Flipping the Script?

As more chains enter the market and their ecosystems hit critical mass, liquidity and efficient cross-chain operations are paramount. Besides Thorchain and Maya, this sector is still far from reaching its full potential, for which competition is necessary. Chainflip addresses this critical gap in the market with a protocol that enables trustless swaps of native assets across different chains (e.g. from $ETH to $BTC). These direct swaps take place without going through intermediaries, relying on bridges, or using wrapped assets. Instead, the protocol operates as a cross-chain AMM based on a Proof of Stake (PoS) validator network.

Recently exiting beta, Chainflip has demonstrated significant traction, showing a rise in swap volumes even absent incentives—indicative of robust product-market fit. The protocol’s growth strategy includes expanding integrations with wallets and marketplaces, adding support for more chains, and enhancing capital efficiency through features like the Just-In-Time (JIT) Automated Market Maker (AMM).

Chainflip operates with limited competition, mainly from Thorchain, which it complements rather than directly competes with. While Thorchain uses $RUNE for economic security, Chainflip uses $USDC as the base asset. With a market cap significantly lower than Thorchain’s, we expect Chainflip to grow in market share as both protocols complement each other. This oligopoly results in a diversity of alternatives to move assets from one chain to another, making the market more efficient overall.

Key Takeaways

- Chainflip provides decentralized, trustless asset swaps across various blockchains, a critical need as the industry expands.

- Unique selling points include direct swaps without intermediaries, bridges, or wrapped assets, using a cross-chain AMM and PoS network.

- Chainflip complements, rather than competes with, Thorchain, enhancing the overall cross-chain swap market.

- Chainflip has demonstrated market traction and robust product-market fit, evidenced by increasing swap volumes without incentives.

- Strategic growth plans to increase wallet integrations, add more blockchain support, and improve capital efficiency – this should increase trading volume for the protocol.

Background

Chainflip, under the leadership of founder Simon Harman, has been in development for nearly four years. The whitepaper, released in 2020, has recently culminated in a mainnet launch on March 11th, 2024, with the team growing to over 35 contributors since inception.

