Introduction

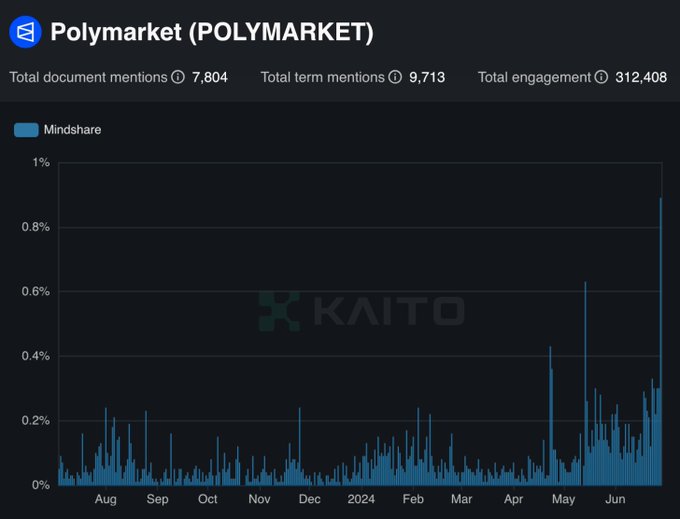

The increasing liquidity and mindshare of crypto-based prediction markets like Polymarket have captured increasing sums of attention, ramping up as we approach the US Presidential elections. Following the latest $70M raise by Polymarket, which is positioning itself as the market leader, the $AZUR token launch, and the advent of new exchanges built on top of the Monaco protocol on Solana, we are starting to see the first signs of adoption in this market sector. Given that we expect to see more competitors entering this segment, each with their own token, the following report will highlight some of the setbacks and challenges that these projects might face in the race for market share and user retention.

Source: Kaito.ai – Prediction Markets are attracting more mindshare, driven by the ambition to replace legacy media with decentralized sources of information that are aggregated through permissionless markets and citizen journalism

Stemming from well-known economic challenges like the no-trade problem, crypto prediction markets might be subject to the same fate as their Web2 counterparts. Even though regulatory barriers are often cited as the primary impediment, it might actually be the lack of substantial demand that remains the core issue. This report will explore why these markets could struggle to gain traction despite the expectation of sudden bursts of attention in the upcoming months.

Key Takeaways

Regulatory Concerns: In addition to lack of regulatory clarity for crypto, the legal frameworks are also unclear for prediction markets, where potential insider trading and concerns around market manipulation might deter broader participation.

Demand Issues: Prediction markets suffer from low liquidity, limited appeal to gamblers, and insufficient interest from sophisticated traders, leading to no-trade scenarios.

Potential Adoption: The potential for crypto prediction markets lies in their ability to leverage decentralized structures, token incentives, and improved market mechanisms – ultimately enabling opportunities that aren’t possible off-chain.

Liquidity Solutions: Innovations at the mechanism design level or the introduction of yield-bearing stablecoins could enhance the attractiveness to engage with and provide liquidity to these markets.

Overview

Event markets have fascinated humans for centuries, from ancient Olympic bets to modern stock trading. Historically confined to specific domains like sports and finance, these markets can allow for betting on virtually anything. This has inspired many entrepreneurs of the modern age, ranging from Luke Nosek, co-founder of Paypal who once tried to tackle this challenge, to Sam Bankman-Fried when FTX was still operational. Large sums of Venture Capital money have been allocated to start-ups such as Kalshi (a CFTC-compliant prediction market), Manifold (a paper-money prediction market), and Polymarket (a crypto-based prediction market).

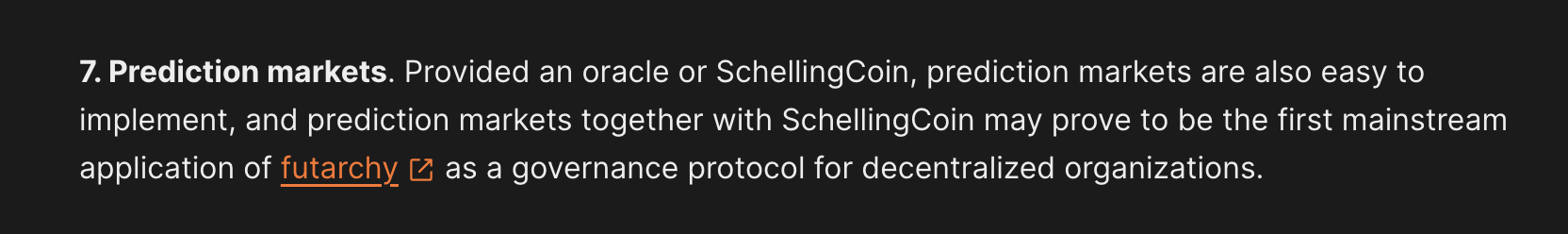

Prediction markets are platforms where users trade contracts to speculate on the outcomes of future events. Since the early days of crypto, they have been one of the most highly anticipated use cases, even praised by thought leaders like Vitalik in the Ethereum Whitepaper.

Source: Ethereum Whitepaper – The Ethereum Whitepaper highlighted prediction markets; bringing together multiple components of crypto, such as oracles, stablecoins, decentralized governance, etc

The central thesis is that a diverse set of independent users are likely to make more accurate predictions than individuals or even experts alone. The key elements for this collective intelligence include diversity of opinion, independence, decentralization, aggregation, and trust, which contrast with the failures of groupthink and emotional bias (i.e. if you want to know how a company is doing, would you visit the office and go through its official reports, or would you look at its stock price?).

Prediction markets find practical applications in business, economic, and social settings for forecasting or making strategic decisions. For instance, companies like Google, Microsoft, or HP use prediction markets to forecast product launch dates, new office openings, and other things of strategic importance. This is conducted in private markets for statistical forecast purposes. In 2007, companies from the United States, Ireland, Austria, Germany, and Denmark formed the Prediction Market Industry Association.

Source: Balaji on X – “Today the free world is online, while Washington itself is the Kremlin. So we do Kremlinology through digital prediction markets that the state can’t stop.”

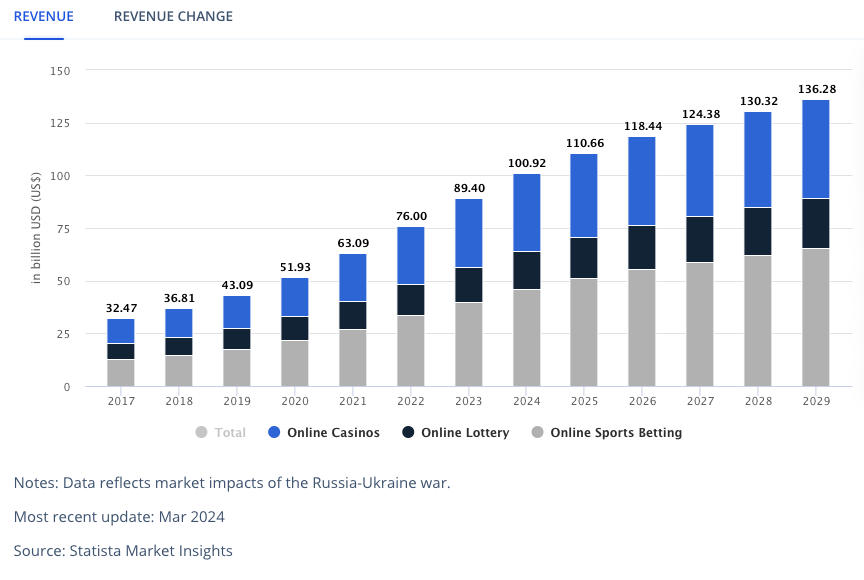

However, similar to their Web2 counterparts, they continue to struggle to gain mainstream adoption beyond a small number of notable and highly anticipated events such as the US elections. Most retail users feel more attracted to the thrill and quick turnaround times of sports betting, while institutional investors don’t really engage with zero-sum markets.

Source: Statista – The gambling industry has seen accelerated growth, indicating a broader appetite for high-risk activities

With the US elections on the horizon and Polymarket becoming the most dominant reference for calculating presidential odds, a series of questions are worth revisiting:

- Will prediction markets manage to keep the momentum going beyond the elections?

- Is crypto the most efficient medium to trade this market and capture liquidity?

- Does society really care about aggregating censorship-free, self-governing, and disintermediated information?

- Is there utility in tokenizing positions beyond regulatory arbitrage?

- Will crypto prediction markets suffer the same fate and lack of demand as their Web2 predecessors?

- Can token incentives help to bootstrap liquidity and solve the cold start problem?

- What’s the utility beyond speculation? Do the predicted odds translate into actual probabilities?

- How might future regulations impact the usability and accessibility of prediction markets?

- Are there any ethical considerations involved with using prediction markets?

In crypto, the current user base consists of people who bet on asset prices, the value of points, APYs, and other narratives on a daily basis, expressing their opinion and having skin in the game at the same time (i.e. a costly endeavor for people with wrong beliefs and a profitable business for those with accurate ones). Being invested in this industry is often seen as an analogy to owning a perpetual call option on human greed. People like to gamble on anything, and prediction markets are the tool that permeates these instincts in our daily lives.

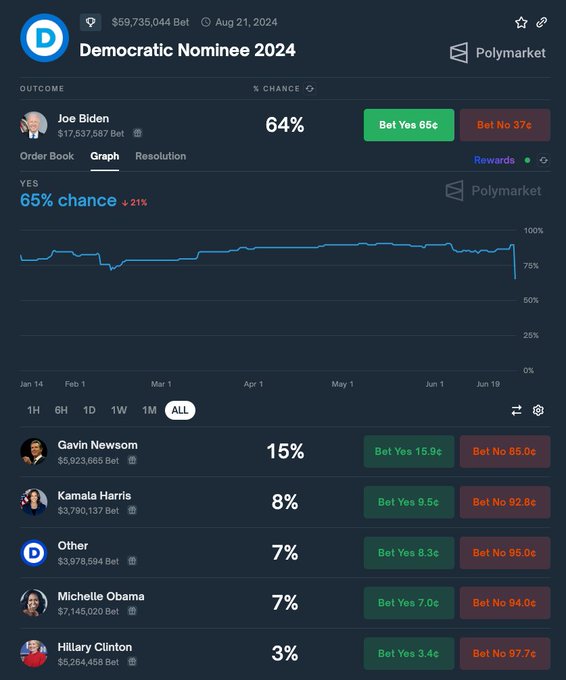

Source: Polymarket – With over $150M staked on the outcome of the US elections, Polymarket has become the most liquid market (also considering non-crypto platforms), almost doubling the peak volume reached in 2021 for all crypto-based prediction markets

The US Presidential elections are around the corner, and the consensus is starting to grow in crypto circles that, this time for real, prediction markets are here to stay. While we don’t necessarily challenge that notion or present a pessimistic outlook on this market sector, the content below will highlight some of the challenges and obstacles that still lie on the way to mass adoption. Presenting both ends of the spectrum is critical to make an informed decision and be prepared for when the time comes to invest in these tokens.

