Introduction

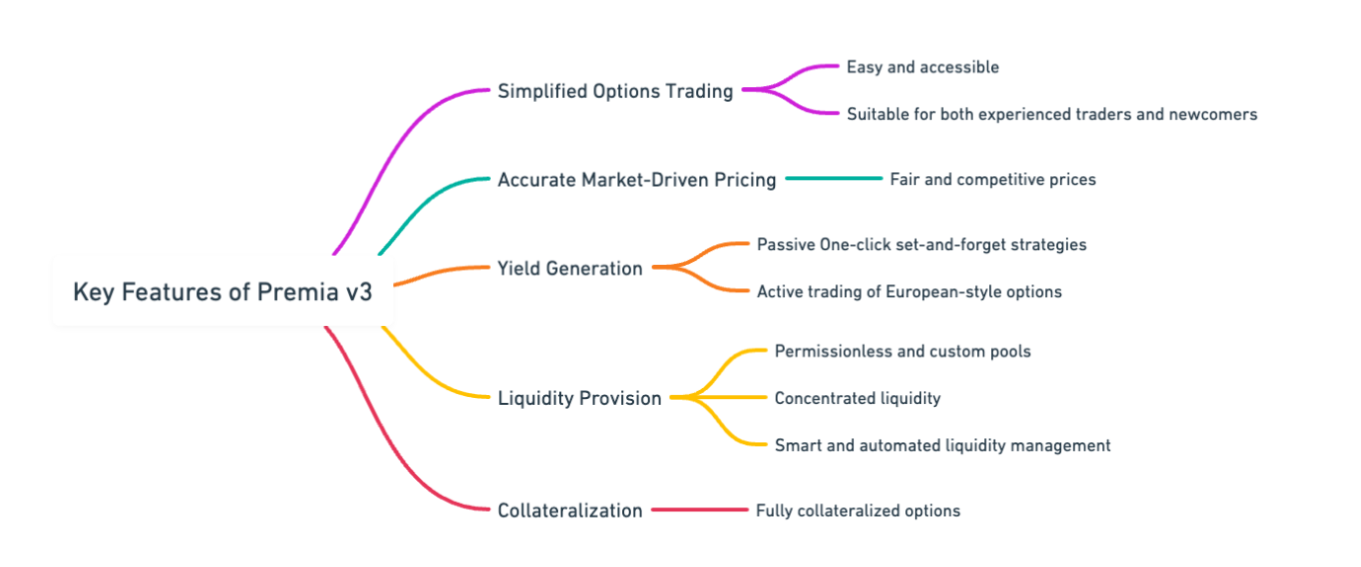

Premia Blue, also referred to as Premia v3, is the latest upgrade of the Premia protocol, designed to simplify and democratize options trading within the DeFi space. In this research report, we will analyze the key features of Premia Blue, its potential impact on the market, and its attractiveness depending on the type of user you are.

Overview

This version of the protocol introduces significant advancements that enhance capital efficiency and composability. Most importantly, the protocol offers benefits for all types of users, regardless of their level of expertise (retail users, passive LPs, active market makers, protail (pro-retail, trading firms, arbitrageurs, etc.).

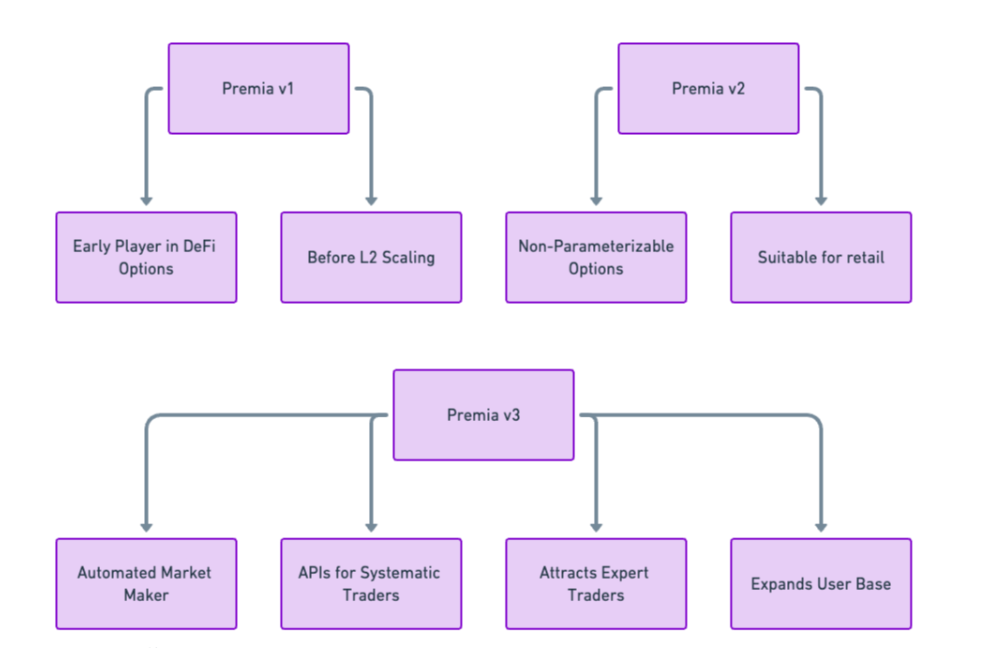

- Premia v1 (Peer-to-Peer) – 2021: Premia v1 predated L2s and operated as a peer-to-peer options trading platform, featuring an OTC market for on-demand and on-match trading.

- Premia v2 (Peer-to-Pool) – 2022: Premia v2 transitioned to a peer-to-pool model, primarily targeting retail traders. However, this version lacked the flexibility to parametrize the options being sold, limiting customization and making it less appealing for more professional users.

- Premia v3 (Hybrid orderbook and AMM model) – 2023: Premia Blue marks a groundbreaking shift with a hybrid approach. It combines an on-chain orderbook with the accessibility of trading APIs for systematic traders. This innovative blend caters to a wider audience, including experienced traders from platforms like Deribit, who prioritize low fees and precise options pricing. Some of the features include:

-

- Concentrated liquidity and range order AMM.

- Passive liquidity vault network with Premia v2 equivalent underwriting vaults (DOVs).

- Real-time decentralized RFQ network.

- On-chain orderbook with off-chain gasless API and gasless limit orders.

Throughout this evolution, the Premia team has expanded significantly, growing from a core team of 4 to a force of 25 full-time contributors.

With L2s increasing in popularity and account abstraction starting to pick up more traction, the focus is now on developing an intent-based architecture that can take the user experience to the next level.

With Premia Blue now in production, it is also worth noting that there are more features that will be released in various stages in the near future, such as a portfolio margin system, partial collateralization for select payoffs, more vaults, etc.

It is important to keep an eye on the development and release of these features since they can serve as new catalysts that will enter the market around Q1 2024. Features like portfolio margin are extremely important for more sophisticated actors and unlock endless opportunities. Think about a mid to long-term future where you can use your existing DeFi positions as margin.

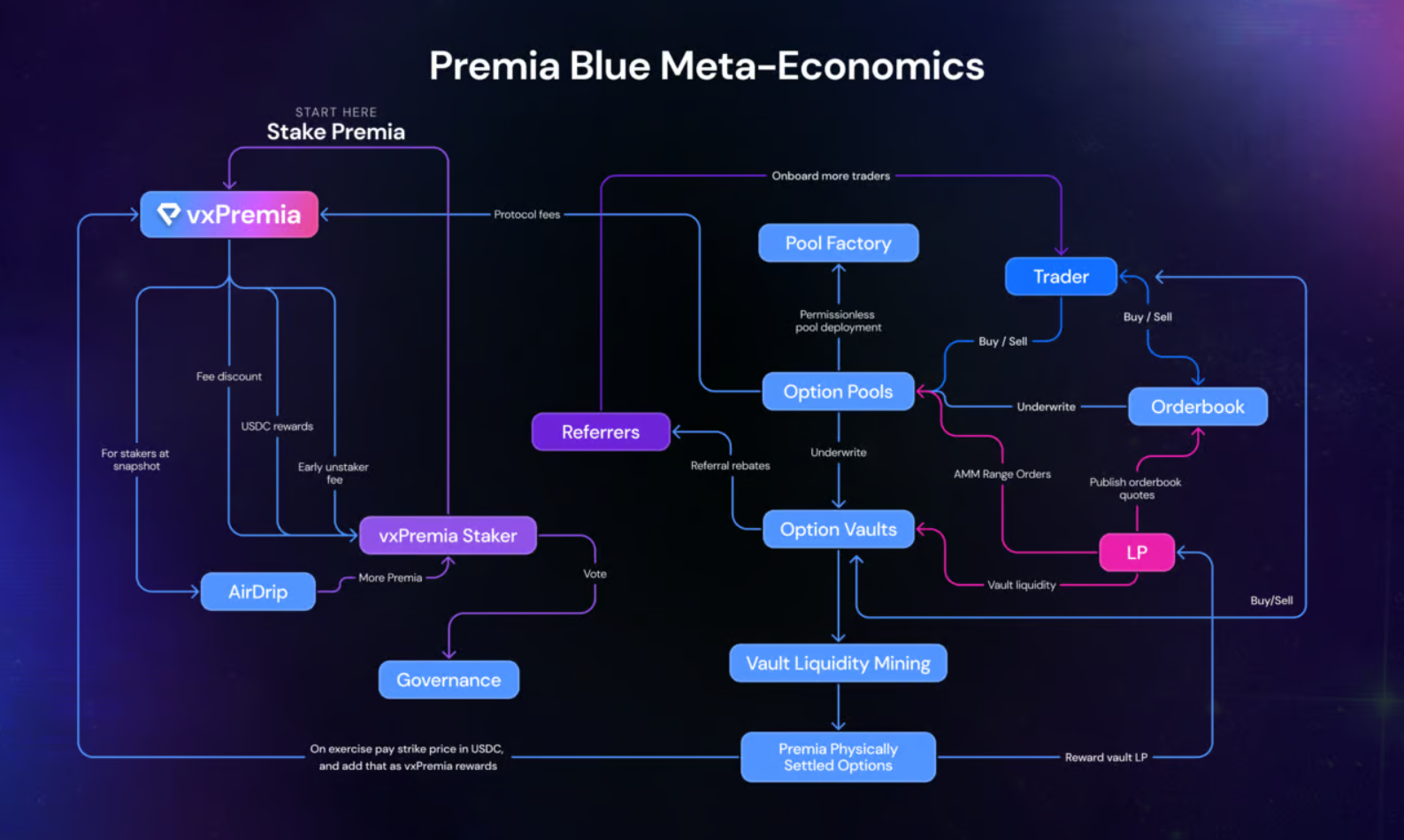

Right now, users can also enjoy revenue-producing liquidity mining rewards ($PREMIA physically-settled call option incentives), use vxPREMIA voting for vault mining reward weights, or engage in a referral program with lifetime revenue share (with 50% revenue share during the first month).

Premia Blue

Pricing has been one of the biggest hurdles for DeFi options to take off. Unlike traditional options-pricing models, which often rely on parameters like the risk-free interest rate, pricing on-chain assets involves a different market microstructure that makes it harder to accurately estimate volatility.