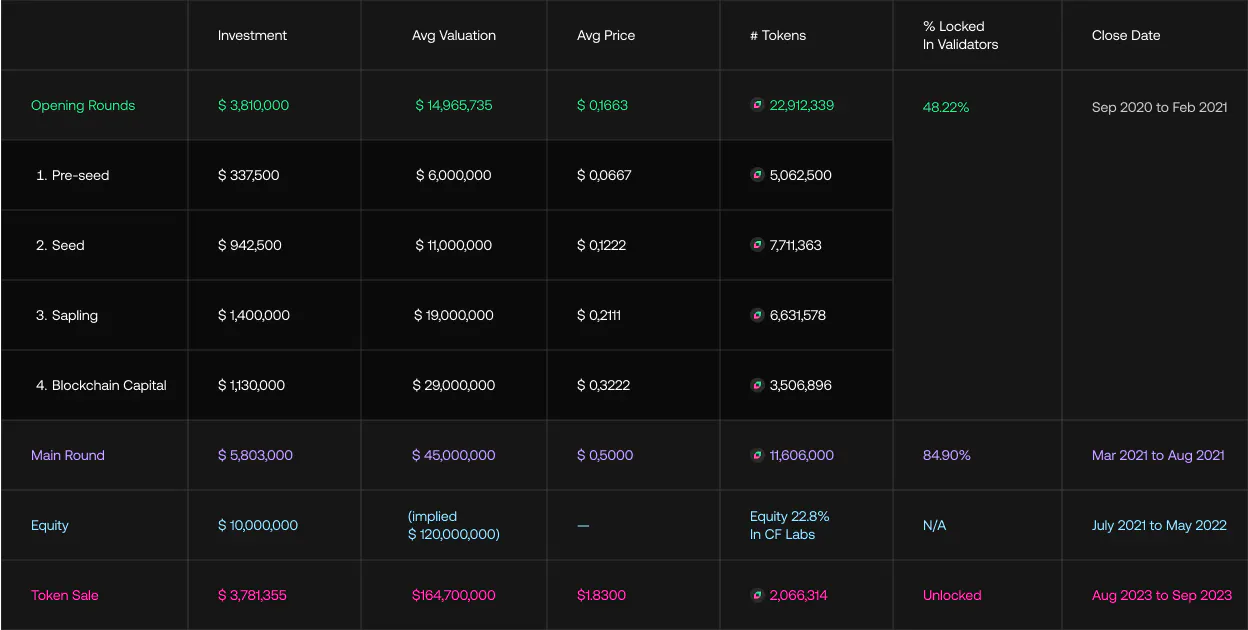

Fundraising efforts commenced in late 2020 and finalized in February 2021 securing approximately $3.8M at a $15M valuation, led by Blockchain Capital and other notable names like Mechanism Capital and CMS Holdings. A subsequent major round in August 2021 raised $5.80M at a $45M valuation, spearheaded by Framework and Coinbase Ventures, among others including Delphi and MetaCartel.

Next up, an equity round gathered $10M at a $45M equity valuation, implying a $120M token valuation with contributions from Pantera Capital, Framework Ventures, and Blockchain Capital. Unlike previous token rounds, these investors commit for 5 years and can redeem their shares for a share of the treasury, instead of a direct token warrant.

Additionally, a public sale via Coinlist in August and September 2023 allowed users to purchase $3.78M worth of tokens, broadening the investor base and market participation. Together, this represents a total capital raise of $23.3M, with the exact details outlined in the table below:

Overview

Chainflip’s mission is to facilitate seamless and decentralized cross-chain swaps, eliminating the reliance on bridges and wrapped tokens that may introduce tail risks or result in liquidity fragmentation.

