Unlocking Fixed Income, Stability and Predictability

Pryzm is a Layer-1 application-specific chain (appchain) dedicated to transforming yield management. By allowing for the tokenization of yield and making it tradeable on an Automated Market Maker (AMM), Pryzm aims to lay the foundations for a multi-trillion market opportunity, akin to fixed income and interest rate derivatives in traditional finance (TradFi).

The unique selling points of Pryzm derive from its ability to unlock fixed income, stability, and predictability in the current DeFi markets. By offering a permissionless and interoperable marketplace for trading yield, Pryzm addresses critical pain points observed in DeFi, such as yield volatility, asset lockup, and governance.

Key Takeaways

- Initially envisioned as a suite of smart contracts for deployment on an existing blockchain, the Pryzm team recognized that to authentically replicate the breadth and intricacy of traditional finance (TradFi) markets, constructing an appchain was imperative. This approach would ensure the essential features of customization, interoperability, scalability, sovereignty, and performance—attributes that are unattainable when operating atop a third-party Layer 1 blockchain.

- Pryzm is a Layer-1 application-specific chain that is immediately interoperable with the Cosmos ecosystem (via IBC), and beyond (via General Message Passing protocols such as Axelar and Wormhole), focused on transforming yield management by tokenizing yield and enabling its trade on an Automated Market Maker (AMM).

- Pryzm addresses DeFi pain points like yield volatility, asset lockup, and governance issues by offering a permissionless and interoperable marketplace for trading yield, aiming to parallel the multi-trillion market opportunity seen in Traditional Finance (TradFi) with Interest Rates Derivatives (IRDs).

- Pryzm allows for the immediate tokenization and trading of future yields, creating a new asset class by splitting yield-bearing assets into principal tokens (pTokens) and yield tokens (yTokens), akin to zero-coupon bonds and coupon payments in traditional finance.

- Amidst market saturation in sectors like lending and stablecoins, Pryzm’s yield tokenization and trading stand out, offering clear value propositions, extending token utility, and promoting collaborative and positive-sum games.

- Pryzm forgoes Venture Capital (VC) funding for a community-oriented and decentralized growth model that avoids the concentration of token supply.

- The chain generates revenue through yield shares, swap fees, MEV capture, and a token restaking tax rate, reflecting a diversified and innovative approach compared to traditional Layer-1 blockchains – with all of this value being accrued by $PRYZM token.

- Managed by $PRYZM token holders, the Pryzm Treasury collects various tokens, empowering strategies like value preservation, buyback and burn, rewards for loyalty, and community pool contributions, governed through a democratic process.

Background

Deeply rooted in the founding team’s experience on interest rate and yield markets in traditional finance (TradFi), they set out to build the first and only application-specific chain (appchain) for tokenizing and trading yield. This would immediately open up the doors to the broader Cosmos ecosystem, finding synergies with other appchains and unlocking more utility for their staking assets

Opting for a community-focused funding model, Pryzm prioritizes decentralization and wide token distribution. This strategic choice reflects a dedication to ensuring broad ownership and participation within the ecosystem, steering clear of early stage private funding to avoid concentrated token ownership.

Pryzm: A Layer-1 for Tokenizing Yield

Pryzm is a Layer-1 appchain dedicated to tokenizing yield and making it tradeable on a specialized AMM, transforming how yield is generated, managed, and traded in DeFi. These characteristics uniquely position Pryzm as the only specialized chain that provides tools for users to fully customize their exposure to yield, price, and governance power.

The platform’s broad utility spans several market verticals, from creating tradeable tokens out of future yield earnings to enabling fixed-income opportunities and facilitating the trade of governance power. Pryzm’s AMM is engineered for efficient yield trading, incorporating features like limit orders, dollar-cost averaging, and time-weighted average price executions, further enriched by restaking capabilities. This amplifies the potential and utility of yield-bearing assets, allowing users to generate additional returns through swap fees, chain revenue, and $PRYZM rewards.

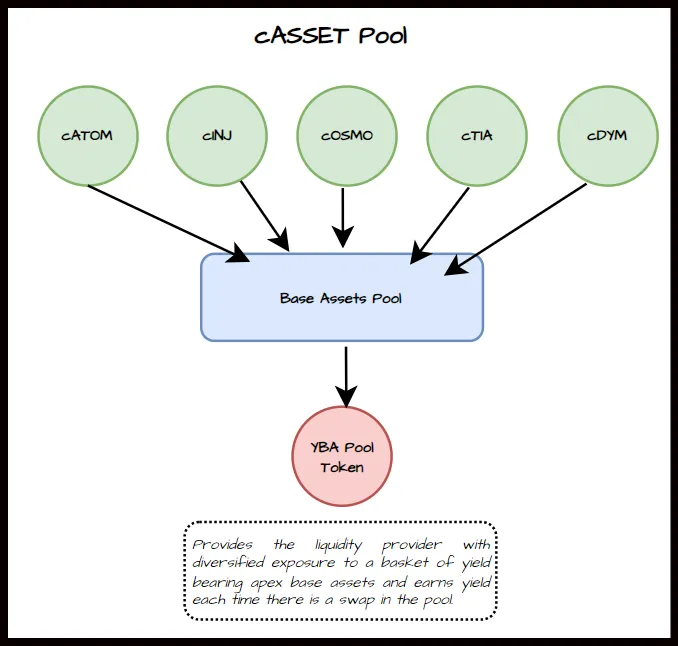

Pryzm’s permissionless and interoperable framework facilitates the trading of any yield-bearing asset from any chain (LP tokens, lending positions, LSTs, LRTs…), addressing a critical gap in the DeFi market. It transforms Pryzm into a central Yield Hub, equipped to meet diverse investor needs. This comprehensive solution not only improves liquidity and yield generation but also enhances governance participation and offers new risk management strategies for investors, providing them with the tools they need to suit all yield-related needs and preferences.

Trading Future Earnings Today

Pryzm enables the immediate tokenization and trading of future yields, offering users the ability to unlock and trade their future yields today. This mechanism is crucial for realizing the time value of money in DeFi, where the future worth of assets can be significantly impacted by market dynamics, liquidity conditions, yields, interest rates, token inflation and token unlocks.

