Introduction

The rapid expansion of the crypto economy has highlighted the need for interoperability across various blockchain networks, leading to the development of numerous cross-chain technologies and bridges. These innovations have the goal to improve the functionality and accessibility of different ecosystems by enabling the seamless transfer of assets, akin to a SWIFT for blockchains. Traditionally, centralized exchanges (CEXs) have facilitated asset transfers across blockchains, but their centralized nature exposes them to significant limitations, such as custody risks and lack of transparency. In response, blockchain bridges emerged as a potential alternative, promising direct asset swaps without requiring centralized control. However, these bridges often face their own challenges, including security vulnerabilities, centralization concerns, and reliance on “wrapped” tokens, which can undermine the trustlessness and censorship-resistance of decentralized finance (DeFi).

Often mistakenly labeled as a bridge, THORChain is a L1 blockchain and cross-chain DEX designed to address these limitations by providing a scalable and economically secure settlement layer for cross-chain swaps on native assets. The core vision is to establish an autonomous, non-custodial, and trustless decentralized exchange (DEX) that facilitates direct swap between native Layer 1 assets, such as $BTC, $ETH, and others.

At the heart of THORChain’s ecosystem is its native token, $RUNE, which plays a pivotal role in securing the network and providing economic incentives. Throughout this document, we will explore how THORChain’s game-theoretical mechanisms ensure the network’s economic security. We will also analyze the token’s price reflexivity and discuss the roles of the key actors within the system—liquidity providers, swappers, traders, and node operators—each of whom interacts with $RUNE in distinct ways that collectively maintain the protocol’s stability and security. The document will further outline how THORChain leverages these game-theoretical principles to achieve a secure and efficient decentralized network, safeguarding the assets it hosts against potential economic threats.

Key Takeaways

- The Vision: THORChain is a Layer 1 blockchain built to create a decentralized, non-custodial, and trustless DEX, enabling direct swaps of native assets like $BTC, $ETH, and others across different blockchains without relying on centralized exchanges or traditional cross-chain bridges.

- Key Actors and $RUNE: the ecosystem revolves around four main actors—liquidity providers, swappers, traders, and node operators—each playing a crucial role in the network’s functionality. The native token, $RUNE, is the core element connecting these actors, providing liquidity, security, incentives, and governance.

- Economic security: THORChain utilizes game theory to ensure economic security, leveraging a Proof-of-Stake model where node operators must bond $RUNE. Also used as the base asset for liquidity pairs, this design aligns the incentives of all ecosystem participants, ensuring that the cost of attacking the network always exceeds the potential gains.

- Risks: THORChain’s economic model mitigates risks by ensuring that nodes are financially accountable for their actions through bonding. However, risks such as potential collusion among node operators and consensus challenges remain, highlighting the importance of ongoing monitoring, especially during periods of downwards volatility in $RUNE’s price action.

Background

THORChain is a Layer 1 blockchain created from first principles to minimize trust and establish a scalable, economically secure cross-chain communication and settlement layer. Launched in 2018 by a team of pseudonymous developers, THORChain’s primary vision is to build an autonomous cross-chain decentralized exchange (DEX) that enables users to directly swap native Layer 1 tokens across different networks. This is achieved in a non-custodial and trustless manner, eliminating the need for centralized exchanges (CEXs) or the complexities associated with cross-chain bridges.

Figure 1: THORChain – Key selling points

Source: THORChain Documentation, Revelo Intel

It is worth noting that, unlike cross-chain bridges, THORChain provides native asset cross-chain swaps instead of locking and minting wrapped tokens. For example, a user could swap native $ETH on the Ethereum network, for native $BTC, on the Bitcoin Network. Currently, 8 native assets are supported: $BTC, $ETH, $DOGE, $BNB, $ATOM, $LTC, $BCH, and most recently, $AVAX. Others like $SOL will be added soon, along with other fast-growing chains and ecosystems such as Sui or Aptos.

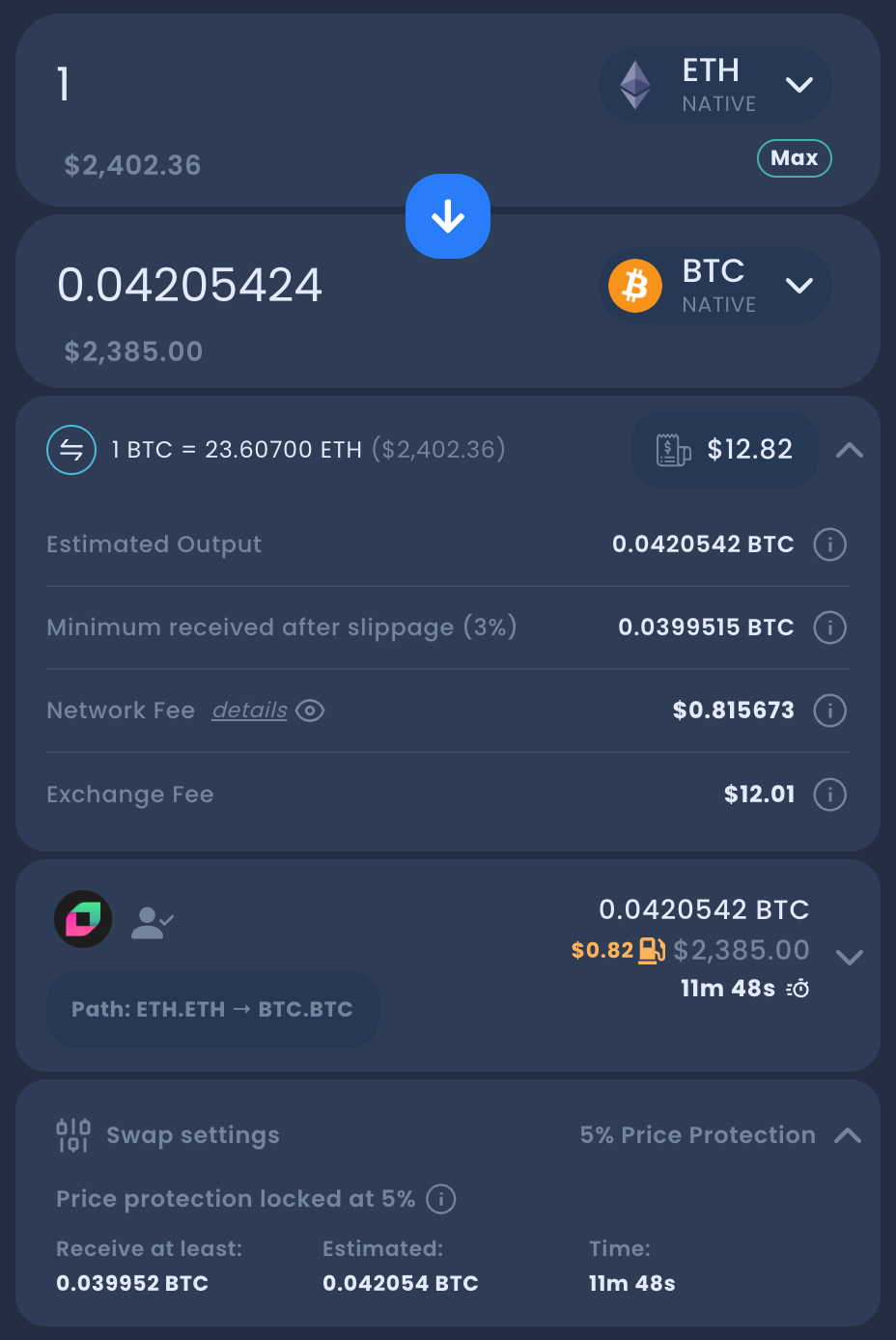

Figure 2: Swap between native $ETH and native $BTC

Source: THORSwap

THORChain draws inspiration from Tendermint and the Cosmos-SDK, incorporating Threshold Signature Schemes (TSS) to manage asset movements based on user transactions. Users simply deposit their trading funds into liquidity pools to facilitate cross-chain asset exchanges. The network monitors these deposits in its vaults and triggers business logic according to the transaction request, such as adding or removing liquidity, or swapping assets. The protocol operates as a state machine responsible for ensuring that its internal state remains in sync with other blockchains, enabling smooth asset transfers across diverse ecosystems with no double spend. This synchronization relies on one-way state pegs, which allow THORChain to accurately mirror the status of assets on connected blockchains in real time.

THORChain’s native token is $RUNE, which powers the THORChain ecosystem and provides the economic incentives required to secure the network. Thus, $RUNE plays key roles in terms of liquidity, security, governance, and incentives. Additionally, $RUNE uses a unique tokenomics design, where the token is used to pair with all native L1 assets, like $BTC or $ETH.