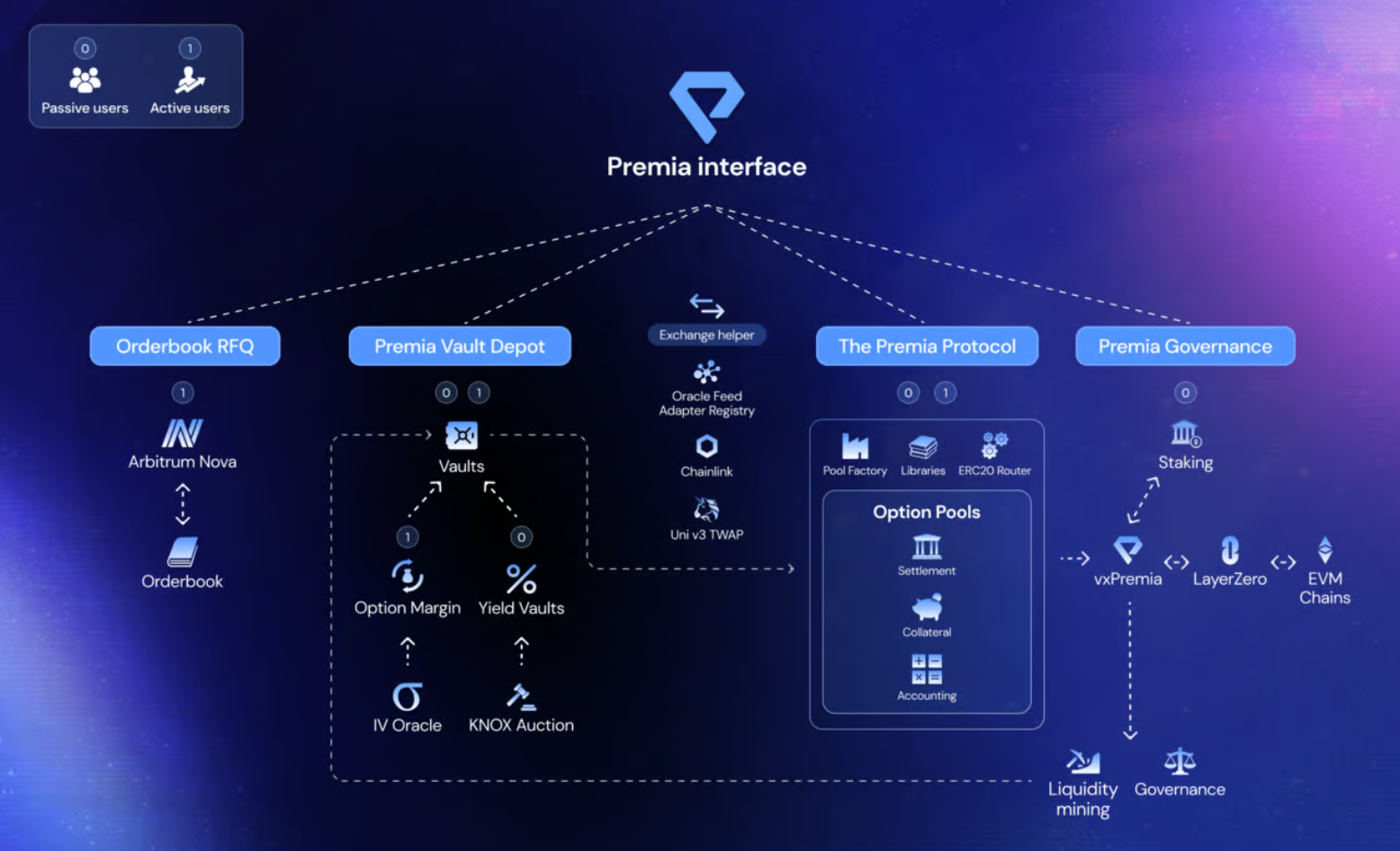

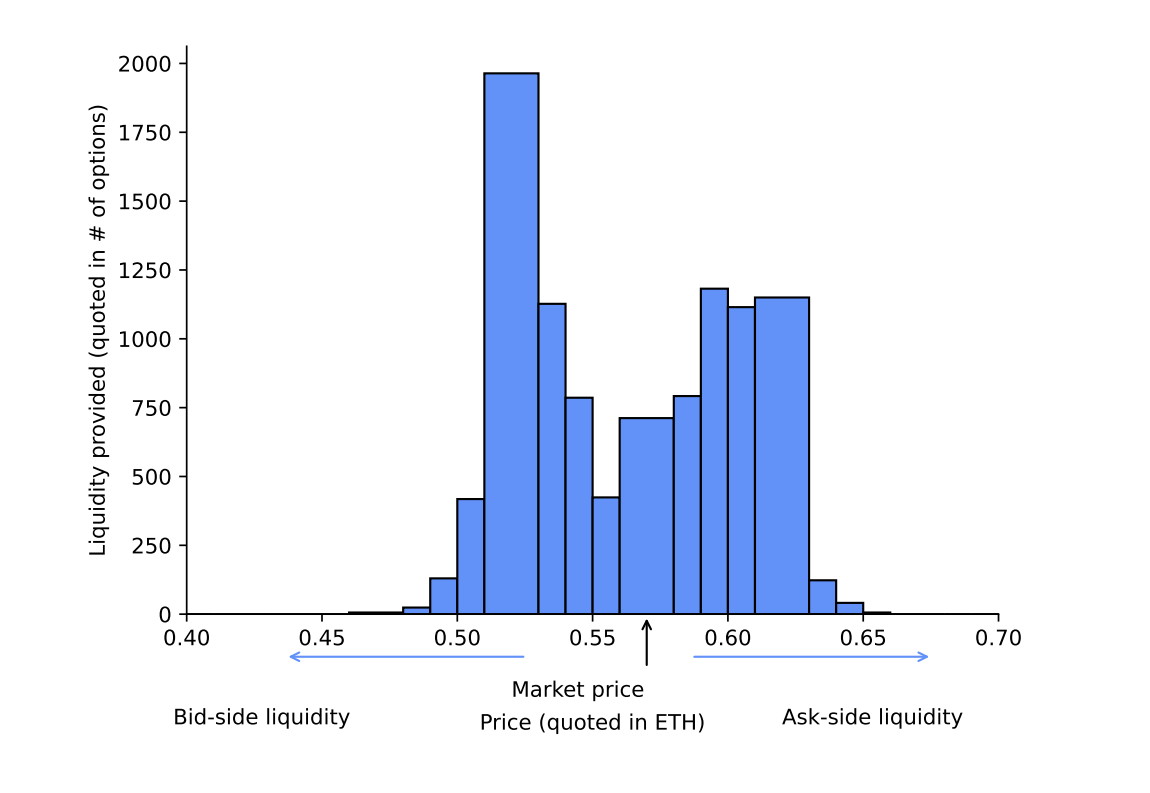

Premia Blue offers deep liquidity and accurate pricing by aggregating liquidity from various internal sources of liquidity, featuring a CLAMM (Concentrated Liquidity AMM), a limit orderbook, strategy vaults, and an RFQ (Request For Quote) network. This makes it possible to offer a non-custodial trading experience that resembles the CLOB (Central Limit Orderbook) of centralized exchanges.

The Exchange

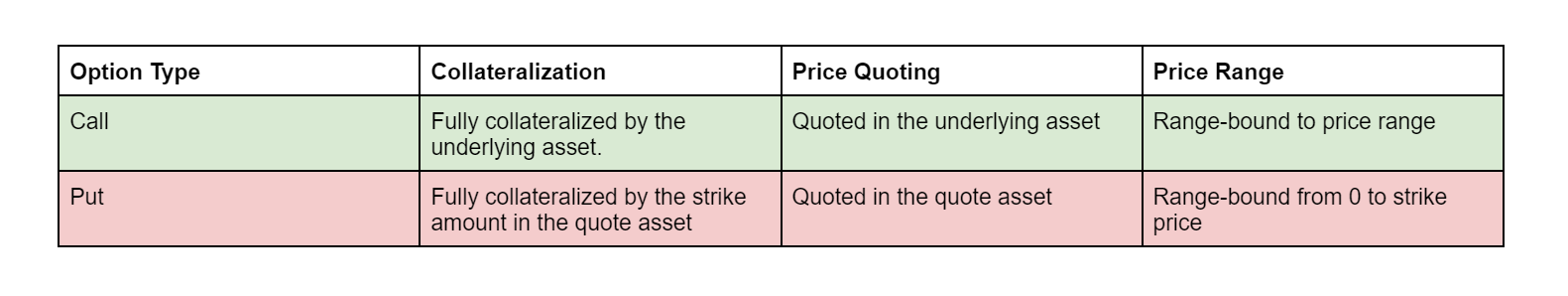

In order to minimize counterparty risk, options on Premia are fully collateralized. However, lending pools will be introduced in the future to increase capital efficiency and enable partially-collateralized positions.

Most often the quote asset will be a stablecoin, such as $USDC.

Premia relies on a hybrid exchange that uses both an AMM and an orderbook. Trades in the orderbook are settled on Arbitrum One, but the quotes are provided on Arbitrum Nova in order to speed up transactions.

While all options settle within their respective pools, it’s possible to interact with multiple sources of liquidity for the same option. Users of the Premia Interface or Premia v3 SDK will have easy access to the best quotes from each source.

To be exact, for each given option, there could be up to 4 liquidity sources:

- AMM – Range Orders.

- Orderbook / RFQ System.

- Vaults.

- External Protocols / Third Parties.

Premia also offers an API and SDK for systematic traders, allowing them to plug and play their existing strategies and leverage them on-chain without even noticing that they are interacting with underlying smart contracts.

The determination of the settlement price is provided by an oracle feed that relies on spot price oracles, ideally corresponding at 8 a.m. UTC. In Premia Blue, pools can be created out of the box with:

- Chainlink VWAP Price Feeds

- Uniswap v3 TWAP Price Feeds

- Third-party oracles that implement the IOracleAdapter smart contract interface.

- The UI will only display well-established price feeds.

The AMM

In DeFi, most Automated Market Makers (AMMs) operate using Constant Function Market Makers (CFMMs), where a trading function governs the exchange of assets. However, Premia takes a different approach. Instead of employing a trading function, Premia’s AMM relies on a linear relationship between price and liquidity. This unique approach is made possible due to the range-bound nature of option prices.

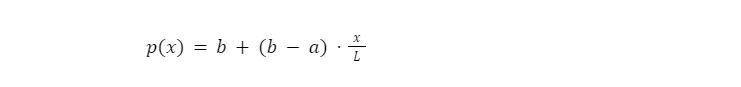

Option prices inherently have a defined price range, typically from ‘a’ to ‘b’, and this range is divided into active tick ranges with associated liquidity ‘L’. For example, if the current price ‘p’ is at the lower bound ‘a’, the AMM’s price formula is used to determine the price for any trade size ‘x’ within the active range.

The price of an option is calculated using the following formula:

- ‘x’ represents the trade size.

- ‘a’ and ‘b’ define the lower and upper bounds of the price range.

- ‘L’ is the available liquidity within that price range.

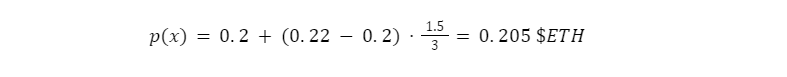

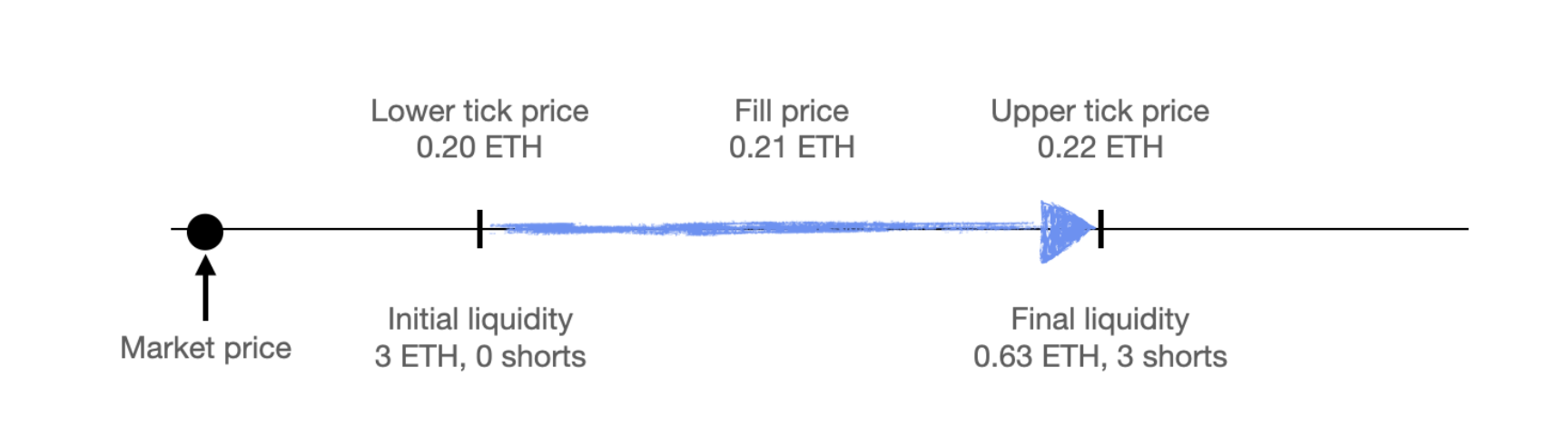

As an example, assume the following:

- There are 3 units of liquidity deposited in the price range of 0.2 $ETH to 0.22 $ETH.

- The current market price is at 0.2 $ETH.

- An individual liquidity taker (LT) wants to buy 1.5 long contracts.

According to the AMM’s formula, when the LT buys 1.5 long contracts, the market price will move to 0.21 ETH because half of the order is filled, and the formula guides the price change.

Now, the quoted price per option is calculated as follows:

So, the LT will receive 1.5 long contracts in return for 1.5 * 0.205 = 0.3075 $ETH.