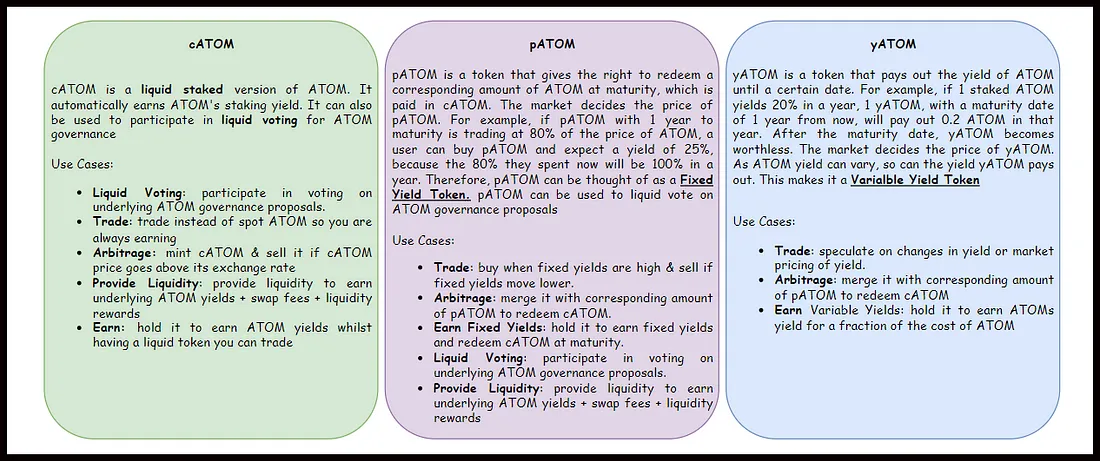

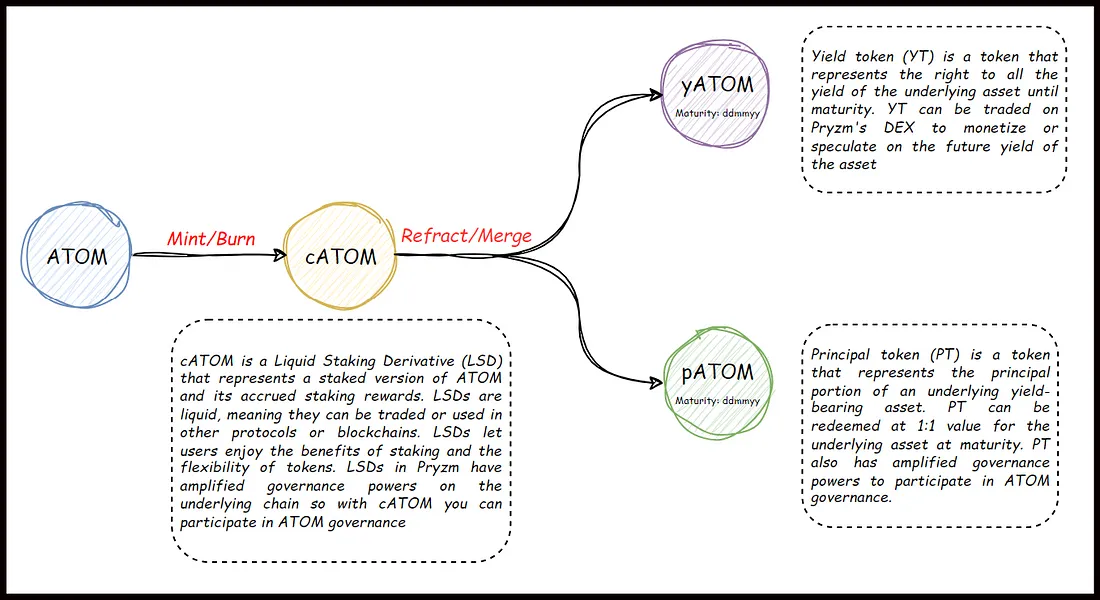

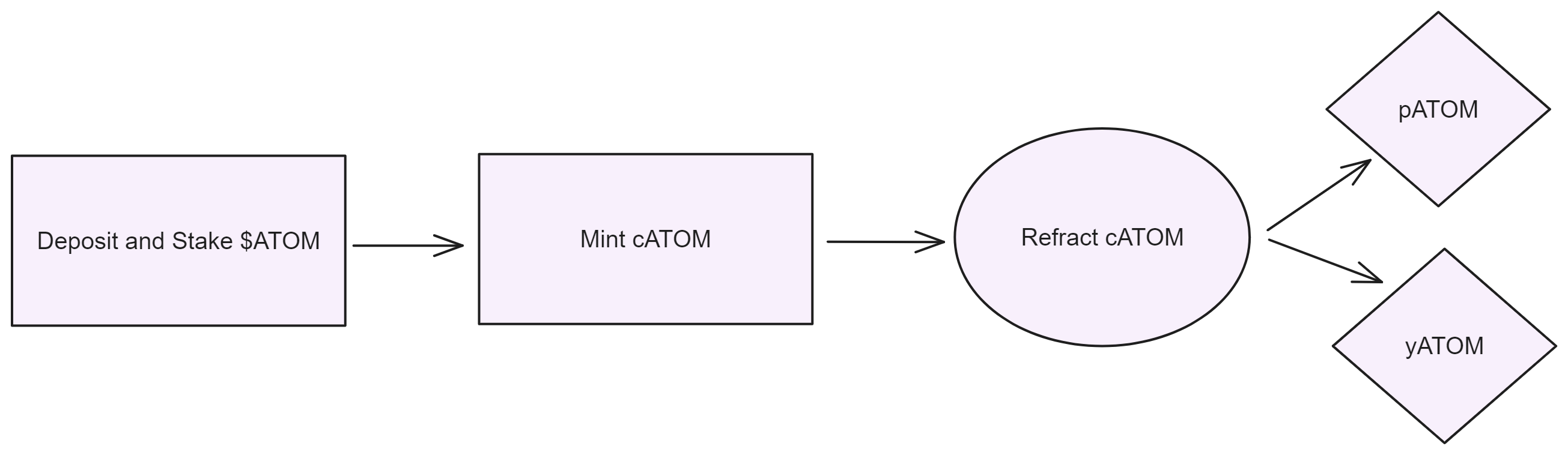

At the core of Pryzm’s functionalities is the tokenization of yield: the process of depositing a yield-bearing asset onto the platform. When users deposit such an asset, Pryzm mints a collateral token (cToken), which is then bifurcated into two distinct components with a maturity date attached: a principal token (pToken) and a yield token (yToken).

pToken: Represents the principal amount of the deposited asset and holds a 1:1 redemption value with the underlying asset at maturity. Essentially, pTokens guarantee the return of the initial principal invested after a predetermined period.

yToken: Represents the future yield that the deposited asset is expected to generate until maturity. Holding yTokens entitles the owner to the yield earnings, which can be realized without having to wait for the natural accumulation period.