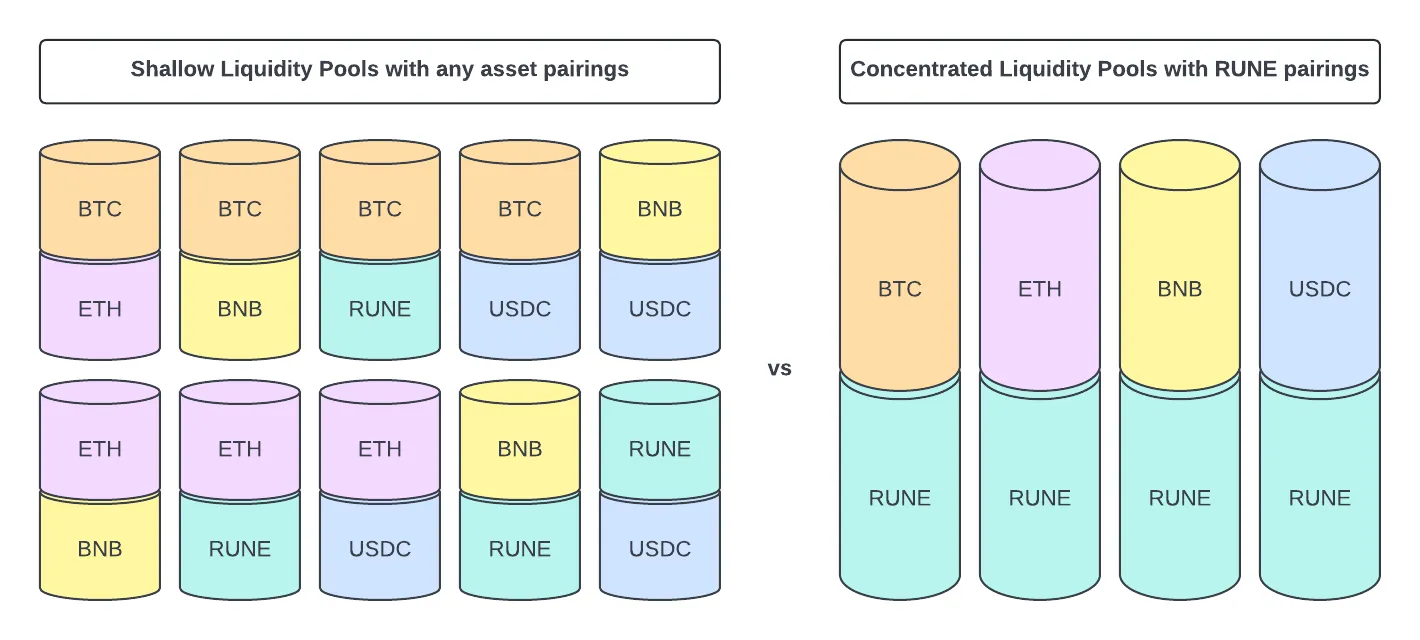

Figure 3: Using $RUNE as the base pair creates a single pool for each asset, paired with $RUNE, allowing any asset to be swapped easily between any other asset

Source: Nine Realms, published on Medium

This liquidity pairing design is implemented to allow the protocol to scale while making liquidity pools reliable. When a user swaps 2 connected assets on THORChain, they swap between two pools. For example, a swap between $ETH and $AVAX follow these steps: (1) swap $ETH for $RUNE in the $ETH-$RUNE pool, (2) move that $RUNE in the $AVAX-$RUNE pool, (3) swap from $RUNE to $AVAX.

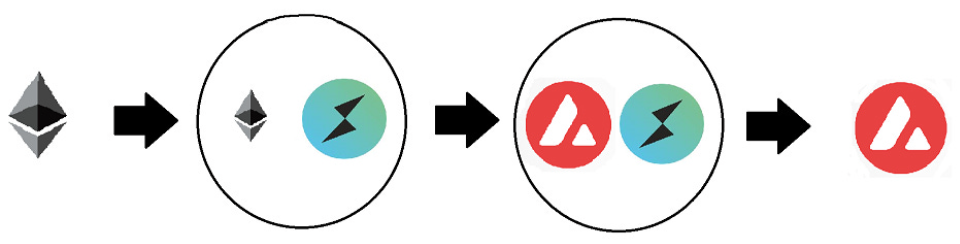

Figure 4: Swap from $ETH to $AVAX

Source: Revelo Intel

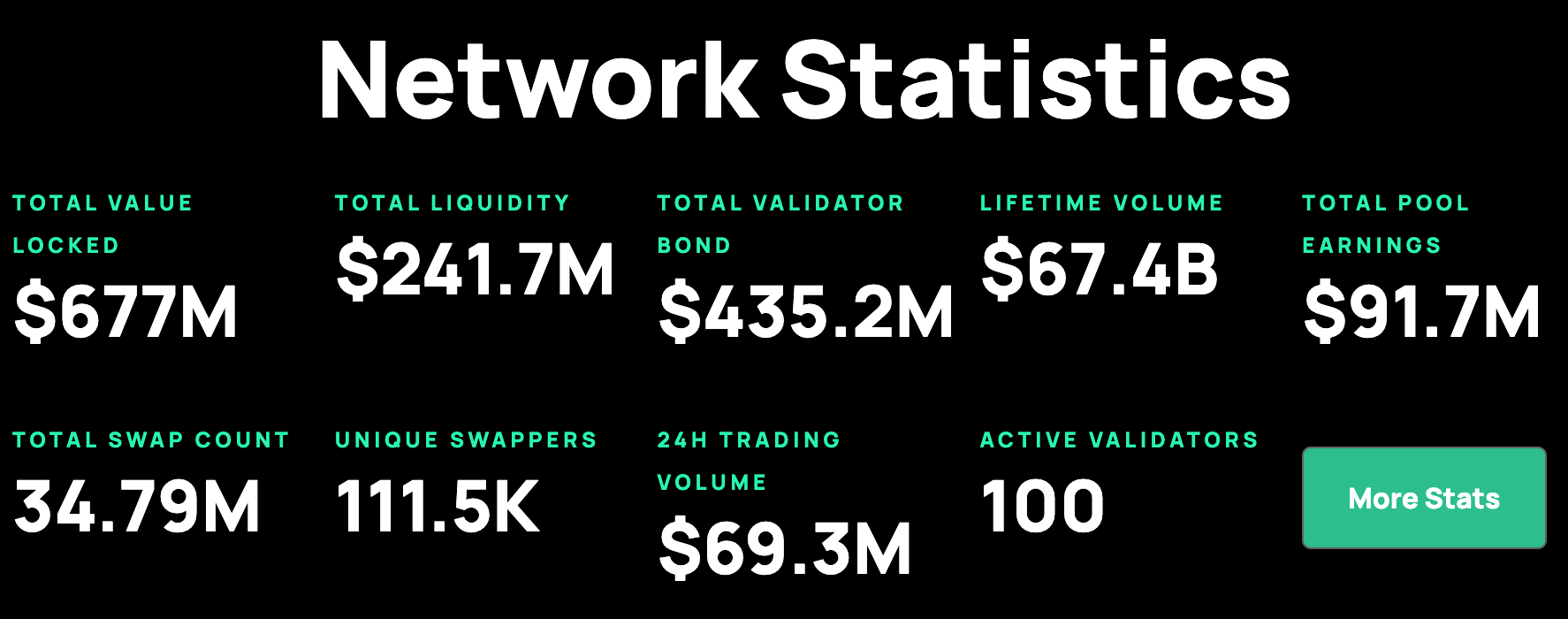

Although THORChain faced many challenges in its development (see here and here), it has grown to become a large protocol. As per the last Q2 2024 ecosystem report, between April and June, the network processed almost $14 billion in total swap volume, in large part by its largest integrators including Trust Wallet, THORSwap, THORWallet, ShapeShift, and Asgardex. New interfaces including Li.Fi and Cake Wallet have added support for THORChain swaps. Trade Assets were delivered — bringing a better swap experience to arbs and high frequency traders. Real-time network statistics of the protocol’s activity across various metrics are available from multiple sources (see here, here, and here).