Orderbook / RFQ System

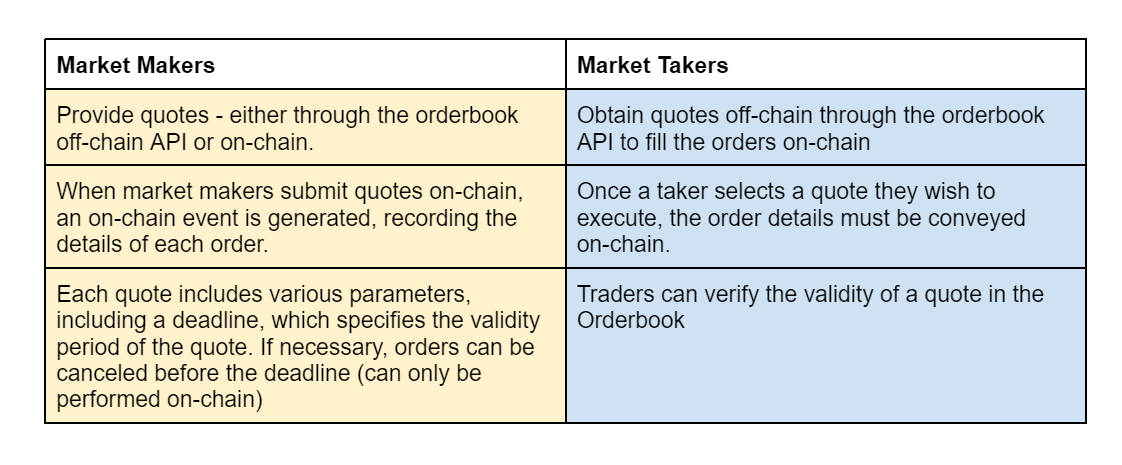

The orderbook facilitates the intermediation between makers and takers.

The orderbook architecture is also unique in the sense that two separate chains are used:

- Arbitrum One acts like the primary chain where all orders are filled, canceled, and positions settled/exercised.

- Arbitrum Nova is used for providing quotes in a decentralized yet low-cost and fast manner. Quotes are simply events that emit the order details by the maker of a transaction that will ultimately be processed on Arbitrum One.

There are two ways to emit quotes, either directly through the contract on Arbitrum Nova or through a rate-limited and tiered API.

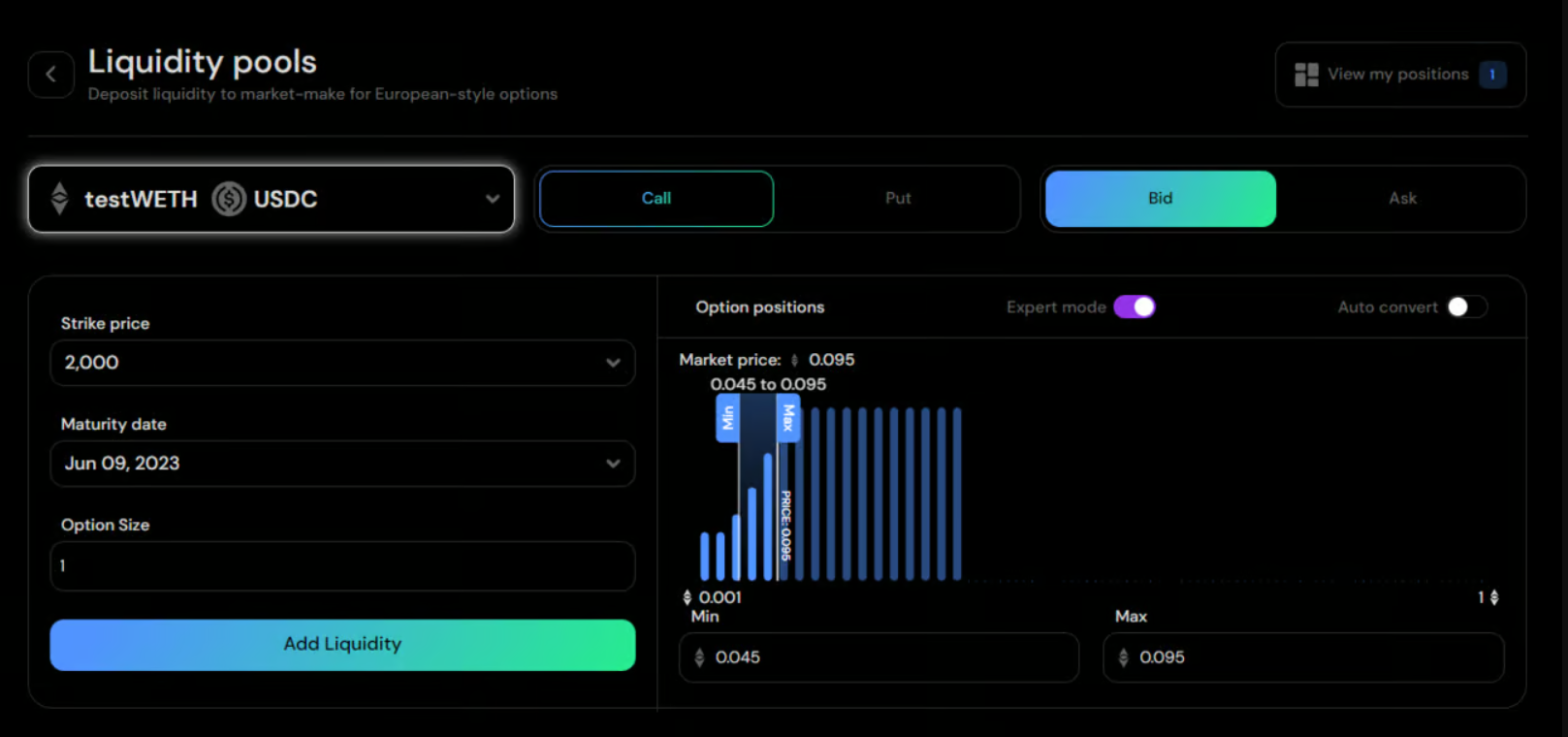

Custom LPs

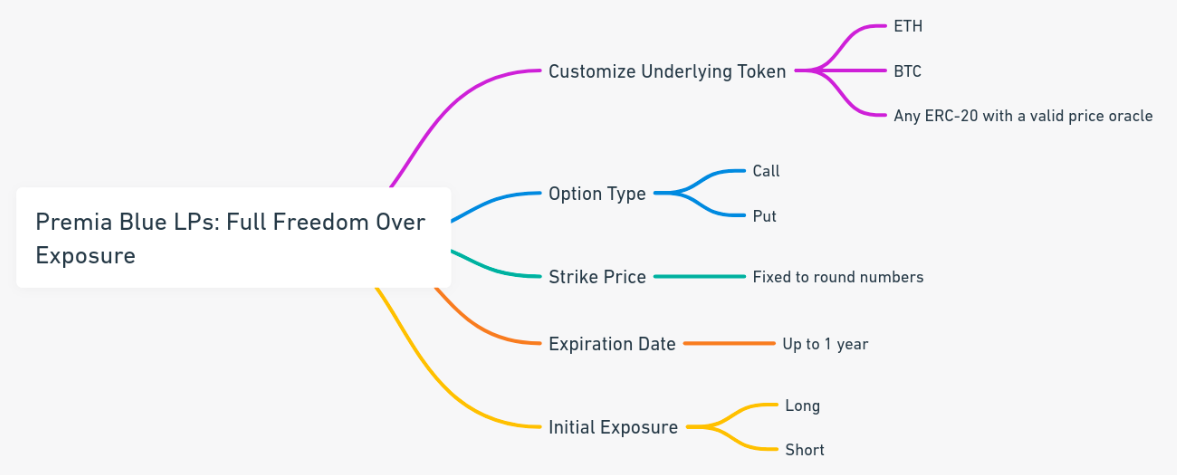

In Premia Blue, LPs have full freedom over their exposure: LPs can customize the underlying token, strike price, and expiration date of the option they wish to market-make. If a pool doesn’t exist for the option, the LP can seed the liquidity to create one.

This unlocks unique opportunities for LPs, who will be able to use their capital efficiently while defining their own risk and setting the exact parameters that they want to underwrite for.

It is important to note that, In order to prevent excessive liquidity fragmentation and ensure maximum composability with other options markets, pools can only be created for common strikes and expirations.

- Strikes are algorithmically limited to common values (log-rounded)

- The maximum expiration is 1 year out.

- All options will expire at 8 a.m. UTC.

- All options with over 7 days to maturity expiring on a Friday

- All options past 30 days must expire on the last Friday of the month.

Concentrated Liquidity

In addition to the fully custom LP system of Premia Blue, its liquidity pools allow for concentrated liquidity. This makes it possible to deploy capital to a specific price range, maximizing utilization and increasing the amount of fees that can be generated per unit of liquidity. This feature is relevant for the most sophisticated users and offers benefits such as:

- Enhanced capital efficiency: LPs can manually set the range at which their liquidity will earn the most fees.

- Maximize liquidity utilization & trading fees: As LPs are incentivized to provide liquidity to the optimal range, capital is used to its maximum efficiency.

When done effectively, LPs get the best fees, while traders get the most liquid markets possible. However, there is a degree of complexity associated with optimally managing positions.

- The most sophisticated traders will be able to maximize the amount of fees they can collect with more concentrated orders.

- Passive LPs with less conviction trades can still earn fees by selecting a wider and less capital-efficient range.

Options positions are represented as fungible and transferable ERC-1155 tokens.

Range Orders

Premia’s concentrated liquidity system offers a unique approach to range orders, providing liquidity providers (LPs) with the ability to calibrate their exposure and define upper and lower bounds for premiums. Unlike Uniswap v3, where a single range order suffices, Premia’s options market requires two distinct range orders to manage exposure effectively: Collateral-Short (CS) and Long-Collateral (LC).

CS and LC range orders in Premia enable traders to fine-tune their exposure to short and long positions within defined price ranges. These orders are adaptable to the current market price and provide flexibility for risk management and trading strategies.

Collateral-Short (CS) Range Orders

CS range orders allow traders to manage their short exposure within a specified price range.

Traders can deposit both collateral and short contracts into the range order, and the composition depends on the current market price.

- When liquidity is deposited above the market price (p), the entire deposit consists of collateral. This collateral is used to underwrite options, serving as liquidity for traders buying long contracts. As liquidity takers (LTs) buy long contracts, the market price increases and the CS order is traversed. This means that the deposited collateral is gradually used to cover the increasing market price due to long contract purchases.

- Conversely, if liquidity is deposited below the market price, the deposit comprises short contracts. These short contracts will be bought-to-close as the market price moves upward. This process unlocks the remaining stored collateral.

- A CS range order that straddles the market price will have a mix of collateral and short contracts, optimizing exposure management.

For instance, let’s examine a scenario involving a range order’s liquidity profile placed above the current market price. As liquidity takers (LTs) engage by purchasing long options, the market price progresses through the range order, leading to specific outcomes. In the illustration below, you can observe that once the market price reaches the upper tick price (0.22 $ETH), the entire range order becomes filled.

A full withdrawal would result in the LP obtaining 0.63 $ETH and 3 short positions.

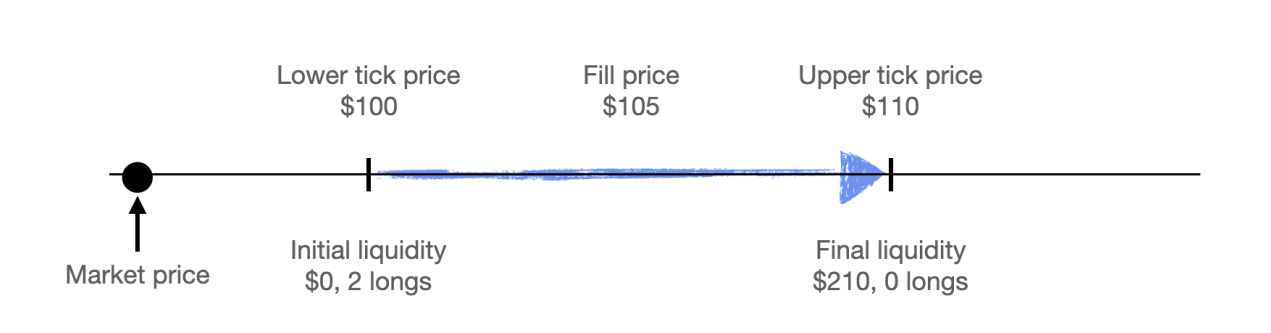

Long-Collateral (LC) Range Orders

LC range orders serve a similar purpose but are used to manage long exposure within a specified price range. The composition of LC orders also depends on the market price:

- Liquidity deposited above the market price consists entirely of long contracts, which are sold to reduce long exposure.

- In contrast, liquidity deposited below the market price is composed entirely of collateral, which is used to buy-to-open long contracts.

- A market order that straddles the market price will include a mix of both assets, facilitating balanced exposure management.

As an example, consider a range order within a put option pool, where liquidity is deposited above the prevailing market price. As the market price interacts with this range order, long contracts are sold to LTs, resulting in the transfer of premiums. Upon the completion of this movement, where the entire range is traversed, the liquidity within the position will consist entirely of the quote asset.

Smart Liquidity Management

To solve the problem of liquidity management Premia offers a Smart Liquidity Management solution for its Range Orders system. One of the most notable features of this system is that range orders are one-sided and can automatically flip their directionality. This represents a massive improvement in terms of user experience.