By separating the principal and the yield into pToken and yToken respectively, Pryzm effectively allows users to individually manage, trade, or leverage these components based on their investment strategies, liquidity needs, or market outlooks.

pTokens are akin to zero-coupon bonds in TradFi, since they do not pay periodic interest but are issued at a discount to their face value. Since they can be redeemed at maturity for their full face value, that makes them an attractive option for investors looking for a predictable return.

yTokens can be likened to the coupon payments of a bond. In traditional bonds, coupon payments provide the holder with periodic interest returns until the bond’s maturity. Similarly, yTokens grant the holder the right to claim the real-time yields generated from the underlying asset until the yToken reaches its expiry date.

Those who prefer a guaranteed return at a future date might lean towards pTokens, mirroring the risk profile of zero-coupon bond investors. Conversely, users seeking regular income from their investments, similar to traditional bond coupon collectors, might find yTokens more appealing due to their yield-generating characteristics.

For example, if you stake 100 $ATOM in a DeFi protocol and you are projected to earn a 14% yield over 6 months, traditionally, you would need to wait the full term to realize the 7 $ATOM yield. With Pryzm, you can immediately tokenize this future yield into yATOM, while your principal is represented by pATOM. This split enables you to trade, leverage, or utilize your future yield (yATOM) in the present.

cToken = pToken (Principal) + yToken (Yield)

Together, pTokens and yTokens form a cToken, such that 1 pToken can be redeemed at maturity 1:1 for the underlying. At the same time, yTokens entitle holders to the yield earnings produced by the original yield-bearing asset until maturity. Hence, yTokens are worthless at maturity.

This design provides some heuristics that can be used to lay out a framework for yield trading:

- Maturity Assessment: Assets with longer maturities might present more substantial yield opportunities but entail greater uncertainty regarding future yield and value. Conversely, assets with shorter maturities offer a more predictable yield landscape but might limit potential gains.

- Stability through Fixed Yield: For investors prioritizing stability, selling yTokens while retaining pTokens can lock in a fixed yield, providing a safeguarded return on investment.

- Maximizing Yield Potential: Investors with a bullish outlook on asset performance might consider acquiring additional yTokens. This strategy leverages optimistic market predictions, aiming to capitalize on higher-than-anticipated yields.

- Mitigating Asset Value Fluctuation Risk: To counteract risks from volatile asset values, selling pTokens while holding yTokens can isolate yield benefits, divorcing yield generation from potential depreciation in the underlying asset’s value.

- Discounted Asset Acquisition: Purchasing pTokens can equate to acquiring future asset ownership at a discount, particularly when the market appears to undervalue the asset’s potential or overvalue its yield prospects.

- Market Sentiment and Yield Impact: Keeping abreast of market trends and sentiment is crucial, as these factors can significantly influence pTokens and yTokens valuations. An informed strategy allows for timely entry and exit decisions, optimizing the investment based on current and anticipated market conditions.

- Diversification as Risk Management: Relying on a single strategy in the dynamic DeFi yield market may expose investors to undue risk. Diversifying investment approaches across various assets and maturity horizons can balance potential returns against risk, ensuring a more resilient investment portfolio.

To understand the significance of this, it is important to emphasize that yield rules every opportunity in DeFi, from liquidity provision and lending to staking and restaking. However, this yield is volatile, making it hard to predict future earnings and cash flows. For instance, borrowing rates depend on the utilization of money markets, LP yield depends on swap volume, and staking yield varies depending on network parameters, fees, and inflationary rewards.

Pryzm is an appchain that gives the tools to capitalize on this volatility and unlock new fixed-income yield opportunities. By prioritizing appchain development with blockchain-level unique features, it can offer a more scalable marketplace for trading yield, serving as a hub for all LSTs and yield-bearing assets.

Technological Foundation

Pryzm leverages the Cosmos SDK and Inter-Blockchain Communication (IBC) to create a highly flexible, cost-efficient, and interoperable platform. This foundation enables the support of diverse yield-bearing assets, including tokenized lending positions, liquid staking tokens (LSTs), liquid restaking tokens (LRTs), and even tokenized real-world assets (RWAs). Utilizing the Cosmos infrastructure, such as IBC, Interchain Accounts (ICA), and Optimistic Execution, Pryzm offers a seamless experience for yield optimization, achieving block times as low as 0.4 seconds. This value proposition is reinforced with the introduction of custom modules for yield trading such as FlowTrade (to facilitate token swaps within a specified timeframe), ICStaking (for liquid staking of Cosmos-based native tokens), Refractor (for yield-stripping), and the Yield AMM (for trading yield) among others.

An Appchain For Yield

Pryzm’s evolution into an appchain is a strategic response to the limitations of smart contracts and the unique benefits appchains offer. Transitioning from a DeFi application meant to be deployed on an underlying L1, Pryzm developed an appchain from scratch, seeking autonomy, customization, and freedom from the constraints of shared computational resources and overarching blockchain parameters that often lead to increased gas fees and restricted optimization.

Appchains provide a dedicated environment for specific applications, allowing Pryzm to implement purpose-built modules for yield tokenization, liquid governance, oracle support, and a specialized AMM for yield trading. This design ensures optimal performance, interoperability, and scalability, aligning with the Cosmos vision of the “Internet of Blockchains” and promoting a synergistic ecosystem.

By building its own Layer-1, Pryzm capitalizes on Cosmos’ interoperability and its position as a conducive environment for yield opportunities. By developing specialized modules Pryzm can extend its tokenization capabilities to a wide array of assets, broadening the scope for income-generating opportunities and enhancing liquidity and capital efficiency in DeFi.

It is also worth highlighting that Pryzm is not restricted only to IBC-connected chains, as it can support any yield-bearing asset on any chain. An integration with General Message Passing (GMP) protocols such as Axelar and Wormhole will allow yield trading for assets such as wstETH or jitoSOL. This underscores the benefits of building Pryzm as an appchain. Besides the sovereignty advantages, Pryzm can seamlessly accept deposits of any yield-bearing asset and check for the yield that has been accrued with its built-in oracle. Contrast this with other projects using smart contracts, which require external oracles and bridging for their operations. Another side effect is the MEV that results from the flash mint and swap functionality for yield trading. By virtue of being built as an appchain Pryzm can capture MEV revenue, network fees, swap fees, and LST yield. If it were as a set of smart contracts then the MEV would be captured by MEV searchers and the network fees would accrue to the actual L1, both of which are extrinsic to the core protocol.

Some examples of supported assets include:

Proof-of-Stake (PoS) assets from IBC-connected zones like $ATOM, $TIA, $INJ, $DYDX, $OSMO, and more. These assets offer high market caps and staking yields, making them ideal candidates for yield tokenization and trading.

Liquid Staking & Restaking Tokens provided by external providers such as Lido and others. These derivatives enable users to stake their assets while retaining liquidity, creating opportunities for yield tokenization and trading.