Figure 5: THORChain Network Statistics

Source: THORChain Website. As of September 4, 2024

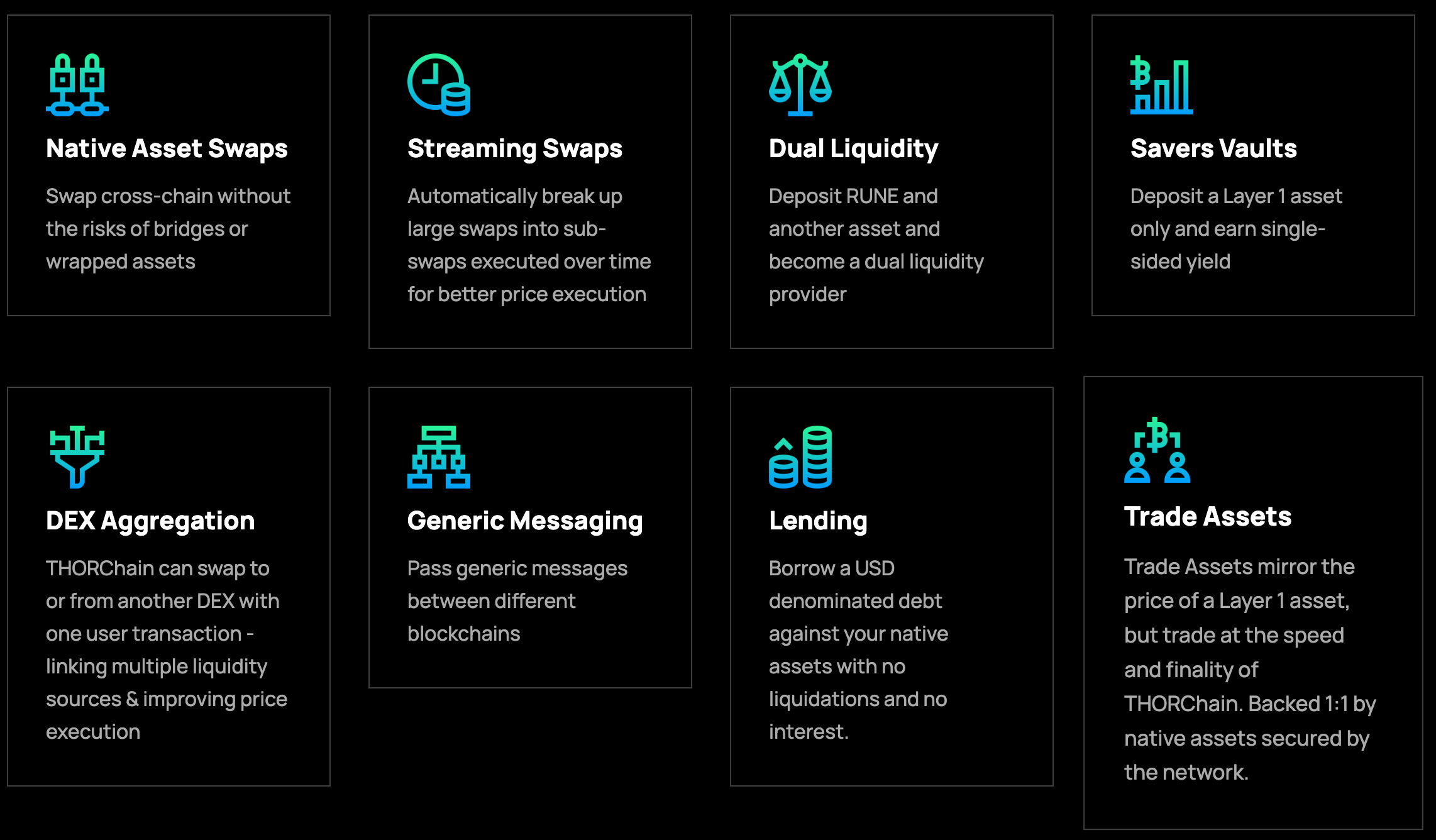

As skepticism around centralized exchanges (CEXs) grows, THORChain’s value proposition has become increasingly clear. The team continues to expand to new blockchains and introduce new features, such as Savers Vaults and Streaming Swaps. Savers Vaults simplify the process for users to deposit native Layer 1 assets on a single-sided basis, eliminating the need to pair them with $RUNE. Streaming Swaps offer a price-optimized trading strategy, particularly beneficial for larger swaps, by breaking them into smaller transactions over a maximum of 24 hours. This approach significantly reduces slip fees compared to traditional time-optimized trades.

Figure 6: THORChain main features

Source: THORChain Website

Key Actors and the Role of $RUNE

The four key actors within the THORChain network are: (1) liquidity providers, (2) swappers, (3) traders, and (4) node operators. Liquidity providers add liquidity to pools, earning fees and rewards in return. Swappers utilize this liquidity to swap native assets, paying fees for each transaction. Traders actively monitor and rebalance pools, paying fees but aiming to profit from arbitrage opportunities. Node operators secure the network by bonding $RUNE and are compensated for maintaining the system’s security and stability.

All participants in the THORChain ecosystem are united by $RUNE, the network’s native token. $RUNE powers the entire ecosystem, providing the economic incentives necessary for its operation and security.

Liquidity Providers

Liquidity providers (LPs) deposit their assets into decentralized pools that enable traders to swap between different assets. THORChain prioritizes the interests of LPs, recognizing them as vital to the ecosystem and implementing measures to protect their capital.

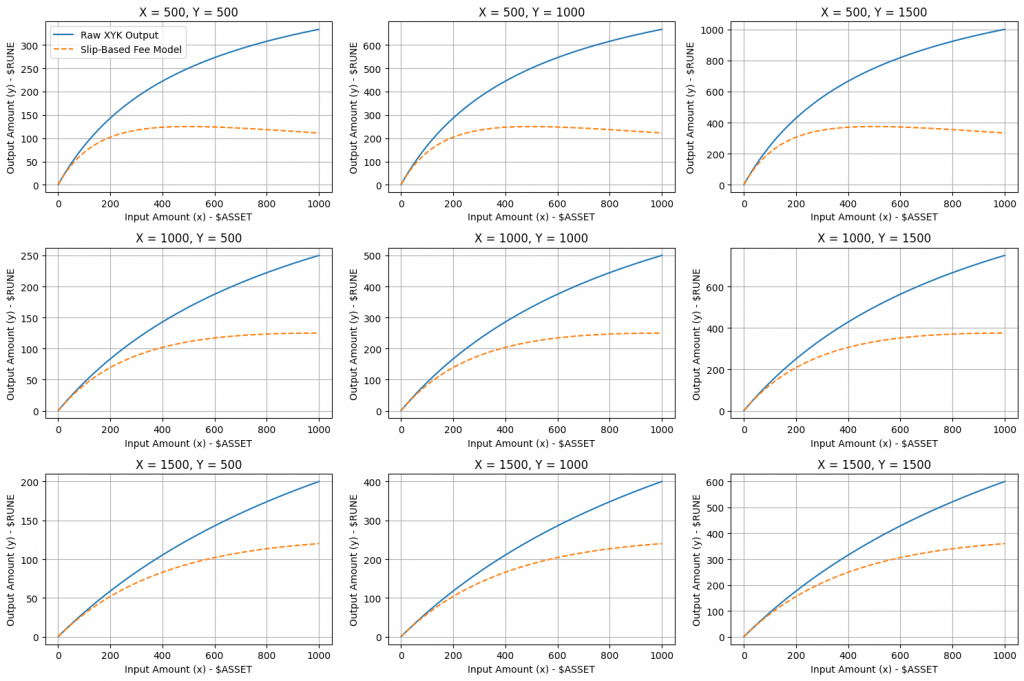

Unlike other platforms that rely on oracles or price feeds, THORChain employs an Automated Market Maker (AMM) algorithm tailored to its unique model. The primary function of the AMM is to offer deep liquidity, low transaction fees, and 100% uptime for users. Specifically, THORChain uses Continuous Liquidity Pools (CLPs) with a slip-based fee model that adds a liquidity-sensitive fee, modifying the traditional XYK model by adjusting fees based on the pool’s liquidity demand. The figure below illustrates the different behavior of the base fixed-product “XYK” model and the slip-based fee model, showing how the output amount, denoted as $RUNE, changes in response to varying input amounts of $ASSET under different balance conditions. Each chart represents a unique scenario with specific input ($ASSET) and output ($RUNE) balances. The base “XYK” model produces higher output amounts compared to the slip-based fee model, especially as the input amount increases. This difference reflects the impact of the slip-based model’s additional fee mechanism.

Figure 7: The Slip-based Fee Model adds liquidity-sensitive fee compared to the XYK model

As users swap assets within the liquidity pools, the underlying AMM generates fees, which are distributed proportionally among LPs. These incentives are based on either the slip-based fee value (if trades occur within a block) or the asset depth in each pool when no trades are processed. LPs earn rewards in $RUNE and the paired asset of the pool; for instance, a $BTC/$RUNE LP earns rewards in both $BTC and $RUNE. Yield is calculated on a block-by-block basis and is paid out to LPs when they withdraw their assets from the pool.

Swappers

Swapper are users who need to swap their digital native assets for other native assets across different blockchains. Swaps on THORChain require native assets, allowing users to trade between any connected assets, including $RUNE. For example, swapping $RUNE for $BTC involves sending $RUNE into the THORChain network and receiving $BTC from one of THORChain’s vaults. In this process, inbound gas fees are paid in $RUNE, while outbound fees are settled in the asset being received, such as $BTC.

Each swap incur a slip-based fee, with additional network fees for outgoing transactions. The slip-based fee is proportional to the liquidity demand, encouraging market participants to weigh the urgency of their trades. Impatient traders pay higher fees through direct swaps, whereas patient traders using streaming swaps benefit from potentially lower fees as the market adjusts to new price information over time. A network fee is also charged to cover the costs of processing each outgoing transaction, including dynamic gas costs, which are paid in the base asset of each chain. This network fee is calculated as a multiple of the trailing average gas fee for each network, providing stability despite fluctuations in external network gas costs.

Traders

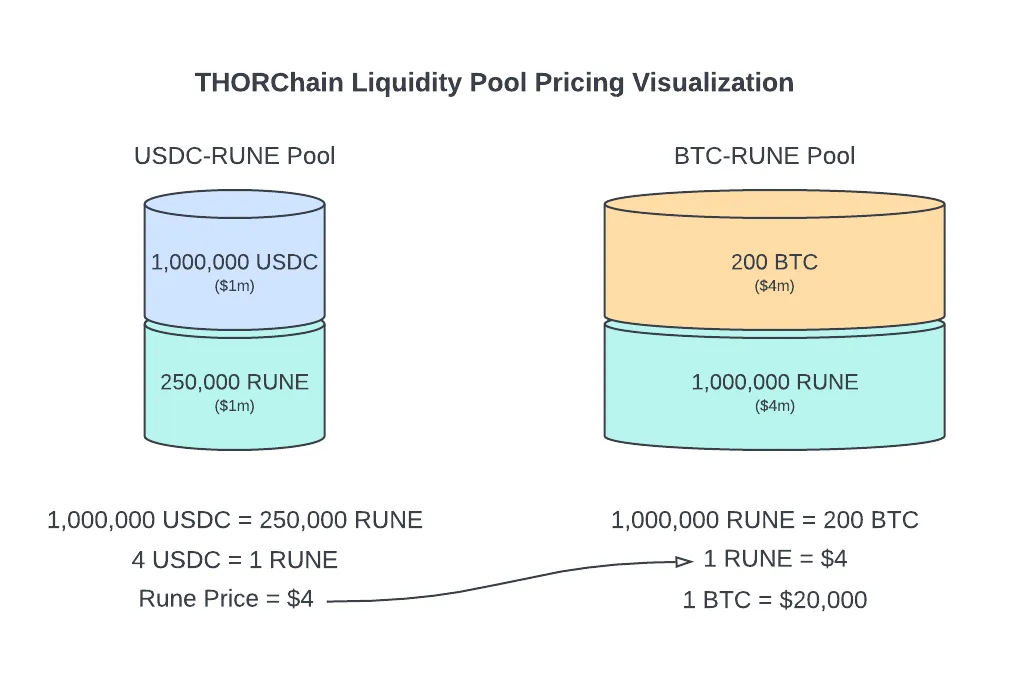

THORChain does not rely on oracles or price feeds, but on free market dynamics in the form of arbitrage to determine asset prices. Thus, traders play a key role in maintaining price balance across pools, taking advantage of price discrepancies between THORChain and external markets. These profit-driven traders and arbitrageurs actively look for asset mispricings, buying undervalued assets on THORChain and selling them on overpriced markets to earn a profit, or vice-versa.