- Range orders are “one-sided” which means that they can be long or short orders.

- For long orders, the liquidity is used to underwrite long positions on that option.

- For short orders, the liquidity is used to underwrite short positions on that option.

- Range orders flip automatically means that as the price changes and moves along the LP’s price range, the position will collect trading fees and the exposure will be updated. In practice, this means that LPs gain both short and long exposure to a given option.

- Fees are collected both ways.

- Lower risk for LPs.

This provides an unparalleled degree of flexibility. As an LP, all you have to do is choose the underlying asset, the option type (call or put), the directionality of the range order (long or short), the strike price, the maturity date, and the size of the position along with the upper and lower price range.

From the point of view of an LP, the process is simplified as follows:

- Choose the underlying token.

- Choose the option type (call or put) and side of the range order (long or short).

- Enter the strike price, maturity date, and deposit amount.

- Define the upper and lower bound of the range order.

- Provide liquidity and accept the transaction.

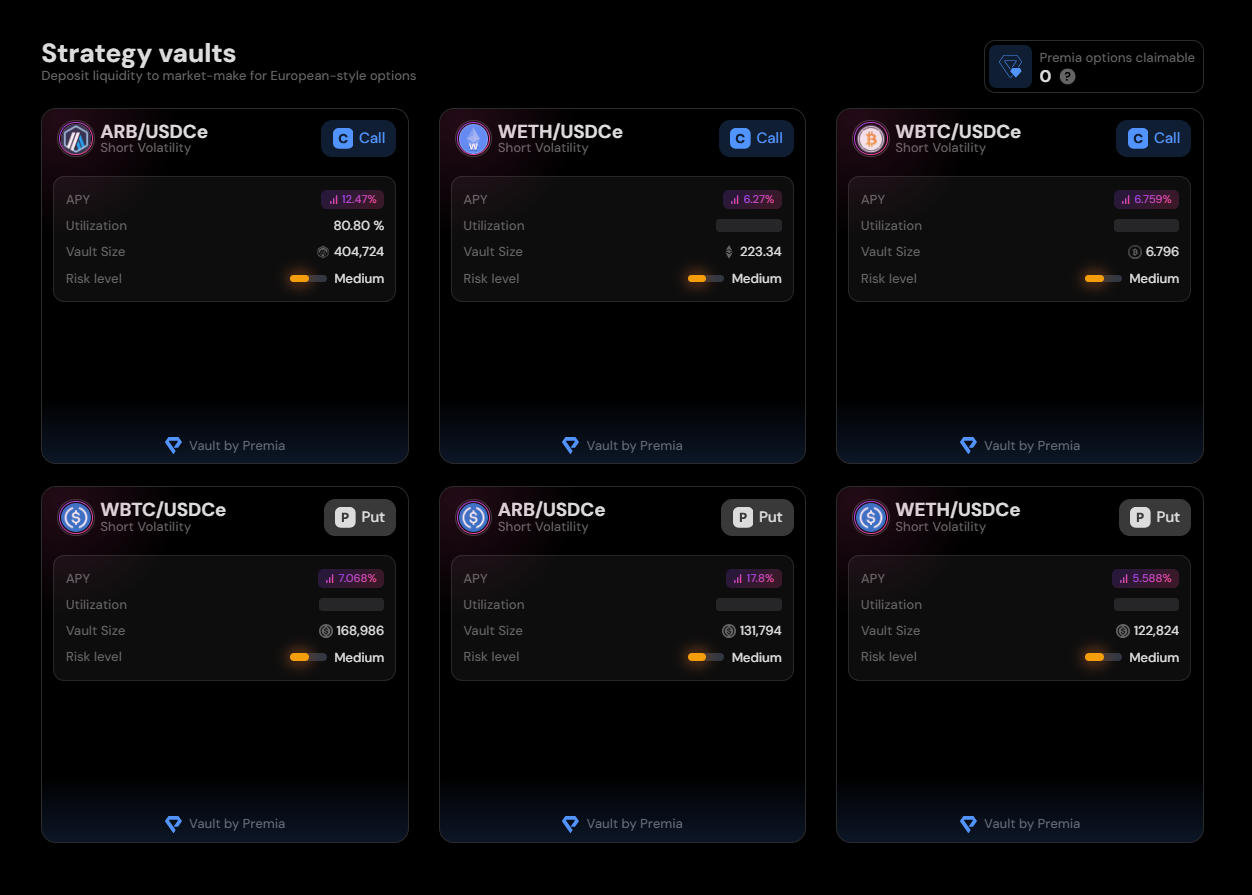

Strategy Vaults – Knox Vaults

Strategy vaults are the most retail-friendly product offering – the perfect alternative for those who want to earn yield without dealing with the complex nature of range orders and concentrated liquidity. These vaults simplify the process of providing liquidity with a series of predefined and automated yield strategies. The emphasis is on simplicity and ease of use, aiming for low-risk and more predictable returns.

The source of liquidity for these vaults includes both liquidity pools as well as the RFQ system provided by Premia’s OTC liquidity. This makes it possible to put together a custom orderbook for traders – allowing to leverage collective liquidity to provide optimal pricing and enhance capital efficiency.

The integration with the base exchange layer is seamless, making it possible to offer just-in-time liquidity for both passive and active market-making, as well as supporting many-to-one relationships between vaults and pools.

The current offering includes Short Volatility Vaults, where the liquidity is used to sell far out-of-the-money (so the potential risk is minimized) options. Future vaults will include options arbitrage strategies.

Additionally, just like liquidity pools, the creation of vault strategies is also a permissionless process. Any third-party provider can create custom vaults and add new ways to monetize liquidity.

Knox vaults are relevant because they help to:

- Increase trading volume in Premia.

- Democratize access to automated yield strategies.

- Compensate strategy creators for their work with vault performance fees.

Premia also offers a set of smart contracts (The Vault Depot) for partners to deploy automated strategies atop Premia. This is also part of the migration from v2 DOVs to v3 Vaults and implements the ERC4626 standard. This is meant to be like a robo-advisor for option strategies:

- LPs pay management and performance fees.

- Traders can buy call/put options from the value, with trades passing filters based on the option’s delta and days till expiry.

- The quoted price includes the option’s fair value, the spread charged by the vault, and the minting fee paid to the pool.

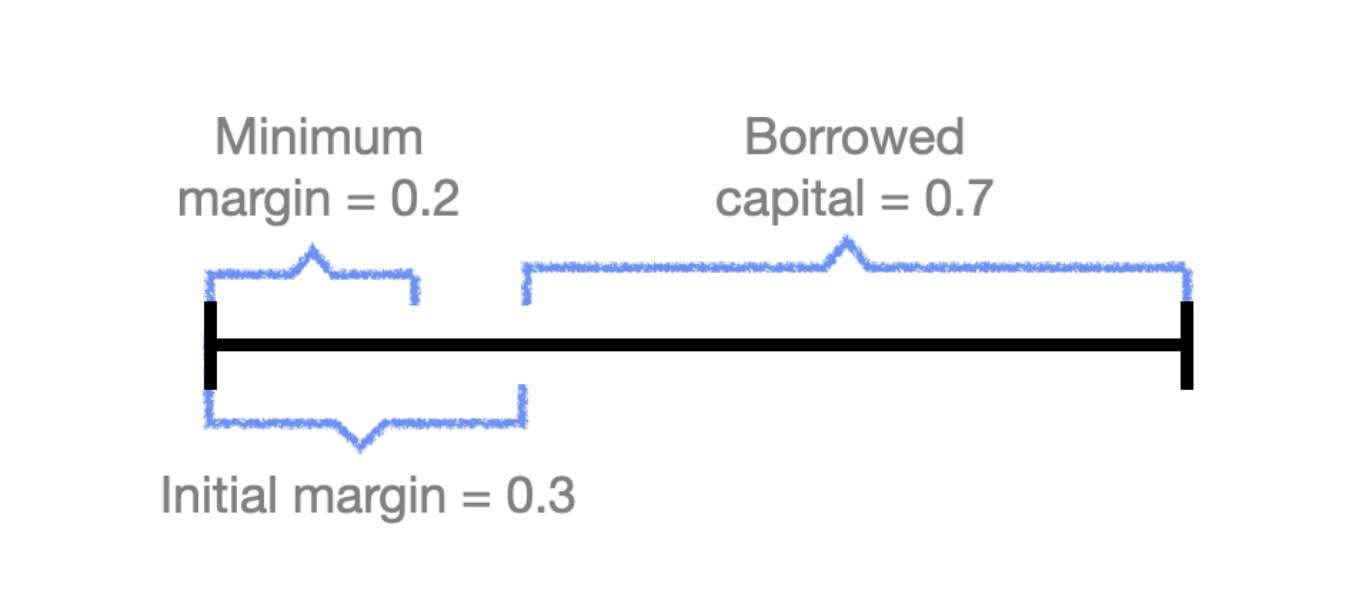

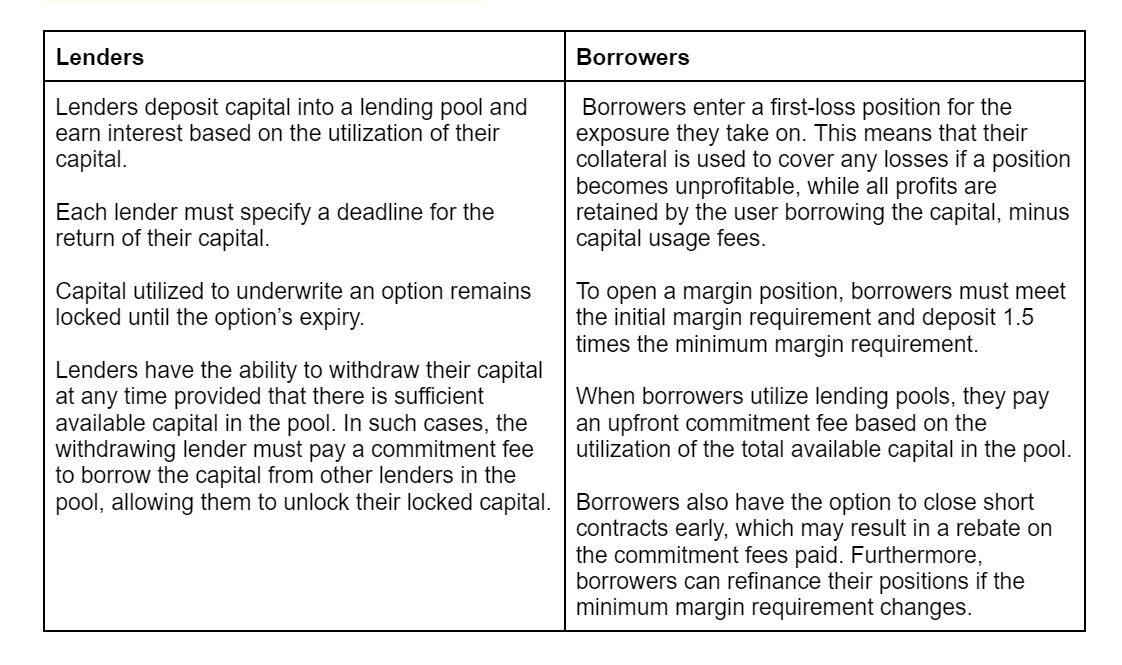

Margin and Leverage

While not available yet, margin and lending pools will play a pivotal role in facilitating trading strategies. This will improve capital efficiency while minimizing counterparty and insolvency risk. This feature is expected to come at the end of Q4 or in Q1 next year.

To address the imbalance in options markets, Premia introduces a sell-side margin vault. This system enables sell-side LPs and option sellers to open positions on margin, up to a limit determined by an automated value-at-risk system.

At the exchange level, all underwritten options are fully collateralized, ensuring the highest level of security. You might think that this full collateralization can create capital inefficiencies and limit the variety of trading strategies that Liquidity Providers (LPs) and Liquidity Takers (LTs) can employ. This is exactly why lending pools are introduced: to allow LPs and LTs to borrow and partially collateralize their short option contracts, thereby expanding the range of trading strategies available.

To participate in margin trading and avoid liquidation during the option’s lifetime, borrowers must meet specific margin requirements. The minimum margin amount is dynamic and determined by a 5% value-at-risk (VaR) for a single-tail, considering the current implied volatility from a volatility oracle based on an eSSVI model. The minimum margin requirement is defined as the 95% VaR, bounded below by 3% of the notional value of the position.

To open a margin position the borrower has to meet the initial margin requirement and deposit 1.5 times the minimum margin requirement.

Example of a first-loss position: If a user borrows 0.8 $ETH, uses 0.2 $ETH from their own funds to achieve full collateralization, and underwrites an option for 0.3 $ETH with an exercise value of 0.15 ETH, the borrower will receive 0.3 + (0.2 – 0.15) = 0.35 ETH during settlement.