Liquidity Provider Tokens (LP tokens) representing shares of liquidity pools on decentralized exchanges like Uniswap, Osmosis, Balancer and more. These tokens generate fees from trading activity and liquidity incentives, allowing users to monetize, trade, or hedge their positions (e.g. hedge against impermanent loss).

Tokenized Real-World Assets with income streams, such as government bonds, corporate bonds, dividend-yielding stocks, and ETFs. Pryzm can tokenize ownership or fractions of these assets, allowing users to access income-generating opportunities from traditional financial markets in a decentralized setting.

As an example, consider you have been staking $ATOM on Cosmos, aiming to earn passive income from inflationary rewards and network activity fees. However, you’ve noticed that the staking Annual Percentage Rate (APR) has fluctuated significantly, dropping from 23% to 14%. This volatility in yield has left you exposed to uncertain income fluctuations, without the ability to hedge or capitalize on these changes.

Pryzm changes this paradigm, offering a dedicated platform for yield trading, helping token holders and stakers to mitigate this volatility and access more stable income opportunities. By leveraging Pryzm’s tools, you could have locked in your yield at a higher rate when it was advantageous, providing stability to your income stream over the long term.

Yield Tokenization and Trading

Yield, fundamentally representing the return on investment (ROI) over time, is influenced by multiple factors including investment type, duration, risk, market conditions, and expectations. However, DeFi encounters challenges with yield, notably:

Yield Volatility: The rapid and unpredictable changes in yield expose users to market risks and uncertainties, potentially leading to missed opportunities or losses.

Yield Lockup: Earning yield often necessitates locking up assets for a specified period, limiting users’ access to their capital and earnings. This lockup can result in liquidity or cash flow issues for users.

Yield Governance: Yield is often intertwined with governance rights, granting users a voice in the decision-making process of staked platforms. However, some users may prefer not to participate in governance or may seek to delegate or monetize their voting power.

At the heart of Pryzm’s offerings is the ability to tokenize future yields from any yield-bearing asset. For instance, any liquid staking token (LST) can be split into its yield and principal components. This cannot be understated, since allowing users to separate and exchange future earnings from any yield-bearing token can pioneer a new asset class.

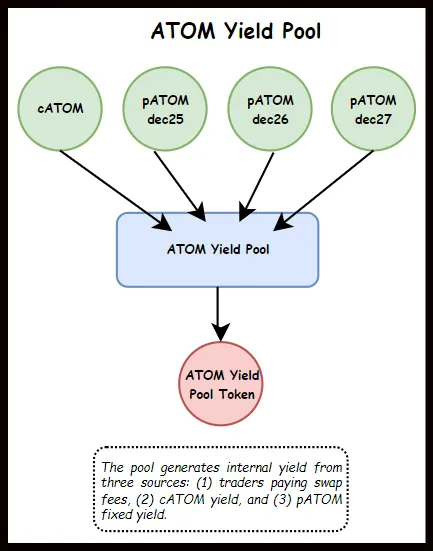

More importantly, Pryzm helps to solve the issue of liquidity fragmentation by having each Yield Pool hold a cToken along with all maturities of its respective pToken. This allows Liquidity Providers to enjoy a passive experience since the Yield AMM automatically removes expired maturities and adds in new maturities.

Holders of yield-bearing assets can isolate and tokenize their future earnings. These tokenized future yields can then be traded, hedged, or leveraged on Pryzm’s Yield AMM, creating a robust market for future yields and providing users with greater flexibility and control over their assets. Meanwhile, liquidity providers continue to earn yield on 100% of the assets in the pool, as both cTokens and pTokens have an implied yield.

Passive LP experience: The AMM module’s automation of pToken updates within respective pools eliminates the need for LPs to select specific maturities to provide liquidity for. This perpetual nature, coupled with auto-compounding features, not only enhances yield generation but also offers tax efficiency in many jurisdictions (by potentially qualifying these activities as capital gains rather than income).

Unified Liquidity: Pryzm’s design of having a single pool for each asset means that liquidity is consolidated rather than fragmented across multiple maturity dates. This results in higher capital efficiency for LPs and ensures that liquidity is not diluted.

Minimal Impermanent Loss: The risk of impermanent loss is also mitigated in Pryzm’s framework due to the high correlation between cTokens and pTokens. This correlation means that the relative values of these assets are likely to move in tandem, reducing the risk of significant value discrepancies between them.