As asset values within liquidity pools fluctuate, arbitrageurs continuously trade $RUNE and other assets, adjusting prices until they align with those in external markets. This dynamic ensures that THORChain’s pools remain competitively priced at all times.

Figure 8: THORChain liquidity pool pricing

Source: Nine Realms, published on Medium

In particular, traders actively compare THORChain’s exchange rates with those of external markets to exploit price differences:

- If an asset is priced lower on THORChain, they buy it there and sell it on an external market.

- If the price is lower on an external market, they purchase the asset there and sell it on THORChain.

This high-frequency, often automated process ensures that mispriced assets are quickly corrected, aligning THORChain’s prices with external markets over time. This mechanism eliminates the need for external resources like price oracles, as market forces naturally drive price convergence, indirectly driving chain activity in the form of both trading and network fees.

Nodes

As stated in the THORChain Whitepaper, nodes are second-class citizens that service the network in return for incentives. In contrast to LPs, while they are compensated for their service, they are also subject to removal should they fail to adhere to the platform’s standards.

To validate new blocks on the network, node operators must post $RUNE as collateral (bonding), which secures liquidity pool assets and deters theft. Anyone can bond the required capital and apply to become a node by depositing it into the system’s primary vault, becoming whitelisted to validate transactions. Every few days, some nodes are removed, and new ones with the highest bonded capital are added, keeping the network live, regularly refreshed, and secure. Nodes are eventually churned out, but they can also exit voluntarily, with their bond and rewards returned within hours. Exiting nodes can re-enter the network after purging and rebuilding their infrastructure to ensure they are up-to-date. Additionally, for security reasons, nodes should remain anonymous and avoid communication or coordination with others.

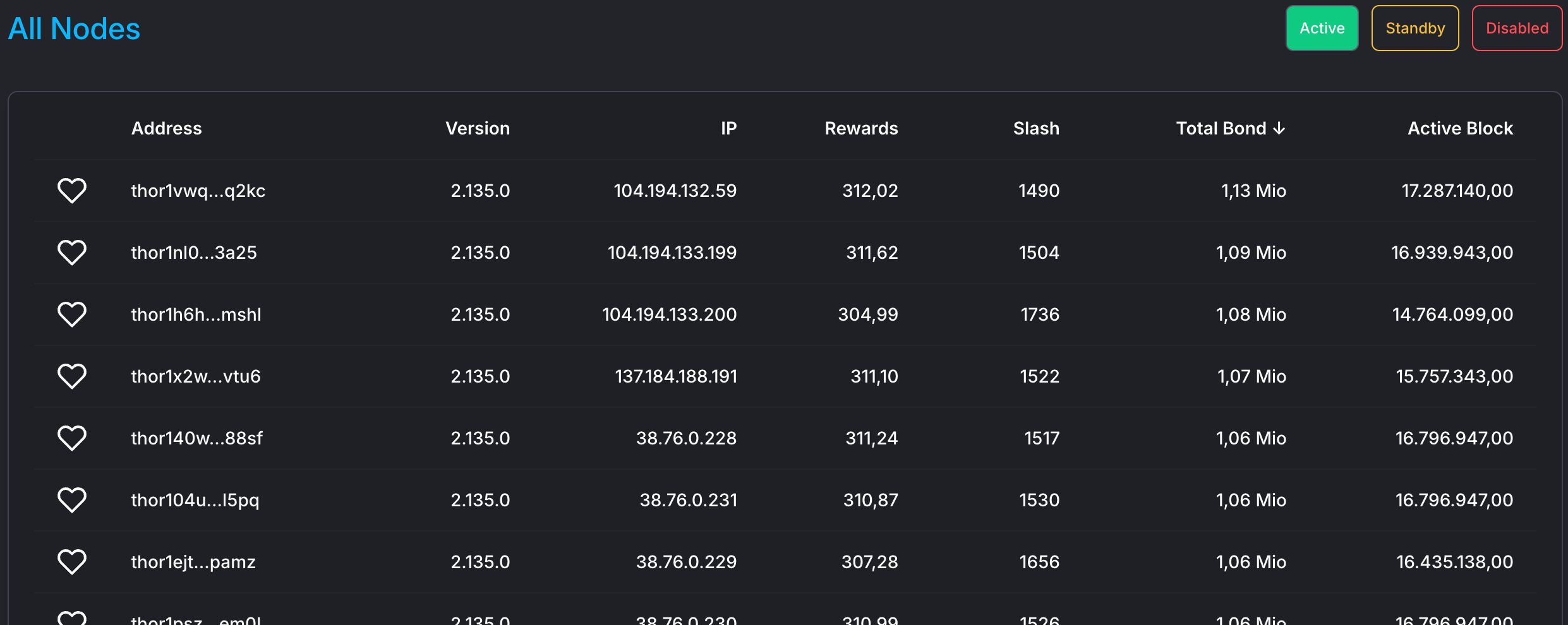

Although anyone can run a Node, running one requires a high level of technical skill and commitment. Each node operates as a cluster of several servers, and the best operators possess strong DevOps and software infrastructure knowledge. Node operators are often on a 24/7/365 on-call schedule due to their critical role in maintaining the network. Moreover, operating nodes costs between $2,000 and $3,500 per month, with expenses expected to rise as more chains are added. In addition to these costs, node operators must bond a minimum of ~300,000 $RUNE to participate as validators. Currently, there are more than 100 active nodes collectively staking over 100M $RUNE as a security deposit for the network.

Figure 9: THORNodes

Source: thoryield.com

In terms of incentive: (1) nodes are penalized for not making witness transactions, committing blocks or interrupting key signing ceremonies, (2) instead, assuming expected behavior, nodes earn continuous incentives that become available to them when they leave the network.

Economic security through game theory mechanisms

Economic security is the ability to create an economic game where rational actors will participate as desired. For THORChain to securely manage external assets, it must ensure that the economic cost of attacking the system always exceeds the value of the assets it protects. If the potential gain from an attack ever surpasses the cost to carry it out, the assets are at risk and not considered secure. In other words, an economically sound mechanism must ensure that the cost of corruption is greater than the profit from corruption (deterring any attempt to act against the rules of the network).

Overview

THORChain employs a Proof-of-Stake (or Proof-of-Bond) consensus mechanism to secure the network. In a PoS blockchain, attack costs are entirely capital-based, allowing the design of incentive structures that promote desired behaviors. By assuming participants are rational and profit-seeking, the security of the system can be objectively measured and aligned with these economic incentives.

There are three main assumptions upon which the network operates: (1) there is always less than 1/3 participation of irrational actors, (2) there is always less than 2/3 participation by colluding actors, and (3) the network asset is worthless if the network is attacked and assets stolen.

Irrational actors are not motivated by profit; their goal is to disrupt the network, preventing the redemption of any assets, whether bonded or staked. They are willing to incur costs with no expectation of financial gain. Such actors could include organizations aiming to shut down the network. The network can be halted if blocks are not committed or if Threshold Signature Scheme (TSS) signing sessions are repeatedly aborted. Colluding actors, on the other hand, are profit-driven and have established communication channels among themselves. They pool funds to become participants in the network and, through coordination, can potentially craft transactions that misappropriate the system’s assets—whether bonded, staked, or reserved. $RUNE, the network’s native asset, derives its value from being the settlement asset in all pools. If pooled assets are stolen, the liquidity of $RUNE collapses. Similarly, if bonded or reserved assets are taken, they cannot be redeemed, leading to a flood of new supply in the market and rendering $RUNE worthless.

To ensure assets are secure, the system needs the following: (1) knowledge of the value of all the assets it is securing, (2) knowledge of the value of the assets providing security, and (3) a means to drive behavior such that assets providing security are always more valuable than assets to be secured. THORChain achieves the first two points using CLPs. Instead, it achieves the third one using a reward system, the Incentive Pendulum, to keep an optimal balance of assets in the system.

As we will illustrate in the following sections, the $RUNE token and its utility are central to THORChain’s economic security model.

Securing the network: $RUNE

To ensure the cost of attacking the network remains higher than the value it secures, the Nodes’ bonded $RUNE capital must be at least equal to, or greater than, the pooled assets.