Background

The first records of political betting date back to 1503, wagering on the papal election. During the 16th and 17th century, betting was the prevalent way to choose government officials. There are various instances of political betting and papal selection in the period during the 18th to the 20th century.

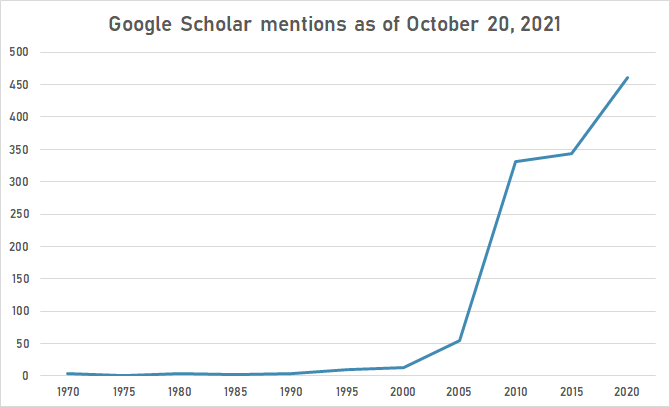

It wasn’t until the early 1990s that research of prediction markets took off, with academic interest in their potential to aggregate information and forecast events accurately. These markets allow participants to buy and sell contracts based on the outcome of future events, theoretically enabling the crowd to arrive at more accurate predictions than individual experts.

Source: Timeline of Prediction Markets – Google Scholar mentions skyrocketed in 2005 after the idea of prediction markets filtered through economic theory and behavioral research literature.

In 1945, the economist Friedrich Hayek published the essay The Use of Knowledge in Society, in which the author suggested that information is decentralized within an economy, and that aggregating such information could contribute to enhancing market efficiency. This was selected as one of the 20 articles published in the American Economic Review. The piece laid the groundwork for understanding how markets could aggregate dispersed knowledge efficiently.

Years later in 1961, the Federal Wire Act in the US, aimed at preventing interstate gambling, influenced the regulatory environment for betting and wagering, indirectly affecting the development of prediction markets. During the 70s, the concept of a prediction market was formally used in a science fiction novel titled The Shockwave Rider by Jonh Brunner. One decade later, the first notable real-world application came in 1988 with the Iowa Political Stock Market, which was intended to serve for educational and research purposes during the US Presidential Election.

Origins and Evolution

The concept gained traction with projects like the Iowa Electronic Markets (IEM) and Intrade, which demonstrated the practical application of prediction markets in forecasting political and financial events. They became highly popular during the 1988 US presidential election. However, these traditional prediction markets faced liquidity challenges and operational constraints, limiting their growth and adoption. Creating a market with enough participants to ensure accurate price signals was difficult. This could lead to situations where trades were infrequent, making it hard to get a clear prediction.

In addition to the liquidity problems, there were other blocks on the road. Even though HedgeStreet was designated in 1991 as a regulated market by the Commodity Futures Trading Commission (CFTC), the sentiment rapidly shifted during the 2000s. In 2001 there was a proposal by the U.S Information Awareness Office (IAO) to create a futures exchange, the Policy Analysis Market (PAM), based on an idea first proposed by Net Exchange, a San Diego, California, research firm specializing in the development of online prediction markets. However, this initiative ended up being shut down after an analysis was published in 2003 by the U.S Department of Defense on their website. US Senators Byron L. Dorgan and Ron Wyden claimed that PAM would allow trading for coups d’états, assassinations, and terrorist attacks. Within less than a day, the Pentagon announced the cancellation of PAM.

Source: AZQuotes – Critics stated that the idea of betting on highly controversial topics was not only useless but also highly offensive

In 2006, the Unlawful Internet Gambling Enforcement Act in the US restricted online gambling, affecting prediction markets. Intrade and other platforms faced regulatory actions from the CFTC for violating trading bans.

Introduction to Crypto

With prediction markets being mentioned as a key use case of blockchains in the Ethereum Whitepaper, it was only a matter of time until builders picked it up and figured out how to bring this idea to market. The permissionless and pseudonymous nature of blockchains provided a solid foundation to bypass regulatory hurdles and bootstrap liquidity.

Augur was one of the first decentralized prediction markets on Ethereum. Founded in 2014 by the Forecast Foundation, it didn’t launch until 2018 despite crowdfunding in 2015. It allowed users to create and trade on event outcomes, utilizing the $REP token for dispute resolution and market creation. The idea was to allow anyone to bet anything. However, the high gas costs and poor UX of Ethereum at the time made it very difficult to scale in number of users and amount of liquidity.

Another prominent player was Gnosis, which focused on providing infrastructure for decentralized prediction markets. Founded in 2015 by Martin Köppelmann and Stefan George, they were the first to launch an application on top of Ethereum. Originally they intended to compete against Augur with the now discontinued Gnosis Olympia. Since then they have focused on spinning up services and applications such as Gnosis Safe and CoW Protocol among others.

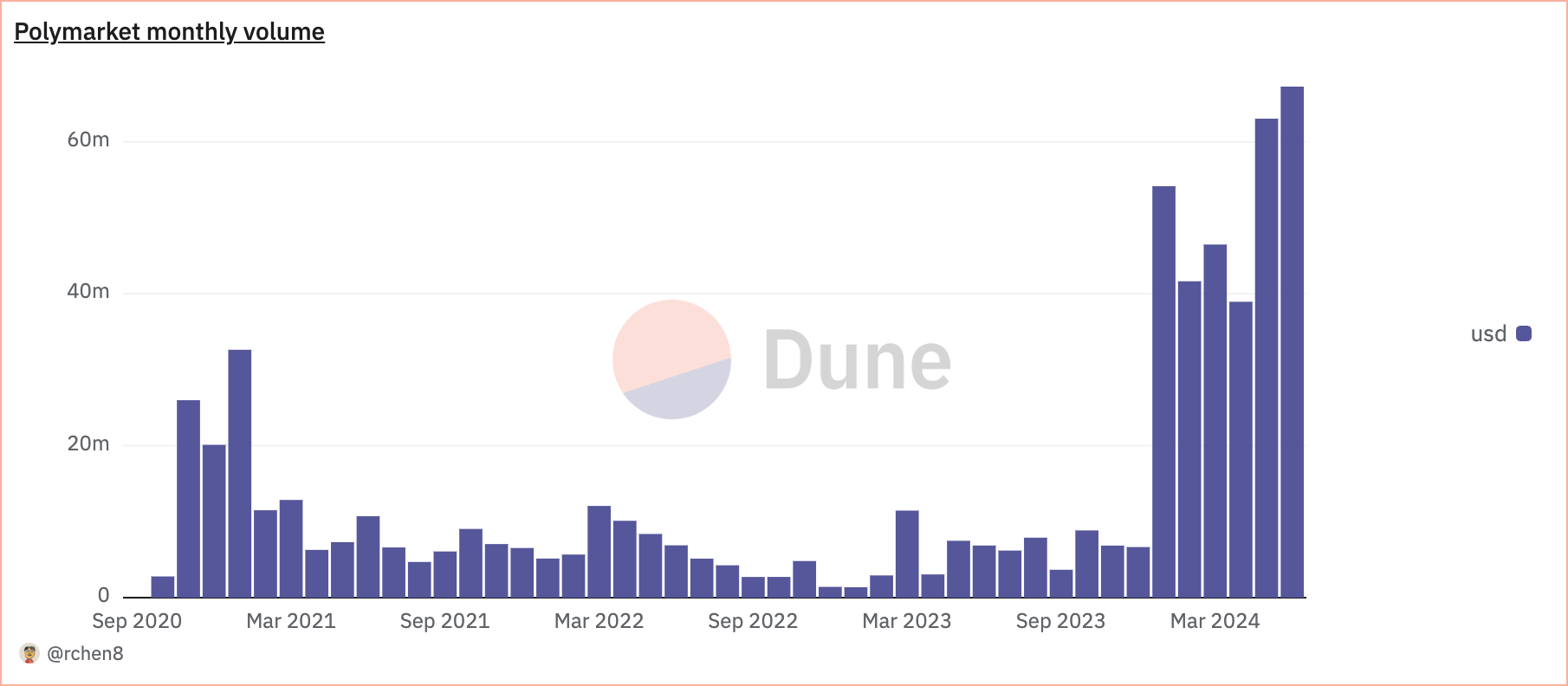

Most recently, Polymarket has become the most dominant protocol and market leader, even surpassing Web2 contenders. This can be attributed to its user-friendly UX and ability to attract liquidity. With L2 scaling solutions and more efficient market designs, we have come a long way to enable permissionless market creation and allow for unconstrained liquidity layers that can support multiple markets at a time.

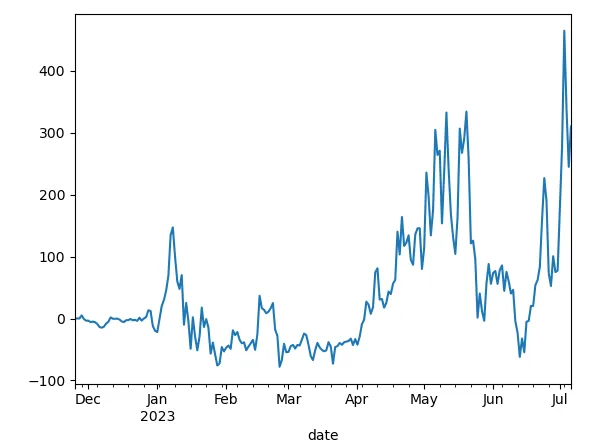

Source: Dune dashboard by rchen8 – Polymarket’s volume has been on the rise since the start of 2024

Besides L2s, reliable oracles and stablecoins have significantly contributed to the greater adoption of prediction markets, ensuring that outcomes can be transparently verified and bets can be settled on-chain. Together, they create a more attractive and user-friendly environment for participants. However, despite the most recent growth in popularity, there are still issues that might slow down the rate of adoption beyond a few key events such as Presidential Elections and other infrequent events.