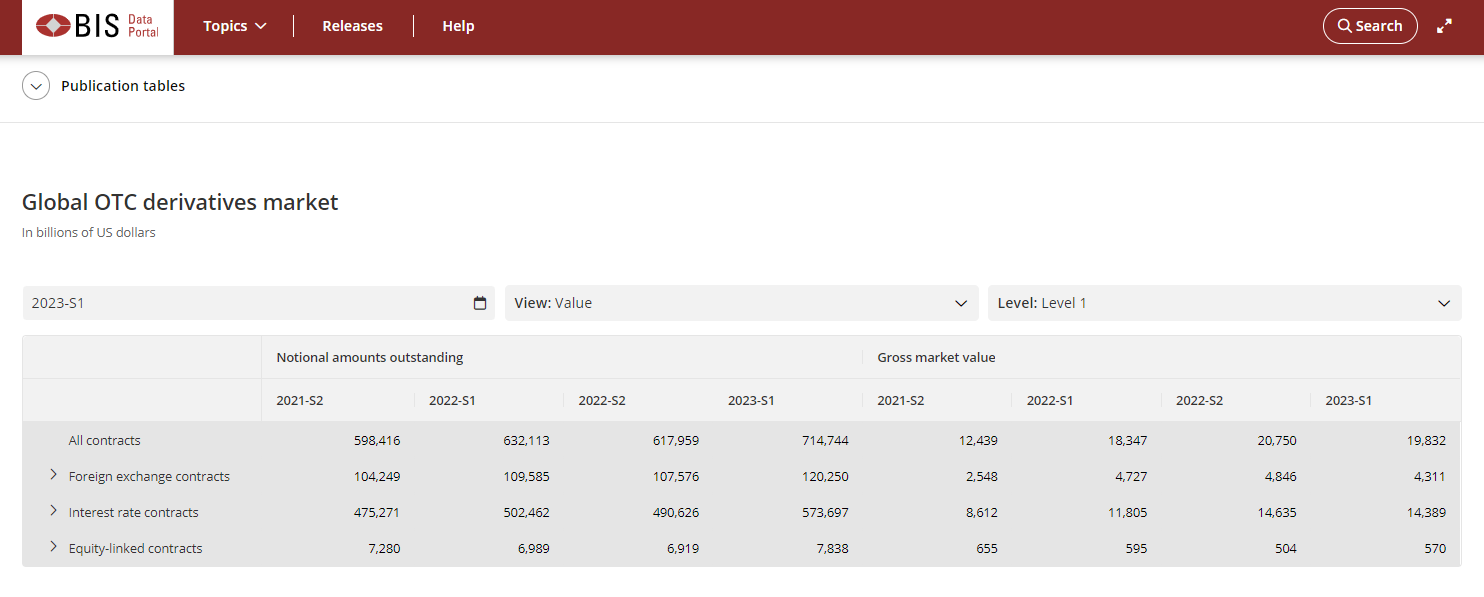

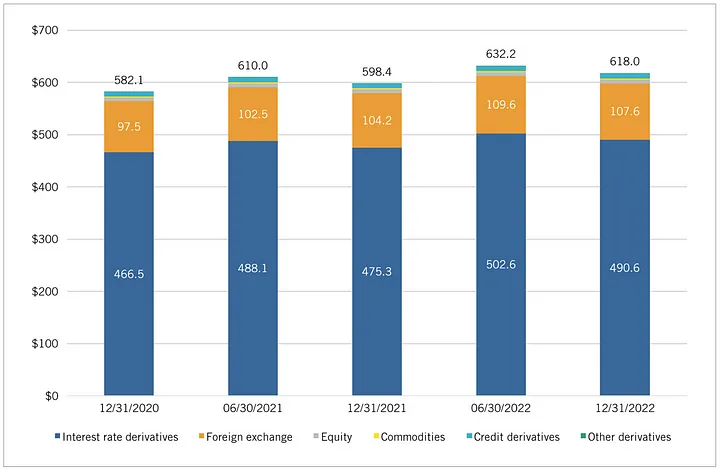

By tackling the prevalent issues of yield volatility, lockup periods, and governance complexities, Pryzm empowers users to secure a fixed yield for a predetermined duration. This introduces a marketplace for fixed yields, akin to the traditional financial market’s interest rate derivatives (IRDs), enabling participants to navigate between fixed and variable yields according to their risk appetite and market forecasts. Through this approach, Pryzm not only simplifies yield management but also broadens the strategic options available to DeFi participants, marking a significant step forward in the evolution of the industry. For reference, IRDs are by far the most dominant financial derivative in TradFi.

Additionally, Pryzm has also developed dedicated modules to take yield trading to the next level. For instance, Pryzm’s Weighted AMM (WAMM) enables the customization of pools to support custom weights such as 80/20 or 60/20/20 pools. This is particularly interesting for LSTs, where in a 50/50 pool half of the assets would not be producing yield. When that 50/50 split becomes an 80/20 pool then only 20% of the asset would not be yield-bearing and it would be more cost-efficient to incentivize liquidity.

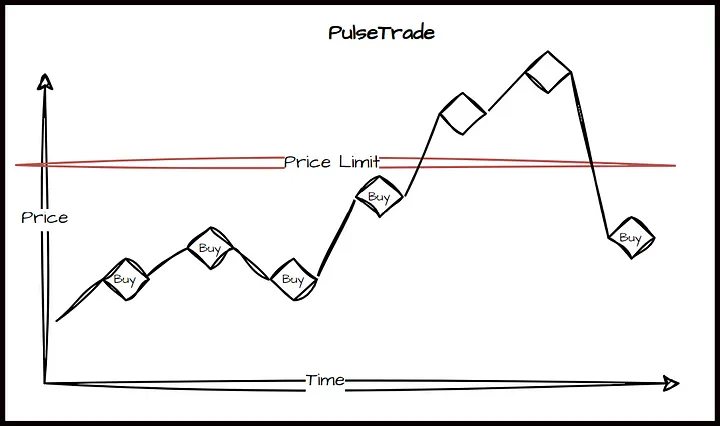

Other tools include PulseTrade, which is a Dollar-Cost Averaging (DCA) module that helps invest small amounts at regular intervals to reduce price impact. Users simply need to set up their plan by specifying a total amount to invest in a specific time interval and the system handles the rest for them. For example, you could specify to swap 1 $USDC for $ATOM every minute over 100 minutes, and even specify an execution price limit to take advantage of price fluctuations. This would allow users to stipulate that if the price of the asset drops below a specific level, they would like to take advantage of the dip and complete the remaining amount all at once.

Value Proposition

Pryzm’s value proposition lies in its comprehensive ecosystem designed for yield optimization, providing users with unprecedented control over their earnings across a diverse range of assets. Unlike other DeFi projects in other chains that focus solely on wrapping yield-bearing assets into principal tokens (pTokens) and yield tokens (yTokens), Pryzm offers a multifaceted approach to yield management.