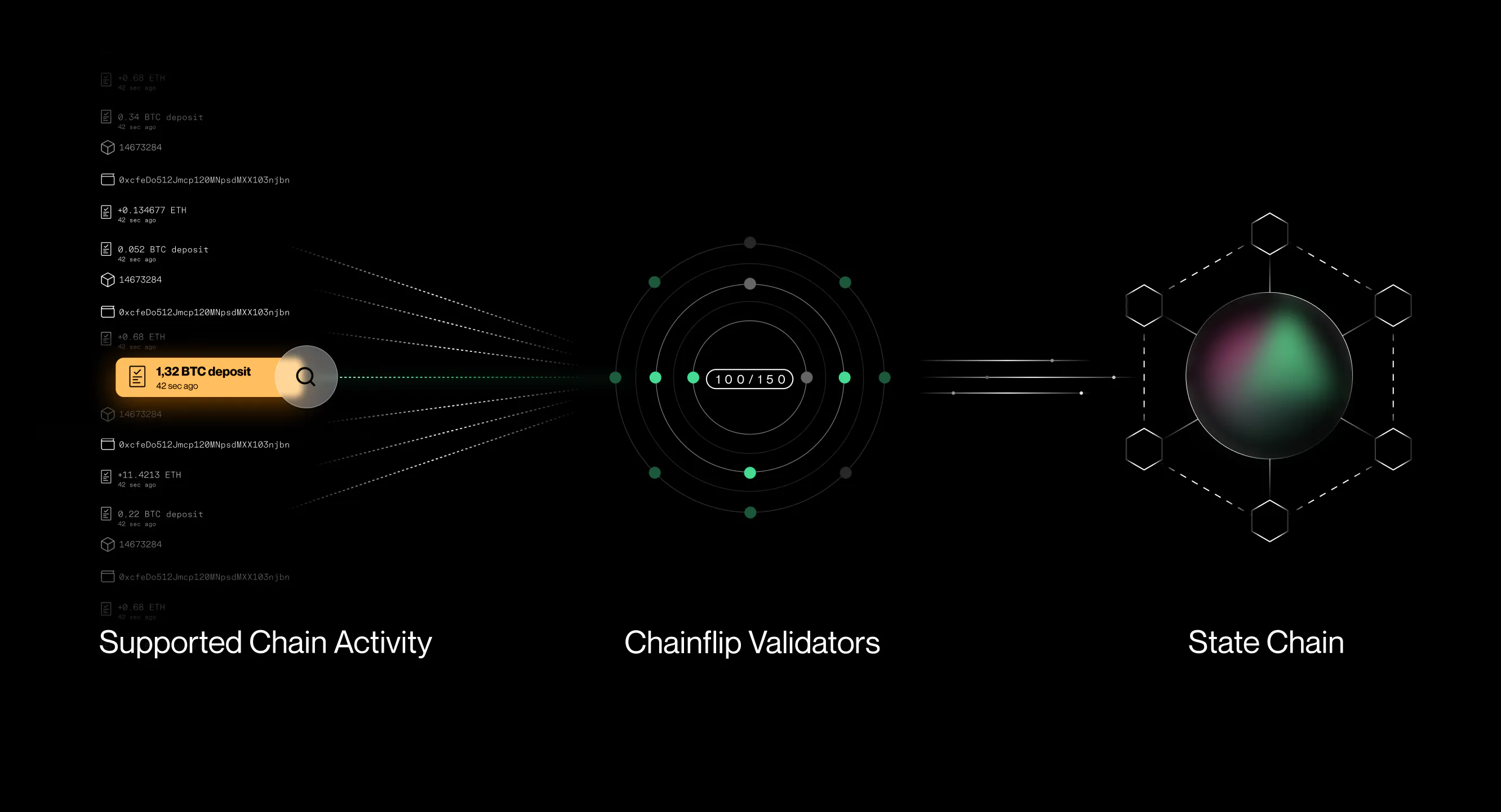

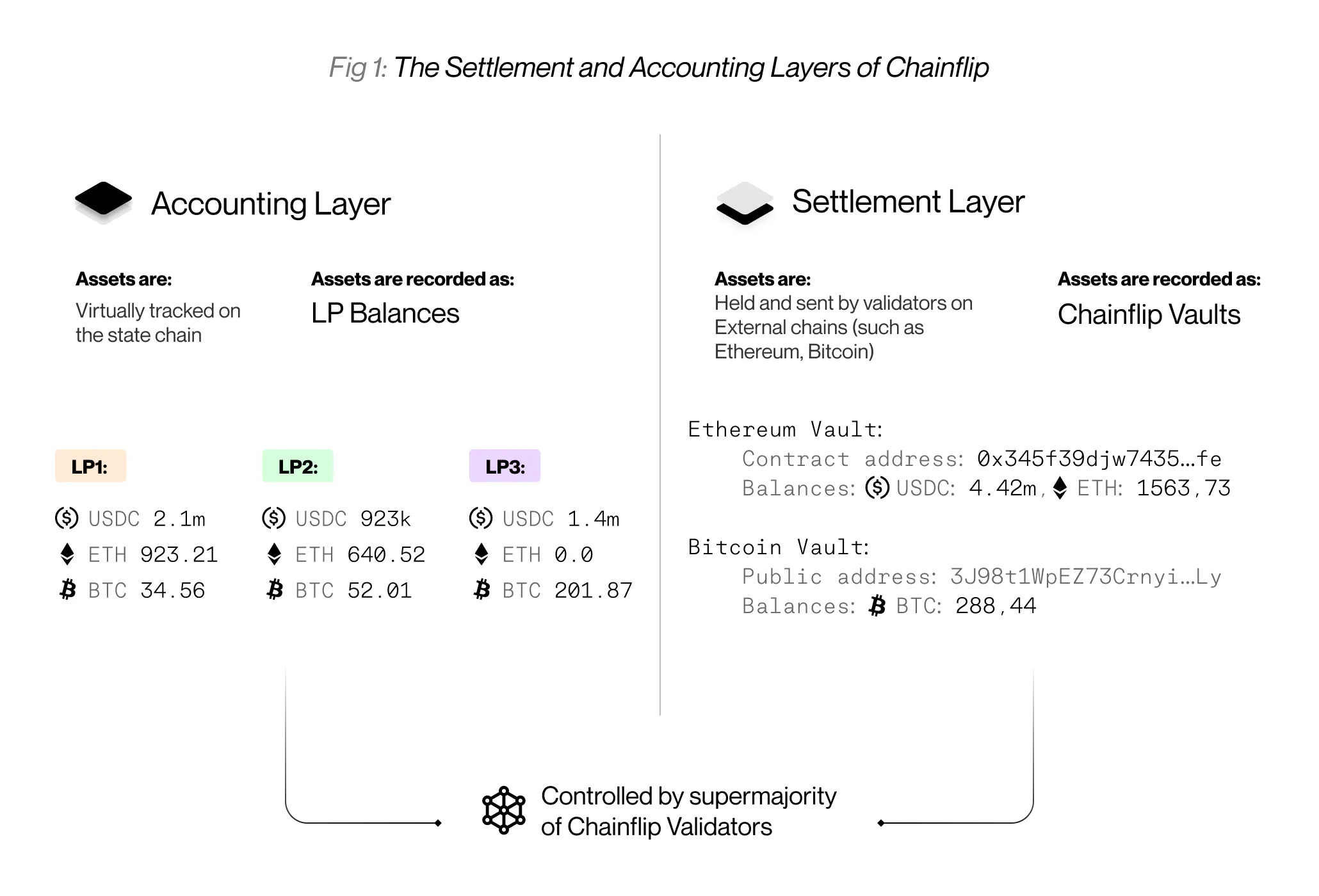

The protocol operates through a cross-chain Automated Market Maker (AMM) integrated into a Proof of Stake (PoS) validator network. Validators operate Vaults that store assets across multiple chains, while the trading process is managed through Chainflip’s State Chain, which takes care of the swapping and asset transfer logic.

At the heart of Chainflip is the Just-In-Time (JIT) Automated Market Maker (AMM), which enhances capital efficiency and pricing accuracy by preventing front-running and ensuring minimal slippage. Unlike traditional AMMs like Uniswap, Chainflip’s JIT AMM does not hold funds in on-chain pools. Instead, it operates virtually, mimicking the operation of centralized exchanges (CEXs) where all deposits are stored in a unified wallet system with individual user balances managed separately.

Similar to how $RUNE is paired with all assets in Thorchain pools, $USDC is utilized as the primary collateral and base asset across all liquidity pools within Chainflip. This choice reduces liquidity fragmentation and enhances market stability, enabling easier addition of new assets and more effective impermanent loss management by market makers.

Selecting $USDC as the base asset aligns with its high liquidity and widespread adoption in DeFi compared to alternatives like $USDT, which lacks some operational features like Circle’s Cross Chain Transfer Protocol (CCTP) and does not meet the ERC20 standard.

This design choice doesn’t diminish the role or utility of $FLIP, and it can even be argued that it reduces endogenous risk. The $FLIP token is actually integral to the ecosystem, and benefits from supply dynamics where transaction fees are used to purchase and burn $FLIP, potentially leading to a deflationary supply model.