OTC Liquidity

Premia Blue introduces an Over-the-Counter (OTC) liquidity mechanism to improve liquidity management for market-makers and vaults. The OTC quote system allows vaults and market-makers, whether they operate on-chain or off-chain, to provide quotes to users or aggregators. These quotes can then be executed through the exchange alongside range orders.

- Increased Liquidity: OTC quotes expand liquidity across various option strikes and maturities, providing users with more options and flexibility.

- Optimization for Market Makers: Professional market makers can optimize their trading strategies, considering both execution prices and transaction fees. This flexibility helps them achieve the best outcomes for their trades.

This feature will become increasingly important as soon as intents become part of the core protocol architecture. Users will then be able to explicitly specify the constraints that they want to apply for their orders (exact strike, maturity, slippage, implied volatility, greeks…).

With intents or without them, OTC orders placed by either market makers or vaults will not be directly visible to users interacting with the pool’s smart contracts. As a result, the intention behind this is that market makers using OTC quotes will source their own trading volume. And since these orders are not displayed to users as available on-chain orders, they become essential for market makers to actively seek trading opportunities.

Additionally, the fact that there are no maker rebates for OTC orders might also affect the behavior of market participants. Instead, the protocol collects the full taker fee.

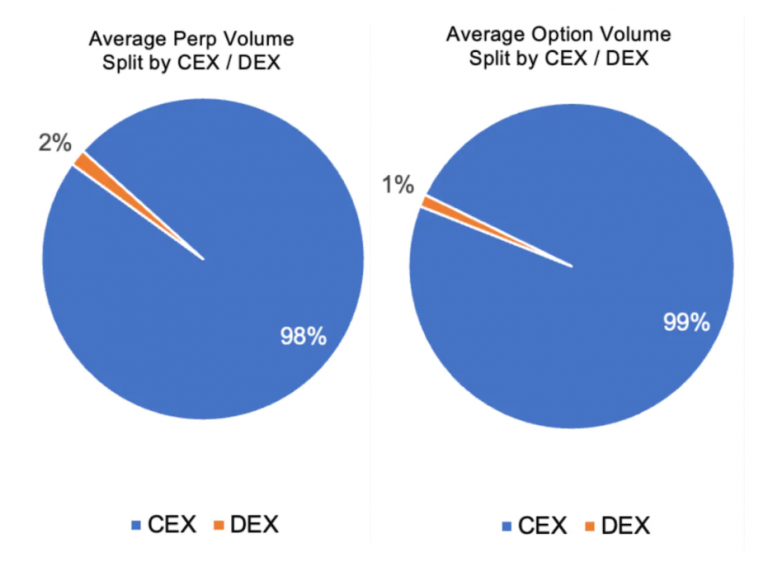

Sector Outlook

Options have emerged as a dominant use case in the realm of DeFi derivatives. They grant traders the coveted right to buy or sell an underlying asset at a predetermined price on or before a specific date, without obliging them to do so. This flexibility empowers traders to hedge risks or speculate on the future price of an asset, all without the need for actual ownership.

The appeal of options in the crypto sphere is further amplified by their customizability. Traders can fine-tune their options by choosing the underlying asset, strike price, and expiration date, thereby gaining remarkable control over their risk and potential rewards.

In the past, most option protocols emerged in the form of DOVs. These were option vaults that sold options in order to allow LPs to earn a steady income from selling OTM options. However, during abnormal volatility conditions, this could result in option underwriters incurring significant losses to traders. Not only that, but the expiration of these vaults made it very predictable and easy to frontrun their flow for arbitrageurs.

Nowadays, the landscape of DeFi options is being reshaped by two transformative trends, catalyzed in large part by the adoption of Layer 2 solutions (L2s). Thanks to L2s it is now possible to come up with AMMs and orderbooks. This has helped to solve the lack of versatility of DOVs.

Notably, within the options space, protocols are taking one of two distinct routes – and it would be unfair to classify them into “second generation” and “third generation” since each comes with its own tradeoffs. On the one hand, there is a clear trend where some option protocols develop their dedicated app chains, often leveraging the OP stack, to offer a comprehensive suite of derivatives instruments, encompassing options, perpetuals, and prediction markets. On the other hand, there is another group of protocols that keep on improving and refining their AMMs, often developing custom AMMs to enhance capital efficiency, enabling efficient trading and hedging of volatility, and capitalizing on yield generation by optimizing existing deployed capital, often by harnessing Uniswap V3 concentrated liquidity positions.

- L2 Appchains: Thanks to RaaS (Rollups as a Service) solutions like Conduit, protocols like Ribbon (now rebranded to Aevo) and Lyra have started developing their custom appchains.

- OpFi: This narrative revolves around the utility and capital efficiency of options. They empower traders to hedge risk, speculate on price movements, and enjoy unparalleled flexibility and customization. This makes it possible to come up with use cases that foster both active speculation and passive yield farming. Protocols working on this include Gammaswap, Smilee, Panoptic, Infinity Pools, and Dopex among others.

Premia stands out because it is able to offer quotes under the same umbrella, which consists of a CLAMM (Concentrated Liquidity AMM), a limit orderbook, DOVs, and OTC liquidity. Quotes from all sources are aggregated and served in the frontend interface, making it a seamless process.

The Hybrid Approach: Orderbook <> AMM

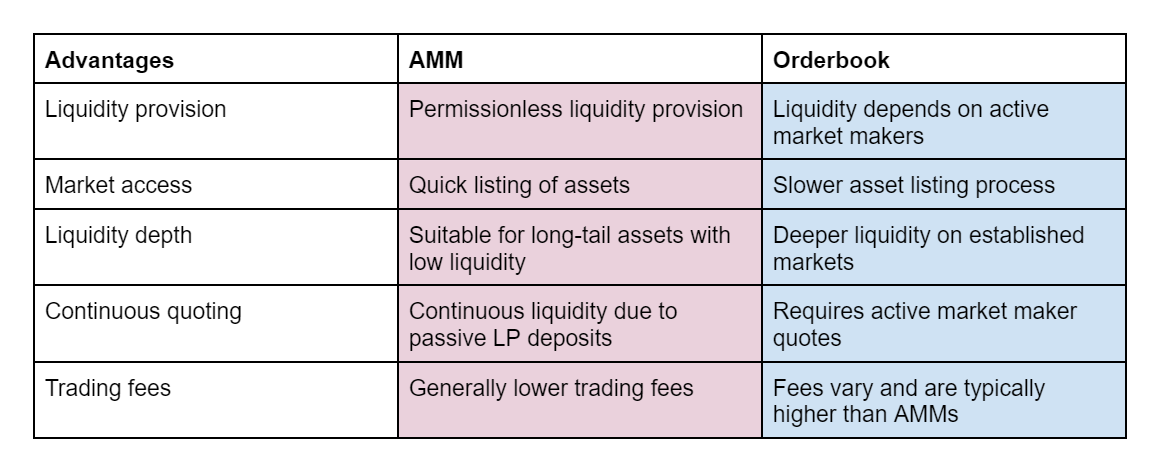

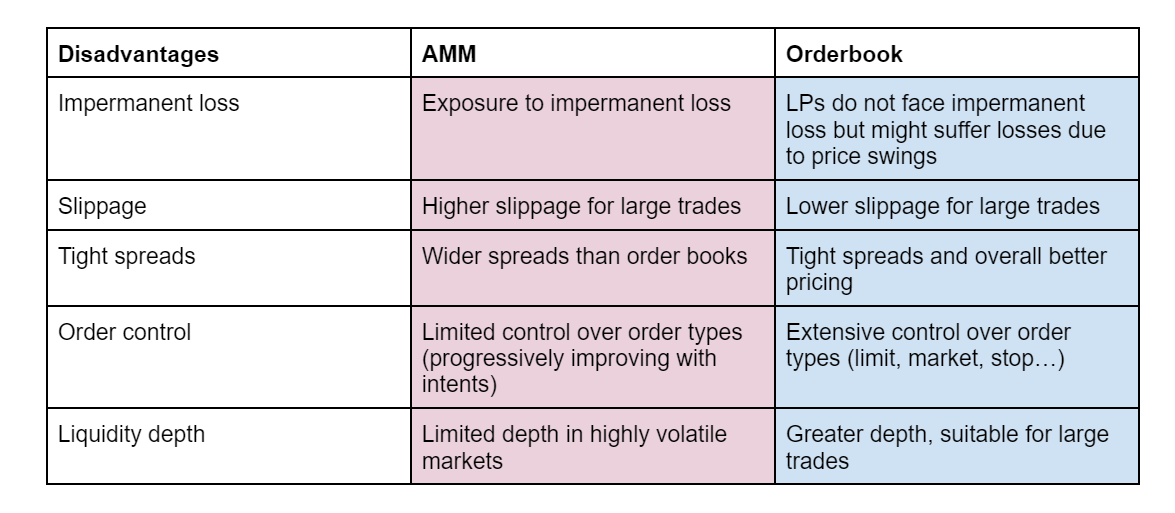

Active users on-chain will have noticed that AMMs (spot or virtual) and order books are starting to feel the same. Both solutions make it possible to trade just about any asset long/short with leverage, whether it is spot, expirable futures, options, perpetuals, or any other derivative. Each design comes with its own tradeoffs, but the major difference stems from the provisioning and active management of liquidity.

However, it is not fair to compare AMMs and orderbooks from the same lens. It is a common mistake to believe that AMMs will eventually go away and be replaced by the more functional design of order books. In fact, AMMs offer a different feature set that enables them to do some things better than order books.

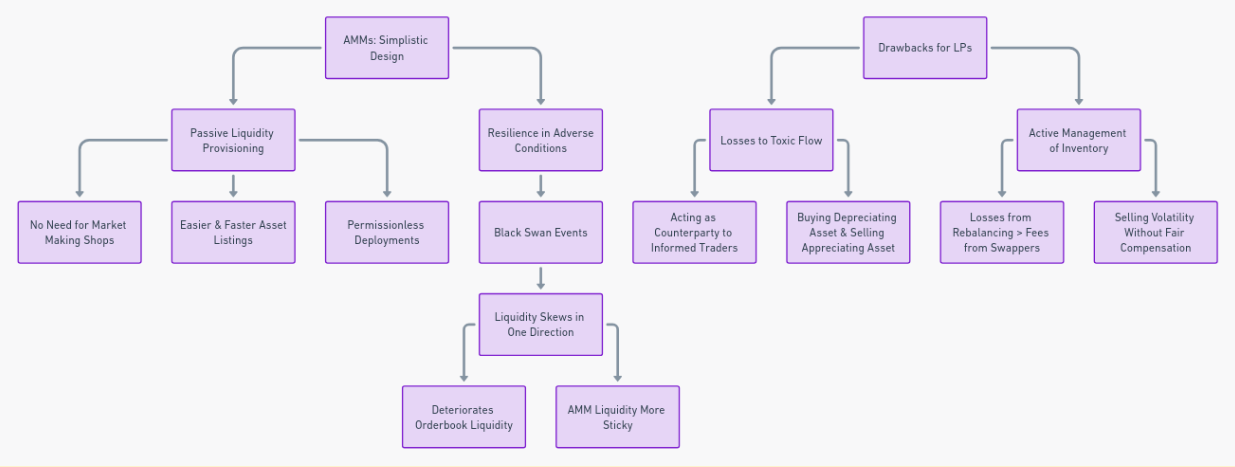

On the one hand, the simplistic design of AMMs allows for passive liquidity provisioning — without the need to rely on market-making shops. For instance, AMMs make it easier to get things off the ground with less resources (faster asset listings, permissionless deployments…). AMMs also show more resilience in times of adverse conditions. For instance, during a black swan event, the liquidity often skews in a single direction. This deteriorates liquidity conditions on an orderbook, since market makers are forced to require a wider bid-ask spread. As capital flows in one direction, liquidity on the book flows in the opposite direction – effectively losing liquidity when the market needs it most. AMM liquidity proves to be more sticky in these scenarios.

On the other hand, the returns for LPs might pale in comparison to their losses to toxic flow, as a result of acting as the counterparty to more informed traders or arbitrageurs. This leads to LPs buying more of the asset that is depreciating in value and selling the appreciating asset on the way up. Additionally, active management of inventory can still cause the losses from rebalancing to be greater than the amount of fees collected from swappers. In other words, LPs are selling volatility and they are not being fairly compensated for it (often because of fixed fees).

Altogether, order books excel at offering more flexible trading conditions, cheaper fees, and lower price impact, while AMMs tend to be a better solution when traders need access to immediate liquidity. As an example, think of those highly volatile times when market makers pull their quotes and the fees of AMMs start to surge to compensate LPs as a reward for continuing to provide liquidity in such adverse conditions. This becomes even more interesting when dynamic fees are applied based on volatility conditions – helping balance adverse market events with sudden and high demand for liquidity.