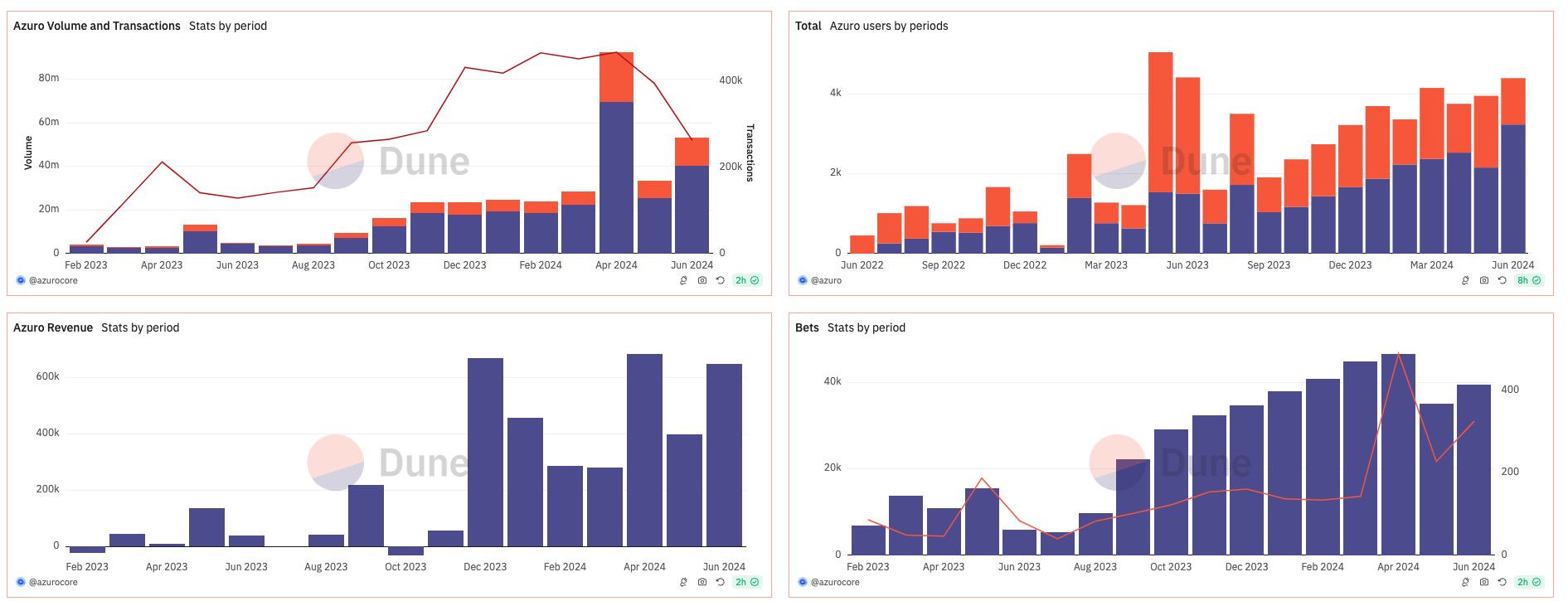

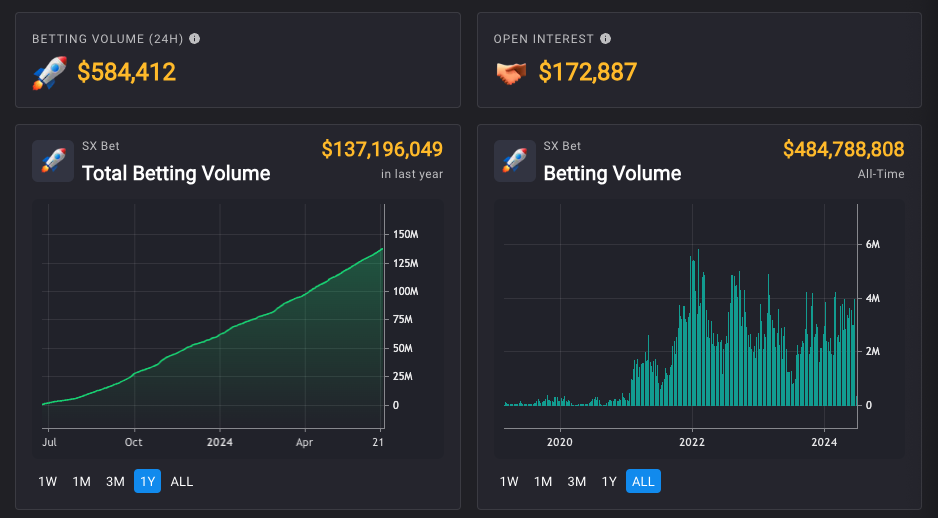

In addition to Polymarket, other notable players include Azuro and SX Bet. The former is a liquidity layer that currently supports more than 30 applications built on top, such as sports betting bookies, and that has generated almost $4M in revenue with over 25k unique users and $7.5M in TVL. The latter is a peer-to-peer betting exchange that allows all users to both offer and take bets, rather than having users accept quotes offered by the “house”.

Source: Dune dashboard by Azuro – All relevant metrics have been on an accelerated uptrend since Q4 2023

Source: SXBet Statistics – SX has been live since March 2019 and most recently announced the SX Arbitrum Orbit rollup

Polymarket has surpassed $900M in volume to date, Azuro $410M, and SXBet $475M, but there are signs that the road ahead should be indicative of more room for growth, especially when taking into consideration that sports betting is a subset of prediction markets.

In the US alone, sportsbooks have generated $30B of lifetime gross revenue from over $360B in total handle in its sixth year of regulated operations. This number is much higher as a result of online volume but still excludes contributions from other countries. The TAM is extensive when we take into account other types of prediction markets such as politics and entertainment.

Who Uses Prediction Markets and For What

Prediction markets are primarily used by individuals interested in forecasting outcomes of political events, sports, and financial markets. These markets attract a niche audience of speculators, analysts, and enthusiasts. However, the broader public remains hesitant, often due to lack of understanding, or perceived complexity.

In the realm of crypto, prediction markets face similar challenges (if not additional). Theoretically, aggregating diverse opinions should improve market efficiency. However, the effectiveness depends on participant diversity, the information they possess, and market liquidity.

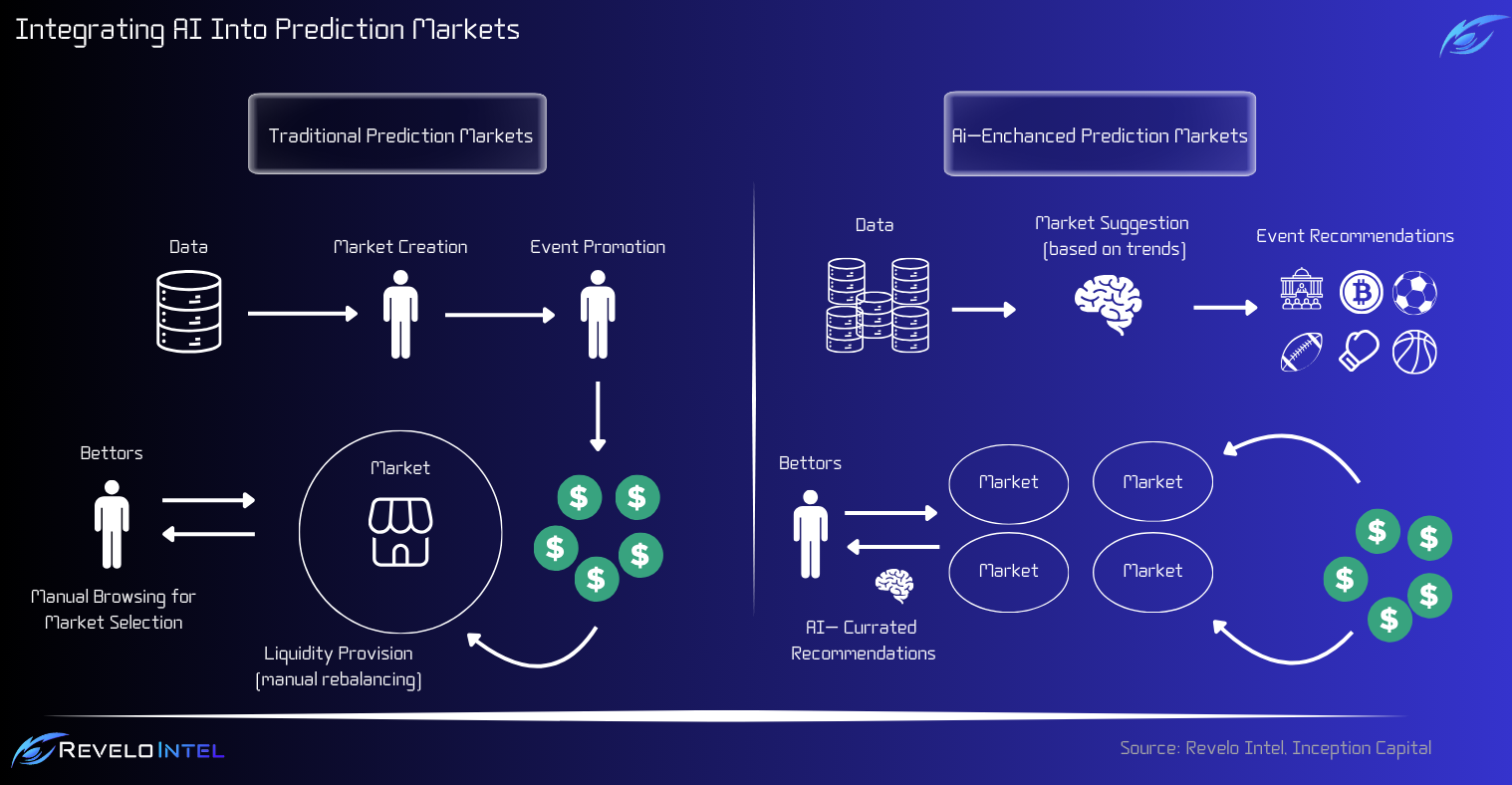

Most recently with the advent of AI, some claims point towards AI agents being the most dominant users of these markets. However, while this might automate certain processes, it does not necessarily enhance the accuracy of predictions. The reason for that is because the management of liquidity is crucial for the proper operations of the market, and this issue is complex in a decentralized and permissionless setting (dispute resolution, liquidity fragmentation across markets, low volume, etc).