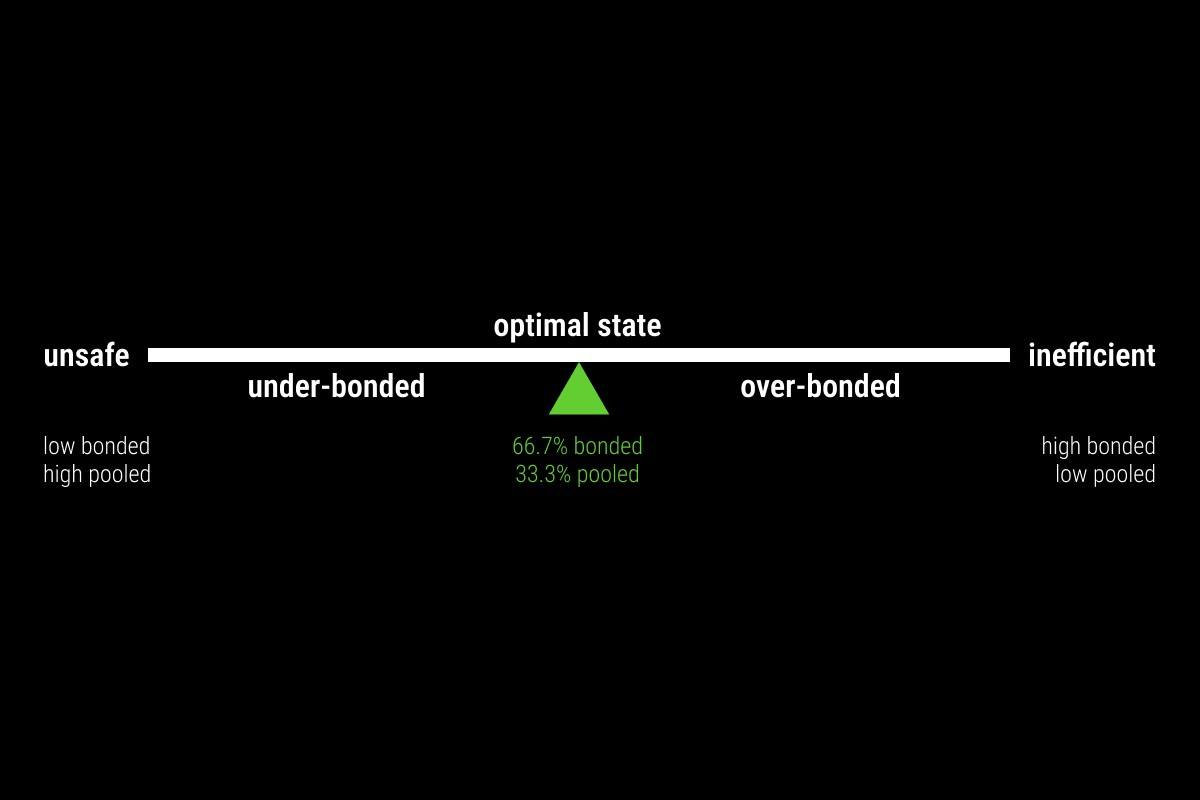

THORChain defines the Optimal State of capital distribution as two units of bonded capital for every unit of pooled capital. This game-theoretical approach disincentivizes anonymous node operators from stealing network assets, as they risk losing more capital than they could gain.

In this model, 100% of the bonded capital consists of $RUNE, while the pooled liquidity is composed of 50% $RUNE and 50% other assets. This distribution results in 66.7% of the total capital being bonded and 33.3% being pooled, placing significant economic pressure on node operators to bond 66.7% of the $RUNE TVL. When the system achieves this balance, it emits incentives to nodes and liquidity providers proportionately, ensuring both security and efficiency.

Figure 10: Bonded vs Pooled Capital – Optimal State

Source: THORChain Documentation

If a node attempts to steal assets, their bond is slashed by 1.5 times the value of the stolen assets, and the pools are reimbursed to make them whole. Additionally, nodes that misbehave face bond slashing, which enforces reliable service.

Keeping the network secure: the Incentive Pendulum

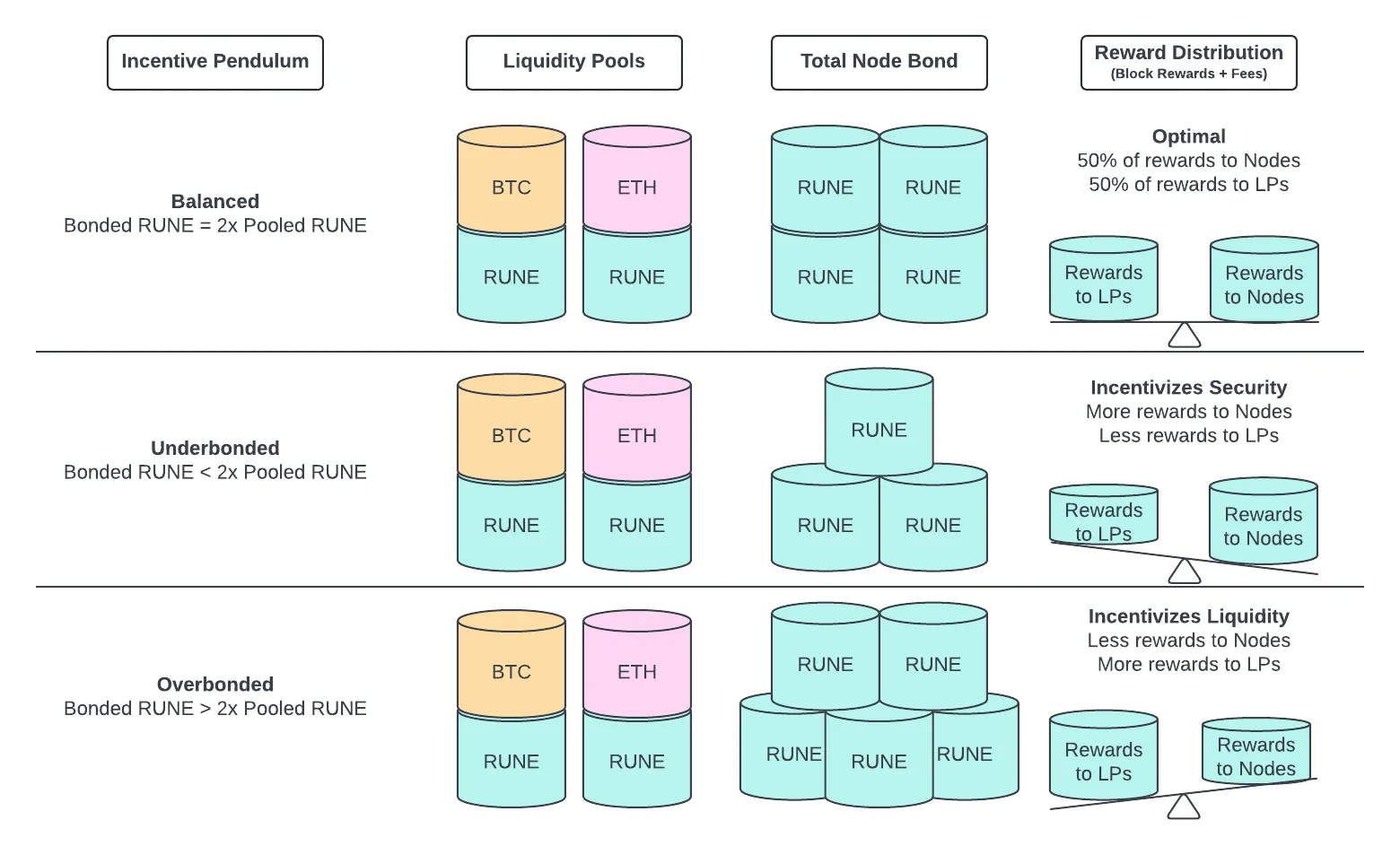

Since the assets secured by THORChain have free-floating market prices, the capital within the network can become imbalanced over time. This imbalance can manifest as either excess capital in liquidity pools or excessive capital bonded by nodes: (1) if there is too much capital in liquidity pools, the network is unsafe, while (2) if there is too much capital bonded by nodes, the network is inefficient. At any given time, THORChain can find itself in one of five main states depending on this balance.

Figure 11: THORChain 5 main capital distribution states – Bonded vs Pooled capital