In this context, hybrid solutions like Premia Blue provide a viable solution to this challenge. By combining the strengths of both AMMs and order books, the final design for on-chain trading can accommodate practically any product with permissionless markets, exceptional execution, depth, and liquidity.

Growth Potential

Because options are a powerful tool for hedging risk, speculating on price movements, and generating income, the fact that Premia enables options contracts on any ERC20 can be an industry breakthrough. Similar to when Uniswap entered the stage offering permissionless swaps for any asset, options contracts on any asset represent a 10x improvement over what is possible on centralized exchanges like Deribit, Binance, or Bybit. In many ways, this could be a zero-to-one moment that propels the industry forward. All without attempting to replicate what centralized exchanges already do but on another L2 chain, bringing innovative and new ideas that are only possible in a decentralized manner.

While it can be very tempting to compare the addressable market of DeFi options and options offered by CEXes like Binance or Deribit, we think this can be a highly misleading metric, since options volume is still much lower than spot volume on-chain. Nevertheless, having new marketplaces on-chain is a net positive for this market sector as a whole, since they open up new arbitrage opportunities. This can attract more volume and capital inflows on-chain.

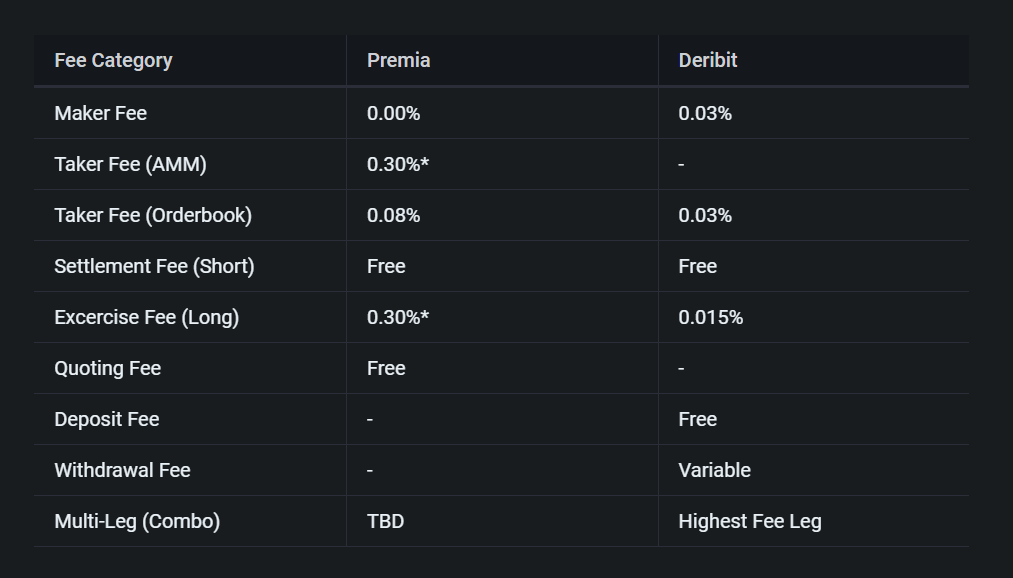

Fees

Unlike spot traders, derivatives traders are very sensitive to fees. Price sensitivity in options trading is also extremely high and, therefore, it is critical to remain competitive when setting trading fees. To do that, trading fees on Premia are set based on Deribit’s fees, with the only difference being that Premia does not charge maker fees.

Instead, transaction fees are paid by LTs and split between LPs and protocol stakeholders at a rate determined by governance. To retain higher composability, transaction fees are accumulated separately and not compounded back into LP positions.

- Similar to Uniswap v3, the Exchange uses a tick-based system that allows it to distribute fee income on a pro-rata basis. To retain higher composability, transaction fees are accumulated separately and not compounded back into LP positions.

- Pool creation is permissionless but fee-based. The fee is dynamic and incentivizes users to initialize pools that are ATM and near-dated, as they are the cheapest to create. Besides, a discount is offered for specific strikes and expiries that would create spread trading opportunities.

- Third parties are charged a minting fee calculated as:

Minting fee = 0.003 * Size * Collateral

Where collateral is 1 for calls and the strike price for puts. In other words, the minting fee is denominated in the collateral of the option.

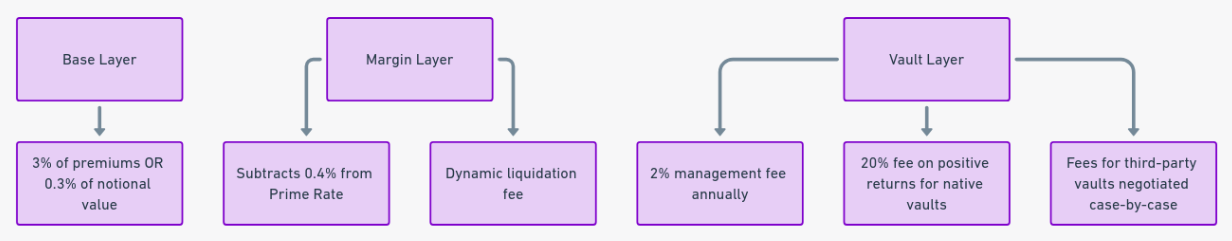

Overall, the fee structure contemplates 3 different layers:

- Base Layer: This layer collects commissions, which are the greater of 3% of premiums paid or 0.3% of the notional value transacted. Additionally, a fee of 0.3% is collected upon settlement, capped at 12.5% of the option’s value.

Trading Fee = max(0.03*Total Premium, 0.003 * Size)

Total Premium = Option Price * Size

- Margin Layer: The margin layer subtracts 0.4% from the Prime Rate, which is variable and influenced by supply and demand dynamics. It also includes a dynamic liquidation fee.

- Vault Layer: The vault layer features a 2% management fee annually and a 20% fee on positive returns for native vaults developed in-house. For vaults developed by third parties, fees will be negotiated case-by-case.

- OTC orders: OTC orders do not receive maker rebates. Instead, the full taker fee is retained by the protocol.

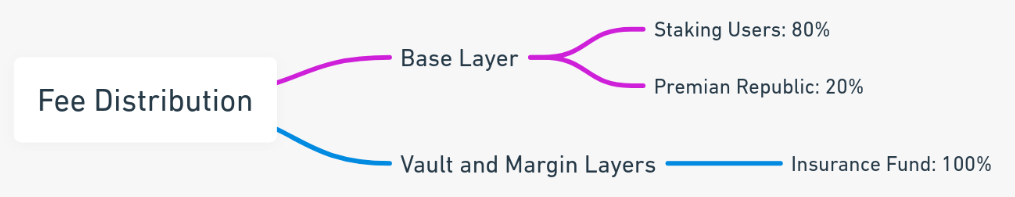

Cumulative fees from all sources are distributed between staking users, the Premian Republic, and an Insurance Fund. This distribution aims to strike a balance such that it is attractive enough for traders to use the platform while also incentivizing $PREMIA token holders to lock their tokens.

The current average lock time is 0.9438 years.

Tokenomics

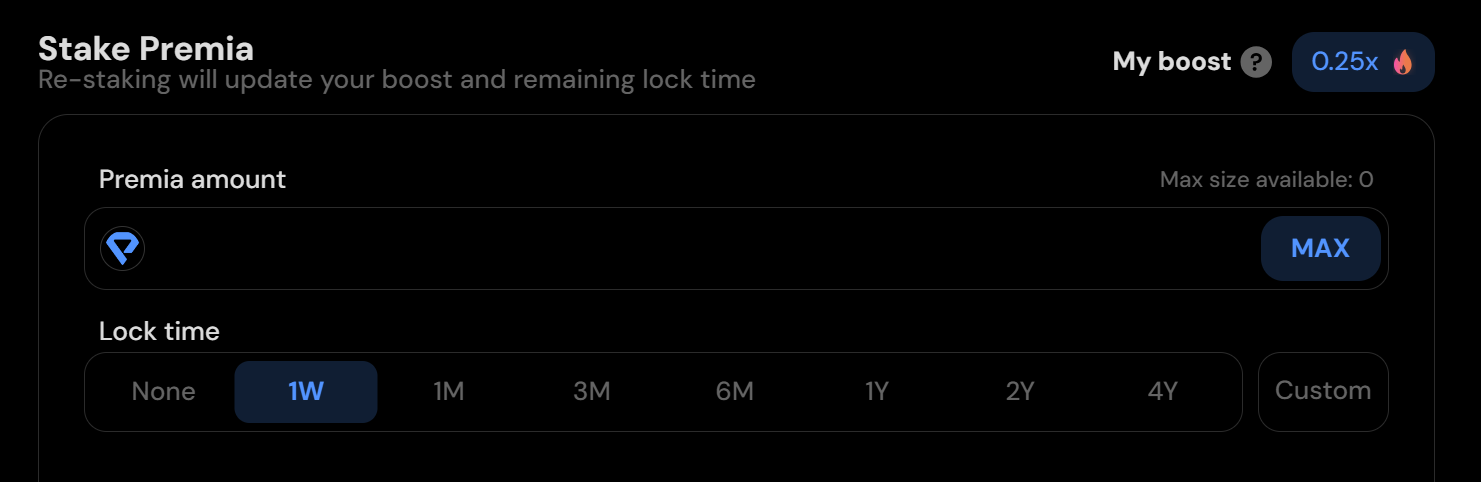

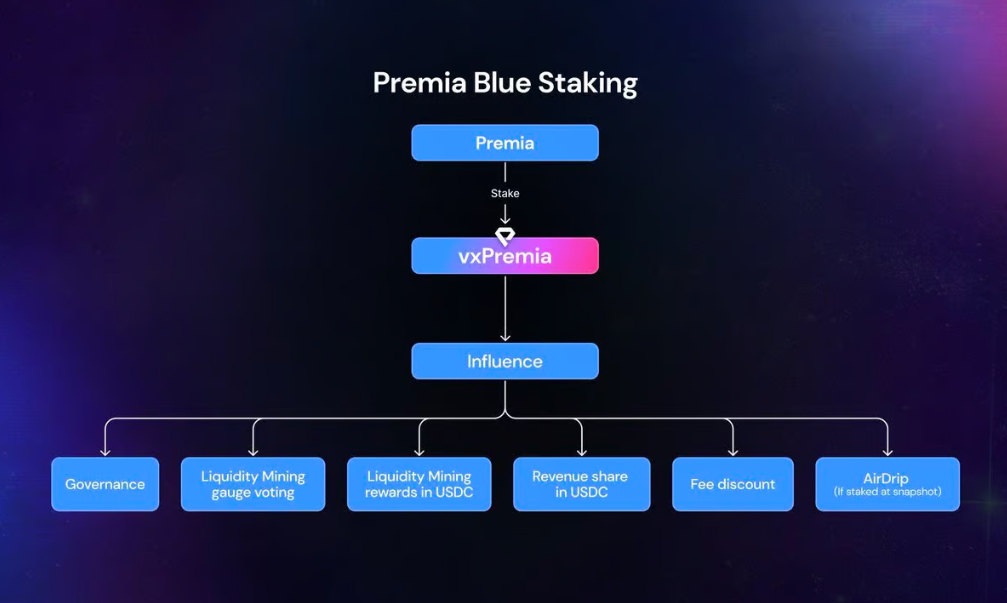

The token structure has undergone significant changes. Premia Blue uses an economic model that allows token holders to lock their $PREMIA tokens in order to access benefits such as revenue sharing, fee discounts, governance participation, and voting power in liquidity mining gauges.

Revenue Share

By staking $PREMIA into vxPREMIA and locking for a chosen period of time, token holders get access to a pro-rata share of the fees derived from the protocol.

Fees are generated from vaults, liquidity pools, trading fees, and options liquidity mining. The distribution ensures that a portion of the fees flows back to vxPREMIA token holders.

- Staking Users: Staking users receive 80% of the fees generated from the base layer.

- Premian Republic: Premian Republic receives 20% of the fees generated from the base layer.

- Insurance Fund: The Insurance FUnd collects 100% of the fees generated from the vault and margin layers.

While simple, one of the most advantageous features of this rewards system is that every benefit from being a vxPREMIA holder scales as more users join and compete to gain more influence over their entitlement.