Source: Inception Capital Medium on using AI to create prediction markets at microscopic scale – “Predictions shape markets, and markets validate our predictions”

Extrapolating the results of sentiment machines to predict event outcomes works theoretically but does not necessarily enhance market efficiency. The accuracy of predictions depends on the participants’ knowledge and market liquidity. Often, AI agents might replace human participants, but this does not resolve the fundamental issue of diverse and reliable information.

Hence, despite their theoretical benefits, prediction markets face significant challenges in gaining mainstream adoption. These challenges persist in both traditional and crypto-based prediction markets. Therefore, even if conducted in a permissionless setting and with a frictionless UX, the issue of low demand might persist.

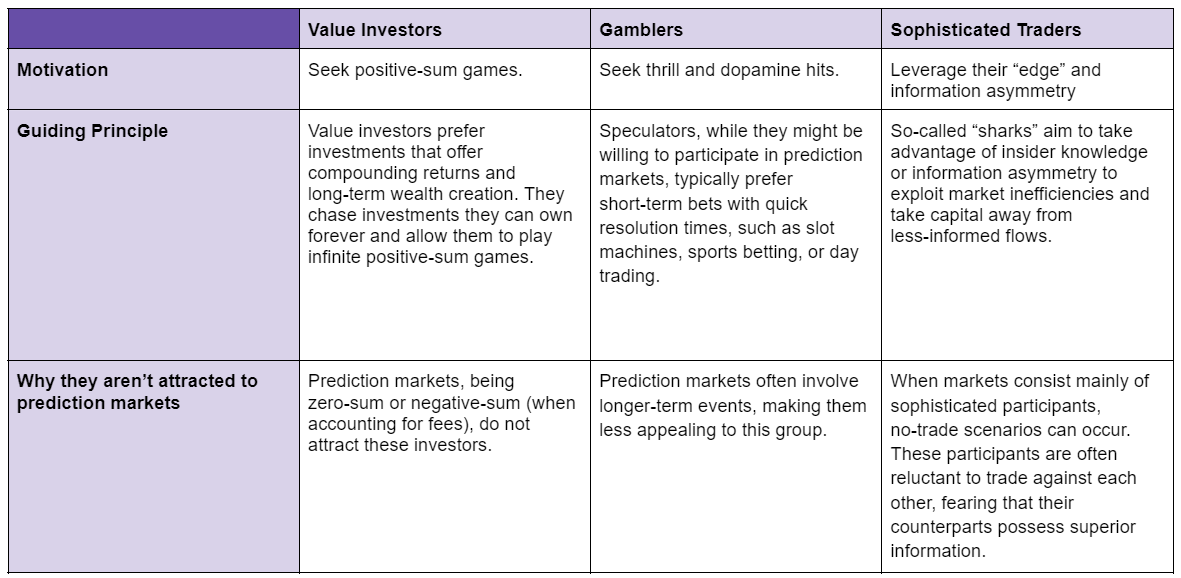

Zooming out, we can differentiate between three different user archetypes: savers, gamblers, and sophisticated participants who possess information asymmetry on a specific market. Let’s consider what role they would play on any given market and what their overall involvement might look like in terms of retention and frequency with which they might interact with any given exchange.

On the one hand, savers are investors seeking wealth-building opportunities through positive-sum games, avoiding zero-sum scenarios. On the other hand, gamblers prefer immediate gratification, making the longer timelines of prediction markets less appealing. Meanwhile, sophisticated traders, facing other informed participants, might opt out due to the low likelihood of finding profitable trades.

This presents a scenario of low demand and abundant no-trade scenarios.

Therefore, even if prediction markets in crypto outpace non-crypto incumbents, this does not necessarily make them a “killer use case” for crypto. They might still remain a niche with very little implications outside of their own bubble. After all, if they had found true product-market-fit, they would have already thrived in crypto after so many years in the spotlight.

Adoption Challenges

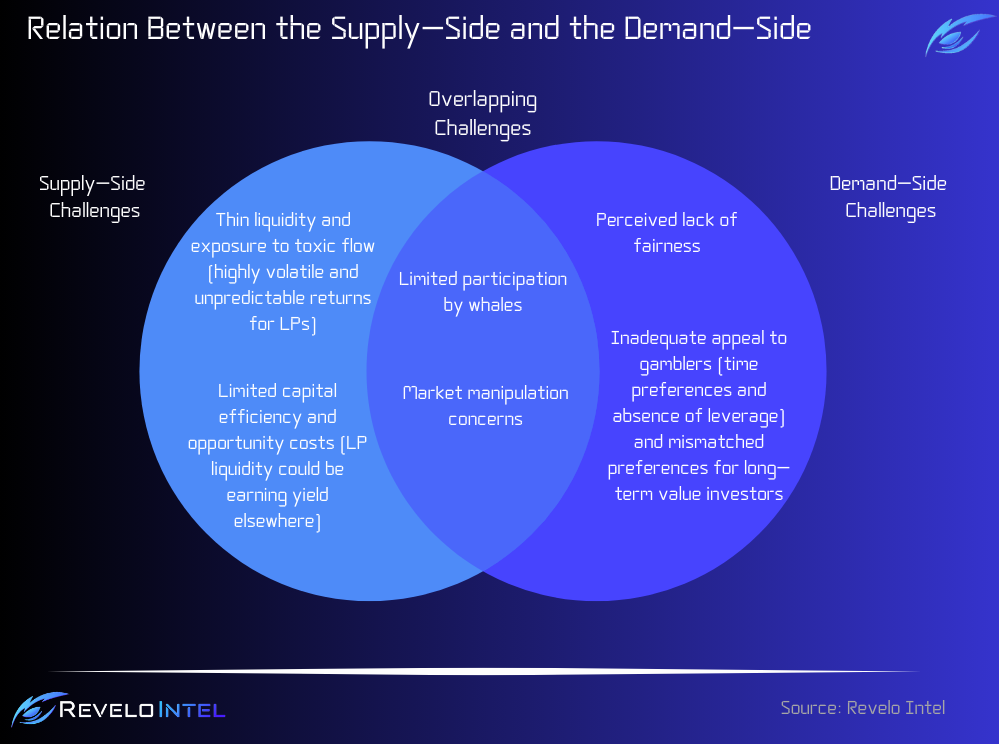

A pessimistic view suggests that prediction markets might fail in crypto for the same reasons they did outside of it. With savers and gamblers largely out of the equation, only sophisticated traders remain. However, without sufficient market size and liquidity, these traders find little incentive to participate. Hence, the absence of escape velocity can be explained by an overall lack of interest from both liquidity providers (supply side) and bettors (demand side).

*Note that the table below is a generalization and that there are nuances that apply to different prediction markets and whether trading occurs via an order book (better price discovery and trading efficiency when liquidity is deep) or an AMM (easier to bootstrap liquidity for new markets, often in a permissionless manner)

On the one hand, prediction markets face supply-side challenges like thin liquidity due to volatile returns, broad spreads to defend against toxic flow, and risk aversion among liquidity providers who don’t want to act as counterparties to more informed traders. On the other hand, demand-side issues include perceived unfairness, inadequate appeal to gamblers, high capital costs, and concerns over market manipulation. The zero-sum nature of these markets underpins all of these issues, where the perceived lack of fairness arises from concerns about manipulation by participants with more information or resources, which can deter broader engagement.

Prediction markets suffer from a chicken-and-egg problem: low liquidity leads to inaccurate predictions, which in turn makes the market less attractive for traders. Without sufficient liquidity, the accuracy of the market’s predictions deteriorates, causing a vicious cycle of declining participation and market confidence.

Low liquidity is both a supply and demand issue. Without sufficient participants, markets remain illiquid, which in turn discourages further participation. Low liquidity can lead to higher volatility and less reliable pricing, making the market less attractive to users seeking accurate predictions.