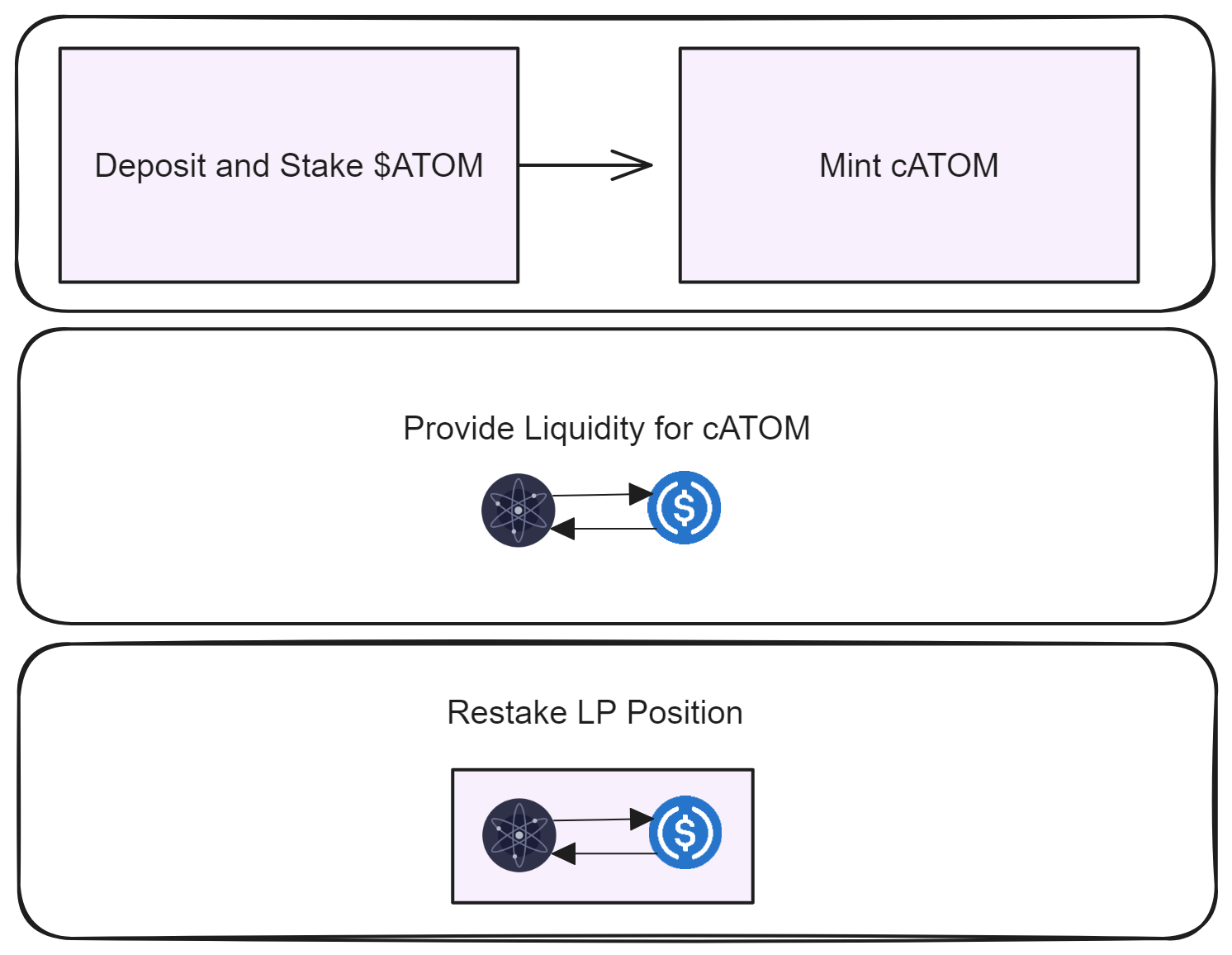

As a Layer-1, Pryzm not only tokenizes and facilitates the trading of future yield earnings but also grants pToken and LST holders liquid governance power, implements a Time-Weighted Average Price (TWAMM) mechanism to reduce price impact, and introduces the concept of “restaking” or “proof of liquidity”, allowing users to stake their LP tokens to secure the chain and earn additional yield (from $PRYZM inflationary emissions and network activity fees).

Unique as a Layer-1 chain, Pryzm unlocks access to fixed-income and derivative markets, establishing itself as a versatile platform for yield-related strategies in Cosmos. Users benefit from the ability to navigate yield volatility across various activities—such as earning interest, collecting LP fees, and participating in staking and restaking—to secure yields, purchase assets at a discount, and engage in governance.

- Stake the native asset of a Cosmos chain and wrap this position into an LST, allowing you to continue earning staking rewards while unlocking liquidity for further use in DeFi.

- Use the LST to provide liquidity to Pryzm’s Yield AMM, contributing to the platform’s liquidity and earning extra yield from swap fees in exchange for facilitating yield trading between fixed and variable rate takers.

- Finally, stake the LP token obtained from providing liquidity into the yield AMM in order to earn block rewards and chain revenue from staking and securing the Pryzm chain itself, providing you with additional yield.

By following these steps users can effectively leverage 3 different sources of yield: LST rewards, swap fees from providing liquidity to Pryzm’s YAMM, and Pryzm’s block rewards and chain revenue earned from staking the LP token as a PoS asset.

The Pryzm Yield AMM equips users with the tools needed to manage risk and capitalize on yield volatility. Loan takers on money markets can fix their borrowing costs, arbitrageurs can capitalize on rate differences of underlying assets, and speculators can long/short the future income produced by yield-bearing assets like LSTs. This system not only maximizes return potentials but also stabilizes investment outcomes, accommodating both conservative investors seeking fixed yields and those pursuing higher returns through variable yields.

This creates a marketplace that meets the needs and preferences of users with different risk profiles: liquidity providers earn additional yield from swap fees, yToken buyers get leveraged exposure to the yield produced by the underlying, and pToken buyers can get a fixed rate or buy assets at a discount.

Sector Outlook

The sector outlook for yield tokenization and trading is highly promising. While the FX market is significant, it pales in comparison to the interest rate swap (IRS) market. Fixed income represents the largest asset class globally and yield derivatives are the biggest derivative market. First, interest rates are a great vehicle for expressing a view on the market, since they are extremely reflexive to changes in supply and demand. Second, sophisticated players consistently demand tools for managing their risk, such as locking in rates or using derivatives to insure against unfavorable rate movements.

Institutions and hedge funds have historically profited from yield trading, as displayed above, but Pryzm aims to democratize access to this lucrative market, making yield trading available to everyone. Tokenizing yield opens up endless opportunities, allowing users to sell future income for immediate cash, lock in guaranteed income, or capitalize on expected yield increases.

As the sole player in the Cosmos ecosystem focusing on yield tokenization, Pryzm enjoys a competitive advantage and faces no direct competition. The success of platforms like Pendle on Ethereum, with over $2.55 billion in total value locked (TVL), demonstrates the market demand for yield tokenization and trading. The potential for growth and expansion of yield trading within the Cosmos ecosystem, particularly through Pryzm as the Interchain’s Yield Hub, represents a significant and highly scalable opportunity – connecting a plethora of Layer-1 chains secured through staking. Pryzm’s primitives also address common challenges in staking, such as lengthy unstaking periods, and providing users with instant access to their assets.

Unlike traditional models that depend solely on asset price, Pryzm’s Total Addressable Market (TAM) is a function of market capitalization multiplied by yield. This means that as more chains are integrated into the Cosmos ecosystem, bringing with them an increased number of assets and Liquid Staking Derivatives (LSDs), the TAM is set to expand correspondingly. Furthermore, the model benefits from both token prices and yields appreciating, which together drive overall growth in the TAM. This approach not only enhances Pryzm’s attractiveness but also its utility by eliminating the conventional unstaking periods and allowing instant redemption of underlying tokens, thereby mitigating common pain points for yield-seekers.

Market Opportunities and Challenges

Yield tokenization and trading can tap into the vast potential of fixed-income markets on-chain. By creating a marketplace for yield and governance, Pryzm not only enhances DeFi’s value proposition but also addresses inherent market challenges such as yield volatility and asset lockup. This approach also addresses some of the limitations present in the Cosmos ecosystem before Pryzm’s inception, where LSTs lack voting rights and have a 21-24 day unstaking period attached.

Pryzm’s utility goes beyond improving liquidity conditions in Cosmos. Yield stripping and trading also unlock opportunities such as repo agreements, fixed-to-floating vault strategies, and the use of future yield for one-off payments. This not only broadens the utility of yield tokens but also introduces a liquid governance marketplace, rewarding participants for their voting activities.

