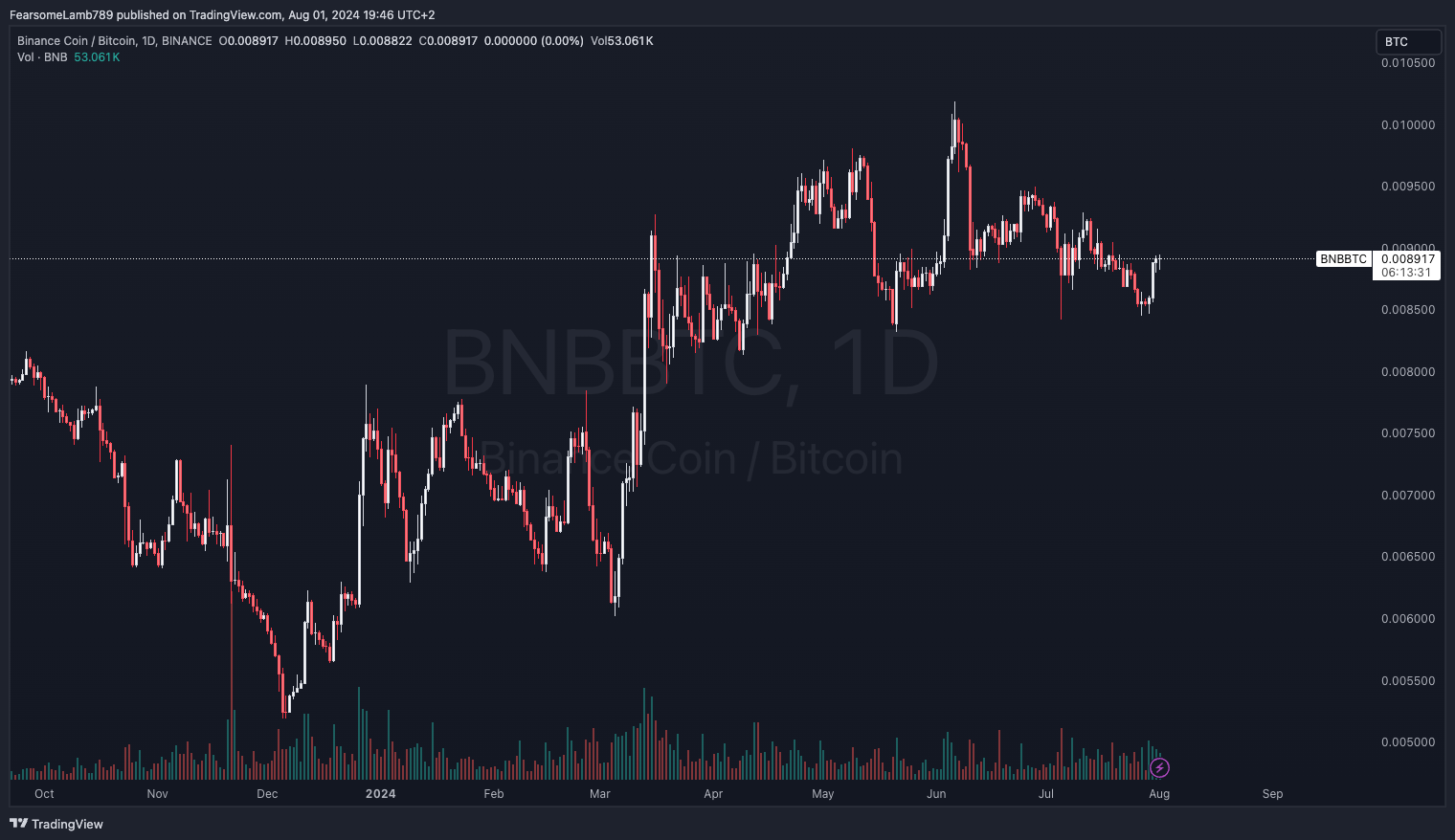

Source: TradingView – BNB/BTC chart; $BNB has demonstrated significant price strength, reaching an all-time high of $710 in USD terms in June 2024.