Options Liquidity Mining

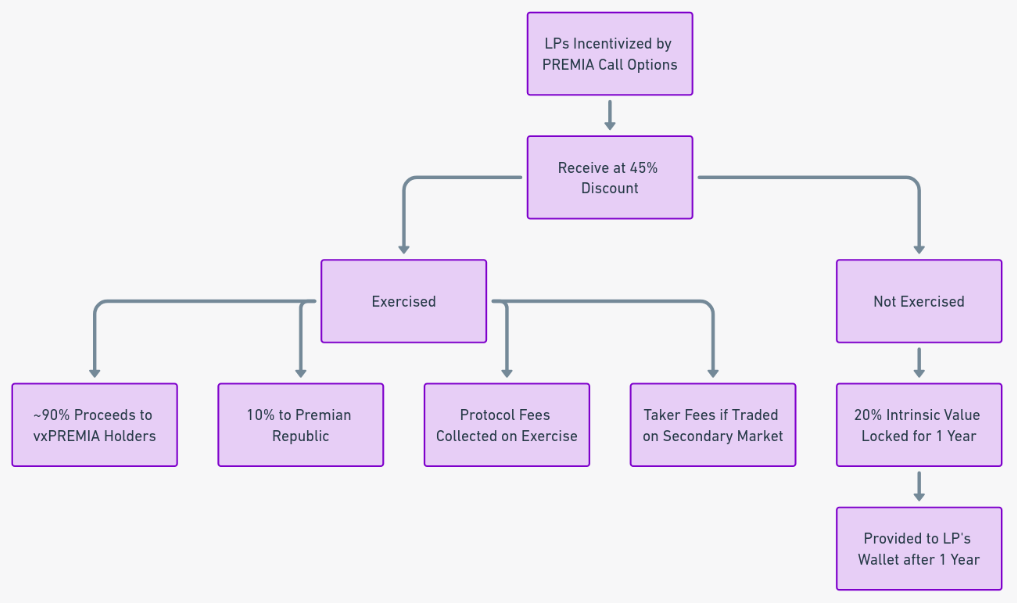

One of the unique characteristics of DeFi protocols is their ability to bootstrap liquidity using token incentives. When done correctly, this ends up carrying huge benefits in the long run – provided that the incoming liquidity ends up being sticky.

However, most liquidity mining programs often make the same mistake. While they are effective in the short term, they often struggle to keep momentum and end up attracting the wrong type of users. This is known as “mercenary liquidity” that only comes to capture the token emissions and extract value from the system by selling the rewards later on – leading to excess sell pressure. When this happens, the protocol ends up giving away tokens for free to mercenary farmers who will sell the rewards and abandon the protocol as soon as the rewards are higher elsewhere.

The goal behind distributing emissions in the form of $PREMIA call options is to align the incentives of both vxPREMIA holders and LPs.

LPs receive these options at a 45% discount to the current market price at no cost.

- If exercised, ~90% of the proceeds are directed to vxPREMIA holders, with the remaining 10% going to the Premian Republic (the team).

- If not exercised, 20% of the option’s intrinsic value will be locked for 1 year and then provided to the LP’s wallet.

Additionally, protocol fees will be collected upon exercise, and taker fees will be collected if this option is traded on the secondary market.

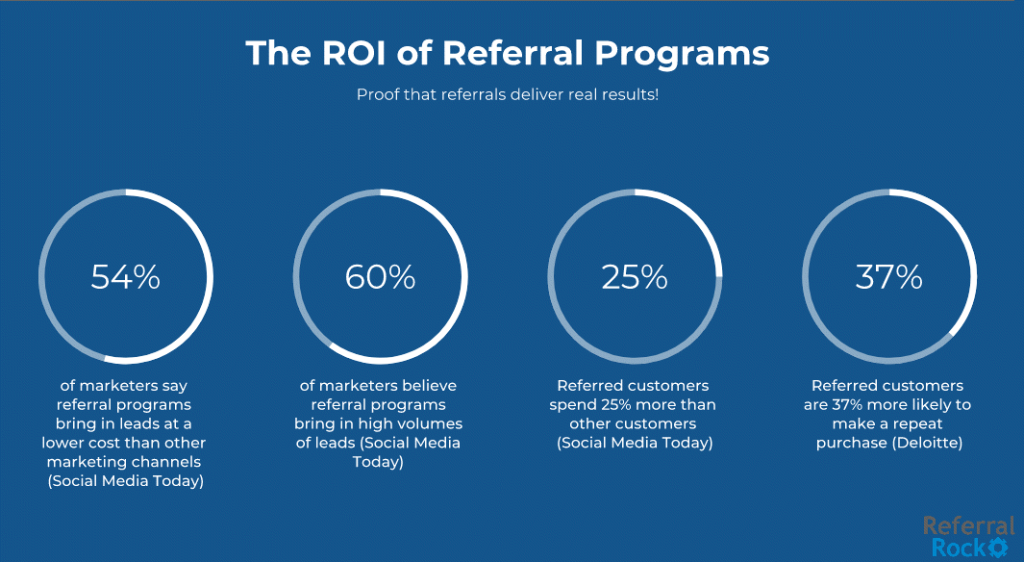

Referral

Besides the Options Liquidity Mining Program, Premia will also leverage a referral program. Referrers will earn 50% of all protocol fees from referred users until October 15th. It is important to keep this date into account in order to grasp a better sense of user retention as well as to determine how much of the actual activity is driven by FOMO.

Over $1000 in @PremiaFinance protocol Referral Fees in under a week, not too bad for this market. People are sleeping on that 50%, teaser period only lasts a month. pic.twitter.com/06qKPeN32h

— DK (@DK3Anon) September 17, 2023

Outside the initial promotion, the program is structured in different tiers. This feature cannot be underestimated, since it incentivizes users to get better and continue to improve not only by referring more users but also by scaling up their trading volume and increasing their total traded notional in order to move to a higher tier.

There will be 3 tiers, earning 5%, 10%, and 20% of all referred taker fees respectively.

- Level 1: 0 – 999,999 Notional Value

- Level 2: 1,000,000 – 9,999,999 Notional Value

- Level 3: 10,000,000+ Notional Value

These tiers will be modified periodically depending on trading volume.

Referral programs have a proven track record of success, due to their ability to standardize the onboarding process and attract new customers at a very low cost. In crypto, this proved to be one of the most effective tools for GMX to take off back in 2022. However, one of the drawbacks is that options trading is significantly harder to understand than perpetuals. This can be easily mitigated by introducing more passive vaults, providing extra utility for the new entrants as they learn and improve their trading options skills.

It is also worth noting that Premia is making a big effort on the educational front. The Premia Academy is one of the few places where new users can learn about options trading and put their newly acquired skills to the test using the Premia protocol itself.

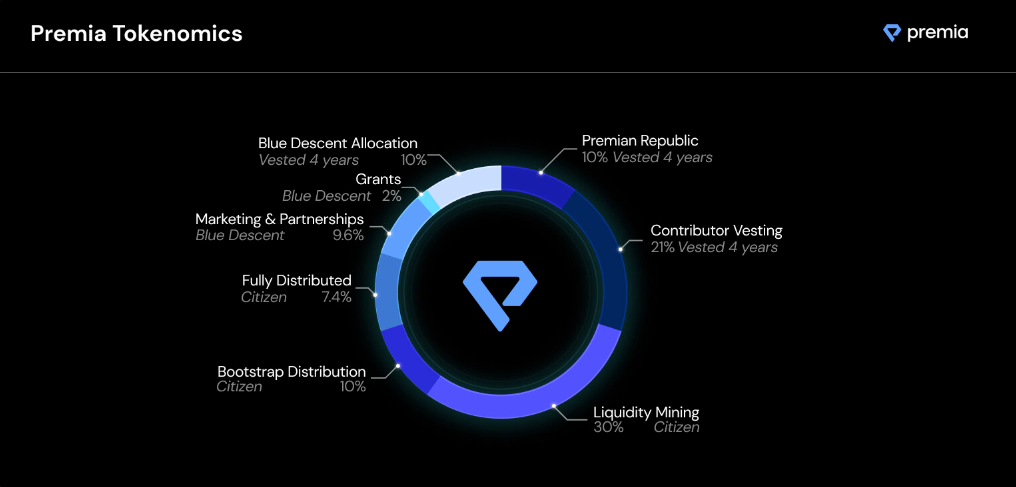

Token Distribution

When assessing the distribution of tokens, it is worth noting that Premia has been a community-owned project from day one and has not received VC funding.

Premia Blue also introduces a shift in token allocation percentages in an attempt to better align the incentives of contributors and the community. 22% of the total token allocation (100M tokens) has now transitioned from the Premian Republic (Operational wallet) to the Blue Descent DAO

At the time of writing, the circulating supply of PREMIA (including tokens locked as vxPREMIA for any duration) is ~35M.

Key Takeaways

- DeFi options have evolved from traditional option vaults (DOVs) to address issues of predictability and vulnerability to losses during volatility.

- Premia’s hybrid AMM and orderbook design stands out for its customizability and permissionless nature, allowing traders to select the underlying asset, strike price, and expiration date for tailored risk management and speculation.

- The protocol architecture makes it possible to aggregate liquidity from 4 different layers: Concentrated Liquidity AMM (CLAMM), a limit orderbook, Options Vaults, and OTC liquidity.

- Premia’s fee structure is designed to remain competitive, using Deribit as the reference and passing value to token holders as well as accumulating capital in an insurance fund.

- vxPREMIA token holders can lock their tokens to access benefits like revenue sharing, fee discounts, governance participation, and voting power in liquidity mining gauges.

- Premia’s OLM approach to distributing emissions as $PREMIA call options aligns incentives for vxPREMIA holders and LPs – disincentivizing mercenary liquidity and promoting long-term engagement and value creation within the ecosystem.

- Premia is a community-owned project without VC funding, emphasizing a commitment to community-driven growth and development.