Source: THORChain Documentation, Revelo Intel

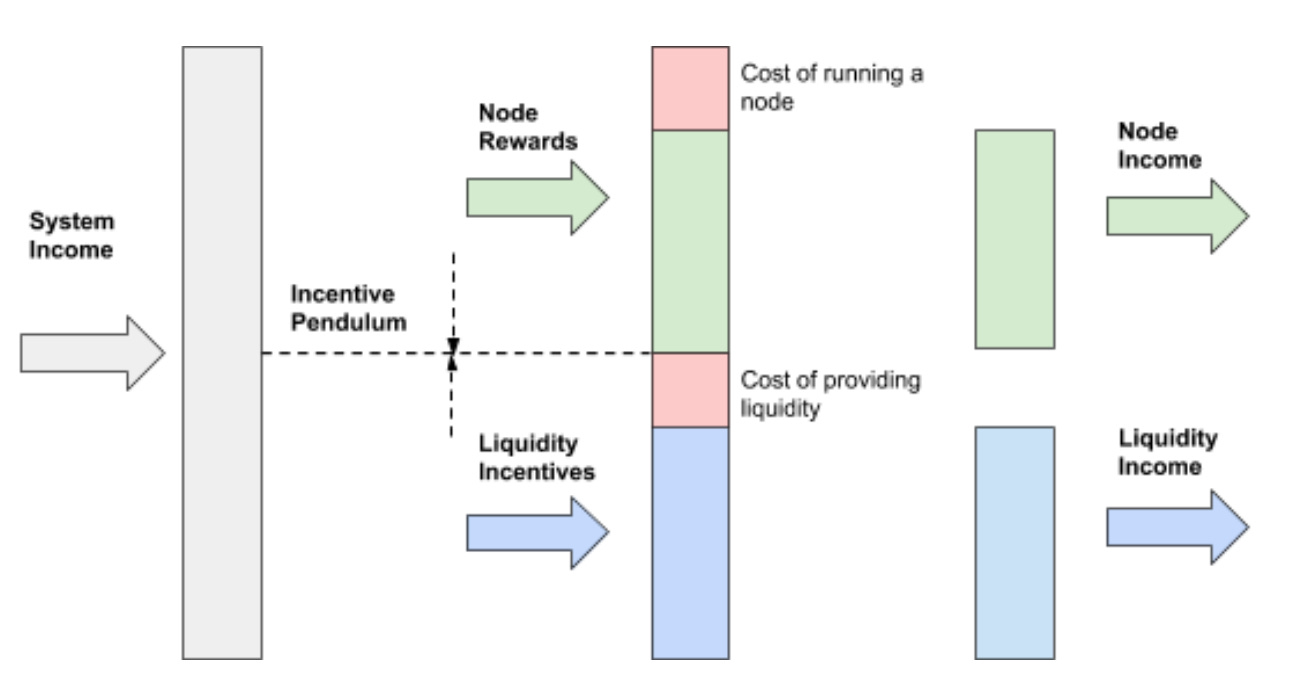

To maintain the network’s economic security, THORChain uses a mechanism called the Incentive Pendulum to drive the behavior of Nodes and LPs through economic incentives. This mechanism encourages participants to aim for an optimal capital distribution. In particular, the Incentive Pendulum determines how to allocate the System Income between LPs and Nodes, starting with a 67% to 33% split. After accounting for costs, the system adjusts the distribution to a balanced 50% to LPs and 50% to Nodes, ensuring stability and security.

Figure 12: Keeping the network secure through economic incentives: the Incentive Pendulum

Source: THORChain White Paper

The System Income is a representation of all of the income revenue generated by the protocol: (1) liquidity fees, and (2) block rewards. Liquidity fees, given as rewards to both liquidity providers and nodes, derive from the slip-based fee that swappers pay whenever they make a trade, which is based on how much a given swap causes the price of an asset to move. Block rewards are paid whenever a block is successfully added to the ledger, and they are paid to network nodes for taking part in consensus.

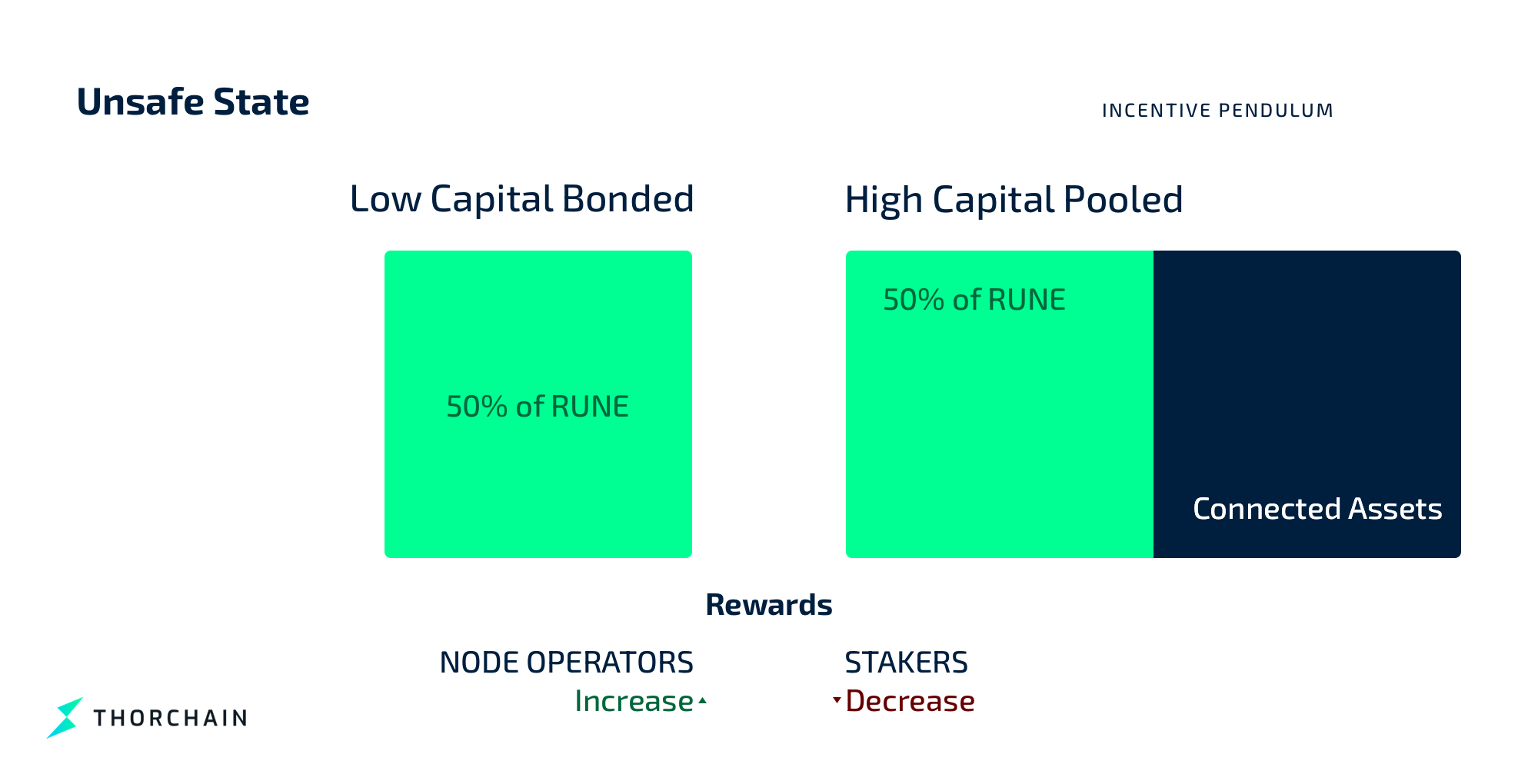

The worst state for the protocol is the Unsafe state, which occurs when the total value in the liquidity pools surpasses the value bonded by nodes. In this scenario, the vaulted capital exceeds the bonded capital, making the network vulnerable. Here, the vaulted $RUNE equals the Effective Security Bond, calculated as the sum of the bottom two-thirds of node operators’ bonds in a 50/50 split, highlighting the imbalance and increased risk to the protocol.

Figure 13: Bonded vs Pooled Capital – Unsafe State

Source: THORChain Documentation

This state is undesirable because it makes it profitable for node operators to collude and steal assets. To correct this, the Incentive Pendulum swings to favor bonders by increasing their rewards while reducing those for liquidity providers. This shift: (1) incentivizes bonders to commit more $RUNE to their bonds, thereby increasing the network’s security, and (2) discourages liquidity providers as their returns diminish. Over time, this rebalances the system, moving it back toward the optimal state.