Besides the exposure to Binance, $BNB also operates under a very simple business model with clearly defined supply and demand drivers. It is the token of the largest CEX and it is also used for gas in Binance Smart Chain. In addition to that, $BNB can be used by users to receive reduced trading fees, participate in launchpools (currently $800M staked with 5M+ unique participants backing more than 90 projects with more than $180M raised in total), engage and get a reward on the HODLR Program (which aligns incentives and distributes value with those subscribing their $BNB to Earn products), and access new account tiers and VIP perks. Most importantly, it is also subject to a double token burn mechanism: a quarterly auto-burn, and a real time burn. This helps the token to receive deflationary pressure from both on-chain and off-chain activity.

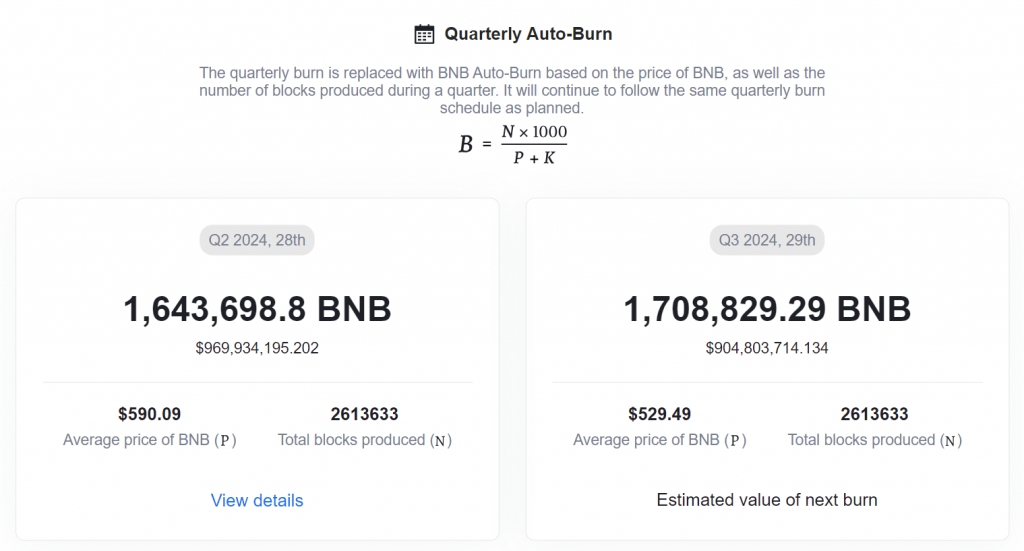

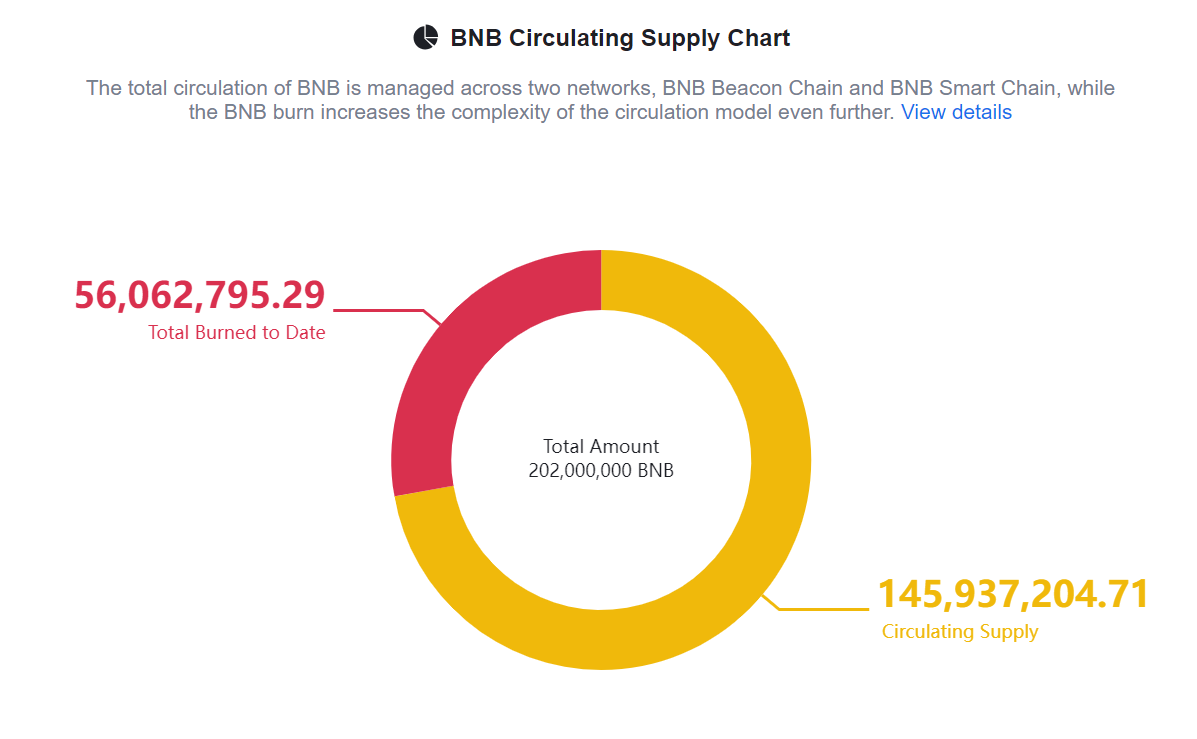

The initial idea was to allocate 20% of Binance’s profits to the buyback and burn initiative until 50% of the supply was bought back, leaving 100M $BNB tokens burned and 100M in circulation. However, given the opacity and trust involved with reporting business activity, a quarterly auto-burn was put in place, using on-chain metrics instead of reported CEX numbers. This shift took place in 2021, as Binance stopped publishing profit figures in 2020.

Source: bnbburn.info – The $BNB Auto-Burn mechanism adjusts the amount of BNB to be burned based on the $BNB price and the number of blocks generated on BNB Smart Chain (BSC) during the quarter.

BEP95 introduced a real-time burning mechanism, and this will continue to burn tokens even after 50% of the circulating supply is erased. A fixed ratio of the gas fee collected is burned in each block, with the ratio decided by BSC validators. However, this real-time burn, when measured quarterly, is substantially less than the ongoing quarterly auto burn. Together, we can expect around 1% of the circulating supply to be burned each quarter. The effect of this compounds when we consider that $BNB is used for multiple purposes within the ecosystem, increasing demand from transaction fees, staking, and participation in both DeFi and CEX activities. This broad utility supports the token’s value, which is enhanced with the introduction of new products and services such as BNB Greenfield.