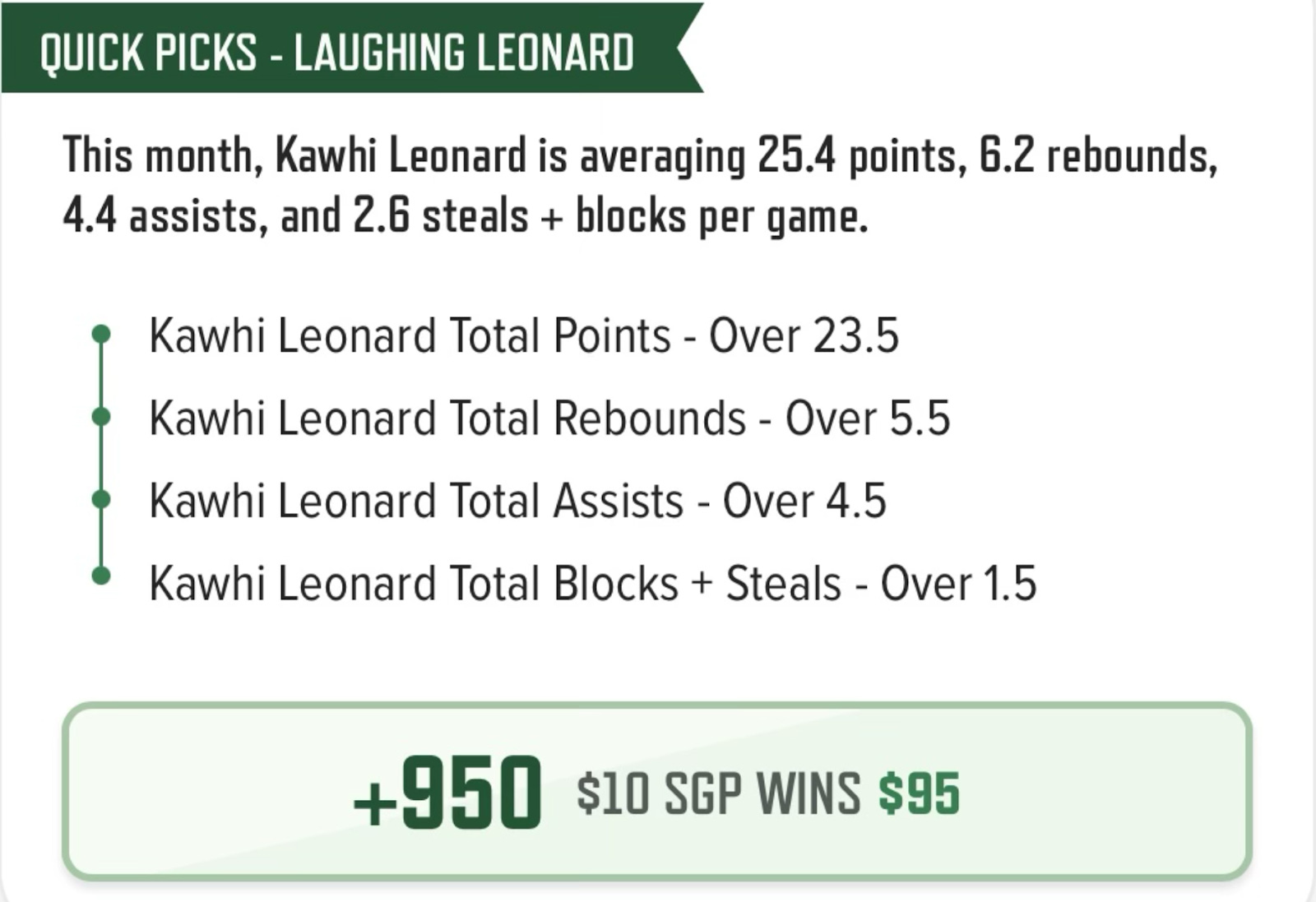

Nonetheless, critical demand problems still remain, such as the inability to get leveraged exposure or increase the potential upside with mechanisms like parlays. In sports betting, parlays are a type of bet that combines multiple individual wagers into a single bet. The potential payout is much bigger than if you placed each bet individually, but the catch is that all bets in the parlay must win for you to win the entire thing (even if you only lose one individual bet the whole parlay will result in a loss).

Source: X post by FezzikSports – Gamblers love parlays because they make it easy to risk a little and win a lot

It is also worth asking the question of who is supplying the capital to a prediction market and what incentives are driving this deposit. Does the volume come from money that wants to beat the market and capitalize from correcting mispricings? Remember that some gamblers may do it just for the excitement, while other actors might be simply arbitraging or hedging their positions to reduce certain risks.

The No-Trade Theorem

The no-trade problem is prevalent in prediction markets, due to the type of market participants that are attracted to them. Absent of long-term value investors and gamblers, only sophisticated and informed participants remain. As game selection is a critical feature to achieve a winning strike, these traders are reluctant to bet against each other, as both possess the same information and none of the parties really has an “edge” or competitive advantage.

The theory describes this as an economic phenomenon that occurs when traders, having similar information, refrain from trading. Since no party believes they have superior knowledge, they see no advantage in participating. This issue is particularly pronounced in prediction markets where information asymmetry is high, leading to low trading volumes and liquidity.

Prediction markets face a demand problem leading to no-trade scenarios due to distinct preferences among potential users. Value investors seek positive-sum games with long-term gains, avoiding zero-sum games like prediction markets. Gamblers prefer short-term thrills, making them unlikely to engage in prediction markets with longer time horizons. Sophisticated traders, capable of exploiting information asymmetry, might avoid trading when faced against equally sophisticated participants, leading to no-trade situations. The lack of diverse participants, combined with these distinct user preferences, limits demand and trading activity.

In fact, a similar phenomenon is also acknowledged in James Surowiecki’s book titled the Wisdom of the Crowds, which originally outlined the central thesis of how independently deciding individuals can make certain types of decisions and predictions better than individuals or even experts. In this piece the author acknowledges the existence of certain situations where crowd intelligence fails to yield effective results, as seen in so-called rational bubbles – prices differ from the fundamental market value because people expect other people to pay more in the future. The book presents a series of anecdotes in which the crowd produces very bad judgment, arguing that the collective intelligence fails to be effective when the members of the crowd are too conscious of the opinion of others and, therefore, begin imitating each other to conform with the consensus view rather than think independently.

When only sophisticated actors show interest to participate in a market, the lack of diversity in thought and information leads to a lack of varied perspectives. In prediction markets, this uniformity means that traders have similar information, reducing the perceived value of trading.

It is critical for bettors in these markets to be aware of potential information cascades that may occur when individuals mimic the decisions of others, assuming those decisions are based on better information. This herd behavior can lead to fragile market conditions. If traders believe others have already set accurate prices, they are less likely to trade.

The Unsafe Unwind Problem

While the no-trade problem exists in both Web2 and crypto prediction markets, there is another crypto-specific challenge that has already been attempted and proven to fail at scale – perps for betting on anything with a vAMM structure (a pool that simulates having liquidity and allows the price to move up and down with buys and sells but that holds no underlying liquidity, just math simulations). Hence, it is not straightforward to offer leverage on prediction markets, and we have empirical evidence of why this is the case.

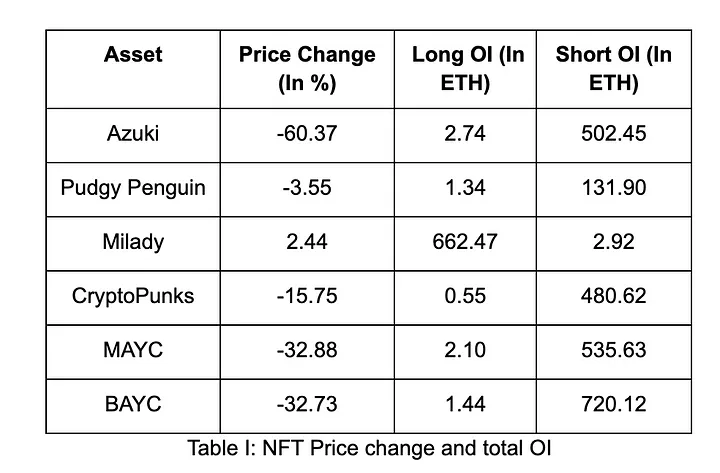

Source: Dan Robison on X – “Most vAMM perps are unsound – long open interest doesn’t match short, and almost inevitably not everyone can exit their paper gains”

In crypto we have seen demand to trade anything, ideally with perps and access to leverage, with a subset of users not being satisfied with trading large altcoins, and demanding venues to gamble on NFTs, memecoins, events, or any other type of long-tail assets. Thus, while there might be a lack of demand to trade on prediction markets due to the mismatch in time preference between gamblers (who prefer short timeframes and quick dopamine hits), and most even markets (which often last for weeks o months), there are precedents that suggest that a product that lets you bet on anything could find product-market-fit.

Source: NFTPerp Blog – NFTPerp v1 beta was shut down after insolvency issues caused by traders being predominantly short (Azuki & Apes Short OI >99%), which resulted in considerable unrealized PnL

Source: NFTPerp Blog showing historic unrealized PnL of traders – Unlike order books, profits in vAMM can only be realized against the margin of open trades. In typical scenarios long and short positions pay funding to each other, but volatile markets can cause large imbalances where a big skew can drive an unbundling of unrealized profit.

We have seen attempts to execute this idea in the past, each with varying degrees of success but providing practical experience about what things can go wrong. An exchange where you can gamble on anything is something that thrives on high volatility and speculative opportunities, with many users seeking quick profits and the thrill of high-stakes trading, often leveraging their positions. The allure lies in the potential for massive gains, fueled by a culture that embraces risk and disregards conventional financial caution – and this is something that shouldn’t be taken lightly by exchange builders.

Source: Foobar on X – “vAMMs are this tricky balancing act of hoping that platform fees outpace platform funding rates, forever. This eventually fails.“

In DeFi, AMMs usually serve as the sole market makers, unlike Central Limit Order Books (CLOBs) used in centralized exchanges or appchains. AMMs are less efficient due to slippage, where larger trades and low liquidity exacerbate the issue (also making them more prone to market manipulation). Virtual AMMs (vAMMs), used in some perpetual futures structures, mint virtual tokens to simulate liquidity and give access to leverage, but face similar inefficiencies and slippage problems (eventually causing insolvency issues when volatility spikes and the market is heavily skewed to one side).

Just like prediction markets, perpetual futures are ideally zero-sum; one trader’s gain is another’s loss. But if a trader’s losses exceed their collateral, the deficit creates “bad debt” for the protocol, covered by an insurance fund (which is eventually drained). Excessive leverage and rapid market movements can lead to forced liquidations, destabilizing the market.

Source: Coinglass BTC OI-Weighted Funding Rate – Perps require an internal price that is distinct from the spot price of the underlying asset, and they implement a funding rate to incentivize traders to bring the mark price back in line with the spot price (if the mark price is above the spot price then funding would be paid to shorts, and vice-versa)

Low liquidity, which is prevalent in assets like NFTs, long-tail tokens, or event markets, allows sophisticated traders to manipulate markets, causing large price swings and liquidations, profiting at the expense of other participants. This undermines trust and deters participation, especially from those who feel at a disadvantage. Note that slippage is necessary in a vAMM because without it the price of the asset would not move. This creates the problem where, if liquidity is too thin, large trades may move the market too much. This potential for manipulation is destructive to any market, and should be avoided by DeFi protocols.

All of this causes unwinding issues that jeopardize the solvency of the exchange. For instance, consider an underlying asset that trends upwards, meaning that exiting large positions requires new entrants to maintain the price. Without fresh capital, the price will revert to initial conditions, causing a market collapse and protocol insolvency. This need for constant new capital makes the system unsustainable under stress.

In other words, in order to force perps to be a zero-sum game, there needs to be a mechanism in place such that, should every position be closed, the mark price would converge with the spot price of the underlying. If the spot price of $BTC is $50k and traders push it to $70k in perps paying lots of funding to shorts then it follows that, for the perp price to remain at $70k traders exiting their long positions will need to be replaced by new longs to keep the same price level. If there is no net new demand and fresh capital doesn’t arrive, then the price will plummet back to $50k if every trader closed their longs, regardless of the spot price. Put simply, if you want to exit a large position in profit you must convince someone else to buy your bags – and this is often a losing strategy when everyone runs for the exit.