Economics

Token Price

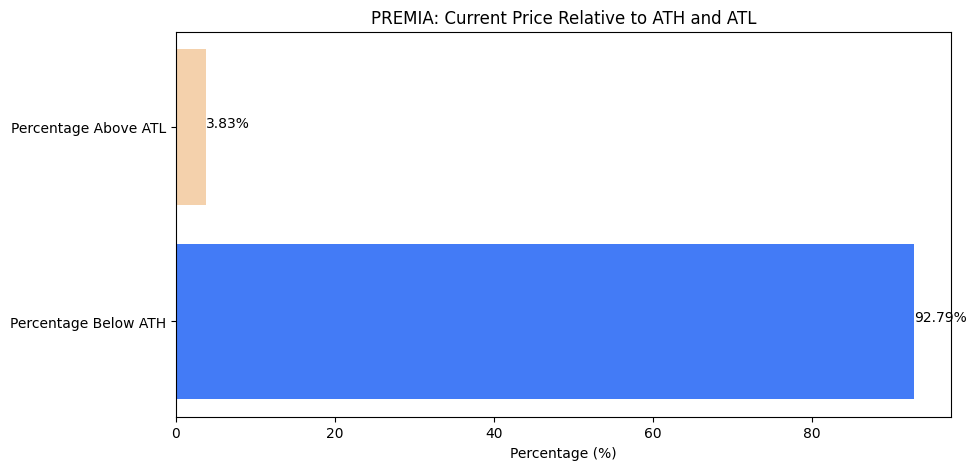

Price relative to ATH and ATL

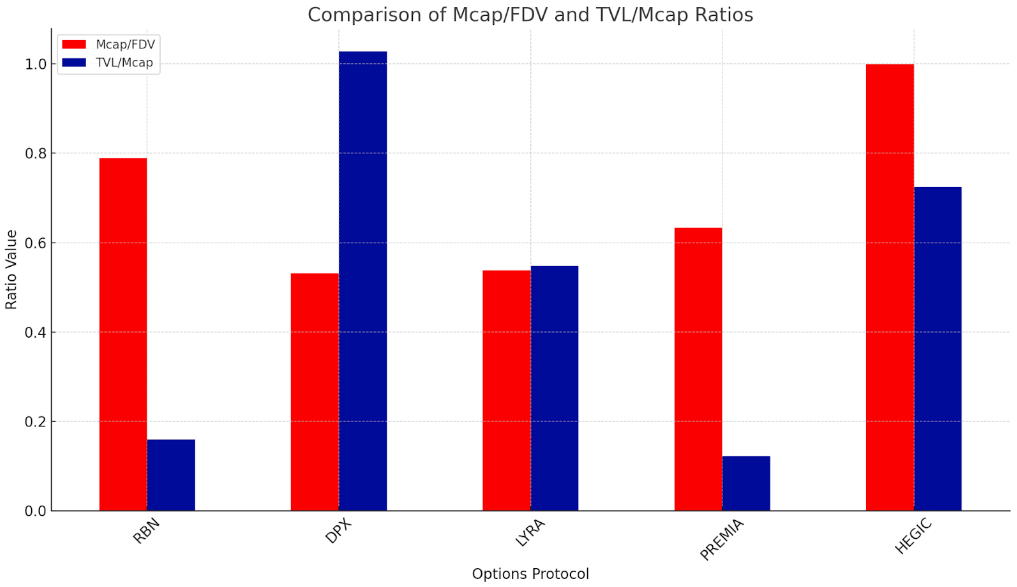

Mcap and FDV

Premia has a 0.31 Mcap/FDV ratio

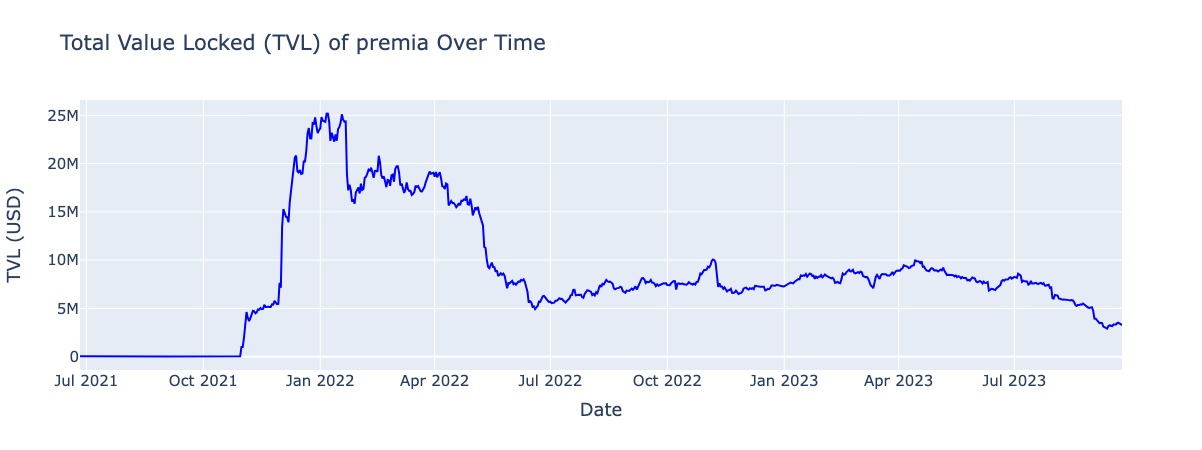

TVL

Premia has a 0,18072751 TVL/Mcap ratio

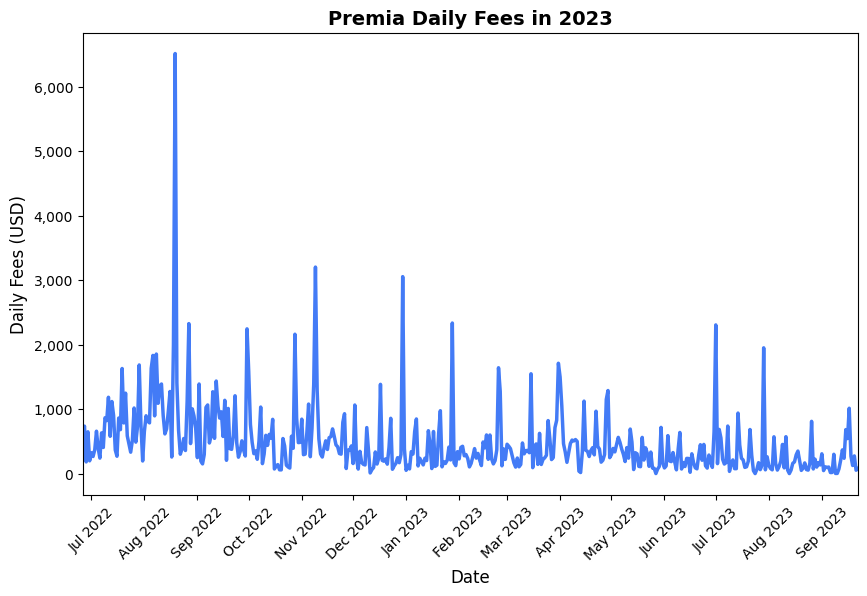

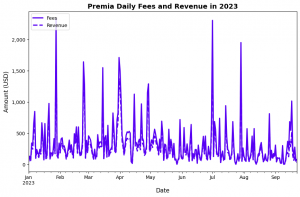

Fees

Revenue

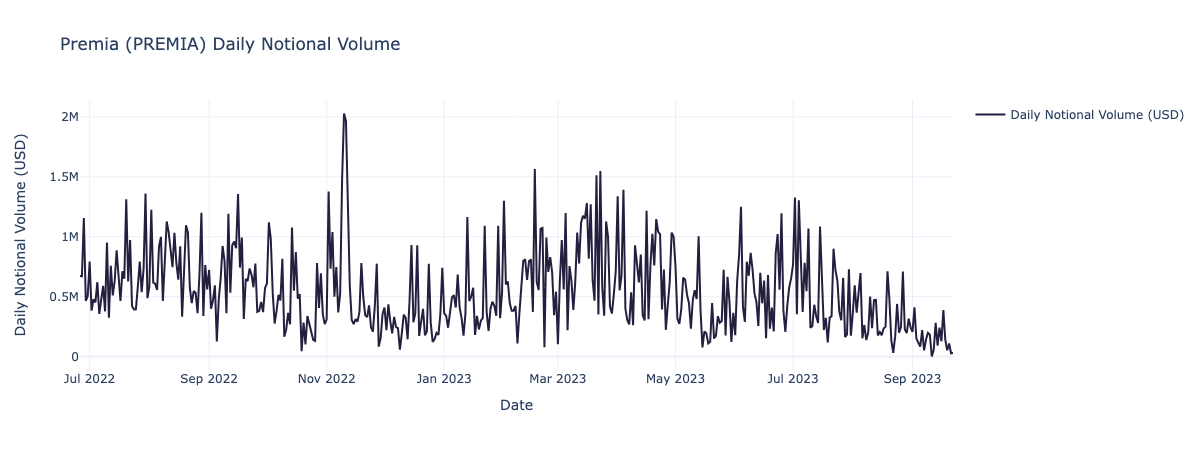

Volume

Volume / TVL

Competitive Landscape

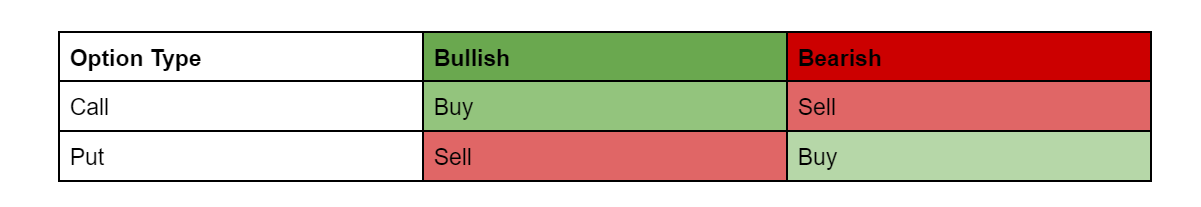

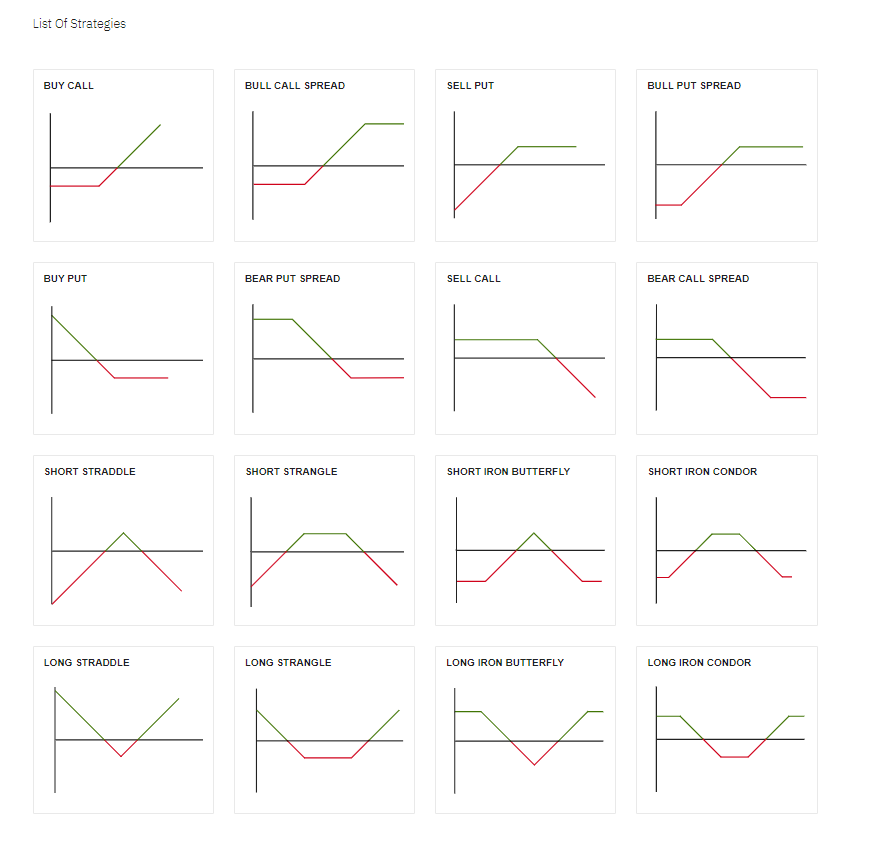

Options Cheat Sheet

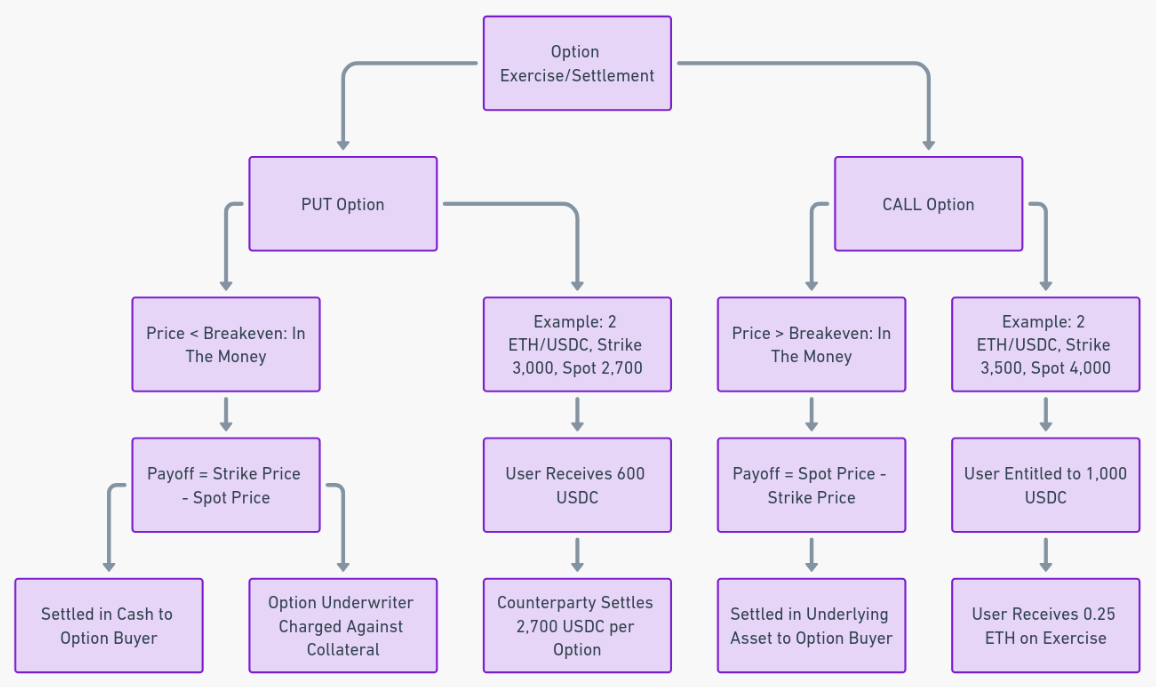

- A call option is a financial contract that gives the option holder the right, but not the obligation, to buy an underlying asset at a predetermined date T, the maturity date, and a predetermined price K, known as the option’s strike.

- A put option is a financial contract that gives the option holder the right, but not the obligation, to sell an underlying asset at a predetermined date T, the maturity date, and a predetermined price K, known as the option’s strike.

Conclusion

While some option protocols are expanding their offering with perps and other derivatives, Premia chooses to capitalize on its unique know-how for options pricing. Even though it might seem that appchains with off-chain order books are the direction where DeFi trading is heading, Premia Blue shows that there is still potential to reimagine the user experience. This is achieved by offering a unique experience and set of products that even centralized exchanges cannot replicate.

References

- Premia

- Premia Blue interface

- Premia Academy

- Premia Analytics

- Orderbook off-chain API

- Docs

- Youtube

- Medium

- Github

- Security Audit by Arbitrary Execution

- Intent-based architectures and their risks

Note that Premia v2 will be deprecated on all chains (Ethereum, Arbitrum, and Fantom) except Optimism. Users are encouraged to migrate their liquidity to Premia Blue in order to benefit from additional features and improvements.

Premia v2 deposits on Ethereum, Arbitrum, and Fantom will be disabled on the front-end UI and withdrawals will be enabled until a few weeks after the last non-Optimism v2 option expires ~2.5 months from now approximately.

Traditional liquidity mining emissions have also been discontinued on every chain. This has been replaced by Premia Blue’s OLM program, allowing liquidity providers to receive $PREMIA call options instead of liquid tokens.

Disclosures

Revelo Intel has never had a commercial relationship with Premia and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.