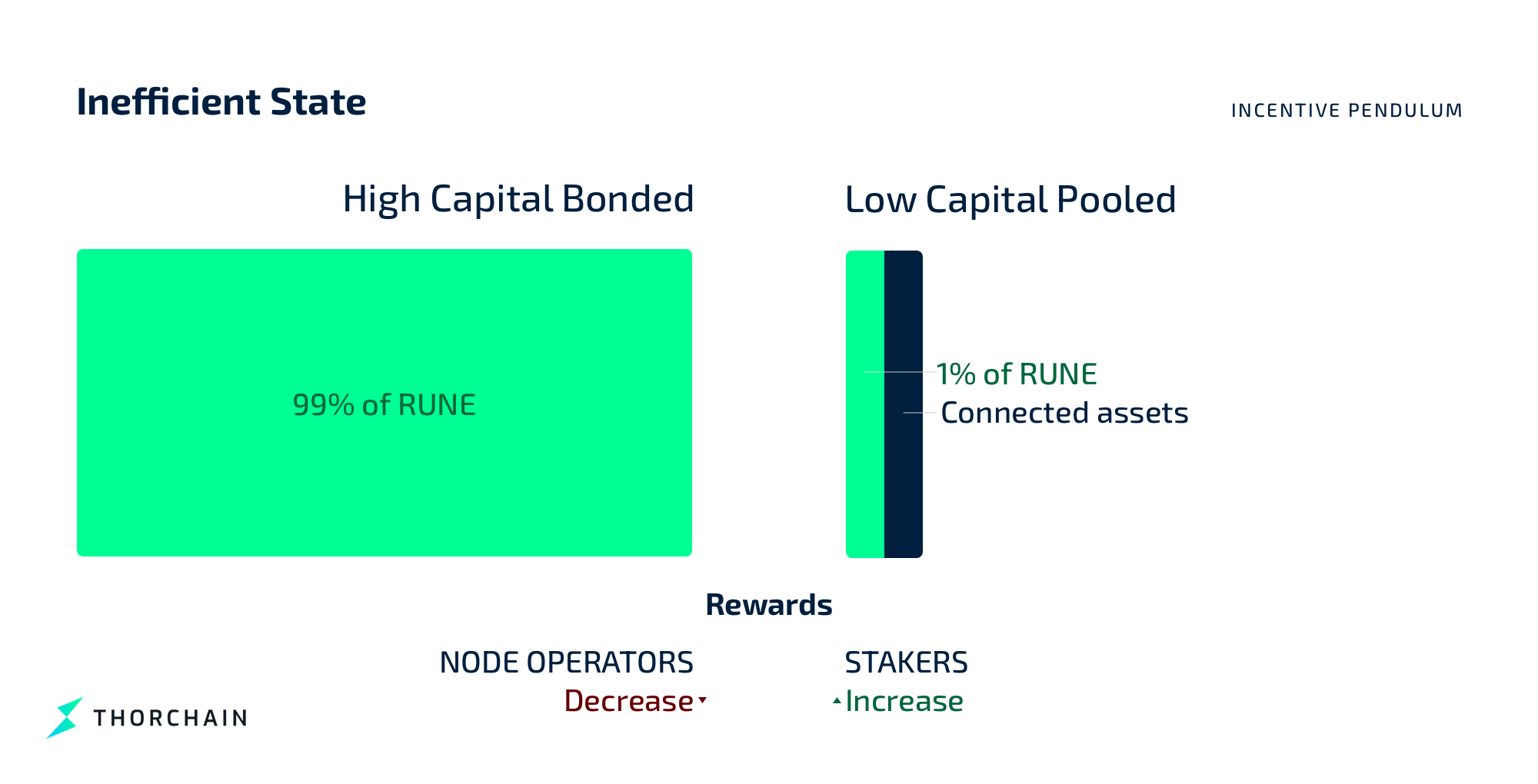

The opposite scenario is the Inefficient state, where bonded capital exceeds the value in the pools. In this case, much more capital is devoted to securing pooled assets than the assets are worth, leading to inefficiency. The pendulum then favors liquidity providers by increasing their rewards and reducing those for nodes. This approach: (1) motivates LPs to contribute more capital, enhancing pooled liquidity, and (2) prompts some node operators to withdraw their bonded $RUNE to seek better returns elsewhere. Additionally, to prevent security and efficiency imbalances, THORChain’s architecture includes a hard cap that pauses new deposits into pools once a certain threshold is reached, maintaining network stability.

Figure 14: Bonded vs Pooled Capital – Inefficient State

Source: THORChain Documentation

THORChain does not anticipate frequent occurrences of unsafe or inefficient states. Instead, the system is expected to be in the over-bonded state most of the time, especially as running nodes becomes more accessible. The under-bonded and over-bonded states are generally considered less severe intermediary conditions. An under-bonded state does not pose an immediate threat since it is not yet profitable for node operators to steal. Similarly, an over-bonded state is not problematic because the system continues to operate near efficiency.

In summary, the Incentive Pendulum dynamically adjusts the allocation of block rewards and transaction fees – the System Income – between node bonders and liquidity providers. The success of this mechanism relies on the assumption that market participants will respond rationally to the economic incentives presented.

Figure 15: The Incentive Pendulum

Source: Nine Realms, published on Medium

Beyond securing the network, $RUNE has two other important roles due to its use in both bonding and pooling. First, as the settlement asset for all pools, $RUNE ensures deep, concentrated liquidity across all assets. Second, its value is influenced not just by speculative factors but also by a deterministic component tied to its utility within the network.

$RUNE as a mean for concentrated liquidity

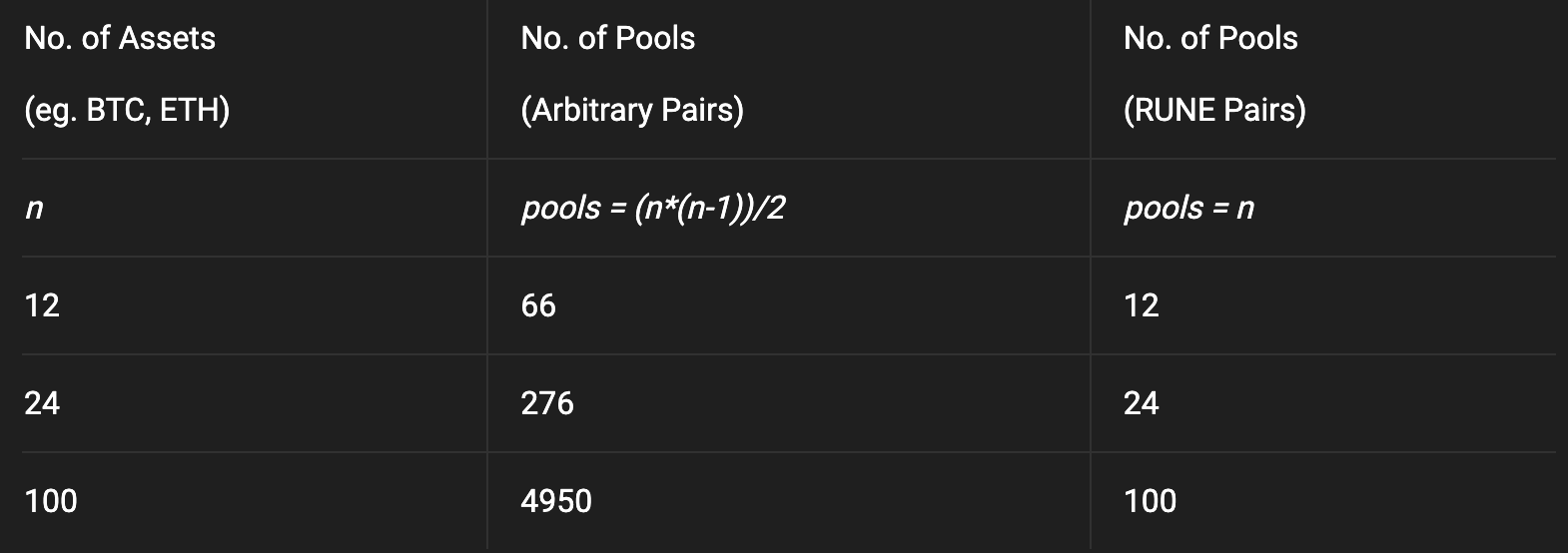

Liquidity is achieved by bonding each supported asset with $RUNE in pools, where the purchasing power of an asset is determined by the ratio of the depths of both assets. This makes $RUNE the settlement asset for all pools.

Pooling requires a 1:1 ratio between $RUNE and the external asset. For instance, a pool holding $100k in $BTC will also hold $100k worth of $RUNE, resulting in a 50/50 split between $BTC and $RUNE. Using $RUNE as the base pair for all pools prevents liquidity fragmentation by concentrating liquidity around a single settlement currency. Without a common settlement asset, each new asset would need to be paired with every other asset, creating hundreds of additional pools and diluting liquidity.

By using $RUNE as the base pair, any asset can be easily swapped with any other, improving swap execution and efficiency through deep and concentrated liquidity across the pools, unlike fragmented pools with low liquidity.

Figure 16: Solving the O(n^2) problem using $RUNE as the base pair for all pools

Source: THORChain Documentation

This design ensures that all assets are interconnected through $RUNE, enabling the network to always be aware of each asset’s price. Assets can be exchanged by placing one asset into its pool and specifying the desired asset, even if it resides in another pool.

As the value of pooled external assets fluctuates, the amount of $RUNE in the pool adjusts accordingly through arbitrage, either increasing or decreasing without necessarily altering $RUNE’s unit value. This dynamic keeps the system constantly aware of the value of the external assets it secures, as it is reflected by the total quantity of $RUNE across all pools. With this information, the network can use incentives to maintain asset security. Since $RUNE is the pooled asset, these incentives are directly paid into each pool, gradually increasing the amount of the paired asset through arbitrage. As a result, $RUNE liquidity incentives can generate real yield for liquidity providers (LPs).