Even though $FLIP is an ERC-20 token deployed on Ethereum for ease of use and composability, it can be staked on the Ethereum State Chain Gateway contract, which loads those tokens onto the Chainflip State Chain for use in the appchain environment. Thunderhead Labs is the leading liquid staking provider, offering ~14% APR with a daily rebase, 22% commission on rewards, and currently making new highs in the amount of tokens deposited.

The economic mechanism of $FLIP, which takes inspiration from Ethereum’s EIP-1559, aims to find a balance between validator rewards and offering an incentive for holders to benefit from network activity. Hence, $FLIP features an elastic supply where minting and burning play an important role. While validators receive network emissions from block rewards, this inflation is offset by automatically converting a portion of the network fees collected in USD into $FLIP, and then burning it automatically within the protocol. Therefore, even if you don’t use the token to stake, there are still potential benefits in holding $FLIP.

Sector Outlook

Centralized exchanges (CEXs) have long dominated cross-chain transactions, hindering the adoption of diverse blockchains and non-custodial wallets for DeFi, NFTs, and other applications. Although platforms like Uniswap have brought innovation within the Ethereum ecosystem, the lack of similar decentralized solutions across other blockchains has constrained ecosystem growth. Emerging cross-chain solutions like Chainflip aim to address these gaps but face challenges such as complexity, centralization, reliance on synthetic assets, and user experience issues like high slippage and pricing inaccuracies.

We should put resources toward a proper (trustless, serverless, maximally Uniswap-like UX) ETH <-> BTC decentralized exchange. It’s embarrassing that we still can’t easily move between the two largest crypto ecosystems trustlessly.