Source: bnbburn.info – The total circulation of $BNB is managed across two networks: BNB Beacon Chain and BNB Smart Chain, while the BNB burn increases the complexity of the circulation model even further.

A Tale of Market Resilience

As everyone chases beta and looks for new narratives, many miss the broader picture: prices create narratives. While attention has been spread across new token launches, fueling the low-float and high-fdv meta, $BNB has quietly outperformed and made new highs. Often overlooked, $BNB maintains its position as one of the major cryptocurrencies by market cap.

Centralized exchanges have come in and out of fashion, but Binance shows no signs of stopping. It has already withstood some of the worst challenges faced by a crypto exchange. $BNB, as a result, is likely the least segmented of the major tokens and serves as an excellent representation of the crypto market cycle. While $BTC, $ETH, and $SOL have asset-specific qualities and news that affect their prices, $BNB has been faring well during the Q2 dump in the overall market.

Source: Coingecko 2024 Q2 Crypto Industry Report – Binance was the market leader amongst the centralized exchanges, with a 46.6% market share of total spot trading volume in 2024 Q2.

In addition to the upside that comes with the lower volatility associated with such a large asset by market cap, it is also worth noting that $BNB has nearly doubled $ETH’s gains in the past year, up ~142% versus $ETH’s ~77%. For many, $ETH has been considered a proxy asset to get exposure to crypto as a whole, with returns (in principle) uncorrelated from the political and macro catalysts that may boost other risk assets like $BTC – hence the stories of “$ETH as the App Store for money”, or the multiple other narrative fallacies that have been propagated along the lines of “ultrasound money”. From that perspective, holding $ETH means not losing out on the benefits that come with increased on-chain activity and protocol developments driving adoption. However, that view completely overlooks one of the most profitable businesses to run in the first wave of adoption, CEXs. $BNB plays this role much better than $ETH and also benefits from onboarding more users on-chain.

Source: TradingView – $BNB has largely outperformed $ETH with >140% returns YTD.