The deterministic value of $RUNE

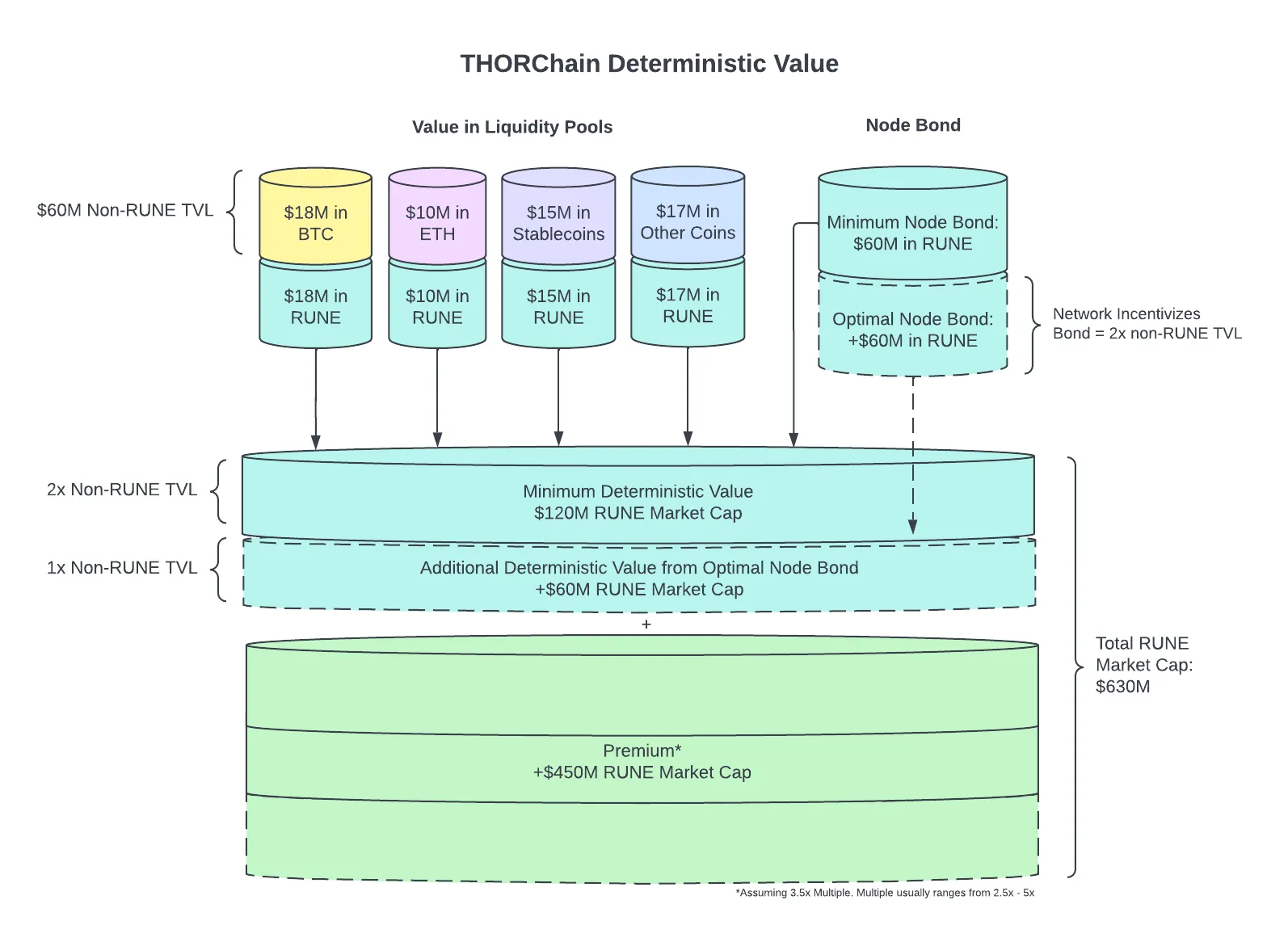

The price of the $RUNE token is influenced by two key components: (1) a deterministic value based on the liquidity within the network, and (2) a speculative premium above this deterministic value driven by market sentiment.

With the protocol’s design incentivizing an optimal 2:1 bond-to-stake ratio and a 1:1 pool ratio, the amount of $RUNE required in the network is three times the value of non-$RUNE assets locked. For instance, if $1M worth of non-$RUNE tokens are staked in THORChain, the market cap of $RUNE must be at least $3M. This means that as more native assets are added to liquidity pools, the baseline value of $RUNE rises proportionally. Therefore, the 3:1 ratio represents the minimum or deterministic value of $RUNE, forming the foundation of its price.

Figure 17: $RUNE deterministic value

Source: Nine Realms, published on Medium

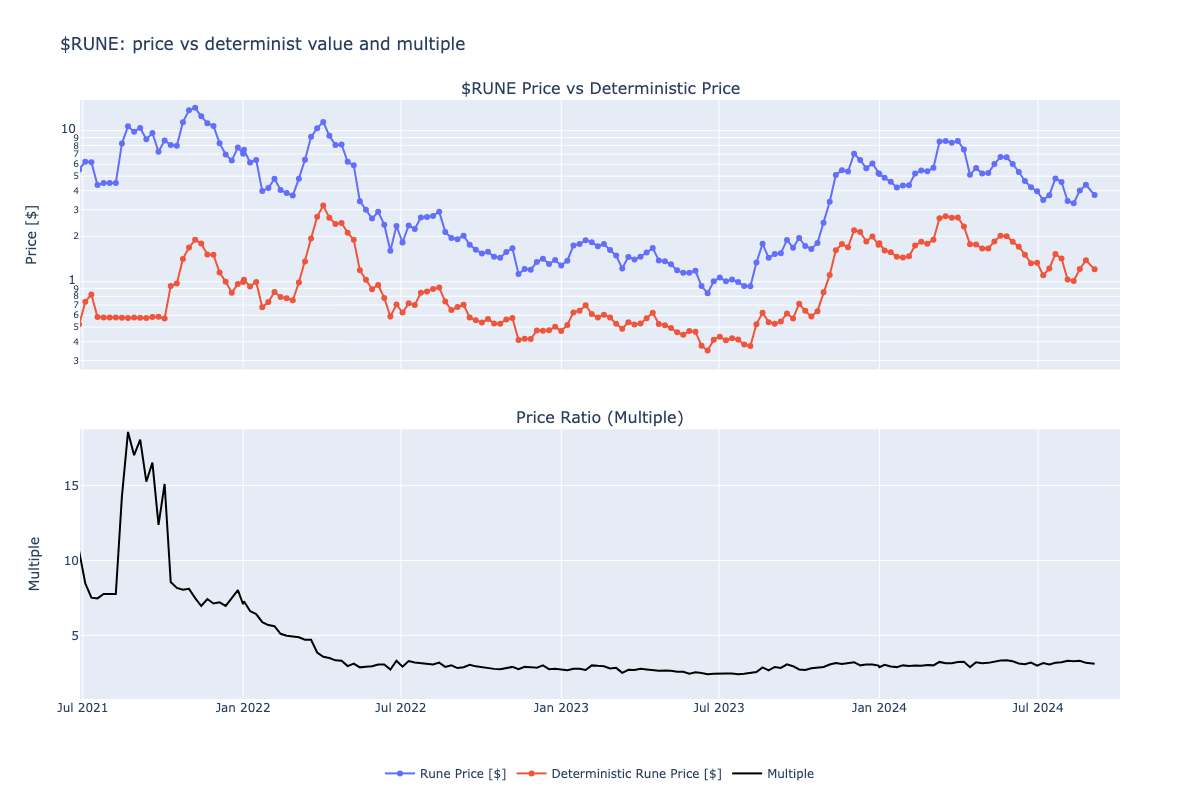

On top of that, like any token, stock, or asset in the world of finance, speculation around future value adds a premium or multiple to the baseline. Since half 2022, the multiple has stabilized around 3x, and it currently sits at 3.1x.

Figure 18: $RUNE price and multiple

Source: thorcharts.org, Revelo Intel. As of September 11, 2024. Weekly data, log prices

Economic Security Risks

The economic security of THORChain relies heavily on the game theory that ensures Nodes must pay for their bond, a core requirement for operating the blockchain. Without the bonding mechanism, a node could exploit the system by paying a minimal amount and profiting from stolen funds. Similarly, allowing public delegation could tempt a node operator to steal assets as soon as they are received. THORChain’s bonding mechanism prevents these behaviors, upholding the economic assumptions critical to the network’s security.

Despite THORChain’s $RUNE tokenomics being designed to incentivize honest behavior among Nodes, the network still faces three key consensus challenges. First, reaching consensus on witness transactions to ensure the correct state is pegged into the network based on the super-majority’s view. Second, achieving consensus on block construction, which includes the state changes derived from witness transactions. Third, agreeing on the generation of valid threshold signatures for outgoing transactions.

All three require a super-majority (67%), but the network remains agnostic about which bonded Nodes participate. By requiring each node to bond a significant amount of $RUNE, THORChain mitigates sybil attacks. Given $RUNE’s fixed supply and its availability on public markets, acquiring a majority becomes prohibitively expensive, leaving collusion among a super-majority of Nodes as the primary attack vector, which could compromise the network despite economic penalties.

Another potential risk arises because THORChain secures external assets and allows nodes to exit voluntarily, potentially causing the node count to fall below the threshold needed for consensus. THORChain counters this by initiating a global shutdown, returning all assets to their original owners, thereby maintaining asset security. Since $RUNE is accounted for on a separate chain, the network retains the ability to restart after a global shutdown, ensuring continuity and security throughout its lifecycle.

Conclusion

THORChain offers a solution to the limitations faced by centralized exchanges and traditional cross-chain bridges. By enabling direct swaps of native Layer 1 assets, THORChain provides a decentralized, non-custodial, and trustless platform that enables users to exchange native assets seamlessly across multiple blockchains. This unique capability not only improves interoperability in the crypto ecosystem but also minimizes the security and centralization risks associated with conventional asset transfer methods.

Central to THORChain’s economic security is its native token, $RUNE, which functions as the backbone of the protocol’s game-theoretical design. Through mechanisms such as the Incentive Pendulum, THORChain ensures that rational actors within the network—liquidity providers, traders, swappers, and node operators—are incentivized to behave in ways that preserve the system’s stability. By requiring node operators to bond $RUNE, the protocol creates a secure environment where the cost of an attack outweighs the potential gains, thereby safeguarding the network’s assets.

THORChain’s model of using $RUNE to pair with every asset not only drives liquidity but also supports the network’s economic equilibrium, allowing it to dynamically adjust rewards and penalties to maintain optimal capital distribution. This approach enables the alignment of incentives among all participants, ensuring that the protocol remains efficient, secure, and resistant to collusion or misconduct.

As the demand for cross-chain interoperability continues to grow, THORChain offers a truly decentralized alternative to centralized exchanges and bridges.

References

Nine Realms, (2022) THORCHain Tokenomics – What is $RUNE?. Published on Medium | Link

Nine Realms, (2024) THORChain Q2 2024 Ecosystem Report. Published on Medium | Link

Rebase, (2020) THORChain Spotlight | Link

Revelo Intel, (2024) THORChain Project Breakdown | Link

THORChain Dev Docs | Link

THORChain Docs | Link

THORChain Website | Link

THORChain White Papers | Link

Disclosures

Revelo Intel is engaged in a commercial relationship with THORChain as part of an educational initiative and this report was commissioned as part of that engagement.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.