— vitalik.eth (@VitalikButerin) March 24, 2020

Source: Vitalik on X

Chainflip is positioned to overcome these challenges by offering a universal, decentralized swapping solution that is agnostic to wallets and blockchains. Through simple RPC calls and SDK integrations, it simplifies cross-chain transactions by eliminating the need for synthetic or wrapped assets, reducing on-chain computations, and thereby lowering transaction costs.

Looking beyond individual projects that aim to rival the dominance of CEXs for cross-chain swaps, the sector’s evolution involves moving towards active liquidity management and intent-based systems, where user demands drive competitive pricing. Despite Thorchain’s current market dominance of over 95%, the potential market for cross-chain decentralized exchanges is vast and expected to continue growing over time, suggesting ample growth opportunities for platforms like Chainflip. It is not about Chainflip and Thorchain competing for a $2B pie, but rather about joining forces to compete against CEXs for a $100B pie.

At the moment, Chainflip’s roadmap emphasizes extending chain support and wallet integrations, improving both the reach and functionality of the protocol. The short-term focus lies on adding major chains like Solana and Arbitrum, as well as integrating with popular wallets and cross-chain aggregators. For now, only Bitcoin, Ethereum, and Polkadot are supported.

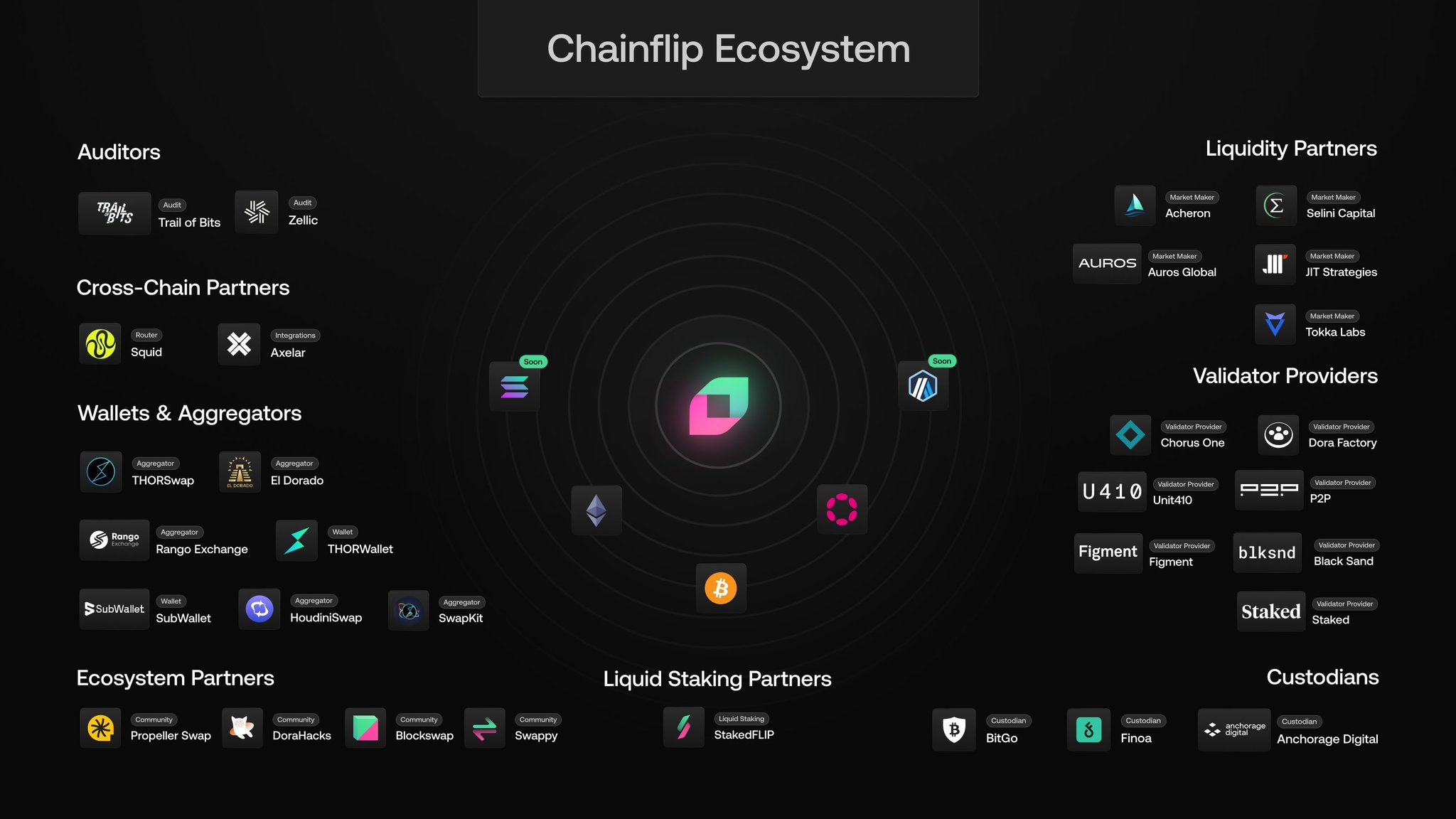

The major brokers include THORSwap, THORWallet, Bitget Wallet, SubWallet, Squid Router, Axelar, swappy.be (swaps from Discord), BlockSwapBot (swaps from Telegram), El Dorado, Houdini Swap, and DeFiSpot. Moving forward, the priority is to integrate Chainflip into Shapeshift as well as other major wallet providers like TrustWallet, Metamask, and Ledger.

The next major milestone for Chainflip is the implementation of Cross-Chain Execution support. This advancement builds upon the protocol’s existing Cross-Chain Messaging (CCM) capabilities, enabling developers to utilize the validator network to execute arbitrary code across different blockchains. This functionality will significantly enhance automation and allow for more complex cross-chain interactions that go beyond the current capabilities of existing messaging protocols. By doing so, Chainflip will expand its utility beyond simple asset swaps, facilitating a range of decentralized applications and operations.

Chainflip Growth

The core thesis for Chainflip as a protocol is that we will live in a multichain world where the demand for secure, efficient, and censorship-resistant cross-chain swaps is accelerating. As regulatory pressures increase globally, decentralized exchanges (DEXes) are capturing volume from centralized exchanges (CEXs) by offering sovereign and permissionless transactions that cannot be censored.