Contrary to popular belief, despite the negative press and controversies surrounding Changpeng Zhao (CZ), Binance’s position as the number one centralized exchange (CEX) remains strong under new leadership. The new corporate structure has shown competence and adaptability to new trends, a quality that previous giants like BitMEX and Bittrex lacked.

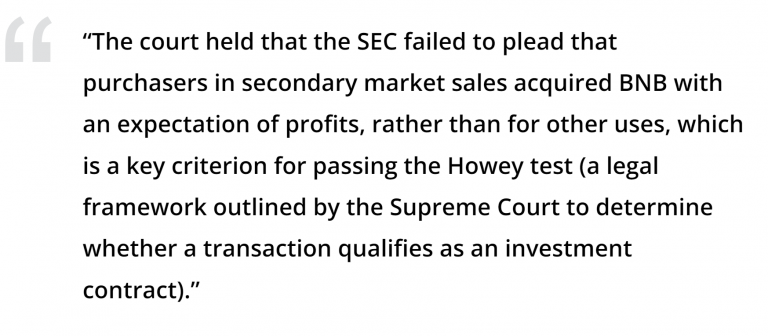

Recent U.S. federal court rulings have dismissed significant SEC claims against Binance, reducing regulatory risk and positively impacting market perception and investor confidence. In a significant win for Binance, the judge dismissed several claims made by the SEC, such as i) crypto tokens are not securities, ii) $BNB sales on secondary exchanges are not adequately alleged to be securities, and iii) $BUSD is not a security. This legal clarity can lead to increased institutional interest and broader adoption of $BNB. Any negative news around Gary Gensler could positively affect $BNB, more so if the Chairperson of the SEC is fired before the November elections, which would catch many participants by surprise.

Source: Cointelegraph – The SEC started cracking down on crypto exchanges after the collapse of FTX and, even though the investigation against Binance will continue, the ruling that cryptocurrency tokens themselves are not securities could mean that they don’t fall under the purview of the SEC.

Thesis

Despite facing increased competition and potential threats to market share on both the centralized (OKX, Bybit, Coinbase, etc) and decentralized fronts (alternative L1s and L2s), $BNB has shown resilience and growth since its inception. This ability to adapt to market changes and survive multiple cycles showcases the Lindy Effect: the longer $BNB remains among the top cryptocurrencies by market cap, the longer its future life expectancy, implying that any potential loss in market share will not immediately impact its price. This gives us ample time to reevaluate our position as circumstances evolve (more regulatory hurdles, unsound strategy under new leadership, competitors denting market share, etc).

Source: TradingView – $BNB has demonstrated robust performance versus $ETH, trading near all-time highs, demonstrating that it can be an attractive asset to have in the long book, gaining broad market exposure and muting volatility.

Our view is that even if Binance loses dominance to competitors like Coinbase, OKX, or Bybit, or if Binance Smart Chain (BSC) loses relevance to other Layer 1 (L1) and Layer 2 (L2) solutions such as Base, this shift won’t immediately reflect in $BNB’s price. $BNB’s broad utility within the Binance ecosystem—its use for transaction fees, staking, and DeFi participation—along with its strong brand recognition, increases our confidence that it can sustain its value in the short to medium term (read end of 2024).

It is this combination of historical performance, recent strength in price action, inherent utility and value accrual, and overall resilience that makes us confident in assigning a heavy weight to it in the long side of the portfolio. We also perceive $BNB as being an asset that is currently being overlooked by the majority of market participants. The fact that it offers little differentiation on the technical side of things might mislead some investors to believe that there are no tailwinds or catalysts that could push the price above recent all-time highs. But it is that exact reason which creates a discrepancy, as we have already shown how $BNB has been one of the few tokens in making new highs this cycle while others like $ETH and $SOL are still not there yet.

Challenges, Risks, and Invalidations

Holding $BNB is as close as it gets to expressing directionality on the global market led by $BTC, acting as a proxy that is unlikely to deviate much from the market leader.

Even though there is optimism around the US elections and the adoption of crypto, it is important to not forget that the US currently presents a hostile environment for crypto and exchanges like Binance, more so after the collapse of FTX. This might as well diminish Binance’s market share if exchanges like Bybit or Huobi gain dominance in Asia while CEX volumes increase on US-based exchanges like Coinbase.