Moreover, this business model fosters positive-sum games with other protocols by allowing the tokenization and trading of their native tokens on the Pryzm Automated Market Maker (AMM). This composability enhances the use cases and utility of the tokens of other Cosmos chains, offering flexibility and matching users with varying preferences such as yield speculation, arbitrage, hedging, and fixed yield opportunities.

Drawing inspiration from the recent success of Pendle on Ethereum, we might expect similar opportunities to arise on Cosmos. Most notably, the Cosmos ecosystem is characterized by high PoS yields and heated debates surrounding the inflation rate and emissions policies in some Cosmos chains. These discussions often lead to fluctuations in expected yield rates, providing fertile ground for both fixed and variable yield trading strategies, even in scenarios where the underlying asset prices remain stable.

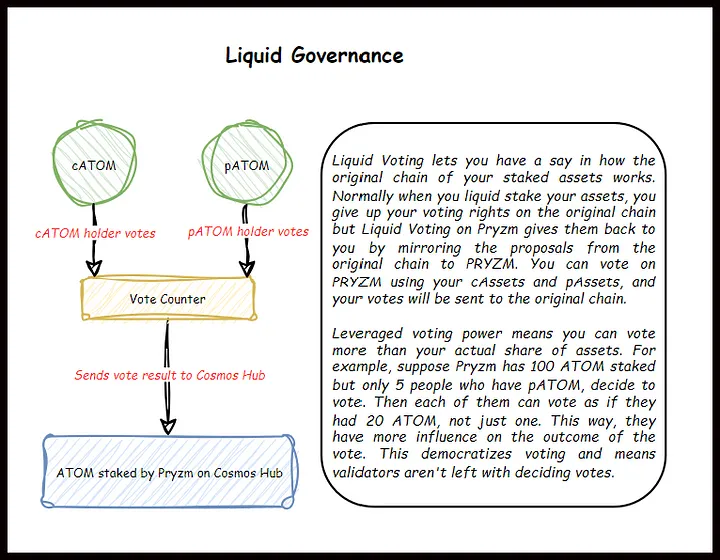

Governance dynamics are also particularly relevant in the Cosmos ecosystem, where the implementation of the pGOV module by Pryzm can amplify exposure to these opportunities. Thanks to leveraged voting, users can wield voting influence disproportionate to their actual asset holdings, further democratizing governance processes. This disrupts traditional power dynamics by preventing validator monopolies and ensuring a more equitable distribution of decision-making power. With this approach, Pryzm not only maintains liquidity for users but also monetizes voting, opening up a new avenue for yield generation through liquid governance.

For instance, by staking assets on Pryzm, users traditionally forfeit their direct voting rights on these original chains. However, Liquid Voting reclaims these rights by mirroring the governance proposals from the original chains onto Pryzm, allowing users to participate in governance through their cAssets and pAssets. Votes cast on Pryzm are effectively reflected on the original chain, ensuring user participation remains impactful. Furthermore, Pryzm introduces the concept of leveraged voting power, amplifying the influence of each voter beyond their nominal share of staked assets. For instance, if Pryzm holds 100 $ATOM and only five owners of $pATOM choose to vote, their voting power is magnified, enabling them to vote as though they control 20 $ATOM each.

Moving forward, the expansion of the Cosmos ecosystem with the launch of new chains introduces additional assets like $DYDX, $TIA, $DYM or $SEI into the yield trading landscape. This diversification enriches the ecosystem, providing yield traders with a broader spectrum of opportunities to explore. The more chains launch on Comos and the more assets are in circulation, the larger the TAM for Pryzm. In addition to that, Pryzm is not restricted to IBC chains in Cosmos; it can also enable yield trading of any autocompounding LST bridged via Axelar or Wormhole, such as wstETH or jitSOL. This functionality will be available at launch.

Tailwinds for Larger Adoption

As time passes we are starting to see oversaturation and little differentiation in market sectors like lending, perps, and stablecoins. However, all of them have in common the demand for leverage and yield. We argue that amidst such overcrowded sectors, yield tokenization and trading stand to benefit from the tailwinds and greater adoption of adjacent projects.

First, projects that extend the utility of existing tokens and enhance the value proposition of their respective platforms offer a compelling proposition for composability. This often materializes in enhanced yield opportunities, synergies and benefits for both parties involved, and longer-term partnerships.

Secondly, projects that are not reliant on a single ecosystem or project for their success have a strategic advantage. Oftentimes being tied to the success of a single platform can pose significant risks. Those projects that manage to abstract away complexities and offer primitives that seamlessly adapt to any asset demonstrate resilience and flexibility, appealing to a broader user base and mitigating risks associated with the volatility of individual ecosystems.

Lastly, the clear value proposition Pryzm offers ensures a positive-sum game for all participants, promoting a collaborative environment conducive to mutual growth. This inclusive approach is likely to drive adoption and user retention, with all participants benefitting from their involvement in Pryzm to maximize their earnings potential and the governance utility of their token holdings

Pryzm exemplifies all of the key factors for larger adoption presented above, showcasing a primitive that can provide significant value across various dimensions. The ability to build pools for any DeFi yield-bearing asset or staking tokens underlines this foundational strength. This versatile approach to liquidity absorption doesn’t vamp underlying projects either. Instead, it boosts TVL for projects within its ecosystem without draining their resources, showcasing a clear value add for all parties involved.

Strategic Growth and Implications for $PRYZM

A particularly noteworthy aspect of Pryzm’s strategy is its deliberate choice to forego venture capital (VC) funding in favor of a community-centric growth model. This decision stems from a philosophy that VC involvement could unduly centralize token ownership, contradicting the ethos of DeFi. Instead, Pryzm opted for a community airdrop, aiming to decentralize ownership among a broader base of stakeholders.