Chainflip is consistently breaking all-time highs in daily trading volumes, signaling robust and growing demand. This sustained increase is evident across various metrics—from weekly and monthly volume rises to the growth in the number of unique swaps, token holders, and active stakers. Such metrics underscore Chainflip’s compelling market fit and operational success even in the absence of airdrop expectations, a points system, or token incentives.

Each swap incurs a small fee, part of which is used to purchase and burn $FLIP tokens, thereby reducing supply and directly impacting the perception of the token’s value. This mechanism aligns with our investment philosophy that prioritizes buybacks and burns over traditional yield-sharing, as it creates continuous buying pressure and reduces supply, making the asset more attractive to both current investors and potential new entrants.

This explains why adding more chains and being supported across major wallet providers is so important. These expansions grow the Total Addressable Market (TAM) and enable Chainflip to tap into a larger volume of cross-chain transactions. More chains and integrations drive more volume, which increases the amount of fees being captured by the protocol.

Conclusion

Delivering a robust protocol for cross-chain transactions is a huge endeavor. As the space matures and demands higher liquidity and interoperability, Chainflip stands out as a protocol with a unique value proposition that complements Thorchain’s capabilities. Currently, there is a big valuation gap between the two, even though both are tackling the same challenges.

As a project with natural demand and product-market fit in the absence of excess incentives, Chainflip is making strides to catch up to THORChain in terms of adoption. The project’s roadmap promises to bolster this growth further through strategic wallet integrations and support for additional chains, all while reinforcing capital efficiency with its JIT AMM design.

Facing limited competition and with the use of $USDC as a base asset, Chainflip can reduce systemic risks while continuing to expand its trading volume. This is augmented by a buyback-and-burn mechanism that strengthens the intrinsic value of $FLIP, establishing a potential for deflationary supply dynamics that could be favorable for a long-term valuation.

All things considered, the key to Chainflip’s promise lies in its scalability and adaptability, with initiatives in place to extend its reach and deepen its market penetration.

References

On-chain Market Making actions

Disclosures

Revelo Intel has never had a commercial relationship with Chainflip and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.