$RUNE is something we want to own during a risk-on market given its high correlation and beta to $BTC. It is a highly volatile token making ample moves to both the upside and the downside, presenting asymmetric opportunities in between. This is an ideal setup to start watching out for more positive price action in order to be ready and opportunistically capitalize during market upswings led by $BTC.

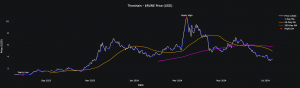

Source: Coingecko – $RUNE’s price since $BTC volatility compressed and ceased making new highs; showing outperformance at the end of 2023 and during the initial inflows to spot $BTC ETFs, yet rapidly giving it all back with a 65%+ downfall since the highs in March. Price is now sitting below key technical levels like the 200-day and 50-day simple moving averages.

Source: Coingecko – $RUNE’s price since $BTC volatility compressed and ceased making new highs; showing outperformance at the end of 2023 and during the initial inflows to spot $BTC ETFs, yet rapidly giving it all back with a 65%+ downfall since the highs in March. Price is now sitting below key technical levels like the 200-day and 50-day simple moving averages.

There is a lot of caution to be exercised when building a position on a token that is down 20% on the monthly chart versus $BTC and 40% on a 3-month and 6-month scale, yet that still represents a 90% increase and outperformance on a yearly scale.

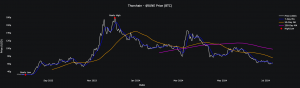

Source: Coingecko – $RUNE peaked much earlier versus $BTC, in December 2023, than versus USD, in March 2024.

The seemingly strong correlation with majors is a good property to have when most altcoins are bleeding and are victims of the low-float and high-fdv phenomenon. New token launches, characterized by aggressive funding rates and very clear deadlines on a calendar, add a lot of headaches when actively managing a portfolio, both on the long and on the short side. Even though $RUNE’s correlation breaks have a tendency for being aggressive, they also exhibit higher sensitivity and beta to $BTC.

This report is reserved for our Pro members. Upgrade your plan to gain access to in-depth analysis, actionable insights, and the tools you need to stay ahead in the crypto space.

Not ready for Exclusive Content? Sign up for free