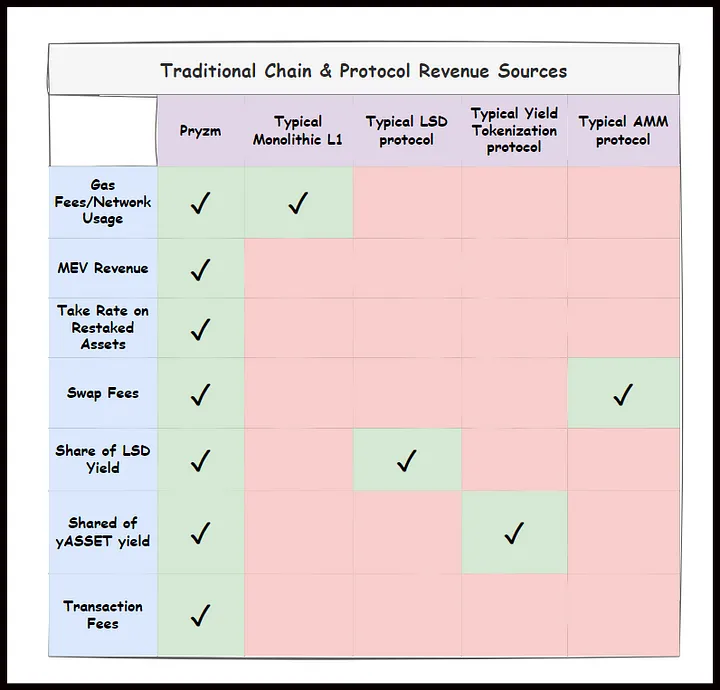

Distinctively, Pryzm diverges from the conventional Layer-1 blockchain revenue model that heavily relies on transaction gas fees. Instead, it pioneers a diversified revenue architecture, tapping into multiple streams that reflect its innovative offerings:

Staking Yield Shares: By facilitating the staking of a variety of tokens (e.g., $ATOM, $INJ, $OSMO, $TIA), Pryzm accrues a share of the yield generated from these assets. This mechanism not only supports the broader blockchain ecosystem by providing liquidity and security but also generates ongoing revenue for the network through its collection of yield from cTokens and yTokens.

Swap Fees: The platform’s AMM imposes a nominal fee on swaps, contributing to Pryzm’s revenue. This is further enhanced by leveraging the Skip Protocol’s Block SDK, which ensures the equitable distribution of MEV gains without undermining network security or user experience.

Token Restaking Tax Rate: Pryzm imposes a modest tax on tokens restaked within its network, specifically on those delegated to Pryzm validators. This “take rate” applies to various Yield Pool Tokens, creating an additional revenue channel.

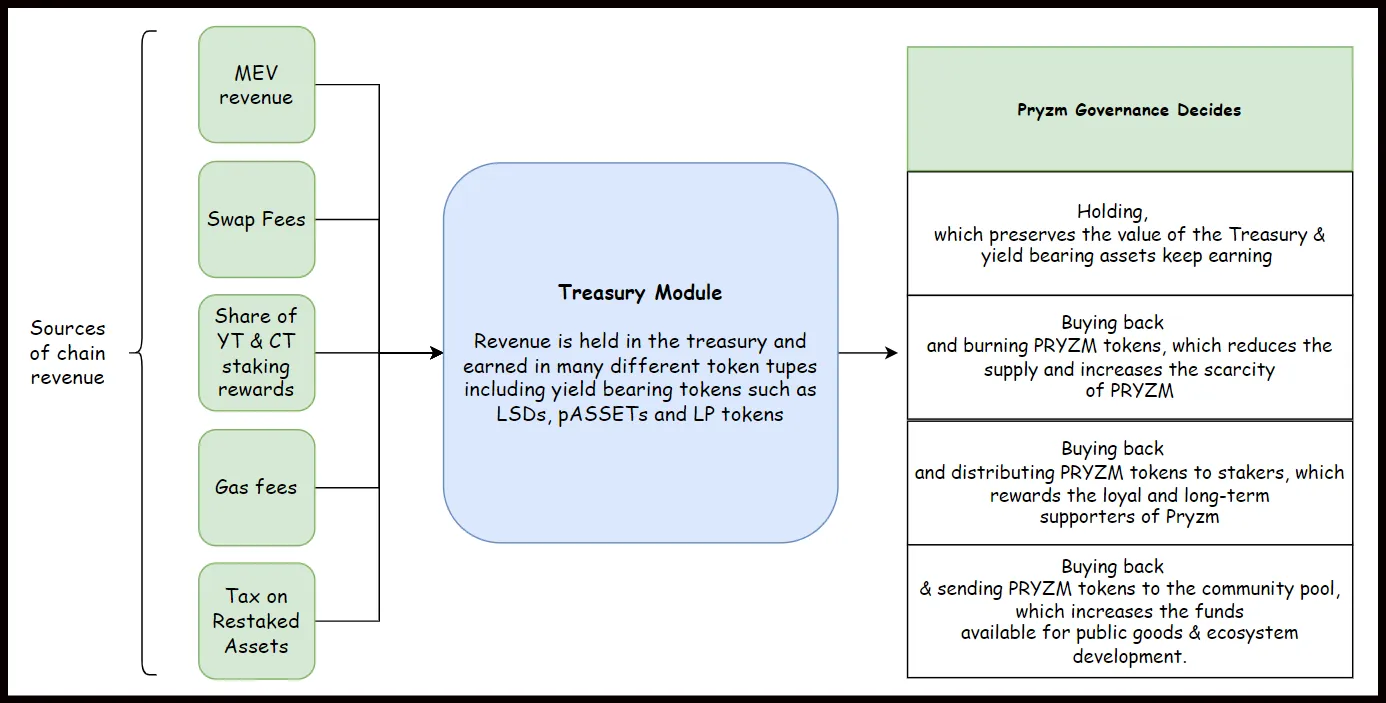

The Pryzm treasury is optimized to harness and optimize the revenue streams generated across the platform, aggregating the yield-bearing assets and LP tokens that endow Pryzm with protocol-owned liquidity (POL). $PRYZM token holders are responsible for ensuring that the deployment of these assets aligns with the collective vision and needs of the community.

Some of the initiatives can include:

Value Preservation: Holding the funds within the Treasury to safeguard their value and ensure the long-term financial stability of the network.

Supply Management via Buyback and Burn: Engaging in the buyback and subsequent burning of $PRYZM tokens in order to reduce the total token supply, thereby potentially increasing the scarcity and value of $PRYZM.

Rewarding Loyalty: Buying back $PRYZM tokens to distribute among stakers as a reward for their loyalty and ongoing support of the network.

Community Pool Contributions: Allocating PRYZM tokens to the community pool, thereby funneling resources toward the development of public goods and the broader ecosystem.

Conclusion

Pryzm is setting the stage for a revolutionary shift in how yields are generated, managed, and traded on-chain. This commitment to unlocking fixed income and boosting yield earnings places it at a significant advantage. Through Pryzm, investors gain access to a versatile platform that not only enhances their yield strategies but also contributes to the broader growth and stability of the DeFi ecosystem.

Our thesis is simple: mature markets call for sophisticated instruments that can drive the demand for the rapid adoption of LSTs, LRTs, and other yield-bearing assets. The introduction of an appchain for yield trading is Pryzm’s response to this need, providing a mechanism for DeFi to meet the requirements of a broader range of investors.

References

Disclosures

Revelo Intel is engaged in a commercial relationship with Pryzm as part of an educational initiative and this report was commissioned as part of that engagement.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.