The further a vAMM’s price is from the initial conditions, the more capital is required to prop up the system – failing to pass the test of “winding down slowly”. vAMM perps cannot unwind safely and trend towards insolvency as they fail on the impossible accomplishment to attract new capital indefinitely – everyone cannot realize their profits without returning to initial conditions of equilibrium, which bankrupts the protocol.

Trust in fairness and the ability to safely enter and exit positions are crucial for user confidence and market stability, and this isn’t something that can be easily offered in a trustless and long-term viable manner.

Where We Are In The Adoption Cycle

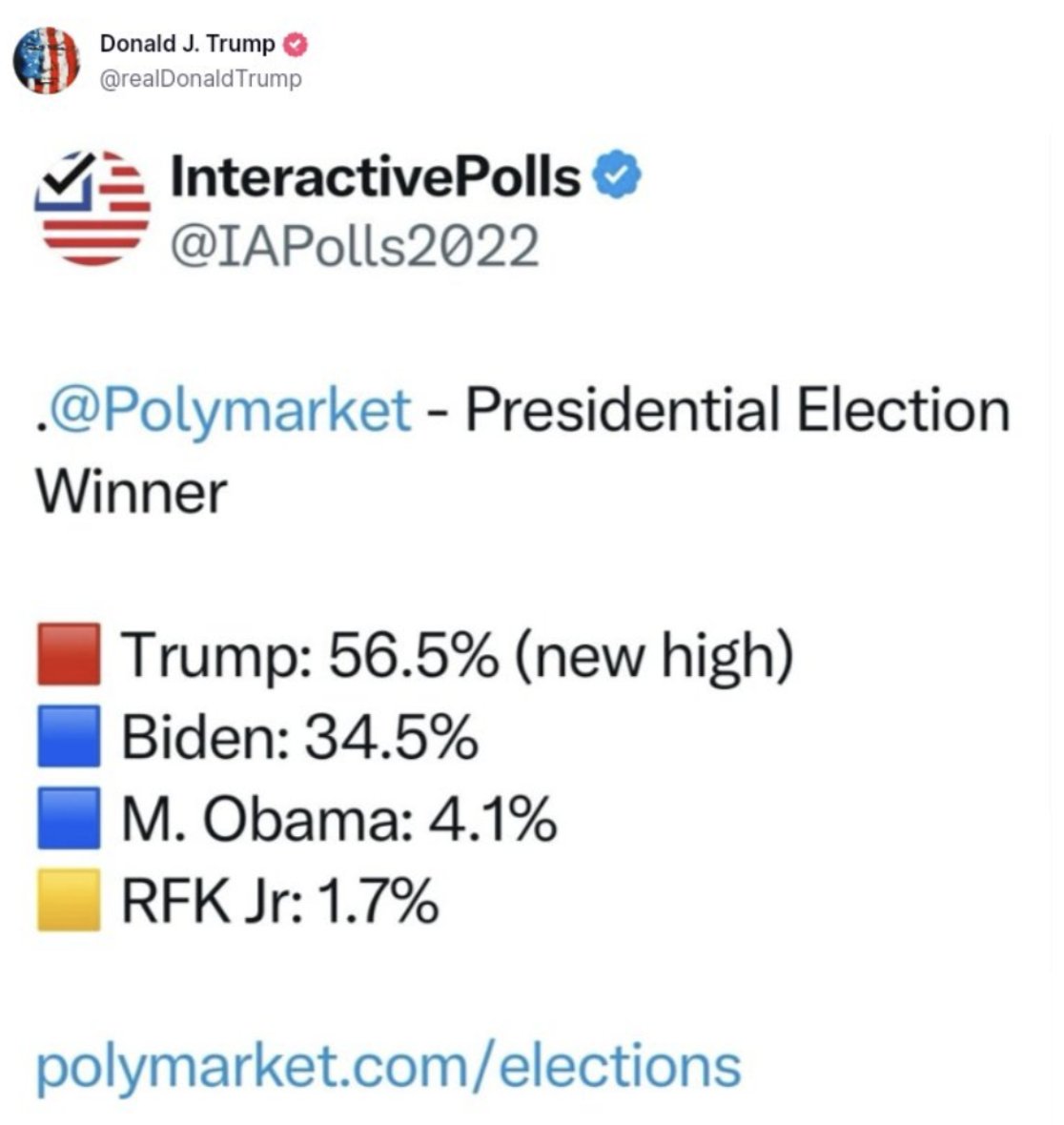

Nowadays, the perceived adoption rate might be biased and skewed towards favorable conditions, most likely due to the US elections and the fact that Donald Trump has referenced Polymarket’s odds on multiple occasions (instead of standard surveying methods).

Source: Polymarket on X

However, several factors contribute to the lack of demand and mainstream adoption. These markets are often seen as complex and difficult to understand (sometimes with ambiguous resolutions), discouraging potential users who might lack the expertise or information asymmetry needed to gain an edge. In addition to that, the lack of inherent leverage makes it less appealing for those users who might just want to gamble and take advantage of the enjoyment value that comes with betting on a specific event.

Regulatory concerns, including the unclear legal status and allowance of insider trading, further deter participation. These markets are zero-sum games (or negative when fees are considered), where one party’s loss is another’s gain, adding to the reluctance. At the same time, traditional financial markets and survey methods have already established greater trust and reputation, whereas prediction markets are viewed with skepticism, particularly regarding market manipulation and accuracy.

Nevertheless, there is still some low-hanging fruit that could be easily implemented in crypto, such as allowing for the provision of yield-bearing stablecoins like sDAI or sUSDe to make a market. This would increase the APY of LPs while they wait for an event resolution that is expected to occur weeks or months down the road. These markets could also draw inspiration from the sports betting industry and add more gamification via leaderboards, winning streaks, free bets, VIP status, etc.

Furthermore, as AI becomes ubiquitous in our daily lives, it is inevitable that its capabilities aren’t used for making markets and/or betting on existing ones. This accelerates the process to list new event markets, and the addressable market trends towards infinity, as the number of short-term events is unlimited and there is already abundant data that can be scraped online. Autonomous agents might as well end up making up for most of the volume, given their ability to estimate the expected value more accurately than humans while staying unbiased (see examples of Omen and Predx). Even though humans might be better than autonomous agents at trading memecoins due to the emotional component and sense of belonging to a community, AI is far more effective when it can access objective information and calculate its expected value as a function of payoff times probability.

Source: Revelo Intel inspired by Inception’s Capital Medium – Information flows from AI to Users with event suggestions, liquidity optimization, and enriched informational content; and from Users to AI with feedback loops that improve content relevance and market efficiency.

AI agents can be put to work for less than $1/hour and operate 24/7 scraping all available information on the internet with real-time search capabilities. In Vitalik’s crypto x AI article he pointed out that “if you put up a $50 subsidy, humans will not care enough to bid, but thousands of AI agents will… making the best guess they can. The incentive to do a good job on any one question may be tiny, but the incentive to make an AI that makes good predictions may be in the millions”.