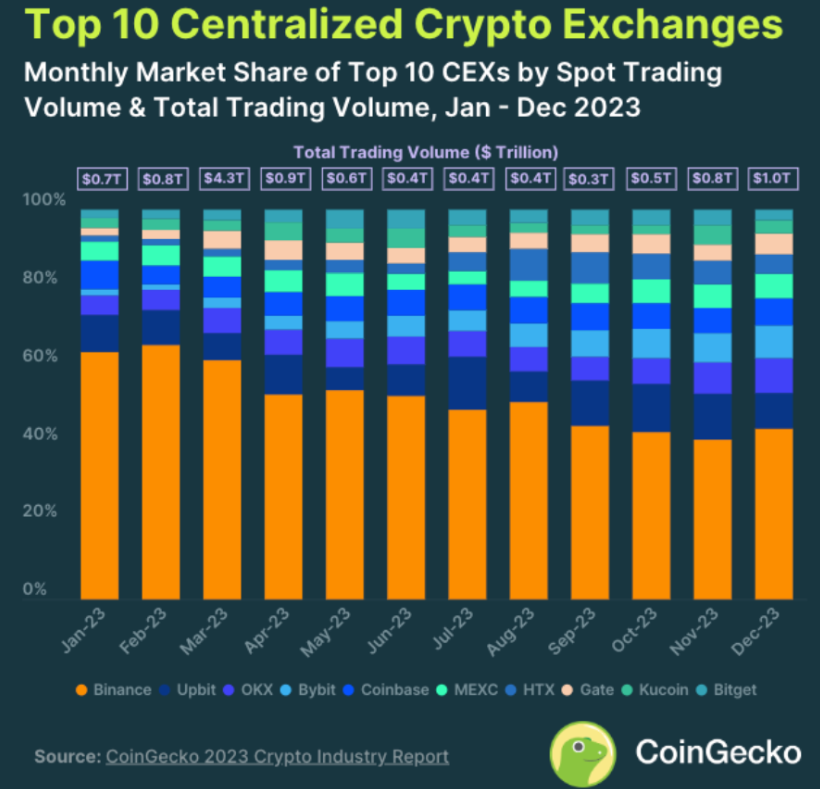

Source: Coingecko 2023 Crypto Industry Report – Binance has been progressively losing market share over the years. Even though it has regained some of its dominance, it has started to lose its edge and fall down from an average of almost 50%.

CZ is in prison and the SEC has already filed 13 charges against Binance entities, including operating an unregistered securities exchange, selling unregistered securities like $BNB and $BUSD, commingling billions of customer assets, artificially inflating trading volumes, and offering staking as a service. These charges, even if most of them have been dismissed, still pose significant regulatory risks and could adversely affect $BNB’s value. Hence, besides market volatility, the high dependence on Binance is a liability for the price of $BNB, which is closely tied to the performance and reputation of the exchange.

It is also worth noting that high market caps can also act as a source of gravity; the higher the market cap, the more gravitational force is required to sustain it. Binance must continually fight to maintain its market share and stay relevant, which is increasingly challenging as new L1s and L2s emerge.

Timing Entries / Exits

When considering the timing of entries for $BNB, it is crucial to recognize that significant returns are unlikely given its status as one of the top five tokens by market capitalization. This positioning means that $BNB is more stable but less likely to experience explosive growth compared to smaller-cap tokens.

Given the risks associated with Binance exposure and the potential for unfavorable news to emerge unexpectedly, it is prudent to approach $BNB with caution. To mitigate these risks, we recommend holding $BNB as part of a balanced long/short book. This strategy allows us to benefit from $BNB’s stability and market position while hedging against potential downturns.

The portfolio weighting should reflect a balanced approach that helps avoid massive PnL swings and ensures that the position remains robust even in the face of market volatility or adverse news.

Conclusion

$BNB’s recent strong performance trading near all-time highs makes it an attractive asset for broad market exposure ahead of anticipated rate cuts amidst the US Presidential Elections. Despite competition and potential market share threats, $BNB’s resilience, utility within the Binance ecosystem, and strong market presence underscore the Lindy Effect. For that reason, we believe that $BNB is one to add to the long book as part of a diversified portfolio that will give us plenty of opportunities to add or reduce size as events unfold until the end of the year.

Disclosures

Alea Research has never had a commercial relationship with Binance and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.