Untangling the Bottleneck

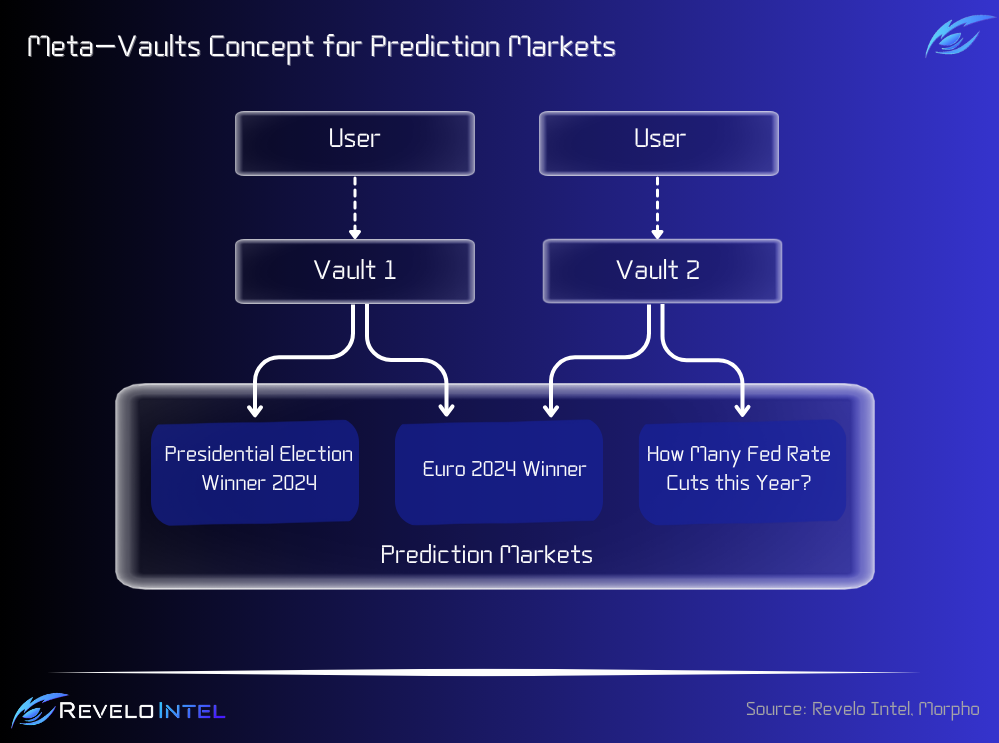

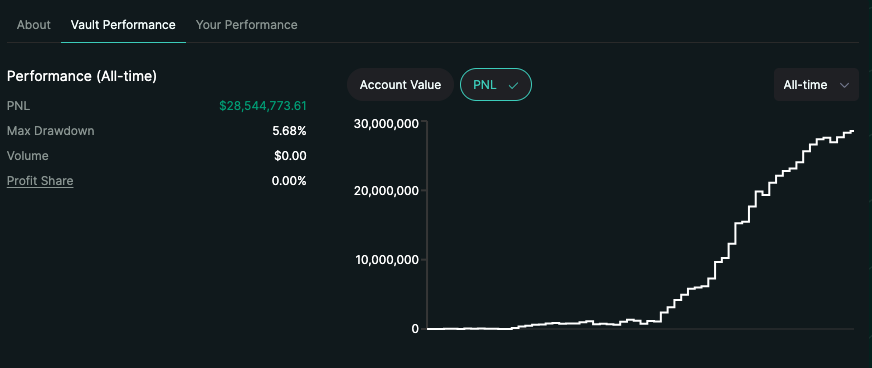

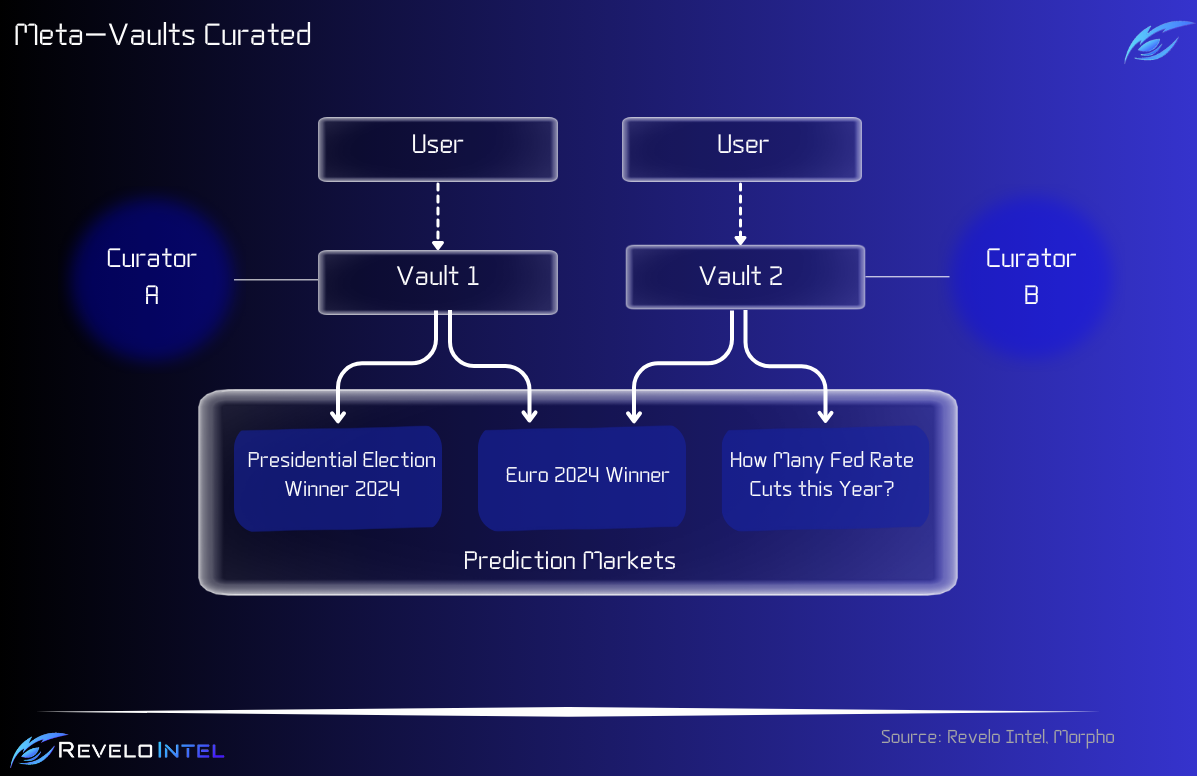

If there is something that DeFi has proven to be useful for, mostly through token incentives, that is coordination among parties in a distributed system. Hence, the next logical step would be to gain an advantage over Web2 incumbents by offering liquidity bootstrapping mechanisms which simply aren’t accessible off-chain. This can take inspiration from current mechanisms such as counterparty vaults (GMX’s AMM LPs acting as counterparty to traders), market making bots (similar to Hyperliquid’s HLP vault, which provides liquidity through different market making strategies on a CLOB), and yield aggregators like Morpho’s Metamorpho vaults (which automatically rebalance assets across markets to maximize yield). The idea behind this is to provide users with deposit structures that abstract away the complexity involved in selecting a market, and frame this as a yield opportunity to generate yield on stablecoins.

Source: Revelo Intel inspired by Morpho’s Metamorpho Vaults – Protocols could add an extra layer of abstraction in the form of meta-vaults that automatically rebalance liquidity across whitelisted markets to optimize for yield generation

Provided that the liquidity is only offered to non-toxic flow (traders with no informational edge) this could work effectively and attract passive depositors, growing the vault’s AUM over time as a result of the aggregate number of traders losing more frequently than they win.

Source: GMX stats – GMX became popular for allowing LPs to be the “house” and have an edge versus traders by charging them a fee. In addition to that, most traders are unprofitable in a long enough timeframe.

Source: Hyperliquid HLP Vault – HLP is Hyperliquid’s flagship vault, which does market making in the exchange and receives a portion of trading fees. It democratizes access to strategies that are often reserved to privileged parties on other exchanges. Anyone can deposit into this and other copy-trading vaults in a permissionless manner.

Over the years there have been many claims around the efficiency of AMMs relative to traditional order books, and how LPs profitability could be eroded by toxic flow from arbitrageurs that have access to more information (i.e. prices in other trading venues). However, not always can you afford to have market makers offering liquidity for a token on an order book. Arguably, AMMs find their utility in the ability to quickly bootstrap a market, which is critical for long-tail assets like memecoins. This also occurs in prediction markets, which often involve more exotic markets with only a few interested parties. The importance of this property cannot be understated. For instance, protocols like Elixir have realized how critical this is: they have come up with a primitive that allows users to deposit assets with the simplicity of supplying liquidity to an AMM but with the actual capital being managed by bots making a market in order book exchanges. Such a simple deposit structure is essential to allow newly listed markets to count with large sums of liquidity from day one.

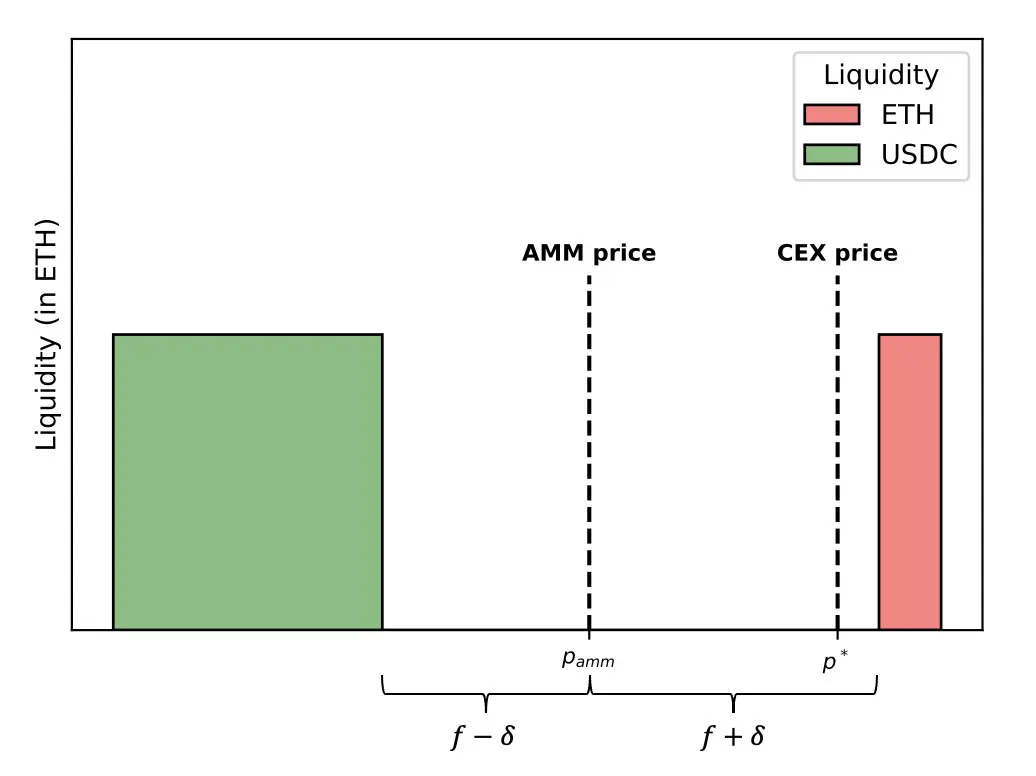

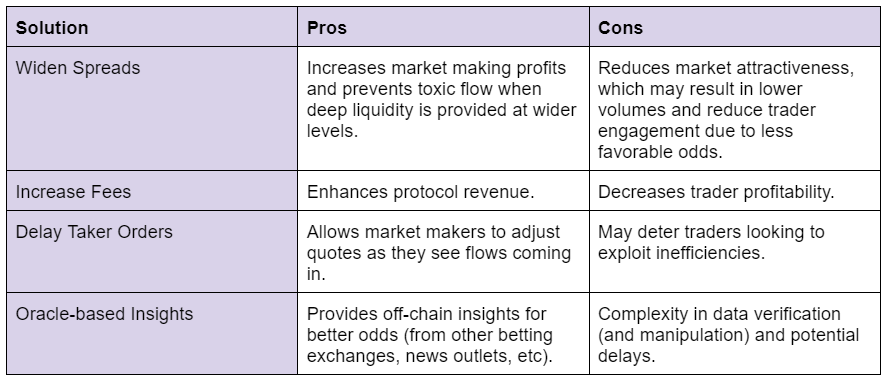

Once the liquidity has been supplied, the challenge comes when actively rebalancing the capital to be defensive versus toxic order flow coming from more informed users.

Source: Mirror by Daftary – Toxic flow exploits inefficiencies that harm uninformed market makers supplying liquidity

One trivial solution to this problem is to widen the spreads, increasing potential vault profits provided that traders keep betting despite accepting worse odds. However, this makes the market less attractive for traders, which results in lower volumes and fee capture. Another alternative is to increase the fees, but this also comes at the expense of traders’ profitability. Lastly, another alternative is to add a delay for taker orders. For example, Hyperliquid enforces a 2-block delay in order to give makers plenty of time to adjust their quotes as they see taker orders coming in. Additionally, mechanism designers could also take inspiration from oracle-based DEXs, bringing off-chain information on-chain in order to provide insights for LPs to adjust the odds as external data is gathered from off-chain information sources – another area where AI and sentiment analysis can be useful.

Arbitrage presents a problem for LPs when there are multiple trading venues, but the impact of informed flows on a market is decreased when there is a single source of pricing. For instance, Binance’s order books adjust in real-time in a matter of mili-seconds, whereas on-chain AMMs are restricted by the block time of the underlying chain, which results in slower price updates. Consider Ethereum’s block-time of 12 seconds, during which hundreds of trades could be taking place in Binance, moving the price up and down as demand changes, while Uniswap’s LPs are restricted by a predetermined formula. This lack of pricing power makes on-chain AMMs vulnerable to informed traders who can exploit temporary imbalances or possess knowledge of future price movements, eroding LP profitability. In essence, AMMs become battlegrounds where arbitrageurs and informed traders pick off profits that could have gone to LPs.

In this regard, outlets like Polymarket currently stand in solid ground, being referenced as the main source. The liquidity depth is critical for pricing power, especially in markets that aren’t as susceptible to high-frequency-trading due to the longer term horizons of bets. This creates flexibility and optionality for on-chain protocols, who have plenty of time to further refine their business model. For example, they could take a cut out of trading profits for re-distribution, similar to sportsbooks like Betfair, or set dynamic fees that increase with higher volatility levels (often seen in more exotic markets).

However, there is another key property of prediction markets that cannot be fully replicated off-chain and that presents a great opportunity to leverage the unique features of crypto. This takes us to the next section, which will make a case for why prediction markets can be a profitable business model for creators.

A Business Model For Creators (and Curators)

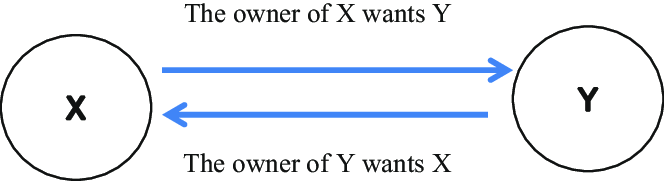

There is a big difference between prediction markets with binary outcomes and sportsbooks. When you bet on a specific game, you are accepting the fixed odds that were quoted to you by a counterparty: the bookmaker. Hence, you are paying for the acquisition of certain odds that are derived from the internal and centralized calculations of a market’s implied volatility. In a prediction market, however, you are actually exchanging your capital with other market participants, presenting opportunities to match orders at a specific price level.

Source: ResearchGate – In a prediction market each investor brings their own knowledge and beliefs to the table, leading to a more accurate reflection of the collective wisdom.

On the market creation side of things there needs to be some sort of curation to prevent sybil attacks or scenarios where useless markets are created. One common pattern that might help with this is to gamify the user experience such that market creators can not only monetize their operations, but also gain reputation and compete for status. This would look like a bounty system where the creation of markets can turn out to be a viable business model for creators. In order to achieve that, it is critical to introduce some degree of competition, similar to developers competing against each other to obtain higher ratings on Dune dashboards. Eventually those creators offering the most lucrative opportunities will make an impression on traders, who will be more inclined to participate in their events.

One could also apply the concept of vault curators, again taking inspiration from Morpho’s meta-vaults, where specialized service providers will whitelist certain markets and dynamically rebalance the liquidity across markets to capture more optimal spreads. All that is required from the user is a passive deposit, while the capital will be seamlessly managed by these curators’ algorithms. These curators would also have the ability to add/remove markets at their discretion based on maturity dates or volatility levels.

Source: Revelo Intel inspired by Morpho’s Metamorpho Vaults – Meta-vaults curated by service providers serve as an extra layer abstraction that unifies liquidity across isolated markets

By adding layers of abstractions on top, the underlying protocol can focus on innovating at the base level, with external integrations adding extra functionality on top, such as copy-trading vaults, meta-vaults, etc. This makes it possible to come up with very basic primitives that could be built with immutable and censorship-resistant code while all other complexities are outsourced to external service providers that users can choose to trust.

A Demand Issue Still Remains

We have briefly introduced the notion of parlays, and while it sounds straightforward in practice, there are challenges due to the different time frames at play and the fact that there needs to exist reserved upfront liquidity in order to bet on any given market. However, that doesn’t mean that new protocols can be spun out to take advantage of the composability of DeFi. The concept of “money legos” became prevalent in the early days of DeFi, and while it may introduce risks and dependencies on external protocols, it can also create unique opportunities.

As an example, let’s assume a protocol that takes inspiration from both Polymarket and Azuro. Similar to the latter it would aggregate and pool liquidity in a single source that acts as the counterparty to traders. The odds of the former could then be used to calculate the payout of parlay bets. AI could also be used to offer pre-packaged parlay slips based on markets with similar audiences, such as Trump winning the election and Biden not being the candidate for democrats, or a simultaneous selection of the Eurocup and Copa America winners. Some users will be attracted to act as the house of the casino, expecting most bettors to lose (as is often the case with parlays), while others will gamble due to the potential upside if they are right.

Source: How Gambling Works – Sportsbook know that parlays are the biggest money makers and they promote them heavily

Since they were introduced by Bitmex, perps have become the most popular derivative due to their simplicity and ability to get leverage. This already wakes the gambling instincts of that specific user base looking for quick dopamine hits and the illusion of huge gains. Crypto trades 24/7 and offers dozens of tickers with varying levels of leverage, offering a casino that never shuts down. Users can stay glued to their screens for longer periods of time than sports betting, and gamblers also feel that, when trading, they have greater power to affect the outcome – attributing gains to skill and losses to bad luck. This dopamine rush can be thrilling and creates the illusion of easy money to be made with quick trades, something with which prediction markets cannot really compete.

While it is possible to emulate this, there are a lot of challenges that come with it, more so in a decentralized setting (as illustrated with the unsafe unwind problem presented above). In fact, there is a precedent in 2020 when FTX created a perps market for the outcome of the American Elections. Traders could long/short a $TRUMP synthetic position that could be redeemed for $1 if the candidate turned out to be the winner. However, you can already imagine how challenging it is not only to estimate the odds, but also to enforce reasonable margin requirements. FTX itself had to change margin requirements multiple times because the odds could be priced at $0.70 at one point and then at $0.10 in a matter of seconds after a news release. Protecting against solvency is definitely not straightforward for these markets, and chances are high that there might not be enough collateral to compensate for winnings. If it wasn’t for Alameda, who would be a willing market maker that steps in to provide liquidity in such a market?

Currently LEVR and SX Bet are offering a similar market applied to sports betting, and the latter also allows bettors to request parlay bets that are matched in a peer-to-peer engine. At a high level, the complexity comes with offering leverage when the market odds can rapidly swing from $0.01 to $0.99 in a matter of seconds (think of a goal scored in the last minute of the game). Another venue for leverage could as well take inspiration from vAMM designs like Vest Exchange, which offers cross-margin capabilities and where positions could be used as collateral to take out loans. Similarly, a protocol might as well come up with a lending market where tokenized prediction market positions (most likely as NFTs) could be priced and used as collateral to borrow and bet more. A side effect could be that some users borrow against a position to provide liquidity in another market, which might improve the overall liquidity conditions across the board.

Conclusion

The sweet spot for prediction markets lies at the intersection of trading and sports betting, forcing participants to have skin in the game and rewarding those who make accurate predictions.

Currently, prediction markets are viewed as a large experiment that is run at scale and allows knowledge to emerge from the collective opinion of independent thinkers, avoiding the inherent biases that are associated with expert opinion and traditional surveying methods.

You can only glean the wisdom of the crowd when there is a financial stake at play, incentivizing the acquisition of truthful information. The decentralized and permissionless nature of blockchains provides an advantage in this regard, but there are still obstacles on the way to mass adoption.

Despite the theoretical advantages of decentralized information aggregation, these platforms face issues similar to their Web2 predecessors: limited mainstream adoption, regulatory uncertainty, and low user demand. The excitement surrounding high-profile events, such as the US elections, may provide temporary boosts in liquidity and participation, but sustaining this momentum remains uncertain.

To thrive, prediction markets must address fundamental demand challenges, diversify user engagement strategies, and leverage crypto’s unique capabilities like token incentives and decentralized governance. Innovation in market design, improved user experience, and broader application beyond niche events will be crucial for growth.

References

- Ethereum Whitepaper

- SX Network

- Azuro

- Polymarket

- LEVR.bet

- Peter Thiel’s Founders Fund, Vitalik Buterin Back $45M Investment in Polymarket

- Gambling and Venetian Noblemen c. 1500-1700

- Crypto-Powered Information Games — Archetype

- Crypto-Powered Status Games – Archetype

- The Long History of Political Betting Markets: An International Perspective

- Improved Liquidity for Prediction Markets by Lukas Kapp-Schwoerer

- The Promises and Challenges of Crypto + AI Applications by Vitalik Buterin

- The No-Trade Theorem, Competitive Asset Pricing, and Bubbles – Oxford Academic

- Prediction Markets: Theory, Evidence and Applications.

- Prediction Markets: Tales from the Election by Vitalik

- The Promise and Challenges of Crypto + AI applications by Vitalik

- Augur: A Decentralized Oracle and Prediction Market Platform — Researchgate

- Automated Market Makers for Prediction Markets – Gnosis Developer Portal

- Using Prediction Markets to Track Information Flow

- Wisdom of the crowd. Nature 438, 281 (2005)

- Using Prediction Markets to Enhance US Intelligence Capabilities

- The Use of Knowledge in Society – Cambridge University Press

- Online Gambling Outlook – Statista

- Why vAMMs are doomed to fail by Foobar

- The Problem with vAMM Perpetuals

- Betting to Improve the Odds

- Understanding Parlays – How Gambling Works

- Prediction Markets: An Information Aggregation Perspective to the Forecasting Problem

- Timeline of prediction markets

- Dynamic Fee Solutions for AMMs

- Using Prediction Markets to Enhance US Intelligence Capabilities

- Order Flow Toxicity on DEXes — ethresearch

- Balaji’s X post on freedom of expression and prediction markets aggregating information around the US elections and Biden’s presidential election

- Prediction Markets Bottlenecks and the Next Major Unlocks – 1k(x)

- The Regulation and Value of Prediction Markets

- Prediction Markets DeFiLlama

- Polymarket Statistics – Dune by rchen8

- Azuro Statistics – Dune by Azuro

- SX Bets Statistics

Disclosures

Revelo Intel has never had a commercial relationship with any of the projects listed above and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose.

Revelo Intel is a research platform and not an investment or financial advisor.